Number 48 - september /2024

Number 48 - september /2024

Throughout the month of September, important data were released showing a faster pace in the current Brazilian economy. The main one is the gross domestic product in the second quarter, which increased 1.4%, accelerating compared to the 1% in the first three months of the year. This performance was influenced by strong household (1.3%) and government (1.3%) consumption, which also contributed to the favorable result of industrial activities (1.8%), services (1%) and trade (4%).

One factor that has led to an increase in demand is the labor market, in a situation similar to that of full employment. The IBGE released the unemployment rate for the quarter between May and July, at 6.8%, the lowest for the period since the historical series started in 2012. With moderate inflation, it has contributed to a real increase in income. So much so that the mass of income, which is nothing more than the employed population multiplied by the average real income, is at the highest volume in the series, with R$322 billion in the quarter up to July, an annual increase of 9.2%.

And given the low propensity to invest and save in the country, these resources go directly to the real economy. Especially because the level of default and outstanding accounts has been reduced, favoring an increase in spending on commerce and services. So much so that the first, commerce, recorded strong growth in July, 4.4% compared to the same period last year and accumulates an increase of 5.1% in the year. Considering the vehicle and construction materials sector in the calculation, the increase in the month rises to 7.2%, driven by the surprising increase of 20% in sales of vehicles and motorcycles.

In addition to the income obtained through work,

consumers are having easier access to credit, serving as another support base for increasing demand. According to information from the Central Bank, credit grants to individuals rose 7.5% in real terms in July year-on-year. When evaluating credit taken out for the purchase of vehicles, for example, the variation is even more significant, approaching a 30% increase and non-payroll personal credit increasing 17%.

Services also ride this good wave of the Brazilian economy. In July, according to IBGE, there was an increase of 4.3% in the annual counterpart and an accumulated increase of 1.8%. And by FecomercioSP, the monthly survey of national tourism shows growth of 3.8% in the month of July, the month of school holidays and high leisure season. Sectors such as air transport rose 6.4% and transport rental sectors rose almost 10%.

By industry, IBGE records annual growth of 6.1% in July and accumulates an increase of 3.2% in the year to date.

And it was observing this heated demand that the Central Bank, through the Monetary Policy Council, COPOM, decided to increase the basic interest rate, the SELIC, by 0.25 percentage points, reaching 10.75% per year. This movement goes in the opposite direction to the decision of the FED, in the United States, which on the same day decided to reduce interest rates to the band between 4.75% and 5% p.a., the first cut in 4 years.

There, inflation is on track to approach the established target. Here, the risk of a heated economy putting pressure on prices, especially because the level of investment remains low, making the process of expanding supply more difficult. The IPCA, general price index, although showing low variations, including stability in August (-0.02%), in the 12-month period

still remains high, at 4.24%, closer to the ceiling of the target established by the Council National Monetary, 4.50%.

With the lack of rain in the country, the hydroelectric reservoirs are at very low levels, which will increase the energy bill this year and next, with the activation of thermoelectric plants, which are more expensive to operate. This is a point that the Central Bank has been monitoring, as it will fuel inflation over the course of a year.

Complementing this scenario of rising interest rates, fiscal risk still remains on the radar. Despite the good performance of the economy and a significant increase in revenue, the government continues to close its accounts in the red, resulting from a sequential increase in its spending, as was even captured by GDP.

1

E-commerce turnover reached R$ 196.1 billion in 2023, according to the most recent survey by the Ministry of Development, Industry, Commerce and Services, a volume very similar to that seen in the previous year. The relationship between ecommerce and physical retail was around 7%.

AUGUST/2024

By not doing its homework, cutting expenses and balancing its accounts, the country is not allowing a gain in confidence, keeping the real devalued and uncertainty about inflation and control of public debt. All of these variables are fundamental in investment decisions. In other words, given the degree of insecurity, the level of investment cannot advance. Therefore, the Brazilian economy is moving forward strongly with the boost in consumption and credit, but it will not be able to maintain this pace for a prolonged period of time without an adjustment, via prices and/or via interest rates. It’s called the low growth trap. There are no conditions for sustainable growth with a possible VAT of 28%, interest rates above 10% per year and inflation at the target ceiling. Unfortunately, it seems that the country is more of a chicken flight.

2

In the 2nd quarter of this year, 10 million heads of cattle were slaughtered in the country, a historic record in IBGE capture. This cycle of slaughter expansion has an impact on the consumer’s table, with deflation in meat prices of almost 10% in 2023 and, between January and August 2024, a decline of 2.45%.

3

According to the National Commerce Confederation, the CNC, family defaults fell from 30% to 28.8% between the months of August 2023 and 2024.

The Consumer Confidence Index (ICC) has been technically stable since June, remaining at around 127 points, with 127.3 points in August, slightly below the 127.8 points of the previous month. In the annual comparison, drop of 2.8%. Even with the improvement of the economy, the heated job market and lower inflation, there is a lack of perspective for the economy in the near future, for 2025. In other words, we live a better day-to-day life, but without a guide to what is going on. to come.

The Commerce Business Confidence Index (ICEC) showed an increase of 1.6% in August and reached 108.5 points, slightly above the figure seen in the same period last year, of 107.8 points. Just like consumers, businesspeople are unable to gain substantial confidence even with the current favorable scenario. With so many uncertainties in the Brazilian economy, there is distrust for next year.

Note: The ICC and ICEC range from 0 to 200. From 100 to 200 points is considered an optimistic level, and below 100 points is considered pessimistic. Although the indicators are from the city of São Paulo, they follow the trend of what is happening in the rest of the country as the city, the largest in Brazil, represents 11% of the national GDP.

This is the time to sell the summer season in Brazil, the busiest in Brazilian Tourism, especially December, January and Carnival. Cruises along the Brazilian coast, resorts and beaches in the Northeast, Natal Luz de Gramado, Rio de Janeiro and Florianópolis stand out in Brazil.

When traveling internationally, the end of the year is in Florida, the cold in Europe and more festive places for the end of the year;

But some trends have arrived to create exceptions in Brazilians’ vacation routine. Operators point out that Brazilian consumers are more conservative when purchasing, fearful of a possible economic crisis. You’ve tightened your belt and that’s why you want more value on your trip. What companies and destinations deliver to him?

In this context, the Caribbean all-inclusive, without the need for an American visa, and with several direct Gol flights or connecting flights via Copa, is the star. Cancún (even with Mexico requiring a visa from Brazilians), Dominican Republic and Aruba are highlights, but Brazilians are very open to other possibilities.

In Europe, Italy remains ahead, but prices require more careful planning. Portugal comes in as the second option, recovering from last year numbers.

The luxury traveler will prefer to venture into Asia, with Japan and South Korea still strong on the wish list.

Furthermore, Orlando’s theme parks, family resorts and theme cruises continue to be unbeatable.

And remember, Brazilians love:

• Party (the more shows on New Year’s Eve the better)

• Service (even more so now, with sky-high prices)

• Direct flights

• Hotel accommodation

• Family trips

• Traveling with friends (and here diversity is the watchword)

• Cruises of all types

• Shopping (always)

• Exchange rate still high (US$1 = +R$5.50)

• Rising prices

• Economy

• Wars and conflicts around the world, especially Europe and Israel

• Visas or electronic permits for Europe, Mexico and the USA (the latter greatly reduced visa waiting times)

• Legislation: new General Tourism Law, signed by President Lula, was an advance in some areas, but displeased travel agencies, hotels and other players with the veto of several important articles

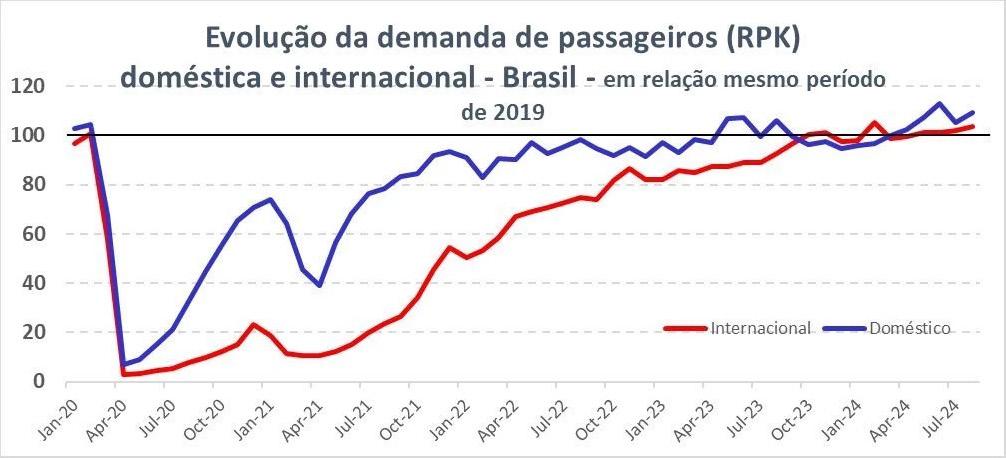

Demand from the Brazilian airline sector continues to expand in 2024. Now in August, it grew 2.7% in the domestic market and 11.7% in the international market, compared to the same period of the previous year. The number of seats also increased by 4.6% for domestic flights and 14.6% on international flights.

The data are from the National Civil Aviation Agency (Anac) and also reveal that, compared to pre-pandemic levels, domestic demand is already growing by 9.3%, while international demand records a modest increase of 3.5%. In August 2024, more than 10.1 million passengers were transported, 8 million on domestic flights and 2.1 million on international flights (a historic record for the month of August.

Business travel continues to trend upward this year. In August, according to data from Abracorp, which brings together 25 of the largest TMCs in the country, they had revenues of R$1.183 billion, an increase of 15% compared to the same month in 2019, with R$1.027 billion, before the Covid pandemic. Between January and August this year, revenue totaled R$9.1 billion.

Even with these good revenue numbers, there has still been no recovery in the number of transactions. According to Abracorp, the total in August was 1,699,271, compared to 1,798,388 in the same month of 2023 and 1,802,162 in August 2019.

CVC Operadora returned with its Preferred Partner program. In Brazil and abroad. Starting with Hospitality and expanding to other products. The first products that appear on the CVC sellers’ screen are those from preferred suppliers and CVC retailers still have a dynamic commission, for more or less, with these brands. In other words, it is the operator’s machine putting strength into the sale of these products, which appear prominently on the screen. Then come the recommended suppliers and finally the others. The goal is to concentrate 80% of sales with these suppliers.

This report is produced by PANROTAS and FECOMERCIOSP to support your business decisions. The contents are valuable assets to Destinations and Travel Organizations, both domestic as well as international. For further information please contact ri@fecomercio.com.br redacao@panrotas.com.br