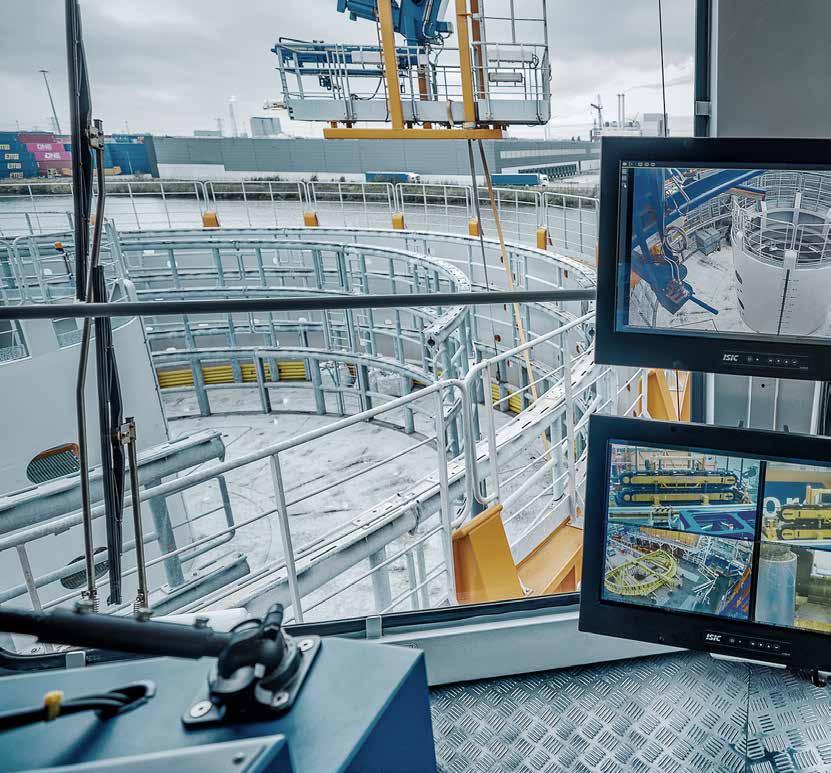

Introducing the Damen SOV 7017 E, a fully electric Service Operations Vessel for the offshore wind industry of tomorrow. With its revolutionary offshore charging capabilities, the SOV E takes a significant step towards zero emissions maintenance of offshore wind farms. Connecting to a turbine offshore, the vessel is able to safely and efficiently charge without manual intervention – making the generation of green energy even more sustainable and providing a solution fit for the future.

Look no further!

With Headway’s BWTU, Reikon supplies one of the lowest power consumers available. Add that to Headways ‘single treatment’ solution and you can save thousands of euros on fuel costs on an annual basis compared to other BWT solutions. And did we mention that in ten years time, we haven’t replaced a single core treatment element?

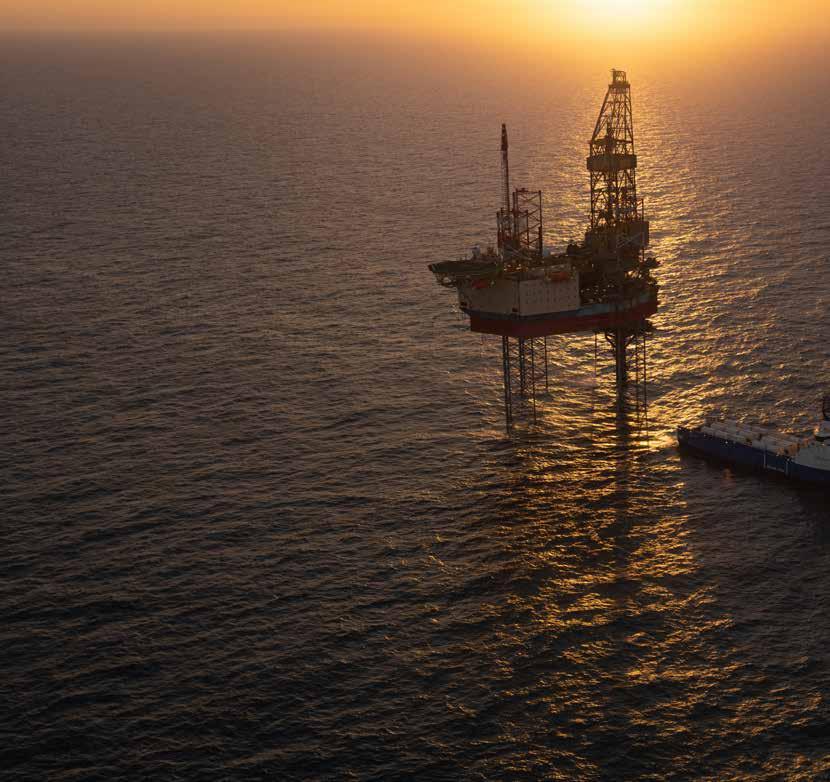

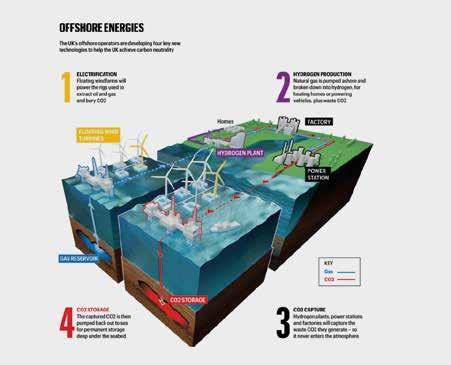

As we navigate the ever-evolving landscape of energy production, the need for sustainable practices has never been clearer. Offshore energy, with its vast potential, stands at the forefront of this transition towards green growth. In this issue, we explore how innovations are not only reshaping our energy sources but also contributing to a more sustainable future.

A key element in this transition is the role of the supply chain in advancing clean technology. From manufacturing components to logistics and installation, a robust supply chain is essential for delivering efficient and sustainable energy solutions. As we expand our offshore capabilities, optimizing this supply chain can lead to significant reductions in carbon footprints and enhance the overall efficiency of energy projects.

The urgency of climate change calls for immediate action, and the offshore energy sector is uniquely positioned to lead the way. With advances in technology, we are witnessing a remarkable shift towards cleaner energy alternatives. These developments not only meet current energy demands but also create a resilient framework for future generations.

However, this transition comes with challenges. Balancing ecological preservation with the need for increased energy production requires thoughtful planning and collaboration across industries and governments.

Importantly, as we shift towards a greener future, energy security remains a priority, especially from an oil and gas perspective. Many companies in this sector are setting ambitious net-zero targets and investing in clean technologies to ensure a responsible transition. By integrating sustainable practices within their operations, these companies not only contribute to energy security but also play a crucial role in the broader pursuit of climate goals.

As we move forward, let us embrace the potential of offshore energy to drive a sustainable future. By prioritizing green growth, strengthening our supply chains, and aligning with the net-zero ambitions of oil and gas companies, we can pave the way for a more resilient energy landscape that benefits both people and the planet.

The editorial team

The Van Es Group is the ideal partner for ambitious startups, scale-ups, and SMEs that aim to impact the offshore and energy transition sectors – not just for today’s world but for the next generation. As a family of nine leading companies, we offer unique opportunities to achieve growth and bring innovative ideas to life. We support our family members with funding and legal, financial, HR, and marketing expertise. Together, we combine knowledge, networks, and expertise to drive change in the offshore industry with our heavy equipment.

STRONGER TOGETHER IN OFFSHORE AND ENERGY TRANSITION

The offshore industry stands on the brink of a major transformation. Globalisation, digitalisation, and the urgent need for the energy transition have reshaped the market.

Many new technologies have emerged with the shift from fossil fuels to renewables, bringing exciting opportunities and challenges for future generations. What was once considered normal –long working hours, limited flexibility, and fixed career paths – is no longer the standard for the new generation.

At the Van Es Group, we witness this transition firsthand in various ways, such as the business succession from father to daughter. This is not just a symbolic handover; it reflects a broader shift in the sector.

In this traditional work environment, letting go of old patterns and making space for new ideas can be challenging. However, the arrival of the new generation presents unique opportunities for innovation, sustainability, and personal development. Now, with the energy transition in full swing, we must look ahead together with them. From an HR perspective, it may sometimes feel like balancing the needs of employers with the expectations of future employees.

But perhaps these worlds are not at odds. Working in offshore offers significant challenges for the new generation. As employers in the offshore sector, it's time for us to seize these opportunities.

A recent study, both quantitative and qualitative, conducted within the Van Es Group highlighted three key pillars that are crucial to keeping the new generation, both literally and figuratively, on board and helping them grow:

The new generation seeks personal and professional growth. Standard skill training is no longer enough. We must focus on development programmes that go further – tailored to individual needs and aimed at leadership, collaboration, and creative thinking. Together with the new generation, we must create plans that strengthen their development and our business goals. This requires customised approaches, regular evaluations, and, above all, the courage to ask what they find important.

The new generation demands more freedom and flexibility in their work. This is a challenge in a traditional sector like offshore, but offering additional leave, more flexible work schedules, and alternative working hours can help. Swift Drilling, one of the Family members of the Van Es Group, is working alongside social partners to ease offshore rotation schedules on the Dutch continental shelf. This calls for transpar-

ent dialogue and mutual trust between employer and employee.

A positive work atmosphere attracts new employees and keeps them motivated. The new generation wants to work in an environment where they feel inspired, their voice is heard, and where they contribute to larger goals, such as the energy transition. The new generation wants to make a difference, and we are ready to support them.

By focusing on personal growth, flexibility, and positivity, we can bridge the gap to the next generation while building the future of the offshore sector and the energy transition together. The Van Es Group and its Family members are ready to face this challenge with you!

The future of offshore is exciting and full of possibilities. Would you like to shape this future with us?

Visit us at stand 1.319 or contact us at info@vanesholding.com and discover what we can do for your project or innovation.

Hannah Bom HR Director Van Es Group

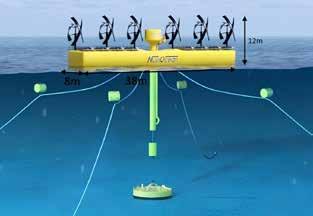

The UK government has unveiled the results of Allocation Round 6 (AR6) of the contracts for difference (CfD) renewable auction, with six projects across five sites securing contracts to deliver 28 MW of tidal stream capacity at a rate of £172/MWh (approximately $225/Mwh).

AR6 marks the third consecutive renewable auction in the UK with a dedicated ringfence for tidal stream energy, the Marine Energy Council (MEC) said. This approach has established the UK as a leader in tidal stream deployment, with over 130 MW of capacity expected to be operational by 2029.

The AR6 contracts include HydroWing, set to deliver 10 MW in Wales, while in

Scotland, MeyGen will provide 9 MW, Seastar 4 MW, Magallanes 3 MW, and Ocean Star Tidal will provide 2 MW, bringing the total to 18 MW.

Scotland now has 83 MW and Wales 38 MW of contracted tidal stream capacity through the UK’s renewable auctions. No tidal stream project has yet been contracted in England, therefore, MEC said it aims to collaborate with the UK gov-

ernment to distribute tidal stream opportunities more evenly across Great Britain. Key industry players have welcomed the latest UK renewables auction results, viewing it as a strong endorsement of the tidal energy sector’s growth.

The HydroWing project at Morlais has been expanded to 20 MW following the AR6 CfD allocation, where an additional 10 MW was awarded. According to In-

yanga Marine Energy Group, the owner of HydroWing, this expansion supports the development of commercially viable generation projects through economies of scale.

“This award is a testament to the hard work of our pioneering team and the relentless drive to make HydroWing competitive. This award further enhances our expansion in Anglesey and our commitment to develop the project in partnership with Morlais Mentor Mon to allow the site to reach its full potential and provide economic growth and benefit to Anglesey,” said Inyanga Marine Energy in a social media post.

In January, Inyanga Marine Energy opened a new office in Wales to support the development of the Hydrowing tidal stream energy project at Morlais, Anglesey.

SAE Renewables, the owner of MeyGen, which is described as “the largest consented tidal stream project in the world,” has added 9 MW to the project, bringing the total project capacity under development to 59 MW. This phase adds to the 6 MW already operational at the site.

SAE’s CEO, Graham Reid, said: “The scale and opportunity that MeyGen represents for the industry, the supply chain, our

stakeholders, and the wider United Kingdom is significant, and we will work with all involved to ensure its success.”

According to the Scottish company Nova Innovation, its EU-funded Seastar and Oceanstar tidal energy projects located at the Fall of Warness wite in Orkney, secured three 15-year contracts, as part of the CfD auction.

“Winning the CFD contract is a testament to our team’s ability to deliver solid results whilst continuing to innovate and grow. This is another significant step towards realising our vision of a world powered by clean, sustainable marine energy,” said Julie Aird, CFO of Nova Innovation.

Scotland’s Magallanes Renovables said it secured a power purchase agreement (PPA) for the next 15 years. The company added: “This is the 4th Project we´ve been awarded within the past 3 years, since the allocation opened for Tidal mills, what reinforces our commitment towards reaching a more sustainable future by unlocking ocean currents.”

In March, Magallanes partnered up with Tadek Ocean Engineering for support related to its first commercial-scale tidal energy array.

Energy developers see Anglesey as ‘center of excellence for tidal energy’ According to Menter Môn Morlais, the CfD awarded to HydroWing provides revenue security for the electricity generated at Morlais and supports the expansion of the Ynys Môn scheme, as owner Menter Môn Morlais plans to increase the generating capacity to 240 MW.

The AR6 supports Anglesey’s goal to become a hub for tidal energy and is important for attracting future investment to the area, said Menter Môn Morlais.

John Idris Jones, Chair of Menter Môn Morlais, noted: “We are pleased that HydroWing has been allocated additional

Megawatts at Morlais and signals that we are headed in the right direction. We are still at the start of our journey and see today’s news as an important step forward as we grow the project to its full potential'.''

The CfD scheme is said to guarantee developers a fixed price for their electricity and underscores the role of tidal stream as a reliable energy source.

Morlais, run by social enterprise Menter Môn, is described as the “largest consented tidal energy project of this type in Europe”, spanning 35 square kilometers of seabed. According to Menter Môn Morlais, Morlais has the potential to generate up to 240 MW of clean, low-carbon electricity once completed. The first turbines are projected to be deployed at sea in 2026.

Richard Parkinson, Managing Director of HydroWing, added: “The successful AR6 application is the culmination of a huge effort from our team to develop a more efficient and cost-effective tidal energy solution for Morlais. We look forward to working closely with Menter Môn and with our supply chain partners in Anglesey to deliver clean and predictable power to the grid.”

Marine Energy Wales stated that HydroWing securing 10 MW of the total 28 MW contracts awarded across the UK means that Scotland now has 83 MW and Wales 38 MW of contracted tidal stream capacity.

“Tidal stream is leading the way in Wales. We are delighted to see this additional capacity at Morlais – almost half of the 22MW secured in last year’s Allocation Round,” said Tom Hill, Program Manager at Marine Energy Wales.

“Continued support from Government in the form of a ringfence for tidal stream technology and lower strike prices will continue to bring the cost of delivery down and provide high quality jobs for Welsh communities.”

Reminder for EU that ‘market visibility and funding support are instrumental in driving ocean energy’s industrialization’ According to Ocean Energy Europe (OEE), Europe’s position in clean energy relies on advancing innovative technologies such as ocean energy, which can generate power at different times compared to established renewables.

The new Commission can capitalize on this momentum to strengthen Europe’s leadership. Continued EU funding and address to risk-reduction tools will be crucial for attracting private investments and advancing the industry, said OEE.

“The UK’s success with tidal CfDs shows that governments can swiftly deliver multi MWs ocean energy farm scale projects with earmarked revenue support,” said Rémi Gruet, CEO of Ocean Energy Europe.

“This should light the way for other European countries with wave and tidal re-

sources to follow suit to unlock the full potential of ocean energy. Such measures brought wind and solar to the market and will be equally crucial for ocean energy. “

According to the UK’s technology and research center, Offshore Renewable Energy (ORE) Catapult, despite the increase in the tidal stream budget from £10 to £15 million for AR6, this auction round was only expected to allow for 20 MW awarded capacity.

The high costs of delivery of tidal stream projects necessitate a high reference price from the government, limiting the impact of the ringfenced budget, noted ORE Catapult. Nonetheless, the results include six projects with a combined capacity of 28 MW, at a strike price of £172/ MWh.

“The strong number of successful bids seen in AR6 sets the stage for further proving out the tidal stream technology, and validates the ringfencing of budget specifically for tidal stream in facilitating a variety of project technologies and locations in this sector,” said ORE Catapult.

According to a research by Offshore Renewable Energy (ORE) Catapult and Imperial College London (ICL), tidal energy has the potential to provide 11.5 GW to the UK energy system, 11% of the UK’s electricity demand, and tidal stream projects could contribute up to £17 billion to the UK economy by 2050.

By Zerina Maksumic

INTEGRATED ACCOMMODATION SOLUTIONS

Subsea infrastructure is critical to the energy security in Europe and with the world not looking so bright there is a real urgency to get something going to protect this infrastructure, but the solution is not easy to find, panelists said at a discussion on seabed security organized by IRO, the Association of Dutch Suppliers in the Offshore Energy Industry, Royal Netherlands Navy and the Netherlands Embassy in Norway.

Held on board the hydrographic survey vessel HNLMS Snellius, moored in Norway’s Stavanger harbor, as part of the ONS 2024 conference, the session gathered Paul Flos from the Royal Netherlands Navy, René Peters, Program Manager for Energy Infrastructure at TNO and IRO board member, Sander van Luik from the recently-launched Seabed Security Experimentation Center (SeaSEC),

and Mark Heine, CEO of Fugro and IRO Chair.

The speakers defined critical infrastructure as the one that can threaten or affect energy security and the security of supply if some of it fails or a cable or pipeline is broken. With the North Sea having 3,000 kilometers of gas pipelines, plus a lot of cables, this is difficult to monitor on a daily basis.

Outlook not looking very bright René Peters from TNO noted that critical infrastructure in the North Sea related to the energy system, not only gas pipelines but also electrical and data infrastructure, is very sensitive and can potentially be a victim of sabotage.

A huge amount of power cable infrastructure will come with the

development of offshore wind in the Netherlands, currently standing at 5 GW with the goal of having 20 GW in the early 2030s, as well as interconnectors and other future infrastructure, including hydrogen if it becomes the gas of the future.

“Things are changing in the world. In Europe, there is a war going on and we expect it will not stop there in the near future. All analyses show that around 2027 something will happen in the world, either in Europe or the Far East. Although no bombs will drop immediately in the Netherlands or

Norway, it will affect us, so we have to do stuff. We need to do differently than in the past. The world does not look so bright and we have to prepare,” Paul Flos said.

To act on safeguarding the existing subsea infrastructure, a six-nation initiative called SeaSEC was launched in December 2023 by the Netherlands, Denmark, Germany, Finland, Norway and Sweden with the aim of developing new techniques and enabling governments to monitor infrastructure in the North Sea and Baltic Sea up to a depth of 30 meters, including pipelines for oil & gas, platforms on which wind turbines are built and internet cables.

SeaSEC as the first step SeaSEC, the research center for submarine infrastructure security, officially opened at Campusatsea in Scheveningen, The Hague, in December 2023 as a commitment to safeguarding the subsea infrastructure in the North and Baltic seas through a combination of experiments, testing, and the development of innovative techniques.

Among other things, the partners behind the initiative want to create a virtual image of the seabed, on which any threats to the submarine infrastructure immediately become visible. The establishment is part of the Northern Naval Capability Cooperation (NNCC), with the plan to eventually open SeaSEC branches in Sweden and Germany.

According to Sander van Luik from SeaSEC, common security concerns relate to such a big area that cooperation is a necessity, both civilmilitary and internationally, to address them, and urgency commands looking

at applying existing solutions for new security challenges.

Van Luik noted that SeaSEC does not have the solutions to the problems but will work on understanding the relevant questions, how to have working solutions that are already used in the offshore industry, and will try to find solutions by working with asset owners and the industry, including both manufacturing companies and service providers.

What can be done?

In terms of what can be done to speed up the action, the panelists agreed that using civilian equipment is one option, which can be done without adjusting it, as well as exchanging ideas and data between countries. Remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) would be used for most of the work.

As a member of IRO, Dutch geo-data giant Fugro is looking to support the project. The company’s CEO Mark Heine said: “We have been collecting data offshore for many years all across the world, increasingly with ROVs and AUVs. This is the first time we are working with the Dutch Ministry of Defense. It is an open dialogue to see how our innovative technology, like the new 18-metre uncrewed surface vessel, can support protection of critical subsea infrastructure.”

The second panel on seabed security will be held at our Offshore Energy Exhibition & Conference (OEEC) on Tuesday, 26 November, at RAI Amsterdam. The session, organized in collaboration with IRO, is on schedule at The Stage from 14:00 until 14:55.

By Nadja Skopljak

The consortium partners behind Project Greensand submitted the final report for the CO2 storage pilot project in September, paving the way for the development of large-scale carbon capture and storage (CCS) in Denmark.

Project Greensand includes capturing CO2 at an INEOS Oxide site in Zwijndrecht, Belgium, which is transported cross-border and stored in the Nini field in the Danish North Sea. The CO2 injected is stored at a depth of about 1,800 meters below the seabed.

The project envisages CO2 being transported by the offshore supply vessel Aurora Storm, which has been adapted so that it can safely transport containers of liquid CO2. In time, an-

other type of vessel known as a CO2 carrier will be used for large volumes.

Confirmation of the technology

Project Greensand marked a world first on March 8, 2023, with the first-ever injection of CO2 in the North Sea, demonstrating that captured CO2 can be transported across borders and stored offshore.

A couple of months later, classification society DNV verified the safety of all

aspects of the project's CO2 storage in the closed Nini West reservoir.

The project is said to be the first in the world to demonstrate that CO2 can be transported across national borders and stored offshore to mitigate climate change.

“We now have documentation that we have a well-functioning storage for CO2 in the North Sea subsoil, where large amounts of CO2 that would oth-

erwise have been emitted into the atmosphere can be safely and permanently stored,” said Mads Gade, Country Manager at INEOS Denmark and Commercial Director at INEOS Energy.

“We can see that the stored CO2 behaves as expected in the reservoir 1,800 metres below the seabed. That confidence gives us a solid foundation to take the next steps that will be crucial for CCS in Denmark."

Pilot phase verified

The partners behind the project have completed and verified the pilot phase, with lead partner INEOS already hav-

'Project Greensand will be able to store up to 8 million tonnes of CO2 per year'

ing applied for approval on behalf of license partners Wintershall Dea, now Harbour Energy, and Nordsøfonden for Denmark's first large-scale CO2 storage facility, and is working to start CO2 storage in the North Sea by the end of 2025 or the beginning of 2026.

In the short run, Project Greensand can store up to 1,5 million tonnes of CO2 per year in 2025/2026. In the final expansion phase, scheduled to begin in 2030, the project aims to store up to 8 million tonnes of CO2 per year in the area, representing 40% of Denmark’s total emission reduction target.

According to INEOS, experience from Greensand will be included in the work to demonstrate safe storage on land in Denmark as an investigation is underway whether it is possible and safe to store CO2 underground on land. Earlier this year, the Minister for Climate, Energy and Utilities awarded INEOS, Wintershall Dea and Nordsøfonden an exploration license for an area of the Danish subsurface in Jutland in the Gassum reservoir.

“We emphasised that Denmark has moved to the forefront of CCS in the world when we stored the first CO2 in the North Sea. Now we are in the process of investigating how to take the next step, and here we stand on the shoulders of the invaluable experience from Project Greensand's pilot," Gade said.

"We are keen to continue this momentum with an ambition that Greensand

will be the first CO2 storage facility in operation in the EU, and we are now awaiting the Danish authorities' approval of a permanent storage. This is an important step, because if Denmark takes just 5% of a future CCS market in Europe, it could mean up to 9,000 jobs, with an economic potential of DKK 50 billion."

To remind, the Danish Energy Agency granted the first-ever permit for a CO2 storage project in Denmark at the end of 2022 to INEOS E&P and Wintershall Dea for the Greensand Pilot Injection Project. In February 2023, the partners received the first full-scale CO2 storage permit for the Danish North Sea.

Besides INEOS and Wintershall Dea, more than 20 other partners are involved in the project, including startups, independent institutes, and the Geological Survey of Denmark and Greenland (GEUS), an institution within the Danish Ministry of Climate, Energy and Utilities. The Danish Government is supporting the project with a total of €26 million in public funding.

Earlier this year, Denmark joined forces with four other northern European countries - Norway, Belgium, the Netherlands and Sweden - to conclude arrangements on the transport and storage of carbon across borders, which allow for the removal of some of the obstacles on the way to a well-functioning CCS market in the wide North Sea region.

By Nadja Skopljak

GE Vernova is working on downsizing its offshore wind turbine business. Siemens Gamesa is undertaking restructuring which includes ramping up its offshore capacities. Meanwhile, Mingyang Smart Energy is gaining a foothold in the European offshore wind market.

Wind turbine original equipment manufacturers (OEMs) doing business in the offshore arena in Europe and the US have been a company of three for a while now. US-based GE Vernova, Danish Vestas and German-Spanish Siemens Gamesa have had their technology installed on numerous offshore wind farms and ordered for new projects worldwide, predominantly in Europe and the US.

However, in Europe, this landscape seems to change, at least to some extent, as Chinese Mingyang Smart Energy could set up shop in Italy and has already secured its second offshore wind order. In the US, GE Vernova’s recent move to slim down its offshore wind business is

raising questions about its technology being part of future offshore wind farms.

These come as Siemens Gamesa has been working to bring its business back to profitability after experiencing notso-great results over the past few years and its owner, Siemens Energy, is now implementing a restructuring plan.

How all this might affect the offshore wind industry and the wind turbine market, especially that in Europe, is yet to be seen. But after around a decade of having GE, Vestas and/or Siemens Gamesa as the go-to suppliers, it is expected that the market will see a slight change in dynamics at the least.

GE Vernova

On September 19, GE Vernova filed a proposal to its European Works Council related to changes the company plans to implement in its offshore wind business globally, which could affect 900 jobs.

According to a company source, GE Vernova will support the potentially impacted employees over the next several months. “We will do everything we can to help everyone in their potential transition inside or outside GE.”

A GE Vernova spokesperson said the proposal reflected industry-wide challenges in wind energy and that the company aims to transform its offshore wind

business “into a smaller, leaner and more profitable business within GE Vernova”.

The move comes amid inflation and global supply chain challenges, as well as lower-than-expected volume associated with delays to GE Vernova’s key projects, according to a source from the company. With the decision to make cuts to its offshore wind business, the company aims to return it to profitability and integrate within its Wind Segment, which is said to be consistent with GE Vernova Wind businesses’ turnaround strategy.

The US-based wind turbine manufacturer has seen more than one setback in the installation of its Haliade-X wind turbines on projects currently under construction over the past few months, all related to issues with blades. First, a blade event occurred at the Dogger Bank Wind Farm in the UK in May 2024,

which was found to have been caused by an installation error. Then, some two months later, a blade on a Haliade-X wind turbine installed at Vineyard Wind 1 in Massachusetts was damaged, with a section breaking off and falling into the sea. This was determined to have happened due to a manufacturing deviation.

In August 2024, another blade failure was reported at Dogger Bank Wind Farm, this time on an installed wind turbine. According to a press release from GE Vernova, the company conducted an analysis and found that this failure was not caused by an installation or manufacturing issue but happened during the commissioning process.

There were also setbacks in new offshore wind projects in the US with GE Vernova playing a part as the company decided not to move forward with the plan to roll out an 18 MW offshore wind turbine. In March 2023, GE Vernova’s CEO revealed the company was developing a Haliade-X offshore wind turbine with a capacity of between 17 MW and 18 MW.

At the end of last year, the planned wind turbine model was listed in plans for a new project in Japan. RWE, which secured a site in Niigata Prefecture in the country’s second round of offshore wind auctions together with partners Mitsui & Co. and Osaka Gas, included 38 Haliade-X turbines with a capacity of 18 MW per unit in its plans for a 684 MW offshore wind farm.

The news about GE Vernova dropping the plan for a 17-18 MW wind turbine emerged in April.

The New York State Energy Research and Development Authority (NYSERDA)

cancelled three offshore wind projects which it selected earlier, citing complexities between provisional awardees and their partners. NYSERDA said that GE Vernova’s offshore wind turbine product pivoting away from the initially proposed 18 MW Haliade-X turbine platform to a 15.5/16.5 MW platform caused material changes to the projects.

Two of the three developers resubmitted their proposals in the offshore wind solicitation New York that opened in July. Also in July, GE Vernova announced plans to install a prototype of its 15.5 MW Haliade-X offshore wind turbine in Gulen, Norway, following an approximately €29 million funding approval from Enova, a Norwegian government-backed agency. GE Vernova’s most powerful Haliade-X offshore wind turbine currently on the market has an output of 14.7 MW.

Siemens Gamesa

In the results for the second quarter (Q2) of Siemens Gamesa’s fiscal year, published in May 2024, Siemens Energy, said that orders were “sharply down from a strong prior year quarter as expected”.

A temporary interruption impacted sales activities for the 4.X and 5.X onshore wind turbines and the offshore and service businesses did not receive any large orders when compared to the same quarter of 2023 which included a €1.7 billion order in the UK, Siemens Energy stated.

The company also posted a negative profit Before Special Items again and said the increased loss year-over-year was mainly volume-driven.

“Profit continued to be impacted by project margins burdened by higher

planned costs due to the known quality issues as well as the increased product costs and ramp-up challenges in the offshore area in the prior fiscal year,” Siemens Energy said in the Q2 results for Siemens Gamesa.

Together with posting Q2 results, Siemens Energy announced it would start implementing a multi-year restructuring plan for Siemens Gamesa that, among other things, contains the concrete strategic goal of increasing the production capacities in the offshore business area.

The restructuring comes after the full takeover by Siemens Energy in 2023 and the subsequent integration into the Group as well as Siemens Gamesa’s notso-good results over the last few years.

Ramping up production

Siemens Energy first announced the ramp-up in Siemens Gamesa’s production capacity at its existing factories at its third Capital Market Day in Hamburg, Germany, in November 2023.

In May, Siemens Gamesa has initiated comprehensive measures for the operational restructuring of the company.

The goal is for the wind turbine manufacturer to achieve break-even by 2026 and return to profitable growth. As part of the long-term strategic development plan, the company will also streamline its onshore business.

“The most important task in the offshore area is the ramp-up of capacities, which is currently running as planned at the sites in Cuxhaven (Germany), Aalborg (Denmark) and Le Havre (France)”, Siemens Energy said on 8 May. At the beginning of this year, Siemens Gamesa rolled out the first 14 MW wind turbine nacelles at its Cuxhaven plant as part of the order for the Moray West offshore wind farm in Scotland.

This October, RWE unveiled the first 108-meter turbine blade produced at the Siemens Gamesa factory in Hull, which will be installed at the 1.4 GW Sofia offshore wind farm in the UK. Each of the project’s 100 wind turbines of the SG 14-222 DD model will have 108-metre-long blades with 44 units equipped with recyclable blades.

Siemens Gamesa has also developed a more powerful iteration of the turbine,

SG 14-236 DD turbine, whose prototype is installed at a test center in Denmark. The new model, featuring 115-meter blades, can reach a capacity of up to 15 MW with the company’s Power Boost feature.

In January this year, it was reported that Siemens Gamesa would install and test the “world’s most powerful offshore wind turbine prototype” at the test center in Denmark, before starting full-scale production of its “next-generation” offshore wind turbine model later. The rating of the new turbine was not disclosed but it is expected to be higher than 15 MW which the company is currently testing.

In 2021, Mingyang Smart Energy delivered wind turbines for the Taranto offshore wind farm (also known as Beleolico) in Italy, marking the first time a Chinese OEM supplied turbines for the European offshore wind market.

The project, which is Italy’s first offshore wind farm and the first in Mediterranean waters, was built by the Italian company Renexia – which has chosen Mingyang’s

technology for its new offshore wind project as well.

The developer plans to use Mingyang’s 18.8 MW wind turbines for the 2.8 GW Med Wind project off Sicily, said to become the largest floating offshore wind farm in the Mediterranean. Renexia said it chose the Chinese wind turbine manufacturer as the company can ensure delivery by the first half of 2026, the time by which the developer plans to start installation work on the first phase of the four-phased floating wind project.

The project developer and Mingyang Smart Energy have signed a memorandum of understanding (MOU) with the Ministry of Enterprises and Made in Italy (MIMIT) that will see the Chinese OEM producing wind turbines in Italy. The agreement includes a € 500 million investment to establish a new company that will manage the production of wind turbines in Italy and initially focus on producing key components for the Med Wind project. In August, the developer said the new company, established jointly by Mingyang and Renexia, would identify a suitable area for the manufacturing site, in agreement with the government, within 90 days.

“The partnership signed today will enable us to create a value chain that also

involves domestic companies, in floating offshore wind power industry, within our borders”, said Riccardo Toto, General Manager at Renexia, a Toto Group company operating in the renewables sector.

Mingyang, which entered the European offshore wind market with the Taranto offshore wind farm in Italy, has been actively expanding its footprint in Europe since. In December 2021, the company signed a Memorandum of Understanding (MoU) with the UK Department for International Trade (DIT) to cooperate on bringing its investment plans for the UK’s offshore wind sector to realization. The agreement focused on Mingyang investing in a blade manufacturing factory, a service center and potentially a turbine assembly factory in the UK.

On 13 July 2022, the company started trading on the London Stock Exchange (LSE) and said the proceeds from the offering to be used to expand its overseas business and to scale up the production of renewable energy infrastructure.

Mingyang has also widened its technology’s reach in Europe beyond Italy as in July this year, the Chinese OEM was named the preferred supplier for a 296 MW offshore wind project in Germany, for which the developer, German clean

energy asset manager Luxcara, plans to use its 18.5 MW turbines.

Another German offshore wind developer, and one of the biggest in the world, RWE, could also be eyeing Mingyang’s technology. Namely, RWE’s Offshore Wind CEO, Sven Utermöhlen, shared on social media this summer that RWE visited Mingyang’s facilities in China, including the factories, research centre, and the OceanX floating prototype that the OEM will soon install offshore.

Mingyang was the first to announce a 16 MW offshore wind turbine. Back in August 2021, the company launched the MySE 16.0-242, saying this was the world’s largest hybrid drive wind turbine with a nameplate capacity of 16 MW.

Since then, the Chinese company has made strides in single unit capacity. In August this year, Mingyang installed a 20 MW wind turbine prototype for testing on land. The same month, the company started installing its OceanX platform offshore, a dual-turbine V-shaped platform with a generation capacity of 16.6 MW, featuring two 8.3 MW wind turbines, which makes it the world’s largest single-capacity floating wind platform, according to Mingyang.

By Adrijana Buljan

Significant investments in green transition are needed for European shipping to remain competitive, a new report found.

The report by Mario Draghi - former European Central Bank President and one of “Europe’s great economic minds” - delivered recommendations to enhance the competitiveness of the European economy.

“The future of European competiti–veness” paper acknowledged the global leadership of European shipping and identified that a fitfor-purpose regulatory and taxation framework has ensured that the sector has remained globally competitive.

The report also recognized that shipping together with aviation, are the most difficult sectors to decarbonize.

Investment needs for shipping alone will be around €40 billion each year from 2031 to 2050. Scaling up the production of clean fuels and clean and innovative technologies in Europe is set as a major objective.

In this regard, the report identified the need for adequate access to finance, including special calls for shipping under the ETS Innovation Fund.

“The Draghi report firmly recognises the global leadership role of European shipping and the need to maintain its international competitiveness. European shipping is a success story and a cornerstone of the energy, food and supply chain security of our continent. In these times of geopolitical uncertainty, it is crucial for Europe to maintain and grow the EU-operated fleet, which ensures Europe’s position

in the global supply chains as well as access to key international markets,” Sotiris Raptis, Secretary General of European Community Shipowners’ Association (ECSA), said.

“An internationally competitive shipping sector is also a prerequisite for a thriving European maritime industrial cluster, which must be part of the upcoming EU Clean Industrial Deal. It is crucial to focus investments into European industrial capacity for clean fuels and innovative technologies for shipping, to deliver on our climate

objectives and to enhance European competitiveness and security,” he added.

Upskilling and reskilling needs for the green and digital transition were also highlighted. The report estimated that up to 250,000 seafarers in the EU could be affected in the coming years, with the figure going up to 800,000 seafarers globally that will have to be reskilled in the next decade.

Competition is fierce

The report is said to be an important

reminder of the challenges Europe faces in global competition, including within the shipping sector.

In recent decades, although European shipping has grown, Europe has been gradually squeezed by both the US and China: Europe’s share of the global merchant fleet has declined, while China has gained a significant market share. Nevertheless, European shipping is highlighted as a considerable strength, with over 35% of the world’s fleet under the European flag.

“European shipping continues to grow, but others are growing faster. Therefore, we must constantly optimise our competitiveness and focus on innovation,” Jacob K. Clasen, Deputy CEO of Danish Shipping, commented.

“The Draghi Report points to the right areas, and we wholeheartedly support strengthening the framework for European shipping companies, with green transition being part of our competitiveness.”

The report noted that the EU’s decarbonization goals are also more ambitious than its competitors’, creating additional short-term costs for European industry.

The EU has put in place binding legislation to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. The US, by contrast, has set a non-binding target of a 50-52% reduction below (higher) 2005 levels by 2030, while China only aims for its carbon emissions to peak by the end of the decade. These differences seem to create massive

'Investment needs for shipping decarbonization will be around €40 billion each year from 2031 to 2050'

near-term investment needs for EU companies that their competitors do not face.

The EU is also the only major region worldwide to have introduced a significant CO2 price. This cost factor is of limited importance so far as heavy industrial production has been largely covered by free allowances under the Emissions Trading Scheme (ETS). However, these allowances will be progressively phased out with the introduction of the Carbon Border Adjustment Mechanism (CBAM).

Need for large investments in green transition

The report stressed the importance of expanding green energy and producing green fuels for the shipping sector. Trade association Danish Shipping has urged the EU to earmark funds for this transition and to simplify bureaucracy.

“A strong European competitiveness also requires shorter decision-making processes and a proactive approach to global climate agreements, particularly through the International

Maritime Organisation (IMO),” Jacob K. Clasen continued.

As already mentioned, there is also a focus on the future of the workforce, as new skills and education are needed in the shipping sector to meet the digital and green transformation.

“We must strengthen the talent pipeline and ensure that the necessary skills are in place for the future of the shipping sector,” concluded Clasen.

By Naida Hakirevic Prevljak

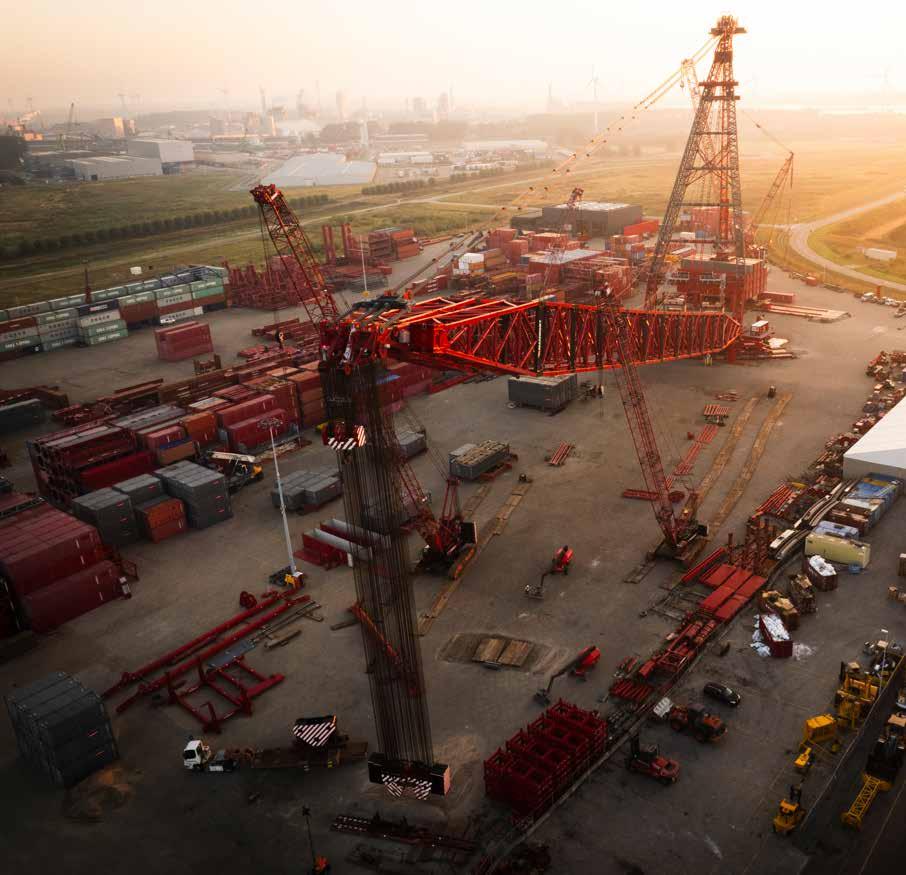

Things in the offshore wind industry continue to move at high speed. Only around four years since the first 10 MW wind turbines were installed offshore, a 20 MW model hit the onshore test site this August. The same month, a 26 MW turbine-ready vessel was delivered to its owner and a crane capable of lifting components of up to 3,000 tons was launched.

20 MW wind turbine

In December 2023, Mingyang Smart Energy produced a nacelle for MySE 18.X20 MW wind turbine at its Shanwei manufacturing base in China and said this was the world’s largest single-capacity offshore wind turbine, with a rotor diameter of 260-292 meters.

The gigantic wind turbine was installed this summer at an onshore site in Hain-

an, where it will undergo testing and demonstration.

The new model build upon the company’s previous 14-16 MW platforms and, according to the Chinese wind turbine manufacturer, is of a modular and lightweight design that provides high efficiency and reliability. Mingyang said the new model was designed for global deployment in medium-to-high wind

speed regions, with specific suitability for typhoon-prone sites. According to the company, the MySE 18.X-20 MW is equipped with active anti-typhoon technology and can withstand winds of up to 79.8 m/s. With an average wind speed of 8.5 m/s, the wind turbine can generate 80 million kWh annually, offsetting 66,000 tons of CO2 emissions, equivalent to the annual consumption of 96,000 households, Mingyang says.

The company’s 18.X MW wind turbine has already been chosen for two projects in Europe, the 296 MW Waterkant offshore wind farm in Germany (18.5 MW) and the 2.8 GW Med Wind floating wind project in Italy (18.8 MW).

The Chinese manufacturer also recently installed its OceanX floating wind platform at the Qingzhou IV offshore wind farm in Yangjiang. The floater has a V shape design that features two MySE8.3180 hybrid drive wind turbines, each with a capacity of 8.3 MW. Mingyang says that this is the world’s largest single-capacity floating wind platform, having a total generation capacity of 16.6 MW.

26 MW turbine vessel

Also in China, a jack-up wind turbine installation vessel (WTIV) was delivered to the port city of Qingdao in August. Named Gang Hang Ping 5 and manufactured by Tianjin Changer Engineering, a subsidiary of Tianjin Port Group, the vessel is said to be capable of installing 26 MW wind turbines. Gang Hang Ping 5 can simultaneously carry two sets of 20 MW wind turbines. The 29,000-ton vessel is 135 meters long and 50 meters wide, and with 135-meter legs on its jacking system, it can lift over 200 meters above water.

The WTIV, which can operate in water depths of over 70 meters, has a lifting capacity of 1,800 tons and an elevating height above the deck of 168 meters. According to Tianjin Port Group, Gang Hang Ping 5 is also the first wind turbine installation vessel in China equipped with an intelligent ship system.

The system enables route and speed design and optimization, intelligent energy efficiency management, and an intelligent integration platform. With the systems for monitoring and intelligent management, the vessel could have an approximately 20 per cent higher efficiency for wind turbine installations, Tianjin Port Group says. Gang Hang Ping 5 is also equipped with a wind-solar complementary green energy system, which can provide sufficient electricity for onboard power needs. Earlier in 2024, South Korea’s Daewoo Engineering & Construction (Daewoo E&C) and CCCC Tianjin Dredging China signed an agreement for the use of the vessel for five years.

In the Netherlands, the offshore wind supply chain is also all in on keeping up with the pace of the ever-growing offshore wind turbine components. Mammoet ended August with a bang as the company launched what it says is the

world’s strongest land-based crane at its Westdorpe facility in the Netherlands.

The new crane, SK6000, has a maximum capacity of 6,000 tons and can lift components of up to 3,000 tons to a height of 220 meters. The crane also offers full electric power capability from a battery or supply from the grid, allowing customers to reduce the carbon impact of projects, Mammoet said.

The crane is currently undergoing testing in Westdorpe and will be ready for deployment to its first project later in the year. According to Mammoet, in offshore wind, the SK6000 supports the continued constructability of next-generation wind turbines and foundations. “In the oil and gas sector, the SK6000 delivers reduced integration times to offshore floating projects, while onshore new build and expansion projects can be delivered with increased uptime”, the company said on 30 August.

A few days after Mammoet launched its new crane, Dutch wind turbine foundation supplier, Sif, said the company launched the first production line in its expanded factory at the Maasvlakte 2 site in Rotterdam, with the first plates already welded and rolled.

The upgraded manufacturing plant is expected to significantly increase Sif’s total combined production capacity to 500 kilotons per year and enable manufacturing the equivalent of 200 XXXL monopiles with a diameter of 11 meters and weighing 2,500 tons.

The company made the final investment decision (FID) to build the extension to its factory in February 2023, allocating € 328 million for the project, which Sif says will make its Maasvlakte facilities the world’s largest monopile foundation manufacturing plant.

By Adrijana Buljan

To achieve 2050 decarbonization goals and make the pace of the global energy transition even, advanced economies would need to deepen their engagement with developing countries. Among other things, this could be achieved with the creation of green shipping corridors between the Global South and the Global North. Renewable hydrogen is believed to be a sector that could play a key role in this.

Green corridors are maritime routes on which there are commercially operating ships using alternative fuels. By implementing the concept of these corridors, countries in the Global South could be supplying green fuels to the countries of the Global North.

As defined by the United Nations Conference on Trade and Development (UNCTAD), the Global South broadly comprises Africa, Latin America and the Caribbean, Asia (excluding Israel, Japan and South Korea) and Oceania (excluding Australia and New Zealand).

Besides green corridors, other parts of the value chain are considered. Through its Global Gateway initiative, the European Union (EU) aims to promote investments in critical infrastructure, including transport and port facilities in the Global South, with hydrogen sector said to be in spotlight.

In September 2024, the EU committed R628 million (approximately €32 million) in grants to promote the sustainable development of green

hydrogen value chains in South Africa. The European Commissioner for Energy Kadri Simson, South Africa’s Minister for Electricity and Energy Kgosientsho Ramokgopa and Minister of the Department of Trade, Industry and Competition Parks Tau announced two grants amounting to approximately €32 million.

The first, an R490 million (approximately €25 million) EU grant, is expected to leverage R10 billion (approximately €505 million) in private and public sector finance across the hydrogen value chain,

covering production, transportation, storage and downstream industries.

Through the development of sustainable green hydrogen value chains, the EU’s contribution is aimed at increasing local value addition and, thereby, supporting South Africa to move up higher in these value chains. Furthermore, the contribution is expected to support efforts toward the creation of a regional green hydrogen hub in the Southern Africa region.

The second EU grant of R138 million (approximately €6.9 million) to assist Transnet in its green hydrogen project, is expected to leverage additional funding for the green transformation of Transnet’s core operational areas, including ports, rail, pipeline, engineering and related facilities.

The AFD-Transnet Green Hydrogen project will support activities related in particular to executing studies (market, legal and feasibility studies as well as impact assessments) and pilot projects focused on the production and storage of low-carbon hydrogen. Moreover, it will back activities related to mobilizing technical assistance to structure Transnet’s green hydrogen strategy and allow for the scaling up of green hydrogen projects in South Africa.

Commissioner Simson commented: “Our cooperation in support of South Africa’s green hydrogen agenda aims to accelerate the green transition, drive sustainable development, create new economic opportunities, and build a more sustainable future for the region.”

EU and Uruguay to strengthen energy cooperation, hydrogen in focus

In September, Simson also visited the South American country Uruguay. The visit is said to be a part of the implementation of the commitments made as part of the EU-Uruguay memorandum of understanding (MoU) on renewable energy, energy efficiency and renewable hydrogen, which was signed in Brussels, Belgium, in 2023.

The commissioner’s agenda, among other activities, included participating in the fifth European Investment Forum on energy, as well as co-chairing the fourth EU-Uruguay Energy Dialogue with Uruguay’s Minister of Industry, Energy and Mining Elisa Facio to discuss the implementation of the MoU, with a particular focus on green hydrogen and energy efficiency.

During the forum, Simson reflected on the EU’s energy achievements,

mentioning green hydrogen as a “technology with enormous potential to decarbonise key polluting sectors.”

The commissioner also noted that many European countries already estimate they will need more hydrogen or e-fuels than they can produce, adding:

“Europe has a strategic interest in developing a global trade in hydrogen and renewable fuels. Imported hydrogen and e-fuels at accessible prices will help Europe’s competitiveness and European industry to achieve their decarbonisation targets, in particular in transport and steel production. This creates great complementarity with partner countries with strong renewables potential and interested in creating trade corridors, like Uruguay.”

“Europe is one of the world’s largest energy importers. So we want to leverage this to support our partners around the world in their economic and green transitions, to become producers of clean energy and sustainable fuels. Latin America, and particularly Uruguay, is a strategic ally and a key partner in this effort. Uruguay stands poised to become a leading green producer of hydrogen and its derivatives, such as e-fuels, e-methane and ammonia.”

Renewable hydrogen sector’s role in global energy trade

The International Renewable Energy Agency (IRENA) found that the renewable hydrogen sector could play a crucial role in reshaping global energy trade, creating opportunities for new players, including developing countries.

According to the report “Shaping sustainable international hydrogen value chains,” low-carbon hydrogen is

key to achieving the goal of reaching net-zero emissions by 2050, but the techno-economic potential to produce low-cost, low-carbon hydrogen is not evenly distributed globally.

“The regions with the potential to produce it may not align with those that will have high future demand. This could lead to the creation of a new global market that not only trades low-carbon hydrogen but also its derivatives. This may reshape global energy trade and create opportunities for new players, including developing countries,” IRENA said.

From an economic standpoint, the report found that the cost-effective production of renewable hydrogen and its derivatives relies on access to cheap renewable energy, as well as access to water and land resources. Future market developments are expected to be “significantly” influenced by regulations and incentive schemes aimed at promoting global hydrogen production.

From a governance and strategysetting perspective, there have been “significant” developments, IRENA stated, noting that the G7 members, as future major hydrogen demand hubs, have been very active in hydrogen policy-making. Additionally, more and

more countries, including developing countries, are moving forward with strategy launches and policy developments. However, compared to G7 members, many developing countries have limited budgets and project developers face high financing costs. Consequently, their strategies often focus on creating a businessfriendly environment through enabling policies, IRENA pointed out.

It is also worth mentioning that countries in the Global South have acknowledged the predicted import demand noted in the national hydrogen strategies of the Global North and have taken an exportoriented approach to address these markets. For this approach to be successful, however, the projected growth of the global hydrogen market will need to materialize as anticipated, IRENA claimed.

In terms of environmental impact, renewable hydrogen is said to emit, on average or typically, less GHG than blue hydrogen over its lifecycle. At the same time, when considering hydrogen production for export, IRENA noted that it is crucial to address the potential for any environmental burdens being transferred to developing countries, if such an offloading of adverse impacts is to be prevented.

When it comes to long-distance transportation of renewable hydrogen and derived products, different carrier options exist, with varying infrastructure requirements and technical considerations. According to IRENA, most likely, there will be a multi-carrier future.

The report also found that social acceptance and community involvement play crucial roles in the successful implementation of new energy technologies, particularly in the context of large-scale infrastructure development.

“By promoting local industrial development, the co-benefits of renewable hydrogen production can be increased. Developing countries could create more sustainable jobs, add long-term value and improve their international competitiveness. They could also reduce the risks associated with the global hydrogen trade by participating in both the upstream and downstream activities of renewable hydrogen production. Therefore, it will be necessary to adopt a comprehensive industrial development policy to address the complexities of this changing landscape in a fair and equitable manner,” IRENA concluded.

By Aida Čučuk

For over 75 years already, REINTJES Benelux –based in Antwerp – handles sales and services of REINTJES gearboxes and reversing gears for Dutch shipping for short-sea, sea going, dredging, fishery, inland vessels and luxurious yachts.

Our service department is available for all spare parts as well as repairs. Whether it is an inspection or repair, our team of experienced service engineers is always there for you and assures you the reliability and quality REINTJES represents.

2x ZWVSA 440 U 1081 kW @ 2000 rpm

|

Haven 2 | Unit F | 2030

Tel +32 (0)3 541 92 33 | www.reintjes-gears.com

MF Estelle, the ‘world’s first’ autonomous electric ferry, has completed its journey between two major islands in central Stockholm, demonstrating the potential for unmanned, sustainable transport, the RISE Research Institutes of Sweden has unveiled.

MF Estelle’s trial in Stockholm

Designed and built by Norway’s ferry builder Brødrene Aa, MF Estelle was launched in June 2023, since when it has been fully-operational.

During a recent trial, the ferry was operated remotely from Trondheim, Norway-600 kilometers away from Stockholm. The demonstration was reportedly performed from the island of Kungsholmen, where the Stockholm city hall is located, across Lake Mälaren to Stockholm’s biggest island, Södermalm.

“We wanted to test whether the ferry could cross a large bay in central Stockholm and dock on the other side all by itself, after just a push of a button 600 kilometers away in Norway. The trial was the first ever of its kind and showed that it is possible. In this way, we can learn togeth-

er and create a market for smart ships,” Håkan Burden, senior researcher at RISE Research Institutes of Sweden, remarked.

The ‘sustainable’ design and features of MF Estelle

The 12-meter-long MF Estelle-owned by Norway’s transportation company Torghatten Midt-is described as a vessel built with ‘sustainability at its core.’

The ferry is a catamaran, meaning it is ‘energy efficient by design’. It was engineered in carbon fiber at Brødrene Aa’s main shipyard in Hyen, on the west coast of Norway, which helps it reduce its weight and thus optimize energy usage.

Furthermore, it was fitted with an autonomous navigation system that was developed by the Norwegian University of Science and Technology, and a

propulsion system driven by electricity supplied via onboard solar panels. In the beginning, it is said that there will be an operator on board MF Estelle, but over time, there are plans to ensure the ferry will be completely self-driving and monitored from land. A radar, lidar, cameras, ultrasonic sensors, AI, and GPS were installed in the ferry to help it navigate through the water by scanning the environment.

The minds behind the initiative Norway’s ferry operator Torgatten along with compatriot autonomous solutions supplier Zeabuz are said to be behind the mobility concept in Stockholm - a city that has long been pushing for new autonomous solutions within its infrastructure-behind ‘Zeam’ (which stands for ‘zero emission autonomous solution’), and the 5G- and IoT-powered MF Estelle.

“We aim to change the way we think about mobility by creating shortcuts in cities, utilizing urban waterways as virtual bridges. Our collaboration with Torghatten seeks to connect communities affordably and sustainably, not only in Stockholm but in the large number of cities with navigable waters worldwide,” commented Erik Dyrkoren, CEO of Zeabuz.

As disclosed, at present, remote monitoring of MF Estelle is a one-way communication-from the ferry to the company. However, there are plans to enable two-way communication, for which 5G would be ‘vital’. To this end, Zeabuz revealed that the company would work with the Swedish mobile network provider Tele2.

According to a statement from the company, Zeabuz has been running a mobility research project since early 2023, and has been an active participant of the Boatplan Stockholm iniative that aims to convert all ferry traffic in the city archipelago to ‘100% emission-free operation’, with electricity or hydrogen as fuel.

In August 2024, neighboring Norway expressed interest in autonomous vessels, too. Specifically, the country’s Haugesund municipality signed a letter of intent late that month with Zeabuz, Torghatten and zero-emission solutions supplier SEAM for an emissions-free autonomous city boat. The plan is to initiate the boat’s route and test the technology starting in the autumn of 2025.

Zeabuz has also worked together with Transportstyrelsen (the Swedish Transport Agency), which was responsible for the final approval of the autonomous technology behind MF Estelle.

Moreover, together with Torghatten, the RISE Research Institutes of Sweden, Norway’s classification society DNV, the Ports of Stockholm, and sustainable urban waterway transport company Vattenbussen, Zeabuz is part of the Policy Lab Urban Zjöfart (PLUZ) project, financed by the Swedish Transport Administration’s maritime portfolio.

RISE has highlighted that this project has the goal of contributing to international policy work within the International Maritime Organization (IMO) and the EU Maritime Safety Agency (EMSA). The results of the project are hoped to pave the way for new conditions for eco-friendly mobility (and automation) services.

Now that MF Estelle is up and sailing, the team behind the electric ferry is looking into broader applications of autonomous technology. Reflecting on the 18-ton ferry’s maiden voyage, Brødrene Aa has stated that the development and production of MF Estelle was ‘a journey of great learning.’

“Cooperations like these keeps us staying one step ahead when it comes to technological innovations. Hopefully it can show prospective partners how the future on seas could look like,” Brødrene Aa concluded.

By Sara Kosmajac

The maritime industry is inching closer to achieving a sustainable transition to zerocarbon fuels, thanks to improvements in ship readiness and fuel handling technologies, as detailed in Lloyd’s Register’s (LR) Maritime Decarbonization Hub’s latest Zero Carbon Fuel Monitor (ZCFM) report.

As disclosed in the update, LR’s Maritime Decarbonization Hub discovered ‘significant advancements’ in the handling, storage and utilization of alternative fuels onboard vessels that are driving the industry’s transition to zero or near-zero carbon emissions.

More precisely, the newest ZCFM reflected on the final stage of the fuel

supply chain – the ship – and explored the current global fleet’s readiness for sustainable fuels like ammonia, hydrogen, methanol and biofuels (fatty acid methyl esters, or FAME, and hydrotreated vegetable oil, or HVO).

Technology preparedness levels for all reviewed fuels have ballooned over the past year. Simultaneously, the report

indicated an uptick in commercial trials and applications aimed at boosting the investment readiness levels (IRLs) within the vessel supply chain stage.

Moreover, community readiness levels (CRLs) have, too, been on an upward trajectory, which the report attributed to an ‘increasing awareness’ of the urgency to meet the International

Maritime Organization’s (IMO) 2030 interim target of achieving 5% vessels running on low-to-zero carbon fuels.

Ammonia

LR highlighted ‘considerable’ progress in ammonia fuel technology. According to LR, there were 31 ammonia-capable and over 400 ammonia-ready vessels in the existing fleet and on order, with the majority of the ammonia-capable ships being gas and bulk carriers.

In April 2024, Spanish hydrogen transport solutions provider H2SITE was greenlit by LR via approval in principle

(AiP) for its AMMONIA to H2POWER technology for onboard ammonia cracking.

As explained, after the process, the resulting hydrogen can further be used by hydrogen fuel cells that can add to the vessels’ electrical power. Alternatively, the hydrogen could be consumed directly in an internal combustion engine (ICE).

On the other side of the world, Japan’s ‘Sakigake’ tugboat was successfully converted to an ammonia-fuelled vessel in late August 2024, through the efforts of shipping giant Nippon Yusei Kabushiki Kaisha (NYK) and compatriot IHI Power Systems in collaboration with the classification society ClassNK.

Part of a Green Innovation Fund Project initiated in October 2021 under Japan’s New Energy and Industrial Technology Development Organization (NEDO), the tugboat will reportedly operate in Tokyo Bay for a 3-month demonstration period.

Hydrogen is highlighted as having 78 vessels capable of using the fuel in LR’s update, primarily in coastal and shortsea shipping. The overall readiness, if it were assessed for larger types of ships only (e.g. an ocean-going boxship) would be lower, the report suggested, ascribing this to the effect that the ‘practicalities’ of these solutions for large ships could affect their operating patterns or cargo carrying capacity.

Nonetheless, over the past years, there have been numerous developments in the realm of hydrogen. In late 2023, LR

gave the go-ahead to BeHydro, a joint venture between CMB.TECH and Anglo Belgian Corporation (ABC), via a type approval for its hydrogen-powered dual-fuel engine that has the potential to cut CO2 emissions ‘by up to 85%’.

That same year, H2 Barge 1, a second inland containership converted to run on hydrogen by Dutch shipbuilder Holland Shipyards Group for compatriot shipowner Future Proof Shipping (FPS), was launched. This vessel is estimated to lower GHG emissions by 2,000 tons of CO2 annually.

The trial for H2 Barge 2 was completed in March 2024, with projections it could decrease GHG emissions by 3,000 tons of CO2 per year.

LR’s report revealed that methanol-driven technology is currently deployed on 315 ‘methanol-capable’ ships with around 500 more classed as ‘methanol-ready’.

According to a white paper by the Methanol Institute, two crucial frameworks, namely the EU Emissions Trading Scheme (EU ETS) and FuelEU Maritime, could help the maritime industry adopt alternative fuels like methanol ‘faster’ and get much closer to the net zero by 2050 target.

To be precise, the rising costs of non-compliance with FuelEU’s GHG intensity reduction targets paired with the gradual phase-in of EU ETS, have led to bio- and e-methanol, in particular, becoming a ‘compelling’ solution by helping ship operators avoid the rising penalties.

In May 2024, LR and Swedish ferry company Stena Line joined forces to work on a retrofit project on two fast roll-on/roll-off (RoRo) vessels with methanol propulsion. As LR’s latest update reiterated, these ships are set to be dual-fuelled, building on the conversion to methanol of the Stena Germanica in 2015.

Biofuels

LR stated that there are a number of vessels presently running on B100 fatty acid methyl esters, which are 100% biodiesel and considered near net zero if the carbon released during vessel operation is ‘sufficiently offset’ by the carbon absorbed by the fuel production resources.

Since biodiesel is considered a drop-in fuel, meaning little to no modification is needed, the technology and infrastructure investments are minimal and are believed to pose low risk.

A notable development from this space happened in June 2024 when The Global Center for Maritime Decarbonization (GCMD) and Japanese shipping titan NYK Line wrapped up the ‘first-ever’ bunkering of a biofuel blend (FAME + VLSFO) on NYK’s short-sea vehicle carrier.

On the other hand, HVO—also known as hydro-processed esters and fatty acids or HEFA-is indistinguishable from petroleum gas oil, the report asserts, and, therefore, requires virtually no onboard modifications.

2024 and beyond: an outlook

Although the update acknowledged progress, it also pointed out the areas in need of more development and investment in order to sail to a greener future more efficiently.

One such area is the issue of safety protocols, which the report believes

need additional improvements. Another would be crew training for the handling of alternative fuels as well as the challenges related to investment because of supply chain uncertainties, including but not limited to fuel availability and regulatory frameworks.

In this context, the report proposed that a policy intervention to unlock the economic feasibility of investing in cleaner fuels is necessary to ultimately kick open the door to ‘accelerated technology readiness’.

Governments and regulatory bodies could opt to introduce such incentives and establish a clear regulatory system that mandates or encourages the adoption of zero or near-zero carbon fuels, the report concluded.

By by Sara Kosmajac

The Blue Economy Cooperative Research Centre (CRC) has unveiled a report, led by the University of Western Australia, outlining seven key recommendations to drive the advancement of Australia’s wave energy industry.

According to Blue Economy CRC, wave energy could boost Australia’s AUD 118 billion (approximately $81,4 billion) blue economy, driving opportunities in fabrication, installation, and marine operations.

Australia already has existing elements that are important for wave energy sector development, such as a skilled workforce for offshore infrastructure and renewable industries, Blue Economy CRC said.

However, research institutions like universities and the Commonwealth

Scientific and Industrial Research Organization (CSIRO) add further strength, enabling innovation in the sector. The potential for market expansion includes grid connections and powering remote facilities, particularly in coastal regions that are poised to benefit economically.

Wave energy stands out as a key player in helping Australia meet its net zero targets, said Blue Energy CRC. With the country aiming to slash emissions by 43% by 2030 and hit an 82% renewable electricity share, the inclusion of wave energy in its energy

mix could address the growing demand for dispatchable power.

The National Electricity Market (NEM) forecasts show significant growth in renewable capacity by 2050, yet a gap in consistent power supply remains – a gap that wave energy could potentially fill.

The report calls for a strategic approach to wave energy, emphasizing its potential as a critical resource for Australia, outlining seven key recommendations to advance the sector, including incorporation into national and state planning, evaluation by

the Australian Energy Market Operator, inclusion in sustainable ocean plan, consistent funding, coastal protection guidelines, data sharing, and climate analysis.

Background of seven key recommendations

The overarching recommendation of this report, according to the Blue Energy CRC, is: “Federal and State Governments in Australia should take a strategic view of the wave energy industry in order to achieve the maximum national benefit from this potentially critical national resource.”

However, there are a few other themes that the development of wave energy in Australia should cover, according to the report.

1. Incorporation into national and state planning

Federal and State governments must integrate wave energy into planning strategies. The Australian Renewable Energy Agency (ARENA) should fund a study to assess the national benefits of the wave energy industry, including its role in economic and social development, sovereign capability, and environmental sustainability.

According to the report by Blue Energy CRC, the benefits of alignment with the international momentum in wave energy should be considered together with the Australian alignment with the International Energy Agency Ocean Energy Systems roadmap for 2050. This should also include encouraging longterm investor confidence in the sector.

2. Evaluation by Australian Energy Market Operator

The Australian Energy Market Operator (AEMO) does not consider wave energy currently, and this report says that AEMO should evaluate wave energy in its integrated system plan (ISP) to gauge its potential impact on energy storage needs by 2050.

Evidence from similar markets, like the UK’s EVOLVE study, shows that adding 10 GW of wave energy could save up to AUD 2.76 billion annually by 2040, thanks to reduced storage and generation demands. For Australia, introducing wave energy is expected to cut storage capacity requirements, translating into lower overall costs.

Modeling from three local grids on the south coast shows consistent results, reinforcing the idea that wave energy could deliver dispatchability and cost benefits across Australia’s southern margin. These findings point to a broader potential, suggesting that the systemwide implications of wave energy can only be fully realized through an integrated national approach.

3. Inclusion in sustainable ocean plan

Wave energy should be part of the Sustainable Ocean Plan alongside other renewable sources, Blue Energy CRC notes. This recommendation highlights the importance of collaboration between technology developers, research institutions, and local governments to foster the industry’s growth.

Cross-sector and cross-departmental joint activities could increase impact and benefits through education, R&D,

and business activities. Australia’s rural, regional, remote (RRR) coastal areas could play a significant role in this case.

4. Consistent funding

Wave energy projects at different scales need funding to validate the technology and showcase the national benefits over longer periods of time, noted Blue Energy CRC. Multi-year field demonstrations are crucial for testing long-term dispatchability and assessing environmental impacts.

A “technology push” funding to accelerate wave energy development is a key mechanism, according to the International Energy Agency Ocean Energy Systems roadmap.

5. Coastal protection guidelines

In addition to energy production, wave energy converters (WECs) could offer coastal protection, reducing flood and erosion risks that are expected to worsen with climate change, according to the Blue Economy CRC report.

Controlled wave alteration could shield assets valued at up to AUD 25 billion, though further study is needed to explore the link between wave energy generation and coastal protection.

The report said that coastal protection is usually dealt with by local councils without the needed resources to study the possible benefits of wave energy.

An integrated national study should establish guidelines for using wave energy in coastal protection, enabling councils to make informed decisions on implementing these technologies. This is said to provide benefits in both climate change mitigation and adaptation.

6. Data sharing

Federal and State governments must promote baseline data collection and information sharing across jurisdictions to accelerate industry growth, Blue Energy CRC said. A coordinated environmental research plan would help de-risk wave energy projects and streamline approvals.

The government plays an important role in baseline data collection or mandating sharing from other industries or sources, in order to reduce the burden on project developers.

Cooperation among Australian government agencies, as well as the publication of guidelines and policies, can enhance the science-based assessment,

alignment, and approvals procedures, and incorporation of wave energy into existing marine estate management plans, said Blue Energy CRC.

To reduce the risk associated with the approvals process and promote the sustainable development of the industry, a coordinated strategic environmental research strategy needs to be created.

7. Climate analysis

In order for the developments in the wave energy sector to continue growing, more research on the wave climate is needed. In shallow water regions, where WECs would probably be primarily deployed, high-resolution, long-term wave climate studies are needed to ensure accurate assessments of the resource and inform engineering designs.

According to Blue Energy CRC, the studies should focus on reliable estimates of extreme wave conditions for engineering design (also needed for the offshore wind industry), wave directional characteristics such as wave spreading around the mean propagation direction, and weather windows for sage installation and maintenance.

By Zerina Maksumic

Proven results

■ Reliable protection of equipment

■ >25% less handling & maintenance

■ Up to 30% volume reduction

Properties

■ Extreme load capacity ■ Good pumpabillity in your systems

■ Certified biodegradable & OEM-approved ■ Worldwide available

Would you like to know more?

Ask for the white paper and let’s get in touch!