GrizzlyDrive® Drum Motors

Maintenance-Free Conveyor Belt Drives

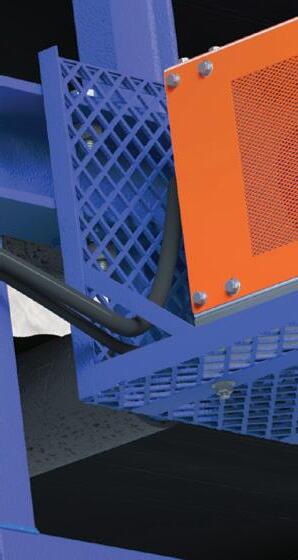

The GrizzlyDrive® Drum Motor, designed for harsh, abrasive, and demanding belt conveyor applications, provides 80,000 hours of continuous operation before maintenance, reducing operational and maintenance costs while increasing throughput.

ELIMINATE external drive components

REDUCE energy consumption

INCREASE workforce safety

The VDG patented Oil Cooling-Conditioning unit circulates, conditions, and cools the oil inside the drum motor for optimal lubrication and heat dissipation, ensuring a cooler running motor, especially in high-temperature applications, and extending the life of the drive. The Oil Cooling-Conditioning unit is supplied as standard for drum motors 75hp and higher.

CONTENTS

10 Charting A Sustainable Future For The Copper Industry

Sidhartha Patnaik and Lance Fogtman, ION Commodities, assess the current state of the copper market and consider its future prospects.

16 Future-Proofing Mining Operations

Alireza Oladzadeh, ABB Process Industries, reviews the role of long-term service agreements in gearless mill drive operation and maintenance.

23 Track Shoes In Mining

Giovanni Treleani, BS Track, presents the critical role of track shoes in the mining industry by reviewing some key features, as well as global production trends.

29 Driving Towards A Greener Future

Michael Fleet, Komatsu, USA, outlines the latest loading innovations that can help promote sustainability.

33 Drilling Into The Future

Nellaiappan Subbiah, Sandvik Mining and Rock Solutions, USA, explains why smart miners are saying goodbye to diesel and hello to electricity to revamp drilling, save costs, reduce maintenance interventions, and act more sustainably.

37 Efficient Excavation

Matthias Stöhr and Nicolas Osswald, Herrenknecht AG Business Area Mining, Germany, consider how innovative technologies can ensure safer and more efficient excavation of ore passes and ventilation shafts in underground mines.

40 Get To Know Your Tyres

Eric Matson, The Goodyear Tyre & Rubber Company, USA, explores how a greater understanding of the technology and construction of tyres can help mine operators optimise performance and lower costs.

45 The Power Of Foam

Anthony Ferrenbach, Weber Mining and Tunnelling, Mexico, highlights how using foam can enhance safety and effectiveness when filling cavities.

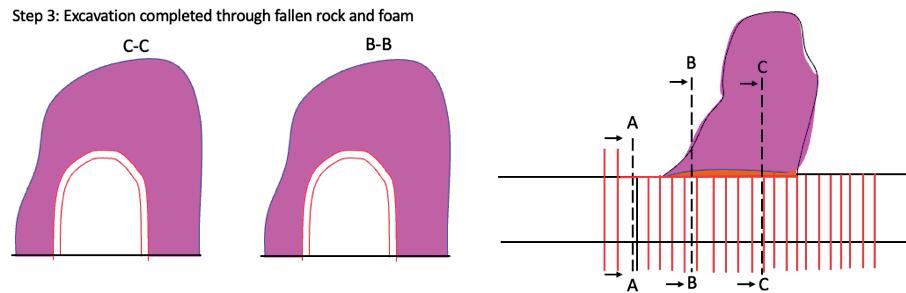

48 The Digital Twin Revolution

Richard Clement, Smart Construction, advocates for the adoption of digital twins for brownfield mine sites to aid safety, efficiency, sustainability, decision-making, and resource management.

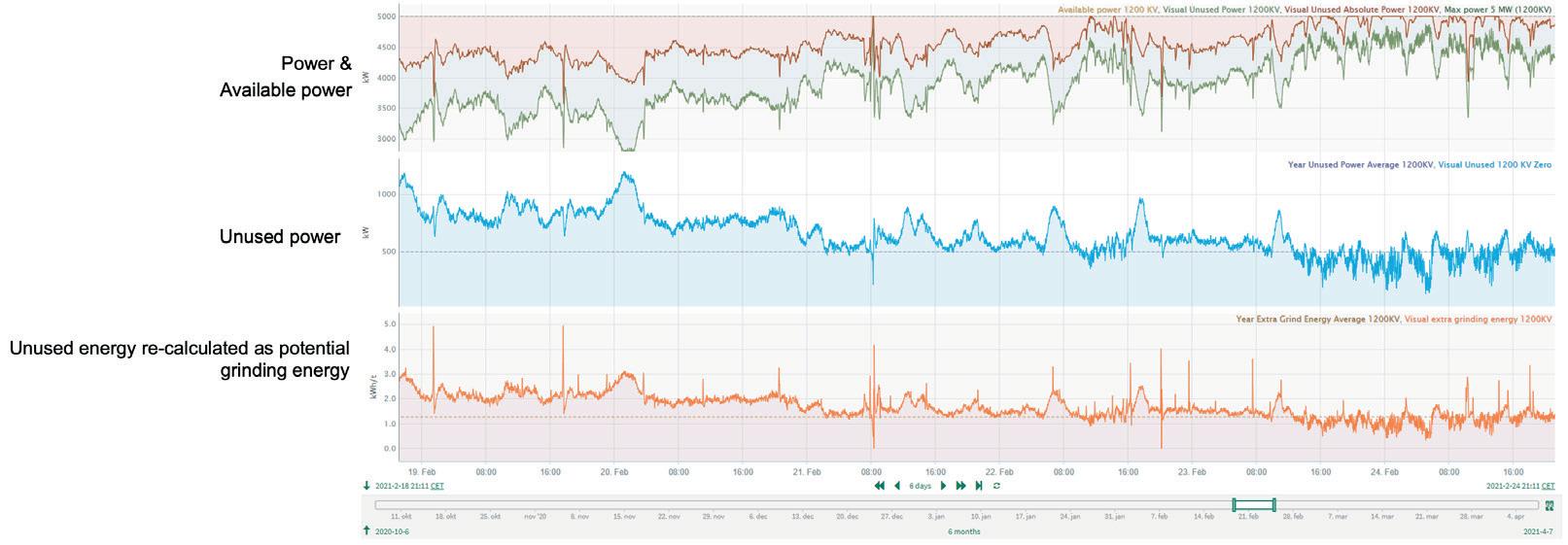

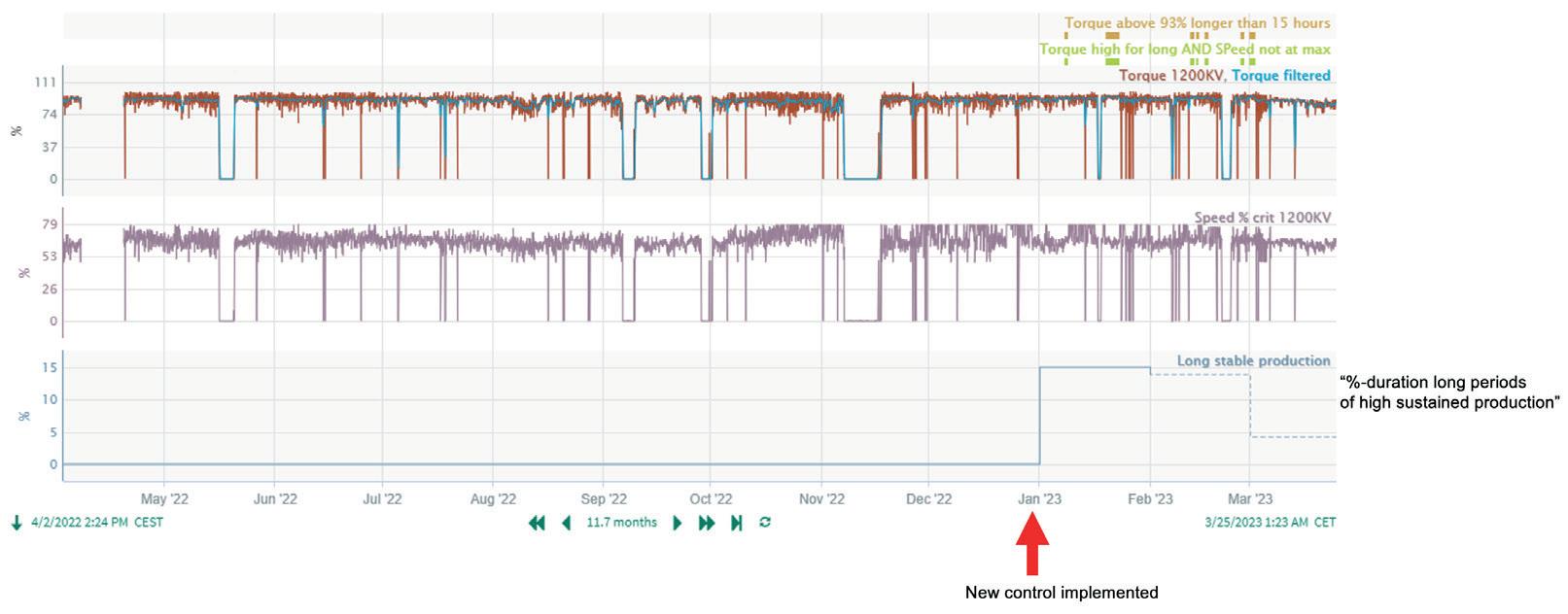

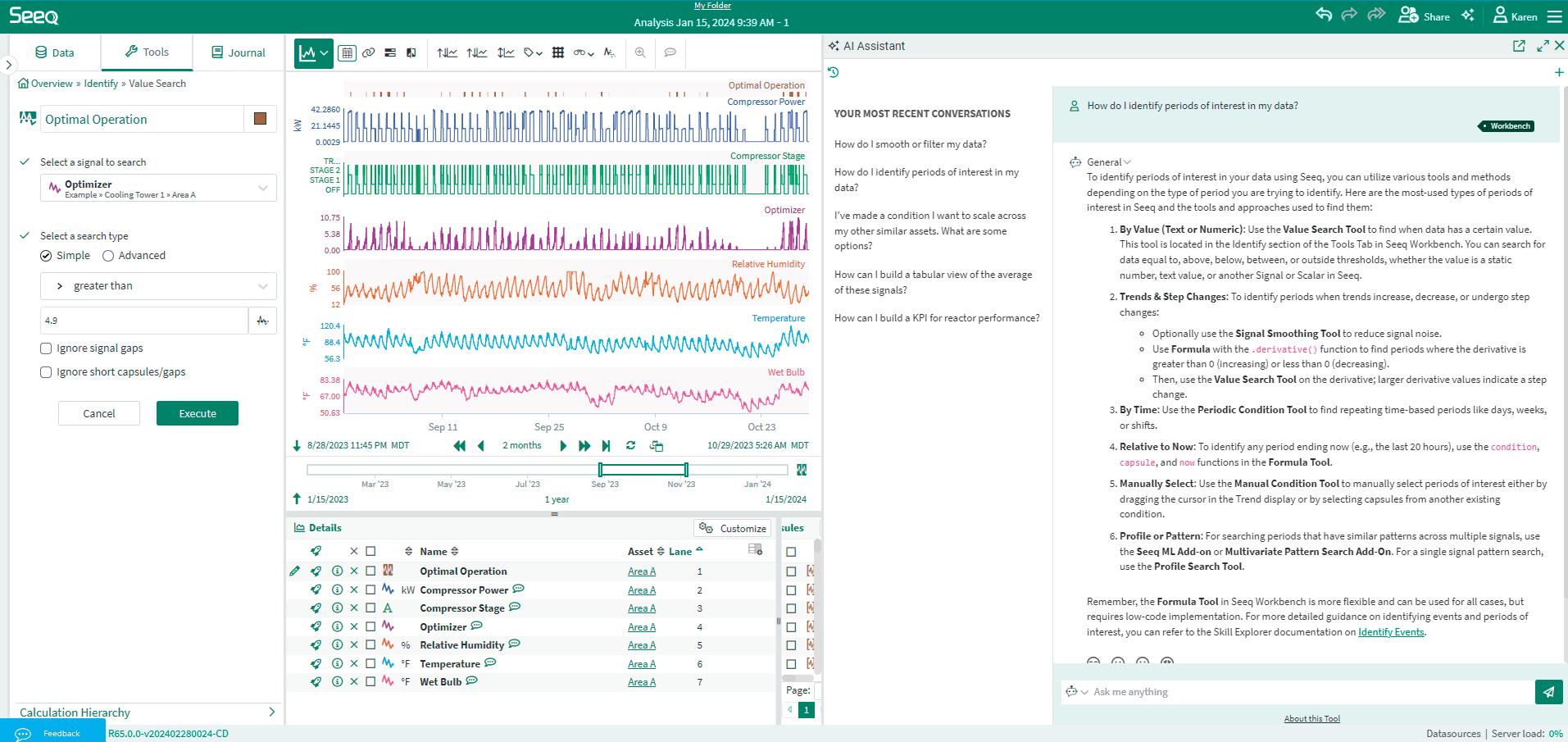

52 Shaping The Future Of Mining With AI

Mariana Sandin, Seeq Corporation, USA, discusses how AI-augmented advanced analytics platforms can deliver new levels of efficiency in mining operations.

57 Worker Safety And Connected Drones

Jaime Laguna, Oil and Gas Development at Nokia, USA, describes how Mining 4.0 connected drones are helping to pioneer worker safety and productivity in the mining industry.

61 Knowledge Is Power

Dr Graham Howell et al., SRK Consulting, examine the importance of a comprehensive knowledge base through the tailings storage facility lifecycle.

65 Prioritise Pumps

Mikael Hjelm, Atlas Copco Portable Pumps at Atlas Copco Portable Flow, evaluates the importance of dewatering pumps in mine water management.

ON THE COVER

MMD Group provides market leading in-pit solutions and systems tailored for mining operations. Our core Mineral Sizer and Apron Feeder technologies are integral to our In-Pit Sizing and Conveying (IPSC) solutions, Ore Sorting solutions (pictured), and fully mobile Surge Loader® (FMSL®), reducing costs, increasing efficiency and safety, and minimising emissions.

CLEANER. FASTER.

Built on the platform of our most popular underground loaders, the R2900 XE is the first Cat ® diesel electric underground LHD. It’s a productive, powerful, reliable machine built to meet the underground mining industry’s need for bigger payloads, faster loading and reduced emissions. Its powerful engine delivers faster acceleration, instant machine response and higher speed on grade for shorter cycle times, while greater breakout force and higher lifting height make digging and loading faster than ever. And its electric drive components help reduce fuel burn and improve productivity — helping mines reduce exhaust emissions.

Guest Comment

MANAGING EDITOR

James Little

james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Jane Bentham jane.bentham@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@ globalminingreview.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@globalminingreview.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@globalminingreview.com

HEAD OF EVENTS

Louise Cameron louise.cameron@globalminingreview.com

Global Mining Review (ISSN No: 2515-2777, USPS No: PENDING) is published 10 times per year by Palladian Publications Ltd., and distributed in the USA by Asendia USA, 701 Ashland Ave, Folcroft, PA. Application to Mail at Periodicals Postage Prices is pending at Philadelphia, PA, and additional mailing offices. POSTMASTER: send address changes to Global Mining Review, 701 Ashland Ave, Folcroft, PA. 19032.

Annual subscription (10 issues) £50 UK including postage, £60 overseas (airmail). Claims for non-receipt must be made within four months of publication of the issue or they will not honoured without charge.

CHRISTIAN KURASEK

CHIEF FINANCIAL OFFICER, PRONTO

The mining industry is often overlooked within the green economy narrative, though it is perhaps the most foundational character in the story. From rare earth elements in high-efficiency solar panels to lithium-based electric car batteries, the global transition to a sustainable energy infrastructure is impossible without the minerals produced by the mining sector.

The energy transition is putting significant pressure on the industry to recruit and retain the skilled workforce necessary to meet the surging mineral demand. This is particularly in the face of an aging workforce that is rapidly retiring, as 50% of American mining workers plan to retire in the next five years.1 Despite strides in environmental and social responsibility efforts, mining still faces perceptions as dangerous and ‘dirty’, hindering recruitment efforts with younger generations.

The digitisation of mining – particularly the rapid adoption of automation that is currently underway – holds the potential to dramatically reshape that dynamic.

The ‘greenest’ mining is autonomous mining

Here at Pronto, we like to say that the ‘greenest’ mining is autonomous mining. Automation delivers a wide range of established ‘green’ benefits to operators, including more efficient use of consumables – such as fuel and tyres – through more controlled driving, adherence to speed limits, etc. Less widely discussed are the even greater potential impacts that autonomy can bring to the industry, via enabling the economics of using smaller haul trucks.

Haul trucks have historically gotten bigger over time, primarily to minimise labour costs – the more material one truck can move, the fewer trucks and drivers required to operate them. But those labour savings come with consequences, including environmental impacts. Bigger trucks need wider roads, which necessitate shallower pit designs, which require more overburden to be removed before productive ore is reached. With a circular pit design, the net impact of every extra foot of haul road width is exponential in terms of tonne-kilometres of unproductive overburden moved to reach the same volume of ore. Fuel efficiency also generally decreases with truck size, contributing to the exponential increase in the carbon footprint of an ore body mined with large haul trucks versus one mined with small haul trucks.

Autonomy eliminates the previously immutable ‘one truck to one driver’ ratio from the haul truck fleet optimisation calculation, which leads to the economics favouring smaller trucks. With smaller autonomous trucks, mines can not only dramatically reduce their carbon footprint, but also reduce their physical footprint. With steeper, smaller diameter pits, less of the environment needs to be disturbed to reach the same ore body.

Upskilling and job creation is happening

As the industry embraces a digital future, the portion of the mining workforce currently dedicated to operating equipment in the field will transition to positions operating and overseeing autonomous technologies from an office. The net impact will be a safer, more highly skilled, more highly paid workforce.

Automation can lead to significant improvements in the efficiency of mining operations – research that we conducted with Whittle Consulting suggests that utilising small autonomous trucks could lead to a 30 – 40% improvement in the net present value of a mine over its lifetime.2 Those kinds of economics can easily support migrating equipment operator jobs into higher-paid technology support positions, while still delivering outsized contributions to the bottom line. We have heard anecdotally from a number of industry participants that to date, with over 1000 autonomous haul trucks deployed around the world, not a single net job has been eliminated by autonomy.

Autonomy promises to transform the mining industry in myriad ways, but one of the most underappreciated and significant is its potential to help solve one of the most intractable problems facing operators – a looming skilled labour shortage. By helping the industry trade higher-risk, manual labour positions in far flung mine sites for safer technology jobs in offices that are foundational to decarbonising the global economy, autonomy is going to be far more central to the future of the mining industry – and mining jobs – than many realise today.

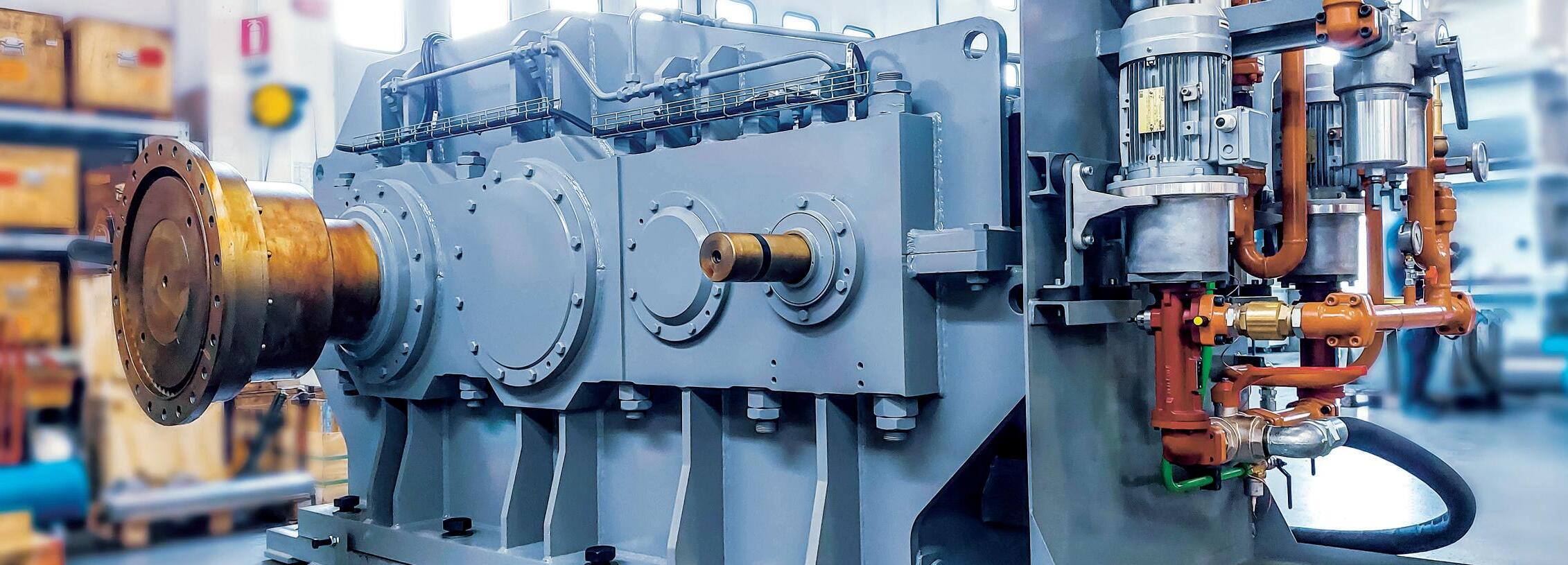

Trust MAAG for unmatched dependability and quality.

World NEWS

CANADA Orica and De Beers collaborate to reduce nitrate concentrations

Orica has collaborated with De Beers Canada Inc. (DBCI) at its Gahcho Kué site in Canada to improve its drill and blast process and significantly reduce nitrate concentrations under the ‘Building Forever – Protecting the Natural World’ Initiative.

Located in northern Canada’s sub-Arctic region, the Gahcho Kué diamond mine is a joint venture between De Beers Canada Inc. (51%) and Mountain Province Diamonds Inc. (49%). As the operator, De Beers is committed to high safety and sustainability standards, with a deep respect for the land and its surrounding pristine water bodies.

Since the mine’s inception, Orica and De Beers have worked together to mitigate the environmental impact of blasting. The environmental monitoring team at Gahcho Kué noted increasing nitrate levels in mine water, a known issue with bulk mining explosives.

Although nitrate and ammonium levels were within regulatory limits, De Beers proactively sought to reduce nitrate generation.

In 2020, De Beers engaged Orica to review the drill and blast process to align with industry best practices and improve safety and efficiency. Orica applied the nitrate risk reduction (NRR) framework, a three-tiered approach to systematically reduce nitrate contributions from blasting in water. The NRR process identifies nitrate sources from blasting and implements managed changes to reduce them. These changes include minimising bulk explosive waste, maximising detonation reliability and efficiency, and selecting products suited to the mine’s groundwater conditions and sleep time requirements. The site team reinforced best practices on-bench as part of the NRR strategy, introducing i-kon™ III electronic detonators to reduce misfires.

ZAMBIA Hitachi begins trial of the world’s first ultra-large full battery dump truck

Hitachi Construction Machinery Co., Ltd. has announced the commencement of the world’s first technological feasibility trial of an ultra-large full battery rigid frame dump truck by an original equipment manufacturer (OEM) operating at First Quantum Minerals Ltd Kansanshi copper and gold mine in the Republic of Zambia.

The technological feasibility trial, which began in June 2024, is being conducted at First Quantum’s Kansanshi deep opencast copper-gold mine, one of the company’s largest mines in Zambia. The technological feasibility trial aims to verify the basic performance of operations required of a battery-powered dump truck –such as travelling, turning, and stopping – under actual operating loads, as well as the verification of battery charging and discharging cycles.

Hitachi Construction Machinery’s Vice President and Executive Officer, President of Mining Business Unit, Eiji Fukunishi, stated, “Mining companies around

the world are working to reduce emissions. As an OEM, it is our vision to provide solutions that can reduce our customers’ environmental footprint. The battery dump truck represents the future, not only for the Hitachi Construction Machinery Group, but for the mining industry as a whole, and we are pleased to establish this proving ground on an active mine site and work with First Quantum on advancing this zero-emission solution.”

First Quantum’s Director Mining, John Gregory, added, “Battery zero emissions development with little to no impact on payload, production, and fleet size is achievable with Trolley Assist and First Quantum have mastered this technology by working with 2600 V systems of Hitachi Construction Machinery to provide stable platforms with multiple trucks on the overhead line at the same time. This system is an operational, practical, and economically feasible solution that will reduce emissions in mining for many years to come.”

World NEWS

Diary Dates

Electra Mining 02 – 06 September 2024 Johannesburg, South Africa www.electramining.co.za

International Fairs EXPO KATOWICE 04 – 06 September 2024 Katowice, Poland www.expo-katowice.com

Mining Indonesia 11 – 14 September 2024

Jakarta, Indonesia www.mining-indonesia.com

MINExpo INTERNATIONAL®

24 – 26 September 2024 Las Vegas, USA www.minexpo.com

FT Mining Summit

26 – 27 September 2024 London, UK & Online https://mining.live.ft.com

XXXI IMPC-International Mineral Processing Congress (IMPC 2024) 29 September – 03 October 2024 Washington, USA www.smeimpc.org

China Mining Expo

23 – 25 October 2024 Xi’an, China www.chinaminingexpo.com

The International Mining and Resources Conference (IMARC) 29 – 31 October 2024 Sydney, Australia www.imarcglobal.com

Resourcing Tomorrow 03 – 05 November 2024 London, UK www.resourcingtomorrow.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

PERU Metso to deliver thickeners and filters to mine water treatment project

Metso has been awarded with a contract to deliver several thickeners and filters to a mine water treatment project in Peru. The value of the order is approximately €15 million, and it has been booked in the Minerals segment’s 2Q24 orders received.

Metso’s scope of delivery includes several high-rate thickeners operating in a high density sludge (HDS) mine water treatment application and automatic EBS Series Liquid Filters with an electric self-cleaning mechanism for ultra-fine filtration. The thickeners, which are part of Metso’s Planet Positive offering, include the Reactorwell™ feed system and are specially designed bolted stainless-steel construction for high corrosion resistance and fast installation.

“We are pleased to continue working with this important customer in Peru to support their needs in mine water treatment with our Planet Positive thickening solutions. The environmentally sound high-rate thickeners will have an important role in ensuring a reliable operation and meeting the customer’s project criteria for high performance, fast installation, and low maintenance”, said Brian Berger, Vice President, Thickening and Clarification at Metso.

NORWAY Public consultation of first licencing round for seabed minerals

Norway’s Ministry of Energy has presented a proposal for the announcement of the first licencing round for seabed minerals on the Norwegian continental shelf for public consultation.

The proposal sets out the areas where companies will be able to apply for exploitation licences, so that exploration and gathering knowledge about whether there is a basis for sustainable mineral exploitation on the Norwegian shelf can begin.

“The world needs minerals for the green transition, and the government wants to explore if it is possible to extract seabed minerals in a sustainable manner from the Norwegian continental shelf. A large majority of the Norwegian Parliament supports the government’s step-by-step approach to the management of seabed minerals. This announcement is an important next step in the management of our seabed mineral resources. Environmental considerations are taken into account in all stages of the activities. Today, we are presenting our proposal for areas to be announced in the first licencing round for seabed minerals for public consultation. We plan to award licences in the first half of 2025”, said Minister of Energy, Terje Aasland.

PROdUCT NEWS

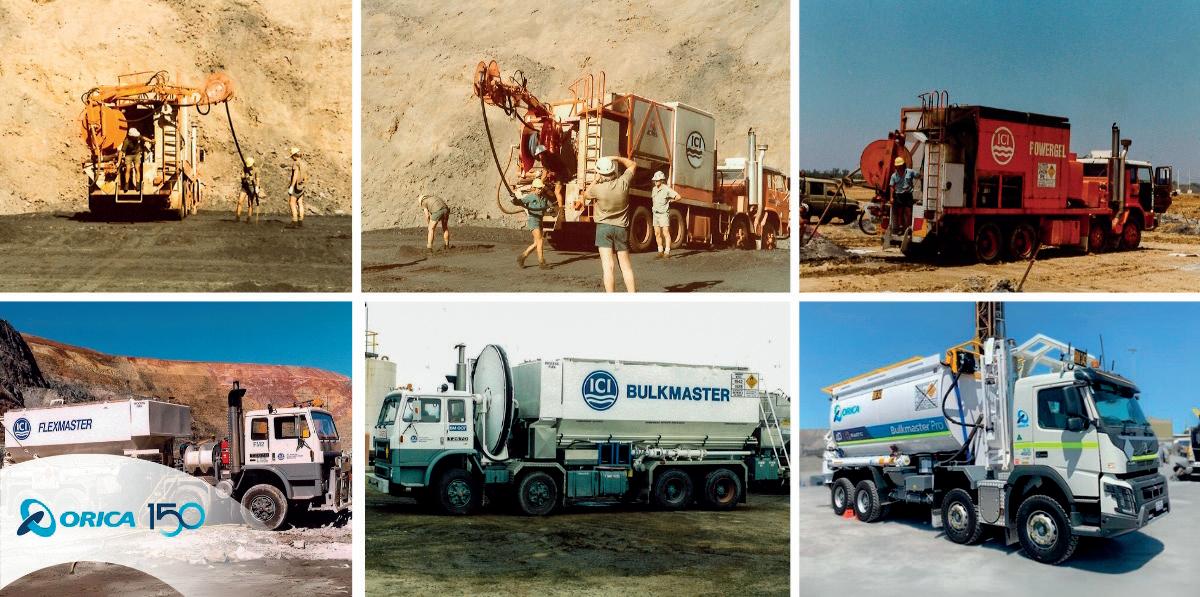

As Orica marks its 150th anniversary in 2024, the company is reflecting on one of its innovations that has revolutionised the mining sector: mobile manufacturing units (MMU™s). Since the early days of on-site ANFO delivery, Orica’s MMUs have set an industry standard for bulk delivery systems, continuously evolving to meet the demands of mines worldwide.

The evolution of Orica’s MMUs

Orica’s MMU journey began in the 1960s with the rise of bulk delivery services. In 1968, the Mt Tom Price iron ore mine in Australia’s Pilbara region saw the first bulk ANFO truck loading, marking a significant milestone. Early bulk technology was based on watergel technology as pumped only products. Despite initial criticisms for being costly and slow, these early systems laid the foundation for future innovations.

The move to emulsions through the 1980s saw the development of site mixed emulsion MMU delivery, where emulsion was manufactured on the MMU and was pumped only delivery. With improvements in emulsifier technology, the models changed to the MMU, which were configured to blend emulsion and ammonium nitrate prills and the focus started shifting to productivity and energy. Orica MMUs were configured to deliver Heavy Anfo or Pumped products and were among the first to mix emulsion and prilled ammonium nitrate on site.

Introduction of the Bulkmaster™

The true game-changer came in 1989 with the introduction of the first Bulkmaster MMU. This model optimised on-bench operations and capital efficiencies by delivering ANFO, heavy ANFOs, and pumped blends from a single platform in a single high capacity, high delivery rate platform. The Bulkmaster was the first design to use a flexible bin configuration, adapting to site-specific product mixes.

The Bulkmaster 7, released in 2018, represented a significant leap in productivity with larger payloads and faster delivery rates. Over the past 35 years, the Bulkmaster MMU has not only improved explosive delivery efficiency, but also significantly enhanced safety measures.

Pioneering technological advancements

Orica’s commitment to innovation has continued since the early days of simple

delivery trucks in the 1960s. Its commitment to innovation has led to the development of various MMUs tailored for different markets, including the Flexmaster™, Quarrymaster™, and Handimaster™. The company’s ongoing focus on safety and productivity has resulted in significant advancements. Among these, the 4D™ bulk system stands out as a technology that harnesses Orica’s knowledge in emulsion chemistry, smart MMU capabilities, and process control. This system enables customers to use a wider range of energy-matched explosives in real time across varying blastholes conditions, whether they be wet, dewatered, or dry.

Customer benefits from innovation

The technological progress in Orica’s MMU range now integrates digital and automated systems to allow precision in drill rate measurement and the tailoring of bulk delivery to achieve greater blasting outcomes. Enhanced safety features protect workers and assets, while increased loading efficiencies save time and boost productivity.

Looking forward: Bulkmaster Pro

The forthcoming Bulkmaster Pro, set to launch in 2025 – 2026, will embody the pinnacle of bulk delivery technology. Combining the best features from previous models, the Bulkmaster Pro promises improved loading efficiencies, superior safety features, and cutting-edge integrated technology. This new model will reaffirm Orica’s position as an industry leader in innovation and technology.

As the company celebrates 150 years of innovation, its MMUs remain at the forefront of mining technology, continually evolving to meet the industry’s needs with enhanced efficiency, safety, and productivity.

Figure 1. Driven by innovation: Orica’s journey in advancing bulk delivery MMU™ technology.

PROdUCT NEWS

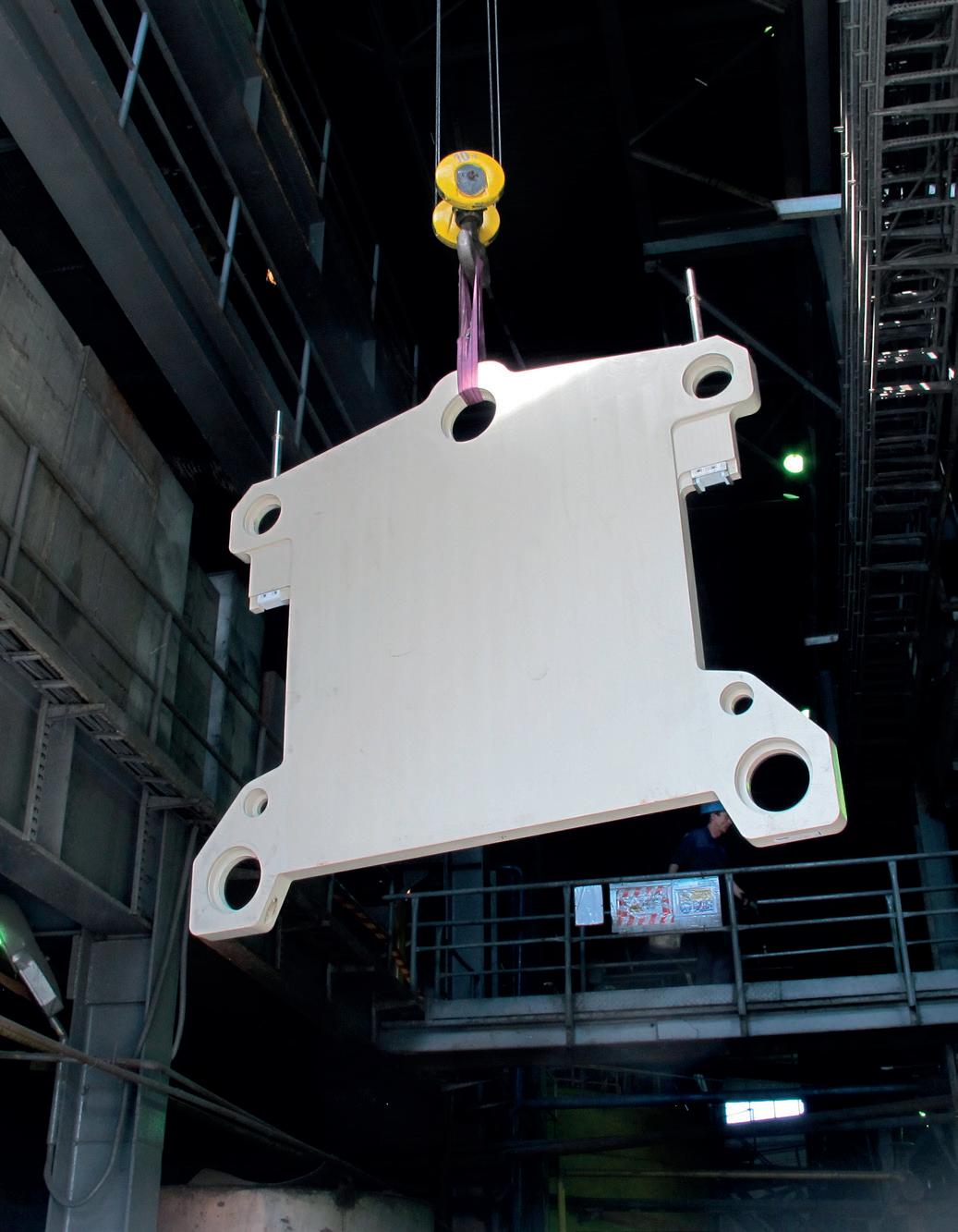

As global demand for metal and minerals rises, so does the need for higher capacities – from processing large volumes of low-grade ore with minimal residual moisture, to doubling an operation’s throughput with an existing filter press. In either of these cases, LENSER offers innovative and reliable filter plate solutions to make high capacity operation both possible and profitable.

The filtration process is the key Obviously, external conditions must align to achieve a sustainable filtration process. One way to improve

conditions may be the costly purchase of a new filter press. LENSER’s vision, on the other hand, focuses on the inner workings of an existing press – the filter plates and cloths –in order to optimise the filtration process. The company specialises in the production of customised filter plates and strives to find the best possible solution to complement a customer’s given situation. Having the perfect and individualised filter plate enables an outstanding filtration result.

Why have a customised plate?

For the mining industry, there are several purposes that a customised filter plate can serve. This can range from increasing filter press volumes and weights of the cake discharge (due to a higher capacity), to a noticeable reduction of the production costs themselves, lower energy and water consumption, and a noticeable increase of dry solid content of the concentrates or tailings. Furthermore, the filtration cycle time can be reduced, which simultaneously increases the service life of the filter plate. All of this results in a remarkable operating cost reduction.

LENSER Mining Plate

The LENSER Mining Plate is well suited to mining applications, especially for dewatering of concentrates and tailings. It differs from a normal filter plate in a number of ways: maximised drainage area, a large external feed port, a purposeful material selection, and detachable corner ports.

The LENSER Mixed Pack

Always highly recommended as an all-rounder alternative, LENSER also offers a standard product combination that suits every kind of mining or mineral application.

The LENSER Mixed Pack is a mix of recessed chamber and membrane filter elements which features all the advantages of membrane technology – i.e. it provides shorter filtration cycles with higher dry solid contents.

Customers have the choice of various filter plate designs and sizes (up to 2500 mm), and, as always with LENSER, the mixed pack is produced according to specific needs and challenges. The membrane filter plates within the LENSER Mixed Pack can also be made from LENSER Aurum, a newly developed, highly abrasive resistant material.

Figure 1. LENSER Mining Plate in Cooper Mine in Kazakhstan. Results: Cycle time per cycle reduced per 10%, residual moisture shrunk from 9% to 8%, and higher cake weight per cycle (11 t instead of 9 t).

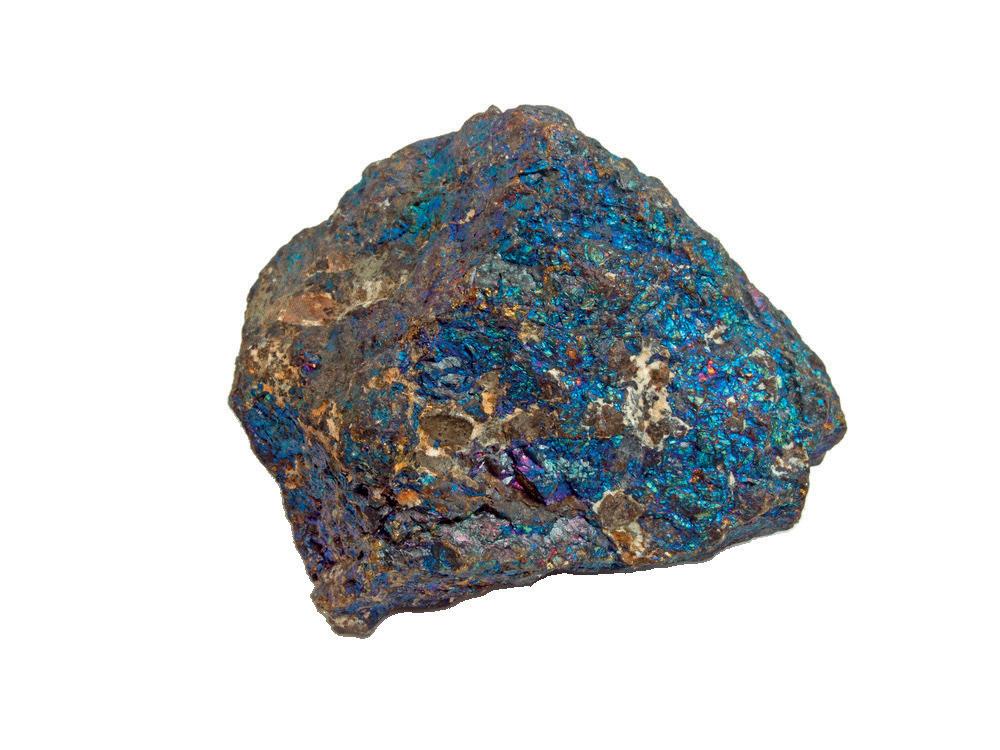

Sidhartha Patnaik and Lance Fogtman, ION Commodities, assess the current state of the copper market and consider its future prospects.

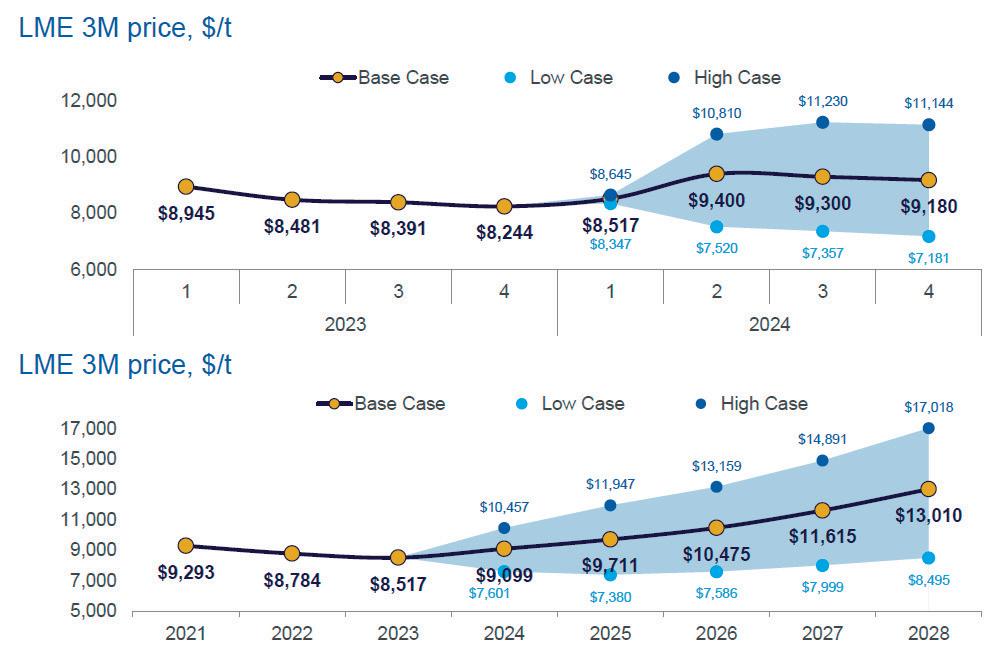

While several commodities are poised for growth in the next decade, few face an evolution as dynamic as copper. 2024’s prices, after hovering around US$8000/t for a good part of the first quarter, have shown a clear breakout and are now above US$10 000/t as of May, with the London Metal Exchange (LME) recording its highest three-month trade volume since June 2022. 1,2 Analysts suspect this bullish trajectory could last for at least the next three years, and some have suggested a new commodities ‘supercycle’ is afoot, led by copper. 3

A combination of short-term factors and structural changes are responsible for the tightness between copper’s high demand and constrained supply. The key question is how well the industry is poised to adapt to the impacts. While opportunities abound for market players to

capitalise on these emerging trends, strategic investment is necessary to chart a resilient, sustainable, and prosperous future in this market as it evolves.

Market changes

Exceptionally conductive and malleable, copper is one of the most widely used metals globally. Its applications span power grids and data centres; industrial machinery and construction materials; chip manufacturing; medical devices; and energy transition technologies.

Modern demand for these applications has already driven an international boom, with global copper reserves estimated to be 1 billion t in 2023. 4 However, the last few years have seen a step change in growth and volatility due to more seismic market shifts underway. 5

Energy transition

Copper’s core applications in electrification, technology, and infrastructure make it instrumental to the global energy transition, which is becoming the most significant factor in the gulf between modern supply and demand.

The metal is a vital component in mineral-intensive ‘clean’ infrastructure and technologies – from electric vehicles (EVs) and charging infrastructure, to solar cells, wind turbines, and batteries. Demand for metals including copper has grown at pace amid the impending phase-out of conventional fuel vehicles and the arms race in EVs, with the latter using more than double the quantity of copper per vehicle. 6 Such is the dependency on copper that any supply-side disruption or tightness would now cause a dramatic slowdown in the production of renewable energy infrastructure, battery storage, and the uptake of EVs, with serious consequences for global supply chains.

New demand

Demand remains concentrated in the Eastern Hemisphere, with China alone consuming more than half of all refined copper globally. 7 Demand has typically stemmed from large infrastructure projects and construction, and though recent structural challenges in China’s infrastructure sector and its population decline could temper levels, other developing powers in Southeast Asia will almost certainly pick up the slack.

Consumption levels are naturally accelerating amid new tipping points in energy and technology. In addition to the feedstock demands of the global energy transition, the meteoric rise of electronics and chip manufacturing has bolstered copper’s bull run, especially among the BRICs. India, for instance, recently

pledged over US$15 billion for three semiconductor plants as it vies to compete globally across automobiles and consumer technologies. 8

Tight supply

In tension with demand, the exhaustion of reserves in addition to disruptions amongst producers – frequently linked to geopolitical tensions and conflict – are tightening supply.

The largest global supplier, based in Chile, is still falling short of pre-pandemic output levels due to depleted reserves, while other producers missed annual targets in 2023 amid unexpected closures. 9 One major case is that of the disputed Central American mine, Cobre Panamá, which previously produced around 1% of global output, but was closed by the local outgoing government following protests last year. 10

The situation has worsened with supply chain disruptions to the Panama and Suez transport routes. With the largest production assets some distance from demand sources like Australia and South America, copper will see a high volume of freight movement for the foreseeable future.

Some projects to ease this strain have already been approved. Copper smelters in China recently pledged to curb output, while Adani is set to open a US$1.2 billion copper refinery in Gujarat to boost production. 11,12 Despite this, mine production in 2024 will most likely contract. Together with the ban on Russian copper and other metals from the LME and COMEX this April, a surge in prices is highly likely. 13

Circular economy

A major portion of copper demand is increasingly met through recycled material. Being durable, energy-efficient, and highly recyclable, copper lends itself to the circular economy trend playing out across metals as a way of mitigating resource scarcity, limiting environmental impact, and boosting economic efficiency. Interest in the scrap market is growing amongst trading firms, and this emerging cycle will continually reshape the dynamic between asset owners and asset traders in the years ahead.

Key implications

All of this demonstrates the level of complexity in copper is constantly growing.

Figure 1. Global copper production has come under pressure in recent years, though forecasts show some signs of growth (Source: CRU Group Copper Market Outlook – March 2024).

Fletcher

For asset owners, optimising assets and eliminating any idle time is crucial to capitalise on surging demand and secure their business against significant risks.

The key challenge lies in achieving this operational efficiency. Though copper offers liquidity and efficient price discovery on multiple exchanges right now – the LME, COMEX, ShFE – too many businesses fall short of the capacity to take advantage, due to inefficiencies in the way they monitor their positions, profit and loss (P&L) calculations, cashflows, and financing facilities.

Optimising these functions is challenging. A flexible, interoperable technological backbone is the bedrock for simplifying operations, yet the industry has typically deployed technology inconsistently, and there are key gaps in awareness about its value.

Those which have invested in digital transformation face issues too, usually related to operating with siloed platforms that cannot interact or using a local solution to manage an evolved and booming global business. Even the best enterprise technology is limited in its ability to support global trading or offer visibility into positions and operations across borders.

The implications for profitability are huge: it is not unheard of for a trader to lose millions of dollars due to unmonitored trades, without real-time monitoring capabilities installed.

Futureproofing the market

In the race for digital transformation across commodities, metals such as copper lag at least a decade behind power. To narrow this gap, the market must address some specific shortfalls.

Every corner of the market must prioritise risk management more than ever before. Some of the

largest market entrants in recent years have witnessed the threat posed by impaired supply chain visibility at times of volatility and disruption. Moving forward, we should see more investment in real-time risk management capability, moving on from generic solutions.

Related to this is the need to pre-empt the rigorous reporting and compliance procedures that will inevitably emerge as the energy transition progresses. Firms will soon be obligated to track their supply chains and more closely monitor compliance, and public companies face even greater scrutiny from investors. Investing in the tools for a more holistic view of supply chains, risk, sustainability metrics, and more will be a major advantage.

Finally, establishing a base level of interoperable technology across the industry would secure the market more broadly. This is especially true for regions that are critically low on high-quality infrastructure, yet have the means to be globally competitive. Once a broader layer of risk management and operational efficiency has been established, the industry can lean into some of the most sophisticated analytics solutions available to fully optimise assets and trading routes.

Futureproofing copper is doubly critical, given climate risk and uncertainty. A recent PwC analysis recently found that even in an optimistic scenario for 2050, over half the world’s copper mines will be in areas exposed to significant drought risk. 14 While research is nascent and evolving, some of the most significant mines today are already a source of key ESG concerns, such as geopolitical contention, armed conflict, and corruption. Being equipped to mitigate this risk is imperative.

Looking ahead

Investment in operational efficiency and risk management was once a secondary consideration for metal traders. However, the rise of the energy transition and the emergence of complex supply-demand dynamics, fuelling copper’s bullish outlook, show a new approach is needed.

Having the capabilities for rigorous risk management and efficiency combined with a futureproofed, interoperable infrastructure will be a key necessity and differentiator in the turbulent years to come.

References

Available on request.

Figure 2. Copper prices recently surged to their highest in years, with the London Metal Exchange (LME) reporting record figures (Source: CRU Group Copper Market Outlook –March 2024).

DEMANDING CONDITIONS

DEMAND JENNMAR

JENNMAR designs and manufactures a wide range of dependable ground control products, from bolts and beams to channels and trusses, resin, rebar, and more. We’re proud to make products that make the mining, tunneling, civil, and construction industries safer and more efficient.

Because we understand the ever-changing and demanding conditions above and below ground we have built the richest portfolio of diverse and complementary brands. JENNMAR sets the bar in every industry we serve and as we continue to grow, our focus will always be on the customer.

We feel it is essential to develop a close working relationship with every customer so we can understand their unique challenges and ensure superior customer service. Our commitment to the customer is guided by three words: SAFETY, SERVICE, and INNOVATION . It’s these words that form the foundation of our business. It’s who we are.

Alireza Oladzadeh, ABB Process Industries, reviews the role of long-term service agreements in gearless mill drive operation and maintenance.

The mining and minerals processing industry is currently navigating a landscape fraught with challenges. Rising exploration costs, volatile market prices, and increasingly remote environments are pushing the industry to evolve. These challenges must be met while protecting the health and safety of workers and adhering to increasingly stringent environmental regulations. Solutions that tackle these issues need to ensure equipment operates efficiently and reliably, with minimal intervention from the operators.

In this context, the upkeep of critical equipment, such as gearless mill drives (GMDs), becomes paramount. GMDs are a foundation for grinding operations at scale in mining, offering enhanced reliability and efficiency. The upkeep of these systems is essential for their longevity and continued productivity. However, maintaining these complex systems requires more than just regular check-ups; it demands a proactive and comprehensive approach to maintenance. This is where long-term service agreements (LTSAs) come into play. Through corrective, preventative, predictive, and prescriptive maintenance strategies, supported by the latest in remote diagnostic services, LTSAs offer a robust framework for tackling industry challenges, while improving health and safety, achieving environmental goals, and reducing costs.

Getting to know gearless mill drives

GMDs are the workhorse of grinding operations within the mining industry. In a GMD, rotor poles are mounted directly onto the mill, meaning the mill itself becomes the rotor of the gearless motor. This eliminates the need for additional mechanical components such as ring-gears, pinions, gearboxes, couplings, and motor shaft bearings, enhancing the reliability and efficiency of the system.

GMDs offer several advantages over alternative mill drives. For example, they can reach higher power levels while reducing overall energy consumption. Furthermore, their overall mechanical infrastructure and the need for fewer components, coupled with greater power, reduce a mine’s footprint by eliminating the need for larger or multiple smaller mills. This reduction in physical footprint translates into a more efficient use of space, particularly in remote areas, and is advantageous for operations in environmentally sensitive areas where minimising land disturbance is crucial.

Unlocking greater performance and reliability

Implementing LTSAs for GMD maintenance offers numerous benefits that enhance reliability and uptime. These agreements provide regular maintenance schedules and predictive maintenance strategies, which help to avoid unplanned downtime. In mining operations, every second counts, and the ability to rapidly address and prevent any unscheduled shut-downs can make a significant difference in productivity and profitability.

Solutions like ABB’s multi-year service agreements embed advanced services that help plan maintenance activities over the long term, extending the lifecycle of equipment and increasing overall equipment effectiveness (OEE). These agreements cover all levels of maintenance strategy, ensuring equipment like GMDs remain operational and efficient.

Streamlining the overall maintenance process, LTSAs ensure that all necessary checks and repairs are conducted in a timely and efficient manner. This not only extends the lifespan of the equipment, but also maintains optimal performance levels. Continuous technical support and access to specialised knowledge further enhance operational efficiency. With experts on hand to manage and troubleshoot complex GMD systems, mining operations can maintain a high level of performance with minimal disruption.

Remote diagnostic services allow engineers to log onto the system regardless of physical location, access cloud-based data, and investigate problems and provide recommendations or immediate resolutions. For example,

if there is an issue on the machine, engineers are able to quickly diagnose the problem and guide operators on how to resolve it. From support lines (24/7) and remote troubleshooting, to predictive maintenance and condition monitoring, these services are designed to support fundamental, complex systems like GMDs and allow experts to suggest solutions from anywhere in the world.

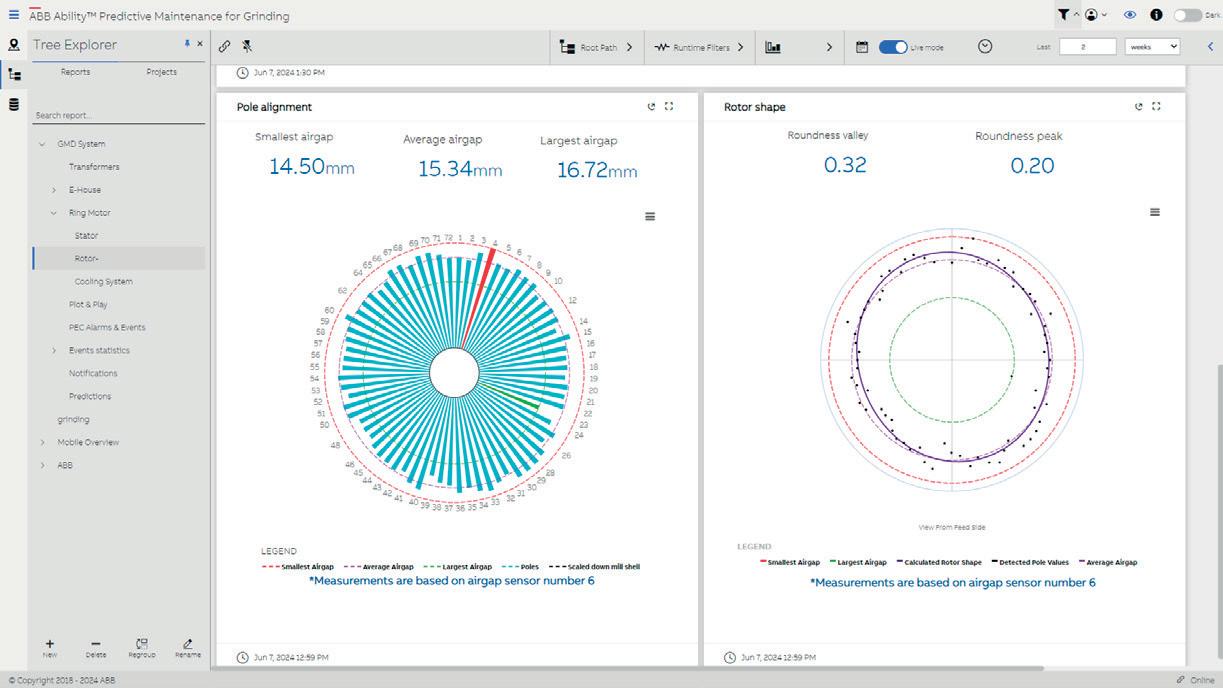

To further prevent downtime and keep the GMDs running, LTSAs allow for service experts to monitor the system on a regular basis without having to be on site. This minimises the risk of costly, unscheduled breakdowns and optimises process performance. Software is able to predict potential failures based on detailed analysis of historical and current data on the electrical, mechanical, and thermal parameters of the GMD. For instance, the ABB Ability™ Predictive Maintenance for Grinding (Figure 4) monitors the health of crucial assets against pre-defined thresholds utilising this data, and is able to notify operators if an anomaly is detected by the system.

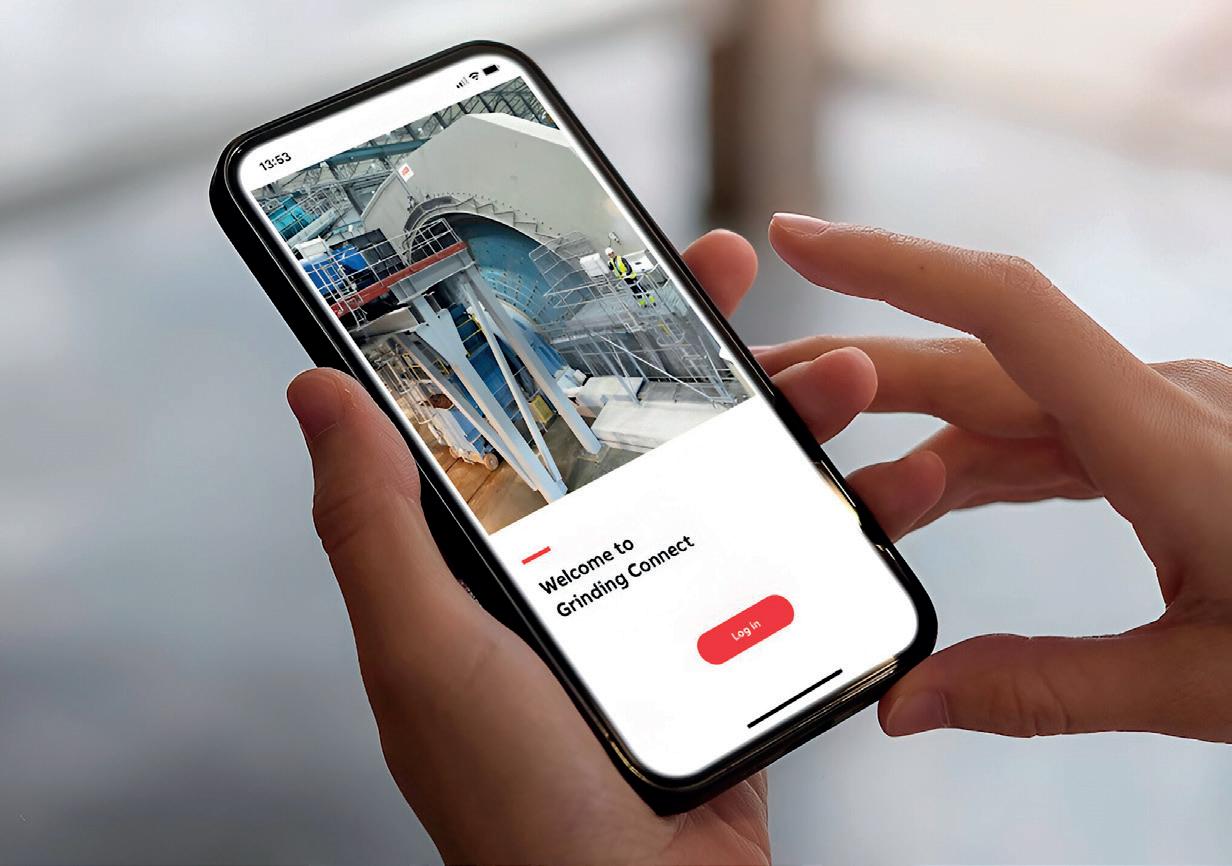

Ongoing health assessments allow operators to take action before failure occurs. Combining these services with the integration of a mobile application, like ABB’s Grinding Connect (Figure 5), allows operators to access status updates and an overview of the equipment from anywhere, at any time.

To provide a full range of maintenance, it is important to provide consistent, detailed condition checks. As such, ABB experts create a number of maintenance reports each year. During structured GMD system assessments, ABB technical experts analyse and evaluate data collected via a secure internet connection. They perform an analysis and deliver these reports which include a summary of findings and recommended preventative and corrective maintenance tasks.

Data is key to corrective, preventive, predictive, and prescriptive maintenance concepts. The ability to collect and analyse data provides accurate visibility into the health of a GMD system. This visibility offers clear advantages to GMD operators, such as the ability to plan maintenance tasks ahead of time or postpone them with confidence based on condition reports and evolving priorities. This targeted decision-making is gaining traction as the advantages become more apparent to mining companies.

The overarching goal of LTSAs aims to help mining companies achieve the most from their investment in critical equipment and ensure that they can predict and plan the resources they need to spend on service. Going beyond short-term success, these maintenance strategies target long-term value creation, helping to identify risks, make qualified decisions, and manage available data to increase the longevity of the systems.

Addressing flexibility and customisation

Flexibility and customisation are key components of effective LTSAs. Mining operations vary greatly in their individual needs and challenges, and a one-size-fits-all approach is rarely feasible. Customised solutions allow for targeted maintenance strategies that maximise efficiency

Figure 2. ABB collaboration Operation Center (CoC).

Figure 3. ABB GMD running in Boliden’s Aitik mine.

Figure 1. ABB service staff.

4D™ BULK SYSTEMS

THE NEW DIMENSION IN BLASTING REAL-TIME TAILORING OF ENERGY TO MATCH GEOLOGY AND HOLE CONDITIONS

A revolutionary bulk system integrated with cutting-edge technologies.

fume & nitrate leaching

drill & blast costs

To learn more about 4DTM and how it can support your operations today, come and see a 4DTM Bulk Delivery System enabled MMU up close at MINExpo 2024 booth #13901 or visit orica.com/4D

and cost-effectiveness. It is also vital that these services evolve with the technology. Continuous adaptation of service requirements to meet the needs of the system helps to extend the lifecycle of the equipment while reducing associated costs.

Furthermore, having experts with GMD Field Service Certification on hand who are familiar with the intricacies of critical equipment ensures that any issues can be addressed promptly and effectively. Whether remote or on-site, LTSAs help to maximise the availability of service for proactive and reactive assistance contributing to asset performance.

The LTSA, lasting three to five years and including a comprehensive lifecycle management programme, aligns focus on long-term reliable maintenance strategies which will support customer operations and maximise operational equipment effectiveness.

Technology made for tomorrow

The future of mining maintenance is increasingly tied to technological advancements in corrective, preventive, predictive, and prescriptive maintenance. Digitalisation and the integration of the Internet of Things (IoT) are

revolutionising how maintenance is conducted. ABB’s advanced services use data analytics and machine learning to anticipate failures and issues with equipment before they occur or escalate, allowing for proactive interventions that prevent downtime and extend equipment life.

Digital tools and IoT devices enable the real-time monitoring and diagnostics of GMD systems, providing valuable insights into equipment performance and health. This allows for more precise and effective maintenance strategies that can adapt to changing conditions and requirements.

Sustainability and energy efficiency are also becoming increasingly important in maintenance practices. As the mining industry seeks to reduce its environmental impact, strategies that enhance energy efficiency and minimise waste are crucial. LTSAs that incorporate these principles not only contribute to environmental goals, but also offer cost savings through reduced energy consumption and improved operational efficiency.

ABB is currently developing its ‘Meet the Expert’ campaign to further support customer operations with its service solutions, as well as raising awareness of the benefits associated with LTSAs. This involves immersion sessions between experts and mine operators designed to cultivate collaboration and ignite innovation for the future of mining technology.

The path to sustainable success

LTSAs play a pivotal role in future-proofing mining operations, particularly in the maintenance of GMDs. The key benefits of LTSAs include enhanced reliability and uptime, streamlined maintenance processes, continuous technical support, and adherence to environmental and safety standards.

Technological advancements in corrective, preventive, predictive, and prescriptive maintenance, driven by digitalisation and IoT integration, are set to further enhance the effectiveness of LTSAs. These advancements, coupled with a growing emphasis on sustainability and energy efficiency, position LTSAs as a strategic imperative for the mining industry.

In summary, the strategic importance of long-term service agreements in the mining industry cannot be overstated. By ensuring the longevity and efficiency of GMDs through a comprehensive service portfolio including maintenance strategies, LTSAs offer a path to overcoming industry challenges while promoting safety, environmental responsibility, and cost-efficiency. As the mining industry continues to evolve, the role of LTSAs in maintaining critical equipment and driving operational excellence will only become more vital.

Figure 4. ABB Ability Predictive Maintenance for Grinding application.

Figure 5. Grinding Connect mobile app.

Giovanni Treleani, BS Track, presents the critical role of track shoes in the mining industry by reviewing some key features, as well as global production trends.

In the mining industry, track shoes play a crucial role in moving heavy machinery – such as bulldozers, excavators, loaders, and drilling machineries. These machines often operate in harsh conditions, including rough terrain, abrasive materials, and extreme temperatures. Track shoes are essential components of tracked vehicles, providing traction, stability, and durability to navigate through challenging environments.

Key features of track shoes

Track shoes and undercarriage are critical components of mining machinery, enabling them to operate efficiently and safely in challenging environments. Investing in high-quality track shoes and proper maintenance can help maximise equipment uptime and productivity while minimising downtime and repair costs.

Material

Track shoes are typically made of high-strength steel or other durable materials capable of withstanding heavy loads and abrasive conditions. Some may also have reinforced designs or specialised coatings to enhance wear resistance.

Design

The design of track shoes varies depending on the specific application and terrain. For example, some track shoes feature deep treads or cleats to improve traction in muddy or rocky environments, while others may have a flatter profile for smoother surfaces.

Size and configuration

Track shoes come in various sizes and configurations to fit different types and sizes of tracked machinery. Larger track shoes are often used in mining equipment to distribute weight and reduce ground pressure, which helps prevent machinery sinking into soft ground.

Maintenance

Proper maintenance of track shoes is essential to ensure optimal performance and longevity of mining equipment. This includes regular inspections for signs of wear or damage, timely replacement of worn-out track shoes, and lubrication of moving parts to prevent corrosion and friction.

Specialised applications

In addition to standard track shoes, some mining operations may require specialised types of track shoes, such as those designed for specific types of terrain (e.g. desert, permafrost, etc.) or for use in extreme conditions (e.g. high temperatures, corrosive environments, etc.).

Undercarriage performance in the mining industry is crucial

Undercarriage performance is of fundamental importance in the mining industry due to its impact on equipment stability, terrain adaptability, wear resistance, fuel efficiency, uptime, safety, and asset longevity. Mining companies must prioritise the maintenance and upkeep of undercarriage components to ensure the reliable and efficient operation of their equipment in the demanding conditions of mining environments.

Heavy load support

Mining equipment carries substantial loads, and the undercarriage bears the brunt of this weight. A robust undercarriage design ensures that the machine remains stable and can navigate through rough terrain without the risk of tipping over or becoming stuck.

Terrain adaptability

Mining operations can be found in a range of diverse environments – from rocky landscapes to muddy terrains. An undercarriage’s ability to adapt to different terrains is critical for maintaining traction and manoeuvrability. This adaptability ensures that mining equipment can operate efficiently across various work sites.

Resistance to abrasion and wear

Mining environments are notoriously abrasive, with rocks, gravel, and other debris causing rapid wear on equipment. The undercarriage components – such as tracks, rollers, and sprockets – must be highly durable and resistant to abrasion to withstand the harsh conditions encountered in mining operations.

Optimised fuel efficiency

A well-maintained undercarriage contributes to optimal fuel efficiency by reducing rolling resistance and ensuring smooth operation. Minimising friction between the undercarriage components and the ground reduces the amount of power required to propel the machine, ultimately lowering fuel consumption and operating costs.

Prevention of downtime

Equipment downtime is costly in the mining industry, where every hour of lost productivity translates to significant

Figure 1. The undercarriage must be able to operate and perform a large dozer with a weight of up to 110 000 kg, where downtime is often simply not taken into account.

SMARTER IN-PIT SOLUTIONS

For over 45 years, we have successfully provided pioneering Sizer technology to many industries worldwide. Our tailored mobile, semi-mobile and fixed Sizer stations as well as our latest in-pit innovations, are reliable and efficient answers to reduce the complexity of today’s modern mining challenges.

As a turnkey provider, we have the specialist knowledge and equipment to offer comprehensive services and support. From conceptual planning and design through to manufacture, installation and aftersales service. We are your partner throughout your sustainable journey.

MMD Fully Mobile Surge Loader™

MMD Bulk Ore Sorting

revenue losses. A poorly performing undercarriage increases the risk of breakdowns and unplanned maintenance, leading to costly downtime and delays in production.

Safety

A reliable undercarriage is essential for ensuring the safety of mining personnel. Equipment instability due to

undercarriage failure can result in accidents, injuries, or even fatalities. By maintaining the integrity and performance of the undercarriage, mining companies can create safer working environments for their employees.

Asset longevity

Mining equipment represents a substantial investment for companies, and maximising the lifespan of these assets is crucial for achieving a favourable return on investment. A well-maintained undercarriage extends the lifespan of mining equipment by reducing the frequency of component replacements and major repairs.

Diving a little deeper

While other undercarriage components – such as rollers, idlers, sprockets, and track frames – are also essential, the track shoes stand out for their direct impact on traction, stability, load distribution, wear resistance, terrain adaptability, and propulsion, the key factors that determine the performance and productivity of mining equipment in challenging operating environments.

Traction and stability

Track shoes provide the primary contact between the machine and the ground, offering traction and stability essential for navigating through challenging terrain common in mining environments. Without adequate traction, the equipment may struggle to maintain stability or move efficiently, leading to decreased productivity and increased safety risks.

Load distribution

Tracks distribute the weight of the machine over a larger surface area, reducing ground pressure and minimising soil compaction. Proper load distribution is critical for preserving the integrity of the ground, especially in environmentally sensitive areas where soil disturbance must be minimised.

Wear resistance

Tracks are subjected to significant wear and tear in mining operations due to constant movement over abrasive surfaces like rocks, gravel, and debris. Therefore, they must be made from durable materials and designed to withstand the harsh conditions encountered in mining environments to minimise downtime and maintenance costs.

Terrain adaptability

Tracks come in various designs and configurations to suit different terrains and operating conditions. Whether the terrain is muddy, rocky, or uneven, tracks must adapt to provide optimal traction and manoeuvrability, allowing mining equipment to operate efficiently across diverse work sites.

Drive and propulsion

In tracked machinery, tracks transmit power from the machine’s engine to the ground, propelling it forward, backward, or enabling it to turn. The effectiveness of the drive system depends on the condition and performance of

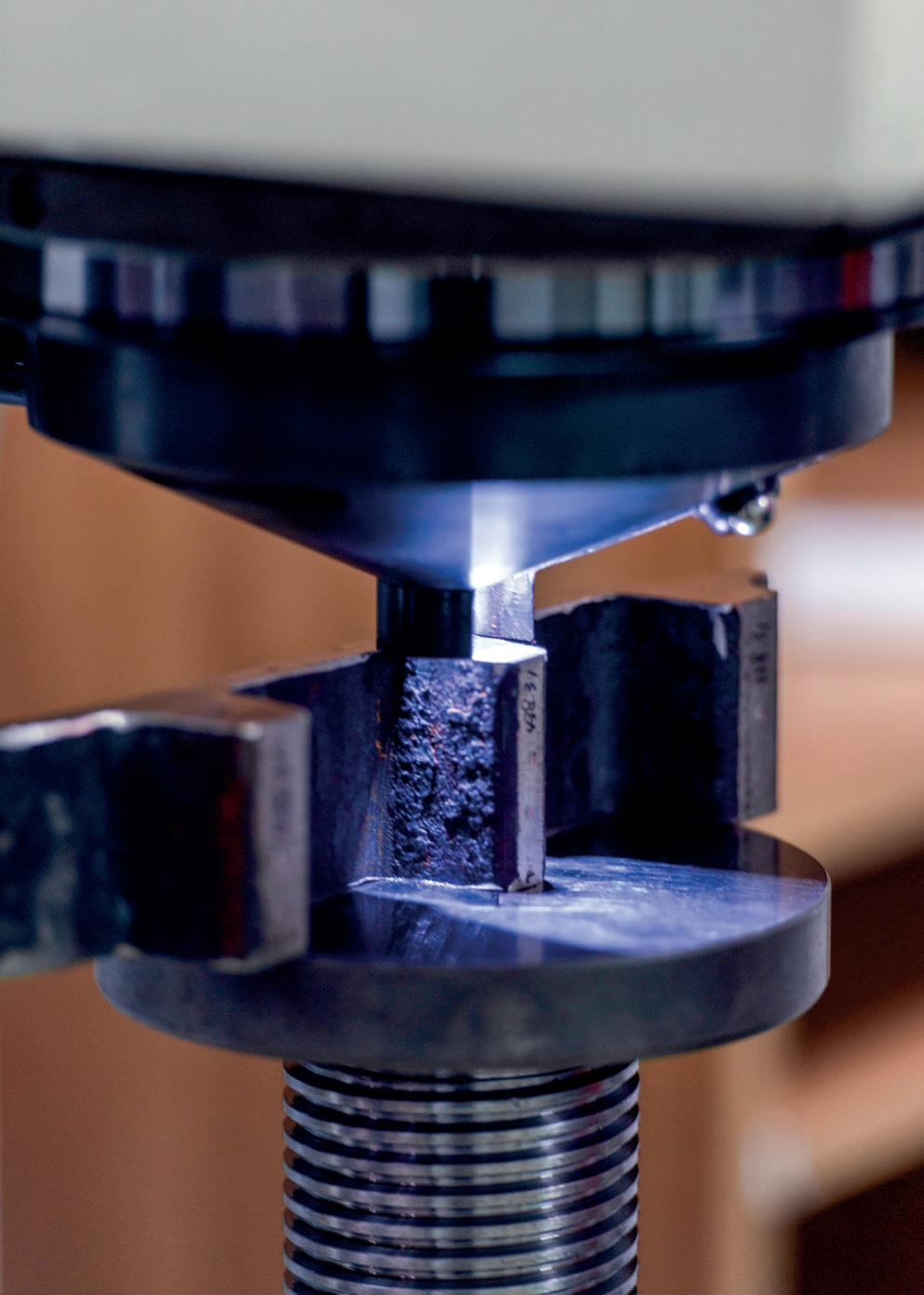

Figure 2. Leading companies provide a complete list of mechanical tests performed in their laboratories.

Figure 3. The profiles can have different shapes and thicknesses for perfect field application.

the tracks, making them integral to the overall functionality of the equipment.

Global production

Track shoes for heavy machinery, including those used in the mining industry, are manufactured by specialised companies around the world. The manufacturing process typically involves precision engineering, high-quality materials, and advanced fabrication techniques to ensure durability and performance in demanding operating environments. Here are some regions and countries where track shoes are commonly manufactured:

USA

Several companies in the US specialise in manufacturing track shoes for heavy equipment used in industries like mining, construction, and agriculture. States such as Illinois, Wisconsin, and Pennsylvania are home to manufacturers with expertise in producing high-quality track shoes.

Europe

Countries like Germany, Italy, and the UK have a strong manufacturing presence in the heavy machinery sector, including the production of track shoes. European manufacturers are known for their advanced engineering capabilities and emphasis on quality and innovation. For example, BS Track, one of the most recent manufacturers to enter this market, has established its operations in Turkey, and will serve the construction, quarrying, and mining market at a global level with its complete range of products.

China

China is a significant hub for heavy equipment manufacturing, including track shoes. Many Chinese companies produce track shoes for both domestic and international markets.

Japan

Japanese manufacturers are renowned for their precision engineering and high-quality products. Some Japanese companies specialise in producing track shoes for heavy machinery, meeting stringent quality standards for durability and performance.

South Korea

South Korea is another key player in the heavy machinery industry, with companies manufacturing track shoes for various types of construction and mining equipment. South Korean manufacturers are known for their technological advancements and competitive pricing.

India

India has a growing presence in the manufacturing of heavy equipment components, including track shoes. Indian companies often cater to both domestic and international markets, offering a wide range of track shoe options for different applications.

Other regions

Track shoes are also manufactured in other regions, including Australia, Brazil, and Russia, among others. These countries may have companies specialising in the production of track shoes to serve local industries or export markets and are, in most cases, branches from the most notable international companies from the same sector.

Conclusion

Track shoes are vital components in the mining industry, integral to the performance and reliability of heavy machinery – such as bulldozers, excavators, and loaders. Made from high-strength materials and designed to withstand harsh conditions, track shoes provide essential traction, stability, and durability, enabling equipment to operate efficiently across varied and challenging terrains. Proper maintenance and specialised designs further enhance their performance, ensuring safety, fuel efficiency, and minimal downtime.

The global manufacturing landscape for track shoes includes notable hubs in the US, Europe, China, Japan, South Korea, and India, each contributing to the innovation and quality of these critical components.

Ultimately, investing in high-quality track shoes and maintaining the undercarriage systems are crucial for maximising the productivity, longevity, and safety of mining operations.

Global

Michael Fleet, Komatsu, USA, outlines the latest loading innovations that can help promote sustainability.

In today’s world, surface mining operations are looking to prioritise being good stewards of the environment. Mining companies that ignore sustainability as a top concern expose themselves to big risks. Overlooking the environmental impact of their surface mining operations can result in regulatory fines, local community backlash, and damage to the company’s reputation.

Of course, it is a huge challenge to balance sustainability and productivity goals. Companies need to produce minerals while doing their best to address environmental concerns.

Like other traditional mining equipment, wheel loaders can be challenging when striking that balance. These immense machines

Figure 1. Wheel loaders and bucket loading technology have advanced and evolved over the years, making loading much more efficient, with fewer emissions.

can be highly productive in moving material, yet older models may produce more CO2 while burning more fuel. The good news is that wheel loader design, technology, and other industry innovations have significantly evolved. Monitoring machine data, telematics, and autonomous and semi-autonomous functions have empowered more efficient operational processes.

Put it all together, and the industry is in the midst of a rapid evolution of hybrid drive wheel loaders. These machines have been designed to facilitate sustainability in mining operations beyond what they were capable of just a few short years ago.

Advancements in haulage wheel loaders

When looking at the most influential sustainability-related innovations for wheel loaders, several factors stand out: regenerative SR hybrid electric driveline, semi-autonomous functions, remote data monitoring, and advancements in operator interface technology are at the forefront.

SR hybrid electric driveline

The electric drive, which R.G. LeTourneau pioneered, is one of those innovations. Electric drive technology was improved in the late 1990s when switched reluctance (SR) technology was first introduced on hybrid wheel loaders.

Through decades of refinements and improvements, some of today’s biggest wheel loaders use a hybrid electric drive. Komatsu’s SR hybrid electric technology has progressed to become an integral technology that powers productivity at mines and construction sites worldwide. Its engineers continue to push the envelope to design for more efficiency out of its SR hybrid electric drive surface loaders. These latest innovations in electric drive technology, which include regenerative capabilities and a unique energy storage system, are engineered to help surface mines achieve their sustainability targets.

Because the Komatsu SR system was specifically designed to improve the efficiencies of mining machines (rather than adopt drives from other applications), the company has developed a system to capture and manage braking horsepower that would normally be lost.

For instance, historically, when a typical electric drive machine brakes, the converted energy from the inertia of the rotating wheels is converted to heat. During electrical

braking (dynamic or retarding), the wheel motors produce power. Komatsu has developed a system that captures the braking energy in the form of an SR device that functions as a motor and a generator.

This device is called a Kinetic Energy Storage System (KESS) unit. During electrical braking, the converted energy is fed into the KESS unit and it acts as a motor. The KESS unit takes the available power and begins to spin at a high rate of speed. As subsequent functions of the loader take place, the KESS unit converts to a generator, providing supplemental electrical horsepower to assist the diesel engine and SR generator in supplying the power needs of the loader.

Combining the hybrid drive system and the KESS unit allows the hydraulic and electrical drive systems to receive full power demand.

With this system, there has been up to 45% less fuel consumption with SR hybrid electric-drive machines than comparably sized mechanical-drive wheel loaders, and loading cycles can become more efficient. Because it is highly productive, the SR hybrid electric drive is designed to strike a productivity-sustainability balance.

Semi-autonomous, remote data monitoring, and operator interface innovations

Automation in wheel loaders continues to evolve, bringing tangible productivity and efficiency benefits. Integrated machine technology provides operators with instantaneous feedback, empowering more efficient loading. The HMI interface on Komatsu wheel loaders also delivers text and visual alerts to operators if they need to take corrective action.

Komatsu’s LINCS II network control system, integrated into its wheel loaders, monitors over 700 data points. It provides virtually instant, real-time feedback, and vital statistics. These metrics include bucket height and angle, total tonnes moved, fuel burn, steering and dump angle, cycle time breakdown, machine health, and more.

Communicating all of these factors to operators can help them adjust to conditions that allow for more efficient loading to promote reductions in fuel burn. This data can also help new or underperforming operators improve their performance. For instance, data from the LINCS system may show an operator spending too much time in the dig space, so tips and guidance can be provided for faster digging.

As an added benefit, personnel can view health monitoring data and other diagnostics remotely via a smartphone or digital device.

Innovations in bucket payload technologies

Bucket payload management is a crucial operational factor that impacts the efficiency of each loading cycle.

Maximising each load can help a mine become more sustainable, as moving more material with each load-and-haul cycle means fewer cycles, which can help decrease overall fuel usage.

Even small improvements in bucket loading can promote tremendous productivity and sustainability benefits. These solutions can help an operation hit the ‘sweet spot’ in loading, realising efficiencies that result in

Figure 2. Today’s loading bucket loading technology optimises efficiency with every haul cycle, which can help mines become more sustainable.

sustainability benefits, such as reductions in fuel consumption and optimised loading.

For instance, Komatsu’s Modular Mining Argus Wheel Loader Monitoring System – an optional aftermarket solution for its machines – can deliver a 3% or more productivity improvement in the total volume of material moved per load cycle.

At the heart of any bucket payload system is data. The actionable insights from data offer many operational benefits. For instance, access to bucket payload data can provide a more holistic view of a mine’s operational performance. It also helps operators do a better job on the surface mine site, while empowering those back at the control centre with robust information to make more informed decisions in real time.

Most payload monitoring systems deliver a host of cycle-by-cycle information that is designed to help enhance a mine’s efficiency. This usually includes bucket payload, cycle time, cycle component time (fill, tram, dump, return, spot), hang time, wait on truck time, time usage modelling, and more. Once all of this information can be accessed, user-friendly data analytics can help operations.

Data analytics generated by a bucket payload solution can have a direct impact on an operation and help companies:

n Control payload range variance and standard deviation.

n Narrow down the payload distribution curve and shift it to targets or the appropriate operating limits for the OEM.

n Empower operators to hit the maximum payload mark while promoting safety and sustainability.

n See how different areas of a mine are connected for a more holistic view and informed operational decisions.

What all of these advancements mean for sustainability

When companies combine the technological advancements in wheel loaders and cutting-edge bucket management solutions, new ways of doing things emerge that can make mining processes more streamlined.

With machines and software communicating with each other, mining control centres can have access to comprehensive dashboards that allow companies to control bottlenecks and make processes more efficient, using the interconnected data and factors with every decision.

With all of these machine advancements and bucket payload solutions, mining operations can become like a choreographed dance – equipment, operators, and the control centre in sync and harmony. The result is a sustainability-focused operation that still can achieve productivity goals while controlling costs.

Nellaiappan Subbiah, Sandvik Mining and Rock Solutions, USA, explains why smart miners are saying goodbye to diesel and hello to electricity to revamp drilling, save costs, reduce maintenance interventions, and act more sustainably.

Mining, like every other sector, has a problem. Processes that have been well-grooved by decades of activity need to be re-engineered as mandates and ethics demand investments in sustainability and carbon emissions reductions. This demand does not brook negotiations. Without adherence to prevailing regulations, miners will lose their licences and permissions to operate. Therefore, whether they go into this willingly or unwillingly, miners have to change. And change is what is occurring everywhere across the big mining houses like BHP, Rio Tinto, and Glencore, but also at a panoply of smaller companies.

This need to change is seeing progressive miners of all sizes and specialisations make investments in automation, digitalisation, data analytics, and anything else that can aid their cause. However, where the rubber hits the road, or rather where the drill hits the seam, is the place to start. In drilling, the advent of a massive transition between diesel and electric is clear.

Why electric trumps diesel

Why this change? The simple answer is that for a host of reasons and in a host of ways, electricity beats diesel hands down. These reasons range from lower maintenance thresholds and extended motor lifespans to cooler running, reduced energy demands, and a hugely significant improvement in total cost of ownership (TCO) levels.

Going electric means the wholesale elimination of standard diesel components, such as filters, cooling packages, exhaust systems, and fuel tanks – all of which

carry a significant maintenance burden. Losing them means a lengthier lifespan for drilling products.

Moreover, a diesel engine is only about 30 – 35% efficient in terms of converting chemical energy into mechanical energy, whereas a high-voltage electric motor typically delivers 90 – 95% efficiency.

Electricity also beats diesel when it comes to lifespan. A diesel lifespan will have an expected life of about 20 000 hr, but the same-class horsepower electric motor will have a life of 80 000 – 100 000 hr. This effectively means that an organisation could avoid changing the prime mover throughout the lifetime of the asset itself. This is a huge advantage, especially in harsh and remote locations with extremes of weather, limited accessibility, or high altitudes.

A related improvement is an ability to seamlessly integrate settings controls for automatic drilling and adaptive drill features that optimise energy usage. Electric drilling often goes hand in hand with smart drilling, as miners tap into ways to remotely control and monitor drilling activities. Results are even better if electric drilling is integrated with business infrastructure and workflows, as organisations deploy intelligent energy management systems, automated engine update alerts, and optimised drilling settings.

The motor control cabinet or transformer does not need a lot of maintenance, compared to the complexity of a diesel engine with its exhaust system, fuel system, radiator, charger cooler, and air-intake filters. These and other items typically have high levels of wear and tear, and must be maintained by periodical interventions every 500 – 1000 hr. With an electric-powered machine, these interventions largely go away for what is calculated to be a total maintenance time saving of about 68% compared to diesel.

Safety is another advantage in favour of going electric. Sensors can more easily be deployed to monitor the speed and direction of the rotation of cable reels and the force on the cable. This means that an operator no longer needs to leave their cabin and take remedial actions and

information can be relayed to a remote-control room. More broadly, automation can also be tapped to minimise manual human intervention and lower cycle times between operations, as well as in maintaining minimum distances between cable routings to avoid electromagnetic interference, thus ensuring the design’s reliability and robustness.

Electrification also plays a role in the human factor: how are personnel in operations impacted by their work? Electric machines generate less noise, heat, vibration, and emissions than diesel machines, so operations not only become more environmentally-friendly, but they are also less exhausting for operators and maintenance personnel. The decreased service intervals of the aforementioned prime mover also mean less time is spent on maintenance, so stress and fatigue are reduced. The result is that drill and blast supervisors, or other personnel on the ground, can work in a less hazardous environment. Therefore, clearer thought processes and, ultimately, smarter decisions are evident.

Think carefully when managing change

Swapping out diesel for electricity is highly effective, but it should not be considered as a ‘slam dunk’ or quick win. Change must be managed, and smart miners are making gradual, measured shifts towards electric power and cutting emissions.

First, there is hardware modularity. By designing drills to accept different fuel sources, companies can ensure that original equipment investment is not squandered and there is no ‘rip and replace’ strategy needed.

Second, infrastructure needs to be considered. Organisations (or their providers or service centre partners) can replace diesel engines with electric prime movers that are connected to the mine grid, usually via a substation and trailing cable.

However, introducing electrified components brings challenges too. Layouts and form factors in circuitry and hardware design when converting a machine from diesel to electric are very different. It is also important to ensure that users are adequately trained and collect feedback to ascertain that they feel they are having a positive experience.

Making the transition and using ‘tailor-made’ equipment

For organisations with unique operational needs, adaptations can be made. Electric motor and diesel power packs should be interchangeable without affecting the machine frame, cab, mast, or

Figure 1. Sandvik DR416iE electric rotary blasthole drill.

Create a large footprint.

While leaving a small one.

Sandvik DR416iE

Ideal for iron ore and copper applications, with a hole diameter range of 270 to 406 millimeters (10.6 to 16 inches) and powered by a robust 1,044 kW (1,400 HP) electric power group designed to meet the demands of high-altitude applications. Sandvik DR416iE boasts a sophisticated electric system that incorporates a soft starter to help reduce the impact on the mine’s power grid, preventing disruptions to other equipment, while the multi-voltage and multi-frequency electric motor offers outstanding flexibility.

The DR416iE - Powering tomorrow, today. Go electric. Go Sandvik.

hydraulic system. Electrical power packs can replace diesel power packs, with changes only being needed for the cooler, plumbing, fans, etc.

In most transformations, it is not just the drill that is electrified, but also the shovel, dragline, or other equipment. However, many organisations will exist in a hybrid environment, combining diesel and electric equipment. Hence the importance of modularity – the ability to extract optimal usage from older equipment and integrate it with the modern aspects of the environment – is clear.

The future is bright

The electrification of what were primarily diesel-powered machines is just one aspect of how the drilling process is changing. Looked at holistically and in the long term, it may best be considered as an interim step. At some point in the future, mining operations could be powered by a blend of alternative and sustainable fuel sources, including batteries, hydrogen, biodiesel, and biogas sources.

However, even today, demand for electric drills is going up and Sandvik’s estimates suggest that these models will soon account for about a third of the total market with the scope to advance to perhaps half of the market in the mid-term. Sandvik’s experience is that a mixture of emissions concerns and related tax benefits

for miners are seeing many take a proactive stance and that this trend is inexorable.

Electric dreams

The advent of electrical drilling marks a radical transformation, but it is also important to have some patience and work through changes. Ground-based controls must still be maintained, because there are situations – such as the loading and unloading of cables, or dealing with some specific or unique obstacles in the field around the pattern – that require those controls.

And, as anyone who has experienced the operation of electric high-voltage electrified equipment will know, there is still a high potential for electromagnetic interference between different circuits. This means companies need to continue to put a lot of effort into making sure that the safety and reliability of the system are world-class.

However, any serious miner knows that radical steps need to be taken to stay relevant in a century that is being defined by attitudes towards power management. Drilling is just one example of how mining is moving away from old, dirty activities towards cleaner, smarter processes. It will be incumbent on everyone in the future of mining to work towards sustainability, reusability, and recycling. If those are watchwords, then the industry will be well-positioned to create a brighter future.

Matthias Stöhr and Nicolas Osswald, Herrenknecht AG Business Area Mining, Germany, consider how innovative technologies can ensure safer and more efficient excavation of ore passes and ventilation shafts in underground mines.

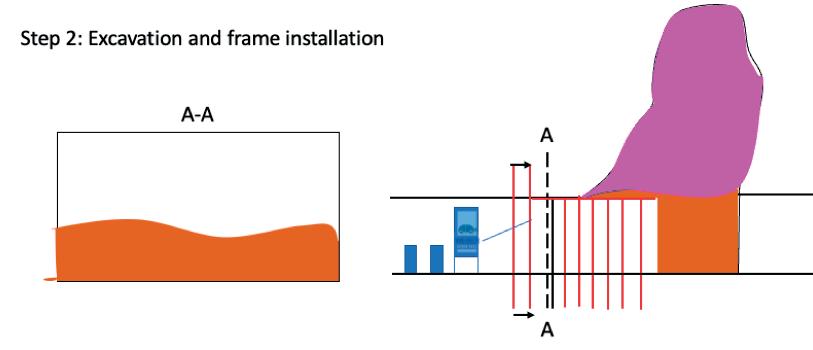

The innovative technology of the Boxhole Backreaming Machine (BBR) and Lining System has been developed by Herrenknecht for the economical and safe excavation of ore passes and ventilation shafts. It allows reaming and lining to be carried out in a single operation. The new technology prevents the collapse of the borehole in unstable rock after reaming and eliminates the rework that would otherwise be required. It also reduces the amount of activity at the production level during initial mine construction and development. The new technology enables mine owners to develop a safer and more efficient mine, resulting in an earlier start to production. A BBR and lowering unit is currently used at El Teniente mine in Chile, where around 300 m of shafts with a final diameter of 3 m were drilled and lined in very challenging geologies.

The BBR