OPTIMISING THROUGH AUTOMATION

SUPPORTING OPERATIONAL PROFITS THROUGH ADDED INTELLIGENCE

SUPPORTING OPERATIONAL PROFITS THROUGH ADDED INTELLIGENCE

The SmartROC D65 down-the-hole drill rig brings the future of mining within your reach today. It’s built to face the toughest of conditions and loaded with intelligent features that will improve your operations, increase safety and boost productivity. This rig is constantly evolving since it’s introduction in order to ensure that your investment delivers increased production and profitability shift-after-shift. Give your operation the chance to profit from the added intelligence of this market-leading drill rig. epiroc.com/en-au

CRITICAL MINERALS

MERGERS AND ACQUISITIONS

PAUL HAYES

paul.hayes@primecreative.com.au

AUSTRALIA HAS LONG RIDDEN THE BACK OF SO-CALLED TRADITIONAL COMMODITIES, BUT CRITICAL MINERALS ARE THE NEXT MINING FRONTIER AS THE WORLD CONTINUES ITS PATH TO NET-ZERO.

Iron ore, coal, gold. You don’t need to be on the frontlines of the Australian resources sector (or even work as a mining journalist) to know these are the kinds of commodities that have long driven the Australian economy.

Iron ore, in particular, has long been the workhorse of the Australian resources sector, earning an estimated $123 billion from exports in the 2022–23 financial year (FY23). Coal generated an estimated $124 billion in export earnings across the same timeframe.

These the types of ‘traditional’ commodities have long sat atop the Australian resources pyramid. And while they are admittedly likely to stay in that position for some time yet, it’s becoming increasingly clear that critical minerals will only increase in importance – for the mining industry and for the whole of Australia.

As Federal Resources and Northern Australia Minister Madeleine King said when unveiling the Australian Government’s Critical Minerals Strategy in June, the “path to net-zero runs through the resources sector”.

“The new Critical Minerals Strategy outlines the enormous opportunity to develop the sector and new downstream industries which will support Australia’s economy and global efforts to lower emissions for decades to come,” King said.

“While the potential is great, so too are the challenges.”

When BHP chief executive officer Mike Henry spoke at the recent World Mining Congress in Brisbane, he said governments around the world, including in Australia, must pursue an economywide transition to net-zero emissions, with critical minerals a key pathway on that journey.

“The Australian Government released its Critical Minerals Strategy, and we look forward to

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY EDITOR

PAUL HAYES

Email: paul.hayes@primecreative.com.au

ASSISTANT EDITOR ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS TOM PARKER

Email: tom.parker@primecreative.com.au

OLIVIA THOMSON Email: olivia.thomson@primecreative.com.au

working further with them on a critical minerals list that reflects the best interests of the nation,” Henry said.

“The world is on a path to what we must ensure is a better future. We will have substantially more people on this planet, seeking higher standards of living, that need to be supplied and powered by resources extracted, refined and used more sustainably.”

This thinking has been backed by the Federal Department of Industry, Science and Resources’ June 2023 edition of the Resources and Energy Quarterly report, which found rising demand for renewable energy and electric vehicles means critical mineral prices are likely to remain strong and, when combined, the minerals needed for the energy transition are expected to generate $46 billion in Australian FY23 export earnings.

“Australia is well positioned to supply long-term demand for base metals and critical minerals such as lithium, which are crucial components of cleanenergy technologies such as batteries, solar panels, and wind turbines,” King said.

With Australia home to some of the most significant recoverable critical minerals deposits on the face of the earth, the country is indeed well positioned to forge its place on the path to a greener future.

The question, however, is whether the country is ready to grab hold of this opportunity.

FRONT COVER

SMW Drilling Services is focused on the provision of safe, predictable and innovative blasthole drilling services. It has delivered more than 25 projects and forged several long-term partnerships with majors like Yancoal, Sojitz, Peabody and Thiess.

Opening its doors in 2006, the company has continued to grow. It now has a diverse fleet of more than 20 drills which the company believes, combined with the expertise of a large team, sets the standard in safe and productive drilling programs.

Cover image: SMW Drilling Services

Paul Hayes Managing EditorTIM BOND

Email: tim.bond@primecreative.com.au

CLIENT SUCCESS MANAGER

JANINE CLEMENTS Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027 Email: jonathan.duckett@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2016

PRINTED BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337 Published 12 issues a year

more traditional resources, but a rising demand for critical minerals.

28 COMMODITY SPOTLIGHT

Copper is key

With some of the most prolific copper resources in the world, Australia is set to be a major player in shaping a decarbonised future.

32 DECISION-MAKER

One of the global mining industry’s most legendary drill rigs has been revitalised. Australian Mining takes a closer look at Epiroc’s evolving Drill Master range.

44 DRILL AND BLAST

Drilling down to added value SMW Drilling takes pride in adding value at every stage of the drill-and-blast process.

RILL AND BLAST

Digging deeper

Aquatech has three decades of experience in water well drilling across the resources sector.

INTERNATIONAL MINING

PNG’s bright mining future

Mining is one of the major economic drivers for Australia’s closest neighbour,

which means there are plenty of opportunities to work and establish a career in the Pacific nation.

58 SUSTAINABILITY

Turning tyres into a resource

Kal Tire’s innovative method of recycling mining tyres is helping to create a more environmentally friendly resources industry.

5

8

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

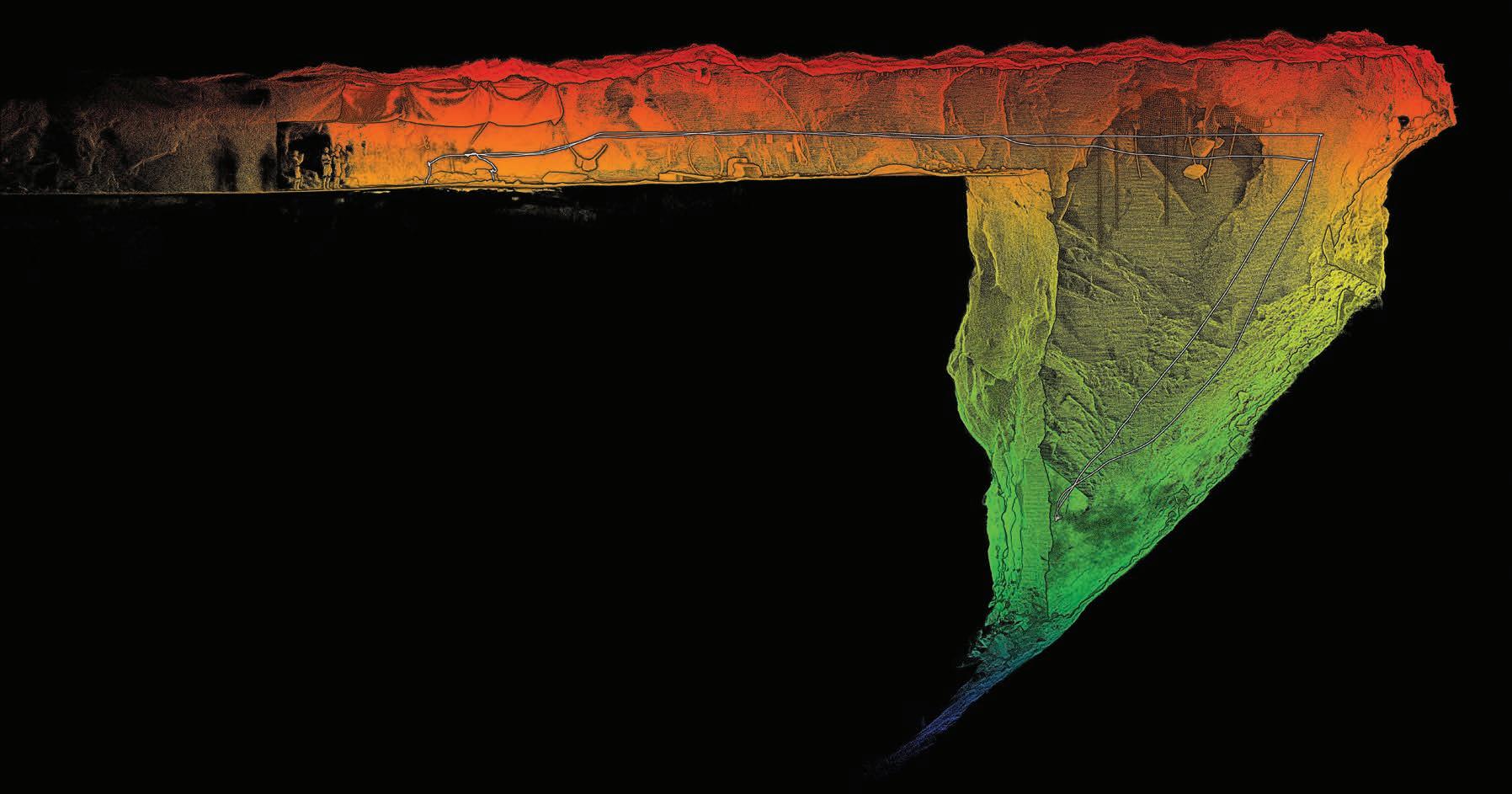

mineralised zone from Kaiser to Boda and then Boda Two and Three and beyond. The company looks forward to releasing results of this program as we work towards an upgraded mineral resource towards the end of the year.”

Alkane was recently awarded the NSW Minerals Council’s Explorer of the Year award for its discovery of the Kaiser gold-copper project.

Kaiser also forms part of the company’s Northern Molong porphyry project alongside Boda.

NSW Minerals Council said Alkane’s drilling program demonstrated an extensive mineralised system, and through the project the company demonstrated leading practice with its approach to exploration and its engagement with the local community.

AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

company says has the potential to make the project a large, Tier 1 goldcopper asset.

The exploration company received the favourable results from diamond core and RC drilling at its Boda Two prospect.

“We continue to see mineralisation extending to the south of Boda into

“In our recent drilling we believe we have intersected a ‘causative’ monzodiorite dyke or pencil intrusive at Boda Two. We will use these results, expected in August 2023, to assist us in locating further higher-grade areas within the mineralisation.

“There is a lot of drilling still to come to further define the full 3km

“The contribution made by all our finalists is a great example of the resilience and ingenuity shown by our world-class exploration sector in successfully overcoming a range of challenges in recent years, including floods and a global health crisis,” NSW Minerals Council chief executive officer Stephen Galilee said.

“Our exploration sector is essential to providing long-term economic security to regional communities right across NSW. It is also essential to help meet demand for the metals of the future in industries like health, defence, advanced manufacturing, renewable energy and telecommunications.”

Alkane also operates its Tomingley gold mine in NSW.

BHP chief executive officer Mike Henry took the stage at the World Mining Congress 2023, where he said mining is pivotal in preserving a better future for Australians.

Henry said mining will help improve future standards of living, job opportunities, and better access to health care and education.

“For nations, mining brings the opportunity for secure jobs, economic development and investment – as well as secure energy solutions and food supply chains that sustain lives and livelihoods,” Henry said.

“I am sure everyone in this room knows the impact that mining has had on Australia. Australia would not be the country it is today, wouldn’t have the living standards Australians enjoy today, without mining.”

Henry said that governments around the world have a responsibility to provide strong institutional and regulatory confidence to foster a dynamic, commercial and open market that encourages competition and productivity, and they must pursue an economy-wide transition to net-zero emissions – including through critical minerals.

“Last week the Australian Government released its Critical Minerals Strategy, and we look forward to working further with them on a critical minerals list that reflects the best interests of the nation,” Henry said.

“I did see some criticism that the new Strategy didn’t contain even more by way of subsidies. For what it’s worth, I think this is absolutely the right approach … What governments here

– federal and state – should focus on are those things within their control to make investment fundamentally more attractive. Not simply due to the sugar hit of a subsidy.”

Despite some positives, Henry said some recent activity in the Australian resources sector will make the country less competitive, such as the Federal Government’s ‘same job, same pay’ legislation and the Queensland Government’s decision to impose the world’s highest coal royalty taxes.

As a result of the Queensland coal royalty taxes, Henry said BHP will not be investing further money in the state.

“In this case, both the outcome and the process have meant for BHP that we have opportunities to invest for better returns and lower

risk elsewhere around the world, as well as here in Australian states like Western Australia and South Australia,” Henry said.

“And we will not be investing any further growth dollars in Queensland under the current conditions.”

Henry concluded that the resources industry is critical in enabling the future.

“The world is on a path to what we must ensure is a better future,” he said. “We will have substantially more people on this planet, seeking higher standards of living, that need to be supplied and powered by resources extracted, refined and used more sustainably.

“This industry is critical to enabling that future. And the opportunity is large. If we deliver on this opportunity, we deliver for the world.”

Major miner Rio Tinto has withdrawn its plan to mine near the town of Dwellingup in Western Australia.

The news came just days after Alcoa announced it would establish an 8344-hectare (ha) mining avoidance area around the town.

Rio planned to mine lithium and nickel in the area but will no longer move forward with this after local communities contested the plans.

“Rio Tinto is in the process of withdrawing its applications for exploration licences in the southwest of Western Australia,” a Rio spokesperson told the ABC.

“This decision has been made for a number of reasons including in response to concerns raised by local communities.”

Chief among the concerns was the protection of the nearby Northern Jarrah Forest.

Shire of Waroona President Mike Walmsley told the ABC that he was happy with the decision.

“It’s a good outcome that the companies listen to community concern and they’ve decided to withdraw,” he said.

“I’m sure there are other areas where some of these minerals might

Northern Star Resources has announced the purchase of the Millrose gold project from Strickland Resources for $67 million. The deal comprises $41 million in cash and 1.5 million fully paid shares in Northern Star.

The WA gold project has a known mineral resource of 346,000 ounces of gold at a grade of 1.8 grams per tonne.

Millrose is located 40km to the east of Northern Star’s Jundee operations. According to the company, Millrose will become a supplementary

feed source for the Jundee mill in the medium term, complementing Jundee’s underground base load.

Jundee underground operations currently source roughly 1.8 million tonnes of ore each year.

Northern Star managing director Stuart Tonkin reacted to the agreement.

“The acquisition of the Millrose gold project presents a very compelling development opportunity that is accretive to the Jundee lifeof-asset plan as it should deliver us a sizeable low-cost, high-grade

exist, but this one’s pretty special being the one and only one.

“It’s important that we protect those spots now. Going forward we need to say to some of these companies: ‘You really got to put up a pretty good case if you want to go into those spots’.”

Alcoa Australia president Matt Reed said the Alcoa’s similar decision to establish the Dwellingup no mining zone followed extensive studies and consultation, and respected feedback about the area’s growing importance.

“We hope this decision provides greater certainty about

our intentions in a prospective mineral area and demonstrates our willingness to protect important environmental and social values,” he said.

“We respect the Dwellingup area has immense lifestyle, ecotourism and forest recreational values that people want to continue to enjoy now and into the future.

“We have worked closely with the Shire of Murray and other stakeholders in reaching this decision, and we believe this commitment will provide certainty to the community for the future.”

supplementary resource feed.

“This bolt-on acquisition, which also comes with significant brownfields exploration upside, will provide us with further confidence to plan organic and profitable growth for Jundee, which already is the lowest cost asset in our Tier 1 portfolio.”

Strickland has advised its shareholders of exactly how it intends to spend its new funds.

Within the first 12 months, Strickland plans to undertake 3500m of diamond drill and 25,000m of reverse circulation drilling. The

company also intends to upgrade its portfolio of gold prospects to mineral resource status, as well as continue base metal exploration at its Iroquois zinc-lead project.

In the same announcement, Northern Star indicated it was strengthening renewable energy at its Jundee operation. The company has entered into a long-term power supply agreement with Zenith Energy, which incorporates 40 megawatts of wind and solar power generation.

Once completed, this will provide 56 per cent of the mine site’s power.

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Red 5’s King of the Hills (KOTH) gold mine delivered a third consecutive month of record gold production in May.

Red 5 wholly owns the KOTH gold mine, which is located 28 kilometres north of the town of Leonora and 80 kilometres south of its Darlot satellite gold mine in the Eastern Goldfields region of Western Australia.

The KOTH gold mine produced 19,039 ounces of gold from 0.35

million tonnes (Mt) of ore processed at an average head grade of 1.8 grams per tonne (g/t) in May.

This is a notable increase from April’s recorded 18,633 ounces from 0.40Mt of ore processed at an average head grade of 1.54g/t, as well as March’s 17,550 ounces from 0.40Mt of ore processed at an average head grade of 1.49g/t.

The KOTH gold mine completed already planned mill and crusher

Glencore and Metals Acquisition Limited have officially closed the sale of the CSA copper mine in Cobar, New South Wales. The mine was sold to Metals Acquisition for $US1.1 billion ($1.64 billion).

Under the transaction, Glencore has received $US775 million in cash and $US100 million in shares, along with:

• $US75 million deferred payment to be paid within 12 months

• A $US150 million payment contingent upon future copper prices

• 1.5 per cent life of mine net smelter return royalty Glencore will offtake 100 per cent of the copper concentrate produced and Metals Acquisition will assume ownership and operation of the mine.

“The acquisition of CSA represents a strong strategic fit for Metals Acquisition. Our management team’s

maintenance shutdowns in May, which were successful and resulted in four days of zero mill production.

Work that was undertaken included replacing the crusher’s mantle and concave liners, replacing the mill’s original discharge grates with ninetimes-larger grates and replacing and bolstering heavy wear areas.

The open pit and underground mines continued to perform well

during the month, with run-ofmine stockpiles containing an estimated 560,000 of ore grading an estimated 1.2g/t at the end of the month.

The second half of the 2022–23 financial year’s production guidance is maintained at between 90,000 and 105,000 ounces at an all-in sustaining cost (AISC) of between $1750 and $1950 per ounce.

operational expertise, understanding of regional operations and relationships with local stakeholders uniquely position us to identify and realise the full potential value of the asset,” Metals Acquisition chief executive officer Mick McMullen said in 2022.

“We believe that copper has favourable fundamentals that will continue to support an elevated copper price.

“Copper is expected to play a key role in the global energy transition ‘megatrend’, with approximately one million tonnes per annum of new supply required from 2024 ... to meet the surging demand forecast.

“With few new projects globally in the pipeline, increasing permitting issues and jurisdictional risk, ... we believe that there are significant challenges ahead to close the projected supply deficit.”

We solve our mining customers’ wear challenges.

And now we’re taking on a challenge of our own.

As leading engineers and manufacturers of wear solutions, we’ve never been shy of a challenge.

That’s why we have committed to being carbon neutral by 2030, while continuing to design, manufacture and supply quality wear solutions for the resource sector.

bradken.com

vanadium flow battery was on its way to SA in December 2020.

As reported by the ABC, Yadlamalka Energy has been undertaking the

The battery will store around ten gigawatts of dispatchable solar power per annum and will be charged from excess electricity produced by the solar

Fortescue Metals has announced that Jennifer Morris has resigned as a non-executive director.

Morris’ experience with Fortescue includes being first appointed to its board as a non-executive director in November 2016, then acting as the chair of the remuneration and people committee since February 2020, and acting as a member of the audit, risk management and sustainability committee since August 2017.

Morris said it has been a privilege to work for the major miner and serve it as a non-executive director.

“This company is truly something special. I look forward to watching on as Fortescue continues to diversify and grow while setting out to become an industry leader in decarbonisation and achieve its vision to eliminate emissions across its operations,” Morris said.

Fortescue executive chairman Andrew Forrest said he was thankful for Morris’ contribution to the company.

“Jenn has made a significant contribution to the company since being appointed as a non-executive

“This is a battery that has significant advantages over lithium-ion ones; the most important one is the duration of this battery is four hours, unlike lithium

into the grid — that margin will have the effect to reduce prices,” Doman said.

“We’re on the verge of a vanadium revolution.”

director in 2016. Her experience has been valuable in guiding the board in its decision making over the past six years,” Forrest said.

“Jenn’s leadership as chair of the remuneration and people committee has been outstanding and her vitality, energy and passion will be missed. We wish her all the very best for the future.”

Fortescue non-executive director Penny Bingham-Hall will replace Morris as chair of the remuneration and people committee, and Elizabeth Gaines will transition

into a new role as a part-time executive director, both effective from July 1.

Gaines has been a global ambassador for Fortescue since August 2022, on top of acting as a non-executive director.

These leadership changes come as the company recently elected a new chief financial officer after an abrupt resignation from Ian Wells in January.

Forrest has rejected suggestions of executive dysfunction at the company.

It’s a big milestone for a piece of rubber. But Linatex® is so much more than that. It’s unlike anything else, using a unique 95% natural latex formula that has made Linatex® the strongest rubber in mining for the last century – exactly as nature intended. So, here’s to 100 Years Strong, and the next 100 to come.

Learn more at linatex100.weir

Mid-tier Australian gold producer Regis Resources has released its annual mineral resource and ore reserve update for the 2022 calendar year.

The company said its mineral resources and ore reserves show progress against its long-term strategy, as well as provides a solid platform to launch the next phase of growth.

Highlights from the report include underground reserves outpacing depletion for the second year in a row as new results highlight underground life extensions at the Duketon gold

project and the Tropicana joint venture, which Regis Resources chief executive officer Jim Beyer said was pleasing to see.

“We are extremely pleased that our underground mines at both Duketon and Tropicana have outpaced depletion for the second year in a row. We have spent the last two years investing in these mines and it is very satisfying to deliver reserve growth on these investments over this short time horizon,” Beyer said.

“It is still early days in the maturity of these undergrounds and we look

forward to the continuing growth potential as we mine deeper. Our long reserve life of eight years and (being) located wholly within Australia provides a strong platform to deliver on our long-term growth objectives and achieve superior returns for our shareholders.”

Other highlights from the report includes group ore reserves of 3.6 million ounces (Moz) and group mineral resources of 7Moz, both as of 31 December 2022.

There was an increase in new ore reserves of 210,000 ounces (koz) and an increase in new mineral

resources of 400koz, both offset by the 2022 calendar year depletion.

Long term gold price assumptions for the calculation of reserves and resources were updated but remain at moderate levels at a weighted average of $1800 per ounce for reserves and $2430 per ounce for resources.

Additionally, early results from the Garden Well exploration decline at the Duketon project has reinforced the potential for a new production front and growth in ounces per vertical metre. The underground site also established an exploration target.

Simon Trott said the major miner spends billions of dollars with local suppliers across WA every year, helping to support communities across

the State by providing local jobs for local people.

“The spending of $1 billion with WA businesses at Western Range marks a considerable milestone for both the

project and those local businesses we are partnering with,” Trott said.

“The connection between Rio Tinto and China Baowu in the Pilbara extends more than 40 years

and we are pleased to be further deepening our relationship through our joint commitment to study opportunities for the production of lowcarbon iron in WA.”

At Hastings Deering, businesses working within the construction industry can now take advantage of a new industry leading warranty with every Cat® Certified Rebuild. Get ‘as-new’ performance and benefit from the multiple lives designed into Cat machines, at a fraction of the cost of buying new.

CALL 1300 186 248 OR VISIT HASTINGSDEERING.COM.AU

Mineral Resources’ (MinRes) Mt Marion lithium operation has seen promising early results from a major exploration program.

The Mt Marion lithium operation is located in the Goldfields region of Western Australia, and is a joint venture between MinRes and Jiangxi Ganfeng Lithium – where both companies own 50 per cent. MinRes is the mine’s operator.

MinRes said the early results confirmed significant exploration potential at depth along strike

and in the surrounding region, and it demonstrates potential for open pit extensions and underground mining.

The company reported approximately 34km of drilling being completed in 2023 so far by utilising six diamond and reverse circulation drill rigs.

The first major exploration program since MinRes took control of the mine found lithium-bearing pegmatite formations approximately one kilometre below the surface.

Global investment management firm Goldman Sachs has slashed its iron ore price forecast by 18 per cent, citing weakened global demand.

The iron ore price has been downgraded to $US90 per tonne (t), down from $US110.

Goldman flagged risks of China’s oversupply in steel becoming increasingly evident, as output targets could be trimmed. A slower recovery rate in property sales saw

demand for steel fall by five per cent.

The weakened demand in China may result in a surplus of iron ore, prompting Goldman to revise the iron ore demand to “flat”.

Goldman said that 2023 was the first full year of global surplus in iron ore since 2018 and could be followed by an even larger surplus in 2024.

The Australian Financial Review (AFR) reported that the share price

MinRes said it will double exploration drilling capacity at Mt Marion by the end of the 2023 calendar year, ramping up to a 12-rig drilling campaign over the following 18 months.

MinRes managing director Chris Ellison said the Mt Marion exploration results highlight how the company is just scratching the surface of the potential lithium resource, including the possibility of underground mining.

“MinRes identified opportunities in lithium, the most important mineral

in the world’s decarbonisation, more than a decade ago and set about building a portfolio of world-class assets that could deliver long-term value,” Ellison said.

The operation produces mixed grade spodumene concentrate which is transported through the Port of Esperance for offshore conversion.

A $120 million expansion of the Mt Marion operation doubled capacity to up to 900,000 tonnes per year, with the commissioning process now underway.

for Fortescue Metals dropped 8.2 per cent on average in May, while BHP and Rio Tinto fell down 0.9 per cent and 0.2 per cent, respectively.

In April this year, Fitch Solutions increased its 2023 iron ore price forecast from an average of $US110/t to $US125/t amid improving market sentiment.

“On the demand side, we expect Chinese demand to continue with its promising momentum over the rest

of 2023,” Fitch said. “China will be the main driver of demand recovery, while other regions will struggle with lingering issues from 2022.

“However, China’s increase in demand may not translate to rallying prices due to its centralised iron ore purchaser China Mineral Resources Group (CMRG). The entity aims to exert Chinese influence over critical mineral imports like iron ore, putting limitations on price upside.”

Schenck Process Mining has become part of Sandvik Rock Processing Solutions. Combining the expertise and reach of our teams allows us to develop even better services to ensure that your equipment operates safely and at peak performance throughout its entire lifecycle.

We are now better positioned than ever, to develop innovative solutions to the challenges of our industry.

Watch this video to learn what this new parternship means to your business or visit our website:

The Northern Star Resources board has approved the expansion of the Fimiston Mill, part of the Kalgoorlie Consolidated Gold Mines’ (KCGM) Super Pit.

The expansion from 13 million tonnes per annum (Mtpa) to 37Mtpa is set to cost $1.5 billion and is due to be completed in 2026.

Located at the centre of the Kalgoorlie goldfields, the Super Pit is one of Australia’s largest open pit gold mines and includes the Mt Charlotte underground mine and the Fimiston

and Gidji processing plants.

“Today is an exciting day for Northern Star and a historic new chapter for this world-class asset,” Northern Star managing director Stuart Tonkin said.

“The board’s decision to approve the KCGM mill expansion and optimisation represents the next stage to revitalise our largest asset as well as the surrounding district for decades to come.

This project is financially compelling, and a significant enabling

step towards delivering our strategy to generate superior returns for our shareholders.”

Northern Star has had a productive start to the year at the Super Pit, increasing gold resources to 57.4 million ounces (Moz) and keeping ore reserves steady at 20.2Moz.

Tonkin said the company is confident the site will continue to produce significant value.

“Our confidence in the economics of KCGM to remain a long-life, low-cost gold mine has been further reinforced

Federal Minister for Resources

Madeleine King has released Australia’s new Critical Minerals Strategy in an effort to grow the country’s critical minerals wealth.

One of the first policy decisions under the Strategy will see the Government target $500 million of new investment into critical minerals projects through the Northern Australia Infrastructure Facility.

A process to update the critical minerals list has also been green lit and has been widely supported by the industry.

“The new Critical Minerals Strategy outlines the enormous opportunity to develop the sector and new downstream industries which will support Australia’s economy and global efforts to lower emissions for decades to come,” King said.

“While the potential is great, so too are the challenges. The Strategy makes it clear our natural minerals endowment provides a foot in the door, but we must do more to create

The Strategy will provide a framework that the Government will use to guide future policy decisions and maximise the national benefits of the country’s critical minerals and, according to the Federal Government, increasing exports of critical minerals could create upwards of 260,000 new jobs.

The Strategy highlights six focus areas:

• Developing strategically important projects, with targeted support

through the feasibility study phase,” he said.

“Expanding the processing capacity of KCGM will strengthen Northern Star’s portfolio, materially increase our free cash flow generation and progress our long-term strategy to be within the 2nd quartile of the global cost curve.

“Further, the project is important in our sustainability journey and will also sustain hundreds of local jobs, economic and social investment, and local procurement opportunities in the Goldfields region.”

optimise trade and investment settings for priority technologies

• First Nations engagement and benefit sharing, to strengthen engagement and partnership with First Nations people and communities, and to improve equity and investment opportunities for First Nations interests

• Promoting Australia as a world leader in environmental and social governance (ESG) standards

• Unlocking investment in enabling

Brokk robots are designed specifically for high-performance demolition and maintenance works and improve effectiveness, uptime, and profitability for operators.

Within a mine, Brokk robots are able to perform various tasks such as oversize rock breaking, scaling, drilling, digging, and shaft sinking.

www.brokk.com/au

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, INCLUDING AT FORTESCUE METALS GROUP, ST BARBARA AND SANDFIRE RESOURCES.

Elizabeth Gaines – who was Fortescue Metals Group’s chief executive officer (CEO) before stepping down last year – has moved into a new role of executive director at the company.

Gaines resigned as Fortescue boss in December 2021 and officially stepped down in August 2022. Since then, she has served as a non-executive director and an ambassador of Fortescue Future Industries (FFI).

“Over the past decade since joining Fortescue, I have been honoured to serve in various roles including nonexecutive director, chief financial officer, chief executive officer and global ambassador,” Gaines said.

“I look forward to continuing to work with the executive chairman and the talented team across the business as we lead industry to decarbonise the mining operations and transition Fortescue to a global green energy and resources company.”

Gaines’ appointment coincided with the resignation of Jennifer Morris as a non-executive director. Morris’ Fortescue experience includes first being appointed to its board as a non-executive director in November 2016, then acting as the chair of the remuneration and people committee since February 2020.

St Barbara has appointed Andrew Strelein as its new managing director and CEO, after he first joined the company as chief development officer in August 2021.

During his time at St Barbara, Strelein has been influential in the acquisition of Bardoc Gold and the recent Leonora sale involving Genesis Minerals.

Before that, he was CEO of a company overseeing the development of the Nimba iron ore project in West Africa.

Strelein’s appointment coincides with Dan Lougher’s retirement from the company.

St Barbara non-executive chair Kerry Gleeson set the scene for Strelein’s new leadership while honouring Lougher’s time at the company.

“Andrew has significant global experience in business development, project advancement and permitting, and knows St Barbara well,” she said. “He is ideally suited to take over as the company enters a new phase.

“I would also like to thank Dan for his invaluable leadership at St Barbara to stabilise Gwalia performance while the company navigated a period of intense change culminating in the transaction with Genesis Minerals.”

St Barbara has also appointed Sara Prendergast as its new chief financial officer (CFO), succeeding Lucas Welsh, who has been CFO since August 2021.

Gleeson is currently overseeing a renewal of the St Barbara board and has appointed Transearch International Australia to assist with this process.

Sandfire Resources has appointed Megan Jansen as its new CFO, succeeding long-serving CFO Matthew Fitzgerald.

With more than 20 years’ experience in various finance, commercial, business integration and M&A capacities, Jansen was most recently global head of finance at Imdex. Before that, she spent 10 years at MMG.

Fitzgerald joined Sandfire in 2010 and was influential in the discovery, financing (to the tune of $380 million), development and operation of the DeGrussa copper mine in WA.

“Matthew has played a key role in the strategic and financial stewardship of Sandfire from its early days as a successful junior explorer to a company with a market capitalisation of $2.7 billion,” Sandfire managing director and CEO Brendan Harris said.

“More recently during FY23, he has been instrumental in the successful transitioning of our balance sheet to position the company well through its

next phase, including re-sculpting of the $US432 million MATSA syndicated debt facility and initial $US140M 3.2Mtpa (million tonne per annum) Motheo project finance facility.”

Russell Clark has joined Red 5 as its new non-executive chair, bringing more than 40 years’ experience to the role.

Clark served as managing director and CEO of Grange Resources for five years and was previously group executive of operations for Newmont, where he oversaw the company’s Australia and New Zealand operations, including the KCGM mine in Kalgoorlie.

The appointment comes as Red 5 continues to renew its board en route to its goal of becoming a leading mid-tier Australian gold producer.

“Russell has held board and senior management positions with major mining companies, and we look forward to his guidance and counsel as Red 5 cements its position as one of Australia’s major emerging mid-tier gold producers,” Red 5 acting chair Andrea Sutton said.

“With the ramp-up of King of the Hills well progressed and the operation now delivering solid results, this is an exciting time to welcome a new independent chair to our board as we embark on this next exciting chapter of our growth journey.” AM

THE AUSTRALIAN GOVERNMENT’S RESOURCES AND ENERGY QUARTERLY

JUNE 2023 DETAILED A SUSPECTED DECLINE AMONG MORE TRADITIONAL RESOURCES BUT INCREASING DEMAND FOR CRITICAL MINERALS.

If there is one thing the past few years have taught us, it’s that things can change at an remarkable rate.

While the Australian resources industry has enjoyed a strong year, with record earnings of $460 billion in the wake of Russian–Ukraine war and COVID-19 pandemic, a golden era of resources may be coming to an end.

The Federal Department of Industry, Science and Resources’ Resources and Energy Quarterly June 2023 has detailed a suspected decline, forecasting that earnings from iron ore and coal will begin to fall.

But the news is not all bad, with critical minerals demand set to rise.

The mining industry employed approximately 189,000 people in the

2021–22 financial year, according to the Australian Bureau of Statistics (ABS). And in a testament to the industry’s ability to grow worker numbers while also retaining existing staff members, this figure jumped to 250,000 in 2022–23.

The industry also contributed to around 13.9 per cent of Australia’s gross domestic product (GDP) and made up two-thirds of the country’s total merchandise exports.

The report forecasts Australia’s export values to be $390 billion in 2023–24, down from an estimated record of $460 billion in 2022–23.

According to the Department of Industry, Science and Resources, this drop is due to a “slowdown in the world economy and the re-organisation and improvement in energy commodity supply has generally reduced commodity prices over the past quarter”.

However, mining investments are still picking up, with the ABS Private New Capital Expenditure and Expected Expenditure survey showing a total of $11.8 billion was invested by the country’s resources industry in the March quarter of 2023.

The coal industry has had a tricky couple of years.

While job numbers were up, especially in New South Wales, which recorded 24,575 direct coal mining jobs, the controversial Queensland coal royalty taxes meant a period of uncertainty for the commodity in its traditional heartland.

Following the announcement of the increased royalties, BHP made headlines when it said it would divest the Daunia and Blackwater coal mines in Queensland in February.

The standout from Resources and Energy Quarterly June 2023 was Australia’s critical minerals.

It is almost impossible to ignore the sweeping global demand for more these minerals as the transition to net-zero ramps up. With more lithium-ion batteries for electric vehicles and solar panels needed than ever before, Australia’s vast reserves of critical minerals are enjoying their time in the sun.

Underpinning this was the release of the Federal Government’s new Critical Minerals Strategy, released in June.

One of the first policy decisions under the strategy will see the Government target $500 million of new investment into critical minerals projects through the Northern Australia Infrastructure Facility.

A process to update the critical minerals list has also been green lit and has been widely supported by the industry.

“The new Critical Minerals Strategy outlines the enormous opportunity to develop the sector and new downstream industries which will support Australia’s economy and global efforts to lower emissions for decades to come,” Federal Resources Minister Madeleine King said.

“While the potential is great, so too are the challenges. The strategy makes it clear our natural minerals endowment provides a foot in the door, but we must do more to create Australian jobs and capitalise on this unique opportunity.”

The strategy will provide a framework to guide future

Government, increasing exports of critical minerals could create upwards of 260,000 new jobs.

“The latest Resources and Energy Quarterly underlines the government’s plan to support the development of our critical minerals sector, to make Australia a clean-energy superpower, and to help Australia and our trading partners meet commitments to lower emissions,” King said.

“The road to net-zero runs through the resources sector.

“Australia is well positioned to supply long-term demand for base metals and critical minerals such as lithium, which are crucial components of clean-energy technologies such as batteries, solar panels and wind turbines.”

Resources and Energy Quarterly June 2023 found the demand for critical minerals means that Australian lithium and nickel assets are more secure as governments across the world rush to secure supplies.

“Australia has significant reserves of battery commodities critical to the global energy transition – including lithium, cobalt, manganese and nickel – and is well placed to provide raw battery materials and refined product to the world,” the report stated.

In addition, global battery demand is expected to grow to about 3041 gigawatt hours in 2030, and Australia is positioned to assist with this growth, as it holds 20 per cent of the global reserves of copper and nine per cent of magnesium ore.

King said the value of lithium exports in 2022–23 almost quadrupled from the previous financial year, increasing to

that forced coal companies to reserve 10 per cent of their output exclusively for domestic use. And the next month saw the Federal Government make its decision not to approve Clive Palmer’s central Queensland coal project.

Perhaps the biggest issue for the coal industry was China’s ban on Australian coal imports. While that decision was reversed in January, 2023 has seen lower-than-average demand for Australian coal.

fall of metallurgical coal prices.

Regardless, coal prices remain above levels seen prior to the war in Ukraine, as some Russian supply is stranded from world markets.

“Weaker demand and improved supply have recently pushed down thermal coal prices, though they are still high historically,” the report states.

“Global demand has softened due to slowing world economic growth

the outlook period, as trade flows reorganise further and supply lifts.”

Australia’s thermal coal exports are forecast to drop down from $64 billion in 2022–23 to around $38 billion in 2023–24 and $30 billion in 2024–25.

“Metallurgical coal prices remain volatile but are holding well above their pre-2019 level,” the report said.

“The Australian premium hard coking coal price is estimated to average $US273 ($408) a tonne in 2023 but

is forecast to fall to around $US200 ($299) a tonne by 2025 as supply conditions improve.”

The Australian sector is the world’s number one for iron ore resources, and it just takes a single glance at the iron-rich soil of the Pilbara to see why.

Some of the world’s largest miners have set up shop in Australia to mine iron ore, directly contributing to the $132 billion earned in exports in 2021–22. However, iron ore prices eased in the most recent quarter as global economic growth slowed.

In early June, global investment management firm Goldman Sachs slashed its iron ore price forecast by 18 per cent, downgrading it to $US90 ($134) a tonne from $US110 ($164).

A weakened appetite in China may result in a surplus of iron ore, prompting Goldman to revise the iron ore demand to “flat”.

Goldman said 2023 was the first full year of global surplus in iron ore since 2018, and that could be followed by an even larger surplus in 2024.

According to Resources and Energy Quarterly June 2023, China,

which accounts for almost 60 per cent of global iron ore demand, is projected to see a modest fall in total steel output over the outlook period to 2025. This is in turn expected to soften the rate of growth in global iron ore demand in the coming years, driving iron ore prices down.

But, more broadly, global iron ore trade is expected to grow by two per cent annually to 2025, with new supply coming from Australia, Brazil and Africa.

“Australia is projected to see continued ramp up of greenfield projects from established producers such as Rio Tinto, BHP and Fortescue, as well as emerging producers such as Mineral Resources Limited and Atlas Iron,” the report stated.

“Over the outlook period, Australia’s iron ore exports are projected to rise at an average annual rate of 2.1 per cent to reach 941 million tonnes by 2025.”

Major miners BHP and Rio Tinto had strong quarters from their iron ore operations, with Rio Tinto shipping 82.5 million tonnes of iron ore in the March quarter, a record for the period.

BHP’S iron ore output was 59.8 million tonnes, and the company

left its 2022–23 production guidance unchanged at 249–260 million tonnes.

Although the fall in earnings from coal and iron ore appears confronting, Resources and Energy Quarterly June 2023 details that falls in other resources

may be offset by the massive demand for critical minerals.

And as electric vehicles and green energy solutions become the norm, the critical minerals space will only continue to grow. AM

From majors selling copper mines for billions to chief executives touting the mineral’s fundamental importance at mining conferences across the world, it’s clear copper will play a central role as the world transitions to utilising renewable energy.

The base metal has a variety of end uses in a green economy, whether it be through electricity distribution, electrical equipment and devices, industrial machinery, wind turbines, solar panels and, of course, powering electric vehicles (EVs).

According to the Australia’s Identified Mineral Resources 2022 report, the country’s copper exploration increased by 65 per cent in 2021, with a value of $550 million up from $334 million in 2020.

This placed copper among the top three commodities in terms of exploration expenditure in 2021 – and the base metal’s rising importance has piqued the interest of major miners.

When delivering the opening address at Austmine 2023 in May, BHP chief operating officer Edgar Basto detailed the central role copper will play into the future.

“We expect global demand for copper to increase significantly as the world transitions to lower carbon sources of energy powered by more solar panels and wind turbines,” he said.

Basto also discussed the possibility of EVs accounting for nearly 60 per cent of global annual car sales by 2030 and nearly all sales by 2050.

“EVs use around three to four times more copper than petrol-based cars,” Basto said. “We often associate EV batteries with nickel and lithium, but they also require more copper – around three to four times more than an internal combustion vehicle.”

Federal Minister for Resources and Northern Australia Madeleine King echoed those sentiments in her foreword of the Australia’s Identified Mineral Resources 2022 report.

“These metals, and others, continue to play a central role in our minerals sector and provide economic growth and employment for regional communities across Australia,” King wrote.

Furthermore, the March 2023 edition of the Resources and Energy Quarterly stated that Australia’s copper exports are projected to grow from 868,000 tonnes in 2022–23 to around 970,000 tonnes in 2027–28.

“(This is) supported by additional production from new mines and mine expansions,” the report stated. “As output grows and prices strengthen, Australia’s copper export earnings are projected to grow, from $13 billion in 2022–23 to $15 billion (in real terms) in 2027–28.”

This was further supported in the June 2023 edition of the Resources and Energy Quarterly

“Growing demand from the power and EV sectors are key drivers of copper consumption over the outlook period,” the report stated.

“Australian export earnings of copper are estimated to have declined slightly in 2022–23. Higher Australian production and exports will support export earnings, which are set to grow to $13 billion in 2024–25.”

Copper’s vitality as an asset now and into the future is evident by it becoming a primary focus for many mining companies in Australian.

Chief among these examples is Glencore selling its CSA copper mine to Metals Acquisition Limited for $US1.1 billion ($1.64 billion) in June.

Located in Cobar, New South Wales, CSA is an established, high-grade, longlife underground copper mine. The site has an estimated mine life of over 15 years, and Metals Acquisition identified opportunities to further extend it, subject to exploration success.

“Our management team’s operational expertise, understanding of regional operations and relationships with local stakeholders uniquely position us to identify and realise the full potential ... of the asset,” Metals Acquisition chief executive officer Mick McMullen said.

“Copper is expected to play a key role in the global energy transition ‘megatrend’, with approximately one million tonnes per annum of new supply required from 2024 onwards in order to meet the surging demand forecast.”

Also in June, Evolution Mining extended the mine life of its Ernest Henry copper-gold operation to 2040. Located 38km north-east of Cloncurry, Queensland, the site was acquired by Evolution in January 2022.

“In under 18 months of owning 100 per cent of Ernest Henry, we have doubled copper and gold reserves and extended the mine life out to 2040,” Evolution managing director and chief executive officer Lawrie Conway said.

Copper has been essential in Ernest Henry’s growth, with the mine’s copper ore reserve increasing by almost 300,000 tonnes, to 589,000 tonnes, from December 2022 to June 2023.

South32 chief executive officer Graham Kerr listed copper as one of the commodities driving the company’s mergers and acquisitions strategy, suggesting it, along with nickel and zinc, has become “far more attractive” in a decarbonising world.

“I think the reality is that every single person in this room, and every mining company in the world, want more copper. The world needs more copper in a major way,” Kerr told the Melbourne Mining Club in April.

Copper miner Codelco signed an unprecedented collaboration agreement with BHP in May, which will focus on exchanging knowledge between the two companies in finding sustainable ways to mine.

“Our copper is part of the solution to climate change that threatens the planet and must be produced in a sustainable manner, consistent with that cause,” former Codelco chief executive André Sougarret said at the time.

“In order to imagine these new ways of doing mining, innovation is one of the main axes of our management, a focus that we can only develop in alliance with players who are equally active in this search, as is the case with BHP.”

It makes sense that Codelco would partner with BHP. After all, the Big Australian owns and operates many prominent copper mines all over the world, chief among them the Escondida mine in Chile.

“We have operated Escondida in Chile, the largest copper mine in the world, for more than 30 years,” Basto said at Austmine. “Every year, Escondida mines enough material to fill the Adelaide Oval to the roof 80 times and produces enough copper to produce around 12 million electric vehicles.”

The Escondida mine is operated and owned through a joint venture between BHP (57.5 per cent), Rio Tinto (30 per cent) and JECO Corp (12.5 per cent).

Looking locally, BHP operates the Olympic Dam mine in South Australia, which is one of the world’s most significant deposits of copper, gold and uranium. But BHP’s Australian copper assets don’t stop there.

After acquiring OZ Minerals, BHP now operates the Carrapateena and Prominent Hill copper mines, which, combined with Olympic Dam, has unlocked a new copper district in SA.

Rio Tinto is also a keen copper participator, with a 30 per cent interest in Escondida bolstered by a 66 per cent stake in the Oyu Tolgoi copper mine in Mongolia.

The major miner held an investor site visit at Oyu Tolgoi in early July, where

five years.

Other assets that will support this dream include Rio’s Kennecott copper mine in Utah, and the company’s Resolution copper project in Arizona.

Newmont chief executive officer Tom Palmer said copper demand is expected to nearly double from 25 million tonnes to about 50 million tonnes by 2035 in order to deploy the technologies needed to achieve net-zero targets by 2050.

“Based on current copper production trends, we will experience copper shortfalls of 10 million tonnes by 2035. In fact, by 2050, the world will only be producing 20 per cent of the copper needed to meet the net-zero climate goals,” Palmer said at the World Mining Congress 2023.

“Bridging this gap will require significantly more copper mines, copper recycling and enhanced copper leaching processes.”

Newmont produces copper as a secondary mineral from several of its gold mines, including the Boddington operation in WA.

A renewable future

Copper’s role in helping the world reach its future climate goals is clear, and we are beginning to see more and more collaborations to ensure this dream becomes a reality.

This includes Anglo American and Jiangxi Copper Company joining forces to create sustainable value chains in the copper industry. Under a memorandum of understanding (MoU), the companies will work together to provide greater assurance on the way copper is mined, processed and brought to market.

“We are developing a series of partnerships to shape a more sustainable and customer-centric value chain – one that meets consumer-driven demand for copper with demonstrably

“In line with our sustainable mining plan goal to establish ethical value chains for our products, this collaboration aims to support Jiangxi Copper’s efforts to contribute to the Chinese industry’s long-term decarbonisation goals and transition to a greener economy, as we work to provide materials solutions that are responsibly produced, sourced and delivered.”

Jiangxi Copper deputy general manager Chen Yunian said the company is committed to green, sustainable and high-quality development.

applications of mining, processing and smelting, and promote the development of a sustainable and responsible copper supply chain with a focus on renewable energy utilisation, energy conservation and emission reduction,” Yunian said.

Through these types of global copper partnerships and developments, it’s easy to see the base metal playing a key role in the global energy transition.

And Australia is a positioned to be a key player in that transition for years to come. AM

WE EXPECT GLOBAL DEMAND FOR COPPER TO INCREASE SIGNIFICANTLY AS THE WORLD TRANSITIONS TO LOWER CARBON SOURCES OF ENERGY POWERED BY MORE SOLAR PANELS AND WIND TURBINES.”

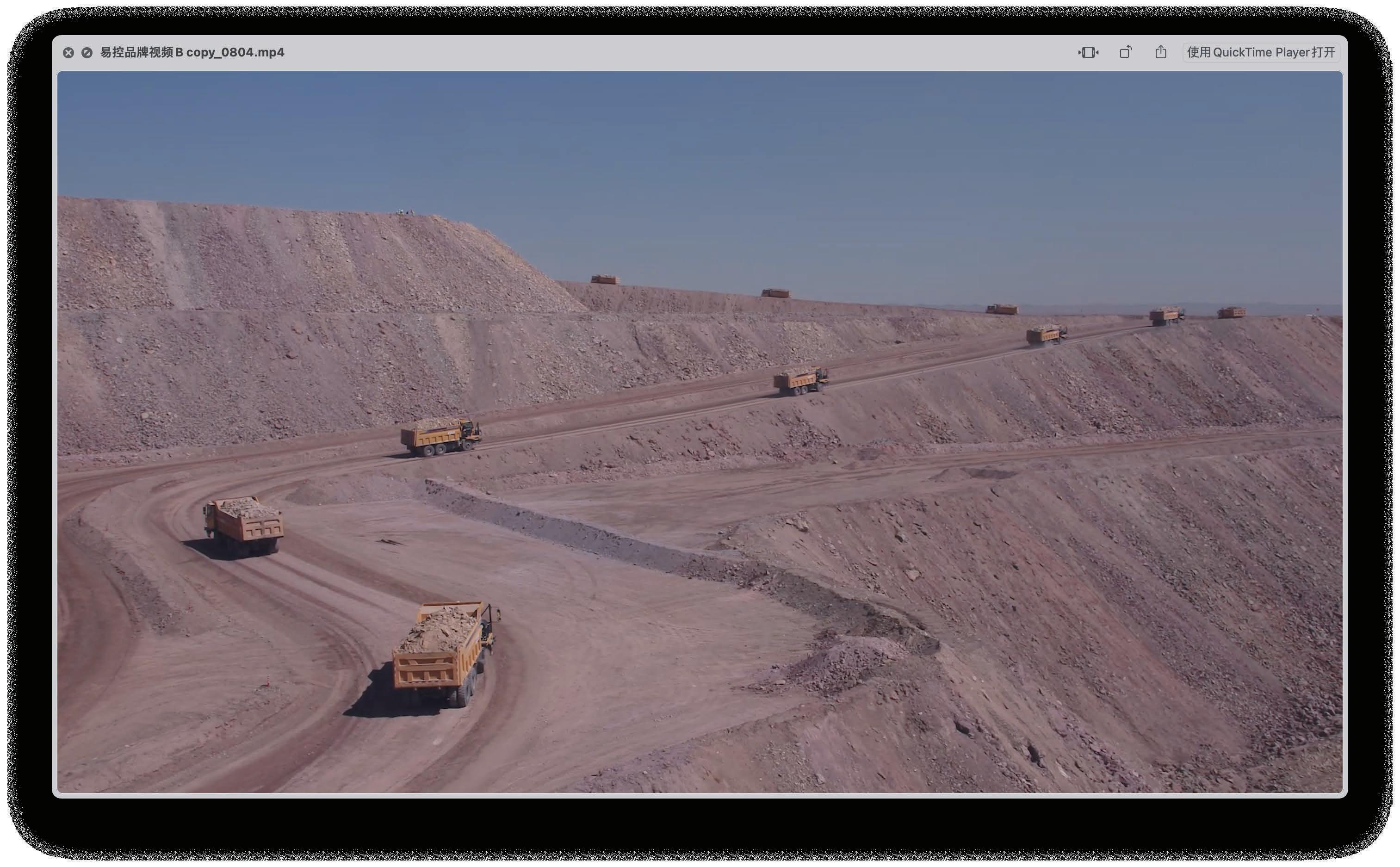

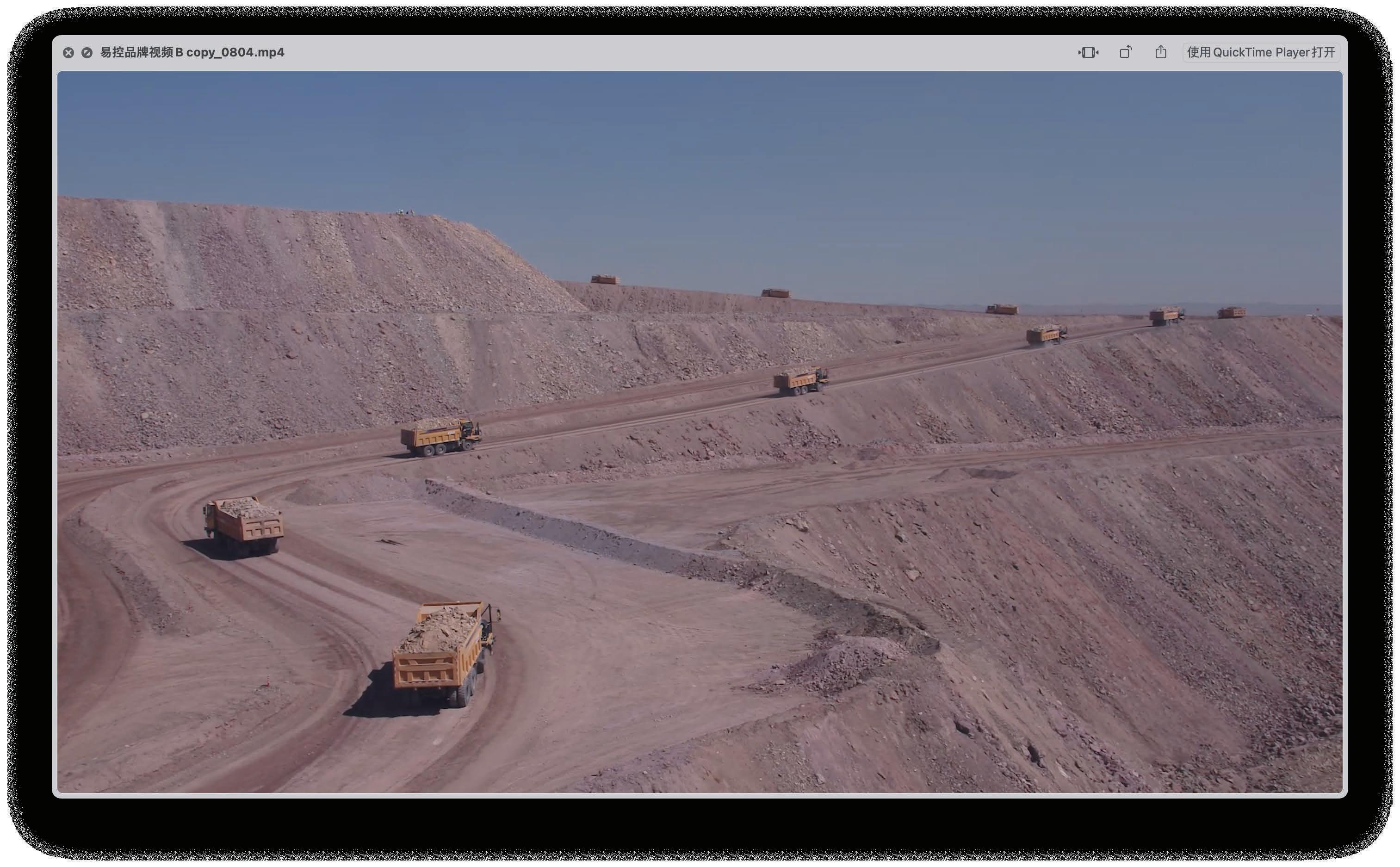

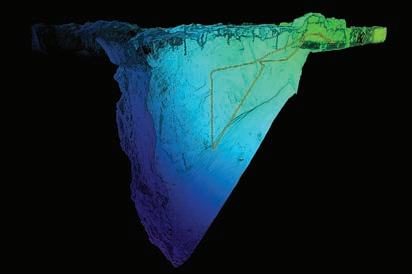

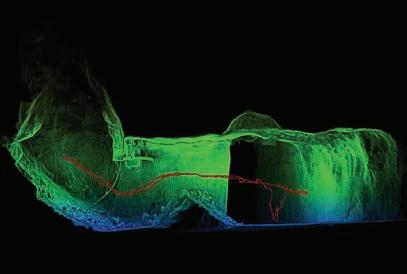

500+ autonomous haul trucks — worldwide

If you see an endless stream of driverless trucks on the mine site, think again.

Advances in Komatsu’s autonomous haulage system and teleoperation excavator mean transitioning upskilled personnel from cab to control room. This evolving and expanding mining technology is helping to redefine mining and boost productivity.

Let us help you embrace a more innovative and sustainable future with a tech-forward workforce and next-level equipment and solutions.

Develop your team. Drive efficiency.

Metals Acquisition Limited established itself with the

We could have bought an asset anywhere, so we looked at a lot of assets in the Americas and we ended up buying

What type of mine was the company looking for?

The beauty of a SPAC (special purpose

Listed on the New York Stock Exchange, the company had a global scope, with a desire to buy a mine in a Tier 1 jurisdiction that would produce minerals to support the renewable energy transition. This led Metals Acquisition to Glencore’s CSA copper mine near Cobar in New South Wales, which the company acquired in mid-June.

Australian Mining Metals Acquisition chief executive officer Mick McMullen to chat about what inspired the CSA acquisition and where to next for the operation.

What’s the background on Metals Acquisition Limited?

We set up Metals Acquisition a couple of years ago and we wanted a

tantalum, which is an adjacency to lithium. We looked at about 80 assets, narrowed it down to about a dozen which we did detailed due diligence on. We had four or five that we then did quite a lot of negotiating on, and then we ended up with CSA as being the one.

If you look at our background, I’d spent most of my career overseas. I spent a decade in North America, doing turnarounds on much larger businesses and, you know, we like

We also said we wanted to go where we knew the ropes, where we didn’t have to learn from scratch. I’m from Coonamble (NSW) and I built Tritton (the Tritton mine owned by Aeris Resources) 20 years ago in western New South Wales. Various members of our corporate team have also worked at Northparkes (copper-gold mine near Parkes) or Aurelia (Metals) or other assets in western New South Wales.

So we bought CSA, which is

specialists. We fix the cost base and get more out of the existing infrastructure.

We didn’t want to do a development asset in the current cost environment. We wanted to take an existing mine where the capital has been sunk and capitalise on that.

What about the CSA mine appealed to Metals Acquisition?

We see a lot of excess capacity in the infrastructure at CSA, so the processing plant will do significantly more than what the current throughput is, because it’s mine constrained.

You look for assets where you’ve got a lot of excess utilisation ability. We’ve got a phenomenal orebody and then the difference is work practices, and we can change work practices relatively cheaply.

When I ran Stillwater (Mining Company) in the US, no one’s ever heard of the mine, but it’s about five CSAs stitched together, with a smelter as well. It was the biggest company in the state of Montana, but appalling productivity. I fixed the productivity, got the cost down, got production up. That’s what that exercise was.

What are your production targets at CSA?

We think about 50,000 tonnes of copper is doable in 2024. That’s the official plan but, ultimately, we think it should do about 55,000 tonnes of copper (per year).

I’ve been using a Back to the Future anecdote: ‘This is what you did in 2017. I’m not asking or promising that this mine is going to do double the best it’s ever done. We’ve just got to get back to where we were in 2017’.

do double the best it’s ever done’, no one will believe that.

But if we say, ‘This is what you did in 2017, we want to get back to that’, and unwind some of the poor mining decisions that were made, I think we can get back to that level, but it’s probably 12 to 18 months before we get there.

Is Metals Acquisition on the lookout for any other mines?

We’re pretty busy. We had a list of assets that we looked at, so there’s a few others on that list that we could prioritise first. There are clearly some other assets in the Cobar Basin that could probably do with consolidation, but they’re a bit small. Northparkes; it’s not inside information, it’s in the newspaper. There’s sort of an (M&A) process being run, not an official process, but there’s a process. Clearly any copper asset in that part of the world is on our list. It remains to be seen where we get to on that one.

Then because our team’s split between North America and Australia, and I’ve spent a decade in North America, there’s a few assets in Canada as well that are on our list.

The last thing (Metals Acquisition chair) Nev Power ran was Fortescue. The last thing I ran was double the size of the Super Pit. And our big anchor (equity) investors, there’s six big funds, and one of them gave us $US50 million, another one $US45 million. They are backing us to recreate an OZ Mineralsstyle business because there’s a huge gap in the market.

Yeah, it’s definitely going to be bigger than that and, look, the timing of these things is not always ideal. Sometimes people kick off a process even though it’s not ideal timing for you, but, you know, decent copper assets in Australia or

CSA hasn’t been in the public domain for 25 years, and the kind of drill results we’ll be announcing very shortly definitely haven’t been seen in the public domain for a long time.

The cut-off grade has been twoand-a-half per cent, so anything under two-and-a-half per cent isn’t even in the resource. Most of our drill results are plus-five per cent and often plus 10 or 20 per cent copper, and I don’t think the market’s seen those kind of drill results since Sandfire (Resources) discovered DeGrussa (copper mine in WA).

Not only from a risk profile point of view and in investment, but you want to be able to offer ability to grow through the organisation. If you’re a single-asset company, you struggle in your ability to attract and retain talent.

If you can show that progression, the growth and the ability to grow with the company, I think we attract a higher level of candidate as well. AM

It makes sense that the World Mining Congress (WMC) 2023 would be held in Australia. After all, the country is universally known as a mining capital of the world.

And while the Australian resources sector has long ridden the wave of commodities such as coal and iron ore, it is now set to be a leading provider of the critical minerals needed for the energy transition.

Taking place in Brisbane from June 26–29, mining company executives and Australian politicians took to the WMC stage to detail the industry’s important role in supplying a greener future.

Federal Minister for Resources

Madeleine King discussed the emerging clean energy systems and how they will be mineral-dependent.

“An onshore wind power plant, for instance, requires nine times more mineral resources than a gas-fired power plant,” King told the WMC audience.

“Each new megawatt of solar power requires between 35-45 tonnes of steel. And steel needs iron ore and coal for the moment, though exciting developments may eventually see us producing green steel using renewable hydrogen.”

King urged miners to keep pace with the rising demand for clean-energy technologies.

“Recent analysis by the International Energy Agency suggests the world will need around 50 new lithium mines, 60 new nickel mines and 17 new cobalt mines to meet net carbon emissions goals by 2030,” she said.

“Right now, there are 26 lithium mines, 186 nickel mines and 89 cobalt mines operating globally. That means producing more raw materials

for renewables and clean energy technologies faster than ever.” Australia, and Queensland in particular, can play an important role in the global energy transition, particularly through vanadium – a metal that can be used to create reliable, safe and stable storage solutions for renewable energy.

“(Vanadium) batteries are large-scale battery storage systems that store excess power from the grid for use during peak demand periods,” King said.

“Unlike better-known lithium-ion batteries, vanadium redox flow batteries boast superior durability for long-term storage and charging and the technology has much greater recycling potential.

“And the technology to build them is in Australia.”

King, who emphasised the fact the road to net-zero runs through Australia’s resources sector, shone a spotlight on the Federal Government’s recently released

Critical Minerals Strategy, which she described as “a framework to grow Australia’s critical minerals sector”.

“Our strategy provides a framework for Australia to become a globally significant producer of raw and processed critical minerals,” King said.

Coinciding with the Critical Minerals Strategy discussion was Queensland Premier Annastacia Palaszczuk unveiling the Queensland Critical Minerals Strategy.

“In Queensland we have some of the world’s richest mineral-producing areas, which in north Queensland alone is estimated to be worth $500 billion,” Palaszczuk told the WMC audience.

“The Queensland Critical Mineral Strategy is about growing this industry by not just mining the raw materials but also being able to process it and manufacturing renewables right here in Queensland.

THE WORLD MINING CONGRESS WAS HELD IN AUSTRALIA FOR THE FIRST TIME IN 2023, GIVING COMPANIES FROM AROUND THE WORLD THE CHANCE TO ENGAGE WITH THE LOCAL SECTOR.MAJOR MINER RIO TINTO WAS ONE OF THE WMC’S DIAMOND SPONSORS.

“I want Queensland to be a global leader, supplier and manufacturer of critical minerals and this strategy will help us achieve that.”

Queensland Resources Minister Scott Stewart echoed these sentiments.

“Queensland has vast reserves of critical minerals, such as copper, zinc, vanadium and cobalt, that the world is demanding to produce batteries and renewable energy as part of their plans to decarbonise,” Stewart said.

As the WMC wrapped up, Federal Treasurer Jim Chalmers took the stage to discuss the integral role of mining in the Australian economy and the country’s path ahead for critical minerals.

“(The resources sector is) the largest sector of our economy,” Chalmers said. “It employs around 300,000 people, including 70,000 here in Queensland. It accounts for two thirds of our exports, bringing in around $460 billion a year.”

“And it will underpin our efforts to make the next era even more prosperous than the last, as we look to take advantage of the big opportunity that is the shift to cleaner, cheaper energy.”

It is clear that Australia’s goal to become a renewable energy superpower cannot be achieved without the mining industry.

“A strong and successful energy transformation will be built on a strong and successful resources sector,” Chalmers said. “The scale of that task is formidable, but Australia stands ready to play a big part.”

Australia will play this part via the Federal Government’s three-part approach to the green energy transition.

“One, building new resilience in supply chains. Two, making the right critical mineral investments that work for our people and our international partners. And three, linking critical minerals up properly with a broader effort to drive growth through the energy transformation,” Chalmers said.

The Federal Government has pledged billions towards building Australia to lead the way in the global energy transition.

“(The Federal Government is) allocating $23 million to ensure that Australian critical minerals have world leading environmental, social and governance credentials, and (is) making more than $2.5 billion available for government investment in critical minerals projects,” Chalmers said.

But for the mining sector to progress towards a net-zero future, sustainability needs to become a key focus.

Many mining professionals touted the importance of sustainable mining and the decarbonisation of the sector.

Emeritus Professor Mike Hood, mining and technology expert and chair of the program committee

for the WMC 2023, discussed decarbonisation efforts.

“Mining companies are actually all well engaged in using and improving existing technologies to reduce their emissions,” Hood said.

“Other players in the value chain, such as steel and cement companies, are developing, adapting and demonstrating new technologies for these downstream industries.”

RECENT ANALYSIS BY THE INTERNATIONAL ENERGY AGENCY SUGGESTS THE WORLD WILL NEED AROUND 50 NEW LITHIUM MINES, 60 NEW NICKEL MINES AND 17 NEW COBALT MINES TO MEET NET CARBON EMISSIONS GOALS BY 2030.”

University of Queensland Professor Anna Littleboy discussed the apparent clash between the need for critical minerals to make the materials, equipment and technologies to deliver net-zero emissions and the timelines required to implement responsible mining practices.

“The volume of minerals we need for this transition is absolutely massive,” Littleboy said. “It takes 25 years on

average from finding a new deposit to getting it opened. So we will be at 2050 before we know it.

“On one hand, we are working to accelerate our minerals production to meet our commitments to net-zero. On the other hand, we are tightening up our awareness of, and concerns about managing environmental, social and governance performance issues.

“We need to act fast on a global scale to meet climate change reduction commitments. But we must also ensure that at a local scale we don’t end up with worse environmental and social practices.”

It’s also clear that in order to achieve sustainability within mining practices to ensure a cleaner future for Australia and the rest of the world, the industry will need to innovate.

and related innovation will help the world move towards a sustainable future.

This included Newmont chief executive officer (CEO) Tom Palmer, who detailed key emerging global megatrends affecting the mining sector, including accelerated technology such as artificial intelligence.

“Together, these megatrends simultaneously animate, interact with, and reinforce one another in ways we cannot predict, giving rise to a growing meta-crisis, one in which we will be expected to succeed in right now and over the long-term,” Palmer said.

“The intensity and velocity of these global megatrends are so universal and disruptive that if, as an industry, we are not agile enough to adapt, align and lead, we will risk losing control of our businesses.”

Recent technology innovation has helped Newmont businesses become safer, cleaner, more efficient and productive.

“Some of the technological benefits we’ve seen at Newmont in recent years include automation and remote operations,” Palmer said.

“Automation is helping us mitigate safety risks, reduce emissions and improve efficiencies. Specifically, autonomous vehicles, automated drilling, remote operations, and asset monitoring are critical to how we mine today and, even more so, in the future.

“As part of our commitment to address the impacts of climate change, we are also challenging ourselves

and our equipment manufacturers to take risks in order to drive innovation and more rapidly develop sustainable solutions to reduce emissions.”

BHP chief technical officer Laura Tyler discussed the “transformations in mining” and how they will assist in reducing emissions.

“I believe nuclear energy will be a part of the base-load mix in the global elimination of carbon emissions-rich energy,” Tyler told the WMC audience.

“As more of our systems and decisions are automated, we will become the orchestrators of improvement and innovation – the skills we need for the future must embrace highly digital operational and project management as the way we deliver value and efficiency.

“As we stand in the future, I see an exciting, safe and automated sector, valued by society for the types of work it provides.”

Tyler said the key to this future is innovation.

“We need to expand the ecosystem of ideas that we are exposed to,” she said. “We are not in every pool of expertise, but we must be more open to conversations and ideas than ever before.”

In utilising these ecosystems, the mining industry must use data to drive solutions to make systems run better.

“Partnering on tech and innovation is making our sites safer and more sustainable as we think and act differently to deliver real results,” Tyler said.

Tyler called for all mining operations to identify, develop and implement

digital and technical innovations to meet

“Build our ecosystems, be open to new partnerships and ways of working, and be organised to move faster – driving ourselves forward with data, with people close to the opportunity finding the solution and then sharing the outcome for us all to use,” Tyler said.

“These mines of the future are vital to help deliver the world of the future and a surer pathway to net-zero – a transformation of mining to deliver a global transformation by mining.”

Fortescue CEO Fiona Hick touted the importance technology advancements will have in reducing carbon emissions. This belief led to the creation of Fortescue Future Industries, which will work to decarbonise its operations and, in time, share this technology globally.

“It is through actions like this that will deliver on that new interpretation of value into the long term,” Hick said.

Hick said the mining industry will need to work collectively and collaboratively across the value chain to drive the changes needed to lower emissions and meet net-zero goals.

“Partnerships and collaborations are pivotal to us as an industry maintaining our licence to operate, and to deliver that new kind of value-creation,” Hick said.

“The success of individual mining companies, and indeed that of the whole mining industry, creates value for local communities, for the national economy, and creates benefits around the world.

“When the mining industry is strong, there are so many direct and indirect benefits.” AM

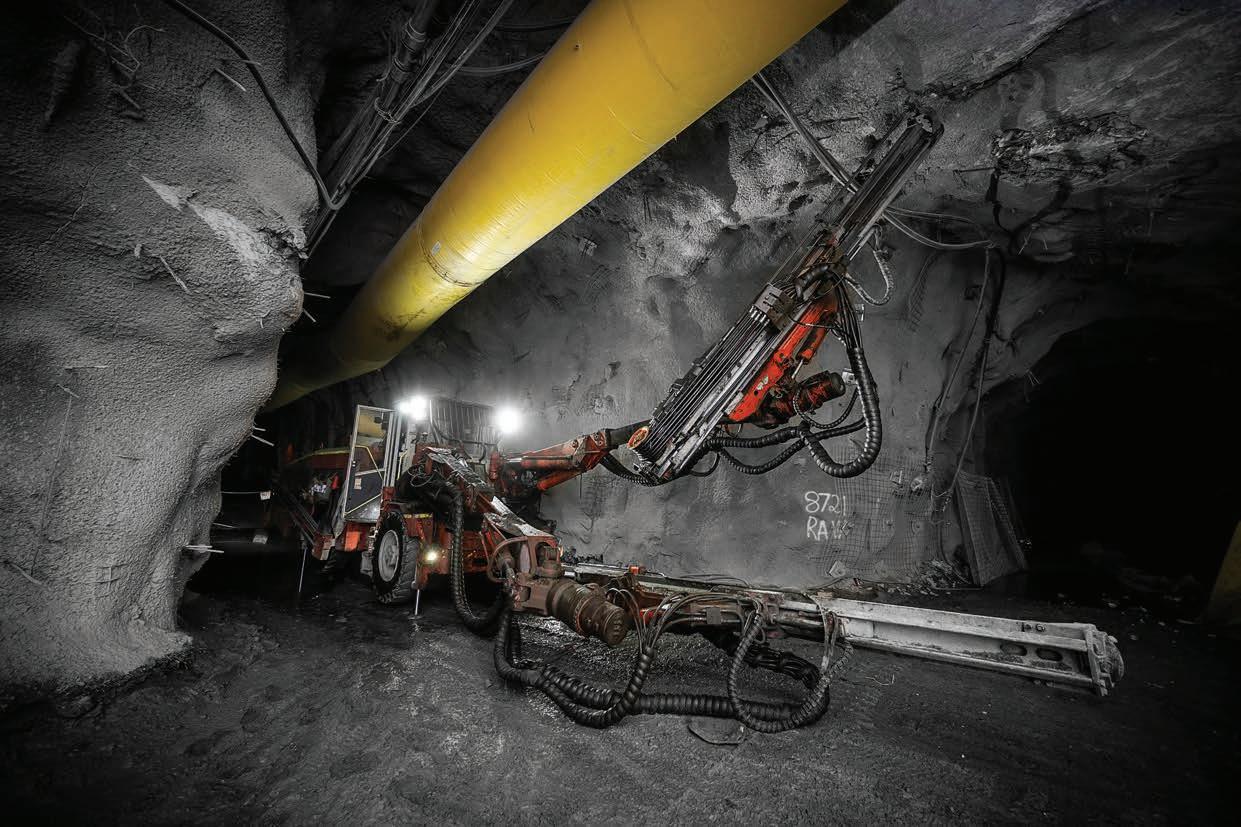

ONE OF THE GLOBAL MINING INDUSTRY’S MOST LEGENDARY DRILL RIGS HAS BEEN REVITALISED. AUSTRALIAN MINING TAKES A CLOSER LOOK AT EPIROC’S EVOLVING DRILL MASTER RANGE.

As one of the world’s leading drilling manufacturers and suppliers, Epiroc has a knack for developing new solutions just when its clients need them most.

Whether it be the Simba, Boomer, Explorac, SmartROC or Pit Viper, Epiroc has engineered drill rigs for every application in the mining sector. And it has engineered them expertly, with Epiroc products some of the most sought-after on the global mining stage.

In the same family as the Pit Viper range is Epiroc’s Drill Master (DM) series, suitable for rotary blasthole drilling applications.

The DM range now spans seven different models, with the most recent iteration – the DM30 XC – launched in 2022, demonstrating the enduring legacy of this series of machines.

As Epiroc puts it, the DM series is “a legend in the drilling industry”.

One of the most reliable DM machines – the DML – has carved out its own reputation for being the mining industry’s go-to rotary drill rig when it needs a heavy-duty solution for the toughest of conditions.

One Epiroc customer, which has been partnered with the Swedish original equipment manufacturer (OEM) since 2012, had been a long-time user of the SmartROC D65 crawler drill. But when the miner was after a new fleet of platform drills, it turned to the DML.

Product manager – automation DS for Epiroc Australia’s surface division, Paul Skaife, told Australian Mining the customer was initially deciding between a Drill Master or Pit Viper drill rig, but they ultimately opted for the DM range as it was best suited to its operation.

The customer purchased the DML rigs in 2022, and after being transported to Perth from Epiroc’s drilling factory in Texas, the machines were modified to ensure they were compliant with Australian standards.

Skaife said the DML was going to be able to deliver the customer enhanced performance, safety and reliability compared to its existing fleet.

“The DMLs will drill production holes in low-risk areas,” Skaife said. “They’ll drill holes more accurately and efficiently not only because of the DML’s superior capacity but also because the machine has been tailored to the operation’s unique specification (spec).”

While the SmartROC D65 has been a more suitable option for the customer in high-risk locations, given it’s a smaller tele-remote rig, the DML is important for situations where drill volume is key.

The DML can also be modified to have tele-remote capabilities if and when required. This can be done by harnessing the smarts of Epiroc company Remote Control

Technologies, which the OEM acquired in December last year to boost its automation capabilities.