Dear Niveshaks,

We are pleased to announce the very special BLS Edition of Niveshak After a fantastic start in January, global markets suffered in February on the back of rate hike fears and volatility The US dollar strengthened after 4 months of continuous decline Europe, however, reported strong numbers on the back of China’s reopening and strong consumer demand, especially in automobiles and luxury goods. The same could not be said for Indian stock markets. NIFTY remained in a seesaw-esque pattern, with Adani stocks hitting lower circuits multiple times

We begin with our magazine with The Month That Was section - The finance bulletin. We explored various developments around the world, such as Ajay Banga leading world bank, CPI inflation numbers, Air India bulk deals, and much more.

However the highlight for February remained the first budget of “Amrit Kaal,” that aimed at innovation and inclusion And this, in turn, became the topic of our Cover Story The article dives deep into new tax regimes and the

TEAM NIVESHAK

government's CAPEX plans The article also covers the unique fiscal math that the government is trying to bank to reduce the deficit and much more.

In this edition of Finview, we interviewed Mr Abhishek Mundra, an alumnus of IIM Bangalore and a finance professional with over 20 years of experience in the stock markets. With him, we explored various themes, such as China’s reopening, fed rate hikes, market volatility, and much more.

In the Know Your Sector segment, we covered the Shipping and Ports industry. We explored the importance of this sector , the government’s key policies, and its vision. Since this is the budget edition of the magazine, we also focused briefly on the effect of the Union budget 2023 on this sector

In the Finsupervise segment, we explored the Curious Case of Credit Cards, in which we focused on different aspects of this revolving credit line We also explored the usage benefits and briefly touched upon the Kisan Credit cards and the RuPay segment. The article also explores the revenue model of these companies and how significant they are in the current times.

"Anubhav Kathan," or learning from experiences, covers a unique case of the South Korean economy,and its recovery in the 1960s The article starts with the change in power that kickstarted this growth We also explored the various challenges that the economy faced and, finally, some of the learnings/lessons that can be gained from this event.

In the Let’s FinUp section, we return with our trusty old crossword where this time , the focus is on the stock markets and valuations.

This is the last magazine edition before Niveshak's senior team graduates With the establishment of the Niveshak Investment Fund and raising the first round of investment, their vision has taken the club to unimaginable heights. We wish them all the best for their future!

We would love to hear your thoughts, feedback, and ideas Please feel free to reach out to us to let us know what you think!

We hope you derive something from this edition and stay safe and sound in these exciting times!

Stay Invested, Team Niveshak

All images, design, and artwork are copyright of IIM Shillong Finance Club

© Finance Club

Indian Institute of Management, Shillong

Disclaimer: The views presented are the opinion/work of the individual author and the Finance Club of IIM Shillong bears no responsibility whatsoever

KNOWYOURSECTOR

SHIPPING AND PORTS

Page 17-18

ARTICLEOFTHEMONTH DIVERSIFICATION

Page 19-22

DEALSBREWERY

CITI - AXIS Deal

Page 23-24

FINSUPERVISE

CURIOUS CASE OF CREDIT CARDS

Page 25-26

ANUBHAVKATHAN

RISE OF AN ASIAN TIGER

Page 27-28

LET'SFIN-UP FINANCE CROSSWORD

Page 29-30

Layoffs to continue

The respite for the employees is yet to come Tech companies were again among the leading sectors to announce layoffs The layoff season started in the second half of 2022 and has taken full pace since January 2023 In February, Google India fired 453 of its employees; Yahoo plans to fire about 1600 of its workforce this year, McKinsey about 2000 of its employees, and many other firms in line with the same. The hiring boom started with the start-up funding peaking in the year 2021 and tech firms being valued at a very high multiple, but as the funding winter started, the companies began to cut their expenses, thus reducing their workforce

Tech Sector Layoffs

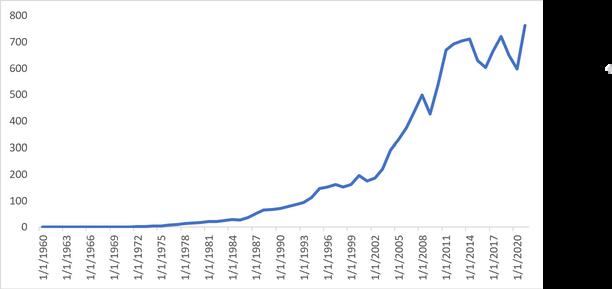

Rate hike by Fed

The Fed raised the fed fund rate by 25 basis points, setting the new range starting from 4 5% to 4 75% This is the smallest hike since March 2022, with clear indications about further hikes to cool down inflation. There is still a gap between the interest rates and inflation, and the Fed is adamant about working on it

Effective Fed Fund rates

UPI-PayNow Linkage

On the 22nd of February, the Prime Ministers of India and Singapore, along with the RBI Governor Shaktikanta Das, announced the official connection of the fastest Peer 2 Peer funds platform from both countries to allow real-time cross-border fund transfer This will allow efficient and cheap

transfers when compared with standard

cross-border transactions

The project was initiated in September 2021 as a stepping stone towards integrating financial payments between countries and will help different segments of people in the economies.

CPI inflation at a 3 month high

In 2023, the CPI in India has shown a mixed trend. While the overall inflation rate has been moderate, there have been fluctuations in the prices of essential commodities such as food and fuel. The rise in fuel prices has been a major contributor to the inflation rate, as it affects the cost of transportation and production of goods This, in turn, has led to an increase in the prices of various goods and services However, the government is taking measures to control the inflation rate by regulating the prices of essential commodities and increasing the availability of food grains. The Stance of RBI also becomes important in terms of repo rates

This is the first time that an Indian American has been nominated as The World Bank President by the US. Padma Shri Mr. Ajay graduated from St. Stephens college of Delhi University and was the CEO of Mastercard, where he led the company towards a technological and cultural transformation He is currently the Vice Chairman of General Atlantic He brings in the diverse expertise of creating jobs and expanding businesses in developing nations He serves as the Honorary Chairman of the International Trade and Commerce from 2020 - 2022 and, a member of the Trilateral Commission, a founding trustee of the U.S.-India Strategic Partnership Forum. Ajay with his knowledge in financial and technological sector can play an essential role in the transforming world and technology being the face of it

Bulk order by Air India

Air India to order 470 jets will be a significant move for the airline industry. It is one of the largest aircraft orders ever placed by an airline, and demonstrates Tata Sons commitment to modernizing and expand its fleet This deal is expected to have a positive impact on the Indian economy through creation of new jobs and will also benefit passengers, as the new planes are likely to be more fuel-efficient, comfortable, and equipped with the latest technologies. However, it is worth noting that such a large order comes with its own risks Air India must ensure that it has the resources and the potential to manage the acquisition, delivery, and maintenance of these new aircrafts. The airline need to carefully assess the market demand and adjust its operations accordingly to avoid overcapacity.

Investment Objective

To foster classroom learnings in the practical world with an intent to generate long-term capital appreciation by investing in companies across large-cap, mid-cap and small-cap brackets However, there is no assurance that the scheme's objective will be realized The Scheme will invest in Equities as notified in NIFTY 500. Portfolio construction will be based on bottom up/top-down stock picking

Performance & Other Metrics

NIF Insights

Given the profit-booking at 18000, Nifty 50 fell to 17300 by the end of February, with Metal Index falling by 15.3%.

Inflation increasing to 6 52% has increased uncertainty regarding the repo rate hikes.

of

invested in Equities

Tracking Macroeconomic Indicators

Introduction

On the 1st of February 2023, we saw the first budget of "Amrit Kaal" and the last budget before the incumbent BJP government heads into the General Elections of 2024 The Budget was expected to be a populist one as we head into an election year However, the government tried to provide a balance between development and populist schemes

The Budget did try to give more cash to the middle class through exemption limit increase, but at the same time, it stuck to the path of fiscal prudence. From the new 'default tax regime' to infra boost, here's a detailed analysis of all the proposals announced by FM Sitharaman.

The New Tax Regime

In an attempt to give woo the Middle class, the FM announced the new tax regime. Under this, the basic exemption limit has been increased to Rs. 3 lakh from Rs. 2.5 Lakh.

Under section 87A, the rebate amount has been enhanced to a taxable income of Rs 7 lakh As a result, the individuals opting for the new tax regime don’t have to

pay taxes till their income is below Rs 7 lakh

The government has also decided to make this new tax regime the default regime. But to give the citizens more freedom, the taxpayers can choose the older tax regime too.

Source - The Economic Times

All In For Capex

The Economic Survey (2022) had some exciting recommendations and observations regarding the Indian Economy. It talked about how India was on the cusp of becoming a developed nation within 20-25 years, given that Indian policymakers keep up the 5th gear on capital expenditure

The Union Budget presented on February 1st didn't disappoint

There was a substantial 37% increase in the capital expenditure done by the government. At the same time, the government plans to increase the revenue expenditure only by 1%.

There was a strong focus on rural transportation to revive the rural demand The government planned an investment of Rs 75000 Crores in more than 100 transportation projects with the intention of increasing rural connectivity

Some indirect financial support has been given to the state governments through 50-year interest-free loans for one more year. The loan amount, however, is expected to be used in the infra development in the respective states

The ambitious PM Awas Yojana saw an uptick in capital outlay by 66% to Rs 79000 Crores This would push steel manufacturing and other infra-ancillaries to grow too To promote steel production, exempting ferrous scrap from basic customs duty and on raw materials for manufacturing CRGO steel will also augment the availability of raw materials to the steel sector and save their cost of production.

The Great Indian Railways

The Union Budget of 2023 was unique in one more aspect The Indian railways were handed over the highest-ever budgetary allocation of Rs 2 6 lakh crores

The confidence shown by the Indian government in the railways is on the back of projects that are in the pipeline. These projects include the laying of new lines and the doubling of existing tracks.

The government is also planning to increase the speed of track construction.

Currently, construction is happening at a pace of 12 km per day The government wants the speed to be around 16 km per day by the end of the next year.

Two to three Vande Bharat trainsets will roll out from the Railways stables every week by next year, produced simultaneously in four factories.

Additionally, there will be Vande Metro trainsets to shuttle from cities to areas within 50-60 km.

Interestingly, the government also plans to increase the production facilities of Vande Bharat trains to the states of Haryana, Maharashtra and Uttar Pradesh This makes a total of four production facilities

The government is also planning to launch its hydrogen-powered train, which will take India one step closer to the target of Net Zero carbon emissions

Based on its finances, the operating ratio of the transporter (money spent to earn every Rs 100; the lower, the better) stands at 98 22 percent, worse than last fiscal’s 96 98 percent It has pegged its next fiscal operating ratio at 98 45 percent

The government also placed huge bets to increase revenues by at least Rs. 22000 crores. This will be on account of an increase in both the freight carriage to 1600 million tonnes and the passenger segment will increase carriage to 7,475 million passengers, up from 6,565 million this fiscal. The national transporter hopes to earn Rs 70,000 crore from its passenger business and Rs 1 79 lakh crore from freight

However, in terms of revenue expenditure, there will be some issues related to extra costs the railways have to bear due rise in diesel prices.

Disciplined Fiscal Math

The Covid-19 pandemic pushed the government to take welfare measures, leading to a sharp rise in government spending

As a result, there was a significant rise in the fiscal deficit to 9 2% of the GDP As the pandemic receded and the economy opened up, government spending decreased.

However, the fiscal deficit is still more than the RBI-designated range of 4%. Hence, it was prudent for the FM to balance spending and revenue collection. For FY 2324, the budget estimates to fiscal deficit to drop to 5 9%

This will happen on account of increased tax and non-tax revenues

The government also plans to divest some of its assets to cover the lagging divestment target

Moreover, the government plans to finance its fiscal deficit majorly Market Borrowings.

Around 68% of the fiscal deficit is planned to be financed by the Market Borrowings which is equal to the figure of FY 22-23.

But the reliance on external debt is estimated to decrease by 7 36%

In terms of tax revenues, it is estimated that the Net Tax revenue of the center is expected to rise by at least 2 4% This is on account of the rise in the tax base of the country

Fiscal Deficit Trends

With the highest ever outlay of Capital Expenditure, maintaining fiscal deficit within the acceptable range becomes extremely important.

Hence, the arithmetic explained above tells us how on the bank of market borrowings the government is planning to decrease its Deficit

But as the interest rates rise, the interest payments would rise too

Let Us Go Green!

Green Growth was one of the top 7 priorities of the Union Budget 2023. After the analysis, it is easy to conclude that this budget was pro-EV The Honorable FM mentioned in her speech that she would extend EV subsidies for one more year to make them much more affordable

Most importantly, the budget cut the customs duty on the essential raw material in EV manufacturing, i.e. lithium-ion batteries, from 21% to 13%.

The policy change on replacing old polluting vehicles should hasten the transition to electric cars, which is consistent with the budget’s goal of encouraging ecoconscious lifestyles and the government’s commitment to promoting environmental sustainability, as emphasized by the Finance Minister in the recent Union Budget 2023

The Finance Minister stated that additional funds had been allocated to support efforts to scrap old vehicles under the central government's control. In addition to the vehicle scrappage policy announced in Budget 2021–22, states will also receive funding to assist them in getting rid of outdated cars and ambulances

The Misses

The budget in some areas could have done a lot better. Many areas again went unnoticed. For instance, it had meager provisions for the marginalized only a one percent rise in allocation for the

sector. Allocations for the scheme for implementation of the Rights of Persons with Disabilities Act have been reduced by Rs 90 crore to Rs 150 crore.

The Government also removed income criteria in PM-JAY for persons with disabilities

There was a big blow for the insurance companies as the incentive of getting deductions on insurance premiums will no longer look attractive Insurance policies are often bought for tax planning which will reduce in the future.

Curbs on exemptions involving high-value insurance policies announced in this budget will also impact large ticket policy sales.

The exemption benefit has been a major factor in India's insurance industry's growth Huge chunks of policies are still sold during the tax planning season of January to March

Lastly, there was no boost to the PLI scheme, as no new sectors/industries were added to the list.

Budget Profile

Source - Union Budget 2023

Can you please share how your two decades plus years of experience in trading and investing in systematic equities has been? Please share your experiences on numerous challenges you might have faced, which young aspirants like us can imbibe and learn from.

All these years have been net profitable in terms of learning and earning. I am a trader and understand profits and losses For me, Wealth Management is wealth creation plus risk management. So the challenges that I faced in the early stages of my career are that there wasn't a broad analysis that I was doing regarding fundamentals, technicals, and macros. I wasn't able to accept that I was wrong, and that is the reason I kept holding on to my losers. I wasn't happy with being reasonable, which is essential to the investing journey A reasonable rate of return, consistently done over a long number of years, makes all the difference. Whenever risk management fails, it snaps back at

you with losses I overcame all my failures with the help of risk management. So there is this, you know, one-line quote, a jack of all trades is a master of none But, the complete quote is that a jack of all trades is a master of none but often better than a master of one. This is precisely what is needed in investing. You got to be a jack of lots of trades So it's been a very entertaining journey so far.

What are your thoughts about the union budget being announced decently first? And was it aligned with your expectations, or was it not? Also, sir, given the measures taken? Do you have some sectors to look for shortly, whether it is six months or a one-year horizon or even longer than that or shorter?

Sure, the union budget for 2023 is a good one. Under the Prime Minister's leadership, the government has focused on growth and spending, even though the debt-to-GDP ratio is slightly unfavourable. They have made space for some fiscal expenditure and aspire to control the fiscal deficit From the stock market point of view, the budget was a

volatile event Since markets are forward-looking, the budget for 2023 is an event of the past. The sectors that look good concerning how the budget has been framed are defence, software, capital goods, power, auto, real estate, everything that needs a lot of spending, and government spending is good.

Given the recent recessionary pressures in global markets, how do you see the IT sector playing out shortly? So, we have seen slight growth in the IT sector. So what do you say? How will it shape up?

The IT sector has its own set of challenges because they have a lot of revenue coming from the US and Europe The US and Europe are right now in trouble. Corporations in the US and Europe are firing people So why would they hire an Indian company to write software programs for them? It is a difficult phase, but it is here for the short term In the long term, the software is not going anywhere. Software is here to stay As problems increase, the demand for software will increase. Five years back, when you had to conduct the interview, you would have called somebody to the campus, but today we are just doing it, you know, with a click of a button So this is the beauty of software. So IT services have some headwinds in front of them for the short term. But in the long term, they are here to stay.

When you talk about stock prices and stock markets, the IT sector has already corrected in terms of time and cost Since January 2022, companies like Wipro have corrected from Rs 650 to almost

Rs 375, roughly a 50% correction

If something happens in Nifty, which is unforeseen and damaging, will IT correct it by 15% or 20%? I don't think so! It will still survive because it has already gone through correction, time and price, both So it is the right time to start collecting IT companies in the mid-cap space because they

The next question is, again, about the Indian economy per se, but slightly on the external part. So, with the dollar holding near a seven-week peak, vital US economic data about consumer spending and accelerating inflation, many investors are uncertain about the future pace of Fed interest rate hikes. So, what is it like to know whether the Fed can maintain a 25-basis point hike or will be forced to reaccelerate the pace?

The United States is right now very precariously placed, it is fighting high inflation at one end, which was caused due to all the COVID spending they made. On the other hand, they have to boost economic growth So the US is targeting an inflation rate of 2%. Now, that might come through over the next several months In the meantime, they are only looking to achieve it by raising interest rates If they do several rate hikes, that would hamper economic growth. So they will have to find a balance between inflation and economic growth

Above all, in 2023, the stakes are very high! So, if the rate hikes are unreasonably done, that would seriously impair the profitability of the companies, and the banks would be affected the most They

might land in the Japanese model, which they cannot risk doing So, I think the US Fed and the US government want to minimize the damage while balancing between inflation and economic growth.

The market started the week on a soft note and lost nearly half a percent in continuation to the prevailing corrective phase as we see right now, the market was dumped up to 17 300 Meanwhile, pressure in the IoT metal and auto measures kept the tone negative, but resilience in the banking cap the damage I made amidst all this pessimism; we include the global market outlook Is it prudent to wait for a rebound? And does the pressure in banking and financials also have a cascading effect on sectors?

If we look at the immediate short term, the market is still on the brink of a significant move The decision is still pending on whether it has to correct by 10% or rise by 10% Markets are standing. The reason why I say this is because US bond yields and the US dollar is standing at a place where the decision is pending. As the US dollar moves, so will the Indian economy and stock markets will move. So, today the market has closed at 17,400. Now, a person you know who is a longterm investor would consider this an opportunity for a SIP investor. This is a beautiful opportunity because he benefits from rupee cost averaging every time he buys above that The fixed deposit rates in the country are at desirable levels; they have not been at this level for the last few years So, that chunk of money will shift

from stocks to fixed deposits because rupee money is always searching for, you know, a risky return The risk has to be minimized So, the fixed deposit risk is at the bare minimum; the returns are beautiful So, there will always be that amount of money that will constantly shift in asset classes, from fixed deposits to equities to gold to real estate

F I N V I E W

Regarding banking and financial services, both have taken a beating thanks to one of the groups that have been in the news for the wrong reasons. But banking is very well placed for a rise in this decade, especially the public sector banks. They will do very well because the valuations of several public sector banks are way below their private sector counterparts, while their loan books are as good as their private counterparts. Please pick it up, but it won't play out in a day or two or a week or two It's going to take some time. That is the theme of SIP. This is a beautiful market for a trader, giving enough volatility to trade on both sides.

As we are seeing that China is opening its purchasing, purchasing managers index is also rising So, would it hamper India's growth prospects, too, because when China was locked down, China was closed? The world was thinking of China plus one policy, but as China is opening and its manufacturing units resettled, would that hamper India's growth prospect?

It shouldn't hamper India's growth or growth prospects in a huge way. If you have read the newspapers in the recent past, you will realise

that the US is shifting a lot of manufacturing even to Mexico So the China plus one policy is giving an advantage to many other nations India stands to gain in all this.

So, the next question is specific to Indian markets. Coming to Indian markets, FII’s have done more than 31,000 crores so far in the calendar year 23. Even if no data showed that FII net shorts in the index futures increased again above one lakh crore contracts with other emerging at this point while other emerging markets like South Korea and Taiwan witnessed better capture inflows as compared to India, considering the anticipation of Fed turning more hawkish and slightly more conservative in their approach?

India is one of the markets where global fund managers allocate their capital So what's attracting capital flows in India are the positive political and economic outlook, a democratic setup, strong defence forces and global diplomatic relations. So, when a global fund manager must consider, he has to go through his elimination process as to where not to invest money. They have to invest in India to generate some good alpha. So, any fund manager has to deploy their money in India, but a little less or more, you know, is a matter of discretion. Will money leave India for Taiwan and South Korea? I don't think so, it might be for a short period, but eventually, it has to come back to India because of the kind of mix India is providing in terms of diplomacy, democracy and geopolitics, it is very unique So, I

don't think money is going to leave in the long term It is here to stay in the Indian economy.

Even with the budget being presented, and defence sector, per se, was one of the highlights of the budget, and there were slight increases in the budget allocation of the defence sector Still, on Budget Day, we saw some correction in the defence stocks, per se And there was also an increase in the defence stocks after a week. So, what does that action pertains to using it? How was that happening? And what is the logic behind it?

The stock market works based on perception So, all the defence stocks were rising just a day before the budget. They rose well, based on the expectation that the finance minister would utter some good words regarding defence spending But, the defence spending has been going on for quite some time. The defence spending is going on, and you look at the stocks like Mazagaon Dock and Cochin Shipyard. They have risen well in the last six months They are just consolidating sideways before the next push comes on the upside

Introduction

The Indian ports and shipping industry is the 16th largest maritime in the world. It is located along its 7517 km long coastline comprising 12 major (6 each on the eastern and western coast) and over 200 non-major ports The shipping industry plays a significant role in sustaining growth in the country's overall trade and commerce The cargo ships that sail between East Asia, America, Europe, and Africa pass through Indian territorial waters

In the last few years, it has been noticeable that non-major ports are steadily gaining market share and large chunks of traffic from major ports. Indian ports handle almost 95% of trade by volume and 68% by value of India's external trade, with solid cargo contributing the majority share, followed by liquid cargo

Government Policies

SAGARMALA PROGRAMME

Sagarmala Programme is aimed to transform India's logistics sector performance by opening the full potential of India's coastline and waterways. The project aims to

reduce logistic costs for exportimport and domestic trade with minimal infrastructure investment, optimize the cost of EXIM container movement, and lower export competitiveness by developing a port proximate discrete manufacturing cluster. Under the program, $123 billion would be invested in over 415 projects under the following components –

Port Modernization Connectivity enhancement

Port led industrialization Coastal Community Development

INDIA MARITIME VISION (MIV) 2030

Under this, a blueprint has been formulated to ensure coordinated and accelerated growth of India's maritime sector in the next decade. MIV identified over 150 initiatives across ten themes with an investment of INR 3 – 3.5 lakh crore. The guiding principles that define MIV 2030 are – to analyze current and future challenges to determine initiatives, drive innovation by utilizing the latest technology, create a time-bound action plan, benchmark to understand current standing and

adopt best-in-class practices, address capability building and human resources, explore ideas to achieve "waste to wealth."

The MIV 2030 will supersede the Sagarmala initiative to boost the shipbuilding industry and encourage cruise tourism in India Under MIV, Port Regulator Authority will be set up under the new Indian Ports Act to enhance ports' institutional coverage and provide stable growth to major and non-major ports Along with this, the focus will be on developing eastern waterways connectivity MIV 2030 will also extend low-cost, long-term finance for inland vessels through Riverine Development Fund (RDF) As expected, MIV 203 will unlock an additional INR 20,000 crores of annual revenue while offering 2 million jobs.

Major Ports Authorities Bill, 2020 The bill was introduced in 2020 to replace the Major Ports Trusts Act of 1963 to decentralize the decision-making and infuse professionalism in the governance of ports ensuring transparency in the operations of major and nonmajor ports

Major ports in the country are under the jurisdiction of the Government of India, and Nonmajor ports come under the jurisdiction of the respective state's government maritime board.

Budget 2023

Since the capacity of ports and the traffic handled by major and nonmajor ports have increased significantly, the government under PM Gati-Shakti has decided to move towards the low transport cost The freight and passengers cost will go through the PPP and Viability Gap Funding, which will further help in capacity expansion under the SARGAMALA project. As per FM, rail-sea-rail will be the preferred mode for coal transport

Key Metrics

Source: IBEF

FDI

The government has allowed Foreign Direct Investment of up to 100% under the automatic route for projects about constructing and maintaining ports and harbors.

1. Turn Around Time – It is the primary metric to analyze the quality of service that ports give to ships. It refers to the time a vessel spends at the port from its arrival at the reporting station till its departure. Every port's efficiency is determined by a lower turnaround time

2. Container Traffic- It refers to how much container traffic passes through a terminal at any given time It is generally measured in TEUs (Twenty Equipment Units or 20-foot containers)

Introduction

“Don’t put all your eggs in the same basket” is a proverb that almost every fund manager has used for all their clients. The popularity of this proverb stems from the reasoning that diversification is the shock absorber a portfolio needs during times of stress In a nutshell, the price of every investible asset does not fall together Thus, by investing in different assets, one reduces the risk to their portfolio. The returns may also reduce by such an exercise, but the risk-toreward ratio of the overall portfolio improves.

That being said, it is imperative to recognise the types of risk faced by any portfolio. The financial academia has kept it simple and divided risk into two types –systematic and unsystematic Systematic risk refers to the risk that is taken by investing in a broad category, the commonly used specimen being the country an investor invests in Systematic risk is, therefore, present in all investible assets associated with the country. For example, someone investing in Reliance Industries Ltd. will take up a similar amount

of systematic risk as someone investing in HDFC Bank Ltd, despite these organisations being in completely different industries and barely overlapping This type of risk is rightly so, also known as non-diversifiable risk, i e , the risk that diversification cannot eliminate Unsystematic risk refers to the organisation-specific risk, the risk taken by investing in Reliance Industries Ltd. or HDFC

Bank Ltd. specifically. Unsystematic risk is thus present in all investible assets but with different magnitudes This risk is associated with the individuality of each asset, such as the management of the organisation, its relations with its vendors, market strength, etc This risk is diversifiable, i e , if one company has a higher risk, it does not imply another company will have it, too.

Thus, having multiple organisations’ stock in a portfolio reduces this risk

Correlation as a factor in portfolio risk

The risk of an asset is calculated using the standard deviations of the expected returns of the asset. The risk of a portfolio incorporates the correlation between assets, the weight of the assets in the portfolio, and the standard deviation of the individual assets. A correlation of less than one between two assets reduces the portfolio's overall volatility and, thus, the risk. Exemplifying the statement above, using logic and mathematics, let us assume that the HDFC Bank Ltd stock has shown a standard deviation of 14% in the calendar year 2019 Similarly, assume that the Reliance Industries Ltd. stock has shown a standard deviation of 10% in the same period If the two were perfectly correlated, i.e., r=1, the portfolio standard deviation would have been 12% if the investor spent equal values in the two stocks. However, if the correlation were 0 5, the standard deviation would have been 10.44%, and if it were -1, the portfolio

standard deviation would be a mere 2%. Logically, if the HDFC Bank stock falls, the Reliance stock will not fall in the same proportion, even if it falls. This policy of diversifying portfolios is agreed upon by most professionals. But the caveat that is often overlooked and of utmost importance is that, in times of crisis, the correlations between assets tend towards 1 This leads to negligible advantage due to diversification when it is most

needed The table below shows the correlation matrix of Morningstar assets, during COVID-19, from October 2019 to September 2020 All but one of the values are greater than 0.5 – clearly signifying that the correlation between assets during this period was extremely high. In the table below, we see the same correlation matrix but from an extended period – from October

2017 to September 2020. Even in this case, the correlations between assets were extremely high but still lesser than that seen above. These two tables thus show that the premise of diversification benefits, during a crisis situation like COVID-19 is questionable.

What is the best way to minimise losses in times such as this?

Diversification, in itself, is not completely useless – that is not the intent of this piece The author merely wishes to point out that the theory is not flawless. No portfolio can be immune to crises – every portfolio will suffer. But the intelligent investor must be conscious to recognise the risk and take necessary steps to alleviate the same.

Taking the example of a married couple with INR 10 Crores in their retirement corpus, with no income after 60, this author feels that a 20-year buffer is enough to negate all ill effects of a crisis. Thus, from the age of 40, the couple must start reallocating to less risky assets. Gold was a favourite asset of all investors during COVID-19 The price of gold surged

from INR 33,360 on July 31, 2019, to INR 48,560 on July 31, 2020 A massive 45% hike in 1 year The reason for this was intuitive –COVID-19. The price of gold surged from INR 33,360 on July 31, 2019, to INR 48,560 on July 31, 2020. A massive 45% hike in 1 year. The reason for this was intuitive –when investors are afraid and withdraw their money from equity markets, they still look for other avenues to invest in Bank

Deposits offer meagre sums that the institutional investor is not interested in Gold, on the other hand, is a visible, tangible asset These basic features of gold and other commodities, such as silver and copper, make for good investment avenues – at least

better than bank deposits Thus, that is where the money goes, and

prices of gold and other commodities rise

One might question why this does not happen with corporate bonds and treasuries On the face of it, money must flow from risky assets to all less risky assets, but in crises such as these, the One might question why this does not happen with corporate bonds and treasuries. On the face of it, money must flow from risky assets to all less risky assets, but in crises such as these, the repayment ability of corporations is a bigger question Yields on bonds and treasuries do fall due to a fall in interest rates, but nobody likes to give a loan when the whole world’s stability is in question

Most investment professionals agree that, although diversification does not guarantee against loss, it is an important component of reaching long-term goals and minimizing risk. Diversification can be done across sectors, industries, companies and asset classes Diversification across borders and time frames can also help reduce risk A longterm bond always has a higher rate of return due to the high inherent risk, while a short-term investment is more liquid and yields less

Protection from losses is especially important for older investors that need to preserve wealth to the end of their professional careers.

Diversification is also thought to increase the risk-adjusted returns of a portfolio. This means that the investor earns greater returns when he/she factors in the risk they are taking. Investors may be more likely to make money through riskier investments. Still, a riskadjusted return is usually a measurement of efficiency to see how an investor's capital has been deployed.

Conclusion

The final thought of this author is simple – reallocate money to safer assets as you close in on the maturity date. The returns may be lower than that of equity, but capital safety must be a bigger priority than capital growth. And as always, all investments are always subject to market risk

On 1st March 2023, Axis Bank completed the acquisition of Citi Bank India's consumer/wealth business for Rs 11,603 crores, marginally lower than what was announced in March 2022 The deal will be funded through internal accruals The CEO, as was iterated before, announced that there are no plans to raise capital in the near future. Besides the synergy benefits, Axis Bank's improved capital position after the merger will enable the bank to avoid the immediate need for capital raising.

Citi Bank's condition before the merger

In terms of overall deposits of Citibank, it dropped by 21% in January 2023 from March 2022 In Consolidation of their banking operations, the management said, was the reason for this The credit card customer base decreased by 28% in January 2023 compared to March 2022. The management hopes that the merger will help reduce the dilution of customers and deposits. In the fourth quarter of 2023, the goodwill amortization and other intangibles might make

Deal Execution

In the first year and a half after the closing date, Axis will be responsible for further integration expenditures of INR15 billion. This is in addition to the upfront payment of around INR123 billion (USD1.6 billion). Some safeguards permit a modification in the final consideration if customer and company attrition exceeds transaction projections The purchase price is approximately 18.7 times the implied price-toearnings on Citi India's normalised FY20 standalone financials

The operating profit as a percentage of RWA, which stood at 2 3% at the end of the ninth month of FY22 and 1.4% at the end of FY21, will drop significantly in the year that goodwill is charged

Still, it should rebound in the year that follows, as integration expenses should be manageable

The number of clients who ultimately chose to open accounts with Axis Bank was significantly smaller than had been anticipated, which caused the value of the transaction to decrease

Immediately after this point, there

will be a transition period of 18 months, during which Citi customers will be moved over to the technological platforms of Axis. The integration would cost Rs. 1,500 crores, which will be paid for by Axis Bank over the course of 18 months as an expense to be amortised.

What would change?

Marked by the signboard at Citi India's iconic Kolkata office, the rebranding process has already begun Axis Bank and Citi Bank have different work cultures and human resource (HR) policies, including leave policies and the accessibility of supervisors These changes stem from the fact that Citi Bank is owned and operated by a Multinational organization based in the US. Citi Bank will also undergo a product realignment exercise eliminating the overlapping products in one segment. Evidently, Citibank will be presented with new chances and synergies as a result of this acquisition, which will propel the company onto a much more rapid path It's not that they aren't developing on their own; rather, this further speeds up the process of building an enviable brand across the country It will provide incredible value to everyone involved in the process. It will provide access to one of India's greatest franchises catering to wealthy consumers. In addition, it will make the power of One Axis available to the customers of the Citibank franchise. The retail franchise of Axis Bank should gain from the acquisition of the retail business of Citibank India (Citi India),

provided that execution risks and capitalization are well-managed

How will the deal benefit Axis Bank

Axis Bank will now own Citibank India's consumer business and NBFC subsidiary Citicorp Finance (India) This will increase Axis Bank's CASA deposits by 8%, AUMs by 33% and credit card base by 19% It does not add much to the loans that will increase by 4%, deposits will increase by 5%, and a normalized profit of Rs 8-8 4 billion adds 3% to the FY24 estimated profit. Axis will have a larger presence in the extremely competitive urban retail industry. With more than 10 million cards, Axis will become one of the three largest credit card carriers in India as a result of this deal. Axis Bank's large loan book would be well complemented by Citibank's affluent customer segment, creating product and branch footprint synergies Goodwill write-off of Rs. 116 billion will drive the losses in the fourth quarter Reports say the earnings for FY23 will reduce by 53%, but the deal will raise the profit by around 3% for FY24-25 The share currently trades at a discount to the other private banks, and the immediate losses and the potential share supply will limit the immediate revival. The important thing here would be to understand the overlap between Axis Bank and Citi's customer base and the synergy benefits that would have effects over a period of time Although the upfront merger costs are high, sustainable Return on Equity (ROE) from the Citi portfolio would be higher than Axis's standalone RoE

Introduction

Credit cards are a revolving line of credit provided by banks or financial institutions that allows their users to borrow money up to a specified limit These cards have an interest-free period before which there is no surcharge if the EMI is paid No problem, right? Not really. Although it provides a convenient transaction method, credit cards are considered some of the riskiest debt instruments. If a person isn't diligent in making payments or is unaware, highinterest rates could force him/her into spiraling debt It is common knowledge that banks make money because people don't pay their part on time Due diligence hence is an absolute must

Usage Benefits

Cashback and Reward Points: The purpose of incentives for credit cards is to stimulate spending. Hence the most common tactic while providing incentives is the promise of cashback. Cashback can be used in many forms, such as Fuel credit cards that give cashback on fuel refills or even travel cards that can be used in an

an airport lounge or while booking a ticket.

The second tactic is linked to the first one Some credit cards possess a full-fledged rewards program in conjunction with a retail giant or otherwise On each transaction, customers gain some reward points that can be redemed later.

Credit Card Insurance: Credit cards offer several covers right, from health insurance to motor insurance to personal accident protection

Building Line of Credit: The most apparent benefit of credit cards is helping customers create an active credit history. A good line of credit would make it easier to acquire more loans in the future.

What Determines Credit Card Limits?

Kisan Credit Cards

Credit cards don’t just exist for the urban segments With Kisan Credit Schemes’ introduction in 1988, the government planned to create a pipeline to grant loans(interestfree mostly) to farmers in case of emergencies. The scheme was a success with several modifications over the years The most recent one was in 2018-19 to extend it to fisheries and animal husbandry The current version of the KCC includes a RuPay card with a credit balance in the account, and if any interest needs to be incurred, it is on the savings rate. There is also an eligible list of crops under which the credit card could be used.

the Indian consumers, security, and, most importantly, this network can be leveraged to penetrate under developed regions.

But how do Credit Card Companies make money?

KISAN CREDIT CARDS BENEFITS

Brief About Rupay

There is one more angle: KCCs are issued under the Rupay (Juxtaposition of Rupees and Payment) Network, a first-of-itskind indigenous payment network

These cards provide additional benefits such as lower transaction costs(due to it being a domestic network), customization for the

The most common answer to the income source for credit card companies is fee collection. These fees can be of different kinds, such as processing, cash withdrawal, annual, and interest charges These are usually a percentage of transaction amounts So it would seem that the volume of usage is of prime importance But what is not quantified is the business generated due to the convenience factor provided by these cashless plastics. Another aspect that often gets missed is the value of user data. Each transaction provides an avenue for tracking. There are trusted "data brokers" existing in the system to facilitate this However, there are systems to protect your anonymity Suppose you buy shoes with your credit card and suddenly start seeing some shoe ads online It doesn't mean you are compromised Credit card companies share selective information, zip code, and history; the data buyers are just aggregators trying to employ digital techniques to increase their volumes.

Conclusion

In conclusion, credit cards are one of the most convenient sources of debt with their convenience, universal acceptance, and much more. However, the common man must be aware of its rules to maximize their benefits

India is said to be at the cusp of becoming one of the leading economies of the world, It is entering the phase of "Amrit Kaal" The government has been continuously giving support in the form of the PLI scheme, ECLGS, and other policies and laws to reinforce this growth.

Similarly, South Korea showed a remarkable recovery from the lows of the 1950s after the Korean War. Government policies and initiatives similar to our country's trajectory were significant contributors to this rise

The Shift

After coming into power in 1961, the Park Chung-bee government introduced an export-oriented fiveyear plan in 1962 instead of import substitution followed by India.

An export-focused growth strategy tries to achieve economic growth by opening the country to international markets

In contrast, in an Import substitution strategy, the government focuses on closing the economy in an attempt to become self-sufficient by developing their own industries

of Economic Growth

This significantly contributed to their growth in contrast with the previous policy of import substitution This growth came with a rise in foreign debt and reliance on other countries for raw materials as South Korea didn't have enough natural resources and other essentials post the Korean war. This further supports such a policy as they could only export manufactured products through industrialization.

Post the success of this policy, their second five-year plan focused on improving the existing industries to make them more robust It focused on heavy and chemical industries There was an attempt to move towards import substitution and developing their industries, as foreign dependency had fueled inflation.

The Obstacle

After President Park's assassination in 1979, there was a rise in the power struggle and the oil-induced worldwide recession in the early 1980s; inflation saw a rampant rise in the economy with widening income disparity. This forced the government to pull back subsidies and preferential loan allotments

Now the focus moved towards industries and sectors that would place the country in a favourable position regarding comparative advantage on the global market This called for an efficient flow of investments and reforms for these sectors. It was also accompanied by an attempt to develop the MSME sector.

This is where their exports witnessed significant growth.

The role of the state was to mobilize and allocate the nation's existing resources to enhance national wealth and industrial strength and to direct private investment in these areas. This was achieved through coherent and forward-looking government support that has proven to be the backbone of South Korea's rise from being a labour-intensive country with a per capita GDP of nearly $100 to reaching $35,000 by 2021

Lesson Time

During the late 80s, the government pushed its investment toward more advanced industries like technology, and more emphasis was laid on R&D and nurturing human resources

These efforts have been embedded in the government's five-year plans and are also interlinked Each plan builds up on the achievement of the previous plan and aims at newer and more critical goals.

While the Indian government is also introducing forward-looking schemes and policies that are coherent with the current market, like introducing PLI schemes for significant sectors and other incentives for firms producing semiconductor chips, the success and contribution of these initiatives taken by the government in the next 25 years, namely the Amrit-Kaal of India, will soon come to light.

How to Play?

Below we have the clues for the crossword on the next page. Questions pertain to finance and investments

You can send your answers via e-mail to niveshak@iimshillong.ac.in

ACROSS

3. The name given to the conversation undertaken by management with its shareholders, usually after quarterly reports are released (7,4)

5. The type of derivative that is traded over the counter (8)

6 In the US, the 401(k) is a plan for which stage of people’s lives? (10)

7 The type of derivative that requires buyers to pay a “premium” to enter the contract (7)

9. The distribution of profits of a firm to its shareholders is most commonly given through? (8)

11. The term associated with financing the daily needs of a business (7,7)

12. The brother of (Down 5) and the unofficial name of FHLM (7,3)

DOWN

1. The type of analysis conducted by valuing segments of a large company and adding them. (3,2,3,5)

2 This tech company was one of the first-movers in its industry It had a history of not paying dividends in its initial years When the company first announced dividends, the share price surprisingly fell, as investors hypothesised that profitable investment opportunities were disappearing for the firm (9)

4 Which asset commonly found in most portfolio exhibits 0 correlation with Equity. (4)

5 In the US, the FNMA provides stability to the secondary mortgage instrument market. The FNMA is popularly known as this (Hint: a female name) (6,3)

8. The tax paid on profits earned after selling an investment (7,5)

10 The name of the volatility index of India, which is inspired from the CBOE (8)