VOLUME 116/05 | JUNE 2024

GRAPHITE FOCUS

INTERNATIONAL MINING

INDUSTRY EVENTS

VOLUME 116/05 | JUNE 2024

GRAPHITE FOCUS

INTERNATIONAL MINING

INDUSTRY EVENTS

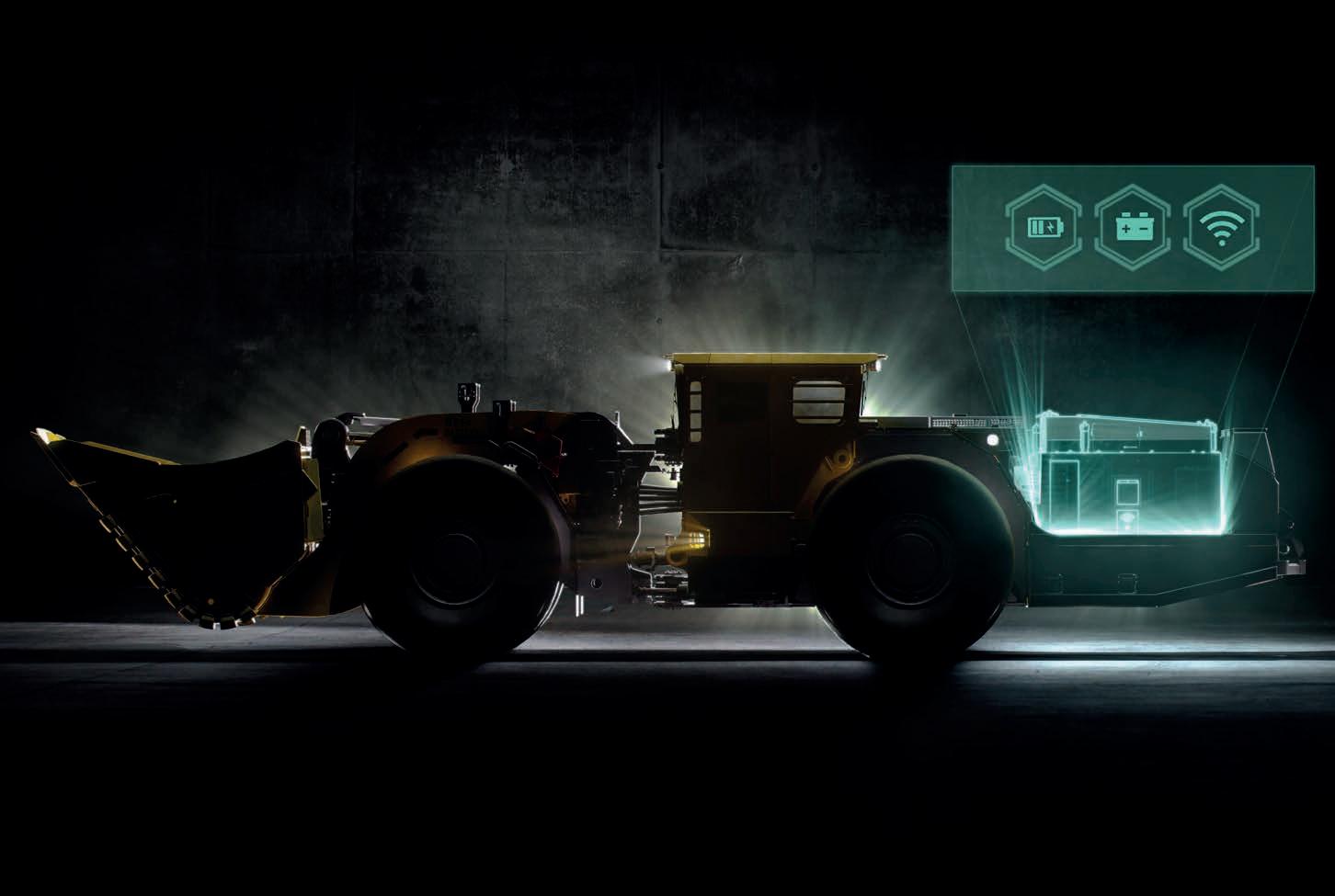

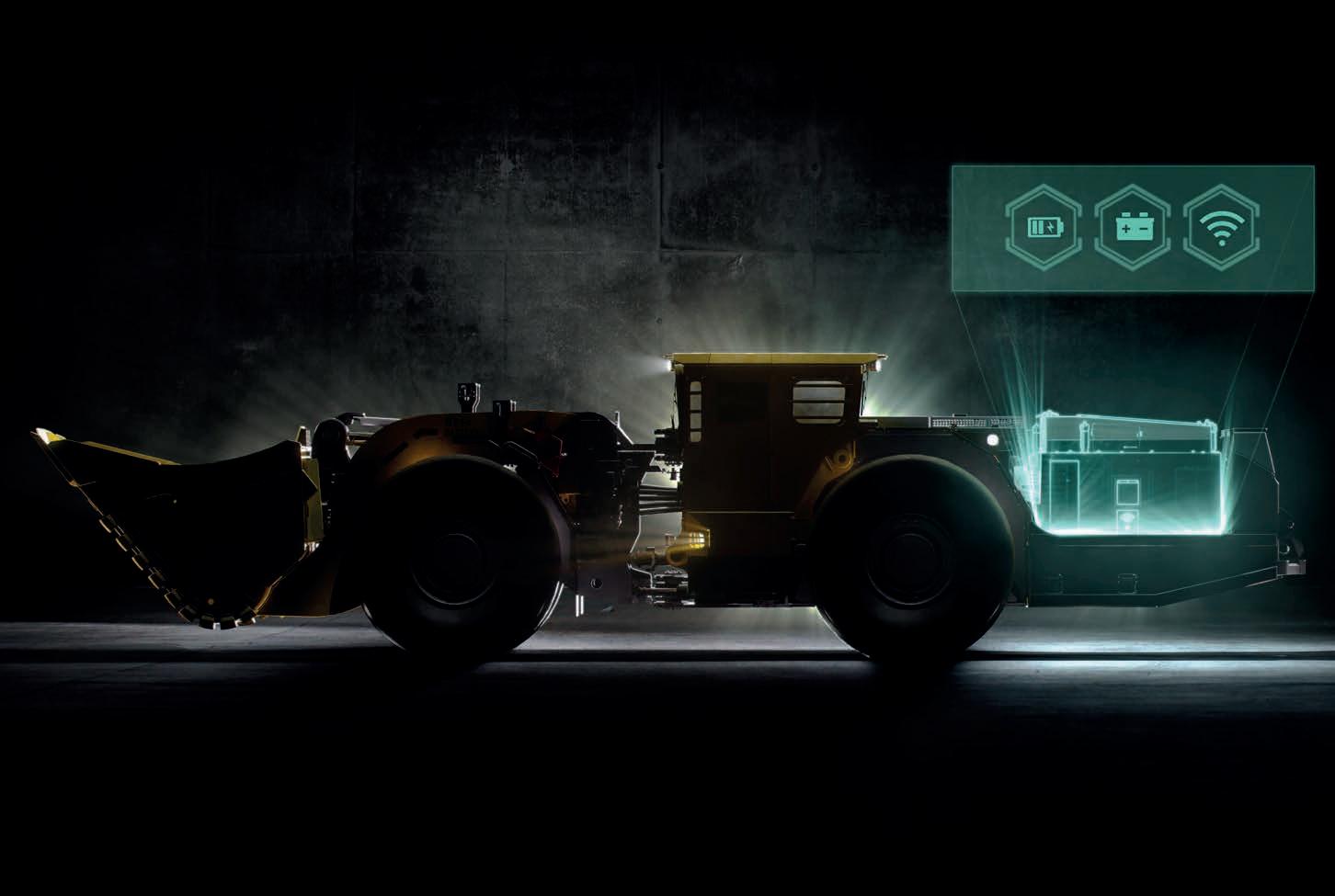

United. Inspired.

Battery conversions play a crucial role in the shift towards electric mining. We can help you accelerate the transition from diesel-powered gear to battery-operated vehicles. These upgrades are cost-effective and can be part of your machine’s midlife refurbishment, bringing your equipment back to its peak productivity and efficiency, while adding thousands of new hours with minimal emissions. Join forces with us as we pave the way to the future of mining.

Never has it been more critical for Australian mining companies and contractors to scrutinise their environmental, social and governance (ESG) performance.

Those who choose not to adopt an ESG framework are likely to be left out in the cold by the lenders and regulators that enable the sector’s continued growth and development.

In fact, new mining projects could be left at a standstill if a regulator doesn’t deem them ESG-compliant, while investors are less likely to provide the necessary debt funding, offtake and equity to get such projects off the ground.

The ESG movement is creating a generational shift for the Australian resources industry, and it’s something companies will need to approach diligently for the best outcomes to be achieved.

Given that reality, it’s reassuring to see the mining equipment, technology and services (METS) sector stepping up to the plate to support the local mining industry on its ESG journey.

Epiroc works closely with its mining customers to understand their electrification barriers and how to best overcome them, before building out a roadmap that doesn’t compromise operational productivity.

The original equipment manufacturer offers battery-electric trucks, loaders and drill rigs, alongside associated infrastructure and know-how.

Hexagon’s MinePlan Schedule Optimiser carries out battery-electric vehicle modelling by determining the most productive mining sequence to achieve the highest project profitability, before generating practical short–long-term project schedules for its customers.

METS companies are coming at ESG from all angles, unlocking new capabilities that are not only enabling a more sustainable and responsible mining industry but also a more efficient and productive sector.

Elsewhere in this edition, we shine a light on Australia’s emerging graphite industry, showcasing the achievements of Renascor Resources, International Graphite and Lincoln Minerals.

We also break down all the March quarter performances from the sector’s leading miners and provide an outlook into the future of some important commodities. ESG

In this edition of Australian Mining, we spotlight the original equipment manufacturers, suppliers and technology providers that will be key enablers of mining’s ESG future.

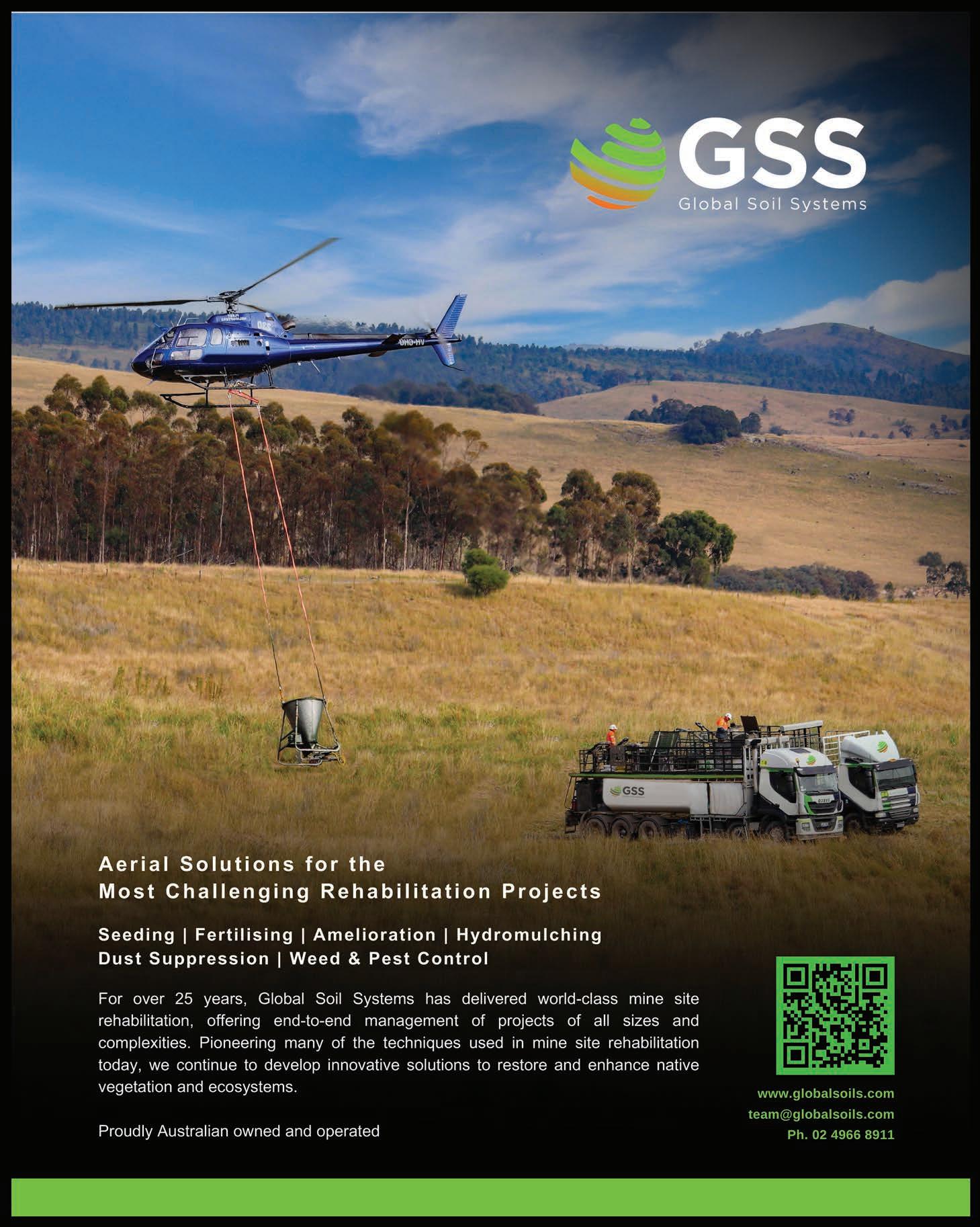

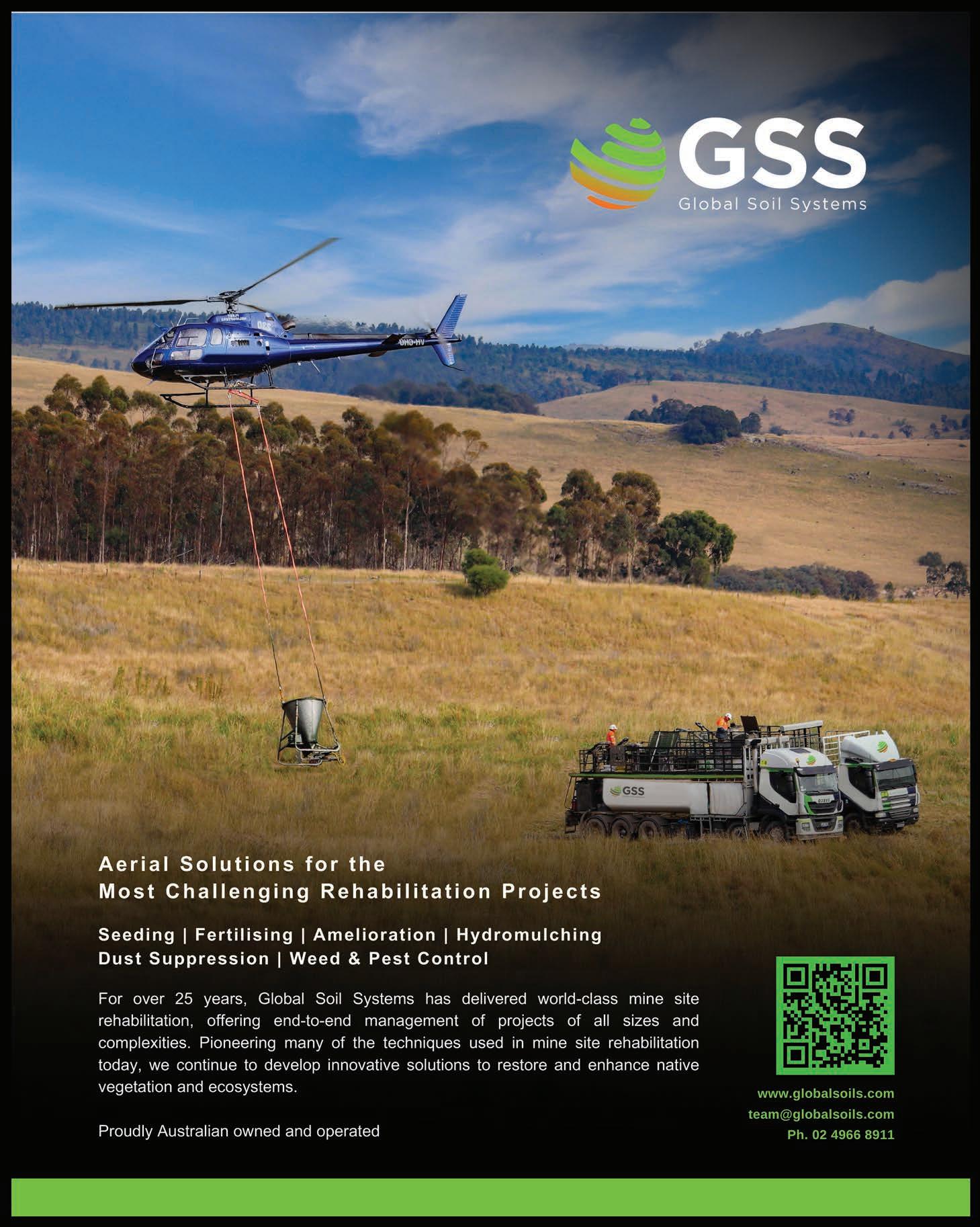

Mine rehabilitation proponents Global Soil Systems and Dendra take centre stage, detailing solutions that are helping to ensure a more environmentally proactive industry. Helicopters are central to Global Soil Systems’ aerial seeding solution, while drones drive Dendra’s seeding offering.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY

MANAGING EDITOR PAUL HAYES

EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

ASSISTANT EDITOR

ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

Tom Parker EditorJOURNALISTS

OLIVIA THOMSON

Email: olivia.thomson@primecreative.com.au

KELSIE TIBBEN

Email: kelsie.tibben@primecreative.com.au

TIM BOND

Email: tim.bond@primecreative.com.au

CLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT

Tel: (02) 9439 7227 Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

ART DIRECTOR MICHELLE WESTON michelle.weston@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl

Overseas A$149.00 For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

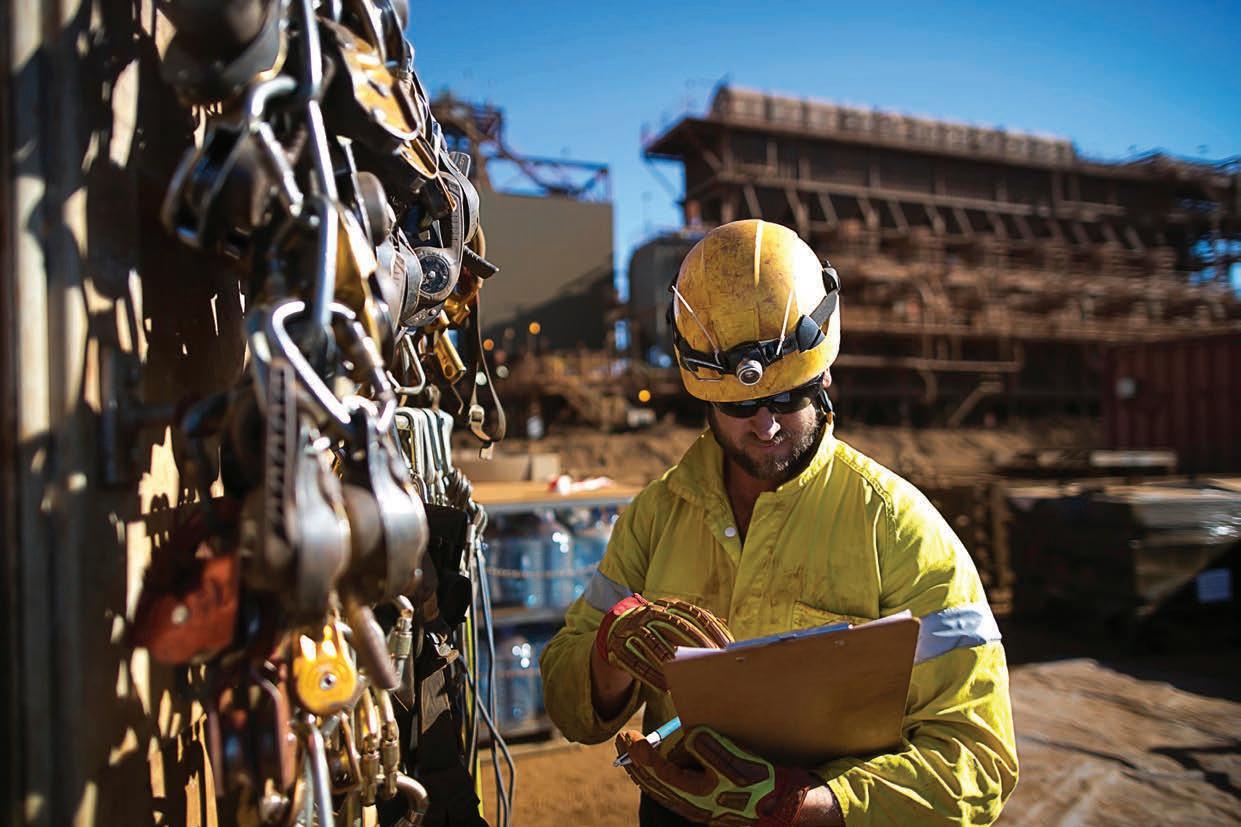

An Australian familyowned and operated business since 1994, Global Soil Systems has more than 25 years’ experience specialising in mining and industrial rehabilitation and revegetation. Global Soil Systems pioneered many of the methods used in mine and industrial revegetation today, and has played an instrumental role in the successful establishment of native vegetation and ecosystems across many mines in the Hunter Valley region of NSW. In 2018, Global Soil Systems was acquired by B&K Revegetation & Landscaping, a leading commercial landscaper operating across Australia. By leveraging the strengths, expertise and capabilities of B&K, Global Soil Systems can now offer a fully integrated approach to environmental project management while still operating as its own entity.

Cover image: Global Soil Systems

Charging up on graphite

Several Australian graphite projects are gearing up as international demand for the battery metal is set to soar. 20 ESG

A commitment to sustainability

As Australia progressively implements sustainable mining methods, the resource sector is adopting TSM – a globally recognised accountability framework.

Taking to the skies

While a mine may be rehabilitated from the ground up, Global Soil Systems likes to have a bird’s eye view of the project. 24

Clearing the electrification hurdle Epiroc is breaking down the barriers associated with going electric. 52 INDUSTRY INSIGHT

Major miners March on While adverse weather posed some

problems, several major miners reported solid results in the first quarter of 2024.

56 COMMUNICATIONS

Lightning-fast coverage

When a fire compromised primary communications at Heathgate Resources’ Beverley uranium mine in SA, Vocus and Peplink came to the rescue.

60 EQUIPMENT

The evolution of the trusty 930E

In 2001, a giant arrived on the shores of Australia, forever changing the landscape of mining operations.

64 COMPANY PROFILE

Mineral sands through the hourglass Time is up on a public hearing process for VHM’s Goschen rare earths and mineral sands project, and the explorer is ready to hit the ground running.

76 INDUSTRY EVENTS

QME returns to Mackay

For over 30 years, QME has been at the heart of the Queensland mining sector.

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, FEATURING NEWMONT, CME AND EVOLUTION.

Trott succeeds Brandon Craig, who stepped down as CME president to take on the role of BHP president of Americas.

In April, Newmont welcomed a new member to its executive leadership team who will lead technical work across the business.

Prior to his current role as Rio’s iron ore chief executive in WA, Trott was the company’s chief commercial officer from 2018 to 2021.

Francois Hardy joined the company as chief technology officer (CTO), taking over from interim CTO Dean Gehring.

Hardy brings more than 30 years of technical and operational experience in mining to the role.

He commenced with Newmont in 2002 and has held roles including exploration group head, managing director Africa and general manager Tanami.

“Francois is a strong leader with deep technical experience and a demonstrable track record of improving operating performance,” Newmont president and chief executive officer Tom Palmer said.

“His appointment will further strengthen Newmont’s executive leadership team, adding valuable technological expertise which will be central to our ongoing success as a business.”

Before joining Newmont, Hardy held executive positions at Avmin Ltd and De Beers Consolidated Mines.

His new role will involve looking for new ways to enhance the company’s operations through innovation and new technologies.

The Chamber of Minerals and Energy of Western Australia (CME) has appointed Simon Trott as its new president.

Trott has been with Rio Tinto for over 20 years in a variety of operating, commercial and business development roles across a range of commodities.

“CME has a proud history of advocacy for WA’s resources industry and I’m looking forward to helping drive the organisation’s strategic direction over the next few years, working closely with Rebecca, the executive council and the team,” Trott said.

“The development of WA’s natural resources continues to underpin the prosperity of our state and our nation. In 2022–23 the sector supported three in 10 West Australian jobs, 15,508 local businesses and 1312 community organisations.

“It also contributes one third of WA Government’s general revenue and 20 per cent of federal corporate income taxes, supporting the delivery of public goods and services from which the whole community benefits.”

CME chief executive officer Rebecca Tomkinson welcomed Trott to the role at CME’s 123rd annual general meeting.

“Simon’s involvement with CME on our advisory board and executive committee has highlighted his experience and knowledge as a leader and industry professional in the mining and resources sector,” Tomkinson said.

“He takes on the presidency at a time of great opportunity and challenges for the sector as we head into state and federal election cycles. It’s a highly pivotal leadership role and one that’s instrumental in holding policy makers to account on behalf of industry.”

“Brandon’s leadership roles with BHP over more than 20 years have been incredibly diverse. Those wideranging skills were an asset to his role as CME’s president, a role he approached with characteristic rigour and passion,” Tomkinson said.

“We wish him every success in his new appointment.”

Evolution Mining has appointed Matthew O’Neill as its new chief operating officer (COO).

Most recently, O’Neill worked at Glencore from 2004 to 2023. His most recent role at the company was the Australian regional lead and COO for the copper and zinc businesses.

In this role, he was accountable for the Ernest Henry gold-copper operation in Queensland. Evolution eventually acquired full ownership of Ernest Henry in January 2022. O’Neill was also responsible for managing all copper and zinc assets in Glencore’s Australian portfolio.

Since leaving Glencore in 2023, O’Neill has been managing his own consulting business in which he supported Evolution with the integration of the Northparkes gold-copper operation in New South Wales.

“I am excited to be joining the team at Evolution, having worked closely with the company since 2016 when they acquired an interest in the Ernest Henry operation,” O’Neill said.

“The way Jake, Lawrie and the team have grown a world class business with an industry leading culture is something I am looking forward to contributing to, including a more reliable operational performance.”

Arafura Rare Earths announced some key executive leadership changes to help the company deliver the Nolans rare earths project in the Northern Territory. Stuart Macnaughton commenced his role as Arafura’s COO on April 8.

Macnaughton has 25 years’ experience and holds expertise in project delivery, including the ramp-up of complex hydrometallurgical facilities, and has successfully overseen the design, build and integration of processing plants for Vale and BHP.

“Attracting a COO with Stuart’s credentials signifies the quality of the Nolans project and Arafura’s growth potential,” Arafura chief executive officer Darryl Cuzzubbo said.

“His expertise in leading diverse teams to deliver complex integrated processing plants is critical to the success of Nolans.”

Shaan Beccarelli recently joined the company in March as Arafura’s head of corporate affairs and investor relations.

Beccarelli has more than 20 years’ experience in the resources sector, previously working for Woodside, Chevron and Rio Tinto. In their new role, Beccarelli will deliver strategic growth across stakeholder engagement, external relations, brand and reputation.

Tanya Perry was also promoted to head of sustainability and environment in February. With more than 20 years’ experience in environment and sustainability management across a range of industries such as mining, Perry is set to deliver Arafura’s ESG (environmental, social, and governance) strategy.

“It has been a pleasure welcoming both Shaan and Tanya to my executive leadership team,” Cuzzubbo said.

“They have brought a step-change in how Arafura executes its corporate affairs, investor relations, environmental management and ESG strategies. AM

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

THE $60B BHP–ANGLO DEAL

BHP confirmed a possible $60 billion acquisition of mining giant Anglo American in April. What does such a deal mean for the sector?

The frenzy began when Anglo released a statement saying it had received an “unsolicited, non-binding and highly conditional combination proposal,” from BHP.

The proposal comprised an all-share offer that would require Anglo to spinoff its entire shareholdings in Anglo

a proposal on April 16.

Under the terms of BHP’s proposal, Anglo American shareholders would receive 0.7097 BHP shares for every Anglo share, as well as ordinary shares in Anglo Platinum and Kumba.

A deal would ring in at a total value of approximately £25.08 ($48.12) per

AUSTRALIAN IRON ORE CROWNED GLOBAL NUMBER ONE

Federal Resources Minister

Madeleine King debuted the 2023 ‘Australia’s Identified Mineral Resources’ report at the Prospectors and Developers Association of Canada convention.

King visited Canada and the US to engage in complex discussions surrounding critical minerals.

The annual ‘Australia’s Identified Mineral Resources’ report is published by Geoscience Australia and draws on more than 45 years of data to track Australia’s known

mineral resources. It also details important trends in mine production, and reserve and resource estimates.

The report revealed Australia produces 27 minerals, with 15 of them ranking in the top five for global supply.

Australia was crowned number one globally for economic resources of gold, iron ore, lead, nickel, rutile, uranium, zinc and zircon.

The country is also the world’s largest producer of bauxite, iron ore, rutile, and lithium, with the latter’s

AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

“The combined entity would have a leading portfolio of large, low-cost, long-life Tier 1 assets focused on iron ore and metallurgical coal and future facing commodities, including potash and copper.”

BHP has been vocal in its hunger for copper, which it sees as a kingmaker commodity as nations turn to netzero technology.

($59.6 billion).

BHP said the terms of the proposal would carry a 31 per cent premium on Anglo’s implied market value.

“The combination would bring together the strengths of BHP and Anglo American in an optimal structure,” BHP said.

A successful acquisition of Anglo would see BHP dominate the world’s copper market and shore up its coal presence in Queensland thanks to Anglo American Australia’s Capcoal and Aquila mines in the Bowen Basin, which increased production by seven per cent in the March quarter.

production up 36 per cent to a record 75,000 tonnes in 2022.

Australia is also a top five producer of zircon, cobalt, manganese, rare earths, nickel and tantalum.

“Australia’s resources are mined and processed to the highest standards – making them the cleanest and greenest in the world,” King said.

“Our geology means that we are home to globally significant deposits of minerals, these

minerals will be crucial as the world turns to renewable technologies to decarbonise.”

Australia’s investment in mineral exploration increased by 13 per cent to $4 billion during 2022.

“Government investment in precompetitive geoscience is critical to understanding quite literally what Australia is made of and to maintaining a pipeline of new critical mineral investment opportunities into the future,” King said.

By utilising the latest technologies we provide an advanced combination of innovative solutions which optimise our customers mining operations performance, sustainability, availability and safety, around the globe. We supply:

• Wear parts and solutions for mineral processing, mobile and fixed plant operations

• Digital and equipment connectivity

• Asset condition and performance monitoring

• Design, engineering and manufacturing solutions

SCAN TO LEARN MORE

Western Australian Minister for Mines and Petroleum David Michael emphasised the importance of attracting global investment in the state’s lithium sector.

Opening Paydirt’s 2024 Battery Minerals Conference in Perth in April, Michael said in less than a decade, WA had established a multi-billiondollar battery and critical minerals processing industry.

“With a rich endowment of these minerals, I look forward to positioning Western Australia as a destination of choice for the responsible sourcing of futurefacing commodities that will drive global decarbonisation efforts,” he said.

“I’m taking a keen interest in the minerals critical in their make-up, but of course I am also curious about the provenance of these minerals, given a typical EV requires six times the mineral inputs of a conventional car.”

The International Energy Agency estimates the average amount of mineral resources needed for a new unit of power generation has increased by 50 per cent since 2010, reflecting the rising uptake of renewables.

Michael said the challenge now is ensuring more global scale investments are made in WA to expand the state’s capacity in downstream processing and battery chemical manufacturing.

Thiess has locked in a six-year contract extension with BHP for the Mount Arthur South coal operations in the Hunter Valley region of NSW. Worth $1.9 billion, this contract will see Thiess continue to provide mining services at the Mount Arthur South mine, operating and maintaining mining equipment to support BHP’s production requirements, and working with BHP and the local community towards the planned mine closure in 2030.

“This contract extension acknowledges Thiess’ strong safety record and ongoing operational performance, and builds on the longstanding relationship between Thiess and BHP that started more than 30 years ago,” Thiess Group executive chair and chief executive officer Michael Wright said.

“We are strongly aligned with BHP

“Our opportunity is to build upon the three lithium hydroxide refineries currently being commissioned or constructed by Tianqi, Albemarle and Covalent Lithium,” he said.

“At full capacity, these three refineries will produce up to 200,000 tonnes per annum, enough to power around four million electric vehicles.

“This would make Western Australia one of the world’s top producers of this ingredient that feeds into lithium-ion batteries.”

Albemarle has invested around $2 billion to build the worldleading Kemerton lithium hydroxide processing plant near Bunbury in the south west of WA.

Covalent Lithium’s refinery near Kwinana will produce about 45,000 tonnes of lithium hydroxide per year derived from the nearby Mount Holland lithium mine.

The Greenbushes operations, including its lithium mine and refinery, banked nearly $6.3 billion in profits last year.

These projects, alongside other emerging assets such as Liontown Resources’ Kathleen Valley project, present significant opportunities for WA to position itself as a global player in the critical minerals space.

As net-zero targets approach, the state is certainly one to watch as it fully realises its critical minerals potential.

has resulted in significant increases in the number of our local Indigenous and female employees.”

Thiess has provided mining services to Mount Arthur since 2017.

Thiess first provided load and haul services. This then expanded in 2018 to include additional mining services, including mining overburden and coal, mine design, planning and

Since October 2018, Thiess has acted as the mine operator at the Ayredale and Roxburgh pits at the southern end of Mount Arthur.

“Thiess has played a key part in supporting the local economy and community of the Hunter Valley region, dating back 80 years, and we are proud to be given the opportunity to continue our presence in the region alongside BHP,” Thiess

In a milestone achievement for Liontown Resources, the miner has crushed first ore at its Kathleen Valley lithium project in Western Australia. First ore was achieved through Liontown’s crushing circuit at the site, after commissioning of the dry plant commenced in late March.

Liontown said its team will now gradually ramp up the volume of ore through the crusher to build a stockpile of crushed ore.

“By starting the commissioning process with the crusher, we’re not only testing the equipment but will have clean ore ready for feeding into the wet plant,” the company said.

The news came just days after Liontown celebrated a big quarter of progress – as of March 31, Liontown had completed 85 per cent of Kathleen Valley, and approximately 90 per cent of the process plant.

“The March quarter saw tremendous progress across all major work fronts at Kathleen Valley, with construction of the process plant, the critical path to first production, being 90 per cent complete on an earned value basis,” Liontown managing director Tony Ottaviano said.

“We are within touching distance of first production and in a very strong position financially with $358.1 million in the bank, together with the undrawn

commercial debt facility, providing us sufficient funding through to first production and beyond.

“Securing capital from a leading international and domestic syndicate, as well as government agencies, further reinforces the strength of the ... technical and financial qualities of Kathleen Valley and provides a very strong endorsement of our project.”

Kathleen Valley is set to achieve first production in mid-2024.

Mineral Resources (MinRes) reached milestones at its Mount Marion lithium operation and Onslow Iron project, both located in Western Australia.

The company announced it has begun preliminary development works to support future underground mining at Mount Marion.

MinRes lithium chief executive Joshua Thurlow said the start of preliminary underground works marked an exciting new phase for one of the world’s few operating hard-rock lithium mines.

“MinRes has been managing all open pit mining operations at Mount Marion since 2016 and this site is a key asset in our growing world-class lithium portfolio,” Thurlow said.

“Recent underground exploration success has confirmed that we’ve barely scratched the surface of this mine’s potential.

“Having now doubled the underground mineral resource, we’re pushing ahead with building the necessary infrastructure and technical expertise to transition Mount Marion into an open pit and underground mining operation.”

MinRes also announced it has welcomed WA’s first third-generation electric hybrid wheel loader, set to undertake load and haul activities at the Onslow Iron project.

MinRes asset management executive general manager Dale Blyth said the Komatsu E1850-3 will bring a host of environmental and productivity benefits.

“MinRes is committed to investing in the latest technology to power our transition to netzero operations, while still achieving operational efficiencies,” he said.

“Our new Komatsu wheel loader does exactly that, producing substantially less carbon emissions compared to mechanical drives while still delivering higher payloads.”

The machine features the fully regenerative SR hybrid drive system, which during braking or retarding causes electrical motors to become generators, feeding power back into its kinetic energy storage system.

This helps deliver up to 45 per cent less fuel consumption than comparably sized mechanical drive wheel loaders.

Magmatic Resources and Fortescue have executed a farm-in and joint venture (JV) agreement at the Myall copper-gold project in NSW.

The agreement will see Fortescue spend up to $14 million over six years to earn up to a 75 per cent joint venture interest in the project.

Fortescue also subscribed for 75,946,151 shares in Magmatic Resources to hold a 19.9 per cent stake.

The Myall project consists of a contiguous 244km² tenement covering the northern extension of the Junee-Narromine Volcanic Belt.

Magmatic Resources has found significant porphyry-associated copper-gold mineralisation in the area.

“We are excited to joint venture and partner with Fortescue to advance our exploration efforts across the Myall project area,” Magmatic Resources executive chairman David Richardson said.

“Myall has many signatures of a Tier 1 copper-gold deposit and Magmatic has recognised the need to partner with a major to further advance the project following the maiden resource.”

The terms of the agreement stipulate that Fortescue may earn a 51 per cent initial interest in the Myall project by incurring $6 million in expenditure on exploration in the initial earn-in period of up to four years.

AngloGold Ashanti has extended a three-year contract with Macmahon for underground mining services at the Tropicana gold operation in Western Australia.

The $352 million contract will see Macmahon continue to carry out services at the Boston Shaker underground mine, which it has been working at since 2019.

Tropicana, located 330km northeast of Kalgoorlie, is a joint venture

largest producing gold mines.

In its current tenure, Macmahon’s scope of services has included mine development, production drilling, cable bolting and ore stoping.

“We are delighted to have been awarded an extension at Boston Shaker where we have worked to build an excellent relationship with our client, focused on driving

chief executive officer Michael Finnegan said.

“The contract extension award is a critical step towards growing the underground portfolio by 50 per cent over the next two to three years.

“With capital already deployed in the project and no new growth capital required, we expect the extension to enhance our return on capital

Gold is enjoying a particularity bright day in the sun with gold prices reaching record levels in recent months.

Prices are expected to continue their run in 2024 due to various factors such as geopolitical disruptions, a weakening US dollar and rising inflation.

Lorbrand are designers and manufacturers of heavy duty conveyor components, used globally in the harshest operating conditions.

Our products include idlers, rollers, pulleys and conveyor steelwork used for the mining, quarrying, agricultural, ship loading, utility, material and bulk solids handling industries.

Exceptional durability, our solutions are engineered to endure, ensuring longevity and reliability in every application.

Get in touch to find out more:

AUSTRALIAN GRAPHITE

Graphite has long been considered crucial for the global energy transition, even before the Federal Government introduced the Critical Minerals List in 2019.

Soft, black and shiny, graphite is composed of carbon in a hexagonal crystalline structure and is used as an input for anodes.

There are currently no active Australian graphite mines, but the country was ranked eighth globally for graphite resources in ‘Australia’s Identified Mineral Resources 2023’ report, meaning there is untapped potential.

With the newly-introduced restriction on graphite exports in China – the world’s top graphite exporter –decreasing the country’s exports by 91 per cent, there has perhaps never been a better opportunity to capitalise on the commodity’s growth.

According to energy transition data provider and analyst Wood Mackenzie, situations like this will open doors for other countries like Australia to step up to the plate.

“As geopolitics plays an everincreasing role across all the battery raw materials, we could start to see more rest-of-world development downstream of mining – if market pricing allows,” the market analyst said in its report, ‘Graphite: Five things to look for in 2024’.

And the timing couldn’t be sweeter for three Australian graphite-focused companies profiled in this edition of Australian Mining

International Graphite Since its inception six years ago, International Graphite has made quite an impression in the sector.

The company was founded in 2018 by Phil Hearse and David Pass, two of Perth’s most prominent metallurgists with over 30 years’ experience.

During the early emergence of lithium-ion batteries – the primary consumers of graphite fines – Hearse and Pass recognised that almost all supply chains ran through China.

“They believed, ahead of time, that there was a need to diversify graphite supply beyond China to support battery and car manufacturers, which created the opportunity for Australia to create new downstream processing facilities,” International Graphite managing director and chief executive officer (CEO) Andrew Worland told Australian Mining

“So, they founded International Graphite and have built the intellectual property (IP) to support their vision for a mine-to-market supply chain in WA.”

In 2022, the company attracted interest from Comet Resources, a base and precious metals explorer that owned the Springdale graphite project in the Ravensthorpe region of Western Australia.

“Comet identified that the Springdale deposit was particularly suited for the lithium-ion battery pathway,” Worland said. “They believed that the IP

International Graphite had built would be key to extracting full value from the natural resource.

“That led to International Graphite purchasing the Springdale deposit and listing on the Australian Securities Exchange (ASX) in April 2022.”

Under International Graphite, Springdale has grown to become one of the top 15 graphite deposits in the world.

“The Springdale deposit has scale and a significant high-grade component to the resource,” Worland said. “The scoping study we released in January

2024 indicated we can hold a head grade of about 10 per cent for the first 15 years of operations.

“The graphite mineralisation is very shallow and soft, as it is in oxide and weathered rock, which translates to cheaper mining costs and, because it’s a fines deposit, cheaper processing costs.”

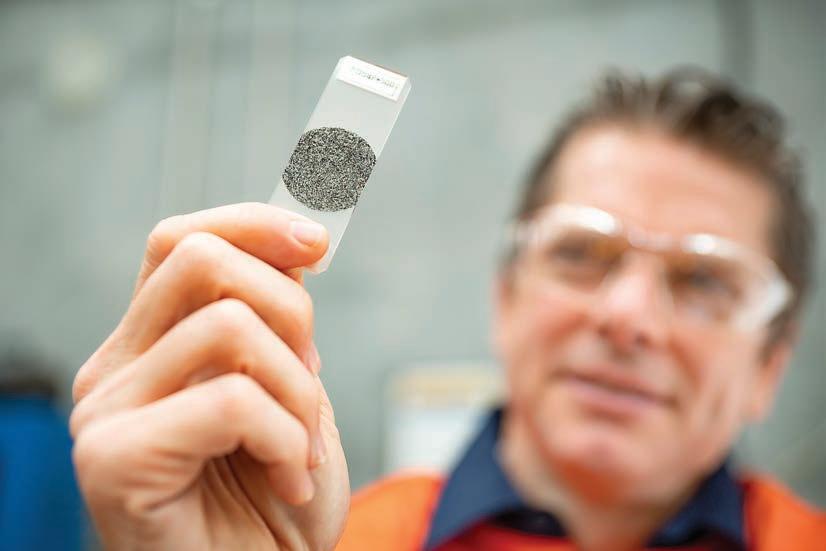

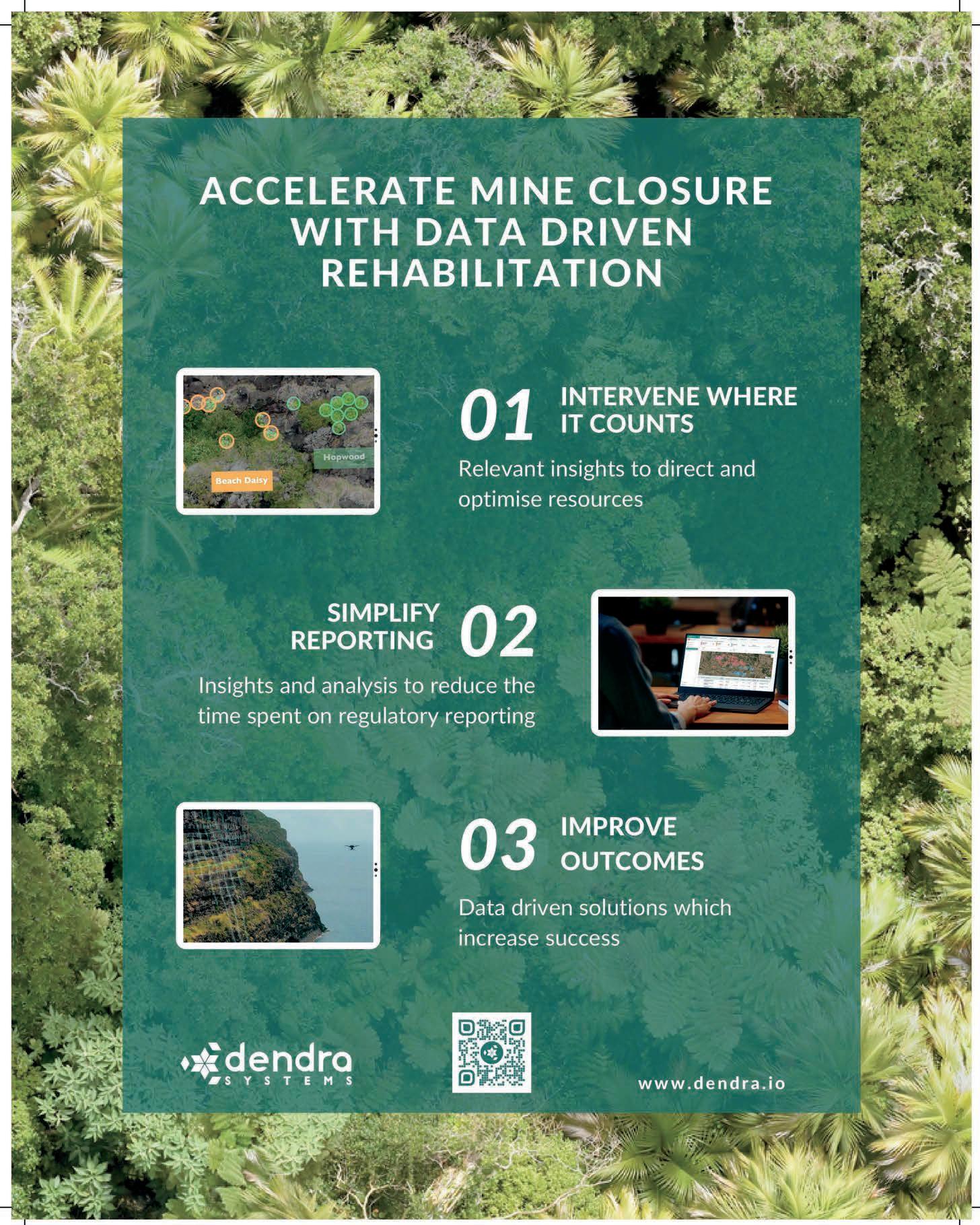

In March 2024, purification test work on micronised and spheroidised Springdale concentrates exceeded the purity requirements needed for lithiumion batteries, with optimised test results achieving between 99.96–99.97 per cent of loss on ignition.

“Our test work programs indicate that we are able to deliver graphite from the mine site at 95 per cent concentrate,” Worland said.

“99.95 per cent is regarded as a minimum battery specification, and we are satisfied we can purify our products to 99.95 per cent and above, so the results are a great tick for the project.”

Complementing the Springdale project is International Graphite’s recently commissioned graphite micronising plant in Collie, which will ultimately be available to process graphite concentrates.

The qualification-scale microniser is the largest pilot plant of its type in Australia and is the pre-cursor to a

4000-tonne-per-annum commercial scale plant that is expected to be built and operating in Collie by the end of next year.

International Graphite has received $13.2 million in grants from State and Federal Governments, including $6.5 million from the WA Government in April. This will support the development of the company’s downstream processing capabilities, from micronising to purified battery anode material.

Micronised graphite is the first stage in producing battery anode material for electric vehicles and green energy storage.

“Micronised graphite has extensive industrial applications, so we are establishing a micronising business as a prelude to the full battery anode business,” Worland said.

“Over the next six to 18 months, we’ll develop a customer base to operate a commercial scale micronising business in Collie, establish our brand and develop greater technical expertise in the handling of materials.”

International Graphite is also looking to convert more Springdale resources from the inferred category to the indicated category.

“We will initiate more exploration work at Mason Bay this year, which was one of our key discoveries in 2023, as we think there’s real scope to significantly enlarge that resource,” Worland said.

“We’re getting an enormous amount of inbound interest from North America, Europe and Asia for our product as we develop our product suite outside of the China supply chain.

“When anticipate being at the forefront of that investor appetite.”

Another aspiring Australian graphite producer, Lincoln Minerals, is advancing its Kookaburra Gully graphite project in South Australia’s Eyre Peninsula.

Leading the company is former mining engineer Jonathon Trewartha, who took over as CEO in November 2023.

“What attracted me to Lincoln Minerals was its resource (Kookaburra Gully) with its high-grade core that starts at surface, and that it already had a mining lease approved and a program for environment protection and rehabilitation well advanced,” Trewartha told Australian Mining

“A feasibility study completed on the Kookaburra Gully project in 2017 was based on a production rate of 35,000 tonnes of graphite flake concentrate per annum, which yielded a 33 per cent internal rate of return and a 10-year mine life.”

In mid-April, Lincoln Minerals announced it had doubled the Kookaburra Gully resource in just seven months.

The deposit now boasts a mineral resource estimate of 12.8 million tonnes at 7.6 per cent total graphitic carbon (TGC). That is, in simple terms, almost one million ounces of contained graphite.

This makes Kookaburra Gully the second largest graphite resource on the Eyre Peninsula and underlines its potential as a Tier 1 project.

“Recent drilling grew the Kookaburra Gully deposit to 3.5 million tonnes at 11.7 per cent TGC, and increased the high-grade core to 2.9 million tonnes at 13.6 per cent TGC, which positions the project as a low cost mining operation,” Trewartha said.

“At surface, we’ve got 20 per cent TGC, so our first bucket load will be 20 per cent. A lot of other Australian deposits have to dig down between 10-15 metres and they’re batting around seven

or eight per cent TGC, so we believe we’ve got a huge competitive advantage.” Trewartha said Kookaburra Gully’s scalability is demonstrated through the exploration targets released in March.

“The targets go up to 126 million tonnes of graphite at four to 16 per cent TGC, which shows we can scale,” he said.

“South Australia’s southern portion of the Hutchison Group formation, on the Eyre Peninsula, possesses more than 60 per cent of Australia’s graphite resources, including the Kookaburra Gully graphite project.”

In 2017, a 39-tonne sample was sent to a pilot plant in China for test work. This test work has now been completed.

“That concentrate has returned a 95 per cent average grade and when leach tested produced a 99.9 per cent grade, which is awesome,” Trewartha said. “Then it was sent to Canada to produce 300kg of spheroidized graphite.

“The benefit of that is we can put spheroidized product into the buyers’ hands, and that’s before acid treatment.”

Looking ahead, Lincoln Minerals is keen to deliver an updated pre-feasibility study in the second half of 2024, examining a 60,000–100,000 tonne-perannum graphite concentrate project at Kookaburra Gully.

“We aim to have approvals, feasibility studies and a conditional sales contract

completed by the second half of next year,” Trewartha said.

The company also aims to continue drilling at Kookaburra Gully at the end of the cropping season in December 2024, in order to further extend known mineralisation and test new high impact targets in order to meet the growing graphite demand.

“We’re three companies in one, spanning graphite, our 1.2-billion-tonne Green Iron magnetite project and our extensive portfolio of uranium targets,” Trewartha said.

“We’re choosing graphite as our core business, as it gives us the opportunity to develop and mine a potential Tier 1 asset at Kookaburra Gully.

“This project’s high-grade core is on an awarded mining lease, in the most prominent graphite region in Australia, and it’s highly prospective for further world-class discoveries.

“In addition, we really believe the demand for graphite is going to continue increasing.”

Backed by a $185 million loan facility from the Federal Government, Renascor Resources is shooting for

RENASCOR RESOURCES WILL USE A $185 MILLION LOAN FACILITY FROM THE FEDERAL GOVERNMENT TO BOLSTER ITS SIVIOUR BAM GRAPHITE PROJECT.

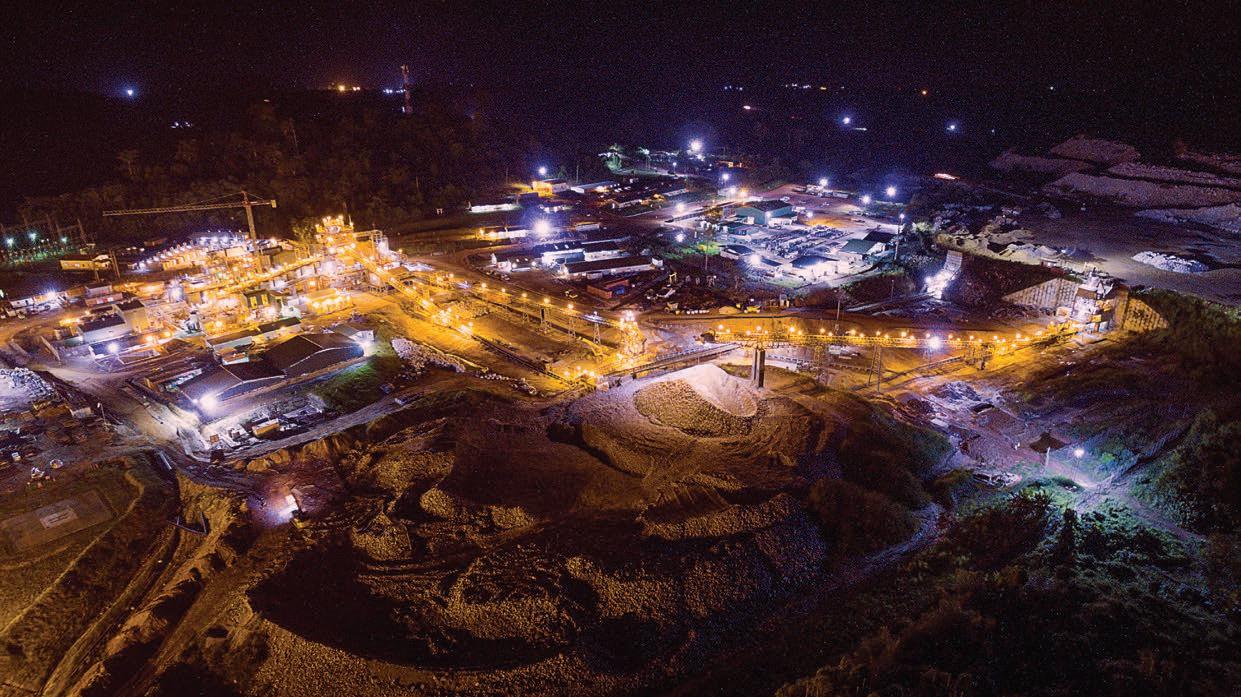

the stars with its Siviour battery anode material (BAM) graphite project in South Australia.

Renascor is set to utilise the loan to fast track the development of the graphite concentrate operation at BAM.

“We are delighted to have received confirmation that the $185 million loan is approved to support our strategy of fast-tracking the construction of the upstream portion of the BAM project,” Renascor managing director David Christensen said in April.

“Our phased development strategy provides us with an early-mover advantage by entering the market with reliable supply of natural graphite concentrates.

“The strategy allows us to generate early cashflows, accelerate production of graphite concentrates, and continue to build offtake relationships with leading anode suppliers.”

The BAM operation includes the Siviour graphite deposit and a state-of-the-art processing facility to manufacture purified spherical graphite (PSG) through Renascor’s ecofriendly purification process.

Renascor holds the world’s second largest proven graphite reserve and the

largest graphite reserve outside of Africa, which could support a mining operation for 40 years.

“In the Siviour graphite deposit, Renascor is fortunate to be endowed with a large world-class asset,”

Christensen said.

“The support from the Australian Government and EFA (Export Finance Australia) is testament to the gravity of the opportunity for Renascor, and Australia, to become a world-leading supplier of graphite into the lithium-ion battery supply chain.”

Like many battery metals, graphite prices have been turbulent recently.

However, Wood Mackenzie forecasted significant growth for natural and synthetic graphite anodes in tonnage terms in its ‘Graphite: Five things to look for in 2024’ report.

“Far more graphite will be required for the energy transition than any other anode material,” the market analyst said.

Lucky for Australia, the country is filled with strong graphite resources, many of which remain untapped. And businesses are taking advantage, with several mining companies working to uncover them. AM

Hexagon's integrated technology solutions help mines become safer, smarter and more sustainable as they pursue:

Zero harm

Zero equipment failures

Zero mine stoppages

Zero dirty emissions

Zero profit leakages

One platform. One partner. For the life of your mine.

Like many Australian industries, the mining sector is racing to meet net-zero by 2050.

But the industry can’t meet this goal without a strong environmental, social and governance (ESG) framework.

It’s for this reason that the resource industry has been quick to adopt Towards Sustainable Mining (TSM), a globally recognised accountability framework supporting minerals companies to evaluate, manage and communicate their site-level sustainability performance.

Overseen by a national Community of Interest Advisory Panel, comprising representatives from key stakeholder

MINING COMPANIES AND CONTRACTORS HAVE AN OBLIGATION TO BE RESPONSIBLE OPERATORS, FOR THE GOOD OF LOCAL COMMUNITIES.

A STRONG ESG FRAMEWORK IS ESSENTIAL TO REACH NET-ZERO.

AS AUSTRALIA PROGRESSIVELY IMPLEMENTS SUSTAINABLE MINING METHODS, THE RESOURCE SECTOR IS ADOPTING TSM –A GLOBALLY RECOGNISED ACCOUNTABILITY FRAMEWORK.

groups such as First Nations entities, communities, investors and nongovernment organisations, TSM provides a consistent approach for companies to assess and communicate site level performance.

Making a change

TSM, which is administered by the Minerals Council of Australia (MCA), is an expectation of MCA membership.

First adopted by the MCA in November 2021, MCA chief executive officer Tania Constable said TSM would build on the existing commitments the MCA has towards sustainable mining.

“Australian mining is a global leader in sustainability performance, and it’s time to take another step forward

to enhance community, investor and customer trust and confidence in the industry,” Constable said at the time.

TSM includes guiding principles and standardised protocols to be adapted for Australian implementation, including:

• communities and people: Indigenous and community relationships, safety and health, crisis management and communication planning, preventing child and forced labour

• environmental stewardship: biodiversity conservation management, tailings management, water stewardship

• c limate change: site-level targets and management.

A key part of ESG is its social pillar, which focuses heavily on human rights and equity.

Across the globe, mining companies continue to strengthen their relationships with First Nations people, and Australia is no different.

TSM contains an Indigenous and community relationships protocol which sets out general expectations for systems and processes that support respectful relationships.

“Indigenous communities are fundamental partners in mining and the social and economic contribution mining makes to Australia,” the protocol said.

“The minerals industry is also a major stakeholder in the creation of Indigenous jobs, skills and wealth.”

The protocol acknowledges that the mining sector must engage with communities through all stages of the mine lifecycle.

It sets a precedent to collaborate on issues related to environmental effects, monitoring and cultural protection, with a focus on developing partnerships and initiatives that generate economic opportunities and wealth for surrounding communities.

Within TSM, the MCA has also adopted the Enduring Value framework. Based on the International Council on Mining and Metals’ 10 Principles of Sustainable Development, Enduring Value establishes the industry’s leadership on responsible resource development.

Like with TSM, it is an MCA membership condition that companies accept the 10 principles of Enduring Value.

The principles:

1. Implement and maintain ethical business practices and sound systems of corporate governance

2. Integrate sustainable development principles into company policies and practices

3. Uphold fundamental human rights and respect cultures, customs and values in dealings with employees and others who are affected by mining activities

4. Implement risk management strategies based on valid data and sound science

5. Seek continual improvement of health and safety performance

6. Seek continual improvement of environmental performance

7. Contribute to conservation of biodiversity and integrated approaches to land use planning

8. Facilitate and encourage responsible product design, use, re-use, recycling and disposal of mining products

9. Contribute to the social, economic and institutional development of the communities in which miners operate 10. Implement effective and transparent engagement, communications and independently verified reporting arrangements with stakeholders

“The success of Australia’s minerals industry, both now and in the future, depends upon its ability to operate in line with community expectations on ESG performance,” Constable said.

“Strong ESG performance creates shared value for workers, communities, investors and broader society. How the industry operates is as important as what it produces.”

An ESG framework is only as strong as the transparency and accountability behind it.

While TSM is overseen by a national Community of Interest Advisory Panel, companies who implement TSM can also help to hold each other accountable.

The TSM framework supports companies to identify opportunities and manage risks across environmental and social performance, with an industry view of ‘good practice’ enabling each company to maintain standards that show mining is being managed responsibly, from start to finish.

“Australian companies are global leaders in innovative, high-tech mining and lead the way in ESG practice,” Constable said.

“The Australian industry’s sustainability credentials are recognised globally, and its expertise and leading practice is exported around the world.”

For as long as companies push to reach net-zero, a strong ESG framework will continue to be an important part of a sustainable mining operation.

“The Australian minerals industry remains committed to doing more,” Constable said. “These ongoing efforts will ensure the industry keeps pace with changing community expectations and fully realise the opportunities afforded by responsible minerals development.”

While the MCA has been proactive in providing the resources sector a clear framework in which to adopt ESGfriendly mining practices, mining companies and contractors should also be wary of how local regulation is evolving.

In late March, the Federal Government introduced the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024 to the House of Representatives. Schedule 4 of the Bill proposes a mandatory climate risk disclosure framework for large Australian companies.

If enacted, the Bill will require companies that lodge financial reports under Chapter 2M of the Corporations Act 2001 and meet certain thresholds to submit a sustainability report disclosing climate-related risks and opportunities

in accordance with the Australian Sustainability Reporting Standards.

A sustainability report will need to contain a climate statement that details any:

• material climate-related financial risks or opportunities

• metrics and targets relating to climate that are required to be disclosed by the forthcoming sustainability standards, including Scope 1, 2 and 3 greenhouse gas emissions (and financed emissions)

• information about the governance, strategy or risk management by the entity in relation to the climate risks, opportunities, metrics and targets.

For some companies, reporting changes could start as early as January 2025.

In October 2023, the Australian Securities & Investments Commission (ASIC) described the shift to mandatory climate-related disclosure as the “biggest change to corporate reporting in a generation”.

ESG accountability must come from various angles for it to be effective, with internal accountability just as critical as obligations set out by regulators and industry bodies.

As the Australian mining industry understands that project development timelines and finance are increasingly being dictated by investors and governments through an ESG lens, companies that don’t refine their ESG strategy risk being left out in the cold, with their projects at a standstill. AM

WHILE A MINE MAY BE REHABILITATED FROM THE GROUND UP, GLOBAL SOIL SYSTEMS LIKES TO HAVE A BIRD’S EYE VIEW OF THE PROJECT.

It may be a surprise to learn that helicopters are often used when rehabilitating a mine.

But considering rehabilitation works can often span hundreds of hectares across potentially steep, difficult and remote terrain, it makes sense.

Aerial access allows for the completion of jobs that otherwise would not be possible, and it can be a more economical means of application due to a helicopter’s speed, efficiency and carrying capacity.

Rehabilitation expert Global Soil Systems (GSS) has used helicopters for its rehabilitation projects for over 20 years, its value extending far beyond native woodland and pasture seeding.

“We had to get creative and innovate,” GSS general manager James Nebauer told Australian Mining. “We were challenged with landscapes that were either inaccessible and unsafe, or simply too costly and inefficient to revegetate using traditional methods.

“We needed a safer, more efficient alternative, which is why we first started using helicopters. They’re now used on site for a range of applications.”

GSS regularly uses helicopters for time-critical projects like seed and fertiliser applications, soil amelioration

and dust-suppression, as well as weed and pest control. The company was also the first to develop a new process of aerial hydro mulching for slope stabilisation and revegetation.

Aerial solutions were a natural evolution for GSS, a company that specialises in the end-to-end management of large-scale revegetation projects across Australia. This includes everything from providing advice on appropriate revegetation methods and ensuring all safety, compliance and risk assessment procedures are in place to organise the materials and machinery required and carrying out the work.

Engaged to work on some of the biggest sites in Australia, Nebauer said the requirement for aerial solutions is steadily growing. The long-standing relationship between GSS and Commercial Helicopters has seen the companies collaborate on several largescale projects over the years, with a focus on continually refining and expanding revegetation solutions.

“There is a lot of work that goes on in the background to ensure the success of an aerial project,” Nebauer said.

“We work extensively with clients to ensure all safety requirements are met

or exceeded, which allows them to have full confidence in the professionalism and safety of our operations.”

Commercial Helicopters general manager Robert Murray said the company’s operations adhere to strict safety regulations enforced by aviation authorities and BARS (Basic Aviation Risk Standard) certification.

“Our pilots undergo rigorous training and meet BARS-approved minimum requirements,” Murray said.

“We are also one of the select few operators in the country to be approved by the Civil Aviation Safety Authority (CASA) for our fatigue risk management system.”

Murray said one of the main benefits of helicopters is their precision, allowing access to specific areas without excessive disturbance to surrounding vegetation or terrain, while also reducing the risk of soil erosion, habitat disruption, or damage to vegetation.

“When operated by highly experienced pilots with established protocols and safety measures, helicopters significantly contribute to restoring disturbed areas, while minimising environmental impact and maximising time efficiencies,” he said. AM

–

–

EPIROC’S SCOOPTRAM ST14 UNDERGROUND LOADER IS AVAILABLE IN BATTERY-ELECTRIC.

EPIROC IS BREAKING DOWN THE BARRIERS ASSOCIATED WITH GOING ELECTRIC.

Through customer collaboration and everevolving research and development, Epiroc continues to set the tone for electrification in the Australian mining industry.

And with Federal Government initiatives such as the Safeguard Mechanism requiring mining companies to pay for carbon credits to offset their emissions, the need to adopt green technologies is becoming increasingly pressing.

Epiroc offers a wide range of batteryelectric vehicles for the Australian resources sector. This includes Epiroc’s battery-electric underground mining trucks (Minetruck range), loaders (Scooptram range), face drill rigs/jumbos (Boomer range), rock reinforcement rigs (Boltec range) and production drilling rigs (Simba range).

Operators can buy these machines new or Epiroc can retrofit an existing diesel machine with battery capability. This can coincide with a zero-hour rebuild.

To best facilitate an electric transition, the esteemed original equipment manufacturer (OEM) works closely with its mining customers to understand their electrification barriers and how

to best overcome them, before building out a roadmap that doesn’t compromise operational productivity.

“Customers have different strategies around their electrification journey, and it’s important for Epiroc to be able to come up with an agile solution that isn’t just about supplying a new machine,”

Epiroc Australia electrification support lead Karl Van Mourik told Australian Mining.

“A solution could involve scoping out a machine and considering what a battery conversion might look at the midlife stage. Maybe their infrastructure isn’t quite ready but maybe they can see an electrification opportunity down the track, and they can tie that in with a new battery-electric machine.

“There are many different avenues to implementing batteryelectric technologies.”

Customers daunted by the scope of electrification can be rest assured that Epiroc has the support networks available to support their electrification journey.

This includes the OEM’s Batteries as a Service (BaaS) offering, which sees Epiroc take ownership and full responsibility for the batteries, from certification to maintenance and technology upgrades.

Van Mourik said BaaS ensures batteries are maintained with the same vigilance and precision as Epiroc would maintain its machinery.

“The service is done by us,” he said. “We’ll ensure that you’ve always got the latest technology because as we own the battery, we’ll do all the updates for you as battery technologies improve.

“And when it comes to maintenance, once you reach a certain cut-off point for battery usage we’ll then install a new battery, guaranteeing battery usage and reducing unnecessary

downtime associated with reactive battery changeouts.”

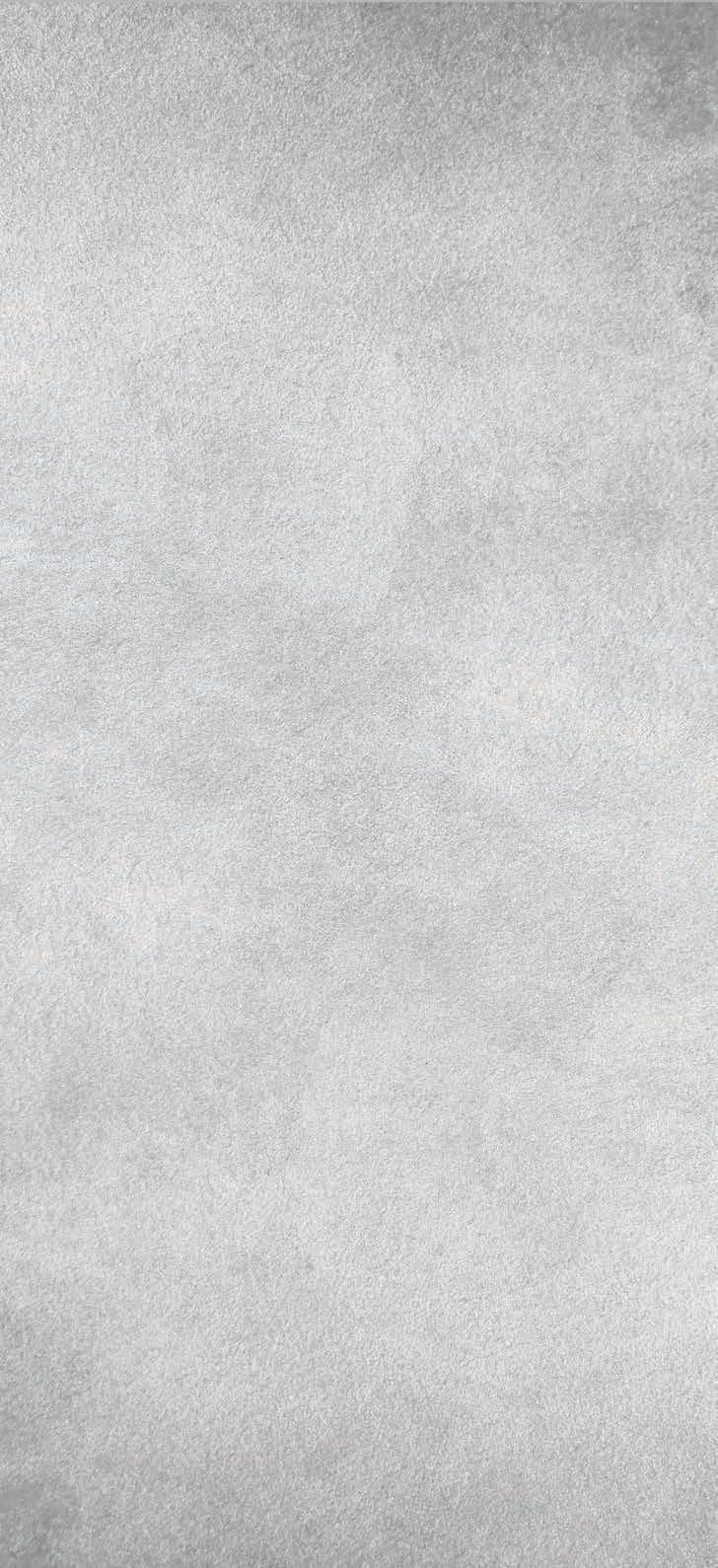

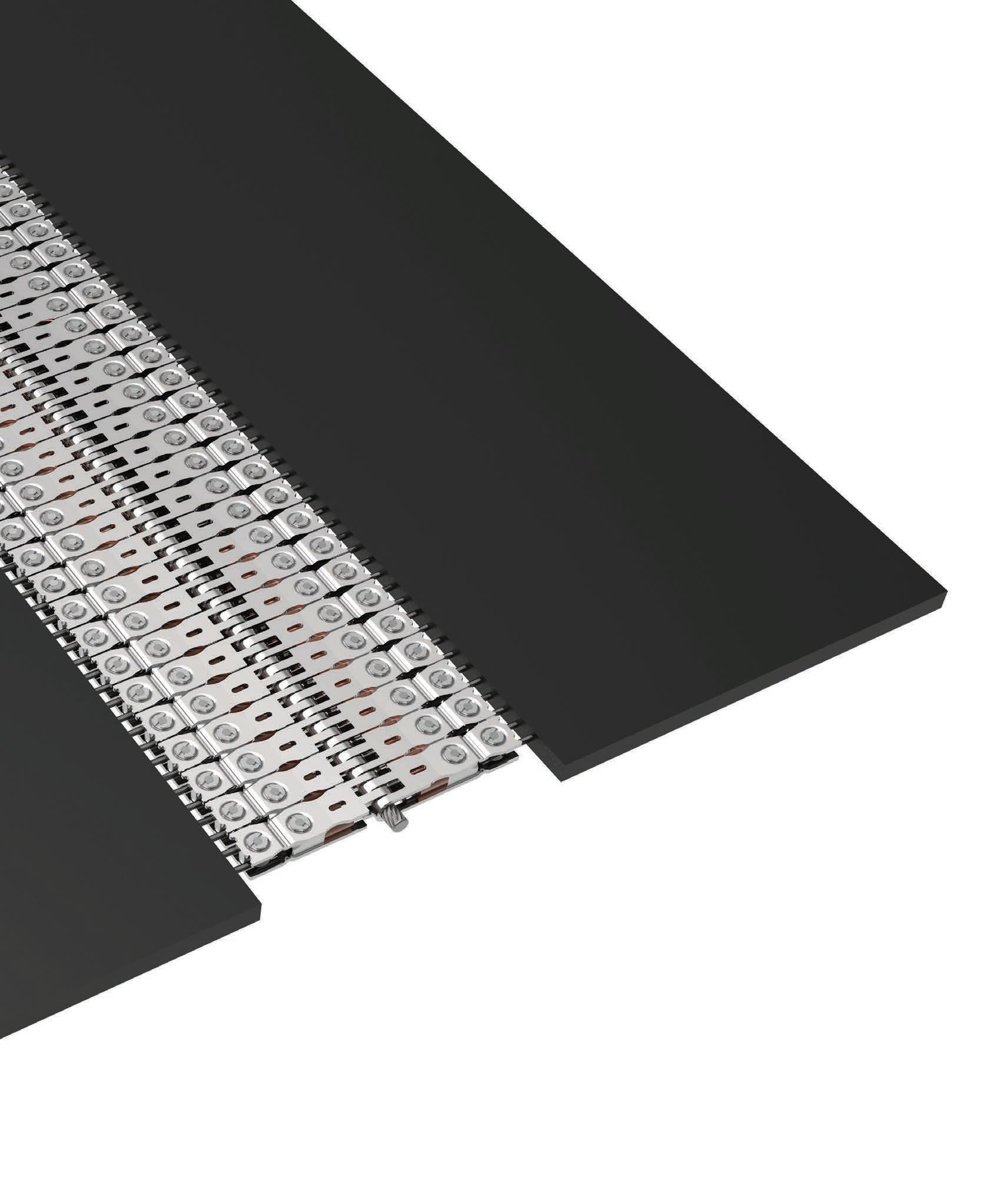

Ahead of the recent Electric Mine Conference in Perth, Epiroc completed the first-ever diesel-to-battery conversion of its Minetruck MT42 to be the basis of BluVein’s dynamic charging solution and slotted electric rail system.

BluVein’s solution sees an enclosed electrified e-rail system mounted above a mining vehicle together with the BluVein hammer that connects the electric vehicle to the rail.

EPIROC’S BATTERIES AS A SERVICE OFFERING SEES EPIROC TAKE OWNERSHIP AND FULL RESPONSIBILITY FOR THE BATTERIES.

The system provides power for driving the vehicle, typically a mine truck, and charges the truck’s batteries while it is hauling load up a ramp and out of an underground mine.

Once proven, this technology has the potential to be a key enabler for electrifying underground mines.

Van Mourik discussed the advantages of deploying a battery-electric truck underground.

“Battery-electric vehicles typically have a higher speed-on-grade because of the efficiency of electric motors and less loss incurred through your drive train,” he said. “So once the mine truck is integrated into the cycle times and patterns of the existing fleet, it has the potential to boost productivity.

“An electric truck provides a solution for any mine that has a problem with heat, diesel particulates, noise, vibration, or other environmental factors that are affecting their working group.

“As mines get deeper, maybe an operator needs to go electric because the environmental conditions in the mine dictate that.”

When combined with the ability to drive down carbon emissions, these advantages suddenly give an operator a mine site that meets the environmental, social and governance (ESG) obligations put to it by stakeholders and investors.

JTMEC is one example of Epiroc’s commitment to inorganic growth.

An electrification infrastructure solutions provider for underground and surface mines, JTMEC offers highvoltage installation and maintenance expertise, transformer servicing and testing, engineering design, feasibility studies, and training.

and telecommunications infrastructure on mine sites.

Another acquisition that has boosted Epiroc’s battery-electric capability is the addition of FVT Research, which designs diesel-to-battery conversion kits and rebuilds mining machines into electric versions.

In 2021, FVT participated in a

Epiroc understands that going electric isn’t as simple as deploying a fleet of battery-electric loaders, trucks and drills into a mine. The transition also necessitates associated infrastructure and maintenance expertise.

Luckily enough for the Australian mining industry, Epiroc has been proactive, building out its business to

Hexagon describes its sustainability efforts as “a natural, integrated part of its operations and core values”.

“Sustainability is crucial to the company’s success, and its work drives profitability and long-term shareholder value,” the company said.

Hexagon Mining head of product – mine planning Jesse Forgues told Australian Mining that sustainability is also crucial to the mining industry amid a global energy transition.

“As mines are increasingly shifting to renewable energy and electrification within their own operations, they are also working to produce the necessary minerals for all industries to do the same,” Forgues said.

To further aid in this industrywide mission, Hexagon has advanced its MinePlan Schedule Optimiser, which determines the most productive cut mining sequence to achieve the highest project profitability, and then generates practical short–long-term project schedules.

The digital solution can now measure an electric haul truck’s energy usage and downhill energy generation.

“Load and haul represent the majority of greenhouse gases within a mine and a large source of costs,” Forgues said.

“By modelling alternative energy sources and integrating them within our current products, such as the MinePlan Schedule Optimiser, we can ensure the mine plan is being assessed to minimise energy usage costs, which ultimately impact mineral extraction costs and trickle down to the end consumer.”

For the last decade, Hexagon’s MinePlan Haulage solution has been providing inputs into MinePlan Schedule Optimiser.

“This is an important step in the planning process and represents the extraction sequence using the fleet available,” Forgues said.

“Fuel consumption is modelled based on the route and vehicle type. Fuel consumption is then calculated for each route, allowing the user to see trade-off scenarios based on fuel usage.”

This process can now be followed for an electric haul truck.

“We can model the kilowatt hours required to move the required amount of tonnes against the optimal routes, considering both the energy usage uphill and the energy generation downhill,” Forgues said.

“This approach results in a mine plan that reflects the specific model of truck being assessed.”

This integration will help mining companies increase their efficiency and safety while reducing emissions.

“The integration between MinePlan Haulage and MinePlan Schedule Optimiser boils down to enabling better decision-making that is considerate of all aspects of the mine plan, ensuring that the economics of the plan are well understood,” Forgues said.

“It also allows for seamlessly understanding trade-offs of different fleets and mixed fleets so that optimal outcomes can be determined with minimal user intervention.”

Hexagon believes its sustainability journey is determined not only by the role its products and solutions play in the market, but also by its own processes and actions.

In 2024, the company will continue progressing its sustainability commitments, including the transition of Scope 1 and 2 emissions to renewable energy by 2027.

“A number of our facilities will transition to renewable energy as part of our ongoing efforts to reduce our energy consumption,” Hexagon senior

director – ESG (environmental, social and governance) Louise Daw told Australian Mining.

“Waste reduction is also a significant focus for us this year as we consider novel ways to reduce, reuse and recycle.

“We will continue to work closely with our suppliers to ensure alignment on policies and goals, and by 2030, 80 per cent of our procurement spend is expected to be with suppliers with Science-Based Targets initiativevalidated net-zero targets.”

The company seems to have had a great start, with EcoVadis – the global standard for business sustainability ratings – awarding Hexagon the gold sustainability rating in March.

“This rating places Hexagon in the top five per cent of companies assessed globally and reflects our demonstrated and measurable commitments to energy reduction, social responsibility, safe working environments and a diverse and inclusive workforce,” Daw said.

“Across the globe, our solutions put data to work for customers in ways that enable more efficient processes and improved decision-making, resulting in fewer inputs, less waste, reduced emissions, increased safety and better preparedness.”

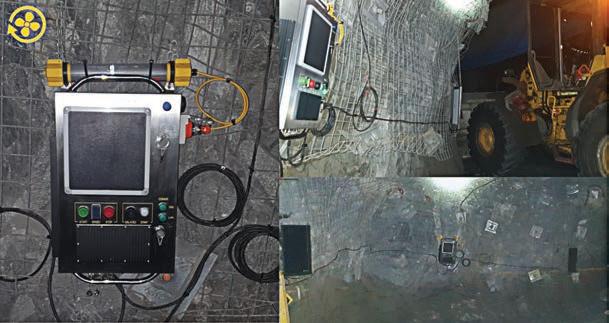

DENDRA HAS EVOLVED ITS AERIAL SEEDING TECHNOLOGY TO THE POINT THAT IT CAN COVER UP TO 44 HECTARES PER DAY –A 10-FOLD INCREASE IN JUST A DECADE.

The Australian mining industry is beginning to understand the gravity of the environmental, social and governance (ESG) movement and what it means for a company’s bottom line. Regulators, investors and other stakeholders are increasingly taking ESG into account when making decisions that affect a mine’s financing and development.

Dendra is enabling ESG compliance in the local resources sector by empowering miners and contractors to implement better ecosystem-restoration practices, leading to improved land treatment and relationships with Traditional Owners.

As an important component of ecosystem restoration, aerial seeding sees drone fleets disperse various seed types and combinations onto disused mining areas, providing the foundation for ecosystem restoration, reducing erosion hazards, and suppressing the growth of invasive plant species.

Aerial seeding usurps traditional ‘boots-on-the-ground’ methods, with drones able to seed larger and harder-toaccess areas faster.

In fact, Dendra is able to seed up to 44 hectares per day through its current aerial seeding processes – a 10-fold scale increase from a decade ago.

Dendra has not only been able to expand the scale of its offerings but also improve the quality of its technology to handle a wider range of seed types.

“In Australia, seed types range from grains to grass and everything in between,” Dendra engineering group manager Ashwin Chandrasekaran told Australian Mining

“This is where Dendra comes in –we’ve pioneered new technology that can help spread far more fibrous and difficult seed types. And we do this with a focus on operational safety and efficiency.”

Dendra Australia engineering manager Alec Lewandowski said Dendra’s technology is ever evolving.

“We are always adapting our system to new seed types,” he told Australian Mining. “When we receive a seed that’s

ONE PROJECT WILL SEE DENDRA SEED ABOUT 500 HECTARES THIS YEAR AT A WA MINE.

DENDRA HAS IMPROVED THE QUALITY OF ITS DRONE TECHNOLOGY TO HANDLE A WIDER RANGE OF SEED TYPES.

outside of our capability, we perform some R&D (research and development) and get the system working again to a good level.

“This is a testament to how our company works; no matter the customer request, we push to make it work.”

Dendra sees new capabilities entering the drone technology sector all the time. It’s one thing to adopt a new technology, but it’s another thing to adapt it.

“Every year new aircraft enters the market that has more agility or carries heavier weights,” Chandrasekaran said.

“Dendra builds a system that can adapt to these aircraft. Just because an aircraft can carry ‘X’ amount of weight doesn’t mean it is better, because you still need to be able to accurately disperse a certain amount of seed per hectare.”

The continued expansion of Dendra’s aerial seeding solution reflects both the growth of drone technology over the years and the company’s ability to evolve with that growth and tailor its solutions to current environmental needs.

Chandrasekaran said when a mining customer in Western Australia requested its mining operation be seeded by “one of Australia’s most difficult seed types”, Dendra went to work.

“The first time we saw the seed, we instantly knew it was going to be a difficult seed to work with; the seed could be compared to a bale of hay,” he said. “But we quickly made some modifications to our system and patented a new technology that focuses on how different seed types can efficiently pass through our system.

“We’ve been able to improve our technology little by little, making it more and more efficient, and we’re now at the stage where we’re doing an extensive project.

“We started aerial seeding about five hectares for this client. This year we’ll be doing 500 hectares.”

Dendra has achieved greater scale and scope with its aerial seeding solution. The company is also changing the way undulating and difficult-to-access terrains can be rehabilitated.

“Much of the mining environment is very treacherous terrain – it’s rarely flat,” Chandrasekaran said. “While traditional methods often involve trucks, tractors or teams of people on ground manually completing seeding tasks, this is not possible or safe in many mining landscapes.

“This is where our aerial solution comes into effect. There is no terrain we cannot seed, which means we can easily scale because we only need to add more aircraft to increase the size of the area we’re trying to spread.

“And even if the terrain is accessible, if you consider the cost per hectare, buying another drone is a lot more economical than buying another tractor to seed the same area.”

Dendra makes seeding simple, with the mobility of its unmanned aerial vehicles (UAVs) meaning solutions can be quickly mobilised to a mine site.

“Some of the mine sites we work with are so remote that it isn’t always practical

• High-precision separation. DENDRA

to get machinery on-site in a short space of time,” Chandrasekaran said. “But we’re able to quickly deploy our UAVs, go out and complete hundreds of hectares of seeding over a couple of weeks.

“We’re efficient, we’re safe, and we’re fully capable of being able to deliver seeding solutions at scale in a short period of time, which saves mining companies a lot of time and money.”

While Dendra has already achieved so much with its aerial seeding solution, there is so much more potential for this technology to grow and evolve.

Lewandowski said the company is always pushing to achieve greater volume.

“The more volume an aircraft can hold, the more seeds you can hold in one flight,” he said. “This means less fly backs, less filling up of the aircraft, which means more spread and more hectares covered per day.”

Dendra has a passion for technology and a passion for the environment, two critical linchpins in determining the mining sector’s ESG future.

And as Dendra establishes a stronger presence in the Australian mining sector, the company will continue to drive greater innovation and unearth safer, more efficient and more cost-effective ecosystem restoration practices. AM

With its broad feed-in spectrum, the alljig® ensures efficient sorting of a wide variety of primary and secondary raw and waste materials featuring different densities. The water- and air-pulsed alljig® is a smart, reliable and economical solution.

For more information, contact JACO BOTHA jaco.botha@allmineral.com or +61 439549 182

• Applications: gravel, sand, coal, ore, salt, industrial minerals, broken stone, shredded material, non-ferrous metals, slag, construction waste, recycling materials.

• Throughputsranging from 1 to 700 t/h.

• Grain sizes from 0.1 to 150mm.

• Jiggenerated stroke practically wear free.

• Easy to configure even during operation.

range, scan QR code or visit

BATTERIES ARE CURRENTLY THE BEST BET FOR DECARBONISING THE MINING INDUSTRY. BUT AS TECHNOLOGY DEVELOPS, HYDROGEN COULD BE A MORE VIABLE CHOICE.

HYDROGEN IS PROVING ITSELF AS A POTENTIAL LONG-TERM ENERGY OPTION.

Miners should be open-minded about the potential of hydrogen-powered vehicles, despite the mining industry’s current focus on battery technology.

Tyrone Woodfin, a senior mining engineer at SRK Consulting, describes hydrogen fuel-cell mining trucks as a potential ‘end-game solution’.

“Hydrogen is not there yet, but if you’re planning a mine for the next 10–20 years, you should consider the likelihood of hydrogen becoming a viable fuel source during that period,” he told Australian Mining.

The choice between battery or hydrogen fuel cell powered vehicles has varying implications for mining operations.

“Companies are starting to assess the options available to decarbonise the haulage of their mining operations,” Woodfin said.

“Batteries seem to be the primary focus at the moment, and this is echoed by major technology developments from original equipment manufacturers (OEMs). This might not be the case in a

decade or more as hydrogen technology develops and the hydrogen industry achieves greater scale and accessibility.

“As it currently stands, hydrogen trucks only exist in prototype form. The mining industry is still testing what works and what doesn’t work for an eventual move away from diesel-powered fleets.”

For now, Australia’s largest mining companies have focused on batteries over hydrogen to decarbonise their haulage fleets. Battery technology is advancing quickly as a result.

Woodfin, a mine planning and scheduling specialist, said most of the world’s mines cannot access hydrogen from external sources.

“Although hydrogen is utilised in industry around the world, green hydrogen, the preferred choice for a decarbonised fuel cell haul truck is currently not commonly available. This means a hydrogen-based solution would require investment in the infrastructure to produce green hydrogen, which is an expensive exercise.

Although hydrogen has its complications, Woodfin said, it remains the closest substitute for diesel power in mining fleets.

“Liquid hydrogen fuel has great longterm potential because it overcomes limitations with battery technology in terms of range and delivers greater flexibility in a mining operation,” he said.

“Take, a deep copper pit for example, with current battery chemistries the energy density is not sufficient for the truck to carry enough energy on-board to exit the pit under its own power.

“The trucks would be reliant upon a trolley-assist to supplement power supply to be able to exit the pit, whereas a fuel cell truck could have the range.”

Trolley-assist systems direct gridbased electrical power to haul trucks in open pit mines through overhead ‘trolley lines’, much like city trams.

More common in overseas mines, trolley-assist systems sometimes require pits to be widened and shut down at times for scheduled maintenance.

In that scenario, Woodfin said, reliability of the trolley system is key to an operation.

“Currently, trolley systems are used to speed up diesel electric trucks on a ramp, the energy to drive the traction motors is taken from the trolley line, and if the trolley is not operational the truck will

just continue to rely on its diesel engine,” he said.

Trolley-assist systems are being developed by the likes of BluVein in collaboration with Epiroc.

Ahead of the recent Electric Mine Conference in Perth, Epiroc completed the first-ever diesel-to-battery conversion of its Minetruck MT42 to be the basis of BluVein’s dynamic charging solution and slotted electric rail system.

As it currently stands, mining companies in Australia are increasingly choosing batteries for their future fleets over hydrogen power.

“Battery technology is far more of a known quantity,” Woodfin said. “It’s easier, cheaper and faster to achieve carbon reduction through fleet electrification.

“Major OEMs are developing the technology and there’s a clear runway for them to deliver a product, so the technology is closer to commercialisation. Most of the West Australian iron ore deposits are relatively shallow which makes battery a good solution.”

All major OEM truck providers have committed to or indicated a battery truck is in development.

THE MINING INDUSTRY IS INCREASINGLY ADOPTING BATTERY-ELECTRIC TECHNOLOGIES TO DRIVE DOWN EMISSIONS.

As for hydrogen, Komatsu recently signed a deal with GE to collaborate on developing a hydrogen fuel cell haul truck and Anglo American’s First Mode is moving to its second iteration to progress from a gaseous hydrogen fuel machine tested on an Anglo Platinum site in South Africa to a liquid hydrogen variant to extend its range.

Battery technology for mining is developing quickly. It’s likely that haul truck batteries will have longer ranges, trolley technology will be improved to increase reliability, as will the ability to access sufficient power to drive traction motors and charge batteries simultaneously.

In addition, battery-electric trolley trucks for underground mining are being tested in Europe, quickening the move towards the all-electric mine of the future and carbon reduction.

Woodfin, who joined SRK Consulting this year, hopes hydrogen fuel cells will emerge as a viable option in mining in coming decades.

In a previous role, he helped study alternative-fuel haulage options for operations around the world and can see hydrogen’s viable application.

TROLLEY-ASSIST SYSTEMS DIRECT GRID-BASED ELECTRICAL POWER TO HAUL TRUCKS IN OPEN-PIT MINES THROUGH OVERHEAD ‘TROLLEY LINES’.

Woodfin has watched the aviation and automotive industry’s continued development into hydrogen-based solutions and hopes this will spill forward into the mining sector.

“I suspect much will depend on a mine’s location, the depth of the pits and access to renewable energy and hydrogen,” Woodfin said.

“If companies can work together to develop shared hydrogengeneration facilities or access external sources, hydrogen will become more competitive with battery technology over time.

“The key for miners is to understand the advantages and limitations of both technologies, especially from an operational perspective.” AM

SRK Consulting is a leading, independent international consultancy that advises clients mainly in the earth and water resource industries. Its mining services range from exploration to mine closure. SRK experts are leaders in fields such as due diligence, technical studies, mine waste and water management, permitting, and mine rehabilitation. To learn more about SRK Consulting, visit www.srk.com

1. Recognise the scale of the decision: The decision to electrify mine fleets through battery technology, or use hydrogen fuel cells, has costly implications for mine planning and design. Batteries need charging infrastructure and hydrogen requires on-site generation or access to external hydrogen sources.

2. Stay aware of technology advances: Battery and hydrogen technologies continue to develop rapidly. Ensure your organisation has access to the latest news on advances in renewable energy technologies for mining, and access to internal or external advice, in what is a highly specialised field.

3. Look forward: Resist making mine planning decisions around battery or hydrogen infrastructure based on what is available today. Consider where these technologies are heading and how that affects mine planning over long periods. Will the technology be superseded? How can infrastructure implemented with mines for these technologies be ‘future-proofed’ to incorporate technology upgrades?

4. Aim to collaborate: On-site hydrogen generation, in particular, will require greater collaboration by mining companies, given the cost. With batteries, developing water, wind or hydropower renewable energy sources to power recharging requires community engagement. Could these renewable energy sources benefit local communities during production or after mine closure?

5. Share learnings: As both technologies develop, it’s important that mining companies share their experiences through industry literature so that other organisations can learn from them. Reducing industry uncertainty with these technologies is the key to a faster move away from diesel-powered fleets and ongoing decarbonisation of mining operations.

6. Remain open-minded: Mining companies are right to be wary of hydrogen and favour battery technology today. Hydrogen, however, has significant longterm potential as a fuel source for mining fleets and could overcome some of the limitations with battery technologies.

FLSMIDTH’S E-VOLUTE FEEDWELL TECHNOLOGY HAS DELIVERED A 27 PER CENT REDUCTION IN FLOCCULANT CONSUMPTION FOR A COPPER-GOLD MINER.

When an Australian copper-gold miner approached FLSmidth to replace an ageing feedwell, the original equipment manufacturer (OEM) came up with an inspired solution.

FLSmidth turned to its engineering team to develop a bespoke solution based on the OEM’s E-Volute feedwell technology.

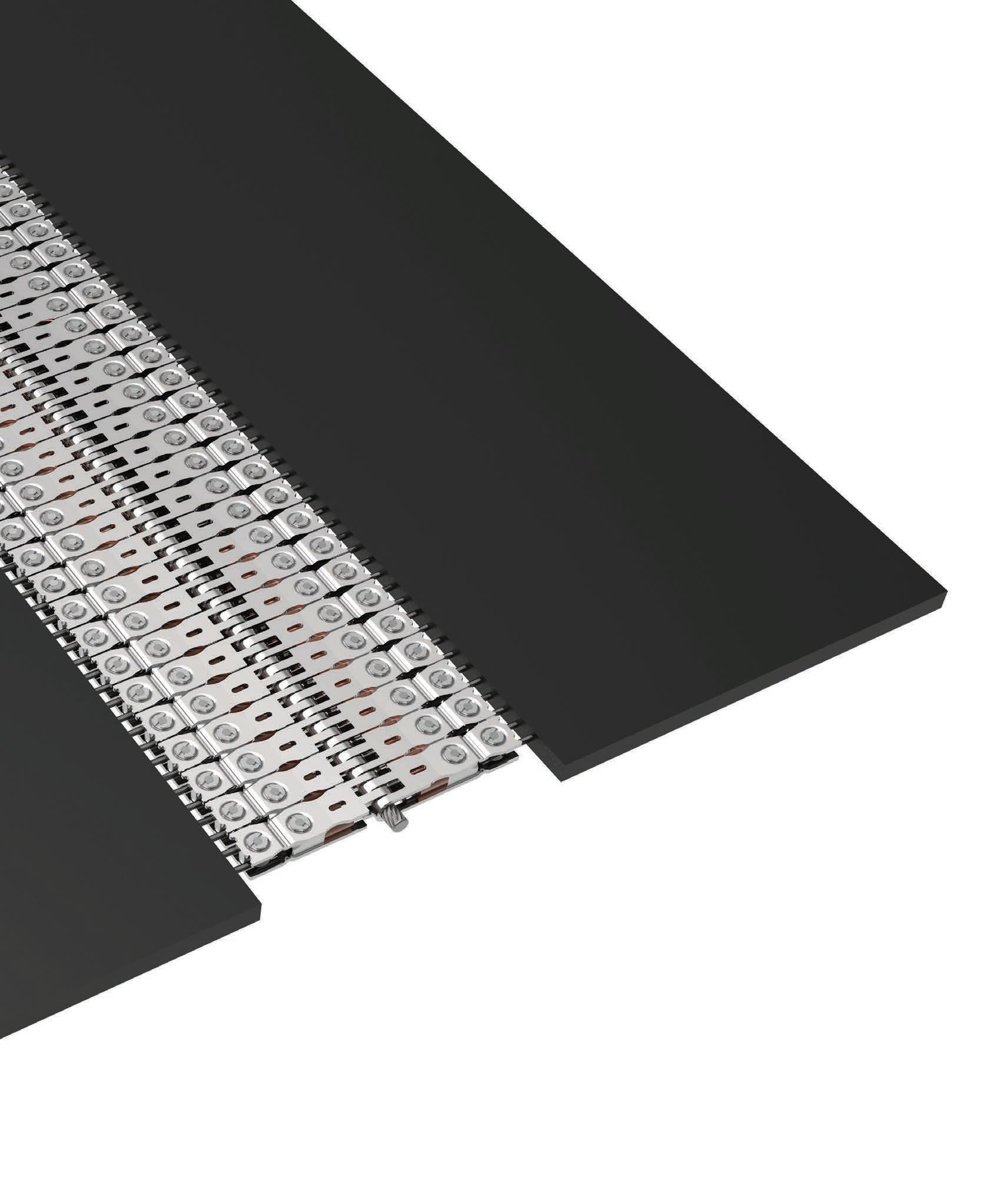

Feedwells support the thickening process, where slurries are separated into two forms: a dense slurry containing most of the solids from the ore, and an overflow of largely clear water.

At this particular mine site, copper and gold are recovered using a conventional single-line grinding and flotation circuit to produce a bulk copper-gold sulphide concentrate. Waste from the process is thickened and deposited in a tailings dam.