The legacy sector was at first apprehensive (would the increases in CGT and potentially IHT deter people from leaving a legacy?); then reflective (the tax incentives could lead more people to leave legacies); then relieved.

The fact that the tax relief associated with legacy giving remained and the threshold for IHT was kept at its previous level meant that there was scope to attract more legacies – a fact lawyers are being urged to point out to potential donors.

• Making a will is becoming more and more likely to be done online, according to the latest research. Around one in 10 wills are now being made online – a proportion that looks set to increase over time. Interestingly, an online will is more likely to include a charitable bequest, and those making a will tend to be younger and richer: there may be a connection between those two facts.

• Younger people generally are more likely to put their charitable tendencies into practice. The Charities Aid Foundation found that over half of 25-34 year old employees said they felt more loyalty to an employer that gives to charity – a figure that rises to nearly two

thirds among those aged 16-24. Older people are less altruistic, it appears. Or are they just more settled in their ways – and their jobs?

• All of which is leading charities generally to be feeling optimistic about the year ahead. Let’s face it, however; they start from a low base. It is difficult to be more pessimistic than the past couple of years have seen. The cost of living crisis is still there, however, so that optimism is tempered with a hint of realism.

• There is less optimism when it comes to charities’ dealings with their banks. Despite being harangued by MPs and the regulator, the banks seem to be impervious to the need to improve their performance. More than 90% of small charities reported at least one problem with their bank in the past year, according to research by the NCVO.

• There was one small victory for charities when it comes to legislation: the Data Use and Access Bill is to be amended to allow charities use of a ‘soft opt-in’ for email marketing, in common with commercial organisations. Let’s hope it’s not abused.

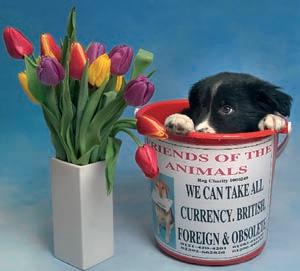

The photograph on the right of border collie Nipper was taken on the same day that he’d been taken to a vet’s to be put to sleep. Purchased as a ‘surprise’ gift, he was unwanted. This beautiful puppy was just eight weeks old and is just one of almost 10,000 animals rescued by Friends of the Animals.

There was a happy ending as –now renamed Stanley – he was rehomed with one of the charity’s voluntary drivers, who adores him.

Friends of the Animals began in March 1990 and had very humble beginnings. Veterinary treatment is invariably the charity’s biggest outgoing and to date they have spayed or neutered 45,000 animals. Thousands more have been wormed and inoculated – often for the first time in their lives!

Founder Helen Sinclair MBE, who was honoured for Services to Animal Welfare in 2014, takes up the story: “There have been many memorable cases, where we’ve saved animals’ lives against all the odds. Animals such as the puppy who slipped under the railings of a balcony – luckily bouncing off the conservatory roof which broke her fall. Then there was the dog who fell down a manhole in the road after someone had removed the cover, and poor Marshall, who had three broken legs and a severed ear.

“Susie, a Labrador/Staffy cross (pictured above), was badly burnt in a house fire, but made a good recovery; and the dear little cat above had everything wrong with him, but survived and thrived.

“When 11 month old Border Collie ‘J.J.’ came into our care, she had a pin / plate poking through

a badly infected front leg, a paw so badly crushed the bones had fused together and a stab wound.

“Her original owner pleaded guilty to causing unnecessary suffering to a protected animal and was fined £2,000 and banned from keeping an animal for ten years.

“As you can see from the wonderful photo below, ‘J.J.’ went on to much better things.”

Gifts in wills fund one in two veterinary treatments and so legacies are an absolute lifeline to the rescue and spaying/neutering work carried out by Friends of the Animals.

The charity has a policy of non-destruction, unless an animal is sick or injured with no hope of recovery, and they keep admin costs to a minimum. Very importantly, 90% of their staff are volunteers, which ensures as much of your gift as possible is spent on saving animals.

Pitted against that constant battle to save lives was the action of the person who set fire to the front of the Charity’s base.

“But, happily,” said Helen, “we're a resilient team and together with the help of supporters, we barely skipped a beat and just kept on going.

“We truly appreciate that people have many choices regarding charities to support, but no one appreciates it more, or tries harder than we do, to get the very best possible use from every penny donated. Thank you for your consideration.”

[IN JANUARY Remember A Charity, the umbrella group for charitable legacy giving, hosted a roundtable discussion at which professional advisers and legacy giving experts came together to explore the potential implications of the upcoming changes to Inheritance Tax (IHT) on legacy giving.

In the autumn Budget the Chancellor announced significant changes to the IHT framework that will impact charities and donors alike. While Agricultural Property Relief may have hit the headlines, the decision to bring pensions into the scope of IHT, coupled with a freeze on IHT thresholds until 2030, will have implications on a large number of taxpayers and could change the way people approach their estate planning.

The roundtable discussion explored the issue, aimed at helping charities anticipate the changes. Expert panellists shared their insights, while acknowledging that there is still a great deal of uncertainty about what lies ahead.

Led by Anaish Yilma-Parmar, chair of Remember A Charity and head of legacies at the British Red Cross, the panel included Alex McDowell, director of fundraising at the Duke of Edinburgh’s Award, Ian Bond, representative of The Law Society’s Wills & Equity Committee, Tanya Watson, senior director of private client services at Alvarez & Marsal and Rachel Steeden, head of legal at Stewardship.

Remember A Charity posted this report of the event.

During the session panellists cited the importance of charitable legacies and the role of tax incentives in growing this form of giving. In the UK any charitable donations in wills are tax-free and estates gifting 10% or more qualify for a reduced IHT rate of 36%.

While a minority of estates pay IHT, Alex McDowell referenced HMRC data showing that over £2bn a year is donated from estates using the charitable incentive and around half of that – a little under £1bn –comes from those paying the reduced IHT rate of 36%.

Panellists agreed that the motivation for giving is typically altruistic, rather than being driven by the fiscal benefits, but that charitable incentives do have a key role to play in bolstering the volume and value of legacy gifts. Tax incentives make it all the more relevant for solicitors and professional will-writers to raise the topic with clients and that is crucial when it comes to normalising legacy giving.

Delving into the IHT rules, Ian Bond discussed the current framework, what’s changing in April 2027 and why it is such a fundamental shift. The panel discussed how pension pots had been used as a taxeffective savings vehicle for many years, meaning that the number of people facing an IHT bill will increase considerably, and many more will need to change or review existing estate plans. Indeed, professional advisers in the room commented on the increase in questions about IHT from their client base.

It was also highlighted that testamentary freedom is a key pillar for wills (with some variance in different parts of the UK), but that the rules for how pensions can be allocated are much more specific. Pension plans often sit outside of a will and are subject to specific rules around how they can be passed on after death. So, for those who wish to donate to good causes from their estate and make use of their pension pot to do so, Rachel Steeden highlighted that it’s not easy – particularly for those with dependants.

While it’s uncertain what process changes will be introduced to draw together the worlds of pensions and wills, the group discussed several potential ways it might impact legacy giving, covering both the opportunities and risks.

The threat of an increased tax bill could certainly run the risk of people feeling more apprehensive about their wealth and less able to

support good causes. Tanya Watson highlighted that uncertainty tends to make it more difficult for people to plan ahead and make decisions. But panellists agreed that it also creates an opportunity for legacy giving to grow, with more people looking for ways to reduce their tax bill and turning to estate or tax planning professionals to support them with their decision making. That may also lead to an increase in the use of discretionary wills and expressions of wishes, alongside Deeds of Variations.

A common theme was that professional advisers and charities can add great value in supporting their clients and donors respectively; not just when it comes to the tax savings, but when contributing to a values-led approach for passing on wealth.

In the lead up to the pension changes in April 2027, there is a considerable job to be done in making the public aware of the changes coming in for IHT and ensuring people understand they may need to make or review their estate plans.

From Remember A Charity’s perspective, they recognise there is a need for and opportunity to work collectively with members and partners in the legal and financial sector to ensure the law makes leaving a charitable gift through a pension more accessible and taxeffective. Doing so would not only open up opportunities to grow legacy giving, but also improve and streamline the estate planning process for supporters.

Further updates are planned in the coming weeks. q

[WHILE MUCH ATTENTION was paid to the changes in the Budget regarding Inheritance Tax (IHT), there were two important elements that remained the same. These were explained by Alex McDowell (pictured), director of fundraising at the Duke of Edinburgh’s Award and vice chair of Remember A Charity, in a blog on the umbrella organisation’s website.

The constants: retained charitable incentives and frozen IHT thresholds

Alex began by looking at what has stayed the same and why that matters.

“The government has chosen to retain the charitable incentives for estates that are liable for Inheritance Tax – this is something we have campaigned for repeatedly over the years. It has also frozen IHT thresholds until 2030.

“The latter is significant because it means the number of estates that qualify for IHT is likely to continue rising as inflation drives up the values of estates. Naturally, this also means more estates will be able to benefit from charitable gift exemptions and a reduction in IHT rate (from 40% to 36%) where 10% of the estate’s net value is gifted to charity.”

He explained that, together those two constants are very significant for legacy giving.

“Remember A Charity’s research with the Behavioural Insights Team and Co-operative Legal Services shows that, when solicitors or

[EVERY DAY IN THE UK, one in 700 babies is born with a cleft lip and palate – the most common birth anomaly.

This condition can profoundly impact a child’s appearance, speech, hearing and dental development, often leaving lasting psychological scars.

In many developing countries, cleft surgeries are delayed – or never happen – leaving children malnourished, struggling to communicate and facing social exclusion.

At CLEFT we dream of a future where clefts are preventable. Until then, we are dedicated to improving lives – both in the UK and around the world.

Support groundbreaking research

By funding pioneering research, we’re uncovering the causes of clefts and developing kinder, more effective treatments for children everywhere.

Expand global cleft care

We work to establish cleft centres in low and middle-income countries, ensuring children there have the same opportunities as those in the UK. q

Every donation brings us closer to transforming countless lives. Leave a legacy of hope and healing.

advisers simply mention the option of charitable giving, the likelihood of a charity being included in the will doubles; and, crucially, charitable IHT incentives are the most common reason for professional advisors to mention legacy giving with their clients.

“With clear evidence of an increase in legacy giving rate just above the IHT threshold, there can be little doubt these incentives influence charitable will-writing behaviour. What’s more, estates that incur IHT are disproportionately important to overall legacy income, with around half of the £4bn charities receive annually from gifts in wills coming from estates that make use of charitable gift exemptions.

“Notably, almost £1bn of this income came from estates that leveraged the reduced IHT rate (of 36%) by donating at least 10% of the net value of their estate to charity.”

Alex went on to discuss the effects the changes to IHT will have, as discussed at January’s roundtable. His full article can be read at www. rememberacharity.org.uk q

[ PROMOTING AND ASSISTING in access to justice in the Family Court is the aim of Parenting Together, a charity set up by former youth worker Gerry Hannah.

Gerry points out suicide is the most common cause of death among young people – often prompted by the depression caused by family break-up. He believes that in many cases the break-up of the family is avoidable if parents are able to present their version of events.

Said Gerry: “British Family Courts sit in private and they convict parents merely on the ‘balance of probability’. In some cases a judge is persuaded to make a misinformed decision based on race, gender, heritage, beliefs and social status – often causing serious depression which can have lethal consequences.”

Gerry formed his association with humanitarian experts and professionals to ensure low-income, disadvantaged parents involved with social services or Family Court proceedings receive fair and equal justice.

He added: “We mostly provide specialist legal services, advocacy and reports for disadvantaged parents in Family Court proceedings. Our experts, professionals and associate solicitors often work pro bono to help us resolve exploitation and unlawful abuse of the family

law and child protection systems. We framed our projects on the government’s Every Child Matters report, published in 2003, that recommended engaging families in the care and protection of children.”

He points to cases of parents with learning difficulties asking people on social media for advice when they cannot understand the legalese, acronyms and procedures.

“They are usually misguided, posting views and comments that go against them in court. Their social media ‘friends’ are often predators who exploit single parents with young children. We recently submitted evidence to the CPS against a few of these sexual predators targeting our vulnerable parents and their children.”

The current project is a continuation of Honeypot Families, a work-in-progress study comparing families in the safest happiest regions of the UK with families in what Gerry describes as ‘the most dangerous city in Europe’.

“We concluded that Judeo-Christian families functioned efficiently to provide the best outcomes for everyone because they are based on a mutually agreed contract where adults vow to love, care and respect each other until death.” q

[ ALMOST ONE IN 10 WILLS are now made online: a figure that is set to grow over the next few years as online channels become increasingly viewed as a more convenient and affordable way to make a will.

That was the conclusion drawn from Online wills through the eyes of the consumer, a public briefing paper from Legacy Foresight – part of the Legacy Futures consortium.

For a large number of charities, online wills are being used to attract and engage would-be donors, providing an effective, scalable and measurable way to generate legacy gifts.

The research brought to light the opportunities and challenges associated with the increasing popularity of online wills.

The key findings from the research were:

• Nearly one in 10 (9%) of people who have created a will

• have done so online, and one in five who have yet to make a will

• plan to do so online.

• Wills made online are more likely to include a charitable gift.

• Online will-makers are more likely to be younger, have a higher

• household income, be working, single and have children than the

• average will maker; however, a significant proportion are aged over 65.

• Charities’ association with online will providers and products lend

• credibility and trust, serving to endorse them.

The research identified a number of key challenges, however.

Confusion exists around the role of the charity in the online willmaking process, with some people unsure whether they are ‘supporting’ the charity just by using the service, or believing the service is part of the charity’s provision.

Many consumers assume that all online will products are broadly the same. When carrying out research to decide which provider to use, their focus is more likely to be on ensuring the company is reputable and that the process of making the will is smooth, rather than the finer details and terms and conditions of the individual product and whether it fits their requirements and circumstances.

The research also found that a consumer’s journey to making an online will is not linear: long time lags were reported between the initial

[FAILING EYESIGHT is nothing short of a personal catastrophe. Do you have a family member, friend or neighbour who is gradually losing their sight?

Reading, recognising friends and living skills are all affected as your sight is going – and it’s much harder if you live alone.

The National Federation of the Blind of the UK (NFBUK) keeps its members in touch with general information, help and updates on what’s going on.

The charity produces bi-monthly news magazines and circulars in audio, braille or electronically, which members can read independently. It also encourages blind and partially sighted people to play a fuller part in society. q

• For further information contact NFBUK on 01924 291313, email admin@nfbuk.org or visit www.nfbuk.org

consideration (to leave a legacy gift) and the action (to commit to the gift in a will).

As consumers go through the online will-making process – moving from consideration to execution – the visibility of the charity often reduces, with the online will provider becoming more prominent.

The research flagged areas for charities to be aware of when forming online will partnerships and promoting this service.

Clarity and transparency: Charities need to be clear about their offering, why they are offering it and their role in the process, so consumers understand their motivations and how to support them.

Optimising the potential for gifts: Given that online wills are attracting a larger proportion of younger consumers, charities need to consider how to effectively steward supporters over a longer period.

Managing risk : as consumers are more likely to trust an online will provider due to its association with a charity, charities must make sure that they understand the finer details of each of the products and that their chosen partners are offering quality, ethical and compliant products.

The full report can be downloaded from www.legacyfutures.com q

For 140 years Edinburgh Dog and Cat Home has been there for the dogs and cats who need us.

We give our all to keep loving homes whole with support from our pet food banks. And when that’s not possible, we take in the animals who need us and love them as if they were our own.

One in three animals cared for at the Home are supported by the generosity of legacy gifts.

With the help of these funds, hundreds of dogs, cats and their people have been given an opportunity to form bonds that last a lifetime.

And it doesn’t stop there. Gifts in Wills ensure that this unconditional love and loyal companionship will be carried forward for future generations.

Whether it's the beloved dog who’s been with you through thick and thin, or the cat who greets you with an affectionate headbutt every time you come home, your pets are always there for you. By leaving a gift in your Will to Edinburgh Dog and Cat Home, you will always be there for them too.

Head of Fundraising, Gillian MacAulay says: “This support can transform the lives of the hundreds of vulnerable animals who need our help each year – for as long as they need it. By leaving a gift, your love and compassion for animals can live on.”

To find out how to make a lasting contribution, please contact Aiste Klisyte, Legacy Officer at aiste@edch.org.uk or visit edch.org.uk/support-us/gifts-in-wills

[ANIMAL CHARITY Wild Futures rescues and offers sanctuary to monkeys who have suffered abuse and neglect. They are dedicated to protecting primates and their habitats worldwide – primates are endangered due to climate change, habitat destruction and the bush-meat and pet trades.

For some species, it is too late. The future of all that remains lies in our hands, so leaving a legacy to Wild Futures is the gift of life and a future for primates and our wonderful planet. Wild Futures’ holistic approach makes them unique – providing sanctuary to rescued

monkeys, supporting projects overseas, campaigning for primate welfare, educating to protect primates worldwide and promoting a sustainability and ethical ethos.

They receive no government funding, so the generosity of those that remember Wild Futures is essential to enable them to continue their work. A legacy can be the gift of a life worth living and a wild and safe future for all. q

• For more information call 01503 262532, email giving@wildfutures.org or visit the webiste at www.wildfutures.org

[ ON 31 JANUARY applications opened for the Institute of Legacy Management Awards 2025. There are two awards to be had: Legacy Professional of the Year and ILM Mentor of the Year.

Legacy Professional Of The Year 2025: This year ILM have once again aligned the award with its mission and values, and nominations can be made for an ILM member in the legacy management sector who reflects those values and deserves to be recognised.

“We really want to hear about people who have taken that extra step to support their team, who champion equality and diversity, listen to others and work collaboratively to get things done,” the ILM stated.

The nomination criteria are that only ILM charity members can nominate and nominees must also be members. ILM directors and staff cannot be nominated; and neither can ILM directors or staff nominate. The nominee must reflect one or more of the ILM values: ambitious, collaborative, knowledgeable and kind.

ILM Mentor Of The Year 2025: ILM members who have a general mentor who has supported them well in their role can be nominated for this award. Or maybe they have previously studied, or are presently studying for the Certificate in Charity Legacy Administration with the aid of a mentor?

Nomination for the award is a chance to acknowledge that support and to show appreciation for someone who has really made a difference.

Nominations will need to include the name and organisation of the

[FOR OVER 80 YEARS Ferne Animal Sanctuary has given hope to animals in desperate need, working tirelessly to find forever homes for those who have never known warmth and safety or offering lifelong care for sanctuary residents.

Much of the support their animals receive – including food, a comfortable bed and veterinary care – is only made possible thanks to the generosity and support of those who believe that every animal deserves a second chance.

By leaving a gift in your will to Ferne Animal Sanctuary, you create a lasting impact that extends far beyond your lifetime. Your legacy will ensure that countless animals receive the love and care they deserve, providing a lifeline for those who have nowhere else to turn.

Not only will your gift secure a brighter future for those who need it most, but it’s also a testament to your unwavering dedication to the wellbeing of animals. Consider leaving a gift to Ferne Animal Sanctuary and help to give every animal a chance to feel safe, happy and loved. q

mentor, which year the mentoring started, whether the mentoring process is still happening or how long the relationship was for. Most importantly, nominators will be asked to write a brief summary of why they feel their mentor should be presented with the award.

Winners will be announced at the ILM Annual Conference on 9 May.

The conference will also see the winners announced of the Crispin Ellison Bursary Award. The bursary is named in memory of former Legacy Link director Crispin Ellison, whose career was dedicated to advancing professional knowledge in the legacy sector. It is open to applicants from the UK who are looking to further their professional development in the area of legacy administration and management.

Two winners will each receive a training package from the Institute of Legacy Management up to the value of £1,000. For example, that will cover the cost of attaining the Certificate in Charity Legacy Administration or any equivalent training package.

Applications for the 2025 bursary are open until Friday 28 March.

Ashley Rowthorn, CEO of Legacy Futures, which now administers the bursary, commented: “Our mission is to help charities grow with legacy giving. As part of our commitment, we set up the Legacy Futures Bursary Awards, aiming to invest in the future talent that will take our sector forward.

“If you are an aspiring legacy management professional, we encourage you to apply for the Crispin Ellison Bursary. Now in its 9th year, we are funding another two people through their ILM Certificate in Charity Legacy Administration.” q

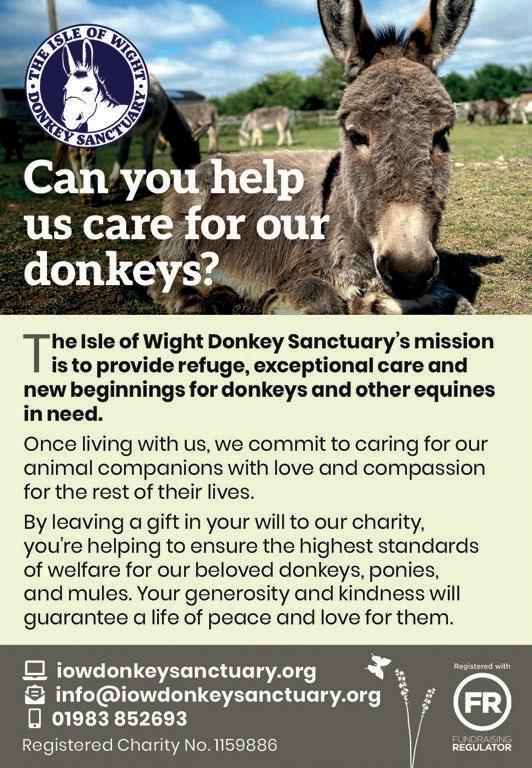

[ AT THE Isle of Wight Donkey Sanctuary, we provide a caring haven for donkeys, mules and ponies in need, whether from maltreatment, loss of grazing, rescue from slaughter, or simply when their owners can no longer care for them. We welcome these beautiful, inquisitive animals, caring for them with love and kindness throughout their lives.

Leaving a gift in your will is a heartfelt way to show your love and support for our donkeys, ponies and mules. Legacies from compassionate supporters enable us to continue providing the highest levels of care and welfare for every animal in our care.

The bonds between donkeys and humans are truly unique. Simply being in their presence can bring joy and comfort. We support many people to develop skills, build confidence, or simply to help them experience a loving connection with our animals. Your gift in a will can help ensure a happy and healthy life for the animals under our care, leaving a legacy of love, not only for our donkeys but for the many lives they touch.

Our mission is to provide refuge, exceptional care and new beginnings for donkeys and other equines in need. Can you support us by leaving a gift in your will? q

[LEGACIES MEAN SO much to the team at Last Chance Animal Rescue. These wonderful gifts have helped them to rescue, rehabilitate and re-home so many abandoned, abused and unwanted dogs, puppies, cats, kittens, rabbits and guinea pigs who otherwise would have had no future.

The charity understand the wishes of its kind benefactors who have considered them in their Wills. A spokesperson said: “We know they want their generous gift to us to be used directly to save lives, provide the very best of care and to find loving homes.

“Legacies really do provide the gift of life and Last Chance Animal Rescue can now, after much planning and prudent use of funds, offer our life saving services to so many more needy pets. We are delighted to announce we now have a second rescue and rehoming centre in Kent, giving hope and a true last chance to so many.

“Sadly we cannot thank those who have enabled this wonderful achievement but are extremely grateful to all those who are currently considering helping us now and in the future to continue our work.” q Pixie

[REMEMBER A CHARITY has announced a new partnership with South West law firm Lyons Bowe Solicitors: helping raise awareness and inspire more people to leave a gift in their will.

Specialising in wills and probate, property and family law, Lyons Bowe is keen to ensure its clients understand the option of including a charitable gift when writing their will. Lyons Bowe’s provision of will-writing services for charity supporters has already resulted in legacy pledges of £4m to UK charities in 2024.

By partnering with Remember A Charity, Lyons Bowe aims to help charities to continue to connect with more supporters, and in turn grow this vital income stream. That includes making their property and family clients aware of the importance of making a will at key stages in their life – such as getting married or divorced, and buying or selling property.

Paul Lyons, managing director and head of conveyancing at Lyons Bowe, explained: “Last year Lyons Bowe made significant strides in positively impacting our community and wider society – partnering with National Free Wills Network and Will Aid, as well as directly with charities. With the help and support of our clients, our work raised significant donations for charities. This year we are thrilled to announce a new partnership between Remember A Charity and Lyons Bowe Solicitors.

“Through this collaboration our goal is to educate our clients on the importance of making a will in both securing their family's future and how they can leave a lasting legacy by supporting charities that matter to them. As part of this initiative, Lyons Bowe will be offering discounted fees for clients who choose to leave a gift to a UKregistered charity of their choice in their will. It is our hope that this partnership will help more people understand the value of charitable giving and inspire them to make a difference.”

Lucinda Frostick, director of Remember A Charity, added: “We know from our consumer research just how important key life stages are in the will-writing journey. Whether it's family changes, from birth to marriage, or the purchase of a new home, these life events are a natural moment to write or review our will, considering all those we care about – family, friends and good causes alike.

“We’re delighted to partner with Lyons Bowe to ensure all clients seeking advice on matters of property and family law, as well as willwriting clients, are aware of the importance of reviewing their will, and that they have the opportunity to include a gift to the charities close to their heart.” q

[HESSILHEAD WILDLIFE RESCUE TRUST is situated near Beith, in North Ayrshire. It was set up as a charity in 1986, although its founders Andy and Gay had been caring for injured and orphaned wildlife since 1970, when they rescued a fox cub from a gamekeeper and his dogs. As the number of casualties increased year on year, Andy and Gay needed financial and practical help.

Once the trust was set up, new aviaries and enclosures were built. A membership scheme proved popular and many volunteers were recruited. The Centre now occupies a 20-acre site, including woodland, marsh and open water, this gives a variety of release sites for its patients.

Approximately 3,500 wildlife casualties are now treated each year, with the aim of returning them to the wild. Among the many hedgehogs, foxes and familiar garden birds, there are deer, otters, badgers and seals. In addition, swans are treated regularly, along with buzzards, peregrines, herons and sea birds.

The centre operates a 24-hour rescue service and there are more than 60 enclosures and aviaries, a hedgehog hospital, a seal/swan unit and intensive care facility. It also offers training courses on the handling, care and treatment of wildlife casualties.

Spring and summer are especially busy, with hundreds of nestling birds being hand reared. Care is taken to rear all youngsters with minimum human contact. That prevents wild birds and mammals becoming too used to people, so giving them a good chance of survival in the wild.

Hessilhead is primarily a voluntary organisation. Its volunteers help in many ways: fundraising, building and maintenance, driving patients to the centre and daily cleaning and feeding. q

[FOR OVER 60 YEARS, Animal Action Greece has been a lifeline for thousands of animals across the country. Every day, we rescue, treat and protect Greece’s most vulnerable animals, including street cats struggling to survive, abandoned dogs, and working donkeys, mules, and horses suffering from neglect and overwork.

Many animals, like Dorothèa the donkey (pictured above), face unimaginable challenges.

Dorothèa, whose name in Greek means ‘gift from God’, has been through more than most of us can imagine. This resilient donkey once worked tirelessly transporting tourists in a gorge. But when she was no longer wanted, she was handed off to a hoarder, where she suffered neglect and maltreatment. Later, she was used and then abandoned by an American film crew after filming a movie.

Her journey has been incredibly tough, but we are happy to share that Dorothèa was rescued and now lives in a donkey sanctuary in Crete, where she is finally safe and able to live out the rest of her days.

But our work is never done. The challenges animals face don’t disappear overnight, and without support, many will continue to suffer.

That’s why leaving a gift in your will is one of the most powerful ways to ensure that our vital work carries on long into the future.

By choosing to leave a legacy, you can help us:

• Provide urgent veterinary care to stray animals who have no one

• else to turn to.

• Support community neutering programmes, preventing thousands

• of unwanted kittens and puppies from being born into hardship on

• the streets.

• Ensure that donkeys, horses and mules receive the farriery, dental

• and veterinary care they need to live free from pain.

• Respond to emergencies, offering lifesaving treatment and shelter

• to animals affected by disasters such as floods and forest fires.

Every gift, no matter the size, has the power to change lives.

Your kindness today can shape a better tomorrow – one where no animal is left to suffer alone.

Will you help us create a future where every animal gets the care they deserve? Please contact us via the details below to find out more. q

[ON 23 AND 24 JANUARY, the Institute of Chartered Accountants of England and Wales (ICAEW) held its two-day virtual Charity Conference. Nearly 1,500 members attended and, despite a varied mix of technical updates, lively panel sessions and thought-provoking keynotes, certain themes were repeated throughout the conference.

Kristina Kopic, head of charity and voluntary sector at the ICAEW, summarised those themes as the ‘Five Cs’: Charities SORP (Statement of Recommended Practice), Confidence, Collaboration, Cash deposits and Continuing Professional Development (CPD).

Charities SORP

Unsurprisingly, the Charities SORP 2026 loomed large in the minds of conference delegates and speakers. In its Accounting Update, ICAEW explored the consultation timeline and discussed how to prepare for the changes, which will take effect in periods beginning on or after 1 January 2026.

The issue was also addressed by Charity Commission CEO David Holdsworth in his keynote speech. He said: “The commission, in its role as the joint SORP-making body, will soon be launching a consultation seeking views on proposed changes to the Charities SORP.

“The SORP ensures consistency and transparency across the sector, making charity accounts comparable and understandable for donors, beneficiaries and the public alike. It represents a gold standard in charitable financial reporting that many other countries seek to emulate.”

The SORP is being updated to reflect the changes to Financial Reporting Standard 102 and the two key areas of concern: changes to lease accounting and revenue recognition.

Kristina Kopic explained: “The need to speak more confidently about our sector echoed throughout the conference. Charity Commission CEO David Holdsworth

mentioned the humility of charity leaders he regularly encounters, while the ‘reframing overheads’ panellists challenged us to speak more confidently about our cost base and redefine ‘overheads’ as ‘enabling functions’.”

Closing keynote speaker Dr Danny Sriskandarajah invited those attending to re-define the sector: “We’ve ended up being backed into this corner to say that we’re the third sector; we’re the non-profit organisations; we’re the non-governmental organisations. Why on earth are we letting ourselves be defined by what we’re not? We should be saying what we're about, which is about humanity; about community; about solidarity.”

The opening keynote from Concern Worldwide (UK)’s Sayyeda Salam outlined the global challenges that the charity sector and its beneficiaries face. With one in five children currently living in a conflict zone, and climate change wreaking havoc on food systems, the charity sector alone will not be able to solve the world’s biggest challenges.

Salam emphasised the role of donor governments and multilateral institutions, including the need to fully fund projects with sufficient flexibility to ensure that charity resources can be used effectively. Salam also advocated for multi-stakeholder relationships, bringing together civil society, governments and the private sector to tackle global challenges. That was echoed by Dr Sriskandarajah, who encouraged charity leaders to reimagine economic organising so that people and planet are put first, and advocated for more co-operatives, mutuals, citizen assemblies and more direct participation.

Several sessions mentioned the banking challenges that charities frequently experience. Kristina Kopic quoted the Q&A following David Holdsworth’s address, in which he emphasised that it was unacceptable

[THE MISSION of Three Counties Dog Rescue is to accept, care for and find homes for unwanted, lost and stray dogs and cats and to ensure their wellbeing afterwards. The charity was founded in 1971 and since then they have improved the lives of over 7,800 dogs and cats.

Before rehoming, all animals are vet checked, neutered, vaccinated, microchipped and kept in suitable conditions. Rehabilitation costs are a major part of the charity’s annual expenditure of over £200,000. Healthy animals are never put down. As part of that non-destruction policy, several elderly dogs are kept in long term foster care. However, this means that the charity can incur large veterinary costs to maintain a dog’s health while they await a new permanent home. They now provide boarding and cremation services with profits supporting the Rescue.

Every penny raised goes to improving the lives of dogs and cats. Three Counties Dog Rescue is run entirely by voluntary and unpaid helpers, who also meet their own expenses. q

for banks to deny charities access to banking, and reassured us that the Charity Commission was engaging with the FCA and politicians to improve charity banking.

CAF Bank CEO Alison Taylor highlighted some of the risks that working around those challenges bring, such as trustees or charity leaders using personal accounts when bank accounts were frozen unexpectedly. While the banking sector engaged positively with the charity sector in the creation of UK Finance’s Voluntary Organisation Banking Guide, more action is needed, and David Holdsworth encouraged charities to report banking challenges to the regulator so that he can advocate on the sector’s behalf with real-life examples.

According to Kristina Kopic, one of the key objectives for the Charity Community of the ICAEW is to offer charities free and low-cost CPD options on a wide range of relevant charity topics.

“However,” she writes, “with rapidly evolving technology and ways of working, I’d encourage you to look at other development areas, too. In our panel session about the future of the accountancy profession, ICAEW’s CEO Alan Vallance reminded us that, as professionals, we need to embrace lifelong learning and to learn from other sectors, too.

“Fellow panellist Kath Qualtrough, interim finance director at CFG, explained that she trained as a professional coach to get the most out of her team, especially as evolving automation will free up their time for more valueadding tasks and many charities now operate in a hybrid working environment.

“Meanwhile, Sage Intacct’s Grant Gevers encouraged finance professionals to lead finance transformations with a hands-on iterative learning approach, tackling tasks that are directly relevant to their role first to build up confidence.”

Kristina is now preparing the schedule for the 2026 conference, based partly on feedback from this year’s event. q

[“I’VE HAD EPILEPSY all my life, so I thought I’d leave something for The National Hospital because of all the treatment I’ve received over the years,” said Richard Atterwill, 79, who has decided to make a legacy pledge to the National Brain Appeal, having been treated at the National Hospital for Neurology and Neurosurgery in Queen Square, London, for more than six decades.

“I first visited The National Hospital in 1958, when it was still called The National Hospital for the Relief and Cure of the Paralysed and Epileptic,” recalls Richard who was 13 when he received his diagnosis at the hospital. “I remember it having heavy, ill-fitting wooden doors that didn’t close properly. We sat outside on a row of chairs waiting for our names to be called. So, if you were keen at listening, you could hear other people’s appointments! But treatment at The National Hospital has aways been outstanding.”

The first consultant to treat Richard was celebrated neurologist Professor MacDonald Critchley, one-time president of the World Federation of Neurology and author of 20 books and more than 200 published articles on neurology.

“He was an eccentric man,” said Richard, “He always used a ledger for writing and used to dip his quill into an inkwell. He was very smartly dressed generally, but he used to cross his legs and – bless him – he didn’t realise or didn’t want to realise that the soles of his shoes were coming away: like alligators, both of them! He was very nice.”

Since those early days Richard has been under the care of numerous

consultants, most recently Professor Matthias Koepp, whom he still sees for bi-annual checkups. He has seen a lot of changes in prescribed treatments and medications over the years as well.

“Originally the only drugs were Luminal and Tofranil. In those days I was taking about 12 tablets a day. I used to wake up in the morning and feel a bit tired, and then I’d take my tablets and be knocked out for the day.”

Richard had attended St Benedict’s School in Ealing since the age of eight, but the impact of his epilepsy, including violent bouts of vomiting, led him to leave school aged 13.

“There was a meeting between the council and psychologists and so on; and they voted about five to three that I should no longer be at school and could work at my father’s business with no pay. He was a turf accountant and had offices in Jermyn Street, London. I did clerical work there or talked on the phone to customers.”

Today, Richard’s epilepsy is well-controlled and he has learned to live with what he named ‘The Unwelcome Visitor’, or ‘TUV’.

“There have been ups and downs: with epilepsy, one minute you’re there and one minute you’re gone; and you wake up with a paramedic each side of you,” he said. “Sometimes I get lots of auras or attacks out of the blue; but I always aim to look on the bright side of life. It hasn’t stopped me holding down jobs over the years.”

For 21 years Richard worked for a manufacturer of car accessories, TriCo Folberch, where he met his wife Lorna in 1985.

“I’ve been lucky, apart from two jobs, where I was sacked because I had epilepsy,” he explained. “In those days there was no protection for people with disabilities.”

His final role was with the Metropolitan Police and he retired in 2010 to care for Lorna, who had been diagnosed with Alzheimer ’s at Queen Square some years before.

“My dear wife’s gone now,” he said. “She died in January 2014, but I lost her before she died because she had developed Alzheimer ’s in 2004, and you don’t get another decade with someone who’s got Alzheimer’s; you just drift further apart.”

Making a legacy pledge allowed Richard to make provision for his own future care before making a charitable gift.

“I had a second stroke three years ago, and if I ever need care at home I have to put that before anything else. So I’ve got a certain amount put aside in my bank to cover care costs; and now that’s in place I can put an amount towards The National Hospital. I’ve left it up to the National Brain Appeal to decide what it goes towards. It was just a thank you to the hospital.” q

• To find out how you can leave a gift in your will, visit www.nationalbrainappeal.org/giftsinwills

[THE HORSE RESCUE FUND is a long-established equine charity. In 2025 they will be celebrating 75 years of service to the equine welfare industry. The charity has a colourful history of pioneering work in changing attitudes towards equine welfare. Most recently they have had to adapt to helping horses relinquished to them due to economic problems or those associated with the social welfare issues of their owners.

As a smaller charity in the equine sector, it is unfortunately often overlooked for funding, which makes the 75th anniversary year celebrations all the more important for raising awareness as well as funds.

In the 75 years since the fund was established by the Walbanke family, hundreds of horses have been given a second chance at a happy life. From early days in their back garden to the purpose-built yard occupied today, the ethos has remained the same – Rescue, Rehabilitate, Rehome

The charity currently has over 50 horses out in homes and can house up to 20 horses, ponies or donkeys on the yard, if needed. These horses, once in their care, are treated as individuals – staying at the yard until they are emotionally and physically ready for rehoming.

A spokesperson commented: “We feel that although we are not trying to turn over numbers, as a smaller charity we can make a real difference to the individual horse, offering a lifetime of ongoing care and support.”

This year the charity is running far more events than they normally do to celebrate the Diamond Jubilee! They need as many people as possible to participate and help them to continue their vital work. They aim to raise a substantial amount between now and December. The details of the events planned can be found on the website. Whether you are local to the charity or not there are many things you can participate in. No horse? no problem –there are non-riding events planned as well!

There will be an event taking place every month from March, keep an eye on the Horse Rescue Fund on social media and their website for details. q

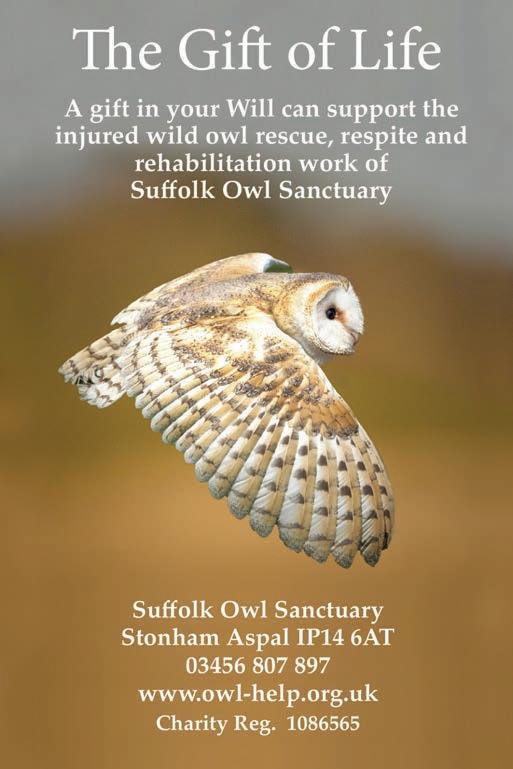

[ESTABLISHED IN 2001, the Suffolk Owl Sanctuary – known, appropriately, as S.O.S. – operates a comprehensive facility for the rescue, care and rehabilitation of owls across East Anglia. It also promotes the need for the conservation of endangered owl species throughout the UK with its Saving Britain's Owls initiative.

The S.O.S. owl and raptor hospital at Stonham Aspal is unique in the region. It is specially equipped for the care and treatment of the many injured wild owls and other birds of prey it receives every year as a result of road traffic accidents, mishaps, starvation, trauma, disease, poisoning and sometimes even shooting or trapping.

Many of the birds can be given a recuperative, short-term pick-me-up before being re-released into the wild. Those that are more seriously injured but stand a chance of recovery are given medical aid and/or surgery, as determined by their vet. The birds are then allowed space and time to fully recuperate in one of the secluded recovery aviaries, before being carefully returned to the wild.

S.O.S. operates a wild owl nest box scheme that includes building, locating, curating, and repairing environmentally friendly nest boxes in appropriate locations to replace the gradual erosion of natural nesting sites.

S.O.S. is funded purely by donations and as a small charity, the legacies it receives play an important role in enabling it to sustain the resources needed to actively promote the conservation of owls and other birds of prey throughout the UK. q

[THE Chartered Institute of Fundraising has claimed a victory in its campaign to have a ‘soft opt-in’ to email marketing extended to charities in the Data Use and Access Bill.

The CIoF had been engaging with government ministers and House of Lords peers, campaigning for an amendment to the Bill to extend the soft opt-in clause to charities.

The government has agreed to an amendment put forward by Lord Clement-Jones, and the extension will now apply to charities.

Last year, the new administration removed the clause from their updated version of the previous government’s Data Protection and Digital Information Bill due to concerns that it would extend too much freedom to political

[THE CHARITY COMMISSION has issued an alert to charities that could be subject to upcoming changes in the law around preventing fraud. On 1 September a new offence of failure to prevent fraud comes into force. It will affect large, incorporated charities that meet at least two of the criteria of more than 250 employees, £36m of income or £18m in total assets.

Under the offence, an organisation may be criminally liable where an employee, agent, subsidiary or other ‘associated person’ commits a fraud intending to benefit the organisation or its clients and the organisation did not have reasonable fraud prevention procedures in place.

As the Charity Commission explains, it does not need to be demonstrated that directors or senior managers ordered or knew about the fraud. The Charity Commission is therefore alerting all relevant charities to read the Home Office guidance, and where necessary to enhance their approach to fraud prevention and seek professional legal advice.

In addition, the commission says: “If your charity has not already done so, you should read our guidance about internal financial controls, which was refreshed in April 2023. It gives advice on protecting your charity and its assets. A new short guide on protecting your charity from fraud was published in November 2024.” q

parties to communicate with people.

Claire Stanley, director of policy and communications at the CIoF, commented: “In November we wrote to the Secretary of State for the Department of Science, Innovation and Technology, outlining our concerns around the removal of the clause and urged him to reconsider this.

“This was followed up by a letter to Baroness Jones, the lead minister for this Bill in the House of Lords, and as I updated last week, engagement with Lord ClementJones, who has been a vocal champion of the sector in regards to this Bill.

“This is a significant win for the sector and will finally put charities on a level playing field with commercial organisations, which have benefitted from soft opt-in since the introduction of the Privacy and Electronic Communications Regulations back in 2003.

“Crucially, it shows a willingness from the government to listen to the sector at a time when it is facing multiple challenges to deliver services amid rocketing demand. This will allow charities to communicate more widely with supporters and share the vital work they are doing.”

The Bill is approaching the final stage in the House of Lords and will shortly be passed back to the House of Commons. q

[ALFIE’S OWNER, Pam, had been diagnosed with a degenerative disorder which affected her ability to care for him. She was also trying to leave an abusive relationship but would not do so until she had secured a safe place for Alfie.

Oak Tree Animals’ Charity managed to safely remove Alfie and brought him to their sanctuary in Carlisle. This enabled Pam to move to a more suitable and safe home, and the charity arranged for Pam to see Alfie again before he went to his new home.

Alfie and Pam are just two of the thousands of animals and owners helped by Oak Tree Animals’ Charity each year. In 2022, Oak Tree hit a new record of 4,300 animals helped and, unfortunately, this number keeps rising every year.

Their ‘A Helping Paw’ service offers pet fostering to victims of domestic abuse and the homeless. The service is run by dedicated volunteer fosterers, and since 2019 they have helped over 60 pets and 40 families. Without generous gifts in wills, the vital work to help animals and owners, like Alfie and Pam, in these devastating situations just wouldn't be possible.

Oak Tree Animals’ Charity and its wonderful supporters have been helping animals since 1909. One supporter who chose to leave a legacy to Oak Tree explained her decision: “I wish more people would support animal charities like Oak Tree and be part of their incredible work. I want to help Oak Tree Animals’ Charity continue its wonderful work for many years to come. It is comforting knowing that I will still be able to support animals long after I am gone.”

More than half of the work at Oak Tree is funded by legacies – including veterinary treatment, food, bedding, heating, enrichment, water and general maintenance, plus so much more. Every donation received means they can open their doors for another day, providing a lifeline to animals across their region. q

• If you would like to find out more about leaving a legacy, please email communications@oaktreeanimals.org.uk or visit the website at www.oaktreeanimals.org.uk/get-involved/ways-to-donate/your-legacy.html

[ IN 2023, the Fundraising Regulator launched a review of the annual levy it asks charities to pay to fund its work. For the first time since it was founded, the regulator felt the need to increase the levy to ensure it could continue to provide the effective and proportionate self-regulation needed to promote public trust and confidence in charitable fundraising.

Making the levy fairer for smaller organisations

Charities spending £100,000 a year and more on fundraising are included in the levy. The review proposed increasing the levy payments for all organisations, but with the largest charities with the highest fundraising spend seeing the greatest increase in their levy payments. The regulator received 222 responses to the review, with the majority of respondents supporting the proposal.

In February the regulator published an appraisal of the changes and their effect. “We know that the current economic climate is challenging for many charities,” the authors wrote. “To help charities manage their finances the board agreed that the increases would be phased in over two years: in September 2024 and September 2025. From September 2026 the levy will increase in line with inflation, though we will reflect on any increases when considering our budget before making any decisions.”

The regulator reported that it had collected approximately 97% of all levy income since the first phase of increases was introduced last September. That is broadly in line with the recovery rate for the past five years, demonstrating that most charities understand the value

of – and remain committed to – the current system of voluntary regulation. It thanked all the organisations that have ‘responded so positively to the changes’, despite the difficult economic headwinds that many are facing.

However, a small minority continue not to pay the levy.

The authors continued: “Despite most organisations accepting that the levy is a necessary cost of doing business, around 3% of those eligible to pay have either refused to do so or have not responded to our requests. It’s disappointing that a small minority of charities do not recognise their collective responsibility to fund the independent regulation of fundraising. It’s also unfair to those charities that do pay and thus play their part in maintaining and promoting public trust and confidence in charitable fundraising.”

The organisations that have not paid the levy have now been marked ‘red’ in the Fundraising Regulator’s online directory. A list of the registered charities concerned will also be shared with the Charity Commission for England and Wales, ‘so that they are aware of the organisations that have refused to support the system of regulation that so many charities and members of the public benefit from’.

In September the second phase of the levy increase will be implemented. As always, the board will reflect on any increase and the broader economic climate when they consider the budget for the year ahead. Levy payers will be updated on the regulator’s plans during the summer. q

[ENTHUSE’S ANNUAL Charity Pulse report has been published. The fourth edition of the report – available to download free at enthuse.com/insights/charity-pulse-report-2025/ – surveyed over 100 UK charity leaders to find out how good causes fared in 2024, as well as the opportunities and challenges that lie ahead in 2025. Enthuse’s James Paull-Wills analysed the report and drew out some key findings.

“In what was a challenging year financially for many UK households, the third sector showed its resilience, with more than three quarters (77%) of good causes either increasing or maintaining their fundraising income in 2024. A significant upturn on the 55% who said the same in the last edition of the report.

“This healthy performance has given charities confidence going into 2025, with 60% of good causes saying they feel optimistic about fundraising for the year ahead. This is another marked increase from the 2024 edition of the report where 44% said the same.

“Trust is a key component of how charities operate and the good news is charitable organisations feel there is a robust level of trust in their causes. In fact 87% of charity leaders see trust in their charity at an eight out of ten or higher.

“Not only is trust high but three quarters (74%) of charities also feel that there is greater awareness of their cause and its need for support – up from 47% in last year’s report. The other key reasons given for optimism in fundraising include: more opportunities to make use of digital channels (74%), increased participation in mass physical events from younger generations (55%) and big name events like the TCS London Marathon and AJ Bell Great North Run being more inclusive and accessible (44%).”

James explained that, when it comes to the areas where charities are expecting fundraising income to grow in 2025, events and activities scored highest at 54%, closely followed by corporate fundraising (53%) and individual giving (48%). Approximately one in three (31%) charities predict growth in regular giving, while 27% said the same for in-memory giving and 25% for legacy giving.

With regards to the type of events charities are planning for this calendar year, mass physical participation events came out on top with more than four in five (82%) having that in their plans. That could be a charity-run event or one put on by a third party. Smaller events such as bake offs and pub quizzes are on the cards for 80% of good causes, while nearly half plan to offer a virtual physical event that participants can do in their own time and a quarter have a hybrid event in their sights.

Chester Mojay-Sinclare, Enthuse founder and CEO, commented: “In the face of adversity, it’s fantastic to see that many charities improved or maintained their fundraising income in 2024. The healthy level of optimism for 2025 bodes well for the sector. Charities have helped so many in need in the past 12 months and I’m glad they feel there’s a high level of trust in their work. They’ve earned it!

“2024 was a record-breaking year for mass participation events like the TCS London Marathon and AJ Bell Great North Run – driven by a real appetite from younger generations taking part in these kinds of events. It’s easy to see why they’re an important part of charities’ plans for this year, too.”

Looking at the adoption of technology in the sector, James found that simple and versatile tools like QR codes are popular, with 79% of charities using them. TikTok and other video channels are utilised by about a third (34%) of good causes, 22% say they make use of mobile apps and 16% are recording or appearing on podcasts. Despite the headlines, only 10% of charities say they’re using AI to personalise donor journeys. Nearly one in three (32%) charities say they’re using,

trialling or researching a replacement for X (Twitter). Interestingly, 30% of good causes say they’re not using a CRM.

“Looking at any concerns charities had around their digital strategy in 2025, data was a key theme. Nearly three quarters (74%) said they had concerns over data privacy and GDPR compliance. Data security and data leaks is a concern for 64% followed by platform owners collecting supporters’ data (52%) and platform owners re-contacting supporters (41%). Away from data, other areas of concern included: developing the skills in-house to run digital campaigns (58%), developing social media strategy (50%) and understanding and developing policies around generative AI (49%).”

In all the report finds that good causes can be proud of their 2024 and there’s every reason to be optimistic for 2025, too. By making shrewd use of technology and putting on a variety of fundraising events that cater to their supporters, charities will put themselves in a great position for a strong year. q

[FOR THE PAST 20 YEARS oncology researchers at Manchester University have been funded by Caring Cancer Trust (Stopcancer. health), which funds ethical, animal-free research into cancer, its non-invasive treatment, cure and prevention. They have discovered potential new causes of children’s cancer, developed new treatments for early-stage cervical cancer and are now working on cancer prevention for children and senior adults of older-age.

Increased life expectancy – people are now living longer than ever before – has been accompanied by an increase in many agerelated disorders, including cancer. Age-related damage to cells has by far the greatest influence on human health, promoting development of not only cancer, but also cardiovascular, neurodegenerative and autoimmune diseases. Novel treatments inhibiting cellular ageing have the potential to reduce the development of cancer and all those ailments simultaneously, rather than having to treat each separately. Such treatments will not just be for the benefit of older people. They will also benefit children and younger adults, since the use of chemotherapy and radiation for cancer treatment artificially accelerates the ageing process.

More recently Caring Cancer Trust has funded Ravan Bio Ltd, Manchester University’s spinout company, to develop a novel anti-aging treatment to prevent cancer and the other agerelated diseases. Indications for Ravan Bio’s

new therapy are that it is extremely successful, resulting in an 80% reduction in the biological age of test subjects, and has potential for cancer prevention and other age-related ailments.

Caring Cancer Trust provides support for children, adult and senior cancer sufferers from England through Exeter, Southampton, Portsmouth, Isle of Wight, Oxford and Manchester hospitals.

Now they are providing London support via North Middlesex University, Royal Free Hospital and Barnet Hospital. A number of charity ticketed concerts are scheduled at Edwin Lutyen’s magnificent St Jude’s Church in Hampstead with the Royal NHS Foundation Truust.

Stopcancer.health funds research that will increase understanding of how silent infections, lifestyle, diet, genetic predisposition and environmental pollution can lead to cancer in children and adults. Simple changes in lifestyle and diet, combined with avoidance of exposure to environmental pollution, will prevent the incidence of cancer in all age groups.

Caring Cancer Trust’s Stopcancer.health aims to identify and understand hitherto unknown cause-and-effect relationships to either limit

exposure to such carcinogenic factors or devise therapies which suppress their effects before a cancer has developed. Their research mission for cancer prevention involves:

• New life-saving cancer prevention medicines

• New therapies for early-stage cancers

• New therapies for children and later-life

• cancers

• Cancer avoidance lifestyle, diet and

• environmental changes

• Heightened cancer awareness by all

Caring Cancer Trust’s programme is entirely managed and run by unpaid volunteers. q

[PAWS2RESCUE has a simple mission: to help animals in need, wherever they are. Because the charity is entirely run by volunteers, every penny raised helps them continue this important work. If you'd like to help create a kinder world for all creatures, remembering Paws2Rescue in your will means you’ll be helping to ease the suffering of animals for many years to come.

The charity’s Alison Standbridge said: “Even though we’re based in the UK, we know that so many animals overseas face terrible neglect and cruelty. That’s why, along with finding loving homes for over 7,000 unwanted dogs and cats in the UK, we also run international projects to help reduce animal suffering, especially in places like Romania, Moldova, Ukraine and Peru where animals often endure awful conditions.

“Our goal is to ease the daily struggles these animals face by providing food, medical care and shelter. We also support rural shelters that really need help in areas where resources are limited and we’ve built our own sanctuary, to ensure traumatised animals can find peace, and set up our own vet clinics in areas where medical treatment was previously unavailable.”

But unlike charities that simply rehome, their mission is to truly end this suffering. That’s why Paws2Rescue offers free neutering for stray and owned animals, helping to prevent unwanted puppies and kittens and encouraging owners to look after their pets’ health.

To date, the charity has spayed an incredible 18,000 animals. Assuming each animal would have twelve puppies a year, that has prevented well over two million unwanted animals being born since their inception in 2013! So, while being focused on helping animals in need wherever they can right now, their dream is to create a world where there simply are no more unwanted animals.

Alison added: “Education is a big part of our mission. If young people grow up with the same old attitudes that allow cruelty to

continue, nothing will change. Our schools programme helps break this cycle by teaching children to love and respect all living creatures. Plus our veterinary scholarship programme helps young students in Romania by funding their qualification, so more vets are available to work in rural areas where animals need the most care.

“If you choose to leave a gift to Paws2Rescue, no matter how small, you can be sure that every penny will go towards helping dogs, cats and other animals in need, both now and in the future. Thank you.” q

[

BANKING IS ESSENTIAL for charities and voluntary organisations, but the latest findings from the National Council for Voluntary Organisations (NCVO) show many are struggling to access suitable services. The report highlights the on-going barriers and how NCVO is pushing for change.

In 2022, NCVO conducted a survey to understand the challenges facing charities and voluntary organisations when it came to dealing with their banks. The findings, published in a detailed report in January 2023, revealed widespread administrative and communication issues. Since then NCVO has been working behind the scenes, engaging with sector leaders, regulators and banks to advocate for improvements to banking services. They conducted a follow-up survey early last year.

The results of that survey have been published in a new report from the Charity Finance Group. They show that banking services continue to fall short of meeting the sector’s needs.

The vast majority (92%) of respondents faced at least one banking issue in the past two years. Key challenges include:

• Updating signatories: 77% reported issues adding or removing

• signatories from their accounts. That process, often required annually

• due to trustee turnover, is unnecessarily complex and time-consuming.

• Dual signatories: Over a third (35%) struggled to set up dual signatories

• for payments – a requirement recommended by the Charity Commission

• for financial oversight.

• Lost information: 32% experienced delays because banks misplaced

• documents previously submitted, leading to duplicate work.

• Opening accounts: 29% faced barriers to opening accounts, including

• excessive requests for trustee information. Some banks required details

• for all trustees, even those not listed on the account mandate.

• Unexpected account closures: Worryingly, 6% of organisations had

• accounts permanently closed, while 11% reported losing access to

• their funds due to account freezes or cancelled debit cards – often

• without explanation.

Beyond administrative issues, poor communication compounds the difficulties charities face:

• 26% said compliant documents were rejected without clear reasons.

• 24% were asked for non-existent documentation, such as a ‘certificate

• of registration’.

• 27% reported that banks failed to explain their requirements or provide

• clear information when resolving issues.

Over half (56%) of respondents said they spent excessive time managing

[ THE BRITISH CHELONIA GROUP publishes six newsletters a year containing details of meetings, short articles, news items and veterinary notes. Their journal Testudo is published annually and contains original articles and reviews on all aspects of turtles, terrapins and tortoises – their biology, conservation, welfare, veterinary care and husbandry. The group also organises symposia. As well as the yearly appeals in aid of specific international causes in chelonia research and survival, the BCG assists other worthy causes in support of its aims with grants. They invite grant applications from organisations and individuals engaged on the work of chelonia conservation – such as zoos, universities, zoologists and students in this country and overseas. q

banking problems, and 12% reported spending more than three hours per week on those tasks.

Banking challenges aren’t just administrative – they also have a broader impact on the voluntary sector. Over half (54%) of respondents said banking issues caused significant stress for trustees and volunteers. That strain is contributing to trustee retention challenges, as highlighted in NCVO’s 2024 Trustees’ Week findings.

Despite the introduction of the Consumer Duty regulation in 2023 – which requires banks to ensure fair outcomes for all customer groups, including small charities – 83% of survey respondents were unaware of its existence.

Since its 2022 report NCVO has been working to improve banking services for the voluntary sector. That includes:

• Developing guidance: NCVO partnered with UK Finance to create

• the Voluntary Organisations Banking Guide. This practical resource helps

• charities navigate account set up, maintain good communication with

• banks and understand key requirements.

• Engaging with regulators: NCVO contributed to the FCA’s investigation

• into ‘de-banking’ – ensuring that the unique challenges charities face

• were included in their findings.

• Advocating with MPs: Banking challenges were raised at the All-Party

• Parliamentary Group for Charities and Volunteering in June 2023, raising

• the attention of policymakers.

• Raising awareness: Collaborations with media outlets like The Guardian

• and The Telegraph have brought national attention to these systemic

• issues.

• Collaborating with charity regulators: In November 2023, the Charity

• Commission, OSCR and CCNI wrote an open letter to UK bank CEOs,

• urging them to address barriers for charities.

The findings make it clear that the banking sector must do more to meet the needs of the voluntary sector. Charities, banks, government and the regulators will all need to work together to address what has proved to be a complex set of challenges.

NCVO is calling on banks to work collaboratively with itself, UK Finance and other sector leaders to improve processes and communication. They should also explore basic accounts tailored to charities, similar to those available for individuals in France and the Netherlands and prioritise financial inclusion, ensuring that banking services are accessible to all charities, especially smaller organisations. Banks must move beyond compliance and take proactive steps to address the persistent issues. q

[ THE SWALLOWS HEAD & NECK CANCER CHARITY has collaborated with solicitors Adkirk Law Ltd and established The Charity Will Month for March.

Adkirk Law is working to help raise vital donations this March by writing basic wills and waiving their usual fee in return for a donation to charity.

The charity supports all people affected by head and neck cancers, including patients, caregivers, friends and relatives. It is their intention for every person affected by head and neck cancer to have access to support at the point they need it, by the method of their choice, on a 24/7 basis.

Hannah Clarkson, wills and probate solicitor of Adkirk Law, said: “The Swallows is an exceptional and much needed charity, this campaign offers people the chance to get a professionally written will while supporting this important charity that changes lives for the better – both here in the UK and around the world.”

The suggested voluntary donation for a basic single will is £100, or £180 for a pair of mirror wills.

Chris Curtis, the founder of the charity, said: “We are very grateful that Adkirk Law has chosen to support us in this campaign. It is only thanks to donations and firms like Adkirk Law volunteering their time that the charity can continue to raise much-needed donations to support sufferers and their caregivers.” q

• For further information about head and neck cancer, the support that The Swallows offer, and how you can support them visit the charity’s website at theswallows.org.uk

[THERE ARE TWO MILLION people in the UK living with sight loss and by 2050 the figure is set to double. Being diagnosed with any form of sight loss is lifechanging and devastating for both the individuals concerned and their families.

The Partially Sighted Society is a national charity that understands this; it has been providing help and support to anybody living with sight loss for over 50 years.

The society’s range of services includes the design, printing and provision of bespoke school exercise books for children, a specialist low-vision and sight test service, and the provision of aids and equipment to assist those living with sight loss to continue to live full and independent lives.

They are there to offer support for both the practical and the emotional impact of sight loss, by phone and in person. They also offer a range of social and support activities to alleviate the social isolation that comes with sight loss.

Leaving a gift in a will is a meaningful way of helping The Partially Sighted Society to help others. Legacies leave a lasting impact on transforming the lives of those living with sight loss. q

[

THE UK’S WEALTHIEST 1% donated £7.96bn to charitable causes in 2023, according to a new report from the Charities Aid Foundation (CAF). CAF’s High Value Giving report explores how the UK’s wealthy currently give and highlights the potential for donations from that demographic – a group for which current data is limited.

The Charities Aid Foundation commissioned Altrata, a company with significant expertise in wealth and the owners of Wealth-X, to produce estimates of the size of the UK’s wealthy population and philanthropic giving by these individuals.

The UK’s high-net-worth individuals give the equivalent of 0.4% of their combined £2trn investable assets, according to the research. The wider UK public donated an estimated £13.9bn to good causes in the same year, equating to 1.6% of their income, according to CAF’s separate UK Giving research.

CAF’s analysis finds that, if each of the UK’s estimated 536,673 millionaires were to donate 1% of their investable assets, it could mean an extra £12bn for the charity sector. When combined with giving from the general public, total giving from individuals would reach £33bn.

According to the report, the donors who give the highest proportion of their wealth are, on average, 63 years old, and are more than twice as likely to have inherited their wealth. Women are over-represented in the group of the most generous donors, making up nearly three in 10 (29%), compared to 19% of the highnet-worth population.

Over the next 25 years an estimated £5.5trn is expected to transfer from the post-World War II generation to younger generations in the UK, dubbed the ‘Great Wealth Transfer’. The next generation are predicted to be the most significant charitable donors in history.

CAF is calling on the government to deliver a national strategy for philanthropy and charitable giving, to bring together a co-ordinated and cross-government approach to boost giving in the UK, including from high-net-worth individuals.