FUTURE FORMULA

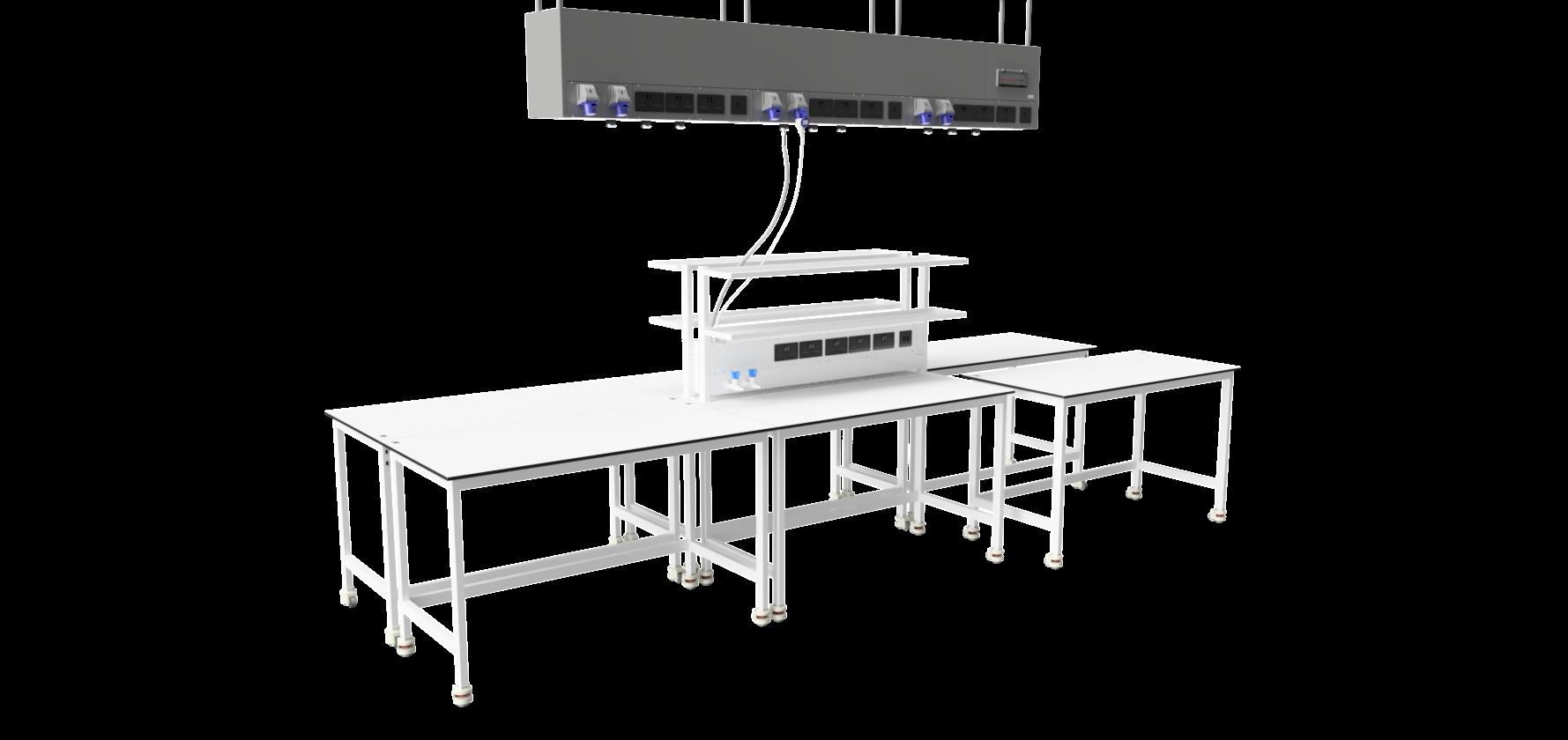

e PURELAB Chorus range.

It’s your lab, your budget, your science, so shouldn’t you be in control of how you work?

e PURELAB Chorus is a modular water purification solution that gives you the freedom to do just that.

www.veoliawatertechnologies.co.uk

For more information please visit our website, YouTube and LinkedIn pages.

In the Spring budget, the Chancellor announced the creation of 12 new Investment Zones. These zones will aim to create new business clusters, focused around universities and research institutions in “priority” sectors of digital and tech, life sciences, advanced manufacturing, green and creative industries. The Investment Zones will seek to accelerate R&D in UK’s growth industries delivering economic prosperity to assist in the government’s Levelling Up agenda. This will be achieved through £80m of funding per Investment Zone as a mix of tax incentives alongside capital and revenue grant funding.

The first tranche of these proposed zones will be in Liverpool, Greater Manchester, South Yorkshire, West Yorkshire, Tees Valley and the West Midlands, all of which already have directly elected mayors, as well as the East Midlands and North East mayoralties, which are due to be created next year.

This is clearly good news for the successful locations to enable the acceleration of investment into, and growth from, key sectors and technologies. It also enables greater collaboration between universities/research sector, Mayoral Authorities and regional businesses – the classic triple helix. However, at the heart of the Investment Zone proposals are physical spaces that bring these communities together to make the magic happen.

From my own experience with the proposals for the Liverpool City Region Investment Zone, Science Parks and Innovation Locations, UKSPA members, are recognised as having a strategic role to play in the successful delivery of these Investment Zones, and therefore much to gain from it. This can only be good news. However it begs the question about those parts of England and the wider UK, that are not in this select group of locations chosen by government. How can they benefit? How can they demonstrate the value that they deliver to their local geography and local communities?

The UKSPA Board has been focused on the issue about the need to demonstrate the value and impact of our members not just in selected Investment Zones but across the wider country. We have an important story to tell that needs to be communicated into government.

We are embarking on building partnerships with research organisations to help build this evidence base and start to articulate more effectively the value that we bring to the UK’s Innovation ecosystem. It won’t be a quick win, it will take persistence, and cooperation from across our membership.

A very important first step is to be able to demonstrate the growth that is taking place within our own organisation. Growth in the number of Science Parks and Innovation locations as we see more created across the country; growth in the physical size of them, as we see greater investment into the development of new buildings; and growth in the number of science and technology companies that call them home, and number of people working in these companies.

We need all UKSPA Science Park and Innovation location members to complete the current Members survey as best they can. To help provide the evidence base that we need to support our sector, and ourselves. Thank you in advance for your cooperation. ■

Please send your comments and feedback to the UKSPA team: info@ukspa.org.uk

UKSPA

T: 01799 532050

E: info@ukspa.org.uk

W: www.ukspa.org.uk

l Chief Executive James Chaffer

l Head of Membership & Communications

Adrian Sell

OPEN BOX MEDIA & COMMUNICATIONS

l Director Stuart.Walters@ob-mc.co.uk

l Director Sam Skiller - Sam@ob-mc.co.uk

l Production Manager Mark.Lamsdale@ob-mc.co.uk

l Design Matt.Hood@ob-mc.co.uk

l Advertising Sales Krishan Parmar 0121 200 7820

l Editor Ian Halstead - halsteadian@aol.com

We are committed to sustainable forest management and this publication is printed by Buxton Press who are certified to ISO14001:2015 Standards (Environmental Management System). Buxton prints only with 100% vegetable based inks and uses alcohol free printing solutions, eliminating volatile organic compounds as well as ozone damaging emissions.

Breakthrough is an Open Box Media and Communications publication produced in association with UKSPA. Open Box Media & Communications Premier House, 13 St Paul’s Square, Birmingham B3 1RB. T: 0121 200 7820. No part of this publication may be reproduced in any form without the consent of Open Box M&C.

“ We are embarking on building partnerships W ith research organisations to help build this evidence base and start to articulate more effectively the value that W e bring to the uk ’s i nnovation ecosystem. ”

The most sophisticated imager the industry has ever seen

Empower your lab with an extensive array of applications and detection options. Create new research opportunities and follow your discoveries–wherever they lead. See it now at: licor.com/odyssey-m

Up to 18 channels across fluorescent, colorimetric, and luminescent spectrums

High-end sCMOS technology for reliable, quantitative protein measurements

True 6-log dynamic range to see the full depth of your data

Industry-leading 5-micron resolution to see detailed tissue sections for triaging

you will no doubt be aware of the recent announcement by the Chancellor of significant funding for 12 new Investment Zones, as already mentioned in the Introduction by UKSPA Chair, John Leake. This is a significant opportunity for many UKSPA Members to play an even more central role in accelerating R&D and economic growth in key sectors across several regions. UKSPA commends this initiative, and we hope to see many positive outcomes from Members forging closer ties with their local universities, research institutions and businesses.

However, we also recognise that many science parks and innovation locations across the country will not be included in these Investment Zones, but are just as important and valuable to both their local communities and the national economy. We want to ensure that they also receive the level of recognition and support they deserve, allowing them to benefit from additional funding for cluster-building.

That is why one of UKSPA’s main priorities is to build a strong evidence base, backed-up by robust data, to deliver a compelling narrative for the impact and contribution of our members, both within and outside the new and proposed Investment Zones. With this in mind, it is encouraging to see the very recent announcement from UKRI of a further £7m fund to establish the Innovation and

Research Caucus (IRC), a centre of excellence in research and innovation funding. Over the next three years the IRC will generate evidence and insights to guide UKRI’s strategies and investments, helping to realise the goals of the UK Science and Technology Framework.

As an association, we need to showcase the diversity, dynamism and excellence of our member locations, and demonstrate how they are driving innovation, entrepreneurship and social change in every corner of the UK. To achieve this, we need your help. We need you to share your stories, your achievements, your challenges and your aspirations with us. We need you to complete the current Members Survey, which is accessible from the UKSPA website. This will provide us

with essential data and insights on the growth and development of our sector. We need you to engage with us and with each other, through our conferences, webinars, newsletters and social media platforms. We need you to be an active part of a vibrant community of practice that can learn from, collaborate with and advocate for each other.

One of the best ways to do this is to join us at one of our regular conferences – the next edition takes place on 27th & 28th June at York Science Park. These are fantastic opportunities to network with your peers, hear from inspiring speakers, learn from best practices, and celebrate our achievements. The theme of the York Summer Conference is ‘Clusters, Networks & Partnerships: Driving Growth’ - you can find out more details and register for the conference on our website.

I am very excited about the future of UKSPA and its members, and I hope you are too. Together, let’s continue to push the boundaries of what is possible and unlock the potential of science and technology for the betterment of our society. Thank you for being part of this journey with us. ■

“ one of ukspa ’s main priorities is to build a strong evidence base, backed-up by robust data, to deliver a compelling narrative for the impact and contribution of our members, both W ithin and outside the ne W and proposed i nvestment Zones. ”

14 UNDE r T h E l IME l I gh T James s heppard, managing director uk & i reland at k adans s cience p artner, outlines its remarkable recent growth trajectory.

18 SMA r TE r r E g U l ATION - A NE w APP r OAC h TO r E g U l ATION IN T h E UK p rofessor r ichard b rook obe , v ice p resident of airto , investigates the smart regulation pathway.

T h E P l ACE TO BE s ciontec’s head of commercial, l eanne k atsande, gave b reakthrough a virtual tour of its l iverpool campus - and reflected on her own journey.

PASSION IS T h E KEY

i an h alstead met up with the newest recruit at b abraham r esearch c ampus, k athryn c hapman … and came away most impressed.

MAN ON A MISSION

m ission s treet’s a rtem k orolev takes a walk along memory laneand offers a glimpse into the future of science real estate.

34 PIONEE r S A r E OF A l IKE MIND

a lisdair g unn, director of g lasgow c ity i nnovation d istrict (gcid), enlightened i an h alstead about its origins, achievements and ambitions.

57 PO w E r MOVES s tephen c layton, a ssociate d irector of esg and s ustainability at l ambert s mith h ampton discusses how a burgeoning l ife s cience sector can mitigate energy cost and carbon emissions.

44 MEMBE r P r OFI l ES

i ncluding 3 pm ; e lga v eolia; dll ; g leeds; s + b ; g ranta p ark; ma 24; l ife s cience reit, Wates and m ace.

52 SCIENCE D r EAM IS MADE r EA l b arry Warden, the md of g lasgow-based product design house Wideblue, explains its role in turning a cherished scientific dream into reality.

C A rg I ll CATA lYST

l iz c ashon, innovation manager at york b iotech c ampus, highlights the crucial role relationships play in building a science hub with national presence and international tenants.

24 UK SCIENCE PA r KS '

r ET r OFIT P r OB l EM

m att r ichards, a partner at r idge and p artners, shares some of the findings from their major study into the attitudes surrounding retrofitting non-domestic buildings.

28 CUSTOMISIN g IT AND CONNECTIVITY SE r VICES

FO r T h E EVO lVIN g SCIENCE PA r K MA r KET b ob c ushing, c onsultant at c ommunicate outlines why the company is in it for the long haul.

SCA l IN g T h E C r O l ADDE r ceo l ee p atterson took i an h alstead on a journey of discovery through c harnwood m olecular.

C AMPBE ll h AS 2040 VISION mepc commercial director p hilip c ampbell outlined the history, present and future of the m ilton p ark campus.

64 SCITEC h FO r MU l A Jamie c lyde, b runtwood s ci tech's director for the southern region and innovation services, offers i an h alstead an insight into its portfolio.

It’s always satisfying when someone’s personal pathway dovetails perfectly with the growth of their organisation. Back in the autumn of 2009, when Katsande started work as an assistant in Liverpool Science Park’s (LSP) operations team, the UK economy was on its knees after six successive quarters of negative growth. However, although market demand had slowed as business owners became more risk-averse, the park launched its second building to increase the profile and presence of its city centre innovation centres.

Now, as Sciontec’s head of commercial, Katsande can proudly highlight LSP’s occupancy rate of 97% as she looks down over Paddington Village, Liverpool’s new £1bn urban innovation-led business destination.

She is taking her bird’s-eye view from the top-floor of a 14-storey tower called The Spine, a £35m office scheme, which since 2021 has been home to the Northern operations of the Royal College of Physicians (RCP).

The city council funded its development, in Paddington Village, during the pandemic to deliver the long-awaited supply of new Grade A office space at scale.

The RCP signed for seven floors within the landmark building, and their very specific requirements make it one of the world’s healthiest buildings for physical well-being and mental health, according to LSP.

Those unfamiliar with its environment might consider that a tad hyperbolic, but Katsande points out that the building was designed to achieve all the required certifications for Platinum WELL status, and its official accreditation is due to be confirmed this summer.

Sciontec even now has a delightful (and pleasingly pithy) slogan to promote its charms: ‘We provide great spaces for great minds to call home’.

“It does look and feel like a different world from 2009,” admits Katsande. “Liverpool Science Park had a great location, was close to the two main train stations and because the city’s graduate retention rate is so high, the potential talent pool was huge.

“However, the park had been established as a not-for-profit organisation, and although all revenues were reinvested back into its buildings, it lacked the capital to deliver new space and services at scale.”

The first step was to create a coherent brand which brought together the various strands of the city’s offer and made its potential clear to investors, companies (from the region and further afield) and entrepreneurs.

Given Liverpool’s significant focus on culture, education, health, science and technology, largely due to the long-term presence of the University of Liverpool and Liverpool John Moores University, the council and its other key partners created Knowledge Quarter Liverpool (KQ Liverpool).

The latter organisation certainly succeeded in raising the area’s brand and attracted particular interest from the real estate sector.

However, the innovation district remained constrained by its inability to deliver Grade A offices, R&D space and labs at the speed and scale which science-based enterprises required.

Katsande says the tipping point came in 2019, when KQ Liverpool created a commercial spin-out property company, Sciontec Developments Ltd, in which both universities and the city council took an equal stake.

When Bruntwood SciTech came on board as a fourth equal partner in May 2020, the £12m publicprivate partnership was finally able to deliver as intended.

“It was genuinely a transformational moment for us, for Liverpool and for the city region’s economy,” recalls Katsande.

“We now had the expertise and financial resources to deliver our original growth vision and match our aspirations.”

Sciontec’s first major project was a £1m refurb of the ground-floor of LSP’s iC1 building, which underlined just what could be achieved.

“There hadn’t previously been quality space where people could come together to collaborate, and to be honest, we’d also lacked a community coffee shop too, where random social interactions can lead to exciting opportunities.” says Katsande.

“We’d worked very closely with Bruntwood SciTech and their consultants about how the new space would look and feel. The refurb began in October 2020 and when it was completed in June 2021, it looked just as amazing as we’d all hoped.

“Carrying out the work during the pandemic was a huge achievement, and the timing was actually a benefit, because a lot of customers were working remotely, with the exception of those who needed to be in their lab space.”

manufacturing sectors,” she says.

“This space was delivered last March, which helped showcase us to the regional economy, and

Even two years on, Katsande’s voice still carries the sense of excitement which she and her colleagues felt.

“It really opened up the science park, the new entrance lounge gave everyone a focal point and the key players from across KQ Liverpool also began coming in there more often,” she says.

The new space also immediately attracted serious interest from would-be customers, and Katsande’s team also persuaded existing occupants, notably the Manufacturing Technology Centre (MTC), that Sciontec’s innovation centres were the place to be and expand within.

“They wanted to bring in a Digital Manufacturing Accelerator (DMA) lab to accelerate the development of technological capabilities in industrial robots and advanced automation systems, a crucial asset to companies operating in advanced

because the lab is alongside a main road within the city centre, it also helped promote Sciontec as a location for leading technology and science businesses.

“We saw more footfall here as soon as the DMA lab opened, and I think it helped people on the outside realise that the science park is a separate entity from the university campus.”

September 2022 saw another high-profile arrival, when Elida Beauty, a new Unilever business unit for personal care products, set up its new global product development hub at the park.

Katsande admits she’s particularly proud that Sciontec’s workspaces benefit not only those who occupy them, but the surrounding communities and wider region.

She and her KQ Liverpool colleagues recently rolled out a ‘Sixth Form into Science’ programme, introducing the next generation of talent to the world of science and technology by bringing cohorts of local youngsters into Sciontec’s innovation centres.

The trend for remote working which evolved during the pandemic subsequently resulted in increased demand for flexible workspace.

Working with the RCP, Sciontec created its Sciontec AI product within two of its floors at The Spine, which after barely a year is now home to around 200 employees.

“Our workspace offering has always been a magnet for creative and technology companies, and increasingly we were finding that customers needed more flexible space and smaller offices, so it made sense for everyone,” says Katsande.

“However, we do pride ourselves, individually and collectively, in responding quickly to shifting markets and demand, so when a leading fintech organisation, Cashplus Bank, asked for a whole floor, we could also easily accommodate them.”

As Katsande continues to scan the horizon from her eyrie, her thoughts turn to the next of Sciontec’s grand projects, Hemisphere.

An eight-storey building scheduled to complete during 2025, it represents a £56m investment which will deliver 120,000 sq ft of Grade A offices and sit alongside The Spine in Paddington Village.

Katsande says that, like The Spine, it echoes Sciontec’s vision

of delivering new space for science and technology businesses. It will also be the region’s first Net Zero Carbon operational new build and be designed to achieve six global sustainability certifications.

“We brought in the same architects who designed The Spine, the planning application was approved last November, and we’re on course to break ground before the end of 2023,” she says. “The Spine still has the ‘wow’ factor, but we expect Hemisphere to be a game-changer.”

However, the UK’s dearth of lab space remains a challenge for all locations and every developer, and Liverpool isn’t the exception.

“LSP delivered the city’s first Cat 2 commercial labs in its third innovation centre, and they now operate at 100% capacity,” says Katsande.

“It does sometimes become frustrating because we get inquiries, but have no available space, although we are working with the city council and the combined authority to deliver more.”

It’s just momentary reflection though, and she quickly returns to her upbeat and positive self by looking ahead to the addition of Sensor City to the Sciontec portfolio.

Liverpool’s two universities established the Copperas Hill innovation hub in 2017 to provide 27,000 sq ft of rapid prototyping and digital technology space.

However, given the remarkable pace of change in the Industry 4.0 and Internet of Things’ sectors, it now needs further investment to achieve its potential.

“It’s right by Liverpool Lime Street Station, just five minutes away from LSP, and we have the resources to redevelop and reconfigure Sensor City to provide additional innovative workspace and labs across its four floors.” says Katsande.

“Talks have been progressing well, so I’d expect our plans to be formally announced later this year.” ■

For more information, please visit: https://sciontec.co.uk/

It’s taken Kadans just three years to move from the fringes of the UK’s life science community and achieve a market-leading presence and profile.

Even for an ambitious, well-funded and established organisation, it’s worthy of note that it has a building due to reach practical completion every six months until 2027.

“It has been a steep transition. Traditionally, Kadans didn’t really seek the limelight, but now we find ourselves being mentioned by senior people who hadn’t heard of us a few years ago,” admits Sheppard.

“There’s been almost a cultural shift, and the market has realised Kadans should be leading conversations and not being dictated to. When I started here, we had maybe 45 people across two countries, but now we have more than 150 across six.

“Like any organisation, we aren’t immune to growing pains, but it is certainly interesting to see how we are now regarded.”

The catalyst for its rapid expansion came in August 2021, when AXA IM Alts, the business arm of AXA Investment Managers, which had acquired Kadans on behalf of its clients in 2020, revealed that it had raised EUR 1.9bn to fuel its growth.

Even given the sharp global uptick in life sciences, it had taken just five months to raise the capital, and as clients piled in from across North America, Asia and Europe, its fund was significantly over-subscribed.

The tipping point for Kadans then came in Q1 2022, when it unveiled a JV with Canary Wharf Group to develop 823,000 sq ft of life-science lab and office space in a 23-storey tower.

Understandably, the thought that Europe’s largest and most technologically advanced life sciences’ building was to be delivered at a location previously known only for finance made international headlines.

It was a moment to savour deeply for Sheppard, who’d only

joined Kadans in the autumn of 2020, and One North Quay is rarely far from his thoughts.

“It’s going exceptionally well, we are due to receive full planning approval in the summer and were already well underway with the enabling works through the outline consent we received 18 months ago,” he says.

“We’re out in the market procuring various construction packages, so it’s ticking away nicely from a development perspective.

“On the commercial side, we continue to see huge interest both nationally and internationally and are having a lot of really exciting conversations happening, with an array of potential tenants from top 10 pharma companies down to more innovative small biotech firms.”

To give potential occupiers a tangible sign of One North Quay’s offer, Kadans has fitted out 40,000 sq ft of wet labs and office space at nearby 20 Water Street.

“It’s targeted at SMEs who need incubator space, and the interest ranges from firms making medical devices and in materials science, to ones in cellular and gene therapy, and global pharma,” says Sheppard.

“It’s very much in tune with Kadans’ long-term philosophy that we are one of the first investors in new markets. We did it in our domestic market of the Netherlands, then in Paris and now across multiple geographies in Europe.

“We say to the market that we believe in a location, in the science, in the quality of the space we will deliver, and in the companies and individuals who come to our schemes.

“Where we see that there has been a market failure to provide laboratory space, rather than waiting for someone to come along and take a pre-let on a building, or somebody else to take up the slack and take on the risk, we are happy to be the first mover.”

Sheppard says it’s a core element of Kadans’ philosophy that once it’s chosen a location, it will always invest for the long-term.

“We’ll take on the risk, build top quality and fully functioning laboratory space, with equipment, lab managers, and a high level of ecosystem and support service, and from that point, we will continue to invest there,” he says.

“We never go to any location, and then deliver just a single building, because if our judgement is correct, the tenants we attract will start growing and growing, and ultimately will need more space.

“If we hadn’t provided grow-on space, all we would have achieved was to move the market failure from year one to year three.”

Life sciences continues to be one of the hottest global sectors, but Kadans isn’t fazed by the increased competition.

“Even five years back, there were just a few niche firms delivering lab space in Europe, but now everyone seems to imagine they can build such space anywhere,” says Sheppard.

“However, the reality is that this remains a very difficult and different asset class because you need

highly technical buildings designed for highly technical tenants who always demand the best.

“We’re already starting to see a divide between the high-quality developers and projects which deliver high-quality space … and everything else.”

Sheppard draws a persuasive parallel between the UK’s office market of a decade ago, in which there was a very distinct ‘flight to quality’ where providers of new Grade A space set themselves apart from those still focused on refurbs and secondary space.

“One of the main drivers in the life science market is power. So many landlords are coming unstuck because they failed to realise that lab space typically requires four times the power of traditional office uses, and power remains the issue regardless of geography.”

Kadans carried out due diligence on Glasgow’s Met Tower, before it was acquired by Bruntwood Sci-Tech, and although he agrees the building could never be converted for lab space, he still sees huge potential in the city.

“Glasgow is thriving from a science and technology perspective, very interesting companies are being spun out of its universities, and it continues to attract companies needing lab space, from across Scotland and the rest of the UK,” says Sheppard.

“Tenants on our West of Scotland Science Park are very happy to be there, as the talent pool is so strong and because of the city’s long manufacturing heritage.”

Kadans also has a presence in Manchester, via its Upper Brook Street scheme, and Sheppard readily acknowledges the impact which Bruntwood has had on its home turf.

“It’s has been an exciting market for years, and I must pay tribute to the tremendous work they’ve done in attracting international attention,” he says.

“We hope to submit a planning application shortly for 215,000 sq ft of space for pharma and bio-tech companies. Interestingly, we’re also seeing significant interest from public sector organisations.

The strength of the local talent pool is a recurring theme as Sheppard discusses the merits of development locations.

“Manchester has a higher graduate retention rate than even Oxford and Cambridge, and there are significant numbers who wish to live and work there, looking to build careers in life sciences.”

Such is the pace of Kadans’ growth that the B900 building on Babraham Research Campus, which it acquired in Q2 2019, is now considered a legacy asset.

In April, the 3D deep-learning company CHARM Therapeutics took 13,500 sq ft there for an R&D centre for its drug discovery team, where it will continue to develop its pipeline of transformational oncology medicines.

A few miles away, and just a stroll from the new Cambridge North rail station, new-build development plans have gone in for at Merlin Place for lab and office space.

“We’re expecting that scheme to progress before Q4. The market there continues to see demand massively outstrip supply, and it’s no secret than winning permission in the county is difficult,” says Sheppard.

“However, we hope there is positive traction for our scheme and others, otherwise the market will be severely impacted.

“There are only so many occasions on which companies can be told there is no space in a particular location before they look elsewhere.

“We are rapidly approaching that point in the Cambridge area, and once one company goes elsewhere it rapidly becomes a tidal wave, which would seriously impact the regional economy.”

Back in London, Kadans owns three buildings at London’s King’s Cross, the most advanced of which is 5-10 Brandon Road which will offer 114,000 sq ft.

The mixed-use scheme, which topped out in May and is on course for practical completion during Q1 2024, is targeted at high-growth SMEs in life sciences who need flexible space for pilot plants, labs and offices.

Sheppard says Brandon Road will be the only location in the capital to offer GMP-standard

manufacturing facilities alongside R&D space and offices, allowing tenants to take innovations from the lab to commercial products or services on a single site.

The other two schemes are due to go to planning in June, and will provide a similar mix of space, also aimed at companies who don’t want long-term leases.

Elsewhere, Abingdon Science Park remains a popular destination and Sheppard says its model has successfully evolved into a community-based eco-system.

Two new buildings will reach practical completion there in late summer, which will together deliver another 45,000 sq ft of lab and office space.

“Some companies want to be in London, Cambridge and Glasgow,

and are willing to pay premium rents, but others are more costconscious, and Abingdon is benefitting hugely from that dynamic,” says Sheppard.

“Now venture capital isn’t as readily available as it was two or three years ago, many companies are assessing their rent rolls to reduce their burn rate and fund their businesses for longer.

“We continue to believe in the strength and the depth of the UK’s life science sector, and although it wasn’t what I expected a year or two ago, I now spend around 70% of my time visiting locations outside the Golden Triangle.” ■

For more information, please visit: www.kadans.com/?lang=en

The Prime Minister’s recent statements advocating smarter regulation have been widely welcomed, most notably the City Week address for Business Connect via Linkedin (24 April 2023).

Rishi Sunak’s comments were primarily intended for the financial services sector. However, the message is also relevant to other sectors of the economy, particularly the ‘smarter regulation’ message which affects the wider industrial, business and research landscape.

The Department for Business and Trade has recently published its plan for ‘Smarter Regulation to Grow the Economy’, the first of three intended publications setting out the role of regulation and plans for its implementation in the context of a free-market approach to management of the economy. Whilst there is much to agree upon in this plan, the government must also focus on requirements to regulate in anticipation of market developments, where businesses and the population need to be protected from foreseen harms. Hopefully, subsequent government publications will address these aspects of regulation.

The term ‘Smarter Regulation’ recognises a need to enhance current UK regulation to match complex modern requirements. To remain effective, regulations should be regularly reviewed, kept up to date, efficiently delivered, and fit for purpose in relation to developing innovations in business practices, technologies and markets. Regulations need to be readily understood and easily adopted by business and the public. Certain significant aspects of today’s regulations in the UK require improvement. Oversight, leadership and setting the regulatory environment is the responsibility of government.

The developing prominence of Artificial Intelligence (AI) and the implications of a rushed approach to the Retained EU Law (Revocation and Reform) Bill for areas such as environmental protection, food security, and employment are thrusting the importance of smarter regulation into the public spotlight.

The complexity of the task is immense, but the need for a smarter approach is evident if the UK is to tackle the challenges posed by the continual flow of innovations arising from advances in science and new technologies

and their expanding assimilation into everyday life. Smarter Regulation will require investment from government as well as the private sector. Benefits will include the removal of unnecessary burdens on business and enhanced public and industrial safety. Particularly important in this regard are key consumer supply chains such as agriculture, food, energy and healthcare as well as potentially hazardous occupations like construction and transport. Regulations have to be properly formulated and policed once in use. Smarter regulation should facilitate better, more cost-effective enforcement and compliance checking, the latter being the responsibility of Conformity Assessment Bodies (CABs). These organisations, accredited mainly private sector entities, are important and essential to the infrastructure underpinning the workings of our domestic economy and the UK’s dealings and trading with other countries. Together with their industry clients, CABs have been seriously impacted by uncertainty, indecision and delays in setting the direction for the UK’s new regulatory environment following Brexit.

The transition from CE to UKCA product marking is still to be completed pending further guidance from government.

Cross-party alignment is needed on the direction of travel for UK regulation. This echoes the recent call by Make UK for a long-term industrial strategy to rebuild manufacturing competitiveness. Right now, post Brexit, the UK has an opportunity to bolster its status on the world stage as a leader in smarter approaches to internationally agreed regulation and standards.

The first step towards achieving smarter regulation is to take a hard look at how we currently approach formulating, agreeing, managing and implementing our regulatory environment. This needs to be undertaken with care, to balance the upside of ‘loosening’ regulation (i.e., stimulation of growth) against the increased risks from ‘looser’ regulation to consumers and the public. Conversely, overtightening regulation will likely slow economic

growth - the price to be paid for increased caution and further strengthening protection for our national and personal well-being.

The UK urgently needs a regulatory environment and ecosystem that works faster and operates much more as a partnership between government, regulators and business. There are lessons we can learn from the approach of regulators during the expedited development and introduction of new vaccines during the COVID pandemic, including changes in regulator behaviour. Regulator capacity, capability and behaviour was recently identified by the UK’s outgoing Government Chief Scientific Adviser in the Pro-innovation Regulation of Technologies Review, Green Industries

Learning from this and other plentiful recent experiences, three core principles should underpin a smarter approach to regulation going forward:

1. There should be greater collaboration between relevant policy makers, regulators, CABs and affected industries;

2. Faster processes should be developed for deciding and approving changes and updates to regulation and for applying existing regulation to deal with developing technologies, newly introduced product and service innovations and take-up in emerging markets;

3. Upskilling and resourcing should become a priority on all sides to ensure progress is not hampered by skill shortages and scarcity of experience and budgetary resources.

Enforcement needs to be thought through carefully. The role of CABs is key. Prior to Brexit, the UK’s accredited CABs led in Europe’s ecosystem of Notified Bodies. They are now being adversely impacted by the UK’s protracted upheaval in regulation and the uncompleted transition towards an as yet undefined post-Brexit regulatory environment. These highly skilled and very specialised bodies are critical assets that must be retained and fully utilised in this new era of smarter regulation. The UK has been an acknowledged world leader in legal frameworks and regulation. However, in recent times, the ‘lived experience’ by innovators in the UK has too often not lived up to our reputation for good governance. It is time for the reality to catch up with the rhetoric as the UK seeks to promote a message of ‘being open for business’ and for the UK to lead the way in shaping effective and smarter regulation for emerging technologies and markets! ■

For more insights, please visit: www.airto.co.uk

hen York Biotech Campus hosted the International Commission for Plant-Pollinator Relationships'

Bee Protection Group's 15th annual symposium in May, it was a tricky challenge for headline writers at the local paper.

The event, which attracted almost 130 delegates from 17 countries, was also a very tangible symbol of the success of YBC in persuading people to return to its space.

“There was a huge take-up in demand for events and conferences after Covid, which was unexpected, as we thought people would still be using hybrid models,” admits Cashon.

“However, we already have bookings running well into 2024, and we've brought national and international events here which is very pleasing.”

The May event also underlined the depth of the links Cashon has carefully cultivated, with the long-term lead occupier of the campus, Fera Science and Make it York, the city's destination management organisation.

Connections across both public and private sectors are, of course, pivotal to the success of any science hub, particularly in such a footloose niche as bio-tech.

It's evident, as Cashon enthuses about the campus and its tenants, that the ability to build productive professional relationships has been the catalyst for her achievements since reaching the 80-acre campus in 2015, when it was occupied solely by Fera and other government bodies.

Her remit was to drive YBC's evolution from a public sector base to become home to an array of bio-tech enterprises, from start-ups to scale-ups, and to attract international tenants.

“Fera Science became a joint venture business in the year I arrived, and since then the business has grown to be increasingly open

and collaborative, they've absolutely transformed themselves,” says Cashon.

“Right from the top down, they really integrate with other tenants. We have innovation breakfasts and lunches, and their people are always present. Our latest tenant arrived in January, and Fera immediately began talking to them about potential collaborations which was so great to see.”

YBC's ongoing challenge is how to take the offices which Fera no longer requires to repurpose them for new uses and new tenants, as the organisation itself invests significantly in its future business model.

“They had an innovative concept of creating an insect research laboratory here to study bioconversion, which is essentially feeding different species of insect with different types of waste to create different applications, such as protein for animal feed, pet-food or fertiliser,” says Cashon.

“It's very sustainable, which is why bioconversion is being looked at around the world, but the UK had never had a research facility of this scale or technical sophistication which could assess the safety of the products being developed, so the discussions with government took quite some time.

n

Liz Cashon, innovation manager at York Biotech Campus, highlights the crucial role relationships play in building a science hub with national presence and international tenants.

“Finally, Fera won approval to deliver the lab in partnership with DEFRA, and they spent just over £1m converting a former storage unit to create 2,000 sq ft of new space for clean labs and related uses, so it was a major milestone for us.”

Early 2023 saw another significant success, when the giant Cargill business empire decided to relocate its bioindustrial operation to the campus, signing for more than 10,000 sq ft of space, including 3,000 sq ft of labs.

Cargill came to the UK in the mid-50s, and with an existing presence stretching from Liverpool to Hull, and from London to Hereford, they were the definition of footloose, so Cashon's negotiating skills were paramount when their search team began trawling for a potential location.

“They wanted somewhere new to house Cargill Bioindustrial, but they also needed to relocate staff from their previous site and found it difficult to identify a location with ready-made lab space,” she recalls.

“Their other requirement was quite unusual because they also wanted 7,000 sq ft of office space alongside their labs, whereas most potential tenants wanted either a small suite or co-working space.

“However, we had a large openplan office available, because a tenant moved out during Covid, and managed to persuade Cargill that it could be converted to satisfy their needs.”

The company and its property advisers found the proposal so appealing that they decided to take the space, and to make it into a showcase office for its wider operations where they could bring different teams together to collaborate.

“We didn't have lab space immediately available, but we did have workshops which could be converted and fitted out to their requirement for 3,000 sq ft,” says Cashon.“They already have around 50 people on site and their labs should be ready to occupy during July.”

The transaction had immediate benefits across the campus, and one long-term tenant is already looking to collaborate with the newcomers.

“Refurbishing such large chunks of space was great for YBC, and the influx of dozens of fresh new faces also brought in so much energy. An international brand had brought a flagship scheme here and there was a real buzz around the place,” says Cashon.

“Cargill's people were also very keen to meet other tenants, so we've been taking them around the campus even before their space is ready to occupy.

“They are very focused on food packaging, which is tremendous for another tenant (Abingdon Health) which is interested in developing sustainable packaging for its medical devices, so hopefully there'll be synergy between them for joint projects.”

Cashon sees an emerging trend for shared spaces within campus environments, rather than corporates and organisations preferring stand-alone and independent buildings which was usually the case in recent years.

Her belief was underpinned by conversations with Cargill's real estate advisers once negotiations for their 'blended' model of lab and office space had completed.

“It was interesting to hear that when they began their search, they were looking for something similar to their previous location,” says Cashon.

“Even when they began looking here, they still had reservations around using shared space and shared corridors, as they had concerns about a possible lack of control around their R&D and their IP, but what actually happened was the complete opposite of what they'd been expecting.”

Meanwhile, ahead of potential collaborations with Cargill, Abingdon Health has just launched the first saliva-based pregnancy test to be available in the UK and Ireland.

The Salistick product, developed by an Israeli company which uses its revolutionary tech platform to deliver rapid saliva diagnostics for an array of uses, will be co-branded within the Abingdon Simply Test range.

“Abingdon is another tenant which converted redundant buildings into new manufacturing space and clean labs, all their R&D expertise is here, and they're expecting more benefits to come from their partnership with Salignostics Ltd,” says Cashon.

The most tangible instance of her willingness to nurture and develop relationships with outside organisations also came this year, when the

University of York took 2,750 sq ft of space for a research project aiming to reduce the scourge of mosquito-borne diseases.

“It really was a tremendous moment, because although we've taken so many of their graduates over the years and multiple research projects linked to them are here, they've never had a physical presence,” she says.

“They needed to work within controlled environments, and we had two former labs which Fera no longer needed which could be converted relatively easily for their research requirements.”

The lead academic, the university's professor of genetics, Luke Alphey, moved on site in January and expects to expand his original research team of around 20 people by another dozen within the first six months.

“They began with five researchers, were up to 20 by the end of April, and now they'll have more than 30 before the year-end, so our priority is bedding their team into the campus and engaging them with our community,” says Cashon.

“Luke is already talking about collaborations with Fera, which makes absolute sense for both parties given their focus on insect research, and we will continue to talk to the university about its future requirements for space in this region.”

However, as with all locations targeting the bio-tech and life science sectors, the most pressing challenge is how to address the nationwide shortage of Cat 2 lab space.

“Demand shows no signs of slowing, and although we would consider new-build space via a pre-let, we also continue to see old offices being surrendered by Fera as it increasingly works in more agile ways,” says Cashon.

“We're talking to a developer to judge the cost of potential refurbs, and to get a better feel for cost, timelines and delivery for new-build lab space and Grade A offices.

“Our range of inquiries runs from just a single office unit to 40,000 sq ft and upward, and everyone seems to want to move in either during the next few months, or perhaps the following quarter.

“However, we are working very closely with the university and the city council's economic development team to study the data and see which way the market is moving. It could be there's not a huge difference compared with converting redundant offices, given the cost of installing labs.” ■

Our apprenticeships range from foundation degrees to master’s level and are a cost-effective way of upskilling your existing workforce or attracting new talent to your business.

Research Scientist – Level 7 MSc in Applied Drug Discovery

Clinical Trial Specialist – Level 6 BSc Hons in Applied Bioscience

Laboratory Scientist – Level 6 BSc Hons in Applied

Bioscience or Applied Chemical Science

Technician Scientist – Level 5 Higher Apprenticeship

FdSc in Applied Bioscience or Applied Chemical Science

Find out more

E: apprenticeships@kent.ac.uk

kent.ac.uk/digital-lifelong-learning

We stand for ambition.

Ridge and Partners, one of the UK’s leading built environment experts, has just completed a major study into the attitudes surrounding retrofitting our non-domestic buildings.

, a partner at the firm, shares some of the findings and what they mean for the UK’s science parks.

while much of the responsibility for reaching Net Zero is placed on the energy sector, others in our economy, including those responsible for our commercial buildings, have a vital role to play.

However, our new research report, The Role of Retrofitting our Non-Domestic Buildings in the Race to Net Zero, shows that whilst more than three-quarters (76%) of organisations say they are working to achieve Net Zero, fewer than one in four are considering how to make their premises more environmentally sustainable.

Bl OCKE r S & B A rr IE r S

A key blocker seems to be the attitude of boards. Over half of facilities and property managers say their boards simply do not consider retrofitting as part of their Net Zero strategy. What’s more concerning, almost a quarter (23%) of these facilities heads in the largest corporations haven’t been involved in Net Zero planning at all.

Even when facilities heads are involved in the conversation, there’s huge misunderstanding around the scale of the problem. The vast majority (86%) underestimate the need to retrofit current buildings to make them more energy efficient. This is, in part, because over a third of decision-makers mistakenly predict that less than 39% of the UK’s current non-domestic building stock will still be in use by 2050. In reality, it will be 70%.

The scale of misunderstanding means that many in the UK’s scientific community, and the science parks which serve it, are heading towards a building/ retrofit crisis. When we reach the Government’s Net Zero deadline, many will find themselves with old, poorly performing buildings.

So how can we address this?

And more specifically, what can science park operators do? Our research found that it’s not just a matter of educating boards about the possibilities and need. To turn

companies onto retrofitting some of its perceived barriers must also be addressed.

For instance, in our study almost a third said retrofitting will involve massive disruption to their day-to-day operations. While at least one in four believe it will simply take too long. These are likely to be very real concerns for the occupants of science parks. It’s true that retrofitting isn’t achieved overnight. It’s a considerable undertaking that can take months or even years to complete. This can be disruptive, and for organisations that require very specific stable conditions for their labs, the disruption can be difficult to overcome. This is magnified if there are multiple tenants occupying one building because the retrofit requires extensive coordination by the estate team.

There aren’t just practical challenges, but financial ones too. For instance, a quarter said they fear retrofitting will involve them having to relocate while the work is done. Relocating during a retrofit project can be costly. Smaller organisations, such as the start-ups typically found in a science park setting, may not be able to absorb the additional costs associated with a retrofit project – even if they do recognise its importance to reach Net Zero.

Matt RichardsAbove: Matt richards, partner at ridge

The good news is that with the right expert input, there are solutions. The trick is ensuring any retrofitting improvements are in step with the tenants’ behaviour and requirement - and that means embedding analysis of building performance needs early into the process.

This should include everything from zone temperatures and room comfort to the operation of an energy-hungry plant. It’s not enough to simply look at peak usage. Monitoring needs to happen throughout the day and from season to season. By investing in monitoring, data can be shared to ensure the occupying organisation’s people remain comfortable and productive and energy saving opportunities are identified.

To plan an effective retrofit project, time also needs to be taken to recognise and understand the critical activities tenants need to keep running 24/7 and to investigate the options for streamlining and improving spatial utilisation.

For example, skilled designers can support energy efficiency through the re-organisation of lab buildings. Spaces with high demands for air movement should be located close to the ventilation plant. Spaces needing close temperature control should be internal or within basements, and those which most benefit from daylight and which can use natural ventilation should be on the perimeter.

Whilst it’s great to have data, that data becomes doubly powerful when it is shared. Tenants then have a full appreciation of the financial and environmental costs of poorly performing buildings over the lifetime of their tenancy – making the case for a retrofit clearer.

Data also ensures tenants understand the impact of their actions. They can see the effects of turning the temperature up beyond recommended levels. They appreciate things such as the temperature rise that comes naturally when everyone’s in or the energy wasted through equipment. After all, leaving fume cupboard extractors, CNC machines or calibration kits running is the lab equivalent of leaving the oven on.

While important, having a baseline of current usage and behaviour, sensors can only say and do so much. Consultation with future end users is also critical to a successful retrofit. Specialists will interrogate things such as the needs of different genders, perhaps responding in the end design with a range of comfort zones, especially in office and write-up spaces.

This is just a flavour of the approach and possibilities, but what it hopefully shows is that with a collaborative approach and expert support, our science parks can play their part in the retrofitting revolution we need if we’re serious about Net Zero. ■

Read 'The Role of Retrofitting our Non-Domestic Buildings in the Race to Net Zero' report in full at: https://ridge.co.uk/insights/the-uksretrofit-crisis/

If you are relocating your laboratory, need project management support or are looking for storage of equipment and consumables, Harrow Green Laboratory Services are the experts you can trust.

We have branches in every major UK city and are able to undertake any size and type of move at any location including all UK Science Parks, universities and public sector institutions.

We look after:

Full turnkey relocation project management, OEM and third party vendor management, Chemical relocations and disposal, Cold chain relocation (including LN2), Equipment packing, relocation and unpacking, Crate and packing material supply, Clean room relocations, Large and heavy equipment relocation, Office, breakout space and write up area relocation, IT relocation, including decommissioning and recommissioning.

What our customers say:

“We used Harrow Green to move our company to a bigger premises. We are a rapidly expanding BioTech company based in Oxford and required RHG to move three labs and two offices to a larger space. We had a lot of sensitive equipment and temperature sensitive samples and these were all handled with care. The team was friendly and checked in with us on everything they were doing. They were also very flexible. We had to change the date of our move and RHG accommodated us without any problem. “

Communicate has been onsite at Discovery Park for ten years and member of UKSPA for over six years.

Discovery Park is one of the largest and most complex Science Parks in the country. Over the decade they’ve been active, we’ve serviced their growth to now 3,500 employees and 160 businesses.

Our onsite team has grown to match the site growth and we now have seven staff at Discovery Park.

During that time we have seen the Science Park market (as a subset of the multi-tenanted commercial property market) change significantly.

Although many Parks are owned by universities, research organisations or public bodies such as Local Authorities, the membership has evolved over the years to embrace more traditional property and asset management organisations, who take a different approach to how they manage the infrastructure and service offering to their clients. Communicate has sought to mirror these variables in how it operates, in its commercial models and how it delivers and supports service.

This semi-custom approach to delivering services and managing relationships seems to be gaining traction with our partners.

There are a number of aspects of how we do business which reflect that change:

1We will build or renew your network infrastructure for you at our own cost and risk, from supplying the kit to building comms rooms and installing cabling.

2

If we can, we will offer on-site support for peace of mind. This is our best guarantee of a responsive and high-quality service. We have more people based on site than we do at Head Office. So, usually we have someone who can call in at short notice to get you up and running or fix faults even if we are not on site.

3 We offer a complete service for you and your clients from network support through a full range of IT and cyber security services, to the more standard Internet access and telephone services.

for new builds but also for existing sites needing a minor refresh or a complete refurbishment.

from its directors and shareholders, and has maintained both its long-term employee relationships but also successfully managed the integration of specialist service providers (such as Cyber and Telephony) which have joined the group over a long period. This is achieved by ensuring good cultural alignment between the various parties and creating a mutually supportive environment. Of course, this then flows down to our relationships with our customers, both landlords and tenants.

4

Communicate seeks long term relationships with its landlord and agent customers through the quality of its services and support.

The ability for us to invest in your infrastructure is attractive not just

One of our latest sites in London is still in development and we have rolled out the infrastructure in stages to reflect the development project and make sure services are available as capacity and occupancy comes online. HYLO is a multi-storey extension in Islington to an existing building so has a mix of refurbishment and new build. The initial infrastructure cost was about £100,000 but will increase to £250,000 or more as new floors and tenants come onstream and over the life of the contract. We are also in the early stages of planning the infrastructure build for 12 new student accommodation properties across London for an existing property management and development partner.

Communicate is itself a company based on long term relationships, with funding flowing

We have also taken some steps which might seem counter-intuitive. Rather than push for exclusive contracts we will support large corporates in their own buildings on site by enabling their choice of service provider at a modest cost. This helps the landlord because they don’t have to sign new wayleaves or deal with the disruption of new fibre installs and reduces time and set up costs for new tenants. Many of these tenants end up taking both connectivity and other services from us because of reduced cost and the decreased lag in moving in. Even if they take their existing preferred supplier they often take a resilient second connection from us at much lower cost than arranging a second external connection

Communicate offers an inclusive approach to service management because we know most building managers, landlords and agents rarely have the expertise and almost never have the time to manage complex service requirements for their clients and tenants. This is especially true for managing Wi-Fi networks in house, which has become a bugbear for may building managers.

Our partnership approach is based on aligning our services and models to fit your preferred operating methods rather than forcing a single approach on you and adapting as requirements change.

We are in this for the long haul. ■

For about Communicate, please visit: https://communicate.technology/

e xtending the frontiers of uk science and industry

Mission Street’s Artem Korolev takes a walk along memory lane - and offers Ian Halstead a glimpse into the future of science real estate.

In our era of science and sustainability, everything feels just so right about Mission Street’s ambitious plans for a 23-acre innovation district in the heart of Cambridge.

Coldham’s Lane is only a stroll from the main train station, near to the city’s largest opportunity for housing development at Cambridge Airport, and on brownfield land which has been derelict for years.

“It is an absolutely incredible opportunity for Cambridge and for us. Having the chance to create a science-focused innovation district in a central location is extremely rare,” says an enthusiastic Korolev.

“The co-location of homes and employment makes it very sustainable, and when you’re building at scale you can do so much more because you have a genuine opportunity for place-making.”

The proposals are still proceeding through the planning process, but he expects site work to begin during 2024.

From a purely personal perspective, it’s also a chance for Korolev to transform an area he knew well when studying at Cambridge, where a degree in Land Economy became his springboard into real estate.

The Mill Road of his undergraduate days was known only

as the birthplace of the sci-fi author Douglas Adams, who penned ‘The Hitchhiker’s Guide to the Galaxy, and for its late-night takeaways. However, the area has since become home to an impressive array of independent shops, cafes and bars, and even its Grade 11-listed library received a £500,000 refurb from the county council during 2022.

So, 15 years since Korolev left Cambridge to join Morgan Stanley’s London-based real estate team, with a first-class degree and a fervent desire to succeed, he’s back as the founder and CEO of a major investor-developer.

He established Mission Street in 2017, having identified both the increased commercialisation of research-based and knowledgeintensive sectors in the UK, and the lack of suitable space for such activities.

“There was a supply/demand imbalance and the space that existed was outdated and based around business parks from the 80s,” recalls Korolev.

“In the tech sector, companies had amazing workspaces, but scientists with PhDs were being asked to work in secondary environments, often in the middle of nowhere.

“The shortage of space was forcing tenants which needed to expand to become reluctant developers, to navigate the complexities of the planning system and to spend money they’d raised to fund their science on the delivery of real estate.

“However, in the US and Europe, you could see urban innovation districts coming forward which were properly integrated into cities, and it was clear that was a pressing need for such space here.”

Initially, Mission Street operated as asset and development managers, notably with Kadans during their entry into the UK market, on Sycamore House, Stevenage, which was one of the UK’s early conversions of an industrial building into speculative space for science uses.

Korolev also observed a shift in the property market’s dynamics, where what was then a small and niche sector of real estate rapidly attracted the attention of institutional investors, particularly during the pandemic.

“Two elements developed in parallel. Investors saw great thematic opportunities around health, science and innovation, looking at the need to deal with key trends around aging populations, healthcare and sustainability” he says.

“At the same time, returns from the major property asset classes into which pension funds had traditionally invested, particularly offices and retail, faltered and their future is still evolving and difficult to forecast.

“In the past, tenants took long-term leases on office space with limited hands-on operational engagement from the landlord once the scheme was let.

“Research space, on the other hand, is an operationally intensive sector, which was seen by many mainstream investors as too complicated.

“However, as lease lengths have shortened, traditional property sectors have become much more operationally intensive, putting innovation real estate on a more equal footing from an investor standpoint.”

Korolev retained his original vision of creating an independent specialist platform to deliver science space, but Mission Street’s growth was accelerated after increased interest from institutional investors and ultimately agreeing a JV with BentallGreenOak.

Their portfolio has since scaled rapidly, now runs into 1.5m sq ft and shows no signs of slowing its pace of growth.

Two of its projects will be delivered during autumn 2024: Inventa, the first phase of a £100m life sciences’ innovation district near Botley

Road, close to Oxford’s railway station, and the first phase of The Press, at Foxton, in the South Cambridge cluster.

Inventa, which will initially see some 65,000 sq ft of purpose-built R&D space delivered, was so well-received that it won unanimous support at the city’s planning committee.

Korolev says The Press combines the creative repurposing of a former printing press, with the demolition of unattractive industrial space, to deliver a new laboratory building surrounded by high quality public realm.

Mission Street’s proposals there received planning consent early this year, and with wide support from the local community.

“We saw the potential to create a new and very well-connected location for science. It’s next to the railway station, so just one stop out of Cambridge, and soon to be one stop from the Cambridge Biomedical Campus when Cambridge South is operational in 2025/26,” says Korolev.

They’re both significant schemes, and so it’s intriguing to hear his take on the dramatic growth of Mission Street and its peers over such a short period.

“The transformative scientific research and its commercialisation which underpins the sector continues to be strong, which means there’s a great opportunity to continue to deliver the space the customer needs,” says Korolev.

“From a real estate standpoint, institutional investors also continue to take interest in the sector, providing the capital needed to deliver the space. Even five years ago, investors didn’t have much appetite for life sciences and lab space, and there wasn’t much talk about science clusters, but that quickly changed.”

However, Korolev says some challenges remain because the delivery of science space at scale is still relatively new to the UK.

“Some planning authorities, particularly those in urban locations, still need to understand more about the sector, to realise what science companies want and how these buildings work.

“There needs to be something of an educational process here, although equally, even in such a mature market as the US, if you are away from Cambridge-Kendall Square and a handful of other established locations, a similar dynamic exists.

“The biggest challenge here, and it’s a global one, is to make local communities more aware of the huge benefits of open science clusters, and to increase engagement before and after schemes are delivered so that everyone can benefit from the value these schemes will create.”

Given the traditionally fierce rivalry between developers of office, retail and industrial space, it’s also interesting to hear Korolev’s take on science real estate.

“I’ve always liked this sector’s collaborative nature. Sometimes, we have to compete very hard for an opportunity, but equally, if we have a potential occupier we can’t accommodate, we’ve directed them to one of our peers,” he says.

“We all share the same desire to ‘grow the pie’, as some say. I think everyone in this sector is very aligned and wants to see the UK increase its already significant presence in science.”

Clearly though, innovation real estate is not immune from the current global and local geopolitical and economic uncertainties facing the UK economy regardless of sector.

“Inflation remains a concern, is having a big impact on construction costs and interest rates are obviously higher than for quite a long time. Because the real estate sector is fundamentally funded by debt, it becomes more expensive and lenders become more selective,” admits Korolev.

“The collapse of Silicon Valley Bank could have had a serious impact, as a significant number of UK life sciences and tech firms had high exposure, so it was reassuring to see how quickly everything was resolved.

“However, despite the more difficult environment, on a relative basis, science space remains very attractive to institutional investors, both from existing and new sources. Of course, there’s more caution in the market, but I think it’s in a stronger position than most other real estate sectors.”

The Mission Street team enjoy the challenge of identifying new development locations and just as Coldham’s Lane exemplifies that mindset, so does a very different scheme underway in Bristol.

The company is converting the former Evening Post building into Projekt, which will deliver 147,000 sq ft of R&D space, making it the biggest scheme of its type in

the South-West and one of the largest outside the Golden Triangle.

“We like being an early mover in an emerging ecosystem and looked there very carefully for more than two years before making this investment,” recalls Korolev.

“You have a top-class university with increasing investment into spinouts, a proven tech ecosystem, successful incubator space, and sizeable companies which had grown there.

“However, one of the constraints on the local ecosystem was the absence of grow-on space. We hope that by supplying this, we can help grow the critical mass of the Bristol ecosystem.

“The Post building on Temple Way was perfect for us because of its large floorplates, vibration resilience and high slab-to-slab heights. It’s very unusual to have a building of this design in a city centre.”

With planning consent granted, and strip out-work ongoing, Mission Street hope to start on site with the main works in Q1 2024, but despite equally positive news across the portfolio, there’s one challenge as yet unresolved.

“We don’t yet have a scheme in London, but we will soon …” promises Korolev, and no-one he’s met since arriving at Cambridge would think otherwise. ■

For more information, please visit: www.mission-property.com

The AstellBio Sink is an autoclave designed for sterilising liquid waste. Compared with chemical sterilisation methods, it provides a safer, cleaner, more validatable method of sterilising biologically hazardous liquids, up to and including containment level 3 / Biosafety level 3. Each model in the astellBio Sink range can sterilize 9 Litres of wastewater every 45 mins, more than 280 Litres a day.

the

The AstellBio liquid waste autoclave. hazardous liquids and it is a perfect

AstellBio Sink & Autoclave Combo combines the AstellBio Sink waste autoclave with an Astell AMA440 Classic Compact it provides both a disposal point for biologically liquid waste and a steriliser for solid materials and and equipment that requires sterilisation before use, perfect sterilisation station!

The AstellBio Micro EDS (e uent decontamination system) is a versatile unit that can be plumbed into a variety of wastewater-producing equipment, ensuing e uent is sterile before it reaches the sewer.

Scotland’s most powerful innovation district has been created in the urban heart of Glasgow, but whilst its driving force is a pioneer of our digital era, its catalyst was a visionary academic from the 18th century.

Even at a time when radical firebrands huddled in the teashops of Edinburgh and London to rail against politicians and aristocrats, whilst others peddled strident pamphlets to rouse mobs to anger, John Anderson stood out.

He held the chair of natural philosophy at Glasgow University during five decades, offered public support for the French Revolution, and even designed a new form of six-pounder cannon which he dispatched to the sans-culottes in Paris as a “gift from science to liberty”.

Anderson then posthumously stunned his alma-mater by leaving most of his estate to create the city’s second academic institution, which evolved into the University of Strathclyde. His stipulation that women students could attend classes was also impressively far-sighted.

The bequest underlined his commitment to what he described as “useful learning” which brought together the advances of science and the innovations of industry to create employment and wealth.

It’s a philosophy perfectly attuned to the mindset of Alisdair Gunn, the impetus behind the GCID’s fast-growing international profile and physical presence, brought in after demonstrating his digital and technology nous and passion for innovation in the public and private sectors.

His reputation for supporting Scotland’s tech and digital start-up scene was solidly established, even before he and two likeminded friends created the annual tech festival in Edinburgh in 2011 named after Alan Turing, the godfather of modern computing.

The event swiftly became a fixture on the international tech calendar, and the organisers of June 2023's Turing Fest have bullishly described it as ‘the ultimate learning party for start-ups’.

As the subsequent founder of Framewire, Scotland’s first advisory practice focused on the building and development of tech ecosystems, it’s easy to see why the GCID team recruited Gunn in July 2020.

In these hyperbolic times, it’s also refreshing to discover that he’s a modest and unassuming individual, regularly praising his team, the district’s partner organisations and the efforts of the tech community which he dedicates his time to support.

“When I was asked to get involved with Glasgow’s first innovation district, engaging with investors across Scotland and driving the international presence of Scotland’s fledgling tech sector, I considered it an honour,” recalls Gunn.

“I’ve always been passionate about digital and tech innovations, what they can achieve and their huge potential to benefit society, and this position is all about supporting start-up enterprises and helping communities.

“Before the GCID was established, although there had been support for the tech eco-system, it had primarily focused on Edinburgh because investors had been keen to back enterprises coming out of its university and the established tech ecosystem.

“However, Glasgow has the UK’s highest concentration of research technology organisations, including its only Fraunhofer, and is the location for all Scotland's Innovation Districts, which is a tremendous platform for growth.

“GCID isn’t the biggest urban innovation district in terms of acres, but it is very dense, built on decades of academic and industrial expertise, and has a solid base of applied research into industry.”

As Gunn talks with such enthusiasm, he highlights the crucial importance of the University of Strathclyde’s vision in taking the district from a concept back in 2015 to the present reality.

“It has long been renowned for the quality of its applied research, its engagement with major Scottish companies, including Scottish Power,

the Weir Group and Rolls-Royce and also its expertise in advanced manufacturing and new technologies,” he says.

“Back in 2011, Strathclyde came up with the idea of a Technology and Innovation Centre (TIC) to bring academics, business, industry and the public sector to deliver partnerships which delivered solutions to crucial economic challenges”.

Construction began in Q1 2012, and the nine-storey triangular building designed as the focal point for collaborative research was completed three years later.

There’s a case to make that the TIC became the UK’s first Catapult: organisations being developed around the same time in London, to bridge the gap between research and industry by helping to commercialise innovative ideas.

Certainly, as Gunn points out, having

four UK Catapult centres in the district has helped the GCID concept evolve, as has the presence of four of Scotland’s Innovation Centres (Cencis, Digital Health and Care, Data Lab and IBioIC), Fraunhofer UK and the National Physical Laboratory.

Given that the Fraunhover concept, of using applied research to underpin the evolution of science innovations, was hugely influential on the development of the UK’s Catapult network, it’s telling that Glasgow was chosen as the home for its centre for applied photonics.

Strathclyde’s impressive track record of bringing academics and entrepreneurs together to deliver new products and services was pivotal to the evolution of Glasgow’s tech cluster, as was the city’s long manufacturing heritage.

Its founder would certainly have warmly applauded Gunn’s commitment to the city’s communities, which is a recurring motif in his thoughts.

“We want to help push technological advances and applications into industry, but also to support new and innovative businesses, so the current generation of entrepreneurs get all the advice and backing it requires, but so does the next,” he says.

“However, creating an innovation district in the heart of a dense urban area is about much more than the buildings, the research and the technological advances coming from its students and its entrepreneurs.

“It’s also about the people who live and work in Glasgow, and making sure that employment opportunities and potential careers are being created for them.

“There’s a strong focus on genuine engagement with the community,

particularly around giving people access to the facilities in the various elements of the district.”

Gunn recognised that for the GCID to realise its full potential, it had to build wider and deeper connections with the tech community.

“There hadn’t been much development of the city’s tech and digital eco-system, so we organised a programme of meetups for founders, developers and product designers which has brought a vibrancy back to the local tech community,” he says.

“We are one of the partners of the Scottish Government’s Techscaler programme that supports the founders of start-ups and help them grow.

“We are also engaged in the development of regional innovation policies with the city council to ensure they are delivered for the benefit of both entrepreneurs, enterprises and industry across the city region.”