EDITION - I | VOLUME XVII | STAY INVESTED EDITION - III | VOLUME XVI | STAY INVESTED The Finance and Investment Club N O V E M B E R DEALS BREWERY COVER STORY ANUBHAV KATHAN VIATRIS ACQUIRES FAMY BRAZIL'S RESPONSE TO COVID NIVESHAK NIVESHAK THE FALL OF FTX

We are pleased to present the November edition of the Niveshak magazine. The Indian equity markets rallied on account of growth in the Banking, Capital goods, and PSU sectors primarily due to 50 basis point hikes by the RBI The index effects resulted in net positive inflows for FIIs/FDI for the second month in a row.NIFTY also rallied on account of better-than-expected quarterly results and robust GST collections. The Fed rate hike did occur by 75 basis points, but the pace of rate hikes is expected to slow.

But the news which dominated the world was the fall of the crypto exchange giant FTX Our cover story encompasses this crash's different elements, from Alameda and FTX's meteoric rise to the final nail in the coffin by Binance that led to total collapse.

The Month That Was section covered the finance news all over the country beginning with recent manufacturing PMI numbers, GDP growth, TATA consumers' interest in buying the Bisleri brand, and much more.

N O T E

NIVESHAK

NIVESHAK

Aayush Jain Akriti K Shashwati A Darshan K Aagam Parikh Akshat Sharma

Nikhil Chadha

Unnati Tanwar

Mayank

Goenka Sankalp Parakh Shantanu M K Tanya Sharma Pulkit Gubgotra Sahishnu S.

Vikram Mathur

Q U I N

S R E

U L E

Abhinandan

Jain Amit Tyagi E D I T O R ' S

' A V A N C E P A

C

NIVEsHAK

Dear Niveshaks,

TEAM

Gaurav Soni

N O V E M B E R

The Drone Space became this edition's theme for the Know Your Sector segment We have covered the niche sector exploring the recent interest in the UAV market. The story also explores the numerous applications andHow government will play a key role in this nascent industry .At the end we present some unique key metrics that need to be kept in mind while analyzing the sector

The Deals brewery section talks about the Famy Life Sciences Private Ltd acquisition by the healthcare giant Viatris The section explores the intricacies of the deal by diving deep into the rationale and the synergies that Famy would provide to the group.

FinSupervise explores a unique topic of GST in the Housing sector. The article covers the inception of this concept, how taxes used to be levied earlier, and finally, its effect on the Indian economy. Anubhav Kathan, or learning from experiences, our newest addition to the magazine, covers learnings from Brazil's response to Covid The section covered the country's monetary and fiscal policy measures

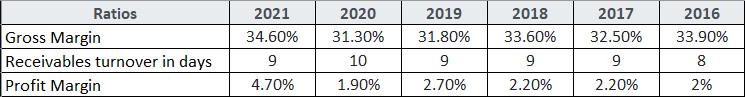

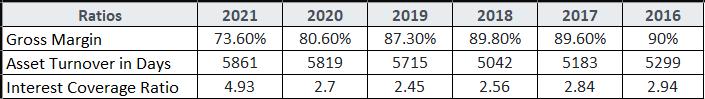

The Let'sFinUp section is again a fun Guess the Industry section Only this time, it is all ratios. That means readers need to guess the industry based on the margin ratios The section is an attempt to signify the importance of ratios while analyzing an industry

The Finview section will be released separately with a special guest on board

We would love to hear your thoughts, feedback, and ideas. Please feel free to reach out to us to let us know what you think!

We hope you derive something from this edition and stay safe and sound in these exciting times!

Stay Invested, Team

Niveshak

All images, design, and artwork are copyright of IIM Shillong Finance Club © Finance Club Indian Institute of Management, Shillong

Disclaimer: The views presented are the opinion/work of the individual author and the Finance Club of IIM Shillong bears no responsibility whatsoever

STAYINVESTED

N

STAY INVESTED

I V E S H A K

CONTENT THEMONTHTHATWAS THE FINANCE BULLETIN Page 5-6 THENIVESHAKINVESTMENT FUND MONTHLY PERFORMANCE Page 7-8 COVERSTORY THE RISE AND FALL OF FTX Page 9-12 KNOWYOURSECTOR DRONE SECTOR Page 13-15

ARTICLEOFTHEMONTH

ESG

Page 15-16

DEALSBREWERY

VIATRIS ACQUIRES FAMY

Page 17-18

FINSUPERVISE

GST ON HOUSE

Page 19-20

ANUBHAVKATHAN

COVID RESPONSE OF BRAZIL

Page 21-22

LET'SFIN-UP

GUESS THE INDUSTRY

Page 23-24

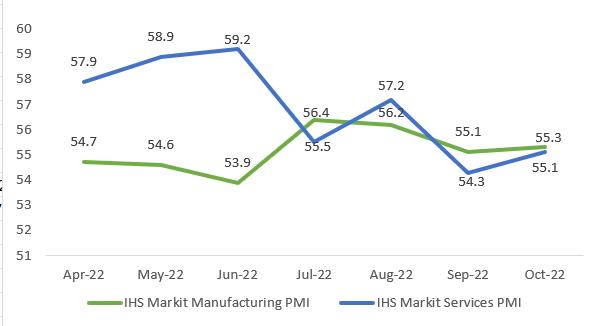

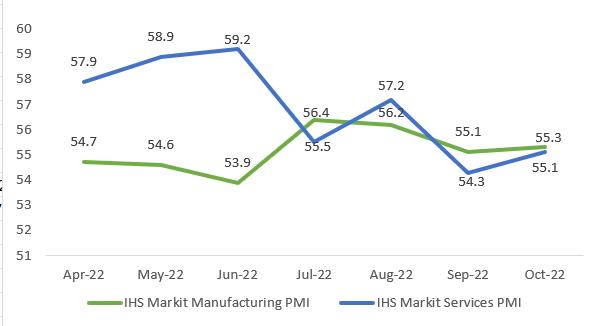

PMI Increases for October

The manufacturing PMI for October 2022 increased to 55.3 from September’s 55.1 buoyed by expansion in employment and increase in input purchasing The services PMI increased to 55 1 in October 22 from September’s 54 3

The service sector grew despite rising inflation The PMI indicates growth if the figure is above 50

PMI Indexes in 2022

The Indian economy grew by 6 63% in the July-September quarter of 2022 The economy grew by 13 5% in the quarter ended June 2022 In the same quarter last year, the GDP had expanded by 8.4%. According to rating agency ICRA, the GDP growth forecast was projected at 6.5% for the quarter ended September 2022.

3 Indians on Forbes Asia heroes of Philanthropy list

Forbes Asia released the unranked list which “highlights leading altruists in the Asia-Pacific region who demonstrated a strong personal commitment to philanthropic causes ” . 3 Indians –Gautam Adani, Shiv Nadar, and Ashok Soota were named in the Forbes list. Gautam Adani pledged ₹60,000 Crores when he celebrated his birthday in June this year The money will address healthcare, skill upgradation and education and will be distributed through the Adani Foundation Shiv Nadar, cofounder of HCL Technologies donated ₹11,600 Crores to his foundation Ashok Soota, Executive Chairman of Happiest Minds Technologies Ltd., pledged ₹600 Crores to medical research.

NIVESHAK

T H E M O N T H T H A T W A S

T H E F I N A N C E B U L L E T I N

NIVESHAK 05

India's GDP grows by 6.63% in the Q2 FY23

Source: CMIE Economic Outlook N o v e m b e r

US hiring, higher than expected

US employers hired more employees than expected in November 22. There was also an increase in wages in the country. Hiring in the US remains strong despite job cuts by technological giants such as Amazon, Meta and Twitter, whom analysts say had over-hired during the pandemic and are now down-sizing to optimum levels Small businesses are however, desperate for willing workers. The unemployment rate of US stood unchanged at 3.7%.

TATA consumer to buy Bisleri International

Tata Consumer Products Ltd. will buy Bisleri International for up to ₹7000 Crores Bisleri is India’s largest packaged water company and Ramesh Chauhan is the man at the helm Mr Chauhan’s health has not been in the best condition recently and his daughter Jayanti is not too keen on the business Chauhan said, “(The TATA group) will nurture and take care of it even better” Chauhan made up his mind after meeting with Tata Sons Chairman N Chandrasekaran and Tata Consumer CEO Sunil D’Souza a few months back

Intranasal COVID vaccine gets nod from DCGI

Bharat Biotech International Limited’s iNCOVACC (BBV154) has received approval from the Drugs Controller General of India (DCGI) for restricted use in emergency situations for ages 18 and above, in India iNCOVACC is the world’s first intranasal vaccine for COVID and was evaluated with successful results in phases I, II and III in a partnership with Washington University, St Louis

Vistara and Air India to merge by

2024

Singapore Airlines and Tata Sons jointly announced the decision to merge Vistara and Air India, with Singapore Airlines getting a 25 1% stake in the merged entity upon further investment of ₹2050 Crores in the entity The now enlarged fleet of Tata Sons comprises of Air India, Vistara, AirAsia India and Air India Express

N I V E S H A K 06 STAY INVESTED

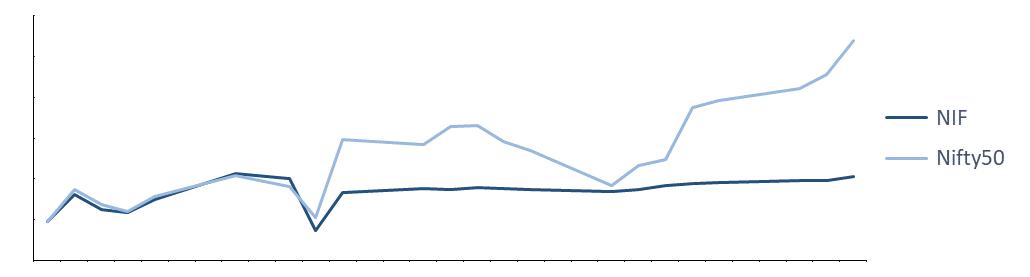

To foster classroom learnings in the practical world with an intent to generate long-term capital appreciation by investing in companies across large-cap, mid-cap and small-cap brackets However, there is no assurance that the scheme's objective will be realized The Scheme will invest in Equities as notified in NIFTY 500. Portfolio construction will be based on bottom up/top-down stock picking

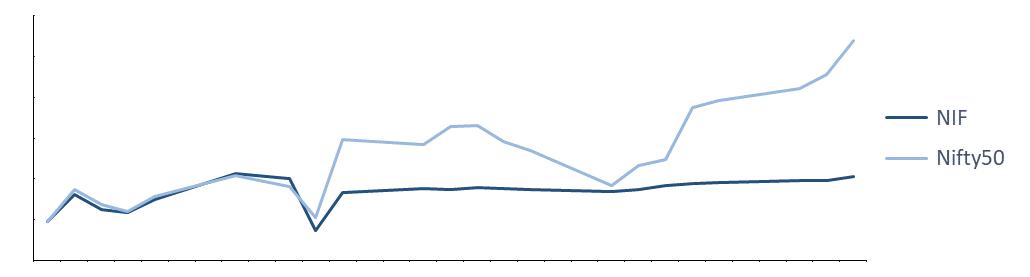

NIVESHAK A U G U S TS 108 06 As on 30th Nov 2022 Large Mid Small Value Blend Growth Style S i z e N I V E S H A K I N V E S T M E N T F U N D T H E F A C T S H E E T NIVESHAK 07 N O V E M B E R November Fund Performance Benchmark Return 1M Return AUM (₹) NAV (₹) Index 1M Return +1 04% As on 30th Nov 2022 13 98 Lakhs As on 30th Nov 2022 NIFTY 50 +4 14% As on 30th Nov 2022 Investment Objective

Performance & Other Metrics Equity Style Box Cap-Wise Allocation 61 10% 30.70% 8.10% Large Mid Small *asofNovember30th,2022

NIF Insights

Assets invested in equities are 8% since we expected Nifty 50 to face headwinds near 18700-18800 given the disparity in the returns between Nifty 50 and Nifty 500 and uncertainty regarding fed rate hikes The decision to invest will be revisited once Nifty 50 corrects to 17900-18100

0% 5% 10% 15% 20% 25% Capital Goods Automobiles & Components Banks Energy Food, Beverage & Tobacco Software & Services Materials Pharmaceuticals, Biotechnology Consumer Durables & Apparel 8% Asset Allocation 10-Year Indian Bond YTM Repo Rate US Fed Funds Effective Rates USD INR Generic 1st Crude Oil, Brent 7 22% 5.90% 3.83% 81.32 7,434 PMI PMI - Manufacturing PMI - Services Industrial Production Index India CPI Combined YoY 55 50 55.70 55.10 3.10 6 77 N I V E S H A K 08 STAY INVESTED Sectoral Allocation 24.73% 21.26% 18.90% 10 83% 08 65% 06.74% 03.93% 03 23% 01 73% Best & Worst Performing Stocks Worst Performing stock Best Performing stock *asofNovember30th,2022 basedonthepurchaseprices.Onlyaccountsforstocksthatexistintheactiveportfolioasof November30th,2022. Banks Consumer Durables 33 55% 23 25% of Assets invested in Equities C a s h Tracking Macroeconomic Indicators

C O V E R S T O R Y

First Alameda Research

Sam Bankman Fried, or SBF, commonly known by his Twitter handle, co-founded Alameda research with Tara Mac Aulay in 2017 Alameda Research started as a cryptocurrency quantitative trading firm specializing in arbitrage Bankman, upon entering, observed the enormous trading volumes of stablecoins Since there is a decentralized aspect to cryptocurrency in the sense that there is no common way to price them, a currency Z could theoretically be bought at one price in country X and sold at another price in country Y.

This happened in reality as well, with Bankman buying bitcoin in the US market and selling them in, Korean(termed as the Kimchi Premium), and Japanese markets

Crypto Derivatives: These are secondary contracts on underlying currency, such as crypto futures and options on bitcoin or altcoin

Leveraged instruments: Use of borrowed capital to invest in cryptocurrency with a small collateral called as a margin.

This, along with other strategies, was enormously profitable albeit risky, and by the end of March 2021, Alameda managed over $100 million in digital assets.

Enter FTX

By January 2018, Through its arbitrage models, Alameda were making almost $1 million daily. But Sam and his team saw a further opportunity in the market, i.e., Crypto Exchanges. See, at the end of the day, Alameda was a crypto hedge fund, a pot of money that bet on markets What currency they traded didn’t matter because the focus was on price movements Through a crypto exchange, money transactions up to billions of dollars could be handled The idea was the same, what currency they traded didn’t matter. So Sam, in May 2019, while Alameda was raking in enormous profits, started FTX or Futures Exchange. FTX offered depositors a wide range of trading products, including crypto derivatives, options, and leveraged tokens FTX raised over $1 8 billion till May 2022 in 7 rounds by 39 investors, but can you guess whom the initial market marker or

T H E R I S E A N D F A L L O F F T X

NIVESHAK 09 N O V E M B E R

liquidity provider to FTX- was?Alameda

The FTT token and meteoric rise

FTX issued its own crypto tokens called FTT and acted as a bank accepting deposits in the promise to pay large amounts in the future. The firm had phenomenal growth because of its strong order book support from Alameda and also the popularity gained from marketing deals. But the gain was primarily from a prolonged bull run in the US equities markets The firm reported revenue growth from $89 million in 2020 to $1 02 billion in 2021

The question now arises about what was so special in the FTT token The simple answer was that the token offered excellent trading benefits. One of the examples was lower fees on crypto futures and insurance protection. This meant that the insurance gain could provide a cushion during volatile market conditions without triggering margin calls.

Deals, deals and more deals

The FTX Group went on a shopping spree from late 2021 through 2022, spending nearly $5 billion on various businesses and investments, many of which may be worth only a fraction of what was paid Alameda Research's investments alone are $5 2 billion dispersed across 474 firms Originally sponsored by FTX's reputation and clout, these startups were unlikely to fetch the amount FTX paid, regardless of their independent success.

Also, as a market maker, Alameda's business model necessitated deploying assets to numerous third-party exchanges, which were inherently risky and compounded by the insufficient protections afforded in certain international jurisdictions All this led to a great downfall for FTX as these deals landed it on the verge of bankruptcy.

Celebrity Involvement & Lawsuits

According to the documents received, celebrities such as Larry David, Tom Brady, Giselle Bündchen, Shaquille O'Neal, Stephen Curry, and others have been listed in a class-action lawsuit because they sponsored FTX and were accused of persuading customers to invest This proposed class action lawsuit, filed in U S District Court in Miami, accuses celebrities of promoting unregistered securities and violating Florida's Securities and Investor Protection Act and the Deceptive and Unfair Trade Practices Act.

At least three lawsuits naming celebrities have already been filed, and with their riches, popularity, and potential liability making them a "juicy target," celebrities are likely to settle

Fed Rate Hikes

The steady rise in Fed rate hikes reduced central bank liquidity and increased the fragility of the crypto market FTX was in the same boat, and the reason was that markets pulled out capital from speculative assets such as Bitoins,Altcoins

N I V E S H A K

10 STAY INVESTED

To combat inflation, the Fed hiked interest rates by an unprecedented 75 basis points in October This tightening drive led to further harm to these "risky assets." Bitcoin dropped to a two-year low of $16,000 after FTX declared bankruptcy. The result was that the leading cryptocurrency in market capitalization lost around 64% of its value by second quarter of 2022.

FTX & Almeda

As Almeda worked on a precarious concept of debt financing for most of its trade, there always was a need for stable funding in the form of loans.

FTX became the sea passage for Almeda to get constant debt from the investors. Thus, Almeda and FTX helped each other grow exponentially but on a hazardous base.

Since Almeda acted as a liquidity provider to FTT, it had a controlling power over the same Thus increasing the price of FTT and luring other customers in the FTX platform to purchase FTT Almeda used these FTT tokens as collateral for raising more debt and ensuring stable funding for its trades. At the same time, FTX earned huge in selling these tokens and used FTT to invest in dozens of other crypto exchange companies.

FTT became a glue, binding Almeda and FTX, and this relationship Turned Mr Bankman into the man of the hour in the whole crypto world This intertwined business model could only work well when the crypto market is on the rise, and there's no sudden fall in their prices

Price of FTT in USD

June18 June26 Jul11 Aug9 Sept1 Sep9

Source: Tradingview

How did we get caught?

Almeda and FTX were not public companies, so they did not need to disclose their books to the world. There was something odd in the book, and it was only a matter of time that someone noticed It was when blockchain com closed out its loan given to Almeda on the grounds of liquidity issues with the firm The major setback came when cryptos were on a free fall in May 2022 and the failure of a couple of renowned companies whit whom FTX had close ties. This led to a fall in the value of FTT and thus reduced the collateral value of Almeda. The cost of borrowing started increasing significantly, and borrowing, in general, became tough for Almeda The clouds were hovering around Almeda until they burst after the report by CoinDesk stating the considerable amount of concentrated investment in FTT by Almeda As Binance held about 20% of the stake in FTX in the form of FTT, this report led to Binance selling its stake in FTT, and it fell further as the public reacted to this announcement by selling FTT. It fell from around $22 to $1 on November 1.

NIVESHAK 11

N O V E M B E R

80

60 40 20 0 2021 2021 2021 2021 2021 2021

Singapore

South Korea Japan

Source:Coin Gecko

297.2k 241.7k 223.5k

As FTT was in a freefall, the trust began to shake in the public's mind, and they all wanted their cash back after selling all their crypto holdings. As FTX was at the cusp of bankruptcy, Binance showed some intent to acquire, only to walk away the next day on the grounds of due diligence leading further run on FTX. FTX didn't have the liquidity to satisfy such colossal demand, finally leading to FTX filing for bankruptcy on November 11, 2022 FTX was rising high with around $32 billion valuation until it got exposed to go bankrupt Almeda came to a situation where it only had the liquidity to pay back its debt holders once it used the customer funds deposited in FTX to clear its debt obligation.

What happens next?

Sam Bankman Fried is in the Bahamas, the birthplace of FTX, and was arrested for securities fraud, fraud, and money laundering The Securities Exchange Commission has sacked Sam Bankman for defrauding the FTX investors Bankman has been denied bail and will be extradited from the Bahamas to the US. There is genuine uncertainty among the common public

concerning cryptocurrencies and exchanges The whole crypto market saw a fall in prices after the FTX saga The too-big-to-fail crypto exchanges like Binance are also under scrutiny to detect any irregularities and there is a particular need for these exchanges to be regulated as public money is involved in something very complex. Looking over the Indian market, it has not been affected much by the fall of FTX However, the recovery process of the already bleeding market after the FY23 budget will be slowed down and the growing trust among the Indians will again take a hit We can expect stringent government regulations over the Indian Crypto exchange firms.

Price of FTT in USD

30 20 10 0 2022 2022 2022 2022 2022 2022

Sept13 Ovt05 Nov06 Nov08 Nov09 Nov13

Source: Tradingview

N I V E S H A K 12 STAY INVESTED

Top 3 countries affected by FTX collapse(in terms of unique traffic volumes Jan 2022-November 2022)

K N O W Y O U R S E C T O R

n o v e m b e r

Introduction

From the mention of the mythical Pushpak Vimana in the Ramayana, flying machines have been transformational in their capabilities throughout history The growth of flying machines based technology has been exponential over the years. The world of Unmanned Aerial Vehicles or Drones has seen similar growth over the years. Its genesis heads back to the 19th Century when Austrians attacked the city of Venice using balloons that were laden with explosives In World War 1, the first pilotless aircraft was designed by the US Army They came to be known as the ‘Kettering Bugs’ and were supposed to fly as aerial torpedoes to attack the enemy behind their lines. In the 1930s, the technology further developed into the RC or Radio Controlled aircraft. But it was in 2013 when the idea of using Drone Technology completely revolutionized. This year, Amazon announced it would start using Drones to make deliveries Since then, we have seen an explosion in drone usage

of drones in various industries ranging from Retail, Entertainment, Sports, Military, Agriculture etc.

Source: Ibef

Rise of Drone Space in India

India is seeing a rise in Drone usage as well as manufacturing. According to various research institutions, the Indian UAV market is set to grow at a CAGR of 18% from 2017–23 in revenue Longrange UAVs will dominate the growth, but the development of the medium and small-range UAVs will be above average India also tops the list of Drone imports in the world. However, these numbers are dominated by military purposes, but commercial usage in India also shows healthy growth

NIVESHAK

T H E D R O N E S E C T O R

NIVESHAK 13

By 2023, the commercial end-use will supersede the military market hitting approximately 900 Mn. USD.

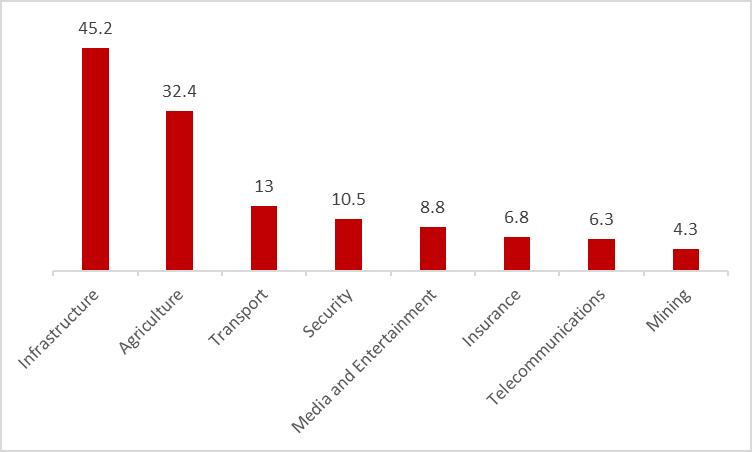

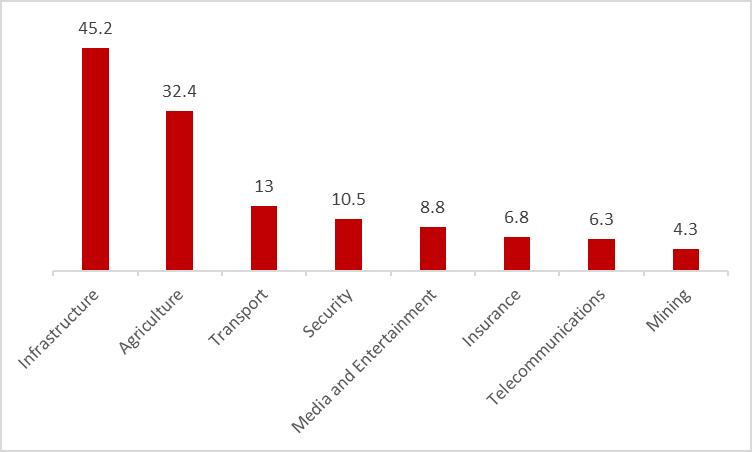

Sectors to Explore

As previously discussed, India was the largest importer of Drone Technology in the world with the majority of this being for Defense usage

But over the years, the demand for commercial usage is rising There are six sectors where drone usage and subsequently its demand would be high for India 1 2. 3. 4 5. 6.

Agriculture Insurance Media and Entertainment Mining Infrastructure Energy and Utilities

Among these, the maximum usage as well demand would be by the Infrastructure and Agriculture Sectors This insight is visible in the graph below. Source:Statista

Role of Government

As Drone Sector is still heavily regulated sector due to security reasons, the role of government becomes more significant. The current government has a positive outlook towards the Drones as a technology.

For the Government, the Drone Sector can help in job creation particularly in the Rural and inaccessible regions. In order to promote Drones, Indian Government has come up with various schemes. 1 2 3.

Drone Airspace Map 2021Under this scheme, they have opened up to 90% of Indian Airspace for the Drone Flight The government implemented the Drone Certification Scheme 2022 to help drone makers secure a type certificate and the Drone Import Policy 2022, banning the import of foreignmade drones The Ministry of Civil Aviation has scrapped the need for a pilot license to fly drones in India. To operate a drone in India, one needs only a Remote Pilot Certificate (RPC), issued by DGCA-approved drone schools; the certificate can be obtained through the singlewindow DigitalSky Platform

All of the above mentioned schemes would help in making the Drone Sector less regulated and would ultimately increase the business in the sector

Key Metrics

Order Book- It refers to the number of pending orders that will be delivered in the future In this case, a strong order book indicates that the product is in demand.

Patents Issued- As Drone Technology is still a new one, so there is still a lot of innovation happening Therefore, new patents issued will also be a solid metric to know about the performance of the technology

STAY INVESTED

K N O W Y O U R S E C T O R

T H E P H A R M A C E U T I C A L S E C T O R

I V

14

N

E S H A K

Introuction

ESG, which stands for Environmental, Social, and Governance, is a standard covering the major driving forces which are gaining prominence in the modern business world in today's time. All stakeholders of major corporations worldwide, including investors, are seeking ESG as a performance metric to check whether any business is worthy of investment

ESG as a concept might sound like the kind of evaluations companies started doing some years ago based on their CSR contributions and making that information public to establish sound goodwill among stakeholders inside and outside the organization. ESG ratings are provided to companies based on extensive analysis of their annual reports and through internal scrutiny by rating agencies like S&P and Moody's. Rating agencies provide ESG scores based on certain parameters and benchmarks and show a comparison of industry competitors based on average scores

ESG is not just about checking a box required as a compliance requirement. Rather ESG is an ideology of creating sustained value and outcomes that fuel the growth of the firm and strengthens the environment, be it natural, social or

legal To ideate and execute specific policies and initiatives focused on ESG, companies nowadays are building special teams, including environmentalists, technologists, and socialists strategists These people help companies bring real change in the world with a commitment towards the betterment of the community and forging new ways of thinking and running successful businesses.

Environmental Aspect

This aspect is probably one of the most crucial and alarming needs of the hour, as with a rapidly depleting environment, human survival is very uncertain Corporations nowadays focus on their businesses' impact on climate change, carbon emission, water scarcity, deforestation, etc. For the betterment of the environment, global initiatives like the usage of clean energy and electricity for powering vehicles, etc , are something that might make a lot of difference Tobacco companies like ITC have initiatives to replenish all the forest cover they utilize to make their tobacco products and reduce the usage of

E S G : R A T I N G S , V A L U A T I O N A N D I N V E S T I N G

A R T I C L E O F

T H E M O N T H

B Y A N M O L D U T T L A K H E R A

NIVESHAK 15 N o v e m b e r

wood drastically. Companies like Coca-Cola have been running global water replenishment and stewardship initiatives like its 2030 Water Security Strategy, which is a holistic strategy to build water security for businesses, locals, and nature everywhere the company operates Companies like Tata Motors are developing new business ventures solely based on decarbonization by launching electric vehicles

Social Aspect

Society has been one of the most prominent pillars of any business environment and still continues to be a major factor that drives investors and the general public's evaluation of companies. Social responsibility means consideration of humans and the businesses' interdependencies with society while making major business decisions As the social environment of a business comprises various stakeholders like employees, customers, people of various ages, workers in factories, etc , companies focus on their welfare on various fronts. Initiatives like data hygiene and security for customers and clients, Gender and diversity inclusion into organizational structure, and mental health betterment focus on ensuring harmony and peace in the internal community.

Governance Aspect

It is crucial for corporations to understand the importance of Governance as a part of ESG as poor Governance exposes the business to a plethora of issues regarding the firm's reputation, and it has been a prominent reason behind major corporate scandals like the recent Whistle-blowing case that happened with Facebook (now known as Meta) which damaged the company's

reputation globally. Governance is primarily concerned with factors like policymaking, organizational structure, decision-making practices, employee participation and transparency, board appointment, and various committees run in the corporation S&P Global's research article states that companies that are ranked well below average on Governance as a parameter are mostly prone to mismanagement and are at high risk of losing their ability to capitalize on opportunities as years go by

Future Ahead

As we have seen in multiple instances throughout this article, ESG is not just a parameter or a confidence metric for investors to compare and judge companies Rather, ESG is a new-age mindset representing the young and responsible management generation's awareness and zeal to make businesses much more responsible and fruitful for the ever-changing dynamic world This concept is here to stay, and companies need to incorporate ESG into the roots of their ideologies and vision to stay relevant, competitive, and sustainable in the years ahead

H A K

16

STAY INVESTED

N I V E S

D E A L S B R E W E R Y

Introduction

"Viatris has been an excellent partner, and this transaction creates a strong demonstration of value creation for an Indian company in the global innovation life sciences space," Famy Life Sciences' promoters Sanjeev and Ashutosh Taparia said "These acquisitions bring us an innovative growth asset, Tyrvaya, and five additional Phase III or Phase IIIready programs that give us a significant head-start in creating a leading ophthalmology franchise," said Michael Goettler, chief executive officer of Viatris.

About Viatris

A multinational healthcare corporation called Viatris Inc enables individuals to live better lives at every stage Through their unique Global Healthcare Gateway, they give access to medications, promote sustainable operations, develop creative solutions, and draw on collective experience to connect more people to more goods and services. Viatris, which was founded in November 2020, combines scientific, manufacturing, and distribution skills with established regulatory,

medical, and commercial capabilities to provide patients in more than 165 nations and territories with high-quality pharmaceuticals More than 1,400 approved molecules from Viatris are included in its portfolio, which covers non-communicable and infectious diseases and includes well-known international brands, sophisticated generic and branded medications, a portfolio of biosimilars, and a range of overthe-counter consumer goods.

About Famy Life Sciences

They are a drug development platform focused on advancements in healthcare and medicine. They are identifying and developing best-in-class clinical-stage assets to bring them to market covering various therapeutic specialties, including dermatology, oncology, and ophthalmology

They are owned by the Taparia Group, a company with over 25 years of experience in the pharmaceutical and healthcare industries. Their prior business, a women's healthcare brand called Famy Care Ltd, was purchased by Mylan Pharmaceuticals for $800 million in 2015. According to Famy

NIVESHAK NIVESHAK

O F O R O P H T H A L M O L O G Y

17 NIVESHAK N o v e m b e r

Life Sciences and Ophthalmology have enormous potential and open areas Over time, they have made considerable investments in developing a solid portfolio in ophthalmology, which consists of six late-stage clinical assets in major unmet medical needs, including presbyopia, blepharitis, and dry eye.

O for Opthalmology

In February, ophthalmology was identified as one of the company's primary therapeutic focus areas. With the support of Viatris' broad commercial reach, R&D and regulatory capabilities, and supply chain, Oyster Point's in-depth knowledge in the ophthalmology area from a clinical, medical, regulatory, and commercial perspective- which includes commercial asset, Tyrvaya, for the treatment of dry eye disease and Famy Life Sciences' Phase IIIready pipeline, the business thinks it has the foundation to develop a top-ranked global ophthalmology franchise. Furthermore, the ophthalmology business of the company will operate as a separate entity. With a robust ophthalmic portfolio of phase 3 clinical assets in illnesses including Dry Eye, Presbyopia, and Blepharitis among others, Famy Life Sciences is an innovation-led drug development platform These are needs that are unmet or underserved that can offer treatment to huge patient populations Viatris announced the purchase of the ophthalmology division of Famy Life Sciences for Rs 2,500 crore. The Famy promoters,Taparia family, will continue to operate their nonophthalmic business,

Deal Execution

Viatris Inc will acquire Famy for $300 million. Viatris will develop a few products that are now in development for phase 3 clinical trials. The combined purchase price of the two acquisitions i.e. Oyster Point and Famy ranges between $700 to $750 million Viatris anticipates funding using cash reserves Following the transaction's completion, Jeff Nau, the current Chief Executive Officer of Oyster Point, will serve as the director of the ophthalmology franchise, which will operate as a separate division inside the business.

Deal Synergies

The business anticipates that the new acquisitions will contribute to top-line growth and at least $500 million in additional adjusted EBITDA by 2028. The USFDA approved Tyrvaya, a nasal spray for treating dry eyes, in October 2021 Viatris plans to increase global sales by $1 billion by 2028 (eye care) Viatris expects the combination of acquisitions and share repurchases to increase adjusted EPS in 2023 on a standalone basis and anticipates that acquisitions could increase net sales and adjusted EBITDA by at least $1 billion and $500 million, respectively, by 2028. The financial targets for 2024 include a 3% CAGR in top-line total revenues, a 4%–6% CAGR in adjusted EBITDA, and a mid-teens CAGR in adjusted EPS.

N I V E S H A K 18 STAY INVESTED

Introduction

Buyers of under-construction homes in India, such as flats, apartments, and bungalows, are required to pay a Goods and Services Tax (GST) at a rate of 1% for affordable housing and 5% for a non-affordable property This tax applies to the purchase of all under-construction residences in India The Goods and Services Tax (GST) applies to purchasing developable plots in real estate. In fact, it has supplanted a number of different taxes and is now one of the primary methods by which the government generates revenue The Goods and Services Tax (GST) is beneficial to India since it may be implemented on many different levels for both goods and services The Goods and Services Tax (GST) that was implemented in India significantly cut down on the ineffectiveness of the country's previous tax structure Real estate specialists say there is still potential for improvement in the GST regime, even though it has been in place for four years and the GST tax structure has undergone numerous adjustments in a short amount of time.

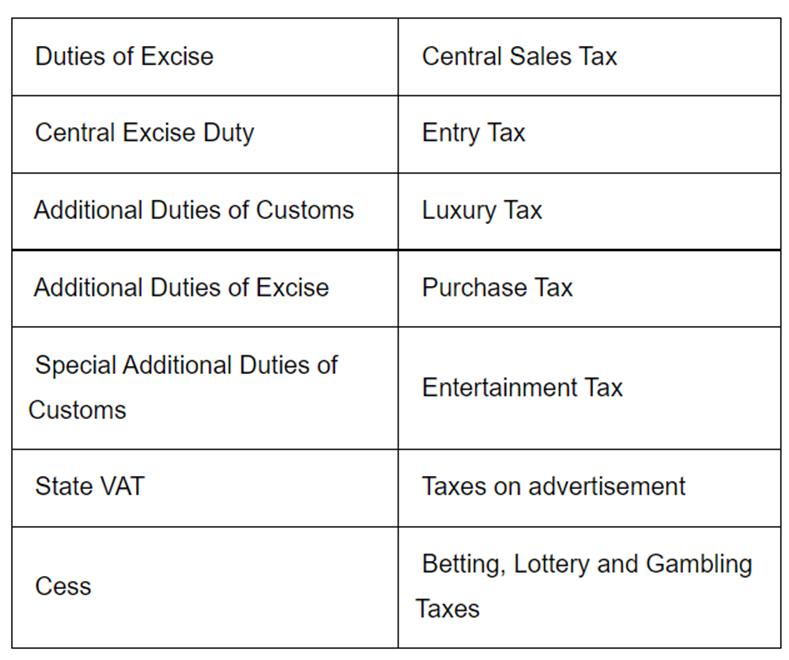

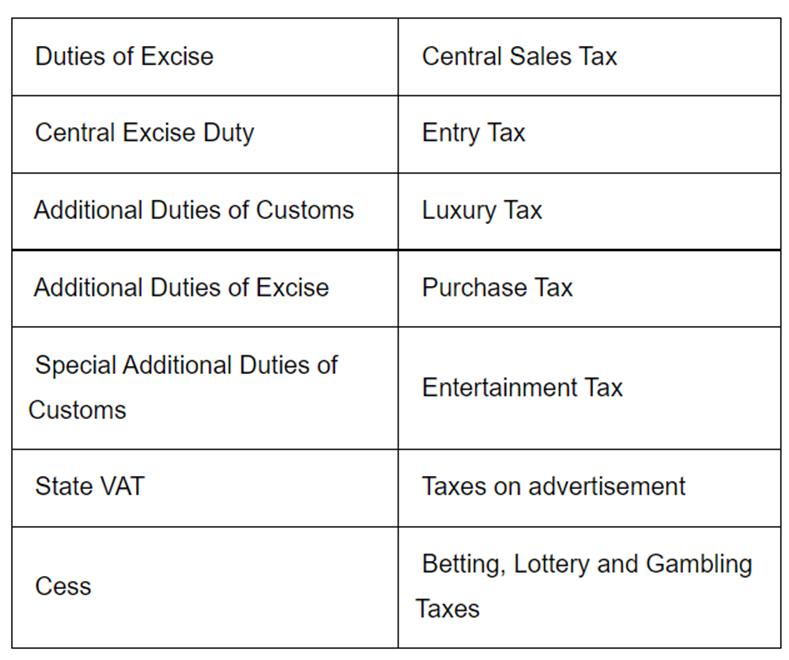

Application of Taxes Prior

to GST

Under the previous indirect tax system, several taxes were assessed and collected on goods and services. Taxes were levied by both the federal and state governments Each state had its own set of laws and taxes, most of which were VAT-based A Central State Tax was levied on interstate transactions at the same time The federal and state governments jointly imposed many other indirect taxes, including Entertainment, Octroi, and Local Tax. In other words, there was a sizable amount of tax overlap. Here is a list of taxes that were in place before the GST:

F I

V I S E

N S U P E R

G S T O N H O M E

N I V E S

A K NIVESHAK 19 Source: NOBROKER N o v e m b e r

H

Registration of Real Estate and Stamp Duty

State government fees like stamp duty and real estate registration have persisted even after the imposition of GST on apartment transactions These prices vary between states, as well as within a single state, among individual circles. While GST on a new flat purchase would only apply to under-construction buildings that are sold, stamp duty and registration fees will still apply to both already built and underconstruction properties across India in the GST era

GST on a flat's purchase

In 2022, buyers of flats and apartments in developments that are still under construction in India's megacities will have to pay GST. It should be noted that purchasing apartments in finished developments are not subject to the GST. A certificate of completion for a completed project has been issued by the relevant authorities GST for a flat purchase in 2022

Property Types GST rate till March 2019

Affordable Housing in Construction 8% With ITC

Non- Affordable Housing other than underconstruction

GST Rate from April 2019

1% Without ITC

GST on Maintenance Fees for Housing Societies

A flat owner is required to pay 18% GST on residential property if they pay their housing society at least Rs 7,500 in maintenance costs.

If housing societies or Residents' Welfare Associations (RWAs) collect Rs. 7,500 per month per unit, they must also pay an additional 18% tax on the total amount collected If a housing society's annual revenue is less than Rs 20 lakhs, they are exempt from paying the GST. Each member must pay more than Rs 7,500 per month in maintenance fees, and the RWA's annual revenue must be greater than Rs 20 lakhs in order for the GST to be imposed. Additionally, the government has said that the entire amount is subject to tax if each member's monthly dues exceed Rs 7,500

GST's effects on the housing market

12% With ITC

5% Without ITC

For Ready-To-Move in Properties No GST No GST

One of the biggest changes to the real estate industry has been the GST Customs Duty, VAT, Excise Duty, legal fees, service taxes, permission fees, and other costs are already covered by the developer, which complicates their tax procedures and burdens homeowners. Property tax was streamlined under GST. The real estate tax rate was raised to 12% under the new GST system, which also lightened the burden on homebuyers. Both property buyers and developers are impacted by taxes The tax rates were cut by the new GST rates, which were revealed during the 34th council meeting in 2019. The new GST was 1% for modest housing complexes and 5% for upscale residences

20 Source: MYGATE

N I V E S H A K

A N U B H A V K A T H A N B

Government policies played a paramount role during the COVID19 pandemic in the functioning of the economy and its financial institutions Supply chain disruptions, lockdowns and increasing unemployment were a few of the many problems that all countries faced Since every economy had its way of dealing with the crisis, it becomes important to analyze how these changes affected economic stability. Keeping this objective in mind, we dive into the policy response implemented by the Brazilian government while facing the pandemic

Effect of the pandemic

Economic activity in Brazil had already slowed down well before the pandemic hit Consumer confidence was low, and the policy rates were continuously reduced to induce demand The pandemic exacerbated the situation since Brazilian economy was hindered when both external demand shock and oil price shock occurred simultaneously. Closing of businesses reduced chances for spending, whereas projected and actual employment losses decreased consumers' proclivity

toward spending money By April 2020, consumer confidence further decreased by 28%. Spending had fallen significantly - restaurants by 59%, retail spending by 57% and tourism by 83%.

Issues faced

The Brazilian economy was exposed to many problems at the beginning of the pandemic that, included foreign reserves depletion, loss in tourism revenue, external debt issues, volatility in oil prices and exposure due to disproportionate dependence on China and the US. Lockdowns all around the world shut the manufacturing sector down, and trade between countries came to a halt Manufacturing and tourism sector were hit the hardest Roughly only 2.5% of Brazil's GDP was held in foreign currency The Brazilian Real started depreciating in January 2020. By May 2020, it lost 30% of its value against the dollar Unemployment rose from 11.8% in Q3 2019 to 14.4% in Q3 2020. The labor underutilization rate also increased from 24 3% in Q3 2019 to 30.6% in Q3 2020. Since a majority of Brazil's agricultural exports were to China, the US and the EU, disruptions in connectivity

NIVESHAK

D - 1 9

R A Z I L ' S R E S P O N S E T O C O V I

NIVESHAK 21

N o v e m b e r

had a deleterious impact on trade.

Fiscal policy changes

For businesses to implement a seamless transition to remote working during quarantine periods, the government introduced a package of temporary measures in late March 2020 that lasted from late March through July. With the expansion of the 'Programa Bolsa Familia', the government could reach and help 1.2 million families that were below the poverty line. By June 2020, the federal government had the states a first fiscal support package of R$37 billion ( 0 5% of GDP), the second package of R$60 2 billion(0 9% of GDP) and the third package of R$60 1 billion (0 9% of GDP) for debt suspensions or renegotiations. The government established a financial assistance programme that equalled 8.6% of the GDP to combat the situation. As a part of the fiscal response plan, the 2020 budget was reallocated to health spending and advances on expected incomes. Brazil enjoyed the increase in commodity prices since it gained more from its exports Soybean and sugar were predominantly exported

Monetary Policy Changes

Policy rate reductions were the monetary policy's response to the crisis Reduction in policy rate was made to induce greater money demand and thereby instill confidence in consumers' spending However, since the policy rate was already below the neutral level, given the economic slowdown in the previous few quarters, its ability to stimulate

spending in the economy was just partially successful Central Bank reduced the policy rate to a record low in June 2020. However, further monetary loosening would have proven less effective since the interest rate was already below the neutral rate Funding and liquidity support through FX swaps auctions, spot auctions, USD credit lines and auctions to reduce excessive volatility and provide a hedge.

Source: Bloomberg

The learnings

Brazil used a combination of fiscal and monetary policy to get the economy back on track post the pandemic Though the ability of the monetary policy to stimulate spending was limited, the fiscal policy response and reduction in policy rates played in a major role in getting Brazil out of the economic slowdown Efforts made to release liquidity and ease capital requirements, the sizable income transfer, and several other credit programs targeting small and medium-sized businesses were also vital By mid-2021, the Brazilian economy had returned to its pre-pandemic levels, supported by boom in terms of trade and robust private sector credit growth. Sustaining the recovery, however, will require further institutional reforms to raise labor utilization and productivity and foster private sector-led investment

INVESTED

I

22

STAY

N

V E S H A K

How to Play?

Below we have ratios shown for a group of companies within an industry These ratios are common amongst the industry as the business model or traditional practices. Based on these ratios and the description available, you have to guess what the industry could be from the options given Submit your answers for the same to niveshak iims@gmail com before EOD 1st January,2023

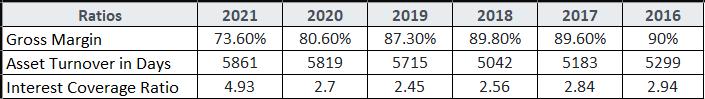

1In the above shown industry has a huge asset turnover ratios which signifies that the assets remains on the books and with the firm for a long period of time, while we can see that the there are high gross margins too for the same as the major cost for this firm does not arise from COGS, rather financing cost is a major component which reduces their gross margin by nearly half to provide the operating margin Guess the industry

a) Financial b) Aviation c) Capital goods

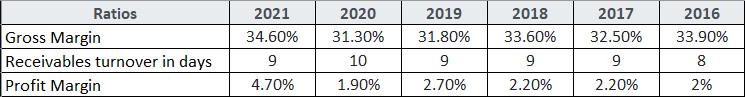

In the given industry, the gross margins are significantly low as compared to other industries as the cost to manufacture the goods is a major proportion of their costs, which further reflects in their low profit margins Their receivables turnover and activity ratios are low Guess the industry

a) Retail b) Defense c) Financial

L E T ' S F I N - U P G U E S S T H E I N D U S T R Y

NIVESHAK 23 N

v e m b e r 2

o

In this industry, fixed assets form a major part of their assets, while the same can be said for inventory of these firms again comprising a major part of their current assets The operating margins also remain low as they earn less profits from the sale of their actual products rather through after sale services. Guess the industry a)

In the above shown industry, the debtors days form the cash conversion cycle as there is no payables or inventory days. This indicates that the industry does not deal with tangible goods. Moreover, storage of inventory is not the concern of the companies operating in this industry While on the other hand employee cost is one of the major line items for the business Salaries becomes the major expenditure in their respective income statements.Guess the industry a) IT Services b)

Why ratio analysis is important?

Ratios of a firm which simplify the financial statements of a firm form an important part of analyzing their liquidity, solvency, and activity These help us understand how the firm has managed various key metrics during the year This can also be seen through a time series analysis to understand the trend. The liquidity ratios help us gauge the ability of the firm with respect to its current liabilities, while solvency ratios help us understand the leverage and capital structure of the firm and how capable the firm is to fulfil these obligations Most importantly, profitability ratios are used to understand the efficiency of the firm.

N I V E S H A K STAY INVESTED Want a digital copy? Don't worry! Scan this QR Code! 24

3

Retail b) Automobiles c) Aviation

4

Manufacturing c) Retail

ANNOUNCEMENTS Team Niveshak invites articles from participants from all colleges across India We are looking for original articles related to Finance and Economics. Participants can also contribute puzzles and jokes related to Finance and Economics References should be cited wherever necessary The best article will be featured as "Article Of The Month" and would be awarded a cash prize of ₹3000/- along with a certificate The runner-up article would be awarded a cash prize of ₹2000/- along with a certificate. INSTRUCTIONS Send in your articles to niveshak iims@gmail com Mail subject line must be "Article For Niveshak <Title>" Mention your Name & Institute Name along with the article Ensure that article has a word count between 1200 - 1600 Please DO NOT send PDF Files and stick to the format Number of authors is limited to 2 for each article Also certain entries which could not make the cut to the magazine will get featured on our website Microsoft Word Font: Times New Roman Size: 12 Line Spacing: 1.5 FORMAT ISSUE III • VOLUME XVI • NOV '2022