Community clusters

Working together to drive collaborative connections

e PURELAB Chorus range.

It’s your lab, your budget, your science, so shouldn’t you be in control of how you work?

e PURELAB Chorus is a modular water purification solution that gives you the freedom to do just that.

VERSATILE MODULAR

Contents

Advocacy

09 Basker's Net Zero zeal

Exeter Science Park’s CEO, Dr Sally Basker on its ambitious growth strategy, its innovative tenants… and the historic origins of GPS.

12 Labs2Zero Energy Score

Discover how to use the first tool released by I2SL's Labs2Zero program, the Labs2Zero Energy Score.

Support

14 Passion is her DNA

A look at the work of Life Sciences Hub Wales and its impact on the country’s health and innovation landscape.

18 HqO brings REX to life science communities

How digital technology is bringing innovation clusters and science-focused locations together to create virtual communities.

22 Challenges to recruit and retain Issues impacting recruitment decision making throughout the UK’s life sciences community.

Innovation

24 Architects with vision

Architects from global NBBJ practice outlined their innovative vision for regenerative lab space.

27 Marine model spawned at Oban

Discover how an innovative and ambitious project is transforming Scotland’s marine economy.

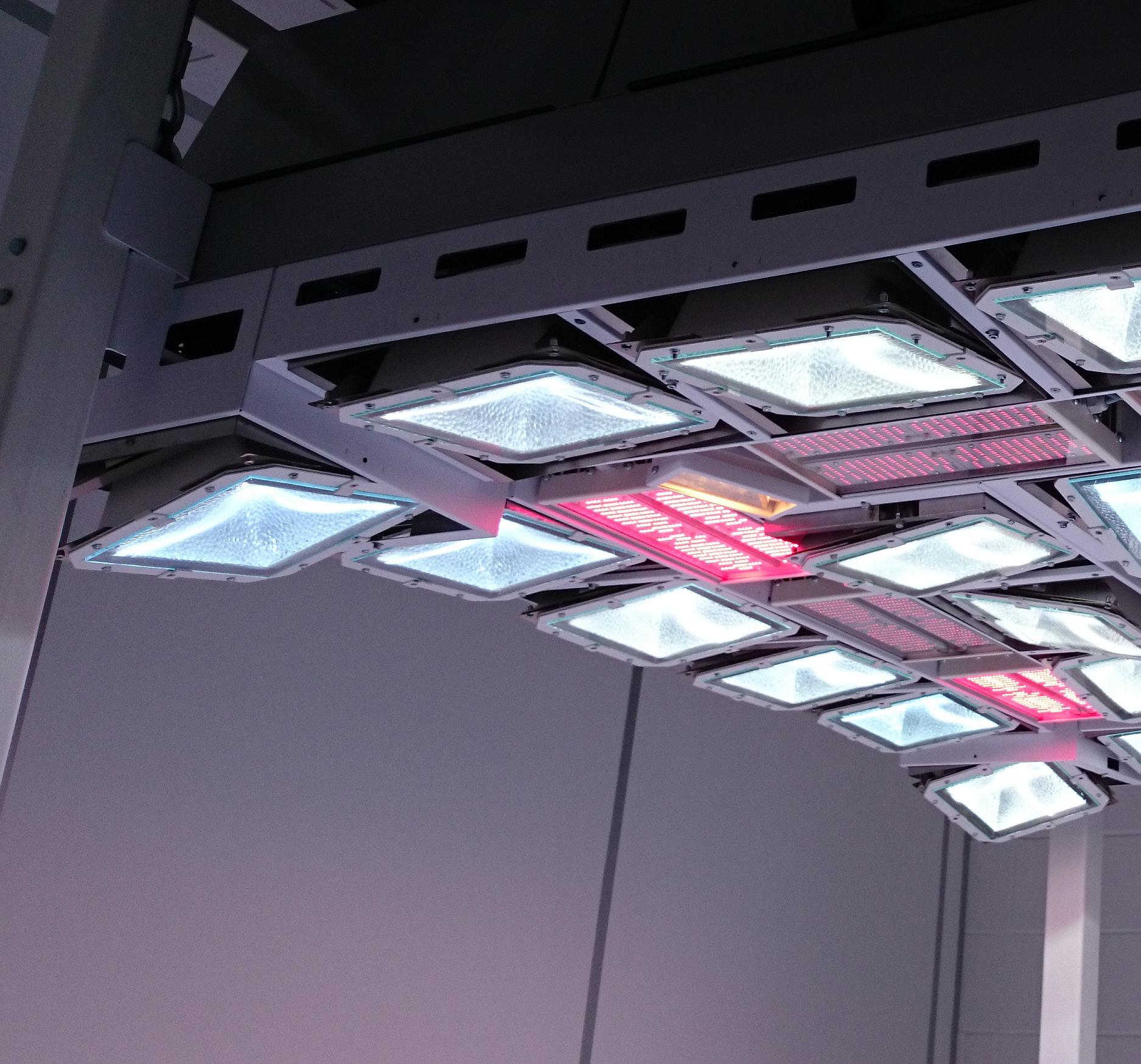

30 Lighting the future

An insight into how LED lighting is future-proofing plant-growth technology and agriculture.

Growth

32 Relationships key to Biomed

Biomed Realty’s commitment to life sciences, development philosophy and more.

35 Biopharma firepower

A global perspective of the biopharma market via the ‘Firepower’ research report from EY’s life sciences’ team.

40 A bright future for beamline technology

Design experts from Ridge have been tackling technical challenges at Diamond Light Source’s national synchrotron.

14

Impact

42 All eyes on the Arc

Latest data on the office and lab markets for life sciences within the Oxford-Cambridge Arc.

45 Bridging the skills gap in the UK's lab industry

Insight on how the lab industry can narrow its skills gap.

46 The transformational power of data

Exploring using technology to harness the power of people attributed data in buildings.

Trends

48 Innovation of the aerial kind

Two pioneers of digital aviation technology spoke about the science and the strategy behind their work.

52 A circular economy in the built environment

Mace Construct's Rob Lemming shares key findings from the insights report ‘Closing the Circle’.

UKSPA CHAIR, J OHN le AK e

Hot spots and the cluster revolution

At our UKSPA Conference at Coventry University Technology Park in November 2023, we had a very insightful presentation on the role of Investment Zones in supporting the development and growth of clusters in the UK. This was given by Andrew Carter of the Centre for Cities independent think tank.

In his presentation, Andrew shared analysis that the Centre for Cities had carried out to identify hot spots in the UK (www.centreforcities.org/publication/ innovation-hotspots-clustering-the-neweconomy/). Hot spots are defined as concentrations of “new economy” firms clustered over very short distances and having national significance. “New economy” firms are defined as using innovative and cutting-edge technologies to boost industrial production and economic growth. Therefore, the types of companies that we would expect to see on our science parks and innovation locations.

In total, 344 hot spots were identified right across the UK, predominantly in England but with some in Wales, Scotland and Northern Ireland. Around

UKSPA

T: 01799 532050

E: info@ukspa.org.uk

W: www.ukspa.org.uk

l Chief Executive James Chaffer l Head of Membership & Communications Adrian Sell

one-third of them were located in Greater London. By definition, urban areas are more likely to have hot spots due to the ability for these firms to be located in greater proximity in smaller physical areas. Around 55% of them were in City Centre areas and just over 30% in the suburbs of towns and cities.

These 344 hot spots were home to around 18,500 “new economy” firms. Although productivity in these hot spots was not higher than outside, their growth rates were around double what you would see in conventional firms.

What was interesting to me was to see how did UKSPA members locations correspond with these hot spots. Could we part of the dynamic driving force behind these hot spots?

We shared postcode data for UKSPA members with Centre for Cities and they came back with this analysis. One-third of UKSPA members had a science park or innovation location located in one of their hot spots. In total they constituted either wholly or in-part one in eight or 12.5% of the total hot spots and one in size or 16.5% of the hot spots outside London.

This data clearly demonstrates that UKSPA members make an important contribution to the high growth “new economy” in the UK. We provide valuable support, networks, facilities

OPEN BOX MEDIA & COMMUNICATIONS

l Director Stuart.Walters@ob-mc.co.uk

l Director Sam@ob-mc.co.uk

l Production Manager Mark.Lamsdale@ob-mc.co.uk

l Design Matt.Hood@ob-mc.co.uk

l Advertising Krishan@breakthroughdigital.co.uk

l Editor Ian Halstead - halsteadian@aol.com

We are committed to sustainable forest management and this publication is printed by Buxton Press who are certified to ISO14001:2015 Standards (Environmental Management System). Buxton prints only with 100% vegetable based inks and uses alcohol free printing solutions, eliminating volatile organic compounds as well as ozone damaging emissions.

and expertise that helps enable the growth of these valuable companies in our national economy. In particular, outside those major city metropolises such as London, Birmingham, Manchester and Edinburgh which are well-known for their clusters and the economic growth and high skills jobs that come from them, we see UKSPA members in smaller cities and rural areas playing an important role in levelling up the UK.

Our challenge and opportunity is to get greater visibility and recognition for the important role we already play in supporting those businesses of the future. It is also to build consensus and collaboration with both the current government to be part of their “cluster revolution” but also with mayoral authorities and LEPs to help shape their local economies.

And the conclusions from Andrew Carter’s presentation - put Investment Zones where hot spots exist, ensure HEIs and large high technology employers act as anchors and avoid being too sector specific. Sounds a lot like science parks to me! ■

Please send your comments and feedback to the UKSPA team: info@ukspa.org.uk

Breakthrough is an Open Box Media and Communications publication produced in association with UKSPA.

Open Box Media & Communications

Premier House, 13 St Paul’s Square, Birmingham B3 1RB. T: 0121 200 7820. No part of this publication may be reproduced in any form without the consent of Open Box M&C.

“And the winner is …”

those who have been involved with UKSPA for a while will know that it has become a tradition to celebrate important milestones in the association’s history with a major national conference, including a gala dinner and awards ceremony, tours, and opportunities for social networking.

Historically, these have taken place each fifth anniversary of the first meeting of the association’s founding members back in 1984 - which was detailed in the chair’s article in the previous issue of Breakthrough.

The last such conference was held at the University of Birmingham in the preCovid world of April 2019, and was jointly organised with S-Lab.

Planning for a stand-alone UKSPA 40th Anniversary Conference, to run from 16th-18th October 2024, is now well underway.

It is fitting that this will take place at the University of Warwick, whose own science park, the UWSP, has just marked the 40th anniversary of its official opening by the-then Prime Minster, Margaret Thatcher, with a celebration involving some of its original tenants, as well as current stakeholders and dignitaries.

Our conference will kick-off on the Wednesday afternoon with a variety of tours across the UWSP, and the wider university campus, including the Warwick Manufacturing Group facilities, before an informal reception and dinner in the evening.

Delegates will have a chance to learn about the history of innovation support and industry collaboration at the university, and its exciting future plans, as well as opportunities to catch up with old acquaintances and meet new ones.

Thursday and Friday will then see delegates getting down to the serious business of reflecting on the success of science parks and other innovation locations across the UK over the years, while looking to the challenges the

future brings, and discussing how members can be best placed to successfully tackle them.

The key conference themes will include Sustainability, The Future of Work, Digital innovation, Life Sciences, Venture Capital, Innovation Clusters & Hotspots and Making Science Parks Inclusive

Discussions will take place across both plenary sessions and themed break-out parallel sessions, where it will be possible to dig into the bones of these issues.

A range of high-profile keynote speakers, including government minsters, senior civil servants and leaders from the world of finance and business are being lined up to share their thoughts with delegates.

"Pl ANNIN g f OR A STAND - A l ON e UKSPA 40 TH A NNI ve RSAR y C ON fe R e NC e IS NO w well UND e R w A y. I T IS f ITTIN g THAT THIS w I ll TAK e P l AC e AT TH e U NI ve RSIT y O f wAR w ICK , w HOS e O w N SCI e NC e PARK , TH e U w SP, HAS JUST m ARK e D TH e 40 TH ANNI ve RSAR y O f ITS O ff ICIA l OP e NIN g."

However, it is vital that we also include the voices of UKSPA members and stakeholders in these discussions, so if there is a particular topic that you are passionate about, we would love to discuss speaking opportunities with you.

Thursday evening will see a black-tie gala dinner, which will include an awards ceremony and a celebrity speaker from the world of science & technology.

The full list of award categories and the nominations’ process will be announced shortly, but this is likely to include awards for environmental sustainability, building design, future of work, community building, partnerships, customer service, innovative & successful companies, as well as a ‘Newcomer’ category for inspirational young Science Park talent.

I encourage everyone to look at which awards might be applicable to them, as we really want to get as many members involved in the process as possible.

There will also be a variety of sponsorship opportunities available, from event partners to drinks, dinner and award sponsors, as well as the chance to host parallel sessions focused on specific topics.

Details of these will be announced in due course, but please do get in touch via the usual channels if you would like to discuss how to support UKSPA in hosting this major profile-raising event. ■

Please send your comments and feedback to the UKSPA team: info@ukspa.org.uk

CREATING SPACES THAT ENABLE SCIENCE SUCCESS

Bringing a niche approach to assist people and teams in all areas of science, combining our in house knowledge of R&D processes with extensive building and construction expertise. We enable the swift delivery of projects for organisations in Pharma, Food, Life Science and Tech spaces.

SPEAK TO ONE OF THE TEAM

Introducing Royce Morton, our dynamic Business Development Executive based right in the heart of Cambridge. Connect with Royce to explore how our tailored solutions can enable the success of science through designing and building productive and applicable spaces

T: +44 7385 494973 E: r.morton@ihguk.com

Leighton Buzzard London Cambridge

Advocacy

The world according to UKSPA and its members

Basker's Net Zero zeal

Exeter Science Park’s CEO, Dr Sally Basker, enlightened Ian Halstead about its ambitious growth strategy, its innovative tenants… and the historic origins of GPS.

hedy Lamarr is immortalised on the Hollywood Walk of Fame for her 20-year film career, most notably in Cecil B DeMille’s 1950 epic ‘Samson and Delilah’.

However, her name also lives on at Exeter Science Park, after CEO Dr Sally Basker decided to honour individuals who challenged conventional thinking to inspire future generations.

Sir Isaac Newton and Alan Turing were noted on two of its latest ‘grow-on’ buildings, and Lamarr was chosen for the third, to mark her creation of an advanced radio guidance system with her business partner in 1942.

Their ‘frequency hopping’ spectrum concept was decades ahead of its time, and the patent expired before she or pianist George Antheil received a cent for their innovation.

However, they did receive much belated acclaim for their idea, which was the catalyst for wi-fi, Bluetooth and GPS.

By coincidence, Basker’s doctoral thesis centred on the latter technology, so she was particularly pleased to see Lamarr’s name selected by a local youngster, from a seven-strong shortlist, along with Newton and Turing.

She arrived at the park in Q1 2017, after its shareholders (Exeter City Council, East Devon District Council, the University of Exeter and Devon County Council) looked to bring in high-value jobs, enhance productivity and deliver growth in the regional economy.

Then there were fewer than 200 people on the 64-acre site, close to J29 of the M5, but it now has some 750.

With all the infrastructure required for future expansion now in place, a raft of new tenants, corporates, SMEs and

start-ups, snugly settled into their space and the pandemic’s impact in the rearview, it’s time for an ambitious STEMMfocused growth phase.

“It’s now about looking ahead to when 3,000 people are based here, and the route by which we get there,” says Basker.

“We have established clusters around life sciences, security, defence, the Net Zero built environment, advanced manufacturing and SaaS.

“I’m very proud of what our clients are achieving, how my colleagues have helped them grow and it’s also satisfying to see that companies have stayed with us as the park has evolved into a mature employment location.”

SO l ID ST r ATE g IES

Before reaching Devon, Basker worked in a range of roles in both public and private sector, including a two-year spell with the UK Atomic Energy Authority.

Although she is typically modest about her role, describing it simply as ‘business development’, the strategy Basker devised and implemented there delivered a £20m order book - and one with solid margins.

Her previous project was to restructure the UK’s three General Lighthouse Authorities, where she created a two-year change programme, and then directed the resultant £8m portfolio of projects across three years.

Thoughtfully understated she may be, but it’s easy to see why the park’s HR advisers and board of directors were impressed by Basker’s skillset and experience back in 2017.

Any would-be chief executive can waffle on about ‘strategic visions’, and many frequently do, but the recruitment benchmark for such a role should always be to identify someone who can identify destinations - and also knows how to reach them.

It was perhaps an intellectual sign of things to come that Basker’s PhD thesis focused on the use of navigation technology.

However, her first degree was in civil engineering, a particularly useful qualification for someone leading a science park through an expansion phase, where the provision of new space via chunky development projects is required.

Basker’s colleagues quickly realised that when she inquired about the PC timetable, she was referring to ‘practical completion’ and not wondering when East Devon’s constabulary might be passing by.

“It is very enjoyable at this stage of my career to return to the built environment, to assemble different elements around technology, R&D and innovation, and then to pull everything together to deliver a science park,” she admits.

Exeter’s Net Zero strategy has been in place for some time, its first building designed and delivered to meet exacting sustainability standards completed in Q1 2021, and Basker is understandably proud that it achieved an EPC rating of A+.

A second has since been completed, the science hub is currently being retrofitted to improve its EPC from a B to an A, and the park hopes to replace gas power by district heating via waste-to-heat plants.

Basker is confident that the completion of the latter programme will lift the park’s overall EPC rating to A+, a very tangible sign for current and prospective tenants that the built environment strategy is achieving its goals.

M IND f U lly MODE r N

She’s also delighted that the park has attracted the UK’s first Net Zero hotel, which will operate under the IMG Hotels & Resorts brand and be managed by Valor Hospitality.

“It is challenging to adopt ESG ethics, whilst not diminishing the guest experience, but we are looking forward to welcoming everyone on our journey,” says Tim Wheeldon, the MD of Zeal Hotels.

Someone within IMG dubbed the design “mindfully modern” – a delightful choice of words, and which should be a welcome in itself.

Construction of the 142-bedroom solar-powered hotel began last summer, is on schedule and in January, it was revealed that the

property had achieved a BREEAM design rating of Outstanding, rather than the previous, and already very demanding, goal of Excellent.

“It’s a very exciting project because it shares so many of our ambitions. They’re working very hard to make the voco Zeal Hotel not just Net Zero in operational terms, but also through the construction process,” says Basker.

“Equally though, for all the built environment we’ve achieved, and that Zeal expects to achieve, Net Zero has to be about continuous improvement and progress.

Below: With a design dubbed 'mindfully modern', exeter Science Park has attracted the UK's first Net Zero hotel

“We’ve already deployed two very large transformers to power EVs, are working with one of our tenants (BINIT) to make our waste management sustainable and are also using reconditioned furniture, for instance.

“Above all, we always question what we are doing about all aspects of our operations, whether that is the IT or someone’s rubbish, because you can’t ever sit back and think you’ve achieved something on Net Zero.”

Basker and her team operate to five-year strategic plans, and the current one offers an insight into its forensic detail, by showing that a conference is already scheduled for February 2025, as the hotel is due to complete in the previous December.

“It’s the best way to overcome possible challenges created by working to individual financial years,” she says, with the delight of someone who embraces both the structure and the minutiae of organisation.

CATC h IN g T h E E y E Basker confesses there are simply too many highlights from 2023 to mention them all, but the achievements of some deserve note.

Diagnexia, which provides remote pathology diagnostic services to NHS trusts across the UK, via operations in Exeter, Toronto and Chicago, has expanded its presence to 1,800 sq ft, which Basker calculates is a sixfold increase on its original tenancy just two years ago.

Another tenant, Attomarker, is a key member of a consortium

researching innovative techniques to tackle the persistent and debilitating virus often referred to as ‘Long Covid’.

Exeter Eyewear, which came to the park in March 2023, creates custom-designed fittings aids and spectacles from novel materials, such as polyamides, for young children unable to wear standard designs because of either their age or disability.

Theta Technologies has acquired international note for its nondestructive testing technologies, designed to cope with the multiple challenges of using additives to manufacture metal components.

The company has also established a partnership with a company on Plymouth Science Park which has expertise in additives and sends samples of metal to Theta for testing.

As she reels off the lengthy list of tenants who caught her eye, it’s evident that Basker has a genuine passion for innovation.

“We hosted the opening event of the British Science Festival, so it was great to meet people from across the UK and hear about their work,” she recalls.

“There’s so much talk about what’s happening in the OxfordCambridge Arc, but I think many visitors were surprised to discover that so much is happening around life sciences in this region, and which is making an impact globally.

“The investment specialist FSE Group, which manages the debt finance and equity finance element

of the £200m South-West Investment Fund for the British Business Bank (BBB), opened an office here in November, and they’ll be a great asset for the regional economy.

“In February, we hosted an informal ‘Meet the Funder’ session with the BBB, to offer tenants and local enterprises into the mindset of investors, help them think more deeply about their own business model and consider what finance they might be able to access.”

Although Basker naturally enthuses about the growth of her science park, and the manifold achievements of its tenants, she also takes a nuanced view of the merits of regional collaboration.

“We work, for example, very closely with Plymouth Science Park, Torbay’s electronics and photonics’ innovation centre (EPIC) and other sub-regional organisations and science locations,” she says.

“We’re all trying to grow the regional economy, to attract more high-quality jobs and to improve productivity, which has bedevilled the UK economy for many years, and none of us can achieve those outcomes if we compete against each other.” ■

For more info about Exeter Science Park, its growth trajectory and Zeal’s Net Zero hotel, please visit: https://exetersciencepark.co.uk

Find out more detail about Ms Lamarr’s far-sighted nous at: www.womenshistory.org/educationresources/biographies/hedy-lamarr

T HE L ABS2ZERO E NERgy SCORE

A new way to look at lab buildings

In this latest article in the series from the International Institute for Sustainable Laboratories, we introduce I2SL’s major new initiative, the Labs2Zero program, which aims to decarbonize the world’s lab buildings, and we explain how to use the first tool released by the program, the Labs2Zero Energy Score

The urgency of decarbonising our building stock has never been clearer, and laboratories in particular pose a great opportunity for improvement in this area.

I2SL is dedicated to helping lab buildings, which typically have high greenhouse gas emissions intensity, to lead the way. I2SL’s Labs2Zero program is a voluntary initiative designed to support and accelerate the decarbonisation of the world’s laboratory buildings.

The program was launched in late 2022, and over the next few years I2SL will develop a suite of Labs2Zero tools: a rating system to assess building performance; a certification system to recognise success; an accreditation program to ensure that professionals are available to support program users; and the tools to enable lab owners to identify next steps and take action to decarbonise their buildings.

The Labs2Zero rating system will include scores for building energy performance and both operational and embodied emissions. Users will thus receive an at-aglance picture of the energy

in October of 2023. Pilot versions of the operational and embodied carbon scores are in development and are planned for release in 2024.

f I r ST O f ITS KIND

and emissions performance of a lab building, allowing for prioritisation of attention within a portfolio of buildings or for tracking of performance over time.

The Labs2Zero Energy Score is the first piece of the scorecard to be released; its launch was the headline event of I2SL’s Annual Conference in Anaheim, California,

Below: Use i2Sl's laboratory benchmarking tool to enter the building properties and annual energy usage to calculate your score

The Labs2Zero Energy Score is unique because it recognises that lab buildings are not a monolithic or homogeneous group. Functional requirements vary significantly from one lab building to another –physics teaching labs do not have the same intensity of requirements as chemistry research facilities –and so lab building energy performance needs to be rated based on lab-specific properties.

To develop the score, I2SL collaborated with Lawrence Berkeley National Laboratory in the United States to analyze a dataset of approximately 1,000 lab buildings and develop adjustment factors for lab-specific functional requirements such as the amount and type of lab space within a facility. The scoring method also corrects for weather variations. Lab buildings are scored on a 1-100 scale, where a score of 80 means that that lab’s energy

performance is better than 80% of other lab buildings. The details of the score development and methodology were published in a white paper, listed at the end of this article.

SEE y OU r SCO r ES

To see your lab building’s Energy Score, simply enter the building’s properties and annual energy usage into the Laboratory Benchmarking Tool (LBT) at https://lbt.i2sl.org. This tool is free to use and is operated by I2SL. Scores are free to obtain and the process is quick; see the Quick Start Guide listed at the end of this article for details. If you already have buildings entered in the LBT, your scores have already been calculated – simply log in and go to the Energy Score tab.

Using the Energy Score to rate lab building energy performance makes comparisons easier between lab types and across national boundaries. The LBT is fully internationalised and buildings can be entered from anywhere in the world.

Please note that the scoring system was developed using data from buildings in the United States, and so the scores correspond to comparisons against U.S. buildings. However, this does not decrease the Energy Score’s utility as a way to track progress over time and to make comparisons among a portfolio of facilities. I2SL also hopes that municipalities and others running building performance programs will encourage the use of the Energy Score in their programs and, once it is released, the Emissions Score for labs.

f EEDBACK IS w E l COME

The Energy Score is currently in a pilot phase, so we welcome all comments and feedback, and are particularly interested in obtaining more non-US participation and data.

NEXT STEPS

The LabsZero program aims to not only rate lab buildings’ energy and

"U S e RS w I ll R e C e I ve AN

AT - A -gl ANC e PICTUR e O f

TH e e N e R gy AND em ISSIONS

P e R f OR m ANC e O f A l A b

b UI l DIN g, A ll O w IN g

f OR PRIORITISATION O f

ATT e NTION w ITHIN A

PORT f O l IO O f b UI l DIN g S OR f OR TRACKIN g O f

P e R f OR m ANC e O ve R TI me."

emissions performance but also to guide owners towards the next steps on their decarbonisation journeys. I2SL is currently developing an Actionable Insights and Measures (AIM) Report, which will generate projected energy and emissions reductions along with cost estimates for a wide range of building improvement measures.

This automatically generated report will also include relevant case studies and advice from I2SL’s community of experts. A first version of the AIM Report tool, focused on existing buildings, is planned for release in late 2024.

A COMMUNIT y E ff O r T

One of I2SL’s strengths is in bringing together industry experts to share their knowledge.

Our community is an integral part of the development of the Labs2Zero program. Over 100 volunteers, including some from the UK, serve on Labs2Zero Technical Advisory Councils dedicated to various aspects of the program. I2SL is also fortunate to have the support of many industry sponsor organisations, each of whom has shown their dedication to decarbonisation by supporting I2SL’s efforts to create the Labs2Zero program.

It is thanks to the contributions of those volunteers and sponsors that the Energy Score is available at no cost to users. ■

Stay tuned for updates as more program components are released in the coming year. For more information about the Labs2Zero program, please contact I2SL at info@i2sl.org

Resouces and references:

• The Laboratory Benchmarking Tool (https://lbt.i2sl.org)

• Labs2Zero (www.i2sl.org/labs2zero)

• The Labs2Zero Energy Score and the Quick-Start Guide (www.i2sl.org/ lab-energy-score)

• Labs2Zero Energy Score technical white paper (linked from https://lbt.i2sl.org/ energy-score)

Support

On and off-site services for your business

PASSION IS HER DNA

if a week is considered a long time in politics, it’s tough to imagine what might fairly describe five years in the equally demanding environment of healthcare, particularly in a national and high-profile role.

However, although it was November 2018 when Cari-Anne Quinn was appointed CEO of Cardiff-based Life Sciences Hub Wales, her infectious enthusiasm and passion remains undimmed.

Her previous role as head of life sciences for the Welsh government gave her insight into the benefits innovative technology could deliver, and time overseas with the Welsh Development Agency helped her learn how to collaborate effectively with corporates large and small.

Even so, it’s impressive that well into her sixth year, Quinn remains such an effervescent ball of energy

that it’ll be a miracle if her Apple watch doesn’t need replacing long before its guarantee expires.

Asked to explain how Life Sciences Hub Wales works, she is pleasingly precise.

“Our remit, which was unveiled in the summer of 2018, was to work for both the health and economic directorates of the Welsh government, focusing on health innovation. We embrace the strategic themes of digital and precision medicine.,” says Quinn.

“Put simply, we are a health innovation organisation working for both NHS Wales and the country’s social care sector to improve patient benefits, identify projects where efficiencies could be introduced to their systems and working directly with industry to grow the economy.

“We see ourselves as a catalyst for innovation, by bringing the right partners together to help such innovations to progress, by

right: ceo of life Sciences hub Wales, cari-Anne Quinn

Ian

Halstead looks

at the work of Life Sciences Hub Wales, and its impact on the country’s health and innovation landscape.

convening the right events, ensuring that the right people are in the room and encouraging collaborative discussions.

“We also work very hard to support businesses, whether they are start-ups, spinouts, national enterprises or international corporations, to achieve long-term growth.

“A key focus for us is helping entrepreneurs progress their ideas and innovations, to make them relevant to people across the country and to help them expand their economic and employment presence.”

Below: the All-Wales robotic Assisted Surgery Programme is revolutionising access to cutting-edge robotic-assisted surgery for cancer patients throughout Wales

Quinn’s time at the organisation bookends the unsettling and often chaotic period of the pandemic, which inevitably impacted how people of all ages now view the provision of healthcare.

“In general, I think there’s a greater awareness of the benefits which technology can deliver in the context of healthcare, and all generations have also become more used to the concept of remote testing,” she says.

“We see many individuals taking a more active role in monitoring their own health, and taking a little more responsibility, and for some, also helping to manage their own journey as patients.

“It’s been also very satisfying to see the progress we’ve made partnering with stakeholders who in turn work more closely with all segments of the population, to encourage them and support them to take more responsibility for their health, and to think about their diet, their lifestyle and their level of activity.”

Technological advances occur at remarkable pace during global heath epidemics, so it was timely that a digital focus was embedded into the strategic mindset of Quinn and her colleagues, long before most people had even heard of Wuhan.

It’s impossible to identify all the corporates and SMEs currently working with Life Sciences Hub Wales, but one intriguing project involves a company specialising in the use of AI.

“We hear a great deal in the media around ‘bed-blocking’, where patients are physically able to go home, but can’t because of issues around support services, which understandably is very emotional and upsetting for everyone involved,” says Quinn.

“In January, I spent time with Faculty, who are working with the Hywel Dda University Health Board, to support patients as they enter and leave the healthcare system.

“The technology uses AI to surface an estimated date of discharge for patients as soon as they are admitted. This information, alongside a programme of change management work across the health board, facilitates proactive planning for patients’ release from the hospital.”

There was significant collaboration to support its adoption, and Quinn says Hywel Dda and Faculty worked tirelessly to make sure teams were equipped with tools and confidence to use this technology in their jobs.

After spending time tailoring the solution, training, and encouraging the teams to use the Frontier system, it went live in Q1 2023, and she identifies “tangible improvements” in the way the local health network is running.

Four hospitals currently use the service, and there’s an opportunity that other locations may consider using it across Wales.

Quinn has an equally noteworthy tale to recount about the second core element of Life Sciences Wub Wales’s strategy –precision medicine.

“One of the government’s key aspirations is to improve diagnosis of all cancers, we work closely with

the Welsh Cancer Network, and support a group of industry and health partners (the Wales Industry Cancer Forum) to enhance the treatment pathway,” she says.

“Bringing all these key individuals together creates a very rich dialogue, and it’s quite inspiring to see how everyone puts their competitive instincts to one side and engages in a very collaborative and productive way to develop and enhance the technology.

“Partners are looking at everything from diagnostics and point-of-care testing - in a hospital setting or at a GP surgery - to delivering advanced treatments based on cell and gene therapies which have the potential to transform the condition of patients.”

MAKIN g h EAD l INES

Her favourite precision medicine project during 2023 was based on genomic sequencing to provide earlier diagnosis of lung cancer.

“In common with other advanced and industrialised nations, many patients in Wales suffering from lung cancer are not identified until their condition is advanced, often stage three or even stage four, so reducing the delay in diagnosis is crucial,” says Quinn.

“The QuicDNA project, launched a year ago by multiple partners including health boards, industry, government and the third sector, is evaluating the use of a simple blood test to extract DNA samples from suspected lung cancer patients. The diagnostic process can be shortened by up to 30 days via genomic analysis.

“Like the Faculty system, partners are looking to extend its use by other health boards during 2024, and the long-term aspiration is that it can be rolled out across Wales, which would make us the first UK nation to routinely use liquid biopsies for patients.

“They’re a simple and noninvasive alternative to tumour biopsies and can be used much earlier in the diagnostic pathway, and they will allow lung cancer patients to start treatment earlier than at the moment.”

QuicDNA’s huge potential was noted in December at the MediWales Innovation Awards, when the programme won the ‘NHS Wales working with industry’ category.

It has also made headlines of a different kind via the heartbreaking story of Craig Maxwell, who worked for the Welsh Rugby Union before becoming the chief commercial officer of Six Nations Rugby.

After completing a charity bike ride from Cardiff to Paris, he made the shattering discovery that the chest pains he felt were a sign that he had stage four lung cancer, which was both inoperable and incurable.

“He had a rare form of nonsmoking related lung cancer and there were 78 days between his first biopsy and his diagnosis,” recalls Quinn.

“He heard of QuicDNA from his consultants and as soon as he’d been able to digest the news with his family, he set out on a series of fund-raising activities to generate revenue for the programme.”

Among Craig’s achievements are climbing all Welsh peaks of more than 3,000 ft in less than 24 hours and completing charity rides from Paris to Bordeaux and from Cardiff to Tenby.

“He’s clearly a remarkable individual, has already raised more than £500,000 and his efforts will enable QuicDNA to be rolled out to

other health boards quicker than would otherwise have been possible,” says Quinn.

EU r OPEAN S h O w CASE

Another notable project has been Life Sciences Hub Wales’s collaboration with multiple research and industrial partners on the use of robotic surgery, and the implementation of a single operational platform across Wales.

Quinn was invited to present details of the revolutionary All-Wales Robotics-Assisted Surgery Programme to the European Parliament last winter.

“We were only one of two European regions showcasing this technology at the European Parliament and it was fantastic to see Wales positioned as a country which embraced innovations to improve medical outcomes and patient pathways,” she says.

“Health innovation is by its nature a long-term journey, so it’s crucial in the short-term to ensure that your strategic partnerships are always operating as intended, and that everyone is aligned to the need to identify potential innovations across the technological landscape.

Above: the team from the QuicdNA project, which evaluates the use of a simple blood test to extract dNA samples from suspected lung cancer patients

Below: cancer patient craig Maxwell's series of fund-raising activities have raised more than £500,000 towards the QuicdNA programme

care, to ensure our services are meeting the requirements of all patients and people living anywhere in the country.”

The new programme has also had unexpected spin-off benefits for NHS Wales, in the constant battle to attract and retain talented individuals.

“We’re being told by our medical teams that embracing advanced technology attracts talent,” says Quinn.

“Individuals who have already invested so much in their training, and their understanding of the benefits of such technology, want to work with organisations and teams who are basing their approach on new platforms and new models.”

Quinn’s final thought before she returns to continue planning for the next five-year cycle of Life Sciences Hub Wales’ operations is her most telling.

“Our key aspiration is to maximise the adoption of technologies, but everything we do is based on the needs of patients,” she says.

“For us, we take our lead from NHS Wales across health and social

“It’s crucial to identify where treatment timescales need to be reduced, and then to bring in the clinicians to see how we can achieve our goals through collaborations, but every solution has to be based on a demonstrable clinical need.” ■

For more information about the work of Cari-Anne Quinn and her colleagues at Life Sciences Hub Wales, please visit: https://lshubwales.com

HqO brings REX to life science communities

Ian Halstead looks at how digital technology is bringing innovation clusters and sciencefocused locations together to create virtual communities.

No sector loves slick presentations and dizzying CGis more than commercial real estate, but behind the glitz and the glamour, there’s long been a puzzling paradox.

Many companies who see themselves at the cutting-edge of property development and management have been desperately slow to digitise their space.

Even when the new generation of giant urban mixed-use schemes appeared, interactions between tenants and owners were still largely based on ad-hoc meetings between their agents and a random sample of occupiers.

Still today, the first sign a landlord often has that someone isn’t happy with their space, the facilities, or the scheme’s wider offering, is when they fail to sign a lease extension and head off to a new location.

Admittedly, WeWork founder Adam Neumann did astutely identify the potential for a new form of community, based on traditional real estate underpinned by digital technology.

Unfortunately, for both his reputation and his bank balance, hubris then saw his supposed hybrid model morph into merely a property company - which subsequently collapsed into bankruptcy after sinking in an ocean of unsustainable debt.

The new approach, as conceived by the developers of the HqO platform, is to realise that

commercial real estate (CRE) only functions best when asset-owners and managers are intimately aware of the myriad experiences of tenants - and in real-time.

The enterprise, which operates in 30+ countries from its HQ in Boston and a European HQ in London’s Borough High Street, uses its app-based offer to help the operators of science parks, innovation clusters, campuses and other people-heavy locations create communities.

Intriguingly, Darren Hill, the MD of HqO’s operations in UK and Ireland, spent more than three years in WeWork’s enterprise sales team, learning first-hand how volatile the CRE sector could be, and learning how best to effectively engage with enterprises and start-ups.

Given that he’d previously honed his skills via spells with CBRE, JLL and Gerald Eve, he is clearly well suited to a company which blends old-school property nous with the latest digital technology to provide insights and data to its clients.

Hill is also refreshingly free of the jargon in which Neumann and many of his peers love to wallow.

“We are a real estate tech company which specialises in experience. Our app brings together everyone within a building, portfolio or campus, and offers them a very wide range of functions, but its core capability is to be a very efficient communications’ tool,” he says.

“Essentially, we bring together and maintain communities across large spaces. For example, if a customer operated multiple clusters where thousands of people were based, their critical need would be for targeted and precise communications across every location.

“We talk to owners and operators of CRE who want to build genuine communities, and a very powerful element of our brand is our back-end data analytics platform, because it delivers tangible and detailed insights into what is happening in their space.”

PEOP l E AS PEOP l E

There’s clearly an appetite for HqO’s real estate experience (REX) offering. As of the end of January, its technology was being operated across more than 400m sq ft of space in 32 countries, which equates to around 350,000 individuals using its app on a daily basis.

Investors also appreciate the company’s potential as a disruptive force within the CRE sector, given the ease with which it raised more than $50m via a Series D round last October, lifting its total funding through the $200m mark.

The round was led by Dallasbased Koch Real Estate Investments, whose MD Justin Wilson then joined HqO’s board, a tangible sign of confidence in both its business model and its technology.

Hill believes the platform will prove particularly appealing to operators of large science-based locations, where many tenants will work all hours in labs and only rarely see their nearest neighbours, let alone communicate with the property’s managers or agents.

“Our ultimate goal is to try to remove the traditional landlordtenant dynamic and replace it by a service provider-customer model where tenants are seen as team members. We want people to be seen as people, not simply as units of revenue,” he says.

“One of the biggest challenges facing all operators of real estate is trying to understand precisely what occupiers want from their space, as it’s impossible to effectively adapt, re-fit or upgrade your space when you have no accurate data about customer sentiment.

“Unfortunately, property is the last major sector where many landlords and property managers refuse to digitise their models, which is why it’s so refreshing to meet people who are willing to discuss our model, realise the potential and embrace the technology.

“Operators of science space have many highly intelligent and

educated tenants in their buildings and on their parks, but they’re all on different journeys and at different stages of those journeys, so it’s not easy for them to communicate, let alone to share knowledge.

“At the moment, we are expanding campus by campus, helping to build communities on a relatively small scale, but our aspiration is to create something across the entire life sciences’ industry.”

Above: hqo's reX platform is proven to boost tenant and employee retention while increasing net operating income and driving efficiencies in operating costs

Below: hqo's back-end data analytics platform, delivers tangible and detailed insights into what is happening in the space

DEPT h O f DATA

Hill says most clients are initially attracted by the thought of an intuitive app-based platform capable of operating across multiple locations, but rapidly also appreciate the depth of its data informing them about the experiences and opinions of their tenants.

“We share a passion for giving people a voice, so we’re always looking to engage with owners and operators of real estate who want to discover the sentiment of their tenants, and the more passionate they are, the easier it is to create a productive partnership.

“Traditionally, of course, real estate landlords only gained knowledge into the thoughts of occupiers, if their agents had time to drop in for a brew and ask them face-to-face, but it was a timeconsuming, random and hugely inefficient process.

“Now though, our app will interact with individuals and gradually acquire detailed insights into their opinions, expectations and hopes for their space, the building and the wider community.

“Everything is anonymised, of course, but targeted questions about how individuals think their space helps everyone, because receiving the right level and quality of support goes to the heart of the operator-occupier relationship.”

“Clients gain a very rich pool of data, and with granular detail, about what academics, scientists, researchers and others think of their space, the service provision and their environment. Satisfied tenants are more productive, so the collaboration adds huge value.

“If you build bonds between landlords and tenants, the relationship will work better for both parties. Our app collates sentiment to provide ratings and rankings, so the operator has early insight into issues.

“It’s like having an old-school agent-tenant relationship, but this agent is available 24/7, never misses an appointment and notes even the smallest problem in meticulous detail.”

HqO’s model also includes access to the world’s largest index for measuring employee workplace experience, created by Leesman, and which was acquired in mid-2022.

“When you have access to a global benchmark, you see instantly which issues are important to tenants, which are marginal in terms of sentiment, but also those which are absolutely pivotal, so an individual client can place everything in context,” says Hill.

" SUPPORT

“We can tell clients where their real estate ranks globally, so they can fine-tune their investment strategies, and can also do via sector or geography.

“We could, for instance, benchmark via anonymised data, how each of Oxford’s sciencefocused locations rank against other, or against Cambridge, London elsewhere in the Golden Triangle, or do likewise for schemes providing space of life sciences, or any other niche.”

APPEA l TO A r C

It’s a powerful and compelling vision, and not surprisingly, it proved particularly appealing to Advanced Research Clusters (ARC), which manages science-focused innovation campuses in Harwell, Oxford, Uxbridge and West London.

ARC was launched in Q2 2022, already has more than 10,000 members across those four locations, and with funding from the global alternative asset manager, Brookfield, it aims to become Europe’s leading network of such clusters.

The relationship began by chance - but blossomed from the start.

m

C

“We made an approach and discovered that they were into the final stages of identifying a technology provider. It was serendipity,” recalls Hill.

“They already had a wellconsidered ‘wish-list’ of needs and issues, so conversations proceeded quickly, and we had an immediate rapport with their leadership team, which doesn’t always happen, but was very pleasing.

“They understood the benefits of our app, and the third-party technologies we’ve invested in, and they shared our belief that every element had to be of demonstrable benefit to the end users.

“ARC had an existing app provider across three of their four clusters, but it operated separately for each location, whereas our technology enabled them to build a digital community across all four environments, which cover around 10,000 people.

“Right from the start, ARC was gaining valuable insights through its new engagement model, which they refer to as ‘members of the future’ and now we’re seven or eight months in, the tangible value of the data they are acquiring continues to grow.

“Also, purely in cost terms, it’s more efficient to operate one app across four locations, than to have one for each, and more sustainable. Stakeholder value and sustainability are, of course, crucial for clients operating via a public-private model.” ■

For more information about HqO, please visit: www.hqo.com

Breakthrough looks at issues impacting recruitment decision-making throughout the UK’s life sciences community.

ChAlleNgeS to reCruIt and retAIN

There may be a debate about whether the life sciences’ industry has reached crisis point in its search for talent, but there is no doubt that its post-pandemic pace of growth has created a disconnect between supply and demand.

The intense focus on global life sciences from the moment Covid-19 was identified, and the subsequent widespread use of remote working, made many talented individuals realise they had become as footloose as their employers.

Equally, the increasing demand for AI-enabled technologies, coupled with the need to negotiate a complex regulatory environment, has placed a premium on candidates with the skillset to match the ambitions of potential employers.

Data issued in December by the Association of the British Pharmaceutical Industry (ABPI) underlined the current challenges facing companies and their HR partners.

The number of life sciences businesses operating in the UK had edged up gradually since 2008-2009, as had their scale judged by turnover and employment numbers.

However, the ABPI calculates that their combined turnover surged by 13% to £108bn during 2021-2022 - of which biopharma accounted for 43% - and staff levels were up 5% on the previous year.

Suddenly, many companies found demand for their products and services increasing dramatically and the scramble to retain staff and attract new ones became intense.

The ABPI had highlighted looming skills gaps back in 2019, as such IT-based disciplines as health informatics increasingly required data analysts and specialists in computing science, information science, biology and medicine.

Academics had also warned that many areas of the NHS and social care providers had developed cultural models in which Big Data was separate from digital health.

Inevitably, such challenges were compounded by the upsurge in patient demand during the pandemic, and the boom across life sciences.

Employers, even those with significant resources and a strong brand profile, have been forced to bump up salaries and increase benefits to attract talent, and there are no signs that the gap between supply and demand is narrowing.

In January, a report from MHA (an independent UK firm operating within Baker Tilly International) suggested that the challenges would remain throughout 2024.

Analysis by its lead partner for life sciences and med-tech, Yogan Patel, indicated that more than 70% of UK life science companies were experiencing staff shortages.

“The (potential) consequences would mean a slowing down of the drug discovery and development process, and make it more difficult to run clinical trials,” he says.

“Such delays will also affect the launch of new products and services and increase the cost of developing new drugs and med-tech products.”

Chloe Baverstock, who heads the UK life sciences team at Michael Page, identifies employer flexibility as a potential solution.

“One approach would be to invest more in potential and upskilling. If a company discovered there were very few candidates around with precisely what they required, it would be a great opportunity to hire someone with less experience, but who had great potential.

“Equally, if an individual wants to make a move, but isn’t sure that their current skillset is sufficiently refined, it could be the perfect time to find an employer who would invest in their potential.”

At the specialist life science and engineering recruitment consultancy, ARx, director Luke Blaney believes the scale of demand has created a challenge in itself.

“Many companies are facing the complexity of managing multiple vacancies across different verticals,” he suggests.

“They have limited time to acquire the knowledge required to fill each individual role, leading to a repetitive and

frustrating cycle where the most urgent roles always take precedence and which in turn perpetuates a continuous loop of urgency.

“Niche agencies, such as us, are structured to shoulder the weight of handling such challenges, allowing internal teams to both collaborate with hiring managers and proactively prepare for future vacancies across the organisation.

“In essence, the industry isn’t experiencing a recruitment crisis, but rather a vacancy management crisis, and the constant finger-pointing at recruiters, often observed on social media and marketing platforms, is often misplaced.

“The key is the type of consultancy employed, and the efficiency and effectiveness of collaborative efforts to achieve optimal outcomes for both employers and recruitment partners.”

It’s an intriguing perspective, and though Blaney would be expected to make the case for external recruitment, his opinions are based on a solid bedrock of experience within the life sciences industry.

His father, Terry Blaney, was a former executive VP at Colorcon, a long-term manufacturer of pharmaceutical products, and the founder and CEO of Phoqus Pharmaceuticals, a drug delivery spin-out from Colorcon, which floated on the Alternative Investment Market in 2005.

ARx was founded a year later, and subsequently took space at Sussex Innovation, a business incubation and

innovation network headquartered at the University of Brighton, with hubs in Brighton and Croydon.

Luke thinks many companies should revisit their fundamental recruitment strategies and establish partnerships with two or three established agencies each specialising in different niches of life sciences.

“The strategic division of roles enables hiring managers to concentrate on such crucial aspects as conducting interviews and honing their strategies for upcoming vacancies,” he says.

“Adopting a more streamlined approach allows all parties to focus on their core skills, and ensures a more targeted and informed recruitment process, which is critical in such a dynamic and volatile landscape as life sciences.”

He notes that even major employers have begun 2024 by implementing hiring freezes, often because of the geopolitical and economic uncertainties, but believes that presents significant opportunities for smaller players.

“Companies who remain active in recruitment during this period have been presented with a great chance to attract top-tier talent, by capitalising on the hiring hiatus we are seeing in larger organisations,” says Blaney.

“Many companies are responding to the current uncertainties by reassessing their talent acquisition policies, and the more fleet-of-foot are incorporating more consultancy support as a cost-effective measure to avoid costly and potentially unproductive retainment fees.” ■

For information about ARx, please visit https://arxconsultancy.com

More can be discovered about the UK’s life sciences and pharmaceutical industry via www.abpi.org.uk

Innovation

e xtending the frontiers of UK science and industry

Architects with vision

Architects from the London office of the global NBBJ practice outlined their innovative vision for regenerative lab space to Ian Halstead.

The principles of design have been set in stone - and many other materialssince before the birth of Christ, when a Roman military engineer, Marcus Vitruvius Pollio, observed that architecture should always be well-built, serve a purpose and be beautiful to observe.

However, in more recent times, many architects have struggled to pay lip-service to his enduring vision under the pressures of the three Cs of client, concept and cost.

It’s pleasing therefore to encounter a practice which proudly proclaims that ideas are the catalyst for its designs.

NBBJ’s philosophy is the product of decades of experience in international markets, since the firm was founded in 1942, and it now operates from a dozen sciencefocused locations in the USA, UK, India, Hong Kong and China.

The two London-based architects who explained its vision have also accumulated more than 30 years apiece in the sector, so their observation come from a solid bedrock of design nous and client-related experience.

Darius Umrigar, who shares leadership of NBBJ’s science practice with a colleague based in Boston, and leads its HE practice, says the notion of creating lab space designed from the outset to be capable of regeneration began to evolve shortly before Covid.

“We’d spent many years working with academics, scientists, universities, researchers, teaching hospitals, private institutions, pharma clients and government bodies,” he recalls.

“However, we then became immersed in the operations of commercial developers who had pivoted from offices and major mixed-use schemes to look at delivering space for science tenants, but who actually knew very little about science.

“Their major strategic challenge was to commission science buildings designed to be flexible, because they weren’t so naïve as to believe that the boom for life science space wouldn’t at some future point be slowed, by either economic or geopolitical influences.”

David Lewis, who leads NBBJ’s healthcare market team and is partner for its UK operations, offers a telling anecdote from the same pre-pandemic period.

Below: life and Mind building at the University of oxford, which NbbJ has worked on for the past four years

“A major UK developer came to us when science was very much on the agenda, but they didn’t know what type of building they wanted to deliver, what type of tenants they wanted to attract, or whether they should fit-out the building or leave it at ‘shell and core’.

“They hadn’t agreed on the various elements, so they couldn’t put their investment model together, but that was also the springboard for us to start thinking in depth about design flexibility.

“We also believe it’s crucial, not just in science space, that because of high demand people don’t just build stuff which won’t be genuinely sustainable for the long-term.”

r E v E r SIN g T h E T r END Umrigar thinks the regenerative lab approach could help reverse the traditional relationship between the US and the UK with regard to trends in the provision of sciencebased space.

“Boston and Cambridge have, of course, been the epicentre of commercial science development which is grounded in very strong academic expertise for the last 20 years or so, and so the US is usually two or three years ahead of Western Europe,” he says.

“However, they’ve slackened off in terms of delivering new space as their market has fallen, but our market is pretty much the Golden Triangle which remains very buoyant. We’re also always conscious that we need to identify future trends and get ahead of them.

“Some of our key clients are USheadquartered developers with a presence here, funded by venture capital funds, and they’re slightly apprehensive about rolling out projects full-steam at the moment, as it would take two to three years just to deliver the first phase.

“From our perspective, for all those reasons, 2024 is the perfect time to look ahead, and imagine how we could design space which could evolve in the future, and perhaps even change to be suitable for another sector.

“We’ve been reflecting about how space which had been designed for the long-term might best be refitted or repurposed, so that the developer continues to get an acceptable RoI rather than seeing buildings just lie idle and languish.”

His colleague notes with equal passion that the firm’s UK clients are typically more committed to adopting

Net Zero designs than those based in the States and elsewhere.

“In the US, they’re usually talking about large and wide-span structures to allow maximum flexibility within the labs, but the challenge there is around embedded carbon because of the materials, especially the concrete and reinforcements which would be required,” says Lewis.

“However, if you take a Net Zero approach, you can get the carbon element right down, and still have the flexibility which is a more popular approach by UK clients.”

“We’d be more likely to propose a timber-based structure, though of course the jury is still out among most insurers with regard to the use of wood,” he admits.

“One idea within our regenerative lab mindset is to consider the use of wood on a mass scale, even if it’s not used within the lab space, but elsewhere in the building, not least as we’re finding that potential tenants are increasingly focused on the use of timber.”

MODU l E MODE l

Although NBBJ’s regenerative approach is at its early stages, Lewis believes it dovetails neatly into wider debates about architectural sustainability across multiple sectors.

“You can’t afford to design for the short-term, not just around the science sector, but generally. Given the investment, it’s not sustainable in any sense to demolish and rebuild space every time the market mood changes or the appetite changes,” he says.

“It does mean upfront investment, of course, but unless someone wanted to develop space and then flip it – and those aren’t the clients with which we work –we believe they should be

thinking for the long-term about how the shell can adapt and evolve as the market changes.”

A design approach which already finds much favour with the two colleagues would also be perfectly suited to the regenerative lab mindset.

“It would be rare if one of our projects didn’t have at least twothirds of the building arriving at the site in modules, which is all about speed, cost and the efficiency of construction. Most of the building’s envelope will also be fabricated off-site,” says Umrigar.

“It’s a much more refined approach than in the past, and also far easier to manage the production process inside a factory than on a windswept site.”

“We also like to assemble the various mechanical-electricalplumbing elements off-site, so they can simply be plugged together later, which has been of tremendous benefit from a health and safety perspective,” adds Lewis.

The trend for internal layouts of large science buildings to be designed so tenants from different enterprises and floors come together has been noted for the last decade and more.

The provision of amenities has likewise been driven by the belated realisation by developers and their investors that such space needs to be far more welcoming.

“For my parents’ generation, the separation between work and home was very distinct, but now most science space is used 24/7 and the lab effectively needs to be a ‘home from home’,” says Lewis.

“Science parks, for instance, had traditionally tended to be rather off-grid and with an insular environment, but in the postpandemic era, we’re seeing many of them start to address those issues.”

INSPI r ED B y MEDINA

NBBJ has been pioneering designs driven by human behaviour for more than a decade, via its partnership with developmental molecular biologist and NBBJ Fellow Dr John Medina, author of the provocative and influential ‘Brain Rules’, and a professor at the University of Washington.

“His research and his data about how to stimulate collaboration within a workplace environment is a regular source of inspiration as we look to evolve the regenerative lab concept,” admits Umrigar.

“We’ve been working on and Mind Building at the University of Oxford for the last four years, example, and at the heart of design is the desire to increase engagement between the research and the education departments.

“It’s the largest building in the university’s history, and UK’s largest laboratory designed Passivhaus principles, which reduce its carbon footprint against traditional designs.

“The scheme won’t be ready until the spring of 2025, but incorporated Medina’s analysis into the design, so it’s all about the quality of the environment and you’re never more than storey away from outdoor space.

“Students, academic staff researchers will have fantastic views across Oxford, and can access landscaped terraces and private balconies, so whilst it’s designed for collaboration, everyone can also ‘escape’ from their labs and offices to relax and unwind.

“The space is flexible, sustainable and of a quality which the tenants desire, and which the university is determined to provide.”

He and Lewis are convinced that though the regenerative approach to lab space is radical will require a shift in mindset some developers and their that the concept is viable and appeal to those with long-term strategic visions.

“Not long ago, who imagined that redundant warehouses which had been derelict for years could be successfully converted into desirable apartments and in-demand retail space?”, asks Umrigar.

“I believe we could design such a science building today which could last for 150 years and be refitted several times during its lifetime.”

It might have been a technological glitch, but the sound which accompanied his confident statement sounded rather like the clunk of Roman armour, as the ghost of Marcus Vitruvious Pollio nodded in approval. ■

For more information about NBBJ, its global projects and the work of Dr. John Medina, please turn to: www.nbbj.com

New m A r IN e m ODel SPAw N e D at O BAN

Breakthrough discovers how an innovative and ambitious project is transforming Scotland’s marine economy.

he town of Oban on the west coast of Argyll has seen different incarnations over the centuries; as a local fishing port, a destination for steamships carrying hordes of Victorian visitors, a wartime communications hub and as the historic gateway to the isles.

Throughout the years, the Atlantic waters which lap, and often crash, against its shoreline have also been irresistible to lovers of

nature - and of just-caught seafood.

Now though, the various strands which have long given Oban its powerful sense of identity are being woven into a new tapestry, in which blue will be the dominant theme.

It’s more than a decade since a UN conference on sustainable development first mooted the idea of a ‘blue economy’ – in which a marine environment was the catalyst for economic growth, employment creation and greater personal well-being.

In 2022, the Scottish government took the concept even further with its Blue Economy Vision, through which the marine

assets of the west coast could underpin transformational and sustainable long-term change of the country’s economy.

It envisaged that its ultimate social, health, economic and development ambitions would be achieved by 2045, in line with its wider Net Zero goals.

The EMSP has been developed over the last 15 years on a phased basis by Highlands and Islands Enterprise (HIE), Scotland’s economic and community development agency for the western half of the country.

It has established the Dunstaffnage location as a self-sustaining and growing cluster at the epicentre of research and collaboration linked to economic growth in Scotland’s marine industries.

EXPE r IENCED E y E

It takes an experienced eye to guide newcomers through the concept and the strategy, and Lucinda Gray is ideally placed as HIE’s head of projects and partnership for Argyll and the Islands to explain EMSP’s growth ambitions.

She begins by setting the park in its local, regional and national context, underlining the financial and strategic commitment of the government and its multiple partners.

“We co-locate with SAMS, Scotland’s oldest and largest independent marine science organisation and an academic partner of the University of the Highlands and Islands,” says Gray.

“A central element of the EMSP’s role is to create an appealing physical environment that encourages and enables collaboration and engagement between businesses, stakeholders and inward investors.”

There’s long been chatter about the triple helix model, which brings academic research, industry and government together to drive business growth, education and innovation, but the theory has visibly become reality here.

Above: the eMSP (european Marine Science Park) has been developed over the last 15 years by highlands and islands enterprise (hie)

left: the first building, Malin house, opened in 2012, attracting marine-focused innovation

“Everything we do at the park is about collaboration, whether that is related to academic R&D and commercialisation, developing space, engaging with tenants and their supply chains, or working with our stakeholders,” says Gray.

“Economic sustainability underpins the business models of companies, entrepreneurs or startups who come here, so we are continually working with them to support the expansion of their products or services to help them prosper and grow.”

Although the concept of the Blue Economy was first noted internationally only after the UN conference on sustainable development in Rio de Janeiro in mid-2012, progress had already been made in the rather chillier climes of Scotland’s western coastline.

“Our first building, Malin House, opened in 2012, attracting marine-focused innovation, including businesses working on the health of maritime species, developers of novel seaweed-based products, carbon cycle research, and consultancy.” says Gray.

EXPANDIN g ENTE r P r ISES

HIE astutely chose to deliver flexible co-working and incubation space on short-term leases, as well as a mix of bespoke lab space and office accommodation for existing tenants looking to expand.

Gray proudly points out that two enterprises, which originally began life at the EMSP in incubator space (known as ‘The Moorings’), have since expanded into their own space.

“Patogen, which is a Norwegian fish health company, initially set up with just one staff member in a small office, but then recruited a larger team and moved into bespoke lab and office space elsewhere in Malin House,” she says.

“Ocean Ecology, which specialises in marine ecological surveys and consultancy projects, in both coastal areas and offshore zones, employed just two people when they came here, but demand for its services quickly saw it take up more space.”

The company’s scale and profile has continued to grow, and last September, it expanded again into a larger area of the same building, where it employs around 20 staff.

A third tenant, Tritonia Scientific, was a start-up in Malin House in 2021 and now employs some 20 people focused on advanced underwater visualisation techniques.

Tritonia and Ocean had collaborated on projects since reaching the park, and last year the latter cemented that rapport by taking a majority stake in the former.

“Tritonia harness cutting-edge technology and innovative methods to provide the data which companies need to make effective decisions, and it was very satisfying to see them capitalise on, and benefit from, the park’s collaborative ethos,” recalls Gray.

Malin House is almost full, with 13 tenants employing more than 70 people, and live enquiries about the remaining space.

Gray says tenders are currently out for the construction of a second building, on which work is expected to begin later this year.

The investment required to deliver 1,600 sq metres of new space will be a chunky £8.5m.

It’s even more impressive to hear that funding in the region of £12m is due to come on stream, through the UK and Scottish government-backed Argyll and Bute Rural Growth Deal, for three future schemes that will be colocated within the park.

UHI Argyll is planning a marine industry training centre, whilst SAMS is proceeding with its proposals for a centre to drive new seaweed and shellfish innovation and development, and a purposebuilt STEM Hub.

Even before construction of the EMSP’s second phase gets underway, Gray says two further phases have already been identified in the site’s masterplan

and will come to the market as future development opportunities.

“These investments will drive further economic activity and employment growth here and align with a marine education campus spanning STEM education from primary school to undergraduate and post-graduate level.

As she outlines the proposals, Gray notes that whilst 160 staff are directly employed at SAMS, it’s equally impressive to note the numbers within each academic niche.

Almost 90 students are taking BSc degrees in marine science, alongside 28 on Masters’ courses and 38 who are researching for PhDs, the latter figure which suggests that a goodly percentage will likely be the future creators of start-ups.

For almost 130 years, the most visible artificial landmark that greets newcomers to the town of Oban is McCaig’s Tower, built by a local banker to provide work for local stonemasons, and as a lasting monument to his family.

Thanks to the visionary ‘Blue Economy’ mindset, future generations will also note the imposing scale of the European Marine Science Park. ■

For more information about the EMSP and its partners, visit: europeanmarinesciencepark.co.uk

Peter Oakey, Technical Manager at Weiss Technik UK , gives an insight into how LED lighting is future-proofing plant-growth technology and agriculture.

L Ig HTIN g tH e future

Plant growth chambers offer tailored environments for plants to thrive in, allowing researchers and growers to play the roleof pragmatic caretakers, tweaking temperatures, humidity and lighting to meet plants’ demands.

Researchers can discover more about the relationship between technology and biology, and how they can harness their findings to advance our understanding of plant biology, optimise crop yields and develop sustainable practices. All in all, plant growth chambers provide a fascinating insight into the secrets of the plant world.

“The magic of these chambers is all about finding effective light sources for mimicking real-world conditions. However, as new legislation shapes the landscape and some light sources become unavailable, the quest for sustainable and efficient lighting solutions has become paramount,” says Peter.

“LED technology is rapidly becoming the unsung hero of the plant growth world and is shaping the landscape of modern agriculture. LEDs offer many advantages compared to other light sources, and highlight the pivotal role of innovative lighting technologies in maximising the productivity and success of plant growth chambers, and the future of agriculture.”

Th E Pr OB l EM

The evolution of plant growth technology is exemplified in a project undertaken by Weiss Technik UK for the University of Liege (ULG), Gembloux in 2018.

The project involved the design and build of a specialised controlled environment facility, requiring a chamber capable of simulating natural growth conditions. This was to facilitate an in-depth exploration of plants, animals and microbioata in the agricultural and natural ecosystems models. In particular, the focus was on studying the impact global warming has on the physiology of field crops and exploring interactions with the biotic and abiotic environment.

We originally opted for light-emitting plasma (LEP) lamps to meet the challenging lighting specification.

With a reputation of being an efficient, full spectrum light source, LEP presented a good representation of visible light, crucially incorporating UVA radiation. However, it became apparent that the spectral requirements, particularly in the red, far-red and infra-red domains, necessitated supplemental sources. To address this, monochromatic LED sources were required to supplement the red and far-red light, and tungstenhalogen lamps for the necessary infra-red heat.