March 2023 In-depth analysis, insight and advice for convenience and foodservice wholesalers STOCK THE NEW TASTE SENSATIONS VUSE GO FLAVOURS IN RECHARGEABLE ePOD UP TO 1900 PUFFS PER PACK* Dispose of responsibly. 18+ only. This product contains nicotine and is addictive. For adult nicotine consumers only. For trade use only. *Based on laboratory testing (including recharging) of VUSE ePod 2 device and may vary depending on individuals usage behaviour.

The wholesale sector is evolving, and so are we. Take a look at our new-look website betterwholesaling.com where you will find:

• More news and thought leadership

• In-depth wholesaler profiles and video interviews

• Sector and category reviews

• Easy-to-digest infographics highlighting key industry trends

betterwholesaling.com

Stay informed and get ahead with

All you need to know about the most innovative and cost-effective methods that guarantee future success

March 2023 In-depth analysis, insight and advice for convenience and foodservice wholesalers

Innovation

On the path of innovation and progression

were forced to move towards b2c/digitally-led frameworks, but the wheels were already in motion at the start of the decade, and have continued at a pace ever since.

Paul Hill

Editor

I’ve been working in this role for more than four years now and the way the industry innovates has increased exponentially over that time. Gone are the days of wholesaler’s relationships with customers being purely transactional. They now deal in a diverse range of services that go beyond what a traditional wholesaler would offer.

Of course, the Covid-19 pandemic accelerated innovation after companies

In this edition, David Gilroy uses examples from the likes of Elon Musk and Pixar to highlight why businesses need to innovate or risk getting left behind. Claire Williams, of Zest Food Partners, then argues the same point within the context of product range. Meanwhile, Rob Mannion, of b2b.store, takes a deep dive into one innovation that has yet to fully take hold in the channel – WhatsApp for businesses.

I also took a visit to Kent to see how the new owner of Q Catering, Stephen Clarke, plans to increase turnover to £20m through innovative investment.

As well as this, we hear from the FWD’s Dawood Pervez and Country Range’s Martin Ward to find out their strategies as they both begin new roles.

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Senior designer Jody Cooke

Junior designer Lauren Jackson

Contributors David Gilroy, Tom Gockelen-Kozlowski, Carl Hillier, Rob Mannion, Charles Smith, Claire Williams

Production coordinator

Chris Gardner

SALES

Head of commercial

Natalie Reeve 020 7689 3367

Senior account director

Charlotte Jesson 020 7689 3389

Account managers

Marie Dickens 020 7689 3366

Megan Byrne 020 7689 3372

Lindsay Hudson 020 7689 3366

Commerical project manager

Ifzal Afzal 020 7689 3382

Better Wholesaling Insight's publisher Newtrade Media cares about the environment.

Printed by Acorn Web Offset Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire, WF6 1TW Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

Better Wholesaling Insight is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. Reproduction or transmission in part or whole of any item from Better Wholesaling may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information.

Join the conversation: @BW_mag

REPORT

P4-5: Viewpoint

Why keeping pace with innovation is hugely important

P6-7: Insight

Is WhatsApp the future of wholesale?

P8: Opinion

What could Bestway’s investment in Sainsbury’s mean?

P10-11: Profile

How Q Catering plans to achieve £20m turnover by 2030

P12: Viewpoint

Why you should be embracing disruption

P13: Overview

How Alibaba’s innovations can aid UK wholesalers

P16-17 Interview

What is the plan for the new chairman of the FWD?

P18-19: Opinion

Innovation is key in making the industry competitive

P20-21: Interview

The man now at the helm of CRG outlines his plans

P22-23: Summary

Five ways wholesalers can innovate to build profits

CATEGORY ADVICE

P24-27: Foodservice focus Exploring the opportunities hotels and restaurants present to the channel

P28-30: Sector review A look at the latest trends and NPD in the breakfast category

P32-36: Sector review

How to navigate the wide-ranging and evolving soft drinks sector https://bit.ly/3lvj7FC

2 CONTENTS

LEADER

Our social channels are the quickest way to keep up to date with all things The Fed. From the latest industry news to upcoming events, membership benefits, partner offers and commercial support Join our retailer community today #TheFed Federation of Independent Retailers Fed The E s t 1 9 1 9 thefedonline.com 0800 121 6376 contactus@nfrn.org.uk @the_fed_nfrn @TheFedOnline YouTube @TheFedNFRN Twitter @TheFedVIP Facebook VIP @TheFedOnline Facebook @The Fed (NFRN) LinkedIn Make money, save money, make business easier! Instagram Follow us Instagram Subscribe to YouTube Follow us Twitter Join us Facebook VIP Like us Facebook Follow us LinkedIn RN 1/2 page horizontal.indd 1 09/12/2022 16:13

“To infinity and beyond!” The immortal words of Buzz Lightyear from the film Toy Story. Sitting behind these words is an inspiring journey of innovation and entrepreneurship. Released in 1995, Toy Story was created by Pixar and was the first computer-generated animation (CGA) feature film.

It went on to gross $373m at the box office worldwide and it changed the landscape of animation forever. Pixar had its origins in the 1970s with George Lucas and Lucasfilm. It continually struggled financially until becoming a separate company in 1986, when Steve Jobs invested $10m and took a seat on the board as chairman.

The company’s financial troubles weren’t over, however. By 1995, it had to do a deal the Walt Disney Company to help fund and release Toy Story. Disney recognised that Pixar, and in particular John Lasseter, their creative lead, had a skillset that they lacked and

they wanted a piece of it. By 2006, The Walt Disney Company knew that CGA expertise was essential and it bought Pixar outright for $7.4bn. Disney treats Pixar as a separate standalone business unit and the merger is often quoted as one of the most successful in recent years. Pixar’s average box office gross per film is $350m compared with Disney’s at $324m. The innovative upstart has eclipsed the established incumbent.

Pixar’s connection to Steve Jobs is apposite. One of the great innovators of our time, he changed our world with Apple computers, the iPod and the iPhone. Most of us have on our person more computing power and connectivity than beyond anything we could imagine in the turn of this century.

Big-scale, adventurous innovation is exceptionally powerful. Jeff Bezos travelled a similar road with Amazon. He recognised early on the potential of the internet and, in 20 years, he completely revolutionised the way we shop.

To the extent that Amazon, starting from zero, is now pushing hard against Walmart to be the largest retailer in the world. Elon Musk, for me, is the greatest innovator of them all.

If you haven’t already, check out The Elon Musk Story on BBC iPlayer. This is a three-part lesson in how to innovate, survive and prevail against overwhelming odds. It should be on the school curriculum.

To create and scale Paypal is some achievement. To go on to found and build Tesla into a major-league vehicle maker worldwide is another level. At the same time, to successfully launch

Space X and Starlink, eclipsing NASA technology, is beyond incredible. What is it that connects these people? Martin Zwilling, writing for Forbes, says: “The goal of innovation is positive change, to make someone or something better. Entrepreneurs need it to start and established companies need it to survive. The front end of innovation, or ‘ideating’, is the energising or glamorous part. The execution seems like behind-the-scenes dirty work.”

One of the most brilliant aspects of all of Amazon, Apple and Tesla is the applied operational excellence in scaling the product. To manufacture such high-quality leading-edge products and services in volume and in short timescales is seriously impressive. Elon Musk put himself right out there.

He took multimillions of dollars in payments from customers up front before he had built a single car. The pressure was then on to deliver. After much angst and turbulence, Musk positioned his desk on the factory floor and personally supervised production until he was satisfied that it was running effectively to achieve output targets. Ideas are the

4 REPORT

B2B should be looking at B2C and what they’re doing – because that will come next

Gilroy’s viewpoint: If wholesalers fail to innovate, there’s a huge risk they will be going backwards

David Gilroy is the founder and managing director of Store Excel

front part, but execution and scalability are vital for success. Jobs, Bezos and Musk were fully immersed in the detail of their respective projects until happy that they were operationally robust. The connecting thread is innovation driven by technology, operational excellence and a relentless focus on the customer.

Martha Lane Fox, who co-founded Last Minute during the dotcom boom at the turn of the century, says: “We ain’t seen nothing yet with tech.” She and other informed commentators seem to agree that digitising business needs to be the arena for innovation. Where are the innovation and digital opportunities for our industry?

Steve Jobs, launching the iPhone in 2007, declared: “Every once in a while, a revolutionary product comes along that changes everything.” ChatGPT is a language model developed by OpenAI. This technology is the latest innovation set to have a major impact on business.

Hamish McRae, writing for the i newspaper, predicts ChatGPT will transform the service industries making them vastly more efficient.

Danny Forston, for The Sunday

Times, writes: “Software appears to be taking a giant leap up the ladder of jobs that, until a few months ago, could only be done by humans.”

Taking the theme of digitising, ChatGPT seems to offer the pathway to massively improving efficiency and service in customer-facing roles. Apply it to telesales: voice recognition, order prompting, order taking, up-selling, cross-selling and substitution recommending. All at high speed and open 24/7. Apply it to the field sales force making it better informed, smarter and more effective: outlet reporting, information gathering, order placement, intelligence recording, competitor activity, unique customer requirements and feedback. This unlocks the real power of the human assets.

Here’s a few slightly controversial digital innovation thoughts on procurement and payment as inspired by Ilija Ugrinic at Proactis. Spurred on by the constraints of Covid-19, he states that more than 80% of major businesses are seeking to digitise their back office. This means junking the spreadsheets, opening up and giving suppliers direct access

to the product files. There are manpower savings to be realised by providing suppliers access: to ensure that their own details are correct, terms of trade are accurate, product details updated, range changes queued, barcodes and product links up to date, promotions plotted and cost price increases granulated.

This could go as far as allowing remote order placement within an agreed set of parameters. Pushing the boat right out, how about an industry-wide framework of product categories and product abbreviations that, in turn, would regularise data analysis?

John Reay, of Rewrite Digital, writing in The Sunday Times, emphasises the need for businesses to innovate by looking outside of their sector. “B2B should be looking at B2C and what they’re doing because that will come next, so it will give you a better idea of what needs to change in your industry,” he suggests.

Let’s apply this thinking to many of the checkout operations and e-commerce platforms across our industry. Thinking about customers first, how do we give them a smoother experience? Payment at tills is a must. Eliminate cashpoints. Offer the full range of payment methods, including open banking at the point of payment. Install a self-scanning operation and extend this to personal mobile-device scanning.

Given that many wholesalers are broadening their customer bases, the e-commerce experience needs to be upgraded. Payment at the completion of the order is essential. Of course, the VAT element needs to be included and clear. People expect to be able to pay at the point of order. Therefore, a full understanding of product availability at the point of order is vital. By all means have the product on the view, but grey it out and restore it when it is back in stock. Include an expected in-stock date.

Innovation inspires, excites, scares and threatens in equal measure. It leads to change, which, in turn, stirs the blood. Strap yourself in. If you never innovate, you risk going backwards.

The final words are from Martha Lane Fox. She says: “Business models keep changing and companies need to keep innovating to survive – most acutely, those that are customer-facing. Look at the rapid flight of the younger demographic from Facebook to TikTok – the advertising dollars have followed.” l

5

Image source: Getty Images/elenabs

How WhatsApp could change the way wholesalers operate

Rob Mannion is the chief executive of b2b.store

e’ve all read the predictions. Grand visions of wholesale’s future punctuated with fully automated warehouses, beacons sending personalised offers to customers as they walk around depots and robot delivery drivers – well, maybe not the last one.

But while there might be a time when one of those come true, it turns out the more immediate future of wholesale could be found in something most of us use every day: WhatsApp.

The messaging app is a powerful tool, and while many of us are more familiar with the consumer version, it’s the use of it in a professional sense that could transform the way wholesalers operate.

Ostensibly, WhatsApp is a method of communication, but adapted in the right way, it can reach into almost every part of a wholesaler’s business, from advertising and credit control, to ordering and marketing.

Almost everyone uses WhatsApp on a daily basis, but they’re only familiar with the consumer version – used to its full potential, though, WhatsApp could be a game-changer for wholesalers.

Some businesses have tentatively explored WhatsApp by creating groups of customers and sharing messages with them, but

Wit creates an environment that’s like the wild west, where anyone can reply in full view of everybody else in the group.

The consumer WhatsApp is great for social messaging, but it’s the upgraded, paid-for version – WhatsApp Business API –that has greater functionality and potential for personalisation.

As part of b2b.store’s vision, WhatsApp can be adapted to become a one-stop shop for wholesalers that includes one-tap ‘add to basket’ buttons on promotions or adverts shared in messages, one-tap reordering and automatic credit control management. By integrating WhatsApp with existing e-commerce or accounting software and assigning customers to phone numbers, several business functions could be funnelled through one channel.

While b2b.store’s development is working towards the full-service capabilities, its phase-one B2B WhatsApp module already encompasses much of this and is currently earning traction with wholesalers and buying groups – particularly for sharing marketing collateral, promotions and content to customers.

Early adopters to B2B WhatsApp are already seeing a glimpse of what WhatsApp can achieve, with 29% of messages read within the first 10 minutes of being sent and rising to 55% within the first hour.

“We see WhatsApp as a great means to get messages out to customers quickly in a secure environment that can track engagement through read receipts and clicks,” says Sugro’s head of commercial and marketing, Yulia Petitt.

“The benefit of using WhatsApp in comparison to other communication methods, such as SMS and email, is that we can send a variety of multi-format messages to customers at scale on a platform that we know the vast majority of people are using regularly throughout the day. The challenge is always guaranteeing that we get eyes on messages and promotions we send,

so WhatsApp ticks this box in a way we haven’t been able to previously.”

The numbers reflect that assertion. In Statista’s Global Consumer Survey, 80% of UK phone owners selected WhatsApp as their most-regularly-used messaging service due to its immediacy and the ability to send multi-format messages at no extra cost. WhatsApp is ubiquitous, so it’s the place to be.

For a business, WhatsApp is even more valuable than that. The ability to have two-way interactions with customers – and the potential to introduce automated chatbots to deal with common queries – can improve commu-

6 REPORT

100 90 80 70 60 50 40 30 20 < 10 mins < 30 mins <1 hour < 2 hours < 24 hours 29 44 55 64 91 Percentage of people reading message in time

82% of UK phone owners use WhatsApp

B2B WhatsApp open rates

nication and efficiency through the business. The functionality to drive customers directly to special deals or brand-exclusive pages within e-commerce platforms could also become additional revenue drivers for wholesalers.

Segmenting customers by region or sector could mean the quality or success rate of each communication is much higher and ensure only relevant messages are sent, which is crucial for prolonged engagement.

HOW COULD WHATSAPP HELP WHOLESALERS?

Advertising

Instantly deliver product offers, promotions and exclusive supplier deals to customers at scale without the need for them to be on your e-commerce platform.

Deep links

Product lists can be sent to retailers within a message including a link to an e-commerce platform for purchase, potentially opening new revenue streams with suppliers.

Add product to basket

With personalisation, promotions and new products sent by B2B WhatsApp are joined by a button prompting customers to ‘add to my basket’ with one simple tap.

Product brochures

99.75% retention rate of people in the channels, indicating that it’s a communication method wholesalers’ customers are happy to receive material on.

“When I first heard about B2B WhatsApp, I started thinking about the app I have on my phone and that a retailer channel would just become another group that sends lots of messages to people,” says Aled Roberts, director at Welsh wholesaler R&I Jones.

99.75% The retention rate since launch of B2B WhatsApp

Since launch, early adopters of

“But the idea isn’t about bombarding customers with lots of messages, it’s about sending updates that have real value – whether that’s an important information thing or sending a suppliersponsored message with an

over-and-above deal that entices a highly engaged channel to buy a certain product.”

The first phase of B2B WhatsApp is already making a splash in the sector, with several wholesalers and buying groups starting on their journey to harness the power of the software in different ways.

And as b2b.store moves into the next phase of its development, B2B WhatsApp’s influence could grow even further.

WhatsApp fits wholesalers’ businesses perfectly and it’s really exciting to be leading the way in this space. We’ve been working with the technology in this way for several months and have an excellent understanding of where this could go and have a roadmap in place of how to get there. This could have a genuinely transformational impact on the sector. l

Save money on print or mailers by sending latest fliers by WhatsApp, with customers able to access and browse from the app.

Credit control

Let customers view and manage their account, with open banking instant-payment capabilities and automated payment reminders set up with personalisation linking a phone number to a customer account.

Reordering

Send automated reordering messages to prompt customers to place repeat orders with a single tap, with messages sent a fixed period of time after previous transaction to increase likelihood of a positive outcome.

REPORT 7

first 1hr

in first 24hr

Messages read in

Read

Data source: b2b.store

Opinion: Bestway upping its stake in Sainsbury’s could be pivotal for the industry

David Gilroy

This was not written in the script. Everyone knows it is the multiples that play the leading roles. Their poorer cousins, the wholesalers, are the walk-on extras. Following the Tesco acquisition of Booker in 2018, all the speculation was around which major supermarket would be next to purchase a wholesaler. Times are changing, and we are witnessing something of a role reversal.

Asda is owned by a couple of blokes who started off running a petrol station in Blackburn. They have gone on to build a retail empire and show no signs of slowing down.

The recent news that Bestway took a stake in Sainsbury’s was unexpected, and sent shock waves through the industry. In a matter of days, Bestway’s stake increased from 3.5% to 4.47%. Any intentions of making a bid

were, and are, being denied. The Qatar Investment Authority holds 14.3% equity in Sainsbury’s and the Czech billionaire Daniel Kretinsk’s Vesa Equity Investment 10%. Financial commentators are not expecting bids any time soon. It is also worth noting that Sainsbury’s revenues at £30bn are way higher than the Bestway Group’s £4.5bn.

This will not stop Sainsbury’swatchers being on high alert. Sainsbury’s offers great value, and anyone considering a bid will have to accelerate their plans. The share price has surged from £2.19 at the turn of the year to £2.63 at the time of writing.

Could Bestway really come to own Sainsbury’s? The two companies are aligned in many respects. They are culturally similar, with family values, a serious responsibility to their employees, and a clear understanding and connection with their customers, and both have high reputational standards.

Bestway has always stew-

arded its business responsibly. It likes solid assets, primarily high-cash-generative businesses and property ownership.

It has carefully grown the business from zero in 1976 to a multi-billion-pound organisation. Bestway is brilliant at assessing risk and weighing up value.

Its negotiating skills are legendary, and it is not afraid to make the big calls. The company’s most recent published results were nothing short of stellar, with turnover at £4.51bn and profit at £399m.

If Bestway was to buy Sainsbury’s and take it private, it would be on a sound financial platform – not a company leveraged to the hilt on massive debt.

Bestway could be planning collaboration with Sainsbury’s in the convenience or pharmacy store sectors. Or maybe it could make another big call and follow through on a full-on bid? Could Bestway digest such a big entity? Absolutely yes, it could. If the Issa brothers can buy and run Asda,

why

The prospect is mouth-watering. Sainsbury’s is a well-run company with great management and the infrastructure to scale for growth. There are some strong benefits on both sides, and such a combination would unlock tons of value – trading terms, distribution infrastructure, fresh-food expertise, ownlabel provenance and cross-selling, to name but a few.

The shared knowledge alone would be worth a fortune, and Bestway would be respectful of Sainsbury’s name and heritage.

Sainsbury’s has been in play for some time and looks undervalued. Bestway has just fired the starting gun. Prospective bidders will be crunching the numbers. If the bids come, it will ultimately be the shareholders who decide.

No one knows how this will develop, but Sainsbury’s could do a lot worse than becoming part of the Bestway Group. What a turnup that would be. l

8 REPORT

couldn’t Bestway own and run Sainsbury’s?

David Gilroy is the managing director of Store Excel

YOUR NEW FAVOURITES YOUR NEW FAVOURITES

Green

HIT REFRESH STOCK UP NOW

It’s an offence to sell tobacco to persons under 18 years old. For tobacco trade use only. Not to be left within sight of consumers.

NEW

£10 .25 RRP PALL MALL Shift Green £10 .25 RRP

ROTHMANS Green Superkings

Spotlight - Q Catering

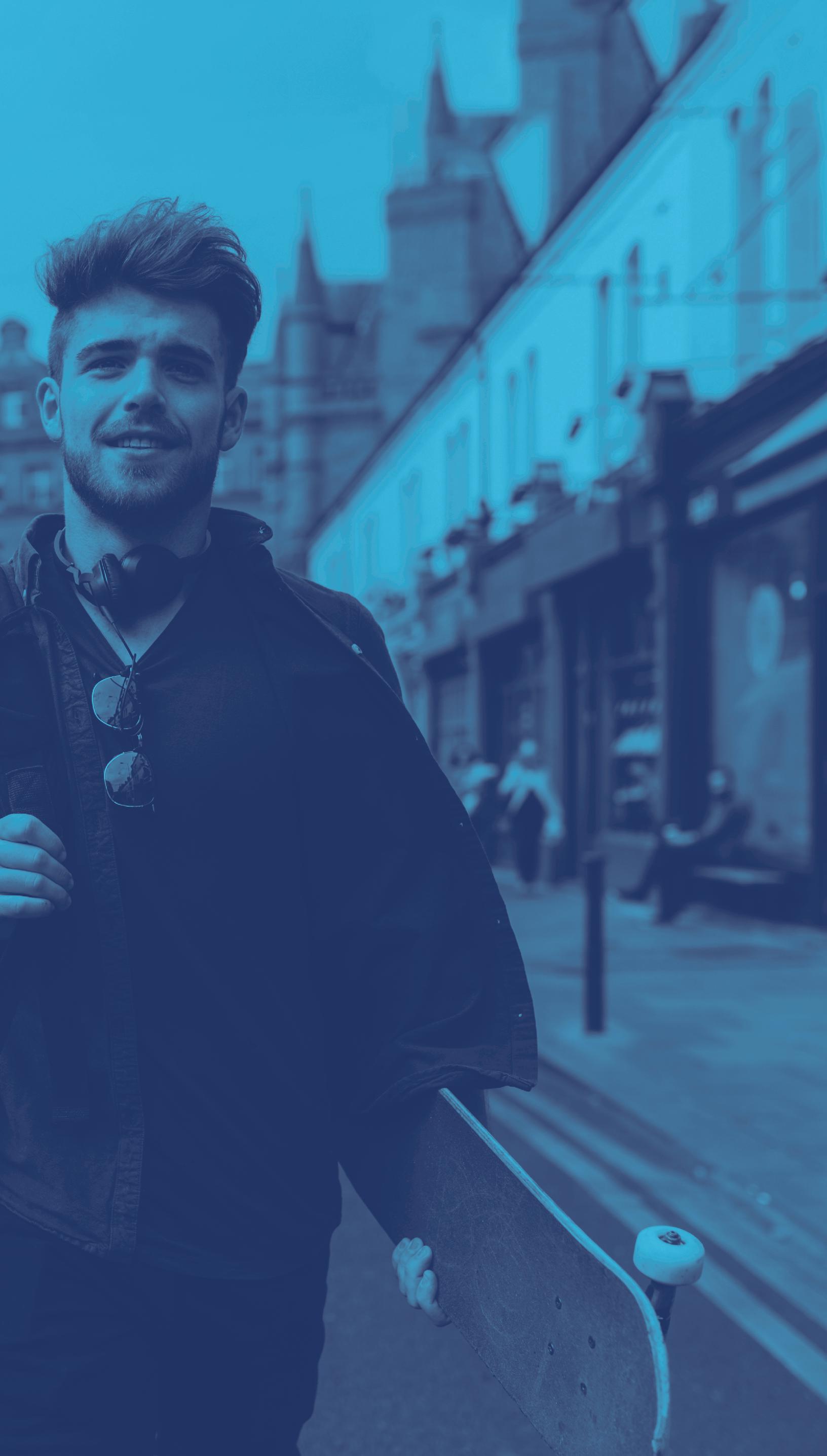

Paul Hill speaks to Stephen Clarke, managing director of Sittingbourne-based Q Catering, on how he plans to achieve £20m turnover by the end of the decade

Stephen Clarke Managing director, Q Catering

Stephen Clarke Managing director, Q Catering

BWI: Talk us through your purchase of the business

SC: I was previously the purchasing and marketing director of Kent Frozen Foods (KFF), and was on a two-year contract with Sysco as part of the handover after they acquired them. Following this, I spoke to Roger Snelling, the previous sole owner of Q, and we had a few conversations about getting me involved.

At the start of 2021, he made it clear how he wanted to get a deal done. By October, I was a joint owner at the company.

I joined Q with the mindset that the independent wholesaler can play a huge part in the future of foodservice, and I’m really passionate about that. There are a lot of outlets out there that don’t want to deal with the likes of Bidfood and Brakes.

They want wholesalers that are going to listen and can move and adapt to the market a lot quicker. They want

to know you are in it for them and are invested in their business.

With KFF getting bought out along with other independents, I saw a gap in the market, and that is what attracted me to Q Catering.

When you look at south-east England, there is huge potential for this region and its huge population.

What is your vision for the company?

I envision us developing our product range, our service levels and the customers we serve. When I first came into the business, I made it clear my intention was investment. I knew we

needed to invest in vehicles and facilities, because if you don’t invest in the front-end, you’re not going to be able to cope when you eventually achieve your desired level of growth.

With this investment in mind, my overall aim is achieving an annual turnover of £20m by 2030. I have a strong vision for the company and believe Q can be a leader in the foodservice sector.

What are your investment plans?

We’ve already achieved the first phase, which was getting us at capacity. We were able to achieve this with our warehouse expansion, which

10 REPORT

I joined Q with the mindset that the independent wholesaler can play a huge part in the future of foodservice

resulted in an extra 11,600sq ft of storage facilities.

This all forms part of a plan that aims to deal with the increase in demand for frozen goods, as well as aiding in the strategy to expand across the south-east and London.

Once complete, we will have 22,600sq ft of warehouse facilities – a increase from the initial 5,000sq ft when the company started in 2003.

Our new warehouse facilities stand just across the road from the original space and will store only ambient and chilled food products. This new unit can hold 545 pallets of ambient and chilled food products to be safely stored on site.

The original facility, meanwhile, has been converted into a 11,000sq ft freezer to store up to 520 pallets of frozen goods at one time. This investment in frozen is backed by up industry data, with reports showing that frozenfood sales rose by 21% in 2020, and that trend is continuing post-pandemic.

Have you made investments in your people?

As part of the growth plan, I’ve made a number of key appointments over the past few months in the form of a

finance director, a sales director and a commercial director.

Nick Jennings (finance), Caroline Martin (sales) and Tony Blake (commercial) have all joined me from KFF, where we worked closely together for a number of years.

They will now form part of the Q Catering leadership team and will play huge parts in achieving our turnover goal of £20m by 2030.

What are your plans for 2023?

At the start of this year, we managed to achieve a sizeable sole-supply agreement with Independent Catering Management, which is one of the leading school-meal providers in southeast England, and this came after 15 years of us sharing the business with Brakes. We’re delighted to be fully partnering with them. They’re a truly inspiring catering company that our values align closely with.

Furthermore, as well as an introduction of a plant-based range we introduced for Veganuary, we also recently launched a next-day delivery telesales service that enables our customers to place orders up to 10pm for next-day delivery. This again aligns with our customer-centric approach. l

11

Why wholesalers should take a risk and embrace disruption

Carl Hillier, head of operations, OGL Software

There’s no getting away from the fact that doing business today is getting more expensive. The Covid-19 pandemic hit component and product availability hard. Brexit added new cross-border challenges and staffing shortages. Then, along came war, inflation and the energy crisis to further affect supply chains.

In the long term, we’ll get used to an even newer norm and be stronger for it. Interest rates and higher costs of borrowing will draw down demand, and inflation will drop. However, wholesalers must be ready for changes in consumer behaviour.

Profitability takes a hit

In OGL Software’s Profitability in UK Wholesale Businesses report, the key factors affecting profitability were the Covid-19 pandemic (54%), Brexit impact (38%), manual processes (33%) and stock availability (32%). It’s likely the energy crisis and recession will appear as factors this year, too.

We are in a crisis, so the top priorities for survival still hold true today for wholesalers, from effective management of cashflow, having a robust sales strategy and exploring routes to market.

We also need to move away from manual processes, as a third of respondents believe they negatively affect profitability. Eighty-two per cent of wholesalers are turning to technology to become competitive, and 76% have switched to cloud hosting of

applications. Indeed, technology – especially ERP software – can help to take tighter control of operations to create efficiencies, improve processes, reduce costs, price appropriately and reach customers effectively.

Initiatives to stay in business and get ahead Businesses realise that efficiency and technology go hand in hand – 86% of respondents agreed technology is vital to the efficient running of their businesses.

While some still have manual processes, others are running multiple systems, with 68% seeing the benefits of integrating disparate systems.

Adding a single, comprehensive system can streamline business operations and increase productivity, as well as providing the data required to make informed business decisions.

Cloud-based software with

intuitive consumer-like interfaces improve the employee experience, enabling them to be motivated and make an impact for their employers.

The inclusion of stock and order management, full CRM and e-commerce integrations in the latest ERP systems for stockists means it’s easier to reach and engage customers, keep them happy and sell online. Nurturing customers is vital during a downturn.

OGL has recently worked closely with the wholesaler Cater4you. This is a good example of a company using integrated software.

Its website was extremely busy during lockdown, but with the integration into our software, the company was able to stay in control of stock and manage customers’ expectations.

As part of a move to multichannel selling, they said: “We’d see products sell out in three-tofour hours and we’ve never seen

products sell that quickly, but the system made us more efficient, so we were able to cope with the sheer volume and be equipped to come into the office on Monday to send out more than 500 orders.”

Shake off despair, embrace risk and profit

The pandemic started to prepare us for the rough road ahead. As a result, many in the wholesale sector see managing cashflow better as a priority (81%), no surprise for a niche severely affected by rising business costs. But using software adaptable to new business models also featured strongly (78%).

Given the current business outlook, there is an argument to say there is more reason to take a risk, and embrace a little business disruption, when there is a chance to survive and prosper with a refined, streamlined, multichannel operation. l

12 REPORT

Top three factors affecting profitability

Automating

Hosting

improve

Top factors for technology adoption Being able to sell products online easily

business processes to stay competitive

applications and data in the cloud to

productivity

Linking e-commerce to ERP 40% Inventory management 33% Business

41% 84% 82% 76% Figures taken from OGL Software’s Profitability

UK Wholesale

Manual processes 33% Brexit impact 38% Covid-19 pandemic 54%

Top three technology priorities for 2022

performance reporting

in

Businesses report

Interview

BWI: How does the Alibaba Group’s B2B sourcing platform technology connect wholesalers to buyers in the UK and abroad?

RP: With the click of a button, UK buyers of wholesale goods can browse, explore and discover hundreds of thousands of products from suppliers around the world. Alibaba is a professional sourcing platform, helping to cost-effectively reach and match wholesalers and buyers, delivering a seamless solution for bulk orders.

It also provides UK wholesalers with the tools they need to sell their products overseas.

Growth categories include food and beverages, which offer raw materials such as sugar, vegetable oils and meats, and pre-packaged goods such as confectionery and soft drinks.

What have you seen regarding customer behaviour?

Online B2B marketplaces are quickly becoming one of the go-to solutions for businesses. In a similar way to B2C marketplaces, they streamline the entire buying process by helping buyers connect with thousands of suppliers. This helps drive margin gains for businesses that can quickly shop around for alternative products, while de-risking a business’s supply chain, which often relies on single channels for sourcing products.

With 49% of B2B purchases in the UK now bought online1, buyers are increasingly looking for more innovative ways to shop than ever before.

To bring the best of the B2C experience to B2B, during our largest B2B sales event of the year – Super September – we hosted thousands of livestream events from suppliers in-markets. We also launched virtualreality factory tours, allowing UK B2B

buyers to go inside the four walls of a supplier’s factory, all from the convenience of their office.

Innovations like these can be a great way for buyers to get to know a supplier, as well as an opportunity for wholesalers to showcase the benefits of their products, the quality, and the story of their operations. This engagement can help to build relationships based on trust and transparency.

What can Alibaba do for UK wholesalers looking to export to overseas markets?

Businesses across the UK are under increased pressure to grow, and Alibaba can help them export around the world. The platform has more than 40 million active buyers in more than 190 countries – from the US to India, Brazil to the EU.

In our survey of more than 2,000 businesses in the UK, almost half are concerned about the challenges of cross-border trade, despite recognising the export potential, with the biggest barriers to exporting identified as paperwork and customs rules. Clearly, businesses understand the importance of trading overseas, but are often worried about their ability to navigate a complex landscape.

We want to ensure more UK wholesalers are given the support they need to achieve global growth.

Confidence among UK businesses that do currently export is high, with around 80% saying they expect their export sales to increase in the next 12 months. Ninety-two per cent of those exporting overseas are currently working with online marketplaces such as Alibaba – because they can provide the tools, platform and reach to strengthen their international presence and boost export sales.

What are the latest wholesale trends Alibaba.com has seen from its platform?

We are seeing strong demand internationally across a range of categories, with more than 500,000 active buyers every day on our platform.

In the UK, food & beverage is one of our most in-demand categories, with UK buyers increasingly using Alibaba to source products from multipack drinks and confectionery to ingredients such as cheese and coffee.

Another area where we have seen increased demand is sustainability. During our Super September event, we saw an uptake in sales of sustainability-focused products, ranging from those focused on renewable energy, to environmental protection, and biodegradable and recyclable products. l

1Insights.wundermanthompsoncommerce.com/ hubfs/@UK/Wunderman%20Thompson%20 Insights/Reports/WTC%20-%20The%20B2B%20 Future%20Shopper%20Report%202021.pdf

REPORT 13

With 49% of B2B purchases in the UK now bought online, buyers are increasingly looking for more innovative ways to shop than ever before

Paul Hill speaks to Roland Palmer, general manager of UK, Benelux & Nordics at the Alibaba Group, on how the company’s innovations can aid UK wholesalers

STOCK UP NOW

Available at most Cash & Carries and Wholesalers

This product contains nicotine and is addictive. For adult nicotine consumers only.

*This product is not risk-free and contains nicotine, an addictive substance. For trade use only.

EMPTY CAN AND RECYCLE

Interview

Paul Hill speaks to Bestway wholesale managing director and new FWD chairman Dawood Pervez

BWI: What are your plans as FWD chairman?

DP: The FWD is an important body in representing the interests of its 600 wholesale members to government, suppliers and beyond. During my two-year term, I would like to see the social and economic contribution of the wholesale sector being recognised, and broadcast to an even wider audience.

I will be looking to encourage FWD members to participate in work in three key areas: planet, talent and trade. This will cover sustainability, recruitment and development, and helping suppliers to understand the opportunity the wholesale channel offers for their brands.

How is Bestway looking to innovate in the wholesale industry?

Our innovative hybrid stores – dual-branded fascia stores within a store where convenience

stores have potential to take their licenced sales to the next level by having a Bargain Booze (BB) store within – are being rolled out across the UK. Weekly sales are 55% higher than comparable stores without a BB store and we are leading the way in offering our retail partners unrivalled opportunity.

Sustainability remains at the forefront of depot/store standards. Deliveries are optimised by constantly reviewing frequencies and routes, ensuring the right service for each retailer (while helping our carbon footprint). We’ve continually improved packaging and plastic reduction, working in association with suppliers and retailers, and 95% of

all Bestway print and packaging is now recyclable.

The investment and launch of next-gen self-checkout units. These small footprint self-checkouts from Toshiba are amazing and help improve customer flow, take both cash and card solutions and deliver an improved customer experience.

2023 will see the next stage of the Bestway Good Food Project in collaboration with Impact on Urban Health and FWD to make healthier foods sold in convenience stores more accessible. This will be supporting the government’s agenda to reduce obesity, and results from the current stage

show a 38% sales lift.

What are your predictions for the future of wholesale over the next 12-to-18 months?

Wholesalers are forward thinking when it comes to sustainability and energy efficiency, and share commitment in improving their environmental footprint. I anticipate even more focus being placed on sustainability with increased commitments to reducing emissions and reaching net zero, alongside science-based targets, which are becoming more important to organisations that are genuine about making a difference.

The value of ‘shopping locally’ will continue to be evidenced.

16 REPORT

Dawood Pervez Managing director, Bestway Wholesale & FWD chairman

Not only in meeting general shopper habits, but a growth in consumer understanding of the benefit of shopping locally during the cost-of-living crisis. Increasingly, it will be seen as a great way to save money, reduce waste, minimise travel costs, get exercise, participate in the local community and reduce emissions. Foodservice will also continue to consolidate before the next round of expansion.

Use of experiential hospitality and ‘retailtainment’ to boost customer footfall. Customers will be focused and engaged in a positive and entertaining atmosphere when shopping.

Changes in the behaviour of

consumers, who are more health conscious. Wholesalers will need to review their categories to cater for the health-conscious consumer and create new product opportunities for the HFSS regulations.

Consumers are favouring premiumisation products and choosing value and quality.

What are the biggest challenges the industry faces?

The unpredictable and erratic supply issues across the food chain have impacted availability from suppliers. This has had the largest impact on our customers –and consumers.

Resourcing has become an industry-wide concern, with supply chain and staff availability

continuing to be two of the biggest issues facing the sector since the outbreak of Covid-19.

Additionally, the sharp increase in banking and credit card fees in recent years is becoming more difficult to ignore, and we are not alone in feeling the pinch that comes with a 200% increase in processing fees in just two years.

The combined cost increase resulting from Brexit, energy bills, inflation and living wage will continue to lead to conditions of poor availability from manufacturers – which not only will affect our business, but, wider than this, the availability of affordable food.

What are your plans for Bestway over the next

12-to-18 months?

Bestway has exciting plans this year, and alongside those plans the company will be continuing to build its retail division while demonstrating that we are the ‘home of choice’ for retailers who want to grow their business.

Bestway will also be reviewing its network strategy to ensure we can provide the best possible service to our customers irrespective of their location.

We will continue to add to our market-leading technology proposition that gives retailers access to a suite of tools designed to help them succeed, alongside key market insights to help them understandtheir customers’ shopping behaviours. l

17

Claire Williams is the marketing director at Zest Food Partners

Innovation is key to developing the UK food and drink industry, and helps us stay competitive and reach our ambitions. Innovation, provenance, sustainability and health are all drivers that should be considered when creating ranges and menus.

Wholesalers, customers and suppliers are currently facing many challenges and there is no getting away from rising prices and the cost-of-living crisis. Brands need to adapt to make sure they have the right products that offer a convenient solution and deliver standout appeal for chefs and caterers.

At Zest Food Partners, we’re always looking for inspirational and innovative products. We understand our customers well, and working closely with our clients, we bring new ideas to the table, develop products with consumer trends in mind, and help create solutions to meet new and evolving needs.

The pace of foodservice innovation is continuing to increase, so we always have one eye on the future to see what’s coming next. It’s crucial that we capitalise on trends and adapt products, ranges and services accordingly, as well as ensuring our clients are agile enough to respond quickly to what the market needs.

Understanding your customer base is key, and it’s important that wholesalers know what’s selling in their business and are monitoring this against what’s trending

elsewhere so that they can adapt to market changes.

Understanding the customer means you can deliver the right product, at the right price, in the right pack format for them.

The conscious consumer is more educated about food than before, so operators are looking to include more British products on their menus. One example is Yallo, a British cold-pressed extra virgin rapeseed oil, which is made with one variety of seed, and offers buyers a compelling value proposition.

The food-to-go market has

seen a rapid rise in popularity as consumers’ appetite for convenience grows and they seek portable meals and snacks throughout the day. Pukka has recently launched an innovative hand-held range of slices and sausage rolls, to meet the demands of consumers on the go.

Working in partnership with customers to develop menu solutions and recipe ideas, and sharing valuable insights and market data, will add a lot of value to their business. Encouraging creativity across all parts of the business and ensuring you have a diverse team of people in innovation sessions

will also be beneficial.

It’s also imperative that you look ahead to spot opportunities, such as introducing own label or value products to meet a specific price or win a long-term big contract or products that will help operators create experiences, have good margin opportunities and offers something their customers can’t recreate at home.

Brands need to innovate to remain relevant in changing times, and we would encourage both suppliers and wholesalers to be brave and bold when it comes to taking on new products and

brew the tea, it saves money for the operator and is better for the planet. Creating this innovative product means any operator can now serve a trendy bubble tea, and it’s a great margin enhancer.

With many caterers stretched more than ever due to rising costs, many are looking to provide a value offering while maintaining quality. Add to that the latest staffing crisis, caterers are looking for innovative solutions and dishes that require minimum time to create, so that less-qualified staff can be employed to reduce costs.

Given the rise in the cost of living, starters, small plates and sides will play a key role as eating habits shift, and they’re also well positioned to gain market share as consumers look for more snacking and sharing.

ranges. We understand that not everything will work – however, if you’re making data-driven decisions, taking the risk may help you find the next big thing.

TeaJoy is a great example of this. Ning Ma was making bubble tea in her Asian street-food restaurants. However, it was presenting lots of challenges, such as long preparation and inconsistent flavours. Ning, therefore, developed her own bubble tea concept, where a real fruit-based syrup is infused with authentic jasmine tea. Not only does this speed up the process and require less storage space, but as there is no need to

Innovation in foodservice is more than looking at NPD and new and exciting food and drink brands, though; supporting the people who work in wholesale plays an important part, as well as innovative use of technology, and sustainability.

With customers striving to offer more sustainable choices on their menus, and wholesalers on the road to net zero, it’s important that suppliers look to improve their sustainability credentials and support wholesalers to reach their ambitious targets quicker.

Offering innovative sustainable solutions that are more ethical and healthier for both the consumer and the planet will be looked upon more favourably.

18 REPORT

Product innovation is a key component in making the wholesale industry competitive and ambitious

Brands need to innovate to remain relevant in changing times

Suppliers need to consider all touchpoints to get key messages out to customers and drive awareness of their brand and product range. Investing in marketing support, incentives that create a buzz, creative sampling initiatives and brand activations to grab customers’ attention will ensure their product stands out and cuts through the noise to drive sales.

With more wholesalers focusing on online ordering for their customers, supporting their online strategies will be key to success. Suppliers need to be having regular communication with wholesalers to monitor online campaigns to understand performance and sales data. Organisations that innovate with their online strategy to support customers will gain a significant competitive edge.

E-commerce, although currently under-exploited in wholesale, will see huge growth in the next few years and it will really help to create a more positive experience for customers.

With the likes of Amazon and other marketplaces, we have come to expect an experience like ones we have in our daily lives as consumers, so there is a big opportunity for wholesalers to stay ahead of the curve and meet changing customer demands.

To innovate in the digital space, we need to access and utilise data across the industry as it helps us to spot opportunities, understand what the consumer is doing and where the challenges are.

It also helps you to remain targeted in your approach and create the right proposition and range

for specific sectors. E-commerce platforms can offer a more personalised experience and enable us to remain targeted in our approach so we can create the right proposition and range for specific sectors.

It also helps wholesalers upsell. For example, making product suggestions based on previous buying habits, proposing items that are commonly purchased together, or introducing new products that would work in their business. Having access to insight and data enables us to upsell through automated push notifications, such as order reminders and product promotions.

Innovation in digital and technology is key to enhancing daily

operations, and can have huge benefits on improving service, customer engagement and efficiency. Digital-led experiences are required by today’s consumers, so you could create an app or a live-chat function, or introduce a shopping list that remembers your previous order for customers who order the same products each time.

Finally, one of the biggest innovations is chatbots, which have the potential to automate mundane tasks, enhance complex communications and improve customer support. I’m not sure wholesale is ready for it just yet, but ChatGPT is said to be the most disruptive trend and useful hands-on marketing tool for 2023. l

If you’d like more information on Zest Food partners, please contact claire.williams@zestfoodpartners.co.uk

19

The Zest Food Partners team is focused on bringing innovation to the foodservice wholesale sector (Williams pictured sitting at the front)

Interview

Paul Hill speaks to Martin Ward, the new chief executive of Country Range Group

Martin Ward Chief executive, Country Range Group

PH: What are your plans as CRG’s chief executive?

MW: Last year was a massive year for me personally, as I proudly became chief executive, and for the group as it celebrated 30 years. As part of our celebrations, we raised a staggering £186,190 for Hospitality Action and a wide range of charities in the local areas of our central office and each of our member depots across the UK and Ireland. I’m still in awe of our team and members for raising such an amazing amount. It was tough going in a difficult year, but it’s going to be extremely rewarding to see how the donations help those local communities across 2023.

Strategically, we have an extremely important and exciting year of activity and projects that lie ahead. We lost two members of our group in January (follow-

ing their acquisitions by Bidcorp), but that’s life and business. We move on. My plan is simple: we need to make the best commercial decisions on behalf of our members and make good progress when it comes to our sustainability. Another big focus for us is the development of the Country Range brand in terms of range, quality, value and relevance to the caterer of tomorrow, and we have some exciting changes we will announce later in the year.

Mostly, I want our members customers to have everything they need so they don’t just survive, but thrive, in 2023.

How is Country Range Group looking to innovate in the foodservice wholesale industry?

Innovation is in our blood and we have already kicked off an exciting schedule of product launches to help our customers face all

obstacles, whether challenging economic conditions or new government legislation.

To provide inspiration ahead of Mother’s Day and Easter, a range of desserts and cake mixes all hit the market, along with our reformulated pudding and bread mixes, which conform to the 2024 HFSS guidelines. The Country Range Student Chef Final also took place this month.

What are your predictions for the future of foodservice wholesale over the next 12-to18 months?

It is incredibly difficult to estimate what will happen, but these are my hopes:

That chefs across the public and profit sectors can roll their sleeves up once again and through imagination, hard work and support from their whole-

saler, they can overcome all challenges, see success and, most of all, stay in business.

That from the bad times, we will all learn and, hopefully, see some exciting new concepts and emerging trends, whether that is flavour or cuisine-based, occasion-based or possibly around low-energy cooking methods. When it comes to dishes and flavours, I think we will see a bit of nostalgia and a return to classics with a twist, but I expect the adventurous UK consumer to continue its love affair with global cuisines, ingredients and tastes.

Unfortunately, I do believe there will be casualties across the hospitality sector in 2023, especially if the vital government energy support to hospitality businesses is cut as it has been announced. The increases will be untenable

20 REPORT

for many businesses, and with consumers being squeezed as well, passing the costs on isn’t a straightforward solution.

The sector has been hammered from all sides these past few years, whether it’s the pandemic, staffing shortages, energy prices, ingredient price rises or, more recently, rail strikes. It really is a credit to the people working within it that we’re still blessed with a vibrant and diverse selection of pubs, cafés, bars, hotels and clubs. More needs to be done to help these venues weather the coming storms, if the social fabric of our streets, villages, towns and cities is to remain.

Chefs in the care, school, college and hospitality sectors also need our support, so we’re committed to giving them the solutions to succeed. Creativity, innovation and a certain amount of doggedness will be vital.

The sector has made great strides from a sustainability viewpoint, but there is so much more to be done. This has to encompass everything, from packaging to supply chain and operations, to how our people are treated. The wholesale sector needs to continually improve so we work in a more environmentally friendly way, we make it easier for customers and chefs to do the same, and we attract the next generation of talent.

I’m lucky to see first-hand, each and every day, what our female managers and team members bring to our group and the wholesale industry as a whole. Across the foodservice industry, we need to attract more female talent and better showcase the sector as a place where women cannot just grow and flourish, but where they can manage and lead.

We’re very proud of the opportunities we provide to our female team members to move up and progress into management positions. I would still like to see more women working in wholesale and more in positions of power in 12 months’ time.

What are the biggest challenges the industry faces?

Rising ingredient prices, energy costs, potential government issues, staff shortages across wholesale and catering, and a much-hyped recession on the way. We’re certainly not short of challenges, but it’s pointless worrying about the things that we can’t ultimately control.

As a group, we have to concentrate on what we can control and fulfilling our roles better than before – leaner, more efficiently, more creatively. At the same time, we hope for a bit of stability and joined-up thinking from the government and an understanding of the importance of wholesale and the foodservice industry to the health of the nation.

What are you looking to achieve for CRG’s members now you’re at the helm?

Simply put – scale, commercial focus and sustainability. While we have had a small setback with two members being bought out in

January, and therefore leaving the group, this is the price you pay for having a successful business formula.

Our goal remains the same: to ensure true independent familyrun wholesalers can achieve faster and more profitable growth by being a member of our group, while continuing to cherish and protect their independence.

Through the group’s buying power, data and insights, Country Range product portfolio, exciting marketing campaigns and our Stir It Up magazine, members and their customers benefit greatly when it comes to customer service, innovation, product diversity, support and sustainability.

The new Country Range Group website launched in January following the rollout of our new logo and identity to take us into the next chapter. Digital will continue to be key moving forward for our group, starting with the launch of new trading and marketing platforms to ensure our members have effective systems to access the information and assets they require.

We will be launching more new websites later in the year, as well as continuing to invest into the development of our central product information management system as data is key to the future of our members’ businesses. l

21

Five ways wholesalers can build profits through innovation

Charles Smith is a journalist with experience writing for the UK’s grocery and foodservice wholesale industry

1. Improving

marketing strategy through

the expansion of product range and customer base, working more closely with suppliers and providing an improved

customer service

Parfetts concentrates on developing promotions, delivering great margins, and ensuring these are clearly and consistently communicated to customers.

The company has invested in its online channels to ensure they are easy to use, offer advice and guidance, and help grow customers’ businesses. Parfetts has also given its field team marketing tools to recruit more customers – to their fascia group and more generally – growing its customer base and sales, and further enhancing the margins it offers.

Pricecheck has invested in upgrading its website to offer the suppliers it works with more marketing and advertising solutions.

This has presented new ways for brands to promote products, crosssell and offer special deals as they create online promotions.

The latter also recently extended their marketing capabilities to supporting brands’ needs directly, whether working on joint marketing plans or acting as their marketing team.

2. Increasing profit margins through data analytics, benchmarking customers and harnessing data insight

Confex’s data-insight platform has helped suppliers and Confex wholesalers make informed decisions on gaps across stock, ranging and sales.

Parfetts monitors which lines are more popular and ensures these are given prominent positioning and are continually on sale. It works closely with suppliers to ensure consistent availability and flags availability issues. Parfetts also provides retail customers with a full store-development service, based on data from their store and the wider estate.

Pricecheck has built unique next-best line selling tools they use with their brand distribution contracted partners, which rank brand owners’ priority SKUs, and based on sales data, make it clear what the next best line target is. Its 40+ sales force then fill those gaps with a targeted customer list. They can also monitor and analyse customer buying trends and set benchmarks to show when active customers are lapsing in volume and frequency.

22 REPORT

3. Developing staff to make them more productive and engaged, and offering them better mental-health support

Parfetts’ employee ownership model means every team member has a voice and input into how the business is run. It develops its people with a training programme, and promotes from within where possible. Its wide range of employee benefits extends from cost-of-living, sales and profit-share bonuses, to help with medical expenses and access to debt and mental-health support.

Pricecheck has made improvements across its well-being package, covering physical and mental health, and financial support. It offers annual well-being checks with its partner, Westfield Health, and provides 24/7 access to mental-health support and health advisors, supported by internal mental-health and physical first-aiders. Pricecheck has also implemented a 7pm–7am email curfew, and introduced working from home and flexible working.

It is currently extending its training capabilities to encourage staff to own their personal development, with KPIs for departments.

4. Transitioning to digitalisation through a personal online experience, developing apps and offering IT services

Confex has been supporting its wholesalers’ move into digital for the past decade by helping with websites, apps and social media. Parfetts is investing in online resources to give customers the best possible experience, mirroring their cashand-carry service. It is also developing an updated app that will be available to a broader customer base, offering information and advice. Parfetts continues to expand its cash-and-carry network, encouraging customers to come into depots for help, support and access to depot-only promotions.

The company invests in its field team, with retail development advisors allocated to individual stores and the same advice available in depots. Pricecheck’s internal systems enable it to create unique customer profiles, including categories engaged with and the type of customers it services, enabling the wholesaler to create a more personalised experience. The goal is to replicate the insight and service usually only possible by speaking with sales teams.

5. Increasing efficiency through automation, robotics, warehouse management solutions, inventory-management software, electric vehicles and energy-efficient facilities

Confex has worked with an energy partner for many years, assisting their wholesalers in weathering the current energy crisis and providing help and support for their sustainability agendas.

Parfetts’ deployment of Optrak distribution software allows for sophisticated data analytics and informs more efficient route planning. Pricecheck’s WMS system operates across two sites, enabling it to plan effective pick flows, manage stock levels and reduce lead times.

To support its growing B2C offering, it has built a dedicated small-pick area to service small orders, and fulfil orders placed on customers’ websites and marketplaces such as Amazon. Savona Foodservice is delivering to customers in North Devon and Oxford with 100% electric dual-temperature vehicles, the first of their kind in the UK and Europe, which will save 24,960kg of carbon per year. Savona has also implemented a new WMS system and ePod devices, resulting in significant reductions in paper use. l

With thanks to:

Tom Gittins, managing director, Confex; Jamie Ferguson, head of marketing, Parfetts; Darren Goldney, commercial director, Pricecheck; Darren Holloway, director of central operations, Savona Foodservice

ADVICE COLUMN

Andy Edwards Business unit controller – wholesale, Ferrero

“At Ferrero, wholesale is a key and vital part of our business, and data support is engrained in how we work with customers in this sector. Within this, data transparency is crucial to unlocking online opportunities and can help us see which of our products perform best online, which may differ to what we see in depot. The more information suppliers can gain from wholesalers, the better they can plan ahead and put steps in place to help ensure e-commerce in the channel goes from strength to strength.

“Our recent research, in collaboration with Newtrade Insight, has revealed 31%1 of wholesalers asked are not sharing data with suppliers, with only 15%1 saying they take a fully transparent approach. Being able to differentiate between online and in-depot sales allows suppliers to understand the impact of online media, optimised imagery and app- or web-focused activations have on online sales. Ultimately, it can help suppliers understand where support is required and where to focus spend.

“Data transparency is crucial. This will lead to engagement and decision-making that ensures mutual benefit between the wholesaler and supplier. An e-commerce plan being implemented is a vital step to being more transparent in data sharing. We know wholesalers are facing resource issues which are preventing them doing this. It’s therefore important that suppliers acknowledge this and do their bit to support.

“The transparency of data offers opportunities around e-commerce, enabling wholesalers to make more informed decisions about product range, pack formats, pricing and revenue, and profitability management.”

23

In partnership with

E-COMMERCE

1 Newtrade Insight x Ferrero research 2022

Hotels and restaurants

Paul Hill looks into wholesale’s relationship with the evolving sectors

Two sectors to suffer the most during the pandemic era were undoubtedly the hotel and restaurant industries. Almost overnight, their customer bases disappeared, with no indication of how long it would last or what government support they would receive.

Then, despite the end of the lockdown period, a deadly mix of surging energy costs, staff shortages and falling bookings has led advisory firm Mazars to report that UK restaurants are going out

of business at a faster rate than during the Covid-19 period, with 1,567 insolvencies over 2021-22, up from 984 during 2020-21.

“Most restaurateurs have not seen this combination of negative factors before,” says Rebecca Dacre, a partner at Mazars.

A similar set of factors has affected the hotel sector after post-Covid recovery slowed following a hugely strong rebound. Recovery in the UK market is now set to stall in 2023 due to continued volatility of trading conditions and rising operation-

al costs. Research from PwC revealed there are deviating fates for hotels depending on where they are in the country, with lower growth in certain UK regions.

However, with 35,129 full-service operating restaurants within the UK and a hotel industry worth £19.8bn, there is still a huge opportunity for foodservice wholesalers.

Service offering

Birchall Foodservice is a company heavily involved in the former, with hospitality making up a third of its customer base, according to marketing manager, Joe Moulton. “When you look deeper at our hospitality customer base, over 20% of it is made up of restaurants. We offer a range of services for our restaurant

customers,” he says. “For those using us as their main supplier, we offer free menu design, which has become a very popular service. We’re also proud to offer the expertise of our development chef for menu development, and we can provide allergen and environmental-health advice through a couple of expert partners we work closely with.”

Bespoke menu design and appointments with an in-house development chef are also services Harvest Fine Foods offers customers. Head of sales Sarah Hall-Attah says chefs and caterers are looking to be more streamlined and efficient than ever, and this has resulted in menus reducing in size in many venues. She says: “We’ve seen many of our customers switch to

24 FOODSERVICE FOCUS

online ordering to save time and for greater product visibility, as well as a switch to more local and seasonal produce to help manage costs while maintaining quality.”

Tom Styman-Heighton, the development chef at Funnybones Foodservice, echoes these thoughts, saying: “We are on hand to support our restaurant operators however we can. Each customer account has a variety of support options, ranging from account management, to a dedicated customer service agent, so we can get to know our customers personally, and ascertain their exact business needs.”

Tough conditions

Styman-Heighton goes on to discuss the challenges. “Restaurants have faced a volatile year in 2022 and operators are also contending with logistical struggles with sup-

ply chain issues – largely due to increased ingredient cost, labour shortages and ongoing illnesses. To combat this, restaurants are looking to reduce menu size and complexity,” he adds.

Hall-Attah, meanwhile, has noticed customers closing for longer periods in the winter, which may be due to operational price increases. “To add to this, local provenance has become really important to customers over the past few months,” she says. “This is to show they are supporting local farmers and growers by showing they are a sustainable and ethical place to eat by using their produce in their menus.”

Emma Chamberlain, marketing director at Pilgrim Foodservice, explains how in these tough times, the Lincolnshire-based wholesaler still offers each of its customers their own relationship

HOTELS

UK hotel’s annualised market size growth 2018-2023

UK hotels’ market size in 2023 -2.9%

£16.4bn

UK hotels’ market size growth in 2023

20.3%

Ranking of accommodation and foodservice activities industry by UK market size

4th

(All stats from IBIS World Hotels in the UK –Market Size 2011–2029 report)

25

FOODSERVICE FOCUS

manager who, in many instances, is an ex-chef and knows the products well. “We also support hotels and restaurants in marketing and e-commerce functions, which enables ease of ordering and offers insight into quarterly food trends. This is on top of the access they get to our development chefs,” she says.

Chamberlain describes how rising food costs is a huge issue and, as a result, lots of establishments are rethinking their menus to increase revenue and profit.

She says: “Controlling costs has been crucial, but when refrigeration needs to be on 24 hours a day, this is a challenge.

“The whole industry has had to rethink how it operates and what needs to change in order to become a profitable, viable business once again.”

The issue of staff is one that has affected Savona Foodservice’s customers,

according to group marketing manager Jenny Squire, who says: “Customers have had to adapt to rising food and energy costs due to inflation. There is a large shortage of hospitality workers, so customers have had to adapt how they operate. This could mean reducing their menu size, focusing on simplicity and consolidation of stock held and a reduction in offerings. Opening hours have also been effected –sometimes it is cheaper to not open than to open at all.”

She says this means keeping Savona’s product range manageable for any skillset – sourcing products that are cross-functional for the menu and can save on labour while not compromising on quality. As a result, the sales team offers as much support as possible with menu alternatives and solutions to adjust to labour shortages and rising costs. “We assist in looking into dosing systems

and other cleaning solutions using a cost-in-use exercise. We also promote sustainable practices and products, and share how we work with our suppliers to work in an ethical, eco-friendly way.”

Meanwhile, Gary Williamson is the managing director of Confex member Williamson, a wholesaler with a customer base of 80% hotels and restaurants, in a purely transactional form. “I’ve seen a number of changes from our customers over the past 18 months, including an increased cost of operation, variable hours of business and huge labour-shortage challenges.

“On the product side, there has been more of a shift towards more ‘ready to go’ food; smaller, more concentrated menus,” he explains.

Products

Meanwhile, NPD has always been a vibrant area in this sector

and continues to be. Norwegian spirits company Bareksten recently entered the UK foodservice wholesale market. “We are well placed to be the spirit of choice for premium UK hotels and restaurants after winning some of the most prestigious awards in the world,” a company spokesperson says.

“Aside from our Bareksten Botanical Gin being the most accoladed, our Navy Strength is the current overall winner of The London Spirits Competition in 2022 across all categories.”

Wholesalers Master of Malt, Speciality Drinks and Threshers are already stocking the range, and the gin forms part of Bareksten Spirits’ super-premium range of Norwegian craft spirits, comprising gins, absinth and aquavit.

Meanwhile, Charlotte Perkins, trade marketing manager at Pan'Artisan, explains how the

26

RESTAURANTS

475,000

company is always responding to emerging trends and customer feedback to enhance its dough range. “Consumers relate dining at hotels and restaurants with a greater sense of occasion, expecting high standards not only in the presentation of their surroundings and service, but also their food offering. For busy foodservice operators, pizza’s versatility can easily address specific dietary needs simply by offering a variety of toppings and appropriate pizza bases,” she says.

challenging times, so reassurance in their product choice is important – our noodles present a reliable store cupboard staple with a long shelf life, suitable for many menu types, and if storage is no issue, buying in bulk can help keep costs down.

35,129

“Thankfully, the hospitality sector is showing signs of recovery as we come out of the last of the pandemic restrictions, yet the cost-of-living crisis presents a new set of challenges. Many operators may well be juggling dine-in service while retaining a delivery or take-out option as a consequence of the pandemic’s hit on income –caterers benefit from employing expertly produced, versatile bakery, like our products.”

Providing an interesting menu to attract custom is key, with dishes that are less likely to be prepared at home winning over curious gastronomes, is the view of Greta Strolyte, brand manager at Lucky Boat. She says: “Caterers across all sectors are navigating their way through

“Asian fusion cuisines are gaining favour and we have experienced wonderful product feedback from traditional and contemporary Asian food operators throughout the UK. Our customers love our noodle range for their superior taste and premium quality, which delivers excellent noodle separation and minimal breakage, the perfect portion-size nests are ideal for waste control, and the fact that they are made in the UK is a big draw. Noodles are a versatile option that offer instantaneous appeal, and can be speedily prepared for an affordable street-food-style menu choice. Lucky Boat’s noodle range is suitable for vegans and vegetarians, too, allowing operators to offer an inclusive menu across diet types,” Strolyte adds.

So, despite tough marketing conditions and a customer base with evolving needs, hotels and restaurants offer thriving industries for wholesalers if they’re selective in how they navigate the two challenging terrains. l

27

The proportion of temporarily closing businesses in the 2020 lockdown and 2021 lockdowns3

Full-service operating restaurants within the UK1 64%

Restaurant insolvencies rise in 20221 The number of people employed in 20222

1. The Guardian, 2. Food and Drink Federation, 3. BDO LLP

81% and 54%

Breakfast

Tom Gockelen-Kozlowski

At a time when consumers are tightening their budgets and trading down where possible, breakfast is one of a small number of categories where wholesalers can claw back profit margin and drive growth, which suppliers agree with.

“Shoppers are being careful with their cash, but bakery is still an everyday purchase,” says Josh Corrigan, senior national account manager at St Pierre Groupe. “The move towards premiumisation hasn’t slowed in this staple category, and premium brands such as St Pierre give consumers an affordable opportunity to ‘trade up’ and elevate their everyday meals. The ongoing financial pressures have made the shopping audience more discerning, but there’s a real mix of indulgence and impulse buys that are driving sales in the sector when it comes to breakfast.”