12/2022: 4,986

12/2023: 4,692

12/2022: 5,398

12/2023: 5,050

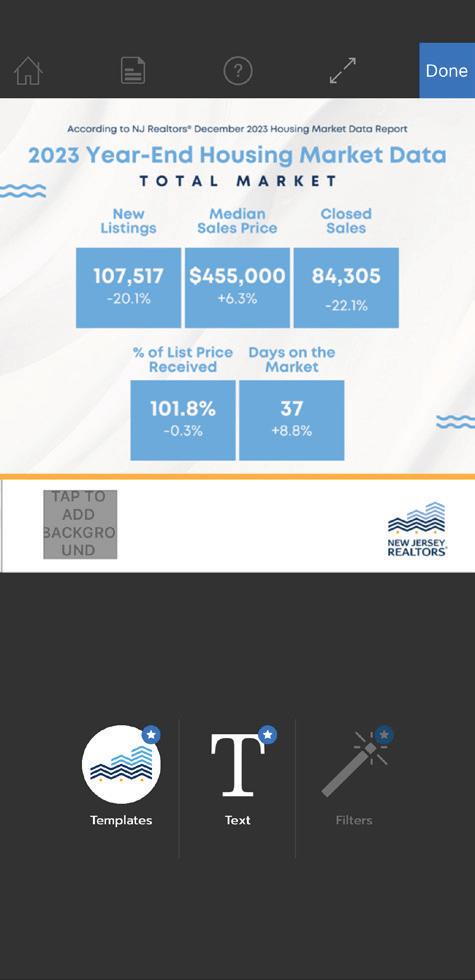

YTD 2022: 134,643

YTD 2023: 107,517

12/2022: 40

12/2023: 36

12/2022: 7,359

12/2023: 6,458

YTD 2022: 108,225

YTD 2023: 84,305

12/2022: $410,000

12/2023: $462,000

YTD 2022: $428,000

YTD 2023: $455,000

YTD 2022: 103,128

YTD 2023: 85,609

YTD 2022: 34

YTD 2023: 37

12/2022: 99.7%

12/2023: 101.4%

YTD 2022: 102.1%

YTD 2023: 101.8%

12/2022: $515,863

12/2023: $593,570

YTD 2022: $535,352

YTD 2023: $572,749

We offer more integrated tech solutions than ever before. Now our agents can leverage more data and share better information with their clients. From accessing NJ Property Record Cards to tracking offers in real-time with Offer Manager by ShowingTime, and our mobile app powered by MLS-Touch®, the NJMLS helps you operate at maximum efficiency. Best part is it's all part of your membership and there's more to come!

To leverage our tech tools become a member at newjerseymls.com/join.

We got you.

SINGLE FAMILY MARKET

NEW LISTINGS

YTD 2022: 91,643

YTD 2023: 71,701

YTD 2022: 70,101

YTD 2023: 57,211

CLOSED SALES

MEDIAN SALES PRICE

YTD 2022: $472,500

YTD 2023: $502,500

TOWNHOUSE–CONDO MARKET

NEW LISTINGS

YTD 2022: 31,425

YTD 2023: 25,155

MEDIAN SALES PRICE

YTD 2022: $340,000

YTD 2023: $375,000

YTD 2022: 73,685

YTD 2023: 56,574

CLOSED SALES

YTD 2022: 24,034

YTD 2023: 19,631

YTD 2022: 25,238

YTD 2023: 19,175

NEW LISTINGS

YTD 2022: 8,968

YTD 2023: 8,521

MEDIAN SALES PRICE

YTD 2022: $315,000

YTD 2023: $330,000

YTD 2022: 7,430

YTD 2023: 7,327

CLOSED SALES

YTD 2022: 7,654

YTD 2023: 7,182

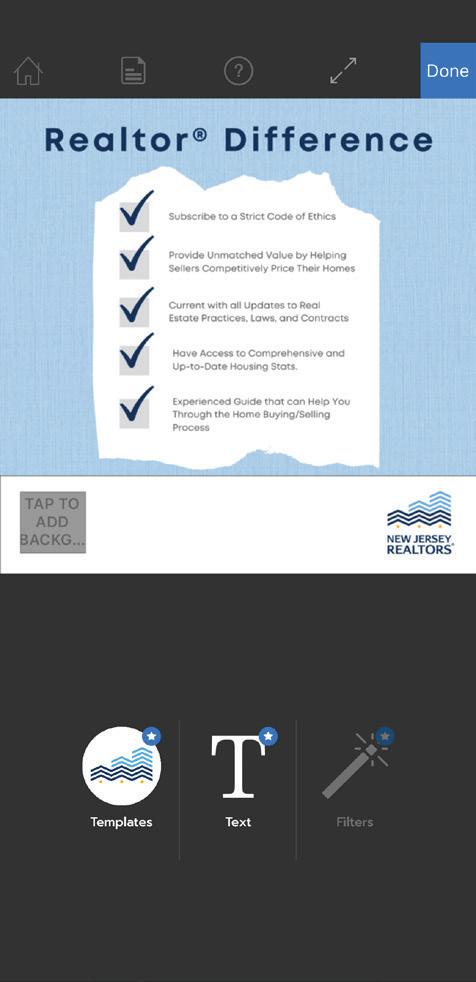

New Jersey Realtors® know the housing market ebbs and flows better than anyone, and no matter the market conditions or trends, Realtors® are the consistent experts providing their clients with top-notch service. To help you continue to bring your best to the negotiating table, New Jersey Realtors® provides its members with the most comprehensive housing market statistics in New Jersey.

We work with all of New Jersey’s MLSs to bring you data reports on the state, county, and municipal levels. They include data points such as new listings, pending sales, closed sales, median sales price, percentage of list price received, days on the market, and more.

Here are four ways to use housing market statistics in your everyday business to highlight your market expertise, help your clients understand the market, and provide value to past and future clients.

1. Share the reports with your buyer clients before their first showing. In your preliminary conversations with clients, consider sharing reports on the state and

county level in addition to their desired municipality search areas. Clients can go into their home search with a better understanding of market trends and how their budget may fall within the total scope of the market.

2. Create expectations with sellers by providing specific selling-related data points. While your seller clients may have a price point in mind, showing them the numbers could help them re-evaluate. Sharing statistics such as days on the market and the percentage of list price received will help them comprehend how long their home could be on the market and if there is potential for bids over the asking price.

3. Provide local market updates on social media. Only New Jersey Realtors® have access to local municipality reports—take this opportunity to promote yourself as the ultimate local market expert for the areas you serve. You can design a custom social media graphic or use New Jersey Realtors® free monthly housing market assets through Photofy.

4. Include market statistics in your listing presentations. When sharing properties with your clients, consider including data points such as the percentage of list price received and the median sales price so clients can compare the listing you’re presenting to trends in the area. Doing so will help them make an informed decision and could help mitigate buyer remorse.

Over the past decade our advertising has told the Real Story, Planted Roots in our neighborhoods, thrived as Not Just A Real Estate Agent, and proved to our clients that We Know Jersey. This year, we’re staying true to who we are at our core with our 2024 consumer advertising campaign—Home. A Realtor® is the Key.

The Realtor® is the center of every transaction and we want every potential buyer, seller, and renter to know that our profession has the ability to unlock access to their American Dream, even in the toughest of markets.

Every transaction is different—with a vast array of clients with unique wants, needs, and dreams. But the constant behind all of those differences lies the Realtor®, with unmatched expertise guided by education, advocacy, and professionalism.

Each New Jersey Realtor® is the key to a successful homeownership journey for their respective clients and we are so excited to tell that story this year.

We have a renewed focus on search engine marketing, where we know a majority of our potential home buyers

are taking that first step forward in their homeownership journey. We’re giving special attention to Gen Z, who are looking to enter the market now or will be soon—we want them to know why using a Realtor® is so important to their own success. We’re testing out new and exciting ways to reach different audience segments through alternative social channels and innovative streaming platforms.

But most of all, we are centered on this core idea of Realtors® as the key to all transactions—unlocking access and opportunity for our clients and being there to support and guide them as they navigate a housing market that has been anything but predictable.

Join us on this journey as we share information and raise awareness of who we are, what our profession encompasses, and how successful we are at doing it.

CHIEF EXECUTIVE OFFICER

Jarrod C. Grasso, RCE

PUBLIC RELATIONS AND MARKETING

DEPARTMENT

DIRECTOR OF PUBLIC RELATIONS & MARKETING

Colleen King Oliver | editor@njrealtor.com

DEPUTY DIRECTOR OF PUBLIC RELATIONS & MARKETING

Erin McFeeters

COMMUNICATIONS COORDINATOR

Nicole O’Rourke

COMMUNICATIONS COORDINATOR

Lisa Fant

2024 OFFICERS

PRESIDENT Gloria Monks

PRESIDENT-ELECT Kathy Morin

FIRST VICE PRESIDENT Sue La Rue TREASURER Jairo Rodriguez

ADVERTISING SALES

Laura Lemos | 973-668-2449 laura@boja.com

DESIGN

ENCOMPASS MEDIA GROUP

Rebecca Ryan McQuigg rebecca@encompasspubs.com

New Jersey Realtors® provides legal and legislative updates as well as information on a variety of real estate related topics solely for the use of its members. Due to the wide range of issues affecting its members, NJ Realtors® publishes information concerning those issues that NJ Realtors®, in its sole discretion, deems the most important for its members.

The content and accuracy of all articles and/or advertisements by persons not employed by or agents of NJ Realtor® are the sole responsibility of their author. NJ Realtors® disclaims any liability or responsibility for their content or accuracy. Where such articles and/or advertisements contain legal advice or standards, NJ Realtors® recommends that NJ Realtors® seek legal counsel with regard to any specific situation to which they may seek to apply the article.

New Jersey Realtor®, publication number 13260, ISSN number 00285919. Published bi-monthly each year. Member subscriptions allocated annually from annual dues: $3. Non-member annual subscription: $10. Known office of publication: 10 Hamilton Avenue, Trenton, NJ 08611. Periodicals

Everytwo years, the New Jersey legislature session ends on the second Tuesday in January. The time between the November election and that Tuesday, known as the lameduck session, is usually a feverish race to the finish line to pass bills and allow members of the legislature who are not returning to work on projects that are close to them. As we do anytime the State Legislature meets, in the recent lameduck session, New Jersey Realtors® played a pivotal role in advocating for real estate related issues.

Amidst the flurry of legislative activity, three significant issues of importance to New Jersey Realtors® saw action: the Flood Disclosure Law, Solar Panel Disclosure, and the Lawn Sprinkler Bill. Let’s take a deep look into the effects they may have on real estate in the Garden State.

Last year, NJ Realtors® Government Affairs Department presented testimony before the NJ Senate Environment and Energy Committee regarding S-3110 which mandates sellers and landlords to disclose information concerning flooding. Working closely with Sen. Bob Smith, of District 17 and the bill’s sponsor, and engaging with various stakeholders, we secured amendments ensuring the disclosure process for sellers remained reasonable. It’s important to note seasonal rentals are excluded from the bill’s provisions.

Under this newly enacted law, property sellers and landlords are obligated to inform prospective buyers and tenants about a property’s flooding history, flood risk, and its designation within a flood zone. Although the new disclosure form through the Division of Consumer Affairs is already available, it will not be mandatory until March 20.

NJ Realtors® plans to update the Seller’s Property Condition Disclosure Statement accordingly and notify our members

promptly. In addition, a new notice to tenants has been released by the Department of Community Affairs, which will go into effect on March 20. This notice was adopted by emergency by the DCA.

As New Jersey residents keep striving to be more environmentally conscious, more and more solar panels have appeared on residential homes. In some cases when there are problems with the panels, it can prove to be difficult if the installation company is no longer in business.

To address that, A-4522 mandates disclosures when selling a single-family home with solar panels. The bill stipulates the contract of sale, rider, contract addendum, or property condition disclosure statement must contain specific information about the solar panels.

NJ Realtors® Government Affairs Department secured amendments so real estate licensees are not held accountable for the required disclosure when the seller fails to provide the necessary information. The law is set to take effect upon the publication of information by the Real Estate Commission.

Some bills take a little time to become law. A-1755, which New Jersey Realtors® successfully opposed for over 17 years, requires automatic rain sensors/smart sprinklers to be installed as a time-of-sale requirement.

Amendments secured by New Jersey Realtors® allow funds to be held in escrow so closings can proceed even if rain sensors or smart sprinklers are not installed, while also delaying the requirement for contracts of sale to contain provisions pertaining to this law for a period of three years. What’s important to know is every lawn sprinkler system for residential homes installed after Sept. 8, 2000, is already

Fundraising total as of February 9, 2024

2024 RPAC Goal: $1,095,389

2024 RPAC Dollars Raised: $326,210.68

30% of goal

required to have a sensor installed. This bill would apply to those properties with lawn sprinklers installed before 2000.

In addition, landscape irrigation contractors are required to notify their clients of the requirements of the new law within 60 days of the law being signed and cannot perform work on a system until one is installed. This will ensure homeowners are aware of these requirements well before the time-of-sale requirement takes effect in three years.

New Jersey Realtors® is actively working on updating its forms and contracts in accordance with these new laws and will update members as soon as they are available.

A586 – Stanley (D18), Atkins (D20)/S1430 –McKnight (D31), Singleton(D7)

Expands the use of affordable housing voucher program funding.

New Jersey Realtors® Position: SUPPORT

Expands the use of housing vouchers for homeownership expenses by creating a state program similar to the federal Housing Choice Voucher Homeownership Program.

Bill History:

1/9/2024 – Introduced in Assembly and referred to Assembly Housing Committee

1/9/2024 – Introduced in Senate and referred to Senate Community and Urban Affairs Committee

1/25/2024 – Reported out of Senate committee with amendments and referred to Senate Budget and Appropriations Committee

A789 – McGuckin (R10), Kanitra (R10)

Provides holders of flood insurance with certain information.

New Jersey Realtors® Position: SUPPORT

Provides holders of flood insurance policies with information concerning damage claims on their properties as well as information concerning what their policies cover.

Bill History:

1/9/2024 – Introduced in Assembly and referred to Assembly Financial Institutions and Insurance Committee

A2253 – Lopez (D19)/S2011 – Gopal (D11), Polistina (R2)

Increases amount annually credited to Shore Protection Fund to $50 million.

New Jersey Realtors® Position: MONITOR

Increases revenue to the Shore Protection Fund by $25 million. This fund receives revenue from the realty transfer fee.

Bill History:

1/9/2024 – Introduced in Assembly and referred to Assembly Environment, Natural Resources and Solid Waste Committee

1/9/2024 – Introduced in Senate and referred to Senate Environment and Energy Committee

Don’t have the time or skills to create customizable social media posts for your business? Photofy allows you to customize pre-made templates specific to the New Jersey real estate industry, and—best of all—it’s free.

Support the future of real estate by donating to the New Jersey Realtors® Educational Foundation. For more than 50 years, the foundation has extended educational opportunities to students pursuing a college or university degree.

Add a subheading

In 2023, $68,950 in donations supported 44 students—just $1.13 per member can make a difference.

To make a donation, please make checks payable to:

New Jersey Realtors® Educational Foundation, 10 Hamilton Ave., Trenton, NJ 08611 or visit njrealtorsef.com.

Questions? Contact Mary Pilaar at mary@njrealtor.com.

The foundation is a 501(c)3 charitable organization.

While electronic signature has been around for quite a while, and early adopters could see the convenience, the pandemic transformed the service into an industry standard. In addition to a Transaction Management System, Transactions (zipForm Edition), included in your membership, you also have unlimited access to the e-signature service through Authentisign. Sending a document for signature couldn’t be easier!

1Accessing zipForm NJ Realtors® has a single-signon integration with zipForm, allowing you to create, fill out, and save all of your forms quickly and easily. To get started you’ll need to log into zipForm using your NJ Realtors® credentials. Visit njrealtor.com/zipform and click the “Log in to zipForm Plus!” button. If you’re not already logged in, you’ll be prompted to do so, otherwise, you’ll be brought right into your zipForm account. If you’ve forgotten your password or never created an account, you can use the “Forgot Password” tool to get set up.

Once you’re logged in, you’ll want to create an e-sign packet. An e-sign packet in zipForm is essentially one or more documents sent out for signature. Once sent, the documents inside cannot be modified, and any changes would require a new packet to be created. This is to ensure the integrity of the signatures and the documents themselves. From the transaction section of zipForms, if you already have a transaction created in zipForm, open the transaction, and click “E-Sign” on the second navigation bar, then click “New.” If you don’t have a transaction and are sending a scanned document or other files on your computer, you can click “New,” select “Quick E-Sign,” and enter a name for the signing. Quick E-Sign will create a simplified transaction without needing to enter any unnecessary information.

Now that our packet is created, we can add the participants of the e-signature transaction. This includes anyone who needs to sign, review, or receive a copy of the completed documents. From the “Signers” tab on the right panel, click “Add Participants.” If you’re sending forms completed from the NJ Realtors Library of Forms, you can select “Add from Transaction,” which will pull details directly from the form, otherwise click “Add New.” You can then enter the signer details, and select a role, or enter a new one, for the signer. Then select a signer type: remote signer, someone who signs the document; reviewer, someone who can

review the document; or CC, someone who receives a copy of the completed documents. As an added security measure, you can enter a signing PIN that will allow you to enter a password you can separately share with the signer to access the documents. Finally, click “Save” to add the signer. Repeat these steps for all participants. Once sent, all participants receive an email to review and sign immediately, however, if you need to set an order of events, you can use the “Set signing order” feature. This allows you to, for example, send a contract to an attorney for review, then continue to the buyer, and finally yourself. You can even set participants with the same signing order, which, for example, allows multiple buyers to simultaneously be requested to sign, but only after their attorney reviews.

Now that we have our signers, we can add the documents and forms we need signed. Head to the “Docs” tab on the right panel and click “Add a Document or Form.”

You’ll have the option to add completed forms directly from your transaction, upload a file, such as a PDF or Microsoft Word document, from your computer, or even connect to your Google Drive, Dropbox, OneDrive, or Box account. Select any documents to send for review and signature. Finally, you can change the order of the documents by dragging the handle to the left of the document name up or down.

One amazing benefit of using the Authentisign integration is that all forms in the NJ Realtors® Library of Forms come pre-tagged, meaning the signature, initials, and date fields are all programmed directly in the form, saving you hours of time and potential mistakes.

If you are using a scanned document or your own form, you’ll need to add the signature fields yourself. Don’t worry, it’s easy! Head over to the “Tools” tab on the right panel. From here, you’ll see a dropdown that includes a list of your remote signers; select the signer to which you’re adding fields. Underneath the signer, you can drag and drop the actions directly onto your form. The most commonly used actions are the “Sign Here” and “Initials,” however, you could allow the signer to fill out a form during the signing process by adding text boxes, dropdowns, and checkboxes. Repeat the steps for each of your signers to complete the document setup.

Now that our packet is set up, we’re ready to send it out for signature! At the top-right, click the “Next” button. In the pop-up, select an expiration date, the date for which the packet, if not signed, is invalidated, and optionally set up email reminders. Email reminders send regular emails to pending signers, keeping the invitation at the top of their inbox. Once you’re ready, click the send button to start the signing process. As each party signs, you’ll receive an email update, and once the packet is complete, you, as well as all participants, will receive the final, executed version. Documents are automatically saved to your zipForm account for safekeeping, along with a signing certificate.

E-Signature through zipForm not only streamlines the document signing process but also ensures the integrity of signatures. As the real estate industry continues to evolve, this integrated solution enhances efficiency and convenience for you and your clients, making transactions smoother and more secure in our digital age.

When compared to year-to-date closed sales in Dec. 2022

West Amwell Twp

Surf

Stow

Please note the number of available properties between all 565 NJ municipalities varies greatly and impacts percentage change.

For New Jersey residents looking to buy their first home, saving enough money for a down payment often comes second to more immediate costs of living – student loans, childcare, rent, insurance, and additional expenses.

When families are ready to purchase their new home, the New Jersey Housing and Mortgage Finance Agency can help.

HOMEBUYER DOWN PAYMENT

NJHMFA’s Down Payment Assistance program provides up to $15,000 in assistance to eligible first-time homebuyers for down payment and closing costs, which is forgiven after five years if the borrower doesn’t sell the home, refinance or default on their mortgage.

Contact Jesse Crawford @ jcrawford@njhmfa.gov to learn more about this opportunity for homeownership.

njhousing.gov

Nestled just ten miles east of Philadelphia, Moorestown Township is an eastern suburb with a charming Main Street adorned with historic buildings, small businesses, cultural venues, and restaurants. Moorestown is notable for its historic architecture and extensive history, as well as having a strong sense of community and plenty of events for residents to attend. The enduring charm of this captivating town ensures it remains a place you’ll always delight in revisiting.

According to The Historical Society of Moorestown, the town has several well-preserved 18th-century homes, with documented residences lining Main Street and dating back to the 1700s. “There are 13 18thcentury plaqued houses on Main Street, and 14 if you also count Kings Highway,” said Historical Society of Moorestown librarian Stephanie Herz. These historic homes can easily be recognized

through plaques bestowed by The Historical Society.

Moorestown features generously sized historic homes with midcentury modern architectural elements, and the demand remains robust in the area. According to the New Jersey Realtors® December housing market data report, single family homes were swiftly sold, spending an average of 38 days on the market year-to-date. Despite a 24.9% decrease in closed sales compared to last year, with 181 single-family homes sold, the area continues to exhibit strong demand. The median sales price for singlefamily homes decreased by 2.5% year-to-date to $700,000, and homes consistently received 99.9% of the list price.

Main Street serves as the central hub and heartbeat of the town, hosting numerous annual parades and events throughout the year, as well as being the go-to place for

residents to enjoy locally owned small businesses. Residents can enjoy brunch at The Cubby Hole known for their pancakes and French toast, or grab a slice of homemade pie and pastries at The Pie Lady Cafe. If you’re looking for a home away from home, The Victorian Lady is a unique and charming bed-and-breakfast and historic establishment dating back to 1868.

“I chose Moorestown because it is a charming town, and their Main Street is filled with boutique shops, restaurants, and cafes that fit the type of products that I sell such as gourmet artisan cupcakes and baked goods that are handmade from scratch,” said owner of Cupcake Carnivale on Main Street Jeffrey Jimenez. Cupcake Carnivale is a boutique bakery initially operated as a mobile bakery truck in 2012 and has since been established on Main Street for over three years.

Notably, their cupcakes received the award for “Best Cupcakes” in South Jersey Magazine in 2023.

Moorestown embraces a strong sense of community, with engaged residents actively participating in a plethora of seasonal events and parades throughout the year. “The Moorestown community and the surrounding towns have been very warm and friendly. I consider them family, as a lot of them have become regulars and good friends of mine,” said Jimenez. “Moorestown residents are very supportive of their small, local businesses and they want to see these businesses succeed.”

In addition to Main Street, those looking to support local businesses can explore the weekly “Here today, gone Sunday” pop-up stores in the Moorestown Mall.

From the welcoming Daffodil Day celebrating the arrival of spring to

the festive Main Street Candlelight Stroll marking the start of the winter holiday season, and the lively Moorestown Day, there are ample opportunities for residents to be part of the town’s vibrant social calendar. In the spring there are also diverse culinary offerings and events during Restaurant Week hosted by the town’s fantastic local restaurants.

Another unique quirk to the town is the fiberglass fivefoot-tall painted dog sculptures scattered throughout Main Street, named Nipper. Nipper is the beloved mascot of the Recording Company of America. In 2005, Moorestown organized a public art project, crafting 30 Nipper fiberglass sculptures funded by sponsors such as Lockheed Martin, Dietz & Watson, and Bayada Nurses. Each Nipper was uniquely painted by various artists and later auctioned with the proceeds supporting a local fundraiser. If you want to see the remaining Nipper statues in Moorestown, you certainly can’t miss them when walking down Main Street.

Oftentimes, as you drive or stroll down Main Street, you will see couples getting married at the newly renovated Moorestown Community House. The venue hosts a range of events from wine tastings and golf outing fundraisers to the Moorestown annual tree lighting ceremony and summer concert series.

Moorestown is enveloped by a variety of well-loved parks and trails. Among these, Strawbridge Lake stands out as a favorite, offering excellent opportunities for fishing, kayaking, and canoeing, as well as boat launch areas, picnic tables, and a playground. For local sports enthusiasts, Jeff Young Park is a popular choice, with a tennis court,

basketball court, dedicated pickleball courts, and a recreation center featuring playgrounds tailored to children of all ages. During winter, families and children eagerly gather with their sleds at Stokes Hill, renowned for its expansive slope that provides an ideal setting for sledding adventures. Dog owners can enjoy their time at the Swede Run Fields Dog Park, a spacious 40-acre area featuring open spaces, water amenities, and picnic tables.

BY MICHELE LERNER

BY MICHELE LERNER

When a young couple wanted to buy their first home in Ocean County, they weren’t willing to compromise on their preferred location or home size, said Louisa Sagarese, a Realtor® with RE/MAX Revolution.

“Their compromise was to have a friend move in with them to share the house expenses,” said Sagarese. “Every first-time buyer has to make compromises right now, mostly because there’s just so little inventory and people are getting outbid.”

Realtors® across New Jersey and in other regions of the country who work with first-time buyers are all too familiar with the hurdles that face this cohort: limited inventory, steep competition, high prices, and higher mortgage rates compared to most of the past decade. Yet many first-time buyers succeed in becoming homeowners despite these challenges with the help of creative and persistent Realtors® who sometimes nurture these clients for more than a year to get them to the closing table.

A variety of tactics such as down payment assistance programs, help from relatives, seller concessions, and compromising on location, condition, or size can help renters become homeowners.

“When you work with first-time buyers, you must take time throughout the entire process to educate them and help them understand market shifts,” said Youssef Genid, broker/owner, Realtor®, and New Jersey director of Realty One Group Legend in Clifton. “Be transparent with your buyers and do a comparative market analysis on properties

they’re interested in to help them understand average prices compared to what they want to buy.”

Many first-time buyers benefit from gifts from their parents or other relatives to pay for the down payment or closing costs, said Ellen Gonik, a Realtor® with Coldwell Banker Realty in Livingston.

“The first step for every buyer is to get a preapproval from a mortgage broker or lender that you recommend,” said Gonik. “Many buyers are able to expand their price range with a gift or loan from their parents.”

The annual federal gift tax exclusion limit is $18,000 per donor in 2024, which means parents can gift $36,000 to their child and another $36,000 to their child’s partner without incurring taxes.

“If you’re getting a gift, you need to have that conversation with your lender during the preapproval process,” said Alexa Micciulli, a Realtor® with ERA Justin Realty in Rutherford. “The underwriters need documentation about where money comes from and whether it needs to be repaid.”

Parents without spare cash may want to co-sign a loan as long as they understand the risks and the terms of the loan. A co-signer can help buyers qualify for a loan or a better rate if they have a lower credit score or not quite enough income, said Sagarese.

Multigenerational living can also help buyers get into their first home.

“Sometimes parents buy a larger house so their kids can live with them, or the parents move in with their kids to share ownership costs,” said Sagarese.

In a recent survey of prospective homebuyers by RE/MAX, 28% said they would consider buying a house with a friend or family member.

In some cases, sellers may be willing to help buyers with closing costs.

“Realtors® should ask the listing agent if a seller could provide concessions at the settlement to ease the buyer’s cash needs,” said Genid. “This frees up cash for the buyers or can be used to temporarily buy down their mortgage rate and the sellers can sell their property for a higher price to compensate for the concession.”

Many first-time buyers in New Jersey qualify for homebuyer programs through state and local programs that provide down payment and closing cost assistance and low interest loans.

“Budget allocations in New Jersey were increased so we can offer up to $15,000 in down payment assistance in high-cost housing markets,” said Melanie Walter, executive director of the New Jersey Housing and Mortgage Finance Agency. “In lower cost areas we can offer up to $10,000. We also have a new program for first generation homebuyers that includes an extra $7,000 in assistance, so some buyers can get as much as $22,000.”

The first-generation program is available to buyers who have not owned a primary residence and whose parents or anyone else in their household have not owned a home, said Walter.

“This program is meant to overcome the lack of funds and generational wealth available to some first-time buyers compared to those whose parents can give them an extra boost to become homeowners,” said Walter.

While down payment assistance was previously limited to borrowers financing their homes with FHA loans, the NJHMFA now offers assistance with conventional loans, too.

“We’re one of five locations participating in a Freddie Mac pilot program that provides a pricing break on loans that we

can pass onto first-time buyers,” said Walter. “We can also use our state subsidies to buy points on a large scale to reduce mortgage rates for our borrowers by one-fourth to one-half percentage point on any given day.”

In many states, loans associated with down payment assistance have above market rates, so New Jersey is a leader in offering lower cost loans, said Jordan Moskowitz, managing director, single family business of the New Jersey Housing and Mortgage Finance Agency.

“The impact of the buy down of the rate and lower loan pricing can save borrowers as much as $200 per month,” said Moskowitz.

Homebuyer assistance is in the form of a loan that is forgivable after the buyers live in the home for five years.

“Historically, people thought our programs were the loan of last resort, but now that one-third of our loans are conventional products and we offer below market pricing, we’re competitive with other loan programs,” said Walter.

The number of down payment assistance awards given grew by 15% in 2023 compared to 2022 despite the decline in first-time buyers statewide.

“Our timeline for our borrower reviews typically take three to five days and can be even quicker because our lenders do a complete preapproval of every borrower,” said Moskowitz. “There’s a misconception that these loans are less likely to close, when actually they’re just as likely to close on time because the source of the down payment funds is transparent.”

Realtors® and buyers can learn more about New Jersey’s programs or fill out a form on that site to receive recommendations for three lenders experienced with the program.

“To be eligible, the buyers must be first-time buyers, defined as anyone who has not owned a primary residence in the past three years,” said Moskowitz. “The income limits vary by county and can go as high as $120,000 to $150,000. In addition, borrowers can’t have assets in excess of 25% of the purchase price. We want to make sure we’re giving money to people who really need it.”

Realtors® and buyers can find out about all available homebuyer assistance programs in their area at nj.gov/dca/hmfa/roadhome/.

More than half of millennial and Gen Z buyers said they hope to buy a multifamily house or a place with space for a tenant to offset their mortgage payments, according to a recent national survey by Zillow.

“Some of the first-time buyers I worked with found two or three-family homes, but it takes a lot of education to help them do that,” said Micciulli. “I partner with an attorney who can explain tenants’ rights and hold classes for people who want to invest in real estate this way and increase their buying power.”

But Micciulli said buyers face steep competition from investors for this type of property and need to be prepared to be a landlord. In many other markets in New Jersey, agents said it’s virtually impossible to find a duplex or similar home to accommodate multiple families.

A simpler option, although not always palatable to buyers, is to expand the geographical region for their home search. Sometimes swapping one town or neighborhood for another that’s safe and has “good enough” schools can result in prices as much as 10% lower than another town, said Gonik.

“Often people have to move farther away to get a lower price, but it may not be as bad as they think to move a few towns over if both partners work at home or don’t need to commute every day,” said Gonik. “But towns with a train station or a bus or closer to Manhattan are more likely to hold their value, especially as some people return to the office.”

The alternative to looking in a different location is to buy a smaller house in the right location, said Gonik.

“Buyers are more willing to buy a townhouse or a smaller single-family home than a condo because of the monthly fees,” said Sagarese. “Sometimes they can buy a twobedroom instead of a three-bedroom to find something they can afford.”

First-time buyers typically prefer a house in excellent condition, but more than half (56%) of buyers said they would consider a fixer-upper in the RE/MAX survey. Micciulli recommends bringing a contractor to look at a potential fixer upper to get a more accurate idea of what improvements will cost.

Buyers willing to consider a fixer upper often face competition from investors. In addition, gathering the cash for renovations is often an obstacle.

“Realtors® should identify lenders who are familiar with renovation loans like the FHA 203(k) program that allows buyers to pay for the renovation with their 30-year mortgage,” said Genid. “These loans allow the repairs to be done before the family moves into the house, which reduces the stress of renovations.”

Realtors® should develop a network of lenders and attorneys to recommend to their clients, said Genid.

“It’s the responsibility of Realtors® to learn about lenders and their programs so they can share that information with buyers,” said Genid.

Whether it’s connecting first-time buyers to homebuyer assistance programs from state and local governments, to lenders with experience with renovation loans, asking sellers or family members to help or simply broadening the search parameters, Realtors® provide the expertise needed to convert renters to owners.

A highlight on the National Association of Realtors® Home Buyers and Sellers

Generational Trends and Wealth Gains by Income and Racial/Ethnic Group reports

BY LISA FANTResearch consistently emphasizes the housing sector’s importance to the economy and the social and financial advantages for individual homeowners. The National Association of Realtors® Home Buyers and Sellers Generational Trends and Wealth Gains by Income and Racial/Ethnic Group annual reports aim to shed light on generational trends among home buyers and sellers, as well as the dynamics of wealth accumulation through homeownership, offering valuable insights into the similarities and inequalities across different demographic groups.

As real estate professionals, it’s essential to acknowledge the diverse needs, opportunities, and challenges of potential

homebuyers and sellers. Recognizing the preferences and obstacles different groups face helps us foster a more inclusive and equitable approach to homeownership.

First-time buyers accounted for 26% of all home buyers, marking a decrease from 34% last year, according to NAR’s 2023 Home Buyers and Sellers Generational Trends Report. Among younger millennials aged 24-32, 70% were first-time buyers, while 46% of older millennials aged 33-42 also purchased their first homes. In the Gen X category, 21% of individuals aged 43 to 57 were first-time home buyers.

While both first-time and repeat home buyers share the common goal of acquiring a property, their distinct experiences, financial situations, objectives, market knowledge, and emotional factors contribute to their unique perspectives and requirements throughout the homebuying process.

Along with an uptick in mortgage rates through late October 2023, first-time home buyers also often face limitations in funds for a down payment and may need assistance in securing financing. Unlike repeat buyers, they may not have accumulated significant equity from a prior home sale or may encounter more anxiety and uncertainty during the homebuying process. The decision to purchase a home is a substantial financial commitment, and first-time buyers may feel heightened pressure in a competitive market.

Baby boomers, encompassing both younger boomers aged 58 to 67 and older boomers aged 68 to 76, comprised the largest generation of home buyers, accounting for 39%. As a collective group, baby boomers also represented the majority of home sellers at 52%. Their reasons for selling varied, with some opting to move closer to friends and family, while others were motivated by the need to downsize from a larger home. 18% of older boomers purchased a multi-generational home to spend time and take care of aging parents, or due to children over the age of 18 moving back home for cost savings. Younger boomers have owned their homes typically for 11 years before selling, while older boomers owned their homes for 16 years before selling.

Among all generations of home buyers, the first step taken in the home search process was to look online for properties; however, younger boomers contacted a real estate agent as a first step more often than other generations.

Generation X buyers aged 43 to 57 made up 24% of recent home buyers. This group remains the highest-earning home buyer group, with a median income of $114,300 in 2022. Gen X buyers were the second most likely to purchase a multi-generational home at 17%. When looking at the reason to purchase a home, they were more likely, in comparison to other ages, to purchase for the desire to be closer to a job, school, or transit, or for a job relocation or move.

This group also remains the most racially and ethnically diverse population of homebuyers, with 23% identifying as a race other than white/Caucasian. Even so, data shows significantly fewer low-income households and households of color own their home and can build wealth compared to other income and racial/ethnic groups, according to NAR’s 2023 Wealth Gains by Income and Racial/Ethnic Group Report.

Similar to years past, buyers continue to finance their home purchases, with 78% of homebuyers choosing to do so. This percentage tends to decrease as the age of the buyer increases. Younger buyers continue to depend on savings for their down payment, while older buyers tend to use funds from a previous home sale. Overall, buyers were delayed primarily by student loan debt and high rental costs holding back savings. 35% of younger millennials reported having student loan debt with a median loan balance of $30,000, compared to 30% of older millennials with a median balance of $40,000. Only 3% of older boomers had student loan debt with a median balance of $9,000, either from personal educational loans or accumulated debt from their children’s educational loans.

Assustainability gains traction among consumers, the demand for eco-friendly homes is reaching new heights. Homeowners are investing in energy-efficient upgrades not only to trim utility bills, but to also make a positive impact on the environment. Being green isn’t just about saving the planet—it can also mean more green in your pocket when it comes time to sell. According to the National Association of Realtors® 2023 Residential Sustainability Report, energy efficiency stands out as a valuable selling point in property listings, with 63% of NAR members agreeing environmental awareness drives buyers to prioritize energy-efficient features to reduce their carbon footprint and contribute to long-term cost savings.

One of the significant revelations from the report is 32% of respondents reported using green data fields in their multiple listing service to highlight eco-friendly features and energy information in property listing descriptions. Green data fields allow real estate agents to spotlight eco-friendly features and energy information, making it easier for buyers to find desired features in homes. Utilizing green data fields in listings, real estate professionals can assist homeowners in identifying energy investments to enhance home performance and boost resale value.

Client interest in sustainability is on the rise, with nearly half of respondents noting varying interest levels among their clients. This shift in consumer preferences indicates the importance of offering eco-conscious options in today’s market. Realtors® are adapting to meet client demand, educating clients on investing in sustainability and connecting buyers with properties that align with their environmental values.

Energy-efficient homes incorporate features such as Energy Star appliances and smart home technology to reduce energy consumption and lower utility bills. Energy Star appliances,

certified by the U.S. Environmental Protection Agency, meet strict energy efficiency guidelines, consuming less energy compared to conventional models. They not only save money on electricity bills but also help reduce greenhouse gas emissions. According to the U.S. Department of Energy, Energy Star appliances can reduce home appliance energy usage, and costs, by as much as 10 to 50%.

With more developments in environmentally friendly appliances and materials, prospective buyers are searching for energy-efficient homes and features. A study conducted by Freddie Mac found homes with energy-efficient upgrades resold faster and for about 2.7% more than homes without those upgrades.

Smart home technology, on the other hand, allows homeowners to monitor and control their home’s energy usage remotely through connected devices. This includes smart thermostats, lighting systems, and energy-efficient HVAC systems. Smart bulbs, for example, are one of the simplest ways to save money and energy usage with the added convenience of control from your smartphone. All smart bulbs are LED bulbs, which use at least 75% less energy than traditional lightbulbs. By optimizing energy usage based on occupancy patterns and preferences, smart home technology further enhances energy efficiency and comfort while reducing waste.

While Energy Star appliances, smart home technology, and do it yourself sustainable home landscaping are commonly adopted sustainability measures for both current and prospective homeowners, solar panels stand out as a

Generated with Ai

significant green feature that can substantially increase a home’s value. A study conducted by the National Association of Home Builders found that homebuyers are willing to pay, on average, an additional $8,728 for a home that saves $1,000 in annual energy costs. In addition to their environmental benefits, solar panels have become increasingly popular for their potential to increase property value. Various incentive programs and tax breaks, such as the New Jersey Property Tax Exemption for Renewable Energy Systems and the New Jersey Successor Solar Incentive Program, further incentivize their adoption. In fact, New Jersey is a leader in the solar industry, with over 174,692 individual solar installations and ranking eighth in total installed solar capacity nationwide, according to the New Jersey Department of Environmental Protection.

Solar energy affordability has also significantly improved, thanks to initiatives like tax exemptions, net metering, and the federal solar tax credit in New Jersey. According to NAR’s report, solar panels are not only instrumental in reducing

The average homeowner could save at least 15% on heating and cooling costs by adding insulation in attics, crawl spaces, and basement rim joists, according to energystar.gov.

Embrace natural lighting during the day to conserve energy.

Wash your laundry with cold water whenever possible.

According to energy.gov, about 30% of a home’s heating energy is lost through windows. They recommend swapping lighter window coverings for heavier drapes or curtains for an additional layer of insulation.

carbon footprints, but 34% of Realtors® perceive solar energy as a valuable investment, further increasing a home’s appeal to eco-conscious buyers. This consumer value presents a win-win scenario for homeowners looking to embrace renewable energy while enhancing their property’s value. The U.S. Energy Information Administration expects solar power to account for the most growth in electricity generation in 2024. According to their 2024 forecast, the U.S. electric power sector will generate 43% more electricity from solar in 2024 than in 2023.

The increasing availability and benefits of sustainability and energy efficiency efforts paint a picture of homeownership and a real estate industry landscape poised for a greener, more sustainable future. By learning more about these green features and the growing demand for sustainable energy information, Realtors® can educate consumers and lead the drive toward a more ecologically responsible future, creating a greener residential landscape.

Welcome to our series, Meet the Decision Makers, where we interview key decision makers on their influential role within New Jersey. For this issue, we have Assemblyman and Financial Institutions and Insurance Committee Chair Roy Freiman. His verbatim responses are italicized below. Do you have an idea of someone you’d like to see us interview? Email editor@njrealtor.com

Can you tell us a little about yourself and how you got started in public service?

My wife Vicki, a retired public school teacher, and I have two grown children, Allison and David, and we live in Hillsborough with our two dogs. We are proud to be longtime residents of Central New Jersey. I spent the majority of my professional career in business working primarily in larger organizations. Something

I learned throughout my life was to respect the amount of responsibility that comes with leadership, I also was keenly aware of the political divide that was, and continues to afflict, our country. I found myself led to public service out of my desire to bridge this gap. I believe that different opinions and points of views should be viewed as an opportunity to work together.

What does the job of the Chair of the General Assembly Banking and Insurance committee entail in the state of NJ?

Across the board, the job of Chair of any committee is to post bills referred to the committee up for discussion. I oversee the committee that considers bills that would impact the banking and insurance sectors. Essentially, this committee might be responsible for matters dealing with financial and health related

issues. During the committee meetings, we might hear testimony from stakeholders who are advocating in favor, or opposed to a bill. The committee will want to learn who it will affect, the costs, benefits, and challenges associated with implementing it.

What have you been working on that would help the real estate market in NJ?

As a place to live, New Jersey is blessed with an abundance of reasons to buy a home and raise a family. However, for a long time, New Jersey is challenged with affordability and regulations. None of these challenges can be easily swept away or reversed overnight. I am proud to have been successful in taking the lead in making positive change in both categories, by prioritizing how the state manages debt, and pushing for changes in the building permit process. Furthermore, I have

1. Does Central NJ exist? Yes!

2. Go-To Pizza Topping: Mushrooms

advocated for New Jersey to be more aggressive in promoting tourism outside of the shore regions. (Central Jersey exists!)

Some other impactful bills I’ve worked on recently that would help the real estate industry are:

A516 First-Time Home Buyers tax credit

A2785 NJ American Dream Act

A5870 Sweat Equity

A573 Expediting Construction Inspections

What other issues have you been tackling in your role as Assemblyman?

Another topic that I am passionate about is education, as you might expect from a husband of a public school

teacher. I believe that our children are our future, so I have been working toward making sure they have access to education of all kinds. I have been working to ensure that learners of all ages can have access to knowledge integral to our communities by creating career and tech grants along with the Fund our Future Grants.

3. Pork Roll or Taylor Ham: Pork Roll

4. Favorite Sports Team: Mets!

5. Dead or Alive, who is someone you would want to meet? Alexander Hamilton, the father of our financial system

What do you think is the most impactful piece of legislation you have worked on?

As I mentioned previously, I believe the active management of the state debt is one of the most impactful pieces of legislation I have ever worked on. Given my background in finances, it is incredibly important to me that New Jersey works toward having a responsible and healthy fiscal status.

In 2023, the Sussex County Association of Realtors® proudly contributed over $27,000 to their local community, including $21,000 to the Sussex County Habitat for Humanity, derived from the proceeds of their 12th annual Charitable Golf Outing. Additionally, their annual fall food drive collected numerous food items for The Weekend Food Bag Program and toiletries for Connect for Community.

Greater Bergen Realtors® Community Service Committee partnered with Jersey Cares for their 2023 Annual Winter Coat Drive, collecting over 600 new and gently used winter coats of all sizes for local communities throughout November and December. With eight participating GBR brokerage offices, the committee reached a record-breaking number of donations since its partnership with Jersey Cares. For over 20 years, Jersey Cares Coat Drive has mobilized the collection and distribution of thousands of gently used winter coats to men, women, children, and infants in need. Companies, churches, police stations, schools, and other organizations collect coats throughout the drive and deliver them to a central location, where volunteers then organize the donated coats and package them for pick-up.

Nexus Association of Realtors® Young Professionals Network held their annual Coats, Cans, and Coffee Charity Drive, where members generously contributed non-perishable items, as well as new and gently used coats, gloves, hats, and more. Members visited the NEXUS offices to drop off donations, enjoying complimentary coffee and pastries while networking and exchanging business cards. All collected food and clothing items were donated to Angels Community Outreach in Pitman and New Beginnings Behavioral Health in Camden.

FINANCE/REFINANCE

FINANCE/REFINANCE — We Have You Covered As A Direct Lender

FIX & FLIPS

FIX & FLIPS

STATED LOANS/DSCR

STATED LOANS/DSCR

STATED LOANS/DSCR

FIX & FLIPS

No Tax Returns

No Tax Returns

No Tax Returns

1 to 4 Family

1 to 4 Family

Loan amounts from 100k to $2,00,000

Loan amounts from 100k to $2,00,000

1 to 4 Family

SFR, Condo 2 -8 family (Investment, Non Owner Occupied)

SFR, Condo 2 -8 family (Investment, Non Owner Occupied)

Up to 85% Purchase Price

Loan amounts from 100k to $2,00,000

Up to 85% Purchase Price

Loan Amounts: $100,000 – $3,000,000

Loan Amounts: $100,000 – $3,000,000

SFR, Condo 2 -8 family (Investment, Non Owner Occupied)

Up to 100% Renovation Cost

Up to 100% Renovation Cost

Up to 85% Purchase Price

LTV: up to 80%

LTV: up to 80%

Loan Amounts: $100,000 – $3,000,000

LTV: up to 80%

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage, Restaurants, Commercial Condo

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage, Restaurants, Commercial Condo

Loan Amounts: $100,000 to $5,000,000

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage, Restaurants, Commercial Condo

Up to 75% ARV

Up to 75% ARV

Up to 100% Renovation Cost

Terms 12-18 Months, interest only

Up to 75% ARV

Terms 12-18 Months, interest only

Terms 12-18 Months, interest only

BRIDGE LOANS

LTV: Up to 75%

Loan Amounts: $100,000 to $5,000,000

BRIDGE LOANS

LTV: Up to 75%

Loan Amounts: $100,000 to $5,000,000

Loan Terms: 30 years

LTV: Up to 75%

Loan Terms: 30 years

Loan Terms: 30 years

Most property types considered

Loan amounts from 100k to $6,000,000 We

Most property types considered Loan amounts from 100k to $6,000,000

Most property types considered

Loan amounts from 100k to $6,000,000 We

PORTFOLIO

LOANS A.K.A.

SBA LOANS

7a and 504 Loans

SBA LOANS

Up to 90% Financing, business owner occupied loans.

7a and 504 Loans

7a up to $5,000,000

7a and 504 Loans

Up to 90% Financing, business owner occupied loans.

PORTFOLIO LOANS A.K.A. BLANKET MORTGAGES

PORTFOLIO LOANS A.K.A. BLANKET MORTGAGES

Purchase

5+ Properties

Up to 90% Financing, business owner occupied loans.

7a up to $5,000,000 504 loans up to $15,000,000

7a up to $5,000,000 504 loans up to $15,000,000

Loan Amounts from $250,000 to $20,000,000

CONVENTIONAL COMMERCIAL FINANCING

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage

$500,000 to $7,000,000 Purchase or Refinance

5+ Properties

$500,000 to $7,000,000

Up to 75% LTV

Purchase or Refinance

FHA 223(f)

Up to 75% LTV

FANNIE SMALL LOAN PROGRAM

FANNIE MAE DUS

FHA 223(f)

FANNIE SMALL LOAN PROGRAM

FANNIE MAE DUS

Loan Amounts from $250,000 to $20,000,000

CONVENTIONAL COMMERCIAL FINANCING

Terms: Up to 25 Years

LTV: up to 75%

Amounts $3,000,000 and up Multi Family

FHA 223(f)

Properties

FANNIE SMALL LOAN PROGRAM

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage

Loan Amounts from $250,000 to $20,000,000

Terms: Up to 25 Years

Multi-Family, Mixed Use, Office, Retail, Warehouse, Auto, Self Storage

LTV: up to 75%

Terms: Up to 25 Years

LTV: up to 75%

Loan Amounts $3,000,000 and up

FANNIE MAE DUS

Multi Family Properties

Loan Amounts $3,000,000 and up

Up to 85% LTV

Multi Family Properties

Terms up to 35 years, Fixed Rate

Up to 85% LTV

Terms up to 35 years, Fixed Rate

www.commercialmortgagedepot.com