Volume 24 Number 6 - June 2024

Volume 24 Number 6 - June 2024

Combining industry-leading abrasion resistance with unmatched flexibility, our range of epoxy solutions are built tough, easy to apply and designed to last.

Whether its HDD or field joint coatings, we’ve got the solution.

03. Editor's comment

05. Pipeline news

Contract news and updates on the Trans Mountain pipeline start date and ONEOK's acquisition of Gulf Coast pipelines.

KEYNOTE: HYDROGEN PIPELINE TRANSPORT

08. Is it all green lights for hydrogen?

Contributing Editor, Gordon Cope, considers the rollout of the hydrogen economy and asks, what will it take to embed an entirely new source of energy throughout the global economy?

15. Hydrogen's pure potential

Garry Hanmer, Senior Simulation Consultant, Atmos International, UK, evaluates how to accurately model pure hydrogen pipelines, using a case study to demonstrate the model tuning process and the selection of appropriate equations of state.

EPC

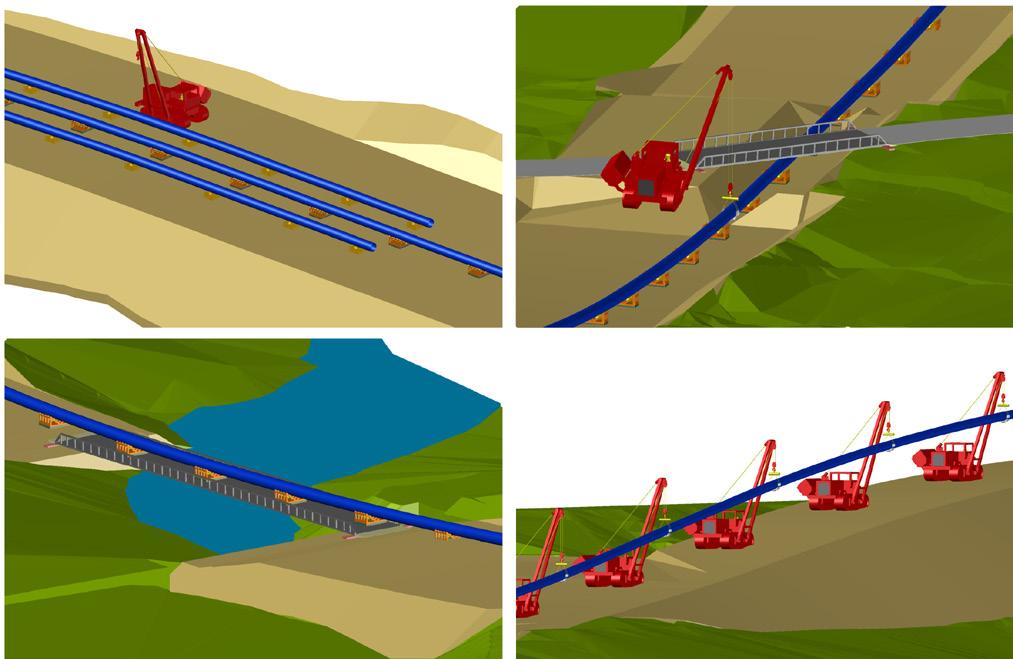

21. A challenging pullback operation

Giacomo Marinelli and Pier Maria Bruzzo, Bonatti, Italy.

SUBSEA PIPELINES

26. The future of subsea surveying unlocked Russell Small, Principal Surveyor, DeepOcean.

COATINGS AND CORROSION

31. Corrosion mapping in action

Angélique Raude, Evident.

INTEGRITY AND INSPECTION

37. The end of radiographic film for pipe inspection?

Norman Stapelberg, Silveray.

PIGGING TOOL PERFORMANCE

43. Debris or corrosion?

Johannes Keuter, 3P Services GmbH & Co. KG, Germany.

49. Managing metal loss

Seamus Jacobs, Dexon Technology, Thailand.

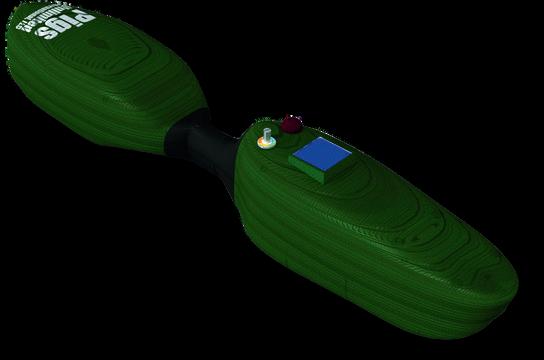

54. No need to chase the pigs

Jim Hunter, Technical Specialist, Pig Tracking, Xylem.

METERING AND MONITORING

58. Putting pressure on fugitive emissions

Mary Loftus, Senior Research and Development Engineer and Valve Doctor, IMI Critical Engineering.

SYSTEMS AND SOFTWARE

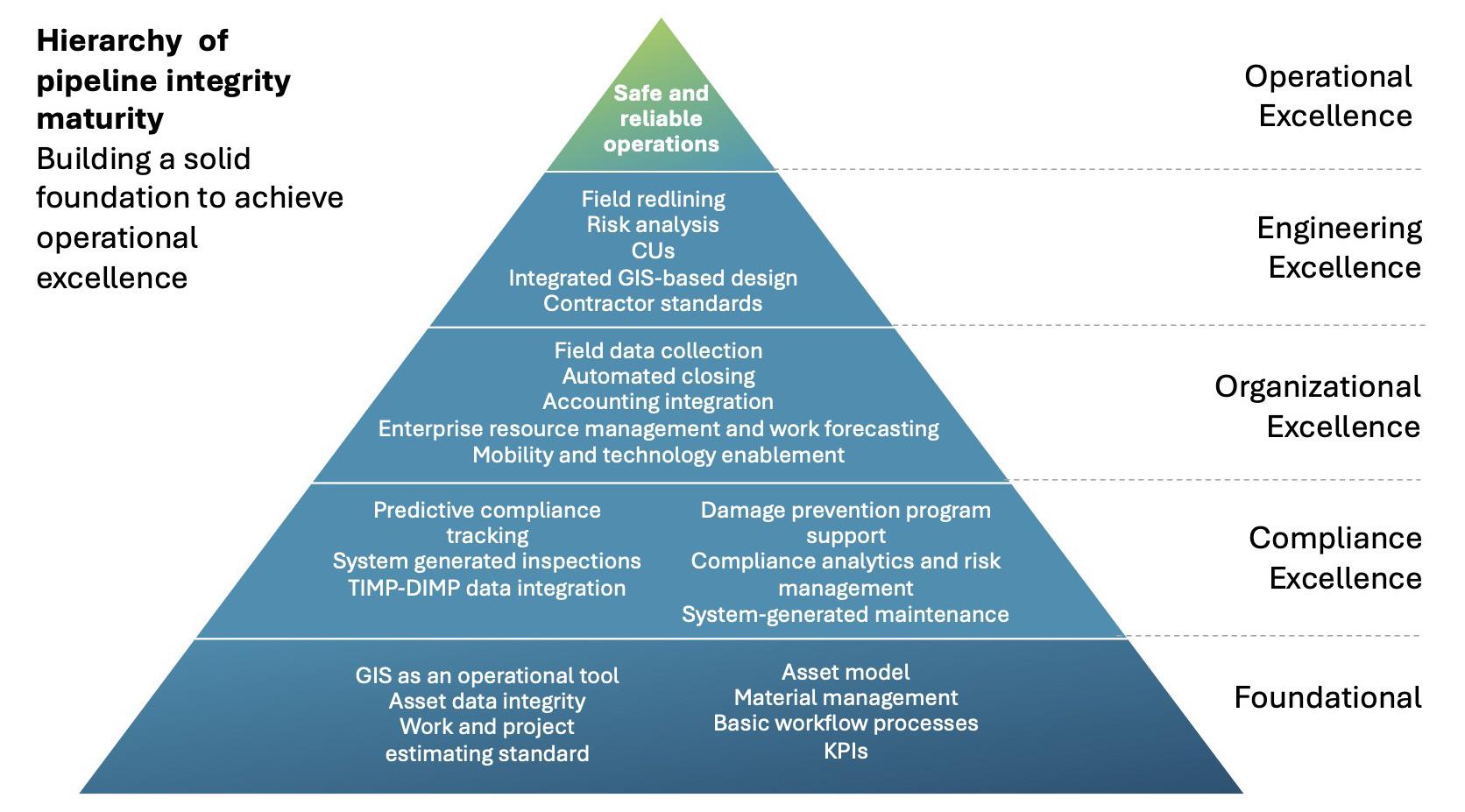

62. Reaching the apex with digitisation

Peter Wilson, Executive Industry Consultant, Hexagon Asset Lifecyle Intelligence.

MANAGING EDITOR

James Little james.little@palladianpublications.com

EDITORIAL ASSISTANT

Isabel Stagg isabel.stagg@palladianpublications.com

SALES DIRECTOR

Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER

Chris Lethbridge chris.lethbridge@palladianpublications.com

SALES EXECUTIVE

Daniel Farr

daniel.farr@palladianpublications.com

PRODUCTION DESIGNER

Kate Wilkerson kate.wilkerson@palladianpublications.com

EVENTS MANAGER

Louise Cameron louise.cameron@palladianpublications.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@palladianpublications.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

ADMINISTRATION MANAGER

Laura White laura.white@palladianpublications.com

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK

Tel: +44 (0) 1252 718 999 Website: www.worldpipelines.com Email: enquiries@worldpipelines.com

Annual subscription £60 UK including postage/£75 overseas (postage airmail). Special two year discounted rate: £96 UK including postage/£120 overseas (postage airmail). Claims for non receipt of issues must be made within three months of publication of the issue or they will not be honoured without charge.

Applicable only to USA & Canada: World Pipelines (ISSN No: 1472-7390, USPS No: 020-988) is published monthly by Palladian Publications Ltd, GBR and distributed in the USA by Asendia USA, 701C Ashland Avenue, Folcroft, PA 19032. Periodicals postage paid at Philadelphia, PA & additional mailing offices. POSTMASTER: send address changes to World Pipelines, 701C Ashland Avenue, Folcroft, PA 19032

In this issue of World Pipelines, we publish articles on: the realities of hydrogen pipeline transport; advances in imaging to detect pipeline corrosion; the performance of inline inspection tools; AI and machine learning for subsea pipeline survey; and monitoring of fugitive emissions from pipelines. One common thread among the articles is that they all look towards a future where the energy transition materialises. Each new piece of technology, or modelling, works to support and sustain the pipeline industry as it evolves.

‘Evolves into what?’, I hear you ask. The energy transition as a phrase is generally taken to mean the elimination of fossil fuels. At this year’s ptc Conference in Berlin, keynote speaker Brigham McCown, from the Hudson Institute (USA), asked “Are we in the midst of an ‘energy transition’, an ‘energy expansion’, or both?” Delegates raised hands according to which term appealed to them, and most people thought that ‘both’ was probably fitting. I got the sense that the term ‘expansion’ felt more comfortable for many of the delegates, since it reflected a broadening of the energy sector to encompass new energy sources, rather than a linear trajectory in which oil and gas are completely replaced by renewable sources.

In research published by Rystad Energy in May, Claudio Galimberti, Global Market Analysis Director, reports: “As oil demand is likely to stay on an upward trajectory in the medium term, the probability of a fast transition away from oil decreases unless we witness breakthroughs in those low-carbon energy carriers that can technically and economically substitute oil. Our updated mid-term forecast should bring a dose of realism to the oil transition narrative, alongside a renewed sense of urgency to explore and invest even more – wherever it makes economic sense – in clean tech and renewables, to achieve those breakthroughs”. 1

The pace of the energy transition, or the energy expansion, is something that has to be judged and recalibrated all the time. We see the pipeline sector reaching to tackle the new challenges that will come with new types of transport such as CO 2 and hydrogen, but we also see it putting much effort into the sustained, safe operation of traditional oil and gas transport.

In what I consider to be a ‘must read’ article on the mining industry (a sector that we cover in our sister magazine Global Mining Review), Nick Bowlin ( The Drift magazine, July 2023), explains how the world’s governments are scrambling to secure mineral and metal supplies, for a future in which decarbonisation relies on EVs and renewable energies. 2

To quote the article: “As the economic historian Adam Tooze argued in March, [the] suggestion of a smooth shift from one mode to another fails to adequately capture the radical nature of the challenge ahead – the total transformation of global energy production required to address the climate crisis. Coal, gas, and oil still account for more than 60% of humanity’s total electricity generation. These need to be phased out immediately; extant and planned fossil fuel projects are almost certain to push the globe past two degrees Celsius of warming. And new energy sources will need to meet surging global electricity demand, which is expected to double, at minimum, in the coming decades. ‘The wholesale displacement of fossil fuels across global electricity generation, with overall capacity expanded to twice its current size, in the space of a single generation, will be a truly staggering undertaking,’ Tooze writes.” 2

I’ll take ‘expansion’ over ‘displacement’ to meet this lofty goal.

1. https://www.rystadenergy.com/news/stronger-for-longer-oil-demand-to-grow-in-the-mid-term-future 2. https://www.thedriftmag.com/a-good-prospect

SENIOR EDITOR Elizabeth Corner elizabeth.corner@palladianpublications.com

Founded in 1933, we cut our teeth in onshore and offshore pipeline construction. Now we are evolving our leading welding and coating solutions for today’s global energy and wider infrastructure sectors.

New GlobalData insight says gas pipelines will underpin global transmission projects growth by 2028. A total of 508 new-build trunk/transmission pipeline projects will start operations from 2024 to 2028. Of these, 368 represent gas pipeline projects, 67 constitute oil pipelines, 60 projects belong to product pipelines, and 13 account for NGL pipelines respectively.

According to the new report, Asia is set to dominate both in terms of pipeline project count and length, globally, by 2028.

Further details from the report include:

) Globally, 508 newbuild trunk/transmission pipeline projects are likely to commence operations during the 2024 - 2028 period.

) About 45% of the upcoming pipeline projects are in the construction stage with expected operational commencement by 2028.

) More than 90 000 km of pipeline length is presently under construction and is likely to become operational by 2028.

) Gas pipelines lead both in terms of project count and pipeline length globally by 2028, as countries continue to grapple with the dual challenges of energy security and environmental sustainability.

Canada’s

) Gas pipelines lead the region in terms of both project count and pipeline length, followed by product pipelines.

) Natural gas and product pipelines account for the bulk of the pipeline length additions in the region due to ever-growing demand from the industrial, domestic, and transportation sectors.

) Among countries, the US leads with the highest number of pipeline projects that are expected to start operations by 2028.

) Gas pipelines constitute the highest number of projects in the country, mainly to supply natural gas for liquefaction terminals.

) In terms of pipeline length, India leads with a proposed 29 800 km by 2028, with gas pipelines contributing the major chunk.

Further analysis on pipeline projects can be found in GlobalData’s new report, ‘New Build Trunk-Transmission Pipelines Projects by Development Stage, Regions, Countries, Project Type and Forecast to 2028’.

After 12 years and CAN$34 billion (US$25 billion), Canada’s Trans Mountain pipeline expansion project (TMX) began commercial operations on Wednesday 1 May, a major milestone expected to transform access to global markets for the country’s producers.

Pipeline constraints have forced Canadian oil producers to sell oil at a discount for many years, but TMX will nearly triple the flow of crude from landlocked Alberta to Canada’s Pacific coast to 890 000 bpd.

Trans Mountain said in a statement: “1 May 2024 signifies the commercial commencement date for the Expanded System. As of today, all deliveries for shippers will be subject to the Expanded System tariff and tolls, and tankers will be able to receive oil from Line 2 by mid-May.

“Line fill on the Expanded System continues, and is expected to be completed within the next few weeks. Both the

existing and expanded pipelines are now able to transport crude oil and Trans Mountain has the ability to load cargoes from all three berths. As of April 30, 2024, the expanded pipeline is 70% full by volume, and 69% complete by distance”.

“Trans Mountain has demonstrated that challenging, long linear infrastructure can be built in Canada,” said Dawn Farrell, President and CEO, Trans Mountain Corporation. “With our project management team and contractors, we were able to build 988 km of new pipeline, 193 km of reactivated pipeline, 12 new pump stations, 19 new storage tanks, and three new berths at Westridge Marine Terminal in Burnaby. We did this while adhering to the highest environmental, safety and social standards including respecting and working with local First Nations and Métis communities throughout the entire process.”

ONEOK, Inc. has announced that it has agreed to acquire a system of natural gas liquids (NGL) pipelines from Easton Energy, a Houston-based midstream company, for approximately US$280 million, subject to customary purchase price adjustments.

The transaction includes approximately 450 miles of NGL pipelines located in the strategic Gulf Coast market centres for NGLs, refined products and crude oil. These pipelines transport a wide range of liquids products through a portion of its capacity to existing customers.

ONEOK plans to connect the pipelines to ONEOK’s Mont Belvieu, Texas, NGL infrastructure and ONEOK’s Houston refined products and crude oil infrastructure, accelerating

commercial synergies.

“This strategic acquisition provides the quickest pipeline connectivity to and within the critical supply and demand centres for our NGLs, refined products and crude oil assets in the Gulf Coast,” said Pierce H. Norton II, ONEOK President and Chief Executive Officer. “We expect that this acquisition will accelerate the ability to capture commercial synergies related to our recent Magellan acquisition and future earnings growth.”

ONEOK expects to close the transaction mid-year 2024. Closing is subject to customary conditions including termination or expiration of the waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act.

Sapura Energy secures US$1.8 billion contracts from Petrobras

11 - 13 June 2024

Global Energy Show 2024 Calgary, Canada

www.globalenergyshow.com

26 - 27 June 2024

Hydrogen Technology Conference & Expo 2024 Houston, USA www.hydrogen-expo.com

26 - 29 August 2024 ONS 2024

Stavanger, Norway www.ons.no

9 - 13 September 2024

IPLOCA convention

Sorrento, Italy

www.iploca.com/events/annual-convention

17 - 20 September 2024

Gastech 2024

Houston, USA

www.gastechevent.com

24 - 26 September 2024

International Pipeline Conference & Expo (IPE) 2024 Calgary, Canada

www.internationalpipelineexposition.com

23 - 24 October 2024

Hydrogen Technology Expo Europe 2024 Hamburg, Germany

www.hydrogen-worldexpo.com

23 - 24 October 2024

Subsea Pipeline Technology (SPT) 2024 London, UK

https://sptcongress.com

4 - 7 November 2024

ADIPEC 2024

Abu Dhabi, UAE

https://www.adipec.com/visit/registration

Sapura Energy has secured contracts valued at US$1.8 billion (9.13 billion reais) from Brazil’s state-owned company Petrobras for the provision of subsea services and six pipelaying support vessels (PLSVs), according to GlobalData.

The Malaysia-based offshore services company said that the contracts were obtained through its joint venture (JV) companies, owned by Seabras Sapura Holding and Seabras Sapura Participações, in collaboration with Paratus Energy Services.

The JVs, in which Sapura Offshore, a wholly owned subsidiary of Sapura Energy, holds a 50% equity interest, won the contracts as part of a competitive tender process.

The deal includes the full fleet of six

Kent secures FEED contract for INEOS Hejre Project

Kent, a global leader in engineering, has been awarded a key Front-End Engineering Design (FEED) contract for the INEOS Hejre project.

The Hejre project, an offshore High Pressure High Temperature (HPHT) development, is located in the Danish sector of the North Sea. It is planned as a tie-back to the South Arne field, utilising the existing Hejre jacket structure.

Kent’s responsibilities under this contract include the complete FEED design for the pipeline, tie-in spools, retrofit risers, and subsea power and fibre optics cable.

Usman Darr, Engineering and Consulting Managing Director for the UK at Kent, expressed his enthusiasm about the project, stating, “We are thrilled to continue our partnership with INEOS Energy Denmark on the Hejre project. Having successfully completed the pre-FEED for the full project scope, this new phase allows us to further demonstrate our robust FEED capabilities and deep understanding of the unique challenges in subsea and offshore engineering, particularly in the challenging conditions of the North Sea.”

Rasmus Enemark-Rasmussen, Project Manager at INEOS, added, “We are delighted to deepen our collaboration with Kent. Their performance in the Hejre pre-FEED phase, coupled with their pivotal role in vital energy transition projects like Greensand, underscores the strength and importance of our ongoing partnership.”

multi-purpose PLSVs, namely Sapura Diamante, Sapura Topázio, Sapura Esmeralda, Sapura Onix, Sapura Jade and Sapura Rubi.

Spanning a period of three years, the contracts have varying mobilisation dates for each vessel, involving the provision of subsea engineering, installation and other related services in Brazilian waters.

The scope of work encompasses operations for the installation of flexible pipes, electric-hydraulic umbilical and power cables, and tasks such as loading, laying and connecting spans at a maximum water depth of 3000 m.

The contracts follow Sapura Energy’s agreement with French oil and gas company TotalEnergies to sell its stake in gas producer SapuraOMV.

• DORIS, ROSEN and SPIECAPAG announce the Pipeline Transition Alliance

• CER orders TC Energy gas pipeline to further reduce pressure

• “Clear and present threat”: three years on from Colonial Pipeline attack

• ATCO Ltd to build 200 km Yellowhead gas pipeline

• Colombia Trasandino oil pipeline likely to stay offline through 2024

Follow us on LinkedIn to read more about the articles linkedin.com/showcase/worldpipelines

Gordon Cope, considers the rollout of the hydrogen economy and asks, what will it take to embed an entirely new source of energy throughout the global economy?

Nations around the world are jumping on the hydrogen bandwagon. From Asia to Europe, governments are opening the fiscal vaults to promote the adoption of this ubiquitous, low-carbon fuel. Already, however, the wheels on the bandwagon are starting to wobble, and for all the predictable reasons.

Why do it in the first place?

Low-carbon proponents have been advocating hydrogen fuels for several decades. The invisible, odorless gas can be produced using electricity from solar and wind farms to break down water into hydrogen and oxygen atoms using electrolysis. The energy-dense gas can be compressed and loaded into special tanks and then burned directly in an internal combustion engine or converted into electricity through the use of a fuel cell. The only emission after combustion is water.

The fuel got a big boost in popularity with the advent of the Ukraine war, which saw Russia use its deliveries of natural gas to Europe as an economic weapon. Energy security quickly became the trump card; hydrogen can be made virtually anywhere, eliminating vulnerability to hostile suppliers.

Production of low-carbon hydrogen falls into two categories: blue hydrogen, where carbon produced during the traditional Haber-Bosch method is captured and sequestered; and green hydrogen, where wind and solar farms produce electricity which is then used to separate hydrogen from oxygen in water molecules through electrolysis.

The EU has gone into overdrive in its desire to achieve a hydrogen economy. Over €13 billion has been earmarked for improving hydrogen technology, production and demand. While onshore sites for wind power in northern Europe are few and far between, offshore sites are abundant. DNV, a consultancy, estimated that a ‘North Sea hydrogen backbone’ consisting of 4200 km of pipelines could be built using existing technology at a cost of between US$15.9 - 23.3 billion. Offshore wind farms could generate an estimated 300 terawatt hours (TWh) of power, enough to create up to 15% of the estimated hydrogen consumption in 2050.

In March 2023, the Dutch government officially designated a site for the world’s largest offshore hydrogen production project: the Ten noorden van de Waddeneilanden (the North of the Wadden Islands). The site, which has the potential for 700 MW of generation, will be connected to Gasunie’s 1200 km hydrogen pipeline network. In late 2023, Gasunie began construction of the first, 30 km stretch to industrial facilities in the port of Rotterdam; plans are being explored that would see the network extend to other hubs, and eventually into Germany and Belgium. Onshore, Germany has been aggressively pursuing a nationwide grid to deliver hydrogen to regional industrial centres. In April 2024, the federal government laid out a financing mechanism to ensure the country’s hydrogen network would be ramped up by 2037. The core network has been estimated to cost US$21.6 billion and extend for 9700 km, and would to be built by private investors, and financed by user fees.

China is the world’s largest producer of hydrogen, with approximately 33 million tpy made from coal and natural gas. There are also several hundred kilometres of existing dedicated pipelines that primarily supply refineries and petrochemical plants.

In 2022, China’s government announced a multi-decade national plan to develop a hydrogen energy sector. The plan, which runs to 2035, seeks to coordinate a complete hydrogen value chain to support a green energy transition, including regulatory framework, production, distribution, fuel cells and vehicles; an initial goal of 100 000 tpy has been set for 2025. Sinopec subsequently announced several green hydrogen projects around the country. In August 2023, it completed construction on the Kuqa facility in Xinjiang province. The plant, which produces 20 000 tpy of green hydrogen from solar farms, is connected to refineries and refueling stations by a 28 000 m3/hr pipeline network.

Japan announced plans in April 2023 to boost hydrogen supplies from 4 million tpy to 12 million tpy by 2040, and up to 20 million tpy by 2050. The plan will involve spending US$113 billion of private and public money over the next 15 years. In February 2024, refiner Idemitsu Kosan announced it would build a 10 000 tpy green hydrogen plant in partnership with Hokuden, a utility located on Japan’s northernmost island of Hokkaido. The island is renowned for some of the highest offshore wind capacity in the world; the plant will be built in the port of Tomakomai and connected to the refinery via pipeline. The JV expects first hydrogen by 2030.

North America is blessed with a secure supply of natural gas, so the geopolitical risk factor is not as severe. Both Ottawa and Washington have imposed net-zero goals by 2050 on wide swathes of their economies, however, and have followed up with multi-billion-dollar subsidies, such as the US Inflation Reduction Act, to get the job done.

A commercial hydrogen infrastructure already exists in the US Gulf Coast (USGC). Over 1600 miles of dedicated pipelines move several million tpy of hydrogen from its sources of manufacture to consumers, primarily refineries and petrochemical plants. The multi-billion dollar system grew organically over the span of nearly a century to meet long-term supply contracts.

In order to convert to low-carbon, hydrogen manufacturers need to either build solar/wind farms and electrolysis plants, or carbon capture and sequestration (CCS) systems. Air Liquide, which specialises in producing industrial gases, makes over 400 million ft3/d of hydrogen at several plants in the USGC and operates over 500 km of the USGC hydrogen pipeline network. The company recently received a grant from the DOE to study the viability of retrofitting carbon-capture to its steam methane reformer in its La Porte plant near Houston, Texas. Air Liquide already uses a proprietary carbon-capture system in France, which allows it to capture up to 95% of produced CO2

Air Products is building a revolutionary hydrogen energy complex in the Fort Saskatchewan industrial region near Edmonton, Alberta. The CAN$1.6 billion facility will create 2200 tpy of blue hydrogen using auto-thermal reforming (ATR), which enables the company to capture 95% of CO2 emissions for sequestration. The power plant is also fueled by hydrogen, avoiding indirect emissions from the grid. The facility will use a 55 km pipeline to deliver blue hydrogen to Shell’s diesel refinery, as well as to third parties and commercial fuel stations.

In October 2023, the US Department of Energy (DOE) awarded California up to US$1.2 billion for a regional clean hydrogen hub. As part of the initiative to promote the hub, Southern California Gas (SoCalGas) is developing Angeles Link, a dedicated, green hydrogen pipeline system that could deliver enough hydrogen to displace the equivalent of 3 million gal./d of diesel fuel. The pipeline would likely originate in the wind and solar-rich desert east of Los Angeles and terminate within the Los Angeles basin near current utility plants or the port of Los Angeles.

To embed an entirely new source of energy throughout the world economy is a staggering undertaking, one that has three main implementation facets; production, consumption and midstream transportation between the two. Each has the same immense challenge, what comes first, the chicken or the egg?

According to Bloomberg, a consultancy, plans for producing clean hydrogen capacity are approaching 50 million tpy, but only about 1 million tpy is so far covered by binding off-take contracts.1 Of these, most is for traditional hydrogen users, including OCI, which will use low-carbon hydrogen to make chemicals and fertilizers, or Shell, which will purchase its own production for use in refineries.

Many more projects have memorandums of understanding (MoUs), but banks are reluctant to lend unless projects can demonstrate guaranteed cash flow, so until good intentions are converted into binding long-term contracts, this financing bottleneck will hamper the construction of production facilities. Analysts also note that major production projects are relying on hydrogen tax credits of up to US$3/kg, but overseers of the US Inflation Reduction Act and the European Hydrogen Bank have been slow to release funds.

Financial wrangling is already having a negative effect. France-based Engie is slow-walking its plans to build 4 GW of green hydrogen, pushing back its 2030 target to 2035. The announcement was made in February, 2024, but signs had already emerged that major projects were being reconsidered. In late 2023, Engie and partners scrapped the Power 2 Methanol project in Belgium. Initially destined to begin producing 8000 tpy of green methanol in the port of Antwerp, it was cancelled due to the fact that no off-takers would commit to long-term contracts at the high prices.

Shell and utility partners have shelved plans to build Project Cavendish, a 700 MW blue hydrogen project in the Isle of Grain in the Thames Estuary. The isle is the site of several power plants and an LNG regasification plant. The plan called for LNG to be converted into hydrogen and the offset CO2 captured and sequestered in Scotland. The blue hydrogen would then be mixed with natural gas and delivered in the London area for home heating. But the consortium became concerned about costs and unproven technologies combined with uncertainty regarding the UK government’s subsidies for mixing hydrogen in home distribution networks. The latter, especially in the face of massive public opposition, eventually derailed the project.

The MidCat pipeline, a 227 km line transgressing the Pyrenees between Spain and France, was conceived over 20 years ago as a way to move Spanish LNG imports to the rest of Europe. In 2019, however, a French independent report concluded that the project would be unprofitable and environmentally harmful. After the start of the Ukraine war, however, France, Spain, Germany and Portugal announced a new project, dubbed BarMar, which would follow an underwater route between Barcelona and Marseille. The line would be developed so that, by 2030, it would be able to move up to 2 million tpy of green hydrogen. Since then, no budget, ROW or customers have been identified. Current production commitments on the Iberian Peninsula are in the order of 50 000 tpy, well shy of economies of scale needed to make the project viable.

A proposed 400 MW green hydrogen project that sought to ship liquid hydrogen from the Portuguese port of Siam to Rotterdam in the Netherlands has been shelved. H2Sines.Rdam, being developed by a consortium of Engie, Shell, Vopak and shipper Anthony Veder, was originally planned to be in operation by 2028, but Shell and other partners found it to be economically unviable. One of the major stumbling blocks was the lack of ships capable of carrying liquid hydrogen at -253˚C, with only one ship with a capacity of 100 t currently under sail; converting the hydrogen to green ammonia would have been a far more viable alternative.

Demand is also in flux. Traditional Haber-Bosch processes produce the stuff for around US$1/kg; green hydrogen is more

than five times as expensive. While breakthroughs in catalysts and such are bound to reduce the price, most advances in technology are unhelpfully slated for the next decade. While much has been made of multi-billions in subsidies to produce green hydrogen, relatively little funding has emerged to incentivise users to buy the expensive stuff. In addition, industrial users are faced with massive bills to convert boilers and production facilities to the gas.

As for transportation, pipeline companies face significant challenges. In addition to weighing out ultimate capacities, midstream firms have to consider their return on investment to shareholders versus their ESG commitments to net-zero targets. When Germany announced financing for the hydrogen network, it included a government guarantee of 6.7% return on equity, as well as a special amortisation vehicle to extend capital expenditure paybacks out to 2055.

Many of the various forecasts for the roll-out of major plants, pipelines and consumption networks are based upon best-case scenarios in which environmental evaluations, public consultations and regulatory licensing all get the green-light. One merely has to recall the Trans Mountain Expansion (TMX) saga to see the pitfalls; the plan to expand an existing export crude pipeline running from Edmonton to tidewater in British Columbia by 680 000 bpd was expected to cost CAN$5.4 billion and take five years to build. In the end, it took over a decade to complete due to First Nation and environmental resistance (as well as COVID, torrential flooding and other factors); the price tag ballooned to over CAN$30 billion.

A final caveat: investors in the production of green hydrogen face the very real prospect of having their assets stranded by white, or natural hydrogen. Scientists know that the gas forms spontaneously during the breakdown of certain igneous minerals; wherever ancient bedrock meets water, hydrogen forms. Most leaks harmlessly into the atmosphere over time, but billions of tonnes accumulate in economic reserves beneath the surface. Already, geologists have discovered 77 million t trapped in the Alsace region of France; all it would take is a conventional drill rig to unlock and produce it at low prices similar to natural gas. Scientists at the USGS speculate that there could be up to 5 trillion t of natural hydrogen underground around the world. Even at 500 million tpy, a figure that would encompass all industrial, commercial and transportation use, the deposits would last for hundreds of years.

The rollout of the hydrogen economy will likely be conducted in fits and starts as governments cajole the energy, transportation, industrial and utility sectors to build electrolysis plants, establish bespoke ROWs, and convert plants and electricity generators into hydrogen-friendly mode. Some jurisdictions, such as the EU, will achieve better results because security trumps cost. Others, faced with the prospects of multi-billion-dollar white elephants, could find their hydrogen schemes curtailed by an unwilling electorate. Regardless, pipeline companies will play an integral part in those projects that succeed, facing significant risks as well as substantial rewards.

References

1. https://about.bnef.com/blog/hydrogen-offtake-is-tiny-but-growing/

Combining industry-leading abrasion resistance with unmatched flexibility, our range of epoxy solutions are built tough, easy to apply and designed to last. Whether its HDD or field joint coatings, we’ve got the solution.

Garry Hanmer, Senior Simulation Consultant, Atmos International, UK, evaluates how to accurately model pure hydrogen pipelines, using a case study to demonstrate the model tuning process and the selection of appropriate equations of state.

The need for a shift in energy generation, transportation and usage to fulfil climate change objectives is acknowledged worldwide, with parties at COP28 agreeing to accelerate decarbonisation efforts. 1 While several competing technologies are vying for a role in this energy transformation, this article concentrates on the potential of hydrogen. Hydrogen provides an opportunity to leverage the existing extensive infrastructure of the fossil fuel industry and hydrogen blends, but there are risks involved.

High pressure steel transmission pipelines face a significant threat from hydrogen embrittlement, which can lead to cracking, blistering and weakness. This occurs when

hydrogen infiltrates the pipeline material, causing corrosion of the steel pipe, valves, and fittings.

Using a case study that examines the implementation of a real-time system for simulating hydrogen pipelines, this article will evaluate the precision of various equations of state by utilising an operational pure hydrogen pipeline.

Transporting hydrogen in large commercial quantities is challenging due to its unique properties. The smaller size of the hydrogen molecules compared to natural gas allows it to diffuse with the pipeline material, leading to hydrogen embrittlement and the deterioration of the steel pipes.

Hydrogen also has a lower energy density than natural gas, requiring larger diameter pipelines to transport

the same amount of energy. This makes long-distance transportation more expensive and less efficient.

While repurposing natural gas pipelines for hydrogen transportation can be beneficial it does require an analysis of operating procedures. Pipeline simulation can assist by modelling the changes in pipeline capacity with the change in fluid.

Hydrogen embrittlement is a process that occurs when hydrogen atoms are absorbed into a metal, causing it to become brittle and susceptible to cracking and fracture. This occurs when hydrogen atoms diffuse into the metal lattice, causing lattice distortion and weakening the metal’s ability to withstand stress.

Hydrogen embrittlement can occur in a variety of ways, but in the pipeline industry it’s commonly associated with when metals are exposed to hydrogen gas or other hydrogen-containing compounds, such as water vapour or hydrogen sulfide.

Preventing hydrogen embrittlement requires a combination of measures, including proper material selection, design and maintenance. In many cases, it’s essential to use materials that are resistant to hydrogen embrittlement, such as high-strength alloys, that have been specifically designed to resist hydrogen embrittlement.

Ensuring the safety of the public in industries such as hydrogen energy, chemical and oil refineries requires careful consideration of hydrogen embrittlement. The selection of a suitable pipeline material is critical in reducing the risk of this phenomenon. An alternative approach to reducing the risk of hydrogen embrittlement is the reduction of the concentration of hydrogen. This can be achieved by blending hydrogen with compounds such as natural gas to dilute the concentration.

The following case study demonstrates how an accurate hydrogen model can be achieved by the model tuning process and the selection of appropriate equations of state so that it can provide a more accurate prediction of the pipeline areas subject to hydrogen embrittlement.

Spanning 160 km from west to east, this pipeline has a mainline section divided into two branches with the southernmost branch splitting into two parallel pipes.

To achieve the required accuracy and reliability of the online model, it is essential to tune the configuration parameters to match actual operational data from the physical pipeline. Operational data was collected for a 27 day

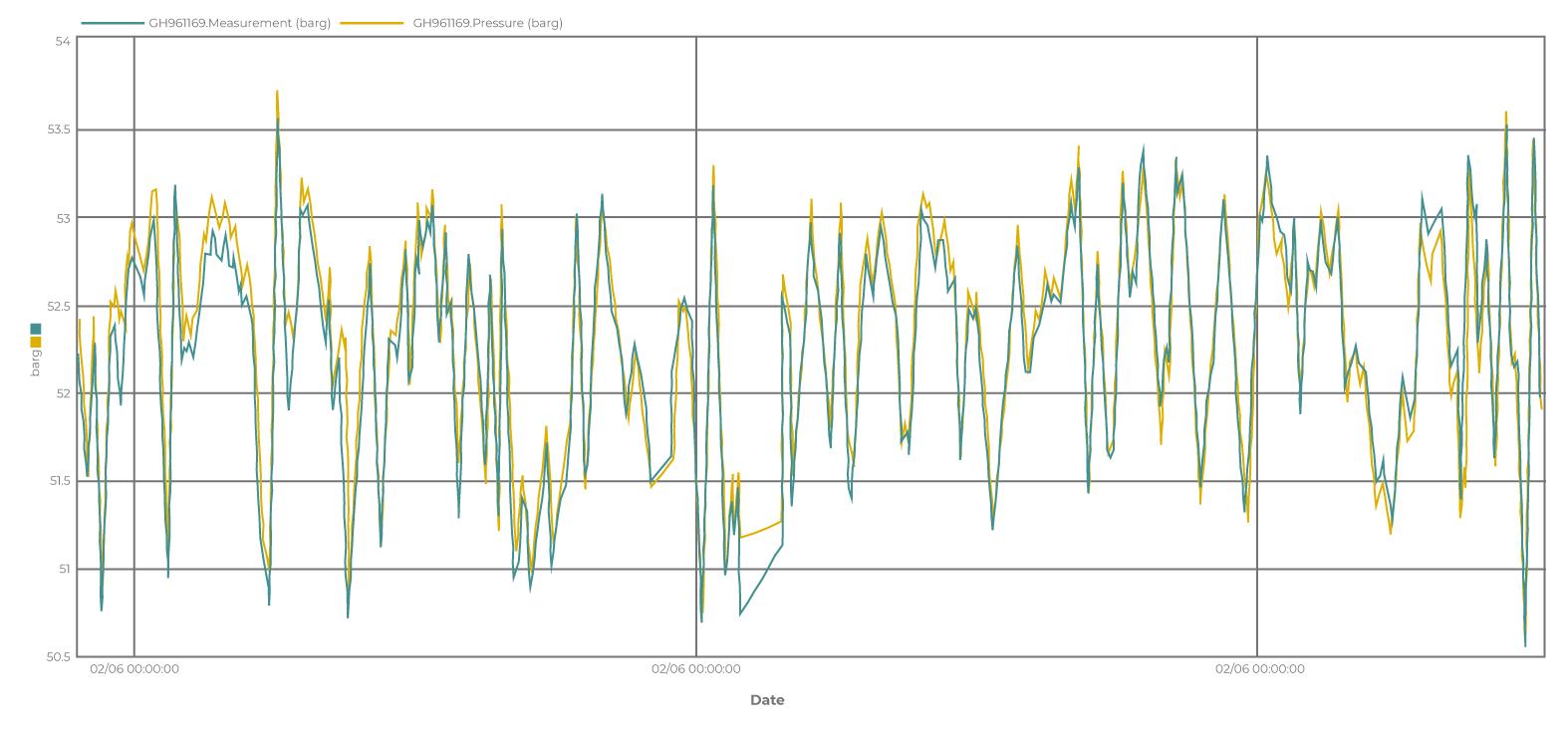

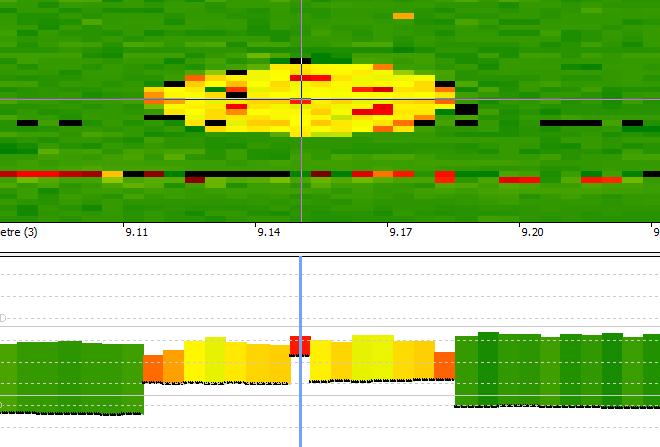

Figure 1. Differences between calculated and measured pressure over 27 days. Figure 2. Measured pressure (in green) versus calculated pressure (in yellow) over 27 days.

period and a shorter dataset was extracted for seasonal comparison purposes. By minimising deviations between the model’s calculated values and the physical pipeline’s data, the model can be tuned.

The aim of the tuning exercise is to ensure the network line pack, pressure, flow and temperature calculations are accurate. To achieve this, the pipeline roughness property is adjusted for tuning the network line pack and the heat transfer property is tuned for the temperature profile. By adjusting these two properties, an accurate pipeline pressure drop for a specific flowrate can be achieved.

A controlled reference case is selected from the datasets for tuning the pipeline roughness and heat transfer properties. This reference case involves analysing stable periods where the flowrates are at or near the pipeline’s capacity flowrates. It is then imported into an offline simulation for tuning purposes.

The tuning of the network line pack and pipeline temperature profile directly affect each other so an iterative

approach is necessary for tuning these properties. By tuning these properties, an alignment can be achieved between the physical pipeline and the simulated pipeline for network line pack and flow, pressure and temperature.

The process for tuning of the temperature profile should follow the tuning of the pipeline capacity, forming the following steps: 2

1. Offline roughness tuning to the controlled reference case.

2. Online analysis of the temperature metre deviations between measurement and calculated values.

3. Offline heat transfer tuning. a. Tune the soil conductivity of buried and partly buried sections to achieve an accurate temperature profile.

4. Offline roughness tuning re-adjust (point 1).

5. Deploy tuned configuration online.

6. Online analysis of the temperature metre deviations (point 2).

a. Repeat the above steps until the target discrepancy in the temperature profile is achieved.

After the initial tuning is completed, a second sample period is used to validate the tuning. The simulation is run against the entire sample period to confirm the accuracy of the model. The differences between the calculated and measured pressure over the 27 day sample period can be observed (Figure 1).

Figure 1 illustrates the difference between all the calculated and measured pressure from the network and a high level of consistency with an error of less than 0.2 bar throughout the sample period, equivalent to over 99.7% accuracy.

Looking closer at the accuracy of the modelled pressures, we can examine the measured and calculated values of a particular pressure metre. Figure 2 displays the measured pressure (in green) and calculated pressure (in yellow) for the 27 day sample period, demonstrating the automatic tuning of the online model.

The precision of the calculated flows can also be evaluated by examining the measured and calculated values of one of the pipeline flowmeters. Figure 3 illustrates the

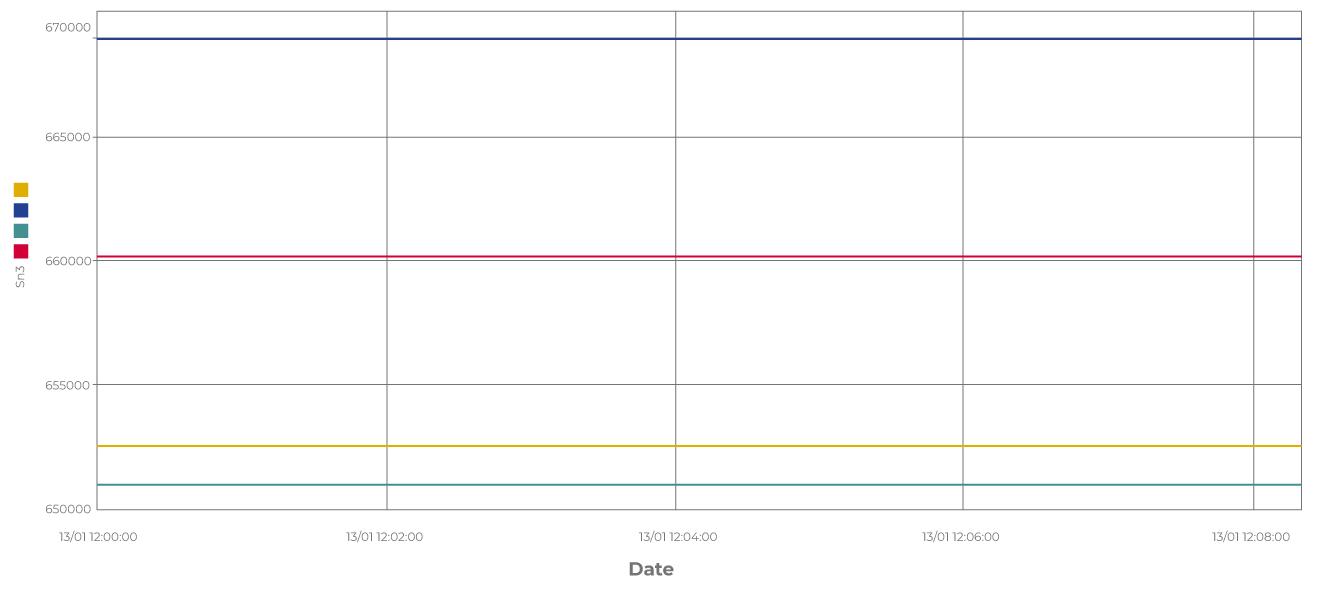

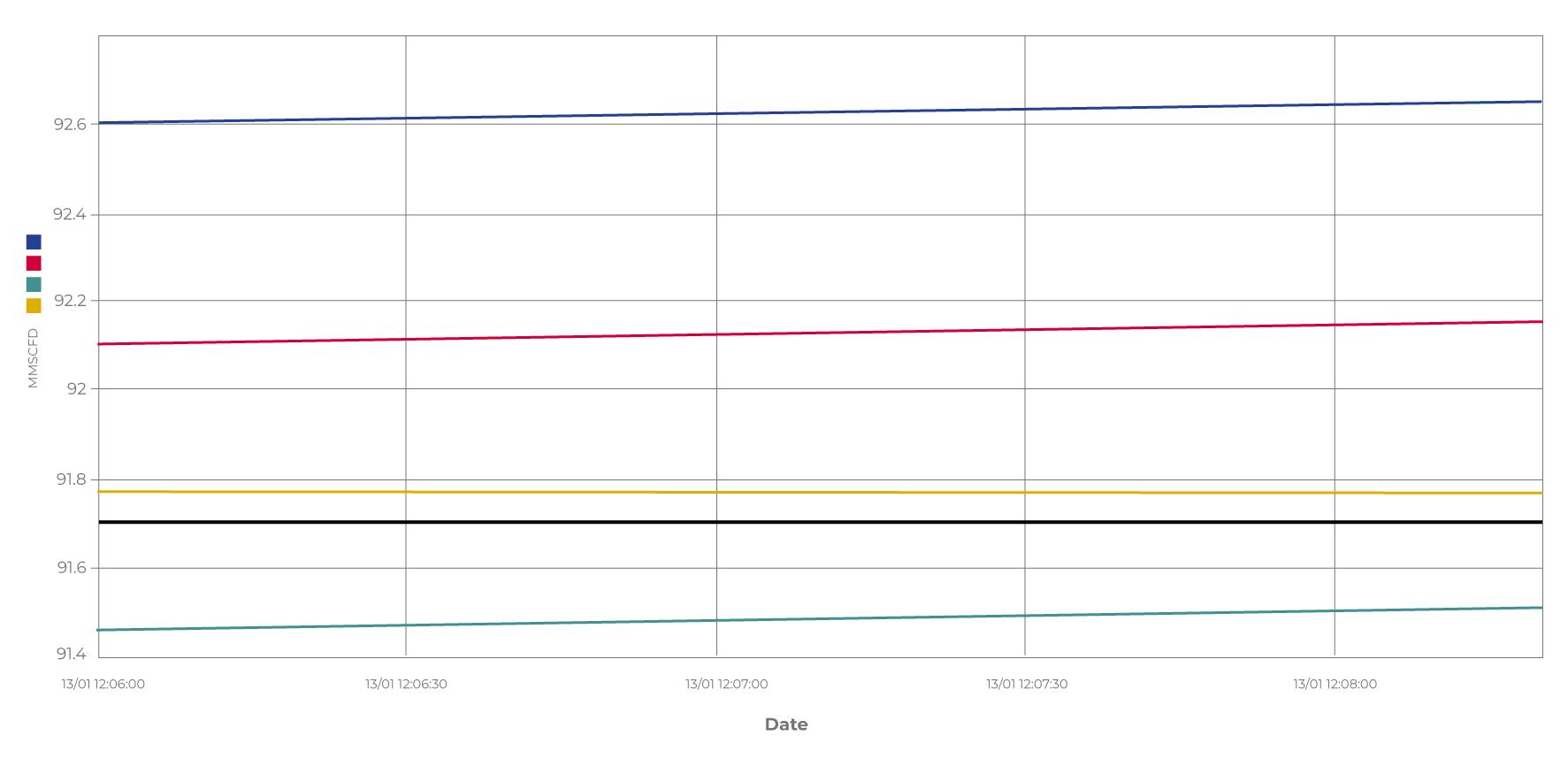

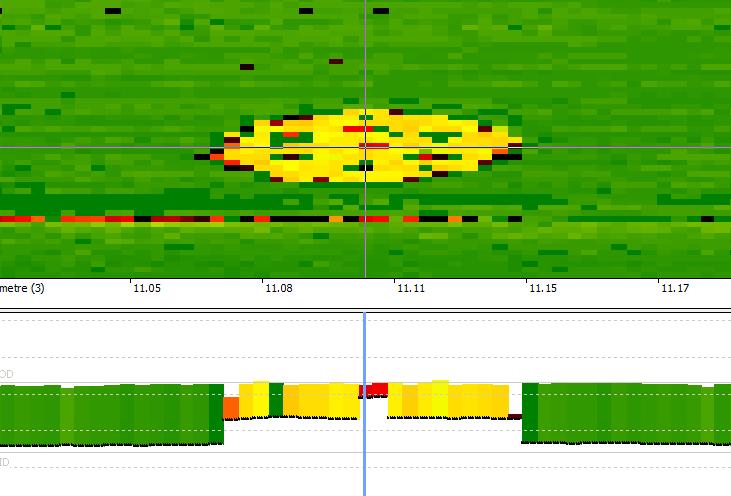

Figure 4. EOS comparisons for pure hydrogen.

measured flow (in green) and calculated flow (in yellow) during the 27 day sampling period.

The most appropriate equation of state for modelling pure hydrogen

A suitable equation of state (EOS) for the modelling of pure hydrogen is required to be applicable for compositional fluids and to be accurate for the operational range of pressures and temperatures observed within the extracted data. While there are other considerations for the choice of equation (ie. performance and accuracy) these would be evaluated as part of the analysis.

The below equations of state were chosen for this case study.

The GERG EOS is a cubic equation that relies on the composition of gas mixtures and a thermodynamic model to describe their properties. It’s based on the principle of corresponding states, which suggests that gases with similar reduced properties exhibit similar thermodynamic properties. This equation is particularly useful for modelling natural gas mixtures but can also be used for hydrogen blends.

Numerous validations have confirmed GERG’s ability to accurately predict the thermodynamic properties of natural gas mixtures. When applied to hydrogen blends, this equation can forecast properties like density, viscosity, and compressibility factor. However, it assumes that the gases in the mixture do not interact, which may result in inaccuracies in the predicted thermodynamic properties.

AGA8 is a cubic EOS that uses composition-based methodology to determine the thermodynamic characteristics of natural gas and gas blends. This equation of state has undergone extensive verification and is grounded in empirical data. AGA8 is based on a broad set of experimental data on natural gas and gas blends, which is frequently updated to ensure that it remains precise and relevant. However, AGA8 assumes ideal gas behaviour, which may not be valid for hydrogen blends under certain circumstances. At high pressures and low temperatures, hydrogen’s behaviour can diverge from ideal gas behaviour, resulting in inaccuracies in simulation outcomes.

Peng Robinson is a thermodynamic model that utilises a composition-based cubic EOS to calculate fluid properties. It follows the theory of corresponding states, which asserts that fluids at the same reduced temperature and pressure display similar characteristics. This equation is commonly used in the oil and gas industry to simulate the behaviour of natural gas and hydrogen blends. The Peng Robinson EOS has been extensively tested and validated across a broad spectrum of fluids and is simpler than other equations of state while still being capable of modelling mixtures with intricate compositions.

A limitation of using Peng Robinson to simulate hydrogen blends is its failure to account for any chemical reactions that might occur in the blend. Such reactions, such as the interaction between hydrogen and other gases in the blend, can alter the properties of the mixture.

Benedict Webb Rubin Starling (BWRS)

BWRS employs a non-cubic composition-based approach to relate a fluid’s pressure, temperature, and volume to its molecular properties, using a thermodynamic model. While typically used for modelling hydrocarbon mixtures such as natural gas, it is also applicable to hydrogen blends. This equation is rooted in statistical mechanics.

BWRS can predict the thermodynamic properties of hydrogen blends and provides an accurate understanding of the behaviour of the fluid as it moves through the pipeline, as well as for designing pipeline systems that can handle different concentrations of hydrogen.

Equations of state in the context of a real pure hydrogen pipeline

The pipeline capacities for the case study pipeline using pure hydrogen are displayed in Figure 4. The GERG 2004 capacity is shown in orange, BWRS in blue, AGA8 in green and Peng Robinson capacity in red.

We can evaluate the EOS by comparing their flowrate calculations with the measurements obtained from the dataset.

Figure 5 illustrates these comparisons, where the flowrates obtained from the GERG 2004 equation are depicted in orange, BWRS in blue, AGA8 in green, Peng Robinson in red, and the actual measured flowrate in black.

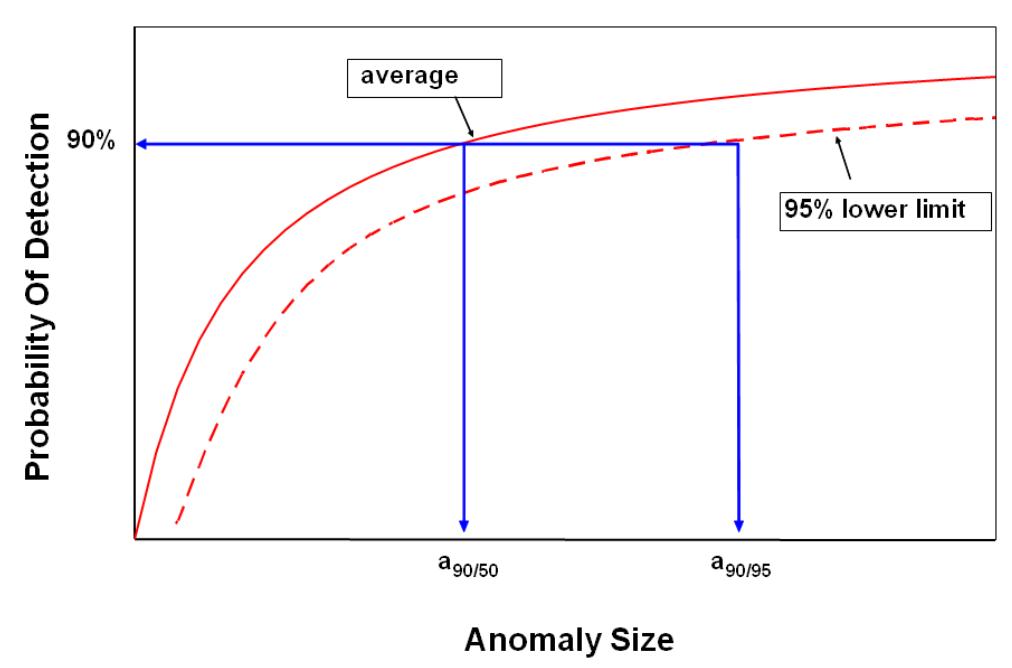

Compared to the measured values, the Peng Robinson EOS exhibited an error of 0.97%, while the AGA 8 and BWRS equations of state exhibited deviations of 0.27% and 0.43% respectively. In contrast, the GERG 2004 equation of state exhibited deviations of only 0.05%.

To conduct this analysis, an offline simulation was performed for each equation of state, with pressure set as the boundary conditions. These pressure setpoints were a part of the controlled reference case that was discussed in the model tuning section above. The simulation then calculated the flowrates for each equation of state, which were subsequently compared against the measured flows observed in the controlled reference case.

Hydrogen plays a crucial role in the future of global energy and the increasing demand for renewable energy sources requires pipelines to be an integral part of the infrastructure. Accurately modelling hydrogen pipelines is essential to mitigating as much risk as possible.

References

1. https://unfccc.int/sites/default/files/resource/Summary_GCA_COP28. pdf 2. https://www.atmosi.com/en/resources/technical-papers/tuning-ofsubsea-pipeline-models-to-optimize-simulation-accuracy/

The distance between the top of the northeast wall and the top of the southwest wall is approximately 225 m. The invert of the gulch is at an elevation of 1101.3 m above sea level on the pipeline alignment.

The northeast wall of Dry Gulch is about 94 m high, with the upper portion featuring a rock outcrop with a slope angle of about 57˚ (locally as steep as 78˚) and extending for about 45 m. Further below, there is a blocky rock colluvium lower slope with a slope angle of about 37˚ extending for about 94 m to the bottom of the gulch.

The southwest wall of the gulch is 97 m high, mostly featuring a rock outcrop with a slope angle of about 42˚ (locally as steep as 58˚) and extending about 121 m downwards. This is followed by a rock block colluvium lower slope with a slope angle of about 29˚ and about 32 m long up to the bottom of the gulch.

Dry Gulch is frequently affected by snow avalanches, making the bottom inaccessible for most of the year. Geologically and geotechnically, Dry Gulch is unique due to the contact between two stratigraphic units (Eagle Gneiss to the northeast and Falls Lake Suite granitic rocks to the southwest), resulting in brittle faulting and fracturing of the rock mass.

Another important aspect is the unknown thickness of accumulated talus and depth to the groundwater table at the bottom of the gulch. There is unconfirmed moderate metal leaching and acid rock potential associated with the stratigraphic unit to the southwest of Dry Gulch. Depending on the chosen crossing method, management of rockfall hazard and snow avalanches prior to and during construction could have required extensive temporary and/or permanent retention measures.

One of the key considerations for the construction of the crossing was the schedule for completion of the works and the available time window. The completion of the project had been forecasted for the end of 2023, necessitating the completion of the Dry Gulch crossing by summer 2023. Additionally, work conditions in this area were very challenging during the winter season due to low temperatures, snow precipitation, and high avalanche risk.

Considering the complex geomorphological, geological, and geotechnical settings and the schedule restrictions, the feasibility of the crossing, related to the construction methodology, was carefully assessed. Initially, ‘open cut’ was considered as the default option; however, after a detailed study, it was deemed too complex in terms of safety, environmental impact, durability, and schedule. After a wide comparison of various technologies (HDD, Direct Pipe, microtunnel, raise boring), the TMEP project management team identified the HDD methodology as the most sustainable option for the crossing execution.

The selected HDD profile had a total length of 1842 m, with a horizontal distance of 1794.4 m. The feasibility of the HDD was confirmed in August 2021 when a 1622 m exploration borehole had been successfully drilled along the actual pilot hole alignment from the South pad to about 200 m from the North Pad exit point.

Figure 2. Dry Gulch view. Figure 3. 3D model for pipeline string preparation works.For over three decades, we’ve successfully delivered welding services for heavy sour service projects with stringent technical demands in line with H2 requirements. With our expertise, we’re driving innovation in the energy transition, enhancing your welding operations for unparalleled excellence.

Material Selection: Choosing and using materials that meet strict quality and safety standards. With our extensive track record we can help select the best jointing/material combination.

Weldability Testing: Testing at our Welding Technology Centre provides project pipe weldability testing using operational welding procedures to ensure required performance.

Welding Processes: Selecting the right welding process for your chosen pipe material and applicable specifications for the best performance in H2 environments.

Mechanised Welding: Welding with our easy-to-use machines ensure robust, repeatable welds, to achieve full pipeline integrity.

Internal Inspection: Inspecting and measuring the internal weld and fit-up alignment is key to managing the Hi-Lo and internal weld profile; promoting firing line efficiency.

Data Monitoring: Documenting all welding data during, and after the project; CleverWeld, our data tracking solution is your ally to ensure long term integrity.

The exploration borehole confirmed a low risk of frack out and bore hole collapse within the rock strata, increasing to moderate risk in the surficial layers (up to 10 - 14 m depth from the drilling surface at both north and south pads). To manage this risk, installation of 60 - 70 m casing pipe was the selected mitigation measure.

Particular attention was given to the design of the pullback section and the fabrication of the pipeline string, as the area surrounding Dry Gulch featured uneven terrain, steep slopes, several creeks, and a winding right-of-way, due to environmental constraints.

By the end of 2021, a detailed pullback study analysed several options, including single or multiple strings from both the northern and southern sides of the gulch. The final selected option was to pull three pipeline strings (the longest of about 1100 m) from the southern side. This was primarily driven by the limitation of earthworks and environmental impact and supported by the low risk of bore collapsing, as it required two tie-in welds during the pullback.

The selected pullback ROW was challenging, featuring hilly and rocky terrain with horizontal and vertical deviations, a 17˚ slope 220 m long, the crossing of two watercourses and one road. The

overbreak section, spanning 280 m with a maximum height of 15 m to allow the pipeline string to pass through the contingency thruster and meet the 11˚ entry angle, was supported by seven cranes (six 120 t cranes and one 160 t crane) as well as four side booms. The remaining 820 m of the drag section had been placed on 100 roller supports designed for the pullback and hydrotest loads (40 t).

To ensure a successful pullback, a comprehensive study for the string preparation was performed, including an integrated 3D model/finite element analysis (FEM) analysis.

Additionally, a FEM analysis was conducted to analyse both the static and dynamic behaviour of the pipe string during the pullback phase. In particular, FEM simulation produced the following results:

) Verification that the maximum stress induced in the string during lifting and pulling operations was within acceptable limits, guaranteeing the integrity of the pipe string.

) Definition of the distribution of the equipment and the vertical and lateral loads required for equipment sizing and design additional anchoring systems.

) Definition of the optimal distribution of roller supports and the vertical and lateral loads required for designing their foundations, under pullback and hydrotest conditions.

) Identification of the optimum positioning of the station for the tie-in of two strings, guaranteeing minimal longitudinal stress and bending moment.

) Calculation of any possible longitudinal or vertical uplift displacement, possibly requiring additional restraints or anchors.

Given the project timeline, Bonatti/Kiewit developed a suitable schedule to accommodate the required deadlines, using different teams working in parallel.

Regarding the works of the HDD execution, the pilot hole was executed from August to October 2022 from the north pad to the south pad, confirming the findings of the exploration borehole executed in 2021 and the low risk of bore collapse along the majority of the HDD alignment. Subsequently, the reaming phase started in late October 2022 and progressed through the winter.

In parallel, works for the preparation of the prefabricated string and its associated working ROW were carried out: initially grading and blasting of the section upslope near Falls Lake Road starting June 2022. Later, the section between Falls Lake Road and the drilling pad required significant earthworks to build a 10 m high launching pad for the overbreak section. The preparation of the pullback ROW required about 91 000 m3 of earthworks overall and 16 000 m3 of imported material from adjacent areas.

By autumn 2022, the preparation of foundations and installation of bridges on Falls Lake Road and Falls Lake Creek was completed, and further grading of the drag section was completed in late 2022.

Afterward, stringing and welding of the first two strings (each 378 m) was completed by the end of January 2023, while

fabrication of the main string (1100 m) was completed in March 2023.

A preliminary hydrotest of the strings had been planned for April 2023 – one month before the planned pullback –allowing the completion of support installation and equipment mobilisation.

The final pullback preparation activities started in September 2023, with the mobilisation on-site of the eight cranes and the 17 side booms required for pipeline string management during pullback and the installation of the HDPE buoyancy control pipe inside the NPS 36 in. pipeline strings.

The pullback had eventually started on 18 October 2023, and was smoothly and safely completed in about 52 hours, 30 of which had been required for the two tie-ins and with an average pulling rate ranging from 80 m/hr to 120 m/hr, exceeding the best estimate scenario. The maximum pulling force was within the expected range, and also the continuous monitoring of the vertical and lateral loads on the cranes and side booms confirmed the loads being consistently within the

Considering the exceptional length and project available work space, the engineering, planning, and setting up of the Dry Gulch HDD pullback required extraordinary effort and multidisciplinary coordination from late-2021 to mid-2023 to match high safety and quality standards, minimise environmental impact, and optimise the execution schedule. In particular, feasibility studies, detailed design, and construction engineering was developed from 4Q21 to 1Q23, including different stages of stress analysis, in static and dynamic conditions, and 3D modelling of the rollers to size the equipment required for string management and pipeline anchoring.

The engineered pullback required three pipeline strings (1100 m, 380 m, and 380 m in length), to traverse across 900 m of rollers across rocky terrain with significant horizontal direction and vertical elevation changes, while crossing two watercourses and one road and being lifted at about 15 m elevation for the 200 m long over-break section. Meanwhile, other civil works required to prepare the rollers were completed in the second half of 2022, and the pipeline strings had been welded, hydrotested, and positioned on the rollers from 1Q23 to 3Q23.

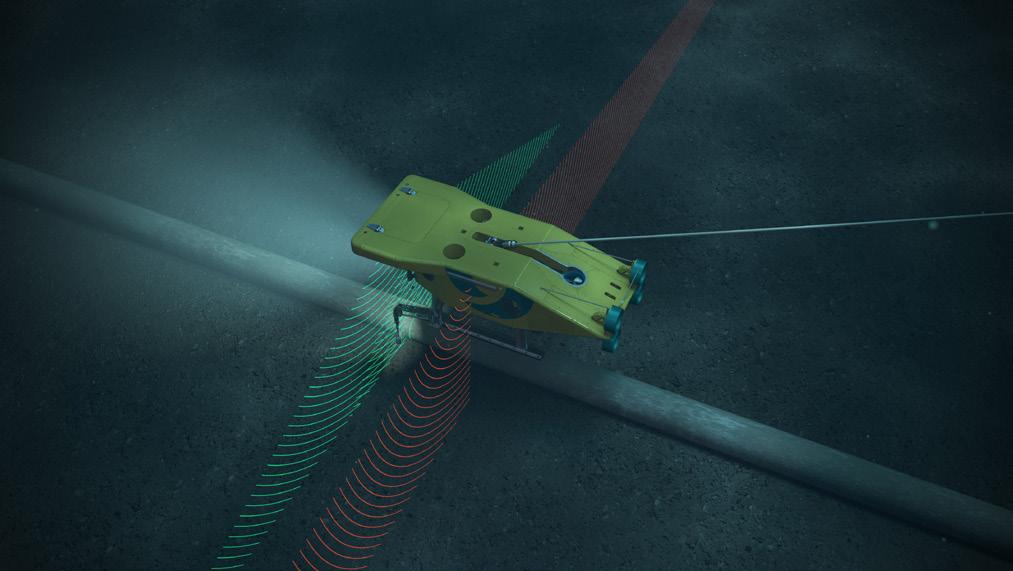

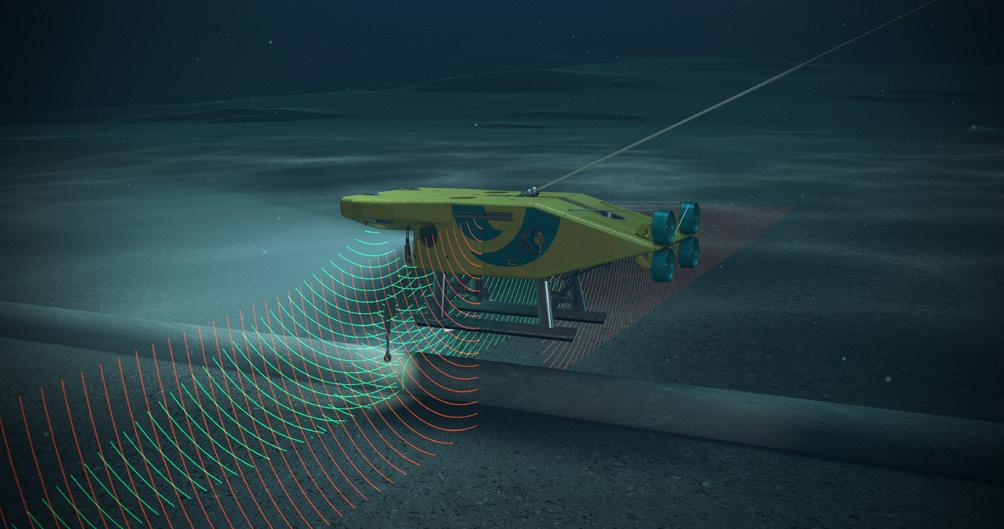

Russell Small, Principal Surveyor, DeepOcean, examines the role of AI and machine learning tools in developing subsea pipeline inspection and maintenance, highlighting the opportunities of this technology in a recent project aimed at improving inspection efficiency.

In the last 10 years, the offshore survey industry has seen the evolution of a new breed of fast remotely operated vehicles (ROVs) specifically designed for high-speed surveys and pipeline inspections. The Survey ROV, or SROV as it is commonly referred to, was in 2020 formally adopted by the rigorous standards of the Norwegian petroleum authorities (NORSOK), thereby defining the specific requirements of this new type of ROV. DeepOcean, headquartered in Haugesund, Norway, was an early pioneer of the SROV concept, taking delivery in 2015 of the very first

Superior SROV from local ROV innovator Kystdesign. In the intervening years, Superior SROV has surveyed thousands of kilometres of subsea pipelines annually and in all likelihood has the largest single-track record in pipeline inspection of any ROV globally.

The benefits of a modern SROV

Operators on the geographically extensive Norwegian Continental Shelf were quick to understand the economic advantages that a modern SROV can bring to their subsea pipeline inspection programmes. They operate a vast network of oil and gas pipelines extending the length of the North Sea from the shores of France and Belgium to the arctic Barents Sea, all of which requires regular external integrity assessment. Employing DeepOcean’s Superior SROV, mobilised onboard DeepOcean’s flagship survey vessel the Edda Flora, pipeline operators have realised substantial cost savings when compared with the alternative of using slow workclass ROVs configured with a survey sensor payload. Not restricted to only the local Norwegian market, Edda Flora has taken Superior to the Mediterranean Sea and Black Sea for trunk line inspections to depths of 2200 m.

Superior SROV can perform pipeline inspections at up to 4 knots as a result of its array of powerful aft thrusters. To ensure highest data quality during these high-speed inspections, Superior SROV has been designed for maximum stability – its sheer size coupled with its hydrodynamic formfactor ensure that it is a superbly stable sensor platform. The SROV can carry an impressive 700 kg payload of dedicated sensors for pipeline inspection, primarily comprising dualhead multibeam echosounders (MBES), HD video cameras, side-scan sonar (SSS), INS/DVL navigation sensors, still imaging system, dissolved methane detector (for gas leak detection) and other sensors as required by the project needs.

Three main modes of pipeline inspection are employed using Superior SROV depending on the client requirements. Where the largest integrity risk to the pipeline is deemed to be from third party threats such as dragged anchors, trawls and such like, an operator may elect to forego collecting full visual coverage of the pipeline and instead perform a high-fly hybrid acoustic/visual inspection. Flown at about 4 m altitude, what this high-fly mode compromises in visual assessment it gains in efficiency, as there is effectively no sensor-imposed speed limit and therefore, weather depending, acquisition speed can be up to the maximum speed of the ROV which is around 4 knots. The echosounders data allows the freespan condition of the pipeline to be assessed without the traditional requirement of boom mounted video cameras imaging the pipeline/ seabed interface. Additionally, the terrain model generated from the echosounders system is reviewed offline in parallel with the side-scan sonar data for evidence of seabed scars crossing the pipeline that might indicate possible impact and damage to the pipeline. This hybrid method includes a visual component by way of vertically mounted still imaging cameras to photograph the pipeline from above. Depending

Figure 1. DeepOcean’s Superior Remote Operated Vehicle (SROV). Figure 2. Assessing subsea pipelines for critical anomalies. Figure 3. Three HD video cameras to capture full visual coverage.on the specific client requirements, these images can be reviewed in full to assess the visual integrity of the pipeline, or a more basic and cost effective review can be performed only visually confirming the identity of any debris items observed beside the pipeline within the acoustic multibeam echosounder data.

The inclusion of still photographs in Superior’s armoury can generate innovative digital products, giving integrity engineers even more value from the survey. The photographs are rendered into georeferenced mosaic strips of about 50 m in length which can be useful to visualise the pipeline in a wider context. If required, the images can also be processed using photogrammetric techniques into 3D models, which can be invaluable in assessing critical anomalies.

Superior SROV can of course perform a more traditional visual pipeline inspection, only much faster. Three HD video cameras are arranged to capture full visual coverage of the pipeline. As with the high-fly mode, echosounder- and side-scan sonar data are also acquired to image scars, debris, boulders and such like outside the visual field of view of the cameras. Acquisition speed with the video cameras in close proximity to the pipeline like this tends to be capped at about 2.5 knots – it’s worth observing that this is still twice the speed of a typical WROV carrying a full survey sensor package. The limiting factors are two-fold: principally the video playback during the offline review process becomes uncomfortable for the video reviewers to watch due to the speed that the pipeline features pass through the frame, with increased risk that reportable events are missed. Secondly, at higher speeds it can become challenging to maintain the optimal lighting that’s required to eliminate motion blur in the video footage.

In response to the aforementioned limitation of motion blur in fast video inspections, DeepOcean has further developed the already impressive flexibility of Superior with the addition of boom mounted still imaging cameras. Strobe lighting and the fast shutter speed of these cameras eliminate the potential for motion blur thereby allowing faster acquisition of full visual data. Speeds of nearly 3 knots have been achieved and as more experience

is gained it is hoped that suitable trunk lines can be surveyed at 3.5 knots.

However, these faster visual inspection speeds exacerbate the issue of reviewing the visual images. The offline playback can be performed using the raw stills, typically overlain one another to improve contextual visualisation, or alternatively the stills are converted into so-called pseudo video which can then be treated in the same manner as video playback solutions. Both of these review methods are manually laborious and are unable to keep up with the rate at which the SROV is acquiring more footage. To cope with this challenge, DeepOcean is developing Artificial Intelligence (AI) and machine learning tools.

Detects holidays, pinholes, and other discontinuities using continuous

AI and machine learning are transforming the way subsea pipelines are inspected and maintained. DeepOcean explores the opportunities of this technology in an internal project aimed at enhancing the efficiency of subsea pipeline inspection. Traditionally, the inspection of subsea pipelines has been a process requiring highly trained experts to manually review images and videos. This method is time-consuming, with skilled personnel spending hours analysing footage where their expertise is required for only a fraction of the images reviewed.

DeepOcean’s Project Hawkeye addresses these challenges head-on by employing machine learning algorithms capable of scanning through thousands of hours of visual data, identifying potential issues such as corrosion, structural deformities, or marine growth that could signal a need for maintenance. By training the computer as the DeepOcean team would train its employees, the project encapsulates AI’s potential to store and replicate expert-level experience. This approach not only enhances the speed of analysis but also ensures that human experts are engaged in the process where their skills are most needed.

The project outlines a phased approach to implementing this technology. The initial phase focuses on developing and integrating the AI model within an onshore IT environment, allowing for refinement and learning in a controlled setting. The next phase envisions the deployment of this model onto vessel IT systems, enabling real-time insights during inspection operations. Continuous improvement is a cornerstone of this strategy, with a feedback loop where human oversight

contributes to the model’s learning, ensuring it adapts and evolves to the intricacies of the job.

Immediate impacts of this technological shift are tangible. Less man-hours for review processes with its associated cost-savings are just the beginning. Future-proofing the process through continuous improvement ensures that as the AI model becomes more sophisticated, it will increase its capacity to handle complex decision-making, with human experts stepping in only when necessary.

The future of managing critical infrastructure

The vision for the project is ambitious yet practical: to synergise the best of machine learning with the seasoned expertise of DeepOcean’s personnel. The aim is to delegate repetitive, high-volume analysis to machines, freeing up human experts to focus on critical assessments and decision-making, particularly when the AI’s conclusions are inconclusive. This hybrid model promises not just to maintain but to elevate the standard of pipeline inspections.

For the industry stakeholders managing critical infrastructure, such as pipelines for factories and oil and gas exports, DeepOcean’s project offers a glimpse into the future where efficiency, safety, and precision in asset management are enhanced through the strategic application of AI. This project serves as a benchmark, propelling the industry towards a smarter, more sustainable operational paradigm, ensuring the longevity and reliability of essential subsea infrastructure.

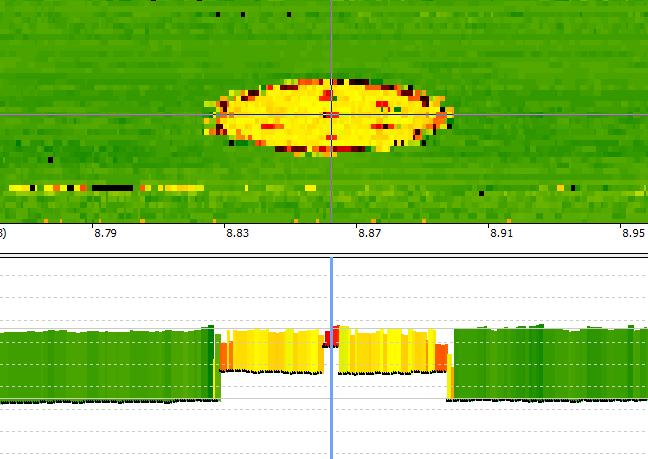

Angélique Raude, Evident, describes streamlining the corrosion inspection process, providing a complete solution for corrosion imaging in industrial pipelines.

Carbon steel is the most widely used material for piping systems and components across diverse manufacturing and industrial settings such as power plants, oil refineries, and petrochemical plants. However, carbon steel pipes are susceptible to corrosion and other damage, such as metal loss, cracking, and welding defects. These issues pose a grave risk to pipeline integrity and cause serious safety issues. Consequently, it’s essential to perform

routine inspections to assess and monitor potential damage, helping prevent unexpected breakdowns, environmental harm, and serious accidents.

Pipeline inspection technology is a growing field, with new technology being used all the time. A critical feature of pipeline inspection is nondestructive testing (NDT), which enables inspectors to examine pipelines for corrosion and mechanical damage without permanently altering

the original equipment or structure. Phased array ultrasonic testing (PAUT) is an advanced NDT method that is widely used in pipeline inspections. Phased array technology involves the use of multielement transducers that are electronically controlled to emit ultrasonic waves at precise angles and timings. By manipulating these parameters, phased array testing can create focused beams of ultrasound that can be steered, scanned, and controlled to effectively examine

complex geometries and detect defects such as cracks, corrosion, and weld flaws. This technology offers greater flexibility, accuracy, and efficiency compared to traditional UT methods, making it widely used in the oil and gas industry for quality assurance and asset integrity assessment.

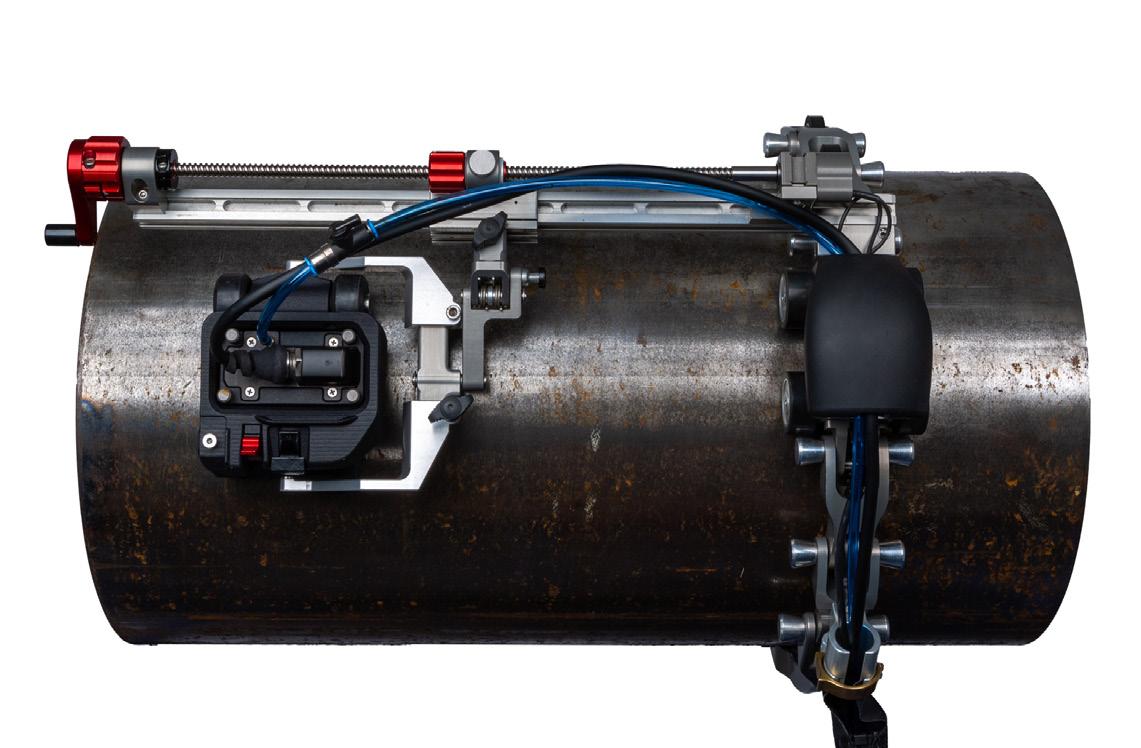

Using PAUT, the Evident HydroFORMTM corrosion scanner provides inspectors with a reliable technique to inspect pipelines quickly and efficiently. Using the next-generation HydroFORM corrosion scanner with the OmniScanTM X3 flaw detector provides a complete solution for corrosion mapping. This pairing facilitates precise measurement of material thickness, simultaneous mapping of internal and external corrosion, and the detection of midwall damage, significantly streamlining the corrosion inspection process.

Building on the field-validated design of its predecessor, the semi-automated HydroFORM scanner now integrates dual-axis encoders, delivering a complete 2-axis corrosion mapping solution without the need for an auxiliary scanner. This advancement facilitates the capture of high-resolution data of large surfaces in minimal time, providing more reliable data and deeper insights for repair and longevity assessment.

The HydroFORM scanner is a proven solution for inspecting internal corrosion in pipes. Its distinctive low-flow water-column design, coupled with foam gaskets, conforms seamlessly to surfaces, eliminating the need for a wedge. The reduced water requirement in the new probe streamlines efficiency, particularly during operations where continuous water feed might not be available. This accelerates the entire process, which can be particularly important when working in more dangerous or physically demanding environments.

Providing excellent surface conformance and coupling conditions, even on rough surfaces, the HydroFORM scanner easily facilitates phased array pipeline inspections. When used with a multigroup instrument, inspectors can map external corrosion simultaneously with internal corrosion in a single scan. This approach provides C-scan mapping that can be analysed directly on the OmniScan X3 flaw detector, streamlining the inspection process and enhancing efficiency.

The HydroFORM scanner’s versatility extends to vertical and inverted scanning tasks, such as monitoring tank walls for corrosion, thanks to its smooth-indexing magnetic wheels and enhanced bubble management. Moreover, the inclusion of gasket protectors significantly enhances the longevity of the foam gaskets, providing crucial protection when navigating rough profiles, welds, and surfaces reaching temperatures of 90°C (194°F).

Equipped with the ScanDeckTM module, the HydroFORM scanner is optimised for easy deployment and one-person operation, helping

Figure 1. First generation Hydroform scanner deployed in field conditions. Figure 2. The HydroFORMTM scanner simplifies corrosion monitoring on pipeline with its smooth-indexing magnetic wheels and advanced bubble management system.

ensure rapid and reliable PA scanning. When used with an OmniScan X3 series flaw detector, the ScanDeck module provides important feedback and remote functionalities, minimising the need for direct operator interaction with the instrument.

Directly in the operator’s eyeline while scanning, status lights indicate which encoder is active, when the optimum index position has been reached, whether the coupling is sufficient, and if the maximum scan speed is exceeded. It also enables the HydroFORM operator to remotely start/ stop and erase the data acquisition on the OmniScan unit. This information and remote-control capability not only reduce time-consuming tasks, but also improve the quality and reliability of the acquired PA data.

Highly adaptable, the HydroFORM scanner accommodates various inspection styles, serving as a manual scanner, a guided 2-axis encoding scanner, or compatible with semi-automated and automated auxiliary scanners for complex, large-area, and remote inspections.

When paired with the OmniScan X3 flaw detector, the HydroFORM scanner delivers exceptional near-surface resolution, accurately identifying the wall thickness in areas as small as 1 mm 2 with precision. By combining a water column system with easy gate synchronisation, the HydroFORM scanner and the OmniScan X3 detector make a complete PA solution for streamlined material inspection. This solution not only addresses present inspection needs but also anticipates and fulfills the evolving requirements of industries reliant on thorough corrosion mapping.

Ever-increasing demand for safe and reliable sources of energy has resulted in the growth of offshore oil and gas production, and the construction of pipelines to support these operations. However, along with this growth comes a heightened need for thorough inspection and maintenance of offshore infrastructure to maintain operational safety and environmental protection.

Based in the UK, a leading engineering and maintenance provider for the onshore and offshore energy sector uses state-of-the-art technology to ensure the integrity and longevity of critical infrastructure within the oil, gas, and wind industries. As part of their routine services, their team of inspection technicians regularly uses the HydroFORM scanner coupled with the OmniScan X3 flaw detector to acquire PAUT data.

This company offers a range of inspection services including phased array corrosion mapping, time-of-flight diffraction (TOFD) for weld root corrosion, and specialised applications, such as identifying touch point corrosion damage at pipe supports. These services are crucial for mitigating the risk of incidents such as oil spills or structural failures, and ensuring the longevity and safety of industrial infrastructure.

Offshore inspections present unique challenges, particularly the safety of personnel due to the remote and often hazardous working environments. Additionally, accessibility to assets can be hindered by factors such as

geographical isolation and adverse weather conditions. To address these challenges, they employ a combination of NDT methods and rope access techniques.

Given the harsh environmental conditions and lack of access to replacements, offshore inspection equipment must be durable, waterproof, and shockproof. It’s also essential that the inspection can be performed quickly, since working on ropes can be difficult and physically demanding. Most importantly, inspectors need to know that their equipment is accurate and reliable as inspection decisions are significantly influenced by the data produced by these tools.

The next-generation HydroFORM scanner sets a new standard for durability, reliability, and efficiency, providing pipeline inspectors with a highly dependable tool for challenging inspections. The system’s 2-axis encoding capability allows for the recording of both the scan and index axes, providing accurate alignment during scanning and resulting in more reliable data capture. This feature is particularly beneficial for assessing the internal condition of piping. By accurately capturing corrosion shapes, the integrity team can then make precise fitness-for-service calculations, determining the longevity of asset operation.

Additionally, the reduced water consumption of the low-flow coupling system for the probe streamlines operations, especially when working in conjunction with rope access where continuous water feed is often unfeasible. Since the probe coupling requires less water, the work can be conducted more quickly and with fewer impediments, which are important advantages considering the challenging and physically demanding nature of working on ropes. This innovation not only enhances efficiency but also improves safety by minimising the need for manual water supply, allowing inspectors to focus more on the task at hand.

Furthermore, the ability to remotely control the OmniScan X3 unit’s data acquisition directly from the scanner enhances operational efficiency, and receiving real-time feedback from the instrument during scanning can improve your data quality. This two-way communication between the instrument and HydroFORM scanner enables inspectors to work more autonomously and efficiently, swiftly responding to changing inspection conditions and troubleshooting any issues that may arise during the scanning process. This seamless integration of control functionalities not only streamlines operations but also helps ensure that scans are conducted with precision and accuracy, ultimately enhancing the reliability of inspection results.

The enhanced efficiency and reliability provided by the new HydroFORM scanner significantly optimise inspection workflows and increase confidence in assessment outcomes. Improved data accuracy and scan quality, coupled with real-time feedback mechanisms, empower inspection teams to make informed decisions swiftly and accurately. Ultimately, these advancements will not only enhance the integrity of inspection outcomes but also contribute to the overall safety and reliability of onshore and offshore assets, benefiting both clients and the broader community.

Propipe has been using test loops since 2000 to verify pig performance prior to deployment.

Test rigs allow us to develop Propipe pig designs and also to help ILI vendors verify their ILI tool performance.

Having the ability to run pigs with water or air and to construct custom test rigs that accurately mimic project layouts, allows clients to perform their work knowing that Propipe pig designs have been validated under like conditions.

ABC. See it. Believe it. Trust it. To advertise email Chris Lethbridge at chris.lethbridge@worldpipelines.com or Daniel Farr at daniel.farr@worldpipelines.com

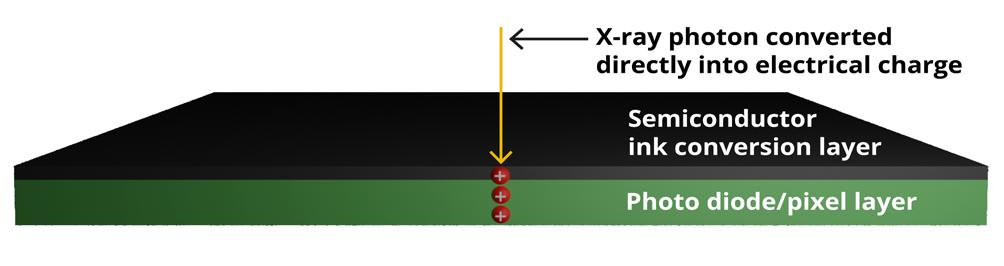

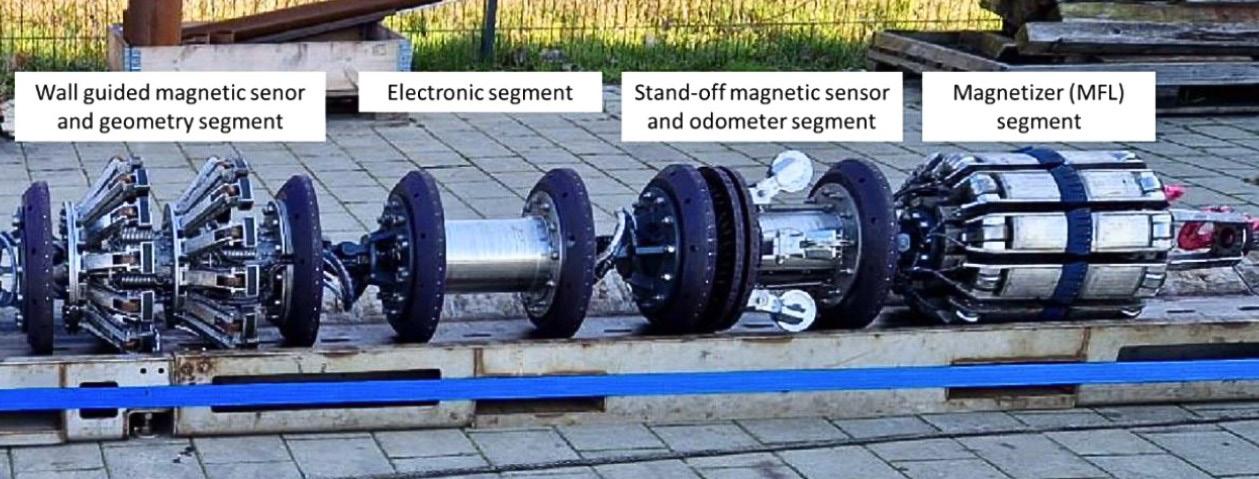

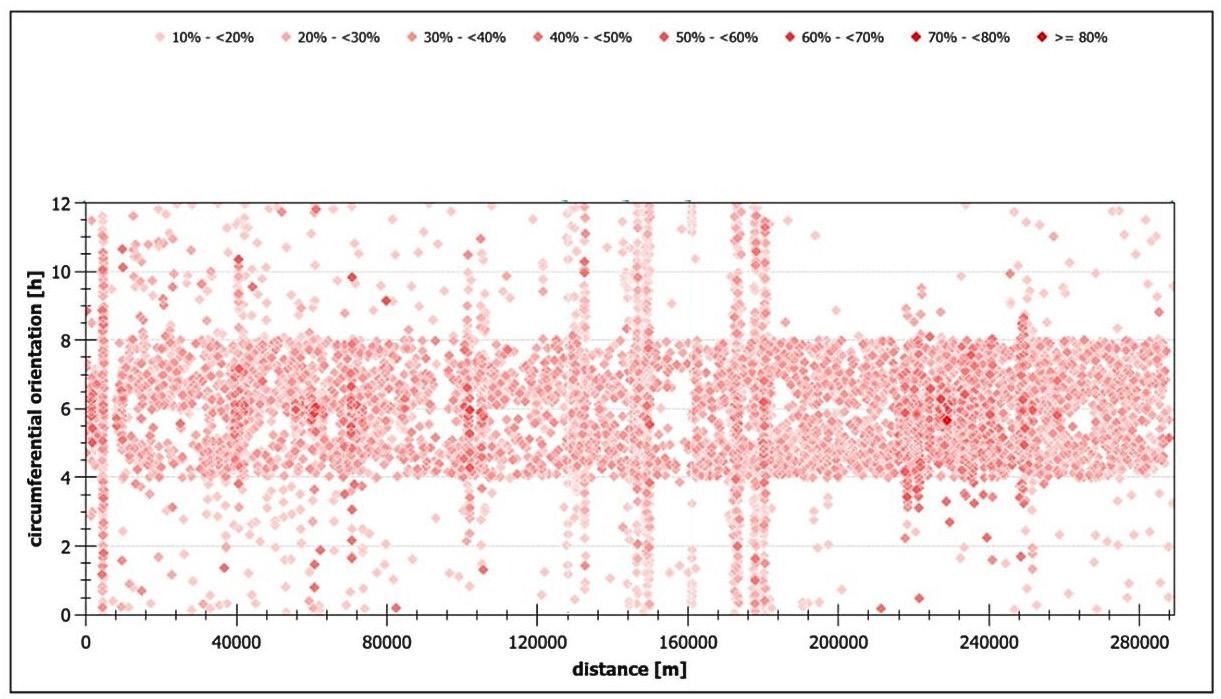

Norman Stapelberg, Silveray, makes the case for how flexible digital X-ray technology is set to transform pipeline inspection.

Radiography is the most common way of inspecting pipes for corrosion and weld defects – usually using traditional X-ray film. So why is it taking so long for the industry to migrate to a faster and more costeffective digital approach?

Digital X-ray film (DFX) takes a different approach to the challenge of inspecting pipe welds, with flexible digital X-ray technology designed to be used just like radiographic film – but with a digital output. This approach allows

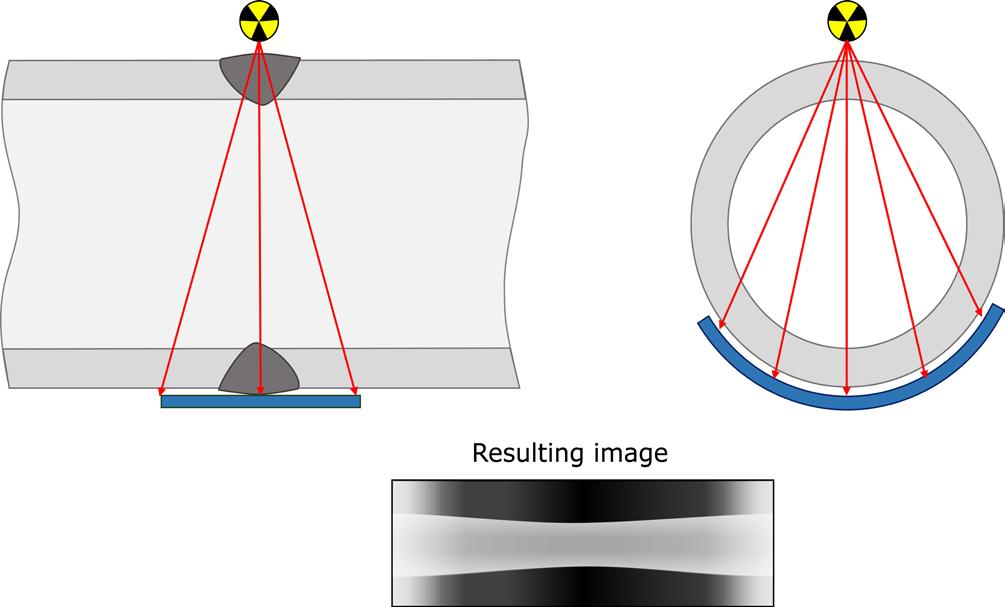

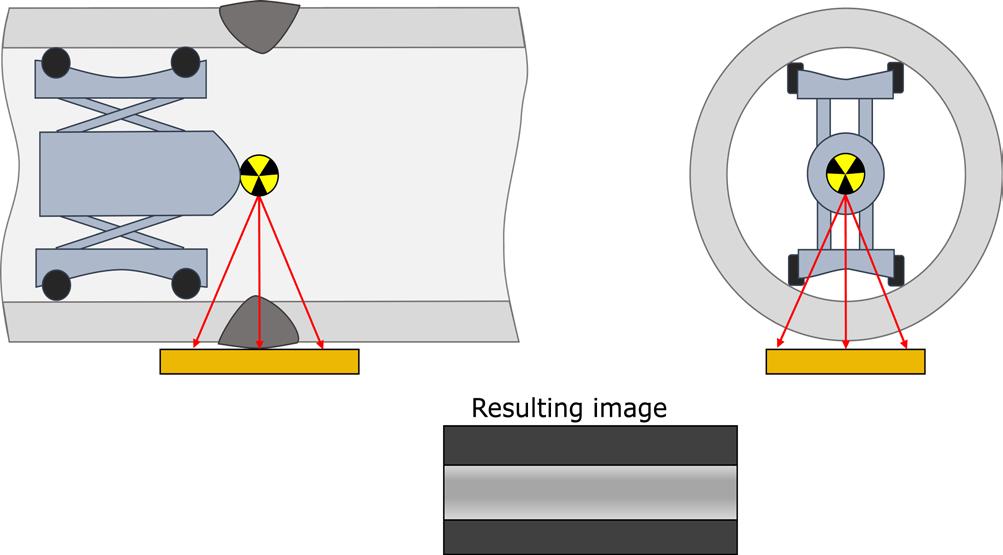

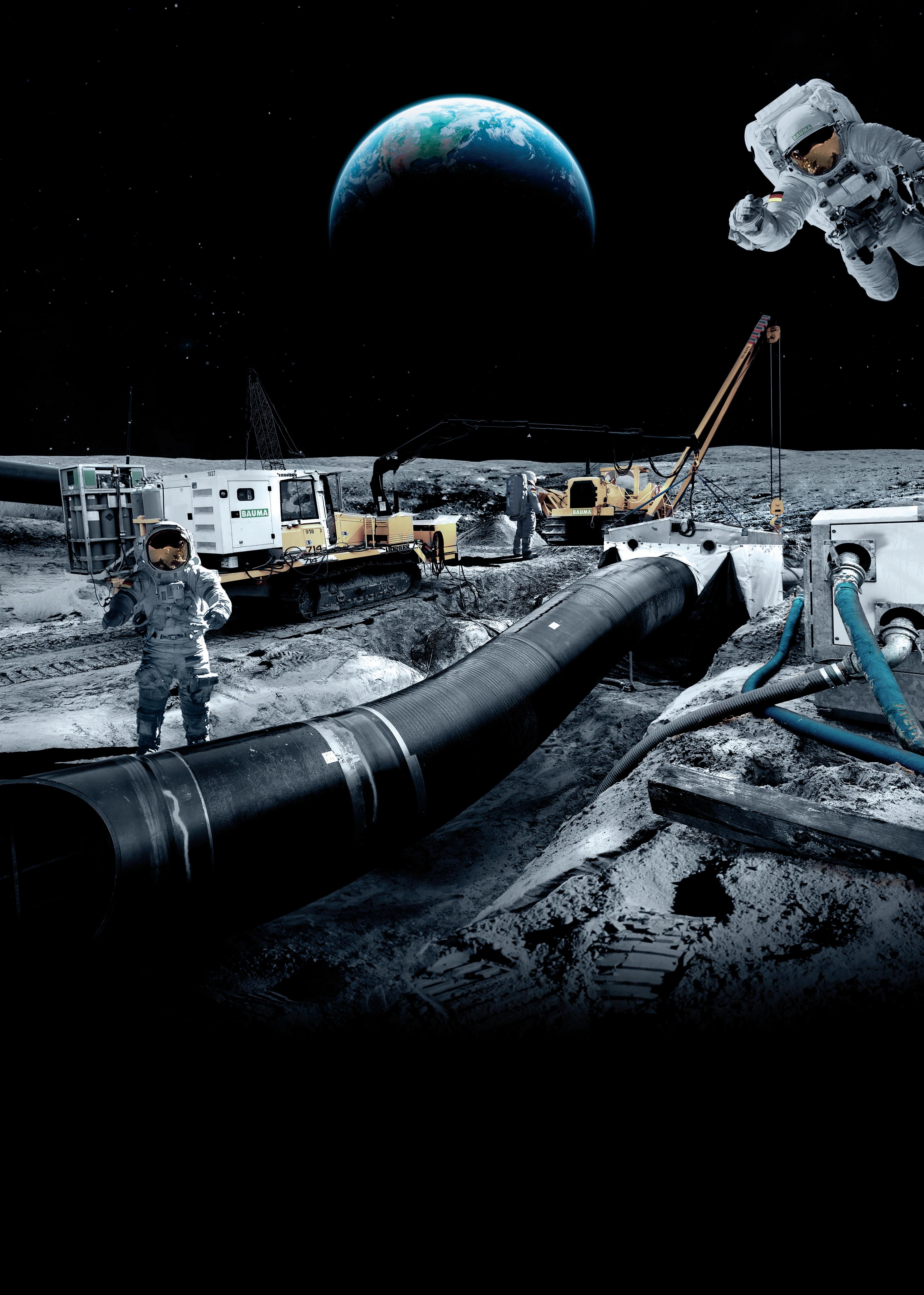

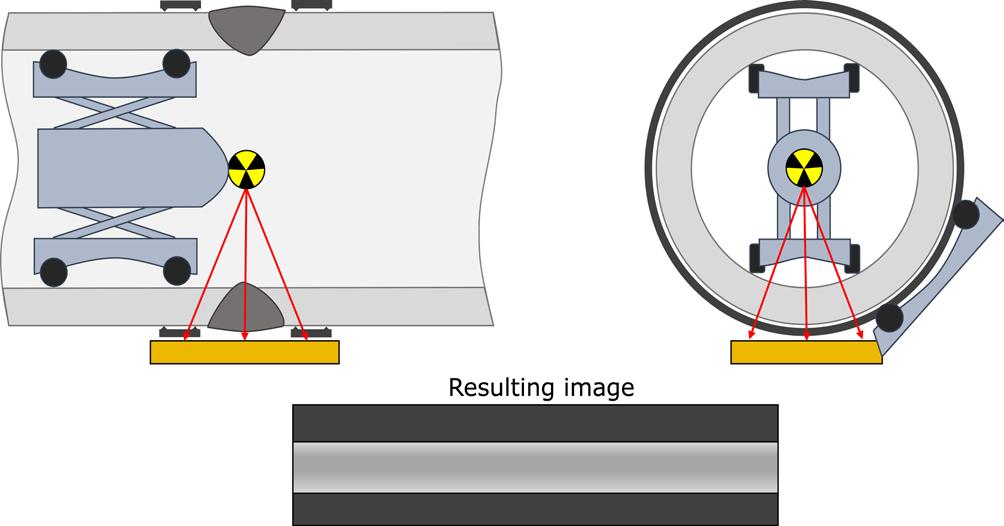

multiple pipeline welds to be prepared for X-ray inspection in advance, before the crawler is inserted – increasing X-ray inspection efficiency and reducing down time significantly compared with traditional film (Figure 1). So, will 2024 be the year that we see the first truly flexible digital replacements for traditional radiographic film?

Radiographic film for pipeline inspection

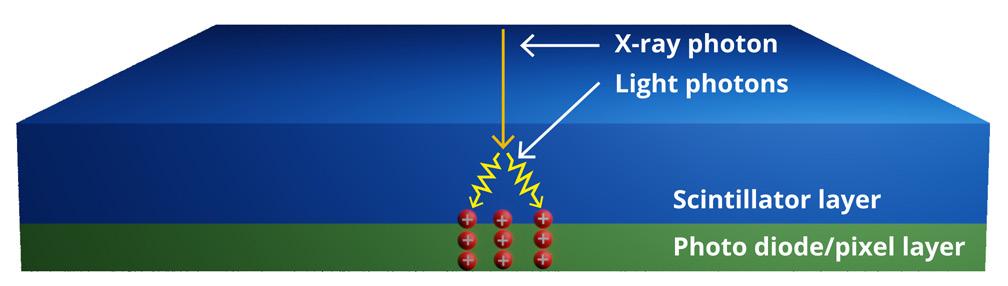

The main advantage of radiographic film is the fact that it is thin and flexible, enabling it to be wrapped around a pipe while the image is taken. And the film is available on rolls that can be cut to length to match almost any pipe size.