d e c e m b e r

We are delighted to present the December edition of Niveshak The US Fed maintained its hawkish tone, yet Indian markets had a mixed response NIFTY peaked at 18877 in the first week, yet there was no Santa rally in the second half as in the last trading month of the year; the index ended at around 18105. Not all was gloom, as the year ended positively on account of Manufacturing and Services PMI numbers reported as 57.8 and 58.5, respectively.

We begin the magazine with "The Month That Was" a segment covering the world's key financial and economic happenings This month we covered some interesting news on Reliance acquiring shares in Exyz, Tata motors' purchase in Gujarat, The Indian rupee falling to an all-time low, and much more. Ready, Aim, Rate hikes! was the motto of the Fed even after positive CPI numbers of November And so, this month's Cover story focuses on the December rate hike by the FOMC, which went against the market sentiment as expectations were moving towards

a lower rate hike and a lower terminal rate for 2023 The article also focuses on its spillover effects in other economies and their currencies, like India and the IT firms of the country.

In this edition of FinView, we invited Mr Vinod Keni, Managing partner at the India Angel Network With him, we explored various themes, including the funding winter, his learnings and experiences of being 30 years in the VC space, and much more.

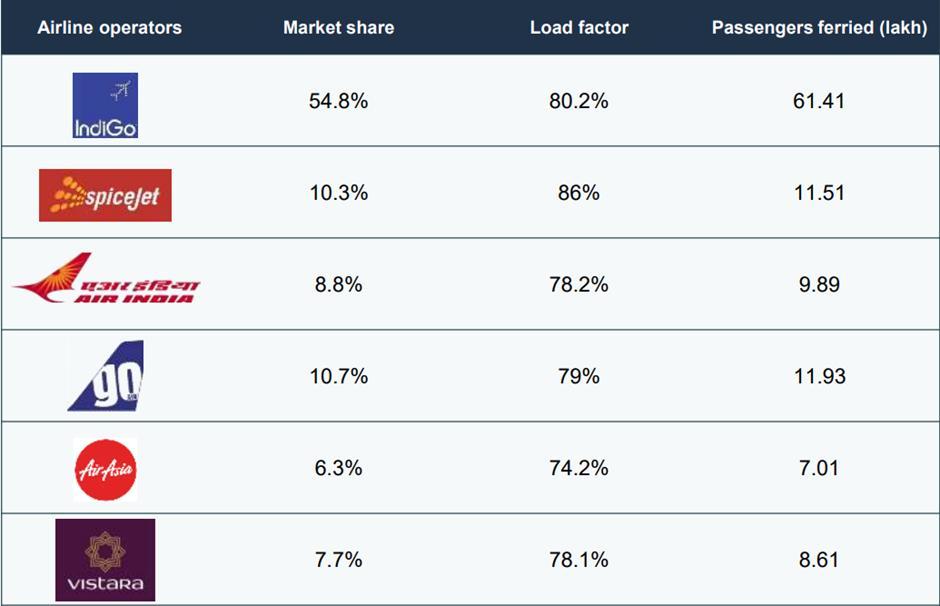

In the "Know your sector" segment, we explored the Aviation Sector Here we explored the development of the industry in terms of CAPEX expansions and traffic growth But our primary focus remained on the key government initiatives undertaken and some of the common key metrics used in the industry.

Vistara's merger with Air India became the theme of our Deals Brewery. It starts with a brief introduction of both companies. The section then dives into the intricacies of the deal, including the deal structure and strategic advantages for both. PS: Did you know that Vistara is just a brand name of airlines operated by the Tata and SIA group?

The "Fin Supervise" section takes a deep dive into the precious metal gold The article explores the numerous ways of investing in yellow metal (yes, there is digital gold and paper gold as well) and even the tax benefits one could avail on its gains.

"Anubhav Kathan," or learning from experiences, covers the fall of Reliance Communications. It coversthe journey from the golden

era to its tragic downfall and, at last, some learnings from the debacle.

We return with our trusty old crossword in the 'Let's FinUp' section. The game is simple, 13 clues and 13 answers based on various accounting topics. We would love to hear your thoughts, feedback, and ideas. Please feel free to reach out to us to let us know what you think!

We hope you derive something from this edition and stay safe and sound in these exciting times!

Stay Invested, Team Niveshak

All images, design, and artwork are copyright of IIM Shillong Finance Club © Finance Club Indian Institute of Management, Shillong

Disclaimer: The views presented are the opinion/work of the individual author and the Finance Club of IIM Shillong bears no responsibility whatsoever.

AVIATION SECTOR

Page 17-18

INVERTED YIELD CURVE

Page 19-22

AIR INDIA AND VISTARA

Page 23-24

A DEEPER DIVE INTO GOLD Page 25-26

THE FALL OF RELIANCE COMMUNICATIONS

Page 27-28

CROSSWORD Page 29-30

For USD 25 million, RIL subsidiary Reliance Strategic Business Ventures purchased a 23.3% share in Exyn Technologies Inc , situated in the US (about Rs 207 crore)

Exyn is one of the top providers of autonomous technology, which enables robots and drones to navigate challenging terrains without the use of GPS or other navigational aids

RIL already owns a majority share in the drone manufacturer Asteria Aerospace and the robotics business Addverb Technologies. The partnership and investment by RSBVL in Exyn will complement Reliance's strategic investments and activities in the fields of industrial safety and security, robotics, and drones while driving Exyn's product and technology development across a variety of application areas

Public sector banks' market share in loan offtake is being reduced by private sector banks, led by HDFC

Bank, ICICI Bank, Axis Bank, and Kotak Mahindra Bank.

According to the most recent data from the RBI, private banks have continued to outperform public sector banks and have raised their proportion of total loans from 37 5 percent a year ago to 38 4 percent in September 2022, up from 29.6 percent five years ago

According to the RBI, bank credit growth (year over year) increased further to 18 0 percent in September 2022 from 14 0 percent a quarter earlier and 5.8 percent a year earlier

The dollar soared on the U S Federal Reserve's hawkish monetary policy stance to contain inflation, making the Indian rupee the worst-performing Asian currency in 2022 with a decrease of 10 14%, its largest annual decline since 2013

The dollar index was on track to post its highest annual increase since 2015, while the rupee ended the year at 82.72 to the dollar, down from 74 33 at the year's end of 2021

T H E F I N A N C E B U L L E T I N

A rise in oil prices brought on by the crisis between Russia and Ukraine also hurt the rupee and resulted in India's current account deficit reaching an absolute record high in the third quarter of that year

A subsidiary of Tata Motors named Tata Passenger Electric Mobility (TPEML) said on Friday that it has obtained the necessary regulatory clearances for the acquisition of Ford India Private Ltd's (FIPL) production facility in Sanand, Gujarat, and that the deal will be finalized on January 10, 2023

The automakers signed into an agreement in August of this year to purchase the facility for Rs 725 7 crore, which includes the complete plot of land and building, all of the machinery and equipment used in vehicle manufacturing, and the transfer of all qualified staff.

The business said that because current capabilities are nearly full, the acquisition will free up an extra, cutting-edge manufacturing capacity of 300,000 units annually that can be increased to 420,000 units annually

Normally, small-saving rates follow yields on benchmark government bonds, but during the past two years, despite changes in G-sec yields, the interest rate adjustments have not closely followed the yield changes.

The reference period for small savings rates for the SeptemberNovember quarter saw an increase of around 15 basis points in the yield on five-year government securities

The National Savings Certificate, one of the most popular fixed-income securities, will now return 7% as opposed to 6.8% previously.

The Finance Ministry raised the interest rates for a few small savings programmes by 20-110 basis points for the forthcoming JanuaryMarch quarter on Friday in response to rising yields on government assets and interest rates

Although the Employees' Provident Fund Organization (EPFO) released a circular on Thursday regarding a higher pension for a particular type of members, information for other members who departed after the deadline of September 1, 2014, or those who began service before it, is still expected.

Board members and experts from the retirement fund organization claim that the circular is silent on a wide range of other concerns connected to the Supreme Court ruling from November.

According to experts, the SC decision rendered members who were EPS members as of September 1, 2014, eligible for the greater pension payout, although EPFO has stated nothing about it

N I V E S H A K‘EPFO guidelines on higher pension still silent on many issues’

When the US sneezes, the whole world catches a cold, which is quite a common phrase and has been confirmed for most of the instances the US economy has faced headwinds A similar trend was expected this year when the USA faced peak inflation in the first year of 2022 This trend can be seen since 2021 as the economy was opening There was much free liquidity within the economy when the country was reopening faster than other countries, which were still under the pandemic, underscored by the supply chain.

Fall disruptions left a lot of cash and lesser goods to buy, pushing the prices upwards.

Post this, the Russian Invasion of Ukraine was another event that pushed inflation to such record levels as gas prices touched record highs, leading to a rise in housing, food, and transportation costs

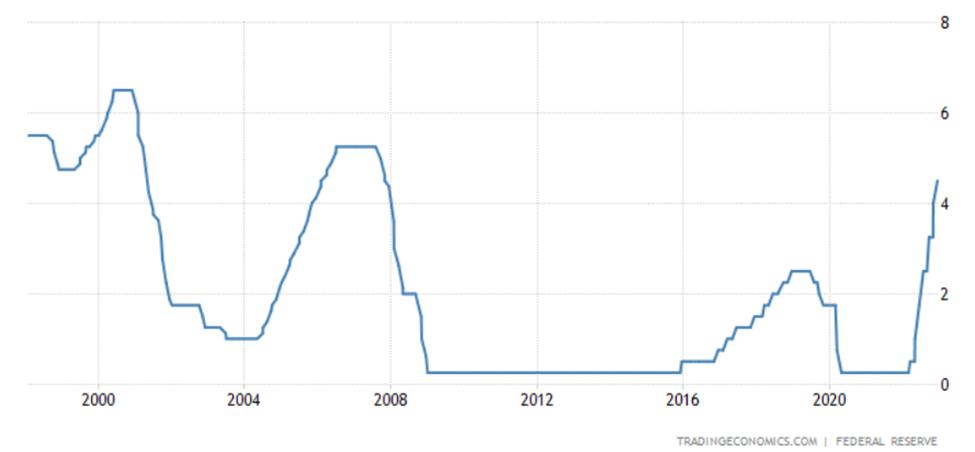

Post these, the Fed was quick in their policy tightening, increasing the rates at a record pace. This contrasted with their strategy at the beginning of the year, when they were still buying.

Inflation Rates in USA from 2002-2022

W H E N T H E U S S N E E Z E S

Bonds and helping the economy stabilize by infusing liquidity

As was the pattern during covid when the Fed reduced the rates by 150 basis points in march 2020.

The fed changed this quickly and started increasing the fed rates. They began with a 25-basis point increase but later ended with 75basis point increases for four consecutive FOMC meetings post the 50-basis point increase in May 2022

These measures are similar to what the central banks of other countries were doing. Although they were all pushed to take such measures due to the increased liquidity and commodity and energy prices, there were also specific issues that led them to take such measures

As we saw in the Cover story of the October edition of Niveshak, the BOE had to increase rates post their Mini-budget instance Alone In 2022, the BoE has raised the interest rates by 325 basis points

and the latest hike was of 50 basis raising interest rates to 3 5% due to double-digit inflation pressures over the cost of living, putting the country into recession.

In India, RBI was also on the path of increasing rates but on a very different trajectory compared to the USA. The rate hikes made by RBI went highest to only 50 basis points. 225 basis points have raised the rates since May 2022

The repo rate stands at three years high, and continuously rising retail inflation and rupee depreciation is to be given the majority of the credit

The GDP projections have been lowered by RBI to 6.8% from the earlier 7%, keeping in mind the global spillovers – geopolitical slowdown, tensions, global rate hikes, and market volatility. Along with this, we saw that the US dollar index has strengthened, leading to a fall in currencies of developing economies, India being one of the worst hits from the same

Interest Rates in USA over the past 25 years

Along with this, we saw that the US dollar index has strengthened, leading to a fall in the currencies of major developed and developing economies

India is one of the worst hit by the same

economies also underscore this. The revenue for these firms is dependent on like countries from Europe, which again poses risks

The ECB has stated that inflation is expected to be on a falling trend post-energy prices ease for their economies It would fall to 3 6% by the end of 2023 and reach its target of 2% by 2025

Along with this, the current conditions will slow the growth to 3.4% in 2022 and to 0.5% in 2023. Hence, The stock prices remained volatile for the year and showed a positive start.

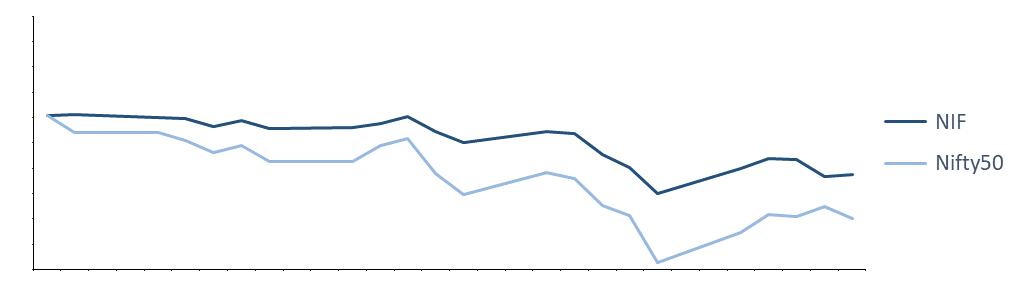

IT stock performance 2022

Source - Economic TimesThis supports the notion that the US dollar index It has been showing to have a positive correlation with the US CPI

Source - Economic Times

Source - Economic Times

The rise in US inflation impacted not only INR but also IT companies as they have a huge dependence on foreign countries for their revenue. 25% of TCS’s, 50% of Infosys’s, and Wipro’s revenue come from America, and these numbers proved that IT firms would not see the boom they witnessed recently

Weak expectations with the other

Source - Investing com .For 2023, Investors and analysts do suggest that the stock would depend on many changes, like easing of the recession fears in foreign economies; a stable and growing order book for these firms is also expected, which is supported by a growing need for firms to expand their digital/online presence Another factor to look out for would be the high layoffs during 2022, which should show a falling trend to prove that the worst sector is over

The efforts taken by the fed were

beginning to show results as inflation was on a declining trend from its peak in June 2022. The most significant of which was for the month of November when the market and economists were expecting the inflation for the month to be 7.3%, but the actual stat came out to be 7.1%. This instilled a lot of hope amongst the people that the qualitative tightening by the fed was showing results and that inflation was on a falling trend

Hence for the December meeting of the FOMC, the market was expecting the fed to announce that the tightening would slow down post these results Hence a 50basis points increase was expected to push the rate to the 4.25% to 4.5% range, which will also be the highest since 2007.

But the December meeting of FOMC was not as pleasant as people had expected. Powell had announced a 50-basis points increase as expected by the market He also stated that 2023 would witness another 75-basis point increase in installments expected 25 basis points, a rise in unemployment, and US GDP to grow at a nearstalling rate These hawkish statements had warned the market that the worst is not yet over and

Source - Bloomberg

Source - Bloomberg

efforts would still be required to tame inflation which remains the priority of the policymakers

The S&P 500 fell nearly 2.5% on the 15th of December, while the nifty also fell almost 1 5%; a similar fall was in mainly all sectors, but the Nifty IT also dropped 2 11% and went on to lose for the next two days

The message was made clear by Powell and other central banks like BOE, that the rates would still be hiked in the coming year as the worst is not yet over, and cautious tightening is still required before expecting any soft landing or easing.

Could you please share how your three decades-plus journeys across various VC functions and work cultures have been? Please share your experiences on numerous challenges you might have faced, which young aspirants like us can imbibe and learn from.

So of the three decades, I have spent a very significant portion of that working with startups & early-stage businesses, including my own start-up. My perspective is that compared to large organizations, or organizations that have been fairly well established, start-ups are a lot more chaotic and may not have formal structures or processes It's very unstructured with much uncertainty, and decision-making, under those circumstances, is also going to be a challenge as you may not necessarily have much data to assist with decision-making as the business is too early to have data. So I think it is a challenge but is also an opportunity to actually be able to thrive in that kind of unstructured or chaotic

environment because it actually sets you up well to be able to perform and interact and work in any situation. I don't think a chaotic environment exists anywhere other than in a start-up or early-stage business. That's one The second I think which is very important is that you get to work with a very diverse set of people And I think I've been fortunate enough, because of work both here in India, as well as in the US, to have worked with a very diverse set of people This has taught me the power of collaboration, diversity in thought, importance of communication and ability to influence, and being able to really take the entire team together, which is very important, It's a shared vision, shared values, shared principles, which are really important to actually understand I also think when you're joining a company, it was not just a question of compensation, though it an important one. But when we actually start thinking about other things, the culture of the organization, the culture of the people that I'm going to be working with, all of those become important because you spent a fairly long period of time with

them, you also want to make sure that your own principles and your own value systems align with the value system and the principles that the company has

India’s stock market outperformed other emerging markets (EMs) and developed markets (DMs) despite FII selling. But with China opening up and other countries like Vietnam gaining momentum, do you feel this trend is likely to continue?

See, I think even though there were FIIs actively participating in the market, one of the things that also happened over the last three or four years was the fact that there was a fair amount of domestic savings and domestic money, which was also getting into the market That's evident from the fact that the number of accounts and retirement accounts that got set up with all these New Age brokerages, right? Look at the growth of Zerodha, Angel One & Groww So there was a fair amount of domestic money that was also coming into the markets.If you really look at FIIs, a lot of them were exiting the markets They were net sellers in a lot of sectors within the public markets in India But a lot of that was actually being taken by Indian investors and Indian capital Now, I think that is also going to slow down a bit, but there is still a fair amount of capital, at least domestically, that's still going to feed the markets. And plus, because of the fact that it's still very attractive market to invest in there will definitely be a lot of overseas capital that will find its way into India I mean, irrespective of China opening up and all of that

happening, India will still attract a fair amount of capital to its public markets.

The pressure on margins and demand depression continue to loom over the Consumer Durables companies. What is your take on this FMCG, FMCD, white goods segment? Do you see this underperformance likely to continue or that it is just a temporary patch?

Yeah, I think some of the margin pressures will continue to be there, especially where you will see some of the pricing issues and the pricing pressure when companies cannot necessarily pass all of that on to the consumer. So, some pricing pressure will continue to be there And plus, there is competition, right, which is fairly intense? There are new players like Reliance that is getting into the FMCG market. This is actually going to completely change the dynamics for existing FMCG players as well So from that perspective, especially on consumer goods and white goods I think we'll probably see a little bit of a price hike, especially with the budgets and everything else going on But my feeling is the pressure on pricing and the pressure on margins will continue to be there I don't think it's going to go away anytime soon. They may probably be able to pass on some of that to the consumer, but at the same time, considering the current situation worldwide.I mean, whatever happens across the world will also happen in India. We're not completely insulated from it Indian consumers are value driven and price sensitive in

in my opinion So, they will not necessarily pay higher prices which offers innovative ways of addressing price rises by the companies From this perspective, I think you'll still see some margin pressure and industries continue to see pricing pressure

I do expect this budget to have a fair number of progressive measures. There are always expectations about what the budget will bring My expectation is this will probably be a fairly prudent budget, considering the global environment Also, I think there is definitely going to be some level of changes/rationalization on income tax, considering the fact that elections are also coming close. And this will probably be the final budget before the elections So, from that segment, I think this is going to be a fairly prudent one. But, I think there will definitely be a fair amount of incentives and a fair amount of SOPs for manufacturing, especially considering the fact that there is this whole global China plus one policy, and India wants to definitely take advantage of that.There is also, I think, going to be a fair number of incentives on the infra front Because that can help with positioning the government as being prodevelopment and also job creation, especially in a situation where there is likely to be a global slowdown And I expect that everybody wants to see additional

tax benefits, especially on the income tax level, and I'm expecting the same, keeping inflation in mind But at the same time, you want the bottom end to actually be able to get relief and incentives too From a VC perspective, there are a couple of things One is how Esops get taxed. Right now, Esops get taxed from the time they are exercised, but we would rather like to see them getting taxed at the time of sale. Because if you exercise at the time, it puts a huge burden on the employee, and the employee in all of these cases doesn't necessarily have the money to buy this So I think, we definitely want to see that happen. And then the second one is, capital gains on unlisted shares I mean, we all invest in unlisted shares as venture capital And we want to see that being on par with what it is for the listed stocks. In listed stocks, the capital gains tax is 10%, and unlisted is 20% We would like to see that on par. Because if that happens, then there is a lot more domestic capital that can flow into this industry and support a lot more startups and entrepreneurial activities.

We have seen conflicting reports regarding the funding winter. We see the obvious effects in startups with stalled expansion and liquidity crunch, but several opinions have been that this slowdown is a positive sign. What is your opinion on this phenomenon? Do you see more pros than cons?

So I see this as not really a funding winter but a normal course of funding.And what is happening no is what has always

With the union budget coming out soon, what are your expectations from the budget? Do you expect some progressive measures?

happening earlier as well. The last couple of years saw a rush of capital into startups, which created the notion that it was normal. It was more of an aberration We saw similar instances during the business cycles of the 90s, 2000 and in the mid of 2004 and 2000 From 2006 to 2008, we saw them again. So you keep seeing these cycles. And every time there is cheap capital available, where interest rates are so low, there is definitely pressure on people to deploy capital in either profitable or even riskier asset classes. And that's where sometimes it ends up coming into venture capital Now, in the current environment, this change has actually moderated the expectations because now, I think valuations have come down and become a lot more reasonable. Expectations from entrepreneurs have also become reasonable and realistic. You can't necessarily just keep saying, I'm going to throw money at any idea or a problem, and I'll actually have a solution You need to be able to build a viable business solution that can actually make money. So, I think from that perspective, this is a good reset It's actually a good way to be able to really let people take a step back and think about how you really build a business that is more sustainable. In all of these processes, what happens is companies that are not necessarily efficient, don't really have business models, don't necessarily have product market fit will find themselves. Investors will always be looking for companies that have a sound and sustainable business model. Investors look at these scenarios as an investment opportunity

since the companies will now be available at a fair valuation post the correction.

The aviation industry in India has benefited from an increase in middle-class households, intense competition amongst low-cost carriers, significant construction of infrastructure at major airports, and favorable governmental frameworks for the industry Seventy-nine million individuals traveled to, from, or within India in 2010 By 2017, that had doubled to 158 million; by 2037, this figure is projected to reach 520 million The Indian aviation sector is expected to multiply due to increased air passenger traffic. Indian airlines have made orders that are significant for aircraft to meet the current and anticipated growth in demand for commercial air travel. By 2038, it is anticipated that the country’s fleet of aircraft will have grown fourfold to about 2500 aircraft

The nation currently has 131 functioning airports, comprising 10 custom, 92 domestic, and 29 international airports Thus, even expanding airport infrastructure to accommodate India’s growing demand for air travel has become essential.

The number of airports has increased from 74 to 141 in the past eight years (including helipads and waterdromes) are expected to reach 200 in the next four to five years. By 2026, the Indian government plans to invest $1 83 billion in the construction of airport infrastructure. With a 3.1 economic multiplier and a 6employment multiplier, the sector has a significant impact on the economy of India

1. The Ministry of Civil Aviation is given a budgetary allocation of ₹ 10,667 crores (US$ 1 38 billion) in the Union Budget 2022–23.

2. Amounts totaling ₹ 601 crores (US$ 77 52 million) have been awarded to the RCS (Regional Connectivity Scheme) UDAN programme, which aims to promote regional aviation connectivity.

3. Mr. Jyotiraditya M. Scindia, Minister of Civil Aviation, requests collaboration between the Central and State Governments to construct 16 new airports in Madhya Pradesh, Chhattisgarh, Uttar Pradesh, Rajasthan, and Maharashtra to carry out the PMGati Shakti vision better

T H E A V I A T I O N S E C T O R

4. Mr. Narendra Modi laid the foundation stone for the C-295 Aircraft Manufacturing Facility in Vadodara, Gujarat, in October 2022

5. As of October 18, 2021, no capacity restrictions will apply to airlines operating domestic flights, according to the Ministry of Civil Aviation (MoCA).

6 Under the RCS-UDAN (Regional Connectivity Scheme - Ude Desh Ka Aam Naagrik) programme, the Union Minister of Civil Aviation, Mr Jyotiraditya M Scindia, essentially signaled the start of the first direct flight between Shillong and Dibrugarh in October 2021.

7. The Ministry of Civil Aviation introduced the Krishi UDAN 2 0 programme in October 2021 The plan calls for financial support and additional incentives for moving agricultural goods by air

Source:IBEF.org

In FY 2022–23, India’s passenger traffic totaled 150,044,013 passengers for April-September 2022

Source:IBEF.org

Airports in India estimate that domestic passenger traffic will reach 166.8 million in FY22, while international passenger traffic will reach 22 1 million

Freight traffic increased at a CAGR of 2 52% between FY16 and FY22, rising from 2 70 MMT to 3 14 MMT In FY 2022–23, there were 1.6 MMT of freight for April-September 2022 By FY40, India’s airports may handle 17 MT of freight traffic. There were 1,757,112 aircraft movements in FY22, while 1,207,279 aircraft movements were made in FY 2022–2023. (AprilSeptember 2022)

Passenger Revenue per Available Seat Mile (PRASM)-By dividing passenger revenue by available seat miles, the passenger revenue per available seat is computed The combination of load factor and passenger yield also equals PRASM

Passenger Revenue per Available Seat Kilometer (PRASK)-By dividing passenger income by the number of available seat kilometers, the passenger revenue per seat kilometer is derived The combination of load factor and passenger yield is also known as PRASK

Could anyone have predicted the Covid-19 pandemic back on 23rd May 2019? While that might have been impossible to do, interestingly enough, the economic recession that followed was predicted exactly on 23rd May by an unusual predictor of economic downturns On this day, the yield curve inverted in the United States with the yield on 10-year Treasury bonds falling below the yield on 3month Treasury bills. The yield curve is a graph that plots the yields of similar-quality bonds against their maturities. In normal economic conditions, yields on longer-term bonds tend to be higher than yields on shorter-term bonds, resulting in an upward slope of the yield curve This is because investors demand higher yields to compensate them for the increased risk and uncertainty of holding a bond for a longer time period However, in some cases, the yield curve can invert, meaning that yields on shorter-term bonds are higher than yields on longerterm bonds. The yield curve has inverted several times in the

recent past, and each time it has had a significant impact on the economy, most notably in 2000 and 2006 The inversion in 2000 preceded the dot-com bubble burst and the recession that followed The inversion in 2006 preceded the housing market crash and the Great Recession The yield curve has also inverted prior to the recessions of the early 1980s, early 1990s, and early 2000s. In each case, the inversion was followed by a recession within the next two years.

1990 - 1991 Recession

First day of yield curve inversion: May 24, 1989. Last day of inverted yield curve: August 25, 1989

Duration of yield curve inversion: 3 months Extent of inversion at peak: 35 basis points. 3-month yield at peak: 8 50% 10-month yield at peak: 8 15%

Start of the recession: July 1990 Time Lag between inverted yield curve and recession: About 13 months.

T H E I N V E R T E D Y I E L D C U R V E

A R T I C L E O F T H E M O N T H

B Y A N E K A N T J A I N

I I M K O Z H I K O D E

First day of yield curve inversion: July 7, 2000.

Last day of inverted yield curve: January 19, 2001

Duration of yield curve inversion: 6 months.

Extent of inversion at peak: 95 basis points

3-month yield at peak: 5.87%. 10-month yield at peak: 4 92%

Start of the recession: March 2001.

Time Lag between inverted yield curve and recession: About 8 months.

First day of yield curve inversion: July 17, 2006.

Last day of inverted yield curve: August 27, 2007.

Duration of yield curve inversion: 13 months

Extent of inversion at peak: 64 basis points.

3-month yield at peak: 4 50% 10-month yield at peak: 5 14%

Start of the recession: December 2007

Time Lag between inverted yield curve and recession: About 18 months

First day of yield curve inversion: May 23, 2019.

Last day of inverted yield curve: October 10, 2019

Duration of yield curve inversion: 4 and 1/2 months.

Extent of inversion at peak: 52 basis points 3-month yield at peak: 1.99%. 10-month yield at peak: 1 47%

Start of the recession: February 2020.

Time Lag between inverted yield curve and recession: About 9 months.

Predicting potential recessions aside, the inversion of the yield curve can also have significant impacts on the debt and equity markets. When the yield curve inverts, it typically means that long-term interest rates are lower than short-term rates. This can be a sign of a lack of confidence in the long-term economic outlook, as investors are willing to accept lower returns on their long-term investments

d e c e m b e r

The inversion of the yield curve can have significant impacts on the debt market. When the yield curve inverts, it often signals that investors are expecting a slowdown in economic growth and, as a result, demand for lower-risk debt instruments such as government bonds may increase. This can lead to a decrease in yields on these instruments, as investors are willing to pay a premium for the perceived safety of government bonds At the same time, demand for higher-risk debt instruments such as corporate bonds may decrease, leading to an increase in yields on these instruments. This can create a challenging environment for companies looking to borrow money, as they may face higher borrowing costs at a time when economic growth is slowing The inversion of the yield curve can also have implications for the creditworthiness of companies, as investors may become more cautious about lending to companies that are perceived to be at higher risk of default. This can lead to a tightening of credit conditions and make it more difficult for companies to access the capital they need to fund their operations

In addition to the impact on developed economy debt and equity markets, the inversion of the yield curve can also have significant consequences for the equity markets of developing economies This is because developing economies often rely

heavily on foreign investment, particularly in the form of debt. When investors perceive increased risk in the developed economy bond markets, they may be less likely to invest in the debt of developing economies This can lead to a decline in the value of developing economy equities, as investors reduce their exposure to these markets Furthermore, if the inversion of the yield curve is accompanied by a recession in the developed economy, this can lead to a reduction in global trade and demand for the exports of developing economies. This can further weigh on the performance of developing economy equity markets.

One example of the impact of an inverted yield curve on developing economy equity markets is the outflow of foreign portfolio investment (FPI) from India in 2019 In August of that year, the yield curve in the United States inverted, with the 10-year Treasury yield falling below the 3month yield. This was seen as a potential sign of a recession in the United States, which led to a decline in risk appetite among global investors. As a result, FPI outflows from India increased,

Indian net foreign equity investment

with investors selling off Indian equities and debt. FPI outflows from India reached a peak of $4.4 billion in September 2019, compared to an average of $1 7 billion in the preceding months The outflows were largely driven by concerns about the global economic outlook and the impact of the inverted yield curve on risk assets This had a negative impact on the Indian equity market, with the BSE Sensex index falling by more than 7% during the month of September.

The yield curve is reaching a depth of inversion not seen for 40 years, this is being considered a strong indication of the US and the global economy heading toward a recession Fear of the predicted recession has kept global equity markets volatile and central banks

cautious about continuing the policy rate hikes. While an inverted yield curve is not a guarantee of a recession, it is worth noting that every recession in the past 50 years has been preceded by an inverted yield curve The inversion of the yield curve is a complex and nuanced phenomenon that has significant implications for the economy and financial markets. Hence, it is important for policymakers, investors, and market participants to pay attention to the shape of the yield curve, as it can provide valuable insight into the direction of the economy. While the future might look gloomy, it is said that risk and opportunity walk hand in hand Just Like Covid-19, the inversion of the yield curve too leaves us hoping for a false positive

Tata Sons chairman N Chandrasekaran said: “The merger of Vistara and Air India is an important milestone in our journey to make Air India a truly worldclass airline. We are transforming Air India, with the aim of providing great customer experience, every time, for every customer " According to Chandrasekaran, as part of the change, Air India is focusing on expanding its network and fleet, overhauling its client proposition, and improving safety, reliability, and on-time performance.

Air India is the national airline of India, with its headquarters in New Delhi. It is now owned by Talace Private Limited, a Special-Purpose Vehicle (SPV) of Tata Sons, following the sale of Air India Limited by the Government of India Air India operates 102 domestic and international destinations with its fleet of Airbus and Boeing aircraft In addition to its hub at Indira Gandhi International Airport in New Delhi, the airline maintains a number of

target cities throughout India. With an 18.6% market share, Air India is the largest foreign carrier operating out of India Air India serves over 60 international destinations across four continents On July 11, 2014, the airline became the 27th member of Star Alliance

Vistara is the brand name of the full-service airline owned and operated by Tata SIA Airlines Limited, which has its headquarters in Gurugram, and its primary hub located at Indira Gandhi International Airport. On January 9, 2015, the carrier, which is a joint venture between Tata Sons and Singapore Airlines, began operations with its first trip between Delhi and Mumbai This flight was the carrier's inaugural flight By June of 2016, the airline had transported more than two million passengers As of May 2019, the airline has a 4 7% market share of the domestic carrier market, which places it as the sixth largest domestic airline. The airline has a fleet of aircraft consisting of Airbus A320, Airbus A321neo, Boeing 787-9, and Boeing

A I R I N D I A & V I S T A R A

737-800NG, and it services a total of 34 destinations

Singapore Airlines (SIA) and Tata Sons have reached an agreement to combine Air India and Vistara into a single airline As part of the deal, SIA would receive a 25 1% interest in the new combined company for an investment of Rs 2,058 5 crore ($250 million) in Air India

This 25 1% interest will be in an enlarged Air India group, which would include Air India, Vistara, AirAsia India, and Air India Express. The merger of all airlines is expected to be finalized by March 2024, subject to clearance from the relevant regulatory authorities. The firm has already begun the process of combining Air India Express and AirAsia India into a single company that will offer affordable flying options This new company will operate as Air India "SIA aims to completely fund this expenditure with its internal cash resources, which as of September 30th, 2022, were S$17.5 billion." SIA and Tata have both indicated that they are willing to take part in any additional capital injections that may be necessary throughout the fiscal years 2022/23 and 2023/24 in order to fund the growth and operations of an expanded Air India "Based on SIA's 25 1 per cent stake postcompletion, its share of any additional capital injection could be up to Rs 5,020 crore ($615 million), payable only after the completion of the merger," SIA said in a statement. "Any additional capital injection would

be payable only after the completion of the merger "

SIA will instantly acquire a strategic position in a business that is between four and five times more significant in scale compared to Vistara as a result of this deal, which will both strengthen its cooperation with Tata and bring the transaction to a successful conclusion. "The combination would further reinforce SIA's multi-hub strategy and allow it to continue directly competing in a big and rapidly expanding aviation market," the airline stated "SIA's footprint in India would also be strengthened due to the merger "

As a result of this merger, Vistara will have the opportunity to strengthen our partnership with Tata and to take an active part in an exciting new chapter of the aviation market's expansion in India. They are willing to collaborate to support Air India's reform initiative, unleash its immense potential, and return it to its position as a premier airline operating on the international stage The announcement included an excerpt that mentioned Goh Choon Phong, the Chief Executive Officer of Singapore Airlines

The combination of Air India with Vistara is a significant step forward in their efforts to transform Air India into a legitimate contender among the best airlines in the world. They say that they are working to improve Air India with the goal of offering excellent service to each and every one of their customers, no matter when or where they fly

Gold with the chemical symbol Au means Aurum or “Shining Dawn ” Since ancient times due to its noncorrosion properties, gold was considered a symbol of power and immortality Even today, it is one of the most preferred investments in the world Beyond its uses in jewellery and financial exchange, the yellow metal finds its application in many domains, namely dentistry, aerospace, and even the kitchen.

its price reflecting global sentiment Also, since it has a weak correlation with other asset classes, gold acts as an excellent portfolio diversifier

But for a conventional investor, safety, liquidity, and returns are of prime importance, and Gold seems to check all three boxes. In times of uncertainty, gold is considered a safe haven for investments because of its inflation-beating capacity (in long-term horizons). Now consider the liquidity perspective. Gold is ideal because it is easy to carry and sellable anywhere A Jewellery dealer, a pawn shop, local coin shops, anyone, and everyone, recognizes the value of the gold and is a potential buyer.

(1971-2022)

Source : Paisabazaar

Gold is a unique asset. It is considered a valuable commodity; thus, it isn’t tied to a particular country. But on the other hand, gold behaves like a currency, All numbers are denoted in percentages Source Statista

F I N S U P E R V I S E

A D E E P D I V E I N T O G O L D

There are different gold investment methodologies. The conventional way would be to own physical gold, and while it has the advantage of easy maintenance and minimal paperwork, there are other modern ways

One of the safest modern ways of investing is Sovereign Gold Bonds SGBs are digital gold bonds (i.e., government securities denominated in gold grams) offered by the Reserve Bank of India on behalf of the Government of India and pay an assured fixed interest rate of 2.5% annually.

There are also gold mutual funds that invest in gold assets (i.e.,99.5% pure gold bullion and companies involved in gold mining) Similar is the case with gold ETFs, where we purchase a proportionate amount for the value of gold Gold ETFs are listed on the BSE/NSE website and can be traded anywhere in PAN India with a management/brokerage fee

Because of their direct gold dependency, both SGBs and Gold ETFs have complete holding transparency. Furthermore, investments could be made for as low as 1 gram.

Another popular form of investment is the derivatives market which includes gold options and futures Apart from hedging, gold derivatives could also be utilized as tools of speculation. However, you require a separate commodity and DEMAT account for option trading.

The tax angle varies across different modes of gold investments Simply whatever maybe the assets, gold attracts capital gain taxes (i.e., whether it is short-term or long-term). Take SGB,s for example Any gain on the maturity of these bonds (i e after 8 years) is considered tax-exempt However, an early redemption after 5 years would amount to a 20% long-term capital tax If these bonds were to be traded on the secondary market and sold within the 36-month range, they are taxed based on an individual’s tax slab Similar is case with ETF's

Married Woman 500g

Unmarried Woman 250g

Men(irrespective of marital status) 100g

Source:Outlook IndiaThe rules differ for the sale of physical gold and gold derivatives. However, there is a silver lining. Gold long-term capital gains can act as tax shields under sections 54E and 54EF of the Income Tax Act.

Gold has been an inconsistent inflation hedge sometimes great but other times, the prices have proved to be just as volatile as others So, it might make sense for some investors, but ideally, any investment decision, whether it be gold, or any asset or debt class should fit into your overall strategy.

N I V E S H A KReliance Communication Ltd (RCom) was a part of the business Anil Ambani got after he broke away from Mukesh Ambani in 2006. Although RCom was seen as a leading player in the telecom industry for many years, sectoral stresses such as high price wars, heavy debt, and plummeting profitability that impaired India's telecom sector also took a toll on RCom This also forced RCom to shut down its wireless operations in 2017 From nearly Rs 25000 crores in 2009-10, its debt increased to Rs. 47000 crores in 2017, forcing it into bankruptcy

Long before Jio, when millennials were mere children, Reliance Infocomm completely disrupted the telecom sector in India When its competitors were charging anywhere between Rs 4-6 per minute, even for incoming calls, RCom offered them free with a Rs 500 handset. The company also hired Indian cricketer Virender Sehwag with a catchy 'Karlo Mutthi Me Duniya' jingle. RCom was majorly in the CDMA market, with 20% of the market share.

Though it enjoyed a higher market share in the CDMA segment, its share in the GSM segment was merely 3%. Mukesh Ambani came up with the 'Monsoon Hungama' scheme. The scheme offered devices with voice and data at a mere Rs. 501. This forced Reliance Infocomm to write off Rs. 450 crores of bad debt and disconnect 10% of its subscribed user base. Anil Ambani still took the firm on a roll and took some swift action as he decided to shift his bets to the GSM segment and laid out the services in 12 months In December 2007, RCom launched GSM services post an investment of Rs 13980 crores He grabbed users through an aggressive pricing strategy (60% cheaper than the rivals) and had an ambitious target to reach 100 million users. Seeing an opportunity in 3G, RCom entered the segment with a bang when it shelled out Rs 8500 crores to buy 3G spectrum in 13 circles, including Delhi and Mumbai The gamble seemed to be working fine, but the first signs that competition was taking a toll were evident during the dispensation of new licenses that doubled the

number of players to 14 overnight. The new players aggravated the price wars and squeezed margins for all. In 2012, RCom lost its No. 2 position to Vodafone and moved further down to No. 4 in 2016, and it was clear that its grip on the market was getting eroded The 2G scam and the CBI probe after the Supreme Court cancelled many licenses also wreaked havoc A lot of time and resources, which were to be utilized for the business, were wasted on the case Another reason for the slow decline was the growing debt burden without a commensurate increase in income. A reason for taking hefty loans other than investment in the network was the price of the spectrum, where the base price was kept very steep. Nearly half of the company's debt in 2010 was to buy the spectrum Not only did the debt balloon from Rs 25000 crores in 2010 to Rs 45000 crores but the net debt to EBITDA ratio also doubled With this, the ability to make investments, especially in 4G, was stymied It tried to find solutions - one of which was the merger deal with Aircel. By October 2017, this deal also fell off, citing regulatory delay and opposition from some creditors, and this further impeded the efforts to pare the debt.

Reliance Jio's entry into the telecom sector disrupted the market completely with its pricing, innovation and investments Its entry floored giants like Vodafone and Idea, who have since struggled to get back their subscribers. RCom, which was struggling to stabilize its debt ratios, posted a loss of Rs. 984 crores in the

fourth quarter that ended on March 31st, 2017 Reliance Jio brought in more than 100 million subscribers in 6 months. On the other hand, RCom was losing subscribers continuously since they were not able to match Jio's prices Eventually, RCom was forced into bankruptcy court in

A few reports mention RCom's inability to sell assets at the right time. In 2015, Tillman and TPG made an offer of over Rs 30,000 crore for its tower and fibre assets, but when it struck a deal with Jio, the assets were only worth Rs 8,500 crore Similar to this, Sun TV allegedly offered Rs 2,500 crore for a 26% share in RCom's direct-to-home business, which it ultimately sold with no cash.

What could have they done differently ?

Loss in market share over the years

T H E F I N A N C E C R O S S W O R D

- Any expense that is incurred in the process of operating a business.

- An independent examination of company's financials

- Debts that are owed by a company in the form of monetary obligations

- An in-depth forecast of the upcoming year's income, expenditures, and other costs in relation to the revenue that is predicted to be earned (2 words)

- Investments made with the goal of holding on to them for an extended period of time

- 2 terms that focus on making a profit through the sale of assets

13 - Belonging to a corporation, which may include a variety of assets such as money, stocks, and real estate, among other things.

- Assets that have a shorter time horizon in the foreseeable future

- The amount of profit that is left over after all of the overhead expenses have been deducted (2 words)

- The availability of finances for additional investments or for the acquisition of new assets The phrase begins with the letter "C."

6 - Assets minus liabilities

- The amount of money that really accrues to the company over the course of a specific time period as a direct result of the selling of shares - the profit made by a company from the difference between the price at which its products are sold and the amount it pays to acquire those things (2 words)