Severe supply issues expected as Suntory halts production until August

KNIVES OUT FOR LOCAL SHOPS

ILLICIT VAPES

Trading standards needs £140m to crack down on illegal sales, new report suggests

STRIKE

Smoking kills

Tropicana Brands unveils new sparkling additions to its popular drinks range

P3

2024 STRICTLY FORTRADEUSERSONLY It’s an offence to sell tobacco to any person under 18 years of age. For tobacco trade use only. Not to be left in the sight of consumers.

• New police data shows surge in shop attacks using a weapon, putting the lives of retailers at risk • Exclusive: UK robbery hotspots revealed 21 MAY-3 JUNE

LUCKY

RED & BLUE GREAT VALUE GREAT PRICE

LUCOZADE DELAYS P2 P10

P4

NEW PRODUCTS

26 June 2024 10.45am onwards

Understand and develop your own personal leadership style

Learn practical ways to empower your team and manage performance

Share experiences and build a network of like-minded retailers

Secure your FREE place today at bit.ly/WiC2024, by scanning the QR code or by contacting Kate Daw: kate.daw@newtrade.co.uk // 07886 784465

independent convenience retail

your

Connecting, supporting and empowering women working in

The Studio, Birmingham Leading

Business to Success

KNIVES OUT FOR LOCAL SHOPS

• New police data shows surge in shop attacks using a weapon, putting the lives of retailers at risk

• Exclusive: UK robbery hotspots revealed

ILLICIT VAPES

DO BOOZE RIGHT THIS SUMMER

Retailers share how they are revamping the category as warm weather approaches P18

Severe supply issues expected as Suntory halts production until August

Trading standards needs £140m to crack down on illegal sales, new report suggests

NEW PRODUCTS

Tropicana Brands unveils new sparkling additions to its popular drinks range

CATEGORY ADVICE SUMMER ALCOHOL 18 DRIVING SUMMER ALCOHOL SALES PRIYA KHAIRA reports on how retailers can drive alcohol sales as the weather gets warmer 21 MAY-3 JUNE 2024 STRICTLY FORTRADEUSERSONLY LUCOZADE

P2

DELAYS

P10

P4

P3

Credit: SWNS

Megan Humphrey, editor

Megan Humphrey, editor

I’VE got a personal announcement to share with you.

A er nearly six years at Newtrade Media, and more than four as editor of Retail Express, I’ll be stepping down from my post at the end of May.

It feels very bittersweet. It’s been an absolute honour working with, supporting and championing independent retailers, but I’m going on to a new adventure, pursuing a passion of mine – women’s football.

This won’t be my last edition of Retail Express, so I won’t talk too much about what I’ve learned and loved from convenience.

Instead, I want to use my experience to inspire you to follow your dreams.

I’ve always loved football, but for a long time assumed that a job in the related industry would be out of my reach, but then I decided to give it a go.

Supply issues wipe out key Lucozade lines until August

JACK COURTEZ

A WORKER at a Suntory Beverage & Food GB&I (SBF GB&I) factory has died, halting production on at least 31 Lucozade lines.

Messages from the wholesaler sent to stores, seen by Retail Express, revealed that it will take until September this

year for all the lines to return to production, likely causing signi�icant shelf gaps for both wholesalers and retailers.

Every line has ceased production except a core range of Orange and Original varieties of Lucozade Energy, and Lucozade Sport and Ribena products.

Retail Express understands

most supplier-funded promotional activity through wholesalers has been cancelled.

A statement from SBF GB&I said it was “deeply saddened” by a fatality at its production facility in Coleford, Gloucestershire, on 25 April.

The latest delays compound strikes, and other issues have caused poor availability on Lu-

cozade and Ribena products since early this year.

A SBF GB&I spokesperson urged retailers “to focus on Lucozade’s core drinks such as Lucozade Energy Orange and Original, and Lucozade Sport Orange and Raspberry �lavours” as it commits to “working hard to resume service as quickly as possible”.

BE CONFIDENT IN YOUR ABILITY

I’m sure the same can be said for you, when you have an idea. It’s frequently easier to think about all the reasons why you shouldn’t do something, rather than the reasons why you should.

Taking the steps to begin working work towards a long-term goal can be scary, but what’s the worst thing that could happen?

That’s why I wanted to take this moment to encourage you to dream bigger, believe in yourself and be con dent in your ability to do great things.

Whatever it may be, take some time this week to let your mind wander about what could be if you took that leap of faith. Speaking from experience, it will always be worth it.

@retailexpress betterretailing.com facebook.com/betterretailing

Yau @AlexYau_ 020 7689 3358

Specialist reporter Dia Stronach 020 7689 3375

From 1 October, a 10scratchcard-per-transaction limit in stores will be implemented, matching the existing limit

line retailer partners. While independent retailers spoken to by Retail Express welcomed the move as “responsible”, others commented the rule lacks nuance and would catch out those who buy scratchcards as seasonal gifts.

JUST Eat has con�irmed it will be increasing listings in small shops as part of wider expansion plans.

UK managing director Claire Pointon said: “We have 8,000 retailer partners out of a total base of 88,000 and that will only expand. We’ve got conversations with many other retail partners about quick convenience.”

She cited an ambition to work with “wholesalers like Booker to reduce cost and increase the scale of buying” for the company’s independentretail estate.

PRICE-MARKED packs are leading to pricing errors in local shops, according to an investigation by the Competition and Markets Authority.

The regulator visited 139 grocery stores in England and Wales, including symbol group sites and chains, between November and February, �inding that symbols were three times more likely to have misleading prices. Examples included whole aisles without pricing for any product.

The ve biggest stories this fortnight 01 02 03 04 05 Pricing errors Scratchcard limit Just Eat expansion

NATIONAL Lottery

will be introducing a new scratchcard limit from October.

operator Allwyn

authorised

for

on-

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editors Jim Findlay 020 7689 3373 Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator (parental cover) Bod Adegboyega 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 07856 475 788 Associate director Charlotte Jesson 07807 287 607 Commercial project manager I y Afzal 07538 299 205 Account director Lindsay Hudson 07749 416 544 Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Finance manager (maternity cover) Isuri Abeykoon 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say

chances – there’s nothing to lose Parcel drop-o s PAYPOINT CollectPlus sites offering Royal Mail’s

pick-up and drop-off services has now hit more than 700 convenience stores in the UK. The agreement marks RM’s �irst new retail network partnership since it moved away from exclusivity with the Post Of�ice in 2020. Retail Express reported earlier this year that 5,000 PayPoint sites will gain RM services by the summer. Customers are able to drop off packages up to a large parcel

Features writer Jasper Hart @JasperAHHart 020 7689 3384 40,152 Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

Take

(RM)

size.

News editor Alex

News reporter Alice

@alice_brooker 07597

Cover image: SWNS For the full story, go to betterretailing.com and search ‘Royal Mail’ For the full story, go to betterretailing.com and search ‘scratchcard’ For the full story, go to betterretailing.com and search ‘Just Eat’ For the full story, go to betterretailing.com and search ‘CMA’ For the full story, got to betterretailing.com and search ‘Lucozade’

Brooker

588955

THE number of shop robberies involving a weapon outnumbered unarmed attacks last year, Retail Express can reveal.

Retail Express analysed Freedom of Information (FOI) responses from 17 police forces, outlining the number of reported robberies across independent shops and supermarkets in England and Wales, and the weapons used between 2022 and 2023. Thirteen forces refused to respond.

Of the reports where a weapon could be identi�ied, there were 147 attacks in 2023 where a gun, blunt or sharp object was involved, compared to an annual reduction of unarmed attacks from 68 to 15 in the same period. Armed instances in 2023 represented a 3% annual rise from 2022.

More speci�ically, sharp weapons – which include blades, glass bottles and screwdrivers – were the most used instrument at 98 instances (up 6%), followed by unidenti�ied weapons at 33 (up 39%), �irearms at 14 (down 64%) and blunt weaponry such as a baseball bat at two, down from seven.

Overall, the total number of robberies between 2022 and 2023 across independents and supermarkets rose from 552 to 642. Independents accounted for 325 of the total incidents last year, up from 306.

Of the FOI data supplied,

“WE

Retailers hit by increase in robberies using weapons

the north of England and the Midlands were the biggest robbery hotspots last year. On average, both regions accounted for 40% of total incidents each, at 237 and 280 attacks, respectively.

The West Midlands experienced the most crime in 2023 at 182 (up 15%), followed by Merseyside at 103 (down 9%), Northamptonshire at 57 (up 11%), Cleveland at 52 (up 31%) and Dorset at 38 (up 66%).

Some retailers told Retail Express they were seeing weapons used more commonly in store robberies, which had become a “daily” threat for them.

One store owner, who asked not to be named, said: “Robberies used to be infrequent several years ago, but it’s a daily occurrence now. We get unarmed attackers, but the frequency of armed robberies with weapons such as knives has increased.

“It impacts my staff more as they’re in the shop all the time and some of them have become too scared to come into work. It’s about giving them time off and showing we’ll support them as much as we can.

“The police response isn’t great, as it’s taken a long time for law enforcement to respond. However, I understand they do want to help tackle the issue. They lack the resources required to support them.”

Another retailer criticised their local police for failing to tackle robberies happen-

We added co ee machines and

and vapes. We’ve redesigned the

so it’s more of a supermarket in line with Morrisons and we’ve had a quicker return by doing this. It’s important to examine demographics, and understand your store’s turnover and get the best deal from suppliers.” Mike Nicholls, Costcutter Dringhouses, North Yorkshire

ing in their store every day. They claimed a criminal who had threatened to stab them had reappeared in the shop months after the incident and attempted another robbery, while another incident had been dismissed entirely by law enforcement.

The accounts come as the latest ACS crime survey for England and Wales released last month revealed overall shoplifting offences for the year ending December 2023 had increased annually by 37% to 430,104 offences.

Julian Hayes, senior partner at criminal law �irm Berris Law, told Retail Express the company had seen in-

creasing instances of gangs targeting stores for crime.

He added: “Many shop owners can’t afford being victims of robberies and we know the police have had issues with numbers. Law enforcement used to have staff speci�ically targeting robbers and thieves.

“You’re no longer getting as many individuals targeting a local supermarket to steal food to eat themselves or to sell on. What we’re �inding now is more organised gangs are going into stores because they know shop crime isn’t being properly policed. It’s not being picked up.”

However, City of London Police superintendent Patrick Holdaway denied claims law enforcement was ignoring shop crime. Speaking at the Retail Technology Show in London last month, Holdaway said: “There’s a bit of a misnomer around police not responding to theft under a £200 value.

“This was a category brought in under former prime minister Theresa May to get quick justice in the courts. It’s been perceived police will not take action and that’s de�initely not the case. It’s about the offender and not the value of the incident.”

PARCELS: InPost’s UK network is up 59% year on year, with 6,800 locker machines installed in the rst quarter of the year. Parcel volumes more widely more than doubled, equating to an increase of 147%. The rm revealed in its latest results that parcel volume is outperforming market growth in all geographies, increasing marker share in all existing locations.

For the full story, go to betterretailing.com and search ‘InPost’

LOYALTY: Jisp has rolled out its ‘Scan & Win’ service more widely, with the rm claiming a previous trial of the cash-prize incentive helped stores retain nearly 40 out of 100 participating customers. It encourages users to scan barcodes of products from suppliers for a chance to win large cash prizes.

For the full story, go to betterretailing.com and search ‘Jisp’

BAD WEEK

COMPETITION: Discounter Lidl has announced it is hunting for “hundreds of new stores”. High up on its target list are Edinburgh, Leeds, Liverpool and London, and towns from Woking and Wadebridge, to Dumfries and Didcot. It’s understood the move doesn’t involve expansion of Lidl’s smaller conveniencestyle format or neighbourhood locations.

CAPRI-SUN: Co-op stores and Nisa wholesale has dropped the popular juice drink as part of a commercial spat. CapriSun Group began taking over distribution of its products from Coca-Cola European Partners at the end of March.

For the full story, go to betterretailing.com and search ‘Capri-Sun’

“WE invested heavily in our frozen sections. Our York site used to have a three-door freezer, but now we’ve got a three-door and a four-door freezer. We’ve spent £25,000 on the deep-frozen freezer and sales have doubled. Frozen meals are replacing takeaway meals, and that’s the way the market is going. Frozen-pizza sales are doing great and we now sell kebab ranges.”

Kopi Kalanathan, Costcutter Kirk Sandall, South Yorkshire

“THE sales from our rst Tango Ice Blast machine returned our investment within two weeks. It cost almost £8,000, and we quickly began selling almost 300-400 cups a day. After two weeks, I had to buy another one because the rst one broke down due to excess use. That also paid for itself in two weeks, and was extremely successful.”

Imtiyaz

03 betterretailing.com

21 MAY-3 JUNE 2024

GOOD WEEK

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk What’s the most pro t-making investment you’ve made for your store?

sales.

invested in some of our stores and converted them into Morrisons. It’s already starting to pay o . That’s had a big increase in

drinks units

store,

Mamode, Premier Wych Lane, Gosport, Hampshire

ALEX YAU

@retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

Imtiyaz Mamode

£140m needed to fight illicit vapes

TRADING standards needs

£140m in England over the next five years to fund 400 new enforcement officers, to tackle the rise of illegal vapes, a new report has suggested.

Research released by the Association of Convenience Stores (ACS) revealed the additional funding would start at £30.7m in year one, rising

to £36.2m in year two and then gradually falling, representing an initial 28.4% increase in budgets.

This would mark the most significant expansion of trading standards for at least a generation.

ACS chief executive James Lowman said: “This report focuses on a key and under-resourced part of enforcement: trading standards officers with a dedicated brief to tack

le the illicit-vape market on high streets, outside school gates and online.

“So far, the government is committing less than £10m a year to this, and this report shows we need three times this investment to make a significant dent on the problem of illegal vapes being sold in our communities.”

Research of trading standards authorities has identi-

legal vapes have been seized every minute.

Between 2020 and 2023, the amount of illegal vape devices seized increased 19fold, hitting a total of 4.18 million devices.

Lowman added: “The illicit vaping market is set to receive a boost when disposable vapes are banned in less than 12 months’ time, so we need to ensure that enforcement

New iSqueeze model

has added to its range of fresh juice machines with the launch of the Citrocasa XPro model.

machine can extract juice from fruits with a diameter of up to 100mm including oranges, grapefruit, lemons and limes.

It also features a touchscreen wider than those on other iSqueeze models, a motion sensor and the option to customise the back cover. The Citrocasa XPro dispenses bottles of 250ml, 330ml, 500ml and 1l sizes, with RRPs of £2.50-£6.

NIGEL Railton has been appointed interim chairman of the Post Office (PO), following the sacking of Henry Staunton in January.

Railton will assume the role at an extremely turbulent time at the company, as hundreds of subpostmasters continue to wait for compensation over the Horizon IT scandal.

“This is an incredibly challenging time for PO as it works to address historic failures while also striving to transform its business,” he said.

Self-service growth

THE number of self-service checkouts in the convenience sector could more than double over the next five years.

“There’s a need to invest,” he said. “It’s more efficient and there’s demand for them.”

The latest ACS Local Shop Report states 16% of stores currently have self-service checkouts.

Speaking at the ACS Summit 24, Henderson Group’s retail director, Mark McCammond, said he expects the percentage of self-service checkouts to rise to 70% in the UK.

04 21 MAY-3 JUNE 2024 betterretailing.com

NEWS

MEGAN HUMPHREY

EX-CAMELOT BOSS

For the full story, go to betterretailing.com and search ‘iSqueeze’ For the full story, go to betterretailing.com and search ‘Railton’ For the full story, go to betterretailing.com and search ‘self-service’ M Y CY CMY RN Full page ad.indd 1 17/04/2024 14:43

JOINS PO

PRODUCTS

Four Loko’s Dark Berry Burst

PRIYA KHAIRA

PREMIUM vodka-based RTD brand Four Loko has added a Dark Berry Burst variety to its range.

The new �lavour comes in 440ml cans, each with an ABV of 8.1% and an RRP of £3.49.

The launch joins the existing Four Loko range, consisting of White, Strawberry Lemonade, Tropical, Blue, Fruit Punch, Gold, Sour Blue Razz and Sour Apple varieties.

The US brand launched in the UK in 2021 and has since added £7m value growth to the convenience sector.

The launch of Dark Berry Burst aims to further tap

into RTD opportunities. RTD volumes have been growing faster than any other major drinks category over the past �ive years.

The category now commands a 4% market share in the alcohol sector and is predicted to reach 8% by 2025.

Raptor data indicates that 65% of consumers are “more than likely” to have purchased an RTD alcoholic beverage over the past month.

“RTDs are enjoying a major period of reinvigoration and the forecast for RTDs is extremely exciting, with particular emphasis on at-home occasions and the linked opportunity to drive sales,” said Clark McIlroy, managing director of Four Loko dis-

Supercharge your energy drinks sales

COCA-COLA Europaci�ic Partners and Monster Energy Co have relaunched the Sales Supercharged initiative for a fourth year.

The platform aims to help convenience retailers make the most out of the energy drinks category, providing them with updates on the latest market trends along with merchandising advice from a group of convenience store owners.

Energy drinks are worth more than £1.9bn in the UK and generate more value to the soft drinks category than any other segment. Monster Energy drinks have added an extra £113m to the category over the past year.

A campaign has been

launched to support the initiative, which will give one retailer a chance to win two vouchers for a motorsport driving experience with PalmerSport.

To enter, retailers should enter their details and apply via salessupercharged.co.uk before 31 July.

promo

COCA-COLA Europaci�ic

Partners has unveiled a new summer on-pack promotion across its Costa Coffee RTD chilled coffee range.

Running until 28 July, shoppers will have the chance to win tickets to events including Boardmasters, Y Not Festival and Kendall Calling, by scanning QR codes on promotional packs of Costa Coffee RTD Latte and Frappé ranges.

tributor Red Star Brands.

“Taste is perhaps the top consideration when it comes

to RTD preferences, so staying ahead of the curve is critical.”

Get a sugar-free energy Boost

BOOST Drinks has launched two sugar-free Energy varieties and added a limited-edition Sport drink to its range. Launches include Energy Apple & Raspberry Sugar Free, Energy Tropical Blitz Sugar Free and LimitedEdition Sport Watermelon & Lime.

They are the brand’s �irst new additions to its range since its rebrand.

Sports drinks are the fastest-growing segment across the soft drinks category, while Boost Sport is the second-most-popular brand by volume.

Additionally, mixed fruit and berry �lavours are fuelling the segment’s growth by up to 30%. The brand has

made its Raspberry & Mango Sport variety a permanent part of its collection.

The new sugar-free varieties are the brand’s �irst sugar-free-only additions to the range.

World of Sweets enlists Paw Patrol

WORLD of Sweets has extended its freezables range with its new Paw Patrol line.

Paw Patrol Freeze Pops come in packs of four, containing Cola, Raspberry, Tutti Frutti and Watermelon �lavours.

With a £1.25 RRP, they are non-HFSS and free from arti�icial colours and �lavours.

They join World of Sweets’ existing freezables lines from Barratt and Warheads.

Kathryn Hague, head of marketing at World of Sweets said: “The added bonus is that many can be sold as multipacks for customers to freeze at home or as singles frozen and ready to enjoy

from the store.

“These low-cost items will please those looking for a tasty treat at affordable prices.”

As well as the chance to win festival tickets, there will be more than 2,000 other exclusive prizes also up for grabs, including online retailer vouchers and e-vouchers to spend at Costa.

The on-pack promotion will be supported by a con-

Swizzels’ new Squashies

SWIZZELS has unveiled a Squashies Strawberry & Cream variety.

The new �lavour is available in 120g bags in pricemarked and non-pricemarked packs with an RRP of £1.15.

flavour

The launch of Squashies Strawberry & Cream comes as customer demand for new Squashies �lavours has risen.

The new variety joins other �lavours including Bubblegum, Sour Cherry & Apple and Banana & Blueberry.

Maryland unveils new variety

The launch aims to target sharing occasions this summer.

According to Circana data, Squashies has demonstrated strong signs of growth and is the number-one sugar hanging bag brand in the total market.

Data indicates that the brand is now worth £52.5m.

The supplier said the launch coincides with National Strawberries & Cream Day on 21 May.

Fanta reveals Orange Zero Sugar refresh

FOX’S Burton’s Companies has introduced a White Choc Chip Cookie variety to its Maryland range which has rolled out to convenience and wholesale channels.

existing customers as well as attracting new shoppers.

PMPs account for 70% of independent outlet ‘sweet biscuit’ volume sales, according to Niq data.

COCA-COLA Europaci�ic Partners has revealed a new taste for its Fanta Orange Zero Sugar along with an updated pack design across all of its �lavours.

sumer marketing campaign which includes social media and digital out-of-home advertising, PR and in�luencer activity, as well as consumer sampling and on-site activation at Boardmasters.

tion at Boardmasters.

The white chocolate variety has an RRP of £1.29 for a 200g pack of 20 cookies.

The variety is available in a price-marked pack (PMP). The price-marked format is designed to appeal to

The launch comes as data indicates that white chocolate is a strong-performing �lavour, with more than a quarter of British households buying white chocolate biscuits.

The reformulated Fanta Orange Zero Sugar tastes more like regular Fanta Orange. The new packaging design has clearer differentiation between regular and zero-sugar variants and bolder colours.

The refresh is being supported with sampling activity, out-of-home activities and social media advertising to connect with young adult shoppers.

The Coke App will also host a Fanta ‘Ride n Sip’ game, enabling consumers to

06 21 MAY-3 JUNE 2024 betterretailing.com

Costa Co ee’s summer

unlock a free Fanta Orange Zero Sugar coupon. Fanta Orange Zero Sugar has also teamed up with Jamie Laing as its ‘chief �lavour of�icer’.

PRODUCTS

Electric blue new Pepsi line

PRIYA KHAIRA

BRITVIC is launching a new limited-edition sugar-free blue Pepsi line, Electric, available to retailers for 12 months.

Pepsi Electric is available now to retailers through Booker in 500ml plain and price-marked bottles, each with an RRP of £1.35.

The launch follows Pepsi’s packaging rebrand earlier this year.

The new variety contains a zesty, citrusy taste. It has been launched to catch the attention of younger soft-drinks shoppers, particularly Gen Z, who are on the lookout for soft-drink innovations, with taste the

largest driver of choice for cola drinkers.

It also taps into increasing consumer demand for sugar-free soft drink options. Market data shows that over 70% of consumers prefer Pepsi Max to full-sugar cola.

Ben Parker, Britvic retail commercial director in Great Britain, said: “Pepsi Electric embodies shopper preferences for fresh, special-edition �lavours while incorporating the unmissable vibrant blue cola liquid, which will grab shopper attention at shelf and capture the next generation.

“Convenience retail will be a key channel for bringing this bold new �lavour to shoppers. We’ve launched exclusively as an on-the-go

30-second smoothies and shakes

DELICE de France has launched a range of Smoothies & Shakes that can be prepared in 30 seconds, in partnership with Batch.

The Smoothie range contains Strawberry & Banana; Pineapple, Mango & Passionfruit; Super Green; Super Berry and Mango & Dragon Fruit �lavours. They have an RRP of £4.50-£5.

The three �lavours available in the Shake range include Chocolate & Peanut Butter, Mixed Breakfast Berry and Vanilla Matcha. These have an RRP of £4.75-£5.25.

To prepare the smoothies, outlets need to add 200ml of apple juice to a blender alongside the contents of the

smoothie packets. Shakes follow the same process, but with 200ml of milk instead.

NORAC Foods is giving its Whaoo! Chocolate Filled and Crunch Cereal & Chocolate Filled crepe range a makeover this spring.

Available now on Booker, the new pack features bold colours and a new design.

Kantar data shows that the brand presents year-on-year growth of 6.9% with retail sales value of £2.5m and over 1.1 million packs sold.

Bruno de Bourmont, director of Norac Foods UK, said: “Family snacking is a competitive category, so we’ve taken great care to ensure its bright and appealing, to drive stand-out on shelf.

500ml bottle to help stores increase impulse purchases and ensure front-of-store chillers have something different to offer versus take-

home formats.”

The launch adds to Pepsi Max’s �lavour range that includes Cherry, Lime and Mango varieties.

Empire unwraps 2024 Christmas catalogue

EMPIRE Bespoke Foods has unveiled its 2024 Christmas range.

The entire range can be viewed on its website. It includes edible Christmas tree decorations, gingerbread ‘mug buddies’, Christmas cookies and a Lebkuchen advent calendar.

The distributor has also added new lines from Italian confectionery specialist Leone.

The range also includes two new gin and vodka �lavour kits incorporating festive dried fruits and seasonal spices.

Edward Rayment, digital marketing & e-commerce manager at Empire Bespoke Food, said: “By planning

ahead and being Christmasready well in advance, retailers can create some beautiful displays which are not only aesthetically attractive, but can help drive footfall and increase basket spend at this busy time of year.”

Alpro launches two 500ml

Cawston Press joins forces with Disney

BRITISH soft drinks brand

Cawston Press has partnered with Disney Pixar �ilm Inside Out 2 ahead of its release this summer.

The partnership involves an on-pack promotion on the brand’s child-friendly Fruit Waters that has launched into retail channels this month.

The promotion gives shoppers a chance to win a family holiday to Lisbon. It is live until 31 August.

Each participating Fruit Waters pack will feature new Inside Out 2-inspired designs.

To enter the competition, shoppers need to scan the QR

code present on these packs and submit their details.

Cawston Press will also be launching retail and consumer activations throughout the summer.

Win holiday prizes with JTI 360

JTI CELEBRATES the launch of its trade platform, JTI 360, with a shopper giveaway.

JTI 360 is replacing the company’s JTI Advance website. The platform includes an up-to-date news feed related to recent industry trends and developments.

Retailers can also earn points on the platform which can be redeemed for prizes within the site.

To celebrate the launch, JTI is giving retailers a chance

to win one of 360 prizes, including holiday vouchers. To enter, retailers must sign up for the new platform before 10 June.

Mark McGuinness, marketing director at JTI UK, said: “After a series of focus groups and one-on-one conversations with our retail partners, we’ve been able to evolve JTI Advance and deliver a new JTI 360 website, designed speci�ically for the independent trade.”

“All the new packs feature a modernised version of our friendly giraffe and his animal friends, to create a major point of difference next to the many plain and clear packs in the bakery aisle.”

ALPRO has extended its range to include 500ml pack sizes across its creamy Oat and Almond No Sugars milk alternatives lines.

The new formats have rolled into convenience stores this month.

Both Alpro Almond No Sugars and Creamy Oat 500ml have an RRP of £1.30.

The launch is being supported by a campaign that is set to launch in August.

Tom Kerr, head of category management Plant Based at Danone, said: “The cost-ofliving crisis has had a signi�icant impact on the plantbased beverage category.

“We want shoppers to still have access to the category and our brand, which is

why we wanted to bring our two most-loved varieties to consumers in a smaller, more affordable pack size.”

Stay fresh with Comfort Botanical

COMFORT has added a botanical inspired range to its scent booster and fabric conditioner collection.

Comfort Scent Booster Elixir and Botanicals Fabric Conditioner are available to convenience and wholesale channels.

Both ranges are designed to work together and are available in three matching Botanical scents including Heavenly Fresh, First Blooms and Summer Bouquet.

With 60% of shoppers using a quick wash at least once a week, the range is suitable for use in short cycles.

Data also suggests that there is a gap in the market for new, natural scent boost-

ers with 12% of consumers avoiding ‘arti�icial’ smelling fragrances.

The launch is being supported by a £9m marketing investment including a TV advert going live until August.

08 21 MAY-3 JUNE 2024 betterretailing.com

formats

Whaoo! gets a redesign

PRODUCTS

Tropicana unveils new ranges

PRIYA KHAIRA

TROPICANA Brands Group has introduced two new additions to its portfolio: Tropicana Sparkling and Naked Natural Energy drinks.

The Tropicana Sparkling range is inspired by two of the brand’s top sellers. The range includes Tropicana Sparkling Tropical Twist and Tropicana Sparkling Zesty Orange varieties.

The drinks have double the fruit content compared to the sparkling category average, according to testing carried out by the supplier.

Consumer research found that shoppers are looking for lunchtime beverages that

are “made with real fruit”, followed by low sugar and no additives.

The Sparkling range is available in 250ml cans and is available to convenience retailers.

Its Naked Natural Energy range, available in Gold: Orange, Pineapple & Mango and Red: Apple, Raspberry & Goji Berry varieties, is a natural energy drink option made with real fruit, natural caffeine, essential vitamins and no added sugar.

It taps into growing consumer demand for functional carbonated drinks.

Research reveals that 80% of consumers will not buy certain energy drinks due to concerns around price,

Win cricket prizes with KP Snacks

KP SNACKS has unveiled details of its partnership with The Hundred cricket competition. As the Of�icial Team Partner, KP Snacks is launching a promotion, offering shoppers a chance to win cash prizes of up to £10,000 as well as daily cash and cricket prizes.

The themed packs feature on multipack, sharing and single-bag formats of KP

Snack brands including Butterkist, Pom-Bear, Tyrrells, KP Nuts, Hula Hoops, McCoy’s and Skips. The promotion will run until mid-August. The brand is also installing 35 community cricket pitches across the country.

Kevin McNair, KP Snacks’ marketing director, said: “We are excited to be launching an on-pack promotion with our biggest-ever prize pool.”

health, sugar and arti�icial ingredients. The range is also available in 250ml cans.

Elizabeth Ashdown, marketing director at Tropicana Brand Group, said: “With Naked, we are leveraging the

brand’s fruit and functionality credentials to democratise the world of natural energy drinks, and with Tropicana, we are bringing genuine fruit expertise to the fruit sparkling category.”

Bouncing berries return to screens

RIBENA’S bouncing berries advert returns to screens this summer.

The Ribena berries made their return to screens last year for the �irst time in almost 10 years as part of the brand’s 85th birthday celebrations and ‘Summer of Fun’ campaign.

After being seen by more than 13 million people last summer, the berries will have even more screen time

this year.

Running for one month longer, the ad is live until July across TV, video-on-demand and YouTube, helping generate awareness and boost visibility for the drinks as retailers start preparing for the summer selling season.

It features the berry characters on ‘Ribena Farm’ with one berry being put into a jug of Ribena. It reaf�irms the drink’s vitamin C content.

‘Choose to

Burts celebrates RNLI’s 200 years

AS part of the Royal National Lifeboat Institution’s (RNLI) 200th anniversary celebrations, Burts is introducing limited-edition RNLI pack takeovers throughout July and August this year.

The pack designs will feature RNLI heroes across Burts Lightly Sea Salted and Sea Salt & Malt Vinegar varieties.

Since the beginning of the partnership in 2021, Burts has raised £220,000 for the charity, sharing vital water safety messages and highlighting the importance of RNLI’s work for Devon locals.

The packs will be available to independent retailers. A 40g pack has an RRP of £1.20

while the 150g packs have an RRP of £2.25. Sales of the limited-edition packs will help the charity share its messaging and the QR code on the back of the packs allows shoppers to donate.

Frozen cocktails set to soar this summer

PARAGON Brands has introduced June Peach Punch, June Watermelon Crush and Pusser’s Frozen Painkiller to the frozen cocktail market.

The launch comes as a study conducted by the brand found that 34% of consumers would opt for a frozen cocktail over a traditional alternative.

Sixty-one per cent stated that a frozen cocktail is more refreshing than a normal cocktail.

The trend has grown signi�icantly in the past few years, with nearly three in 10 (28%) UK consumers saying they are more likely to drink a frozen cocktail now than they were two years ago.

Chris Jones, managing

director of Paragon Brands, said: “Our survey shows that Brits can’t get enough of frozen cocktails right now, so we’re sure they’ll be a huge hit with consumers.”

Relentless energy gets fruity

HELL Energy has launched a new variety that it claims is the world’s �irst energy drink to be created by AI.

The new launch, which the supplier says has a tutti-frutti and berry �lavour, is available now from Bestway, Parfetts and United Wholesale Scotland. It contains vitamins and amino acids, and is free from preservatives.

Hell’s head of �ield sales, Andy Pheasant, said AI was involved in all aspects of the drink’s creation, including can design, recipe and tasting.

It was initially launched with 20

convenience retailers across the UK, who were supported with in-store PoS and digital material for social media.

It is available as a 79p price-marked can.

HEINEKEN UK has launched ‘Choose to Cruz’, its �irst consumer marketing campaign for its Spanish lager brand, Cruzcampo.

in the beer, wine and spirits category since its integration into the off-trade in August 2023.

COCA-COLA Europaci�ic Partners Great Britain (CCEP) is tapping into demand for �lavoured energy drinks with Relentless Fruit Punch.

Live now until July, the £10m campaign is appearing across TV, out-of-home, radio, social media and in�luencer activity.

It aims to emphasise the brand’s Spanish heritage, tapping into the demand for Mediterranean styles this summer and relaxed drinking occasions. Cruzcampo has become the numberone innovation

As part of the campaign, the supplier is offering a limited-edition gift-withpurchase mechanic. Shoppers can get a branded ceramic tile coaster or pint glass when purchasing a pack of Cruzcampo from select stores.

The new tropical �lavour has been launched to help drive summer sales of Relentless, which is currently the number-four energy drink brand in Britain, according to Nielsen �igures.

It rolled out in plain packs in May, with a £1 pricemarked pack to follow in June.

Relentless Fruit Punch joins the six-strong Relentless portfolio, which includes Origin, Cherry and Passion Punch, alongside its Zero Sugar range of Watermelon, Peach and Raspberry.

Helen Kerr, associate direc-

tor of portfolio development at CCEP GB, said: “The energy drinks market is booming and is now worth more than £2bn in GB and growing, and innovation is key to driving this momentum.”

10 21 MAY-3 JUNE 2024 betterretailing.com

Cruz’ with Heineken

AI-formulated energy drink from Hell

If I need to know the latest retail trends or industry news, I start by looking at Better Retailing We find the news and trends that matter, so you don’t have to. Join thousands of successful retailers who rely on Better Retailing to stay informed, competitive and profitable. Dave Hiscutt, Better Retailing survey, 2024. betterretailing.com

OPINION

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

GLOBAL CONFECTIONERY: What are the latest trends you are tapping into?

“YOU need to stay on top of the trends. We’ve recently expanded our fixture to include Canadian and US-based brands Peeps and Nerds Gummy Clusters. Jolly Ranchers and Airheads are some of our bestsellers. We generate more than 30% margin.”

Lewis Woodward, Nisa Local Colleygate, Halesown, West Midlands

“WE’VE made 50% margin on freeze-dried sweets. We sell each bag for £5.99, and we sold out just two days after bringing them in. We made a large order from Exploded Sweets Wholesale after noticing the products were going viral on TikTok.”

Sophie Williams, Premier Broadway Convenience, Edinburgh

We sold out just two days after bringing them in

CORE RANGING: How are you balancing premium and value offers?

“MY vape sales have come down. I’ve got a small number of dedicated nicotine pouch shoppers. There’s now probably enough out there to fill a cabinet, but I just keep the top sellers. They’re not necessarily the ones everyone wants everywhere else according to the suppliers.”

Faraz Iqbal, Premier Linktown Local, Kirkcaldy, Fife

“RANGING is about what I can get my hands on. There are so many ups and downs with stock. We’ve had to adapt; it’s made us look at a lot of medium-to-slow sellers and cut them. Households are being hit heavily – a lot of branded price-marked packs have gone for us.”

Pratik Patel, Jay’s Budgens, Crofton Park, south London

CASHFLOW: How are maintaining and improving cashflow in your store?

Sasi

There are so many ups and downs with stock The margins sit at around 20%

“MONITORING stock take can help you keep on top of any discrepancies. If you’ve got a member of staff stealing from you and you’re not on your stock take, it’ll hurt your cashflow. Check your suppliers. Make sure they’re delivering what you’ve paid for.”

Andrew Cruden, Market Square News, Northampton

Make sure they deliver what you’ve paid for

SUMMER PROFITS: What categories are you pushing to boost sales?

“SUMMER is the perfect time to highlight new soft drinks items that offer a point of difference. We installed a SodaStream machine last year and sales picked up. It’s cost effective and easy for us to use. The margins sit at around 20%, but it brings in repeat customers.”

Ian Lewis, Spar Minster Lovell, Oxfordshire

“WE sold approximately 200-300 ready-to-drink (RTD) cocktails per week last summer, with brands such as BuzzBallz, Absolut, Au and Buckfast. We will reorganise our soft drinks and RTD display in chillers at the front of the store as summer approaches.”

Umar Majid, Baba’s Kitchen, Bellshill, North Lanarkshire

12

“I CHECK my bank balance every single morning. You have to be disciplined with it. Treat cash like a customer

give it the attention it deserves. It’s easy to just rely on the bank being there, but that can end up with you in a hole you can’t get out of.”

and

Greater Manchester TWO NEW OPPORTUNITIESHIGH-MARGIN FOR YOUR SHOP betterretailing.com ● 06.10.2023 THELEADINGTITLEFORNEWSANDCONVENIENCERETAILERS The seven muststocktypesofXmas biscuits and cakes RANGE Page Why adding this trending doughnut brand could be your store’s next smash hit betterretailing.com 08.12.2023 THE LEADING TITLE FOR NEWS AND CONVENIENCE RETAILERS Changes to your top vape lines revealed HowElfbar,LostMaryand 88Vapearepreparingforlegal restrictions bans REGULATION effortstoconvertmore Englishstoreownersto Pricewatch: see what other retailers are charging for RTD alcohol, and boost your own profits

Find out what your store needs to boost your fresh and chilled sales ● Discover how you can improve your snacking ranges this summer New voucherpaper ‘fraud’ risk Publishersconcerned thatlegalchangescould costthem‘significant sums’ » Better prices on your top soft drinks Comparetake-home drinkprices local shopstofindwhereyou canaddmarginPage MARKETING STORE ‘How my shop made £4.5k from TikTok’ Yourgu usingTikTok to newcustomersand addextrasales your shop Bespokepick-and-mixunitsdelivering65%profit andextrasalesfor storeslikeyours Page Small‘mocktail’slush devicesdelivering56%profit andwinningbigspend fromadultcustomers REVEALED: The major brand looking to supply local shops for the first time Everything you need to work out if this 50% margin opportunity is right for you Scottish symbol Your area’s top beers Alternative snacking DON’T MISS THE 24 MAY ISSUE OF RN KNOW MORE ● SELL MORE ● MAKE MORE 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today. Find out more at bit.ly/RNMagazine

Patel, multi-site Go Local owner,

●

‘We’re

still having Lotto scratchcard problems’

I’M still having scratchcard availability issues.

I �irst spoke out about this in March, and mentioned that we hadn’t delivered for about a month, which was leaving us vulnerable to losing sales.

Customers told us that they were going to the Co-op and the Spar down the road because they had the scratchcards they wanted

At the time, Allwyn told us the delays were a knockon effect from changing

the distribution of scratchcards to a new warehouse in Warrington.

However, we are still having the same problem and it’s getting out of hand now.

There are two speci�ic ones that we just aren’t getting, and they are our bestsellers.

I’ve tried to get in touch with someone but, at this stage, I have no idea when my latest deliveries will arrive, and my sales are going down as a result of this.

I’d like Allwyn to deal with this immediately.

Bhavna Patel, Sandwich Convenience Store, Kent

A spokesperson for Allwyn responded: “Thanks for bringing this to our attention. We’re sorry to Ms Patel for the inconvenience caused by this. She’s correct to say we did experience some initial short-term scratchcard replenishment challenges, but

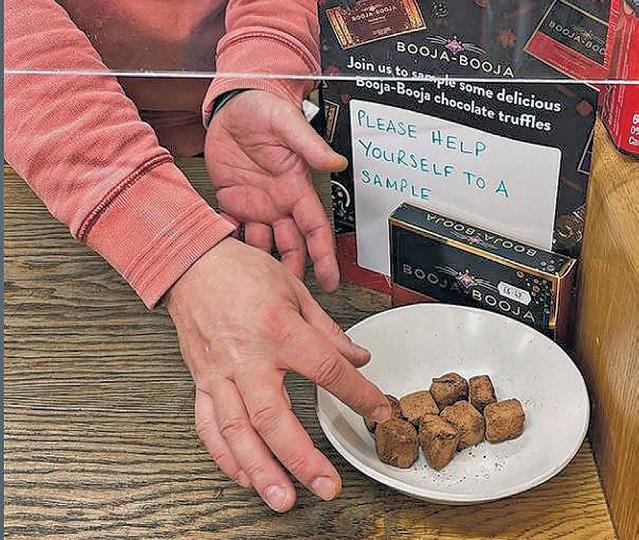

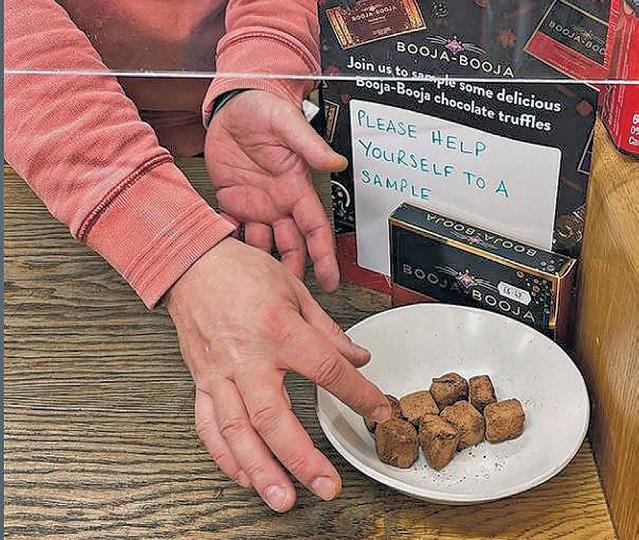

Doing in-store tastings

WE’VE done tasting sessions in our store for a long time, but we recently changed the way we ran them.

are pleased to con�irm that stock has returned to normal levels in the vast majority of stores. My colleague has had a look into Ms Patel’s account, placed an urgent order that should arrive within 48 hours and has made some adjustments which should prevent this from happening again. If retailers have any questions or need any additional support, we’d ask that they call us on the Retailer Hotline on 0800 8 40 50 60.”

and Balbir Dhillon, Locking Stumps Nisa Local, Birchwood, Warrington COMMUNITY RETAILER OF THE WEEK

‘We raised £15k for

Swizzels has partnered with Retail Express to o er ve retailers the chance to win £50-worth of new Swizzels Squashies Strawberry & Cream stock. The new flavour, which is ideal for both sharing and self-treat occasions, is a direct result of the success of the Squashies range, coupled with consumer research. It combines the popularity of Squashies with the classic British combination of strawberries and cream.

CHRISTINE HOPE Hopes of Longtown, Hereford TO ENTER

“WE started our charity work by making curries at home during Covid-19 and donating them to a food bank. Now, through Nisa and Making a Di erence Locally [MADL], we have raised £15,000 in funds for local causes like schools and youth centres. Last year, there was a knife attack in our community. We’re supporting the charity that was set up by the victim’s mother. Also, as part of MADL, Balbir prepares meals every Thursday for homeless people. This should be a model for other Nisa shopkeepers because it helps bind us more closely with our customers.”

We have a regular Friday a ernoon session that rewards loyal customers coming to do a bigger shop for the weekend. It’s also a treat for our visiting market as well. We’re not seeing that it’s increased the basket spend all that much, but it has created a really nice vibe in the shop. We recently got some Coca-Cola Lemon samples and that worked really well for us. We get a real mix of demographics and we sometimes catch the school rush at the end of the week.

Beforehand, we’d paid someone £30 to run a tasting session on a Saturday, but we could no longer justify the cost of that. It just didn’t make sense to us, even if we had a good sales session o the back of it. So, now we have a member of our team handling it because there are enough team members working on a Friday a ernoon. They have to like the product they’re showcasing, though.

You’ve also got to think about how much the product you’re sampling actually costs. We did a co ee tasting once and it was great and people were chatting and engaging with it, but the co ee was £8.99 a bag. That just put people o and they didn’t pick it up. It added way too much to their normal basket spend.

Something smaller and more a ordable encourages people to buy it a er sampling. What worked best for us was a cinnamon popcorn because it had such an unusual taste, and a vegan chocolate.

It’s not a footfall driver for us, but we’re in a quite a unique location, so we don’t advertise that it’s happening in the way that other stores might want to do. It’s more about building product awareness among our existing customers.

Find the way it works for you and consider how things have changed. People might not want to use their ngers as much a er the pandemic, they might want cocktail sticks instead. People might be funny if you’re serving things in plastic, non-recyclable cups.

And, of course, always bear in mind what the weather is doing, because some products will work better on sunnier days than others.

13 betterretailing.com 21 MAY–3 JUNE 2024

edited

Letters may be

LETTERS

Each issue, one of seven top retailers shares advice to make your store magni cent

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

Kuldeep

local causes’

WIN £50-worth of Swizzels Squashies Strawberry & Cream Fill in your details at: betterretailing.com/competitions This competition closes on 18 June. Editor’s decision is nal.

THE CIGARETTE SITUATION

CHARLES WHITTING nds out how retailers approach cigarettes and roll-yourown tobacco di erently to maximise sales

WHAT’S HAPPENING WITH CIGARETTES?

THE tobacco category is largely in decline, with most retailers stating that sales are slowing. With the number of smokers having decreased by 30% to 12% of the UK population since 2014, the customer base that retailers could once rely on is shrinking.

Not only that, but those smokers that remain are increasingly turning to illicit tobacco in a bid to get hold of cigarettes at lower prices. A survey by the Tobacco Manu-

facturers Association found that 80% of a survey of 12,000 smokers had bought illegal tobacco in 2023, with one in ve only buying ‘branded’ tobacco, despite all legal tobacco in the UK being sold in plain packaging since 2016.

This means that for retailers stocking legal tobacco, a smaller customer base is turning away from them as price becomes the deciding factor when it comes to purchasing behaviour.

Many retailers have responded by streamlining their ranges and cutting out certain brands, but others are reducing stock while maintaining as wide a range as possible.

“We’ve not reduced our range. I like to say to customers ‘yes, we’ve got that’,” says Atul Hathi, from Latchford Londis in Warrington, Cheshire. “I don’t stock every brand going, but I certainly stock all the major brands. I’m just not holding as much as I used to.”

Nirav Patel, from News Boutique in Hayling Island in Hampshire, also hasn’t reduced his range at all because the majority of his customer base are older, retired people who haven’t taken to next-gen nicotine products in the same way as younger adult generations.

“They prefer cigarettes to vapes and so our range is a footfall driver in its own right,” he says. “For us, it’s a 50/50 split between RYO and FMC.”

CATEGORY ADVICE TOBACCO 14

CATEGORY ADVICE TOBACCO

WHAT ABOUT ROLL-YOUR-OWN?

WHEN it comes to RYO tobacco, there is a clear split between brand-led and price-led customers. With value options growing faster than any other segment at 8% year on year, retailers need to be stocking them, but there is clearly a place for more premium options as well.

“Value accounts for almost a quarter (24%) of all RYO sales,” says Rasool. “While products in the value and economy price tiers make up over half of RYO sales, the premium price sector in fact holds the largest share of the RYO market at 36%.

“Data shows that 30g packs

FINDING MARGINS

TOBACCO isn’t a high-margin category, but there are still ways that retailers can squeeze extra pounds out of sales without driving valuefocused customers away.

Keeping an eye out for promotions and deals from wholesalers is one way, but Nikheal Patel, from Plummers News in Barking, Essex, recommends going direct to source and talking to supplier reps.

“It’s their job to make sure you have the stock,” he says.

“Find them and get them to visit your store. They might be able to give you promotional prices or even freebies.”

Nirav Patel also nds that

the less expensive options tend to provide better margins because of the special deals that retailers can get, which allow them to o er cigarettes at more attractive prices.

“The expensive ones only get us a 3-4% margin, so we recommend the less expensive ones from JTI and Imperial,” he says. “Amber Leaf and Golden Virginia are the popular rolling tobaccos we stock.

“Beyond that, people just want the cheapest one. Similarly, Benson & Hedges are the most popular because they’re the least expensive.”

of rolling tobacco are now the most popular, with this format now making up a signi cant 69% of all RYO sales. Although 30g formats may be proving the most popular for shoppers, larger formats still account for 31% of RYO sales, so ensuring a range of 50g formats is available should also be a focus.”

Nikhael Patel, Plummers News, Barking, Essex RETAILER VIEW

Nikhael Patel, Plummers News, Barking, Essex RETAILER VIEW

“WE only ever stock one box of each RYO brand at a time, and we’re not afraid to have it out of stock for a few days. It’s not that much in demand, but you have to have it because enough customers will buy it. Each RYO smoker has their own preferred brand though, but new smokers will be looking for the cheapest rolling tobacco, which is Marlboro at the moment.

“For FMC, it’s the same approach apart from Benson & Hedges Blue. You have to have Benson & Hedges Blue in stock or you can lose two or three sales a day. If I don’t have it in stock, then I will go out and get hold of some. It’s the only brand we’re likely to have in storage. It’s a well-known brand, but it’s the less expensive version of it. The price point is accessible and everyone knows it.”

16

STAFF TRAINING AND RECOMMENDATIONS

ACCESSORIES BOOST

FOR retailers with a strong RYO range and customer base, there is a real opportunity to drag the traditionally low tobacco margins up through the sale of accessories. Papers and lters are key subcategories for RYO tobacco, while lighters and matches are important for all tobacco smokers. Stocking up with a varied range of sizes and flavours can be a signicant boost to sales.

“Those retailers who o er a varied selection of product formats, from king-size papers to eco-friendly lters, are seeing the highest levels of repeat purchase, which is a key driver for incremental sales,” says Gavin Anderson, sales and marketing director at Republic Technologies. “Papers remain the highest

value subcategory in tobacco accessories, worth over £115m and growing year on year.”

It’s also legal to display your accessories, meaning they can act as a signpost for customers, letting them know you’ve got a good range and reminding them to make an impulse purchase.

“Republic Technologies’ Perspex units feature interchangeable inserts for multiple bestselling brands,” says Anderson. “They enable retailers to create eye-catching o -gantry displays, and not only do they draw attention to new products, generating interest and impulse purchase, they also create more opportunities to upsell, as retailers can site them close to other tobacco related products.”

than in many other categories, as sta need to know about the products you’re o ering, but also what will appeal most to customers at that time.

WITH cigarettes hidden from view in plain packaging and without any promotion or advertising allowed, there are various ways for retailers to let their customers know what they’ve got on o er. This could result in lost sales if ranging and pricing is not made clear. As a result, sta training is more important in tobacco

gain in-depth knowledge of the category and any relevant trends, as well as improving their understanding of tobacco terminology and awareness of new products.”

“Retailers should encourage their sta to read up on the latest industry trends, news and features in the trade media on a regular basis,” says Rasool.

“This will allow employees to

Education also means being aware of the latest updates to the law, with the generational smoking ban an important recent example.

17 21 MAY-3 JUNE 2024 betterretailing.com

DRIVING SUMMER ALCOHOL SALES

PRIYA KHAIRA reports on how retailers can drive alcohol sales as the weather gets warmer

WARM UP YOUR SUMMER SALES

ALCOHOL is a signi cant category all year round, however, it is particularly important over the summer months.

This summer is lled with music and sporting events including the UEFA Euros, Paris Olympics, Wimbledon, T20 Cricket World Cup and Formula 1 British Grand Prix.

These events present the perfect opportunity for customers to shop for ‘big night in’ occasions. “This summer is

set to be a busy one with a wide range of occasions on the horizon,” says Lauren Priestley, head of category development o -trade at Diageo. “A summer of sport and celebration presents a golden opportunity for retailers to encourage their shoppers to create celebratory serves at home,” she adds.

Amandeep Singh, of Singh’s Convenience Store Premier in Barnsley, South Yorkshire, stocks up on beer and cider

multipacks in the summer. He says he tends to increase the volume of his orders for these products in the summer as he knows demand is likely to increase.

Singh notes that keeping on top of orders and managing alcohol stock levels is going to be crucial, especially as the football season approaches, when multipack sales are likely to increase.

Sally McKinnon, head of

marketing at Westons Cider, says that research from the Westons Cider Report 2024 indicates that single-can formats are experiencing volume growth, with space for larger pack formats to grow ahead of the summer.

She notes that retailers can drive incremental sales across other categories by placing chilled barbecue produce and bagged snacks close to cider and beer xtures.

CATEGORY ADVICE SUMMER

18

ALCOHOL

RISE OF RTD COCKTAILS

FOR Umar Majid, of Baba’s Kitchen in Bellshill, Lanarkshire, ready-to-drink (RTD) cocktails are the most-popular alcoholic summer beverages, selling 200-300 cans of RTD cocktails each week.

He says he receives lots of customers stopping by on their way to festivals, so he makes sure to reorganise his alcohol xture when the weather gets warmer to draw in passing trade.

“I use PoS and decorations to create a xture at the front of the store, highlighting our

display of RTD cocktails, beers and cider. BuzzBallz, premixed Au Vodka cans, Buckfast and Absolut RTD cocktails are some of our most popular lines,” he says.

Nielsen data indicates that the RTD category is the fastest growing within the alcohol category in the o -trade. “More and more brands are also launching their own mixed, premix and cocktail RTDs, which is great to see,” says Priestley.

“We know the cocktail-athome trend is still of interest

to consumers, with premium cocktails accelerating the growth by 82%.”

Susan Connolly, from Spar Tidworth in Wiltshire, will decorate her store ahead of the Euros to increase footfall, and recommends retailers think about what deals they can run ahead of summer to drive customers to the category.

She notes that she will be shifting her attention to her cider lines in the summer, with fruity flavours on single formats and multipacks being the most popular.

Caitlin Brown, category executive, BrewDog PLC

“MULTIPACKS are a key growth driver for the category and a must-stock format in the warmer months as summer socialising increases.

“Our research shows that 50% of rst-time purchases come from multipacks, and larger mixed formats signi cantly over index with rst time buyers, with 51% of cra -beer shoppers repeating their category purchase, following their rst trial.

The four-can pack remains the most important cra beer format throughout the year with 47.4% share, however, we have seen signi cant movement in the 440ml single can format, driven by the cost-of-living crisis, so it is important to have a mix of formats available to meet di erent shopper needs.”

product news

Rekorderlig has added Peach Raspberry and Blackberry Blackcurrant flavours to its cider portfolio.

Diageo has launched Cîroc Limonata (37.5% ABV), available in a 70cl format.

Aspall Cyder unveiled a new premium cider, available in a 330ml can in four- and 10-can multipacks. The launch is being supported with a marketing and PR campaign.

BrewDog released its new beverage, Cold Beer, in a move to meet consumer demand for low ABV beer. The product is available from Booker in 10 x 440ml packs with an RRP of £9. The beer has a 3.4% ABV

BrewDog Distilling Co added a Duo White Rum to its lineup. It contains notes of pineapple and guava and has an RRP of £25.

Bottlegreen partnered with Edwards 1902 to launch its Vodka Spritz range. The 250ml cans will be available in Elderflower, Raspberry and Lime & Mint varieties, each with an RRP of £2.50.

Four Loko has extended its vodka-based RTD range with the launch of Dark Berry Burst. Delivering a mix of blackcurrant flavours, Dark Berry Burst comes in 440ml cans (8.4% ABV) with an RRP of £3.49.

Nirvana Brewery has launched two new brews to its larger lineup, including a traditional Bavarian Hefeweizen (0.3 ABV) and a Cloudy Lemon Lager (0.2 ABV).

Thatchers Cider has released its alcohol-free cider, Thatchers Zero, in a can format. The new Thatchers Zero cans join the company’s other four packs; Thatchers Gold and Thatchers Blood Orange.

19 21 MAY-3 JUNE 2024 betterretailing.com

SUPPLIER VIEW

UNFILTERED PREMIUM LAGER WITH A HINT OF ITALIAN SEA SALT FOR FULL FLAVOURED REFRESHMENT

ENJOY BIRRA MORETTI RESPONSIBLY

bREWED IN THE UK *Nielsen Scantrack / Value / FY 2023. To find out more, sign up to HEINEKEN UK’s free Star Retailer programme today at starretailer.co.uk

CATEGORY ADVICE SUMMER ALCOHOL

DIVERSIFY YOUR OFFERING

A SELECTION of low- and noalcohol lines can be a strong addition to alcohol xtures. A spokesperson for Eisberg Wine says: “Retailers can optimise summer sales by recognising that within any group, there is bound to be at least one individual abstaining from drinking.”

Amit Puntambekar, of Ash’s Shop in Fenstanton, Cambridgeshire, notes that customers are more likely to purchase low- or no-alcohol

options from brands that they are familiar with and that younger customers are more likely to shop the category.

The spokesperson from Eisberg Wine adds: “O ering bundle deals or discounts for mixed purchases of alcoholic and non-alcoholic beverages can incentivise cross merchandising and increase sales.”

Steve Young, sales director at Asahi UK, notes that lowand no-alcohol makes up 0.7% of sales within chilled beer,

while 96% of sales are lager. He says: “The no-alcohol beer market is growing rapidly, with an expected global CAGR of 8% in the next ve years.”

“No- and low-alcohol is incremental to the category. No-and low-alcohol tends to be an additional purchase in the beer category rather than a substitution, so with the right beer range available, no- and low-alcohol products should bring additional sales for retailer,” Young adds.

Events and alcohol

Summer events and their alcohol sponsors

2024 Olympic Games

AB Inbev

Wimbledon

Pimm’s

Stella Artois

Sipsmith

Lanson

UEFA Euro 2024

Heineken

Budweiser

Carling

Boardmasters Festival

BrewDog

Glastonbury Festival

Brooklyn Pilsner

alcohol promotions

Heineken UK has launched an on-pack promotion for Foster’s, giving one retailer and 10 shoppers a chance to win a holiday voucher. The promotion is running until the end of August, featuring across holiday-themed multipacks of Foster’s core range.

Heineken UK has also released limited-edition sport packaging and glassware across its Original and O.O varieties in the lead up to summer sporting events. Available until July 2024, the packaging reflects the brand’s status as the o cial sponsor of the UEFA Champions League and UEFA Women’s Champions League.

Westons Cider is running its biggest on pack promotion across its Henry Westons range. The ‘Taste of Adventure’ promotion is giving one shopper a chance to win a trip to their dream holiday destination. It is running across its Westons Vintage, British Vintage, Cloudy Vintage, Organic, Signature Vintage and Aged varieties until August.

Jameson has partnered with Classic Football Shirts to launch ve limited-edition whiskey bottles, paying homage to iconic away jerseys in British football history. The partnership came as the brand commemorated its four-year deal with the English Football League. The bottle designs feature away kits from Leicester City, Sunderland, Charlton Athletic, Portsmouth and Tranmere Rovers.

22

PETCARE

UNLEASH PETCARE’S POTENTIAL

Petcare presents a growing opportunity for independent retailers, writes CHARLES SMITH, with consumers continuing to spend on their pets

THE PETCARE OPPORTUNITY

THE pet food category is worth £150m in convenience stores, and sales in the channel are six times bigger than hot drinks or household cleaning.

A spokesperson for Bestway says a single convenience petfood shopper is worth £1,600 more annually than the average convenience customer, and 80% of pet owners would sac-

ri ce spending on themselves to buy high-quality food and products for their pets.

“The petcare category saw strong growth in 2023 across total market and continues to be a growth driver for FMCG,” says Adelina Bizoi, category and market activation director at Mars Petcare.

“Additionally, we know own-

ers are shopping for their pets in more channels than ever before – this includes convenience, grocery, discounters and the specialist pet trade, with consumers shopping across three channels on average.”

Pet ownership levels may have slipped from the pandemic highs, but more than half UK households own at

least one pet, and 48% own a cat or a dog.

“People bought pets to cheer them up during the pandemic,” says Imtiyaz Mamode at Wych Lane Premier, in Gosport, Hampshire “The same numbers are buying pet food as then, and the cost-of-living crisis hasn’t changed how they’re buying it.”

RETAILER VIEW

Imtiyaz Mamode, Wych Lane Premier, Gosport, Hampshire

“WE currently sell £200-worth of petcare a week in a section with ve shelves of 2.5 metres. Most customers know where it is in the store, and all the products on promotion are there. People can see everything in one place, which prompts them to buy di erent things. If they want something that isn’t there, they can always ask us to get it.

“My best advice to retailers coming into the category is to begin with wholesalers’ planograms and stock a core range of tins, pouches, boxes, treats and cat litter. Get customers’ feedback, then go with what they want.

“If the planogram works and there’s no other demand, stick with it. Smaller stores should start by trying a few Euro Shopper or Jack’s price-marks and take it from there. We also have a small selection of sh food, rabbit food and wild bird seed, because customers asked for them.”

23 21 MAY-3 JUNE 2024 betterretailing.com CATEGORY ADVICE

23

CATEGORY ADVICE PETCARE

GET THE RANGE RIGHT

IT’S essential to have a variety of the core pet food flavours and formats, and tailor your range to your location and customers. Nine out of 10 petfood purchases are planned, good news for multipacks and big bags of cat litter, but one in ve pet owners will go elsewhere if they can’t nd what they want.

Pouches, boxes and treats are seen as more modern, but tins are still big sellers.

Kantar says 64% of cat-food shoppers and 53% of dog-food shoppers buy wet and dry food, and use ‘dry’ as a mixer.

Some pet owners might be considering moving to plant-based, but the core

petcare sectors remain dog and cat food in tins, pouches and dry, cat litter, and cat and dog treats.

Flexible working means people are spending more time at home and doing more dog walking, and buying more dog treats, which account for more than a quarter of dogfood sales in convenience stores and represent a possible impulse opportunity.

Check the local shops you’re competing with for pet sales, and think beyond dogs and cats – consider sh food, bird seed, straw for hamsters and guinea pigs, hay for rabbits, and bird food balls with seeds in winter.

Adelina Bizoi, category and market activation director, Mars Petcare

Retailers can help retain shoppers by making their store fronts more pet-friendly and by o ering a safe place for shoppers to leave their dogs and provide fresh water bowls outside.

Placing impulse-style products such as treats nearby everyday products like pouches will encourage cross segment purchasing and can inspire pet parents to pick up something new.

Merchandising ‘grab and go’ products such as Pedigree Dentastix at till points will help encourage impulse purchasing and drive sales.

Position it properly

Merchandise petcare away from food, in the middle of the store with household products, or at the back.

Allocate space wisely

DCS Wholesale say smaller retailers should have at least a one-metre bay with ve shelves for products. Retailers should position dry food at the bottom, then tinned, and pouches at the top.

Drive incremental sales

Place treats and snacks at eye-level to grab shoppers’ attention, and as a reminder to purchase in addition to pet main meals.

Stock core brands

Make sure well-known brands such as Pedigree, Bakers, Whiskas and Felix are highly visible, as they are instantly recognisable. Create vertical and horizontal brand blocks to raise brand presence.

Keep track of what sells

Allocate space on shelf by the percentage of total sales and margin: watch sales and adjust.

Multipacks

Multipacks of wet cat food account for 57% of mainmeal sales, so stores of all sizes should include multipacks in a choice of flavours.

Ranging

Merchandise heavier products such as large packs of dry pet food and bags of cat litter at the bottom of the xture.

24

top tips Make the most of merchandising

TOP

TIPS

NEARLY nine out of 10 shoppers say they like to stick to brands, but half of Imtiyaz Mamode’s pet food sales are own label. Retail Data Partnership (RDP) data shows own-brand pet food dominates in convenience, with four of the top- ve lines own label. Price-marked packs (PMPs) account for 19 out of the top 20 pet food lines, and squeeze margins, as Mamode con rms, but retailers can build margin back by making the most of pet food multipacks and big bags of cat litter. Similarly, bigger bags of cat litter o er extra convenience for shoppers, and higher cash sales for stores. The other way retailers are widening margins is marking up premium pet foods. RDP say Sheba Classics Chicken in Terrine has a 75p usual price, but three-in- ve retailers are charging up to 60p more. BRANDED VERSUS OWN

AND PMPS VERSUS PREMIUM

LABEL

betterretailing.com 21 MAY-3 JUNE 2024 25 CLASSIFIED The Fed Stocktaking Professional stocktaking services FOR ALL YOUR STOCKTAKING NEEDS Stocktakers to independent: TEL: 07899 002692 Retailers/wholesalers Grocery stores DIY stores Specialists in CTN O licences Forecourts For competitive rates and professional service call now on... Fax: 020 8360 6348 nikharstocktaking.com ajit.nikhar@gmail.com H/O: 13 Green Moor Link, London N21 2NN 020 8360 2491 Mob: 07802723561 Advertise with us Contact Natalie Reeve to find out more commercialteam@newtrade.co.uk 020 7689 3372 Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The regular positive response we receive leads to confirmed sales and contented customers. Robin Ranson, Thornbury Refrigeration Refrigeration Remote Unit (Motor sited externally) Osaka Finance available Chillers and freezer (available in 3 doors)

ADVICE

REPLACING FADING CATEGORIES

The RETAIL EXPRESS team nds out which categories retailers are phasing out to make room for more pro table replacements

We haven’t done anything yet, but conversations keep reoccurring. Which categories are retailers phasing out? – Jack Matthews, Bradley’s Supermarket, Quorn, Leicestershire

Andy Miles, Dike & Sons, Stalbridge, Dorset

Andy Miles, Dike & Sons, Stalbridge, Dorset

“IT’S an interesting question. If you look at all the big supermarkets, over the past 10 years, the grocery departments have got smaller, while homeware and stationery has grown. Presumably that’s because there’s more margin in those categories.

“We’ve had several conversations here about what we would do if we rejigged our grocery department to get rid of slower selling lines without losing customers who might come in especially for that odd jar of pickles. But we would love to introduce more homeware – from duvets to photo frames.

“Because our store is so rural, people who don’t want to shop online have to travel for half an hour to get products like this, so it would work really well for us to stock them. We sell so many cards, it’s ridiculous. By reducing our fruit-and-vegetables section by half a metre without losing any products, we were able to increase our card section by 50%.”

2

Vrajesh Patel, Londis Dagenham, Essex

3

Joshua

James, Fresh & Proper, Fordham, Essex

“WE’RE looking to phase out newspapers and magazines, especially since the recent carriage charge increases. Our margins are just getting eradicated. We’re also cutting back on US sweets because I think they’ve had their time. We’ll phase them out and do something with other world sweets and world products.

There are other countries that we want to explore.

“We’re looking at other sectors that are on the up and we’ll try to expand that range. For example, we’ve seen an increase in specialised pet food – for rabbits, guinea pigs and other animals beyond cats and dogs – so we’re looking for a local supplier to provide food and accessories. It’s a category with good demand and good margins so it should be a good �it.

“Ultimately, there’s so much we could be stocking that we’re not. So, it’s about �inding out how much footfall that square metre is generating minus the cost of maintaining it.”

“WE went quite hard with vegan products when we launched the store but we’ve now almost completely phased them out. If we had more freezers we might get some frozen vegan options, but without them it was just a high wastage category for us, which defeats what we’re trying to achieve. It was weird, because we thought it would be a target market when we launched. But we had one customer saying we didn’t have a big enough vegan range and then after we expanded it, sales just wouldn’t go up. The range of products on offer is growing so fast the planogram can’t stay the same very week so you very quickly get into waste.

“We’ve gone very heavy with produce for cooking from scratch since then. We’ve got lots of produce and local goods. We’re in a rural area, so we’re targeting farmers and farmers’ wives.”

“We also took newspapers and magazines out almost straightaway because the returns can be dif�icult.”