A special publication of the Bennington Banner and Brattleboro Reformer Thursday, March 27, 2025

91WesternAve,Brattleboro,VT05301 802-254-4414O ice 802-521-5722Fax

Sarah@putnaminsurance.net

Home•Auto•Farm•Life•Business Co-operativeInsuranceCompany·ConcordGroupInsurance ·UnionMutual·LibertyMutual·Safeco·Merchants· AmTrust·Foremost·AIM· eHartford·Progressive· Farmers·VermontMutual

OUROTHERLOCATIONS

CuttsInsuranceAgency

91WesternAve,Brattleboro,VT05301·802-365-7508

PutnamInsuranceAgency

91WesternAve,Brattleboro,VT05301·802-254-4414

WilliamBurnsInsurance

42VTRoute30,Bondville,VT05340·802-297-3944

BurnsInsuranceAgency

1090Route30,Dorset,VT05251·802-362-2442

ShaftsburyInsuranceAgency 102NorthsideDrive,Bennington,VT05201·802-447-3366

Wehse&KinneyInsuranceAgency

455WestStreet,Rutland,VT05702·802-775-4343

RossInsuranceAgency

455WestStreet,Rutland,VT05702·802-775-4477

Wood’sInsuranceAgency

65MainStreet,FairHaven,VT05743·802-265-3640

erhighly skilledcarewithateamapproach, soyourlovedonescanstay comfortableathome.

At VNA & Hospice of the Southwest Region (VNAHSR), we are committed to providing compassionate, high-quality care to patients and families across Bennington, Rutland and Franklin counties here in Vermont. As your trusted, local home health and hospice agency, we offer a wide variety of services designed to help individuals maintain their dignity and independence while aging in place, recovering from illness or injury, or managing end-of-life care. Whether you need short-term support, or ongoing assistance, our team is here to guide you every step of the way.

VNAHSR provides comprehensive home health services that are tailored to meet the unique needs of each patient. Whether you are recovering from surgery, managing a chronic condition, or need support with daily activities, our team is here to help you remain in the comfort of your own home. We offer a range of services, including pediatric nursing and rehab, skilled nursing care, physical, occupational, and speech therapy, wound care, and more. Our expert team works closely with your physician and specialists to develop a personalized care plan that ensures the best possible outcomes for you.

When facing a terminal illness, the right hospice care can make all the difference for both patients and their families. At VNAHSR, we are dedicated to providing compassionate and dignified end-

of-life care. Our hospice team, including a group of wonderful volunteers, offers pain and symptom management, emotional and spiritual support, respite care for family members, assistance with daily activities and more. We understand the physical and emotional challenges that come with end-of-life care, and our team is committed to offering a supportive environment for both patients and their loved ones.

VNAHSR is widely recommended by both patients and caregivers for the exceptional care we provide. Our patients trust us to deliver compassionate care with empathy and respect. We focus on building relationships and ensuring that every person is treated with the highest level of dignity and care. Our staff are trained to respond to the individual needs of each patient, and we are always available to address any concerns or questions.

Choosing a local agency that you can trust is crucial when it comes to home health and hospice care, and we are proud to be your local partner. Our services are highly recommended because of our commitment to personalized, high-quality and compassionate care. With our expertise and dedication, we are here to help you and your loved ones navigate the challenges of healthcare and ensure the best possible quality of life.

For more information about our services, visit our website at www.vermontvisitingnurses.org.

Ful llingourpromisetocareforVeterans, theirspouses,andGoldStarparents.

Clean,spaciousfacilities.Sprawling,open campus.Stimulatingactivityprograms.A deeplyrespectful,caringstaff.

TheVermontVeterans’Homeisanexceptional nursingresidenceandmedicalfacility,offering arangeofservicesinskillednursingcare, rehabilitation,short-termcare,specialized dementia,palliativecare,easternapproaches, andreligioussupport.

Weareanexemplaryplacetoseekthe supportyouneed,ratedbest-in-classbythe Federal Government’scomparison website.

Pleasecometakeatourofourcampus.Visit us atvvh.vermont.gov.

VERMONTVETERANS’HOME 325NorthStreet,Bennington,VT 802.442.6353|VVH.VERMONT.GOV

Freedom is often cited as a benefit of retirement. Many professionals look forward to the day when they retire and have more free time and the freedom to spend that time however they choose. Of course, the opportunity to spend retirement how one sees fit typically requires considerable financial freedom.

Financial planning for retirement is often emphasized to young professionals beginning their careers. But it’s equally important that people on the cusp of retirement continue to look for ways to protect and grow their wealth. As retirement draws near, professionals can consider these strategies to ensure they have the financial freedom to make their golden years shine even brighter.

• Plan to grow your wealth in retirement. It’s widely assumed that retirees need less income after calling it a career because the need to save for retirement is no longer present. However, some expenses, including health care, may rise

in retirement, which underscores the need to continue growing your wealth. Cost-of-living also will increase over the course of your retirement years, which highlights the need to keep growing wealth in retirement. It can be tricky to protect your existing retirement savings as you approach the end of your career while also growing that wealth, so it is best to work with a financial planner to navigate that situation.

• Maintain a mix with your investments. A model from the Schwab Center for Financial Research indicated that a hypothetical retiree with a $2 million portfolio in year one of retirement will have slightly less than $1 million left 30 years later if her portfolio maintains a mix of 60 percent stocks and 40 percent bonds and cash. The model found that a second hypothetical investor with the same size portfolio in year one of retirement will run out of funds prior to year 29 if his portfolio is 20 percent stocks and 80 percent bonds

and cash. Though conventional wisdom suggests limiting risk as retirement nears and eliminating it entirely upon retiring, modern retirees are living longer and may therefore need to maintain a mix of investments to ensure they don’t outlive their money.

• Make the maximum allowable contributions. Many aging professionals may not have saved as much for retirement as they might have hoped to upon starting their careers decades ago. In fact, a 2024 survey from Prudential Financial found that many 55-year-olds have fallen far short of establishing the level of financial security they will need in retirement. The Prudential survey found that 55-yearolds had a median retirement savings of less than $50,000, a number that falls considerably short of the recommended goal of having eight times one’s annual income saved by this age. If that situation sounds familiar for professionals nearing retirement age, then now is the time to begin catching up. Make the

maximum allowable contributions to a 401(k) plan ($23,000 in 2024) and/or an IRA ($7,000). In addition, the Internal Revenue Service notes that IRA catch-up contributions remained $1,000 for individuals age 50 and over in 2024.

Brattleboro Burlington

Keene Manchester Rutland

Busy days tend to be productive days. But when especially busy days are strung together, adults can begin to feel a little overwhelmed and may wonder if there’s anything they can do to make hectic schedules more manageable. Time management strategies can be an effective tool in busy adults’ arsenals. Efficient time management can free up more minutes or hours in the day, which can ultimately afford adults more time to exhale and thus make each day seem a little less overwhelming. Time management may require a little trial and error before adults find a formula that works for them, but the following are some tips to improve personal efficiency each day.

• Identify tasks that can be tackled at night. A hectic start to a morning can set a bad precedent for the rest of the day. With that in mind, adults can identify tasks they can perform at night to ensure mornings are less hectic. Lay

out clothes the night before to save the trouble of finding an outfit in the morning. Prepare the family’s lunches and even breakfasts the night before so mornings go more smoothly.

• Exercise in the morning. A recent study from the World Health Organization published in the Lancet Global Health Journal found that 31 percent of adults don’t get enough exercise. Lack of routine physical activity has been linked to a host of negative health outcomes, including an increased risk for conditions like heart disease, diabetes, cancer, and stroke. Adults who exercise at night may find that attempts to squeeze in early evening or nighttime workouts add to feelings of being overwhelmed brought on by busy schedules. Exercising in the morning can free up time for other tasks in the evening, and doing so can even make it easier to manage daily stress, as the Mayo Clinic reports that exercise in any form releases endorphins and helps to relieve stress.

• Minimize distractions. Distractions are arguably more prevalent than ever, as many adults feel nary a minute goes by without a smartphone notification and/or message from friends, family and coworkers. Minimizing those distractions and resolving to tackle one task at a time can improve efficiency and reduce stress. Turn off smartphone notifications from apps that are not vital to work and family. During the workday, prioritize tasks each day and block off hours on your schedule so time can be devoted exclusively to the most important jobs. If hours on a schedule are left open, coworkers may schedule meetings that can make it difficult to complete necessary tasks.

• Incorporate small breaks throughout the day: Constant work without breaks can lead to burnout and decreased productivity. Taking short, regular breaks throughout the day can boost energy levels, improve focus, and reduce stress. Adults can use these breaks for a walk, a quick stretch, or a few minutes of meditation.

• Use productivity tools and apps: There are numerous produc-

tivity tools and apps designed to help individuals stay organized and manage their time more effectively. Whether it’s using a calendar app to schedule appointments, a todo list app for tracking tasks, or a time-tracking app to monitor work hours, leveraging technology can improve efficiency.

• Learn to say “no” when necessary: Busy adults often take on too many responsibilities because they feel obligated to please others. Learning to say “no” is an essential skill for effective time management. By setting boundaries and politely declining non-essential tasks or commitments, adults can protect their time and energy for the most important priorities.

• Adjust as necessary. Flexibility is a must when trying to avoid feeling overwhelmed. Each day presents its own unique and fluid challenges, so remaining flexible can help busy adults overcome unforeseen obstacles. In addition, some time management strategies may not be effective for everyone nor useful every day, so it’s best to recognize the need to adjust from time to time.

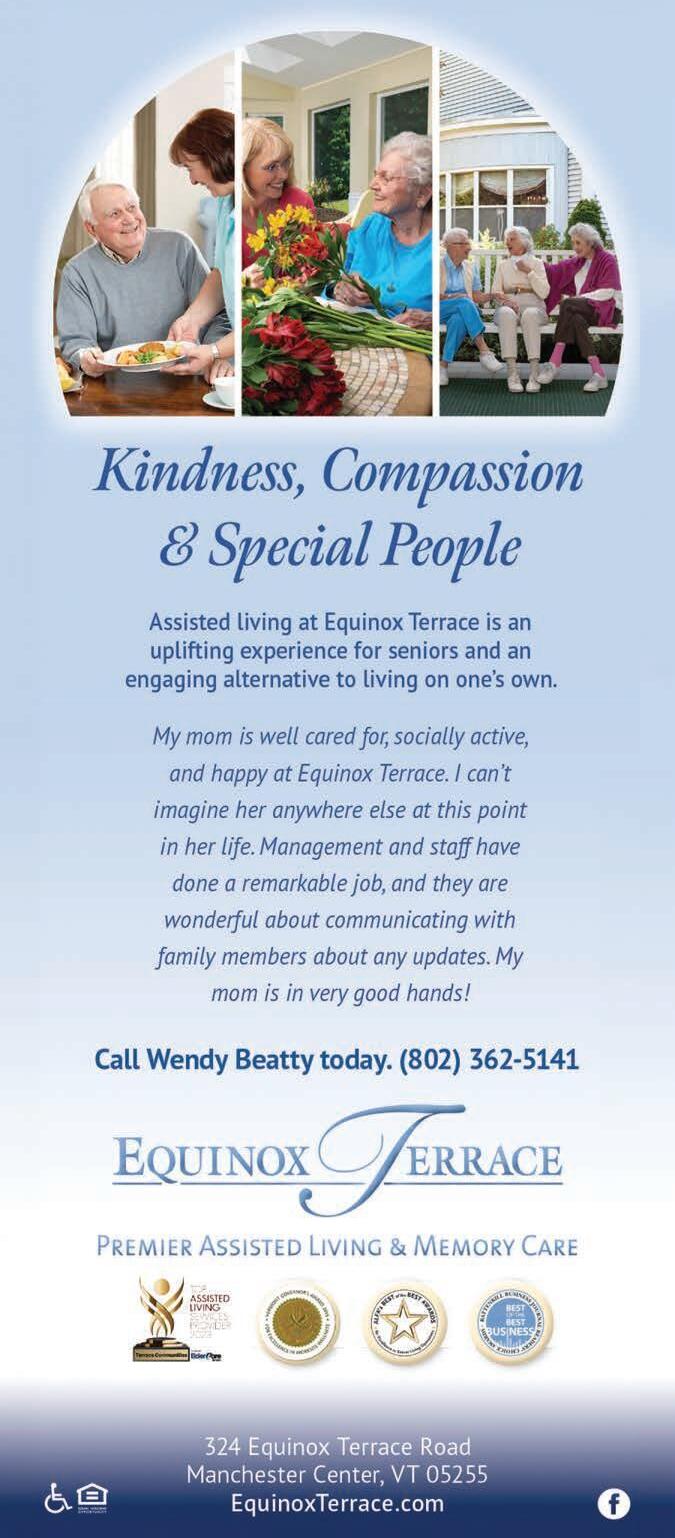

Amodern,state-of-the-artAdultDay Serviceservingolderadultsandyounger personswithdisabilitiesinBennington andthesurroundingcounties.

Seniorsareencouragedtojoin, especiallythosehopingtolivetheirlater yearsinthecomfortoftheirownhomes.

BPIisanidealalternativetoanursing homeorin-homecare.Pleasegiveusa calltolearnmoreandarrangeatourof ourbeautifulcampus,andextensive facilitiesandservices.

As we age, older Americans and their families face the challenge of planning for care in the coming years. Living at home is a high priority, but the march of time, and challenges to health, can make that difficult, if not impractical.

Fortunately, seniors in southwest Vermont and nearby New York have a remarkable resource for healthcare, recreation and socialization that ensures a rewarding quality of life as they “age in place” in their homes. They can live at home with family or caregivers, while spending days during the week in an active and welcoming community of peers with similar interests, supported by a caring, professional staff who specialize in the needs of seniors.

Bennington Project Independence is an expansive, modern, adult activity center on a hillside overlooking Bennington that has welcomed thousands of senior members since it opened in 1978.

It’s open every weekday of the year except for holidays.

The activities and services are spread throughout a 10,000 square foot facility, housed in a historic house and barn that were combined in an expansion in 2009. They include an art/craft studio, library, dining/event room, a fitness studio, medical offices, plus space for personal care and assistance. There’s also an outdoor patio where members can sit and watch the eagles soar across the valley.

BPI provides individualized plans of care that coordinate services from personal care, health monitoring, education, door-thru-door transportation, healthy snacks and access to nutritious meals and specialized therapeutic and engaging adult activities.

Members can participate in a host of group activities or spend time reading or working on their own. The cheerful staff is adept at keeping the days fun and interest-

ing, with experiences that promote feelings of success and enjoyment, encourage choice, and stimulate socialization and cognitive, perceptual and physical skills.

Especially for seniors who would benefit from support, BPI is a powerful option to a nursing home or full-time in-home care. There is a fee for members to attend each day, and financial support is available

for those who qualify. For families who would otherwise have to juggle work schedules to care for a parent or sibling, BPI has proven to be a blessing.

The center encourages all families with members who might benefit from these services to contact Gina Anzivino, BPI Membership Coordinator, at 802.442.8136 to learn more and schedule a tour of the facility. You can also learn more at BPIADS.ORG.

Exercise is a necessary component of good health. Physical activity improves overall well-being and can help a person maintain a healthy weight and bone density while improving flexibility and muscle strength. It is essential that people continue to exercise into their golden years for all of the reasons mentioned above. But adults age 50 and older should find an exercise program that won’t make them vulnerable to injury.

AARP and the Consumer Product Safety Commission says exerciserelated visits to the emergency room surpassed 107,000 for those aged 50 and older in 2020. That figure was even smaller than usual due to the COVID-19 pandemic being in effect. Poor form when exercising can be worse for an older adult than doing no exercise at all, particularly for people with arthritis or preexisting conditions. Older adults can keep these tips in mind to avoid exerciserelated injuries.

• Ease into exercise. It is good to be excited about exercise, but jumping in too quickly or intensely is a recipe for injury. This is particularly true in strength training when lifting too much weight can cause injuries like rotator cuff tears and lower back strain.

• Stretch regularly. Johns Hopkins Medicine says as a body ages, tendons get thicker and less elastic. Stretching can help counter this occurrence and help prevent injuries at age 50 or older. Stretching should be done slowly and smoothly. Do not force stretches or speed through them.

• Incorporate strength training. It is important to prevent muscle atrophy as you age, and strength training can help achieve that. Strength training also helps reduce the risk of bone fractures later in life. However, start slowly at minimal weight and low repetitions, and gradually build up. Try 10 to 12 repetitions to start. Work with a quali-

fied physical therapist or personal trainer to learn the proper form.

• Warm up before exercise. Warming up involves slow motions to acclimate the body to exercise. It may include walking and other full-body movements. As opposed to stretching, a warm-up involves movements similar to the workout but done more slowly. Warm-ups increase blood flow to the muscles and improve tissue elasticity, says AARP.

• Vary your activities. Switch up the exercises you do so that you focus on different muscle groups on alternating days. This can help avoid overuse injuries that occur from working one part of the body or muscle group too frequently, according to Intermountain Health.

• Invest in good shoes. Choose workout footwear that is comfortable, supportive and designed for the activity you will be doing. Shop for athletic footwear in the after-

noon to account for foot swelling. Older adults need to take extra precautions to avoid injuries while staying fit.

• Stay hydrated. Proper hydration helps maintain joint lubrication, muscle function and overall performance. Dehydration can increase the risk of cramps and injuries.

• Consider low-impact exercises. Activities like swimming, cycling, or yoga can be gentler on joints and reduce the risk of strain, especially for those with arthritis or other joint issues.

HistoricBradleyHouseisaprivate,licensed,nonprofitresidentialcarehome.Weprovideassistance withdailytasks, allowingresidentsthefreedomto enjoylifeandmaintainpersonalindependence.

Caringsta areavailable24hoursadaytohelpwith personalcareandmedication.Anursemonitors eachresidentclosely,ensuringhealthandcomfort. Alsoincludedinthemonthlyfeearethreedelicious mealseachday,activities,housekeepingand laundryservices.

Wealsoo ershort-termRespiteCare 65HarrisAvenue,BrattleboroVT05301 802.254.5524info@gardenpathelderliving.org

Green eld,MA 329Conway Street (413)773-5119

Brattleboro,VT 130AustineDrive (802)254-3922

•HighestQualityMonuments•CustomEngraving •BronzePlaques•GranitePosts•Benches •Steps•DeliveryandInstallationavailable

802-254-4855

39SouthMainStreet•Brattleboro,VT•abbiatimonuments@comcast.net

Swanzey,NH 217OldHomesteadHwy (603)354-3325 www.brattleborohearing.com

Long-term care is an important component of financial and personal wellness planning. Planning for long-term-care can help aging individuals maintain their independence and quality of life into their golden years.

According to the National Institute on Aging, long-term care (LTC) involves a variety of services that accommodate a person’s health or personal care needs when they can no longer perform everyday tasks on their own. LTC can help people with chronic illnesses, disabilities or other conditions. LTC can be expensive, but planning for such needs can help families avoid financial strain and stress, and also provide peace of mind.

One of the initial steps when planning for LTC is to identify the available options. LTC is multifaceted and can come in a variety of forms. LTC can involve in-home care, with a care provider coming into an individual’s home to offer services like housekeeping and assistance with personal care. In addition, LTC can take place in nursing homes or assisted living facilities. Adult daycare facilities also may be considered part of LTC.

It’s important that families recognize that traditional health insurance does not cover the costs associated with LTC. In addition, Medicare cannot be used for LTC in most cases in the United States. It is essential to earmark funds or find alternatives to cover these costs.

According to Medicare.gov, some insurance companies will enable people to use life insurance policies to pay for LTC. Long-term care insurance also merits consideration. This insurance may cover LTC facilities or even home care and medical equipment. Families can explore all their options and find a policy that aligns with their needs and budgets.

Additional financial tools to consider are a Health Savings Account (HSA) or a Flexible Spending Account (FSA), which allow for taxadvantaged savings specifically for health care expenses. Those with limited income can be eligible for Medicaid in the U.S., which can pay for nursing home care. However, it is important to research which homes accept Medicaid.

People can work with licensed professionals to solidify long-term care and financial plans. An estate attorney can help create a durable power of attorney and a living will to ensure that health care and financial decisions are managed according to a person’s wishes if he or she becomes unable to do so. An irrevocable trust also could be beneficial in managing assets and potentially shielding families from LTC costs.

Families should discuss health care wishes and other financial plans as they pertain to long-term care. Early planning can help families navigate caring for aging individuals.

Care , Compassion & Community intheWestRiver Valley

AtValleyVillageSeniorHousing, weofferoptionsforspacious&affordable AssistedLiving, SupportiveLiving& Independent Living Apartment s.

CurrentlyavailableintheAssistedLiving: affordable,modern1BRapartmentsand 2BRapartments withprivatebath,living room,kitchenette, emergency call system, in-housemeals,laundry,cleaning,andpersonalcareservices. Hospital near by.

Formoreinfooranapplication,callDanielleat (802) 365-7190, opt.1

Couldusealittle supportathome?Personalizedservice coordination –FREE to anyonewithMedicare–AskforourSASH(SupportAndServicesatHome)program

461GraftonRd,Townshend,VT05353

Homeownership is a dream for millions of people across the globe. The National Association of Realtors indicates real estate has historically exhibited longterm, stable growth in value. Money spent on rent is money that a person will never see again. However, paying a traditional mortgage every month enables homeowners to build equity and can be a means to securing one’s financial future.

Homeowners typically can lean on the value of their homes should they need money for improvement projects or other plans. Reverse mortgages are one way to do just that. Who is eligible for a reverse mortgage? People near retirement age are eligible for a specific type of loan they can borrow against. Known as a “reverse mortgage,” this type of loan can be great for people 62 or older who perhaps can no longer make payments on their home, or require a sum of money to use right now, without wanting to sell their home.

People near retirement age are eligible for a specific type of loan they can borrow against. Known as a “reverse mortgage,” this type of loan can be great for people 62 or older who perhaps can no longer make payments on their home, or require a sum of money to use right now, without wanting to sell their home.

In addition to meeting the age requirement, a borrower must live at the property as a primary residence and certify occupancy annually to be eligible for a reverse mortgage. Also, the property must be maintained in the same condition as when the reverse mortgage was obtained, says Fannie Mae.

The Consumer Finance Protection Bureau says a reverse mortgage, commonly a Home Equity Conversion Mortgage, which is the most popular type of reverse mortgage loan, is different from a traditional mortgage. Instead of making monthly payments to bring down

the amount owed on the loan, a reverse mortgage features no monthly payments. Rather, interest and fees are added to the loan balance each month and the balance grows. The loan is repaid when the borrower no longer lives in the home.

With a reverse mortgage, even though borrowers are not making monthly mortgage payments, they are still responsible for paying property-related expenses on time, including, real estate and property taxes, insurance premiums, HOA fees, and utilities. Reverse mortgages also come with additional costs, including origination fees and mortgage insurance up to 2.5 percent of the home’s appraised value, says Forbes. It’s important to note that most interest rates on these loans are variable, meaning they can rise over time and thus increase the cost of borrowing. In addition, unlike traditional mortgage payments, interest payments on reverse mortgages aren’t taxdeductible.

A reverse mortgage is not free money. The homeowners or their heirs will eventually have to pay back the loan when the borrowers no longer live at the property. This is usually achieved by selling the home.

The CFPB notes if a reverse mortgage loan balance is less than the amount the home is sold for, then the borrower keeps the difference. If the loan balance is more than the amount the home sells for at the appraised value, one can pay off the loan by selling the home for at least 95 percent of the home’s appraised value, known as the 95 percent rule. The money from the sale will go toward the outstanding loan balance and any remaining balance on the loan is paid for by mortgage insurance, which the borrower has been paying for the duration of the loan.

Reverse mortgages can be a consideration for older adults. However, it is essential to get all of the facts to make an informed decision.

“Thisisthe year Ireallystar t planningforretirement.”

Whatever you’re planning thisyear, StartHere.

As a divisionofBrattleboro Savings &Loan, we area community resource So, whether it’s opening aretirementaccount,socially responsibleinvesting, managinganinheritance, orjustlooking forward, wewant to help you reachyourgoals.

221MainStreet,Brattleboro,VT05301|(802)257-7766

108EastMainStreet, Wilmington,VT05363 | (802)464-750 4 vtplanners.com

ThefinancialadvisorsofParkPlaceFAoffersecuritiesandadvisory servicesthroughCommonwealthFinancialNetwork®, member FINRA/SIPC,a RegisteredInvestmentAdviser BrattleboroS&Lisnot aregisteredbroker-dealerorRegisteredInvestmentAdviser Brattleboro S&L andCommonwealthare separate andunaffiliatedentities

INVESTMENTSARENOT FDIC-INSURED NOT GUARANTEEDBYTHE BANKANDMAY GODOWNIN VALUE.