TRANSFORMING THE FUTURE

MINING’S DIGITAL EVOLUTION CONTINUES

Are you ready for the future of mining? Epiroc’s digital technologies can help you build a more efficient, safe and sustainable workplace. Our solutions are designed for interoperability, which means you’re never locked in. You can design your own technology agnostic ecosystem with mixed fleets, legacy equipment, and existing partners. Working closely with our customers and partners, we are at the forefront of technological advances in mining and construction. Join us as we build the future. epiroc.com/en-au

PAUL HAYES

paul.hayes@primecreative.com.au

As industries around the world further utilise digital practices and platforms, it’s little surprise the mining sector is heading firmly in the same direction.

And given its fundamental role in so many aspects of modern society, it makes sense that mining makes use of every available tool to ensure it runs as smoothly as possible.

Through recent innovation in areas such as integrated automation, Internet of Things (IoT) solutions and detailed data analysis, mining operations have been able to increase productivity, safety and sustainability, while also reducing downtime, costs and maintenance work.

Investing in mining visionaries is one of the keys to creating digital solutions that will help operations continuously improve and grow.

Constant innovation means digital mining products and services are helping to achieve record productivity results, which ensure operations are on a path of continuous growth.

But what do we mean when we say, ‘digital mining’?

The answer, it turns out, is incredibly broad. From data security to autonomous machines to greater levels of connectivity and internet access, digital solutions can spread across pretty much every corner of a mining operation.

One of the more exciting aspects of the digital mining world comes in the form of artificial intelligence (AI). This is an area that has seen some mixed coverage in the news this year (and anyone familiar with the Terminator franchise is likely to raise an eyebrow at the idea of a machine

CHIEF EXECUTIVE OFFICER JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY EDITOR

PAUL HAYES

Email: paul.hayes@primecreative.com.au

ASSISTANT EDITOR

ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS TOM PARKER

Email: tom.parker@primecreative.com.au

OLIVIA THOMSON Email: olivia.thomson@primecreative.com.au

making any important decisions), but AI has a number of interesting roles to play in mining.

According to Andrew Borthwick, Orange Business managing director for Australia and New Zealand, AI and machine learning can be used to help mining operations in many ways.

“We can help our customers make better use or their data and keep an eye on cost,” he said. “If a truck on a site has continued to break down, for example, we can help companies get down to the granular level of why this keeps happening through our technology.

“We help (mining companies) get hold of the data so they can make informed decisions at a broad level.”

Digital mining is not the future – it’s the present. Companies that innovate and adapt accordingly are the ones that will continue to thrive for years to come.

Orange Business, a division of the Orange Group, supports companies and organisations throughout their digital transformation. Its customers can benefit from the skills of more than 29,000 employees, who are experts in business-to-business challenges.

According to the company, its difference is built on four main pillars: Evolution platform (a modular platform); employee experience; customer experience; and operational experience.

What sets Orange Business apart?

Paul Hayes Managing Editor

TIM BOND Email: tim.bond@primecreative.com.au

CLIENT SUCCESS MANAGER JANINE CLEMENTS Tel: (02) 9439 7227 Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

“We bring the rigour of a network and connectivity expert together with the agility of a global digital solutions integrator,” the company said. “We combine global presence with a local approach to unlock your innovation potential and support your economic growth in a responsible and sustainable way.”

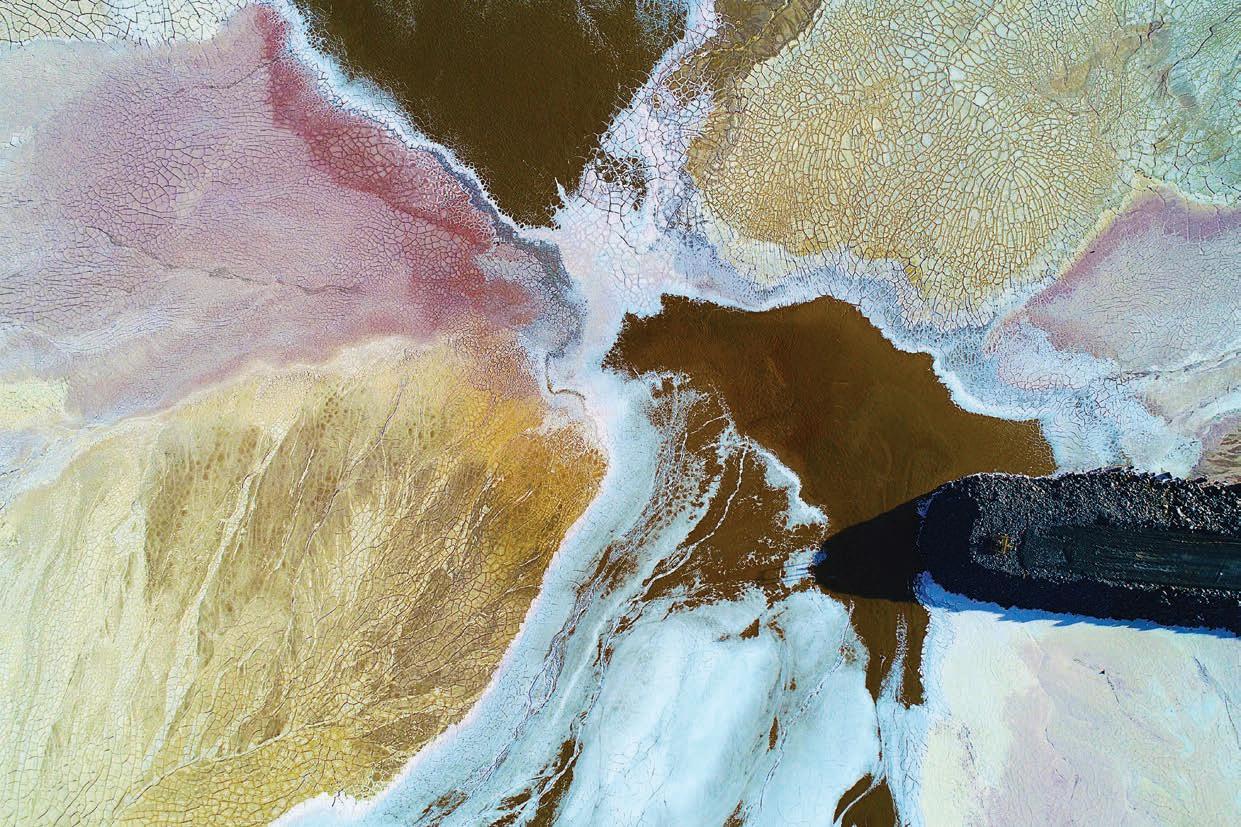

Cover image: Orange Group

PRINTED

SUBSCRIPTION RATES

Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au

20 INDUSTRY OUTLOOK

Australia: A clean-energy superpower?

It has long been a trusted mining partner of countries across the world, but there is urgency for Australia to expand its downstream capabilities as the world decarbonises.

24 DECISION-MAKER

Worth its weight in copper

Australian Mining was in the audience when BHP chief operating officer Edgar Basto spoke at Austmine 2023 about copper’s role in a low-carbon future.

26 DIGITAL MINING

Orange means business

Orange Business has grown from its telco roots to become a multi-level technology and service provider for the Australian mining sector.

32 DIGITAL MINING

Smoothing out complex operations

The Olive Downs Complex is shaping up to be a world-class producer of steelmaking

coal, and several companies are working together to make it run smoothly.

40 DIGITAL MINING

New tech to solve age-old problems

A computer-science revolution is enabling Orica to conquer operational problems customers had been wrestling with for decades.

48 MINE REHABILITATION

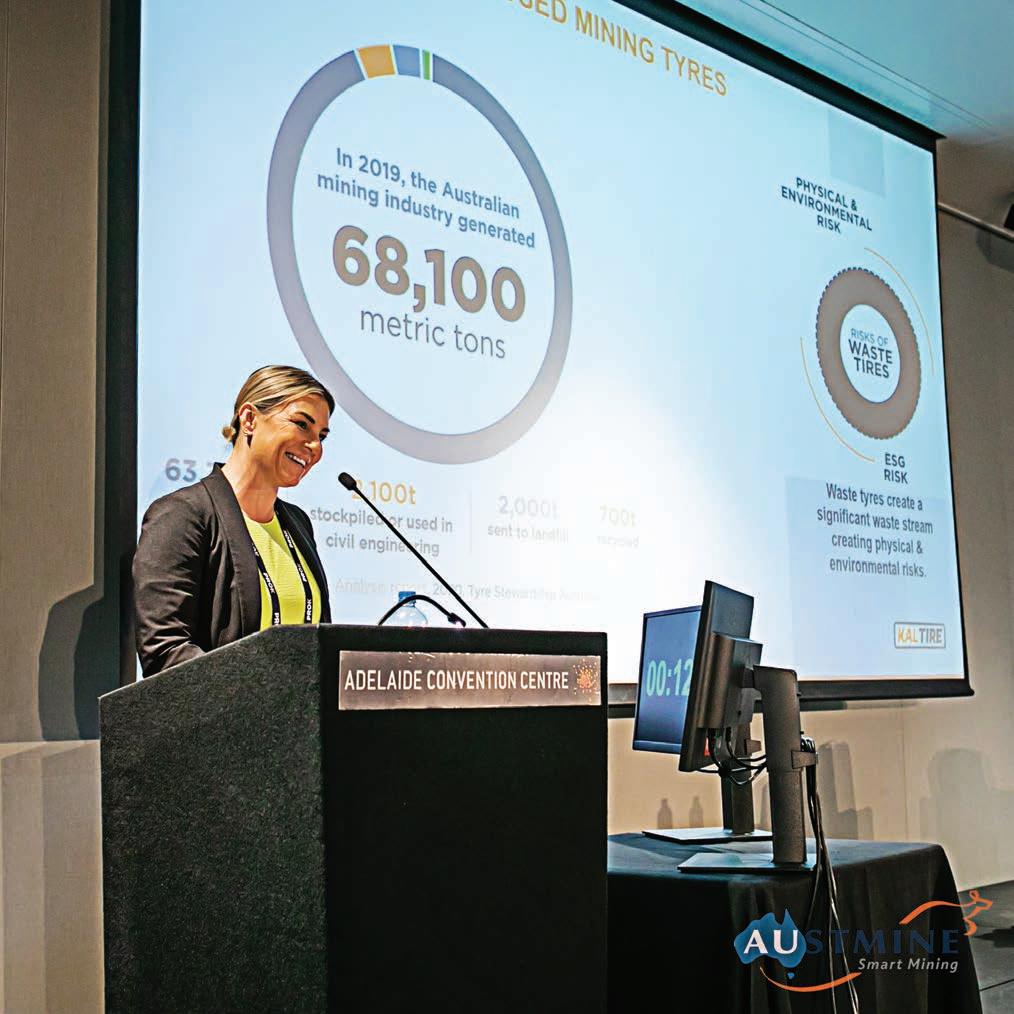

Unlocking abandoned mines

When Dendra Systems recently sponsored an event exploring the mining industry’s environmental future, Australian Mining was on hand to document the key takeaways.

58 WOMEN IN INDUSTRY

Driving change and breaking down barriers

The annual Women in Industry Awards recognise outstanding women across the industrials sector, acknowledging exceptional work and dedication.

64 AUSTMINE 2023

Transforming the future

Austmine 2023 showcased the leading technologies, ground-breaking innovations and transformative solutions provided by the Australian resources industry.

70 DECISION-MAKER

The rise of South32

Australian Mining sat in on a recent fireside chat with South32 boss Graham Kerr, where he spoke about the company’s unlikely journey to being the diversified miner it is today.

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

Stausholm touched on the company’s humble beginnings while celebrating its 2023 successes at the annual general meeting (AGM), held on May 4.

“Our very first project was the redevelopment of an ancient copper mine in the south of Spain that gave our company its name,” Stausholm said at the AGM in Perth.

“Buying a loss-making mine with a depleted resource in a country recovering from civil war was seen as mad at the time. But a group

Almost six months after former Fortescue chief financial officer (CFO) Ian Wells resigned, the iron ore major has appointed Christine Morris to the position.

Morris brings over 30 years’ experience to the table, spanning energy, media and telecom, manufacturing and technology industries.

“Christine is a very experienced CFO with a successful track record in aligning financial and corporate

opportunity. And on 29 March 1873, they formed the Rio Tinto Company to purchase and develop the mine.

“Their vision paid off, and they turned that run-down operation into one of the most profitable mines in Europe.”

This year the company celebrated its 150th year, delivering underlying earnings of $US13.3 billion and a return on capital of 25 per cent.

“As a result, the board has recommended a final ordinary dividend of 225 US cents per share,

to you, our shareholders,” Stausholm said.

“This represents a pay-out ratio of 60 per cent, in line with our policy and the second-largest ordinary dividend in our 150-year history.”

This year Rio Tinto hit several milestones, including acquiring the Platina scandium project in NSW for $14 million; expanding the Oyu Tolgoi copper mine in Mongolia; and reaching separate agreements with BMW Group and Japanese conglomerate Marubeni

AUSTRALIAN MINING GETS

THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

Corporation to supply Rio’s aluminium to downstream manufacturers.

Stausholm also addressed the company’s environmental, social and governance (ESG) aspirations.

“We have been working hard to implement meaningful change in the way we partner, especially with Indigenous peoples and the communities where we work,” Stausholm said.

“A real highlight was the agreement with the Puutu Kunti Kurrama and Pinikura people to create the Juukan Gorge Legacy Foundation as part of the remedy for the destruction of the rock shelters in May 2020. This is a significant step forward, but we know it will be a long journey to rebuild trust.”

strategy and leading the finance divisions of global organisations,” Fortescue Metals chief executive officer Fiona Hick said.

“I look forward to Christine joining Fortescue as CFO of Fortescue Metals and working together to maintain Fortescue’s position as the world’s best, lowest-cost iron ore operator.

“During this critical time of growth and development, Christine will help lead the business to our next phase.”

Morris will take the helm from Wells, who resigned in January 2023.

Morris said she was delighted to be joining Fortescue and was dedicated to delivering the company mission of eliminating emissions profitably and leading heavy industry globally to decarbonise.

“My focus will be on continuing to provide exceptional value for Fortescue shareholders and maintaining and growing the strength of our iron ore and emerging critical

minerals business,” Morris said.

“I am pleased to be joining Fortescue, a hugely successful company that is undergoing significant transformation to become a global green energy and resources company.

“I look forward to working with the company’s exceptional leadership team to continue Fortescue’s strong track record of outstanding financial performance and disciplined capital management.”

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Core Lithium has announced the appointment of a new non-executive director.

Andrea Hall is an experienced nonexecutive director who is currently a member of the board of Evolution Mining and Perenti.

Hall has also previously held directorships at Automotive Holdings Group, the Western Australian Chamber of Commerce and Industry, Lotterywest, Murdoch University, Pioneer Credit and Tap Oil.

Hall’s career in the financial service industry has spanned over 35 years, which the company board said will allow her to bring a strong skill set including risk management, finance, external and internal audit, and corporate and operational governance.

Other industries which Hall has experience working in include transport, healthcare, insurance, property and government.

The Western Australian Government allocated land for four projects across the Maitland strategic industrial area (SIA). Under the land allocations, the Maitland greenfield site will be transformed into a globally competitive, multi-product industrial precinct, supporting the diversification of the Western Australian economy and the creation of more jobs.

The Maitland SIA is located 24km west of Karratha and 39km south of Dampier Port, with the projects approved producing hydrogen and

ammonia to generate renewable power. Proponents allocated land in the Maitland SIA include:

• Fortescue Future Industries (FFI)

• Yara International

• Hexagon

• Perdaman Chemicals and Fertilisers. Fortescue subsidiary FFI recently joined forces with Kenya to develop a major green energy and fertiliser project while also supplying green electricity to Kenya’s grid. It is just one

Hall said she is excited to join the company as a non-executive director.

“I am delighted to join the board of Core Lithium, a progressive, young resources company, with a highly capable team, which is maturing into the next exciting phase of its corporate development as a producer of this critical commodity,” Hall said.

Core Lithium non-executive chair Greg English said the company is excited to have Hall on board.

“Andrea is a highly respected industry leader with a distinguished career as a company director and consultant,” English said.

“As Core Lithium moves from developer to established producer at the forefront of Australia’s critical minerals sector, Andrea’s skillset, industry experience and commercial acumen will be invaluable.”

Hall’s appointment was made effective as of May 18 2023.

“Land allocated in the Maitland SIA will enable a range of projects, including ammonia, hydrogen and renewable energy, which will aim to decarbonise emissions on the Burrup Peninsula,” then-WA Development, Jobs and Trade Minister Roger Cook said.

“This is exciting news for the Pilbara, and in particular for Karratha and Dampier.

“These projects will create a

Lands Minister John Carey said the projects would help to diversify WA’s economy.

“This is a major boost for regional WA, and in particular for the city of Karratha, as these projects create and sustain local jobs while strengthening and diversifying the state’s economy,” Carey said. “Land allocations in Maitland SIA will enable a range of projects that will aim to decarbonise emissions on the Burrup Peninsula and

The Federal Government has announced it will give out $50 million in grants to help boost the development of critical minerals projects.

The grants will go toward helping diversify supply chains, build domestic downstream processing and support new jobs and regional development.

“The successful projects will create jobs and opportunities across regional Australia and help Australia realise its ambitions to be a clean-energy superpower,” Minister for Resources Madeleine King said.

Successful projects are located across Western Australia, Queensland and New South Wales.

The majority of projects are located in WA, with a total of $29.15 million allocated to companies such as Magnium Australia to commercialise its CSIRO-patented technology for clean extraction of magnesium metal and Northern Minerals to support its Browns Range heavy rare earths project.

In NSW, $6.5 million has been allocated to Australian Strategic

support mining, separation and refining.

Over in Queensland, Evolution Mining has been allocated $2.2 million to support its Ernest Henry operation.

A total of 13 projects will receive funding across the three states.

“The 13 projects to receive funding under the Critical Minerals Development Program grants include plans to produce key inputs to lithiumion batteries for electric vehicles, and to support supply chains for advanced

energy and defence applications,” King said.

“The grants will support Australia’s new Critical Minerals Strategy, to be released shortly and which will outline how Australia can capture the significant opportunity of growing its critical minerals processing sector.

“Australia has remarkable potential to meet the increasing global demand for the critical minerals needed for clean energy technologies, such as electric vehicles and batteries, as the

BHP has officially become the parent company of OZ Minerals, with OZ removed from the ASX on May 3.

“This acquisition strengthens BHP’s portfolio in copper and nickel and is in line with our strategy to meet increasing demand for the critical minerals needed for electric vehicles, wind turbines and solar panels to support the energy transition,” BHP chief executive officer Mike Henry said.

“Combining our two organisations will provide options for growth,

bring new talent and innovation to unlock these resources in a sustainable way, and deliver value to shareholders and communities.”

The takeover will allow BHP to focus on safe and reliable operation of the Olympic Dam, Prominent Hill and Carrapateena assets.

OZ Minerals shareholders received $28.25 per OZ share, marking the implementation of the scheme of arrangement. This follows approval of the $9.63 billion deal by the Federal Court earlier this month.

The revised offer was an increase on the original $8.4 billion offer made in August 2022.

OZ Minerals has a number of operations in Brazil, including the Santa Lúcia iron oxide coppergold mineral deposit, the Antas copper-gold mine, and CentroGold, one of the largest undeveloped gold projects in the country. The acquisition gives BHP access to OZ’s significant portfolio of futurefacing minerals – namely copper and nickel – that are vital to the world’s push for clean energy.

In its final-ever quarterly report, OZ Minerals announced 31,362 tonnes of copper and 46,722 ounces of gold.

“As this is the final production report from OZ Minerals, the board and management would like to thank all our stakeholders for their contribution to the company’s success,” OZ Minerals chief executive officer Andrew Cole said. BHP has indicated it intends to retain the majority of OZ Minerals’ workforce, particularly at Prominent Hill and Carrapateena.

Schenck Process Mining has become part of Sandvik Rock Processing Solutions.

SP Mining & Sandvik share a deep passion for innovation. Our combined global footprint of R&D and

production facilities bring the expertise of our people even closer to our customers.

We are now better positioned than ever, to develop innovative solutions to the challenges of our industry.

Following the February rejection of the Bird In Hand gold mine in Adelaide’s Woodside region, Minister for Energy and Mining Tom Koutsantonis has committed to preventing further mining applications in the area.

The gold deposit area has now been proclaimed by the Governor at the request of the State Government, a mechanism that has been used in the past to protect the Mintabie town lease area and the Burra Monster mine historic area.

In February, Terramin, the developer of the proposed mine, submitted a mining lease proposal (MLP) following five years of community consultation.

This was rejected by Koutsantonis on February 9, citing broader state interests such as potential socioeconomic and amenity impacts as the reason for the rejection.

“This was an important and necessary step to protect against future attempts to mine this deposit,” Koutsantonis said, regarding the proclamation of the area.

“We want to ensure local tourism businesses – including world-class wineries – as well as the local amenity of this area remain protected.”

Terramin was advised of the proclamation plan in March and was invited to make a submission, but declined.

The proclamation will not restrict Terramin’s ability to undertake rehabilitation activities associated with previous exploration in the area.

“In circumstances where it is determined mining operations are not compatible with a particular area, it is

important to shift the primary control over any future potential applications to the Government,” Koutsantonis said.

“This mechanism will ensure full control by Government over the ability for anyone to make future applications for mineral tenements over this small area.

“That was the basis for my decision in February to decline Terramin’s application to develop this mine. By protecting the Bird In Hand mine area under proclamation, we will ensure that decision holds firm both now and into the future.”

Previously mined and discarded rock and earth will be searched for overlooked critical minerals to help accelerate Australia’s clean energy switch.

Geoscience Australia has developed an atlas of sites across the country that it believes may have critical minerals that were previously discarded, including minerals used in solar panels and electric vehicles (EVs).

Dubbed the Atlas of Australian Mine Waste, the search has been

created in collaboration with RMIT University, the University of Queensland and the geological surveys of Queensland, New South Wales, Northern Territory, Victoria and South Australia.

“Some of the minerals we need now, and into the future, may not just be in the ground – they’re also in rock piles and tailings on mine sites around the country,” Minister for Resources Madeleine King said.

“These minerals might not have been of interest when first extracted but could now be in hot demand as the world seeks to decarbonise – for example, cobalt in the tailings of old copper mines. This new Atlas puts these potentially lucrative sites on the map for the first time and may open up new sources of critical materials.”

The Atlas has identified over 1000 sites across Australia to search for critical minerals.

“Our resources sector is the key to our net zero future – and this is another tool developed by Government to help facilitate the discovery of critical minerals in a more efficient, sustainable way – and to the highest standards,” King said.

“Reprocessing rocks and earth that have been previously excavated during mining operations can give new life to old mining towns, create jobs and rejuvenate local economies.”

Gina Rinehart was recently announced as this year’s Western Australian of the Year.

Rinehart is the executive chairman of Hancock Prospecting, an independent, privately owned Australian company that shares a proud history with the Pilbara region in WA and the iron ore sector.

Rinehart has been recognised for her contribution to the WA economy, as well as the overall Australian economy. She was also awarded the 2023 Business Award.

The Western Australian of the Year Awards celebrate exceptional Western Australians making extraordinary contributions in key areas such as arts and culture, the Aboriginal community, positive social, scientific and economic impact, sport and the overall WA community. This year marks the 50th anniversary of the awards.

As reported by used her acceptance speech to reflect on what the company has achieved.

“It’s actually a very long way from where my family company was 30 years ago, and I’m incredibly proud of what we have achieved in this time for our company and what we’ve been able to contribute to West Australia and our country and our future,” Rinehart said.

Rinehart also called for the state and federal governments to help keep Australian businesses competitive within a global market.

“We must ensure that our country is not left behind by short-sighted decisions and encourage policies that welcome investment in our wonderful state,” Rinehart said.

Coal miner Glencore recently sold its CSA copper mine in Cobar, New South Wales, to Metals Acquisition Corp (MAC) for $US1.1 billion ($1.64 billion).

CSA is an established, high-gradeproducing, long-life underground copper mine with an estimated mine life of over 15 years, and MAC has identified opportunities to further extend it, subject to exploration success.

The sale is the another indicator of copper’s growing importance, after Evolution Mining extended its Ernest Henry mine life to 2040 earlier in May.

Similarly, South32 has been looking to grow its portfolio, identifying a copper mine that could

be an M&A fit. The copper outlook continues to be supported by the rising decarbonisation narrative, with the commodity a highly efficient conduit for renewable energy systems such as solar, wind, hydro and thermal energy.

The Glencore/MAC deal has been on the table for some time, with the companies entering into an agreement back in March 2022.

“The acquisition of CSA represents a strong strategic fit for MAC. Our management team’s operational expertise, understanding of regional operations and relationships with local stakeholders uniquely position us to identify and realise the full potential value of the asset,”

MAC chief executive officer Mick McMullen said at the time.

“We believe that copper has favourable fundamentals that will continue to support an elevated copper price.

“Copper is expected to play a key role in the global energy transition ‘megatrend’, with approximately one million tonnes per annum of new supply required from 2024 onwards in order to meet the surging demand forecast.

“With few new projects globally in the pipeline, increasing permitting issues and jurisdictional risk, and declining copper grades across the industry, we believe that there are significant challenges ahead to close the projected supply deficit.”

MAC acquired 100 per cent of the issued share capital of Cobar Management from Glencore. Cobar Management owns and operates the mine.

The company has made arrangement for the copper streams with Osisko Gold Royalties in the US.

“CSA is a high-grade, long-life asset, with significant upside that can be unlocked by the MAC management team,” Osisko president and chief executive officer Sandeep Singh said.

“We are pleased to see this important transaction nearing completion, and look forward to having both the silver and copper streams contribute to our near-term cash flows.”

Greatland Gold and Rio Tinto have entered into a farm-in and joint venture agreement to accelerate exploration across highly prospective tenure across the Paterson south project.

The Paterson South project is located in the Paterson region of Western Australia, which is one of the most prospective frontiers in the country for the discovery of multicycle, Tier 1 gold-copper deposits. a 75 per cent joint venture interest in the project tenements under the twostage farm-in arrangement.

Stage 1 states that Greatland is entitled to earn a 51 per cent joint venture interest in the Paterson project by incurring at least $7.1 million of exploration expenditure and completing 7500m of drilling within four years.

Stage 2 states that Greatland is entitled to earn an additional 24 per cent joint venture interest in the Paterson project by spending

The eastern group of the Paterson project tenements host several underexplored magnetic anomalies. These targets are within proterozoic sediments and are considered by Greatland to be the closest to a Havieron look-alike within the Paterson Province.

The Havieron project is a joint venture between Greatland and Newcrest.

Greatland managing director Shaun Day said the project is an opportunity with high-priority, high-prospective and heritage-cleared drill targets.

“We expect that some of these targets can be incorporated in our 2023 drilling campaign,” Day said.

“Our farm-in and joint venture with Rio Tinto is consistent with our strategy of continuing to invest in exploration success, and aligns

BHP is looking into initiatives to grow its iron ore production to 300 million tonnes per annum.

In his speech to the Bank of America Securities 2023 Global Metals, Mining and Steel Conference, BHP chief executive officer Mike Henry said the company’s Western Australian iron ore business was designed with an initial capacity of 240 million tonnes per annum, but is currently producing 280–290 million tonnes.

“We’re now looking at initiatives to grow our production to 300 million tonnes per annum over the mediumterm,” Henry told attendees.

“This low capital intensity volume increase involves further debottlenecking our port and rail systems, the rollout of autonomous haulage trucks, and ongoing productivity enhancements.”

Eventually, Henry said, BHP would like to grow iron production to 330 million tonnes and has developed

studies to assess how this could be done. The studies are expected to be concluded in 2025.

In terms of potash, which includes mined salts that contain potassium, Henry said BHP had accelerated studies on its Jansen Stage 2 project in Canada to process an extra four million tonnes per annum.

“We are really excited about the pipeline of growth projects that we have ahead of ourselves in potash,” Henry said.

“Jansen Stage 1, the first stage, remains on track and on budget and, in fact, we have been able to accelerate first production from 2027 into late 2026.

“We have recently started blasting and excavation works at the bottom of the shaft, and we’re looking forward to a productive summer construction season, with a continued focus on civil and mechanical construction activities on the surface and underground.”

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, INCLUDING AT FORTESCUE, ANGLO AMERICAN, NEWMONT AND MORE.

Fortescue Metals Group has appointed a new chief financial officer (CFO) almost six months after former CFO Ian Wells resigned.

Christine Morris has been appointed in Wells’ place, bringing over 30 years’ experience to the table, spanning energy, media and telecommunications, manufacturing and technology.

“Christine is a very experienced CFO with a successful track record in aligning financial and corporate strategy and leading the finance divisions of global organisations,” Fortescue chief executive officer Fiona Hick said.

Morris said she was delighted to be joining Fortescue and was dedicated to delivering the company mission of eliminating emissions profitably and leading heavy industry to decarbonise globally.

“My focus will be on continuing to provide exceptional value for Fortescue shareholders and maintaining and growing the strength of our iron ore and emerging critical minerals business,” Morris said.

Anglo American recently announced several changes to its senior management team and organisation as the company reorganises how it manages its production businesses.

“We are building on the significant progress we have made in recent years to further improve our portfolio of

world-class assets and deliver our growth potential – in service of our commitments to our shareholders, employees and stakeholders, as a responsible producer of future-enabling metals and minerals,” Anglo American chief executive Duncan Wanblad said.

“We have been refreshing the executive team steadily over the last 12 months and we welcome this new generation of Anglo American’s leadership. As a team, we are embarking on our next phase of sustainable value creation.”

The changes will see Anglo American’s production businesses consolidated into two regions: Africa and Australia; and the Americas. Themba Mkhwanazi was named regional director Africa and Australia, while Ruben Fernandes has been appointed as regional director Americas.

Anglo American has also installed a team to support the regional directors, including finance director, technical and operations director, strategy and sustainability director, and people and organisation director roles.

Newmont Corporation recently announced the appointment of Karyn Ovelman as executive vice president and CFO.

Ovelman is a highly experienced financial professional who will focus on Newmont’s financial discipline, maintaining a robust and flexible balance sheet to support the company’s

capital allocation strategy, and will be responsible for Newmont’s global finance functions.

Ovelman brings extensive global leadership experience to the role. She has previously held CFO roles for highly complex and capital-intensive companies in the resource and energy sectors, including Flowserve, LyondellBassell Industries, and the now defunct Petroplus Holdings.

Aurelia Metals has appointed former OZ Minerals executive Bryan Quinn as its new managing director and chief executive officer (CEO).

Quinn had led the growth, strategy, exploration, sales and marketing businesses at OZ over the past 12 months and spent more than 27 years before that at BHP, where he was employed in various president and general management roles.

The appointment coincides with the departure of Andrew Graham who had served in an interim CEO role since November 2022.

“Quinn’s extensive experience in business improvement, operational excellence and project delivery is an ideal background to help Aurelia deliver on its exciting development pathway for Federation and Great Cobar, whilst optimising value and performance of our existing assets,” Aurelia chair Peter Botten said.

“With the refreshed management team and a competitive and flexible

financing package now in place, Aurelia is well positioned to deliver on its valueadding growth trajectory.

“This represents a pivot point for the company and we look forward to providing our shareholders with reliable value enhancement.”

Shaun Ren has retired as managing director of Richmond Vanadium Technology (RVT) and will be succeeded by Jon Price.

Price was most recently managing director of Horizon Minerals and is currently a non-executive director of Richmond Vanadium. He has also held senior management and executive positions at the likes of Gold Fields and Phoenix Gold.

“We thank Shaun for his expertise, dedication and invaluable contribution to the growth of our business, including recently as the managing director of the company’s initial public offering in late 2022,” Richmond Vanadium nonexecutive chair Brendon Grylls said.

“As a metallurgist with a masters in mineral economics, he (Price) brings with him a deep understanding of the project and a passionate advocacy to build a new industry for Australia.

“With the world facing unprecedented change and looking towards renewable energy to combat the effects of climate change, we believe that Jon is the ideal candidate to build on Shaun’s work and lead RVT through the next phase of its journey.” AM

FRAGMENTATION FOR DOWNSTREAM PROCESS EFFICIENCY

Reduces operation costs

Reduces carbon footprint

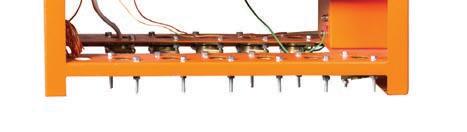

FRAGTrack™ Gantry is a market-first haul truck measurement solution combining real-time oversize detection alerts and accurate Particle Size Distribution (PSD) of fragmentation on all models and sizes of haul trucks.

FRAGTrack™ Gantry uses advanced machine vision and machine learning technologies to enable autonomous triggering and processing, without interfering with the haulage operation.

Improves safety

Improves visibility of blast outcomes

To learn more about FRAGTrackTM and how it can support your operations today, please contact your local Orica representative or visit orica.com/FRAGTrack

Machine vision digital stereoscopic camera

Machine vision digital stereoscopic camera

IT HAS LONG BEEN A TRUSTED MINING PARTNER OF COUNTRIES ACROSS THE WORLD, BUT THERE IS URGENCY FOR AUSTRALIA TO EXPAND ITS DOWNSTREAM OPTIONS AS THE WORLD DECARBONISES.

Any new industry can present a race to the top, with early adopters best placed to capitalise on new market share and gain a competitive advantage.

This is certainly the case in the context of decarbonisation, where more and more countries are recognising the commercial opportunities that come with establishing the net-zero power sources of a cleaner future.

The situation represents a oncein-a-generation opportunity, and Australia is beginning to understand the role it can play in supporting the green transformation.

Having established itself as a mining superpower, Australia is already a key supplier of materials driving renewable energy technologies. But the country can be more than the world’s greenenergy quarry, with opportunities to look downstream and establish vertically integrated renewable industries onshore.

One avenue could be to develop a local battery supply chain, something the Future Battery Industries Cooperative Research Centre (FBICRC) sees as a particularly urgent commercial pathway.

“The clean-energy transition is moving faster,” FBICRC chief executive officer Shannon O’Rourke told Australian Mining.

“Government spending on clean energy has increased 30 per cent in the past two years.

“Greater subsidies are driving electric vehicle (EV) demand and increasing commodity prices and volumes. In the past 18 months, the opportunity for Australia has doubled.”

FBICRC released a report in March suggesting Australia’s battery opportunity could contribute $16.9 billion to the country’s economy by 2030.

is the result of Australia’s abundant lithium reserves and mining capacity, which creates natural synergies with downstream applications.

Some Australian companies are already harnessing onshore lithium

HAVING ESTABLISHED ITSELF AS A MINING SUPERPOWER, AUSTRALIA IS ALREADY A KEY SUPPLIER OF MATERIALS DRIVING RENEWABLE ENERGY TECHNOLOGIES. BUT THE COUNTRY CAN BE MORE THAN THE WORLD’S GREEN-ENERGY QUARRY, WITH OPPORTUNITIES TO ESTABLISH VERTICALLY INTEGRATED RENEWABLE INDUSTRIES ONSHORE.”

The report, Charging Ahead –Australia’s Battery Powered Future, highlights Australia’s mining and geological upside, particularly in the production and endowment of critical minerals, and how this can support capabilities further downstream.

This encompasses not only battery manufacturing but other segments in the value chain, such as refining and active materials.

“Australia is cost-competitive across the entire value chain,” O’Rourke said. “We are eight per cent cheaper than Indonesia to produce advanced materials and five per cent cheaper than the United States to produce cells.”

Australia also has a significant advantage in refining, with the potential to be the world’s cheapest producer of lithium hydroxide monohydrate (LHM) through upstream integration in the supply chain. This

hydroxide opportunities, with Mineral Resources (MinRes) and IGO producing the refined product from their downstream processing facilities in Kemerton and Kwinana, respectively.

The Kemerton plant sources spodumene concentrate – a raw lithium material – from the Greenbushes lithium mine in WA, which is part owned by MinRes’ Kemerton partner, Albemarle Corporation.

IGO’s Kwinana plant, which it owns in partnership with Tianqi Lithium Corporation, also sources spodumene from Greenbushes.

The lithium hydroxide produced from Kemerton and Kwinana is then shipped offshore for further processing before it is upgraded to active materials such as lithium-iron-phosphate (LFP) or nickelcobalt-manganese (NCM) – two key cathode inputs for renewable batteries.

But demand for Australia’s upstream products is not coming solely from

overseas, with a growing local renewable energy sector seeking more materials than ever.

“Australia’s local demand is skyrocketing,” O’Rourke said.

“Bloomberg reports that Australia has the largest pipeline of energy storage projects behind China, and a recent Sunwiz report shows that Australia’s behind-the-meter battery storage market is up 55 per cent year-on-year.”

The Australian Government is funding the construction eight largescale batteries, storing renewable energy and reducing the reliance on fossil-fuel power generation. Project locations extend from Victoria’s surf coast to Queensland’s tropical north.

Building independent capabilities is important, but for Australia to effectively

“Building an ecosystem is like trying to solve the chicken-and-egg problem,” O’Rourke said.

“A healthy ecosystem needs multiple suppliers, customers and producers, supported by service companies, a flexible workforce, the research sector, and government.

“Building that incrementally could take

linear and needs to be supported by trade and accelerated by domestic support.

“Australia is in a good position. It has multiple projects either announced or operating across all elements of the value chain, including refining, materials, (and) cell and system manufacturing.

“We have a complete value chain today, including cell manufacturers. The

FBICRC believes Australia can be competitive all the way from refining to manufacturing, but the country must find its sweet spot.

“We do not need to match China’s scale; rather, we need to achieve minimum economic scale,” O’Rourke said. “Our minerals strength, our secure supply and our ESG (environmental, social and governance) credentials help sharpen our competitive edge.

“Australia has two cell manufacturing projects which meet this minimum scale: Recharge Industries’ 30-gigawatt-hourper-annum project in Avalon (Victoria) and Energy Renaissance 5.3-gigawatthour-per-annum project in Tomago (New South Wales).

“The NRF (National Reconstruction Fund) and other support mechanisms can help Australia’s lighthouse projects get to scale and develop their supporting industries to build a competitive ecosystem.”

The Australian Government introduced the NRF in October 2022,

contributing $15 billion to transform several future-facing industries, including renewable energy and downstream opportunities within the resources sector.

Federal support has also been flowing via the Critical Minerals Development

‘mine-to-market’ graphite strategy in WA, and $4.6 million for IGO’s integrated precursor cathode active material (pCAM) facility in WA.

IGO is developing its downstream project in partnership with Andrew Forrest-backed Wyloo

“There is a strong collaborative spirit supporting our cathode precursor production pilot plant facility, where we are currently manufacturing high-performance materials to world standard,” O’Rourke said.

“Four universities and 18 other businesses have come together to build and demonstrate an Australian manufacturing capability.”

Key mining industry players such as BHP, Allkem, IGO, Cobalt Blue, Lycopodium and BASF have come together with FBICRC to further Australia’s understanding of the active materials industry.

Program, which recently provided close to $50 million in grants for emerging upstream and downstream projects. This included $6.5 million of funding for Australian Strategic Materials’ Dubbo rare earths project in NSW, $4.7 million for International Graphite’s

Metals, demonstrating the power of collaboration in Australia’s downstream ventures.

Collaboration is also a key aspect of FBICRC’s work and underpins its own pilot plant, which is exploring the local production of NCM cathode materials.

Australia’s battery opportunity is there for all to see, and there are enough developments to suggest that an integrated supply chain could be established.

But the country must be firing on all cylinders for that to happen, with stakeholders right across the battery supply chain working together to make this dream a reality. AM

BUILDING AN ECOSYSTEM IS LIKE TRYING TO SOLVE THE CHICKEN-AND-EGG PROBLEM. A HEALTHY ECOSYSTEM NEEDS MULTIPLE SUPPLIERS, CUSTOMERS AND PRODUCERS, SUPPORTED BY SERVICE COMPANIES, A FLEXIBLE WORKFORCE, THE RESEARCH SECTOR AND GOVERNMENT.”THE KEMERTON AND KWINANA LITHIUM HYDROXIDE PLANTS SOURCE ORE FROM THE GREENBUSHES MINE IN WA.

AUSTRALIAN MINING WAS IN THE AUSTMINE 2023 AUDIENCE WHEN BHP CHIEF OPERATING OFFICER EDGAR BASTO SPOKE ABOUT COPPER’S ROLE IN A LOW-CARBON FUTURE.

Still riding the high of its $9.6 billion purchase of OZ Minerals – its first such acquisition in a decade – BHP looks set to lead the global push toward a net-zero future.

BHP chief operating officer Edgar Basto took to the stage at Austmine 2023 in May to deliver an opening speech on the company’s current growth corridors and opportunities.

And high on that list was futurefacing commodities, or resources that can help to meet the demands of decarbonisation, electrification and population growth.

“The world needs good companies to develop these resources and that presents a huge opportunity for us and for the entire industry,” Basto said. “The demand for copper is on the rise.”

Basto said BHP estimates that electric vehicles (EVs) could account for nearly 60 per cent of global annual car sales by 2030, and nearly all car sales by 2050.

EVs use three-to-four times more copper than petrol-based cars, making it clear that BHP’s acquisition of OZ Minerals, and its considerable copper portfolio, could not have come at a better time.

“We have added to our copper assets in South Australia with the acquisition of OZ Minerals, bringing the Carrapateena and Prominent Hill mines into our portfolio,” Basto said.

“And, in March, we received environmental approval for our next phase of exploration at Oak Dam, which is around 65km south-east of Olympic Dam.”

“Oak Dam is an exciting prospect and potential growth option,” Basto said. “We’re undertaking further exploration to better define the resource and inform our future planning.

potential synergies to build a copper province that could put SA on the global copper map.”

Basto referenced South Australia’s copper strategy, which he said aligned

production of one million tonnes of copper each year by 2030. BHP has similarly committed itself to educating the next generation of copper mining professionals.

“I’m deeply passionate about new people joining our industry and taking opportunities to grow and pursue rewarding careers,” Basto said. “We’re investing heavily in skills and training.”

BHP runs a number of apprenticeship and trainee programs, including the FutureFit Academy, which offers a purpose-built learning centre to support mining industry newcomers.

“At the end of 2020 we pledged to fund 2500 new trainee and apprenticeships across Australia over the next five years,” Basto said.

“To date, we’ve welcomed 800 new students and more than 350 have graduated.”

BHP also runs the Olympic Dam Underground Mining School of Excellence, which creates opportunities for people without mining experience.

The school started in 2018 and consists of a tailored five-week course of theory and practical training, including haul truck driving simulators to give students a feel for what they might be driving once in the workforce.

“Around 300 people complete the program each year and enter into roles at Olympic Dam,” Basto said.

“Our people are paid to train and move into roles with BHP when they graduate.

“These programs, in addition to our graduate and intern programs, ensure that we’re reaching all the big

per cent of Australia’s mined copper production,” Basto said.

“The world needs more copper supply to be brought to the market more quickly. We are part of the start of that supply chain. We must grow the supply of these commodities safely and more sustainably.”

Basto said the company would like to develop a mining hub centred around a smelter that would bring more of South Australia’s copper to global customers.

Although there are no plans in motion for this ambitious goal yet, Basto said BHP would continue to work with governments and local stakeholders to drive better performance.

Chief among this work is water stewardship.

BHP is also looking at new ways of finding and extracting copper, including executing the largest-ever hard-rock 3D seismic survey in 2023.

“In partnership with some new startups and tech firms, we’re testing new ways of breaking and separating mineral particles to reduce energy consumption and improve throughput of our mills, which are a high energy consumer for the Olympic Dam operation,” Basto said.

“The Carrapateena team partnered with Australian companies on a world-first trial to use battery-electric trucks for heavy haulage across long distances.

thinkers and bright minds to open up opportunities here in SA.”

BHP expects that Olympic Dam will produce 200,000 tonnes of copper in 2023, with an additional 115,000 tonnes coming from Carrapateena and Prominent Hill.

But more can be done.

“Here in South Australia, we have nearly 70 per cent of Australia’s copper resources but we produce just under 30

“Here in South Australia, one of the challenges facing greater development in the Gawler Craton is the potential impact on local water resources,” Basto said.

“We are working closely with the South Australian government on the Northern Water Supply project.

“This would reduce the reliance on the Great Artesian Basin and the River Murray and provide a sustainable source of water for a range of industries, supporting more jobs and investment in the region.”

“The batteries being trialled can be exchanged within five minutes and retrofitted into any prime mover to reduce greenhouse gas emissions when combined with power from renewable or other low-carbon sources.

“This could potentially be the future of modular batteries on all mine sites. The opportunity in front of us is huge.

“I see the potential for great prosperity as we collaborate to discover the commodities of the future … faster, more efficiently and more sustainably than ever before.

“There is an exciting path ahead. South Australia has the potential to be a global leader in the race for critical minerals.” AM

THE WORLD NEEDS GOOD COMPANIES TO DEVELOP THESE RESOURCES AND THAT PRESENTS A HUGE OPPORTUNITY FOR US AND FOR THE ENTIRE INDUSTRY. THE DEMAND FOR COPPER IS ON THE RISE.”THE OZ MINERALS ACQUISITION SAW BHP GAIN CONTROL OF THE CARRAPATEENA COPPER MINE IN SA.

ith news of business-related hacks and cyber-attacks so prevalent in recent Australian headlines, it can be concerning to think about the same fate happening to mining networks.

Technology that keeps hackers at bay is often only found in the corporate world, but Orange Business is working to expand these systems into the mining sector to help ensure that all businesses can run their operations with peace of mind.

“The run state of mines is under threat, because it can be hacked,” Orange Business managing director for Australia and New Zealand Andrew Borthwick told Australian Mining

“Technology and electronics have evolved at such a rate that someone can hack into the system and create real explosions.

W“I don’t mean to be dramatic, but that sort of thing has to be secured in some way, shape or form.

“The technology and services we provide actually secure that environment for that particular customer of that particular mining organisation.”

Orange Business has been serving mining organisations in Australia for decades and is committed to continuing to provide digital services that secure its customers’ organisation.

A mine’s supervisory control and data acquisition systems (SCADA) are at particular risk of being hacked, as the systems gather and analyse data that controls equipment and deals with critical and time-sensitive materials or events.

“Your SCADA networks can be hacked in exactly the same way corporate IT systems can be hacked,” Borthwick said.

“So what we’re doing is, we’re starting to provide those services to ensure we secure all environments; for example,

a malware device to protect the OT (operational technology) environment.”

Beyond security, Orange Business is also helping mine sites to upgrade their tailings dams.

Used to store the waste or by-products of mining operations, these facilities are sometimes not well constructed, leading to dam failures and potentially catastrophic results.

“If the dam wall bursts, we know the consequences,” Borthwick said. “They’re horrendous, horrific – not only from an ecological perspective, but from a livelihood perspective.

“We’re working with some of the big mining companies to upgrade the sensors that go on the dams that pick-up shifts in weather patterns or whether the dam wall is moving.

“The sensors also pick up any potential breaches, any potential movement of the sediment inside of the water itself, and they can then push the sediment way from the dam wall.

which can, over time, push against the dam wall.

“Now, tailings dam management is not just done for the life of the mine, it’s

for the life of the entire program of work, including rehabilitating the site.”

Australia currently has over 3000 dams, weirs, catchments and tailings dams in operation in mines across the country. Orange Business wants to work with operators to ensure there is a broad solution in use across all sites.

“If you have this technology in place, you’re looking after the dam and managing it, and it’s not just the sensors that do this,” Borthwick said. “It’s the data visualisation and the understanding of when and how failures occur.

“We can even go as far as to monitor the weather patterns and use that to determine future weather patterns to ensure companies are managing their environment well.”

Offering these solutions is relatively new territory for Orange Business, but it has approached the challenge head-on.

“We were originally a traditional telco – we provided pure connectivity, globally, to hard-to-reach places,” Borthwick said. “That was our catchphrase: global presence with local leadership, local partnership.

“What we’re doing now is actually flipping the conversation and saying it’s not about the technology – we’re more interested in you and your business requirements.”

to make their sites run more smoothly.

“We can help our customers make better use of their data and keep an eye on cost,” Borthwick said.

“If a truck on a site has continuously broken down, for example, we can help companies get down to the granular level of why this keeps happening through our technology.

“We can help manage the cloud environment for customers and consult them about AI capabilities in a secure environment.

“We help them get hold of the data so they can make informed decisions at a broad level.

“In our space, we need to innovate to meet different business requirements as technology advances. We do that through new technology or services that deliver outcomes for our customers.

“But what does that deliver for the business? It delivers more budget that they can go and focus in on other areas. For example, they may choose to look into predictive AI, so they can start to predict maintenance for haul truck fleets or the likelihood of potholes for particular routes.”

The Orange network covers more than 220 countries and territories. With its teams present in 65 countries, the

and in Australia we’ve really doubled down on the mining and resources sector,” Borthwick said. “That may include a tailings dam solution, a completely customised global network, cybersecurity or integrating applications and services into existing IT systems.

“We’re moving into the systems integration space, rather than the oldschool version of people buying some internet from us.

“Yes, we have telco roots; however, we are now very much a digital service organisation partnering with our customers to deliver business outcomes.” AM

in iron ore may not translate to a machine operating in coal,” Geographe sales manager Matt McDonald told Australian Mining. “Machines have vastly different requirements due to the environment they work in. We consider this in all developments and actively engage our customers to help with the commercial viability of a product.”

Geographe’s brand has grown to include Specialised Tooling to aid in the installation and removal of components, as well as a fourth extension called Geographe Asset Optimisation.

Asset Optimisation employs a holistic approach to the entire maintenance

“In this approach, we work back from the customer’s safe work procedure, and in most cases attend a mine site to watch the maintenance task take place,” McDonald said. “This allows us to first understand what should occur, followed by what actually occurs. In a perfect world, there should be no variance in the two, but sometimes this isn’t the case.

“Being on-site allows us to solicit comment from the front-line workers and allows us to accommodate, where possible, their thoughts and ideas. We’ve found that discussions like these often lead us to the best user-friendly

practice that has been used over many years and widely accepted as a common maintenance practice to remove seized or stuck components.”

The Geographe Asset Optimisation team commenced the elimination of hot works and thermal lancing projects in 2019, engaging miners across Australia with the aim to understand problems and the appetite for change.

“It didn’t take long for our first project to kick off, where a large iron ore miner reached out to us to say that they were having trouble with the rear suspension pins and sway bars becoming seized on their Komatsu 830e fleet,” McDonald said. “In this instance, when thermal lancing is used, a single boilermaker can take five-to-eight hours to remove the two pins required to disconnect one rear suspension cylinder. This process can lead to prolonged downtime and subsequent decreases in productivity.”

In response, Geographe manufactured a specific Collated Pin Assembly (CPA).

The CPA eliminates the need for thermal lancing by addressing the root cause of seizure by incorporating a tapered collet system to create a self-wedging effect between the pin and frame bores. This fundamentally changes how the component is retained in position, supporting an in-built

removal method that removes pin seizures and the risk of thermal lancing from the maintenance task.

The CPAs were successfully trialled in a truck on a mine for over 12,000 hours.

“We looked to optimise the product a little further,” McDonald said. “In our first installation, we found areas for improvement so we made some changes to create the installation and removal tooling kit to suit the Komatsu 830e haul trucks. We are now rolling this out across multiple mine sites and working on several other developments for larger haul trucks.

“These types of products are what allow us to have business sustainability in the market. It’s what we’re good at and it’s what we’re designed to do.

“It’s why we all come to work; no one just wants to recreate the same thing day in, and day out. We want to innovate, and we want to make things better.

This commitment to innovation, according to innovation project manager Ryan Hyder, shows Geographe is a solution-based company.

“We want to be in relationships with our customers that allow us to produce a product that solution-based, solving safety and productivity issues,” Hyder told Australian Mining. “Creating a safer environment for people to work in.” AM

Tough digging made easier and smarter with the new generation of GET.

All technical information at your fingertips.

GET

Detection of GET detachments in less than 3 seconds, with zero false alarms.

The mining industry has never been more scrutinised, with stakeholders calling on the sector to operate more responsibly. It’s a matter of regulation, social trust

now leaving irresponsible miners out in the cold. The environmental, social and governance (ESG) movement is in full force, and wise mining companies are establishing dedicated divisions to improve their accountability and

One of these opportunities is a miner’s social license to operate, where companies are becoming more vigilant in terms of monitoring and improving their relationships with local communities to improve connections

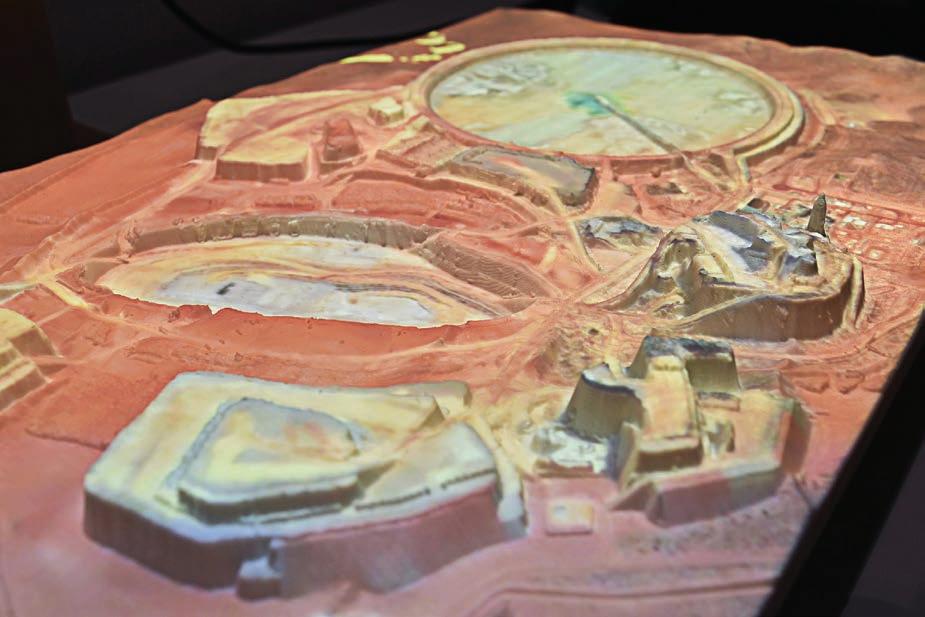

To support miners on this journey, SRK Consulting has established its Project 4D data visualisation tool, which models potential environmental and safety risks on a mine site.

The tool projects data sets onto a 3D printed topography of a mine site and its surrounding environment, forecasting how potential risks such as floods, dam breaches or erosion could eventuate based on a mine’s unique topography.

For example, how quickly will floodwaters move given a site’s terrain? And how will this affect local communities adjacent to the mine?

With the help of Project 4D, communities can accurately understand the pace and nature of potential water run-off from a neighbouring mine and develop clear action plans if floods occur.

Until now, outputs such as this have typically been limited to static images on a PDF.

“Project 4D extracts more information from modelling than typical outputs,” SRK senior civil engineer Heather Thomson told Australian Mining

“We run dam breach models to simulate how tailings would flow out of a failing dam, and then typically extract particular data that a client might be interested in and present that in a report.

“With Project 4D, we can now clearly visualise the evolution of the dam breach over time rather than a simple static image.”

These outputs can then be clearly communicated with stakeholders.

“The Global Industry Standard on Tailings Management (GISTM) calls it ‘meaningful engagement’,” Thomson said.

“Engagement needs to be conducted in a way that everyone can understand – a mining company can’t just show stakeholders a technical report and expect them to know what they’re talking about.

“And with one of the core components of the GISTM being public disclosure, it’s not a guideline but a requirement that mining companies must disclose certain information.”

The GISTM was established in August 2020 following the Brumadinho dam failure that devastated communities adjacent to the Córrego do Feijão iron ore mine in Brazil.

Members of the International Council on Mining and Metals (ICMM) have until August this year to conform to the GISTM for tailings facilities with ‘extreme’ or ‘very high’ potential consequences. All other tailings facilities have until 2025 to conform.

Project 4D can help with GISTM compliance, enabling companies to visualise their tailings landscape and clearly and accurately communicate this information with their stakeholders.

Thomson explained the inspiration for Project 4D in more detail.

“Project 4D was just going to be something fun that we could take to conferences and have in our office to project multidisciplinary data sets, such as water, tailings, geotechnical data, closure data or environmental data,” she said. “Anything we could come up with, we could present on Project 4D.

“But after we got it up and running, everyone we’ve shown it to has come up with new data sets that can be added to it.

“So what started as a fun, engaging tool for conferences has become quite a powerful solution.”

One SRK client suggested Project 4D could be used for emergency response planning, while tailings deposition modelling has also been suggested as an idea. Thomson’s colleague and Project 4D partner Jason Beltran is harnessing the technology for mine closure modelling.

The beauty of Project 4D is that it can be easily adapted to a range of mining applications.

“As long as you have the data set, you can project anything. And there’s potential to further extend the solution,” Thomson said. “Someone had the idea

that project deliverables should come with a Project 4D file that you can plug into your model, which could be accessed on your computer or via an app to enable you to see the outcomes of your study.”

Project 4D may not only be the future of risk management and mine planning, but also the future of ESG and achieving social harmony with stakeholders.

It’s a simple, easy-to-understand tool with the potential to grow and evolve with the companies that use it, supporting smarter and more proactive mining operations in the process. AM

Variable speed independently adjustable hydraulic vibrators. 5 force amplitude settings on each vibrator. Ideal for high moisture levels, sticky materials, fines separations. Conventional screen blinding and bottom overload.

The Olive Downs Complex is no small operation. Sitting in the heart of Queensland’s Bowen Basin – the coal-mining mecca of Australia’s east coast – this greenfield mine has a yield of up to 15 million tonnes of product per annum for steel production.

Located almost 40km south-east of Moranbah, the Olive Downs Complex is home to an open-cut metallurgical coal mine and a coal-handling and preparation plant. With approximately $1 billion having already been invested in the site, it’s estimated to deliver 500 construction jobs and 1000 operational jobs to Queensland.

There are also plans for an automated train-loading facility to be constructed, with the ability to load 10,000 trains.

A new rail spur will provide connection to the existing Norwich Park Branch Railway system for the transportation of coal product to the port facilities.

Coal will be transported to the Dalrymple Bay Coal Terminal for which capacity is secured for stage one of the project. Linear infrastructure corridors will provide for power, road, water and rail services to the project site.

The Olive Downs Complex has been wholly owned by Pembroke Resources since 2016, when the company acquired 100 per cent interest in Olive Downs South, which began construction in 2019, and Willunga, which will begin construction in 2027.

Olive Downs South and Willunga are both domains which make up the project, along with associated linear infrastructure corridors.

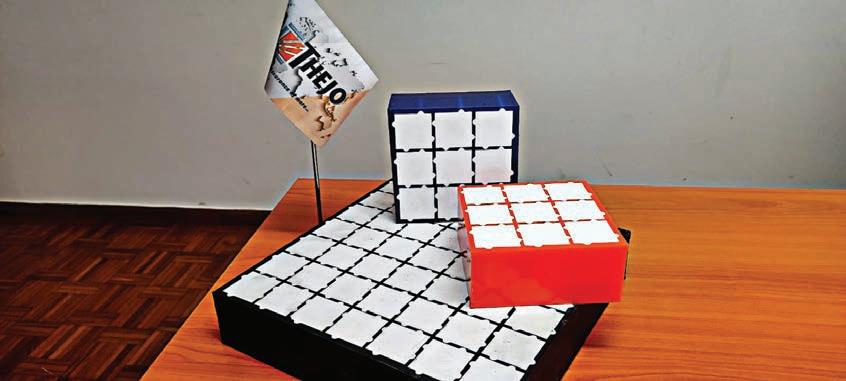

The operation of the Olive Downs Complex is made easy through Pembroke’s strong relationship with Thiess, Hastings Deering and Liebherr.

“Thiess is a Tier 1 mining contractor that has a lot of experience in mining, with strong foundations in safety, innovation and sustainability,” Pembroke Resources operations manager Jamie

Vaughan told Australian Mining. “They have a proven track record of success operating at large-scale operations in the Bowen Basin.

“Thiess is well positioned to continue to assist in the growth of the Olive Downs Complex.

“Hastings Deering and Liebherr have delivered new heavy earthmoving equipment on schedule to Thiess to enable the assembly and commissioning of the machinery on-site.

“The Thiess senior leadership team on-site has already delivered on achieving mobilisation milestones safely.”

Pembroke hired Thiess to deliver fullservice mining operations to the Olive Downs Complex.

These operations include mine planning, overburden removal, drill and blast, load and haul, water management, and rehabilitation, as well as the construction of mine infrastructure, and provision of all mobile plant and equipment. Thiess is also the statutory operator at the Olive Downs Complex.

Thiess general manager of mining

Vikesh Magan emphasised the strong working relationship between Thiess and Pembroke, highlighting their collaborative approach

and shared commitment to achieving sustainable outcomes.

“The partnership comes in many forms,” he told Australian Mining

“Pembroke Resources relies on us to optimise mining operations, including identifying optimal mining locations and implementing proven efficiencies to enhance safety, minimise environmental risk and achieve maximum productivity sooner.

“Pembroke supplies the core infrastructure, while Thiess provides the capital for mobile plant, along with the people, processes and equipment needed to deliver safe mining operations.”

Magan said Thiess and Hastings Deering are enabling autonomous operations at the Olive Downs Complex, which includes the supply of autonomous Cat 794 AC trucks.

Hastings Deering resource industries business manager Brad Scholz said the company has an obligation to meet strict deadlines at the Olive Downs Complex.

“Hastings Deering provides quality equipment to Thiess in line with production dates set by Pembroke Resources,” Scholz told Australian Mining

Not only do we supply the new equipment, we also carry out a pre-assembly at our Mackay and

Rockhampton business centres prior to the equipment being transported to site, where the final assembly and commissioning takes place.

“Once equipment is fully assembled, we then calibrate it and get the technologies, such as command for haulage and command for drilling, up and running.

According to Dean Morgan, Hastings Deering technology site performance manager, the benefits of automation spread far in the resources sector.

“Automation in mining enables a real step change in safety, productivity and efficiency,” he told “In fact, automation is the only system that eliminates risk to truck operators in the mining environment.”

Morgan said Caterpillar has more autonomous fleets throughout the world than any other original equipment manufacturer (OEM).

“Hastings Deering and Caterpillar provide a fully engineered end-to-end solution for all Cat equipment,” he said.

A wide array of Cat equipment will be used at the Olive Downs Complex, including the 15 Cat 794 AC trucks.

The truck also features an electric drive powertrain that Caterpillar has designed and integrated.

In addition, the Olive Downs

Morgan said Hastings Deering’s broader portfolio can also provide safety, productivity and efficiency.

“The results are game-changing,” he

And when it comes to the success of the Olive Downs Complex, relationships are key.

“Our relationship with Thiess has spanned a very long time,” Scholz said.

“We work well together, collaborate well and, at the end of the day, we try and put a solution in place for Thiess that’s going to meet their expectations, as well as their clients.

“Not only do we sell the equipment, but we also provide support through the life of the asset.

“We have product-support personnel on the ground at the Olive Downs Complex. If there’s any issues or concerns, we’re able to act swiftly to ensure we can get that product back to work.”

Scholz believes being involved with the Olive Downs Complex is a prime opportunity for Hastings Deering to display its autonomous trucks and blasthole drills.

“Olive Downs is going to be a flagship site because majority of the mobile fleet is part of the Caterpillar brand,” he said.

“It’s a great opportunity for us to be able to demonstrate and provide awareness far and wide as to what we’re capable of, (including) collaborating closely with our customers to ensure they are successful.” AM

FIVE YEARS AFTER THE COMPANY OFFICIALLY OPENED ITS DOORS, EACON MINING HAS MADE A NAME FOR ITSELF IN THE AUTONOMOUS DRIVING SOLUTIONS MARKET.

Eacon Mining was founded with a vision: making transportation easier.

Encompassing algorithms and software for autonomous driving, Eacon is responsible for the integration and commission of the whole autonomous driving solution, from start to finish.

The company has enjoyed a wellearned ride to the top since its opening, operating three mines in China and developing a fleet of over 70 autonomous trucks.

“As a new entrant in the industry without additional resources or project endorsements, we reached out to many mining enterprises to promote our autonomous driving solutions,” Eacon Mining director of overseas strategy Elaine Jin said.

“After a year of testing, debugging, refining and iterating our autonomous driving solutions, we succeeded in making one fleet of trucks that can perform all haulage tasks together with our dispatching platform.

“The fleet was deployed in a real mine site in 2020.”

After another two years of production and deploying its autonomous haulage fleet in China, Eacon decided to expand into the Australian market.

“Mining is a pillar industry in Australia, with vast opportunities for autonomous haulage,” Jin said. “Australia is at the forefront of autonomous haulage.

“There are also excellent mining schools in Australia that have trained outstanding engineers, so we have a strong confidence in the technical cooperation between the two countries.” Australia has hit the ground running when it comes to adopting autonomous haulage solutions, with entire mines

making the switch from traditional fleets to unmanned options.

Traditional mining trucks can be retrofitted with autonomous haulage technology, something that Eacon is particularly keen to do for Australian clients.

“The retrofit includes retrofitting the truck into a drive-by-wire version and the installation of autonomous driving software and hardware, collaborative systems for on-site mobile equipment, and cloud-based dispatching and management platforms,” Jin said.

“Our vehicle engineering team of over 30 people possesses experience in wholevehicle design and has successfully retrofitted over 200 mining trucks.

“In terms of safety, we have implemented complete fault-diagnosis strategies which monitor the vehicle’s status and initiate back-up activation, deacceleration, or braking procedures where necessary.”

Automation also comes with larger goals in mind. Reducing emissions and hitting net-zero by 2050 is a longterm goal for most companies, and Eacon is no different.

“It is crucial to replace fleets with zero-emissions trucks, because carbon emissions from haulage trucks account for 50 per cent of the overall Scope 1 emissions that come from mine sites,” Jin said. “Autonomous driving systems can be set up to ensure the truck takes the best route to reduce unnecessary travel time and avoids unnecessary braking, which will all help to reduce fuel consumption and carbon emissions.”

Having unmanned trucks on a mine site is a safer and more environmentally friendly than traditional fleets, while also helping to improve efficiency.

“Our solutions can adapt to various working environments, particularly

crowded sites and complex routes,” Jin said. “Using Eacon’s system, trucks can bypass or go over obstacles and will always adjust to the right of way based on its situation.

“The remote driving function also helps trucks out of trouble, which improves overall operational efficiency.”

With a mine’s permission, Eacon can use data gathered from the autonomous haulage trucks to improve future algorithms and boost productivity for the individual miner, or all mines depending on the terms.

Information on factors such as weight, material type, truck speed, and dumping cycle can be collected to help Eacon stay on top of its solutions. The data can also be used by the miner to check maintenance or servicing needs.

Now that it has amassed such an impressive portfolio in a short amount of time, what’s next for Eacon?

“Eacon’s goal is to be a top autonomous haulage company,” Jin said. “We hope that autonomous driving technology can be applied across the globe so all mines can benefit from it.

“We aim to do away with rigorous and harsh mining environments and make mining safer and more environmentally friendly.” AM

CSE Uniserve delivers compact, versatile electrical energy storage and control solutions for mining, industrial and ultility industires.

Ensure continuity of power supply, and optimise asset performance and selfconsumption.

Engineered by an expert team of lateral thinkers, the Battery Energy Storage and Control solutions from CSE Uniserve demonstrate the future of clean energy systems in grid and off-grid applications.

CSE Uniserve provides comprehensive solutions to ensure maximum security while minimising emissions, fuel and maintenance costs.

Specialist engineers monitor, control, and optimise the performance of your systems by maintaining connectivity between renewable energy sources, gensets and loads.

Experience real value with CSE Uniserve’s local integration and lifetime support. For more information, visit cse-uniserve.com/battery-energy-storage-system.

Leading mining companies need the best in network infrastructure and data connectivity to ensure operations run smoothly. So when a large magnetite project in WA found itself needing reliable connectivity, it was only natural that Intellect Systems, the company responsible for delivering the integrated operational technology solution, turned to Moxa’s networking devices and technical know-how.

“We provided end-to-end operational technology solutions, and for the project this encompassed a large part of the communications, electrical and control systems infrastructure,” Intellect Systems managing director Jason Monzu said.

“We were also a key technology partner of choice for the systems integration component, which included the control systems software development, acceptance testing and commissioning.”

This was not the first time Intellect Systems had partnered with Moxa, a leading provider of industrial networking, computing and automation solutions.

“We’ve been working with the Moxa product for over a decade now, and over that time we have built a vast knowledge

base on how to specify, install and integrate their products,” Monzu said.

“We have a transparent and supportive relationship with the factory at Moxa as well as the local distribution channels.”

Moxa and Intellect Systems were joined were joined on the project by Colterlec, an electrical engineering distributor company.

“Moxa and Colterlec worked very closely to not only overcome any supply and demand challenges, but also any design changes,” Colterlec national general manager – Moxa Shahwar Khan said. “Intellect helped Colterlec with timely design changes, various approvals and providing new timelines.”

“It was important to accommodate the customer and contractor’s requirements of different models.

“Our planning and close coordination between Intellect Systems, Colterlec and Colterlec/Moxa made it possible to meet these deadlines.”

Colterlec also conducted a Moxa specialised network training for the end customer, consultants and the wider Intellect System team of engineers at its premises in Perth.

Moxa, which has been a trusted automation partner for the mining

industry for almost 20 years, understands the time constraints and strict requirements that a large project demands.

“Because of the scale of the project, we had a large amount of work to do in a short amount of time,” Monzu said. “We worked with Moxa to find innovative ways to deliver .