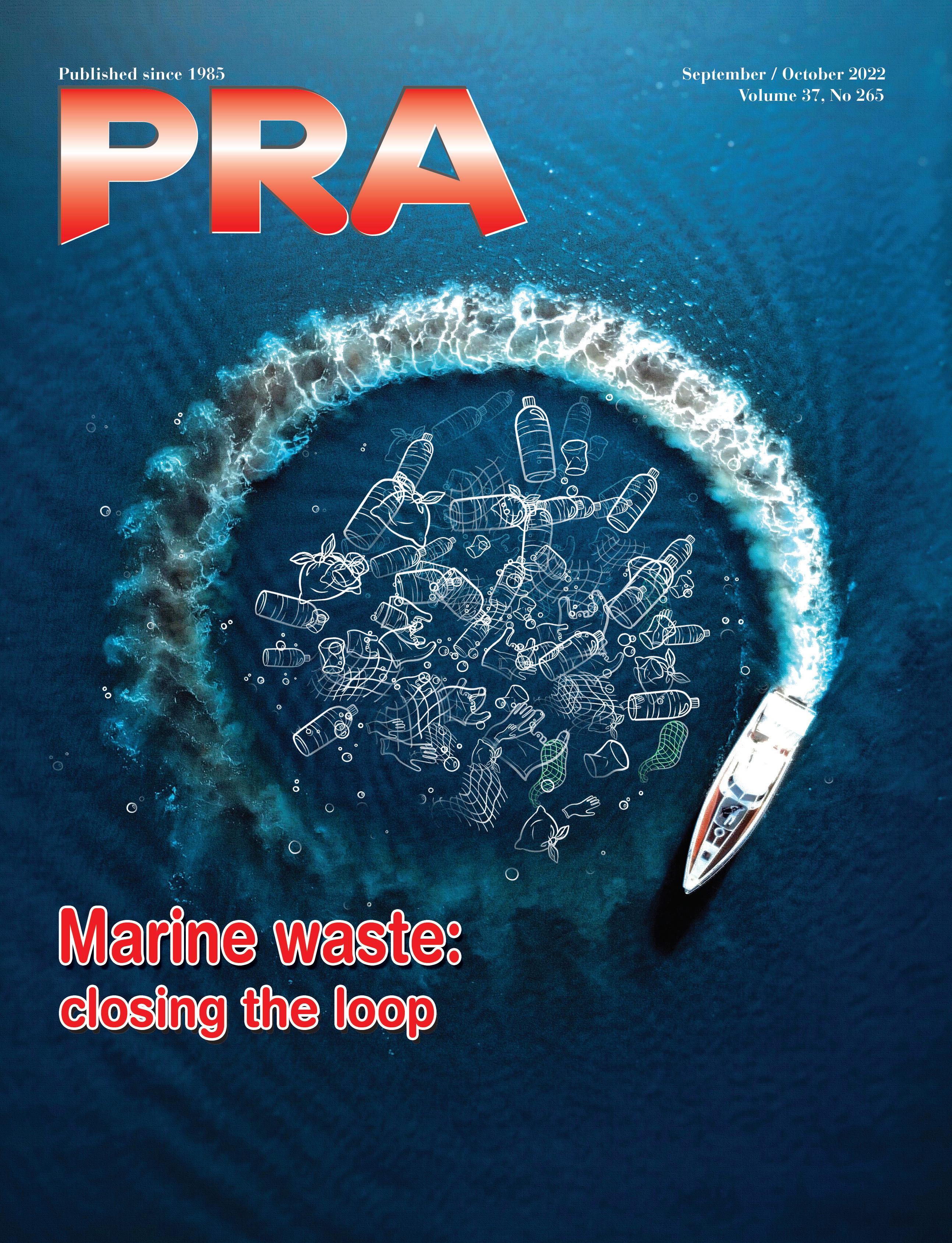

AS l A’S LEAD l NG m AGA z l NE for th E p LAS t l c S AND rubb E r l ND u S try PRINT/DIGITAL www.plasticsandrubberasia.com

k-online.com/pioneering AS PIONEERING Messe Düsseldorf GmbH P.O. Box 10 10 06 40001 Düsseldorf Germany Tel. +49 211 4560 01 Fax +49 211 4560 668 www.messe-duesseldorf.de

Features

7 Materials News – Renewable raw materials are the key to more sustainable plastics, says Jeroen Verhoeven, Vice President Value Chain Development, Renewable Polymers and Chemicals business unit at Neste, in this article

10 Blown Film – Collation shrink films may no longer need to be designated as single-use plastics, say three companies that have successfully innovated a solution for mechanical recycling of shrink films containing 50% recycled material content, in this article by ExxonMobil

14 K2022 Show Highlights – At the triennial K Fair taking place 19-26 October in Düsseldorf, Germany, organised by Messe Düsseldorf, the focus will be on sustainability

20 Recycling – As the saga of marine plastic waste continues, the plastics industry is taking a serious look at recycling and to offer well-rounded solutions

23 Country Focus – Asia is expected to be one of the leaders in the global pathway to a circular economy, recycling and renewable energy use

publisher/editor-in-chief

Arthur Schavemaker

Tel: +31 547 275005

Email: arthur@kenter.nl

Associate publisher/executive editor

Tej Fernandez

Tel: +6017 884 9102

Email: tej@plasticsandrubberasia.com

senior editor

Angelica Buan Email: gel@plasticsandrubberasia.com

circulation

Stephanie Yuen Email: stephanie@taramedia.com.my

permits

ISSN 1360-1245

printer

Automotive: Electric vehicle penetration has been increasing, with Asia-Pacific posting a whopping 150% growth; but will EVs be the answer to Asia’s net-zero future?

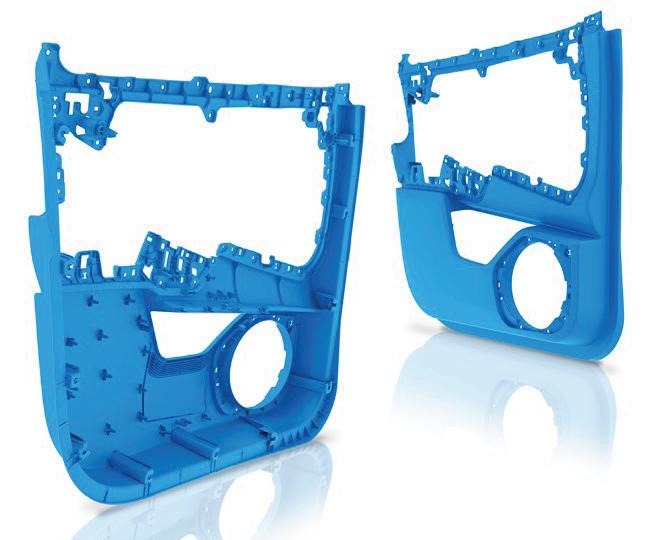

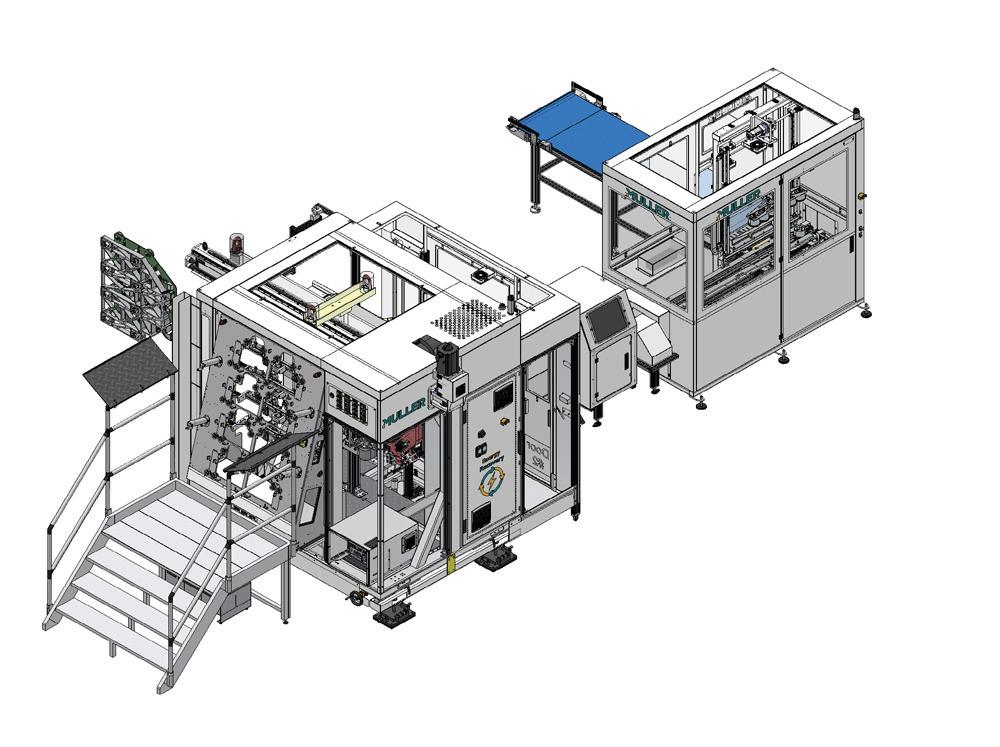

K Show highlights: Injection moulding machinery makers, automations, hot runners and auxiliaries will also be on display at the upcoming K show in October

K Show highlights: the rubber sector is given due feature at the world’s largest show for plastics and rubber machinery, with rubber majors showcasing machinery and materials

Silicone elastomers are enabling innovations, especially in the automotive and healthcare markets

and producing feedstock

innovations for

the oceans and recycling are closing the

United Mission Press Sdn Bhd (Co. No: 755329-X) 25 & 27, Jalan PBS 14/14, Taman Perindustrian Bukit Serdang, 43300 Selangor, Malaysia.

is published 4 (four) times a year in English by Kenter & Co Publishers’ Representatives bV.

Whilst every effort is made to ensure that the information contained in this publication is correct, the publisher makes no warranty, expressed or implied, as to the nature or accuracy of such material to the extent permitted by applicable law.

© 2022 Kenter & Co Publishers’ Representatives bV No part of this publication may be reproduced, stored or used in any form, or by any means, without specific prior permission from the publisher.

PRA is circulated free to trade readers in the plastics and rubber industry. Airmail subscriptions are available at uS$160 within Asia and uS$250 to all other countries outside Asia.

is a member of AbC (Audit bureau of Circulation)

www.plasticsandrubberasia.com

www.rubberjournalasia.com

www.injectionmouldingasia.com

www.plasticsandrubberasia.cn

AS l A’S LEAD l NG MAGA z l NE FOR th E PLASt l CS AND R ubb ER l ND u St Ry

AS l A’S LEAD l NG MAGA z l NE FOR th E PLASt l CS AND R ubb ER l ND u St Ry

In this issue

Volume 37, No 265 publlshed slNce 1985

Regulars 2 Industry News supplements th LAS t S AND rubb E ND S try PRINT/DIGITAL www.plasticsandrubberasia.com rubb by preventing marine litter

from ocean plastics, straightforward

cleaning up

plastics loop On the Cover facebook.com/PRA.Malaysia twitter.com/PRA_Malaysia Connect @

1SEPTEMBER / OCTOBER 2022

M&As/Tie-ups/ Investments

• Thai conglomerate Siam Cement Group (SCG) is to invest in a US$22.7 million project to produce BOPET in Vietnam. The project will be undertaken by flexible packaging producer AJ Plast (Vietnam) and is expected to start commercial production in 2024.

• Swiss firm Clariant’s German subsidiary in Frankfurt is to sell the former Clariant pilot plant to APK AG. It will be operated by the newly founded APK Newcycling Competence Centre, which will focus on recycling.

• BASF Venture Capital, the corporate venture arm of German chemical firm BASF, has invested in Climentum Capital’s first EUR150 million venture fund. Other investors also include Danish growth fund Vaekstfonden and Arbejdernes Landsbank

• Sustainable materials firm Neste has received a grant of up to EUR135 million from the EU Innovation Fund for its chemical recycling facility at its Porvoo refinery in Finland.

Also, Neste has purchased the European rights to US firm Alterra

Energy’s liquefaction technology, to advance its chemical recycling.

• US-based industrial group Hillenbrand, which owns Coperion, Milacron Injection Molding & Extrusion, and Mold-Masters, is to acquire Linxis Group from Iberis International, an affiliate of IK Partners, for EUR572 million. Linxis is a provider of mixing, ingredient automation, and portioning solutions for food and other end markets.

• Material supplier Chase Corp. is acquiring US specialty polymer maker NuCera Solutions from private equity firm SK Capital for US$250 million. NuCera makes specialty resins and waxes.

• Packaging company Alpla is boosting the presence of its pharma division in Europe with the acquisition of Polish company Apon, which produces packaging for the pharma industry in Warsaw.

• Thailand-based integrated chemicals maker Indorama Ventures Public Company Limited (IVL) has completed the acquisition of the wool spinning businesses in Italy and Poland of Tollegno 1900

• Materials supplier Avient Corporation is

to sell its Distribution business to an affiliate of private equity firm HIG Capital for US$950 million in cash, subject to regulatory approval. It had in April announced it was exploring the sale in connection with acquiring the Protective Materials business of Dutch materials firm DSM for US$1.5 billion.

• UK-based testing services firm Element Materials Technology has acquired testing, inspection, calibration and certification provider, Singapore Test Services (STS), a subsidiary of ST Engineering.

• Styrenics maker Ineos Styrolution is to sell its entire shareholding in Ineos Styrolution India to Shiva Performance Materials, which has businesses in specialty chemicals for pharmaceuticals, agrochemicals and other intermediates.

• Swedish engineered polymers firm Trelleborg Group is to buy US elastomers maker Minnesota Rubber and Plastics (MRP), which is owned by investment firm KKR, for US$950 million. KKR bought MRP from Minneapolisbased Norwest Equity Partners in 2018.

• Finnish packaging maker Walki Group is to acquire familyowned Westpak and Flexipack, which

provide flexible packaging solutions to Nordic food brands.

• Family-owned German additives supplier Brüggemann has acquired Italy-based manufacturer of functionalised polymers Auserpolimeri, a part of the Eigenmann & Veronelli Group.

• Speciality materials supplier Trinseo has decided to put a pause on the sale of its styrenics business.

• Saudi Arabian Oil Company (Aramco) has acquired US firm Valvoline Inc.’s global products business for US$2.65 billion.

• Technology firm Merck has acquired the chemical business of Mecaro Co., a South Korea-based and publicly-listed manufacturer of heater blocks and chemical precursors for semiconductors. The deal comprises an upfront cash payment of EUR75 million, plus contingent payments of up to EUR35 million, totalling EUR110 million.

• Speciality chemicals firm Azelis is to acquire Dagaltı Kauçuk San, a specialty chemicals distributor active in the Turkish rubber and plastics additives market.

• Distributor of speciality chemicals and ingredients IMCD is to acquire Mexican

Industry n ews 2 SEPTEMBER / OCTOBER 2022

masterbatch suppliers PromaPlast Resinas and PromaPlast USA, both of which serve the Mexican and US markets.

• PVC Europe Group, an independently managed investment subsidiary of Investindustrial Growth, is to sell the compounds business of Francebased Benvic Group to privately-owned German industrial group International Chemical Investors Group

• Dutch firms Koch Technology Solutions (KTS) and Ioniqa Technologies

have entered into a partnership to scale up and commercialise Ioniqa’s PET recycling technology, with KTS to invest up to EUR30 million in Ioniqa.

• The acquisition of recycling company Herbold Meckesheim has been completed and it will be integrated with German machinery firm Coperion’s recycling product lines into its new Recycling business unit that plans to offer complete solutions for plastics recycling processing.

• An affiliate of funds advised by private equity firm SK Capital Partners has sold

Techmer to Gryphon Investors, a middlemarket private equity firm.

Also, SK Capital Partners and Edgewater Capital Partners are in a binding offer to acquire the scintillation and photonic crystals business of Saint-Gobain. SK Capital will lead the investment with Edgewater acting as a minority shareholder.

• French chemical firm Arkema has finalised the acquisition of Mexico’s Polimeros Especiales, strengthening the group’s offering in solvent-free solutions.

• Technology firm Technip Energies has purchased the Biosuccinium technology from DSM, adding a technology solution to its Sustainable Chemicals portfolio.

• Pexco, a North American specialty plastics extruder, has acquired Enflo, a manufacturer of PTFE products in North America.

• US specialty and intermediate chemicals supplier Stepan Company is to acquire the surfactant business of PerformanX Specialty Chemicals, adding on US$20 million to Stephan’s revenue.

INDUSTRY NEWS

October 19-26, 2022 K 2022 | Düsseldorf, Germany | Booth 14B19 + Circular Economy Forum OA-CE09 > extruders > feeders > components > pneumatic conveying > complete systems Join us on the responsible path to a successful future. Visit us at Booth 14B19 and at the Forum and find out more about our comprehensive technology solutions for sustainable compounding, extrusion, feeding, conveying and bulk material handling. www.coperion.com/k2022 COPERION COMPOUNDING TECHNOLOGY. EFFICIENT. SUSTAINABLE. RESPONSIBLE. Discover our superior technology solutions at K 2022: + for compounding, extrusion, feeding, conveying and bulk material handling + for recycling, upcycling, processing of biodegradable products and much more + fulfilling higher quality standards and reliability + efficient equipment operation with regard to processing, energy and other resources

• German chemical/ consumer goods company Henkel is to acquire US-based start-up NBD Nanotechnologies Inc, which develops coatings for the electronics and accessories market.

• Indian petrochemical major Reliance Industries Ltd (RIL)’s subsidiary Reliance Petroleum Retail (under name change to Reliance Polyester), has acquired two Indian polyester companies for US$200 million. The two companies are polyester chips and yarn manufacturers Shubhalakshmi Polyesters and Shubhlaxmi Polytex.

• Japan’s Toyota Tsusho Corporation, together with Nippon Shokubai, will participate in a joint capital venture in Hunan Fluopont New Materials, which makes electrolytic lithium salt for lithium-ion batteries.

• German speciality chemicals firm Altana has sold its stake in the 3D printing systems manufacturer dp polar to 3D Systems, an additive manufacturing solutions partner.

• Packaging firm Constantia Flexibles has acquired UK

flexible packaging firm FFP Packaging Solutions, for its first consumer plant in the UK.

• German materials firm Covestro is to sell its Additive Manufacturing Business to 3D printing solutions provider Stratasys for EUR43 million.

• US diagnostics equipment firm Agilent Technologies Inc has acquired Polymer Standards Service, a German provider of hardware and software solutions used in defining the make-up and

Plant Expansions/Plant Set-ups/Openings

• The petrochemical arm of SK Innovation, SK Geo Centric, has teamed up with Paris-based Veolia Environment to carry out a joint study on PET, PP, and waste plastics as raw materials for pyrolysis, or thermal decomposition, in Asia. In addition, the two companies will establish a chemical recycling cluster in Ulsan, where SK Innovation’s other subsidiary SK Global Chemical will invest US$522 million to construct South Korea’s largest plastic waste recycling factory by 2025.

Also, SK Chemicals,

creation of molecular structures.

• Austrian packaging firm Greiner Packaging has purchased Serbian PET flake producer Alwag, marking its first foray into recycling.

• US infrastructure solutions provider Atkore has made two acquisitions of separate but related Oregon-based companies: Cascade Poly Pipe & Conduit and Northwest Polymers With the addition of these two, the company now has deployed more than US$310 million to complete six acquisitions in fiscal year 2022.

with Shuye, a Chinese green material company, will establish two joint venture chemical plants in Shantou, China, following SK’s US$18 million investment of a 10% stake in Shuye last year.

SK Geo Centric is also tying up with Zhejiang Satellite Petrochemical Co to build a US$222 million ethylene acrylic acid (EAA) plant in China, with a capacity of 40,000 tonnes/year and completion in 2025.

• Ineos Oligomers has started up its new 120,000-tonne/ year Low Viscosity Polyalphaolefin (LV

PAO) unit at Texas, US, said to be the world’s largest single PAO train and complementing existing units in La Porte and Feluy, Belgium. Also, it has launched a phased 50% expansion of its LaPorte, High Viscosity (HV) PAO unit, fully effective by mid-2025.

• Process technology provider Lummus Technology has been awarded a contract award from Numaligarh Refinery Ltd (NRL) for a new 360 kilotonnes/year PP unit using Novolen technology at NRL’s refinery in Assam, India.

Also, Lummus Technology and its catalyst partner Clariant, have announced the startup and acceptance of Qingdao Jinneng New Material Co.’s 900,000 tonnes/year Catofin propane dehydrogenation (PDH) plant in Qingdao, China.

• BASF has started up an acrylic dispersions production line in Dahej, India, serving the coatings, construction, adhesives, and paper industries for the South Asian markets.

Also, BASF is moving forward with the final phase of the expansion project, to increase production

Industry n ews 4 SEPTEMBER / OCTOBER 2022

capacity to 600,000 tonnes/year, for the MDI plant in Louisiana, US. The investment in the final expansion phase from 2022 to 2025 amounts to US$780 million.

Meanwhile, BASF has inaugurated the first plant of its new Zhanjiang site in South China, with a capacity of 60,000 tonnes/year of engineering plastics compounds, raising its total production of engineering plastic compounds in the Asia-Pacific region to 420,000 tonnes/year.

• Chemical firm Huntsman Corporation has started up commercial operation of a US$180 million MDI splitter at its Geismar site in Louisiana, US.

• Thailand-based PTT Global Chemical Public’s subsidiary

in the US, PTTGC America (GCA) has decided to locate a plastic recycling facility in central Ohio, US.

• Shandong Ruize Chemical Technology has commissioned a new PDH unit at its refining complex in Zibo City, Shandong Province, China, with the capacity to produce 300,000 tonnes/year of polymer-grade propylene.

• Covestro has broken ground on two new plants in Shanghai for polyurethane dispersions (PUDs) and elastomers, with a combined investment of a mid double-digit million euro amount. The new plant for PUDs, as well as a further line for polyester resins, from which PUDs are produced, will be completed in 2024.

• Wanhua Chemical Group will build a 200 kilotonnes/year maleic anhydride plant, which will be one of the largest in the world, located in Yantai city, Shandong province, and scheduled to commence operation in 2023.

• Speciality materials firm Trinseo and GMP Group (GMP), a circular business innovations company in the Netherlands, are to set up a 25,000 tonnes/year PS recycling plant in the Netherlands.

• Bayport Polymers (Baystar), a 50/50 joint venture between Austrian chemical firm Borealis and TotalEnergies, has started up commercial operations of a US$2 billion ethane cracker with a production capacity of 1 million tonnes/

year of ethylene, in Port Arthur, Texas.

• China’s second largest refiner PetroChina is investing US$4 billion to expand a subsidiary refinery in southern China into an integrated petrochemicals complex, to build ethylene, aromatics, polyolefin units for completion in 2025.

• US technology provider Honeywell says that China Tianying Inc will apply Honeywell’s UpCycle technology in its planned plastics recycling factory in Jiangsu Province.

• South Korean chemical firm LG Chem and partner GS Caltex have broken ground at GS’s Yeosu plant to produce 3-Hydroxypropionic acid prototype, a key raw material in the production of biodegradable plastics.

INDUSTRY NEWS

The construction will be completed by 2023.

• Sabic SK Nexlene Company (SSNC), a joint venture with SK Geo Centric (formerly SK Global Chemicals), in South Korea will expand the capacity of its Ulsan plant for the production of Sabic’s portfolio of Cohere metallocene polyolefin plastomers (POP), Supeer mLLDPE and Fortify polyolefin elastomers (POE).

• Fujian Eversun New Material Co. has selected Lummus' Catofin technology for a new 900 kilotonnes/ year PDH unit and Lummus' Novolen technology for a new 800 kilotonnes/year PP unit at its complex in Fujian Province, China.

• UK’s PX Group, the owner of Saltend Chemicals Park and operator of several energy infrastructure sites in the UK and Europe, has been awarded a tenyear Operations & Maintenance contract by ReNew ELP, a subsidiary of Mura Technology, at what it says is the world’s first commercial-scale plastic recycling plant, to process over 20,000 tonnes/year of waste plastic, during phase 1 of operations.

• Materials firm LyondellBasell says that Hanwha Solutions Corporation (Hanwha) will use its Lupotech

T high-pressure PE technology for a 300 kilotonnes/year vinyl acetate copolymer (EVA) line in Yeosu, South Korea.

• Japan’s Toyobo Co will open another facility in Indonesia to manufacture polyester films for packaging at Trias Toyobo Astria (TTA), a joint venture company that Toyobo established with Indonesian film maker Trias Sentosa Toyobo plans to start construction in 2024 and start-up in 2025.

• US masterbatch maker Ampacet has opened a new production plant in Brembate, Italy in response to increased product demand. The new site doubles additive capacity and all lines are up and running.

• Henkel Korea has completed its EUR35 million Songdo plant within the Songdo High-tech Industrial Cluster in Incheon, which will become the Asia-Pacific production hub for high-impact electronics solutions of the Adhesive Technologies business unit.

• Japanese chemical firm Mitsui Chemicals is bolstering capacity in Singapore by building a new plant to produce high-performance elastomer Tafmer in Jurong Island. It will have a capacity of 120,000 tonnes/year

and be scheduled for running in 2024. The capacity of the existing facility is 225,000 tonnes/year.

• South Korea’s LG Chem is expanding its investment in carbon nanotubes (CNTs) with the construction of its fourth CNT plant, following Plant 3, which started construction early this year, and Plant 2, which has been operational since last year.

• Auto company Honda Motor Co. and LG Energy Solution will invest US$4.4 billion through a joint venture to establish a new lithium-ion battery factory in the US to power Honda and Acura electric vehicle models.

• US styrenic block copolymers maker Kraton Corporation and Formosa Petrochemical Corporation are to expand their HSBC joint venture manufacturing facility in Mailiao, Taiwan, by 30%.

• Germany’s Evonik’s Coating Additives business line is expanding the production capacity of its Acematt precipitated matting agents at its facility in Taiwan, scheduled for completion by 2023.

• Indorama Ventures and Capchem Technology USA, a subsidiary of Shenzhen Capchem

Technology, are to study the building of a world-class lithium-ion battery solvents plant at one of Indorama’s petrochemical facilities in the US Gulf Coast.

• Chinese chemical firm Sinochem International, Elix Polymers' parent company, is to build a compounding factory in the Yizheng Chemical Industrial Park, Yangzhou, with capacity of 56,000 tonnes/year of ABS and PC modified materials in two phases.

• Sumitomo Chemical’s Sumika Semiconductor Materials Texas subsidiary intends to build a plant to produce high-purity semiconductor process chemicals in the US, to commence operations in 2024.

• Japan’s UBE Corporation will build a new compounding facility for special grades at one of its local subsidiaries in Thailand by 2024.

Also, Ube is to expand the capacity for polycarbonate diol (PCD) in Thailand, to start operations in 2023. It will make one of Ube’s core products, used as a polyol component to make high-grade polyurethane. The production capacity is planned to be increased from 8,00012,000 tonnes/year.

Industry n ews 6 SEPTEMBER / OCTOBER 2022

Taipeiplas 2022 carries on as an online exhibition

Taiwan's total exports of plastics & rubber machinery from January-August this year reached US$704 million, an increase by 7.71% over the same period last year. And the total exports of shoe-making machinery were US$70 million, up 18.9% compared with the same period last year. Taiwan is ranked as the world’s sixth exporter of plastics & rubber machinery and world’s second exporter of shoe-making machinery.

Taipeiplas, which was held in conjunction with ShoeTech Taipei from 27 September-1 October, will be back with a month-long online exhibition till 27 October. After a four-year absence, the physical Taipeiplas had 300 exhibitors in 1,300 booths under one roof.

Simon Wang, President/CEO of TAITRA pointed out that Taiwan's industries have accelerated digital transformation and become active in the circular economy.

Larry Wei, Chairman of TAMI, elaborated that machinery manufacturers in Taiwan recently have focused on the developments of all-electric machines, servomotors, multistation linkage, recycling solutions for raw materials and energy, for more intelligent and energy saving machines. Also, Taiwan's machinery industries have demonstrated resilience and resistance to external challenges despite rapid changes in international trade lately, as well as the damages caused by the Russian-Ukraine war, labour shortage, inflation and raw material prices.

Alan Wang, CEO of FCS Group, Bert M.H. Huang, Chairman of Victor Taichung and Victor Chang, Vice Chairman of Chuan Chyi Machine shared opinions and experiences about adding value to the products and services in the wake of such opportunities and challenges, while integrating the concept of circular economy into the corporate management.

Meanwhile on 28th September, Taiwan Excellence held the “Exceed Excellence with Taiwan Plastic Machines” product launch with the aim to familiarise global buyers with Taiwan's plastic industry. Held in conjunction with the largest plastics exhibition in Taiwan, Taipeiplas 2022, the event saw four Taiwanese plastic machine manufacturers gave a brief presentation to help reduce energy consumption through their more sustainable production practices. The brands included iconic names like Chumpower, FCS, Polystar and Yoke.

Exemplifying the best of Taiwan’s plastic machines, these products are said to be driving trends that combine information communication technologies in more sustainable production practices.

The event featured:

• Taiwanese PET stretch blow moulding machinery maker Chumpower introduced its new model of single-stage stretch blow moulder providing a sustainable ISBM solution in rPET. The moulding machine also applies the artificial intelligence (AI) technology providing customised optional functions, which include real-time active control of preform temperature and blowing pressure so as to monitor abnormal machine vibration value and motor torque value during preventive maintenance.

• Fu Chun Shin (FCS)’s customised injection moulding machine boasts lower energy consumption of 30%-70%. Its iMF 4.0 system can be mounted on any injection moulding machine to exchange data with peripheral equipment to independently adjust and control quality parameters and display the overall equipment efficiency in real time.

•

Leading supplier of recycling machines, Polystar showcased an all-in-one shredder that is equipped with energy-saving feeding technology to ensure optimised feeding. Furthermore, Polystar utilises digital programming technology with ECO inverter modules for a fully automated pelletising system.

•

The IoT innovation is also adopted by industrial lifting safety hooks maker Yoke. With the completion of its digital product line this year, Yoke’s equipment is embedded with digital chips enabling immediate digital access to the instruction guide and pre-use inspection information for users.

To watch the full online product launch, visit: https:// youtu.be/D8Ff_kvB9j4

For more information about Taipeiplas 2022, please visit: https://www.taipeiplas.com.tw/en/index.html

7SEPTEMBER / OCTOBER 2022 AdvertoriAl

Renewable raw materials: key to more sustainable plastics

by Jeroen Verhoeven, Vice President Value Chain Development, Renewable Polymers and Chemicals business unit at Neste

Withthe clock ticking on the usage of fossil resources, the plastics industry has to quickly switch to new technologies and solutions to reduce its dependence on fossil raw materials. Renewable, bio-based materials offer a huge opportunity to bridge the gap and make plastics more sustainable - already today.

“You can’t decarbonise polymers,” a chemist told me a few years ago. And it’s true: considering carbon is the basis for organic chemistry and therefore also for the majority of polymers. And that’s why at a time when everyone is talking about decarbonisation to combat climate change, the plastics industry seems to be facing a problem.

The good news is, the problem isn’t carbon itself. The problem is the source of the carbon. Hence, for polymers, the order of the day isn’t decarbonising, it’s defossilising and finding alternative, more sustainable carbon sources.

Conventional plastics take their toll on the planet

As of today globally, the major source of carbon for plastics is fossil crude oil. Yet, every litre of fossil crude oil we use ultimately leads to additional carbon in the atmosphere in the form of CO2: when plastic products reach the end of their life and are incinerated, landfilled, or even worse, are littered in the environment where they slowly decay. The effect of this could be even similar to just burning the fossil crude oil right from the beginning. And that’s why fossil carbon sources need to be replaced.

Luckily, there are other carbon sources we can tap into to replace virgin fossil carbon, namely biomass, which is part of the Earth’s natural carbon cycle. There is a constant emission of CO2 to the atmosphere via plants at the end of their life, but also a constant absorption of CO2 from the atmosphere through plants’ photosynthesis during their growth. Instead of using fossil resources, we can use the renewable carbon from biomass, resulting in a significantly improved carbon footprint of plastic products from these bio-based sources over fossil plastics.

Before digging into the details of the technology to do so, some clarification might be helpful as there often is confusion about bioplastics, bio-based plastics and biodegradable plastics.

While similar, these terms aren’t synonymous. “Biobased” refers to the verified use of renewable materials/ biomass in the production of plastics.

“Biodegradable” refers to the end-of-life properties of the plastics, which allow decomposition, but it doesn’t say anything about the raw materials they are derived from.

Finally, “bioplastics” is the most confusing of the three and often misused as an overarching term for both or it’s used to describe one or the other.

Bio-based plastics can be made from waste and residues without loss in quality

The raw materials that can be used for bio-based plastics are numerous. Looking at the raw materials we use at Neste for our renewable products, over time our raw material mix has evolved.

We have shifted more and more to using waste and residue oils and fats, including used cooking oil or waste and residues from vegetable oil production.

These materials are then processed in our proprietary NEXBTL refineries. In contrast to fossil raw material, the oils and fats we use contain oxygen, which is an undesired element for our customers and we therefore remove them with hydrogen atoms.

What remains at the end of the refining process are pure hydrocarbons. This means the NEXBTL technology allows us to turn renewable raw materials into fuels such as renewable diesel or renewable aviation fuel or into feedstocks for the chemicals and polymers industry. There, they can replace, for example, fossil naphtha.

In the future, lignocellulosics, biomass from forestry and agriculture, microalgae, vegetable oils, and other raw materials may become relevant for bio-based polymers

The big advantage of our renewable feedstock for polymers and chemicals is that it’s chemically hard to distinguish from the fossil version. In fact, it can replace fossil feedstock 1:1 and it can be used either in neat form or be mixed with fossil feedstock. This makes it rather easy to make the switch from fossil to bio-based plastics as

8 SEPTEMBER / OCTOBER 2022

Materials News

there is no need to build up new facilities or make big changes or investments into the existing manufacturing infrastructure.

At the same time, the plastics produced from the renewable feedstock come with the same properties and qualities as the conventional ones: they can be used in the same industries and for the same applications.

Some examples of end-consumer products that are made out of our renewable feedstock include high-quality coffee capsules, plastic film for packaging, diapers and plastic cups. Any product that is made of fossil-based plastics could also be made from bio-based plastics. The big advantage is that these products have exactly the same look and feel, as well as (food) safety and mechanical properties as their fossil-based equivalents.

While that’s true, we estimate the current globally available waste and residues raw material pool that is fit for use in our refineries to be around 40 million tonnes - so there is quite some room left.

Nevertheless, it will be necessary to diversify the raw material portfolio further if we want to significantly reduce the millions of barrels of crude oil the global petrochemical industry is processing every single day.

There are multiple raw materials that may become relevant for bio-based polymers in the future.

At Neste, we are for example looking at lignocellulosics, biomass from forestry and agriculture that only has lowervalue uses as of today. Other sources could be microalgae as well as novel vegetable oils, new and additional volumes of vegetable oils derived from existing agricultural land without replacing existing cultivation.

With these technologies, the future raw material pool could easily reach hundreds of millions of tonnes/year.

Bio-based solutions as an enabler for the industry

Wrapping it up, “enabling” strikes me as the best characteristic to describe bio-based raw materials when it comes to the sustainable transformation of the plastics industry: using such materials is an enabler to successfully manage this transformation.

While chemically identical to their fossil counterparts, the big difference with the feedstock lies in the carbon footprint.

Life cycle analysis for our renewable hydrocarbons, i.e. renewable feedstock for polymers and chemicals, shows a decrease in greenhouse gas emissions of more than 85% over fossil feedstock.

If emissions from transportation and energy use in the value chain leading to the feedstock produced were reduced further by increasing the use of renewable energy, the greenhouse gas emissions reduction could very well move even closer towards 100%. This is what we are currently working on at Neste.

Capacities are there already today

Another advantage: in contrast to other sectors or technologies, bio-based plastics are not a future technology. They are available and used already today and there are industrial-scale capacities in place to produce the feedstock required.

At Neste alone, we can currently produce 3.3 million tonnes/year of renewable products. This capacity will increase to 5.5 million tonnes by the end of 2023 and once more to 6.8 million tonnes by the end of 2026.

Neste’s facilities to produce the renewable solutions are located in Finland, the Netherlands and Singapore.

When using mainly waste and residues as raw materials, it could be argued that this raw material base has to be limited.

The technology is available today, it’s available at scale and the hurdles to introduce it into existing value chains are low.

Bio-based feedstock can do just what conventional feedstock can do.

So the question we should ask ourselves isn’t “if” we should use bio-based plastics. The question is, when do we start scaling up their usage to make sure that plastics also have their place in a more sustainable society? We should start using them today as every single drop of fossil we can replace is a win for the environment.

Renewable feedstock can replace fossil feedstock; it can be used either in neat form or be mixed with fossil feedstock

Jeroen Verhoeven, Vice President Value Chain Development, Renewable Polymers and Chemicals business unit at Neste

Neste's Singapore refinery

Materials News 9SEPTEMBER / OCTOBER 2022

Blown Film

Recycling collation shrink film

Collation shrink films may no longer need to be designated as single-use plastics, say three companies that have successfully innovated a solution for mechanical recycling of shrink films containing 50% recycled material content.

Some collation shrink films may no longer need to be designated as single-use plastics, thanks to an innovative solution that may help enable them to be mechanically recycled multiple times without compromising their performance.

The solution, enabling collation shrink films that incorporate 50% recycled content, has passed “proof of concept”, meaning the films met required performance parameters after three months of testing in a tripartite collaboration involving materials firm ExxonMobil, Malaysian processor Thong Guan Industries Berhad and Malaysian test centre, Newton Research and Development Centre

“Shrink films play a critical role in keeping food and drinks safe to consume, but are typically discarded after use. This is due to the lack of collection and sorting amenities and perceived processing challenges posed by recycled plastics,” shares Chan Kwee Lin, ExxonMobil’s Asia Pacific Advance Recycling and Sustainability Market Manager.

“ExxonMobil is developing solutions to improve the recyclability of these essential films. We hope this will change the mindset of the industry, encourage more companies to extract value and extend the use of shrink films not once, but repeatedly, therefore potentially reducing a source of plastic waste in the world,” he adds.

The tripartite collaboration was initiated by Thong Guan, a leading packaging film manufacturer in Malaysia and Southeast Asia. Its senior general manager, David Ang, explains the project’s origin: “The primary value we see in using recycled shrink films is that it can contribute to less materials being sent to landfills. Alongside the potential recyclability of polyethylene (PE) shrink film, it is an excellent opportunity to help support our vision of closing the plastic loop. Our primary mission, leveraging the results of this project, is to demonstrate that we can still retain quality performance in shrink films by incorporating post-consumer recycled (PCR) content. This, in turn, supports our company’s effort to promote plastic circularity.”

The incorporation of recycled content (especially PCR) in collation shrink films, however, can lead to challenges.

When producing collation-shrink films from mechanically recycled PE, there are three stages where the raw material is subject to heat exposure: film production, shrink tunnel operations and film re-pelleting for recycling.

Each of these exposures to high heat and shear rate can lead to polymer chain degradation and the lowering of mechanical performance.

If one were to continually collect, sort, and recycle the same collation shrink film, it would mean that the same recycle stream would be going through these heat exposures again and again, adding further

ExxonMobil’s blown film testing at its Shanghai Technology Centre in China

10 SEPTEMBER / OCTOBER 2022

Typical heat exposure through a collation shrink film's production, usage and recycling

Typical film production

• Ext temp: 160-200

• Residence time: 5-20

need to consider re-feed

Typical shrink tunnel Brand owner/bottler

• Shrink temp: 160-200 degrees

• Residence time: 15-30 secs

challenges to maintaining film properties via mechanical recycling.

Mitigating loss of strength of film

Thong Guan collaborated with ExxonMobil for a solution to help mitigate the potential loss of mechanical strength from the incorporation of recycled content. They sought further help in testing the solution from Newton Research and Development Centre, a

All

from tests performed by or on

of ExxonMobil

Typical film re-pelleting Recycler/film converter

• Shrink temp: 200-220 degrees

• Residence time:

leading research institute in Malaysia specialising in packaging solutions for palletised loads.

ExxonMobil recommended a solution incorporating Enable 4002 performance polymers. “When used in conjunction with recycled PE streams, Enable polymers can help maintain the required mechanical and processing capability to help reduce the performance variability typically associated with mechanically recycled PE film. This approach leads to a final product

shrink film versus similar market

* Reference: Commercially available film used for shrink film application

# 5th extrusion: Extruded reference film after 4 more passes through pelletiser

from multiple rounds of mechanical recycling

11SEPTEMBER / OCTOBER 2022

Blown Film

data

behalf

to simulate extreme heat exposure

Performance of Enable-based 50% recycled content

reference 100% virgin shrink film Market Reference* Multi–cycle 100% VIRGIN PE 5th extrusion # Virgin PE containing Enable 4002 Puncture Force [0-3N] Dart Impact [0-150g] Retramat Holding force [0-2.5N] Betex TD shrink [0-20%] MD Tensile Strength [0-60MPa] 1% Secant Modulus Market Reference 50% Multi-cycle Potential benefits: Increased Recycled content in shrink films Reduced plastic waste Film-based testing results (50 m) All data from tests performed by or on behalf of ExxonMobil

Film converter

degrees C

mins (May

of trim)

C

C

5 mins

Blown Film

that incorporates recycled content, while helping to maintain its mechanical strength and properties,” Chan explains.

In plastic recycling, sorting of waste at the source has a great deal of impact on the quality and consistency of the plastic recycling stream. The three-company team simulated the typical collection and sorting of the collation shrink films to provide a known and consistent source of recycle for mechanical recycling.

The team tested and compared a commercially available three-layer, 50-micron market reference shrink film against a three-layer, 50-micron shrink film with virgin PE containing Enable 4002 in the skin layers and 100% simulated fifth extrusion recycle material in the core layer. The Enable-based shrink film solution incorporated a total of 50% recycled content.

By incorporating 50% virgin PE containing Enable 4002 in the solution, film performance consistency can be achieved across multiple extrusion cycles. This allows the potential for films containing recycled content to be recycled back into shrink films up to five times through the process without compromising film consistency.

In summary, Enable 4002 in shrink film that incorporates up to 50% recycled PE content can maintain major mechanical properties and comparable shrink performance versus a market reference film (100% virgin reference film), allow increased use of recycled PE content and enable the potential to reduce plastic waste.

Market for recycled shrink films in beverage sector

Is there a market for recycled shrink films? Yes, says Ang, “Recycled shrink films are most popular in the beverage industry. We distribute some locally and export to countries like Australia and New Zealand.”

Ang also revealed that recycled shrink films can be more expensive to produce than virgin films, but there is still a demand from companies with sustainability goals and commitments, and that they may benefit from potential tax savings depending on their market.

“Our customers can potentially save on plastic packaging costs by meeting the requirements of various plastic packaging tax schemes like the one imposed in the UK, where companies using plastic packaging with less than 30% recycled content are required to pay tax of £200 per tonne of plastics.”*

For now, perhaps only one thing stands in the way of the production of more shrink films with recycled content.

Quips Ang: “The response to our recycled shrink film is excellent as more companies are pursuing their sustainability goals and commitments. However, the commercialisation of shrink films containing recycled content is largely dependent on the availability of quality recycled content. Making quality recycled content widely available will require investment and close collaboration along the entire packaging value chain.”

*Source: https://www.gov.uk/government/ publications/introduction-of-plastic-packaging-tax/ plastic-packaging-tax

12 SEPTEMBER / OCTOBER 2022

Illustration shows the components of a 50% recycled content film that have undergone multiple heat exposures from production, usage and recycling. The recycled component may have lower film performance, due to potential polymer chain degradation. The inclusion of 50% polymer from virgin raw materials potentially helps to maintain the film properties. Enable performance polymers help shrink films with mechanically recycled content maintain performance over repeated extrusion cycles Illustration – 50% recycled content film over 5 extrusion cycles High quality performance polymer ensures film performance cycle after cycle Virgin 1st cycle 50% Recycled 50% Virgin 1st extrusion - Virgin Performance polymer - Virgin Performance polymer - Virgin Performance polymer - Virgin Performance polymer - Virgin Performance polymer - Virgin 2nd extrusion 2nd extrusion 2nd extrusion 2nd extrusion 2nd extrusion 3rd extrusion 3rd extrusion 3rd extrusion 3rd extrusion 4th extrusion 4th extrusion 4th extrusion 5th extrusion 5th extrusion 6th extrusion 2nd cycle 50% Recycled 50% Virgin 3rd cycle 50% Recycled 50% Virgin 4th cycle 50% Recycled 50% Virgin 5th cycle 50% Recycled 50% Virgin 3.125% 3.125% 6.25% 12.5% 25% 50% 50% virgin performance polymer maintains film properties Decreasing % of Recycled content with multiple heat exposure

Asia

China

to Guangzhou, China , in December 2022. It’s the leading exhibition for the Chinese polyurethanes market and enables visitors to see the latest innovations and solutions available from hundreds of key suppliers.

UTECH

/ PU

returns

New Dates Announced! REGISTER TODAY PUCHINA.EU CONNECT WITH US: @UTECH_PU UTECH Polyurethane #PUChina #UTECHAsia Contact Matt Barber, Global Events Director, at mabarber@crain.com / +44 (0)7739 302081 to find out about exhibiting and sponsorship opportunities. Organized by: In association with: GLOBAL POLYMER GROUP

K2022 show highlights

Materials

• Avient will showcase its TPEs (reSound REC) made from recycled polyvinyl butyral (PVB), recycled from laminated car windows by Danish clean technology company Shark Solutions The TPEs, made from 60% recycled materials, are used in automotive chassis and under-thehood applications. Their performance characteristics are said to be comparable to traditional products, including appearance, feel and physical properties.

• US nylon maker Ascend will highlight Vydyne Thermaplus, a new platform of high-temperature, high-ductile PA66 for fasteners; designed as a smarter replacement for PA46; Starflam flame-retardant PAs; and HiDura long-chain PAs for consumer goods and connectors; as well as copolymers for films that make packaging more durable.

• Germany’s BASF will showcase a number of solutions to reduce carbon footprint using renewable or recycled feedstock. BASF’s biomass balancecertified materials are used in the furniture industry or by a safety shoe brand offering a carbon neutral safety shoe containing BASF’s biomass balance PU, certified according to REDcert2.

BASF and Steelcase have collaborated on Steelcase’s Flex perch stool, made with an injection mouldable PA6 that utilises a material from a waste stream generated during electronics production

market, including PC blends for IT applications with up to 75% recycled material, besides products based on mass balanced raw materials.

• Dutch firm DSM Engineering Materials has launched what it says is the industry-first 100% biobased hightemperature PA: Stanyl B-MB, which is a fully ISCC+certified mass-balancing solution, and delivers the same characteristics, performance as conventional Stanyl. Production of Stanyl B-MB now generates a carbon footprint up to 50% lower than the fossil-based original. In practice, this means a 3.3-tonne CO2 reduction per tonne produced equivalent to charging 420,000 smartphones. The PA is noted for its high-temperature mechanics, and wear and friction resistance for hightemperature applications in automotive, electronics and consumer goods industries.

DSM’s latest sustainable version of its flagship product Stanyl can be used for highheat gear applications

• Sabic will introduce Bluehero, an automotive solution aimed to help accelerate the world’s energy transition to electric power, with an emphasis on improving structural battery components with flame retardant materials in electric vehicles.

• Belgian firm Solvay is introducing a new portfolio of high-performance Tecnoflon peroxide curable fluoroelastomers (FKM) produced without the use of fluorosurfactants (a type of PFAS used as process aids). Called NFS (non-fluorosurfactant), it is a breakthrough in FKM polymerisation and aligns with the company’s sustainability roadmap. Peroxide curable FKM rubbers are key to applications in industries from automotive and aerospace, oil & gas, chemical processing, to electronics and healthcare. Typical components include seals, gaskets, O-rings and hoses.

• Germany’s Covestro has tied up with the Zurich-based bag company Freitag for the recycling of truck tarps, based on thermoplastic polyurethanes (TPUs) from Covestro. At the end of their useful life, the tarps are to be chemically recycled and used for new tarps or other products. Freitag plans to have a prototype on a truck as early as this year. Covestro has focused mainly on mechanical recycling of PCs, with numerous products from Covestro already on the

Sabic has also joined forces with Heinz, Tesco and Berry in a recycling trial in the UK. Packaging collected from Tesco stores has been used to produce certified circular PP from Sabic’s Trucircle portfolio for microwavable Heinz Beanz Snap Pots, made from 39% recycled plastic.

• US-based DuPont’s Mobility and Materials (M&M) will showcase Hytrel Eco B biobased TPEs, with a biomass content of up to 72% by weight; Rynite PET based on PCR; low-density Zytel PA and foamable grades of Hytrel for weight reduction. A recent innovation, Hytrel Eco B is produced under the biomass balance, which is certified according to the ISCC-Plus standard and is targeted at consumer/sporting goods, electronics and furniture. It is also an option for the automotive industry.

In addition, M&M will feature several low GWP materials and solutions, including eCool technology for sustainable EV battery cooling lines and Zytel RS resins that contain between 20-100% material (by weight) derived from castor beans.

14 SEPTEMBER / OCTOBER 2022

It will also show a three-in-one solution for EV batteries: a patent-pending concept to increase energy density that combines three elements into one modular unit to decrease range anxiety, increase passenger room, improve cooling, and integrate components.

Another highlight is DuPont Chemical Bonding, a patented technology simplifying manufacturing via direct PA-aluminium joining, a common challenge for automotive and industrial components, which produces higher bond strength.

• Germany’s Lanxess will present a sustainable range of TPUs and biobased PA 10.10. The recycled TPU products are primarily intended for sports equipment. One of their strengths is their good composite adhesion with other injection-moulded materials when processed using the insert moulding or hybrid moulding methods. The semifinished products with a PET recyclate matrix are a costeffective alternative to virgin PC/PA, for example. The PET comes from used beverage bottles and is also available in large quantities thanks to the closed recycling chain for these bottles. The biobased PA 10.10 is derived from castor oil.

Recently, the company has launched a biobased composite material based on flax and PLA; while development is to be completed on a plastic (PA6) matrix for Tepex dynalite, produced starting from “green” cyclohexane with 80% sustainable raw materials. When the matrix plastic is reinforced with continuous-fibre fabrics, the resulting semi-finished products exhibit the same properties as comparable products. These are suitable for applications in structural lightweight design that are typical for Tepex dynalite – such as front-end carriers, seat shells, or battery consoles in vehicles.

Another new product line comprises variants of Tepex with 80% recycled material, based on carbon fibres from post-consumer and post-industrial waste, that yield surfaces with a so-called forged carbon look. A variety of thermoplastics are suitable as a matrix material, such as PA6, PA66, PP or PC, where recycled material made up of these plastics can also be used. It sees good opportunities for these products in applications that require high-class decor and high-grade mechanical properties, such as in car interiors and exteriors or in housings for consumer electronics.

• Germany-based Kraiburg TPE will present sustainable Thermolast RC/UV, with a proportion of post-industrial recycled materials ranging from 20-40%, targeted at automotive exteriors, for weathering resistance and a high surface quality.

Another highlight will be the interior PIR TPE with a proportion of recycled material of up to 38% from externally sourced waste.

Also on show will be the Universal PCR TPE materials with up to 41% PCR that meet the requirements for consumer and industry applications. Mechanical properties are said to match those of standard materials. Compounds are available in natural colour as well as in a grey colour characteristic for recycled plastics, which can be dyed in many different colours as needed.

Kraiburg TPE has also engaged independent firm Institute cyclos-HTP to assess the compatibility of selected TPS (styrenic TPE) materials in the recycling stream for HDPEs and PPs and found that its TPS materials are compatible within the PP and HDPE stream.

• Oman-based integrated energy company OQ has developed a portfolio of solutions designed for a wide range of film extrusion applications, including PP, LLDPE and HDPE grades. HP4102M, for example, is a homopolymer PP designed for CPP and is suitable to produce metallisable and lamination films, used for confectionery packaging and food products requiring an aroma barrier. OQ has also developed a range of HDPE and LLDPE film grades to support mono and multilayer film structures providing solutions for a wide range of applications.

• UK headquartered Aquapak has launched Hydropol Polyvinylalcohol (PVOH), a biodegradable and compostable polymer capable of replacing ethylene vinyl alcohol (EVOH) in many applications. When extrusion coated or laminated onto paper, Hydropol adds strength and barriers to oxygen, oil and grease, and its solubility allows 100% paper fibre recovery through paper recycling mills. It can be used in a range of products, including ecommerce mailer bags, and packaging for dried pet food, snacks, cooked meat and convenience food.

• Spanish ABS provider Elix Polymers will focus on sustainability, with the first product with mechanically and chemically recycled content that is already available on the market and validated by customers for key markets such as the automotive industry, the medical sector and consumer goods. One of the products will be E-Loop H801 MR, which contains mechanically recycled material and has properties that are equivalent to the raw material ELIX ABS H801.

Additives

• US-based Milliken & Company is partnering with European recycling firms Erema and PreZero to highlight the use of its Hyperform HPN additives in rPP compounds.

K2022 show highlights

Under the brand name Adiprene Green LF Lanxess provides a range of biobased low free monomer prepolymers for PU CASE applications

15SEPTEMBER / OCTOBER 2022

K2022 show highlights

At its live recycling demonstration of recycled material, Erema will use post-consumer waste collected by PreZero. Erema’s patented Intarema TVEplus RegrindPro extruder system with ReFresher technology allows PreZero to create odour-optimised premium rPP pellets. Hyperform HPN upgrades the rPP by improving the material’s physical properties while also reducing the cycle time needed to process it. Additionally, these additives also provide for better dimensional control and crystallisation stability during the post-injection moulding period.

physical properties can be achieved with these types of compounds. One of the developmental grades contains graphene oxide and is undergoing testing to assess certain property enhancement features including electrical and thermal conductivity, increased tensile strength, and improved barrier properties. The developmental grade is targeted for fibres and films.

Milliken, together with Erema and PreZero, will showcase technology for producing rPP

• Denmark’s Palsgaard will introduce a new plant-based, food-grade anti-fouling additive for PP and PE. Einar 981 has been developed to remove severe concerns about the ethoxylated amine chemistry currently used. It is supplied as a clear and easily pumpable liquid for use in existing dosing systems and eliminates static build-up during polymerisation and prevents fouling of the reactor wall, thus helping PP and PE producers maintain the cooling efficiency of the reactor. It provides high anti-fouling efficiency at low concentration (100-300 ppm) without any negative effects on catalyst mileage, productivity or final polymer performance.

• Germany’s Brüggemann is presenting performanceenhancing additives ranging from electrically neutral heat stabilisers for PAs in electrical/electronic applications, for example for e-mobility, to high-performance stabilisers for exposure to moderate to very high-temperatures; and additives for stabilising recycled polyolefins. A further focus is on efficiency-boosting flow enhancers that enable shorter cycle times and low wall thicknesses for components made of PAs and PBTs.

• SI Group will be introducing its new additives brand for plastics recycling. The first solutions to be introduced under the new brand name will be stabilisers for recycled polyolefins and PET that are specifically designed to allow customers to use more recycled materials without compromising performance in the end application.

• US-based Modern Dispersions will highlight its latest work with nanocarbons to boost the performance of masterbatch and compound solutions. Its new grades of carbon black, graphite, and nanocarbons are to improve thermoplastic compound properties such as colour, UV resistance, and electrical and thermal conductivity. Due to the lower filler loadings required with nanocarbons, better

• Tolsa is showcasing its Adins range of flame-retardant additives for PP, PVC, rubber polymer systems, and silicones. Recently, it has translated its Adins FR technology to PA matrices for applications in electrical/electronics, automotive, textile, and transportation markets. The company is developing new products for these systems. The company says it has successfully reduced Total Heat Release (THR) levels more than 20% compared to competitive additive solutions.

• Brazilian masterbatch supplier Cromex will present its new Act Green rC-Black masterbatch, which uses carbon black pigment obtained through the reprocessing of used tyres. Currently, Cromex recycles around 100,000 tyres/month into masterbatches. Another solution is black NIR masterbatches, for recycling black packaging in PE, PP, PS and PET, as they are carbon black free, allowing the identification and separation by type of resin via FTIR (infrared) for recycling.

Tolsa will highlight the latest Adins products for FR and biocide applications

For recycling, the company presents additives to improve properties of PCR, like odour reducers; modifiers used to improve the mechanical strength of films processed with recycled resins; antioxidants to reduce changes in the flow rate and physical properties during thermal processes; desiccants to capture moisture during the process and optical brighteners to improve the visual aspect of the resin by reducing the yellowish tone.

Blow Moulding/Thermoforming

• US’s Wilmington Machinery will debut its all-new series IV 8-station machine for volume production of 8 oz to 4 l bottles at rates from 48-144 bottles/ minute. The new machine is available with single, dual, and triple parison die heads for monolayer or multilayer bottles for food, chemical and other

Wilmington Machinery will show a new rotary blow moulder for calibrated bottles

16 SEPTEMBER / OCTOBER 2022

applications. Like Wilmington’s other rotary machines, it is all-electric, with a small footprint, and boasts minimal labour and maintenance. New control systems are more said to be operator friendly and provide for data collection and trending analysis.

• Agr will display Process Pilot+ automated blow moulder control for PET bottles, incorporating a patented technology enabling operators to optimise performance, energy efficiency or operating costs. The control works in conjunction with the blow moulder to continuously measure material distribution on every bottle, and proactively manage the machine to maintain optimal material distribution. With material variations due to rPET that occur during the production process, the system is an essential tool for PET bottle manufacturers that are committed to incorporating rPET into their product mix.

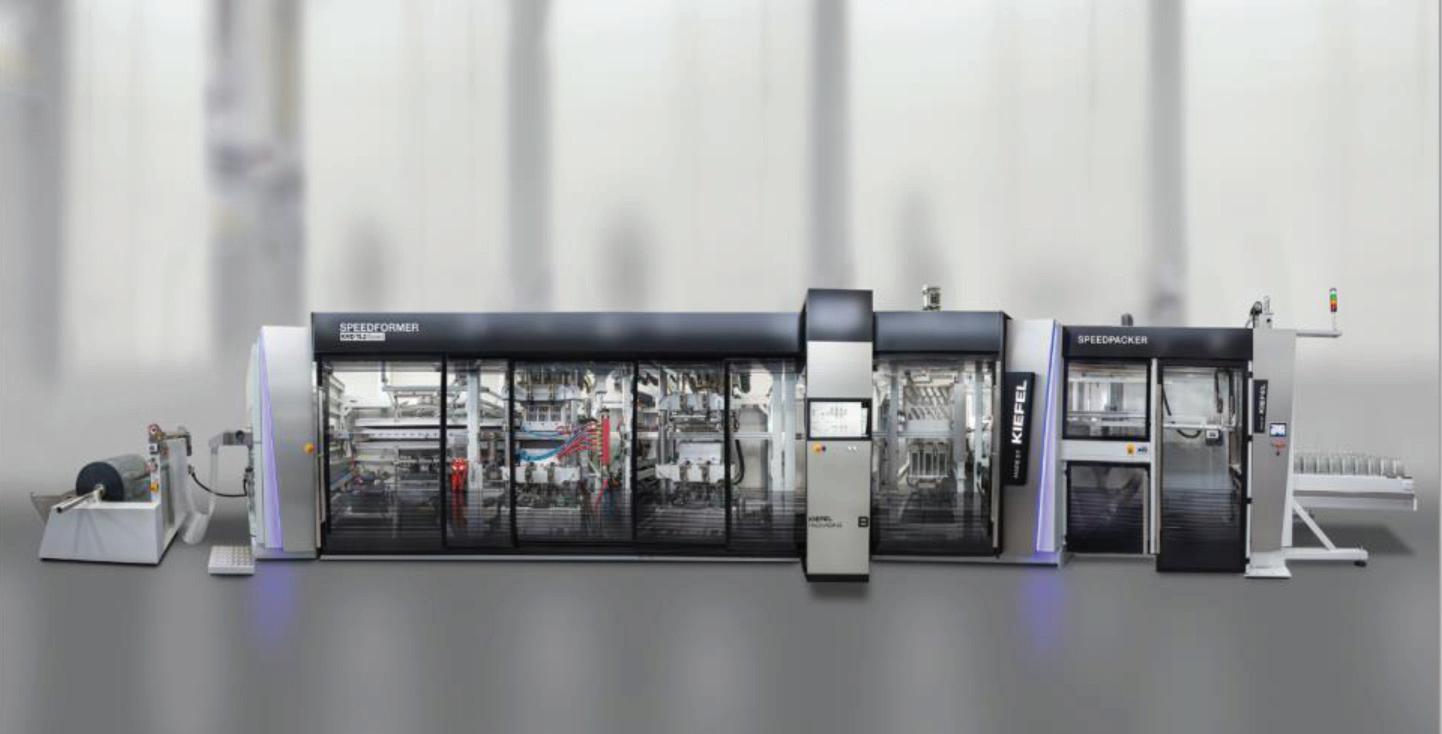

• For thermoforming Kiefel will be demonstrating a Speedformer KMD 78.2 Speed producing a tray made from an rPET film with a thickness of 0.35 mm. The steel rule machine is just as at home in large series production as it is with smaller quantities. The machine's highlights include high productivity and process control, as well as intuitive user guidance. The new KMD generation not only saves energy, but film too. The film feed table with rollers prevents scratches and particle contamination and ensures reliable and safe film transport. The servo motor-driven components, the high forming air speed and the cutting force ensure speed and accuracy.

• Reifenhäuser Blown Film will display its EVO Fusion technology, which is said to allow blown film processors to process unusable, inexpensive recyclates into highperformance blown films for simple end uses such as garbage bags or mailing bags. Until now, such lowquality recyclates could only be used for simple and thickwall injection moulded products. The EVO Fusion process relies on direct extrusion, which saves the energy and cost of repelletising. The twin-screw extruder is able to homogenise the melt better and ensure a stable process. Furthermore, processors can degas the system easily, removing unwanted components in the recyclate.

It will also show a fully recyclable pouch for food packaging, with an oxygen and water vapour barrier. The solution is a further development of the All-PE-MonoPouch, which is already established on the market and achieves barrier properties with an EVOH content of less than 5%, allowing it to be recycled in PE streams. Barrier properties are enhanced with the German firm’s EVO Ultra Stretch solution.

• Italy’s Bandera will show a nine-layer blown film line producing barrier structures, with a new control system and user interface for advanced machine operation and data acquisition supporting Industry 4.0. Bandera will also host an open house at its headquarters in Italy to show running lines for recycling and upcycling, and a five-layer polyolefin-dedicated (POD) blown film line.

Extrusion Machinery

• Germany’s Windmoeller & Hoelscher (W&H) will focus on barrier films or packaging with an increased content of PIR/PCR. It will also show automation and digital systems, like the Ruby IoT control system, for improving efficiency. At K2019, W&H showed its Turbostart system for automated stops and start-ups on blown film lines, at K2022 it will show how automated machines can help operators boost productivity; with live demonstrations run on its Varex II blown film line.

• Macchi will have on display its R-POD Flex line, the latest evolution of its POD Flex system, for higher productivity and PIR/PCR content. The five-layer R-POD Flex line is targeted at sustainable speciality films with reduced thickness and improved optical, mechanical and sealing properties. This new line is expected to meet growing market demand for highly flexible extrusion lines, capable of extruding recycled materials up to 1,200 kg/hour at 2,500 mm net width. The line on display will show how production can be shifted from high-capacity production of lamination films to recycled materials for industrial packaging.

K2022 show highlights

Thanks to the twin-screw and degassing unit, Reifenhauser’s EVO can safely process low-quality recyclate

Kiefel will be demonstrating a Speedformer KMD 78.2 Speed producing a tray made from an rPET film with a thickness of 0.35 mm

17SEPTEMBER / OCTOBER 2022

• Germany’s Brückner will present new line concepts with significantly higher running speeds for BOPP and BOPET. It will also show a new biax line for nylon (BOPA) that provides up to 80% more output, based on an increase in production speed from 220-350 m/minute and in line width from 6.6-to 7.4 m. For battery separator and capacitor films, Brückner will present a wider line of 6 m from the previous 5.5 m, to provide a 20% higher output.

• US Addex will display its short stack cooling ring, said to boost output by more than 25% compared to the company’s original Intensive Cooling Down-on-theDie version, which already improves output by 10-15% over conventional dual-flow air rings. In the new short stack configuration, the bubble is pulled through a circular enclosure located between the die and air ring that naturally pulls the bubble into an oversized air ring, which further increases output.

• US sheet machine maker Davis-Standard will show the latest addition, XP Express AGT roll stand, said to provide greater automation and process control. With a space-saving, multi-roll design, processors can take advantage of advanced cooling and polishing, die-to-nip management, web flatness, heat transfer, consistent sheet clarity, and improved performance for low-melt-strength resins.

• To reduce the amount of materials used, Dutch sheet extrusion equipment maker Meaf has partnered with Swiss foaming manufacturer Promix Solutions to add physical foaming capabilities to its extrusion lines. This allows for a further reduction in material use and lower weight, without compromising on features such as stackability and strength. Thanks to the use of nitrogen rather than the often used butane and propane, the process has almost no environmental impact.

Pipe/Profile

• Davis-Standard company Maillefer will display new MXD series extruders in 45 mm and 80 mm sizes. Beside the two extruders will be three ECH extrusion heads dedicated to three application areas; microdrip irrigation, blown fibre microduct, and heating and plumbing applications. Downstream equipment will

also be shown, featuring the most recent dual coiler and reeler technology with robotised handling capabilities.

• Battenfeld-Cincinnati will display its latest solEX NG 45 extruder for polyolefin pipes, featuring a processing unit consisting of an internally grooved barrel combined with matching screw geometry. This ensures a highquality for the extruded semi-finished product. When processing HDPE, these extruders also achieve a 25% higher output and for PP up to 40%. Another advantage is the 15% lower energy use than the previous solEX series.

Also, Battenfeld-Cincinnati says it has responded to the rising demand for higher throughput rates and more flexibility by developing a new pelletising extruder series for PVC, aglomEX counter-rotating parallel twinscrew extruder. This series includes two variants with or without electrically driven shear gap adjustment (EMS) and several machine sizes. With 93, 114 and 135, aglomEX models achieve output rates of up to 1,500 kg/hour and able to handle both dry blend processing and recycling of PVC windows.

Battenfeld-Cincinnati will display its latest solEX NG 45 extruder for polyolefin pipes

Compounding

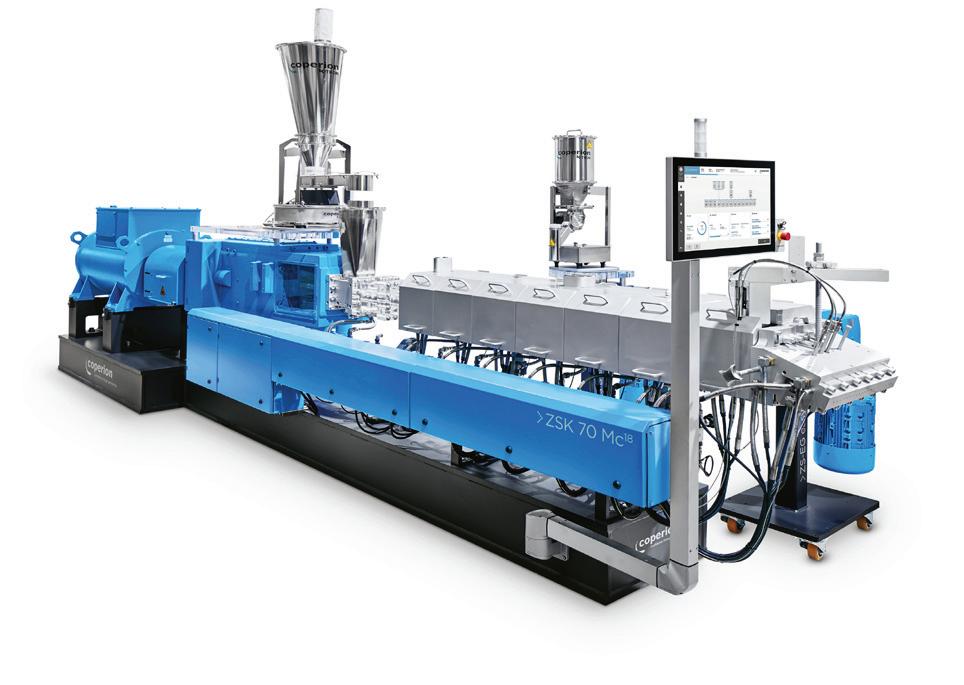

• Germany’s Coperion will be featuring the highperformance ZSK Mc18 extruder with 70-mm screw diameter. With its high specific torque of 18 Nm/ cm3, it is especially suited for compounding of plastics at very high throughput rates and with low energy consumption. The ZSK extruder is equipped with a ZS-B easy side feeder as well as a ZS-EG side devolatilisation unit. Thanks to their simple design, both units reduce the time needed for recipe changes or maintenance tasks, since they can easily be removed from the process section in just a few steps.

The ZSK 70 Mc18 twin screw extruder that Coperion is presenting has a 70 mm screw diameter and is equipped with numerous features that improve handling and enable increased efficiency in compounding and recycling

K2022 show highlights

Addex’s short stack cooling in trials running 90% LLDPE rich blend demonstrate a 28% increase in output over its original version

K2022 show highlights

Addex’s short stack cooling in trials running 90% LLDPE rich blend demonstrate a 28% increase in output over its original version

18 SEPTEMBER / OCTOBER 2022

A K3-ML-D5-V200 vibratory feeder from Coperion K-Tron will be on display at the main intake of the ZSK 70 Mc18. The ZS-B easy will be equipped with a K-MLSFS-BSP-100 Bulk Solids Pump (BSP) feeder.

Another highlight at the Coperion booth will be the STS Mc11 series laboratory extruder with a 25-mm screw diameter. It stands out with its simple design, user friendliness and easy cleaning. The STS 25 Mc11 will be exhibited with a Coperion K-Tron K-ML-SFSKT20 twin screw feeder.

Moreover, the new, preconfigured ProRate Plus feeder line from Coperion K-Tron will be displayed in all three available sizes: small, medium, and large. This continuous gravimetric feeder is said to be robust and an economical solution for reliable feeding of freeflowing bulk materials.

With the SP series dual-bearing strand pelletisers given a comprehensive facelift; Coperion’s SP340 model will be presented. Compared with the previous model, the new SP strand pelletiser allows even faster recipe and colour changes. The cutting chamber works with no dead space; thanks to its quick-release function, the cutting unit can be swapped out quickly and easily. The pelletiser’s interior has improved accessibility and is very easy to clean.

Coperion will also display its ZXQ 800 rotary valve, which works with especially low gas leakage, and was developed for powder intake into pneumatic conveying lines at up to 3.5 bar. Thanks to its huge capacity, it is suited for polyolefin manufacturing lines.

• Germany’s KraussMaffei will show its ColorAdjust technology, said to be the first of its kind on the market, on a twin-screw compounding extruder. Shredded medical caps will be compounded into a fibre-reinforced recyclate. The system combines a spectrophotometer and machine control to ensure precise, reproducible colours.

• With the new Mini-Compounder B-TSE-A 12/36, Brabender has now developed the smallest solution for recipe and process development or the production of very small quantities. It is a twin-screw extruder attachment for the MetaStation 4E and 8E drive units and can be used for plastics, pharmaceutical, food and feed applications, among others. The unit measures just 1.2 m in width and weighs 230 kg and can also be used as a table-top unit. Compared to its predecessor, the mini compounder can now process standard pellets up to 3 mm in diameter.

Recycling

• Weima will be exhibiting two new plastic shredders with single-shaft technology: the revised W5.18 universal machine and the WLK 1000 with FineCut rotor for secondary shredding. In addition, there is another machine premiere in the field of compaction.

With the new Puehler C.200 press, fine particles can be dewatered and compacted in a single step after the washing process.

• Under the Austrian Erema recycling group will be Pure Loop, Umac, 3S, Keycycle and Plasmac at the fair stand for the first time. Seven new recycling systems and components will be presented that enable large-scale plants with a production capacity of up to 6 tonnes/hour with recyclate quality and process stability. This is made possible by innovations in the plasticising unit that have been specially developed for high throughputs with low energy consumption, the new Erema 406 laser filter with a 50% larger screening area, and new digital assistance systems that will be launched and made available on the BluPort customer platform. These include, for example, the PredictOn app, which helps to anticipate and eliminate imminent malfunctions based on continuous measurement and evaluation of machine data.

• Germany’s Kreyenborg says it has delivered a tailor-made mixing system, to be used by a customer for a wide range of regrinds. Since the customer needed to reuse different materials from different mills and shredders, and in various batch sizes in their production, it wanted to have the greatest flexibility for the mixing system. Among other specifications, is to guarantee performance with speed, reproducibility, and precision, with a wide variety of regrinds. At the same time, the unit had to have a small footprint, mix small and large quantities of regrind, and be easy to clean when changing materials. The mixing system, designed by Kreyenborg, includes two of its Universal Quick Mixers, operated individually, for mixing smaller quantities, or they can be connected and used together. For smaller quantities, this has the advantage that mixing times can be reduced by around 50%. For larger quantities, the mixer volume can be doubled to generate a single, larger batch.

Kreyenborg’s Universal quick mixers were supplied for a tailor-made mixing system for regrinds

K2022 show highlights

Kreyenborg’s Universal quick mixers were supplied for a tailor-made mixing system for regrinds

K2022 show highlights

19SEPTEMBER / OCTOBER 2022

Recycling

Keeping marine litter at bay and useful with recycling

As the saga of marine plastic litter continues, the plastics industry is taking a serious look at recycling and to offer well-rounded solutions, says Angelica Buan in this report.

Of the marine litter found in the sea, plastics make up 90% of marine waste. Plastic waste's slow decay rates are impeding efforts to reduce marine litter quickly. Plastic waste production is also increasing, with estimates indicating that it could triple to 265 tonnes/year by 2060, up from 99 million tonnes in 2015.

Meanwhile, recycling, which has the potential to reduce plastic pollution in the environment, has been an underutilised solution. Only 9% of plastic waste is recycled globally, while 22% is mismanaged.

New “socially responsible” feedstock

A truckload of plastic enters the ocean every minute, or 8-12 million tonnes/year of plastic, with the production of plastic set to quadruple by 2050, according to data by the UN Environment Programme ( UNEP ).

The Canadian not-for-profit social enterprise Plastic Bank , which boasts over 23 thousand community members, has already stopped over 61 million kg of plastic, or an equivalent of over 3 billion of bottles, from entering the oceans, and engaging more than 600 recycling communities.

It builds recycling ecosystems in underdeveloped and developing communities to help counter both plastic pollution in the oceans and poverty.

Ocean-bound plastics are then reprocessed into what Plastic Bank refers to as “social plastic” and reintroduced into the global supply chain. These include PET, LDPE, and HDPE materials, available in bale, flake, and pellet form.

In 2017, German multinational firm Henkel became the first major consumer goods company to join forces with Plastic Bank. As of September 2022, Henkel has contributed to the collection of six million kg of plastic waste, which is equal to more than 300 million plastic bottles since 2018. Henkel's consumer business units in Laundry and Home Care, as well as Beauty Care, have introduced product packaging made from social plastic feedstock.

Meanwhile, Italian packaging company Carton Pack is the first and only fruit and vegetable manufacturer in Europe to offer packaging made entirely of social plastic feedstock.

Carton Pack adds it has already prevented over 440,000 kg of plastic - the equivalent of more than 22 million plastic bottles, from entering the ocean since partnering with Plastic Bank in 2020.

Thus, interest of using recycled feedstock is gaining strong momentum.

Bin there, done that: “bin” technologies to collect waste Elsewhere, practical technologies are game changers in combating marine litter, such as the Trashboom from German start-up Plastic Fischer , whose founders had the idea for their business when they saw a stream of waste plastic floating down the Mekong River.

Plastic Fischer, founded in 2019, is led by CEO/Co-founder Karsten Hirsch and describes itself as a "3L Initiative" - locally, low-tech, and lowcost. According to the company, it develops "very simple technology" in its location while boosting the local economy.

Plastic Bank's "social plastic" reprocessed ocean-bound plastics that are reintroduced into the global supply chain

20 SEPTEMBER / OCTOBER 2022

TrashBoom is a swimming barrier made of readily available materials such as PVC pipes and PET bottles that stops the vast majority of floating plastic in rivers. Trashboom has been tested in Bali, Indonesia, in 2019. The next stops will be in Bangalore, Varanasi, and Thiruvananthapuram, India; Bandung, Indonesia; and Ho Chi Minh, Vietnam.

Plastic Fischer claims to have collected, sorted, and processed river waste in a safe and "as good as possible" manner. All recyclables are sold to a local recycling company, while non-recyclables are incinerated with energy recovery (thermal recycling), in accordance with international best practices.

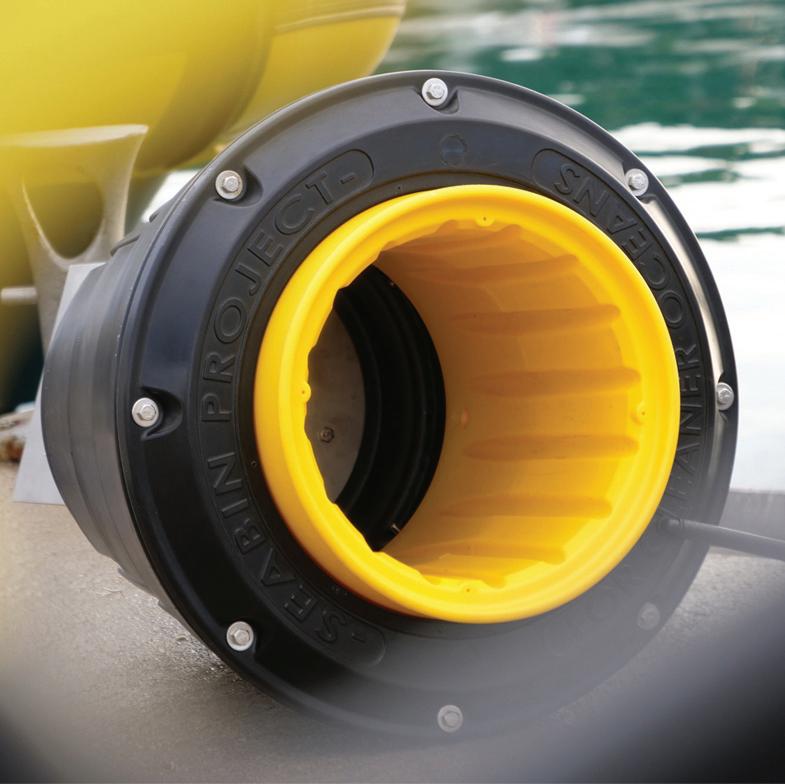

Another venture is the Seabin Project, created as a long-lasting floating garbage can capable of collecting water-borne plastics and trash 24 hours/ day, by Andrew Turton and Pete Ceglinski, two avid water lovers. Turton and Ceglinski launched Australian company Seabin Pty Ltd in 2015 and the Seabin project.

Recycling

The V5 Seabin unit, which features a sturdy and 100% recyclable plastic mesh, is a floating debris “skimmer” designed to be installed in the water of marinas, yacht clubs, ports, and any other water body with a calm environment. The seabin’s catchbag holds 20 kg of debris and acts as a filter for both macro and micro floating waste. It is installed in a specific problem area in the marina on a floating dock, enabling the wind and the currents to push the debris directly to the seabin.

The Seabin project team is now working on developing a recycling programme to reuse captured plastic waste and contribute to the circular economy.

More ways to recycle difficult plastics

Oneworld Japan Corporation , based in Osaka, has developed what it says is a one-of-a-kind device called Urban Rig, which uses pyrolysis to decompose marine waste and recover oil, charcoal, and metals for recycling.

The V5 Seabin, a floating debris "skimmer," has a sturdy, 100% recyclable plastic mesh and a catchbag that holds 20 kg of debris