26 MARCH-8 APRIL 2024 STRICTLY FORTRADEUSERSONLY P3 • Revealed: shopkeepers make stark warning as violent incidents rise by 85% • Store owners forced to take matters into their own hands as police response branded ‘inadequate’

MANY OF US HAVE TO DIE?’ RedBull_UK1460_ED+SUMMER_Retail Express Ad_260x215mm_AW.indd 1 23/02/2024 15:15 TOBACCO AND VAPE BAN P2 P6 PepsiCo turns up the heat with new Extra Flamin’ Hot variety for popular lines P4 POOR AVAILABILITY More Lucozade and Ribena shortages expected ‘over the coming weeks’ PRODUCT NEWS Retailers face new penalties for breaking anti-smoking ban under new legislation

‘HOW

NEWBRAND 2024!FOR Have you always got the products your customers are looking for? If the answer is YES, enter the Better Retailing Effective Ranging & Availability Award and gain the recognition you, your store and your team deserve. From monitoring sales to managing stock and effective sourcing, availability and effective ranging is all about making sure you have the products your customers want, when they want them. NEED SOME HELP? Contact: marketing@newtrade.co.uk or call Kate Daw on 07886 784465 Not sure about Effective Ranging & Availability? We have seven other exciting categories to enter, from Customer Engagement to Responsible Retailing and everything in between. Find the full list at betterretailing.com/ Awards-2024 or scan below: EFFECTIVE RANGING & AVAILABILITY AWARD AWARDS PARTNERS Sponsored by Mars Wrigley

Retailers face new penalties for breaking anti-smoking ban under new legislation

‘HOW MANY OF US HAVE TO DIE?’

• Revealed: shopkeepers make stark warning as violent incidents rise by 85%

• Store owners forced to take matters into their own hands as police response branded ‘inadequate’

More Lucozade and Ribena shortages expected ‘over the coming weeks’

PepsiCo turns up the heat with new Extra Flamin’ Hot variety for popular lines

CATEGORY ADVICE SPIRITS 24 betterretailing.com CHARLES WHITTING nds out what it takes to have a successful year-round spirits range while driving summer and festive pro ts GETTING SPIRITS RIGHT

SPIRITS RIGHT Top tips on how to secure a pro t-making range all year round P24 26 MARCH-8 APRIL 2024

FORTRADEUSERSONLY

GETTING

STRICTLY

AND VAPE BAN P2 P6

P4

TOBACCO

POOR AVAILABILITY

NEWS

PRODUCT

P3

JUST like you, I nd it can be easy to get caught up in the everyday. It was refreshing to take a step back last week, to look at how Retail Express is performing, and whether our objectives are aligned.

My mantra has been the same since I became editor of Retail Express – I want retailers to see this publication as a safe space in which they can read about like-minded individuals, seek advice and ask for help when they need it.

However, sometimes the day-to-day processes involved in putting an issue together can get in the way of this thinking. Being busy can o en be a barrier to reflection for all of us, and giving ourselves the opportunity to see whether there’s anything we could be doing to improve.

I want to ask you to do the same this week. Take 10 minutes in the morning, with a cup of tea or co ee, and list your goals.

Not just any goals, but the goals you had when you rst opened your store’s doors.

Have you hit them? If not, are you on track to? Have you been distracted lately, and if so, why?

BEING BUSY CAN OFTEN BE A BARRIER

Bringing your priorities to the fore is instrumental to remembering why you do what you do. Of course, this isn’t always easy, especially as the trading landscape remains trickier than ever, so it’s important not to be hard on yourself.

I promise you will be le feeling energised and remotivated. While you are at it, give yourself an overdue pat on the back for how far you’ve come.

Fines for stores not complying with tobacco and vape bans

RETAILERS who break the upcoming smoking ban will face on-the-spot �ines and risk imprisonment, as legislation to phase out tobacco sales for future generations is laid out.

The Tobacco and Vapes Bill was introduced in Parliament last week, and if passed unamended, will be a landmark ruling, preventing children

turning 15 this year or younger from being able to legally buy tobacco.

Prime minister Rishi Sunak said the government was delivering on its commitment to “create a smoke-free generation and stop our kids from getting hooked on cigarettes and other nicotine products”.

Enforcement of�icers’ powers will be strengthened with on-the-spot �ines of £100 to uphold new laws and clamp

down on underage sales of tobacco and vaping products.

This builds on the maximum £2,500 �ines that local authorities can already impose.

The bill will also introduce new powers to restrict vape �lavours and packaging that is intentionally marketed at children.

It will allow the government to change how vapes are

displayed in shops, moving them out of sight of children and away from products that appeal to them, like sweets.

The ban will come into force on 1 April 2025, with a transition period of “at least six months”, indicating the time period in which stores and wholesalers will be expected to begin running down stock levels and educating customers on alternative products.

things might take a bit longer,” they said.

News reporter

Alice Brooker

@alice_brooker 07597 588955

Features writer

Priya Khaira 020 7689 3379

Specialist reporter

Dia Stronach 020 7689 3375

One blamed the “big process” of the operator switch, which took place in February. “It’s not surprising

Responding, a spokesperson for Allwyn said “new kit and network solutions” will be introduced this spring, and “phased rollout of the terminals” will take place “towards the end of the year”.

STORES using PayPoint’s Counter Cash service to avoid card-merchant fees are at risk of having the service removed.

Last week, a customer attempting a card purchase in an unidenti�ied local shop suggested the retailer had rung through a cash transaction and processed a cash withdrawal for the equivalent amount using Counter Cash. A PayPoint spokesperson warned this “is not permitted”, and con�irmed it monitors “to assess whether this is taking place”.

PWC’s Local Data Company tracked more than 200,000

but also found that there has been an acceleration of openings across the

retail sector, with 2023 seeing the most doors opening since 2019.

Petrol stations were among the top growing categories, alongside supermarkets, “primarily due to the opening of discount supermarkets”. ALLWYN

MEGAN HUMPHREY

MEGAN HUMPHREY

-

betterretailing.com facebook.com/betterretailing

@retailexpress

The ve biggest stories this fortnight

01

02 03

NEW data suggests the net closure of independent stores is accelerating in

04 05 Closures on the up Lotto terminals PayPoint warning

the UK.

chain

outlets,

reps have

independent stores

claimed

will have to wait “about 12-to18 months” before receiving new terminals.

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editors Jim Findlay 020 7689 3373 Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 07856 475 788 Associate director Charlotte Jesson 07807 287 607 Commercial project manager I y Afzal 07538 299 205 Account director Lindsay Hudson 07749 416 544 Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Management accountant (maternity cover) Michael Stack 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say Don’t underestimate the power of reflection Morrisons review MORRISONS is helping its Daily franchisees become more competitive with rival supermarkets. Several Morrisons Daily franchisees con�irmed to Retail Express they had received verbal and written communication about the review. Morrisons reviewed the prices of 1,896 products, across all major categories both in store and online, against the same or similar lines in Tesco Express, Sainsbury’s Local and Co-op stores. Features writer Jasper Hart @JasperAHHart 020 7689 3384 40,152 Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

Humphrey,

News editor Alex Yau @AlexYau_

Megan

editor

020 7689 3358

For the full story, go to betterretailing.com and search ‘Morrisons’ For the full story, go to betterretailing.com and search ‘Allwyn’ For the full story, go to betterretailing.com and search ‘PayPoint’ For the full story, go to betterretailing.com and search ‘vape ban’

Cover image: Getty Images/ lo+Evorona

07597

GOOD WEEK

ALEX YAU

RETAILERS are close to turning their backs on the sector after being faced with a “harrowing” increase in violent incidents over the past year.

Speaking at the Scottish Grocers’ Federation’s (SGF) Crime and Wellbeing seminar this month, retailers revealed the stark toll increasing crime levels is having on on their mental and physical well-being.

Dan Brown, of Spar Pinkie Farm in Musselburgh, said: “It certainly has us questioning whether we want to work in retail. When you’re facing that level of violence, it no longer is about the cost to the business.

“My biggest concern is the safety of myself and colleagues. Retailers are being killed, but nothing is happening. We need action.

How many of us have to die before something actually happens?”

Brown recalled previous incidents where he had been threatened with knives and guns in his shop.

He added: “It’s happening to almost every retailer. These are mothers, fathers, sons and daughters who are facing abuse on a daily basis.

“My �iancée was involved in an armed robbery. This was a 25-year-old woman literally looking down the barrel of a shotgun.

“The knife incident took four days for an of�icer to

Retailers at breaking point over escalating violence

come out. I do recognise the police are massively underresourced, but there needs to be more of a deterrent.”

Brown’s experiences are re�lective of new �igures highlighting growing shop violence.

The SGF’s 2024 Crime Report revealed that 92.8% of retailers experienced violence once a week, while 55.7% described police response times as “unsatisfactory”.

Nationally, the latest ACS statistics stated violent attacks against retailers in the past 12 months rose annually by 85% from 41,000 to 76,000. Co-op also reported 1,000 daily abuse, violence and shoplifting incidents in its stores, a 44% annual uplift.

Meanwhile, member of Scottish Parliament Daniel Johnson revealed the latest on charges brought under the Protection of Workers Bill in Scotland. As of February 2024, 3,607 charges were made under the bill for violence against shopworkers. This included 1,199 convictions, with 1,313 still in court, while 154 have not been pursued.

Despite the rise in shop attacks, retailers at the SGF event criticised police response to shop crime.

Umar Majid, of Baba’s Kitchen in North Lanarkshire, said: “We confronted a shoplifter and their response was the police couldn’t do anything. You try to introduce deter-

“IT’S about ensuring you’re well stocked with the latest products. We use Facebook and Instagram excessively to let customers know about updates. We’re always communicating that we’ve got great o ers and great customer service. The most growth we’ve had has been in home delivery because that has no limits. Our footfall has gone up 16%, but home delivery is up by 400%.”

Daniall Nadeem, Spar Motherwell Road, Belshill, North Lanarkshire

rents, but these are the interactions you are dealing with now.

“A couple of years ago, I was assaulted. A warrant was put out for their arrest because they never showed up at the court case, but nothing has come of that. You wonder whether there’s actually any point.”

Meanwhile, Anand Cheema, of Costcutter Falkirk, highlighted rising issues in racial abuse. He said: “Abuse is more invisible now through intentions and actions. My family didn’t want me going into the sector.

“I’ve done it, but I don’t think I would tell my kids

to pursue a career in this sector. If you won’t put your own children in retail, why would you put another human being there?”

Each retailer also highlighted increasing challenges retaining and hiring staff due to shop crime.

Frustrated with the lack of police action, some store owners have resorted to community WhatsApp and Facebook groups to prevent shop crime. Sasi Patel, of Go Local Extra in Rochdale, said posts about crime in one of his WhatsApp groups had become a daily occurrence, compared to a post every few days when the

What are you doing to get customers back into your store?

“GEOGRAPHY is important. I’m on a council estate, whereas it would be di erent if you were on a high street. With returning customers, I can point products and o ers out. You’ve also got to know what customers come to you for. My shop’s not that big and there’s a massive Co-op down the road. People aren’t coming for their weekly shop with us, but they will get their essentials.”

Arjun Patel, Premier Cavendish Square, Swindon, Wiltshire

group was set up.

Ken Singh, of BB Nevison Superstore in Pontefract, expressed similar concern, and added: “There is a Pontefract community watch Facebook group with shop owners where we alert each other. It’s a name-andshame group that’s acting as a deterrent.

“It’s not something we should be doing, but retailers are trying to get results themselves due to no or very little support from the authorities.

“Theft is on the increase and we’re seeing more retailers embrace social media to tackle the issue.”

“WE’RE resourceful and we’re independent, and we source those products for customers. If the demand is there, I’ve got to supply it. It’s also about talking to the customers, really, and getting to know them. Any freebies I get from suppliers, I give out to our customers. We gave some free samples from Cadbury to customers, and they gave us a shoutout on Instagram, which creates that bit of interest and loyalty.”

Atul Sodha, Londis Hare eld, Uxbridge, west London

REWARDS SCHEME: MyDD Points is reportedly “months away” from launching a symbol-groupbacked version. Chief executive Kandiah T Konesh claimed 2,500 UK shops are now using the service, with convenience stores seeing a 15-20% uplift in total sales. The scheme o ers shoppers members-only pricing on key lines, similar to ‘Clubcard prices’ by Tesco.

For the full story, go to betterretailing.com and search ‘MyDD Points’

POST OFFICE: Branches have seen cash withdrawals increase by 15% year on year, reaching a total of £806m in personal cash withdrawals. According to latest statistics released by the rm, this represents a 3.6% increase from January. Personal cash deposits also amounted to £1.28bn, up 6.2% year on year.

For the full story, go to betterretailing.com and search ‘Post O ce’ 26

BAD WEEK

UNILEVER: The supplier has announced plans to split its ice cream division o , a ecting Wall’s, Magnum and Ben & Jerry’s, in a move to be completed by the end of 2025. The news comes alongside jobs cuts, amid claims the company is underperforming. Chairman Ian Meakins said the change “will help create a higher-performing Unilever”.

For the full story, go to betterretailing.com and search ‘Unilever’

ABRA WHOLESALE: The company’s director con rmed it is seeking buyers to take over its depot in north London. Dee Thayas said he wants to sell the business “as soon as possible”.

For the full story, go to betterretailing.com and search ‘Abra Wholesale’

03 betterretailing.com

MARCH-8 APRIL 2024

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers? Call 020 7689 3357

megan.humphrey@newtrade.co.uk

or email

Atul Sodha

@retailexpress facebook.com/betterretailing

Anand Cheema, Umar Majid and Dan Brown discuss the impact of shop violence at the Scottish Grocers’ Federation’s Crime and Wellbeing seminar

megan.humphrey@newtrade.co.uk

588972

Lucozade and Ribena shortages

ALICE BROOKER

DELAYS and shortages of Suntory Beverage & Food GB&I’s (SBF GB&I) top Lucozade and Ribena lines, including its recent Blucozade launch, were to continue for several weeks, according to a major wholesaler.

The problems were attributed to a seven-day strike at the company’s Gloucestershire manufacturing plant in

February. Despite a deal with union Unite averting further strike days, a message sent from the wholesaler to stores on 12 March, and seen by Retail Express, said Suntory is “still experiencing supply distribution” problems. Retailers are seeing limited access to Lucozade and Ribena, including Blucozade, as a national wholesaler has reported supply distribution issues due to industrial action.

“Our supplier is now working to recover from the impact of the industrial action,” the wholesaler warned.

The statement added: “We remain on allocation from the supplier and will continue to experience disruption over the coming weeks with intermittent supply.

“On some products, productions will be delayed to recover on faster-selling lines and will be temporarily blacklisted.”

Suntory Beverage & Food GB&I’s wholesale channel director, Matthew Gouldsmith, responded: “We reached an agreement with our union and employee representatives last month to conclude talks and end industrial action.

“We are experiencing some limited disruption to supply levels, but our priority is making sure our drinks continue to reach our customers and shoppers.”

For

Jisp shoppers up 8%

JISP reported an 8% jump in shoppers using its Scan & Save mobile app, alongside a 27% rise in retail sales.

The company unveiled the latest figures this month, with scans, taps and redemptions also up 45%, 43% and 42%, respectively, in February 2024, compared with the previous month.

Retail sales in February generated more than £500,000, bringing retail revenue to almost £1m in the first two months of the year.

TRADING standards is calling on the government to invest £100m over the next four years to tackle the sale of illicit products.

The Chartered Trading Standards Institute published its manifesto last week, calling for greater levels of protection and developing a regulatory system that supports businesses.

Polling of trading standards

officers in early 2023 revealed 61% said they didn’t have the resources to tackle the illicit trade in tobacco and vaping.

One Stop’s Olio tie-up

ONE Stop donated more than 155,000 meals to families through its partnership with food-waste charity Olio.

Olio co-founder Saasha Celestial-One said: “We couldn’t be prouder to be working alongside one of the UK’s best-loved convenience retailers to fight food waste – especially while the rising cost of living means so many are going hungry.

“It’s been great seeing our partnership going from strength to strength.”

NEWS 04 26 MARCH-8 APRIL 2024 betterretailing.com

PLEA

ILLICIT TRADE FUNDING

the full

Suntory Beverage

GB&I,

to betterretailing.

the full story,

to betterretailing.com

‘Jisp’

the full story,

betterretailing.com

EVERYTHING IS PREMIUM EXCEPT THE PRICE* *Based on ITUK RRP as of February 2024. For the avoidance of doubt, customers are free at all times to determine the selling price of their products. For Tobacco Traders Only

FINEST TOBACCO BLEND NOW WITH FRESH PROTECT RRP* £12.75

response from

& Food

go

com and search ‘Lucozade’ For

go

and search

For

go to

and search ‘trading standards’

OUR

Have you been affected by the recent Floods? Are you struggling to stay warm and cover your heating bills during the colder weather? For more information visit www.newstraid.org.uk call us FREE on 0800 917 8616 or email mail@newstraid.org.uk NewstrAid is here to help and can provide FINANCIAL, EMOTIONAL and PRACTICAL support to retailers and their staff this winter.

PRIYA KHAIRA

PEPSICO has unveiled a new ‘Extra Flamin’ Hot’ variety across its Doritos, Walkers Max and Wotsits Crunchy lines.

Doritos Extra Flamin’ Hot, Walkers Max Extra Flamin’ Hot and Wotsits Crunchy Extra Flamin’ Hot became available to independent retailers on 18 March. The Doritos and Walkers Max Extra Flamin’ Hot varieties are both HFSS-compliant.

All lines are available in sharing bags with an RRP of £2.50 and price-marked sin-

PRODUCTS

gle bags with an RRP of £1.25.

The launch comes after research indicates that consumers are gravitating towards spicy �lavours.

Ipsos data found 51% of consumers say they love spicy food, and that the UK has the second highest desire for spice in Europe.

As part of the launch, the Flamin’ Hot range across Monster Munch and Cheetos is going to be rebranded as Sweet & Spicy Flamin’ Hot.

The launch will be supported by a two-month multimillion-pound marketing campaign from early

April across TV, social, digital and consumer PR, with a second wave to follow later in the year.

The Flamin’ Hot range is already the second-biggest PepsiCo sub-brand in Mexico.

Rob Pothier, Doritos senior marketing manager, said: “We couldn’t wait to bring Extra Flamin’ Hot to the UK, and given the response we’ve already seen worldwide, we’re certain shoppers will be just as excited.”

Kick o sales with Bovril limited-edition jar

BOVRIL is continuing its partnership with Burton Albion FC and Peter Crouch with its new, limited-edition collectable jar.

Bovril assumed the role of Of�icial Hydration Partner of Burton Albion FC last October. This launch aims to continue the brands alignment with football.

The limited-edition 250g jar has an RRP of £4.40 and a footfall-themed design that is inspired by classic footfall shirts.

The design also features elements of gold to provide the collectable with a premium touch.

The jar aims to appeal to loyal customers, encouraging them to pick up the jar as a collectable item.

Bovril is investing £100,000 towards a media

Heineken brings the Zest with Strongbow

ents this April in 4x440ml and 500ml formats.

HEINEKEN UK is expanding its Strongbow cider range with the addition of Strongbow Zest (4% ABV).

campaign to accompany the launch. The campaign will provide retailers with PoS materials.

Strongbow Zest is a vegan and gluten-free apple cider blended with lime, lemon and orange �lavours. It contains no arti�icial �lavours, sweeteners or colours.

Strongbow is the numberone brand in the total cider market in volume and value sales, with a 21% market share.

The new variety will be made available to independ-

A 10x330ml format is set to launch in June. It will be supported by a £10m marketing campaign that is set to launch in May.

BARR Soft Drinks is expanding its Rubicon Spring range with the launch of a Pink Grapefruit Blood Orange variety.

The new variety will be available in 500ml and £1 price-marked packs from 1 April.

According to IRI data, �lavoured water is growing ahead of the total water category.

Barr’s commercial director, Jonathan Kemp, said that the launch was a response to taste being shoppers’ top consideration when purchasing soft drinks, along with growing interest in lower-calorie products and �lavoured water.

The launch will be supported by a marketing campaign spanning digital and sampling activity.

06

citrus additions

up

†50% off card reader rental fees until 31 December 2024 on selected products only. Apply by 30 April 2024. The approval of your application depends on financial services and borrowing history. *Settlement terms may vary. T&Cs apply. Barclaycard is a trading name of Barclays Bank PLC. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 122702). Registered in England No. 1026167. Registered Office: 1 Churchill Place, London E14 5HP. Because with a card reader that stays connected and gets you paid the next day,* the time you used to spend pacing is now spent giving chin scratches. And with half your card reader rental fees covered†, your resident feline got a new scratching post. The cat in your bookshop adores Barclaycard Payments. What’s good for small business is good for everyone.

Rubicon Spring unveils two new

to drinks range PepsiCo turns

the heat

Capri-Sun’s new packaging goes green

CAPRI-SUN has redesigned its drink pouches with its �irst recyclable pouch.

The 200ml pouches in Orange and Blackcurrant & Apple �lavours are the �irst to transition to the new packaging. The brand aims to transition its entire range by mid-2025.

The new packaging reduces carbon emissions by 25% more than its current pouch.

Alice Harlock, head of technical and member services at OPRL, said: “The launch will be a catalyst for the industry as well as bene�itting consumers and the environment.

“OPRL research shows that despite the cost-ofliving crisis, recycling is still important for consumers, and we are delighted to have assisted Capri-Sun on the journey to full recyclability.”

Chocomel returns to TV screens

MILK drink brand Chocomel has kicked off six months of promotional activity for its latest ‘When Life Gives you Chocomel’ campaign.

The campaign involves a TV advert, designed to raise brand awareness.The advert builds on last year’s campaign, which saw more than 300% growth in penetration.

It is hoped that the campaign will reach 86% of UK adults via TV, cinema and digital platforms, following a media investment of more than £5m.

Jake Rylands, UK brand manager for Chocomel, said: “Our ATL marketing spend in 2023 and 2024 combined has seen us invest over £15m in the category.”

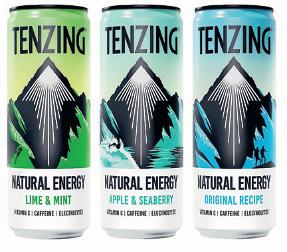

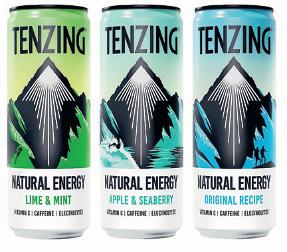

Tenzing refreshes and ups can size

TENZING is upgrading its 250ml can range to a larger 330ml format.

The move comes after consumers expressed a preference for larger can formats containing more functional ingredients.

A trial of the new can size last year saw a 50% increase in sales.

To complement this change, Tenzing has also refreshed its can design. The new design dedicates each blend to one of its core communities, including climbing, running and sur�ing.

Huib van Bockel, chief executive of Tenzing, said: “We listened to the demand of people wanting more energy, which is why the new

Bio&Me gives your gut some love

BIO&ME has launched a range of on-the-go cereal snack bars that boast guthealth bene�its.

The launch came after consumer demand for the format, as 91% of consumers voted for the brand to produce ‘gut-loving’ bars.

330ml

seeds and calcium-rich seaweed. The launch will be supported by billboards, a HelloFresh sampling campaign, digital and social advertising, and PR.

The bars are available in Toffee Apple, Superberry and Cocoa Hazelnut varieties. A single 38g bar has an RRP of £1.20 and the 3x38g multipack formats have an RRP of £2.95.

multipack formats have an

The bars are available to independents via CLF, Delicious Ideas, Epicurium and Suma.

They contain wholegrain oats, almonds, pumpkin

EMMI Group is launching a marketing campaign for its Onken Yogurt range in partnership with comedian and actor Paddy McGuinness.

The ‘Feed their Inner Happiness’ campaign will be running for one year, with a series of digital ads set to run from April.

The advert aims to focus on relatable moments and meal occasions. It will run across multiple channels until October.

Onken is the of�icial sponsor of McGuiness’s Nearly There Tour, which starts in October.

Mathilde Van Roon, head of Onken at Emmi UK, said, “We all lead such busy lives that it’s harder than ever to

McGuinness fronts Onken campaign

CHOLESTEROL-LOWERING product Benecol returns to televisions after three years.

The ‘Every Heart Deserves One’ campaign will air on TV channels and will be supported with PR activations.

Benecol partnered with charity Heart UK and Heart FM radio station last year to raise public awareness of heart health conditions.

The advert shows two friends navigating day-today life, highlighting the importance of looking after heart health.

Benecol products contain plant stanols, which are proven to help reduce the development of cholesterol.

Paula Nelms, global head of marketing at Benecol,

enjoy some quality time for ourselves.

“That’s why we’ve teamed up with Paddy to encourage people in the UK to make time to feed their inner happiness, with Onken.”

Benecol raises hearthealth awareness

said: “All our campaigns are designed to raise awareness of how to better look after your cholesterol and heart health. With this campaign, we’re moving into a more emotive landscape.”

26 MARCH-8 APRIL 2024 07 betterretailing.com

cans have 33% more functional ingredients like caffeine, L-theanine, vitamin C and electrolytes than the old 250ml cans.”

PRODUCTS

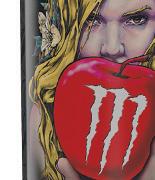

Monster launches new flavour

PRIYA KHAIRA

COCA-COLA Europaci�ic Partners (CCEP) has added Monster Bad Apple to its Juiced range.

Available now in plain and £1.65 priced-marked cans, Monster Juiced Bad Apple aims to tap into the apple �lavour’s popularity across categories including fruit juice and cider.

The brand is now worth more than £613m to the soft drinks category. The Monster Juiced range is up 25% in value, now worth just over £244m in sales.

Monster Juiced Mango Loco has contributed to much of this success and is worth £79.7m, making it the

number-one �lavoured energy drink in the UK, according to Nielsen data.

Bad Apple joins the eight-strong Monster Juiced range, which includes Mango Loco, Pipeline Punch, Aussie Lemonade, Khaotic, Paci�ic Punch, Monarch, Ripper and Mixxd Punch.

The can design features a female character holding an apple with the Monster logo inscribed on it.

Retailers can request Monster Juiced Bad Apple PoS materials and download digital assets via the CCEP website.

Helen Kerr, associate director of portfolio development at CCEP GB, said: “More than half of energy drinks’ innova-

Tayto Group teams up with Marmite

MARMITE has partnered with Tayto Group to launch a new Marmite-branded portfolio of crisps and snacks.

Marmite Crisps (65g) and Marmite Tortillas (70g) will be available as sharing pricemarked packs (PMP), with an RRP of £1.25.

PMPs are a key driver for the snack category. The format contributes to 77% of snack sales in the convenience channel, according to Circana Market Advantage research.

Further research shows that sharing PMPs account for 56% of total snack sales. Data also shows that 53% of the

sponsored

BRITVIC is offering �ive retailers the chance to win £1,000 each towards their energy bills, alongside a bespoke planogram to help power up their soft drinks sales. This comes after exclusive research with the ACS revealed that half of the surveyed retailers1 are concerned about increasing energy costs.

This aligns perfectly with Britvic’s mission to showcase the strength of its on-the-go portfolio, which includes Pepsi Max and Tango, and has contributed

UK population enjoy Marmite

The supplier hopes that the launch will bring more consumers to the category.

Jolanda Wells, licensing manager at Unilever, said: “Shareable PMPs of Marmite crisps and tortillas offer a great opportunity for consumers to try something new.”

tion sales over the past year have come from Monster’s NPD, which has helped us

Molson Coors unveils multipack

grow our value sales by £111m. Our Monster Juiced range is up by 25% in value.” ‘THE Prague Expert’ has returned to screens following the announcement of a Staropramen multipack.

activity and PoS materials, along with the return of ‘The Prague Expert’ campaign.

Molson Coors is rolling out its Staropramen 4x440ml multipack from April.

The launch comes after research indicates an increase in demand for multipack beer formats in the world beer category, accounting for 10% of total category sales.

The £1m campaign includes 30-to-75-second adverts featuring global brand ambassador Orlando Bloom, and will play across on-demand channels and cinema advertising.

Young’s new Friday night fakeaway

FOLLOWING on from the success of its Chip Shop range, Young’s Seafood has introduced a Mini Fish Fillets variety.

The multipacks will be encased in a recyclable cardboard sleeve, containing scannable QR codes which enable customers to receive brand updates.

The launch will be supported by social media

Chupa Chups get slushy for summer

ROSE Marketing has collaborated with Perfetti Van Melle to launch Chupa Chups Slush Pouches.

Mini Fish Fillets come in 300g packs of six at an RRP of £3.75. The product’s launch comes as the Chip Shop brand has grown by 10.3% in the past year, according to Nielsen data.

The launch aims to build on the growing number of consumers looking to save money and recreate takeaways at home.

The smaller portion size targets families with children looking for smaller portioned meals.

Julian Fletcher, marketing director at Young’s Seafood,

said: “By taking smaller portioned �illets, we are able to offer new shoppers new opportunities to enjoy frozen �ish outside of the traditional meal occasion.”

New ranges for Delice de France

to its 8% growth over the past year2. Retailers can view full terms & conditions and enter the draw on Britvic’s At Your Convenience online platform.

DELICE de France has released its spring and summer ranges for 2024, including 55 new products.

These are a mix of sweet and savoury rolls, ciabattas, cakes, scones, doughnuts and butter pastries. These include a New York Cacao Croissant, Chocolate Babka, Palmier, Tarti�lette Quiche and Macarons.

Delice de France has seen an annual growth of 14% across sweet bakery items.

It has also extended its world food range to include two Khobez-style �latbreads and a range of Taquitos.

Vegan Pain au Chocolat, Croissant and Orange & Hazelnut Crowns options will also be available.

After witnessing a 30% increase on its Macaron Mixed Case sales, the supplier is launching single cases of pistachio, raspberry and lemon �lavours. All items are available to order from the supplier’s website.

It is available in Cola and Strawberry varieties, and contains real fruit juice and 41 calories per pouch. Cola and Strawberry are Chupa Chups’ two most popular lollipop �lavours.

Each pouch is fully HFSScompliant and has an RRP of £1.25. They are available to buy directly from Rose Marketing.

The pouches come in an ambient format, allowing consumers to freeze at home.

The launch marks an extension of the partnership between Rose Marketing and Chupa Chups follow-

ing the release of Squeezee Freeze Pops and Eezy Freezy Triangles last year. These are available in Cola, Apple, Strawberry and Orange varieties in an assorted bag of 14x45ml freeze pops.

Tyrells Lentil Crisps go bitesize

KP Snacks has announced the launch of Tyrells Lentil Crisps in a single-pack format.

Tyrrells Lentil Crisps Sour Cream & Onion and Sweet Chilli & Red Pepper are available now in a new 24g format with an RRP of £1.

The transition comes after the healthy snack category has grown by 14% ahead of the overall crisps, snacks and nuts (CSN) category, with the healthier snack segment growing faster than any other CSN sub-category, according to Nielsen data.

An out-of-home and social media campaign supported the initial launch.

Sammy Harmer, Tyrrells brand manager, said: “It’s the

perfect permissible snack for the lunchtime occasion or an afternoon nibble, which we know is what shoppers are on the lookout for.”

08 26 MARCH-8 APRIL 2024 betterretailing.com

Power up your store with Britvic

For T&Cs and to enter, head to atyourconvenience.com/ power-up-your-salescompetition 1ACS TempCheck, February 2024, Sample size: 26 respondents, 2NielsenIQ RMS, Total Coverage incl. Discounters GB, Britvic Singles, Britvic De ned, Value Sales, MAT to 27.01.24

PRODUCTS

Sneak Energy exclusive

PRIYA KHAIRA

WORLD of Sweets has become the exclusive UK distributor for Sneak Energy.

World of Sweets will now be stocking the brand’s range of 500ml cans, including Tropikilla, Purple Storm, Raspberry Lemonade and Blizzard Lemonade.

Sneak Energy was launched in 2018 in the UK and US, and has become popular within gaming communities.

The brand aims to widen its audience reach through its collaboration with World of Sweets.

The energy drinks market is showing signs of growth in the UK, with 11 million Gen Z and millennial consumers regularly purchasing energy drinks, according to Statista.

Data shows that �ive million of those consumers say that they are looking for energy drinks that boast functional bene�its. Sneak Energy drinks contain no added sugar, preservatives, re�ined sugars, arti�icial colours or �lavours.

The drinks contain natural caffeine, taurine, ginseng, choline and carnitine plus added B vitamins.

World of Sweets will provide independent retailers with branded PoS to help them highlight their Sneak Energy offering.

World of Sweets brand manager Chris Smith said: “Since the brand launched �ive years ago, they’ve built a massive following online to become a popular online energy drink.

“Now is the time to take them to a wider audience.”

Frozen snack Trüfrü enters UK market

AMERICAN frozen snack brand Trüfrü is entering the UK market.

Having �irst launched in the US in 2017, Trüfrü has reached a retail sales value of $215m (£168m) and was acquired by Mars last year.

Its UK launch will begin with three �lavours, including Strawberries in White & Milk Chocolate, Raspberries in White & Dark Chocolate and Piña Colada

Pineapple in White Chocolate & Coconut, each with an RRP of £5.

Trüfrü is set to roll out to convenience and wholesale channels later this year, following its initial launch in Tesco this month.

Trüfrü is made using ripe fruit, which is doubleimmersed in chocolate and chilled. It has no arti�icial colours, �lavours or preservatives and is gluten-free.

Speciality Brands unveils new rums

PREMIUM spirits distributor Speciality Brands is rolling out a new range of premium rums to the UK market.

The new range includes four lines from Transcontinental Rum Line and two from Hampden Estate.

The four lines from the Transcontinental Rum Line include: Australia 2014 (48% ABV, £57 RRP), Panama 2015 (43% ABV, £57 RRP), Jamaica 2016 (57.8% ABV, £73 RRP) and French West Indies VO (46% ABV, £55 RRP).

Line and Hampden Estate to our portfolio,” said Chris Seale, managing director of Speciality Brands.

Silver Spoon’s sweet new designs

SILVER Spoon has rebranded its entire sugar range.

The brand has stated that the new packaging has been designed to help consumers choose the best sugar for their needs.

The new visuals on each pack contain an image of what each sugar is most appropriate for.

For example, Caster Sugar now features a Victoria sponge, Icing Sugar features an image of butter cream

icing while the Light Brown Soft Sugar has an image of chocolate chip cookies on the front of the pack.

The launch comes after consumer research conducted by the brand found that 62% of shoppers prefer to bake from scratch and tend to struggle deciphering which sugar is the best option for their speci�ic baking needs.

New Vintage Pear from Westons Cider

WESTONS Cider has launched Henry Westons Vintage Pear.

The two new rums from Hampden Estate are: Hampden Pagos (52% ABV, £79 RRP) and the Hampden Estate Great House Distillery Edition 2023 (57% ABV, £115 RRP).

“We’re thrilled to be adding new premium rums from Transcontinental Rum

The new sparkling pear cider joins the Henry Westons brand portfolio, with the brand believing that there is an “untapped opportunity” within the pear category.

The pear category is attracting 1.5 million buyers and is worth almost £50m, growing year on year, according to Circana Info Scan data.

The Herefordshire-based cider brand aims to tap into this opportunity with a premium, crafted offering. Within the total category, crafted options make up on �ifth of cider sales.

The new variety has an ABV of 6% and an RRP of £2.50 per 500ml bottle. It contains medium sweet �lavours and notes of pear blossom.

10

MAX iS

SOLD SOFT DRiNK

iN GB

RETAIL* Scan the QR for all the details on PEPSI’s Fresh New Look plus sign up to Britvic’s At Your Convenience to claim your free PEPSI POS Kit** and much more! * NielsenIQ RMS, Total Coverage GB (Traditional Grocers & C&I), Soft Drinks Brands, Britvic Defined, Volume Sales, MAT WE 09.09.23 ** Max 1 kit per outlet. 500 kits available on a first come first serve basis. NPN. Registration & email required. Visit at yourconvenience.com for Terms and Details. Promoter: Britvic Soft Drinks

PEPSi

THE #1

BRAND

GROCERY

Rude Health launches Organic Oat Barista milk

RUDE Health has added new oat-based milk Organic Oat Barista to its Rude Health range.

The product is available from wholesale channels now including Suma, Essential, In�inity, CLF, Greencity, Queenswood and Auguste Noel. The 1l bottle has an RRP of £2.40.

Organic Oat Barista is made using spring wa-

ter, oats, organic pressed sun�lower oil and sea salt. It contains a 14% oat count, giving it a sweet, creamy �lavour, ideally to be served with coffee.

The oat milk market has risen considerably over the past four years, according to Mintel data.

Camilla Barnard, Rude Health co-founder, said: “With the foundations of the

Kerrygold ads to bolster sales boom

BUTTER brand Kerrygold is making a return to screens this spring as part of its advertising campaign.

The ‘May your table always be full’ campaign will run throughout the year, focusing on connecting with friends and family at mealtimes.

The campaign spans across digital platforms, ondemand video channels and social media activations.

The brand is currently ex-

periencing a 35.9% increase in volume and a 30.2% increase in value. The new campaign therefore aims to drive brand awareness and extend this growth.

Nicola Blackmore-Squires, marketing director at Ornua Foods, said: “Our new campaign lands at a time of ‘golden opportunity’ for Kerrygold in the UK as the brand experiences strong and sustained growth.”

Rockstar adds Blueberry variety

ROCKSTAR Energy has launched a Zero Sugar Blueberry variety to its range.

Zero Sugar Blueberry is available in a price-marked format with an RRP of £1.29.

The Blueberry �lavour aims to appeal to more consumers as the �lavour is currently in demand, according to Nielsen data.

Berry stimulants are now worth £67.6m a year and are growing by 85% year on year.

Furthermore, research shows that zero-sugar energy drinks are growing twice as fast as standard varieties.

The launch will be supported by out-of-home

Barista category having been laid, there is still signi�icant opportunity for growth.”

Jammie Dodger Blackcurrant & Apple Minis unveiled

media, sampling, in-store activations and a combination of PR and in�luencer initiatives.

Ben Parker, Britvic’s retail commercial director, said: “Providing a �lavoursome, zero-sugar choice is key to making the most of the category.”

FOX’S Burton’s Companies is adding Jammie Dodgers Apple & Blackcurrant Minis to its Jammie Dodgers Minis range.

The launch follows the launch of its 140g Jammie Dodgers Apple & Blackcurrant �lavour last May, and comes as consumer demand for pre-portioned mini snacks continues to grow.

The new mini offering

has an RRP of £1.25 for a 6x20g pack.

The new format aims to tap into a wider range of shopper missions, including on-the-go snacks occasions.

It will be available in Sainsbury’s �irst, with a wider rollout across the grocery, wholesale and impulse channel to follow.

Colin Taylor, trade marketing director at FBC UK,

comments: “We are constantly reviewing trends within the category.”

26 MARCH-8 APRIL 2024 11 betterretailing.com

UK, 18+ only. Winning Moments Period: 00:01 26/02/2024 – 23:59 16/06/2024. Wrap-up Draw Period: 00:01 17/06/2024 – 23:59 15/09/2024. A chance to win 1 of 60 x £500 cash prizes or 1 of 70 x £1,000 cash prizes AND/OR 1 x £250 cash prizes for you and your local store. Retain receipt. Internet access required. Max 1 entry per person per day. Max 20 entries total per person. Visit www.cadbury.co.uk/terms-and-conditions/cadbury-big-win-win/ or full T&Cs, entry & prize details. Promoter: Mondelez Europe Services GmbH – UK Branch, Cadbury House, Sanderson Road, Uxbridge, UB8 1DH. STOCK UP ON PARTICIPATING CADBURY BARS FOR A CHANCE TO WIN VISIT BIGWINWIN.CADBURY.CO.UK SCAN FOR DETAILS

The trends to look out for to elevate your confectionery ranges

How to boost your sales and footfall during the lunchtime rush +

Pricewatch: see what other retailers are charging for value cigarettes, and boost your own profits

3,451

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

It does feel like another nail in the co n

STORE CHANGES: What quick, easy wins have you implemented recently?

“WE conducted a customer survey to better understand what our customers wanted. We’re thinking of shifting our eco re�ills, freezers and greetings cards from the back to the front. We are then going to install a little tea shop at the back.”

Ruth Crockett, Hitcham Post Of�ice & Stores, Suffolk

“I STARTED writing down my weekly goals on Sunday mornings over coffee. I then shared them with staff members, giving them goals of their own and tracking them. When I stopped, they stopped caring. It has to be in their minds all the time.”

Dipesh Modha, Edgware Road Post Of�ice, London

We’ve seen a 50% growth in sales

FREEZE-DRIED SWEETS: How is this craze benefitting your store?

“I WASN’T sure they how they would sell. We put them out at 3pm, and by the time we shut the shop, all the stock had gone. I ordered another 100 bags, and they sold out in two days. We are making £600 a week. It’s about helping us become a destination.”

Sophie Williams, Premier Broadway Convenience Store, Edinburgh

“IT’S clear the demand is there. We haven’t received our delivery yet, but customers have already come in to make pre-orders, even though they don’t know what price we will be selling them at. We need to make sure the price is right for our demographic.”

We are making roughly £600 a week

SPRING BUDGET: How will the gov’t changes affect your business?

“THE addition of a vape tax feels like another nail in the cof�in for independent convenience store owners, especially for margins. I’m optimistic, however, because I don’t believe it will change customer demand for the products, which is still very buoyant.”

Dean Holborn, Holborn’s, Redhill, Surrey

“NATIONAL Insurance being cut by 2p won’t have an immediate impact on my business, but it is good for my staff, especially with the National Living Wage (NLW) set to also rise next month. This will see NLW rise by 9%, representing an increase of £1.02.”

Sue Nithyanandan, Costcutter Epsom, Surrey

We conducted a customer survey

REFILLS: What benefits have you seen by introducing a station in your store?

“MERCHANDISING is key when it comes to highlighting your retail �ixture. Think carefully about where you place the station. One corner of my shop is dedicated to healthy and eco-conscious customers. We keep a massive vegan range here, which helps boost sales.”

Peter Patel, Costcutter Brockley, London

“THEY work out cheaper long-term for customers and retailers, and demonstrate your commitment to your community. We have expanded our range to include laundry powder, sanitiser spray and shampoo. We’ve seen a 50% growth in sales over the past year.”

Trudy Davies, Woosnam & Davies, Llanidloes, Powys

12

26 MARCH-8 APRIL 2024 betterretailing.com

OPINION

Natalie Lightfoot, Londis Solo Convenience, Glasgow

UP IN

COMING

THE 29 MARCH ISSUE OF RN

STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172

RN’s news stories

exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of

are

© 2024 The Coca-Cola Company. All rights reserved. COCA-COLA Lemon and Coca-Cola Original are registered trade mark of The Coca-Cola Company. *Nielsen & CGA Total Coverage MAT Val w/e 31.12.23 **Nielsen Total GB excl. discounters MAT val % growth WE 30.12.23 A HIT OF ZESTY LEMON Stock mmmmore flavour! Coca-Cola Original Taste & Coca-Cola Zero Sugar –Available in plain and price-marked packs across a variety of on-the-go and sharing pack formats. From GB’s No.1 soft drink brand* Tap into the demand for flavoured colas, which are growing ahead of total colas** To find out more, email connect@ccep.com, call 0808 1 000 000 or visit My.CCEP.com for POS materials and downloadable digital assets. SCAN TO VISIT NEW LEMON FLAVOUR COC1776_Coke Lemon Ad_Convenience_RE_AW2.indd 1 07/03/2024 17:22

C M Y CM MY CY CMY K ai169747038525_RN16Oct- Fed SSSAdvert print.pdf 1 16/10/2023 16:33 Untitled-17 1 18/10/2023 10:03

‘Write to your MP for support over vape ban’

THERE’S nothing in the latest draft regulations for the disposable vape ban to stop rogue sellers, and they are the ones selling to underage children.

I’m calling on other retailers on WhatsApp groups to write to their MP. I wrote to mine, and they responded to me with support. Retailers should take this seriously if

they want to make a difference. People with marginal seats could enforce a change of government, and they could be very keen to support small businesses. We need to make our position on this known. In the draft legislation, they’re not saying how vapers will be affected and how they can be protected, and these

COMMUNITY RETAILER

OF THE WEEK

Julie Duhra, Jule’s Convenience Store, Telford, Shropshire

‘I’m running the London Marathon’

people will have to access the rogue businesses. If we had better enforcement, we wouldn’t have this problem. The government should focus more on enforcement, it’s pretending there’s no big problem here, but there is – it didn’t even try a licensing scheme. A lot of us have spent money doing up the shop to

accommodate the products. All the costs for a smaller business are going to be huge, and it’s changing the rules without giving much notice. There are other ways to manage this, like enforcement. Banning vapes will not solve the problem.

Sue Nithyanandan, Costcutter Epsom, Surrey

COMMUNITY RETAILER OF THE WEEK

‘We’re supporting a youth rugby club’

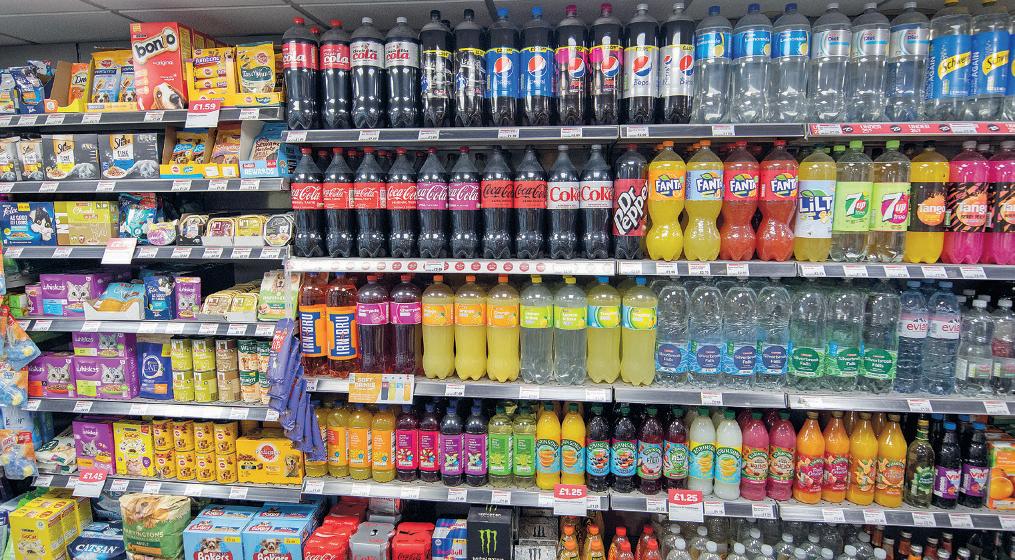

Tighten up your so drinks with suppliers

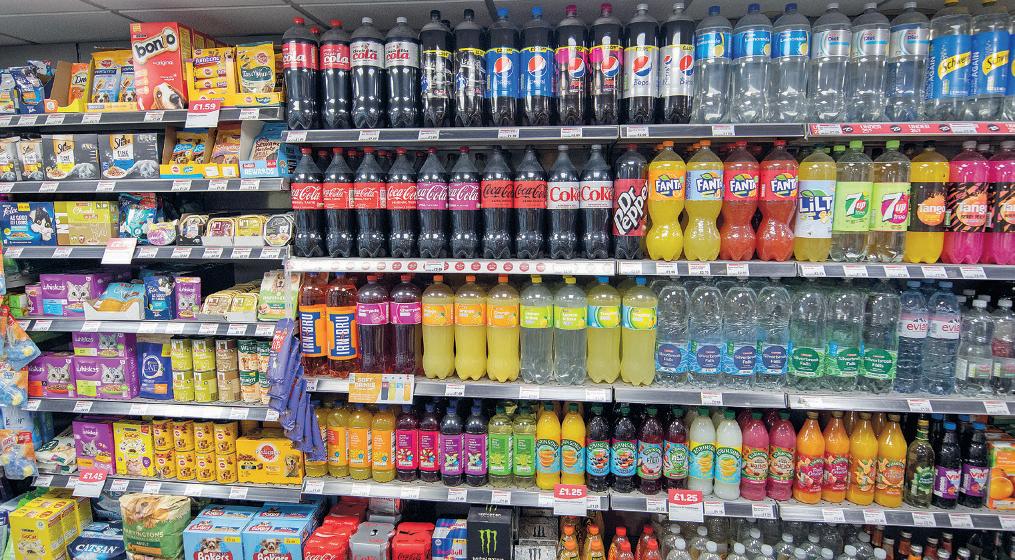

I’VE been working closely with lots of suppliers, which adds good value to my stores.

We’ve been working with Coca-Cola Europaci c Partners (CCEP), for example, and it’s helped massively with how we manage our stock and has made our merchandising look much more professional.

I’ve been working with crisps brands and with Cadbury as well. It’s about working with lots of categories, whoever can add value to my store.

Each issue, one of seven top retailers shares advice to make your store magni cent

People think there’s lots of value in alcohol, but so drinks are so important for your pro t line, which means working with so drinks suppliers is paramount. It’s just such a strong category with such strong margins. We’re trying to get on top of the category, and working with CCEP has helped us to track things in the chiller. You might think that the more lines you have, the better your range will look, but that ends up with you overstocking and you’ve then got so many lines you don’t know where to put things and people don’t know what’s there and walk out of your store without buying anything.

People like to see better displays with more facings and the core lines they want. It’s so easy to get a new line on promotion, and then another, and before you know it you’ve got far too many and you haven’t got time to sell them. It also a ects your display. We had six flavours of Rubicon in one of our stores, which is just too many. We’ve gone down to three Rubicon now, and I might reduce it again. If I halve the number of products and double-face the bestsellers, it looks better in my chiller.

It took me eight weeks to organise new installations, deep clean the chillers and go over the display, and CCEP has been coming back and helping us with it. In total, we’ve taken 20 so drinks lines out of the chiller to give more facings to the products that matter.

When it comes to supplier support, however, I want them to help me to grow my category, not just their brands. I want to grow energy drinks sales, not just Monster, and that means we are giving facings to Red Bull because it’s the number-one energy drink.

To donate: 2024tcs londonmarathon. enthuse.com/pf/ julie-kaur

“I’M running the marathon on 21 April for Teenage Cancer Trust. All the customers ask questions about it, and it creates a good atmosphere in the shop because you are all talking about something positive. People aren’t chatting about the cost-of-living crisis – they’re counting down the weeks and getting excited. I’ve raised more than £2,000 with help from Suntory, PepsiCo, Bookers, JTI and BAT. I’d like to thank those who have helped me raise funds.”

15 betterretailing.com 26 MARCH-8 APRIL 2024 Letters may be edited LETTERS

would really urge fellow retailers to support it, too. You meet some marvellous volunteers.”

Nevison

Pontefract, West Yorkshire

Bobby Singh, BB

Superstore,

Belle Vue Convenience (Go Local), Middlesbrough

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

BAY BASHIR

Image credit: Getty Images/Yaroslav Litun

NewstrAid Cost of Living Crisis Fund

Are you struggling with the Cost of Living?

Are you worried about paying your bills and putting food on the table?

Have you worked in the sale or distribution of newspapers and magazines in the UK full time for 2 years or more?

If the answer is yes to the above questions then you could be eligible for a grant from the NewstrAid Cost of Living Crisis Fund.

Created in response to the current Cost of Living Crisis, the fund offers grants of up to £250 per household to help bridge the gap between income and costs for anyone with a newstrade connection. That means people who work or have previously worked in the sale and distribution of newspapers and magazines for a minimum of 2 years, full time. Eligibility criteria apply.

For more information scan the QR code, call us FREE on 0800 917 8616 or email: mail@newstraid.org.uk

REFRESH YOUR RANGE

RETAIL EXPRESS gets the lowdown from top suppliers on how retailers can optimise their ranging across key convenience categories

GETTING IT RIGHT

RETAILERS cannot a ord any ine ciencies across their stores in the current climate, and this extends to their ranging and merchandising. With such a broad range of products available across so many categories, and with space at a premium, retailers need to ensure they are meeting their customers’ expectations by providing the right products with the correct amount of exposure.

It’s because of thisthat Retail Express has teamed up with ve leading suppliers to

help retailers optimise their ranging across their respective categories.

BAT UK goes over the benets of its new back-wall gantry, which has enabled retailers to display their next-generation nicotine ranges in well-lit and easily secured spaces that put customers at ease with an ever-evolving category.

Britvic talks about the importance of organising your soft drinks xture by category segment and using limitededition flavours, such as its re-

cently launched Tango Mango, to drive interest among shoppers and prompt purchases.

Coca-Cola Europaci c Partners (CCEP), meanwhile, looks at the growth of the energy drinks segment and how retailers can capitalise on this growth through its Sales Supercharged online platform, which o ers advice, planograms and giveaways.

There’s information about how to stock a chilled flavoured milk range among your soft drinks o ering, courtesy

of FrieslandCampina, with particular focus on Yazoo, currently the UK’s top-selling flavoured milk brand.

Finally, KP Snacks emphasises the importance of focusing on top savoury snack sellers, with just a small proportion of leading lines accounting for a majority of sales within the category. Retailers can use its ’25 to Thrive’ advice to inform their ranging. Some suppliers have also provided planograms to help retailers reorganise their shelf spaces.

17 betterretailing.com 26 MARCH-8 APRIL 2024 CATEGORY ADVICE REFRESH YOUR RANGE

In partnership with

ALTERNATIVE NICOTINE PRODUCTS

RANGING EFFECTIVELY

THE rst question we need to answer is “what is ranging”? Ranging is simply the process used to determine where products are placed in a store. It is important to instantly captivate and educate consumers on the products available, and it can have a signi cant impact on sales.

BAT UK o ers support in helping retailers to understand how to build a strong display that makes their products stand out. Considering where to place flavours or

nicotine strengths can make it easier for the consumer to navigate available options. It’s also important to identify which products are moving the fastest so that they can be placed in a position where sales can be maximised.

For the BAT brands Vuse and Velo, it recommends that retailers stock a mixture of its mint and fruit-flavoured products with nicotine strengths ranging from zero to high to give adult nicotine consumers a range of choices.

1

2

3

THREE TIPS ON RANGING

Have an understanding on current trends and opportunities that suit your local demographic of consumers. This can be used to adjust the merchandising in order to place the most popular products where customers can see them.

It’s also important to ensure the merchandising is welllit, behind the counter and at eye level. This is to make the products easy to see and stand out within your alternative nicotine product displays.

Organise each brand together. This includes the grouping of strengths and flavours of the same brands together to simplify the process of identifying and choosing the right product.

SUPPLIER VIEW

Hashim Tahir, B2B manager, BAT UK

“OUR next-generation back-wall gantries have demonstrated the bene t of using behind-thecounter space to display alternative nicotine products. Organising these with a clear structure has allowed retailers to display their full range of products. Through planogram layout and maximising display space visibility, this improves merchandising across all alternative nicotine categories. It also frees up valuable counter space and keeps nicotine products away from the and youth access.”

PAID FEATURE REFRESH YOUR RANGE 18

Visit vapermarket.co.uk or @batretailchampions on Facebook/Instagram

STRENGTHEN SOFT DRINKS SALES

RANGING EFFECTIVELY

IT’S key that retailers make their soft drinks xture easy to navigate. With such a wide range of products to choose from, the category can sometimes feel overwhelming. Signage like point-of-sale (PoS) will help customers nd their preferred choice with ease. Additionally, ensuring soft drinks products are stocked by subcategory (carbonates, energy, water etc.) means customers can easily nd what they are looking for. Another way to engage with consumers is to stock up on trusted core brands such as Tango, Rockstar Energy and Pepsi Max. Retailers can then build them out with limitededition or flavoured variants. For example, stocking the new Tango Mango limitededition will pique customer interest and drive purchase. Retailers should utilise PoS to create standout on shelf, to attract attention and drive visibility, which in turn could result in impulse purchases and additional sales.

THREE TIPS ON RANGING

1

It is important to cater to all customer needs, so retailers should o er a range of on-the-go and take-home products. The newly launched Tango Mango is available in 330ml cans and 500ml bottles.

2 Merchandising complementary categories together can help drive cross-category purchase. Site soft drinks and main meals or snacks next to each other and create a deal to help drive basket spend and o er consumers value.

3

As demand for healthier options continues, consumers will be on the lookout for low-sugar choices, which retailers should always have on o er. All drinks in Tango’s rotational flavour series are sugar-free, including Tango Mango.

SUPPLIER VIEW

Ben Parker, retail commercial director, Britvic

“FLAVOUR innovation is crucial for keeping shoppers excited by so drinks, and at a time when the cost of living is still a concern, it’s important to o er new products from well-known, trusted brands to help maintain basket spend.

“Adding interesting, limited-edition flavours into the mix can support retailers by driving impulse sales. For example, Tango’s rotational flavour series has seen great success with both its Berry Peachy1 and Paradise Punch2 flavours, leading to the recent launch of Tango Mango.”

betterRetailing.com PAID FEATURE REFRESH YOUR RANGE 26 MARCH-8 APRIL 2024 betterretailing.com 19 In partnership with

To nd out more about Britvic’s range of so drinks, visit atyourconvenience.com 1NielsenIQ RMS, Total Coverage GB, Value/Volume sales, Fruit Flavoured Carbonates, Britvic De ned, YTD Calendar year 2022-w/e 31.12.22, 2NielsenIQ RMS, Total Coverage GB, Value/Volume sales, Fruit Flavoured Carbonates, Britvic De ned, YTD Calendar year 2023-w/e 30.12.23

SUPERCHARGE YOUR ENERGY DRINKS SALES

RANGING EFFECTIVELY

ENERGY drinks are the numberone deliverer of value growth in soft drinks, worth more than £1.95bn to retailers1 They o er the same choice and great taste of soft drinks, but with added functional bene ts. The energy category has also become more evenly split between male (59%) and female (41%) consumers2. Monster, worth over £613m in Britain1, and growing by 22% in value1, has been helping independent convenience stores tap into this opportu-

nity through its Sales Supercharged retailer platform.

Salessupercharged.co.uk provides the lowdown on the latest trends within energy drinks, alongside ranging advice. It’s supported by retailers who share how they’ve supercharged sales in their own stores.

It also includes easy-tofollow tips, downloadable planograms, quarterly giveaways and links to Coca-Cola Europaci c Partners’ wider trade website.

1THREE TIPS ON RANGING

One in three on-the-go soft drinks sold is an energy drink3, so make plenty of space for them in your chilled soft drinks lineup so shoppers can enjoy them straight away. You can also activate your meal-deal o ers with top-sellers.

2 Group brands, and remove slow-selling lines, replacing them with double facings of bestsellers. Use launches such as Monster Juiced Bad Apple and PoS in store to catch customers’ eyes.

3 Make sure to o er lots of choice in your energy drinks lineup, with a range of options spanning the big four energy segments – traditional, zero-sugar, flavoured and performance.

SUPPLIER VIEW

Helen Kerr, associate director of portfolio development, Coca-Cola Europaci c Partners GB

“MONSTER’S NPD has driven over half (59%) of energy drinks’ innovation sales in the past year4 and we’re con dent Bad Apple will continue this momentum. Ranging is all about getting the core range right, but also o ering choice through the latest NPD and making room for growing segments like zero-sugar and performance energy. Chilled is also crucial, with 78% of consumers preferring to purchase energy drinks cold5. Check out our Sales Supercharged site for guidance.”

PAID FEATURE REFRESH YOUR RANGE 20

To nd out more, visit salessupercharged.co.uk 1Nielsen Total GB, val MAT w/e 30.12.23, 2Energy Audience U&A, May 2022, weighted base: 6,531 Consumers, GB, BE, DE, SP, SW, FR, NO, 3Nielsen Independents and symbols, MAT val w/e 30.12.23, 4NIQ, Value Sales, Total Coverage, Total Year 2023 to 31.12.23, 5Energy Audience U&A, May 22, weighted base: 1,003 consumers, GB When you buy energy drinks, where do you prefer to buy in store? In partnership with 26 MARCH-8 APRIL 2024 betterretailing.com

COC1769_Bad Apple Ad_RE_AW1.indd 1 11/03/2024 09:34

In partnership with

DRIVE FLAVOURED MILK

RANGING EFFECTIVELY

AS the UK’s number-one flavoured milk brand1, purchased by one in nine households2, Yazoo knows a thing or two about maximising fridge sales and unlocking the value of the category. A muststock of any fridge, Yazoo has a range of products that meet all shopper’s needs. Its bestselling Yazoo core range provides a deliciously refreshing afternoon pick-meup, perfectly suited for on the go in its 400ml format or for those social occasions with

its 1l sharing pack. Breadth of range and ensuring all shoppers needs are met are key ranging principles to drive more sales, so Yazoo recently launched the Yazoo Thick N’ Creamy range of 300ml Indulgent Chocolate and Creamy Strawberry onthe-go packs. These sit perfectly beside the core Yazoo range, as they are for the thicker milkshake lover. Stock up on both ranges to meet the needs of all flavoured milk shoppers.

1THREE TIPS ON RANGING

Ensuring there is a visible shelf-edge label for your products is crucial. Shoppers don’t have time to dwell and price is a critical point of reference when it comes to purchasing decisions.

2 Flavoured milk should be merchandised within soft drinks, and bestsellers should be stocked in the middle of shelves at eye-level. Extra facings should be given to top-selling flavours including strawberry and chocolate.

3 Yazoo has invested in a £3.1m TV campaign, so shoppers will be on the lookout. Ensure you are stocked up and it is easy to nd by positioning the packs in high-footfall, front-of-store chiller areas.

SUPPLIER VIEW

“THE shopper’s experience is paramount to ensuring retailers drive sales – if shoppers can’t nd what they are looking for, they will go elsewhere. Ensure you are stocking Yazoo, the number-one flavoured milk brand, to clearly signpost your flavoured milk range to shoppers.

“Factors such as flavours, pack size, price and consistency are all key considerations for shoppers. To drive sales you need to make shopping as easy as possible for your customers using these tips.”

PAID FEATURE REFRESH YOUR RANGE 22

Adam Tidbury, category manager out of home, FrieslandCampina

To nd out more about Yazoo’s range, visit yazoo.co.uk 1IRI Infoscan, Total Market, Volume Sales, Flavoured Milk, 52 w/e 23.12.23, 2Kantar Worldpanel, YAZOO Penetration, 52w/e 23.12.23

SEND SNACK SALES SOARING

RANGING EFFECTIVELY

AS part of its mission to help retailers thrive in the crisps, snacks and nuts (CSN) category, KP Snacks launched its impartial ‘25 to Thrive’ ranging advice last year. Delivering a core recommendation of 25 lines to stock, ‘25 to Thrive’ was designed to help retailers bag their share of CSN sales, with the category worth over £4.3bn and growing strongly by 11.9%1. By stocking the ‘25 to Thrive’ range and positioning CSN xtures with promi-

nence, retailers can revive their sales, drive impulse purchases and thrive in a competitive market.

The 25 spotlighted lines are leading brands from multiple suppliers, featuring iconic KP Snacks products including Hula Hoops, McCoy’s, Butterkist and KP Nuts.

The ‘25 to Thrive’ retailer guide also o ers suggestions for an additional 20 lines to ll a larger CSN xture, o ering a wider range to meet all shopper needs.

1THREE TIPS ON RANGING

With 10% of lines representing 60% of sales2, it’s important to stock top brands with prominence. Consumers gravitate towards well-known, trusted brands and retailers should cater to this with a strong, familiar core range.

2 Retailers should focus on PMPs, with 57% of impulse shoppers buying this format3. All but two of the ‘25 to Thrive’ lines are PMPs, ranging from 40p PMPs to £1.25 PMPs, which account for 61% of Independents’ sales1.

3 Retailers should provide a variety of products to meet shopper needs. Products in ‘25 to Thrive’ range from familiar favourites such as Nik Naks and Space Raiders to bestsellers including Hula Hoops and McCoy’s.

SUPPLIER VIEW

Matt Collins, trading director, KP Snacks

“WE are committed to helping our retail partners win their share of CSN sales by providing greattasting, well-loved products as well as simple, e ective ranging advice. The ‘25 to Thrive’ range covers critical shopper missions and occasions across the entire value spectrum to deliver the optimum core range. By stocking the ‘25 to Thrive’ range, retailers can appeal to consumers with an attractive, impactful CSN xture, capitalising on the growth of this category.”

betterRetailing.com PAID FEATURE REFRESH YOUR RANGE 26 MARCH-8 APRIL 2024 betterretailing.com 23 In partnership with

To nd out more, visit kpsnackpartners.com/ retailer-guides/25tt/ 1Nielsen IQ, Total Coverage, Total Value, MAT 30.12.23, 2Lumina Intelligence Convenience Tracking Programme 28.05.23, 3Lumina Q1 Convenience Strategy Forum 2023

GETTING SPIRITS RIGHT

CHARLES WHITTING nds out what it takes to have a successful year-round spirits range while driving summer and festive pro ts

TAKING A SEASONAL APPROACH

A SPIRITS range has the potential to cover a seemingly endless range of options, but most retailers agree that vodka is the key category to stock, especially in the summer.

According to TWS, vodka accounts for the largest share within spirits, with more than a 39% share, but there is plenty of scope for experimentation within it.

“The spirits category is largely being driven by

Smirno products, which enjoys a 16% share, and Glen’s products, which have a 14% share,” says a spokesperson for TWC. “However, viral products from the Au brand are seeing the strongest growth in this category, growing at 68% year on year.”

Retailers need a strong core range before they can even consider looking at expanding things. In the cost-of-living crisis, this could mean smaller

bottle sizes, bulk discounts, speci c promotions or ownbrand products.

“We sell a lot of Famous Grouse, Whyte & Mackay and High Commissioner whisky throughout the year, which are between £20 and £26,” says Anand Cheema, from Costcutter Fresh in Falkirk, Central Lowlands.

“Towards the end of the year, you get up past £30 bottles. We have £40 bottles of Dalmore

and Balveniue, which sell well, and a Glen ddich 23 Year Old, which comes in a presentation box and costs £200.

“Belvedere and Cîroc do well in the summer months and Christmas. For rum, Kraken overtakes Captain Morgan during summer. In winter, it’s Havana Club and special editions. “Martell ticks over throughout the year for brandy, but it’s all about Hennessey and Courvoisier at the end of the year.”

CATEGORY ADVICE SPIRITS 24 26 MARCH-8 APRIL 2024 betterretailing.com

SUPPLIER VIEW

“WE’RE expecting the trend for at-home cocktails to continue to boom over the coming months as the warmer weather approaches and evenings in the home and garden bring people together to socialise. At home, mixologists can experiment with go-to classic cocktails such as the Espresso Martini or Old Fashioned – both of which are established for in-home consumption.

“Additionally, agave drinks have attracted an army of followers who are exploring the tequila category and this shows no sign of slowing down in the summer months.

“Smaller-format stores are perfectly positioned to bene t from impromptu evenings in and impulse occasions, so plan ranges accordingly highlighting how drinks brands and products t the occasion.”

USING SPIRITS TO CREATE A USP

IF a retailer wants their store’s spirit o er to be a unique selling point, they need to take things further than the standard core range of vodkas, gins and whiskies, nding the latest launches, niche producers and premium options that no one else o ers.

Summer is the best time to try this with gins and vodkas, while the lead-up to Christmas is the time to try premium whiskies, brandies and rums as people look for gifts.

“We get single bottles of the expensive ones,” says Reuben Singh-Mander, from The Three Singhs in Selby, West Yorkshire.

“We hold no more than two bottles. If customers come in asking for one and we’re out, we tell them to come back in on Friday, and we’ll have it in stock for them by then. It works for us because we don’t have to fork out for a whole case and we don’t have to hold onto lots of stock for ages.”

Reuben Singh-Mander, The Three Singhs, Selby, West Yorkshire RETAILER VIEW

Reuben Singh-Mander, The Three Singhs, Selby, West Yorkshire RETAILER VIEW

“IT’S a point of di erence for us. We don’t pay it much heed at this time of year, we just stick to the main brands and o er value. When it comes to summer and the six months leading up to Christmas, we start looking for new products and seasonal options.

“We get all the weird gins in May. The premium bottles have gi ing potential. We’ve got it behind the till where it’s all backlit. It can be a bit frustrating because you have customers crowding round the counter, but from a security point of view it’s much easier.

Spirits brands are always keen to launch new and interesting options, with Smirno recently announcing seven new flavours of vodka and RTDs, including Spicy Tamarind, Electric Guava, Lavender Lemonade, Smash Vodka Soda and Watermelon Lime Smash. Find out what’s trending, source the products and get the word out about what you’ve got, and you can become a spirit destination in your own right.

ing, source the products and

“Follow brands’ social media pages and the retail magazines as well. If you know a new flavour of Cîroc is coming out, you’re going to nd it in the magazines and on Facebook, even if you’re not sure whether you want to stock it. If you can grab a picture of it and put it on social media, saying ‘coming soon’, you can then gauge your customers’ reactions to that spirit and decide whether you want to invest in a couple of cases or a couple of bottles.”

SUPPLIER VIEW

“POSITION popular or high-margin spirits at eye-level to increase visibility and encourage easier access for customers. Highlight featured brands or promotional items on separate displays or shelves. This can include new releases, limited-editions or products on special o er.

“Ensure high-value or the -prone spirits are appropriately secured. Consider using locked display cases or security tags to prevent the and protect customers and your inventory.

“Adequate lighting is crucial for displaying the products and creating an inviting atmosphere. Ensure the spirits section is well lit to enhance visibility and highlight the packaging.”

26

CATEGORY ADVICE SPIRITS

Tim Dunlop, European commercial director, Biggar & Leith

Kenton Burchell, group trading director, Bestway Wholesale

SCOOPING UP SALES

PRIYA KHAIRA gets the latest scoop on the ice cream category, nding out how independent retailers can increase their sales

CONE-FIDENTLY MAKE MARGINS

THE global ice cream market is anticipated to rise at a considerable rate over the coming years. According to Lucy Richardson, category director at Unilever UK, the category accounts for 36% of frozen sales in the convenience sector.

In the lead up to summer, retailers should refresh their ice cream ranges to make the most of the category.

Richardson suggests that retailers cross-merchandise ice cream displays in accordance with shopper missions. “For shoppers on a ‘for tonight’ mission, take-home ice cream

is an ideal treat,” she says. Retailers should keep luxury and premium ice cream close to quick evening meals or wine to encourage incremental sales among these shoppers.