25 minute read

COMMENT

PAUL HAYES

paul.hayes@primecreative.com.au

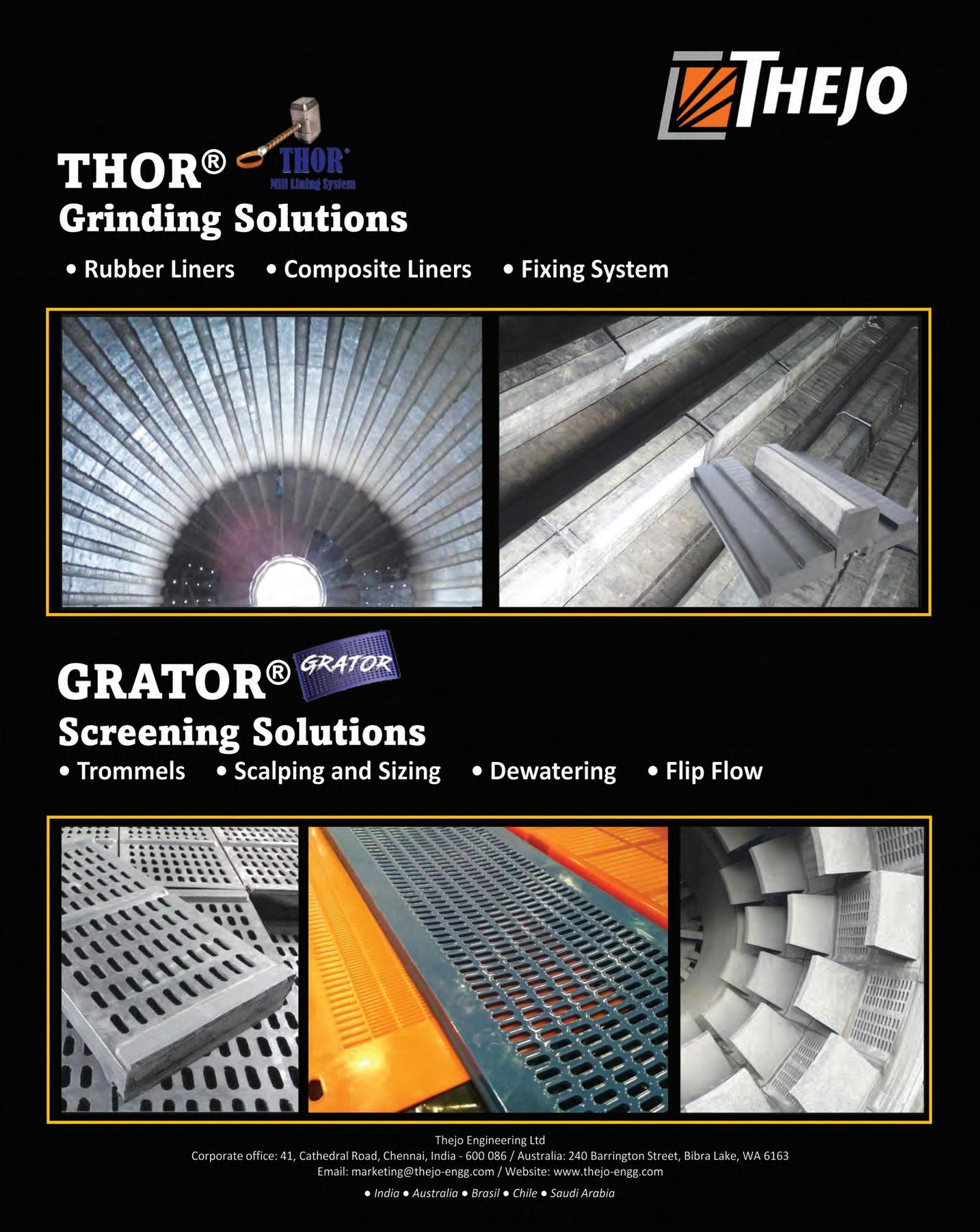

KEEPING THE MACHINES MOVING

THE COST OF MACHINERY BREAKDOWNS MEANS THE IMPORTANCE OF REGULAR MAINTENANCE IS CRUCIAL TO ENSURING THE MINING AND RESOURCES SECTOR STAYS ON TARGET – AND ON BUDGET.

Time, as they say, is money. And that is especially true on a mine site.

Shutdowns due to equipment failure can cost a company millions during the downtime needed to make repairs, not to mention the consequence of reduced uptime.

And with Australian mine sites often located in some of the more far-flung corners of the country, the time and money needed to actually get parts fixed or replaced only adds to the costs.

That’s why maintaining a mine’s equipment is so important to keeping a site running smoothly.

Maintenance is necessary on all aspects of the mining process, from the machinery that digs the precious ore and minerals from the ground to the fleets of vehicles delivering their cargo for export.

Not only does it mean that expensive and specialised equipment is kept in the best possible condition to improve operations, it’s also a vital part of keeping the workforce safe.

And while some breakdowns in machinery are inevitable, careful maintenance provides the opportunity to identify a potential problem before it happens and can even extend the life of the equipment.

This is where the practice of preventive maintenance is so critical. As mining companies look to improve their operational anticipation, digital companies are building the Internet of Things (IoT) infrastructure to offer miners more foresight than ever before.

Original equipment manufacturers and other mining equipment, technology and services (METS) companies have developed their service divisions to a point where they can attend to a miner’s concern at the drop of a hat. Machinery is built to be smarter and more robust to ensure vehicles remain on the park for longer.

As new maintenance solutions are discovered and put into practice, Australia’s mining industry grows exponentially.

At the end of the day, there’s nothing more valuable to a mining company than optimising productivity – and properly maintained machines are big piece of that puzzle.

In the March issue of Australian Mining, METS companies from across the industry are showcased, whether they’ve got a maintenance solution or a pioneering concept that’s changing the game.

From Australia to South Korea and back, we explore Australia’s major critical minerals opportunity and unpack the issues facing the emerging opal and potash industries.

While their outlook remains uncertain, iron ore producers continue to weather the cyclical storm and have enjoyed an improved price climate to start 2022. We’ll look at what’s next for iron ore’s junior and mid-tier miners.

Austmine provides its industry insight, highlighting the key themes for METS companies in 2022, while mining’s electric rail evolution catches the eye.

The likes of Aurizon, Wabtec and major miners such as BHP, Fortescue Metals Group and Roy Hill have been particularly active in this space.

As always, it’s a busy time in Australia’s mining industry.

Paul Hayes Editor

FRONT COVER

In this edition of Australian Mining, we include a special focus on mine-site maintenance, with a number of feature articles looking at equipment, technology and processes that help to keep a site’s machines running as well – and for as long – as possible. We examine the state of one of Australia’s key commodities in iron ore, while also taking a look at opal and potash. Leading experts provide their thoughts on a handful of key areas for the industry and, as usual, we cover the latest mining equipment and technology in our products section.

Cover image Elphinstone

CHIEF EXECUTIVE OFFICER JOHN MURPHY

PUBLISHER CHRISTINE CLANCY

EDITOR PAUL HAYES Email: paul.hayes@primecreative.com.au

ASSISTANT EDITOR MICHAEL PHILIPPS Email: michael.philipps@primecreative.com.au

JOURNALISTS EMILY MURPHY Email: emily.murphy@primecreative.com.au HENRY BALLARD Email: henry.ballard@primecreative.com.au

CLIENT SUCCESS MANAGER JANINE CLEMENTS Tel: (02) 9439 7227 Email: janine.clements@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027 Email: jonathan.duckett@primecreative.com.au

SALES ADMINISTRATOR EMMA JAMES Tel: (02) 9439 7227 Mob: 0414 217 190 Email: emma.james@primecreative.com.au ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

GRAPHIC DESIGNERS KERRY PERT, AISLING MCCOMISKEY

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au © Copyright Prime Creative Media, 2016 All rights reserved. No part of the publication may be reproduced or copied in any form or by any means without the written permission of the publisher.

PRINTED BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337 Published 12 issues a year

AUTOBIT THE DRILL MUST GO ON

The key to productive mining operations is to always keep your machines busy.

Autobit has an extended first grinding interval, lasting up to three hours. It enables your automated rig to drill during shift changes. The result is several hours of extra productivity every day.

Ready to minimize your downtime?

THE LATEST MINING AND SAFETY NEWS

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

CHINA RELEASES AUSTRALIAN COAL FROM ITS PORTS

China has cleared most of the Australian coal that had been held at Chinese ports due to a coal import ban, according to Fengkuang Coal Logistics.

The data released by the General Administration of Customs of China on January 21 shows that 5.6 million tonnes of Australian coking coal that was detained in Hong Kong – including 706,000 tonnes in October, 2.67 million tonnes in November, and 2.42 million tonnes in December – has been released.

China has historically been reliant on Australian high-grade coking coal; however, in the wake of the import ban, China has turned its sights to North America.

Throughout 2021, China imported 9.29 million tonnes of US coking coal, a 977.4 per cent increase on the previous year, taking its coking coal imports to 18.7 per cent of China’s imports, according to Fengkuang Coal Logistics.

In December, the import volume of Canadian coking coal increased by 23 per cent from the previous month to 1.11 million tonnes.

The cumulative import of Canadian coking coal was 8.4 million tonnes in 2021, an increase of 98.62 per cent from 2020.

The import volume almost doubled, and the import share of Canadian coking coal accounted for 16.9 per cent, whereas Australia’s coking coal imports accounted for 11.3 per cent.

In 2021, Mongolia’s coking coal imports fell by almost 41 per cent to 12.74 million tonnes, and coking coal imports accounted for 25.7 per cent of China’s imports.

The Fengkuang report outlines that there is still great uncertainty on the future of the coking coal import market in 2022.

This includes whether new Australian coal will be imported, and the impact on Mongolian coal customs clearance.

China imported 6.79 million tonnes of coking coal in December, a decrease of 3.28 per cent from the previous month.

The cumulative import of coking coal for 2021 was 49.6 million tonnes, a decrease of 16.2 million, or 24.6 per cent, from the same period last year.

5.6 MILLION TONNES OF AUSTRALIAN COKING COAL WAS DETAINED. AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TOTHE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

FORTESCUE CONSIDERS TAKING BACKSEAT AT IRON BRIDGE

Fortescue Metals Group has indicated it is open to contracting for mining services at its Iron Bridge magnetite project in Western Australia, contrary to its usual strategy.

The mine is on schedule for first production by the end of 2022, according to chief executive officer Elizabeth Gaines, after COVID-19-related strains on the labour force pushed this date back by six months.

While the major miner has already begun early works itself at the operation, it is keeping its options open as to how it progresses from here.

Gaines said the reason for considering a contractor was to reduce the cost of using Fortescue’s own diesel-fuelled fleet and opt for a contractor with a “greener” fleet.

“As we transition to commissioning and operations, we will maintain our focus on maximising value, including through our fleet strategy, which will be underpinned by our industryleading decarbonisation targets and our ongoing green fleet development,” Gaines said.

“Retaining optionality is particularly important when considering the benefit of avoiding investment in new diesel equipment as part of our decarbonisation pathway and contract solutions will be considered to enhance our flexibility.”

Several key milestones were ticked off at Iron Bridge during 2021, as the project fulfils its forecast capital investment of $US3.3 – $3.5 billion ($4.59 – $4.87 billion).

“(Milestones included) the delivery and installation of the modules on site, installation of the first high-pressure grinding roll in the tertiary crushing facility, completion of earthworks for the tailings storage facility, and commissioning and operation of the airport,” Gaines said.

“We also marked the completion of construction of the module offload facility at Lumsden Point.”

It was not disclosed by Fortescue who had been approached for a mining services contract.

Fortescue last year signed Veris Australia for surveying and pipeline design and SIMPEC for major construction works to the wet processing plant at Iron Bridge.

ALIEN DISCOVERS OUT-OF-THIS-WORLD SILVER GRADES

Alien Metals has discovered historic silver grades at its Elizabeth Hill silver mine in Western Australia, with one drill hole finding more than 36kg of silver per tonne.

The bonanza results far exceeded expectations of the long-dormant mine, which once averaged grades of 2195g of silver per tonne (g/t) before it was mothballed in 2000.

One new drill hole at Elizabeth Hill also recovered copper grades of 10.8kg per tonne (1.08 per cent) – equivalent to some of Australia’s most prominent copper operations.

Alien chief executive officer and technical director Bill Brodie Good said this was a momentous day for the Australian mining industry.

“These fantastic initial results support the company’s view that the near surface oxide expression of the deposit was never fully tested, nor its potential fully explored for both the silver and the base metals present,” Good said.

“Some of these grades have to be some of the highest for a silver project in Australia.”

Indeed, some of Australia’s largest silver mines currently in operation pale in comparison to these results at Elizabeth Hill.

Western Australia’s current largest silver asset, 29Metals’ Golden Grove copper-gold-zinc-silver mine, milled silver at about 43g/t in 2021, while copper was milled at almost 1.3 per cent.

In Queensland, South32’s Cannington mine milled silver at grades around 177g/t for the second half of 2021, while Glencore’s Mount Isa zinc-leadsilver mine has a measured and indicated resource of 69g/t of silver.

The Elizabeth Hill resource also appears to contain nickel, cobalt, zinc and lead.

The price of silver has ridden the COVID-19 wave since the beginning of 2020, reaching just over $US900 ($1278) per kilogram in the September quarter of 2020.

The price has maintained a steady tilt above $700 per kilogram and sits at $729 per kilogram at time of writing.

THE RESULTS FAR EXCEEDED EXPECTATIONS OF THE LONG-DORMANT ELIZABETH HILL MINE.

BHP TRUSTS CIMIC FOR PORT HEDLAND DE-BOTTLENECKING

BHP has chosen a CIMIC Group subsidiary for a de-bottlenecking project at Nelson Point in Port Hedland, Western Australia, in a contract worth $100 million.

CPB Contractors will deliver a structural, mechanical, piping, electrical and instrumentation package at Port Hedland, with works to begin this year and conclude in 2023.

As a major engineering-led construction, mining and services company, CIMIC has held a long and strong partnership with BHP in multiple contracts across multiple sites.

CIMIC Group executive chair and chief executive officer Juan Santamaria said he was confident in this history as CPB tackles the de-bottlenecking.

“We’re pleased to be supporting BHP with this project. Our mining and resources experience and history in the Pilbara means we can collaborate on the project’s high standards of safety and quality,” Santamaria said.

Past CIMIC Group/BHP contracts have included Thiess’ $110 million mining services at BHP Mitsubishi Alliance’s (BMA) Caval Ridge coal operation, and UGL’s $180 million maintenance and shutdown services at BMA’s Queensland coal mines.

CPB Contractors was originally part of the Leighton Contractors group since 1949 before a merger with CIMIC in January 2016.

CPB Contractors managing director Jason Spears said the company could capably complete the task for BHP.

“This project builds on CPB Contractors’ substantial experience in delivering resources infrastructure,” Spears said.

“We are pleased to continue our long-term partnership with BHP to deliver another important resources project in the Pilbara.”

In October, BHP also contracted Civmec to the de-bottlenecking project at Nelson Point with works including de-watering, piling, ground improvement, concrete foundations, new roads and high-voltage power works.

STANMORE WELCOMES EPSA TO ISAAC DOWNS

Stanmore Resources has enlisted EPSA Pacific as the statutory coal mining operator at the Isaac Plains Complex, for a five-year term worth $564 million.

The open-cut mining services agreement will allow the Isaac Downs mine to commence full production, while Stanmore will begin an owneroperator model at the coal handling and preparation plant (CHPP).

Isaac Downs produces metallurgical coal near Moranbah, Queensland, and is expected to produce up to 35 million tonnes of run of mine (ROM) coal over 16 years.

Isaac Downs was approved for construction and operation in July 2021 at a rate of 2.5 million tonnes per annum over 10 years.

At the time of approval, Resources Minister Scott Stewart said jobs and the economy would be boosted strongly by the mine.

“This project will mean mining jobs for another 10 years, including for the 300 mine workers currently at Isaac Plains, as well as jobs completing rehabilitation in the Isaac Plains East area until 2025,” Stewart said.

EPSA Pacific is a subsidiary of Spanish company EPSA Group, a mining, civil and earthmoving business with a workforce of more than 3000 people.

Stanmore recognised the efforts of its previous coal mining operator, Golding Contractors (an NRW Holdings subsidiary), as it makes room for its replacement in EPSA.

“Stanmore acknowledges and thanks Golding, the current CMO under the existing mining services agreement, for their services and successful partnership over the duration of that mining services agreement,” Stanmore stated.

“A termination notice in respect of the Mining Services Agreement has been given to Golding and a carefully managed transition plan will be implemented to ensure business continuity and the minimisation of any disruption.”

In replacing Golding, EPSA will deliver brand new equipment and its own management team to operate and maintain the mine from the second quarter of 2022.

ISAAC DOWNS PRODUCES METALLURGICAL COAL NEAR MORANBAH, QUEENSLAND.

ILUKA GETS RARE REFERRAL WIN

Iluka’s rare earth refinery at the Eneabba mine site in Western Australia has made it through the Environmental Protection Authority’s (EPA) referral process without issue.

The rare earth refinery will produce separated rare earth oxides, and beyond the Eneabba stockpile, Iluka’s Wimmera project could serve as long-life rare earth concentrate feed source to the Eneabba refinery.

The EPA decision considered that the likely environmental effects of the refinery are not so significant as to warrant formal assessment, due to it being within the existing brownfield Eneabba mine site with limited environmentally sensitive receptors.

The potential impacts of the refinery can be adequately managed through the implementation of the proponent’s management and mitigation measures.

The Eneabba operation involves the extraction, processing and sale of a strategic monazite-rich mineral stockpile that is currently stored in a former mining void at the site.

The refinery will utilise the existing Eneabba monazite concentrate, future Iluka feedstocks and thirdparty feedstocks, and products will be transported via road trains from Eneabba to the port of Fremantle for export.

Iluka has approached the Eneabba development incrementally to maximise value and take a measured approach to risk.

The rare earth refinery is the third phase of the project, and it will produce approximately 17,500 tonnes per annum of individual rare earth oxides and carbonates.

Phase one was the screening plant that involves simple reclaim and screening of material stored in the former mining void at Eneabba, which commenced in the third quarter of 2020.

The second phase was the concentrator that processes the reclaimed material to separate the monazite and zircon streams, producing a 90 per cent monazite concentrate and zircon products, which is in execute phase, with commissioning scheduled for the first half of 2022.

The decision made by the EPA is appealable, with submissions having closed on January 31, 2022.

MRL SETS ITS SITES ON LITHIUM

Mineral Resources (MRL) has seen strong growth in its lithium operations with realised spodumene prices rising 56 per cent from the previous quarter to $US1153 ($1619) per dry metric tonne (dmt), its December quarterly report shows.

The Mt Marion lithium mine in Western Australia produced 98,000 dmt of spodumene and saw shipments increase by 92 per cent, reflecting the previous quarter’s shipment being delayed to the second quarter of the 2022 financial year.

Further south, the 50ktpa Kemerton Lithium Hydroxide plant is continuing construction, with spodumene ore now introduced into the plant as part of the commissioning process, and commercial production expected in mid-2022.

The restart of the Wodgina Lithium mine in the Pilbara is underway, with the first spodumene production expected during the first quarter of the 2023 financial year.

While December saw growth for lithium, MRL felt the effects of falling iron ore prices which declined 19 per cent from the previous quarter to $US63.23 ($88.86) per dmt, only 58 per cent of the Platts IODEX benchmark iron ore price.

Unplanned border closures and lockdowns implemented due to COVID-19 continued to impact MRL operations throughout the quarter.

Ore mined at the Yilgarn hub was 11 per cent lower as a result of labour constraints; however, the mine produced a consistent amount of ore at 2.6 million wet metric tonnes (wmt).

Iron ore shipments totalled 4.9 million wmt during the quarter, driven by the growth of the new Wonmunna mine at the Utah Point hub in the East Pilbara region.

In January 2022, iron ore prices reached four-month highs of $130 per tonne for the first time since October 2021.

The December quarterly report shows figures up until December 31 2021, so the recent price increase is not reflected in the report.

THE RESTART OF THE WODGINA LITHIUM MINE IN THE PILBARA IS UNDERWAY.

CARMICHAEL COAL READY TO SET SAIL

Bravus Mining & Resources has successfully delivered its first shipment of high-quality coal from its Carmichael mine to the North Queensland Export Terminal (NQXT) in Bowen.

The coal was delivered during the testing and commissioning of Bowen Rail Company’s new trains and is ready for export.

The coal will be loaded and dispatched as per NQXT’s normal operations and subject to the port’s shipping schedule.

“This is a big moment for everyone who has worked so diligently and passionately to build this mine and its worldclass supporting civil and commercial infrastructure,” Bravus chief executive officer David Boshoff said.

“From day one, the objectives of the Carmichael project were to supply high-quality Queensland coal to nations determined to lift millions of their citizens out of energy poverty and to create local jobs and economic prosperity in Queensland communities in the process.

“With the support of the people of regional Queensland, we have delivered on that promise.”

Boshoff said the Carmichael project had provided more than 2600 direct jobs and paid more than $1 billion to regional Queensland contractors and businesses since construction began.

“High-quality Australian coal will have a role to play, alongside renewables, for decades to come as part of an energy mix that delivers reliable and affordable power with reduced emissions intensity,” he said.

The Carmichael project struck first coal in June last year, following a decade-long effort to get mining operations up and running at the site.

“High-quality Australian coal will have a role to play, alongside renewables, for decades to come as part of an energy mix that delivers reliable and affordable power with reduced emissions intensity,” Boshoff said.

Bravus is expected to produce 10 million tonnes of thermal coal per annum at the Carmichael mine.

RIO TINTO TO CHARGE UP WITH WABTEC

Rio Tinto will purchase four battery-electric trains from Wabtec Corporation for use in the Pilbara region of Western Australia as part of its strategy to reduce its carbon emissions by 50 per cent by 2030.

The four seven-megawatt-hour FLXdrive battery-electric locomotives from Wabtec will be used to carry ore from Rio Tinto’s mines to its ports and will be recharged at purpose-built charging stations at the port or mine.

The locomotives will also be capable of generating additional energy while in transit through a regenerative braking system which takes energy from the train and uses it to recharge the onboard batteries.

Wabtec’s next-generation energymanagement software system will determine the optimal times to discharge and recharge the batteries along to route, ensuring the most fuel-efficient operation of the entire locomotive consist during the trip.

“Our partnership with Wabtec is an investment in innovation and an acknowledgement of the need to increase the pace of our decarbonisation efforts,” Rio Tinto managing director of port, rail and core services Richard Cohen said.

“Battery-electric locomotives offer significant potential for emissions reduction in the near term as we seek to reduce our scope one and two carbon emissions in the Pilbara by 50 per cent by 2030.”

In mainline operations, Rio Tinto currently uses three diesel-electric locomotives in a consist to pull trains with 240 cars hauling about 28,000 tons of iron ore.

“Rio Tinto is a progressive leader in the mining industry, adopting advanced technologies necessary to drive sustainable, efficient operations that deliver results for its customers, shareholders, and communities,” Wabtec regional senior vice president Southeast Asia, Australia, and New Zealand Wendy McMillan said.

This announcement follows Wabtec’s recent partnership with Roy Hill for the world’s first fully batterypowered, heavy-haul locomotive, and the testing of its mining collision awareness system (CAS) vehicle intervention solution with Komatsu haul trucks.

Production is due to commence in the US in 2023 ahead of initial trials in the Pilbara in early 2024 tested against a range of safety and functional criteria, including integration with AutoHaul.

THE BATTERY-ELECTRIC TRAINS WILL CARRY ORE FROM RIO TINTO’S MINES.

RINEHART SEEKS EPA APPROVAL FOR MULGA DOWNS MINE

Mining magnate Gina Rinehart’s Hancock Prospecting has filed for environmental approval for a 20 million tonne per annum (Mtpa) iron ore mine on her family’s Mulga Downs station in the Pilbara.

The proposed area is located within an area of existing pastoral and mining land use, with transport of the ore proposed via the Great Northern Highway to Port Hedland for export.

According to the proposal filed with the Western Australian Environmental Protection Authority (EPA), facilities will be developed to support production of up to 20 Mtpa over a minimum 30year period.

The Mulga Downs project includes, but is not limited to, mine associated infrastructure and support facilities, including an accommodation camp, energy supply infrastructure, airstrip, wastewater treatment plant (WWTP) and an ore processing facility.

Earlier this year, Hancock Prospecting signed a development agreement to lead a bankable feasibility study on the Hardey iron ore project in the West Pilbara owned by the Australian Premium Iron (API) joint venture.

Under the terms of the development agreement, Hancock will lead the development and operation of the project, subject to a final investment decision.

“I am particularly delighted that Hancock is joining forces with Boawu, the largest steel maker in the world,” Hancock executive chair Gina Rinehart said.

“Whilst Hancock already has a long-standing successful partnership with POSCO through our Roy Hill mega project, and great relationship with Chinese companies who helped us deliver the outstanding Roy project, we look froward to enjoying the same successes as we work with Boawu and our friends at AMCI through the studies, development and operations of the Hardey project.”

The project is expected to be a $US7.4 billion ($10.3 billion) mine, rail and deep-water port development.

SOUTH32: CANNINGTON HAULS ITSELF ABOVE EXPECTATIONS

South32’s Cannington silver-lead mine in North West Queensland has had a successful second half of 2021 as the company prepares to transition to 100 per cent truck haulage at the site.

Cannington remains on track to transition to a 100 per cent truck haulage operation from the June 2022 quarter as a low-cost capital option that has the potential to bring forward further higher-grade material from the 2023 financial year at current operating costs and throughput rates.

A trial of light battery electric vehicles is also expected to commence during the June 2022 half-year, testing their potential use in the vehicle fleet.

Cannington has recorded a nine per cent increase of payable zinc equivalent production in the December 2021 half year.

The increase brought the production to 152,500 tonnes for the half as higher grades across all products and strong underground performance supported metal production.

Payable zinc sales increased by 29 per cent during the quarter as South32 drew down inventory at Cannington, while payable lead and silver sales increased by 50 per cent and 47 per cent, respectively, due to the timing of shipments, following adverse weather in the September 2021 quarter.

“We achieved a number of strong production results across our portfolio and realised significantly higher commodity prices in the December 2021 half-year, lifting operating margins across the group,” South32 chief executive officer Graham Kerr said.

Production guidance for the 2022 financial year has been revised to be five per cent higher than previously expected, to reflect continued strong underground mine performance and higher average grades, making the updated targets 12.28 million ounces for silver, 117,900 tonnes for lead, and 292,200 tonnes of payable zinc equivalent production.

In New South Wales, the South32 Illawarra metallurgical coal operation saw a saleable production decrease of 23 per cent following an extended longwall move at the Dendrobium coal mine.

Over to the west at Worsley Alumina in Western Australia, saleable production decreased slightly by two per cent.

However, the production guidance for the 2022 financial year remains unchanged with the ongoing focus of improving initiatives at the refinery expected to maintain production above nameplate capacity of 4.6 million tonnes.

CANNINGTON WILL TRANSITION TO 100 PER CENT TRUCK HAULAGE.

OZ MINERALS BREATHES LIFE INTO PROMINENT HILL EXPANSION

OZ Minerals has selected long-time partner Zitrón Australia to design and manufacture a new primary underground ventilation system for the Prominent Hill gold mine in South Australia.

The companies have worked together since 2014, and the new project will see this relationship extended until at least the end of 2022.

Zitrón Australia managing director Javier Fernandez Lopez said the deal was a credit to his team.

“Congratulations to all the Zitrón Australia team members who have contributed to securing this contract, to our suppliers and partners for their contribution and to our customer, OZ Minerals, for the trust it has shown in us,” Lopez said.

The scope of works includes two high-pressure axial fans with a 3.8m impeller and installed motor power of 3400 kilowatts (kw).

This will bring the total installed power of primary fans by Zitrón at Prominent Hill to 8.6 megawatts.

“The contract will see Zitrón carry out a complete fan performance test in the company’s AMCAaccredited test bench, the largest in the world for axial fan testing,” Lopez said.

“All the fan performance parameters will be tested (flow, pressure, efficiency, vibrations, temperature) when the fan is run at its nominal speed and projected working conditions, in line with the resistance levels nominated in the project specification.”

Zitron Australia is part of the larger namesake Spanish group, which is a leader in ventilation solutions for underground environments.

In August, OZ Minerals was approved to construct a new hoisting shaft at Prominent Hill, adding four years to the mine’s life for a cost of $600 million.

The Wira shaft will allow the mine to operate until 2036 at around six million tonnes per annum.

ELPHINSTONE WR810 SERIES HIGH PERFORMANCE. LOW EMISSIONS

AVAILABLEIN TIER 3 & 4 ARRANGEMENTS

WR810 Delivery with Crane - Ensures parts, components, equipment, and maintenance personnel are transported safely and securely. Crane operated via manual lever control or wireless joystick remote, Crane Rated Lift Capacity 8.8 TM and Reach 7.7 m, Maximum Vehicle Payload 11,130 kg.

DUAL APPLICATION IN SITUTOP-UP

WR810 Water Cannon

The dual application machine features a water cannon to wash down valuable ore fines or blast material hangups and side and rear water sprays for dust suppression. Volume 8000 L, Water Pressure approx 150 psi, Water Flow approx 2,700 L/min.

MIX INTRANSIT

WR810 Fuel & Lube

Provides in situ top-up of lubricants, greasing, and refuelling of production machines, eliminating the need to leave the work area. Diesel Tank 5000 L, Individual Air Operated Oil Pumps, 4 x 300 L Oil Tanks, 44 Gallon Drum Storage.

AS1418.10COMPLIANT

WR810 6m3 Agitator

Specialising in bulk transport of concrete to back fill voids, this dual loading agitator has an excellent top speed at full capacity improving cycle times. Volume 6m3, Plant Bowl Speed 0-19 rpm (In Transit 0-6 rpm), Slump Meter in Cab.

WR810 Scissor Lift

A purpose-built underground elevated work platform with 17% levelling capability utilising hydraulic jacking legs. Compliant with AS1418.10 Group A, Type 1, Rated Lift Capacity 5000 kg, Platform Size 2,400 wide mm x 4,000 long mm.