Welcome to the 127th edition of the Aussie Painting Contractor Magazine.

The financial year has come to an end and things from all reports don’t look like slowing up anytime soon.

It’s been another one of those busy months with me attending another three Career Expos which have been successful in getting a few people into the trade and starting trials with employers looking at painting as a career.

Ten training days which included me spending the best part of a week spotting apprentices as they learnt how to use boom and scissor lifts. I also managed a trip to Toowoomba to train this month as well.

In a couple of days, we start the I Got Brushed Program doing the Volunteer Marine Rescue (VMR) Currumbin. We are doing this program in conjunction with MEGT and Major Training. In this program we have 8 participants that will be repainting a couple of buildings for the VMR and learning the skills to get them ready for gaining painting apprenticeships. If you are interested in finding out some more information about the participants for potential apprenticeships, contact me.

• Aaron Gilbert

• Andrei Lux

• Ayesha Scott

• Helen Kay

• Jim Baker

• Leo Babauta

• Mary Cairns

• Nigel Gorman

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Nigel Gorman

nigel@aussiepaintersnetwork.com.au

07 3555 8010

'Til next month, Happy Painting!!

06 08 11 14 16

Transitioning from Sole Trader to Company How a Commercial Lawyer can assist. Time for a wage review?

Legal Expense Insurance FOR SOLE TRADERS

Cybersecurity Best Practices for Small and Medium-Sized Businesses

Why Your Business Needs You to Say NO

6 POWERFUL MINDSET SHIFTS

25 20

Toxic work cultures start with incivility and mediocre leadership. What can you do about it?

The Importance of TRAINING (Part 3)

28 30 35 36 38 42 43 22

How Much Cash Does My Business Need?

A Painters Pathway

Need ideas for your next team building or social event?

Competitive advantage AND UNIQUE SELLING POINTS

Know thyself, know thy finances: which of the 5 money personalities are you?

Industry Idiots

Important Contacts

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you July incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

Making the transition from a sole trader to a company is a significant decision that can bring numerous benefits, such as reduced personal obligations and the ability to attract investments. However, it is important to ensure that you follow the correct legal procedures when making this transition. In this blog, we will outline the steps involved in transitioning from a sole trader to a company and how a commercial lawyer can assist you in this process.

Before making the transition to a company, it is important to determine your company’s structure, the staff you will hire, and a suitable business name. A commercial lawyer can help you to choose the right company structure, whether it be a proprietary company or another type of entity. They can also assist you in selecting a business name that complies with the Australian Securities and Investments Commission (ASIC) regulations.

It is important to consult with your accountant before making the transition to a company to ensure you are registered for GST and comply with other requirements, such as PAYG. A commercial lawyer can liaise with your accountant to ensure that all necessary requirements are met during the transition process.

Transferring your business name from your ABN to the new company entity with ASIC is a crucial step

in transitioning from a sole trader to a company. However, it is important to note that transferring the business name from a sole trader to a company does not automatically transfer the legal responsibilities of products sold previously under the former ABN structure. You will need to ensure that the new company is insured, and the old ABN has sufficient runoff cover for any liabilities.

Apart from transferring the business name, it is also essential to transfer other relevant assets, licenses, and trademarks to your new company. A commercial lawyer can assist you in ensuring that all transfers are conducted correctly and that the appropriate legal procedures are followed.

As a company, you will have to comply with additional reporting obligations, such as record-keeping, lodgement of financial records, company registrations and fee payments, and notification of changes to company details, including updating ABN details on the Australian Business Register (ABR). A commercial lawyer can assist you in ensuring that you comply with all additional reporting obligations and that all relevant paperwork is filed correctly.

Once you have moved everything over, it is important to cancel the ABN that you were using to do business as a sole trader. A commercial lawyer can assist you in cancelling your ABN and ensuring that all relevant documentation is filed correctly.

While it is possible to make the transition from a sole trader to a company independently, it is advisable to seek the assistance of a commercial lawyer to ensure that you comply with all legal requirements. A commercial lawyer can assist you in navigating the complexities of the transition process and ensuring that all necessary procedures are followed.

In addition, a commercial lawyer can help you to draft a shareholder agreement and other relevant documents to protect your interests as a shareholder in the new company if there is more than one owner. They can also provide advice on the legal implications of your shareholding and the rights and responsibilities of shareholders in the new company.

In summary, transitioning from a sole trader business to a company can offer a range of benefits, but it is important to follow the correct legal procedures to ensure a smooth transition. Seeking professional legal advice is highly recommended to avoid any potential issues or complications down the line. A commercial lawyer can assist with the legal aspects of the transition, including transferring business assets and licenses, ensuring compliance with reporting obligations, and drafting the necessary documents. It’s important to note that each business’s situation may be unique, and it may be beneficial to seek professional advice from a commercial lawyer or accountant to ensure that all legal and financial requirements are met. By working with a legal professional, you can rest assured that your transition to a company structure is in compliance with Australian laws and regulations.

To get further information as to how Rise Legal can assist you in transitioning from sole trader to company, book in for a free 15-minute consultation with one of our lawyers.

The past couple of weeks has seen a number of issues arise around the topic of wages. Whether it be back pay for employee underpayments; changes to award rates, or increases in award allowances, it’s a timely reminder that annual wage reviews are an absolute must for employers.

Suncorp’s insurance arm has paid out about $32 million to more than 15,800 underpaid staff after it failed to adequately pay employees the minimum wage since 2014, due to the inconsistent use of ‘rostered employee’ and misunderstandings of appropriate entitlements.

The payback includes interest and superannuation, including about $26 million in wages and entitlements, $4.5 million in interest, and $1.4 million in superannuation.

This comes after BHP announced last week it had underpaid 28,000 employees $430 million due to basic payroll errors.

These companies are huge employers with equally huge Human Resource departments and if they can get it wrong, so can smaller businesses. Whilst underpayments of that magnitude are not common, they can certainly run into the thousands for smaller employers – and it only takes one employee to raise a concern.

The Fair Work Commission has announced:

the National Minimum Wage will be increased to $882.80 per week or $23.23 per hour

a 5.75% increase to minimum award wages. The increase applies from the first full pay period starting on or after 1 July 2023.

Make sure you are paying your staff correctly and talk to us about a wage review if you have any concerns.

Being open to new possibilities is a positive trait shared by most entrepreneurs—but saying yes to all the people you meet and opportunities that come your way can get you into trouble.

When we overcommit—especially when we take on projects that don’t actually benefit our business— our stress can hit the roof. It’s much hard to be productive when we’re feeling burned out and resentful.

One of the most impactful changes you can make in your business is to form one simple habit: give yourself time to weigh the cost and benefit before making any decision, and politely decline any opportunity that doesn’t align with your goals.

If you’re feeling stressed and less productive than you’d like, it’s time to get better at saying no.

Your business plan is more than a record of the year’s goals and projections. It’s a living document designed to help you guide your business in the direction you want it to go.

Although some decisions may seem small—an invitation to coffee, a request for advice—all of those “asks” add up. In order to stay focused on the success of your business, you need to always keep your short and long term goals in mind.

If you don’t have a business plan (or it’s been some time since you wrote one), any of these free small business plan templates can help you get clear on where you want to take your business—and how you’ll get there.

If someone’s request does not help your business, your decision is easy. If you may want to work with the person in the future, or there’s something you can ask in return that will benefit your company, a definite maybe is in order.

Before you say yes ask yourself the following questions:

• How does agreeing to this benefit my business? How important is that benefit at this time or in the future?

• Do I have the capacity to carry out this request at this time? How might other aspects of my business suffer if I prioritize this request?

• What does my gut say? Will I feel burdened, owed a favor, or for any other reason resent saying yes to this request?

If you’ve weighed the decision and need to turn someone down, these simple phrases can help you to say no gracefully.

• Thank you for thinking of me but I can’t take on another project right now.

• I’d like to help you but I have other commitments.

• A healthy balance at work at home is my priority at the moment. I know this is a small request but I can’t be of service right now.

• I’m sorry I can’t do what you’ve asked, but I can do this for you if it helps.

• I’m unable to help you now, but perhaps another time.

Notice that specific reasons given for declining a request aren’t offered. You don’t need to give a list of excuses for saying no, which can sound unconvincing. Unfortunately when offered reasons for refusing a request, some people will add pressure by trying to challenge them.

When you become skilled at saying no, you’ll not only avoid additional stress, you’ll have more time to spend doing meaningful work you enjoy, building a business you love.

One final thought: if the thought of saying no still fills you with dread, don’t think of it as saying no. Think of it as saying an enthusiastic yes—to you and the success of your business.

Book a strategy session HERE to see how we can improve your bottom line.

Having worked closely with dozens of people’s transformative journeys, I’ve come to recognize a handful of mindset shifts that make an incredible impact.

Those who’ve worked to shift in these ways have remarkable transformations.

I’m going to share them here with you in hopes that they might inspire your own transformation. If you take these on fully, they could be life-changing. This isn’t all there is, but these are a huge, huge foundation.

1,) I am enough. You can notice the opposite of this when you’re afraid you’ll be judged, afraid you’ll fail, afraid you’re unworthy of respect or admiration. When you’re caught up in what other people are thinking, or blaming them for making you feel not enough. When you’re overwhelmed and think you can’t do everything. What if you were always enough, no matter what you do or don’t do? What if you didn’t

have to worry about being good enough anymore? What if this were your base assumption? Then everything else where you worry about this becomes so much easier.

2.) I let myself feel my emotions. Most people don’t want to feel sad. Or feel fear, frustration, anger, grief. We avoid these emotions because we feel there’s something wrong with feeling them. Most of our lives are actually spent trying to avoid the emotions, distracting and avoiding and denying. What if we just allowed ourselves to feel sad? Or afraid? Or angry? Going through these emotions is not that difficult, if a bit unpleasant. But these emotions can also be beautiful, places of learning and wisdom, and much more, if we open to the experience. Then they pass, and we don’t have to spend so much energy resisting and suppressing. We become more relaxed around these emotions. Give yourself permission to feel these emotions.

3.) I love myself when I feel stuff. When you feel emotions, if you’re like most people, you’ll not only resist … but make yourself feel bad for feeling them. I won’t go into much effort to explain this, but ask that you trust me. If you simply noticed that you’re feeling the emotion (let’s say frustration or sadness) and gave yourself some love, some breath, some space … it would be an entirely different experience. You would not make a big deal about having the emotion, but would simply give yourself some love. It’s a game changer.

4.) I’m not stuck in right vs. wrong. It’s incredible how often we make ourselves wrong — I shouldn’t have done that, I suck for not doing this, I should feel ashamed for how I am. And we do the same thing to other people — they suck for doing this or not doing that. We stress out trying to do things right. What if we got out of that game of right and wrong? Play a whole different game, that isn’t constrained by this mental framework. It would be free of shoulds and shame, and free to play, invent, explore, create art, have a joyful ruckus of a time.

5.) I trust myself. What would life be like if you trusted yourself? Most of us are caught up in worry and anxiety because we don’t trust ourselves. What else is possible if you started to trust yourself? A life of greater ease and playfulness, for example. This is an incredible way to live.

6.) I choose my life. We often do things because we feel we should, or have to. Out of a sense of obligation, or not having any choice. What a life! It’s a life of victimhood and burden. Most people don’t even notice when they feel this way, because it’s so ingrained. When you shift to a mindset of choosing your life … it’s powerful. You feel empowered and enlivened.

How do you work with these? I would love to work with you as a coach, because it’s often impossible to do this work without support. We just can’t see what we can’t see. That said, here are some keys to working with these mindset shifts.

First, notice when you have the opposite mindset. Notice when you’re stuck in the old mindset, as often as possible. Notice the impact of the old mindset — what effect is it having on you, on other, on your life? Have grace for yourself, and love, when you notice. Breathe.

Second, practice the new mindset. What if the new mindset were absolutely true? Empower it. Be it.

Third, when you get trapped in the old mindset — you’ll revert to it often — get support. From a coach, from a therapist, from a meditation teacher, from someone outside of yourself. Someone who can help you see it, help you bring love to it, help you practice outside of it.

And then keep practicing! This takes a lot of practice, a lot of messing up the practice, a lot of getting yourself back into it. It’s all a part of the practice. It’s not easy work, but I promise, it’s transformative.

Leo Babauta ZEN HABITSYou’re in a meeting, with something important to say. Just as you begin, a colleague sighs and shares an eye-roll with their buddy. And not for the first time.

Workplaces aren’t always harmonious. Whether it’s a cafe, factory or parliament, people do and say hurtful things. They may talk down to you, “call you out” in front of others, make jokes at your expense, gossip about you behind your back, or give you the silent treatment.

This type of incivility doesn’t quite rise to the level where you can complain to human resources and expect a satisfying resolution. Organisations typically have policies against racism, sexism, harassment and other overt forms of abuse. But incivility – being less severe and more difficult to prove – tends to fly under the radar.

Most of us will experience incivility at some point at work. More than 50% experience it weekly. According to a 2022 meta-analysis of 105 incivility studies, you’re more likely to cop it if you’re new, female, in a subordinate position, or from an ethnic minority.

Unkind and thoughtless words matter. As linguist Louise Banks says in the 2016 film Arrival: “Language is the first weapon drawn in a conflict.”

What people say and how they say it affects us deeply. One cruel remark can ruin your whole day. Left unchecked, incivility makes for a toxic workplace.

Read more: Is workplace rudeness on the rise?

Why are people rude to each other?

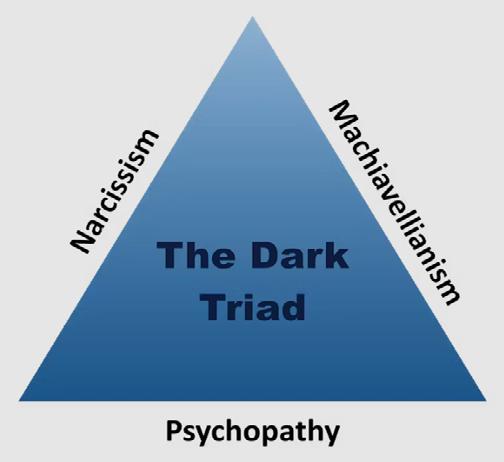

It’s tempting to simply blame bad character. Certainly such behaviour is much more likely from people with dysfunctional personality traits, especially the “dark triad” of narcissism, psychopathy and Machiavellianism.

Narcissists are self-obsessed and dominate social interactions. Psychopaths lack empathy and don’t understand social norms. Machiavellians are manipulative, self-interested and amoral.

But even “nice” people can be uncivil, with the three most common incivility triggers being because they feel let down by their leaders, are under more pressure than they can handle, or someone else was rude first – to them or others.

Incivility can therefore become a vicious spiral that turns victims and bystanders into perpetrators. That’s how toxic workplaces are born, develop, and perpetuate.

Read more: What Jeremy Clarkson taught us about incivility in the workplace

Leadership sets the tone. We’re social creatures and learn what’s expected and acceptable from those we look up to. Our leaders’ behaviour is infectious, and cascades down throughout and across organisations – for better or worse.

Incivility is most harmful when it comes from a supervisor: someone we’re supposed to trust, who’s supposed to look after us.

Read more: Staying in grace: Why some people are immune from scandal – until they're not

But managers can be derelict in their duty without being perpetrators. As in the case of sexual harassment, it may be easier to see and hear no evil, perhaps because the perpetrator is favoured as a high performer or a friend. With the capacity for one individual to make life a misery for many colleagues, this leadership failure can lead to a toxic workplace culture.

Authentic leadership ‘in the trenches’

It’s up to leaders to be the first movers against incivility and create positive work cultures with their own behaviour. What leaders will tolerate on their team sets the bar for how everyone else will behave.

With colleagues Stephen Teo and David Pick, I’ve surveyed 230 nurses across Australia about the leadership qualities that help reduce incivility.

Why ask nurses? Because their work is stressful and demanding. The strain of providing critical care for patients creates conditions conducive to conflict, from swearing to physical violence. Workplace incivility is frequent and these stressors increase the likelihood of medical mistakes. So there’s good reason to reduce incivility to improve health-care quality.

The power asymmetry means leaders’ inappropriate behaviour is less likely to be challenged. Take, for example, Harvey Weinstein, who for decades abused his position as one of Hollywood’s most successful film producers to sexually exploit women, before finally being held to account.

Our research shows that authentic leadership promotes workplace cultures with less incivility and better well-being. Such authentic leaders are aware of their own strengths and weaknesses, act on their values even under pressure, and work to understand how their leadership affects others.

Incivility isn’t okay. It should never be excused as “just part of the job”.

If this is happening to you, or others in your workplace, avoiding it won’t help you or your colleagues. Putting up with incivility is emotionally taxing, entrenches feelings of resentment and will likely lead to bigger conflicts down the track.

Responding with more incivility of your own isn’t a good idea. Retaliation rarely deters a person who engages in such behaviour and instead effectively endorses it.

One approach recommended by psychologists when dealing with high-conflict personalities is known as the BIFF technique: be brief, informative, friendly and firm.

When someone says something mean, you might respond, as calmly as possible, along the lines of: “Your comments are hurtful and damage our working relationship. Please, let’s keep things professional.”

Will this fix the problem? Possibly not. Your manager might simply shrug their shoulders, or arrange a “mediation” that resolves nothing. But saying and doing nothing will almost certainly leave you unsatisfied.

If your manager is the perpetrator, contact your HR department first (if your organisation has one) or else your union. The union can offer advice on other avenues to seek redress.

Statutory agencies such as Australia’s Fair Work Ombudsman, Employment New Zealand and the UK’s Advisory, Conciliation and Arbitration Service have the power to investigate workplace complaints, and to intervene in disputes through formal conciliation or arbitration. But before embarking on such a process, it’s best to get expert advice. You might get justice, but also still need to find another job.

Incivility is unlikely to stop on its own, however. Your voice matters and can help break the cycle.

If the behaviour persists, approach your supervisor. Again, stay calm. Explain what’s happening and how it’s affecting you. You don’t have to go at it alone either: consider inviting colleagues who can support you, and your claims.

Andrei Lux Lecturer of Leadership and Director of Academic Studies, Edith Cowan UniversityWelcome to part 3 of The Importance of Training. This month I am going to cover All things heights. This basically constitutes 4 units that I feel come under heights.

Work safely at heights:- For this unit, students need to understand the knowledge behind working safely at eights as well as use a harness and traverse between anchor points and use fall protection like handrail systems in a multiple situations. One of the biggest things I find with students when completing training is that in most cases they have never used a harness let alone lanyards, or trestles with handrail systems.

Erect and maintain trestle and plank systems:- Once again theory is required as well as actually building a trestle and planking system using handrails, double planks and plank clamps. As previously mentioned, most sites only have trestles with 1 plank let alone handrail systems.

Erect and dismantle restricted height scaffolding:This includes erecting and dismantling one modular scaffolding system up to four metres, including three bays (one with a return), one lift with ladder, and fall and edge protection.

Operate elevated work platforms up to 11 metres:The unit includes locating, setting up, operating and shutting down scissor lifts and self-propelled boom lifts with a boom length under 11 metres.

I see these all as extremely high risk units for the students to complete. And for some it can be confronting when they have to go up so high in the boom lift.

In the last 2 months I have trained apprentices all over Qld in these units and its amazing to hear some of the stories from some that have been in the industry for many years.

Here is one from a student with the EWP High Risk Work Licence Over 11 Metres qualification. “Why do I have to do this training I already have my license. So, I questioned him, ‘what did they get you to do to get your license?’ His reply ‘we did the paperwork, sat in a room and the trainer gave us the answers and we were done in about an hour, I then got in a scissor and went up and down then got in a boom lift and went up and down. There wasn’t room for us to drive them!’”

Once he came down from being in the machines for over an hour, driving through a set course as well as going up and down multiple times, he said he felt so much better knowing more about the machines and what they can do.

Unfortunately, I hear this sort of stories way too regularly, I’ve got my ticket for this, I’ve got my ticket for that, why do I have to do this again? This is where I really find that time spent with apprentices/ students really show some of the problems we have within our industry.

If you want your staff and apprentices trained correctly, contact me and I can assist you with your training needs.

Nigel Gorman nigel@aussiepaintersnetwork.com.auYour business needs cash. Cash is what keeps your company in operation and enables it to grow, so you should know how much cash your business needs to survive. Although many people think the answer is linked solely to operating expenses, this isn’t the case. There is no single factor that determines how much cash every business needs to have on hand. Somewhere between 3-6 months of operating expenses is a good baseline to start from, but there’s more to it than that.

Here are some factors that determine how much cash your business needs.

1.

The source of your income helps determine if you need more or less cash. If your income isn’t highly diversified—that is, if the majority of your income comes from one or two main clients—you’ll need to have more cash on hand. That’s because if your main client leaves you, you’ll suddenly find yourself with significantly less money coming in.

If your income is diversified, you’ll be better able to withstand losing a client, so you’ll need less cash available. But if the majority of your income comes from one source, you need to be prepared to have little income if they leave. Likewise if your business has investors, they could request their money back at any point. You’ll need to cover that.

Businesses typically have fixed overhead expenses and variable expenses related to the cost of goods sold. You need to know how each of these affect you over a few months so you can prepare to cover them.

Look at your financial statements for a period of at least six months, and make sure you account for busy seasons and slow seasons. See where your money is spent and how much you need on average to cover those expenditures.

Liquidity refers to how easily your assets can be turned into cash. Stocks and bonds can easily be converted to cash, whereas property and equipment often take time to sell and are therefore less liquid.

The more liquid your assets are, the less cash you’ll need. If you don’t have a lot of liquid assets, you’ll want more cash accessible.

Your spending situation is based on how much of your expenditures are mandatory and how much are discretionary—that is, you can operate without those expenses. If you have a high proportion of mandatory expenses, you’ll need cash to cover them if times get tough.

Discretionary expenses can be cut without significantly affecting business, saving you money or freeing it up for mandatory expenses. If you spend $5,000 a month on employee meals, you can easily save that money by not going out for a few months.

The more rigid your spending situation is, the more cash you’ll need on hand.

A final important factor is opportunity cost. Money covers emergencies and downtimes, but keeping too much money in the bank means you’re missing out on investments that could build your wealth and quickly be converted into cash. Talking to a financial expert can help you understand your opportunity cost and whether you need more or less cash available to you.

If you are unsure whether your business has the necessary cashflow to weather any market conditions feel free to arrange a FREE Business Health Check with me. Call my office on 07 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Copyright © 2023 Robert Bauman

Copyright © 2023 Robert Bauman

Whether we like it or not, Australia is becoming a more litigious country.

People seem to be more willing to jump straight into legal action than ever before.

Depending on the reason for that legal action, you might be covered by your public liability insurance, but not always…

Public liability insurance will cover you in the event that legal action is taken due to property damage or personal injury suffered by a third party, that has resulted from your negligence.

But that’s not the only reason you’ll find yourself needing legal assistance, and as a sole trader you’re particularly exposed.

We certainly don’t want to be scaremongering, but it’s part of our job to highlight the risks involved in being a self-employed tradie, and which insurance products are available to protect you.

Most tradies will go through their working lives without having a major legal issue, just like most of us won’t have our houses burn to the ground…

But that’s not to say it doesn’t happen, and shouldn’t be insured.

Leading legal expense insurance provider ARAG have put together some case studies that relate specifically to tradies:

“Following an accident on their worksite, SafeWork attended the premises and issued a Prohibition Notice requiring the business to stop work. The business challenged the Prohibition Notice on the grounds that the system of work was deemed safe. The insured contacted ARAG and a claim was lodged. ARAG appointed lawyers who ran proceedings to challenge the Prohibition Notice with the result being that the Prohibition Notice was cancelled. ARAG paid the business’ legal costs in relation to the proceedings.”

“Knock on Wood, a carpentry business, was approached by a customer to install skylights in their customer’s home. Knock on Wood is a small enterprise and engaged a Skylight contractor to supply and install the skylights. The skylights were installed and not properly sealed. The cost of installation of two skylights was $7,000. Following complaints by the customer, Knock on Wood arranged for the skylights to be replaced by a different contractor, they then claimed damages from the original contractor. The originally contractor refused to compensate Knock on Wood. Knock on Wood contacted their broker who then contacted ARAG Claims team, and formally lodged a claim on behalf of their client. ARAG reviewed and accepted the claim, appointed lawyers who forwarded a demand for payment of compensation to the contractors which resulted in negotiations and a quick settlement with damages paid to Knock on Wood. As there was a nil excess there were no out of pocket expenses and ARAG paid the legal costs incurred.”

“Perfect Plumbing has been lodging its BAS statements and Tax returns regularly. The ATO has announced its intention to look at compliance in several industries including the plumbing industry. The then ATO randomly selects Perfect Plumbing for a tax audit. After preliminary inquiries the ATO advised Perfect Plumbing’s accountant that it intended to audit their BAS lodgements. ARAG appointed accountants to assist with the audit and demonstrate BAS has been appropriately accounted for. ARAG met all costs of the appointed accountant other than the excess which was paid by Perfect Plumbing to the appointed accountant.”

“Bright Spark Electrics purchased bespoke lighting, with accompanying accessories for a large residential project. Mid-way through the installation the client changed their mind and wanted different lights. They asked Bright Spark to cancel the remaining order. Bright Spark explain that the client will need to pay for the change as the lights were non-refundable. The client agreed and Bright Spark ordered and installed new lights. However, when issued with the final invoice, the client then refused to pay for the unused lights. The client refused all requests for payment and denied they had agreed to pay for the unused material, despite text messages and emails. Bright Spark contacted the ARAG Legal Information Helpline, and then referred to ARAG claims. Lawyers were appointed to recover damages from the client. After debt recovery proceedings commenced

the client agreed to pay for 80% of the total invoice. ARAG paid all legal costs incurred in the proceedings, and Bright Spark Electric paid a $1,000 excess.”

In a perfect world we wouldn’t need lawyers and accountants to settle disputes, but it’s a far from a perfect world…

As a sole trader your exposure to such matters can be even more serious, since you’re personally liable for any legal costs incurred by your business.

Legal expense insurance can give you considerable peace of mind, knowing that you have access to legal assistance when you need it, without ending up with a huge legal bill.

As with any type of business insurance, the cost of legal expense insurance will vary depending on the size and type of business you run.

Our experience shows that for sole traders, legal expense insurance will sometimes cost no more than your public liability insurance.

Compare that to the cost of a solicitor, which could be anything up to $3,000 per day if you end up in court, and it’s incredible value.

Included in the policy is access to a legal helpline, so even if you just need some quick advice and don’t end up in court, you can still benefit from the policy.

Yes, public liability insurance will cover legal costs, or more specifically, your defence costs.

But it only covers defence costs for something that will be (or could be) a public liability insurance claim.

If the potential claim relates to property damage or personal injury suffered by a third party, then your public liability policy may cover those legal / defence costs as part of the overall claim.

But if the issue is not related to a public liability claim, then it will not cover any legal or defence costs.

This could include contractual disputes, licensing issues, employment disputes, tax audits or many other potential legal issues which don’t relate to public liability insurance.

What if I’m not a sole trader?

Legal expense insurance is available for Pty Ltd companies, it’s just that this guide focuses on sole traders.

We can help trade businesses of any structure –company, trust or otherwise – with legal expense insurance.

We know that for most sole traders, the cost of an insurance policy is a major consideration. If what you’ve read so far has piqued your interest, the next step is to request a quote from us.

For existing Trade Risk clients we recommend speaking with your dedicated account manager. If you don’t have their details, call our office on 1800 808 800 and we’ll transfer you through.

For new clients, call our office on 1800 808 800 and one of our brokers will help you out with quotes and information.

In our digital age, cybersecurity is a crucial aspect of running any business. Cybersecurity breaches could lead to not only data theft but also reputational and financial loss. Hence, it’s imperative to establish robust cybersecurity measures to protect your business and customers’ sensitive information. Here are some cybersecurity practices that could help safeguard your online presence.

1. Invest in Security Software: One of the fundamental cybersecurity practices for small and medium sized businesses is installing reliable security software that includes antivirus, firewalls, and antimalware protection. These security solutions can prevent illegitimate access to sensitive information. Keeping the software updated regularly can ensure that you remain protected from the latest threats.

This practice can help your business to recover your data and restore your business operations quickly. Don’t risk losing critical information when a simple solution already exists.

4. Educate Employees: Human error is one of the leading causes of cybersecurity breaches. Make sure your employees understand and employ cybersecurity best practices. Raise awareness of potential threats such as phishing emails, malware, and social engineering attacks. Conducting regular training sessions can help employees stay vigilant and avoid falling prey to cyber threats.

2. Use Strong Passwords: Creating strong passwords is crucial as weak passwords can be easily guessed or hacked. Best practice is to use complex passwords and update them regularly. Using multi-factor authentication (MFA) can also contribute to enhancing password security as can using a third party password vault such as 1Password, Keeper, NordPass or others on the market – search for Password Managers and see what suits your needs.

3. Back-Up Data Regularly: Losing critical data due to cyber threats could have serious consequences. You need to have a backup system in place, either through physical storage or cloud-based back-up.

5. Monitor Network Activity: Monitor your network activity regularly to detect any suspicious activity promptly. Keeping an eye on network traffic and logs can help identify unapproved access or unusual traffic patterns that may indicate a breach.

Every business needs to focus on cybersecurity to protect their reputation and sensitive data from cyber threats. Start by implementing these five cybersecurity practices as a foundation for robust cybersecurity and continue to thrive in the digital age.

Sandra Price tradiebookkeepingsolutions.ourclienthub.com

When it comes to painting, there are multiple routes a painter can take: becoming the best painter they can be or becoming the most successful businessperson in the painting industry is just two to consider. Each is a valid choice and will lead to different results, depending on what someone's goals are.

For those interested in becoming the best painter they can be, there is a lot of hard work involved. First and foremost, an aspiring painter must have an eye for detail and be able to turn their vision into reality. This means having excellent colour acuity, knowledge of different types of paints and finishes, as well as understanding how to properly prepare surfaces for wallpapering or painting. It takes plenty of practice to develop these skills, but with dedication and effort, anyone can become a great painter.

also know how to manage finances efficiently and hire reliable employees who are passionate about providing quality service. Additionally, knowing how to network with contractors or suppliers can help build relationships which may further expand one’s business.

In addition to mastering painting techniques, a great painter also needs to stay up to date with new products and innovations in the industry. Many times, painters will use specialized tools and materials that require them to constantly learn about the latest trends in order to provide top-notch services for their customers.

On the other hand, if someone is looking to be successful in the business side of the painting industry, then there are some different skills that need honing. Business owners must understand different aspects of marketing including how to create effective advertising campaigns that target potential customers. They must

The good news is that both paths – being the best painter or being the most successful businessperson – are within reach for talented individuals who put in enough effort into reaching their goals. With dedication comes rewards; whether it’s building a strong reputation from your high-quality craftsmanship, or successfully expanding your client base beyond your own city limits due to impressive marketing tactics.

However, you choose pursue success as a professional painter, make sure you remember why you started this journey in the first place - because you love it!

There are many other pathways available once you have completed your trade, becoming a painter and decorator doesn’t mean you need to swing a brush for the rest of time. Here are a couple of other pathways you could consider, become a rep for a paint manufacturer, a trainer or an estimator, just to name a few.

Hopefully this gets you to start thinking outside the box of I’m just a painter.

Nigel Gorman nigel@aussiepaintersnetwork.com.au

We all know that getting our teams together to enjoy some down time can have significant benefits for morale and business culture. Some employees love social events whilst others might find them overwhelming, so it’s important to check in with your teams to understand the types of activities they enjoy.

We’ve put together a few ideas for your next team event. But don’t forget that the best ideas come from your people! If you really want to reward your team and help them feel valued, send around a ballot and ask for suggestions and then plan the event together.

Here’s some suggestions to start you off:

• Staff family day

• Themed office party

• Murder Mystery party

• Escape Room event

• Office trivia night

• Great office bake off/cook off

• Office Karaoke night

• Sip and Paint night

Whatever you choose for your next team building event, do it soon! They really do make a difference to team morale and are great for creating fun work memories.

Mary Cairns HR MaximisedSince being in business for myself, there has always been that awareness of the competition, but I have never thought of them as a threat or felt the need to keep up, because, in fact, I feel I have always managed to keep slightly ahead.

My skills and capabilities as a painter and business operator have developed over a period of over forty years. Besides extensive practical skills, my most relied upon skill is the ease with which I communicate with potential clients for the first time; a selling point that relies on acute listening skills, affirmative communication, quick and informative responses to queries and swift attention to problems.

To market the business successfully to a prospective client means that I have to sell myself and the service I have to offer. Confidence in both must be instilled in the customer in the first phone call or first personal contact with them.

Some of the concepts that are key to a successful customer relationship are:

Customer trust and satisfaction. A customer is seeking a tradesperson who they can trust to be on their property, in most cases without supervision, and someone they can rely on to start and finish the project without any hassles. Keeping good-working relationships with clients means keeping them happy, keeping them informed and results in keeping them coming back. These are the elements that make for a contented client, and creating a balance of these elements as they apply.

Quality workmanship. Quality of workmanship is reliant on our work practices and the premium materials used.

Quality materials. We use products of the highest quality, specifically those of the Dulux brand, and strictly adhere to their recommendations and specifications in order to further ensure quality work.

Reliability. Reliability means turning up on time. It is common decency if we are running late to a meeting or to the job a phone call and a sincere apology will always precede our arrival. Speaking to clients for over twenty five years has shown me that many business operators are reluctant to do this. Reliability also ensures that jobs are run smoothly and customers are treated with the respect that they deserve.

Internal reliance. Internal reliance means that I only ever use my own workers. There are no sub-contractors used. The advantage of this is that I can personally and directly account for all the work produced.

Environmental awareness.

Our environmental awareness extends to the environmentally sensitive materials and the paints we use and our innovative methods of waste disposal. I mention to the client our cleaning process of our brushes and rollers using the Dulux Envirowash cleaning system. I explain to them the reason for this process and they are generally happy for my concern for the environment. The products I use are thoroughly explained with the emphasis on environmentally friendly VOC paints.

Detailed quotes. Provide concise but thorough written explanation of work to be performed, commitment and length of warranty. If you follow these steps also, you will gradually see a continual flow of work coming in either from repeat customers or from recommendations.

Remember:

You need to be good in painting but you have to be exceptional in your service and what you have to offer.

Jim Baker Author of ‘How To Become A Really Successful Painter’ www.mytools4business.com

When it comes to money, are you a big spender or a fearful saver? Do you give away all your money or ignore financial demands until they become urgent?

After decades of focus on financial literacy, it has become clear there is more to how we manage our money than access to information. Now new research has identified five distinct money personalities that drive how we spend.

Commissioned by Te Ara Ahunga Ora (Retirement Commission) for their free, independent personal finance site Sorted, our study included an extensive review of the research on personality traits, values and attitudes. We then created an online survey, completed by nearly 500 New Zealanders, exploring how people engaged with their money.

The research findings form the backbone of a new online money personality quiz designed to help people understand their money personality and inform their financial decisions and behaviour.

With New Zealand officially in a recession, it has never been more important to understand money management. Despite our best intentions, we often struggle

to make “good” financial decisions consistently – including saving enough, using debt wisely, and staying on top of insurance policies and KiwiSaver.

According to Te Ara Ahunga Ora, New Zealanders are good with the basics of financial capability – budgeting and keeping track of money. But we score lower than comparable countries like Canada, Norway, Australia and Ireland on more advanced financial capabilities like long-term savings. We also lack confidence when it comes to our cash.

There is a growing body of evidence that personality traits, money values and attitudes each play a crucial part in either aiding or hindering us making those “smart” financial decisions.

Read more: The coming storm for New Zealand’s future retirees: still renting and not enough savings to avoid poverty

Attitudes towards saving, the degree to which we value material possessions, and how comfortable we are with risk, will all affect the financial decisions we make – and, as a result, our financial wellbeing.

We identified five distinct money personalities, each with their own strengths and weaknesses: the enterpriser, socialite, minimalist, contemporary and realist.

An enterpriser is a financially confident, future-orientated planner who enjoys looking after their finances and is proud of being money savvy. Their strengths include self-control, financial knowledge and making their money work for them.

An enterpriser is unlikely to make impulsive or emotional purchases. However, their aspirational approach – viewing money as a priority and a symbol of success – may pair badly with materialism, causing them to spend money to gain status rather than for value or utility. Enterprisers benefit from learning about investing and planning for the future.

The minimalist is frugal, confident with their saving ability, and on top of their financial situation. Minimalists value a simpler life, scoring low on materialism and are not prone to impulsive or emotional purchases.

Their weakness is not always making their money work as hard for them as it could, as they are less likely to take financial risks – even where there is a potential for higher investment returns. Low-cost, passive investment strategies may appeal to minimalists.

A socialite is a joyful risk taker, outgoing, and confident with their money handling. A generous extrovert, they are more likely to be materialistic than other personality types and tend to live for today rather than plan for tomorrow.

Their high tolerance for risk suggests some socialites may take on unwise levels of financial risk. Those in this group who are also impulsive or prone to emotional purchases may find themselves overspending or vulnerable to over-extending themselves with consumer debt.

Socialites may like to explore active investment strategies and riskier investment classes, however. Taking calculated risks and building financial resilience is an important focus for them.

A contemporary doesn’t enjoy managing their money and they lack confidence when it comes to financial matters. They are likely to say they’re a spender despite being less materialistic than others; living for today, they tend to engage in impulsive emotional spending and are generous to a fault.

For contemporaries, the focus is increasing financial resilience by paying down debt and building an emergency savings fund, enabling them to share their wealth with others without affecting their own financial well-being. Working on their money mindset and general financial knowledge may allow them to build confidence and savings, then take a passive or “set and forget” approach to their financial life.

Read more: A $400-a-week shortfall: people in their 40s face a bleak retirement on KiwiSaver's current trajectory

A realist is future-focused, very conservative with risk, and values money highly. But they are not confident with their money handling, despite paying close attention to their financial situation.

The most introverted personality type, a more aspirational realist may be materialistic but is unlikely to make impulsive or emotional purchases a habit. This suggests building confidence and encouragement to take appropriate investment risks is important. Given

they do not like making money decisions, automation of bill payments and savings may appeal.

Each money personality offers different challenges when it comes to making financial decisions.

Taking Sorted’s money personality quiz is fun, but it’s also a useful financial decision you can make right now.

It’s not just about the label. Knowing your money personality can help you understand your strengths and weaknesses when it comes to financial decision making, giving you tools to improve your financial resiliency and security.

Ayesha Scott

Senior Lecturer - Finance, Auckland University of Technology Aaron Gilbert Professor of Finance, Auckland University of Technology

Aaron Gilbert Professor of Finance, Auckland University of Technology