INTERNATIONAL MINING

DECISION-MAKERS

INDUSTRY INSIGHTS

INTERNATIONAL MINING

DECISION-MAKERS

INDUSTRY INSIGHTS

EXPLORE A DEEPER LEVEL OF MINING, DECISION MAKING AND COLLABORATION

Deep Automation is Epiroc’s cutting-edge set of automation systems and applications, used to orchestrate loaders and trucks in underground mining operations. Developed with interoperability in mind and suitable for a variety of operation types - from small stoping to large block caving. Explore a deeper level of mining, decision-making and collaboration. epiroc.com/en-au

By utilising the latest technologies we provide an advanced combination of innovative solutions which optimise our customers mining operations performance, sustainability, availability and safety, around the globe.

We supply:

• Wear parts and solutions for mineral processing, mobile and fixed plant operations

• Digital and equipment connectivity

• Asset condition and performance monitoring

• Design, engineering and manufacturing solutions

bradken.com

PAUL HAYES

paul.hayes@primecreative.com.au

WE MAY BE CALLED AUSTRALIAN MINING, BUT THAT DOESN’T MEAN WE CAN’T LOOK PAST OUR OWN SHORES.

Australia might seem like the centre of the mining universe (and, in a lot of ways, it kind of is) but it’s important to remember that the industry is a truly global one and Australian companies have spread their connections all around the world.

Just this week (at the end of July and start of August), Australian mining companies like Rio Tinto and Glencore set their sights on critical mineral operations in Chile and Argentina, respectively.

And these are only two relatively small examples.

Rio’s months-long efforts in 2022 to get its hands on the Turquoise Hill and its Oyu Tolgoi mine in Mongolia, considered one of the largest known copper and gold deposits in the world, is a prime illustration of Australian mining companies going international in a big way.

But not all international mining is so far from home. In fact, a key spot on the mining globe is right on Australia’s proverbial doorstep, with our nearest neighbour.

Papua New Guinea is home to a large number of Australian mining and mining services companies.

The Pacific nation is bestowed with vast gold, copper, nickel and cobalt mineral deposits and mining has long been a major driver of its economy, and the likes of Ok Tedi, Lihir and Simberi are some of the active mines in PNG still producing today.

CHIEF EXECUTIVE OFFICER JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY EDITOR

PAUL HAYES Email: paul.hayes@primecreative.com.au

ASSISTANT EDITOR ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS TOM PARKER Email: tom.parker@primecreative.com.au

OLIVIA THOMSON Email: olivia.thomson@primecreative.com.au

The country’s mining past has not been without its troubles, but a series of local and international companies are driving today’s sector forward, generating new opportunities for PNG communities and emerging professionals.

In this month’s issue of Australian Mining we direct our gaze a little further and look past the horizon to some international locales, and PNG is chief among them.

We take a look at some of the latest developments in the region, highlighting the work of big-ticket industry players like Newcrest, St Barbara, Hastings Deering, K92 Mining, and more.

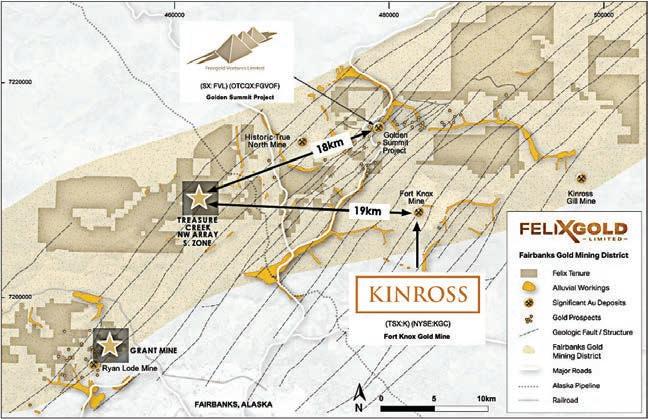

We also check in with Fenix Gold and take a closer look at Treasure Creek, the gold-antimony project the company is developing in Alaska.

Closer to home, this month’s issue heads below the surface for a deep dive into the latest in underground mining.

We all know there’s a lot going on down there, so it pays to check in with the latest products, technologies, software and more that make life underground that much easier and more efficient.

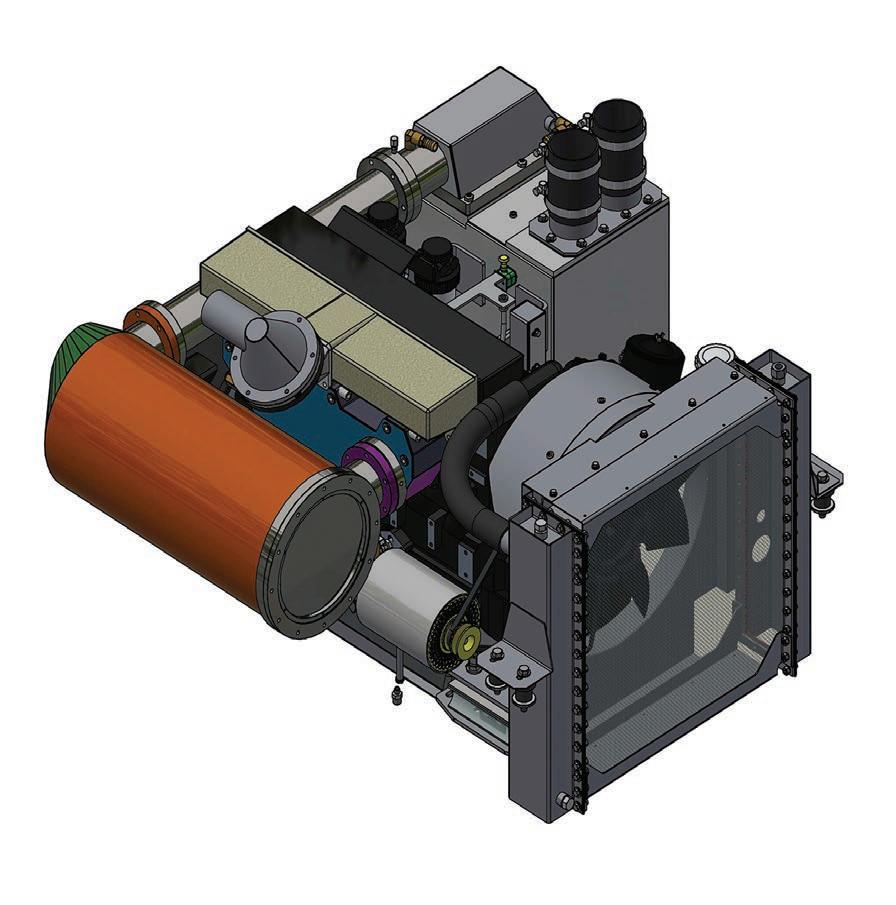

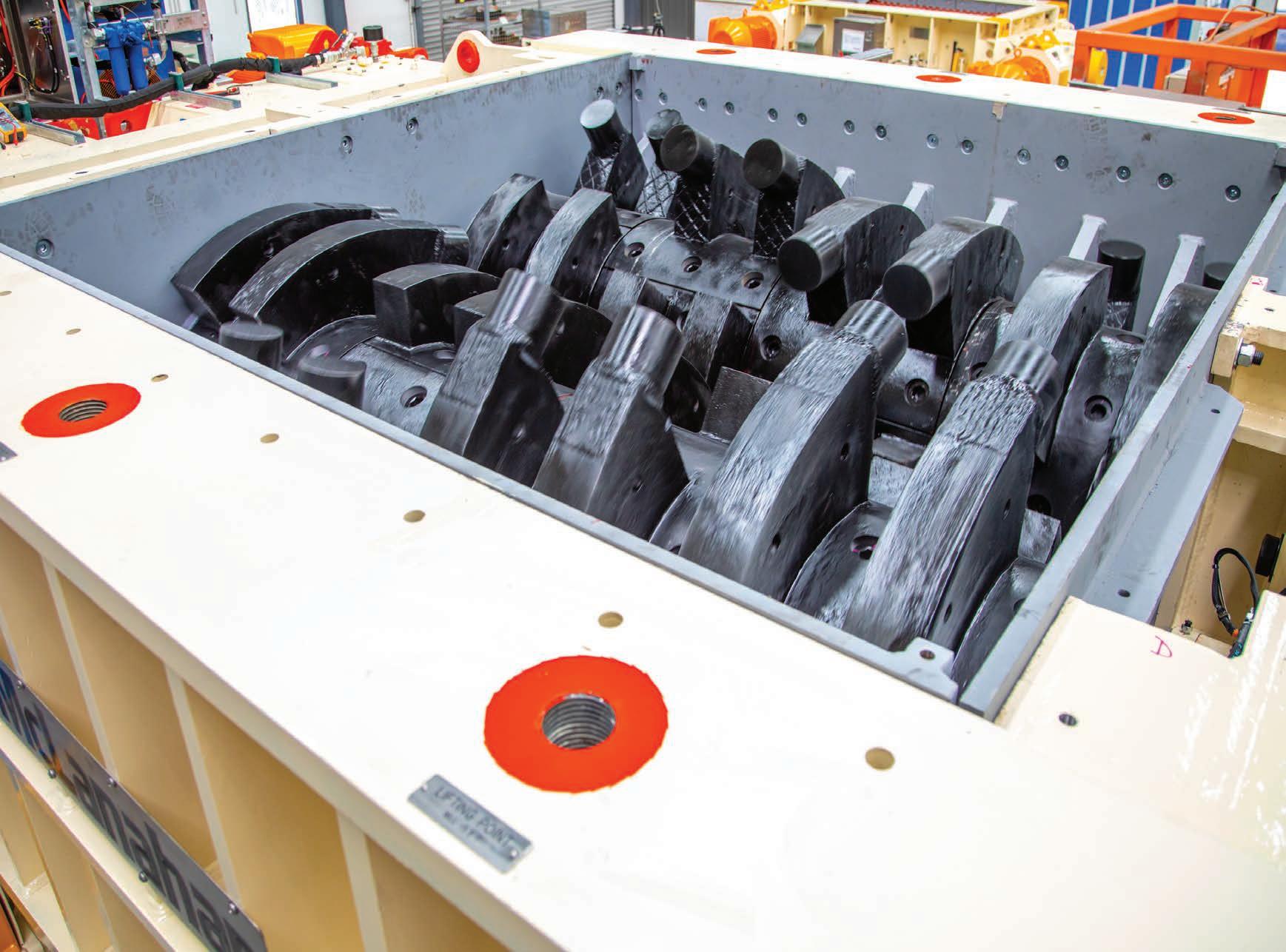

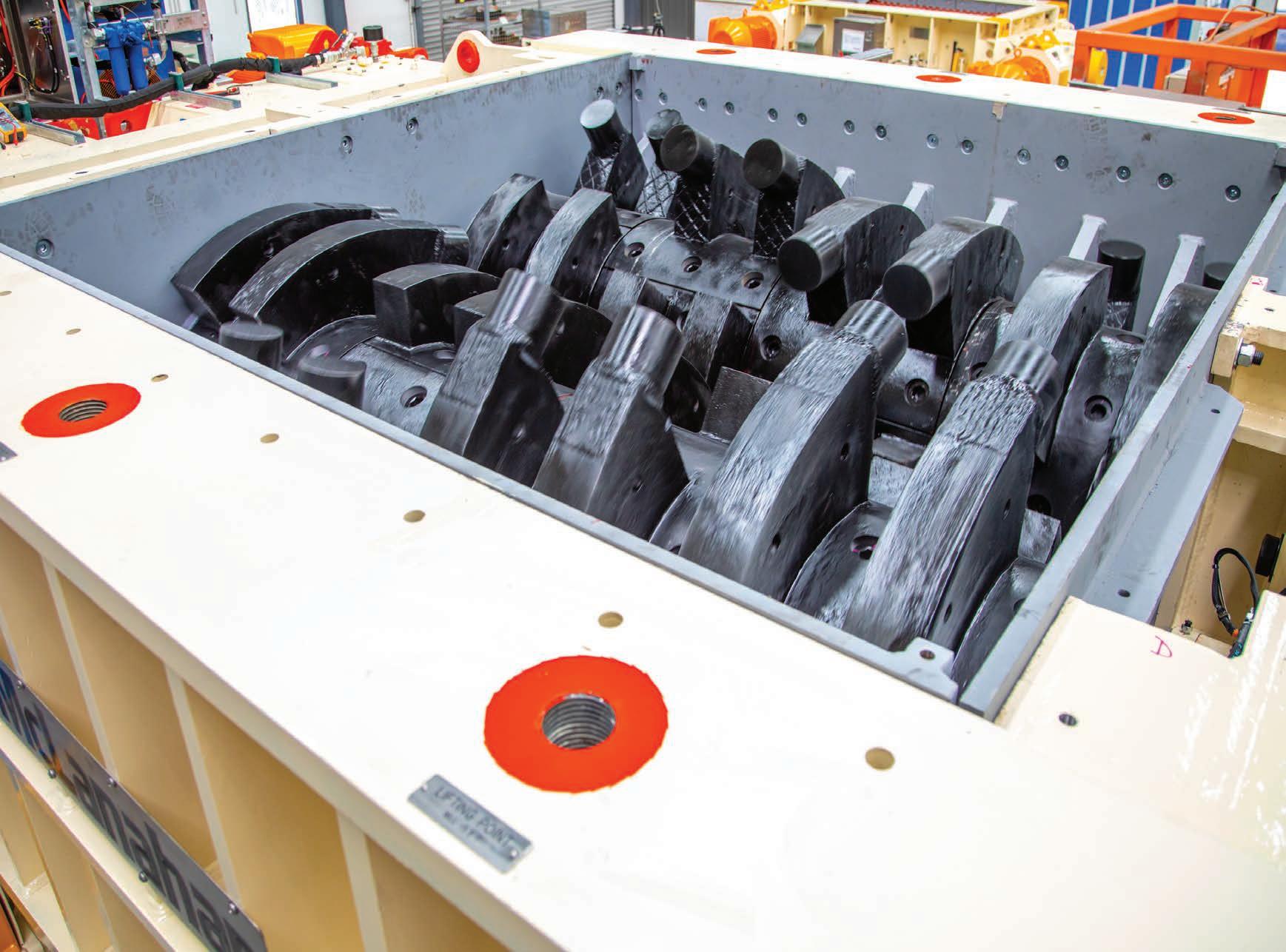

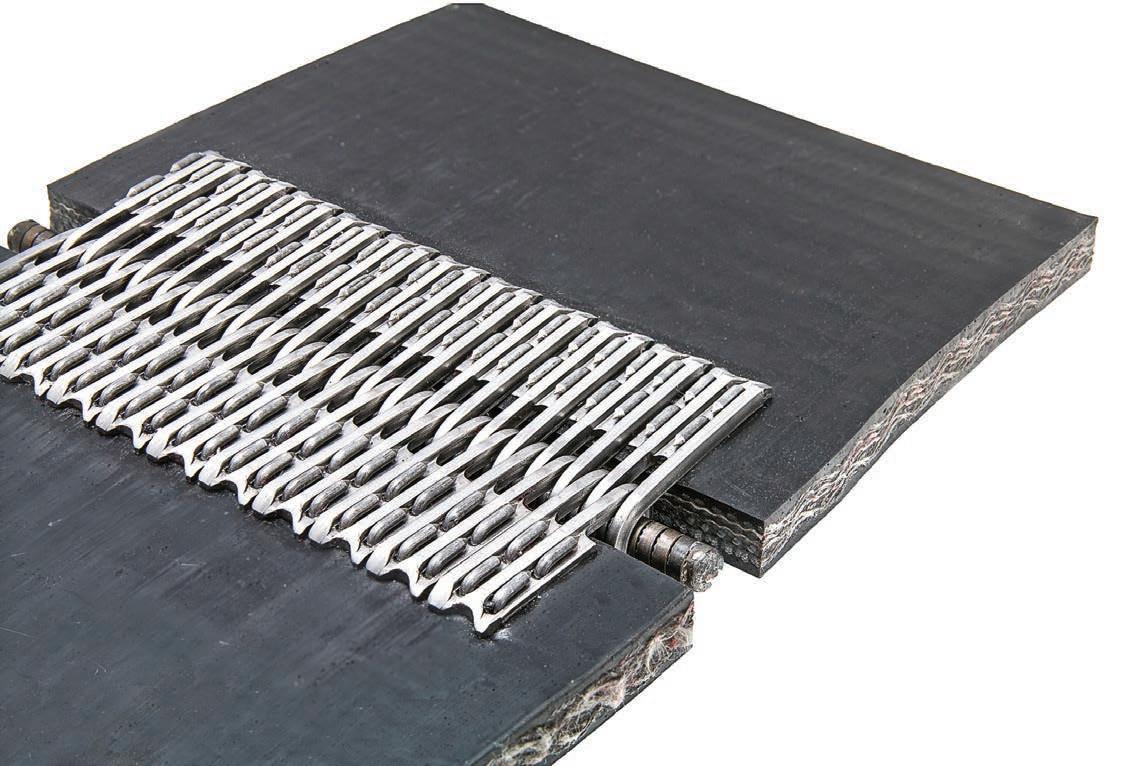

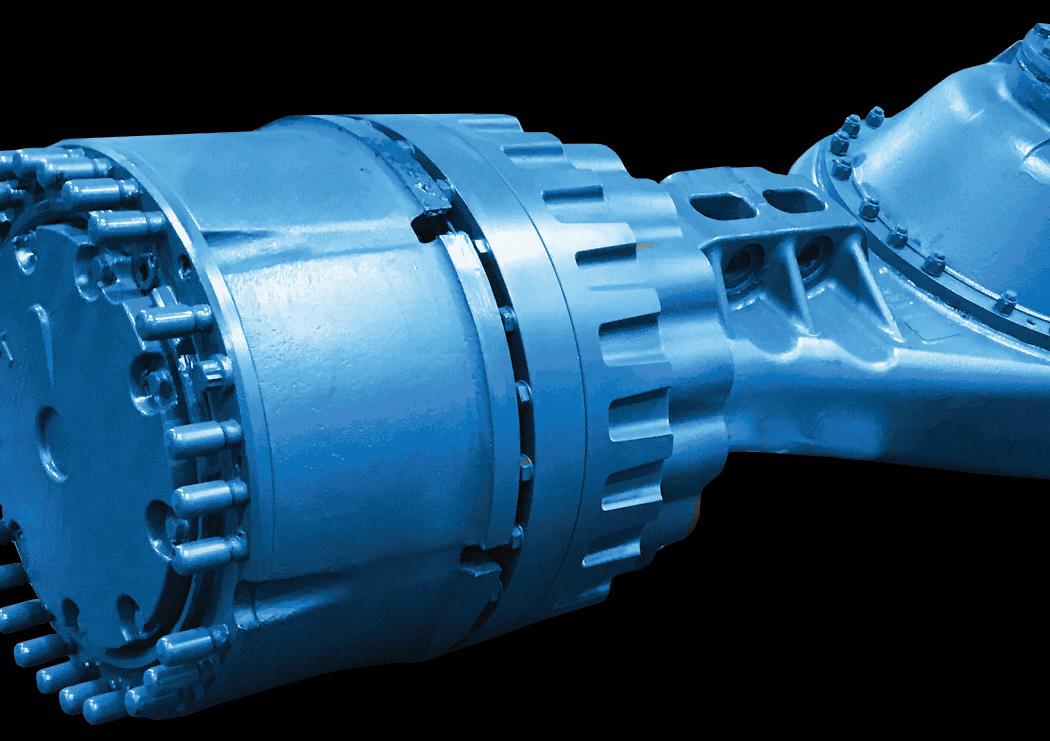

Minova is considered an industry leader of ground support and geotechnical solutions for mining, tunnelling and surface engineering projects. The company is known for its quality products, technical expertise and customer problemsolving.

“Our 140-year track record of developing and delivering innovative ground support solutions is a heritage we are proud of,” the company said on its website.

“With manufacturing plants across five continents and operations in more than 25 countries, we offer our customers full portfolio solutions, consisting of a comprehensive range of bolting systems, injection chemicals, grouts, resin capsules and sprayable membranes, coatings, and services.”

Cover image: Minova

Paul Hayes Managing EditorTIM BOND Email: tim.bond@primecreative.com.au

CLIENT SUCCESS MANAGER JANINE CLEMENTS Tel: (02) 9439 7227 Email: janine.clements@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027 Email: jonathan.duckett@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au © Copyright Prime Creative Media, 2016

24 INDUSTRY INSIGHT

Takeover targets

This year has seen a pattern of takeover offers and acquisitions as ASX-listed mining companies work to expand their portfolios.

34 INTERNATIONAL MINING

New horizons

Papua New Guinea has always had a strong mining presence.

Australian Mining examines some of the latest developments.

36 RESOURCES AND INVESTMENT

An Alaskan treasure chest

Australian Mining takes a closer look at Treasure Creek, the gold-antimony project Felix Gold is developing in Alaska.

38 DRILL AND BLAST

Million-metre milestone

Adapting Epiroc’s autonomous Pit Viper drill rigs to a multi-pass coal operation seemed like a tall ask at first, but the Swedish OEM silenced the critics.

42 UNDERGROUND MINING

Raising the roof

Komatsu has updated its powered roof support business to meet the needs of contemporary coal mines.

52 UNDERGROUND MINING

Filling the underground gaps

Minova’s long history in ground support comes together with its toolbox of products to solve just about any problem in underground operations.

64 MINING SERVICES

On time and on budget

Able to deliver a range of services, National Group is recognised for its end-to-end offering. This is driving rapid company growth across NSW, Queensland and WA.

78 DEWATERING

A proven winner

A recent trial of Crusader Hose’s Hamersley system for rapid in-pit dewatering proved to be a “game-changer”.

REGULARS

10

104

106

Mining progress over the centuries has been primarily driven by tool and machine designs. The next generation will be driven by advances in data and technology — especially automation. Automation removes workers from the face for safety, and can improve productivity and sustainability through its precision and repeatability.

With these new technologies — and others — from Joy, the next generation of longwall mining is now.

To learn more about new Joy longwall mining tech visit komatsu.com/longwall

Video

Video

Designed for use on powered roof supports and armored face conveyors (AFCs), the RS20n is the industry’s first 1Gb/s two-wire Ethernet system. With an open network to connect 3rd party Ethernet devices, the RS20n is engineered for standout productivity and reliability.

This intelligent variable speed and torque drive solution for AFC and BSL can significantly increase equipment life by reducing chain travel. It’s the only variable speed drive approved for underground mining in Australia.

Read more

High-performance valve technology can improve PRS cycle times by up to 12% compared to the previous model and can be retrofitted to PRS of any manufacturer. It’s also been designed for longer life and easier for operators to position.

Read more

This successor to the J-525-H arm has up to 23% more power — in the same width envelope — and enables full cut-past on larger AFC tail frames. It’s packed with reliability improvements as well. For upcoming availability of this product, contact your Joy representative.

WWW.AUSTRALIANMINING.COM.AU

project’s Hermes prospect in Western Australia in July.

Following the discovery, Platina is set to commence drilling at Hermes later in the year.

“Our team is very excited to start drilling Hermes later this year post the completion of a second-stage heritage

in close proximity to the mantle tapping Nanjilgardy fault, Howies Hole fault, strong multi-element values and the presence of conglomerates similar to the Mt Olympus-style indicate Hermes’ high prospectivity.”

The Federal Government gave its approval for thermal coal to be mined at Ensham in Queensland for a further nine years.

Located 40km north-east of Emerald in central Queensland, the mine was first owned by Japanese oil giant Idemitsu before it transferred its 85 per cent interest to South African energy company subsidiary Sungela.

Swiss investment group

Audley Energy and Australian Mayfair Corporations Group each

earned a 12.5 per cent stake from the acquisition.

The mine is the first thermal coal project approved by the Federal Government since it was elected in 2022. It is set produce 4.5 million tonnes of coal annually.

According to the project overview, the mine will produce an estimated 39 million tonnes of thermal coal throughout its life in an export value of $3.66 billion.

The mine currently has a workforce of approximately 600

of WA. Current gold mineralisation at the site is 1–3cm thick, with the bulk occurring in a central corridor.

“Field geological mapping, rock chip and channel sampling were conducted at Hermes in June,” the company said in an announcement.

AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

“A total of 34 rock chips and 13 channel rock samples from three lines were taken over a strike length of 1km and a width of 650m.”

March 2023 saw Platina enter into a joint venture with Chalice Mining for the Mt Narryer gold project in WA.

Platina’s Mt Narryer gold project is located 300km north-west of the company’s Challa gold project on the fringe of the Yilgarn Craton, a prodigious gold and base metal producing province of WA.

Nolan said the joint venture would allow Platina to channel its time and financial resources towards its other key projects in WA, Brimstone, Xanadu and Beete.

people, including employees and contractors, and has a current production level of 5.3 million tonnes per annum.

While some have questioned the decision, Federal Environment Minister Tanya Plibersek said the approval was made in accordance with the current environmental laws.

“The Federal Government has to make decisions in accordance with the facts and the national environment law – that’s what

happens on every project and that’s what’s happened here,” a spokeswoman for Plibersek said.

Idemitsu maintained that the mine maintains a strong commitment to the environment.

“Ensham maintains a strong commitment to the environment and the local community where we operate and we actively engage with local businesses, landowners and government in order to meet stakeholder expectations,” the company said.

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT

TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

EQ Resources will undertake exploration activities across a 480km² area in an effort to find more critical minerals deposits that will be essential in Australia’s transition to net-zero.

In particular, the company will be on the lookout for tungsten deposits, which has been mined at the Wolfram Camp site since the 19th century.

The exploration will form part of Queensland’s Critical Minerals Strategy

mines would transform them from a liability to an asset.

“EQ Resources has a proven track record in revitalising former mines, having established significant mine waste reprocessing operations and recently announcing starting open cut mining at its nearby Mt Carbine tungsten project, creating up to 135 good jobs,” Stewart said.

“Queensland has many of the critical minerals needed to make

Albemarle recently awarded Monadelphous a $200 million contract for construction work at its Kemerton lithium hydroxide processing plant in WA.

Under the contract, Monadelphous will construction processing trains three and four, creating over 1000 construction jobs.

The new trains will enable Kemerton to produce up to

100,000 tonnes of lithium hydroxide per annum, supporting the annual manufacture of around 2.4 million electric vehicles.

Monadelphous has previously worked on Kemerton processing trains one and two.

“We are very pleased to have Monadelphous back on-board for the construction of processing trains three and four,” Albemarle vice president, capital projects

meet the challenge of leading the world towards a decarbonised future.”

EQ Resources chief executive officer Kevin MacNeill said EQ is committed to engaging with the local communities as it works toward reopening.

“This includes generating new employment avenues, contributing to the local economy, and promoting responsible environmental stewardship in alignment with EQR’s core values,” he said.

surrounding communities and we envision a similar transformation for Wolfram Camp.

“Our team of experienced professionals will apply modern exploration techniques and state-of-the-art technologies to maximise the site’s potential while minimising its environmental footprint in order to unlock Wolfram Camp’s potential as a critical mineral producer.”

Australia Josh Rowan said. “Their ability to deliver the works safely and at schedule is critical to the project’s success.

“Monadelphous was also recently awarded long-term maintenance and sustaining capital projects contracts for Albemarle’s Kemerton operations.”

Albemarle agreed to amend the terms of the MARBL lithium joint venture (with includes the

Kemerton processing plant) it shares with Mineral Resources (MinRes) in early July.

Under the new agreements, Albemarle will take 100 per cent ownership of Kemerton and retain full ownership of its Qinzhou and Meishan lithium processing facilities in China.

Kemerton recently took delivery of first steel, and construction work is expected to begin soon.

Black Cat Syndicate has announced a surprising main zone extension at its Paulsens gold operation in WA.

Most recent drilling results indicate that the main zone of mineralisation at Paulsens extends at least 175m longer than originally estimated.

Of the nine holes drilled, eight intersected broad intervals of quartz veining associated with gold. With further drilling, this extension has the potential to materially add mine life or increased production rates to the recently completed Restart Study.

Paulsens has a history of surprises. The mine changed hands

in 2009 when it was believed the main zone had a pinched out down plunge, only for an additional 1500m of quartz veining to be discovered in 2017.

Prior to Black Cat’s most recent drilling campaign, the main zone was again believed to have a pinched out down plunge.

Paulsens is one of Australia’s highest-grade gold deposits, with a current resource of 328,000 ounces (koz) of gold at 9.9 grams per tonne. Around 154koz of this is located in the main zone.

Black Cat is planning a restart of the mine, with a production target of 42koz per year over an initial three-year life of mine.

Previous underground mining, particularly from the main zone, produced one million ounces of gold at an average of 75koz per year.

Black Cat managing director Gareth Solly said the drill program was the company’s most significant since listing in 2018.

“The results are extremely encouraging and show the strong growth potential at Paulsens,” he said.

“Extending the main zone down plunge by up to 175m opens up potential to extend mine life and/or production rates from the zone that has produced about one million ounces to date.

“None of this has been included in our recent restart study and is all upside.

“Importantly, the main zone remains open down plunge and has unfinished business up plunge.

“In a mine that has delivered 1000 ounces per vertical metre, finding another 175m of plunge extension is significant to both Paulsens and more broadly for Black Cat.

“This is just the beginning for the main zone’s next phase.”

Black Cat acquired Coyote and Paulsens from Northern Star Resources in June 2022 in order to accelerate its ambition of becoming a mid-tier gold producer.

Larvotto Resources recently announced that reverse circulation drilling at its Mt Isa project has commenced. The Mt Isa project is located in north-west Queensland and within the eastern portion of the Mt Isa Inlier, which is recognised as one of the richest metallogenic regions in the world.

Initial drilling at the Mt Isa project will target the Yamamilla and Whitehorse prospects, which are two highly prospective areas of copper, gold and cobalt.

Western Australia has broken a total of 16 shipping records across its Albany, Bunbury and Esperance ports, thanks to record shipments of spodumene.

Spodumene is a mineral consisting of lithium and is used primarily in vehicle and mobile phone batteries.

Combined, the three ports exported a total of 2.4 million

A total of 3100m of reverse circulation drilling has been planned for this phase of the project’s program: 2500m of reverse circulation drilling at its Yamamilla prospect and 600m at its Whitehorse prospect.

The 2500m at Yamamilla will test the geochemical and geophysical anomalies and will be undertaken by a track-mounted, high-capacity air reverse circulation drill rig.

Larvotto Resources said geophysical VTEM anomalies and geochemical anomalies along the Yamamilla fault

were poorly drill-tested by reverse circulation drilling in 2012, when most of holes failed to intersect the targeted zones, predominantly due to a lack of air while drilling.

The company is now utilising a drill rig with the ability to withstand these issues.

“The Yamamilla Prospect is one of our lead areas, with over 10km of mineralised strike that contains a welldefined geochemical and geophysical anomaly,” Larvotto Resources managing director Ron Heeks said.

“The majority of holes from the very limited historic drilling back in 2012 were mineralised but, significantly, most did not reach the planned target due to drilling issues at the time.

“Whitehorse has been identified from Larvotto’s recent field work and has produced extremely high-grade rock chips over 2300m of strike,” Heeks said.

“We look forward to commencing the initial drilling of very promising targets and reporting our results to the market in due course.”

tonnes of spodumene for the 2023 financial year (FY23), smashing the previous record of 1.9 million tonnes set last year.

The Port of Bunbury alone exported 1.5 million tonnes of spodumene, while the Port of Albany exported 256,000 tonnes of silica sands.

Southern Ports chief executive officer Keith Wilks said that FY23 has been a bumper period for trade.

“Growth and diversification of our trade is important as our state transitions to new commodities, including those that support renewable energy production,” Wilks said.

“A record 2.4 million tonnes of spodumene was also exported through our ports over the past year, contributing to our state’s critical battery and minerals trade

which will shape our country’s clean energy future.”

“These records are testament to the terrific work of our local teams and all of our customers and port service providers who are working together to deliver Western Australian products to world markets. Ports play a critical role in WA’s economy, and we’re proud to be delivering outcomes to support this.”

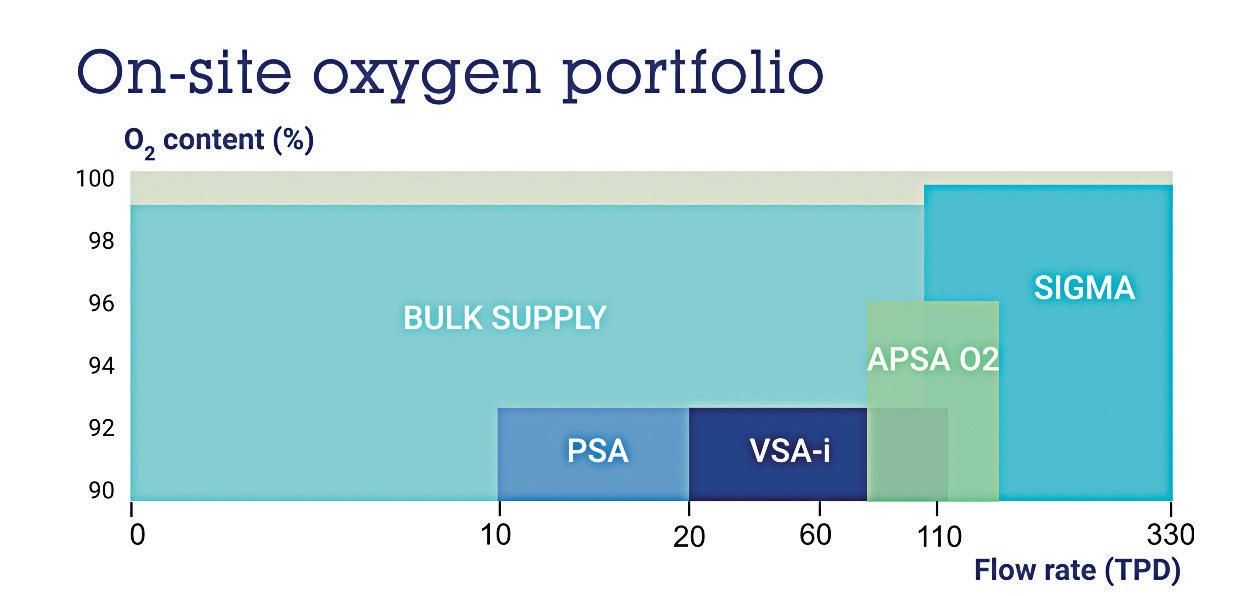

In the mining industry, our equipment, including air compressors, air blowers, gas generators, and carbon dioxide compressors, plays a crucial role. At Atlas Copco, we are dedicated to helping you reach your sustainability goals through our latest energyefficient machines and technologies. With our innovative solutions, you can optimise operations and work towards a more sustainable future.

Available in 200kW and 250kW

These compressors include a fixed speed and a variable speed motor and element package, catering to sites with specific base flow requirements and variable higher flow demands. Furthermore, the compressor is engineered to offer enhanced reliability, as it can operate with just one motor element in the event of maintenance, ensuring uninterrupted productivity.

Are you looking to reduce your net carbon emissions? Whether you have a greenfield or brownfield installation, our team of experts are ready to conduct a comprehensive site assessment, providing valuable insights into your emissions and potential energy savings.

Papua New Guinea’s (PNG) Independent Consumer and Competition Commission (ICCC) has granted clearance for Newmont to proceed with its acquisition of Newcrest.

After a three-month process beginning in February 2023, Newmont secured a $26.2 billion takeover deal with Newcrest.

The Canadian Competition Bureau issued a ‘no action’ letter clearing Newmont’s announced transaction with Newcrest under Canadian competition law in July.

Newmont has since been continuing to advance other regulatory approvals, such as

PNG’s, and it expects to close the transaction in the December 2023 quarter.

Newmont still needs regulatory approvals from the Australian Competition and Consumer Commission (ACCC), the Australia Foreign Investment Review Board (FIRB), the Japan Fair Trade Commission (JFTC), the Philippine Competition Commission (PCC), and the Korea Fair Trade Commission (KFTC) to complete its acquisition of Newcrest.

In additionally, Newmont has been in consultation with Newcrest, and through this has determined that a pre-merger

notification under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 will not be required in the US for the transaction to proceed.

“We appreciate the ICCC in Papua New Guinea carefully reviewing and clearing our proposed acquisition of Newcrest,” Newmont chief executive officer Tom Palmer said.

“Lihir in PNG is one of the world’s great gold mines and a Tier 1 operation by any measure.

“In addition to Lihir, we see profitable gold and copper growth through the world-class WafiGolpu project.

“We remain committed to building strong, mutually beneficial and long-lasting relationships with PNG’s government and local communities.

“As part of this commitment, Newmont plans to establish PNG as a standalone fifth region in our portfolio with an in-country senior leadership presence and pursue a secondary listing of Newmont depositary interests on the PNG’s National Stock Exchange (PNGX).”

Newmont and Newcrest will continue engaging with the PNG Government and regulators about other approvals and clearances for the takeover.

Mineral Resources’ (MinRes) Mt Marion lithium operation has seen promising early results from a major exploration program.

The Mt Marion lithium operation is located in the Goldfields region of Western Australia, and is a joint venture between MinRes and Jiangxi Ganfeng Lithium – where both companies own 50 per cent. MinRes is the mine’s operator.

MinRes said the early results confirmed significant exploration potential at depth along strike and

in the surrounding region, and it demonstrates potential for open-pit extensions and underground mining.

The company has reported approximately 34km of drilling being completed in 2023 so far by utilising six diamond and reverse circulation drill rigs.

The first major exploration program since MinRes took control of the mine found lithium-bearing pegmatite formations approximately 1km below the surface. MinRes said it will double exploration drilling

capacity at Mt Marion by the end of the 2023 calendar year, ramping up to a 12-rig drilling campaign over the following 18 months.

MinRes managing director Chris Ellison said the Mt Marion exploration results highlight how the company is just scratching the surface of the potential lithium resource, including the possibility of underground mining.

“MinRes identified opportunities in lithium, the most important mineral in the world’s decarbonisation, more

than a decade ago and set about building a portfolio of world-class assets that could deliver long-term value,” Ellison said.

The operation produces mixed grade spodumene concentrate which is transported through the Port of Esperance for offshore conversion.

A $120 million upgrade and expansion of the Mt Marion operation doubled capacity to up to 900,000 tonnes per year, with the commissioning process now underway.

Enabling new possibilities for the resources industry across regional and remote Australia.

The processing plant at Northern Star Resources’ Super Pit gold mine went up in flames in July, but site and emergency crews were quick to contain the worst of the blaze.

The mill ignited at 3.36am on July 17, believed to be caused by welding works being conducted inside one of the tanks. Workers snapped into action, conducting a full evacuation of the site with zero injuries, in an effort that was later praised by Kalgoorlie Consolidated Gold Mines (KCGM) management.

Kalgoorlie firefighters arrived on scene shortly after 4.00am and, over the course of an hour and a half, battled to extinguish the blaze.

Firefighters said was the biggest industrial fire they had seen since the Kalgoorlie nickel smelter burned in 2018.

A response team made up of professional and volunteer firefighters, as well as KCGM emergency personnel, was able to put out the fire

Early estimates put the damages between $500,000 and $700,000, but that could easily have reached the tens of millions had the fire not been mostly contained to a single tank. No injuries were reported.

Kalgoorlie Fire Station officer Troy Della-Costa praised response crews for their efforts.

“We contained it fairly rapidly,” he said. “Extinguishing it took a little bit of time because the rubber just kept

“It definitely had the potential to spread, so I applaud the rapid response of my crew and the emergency response team — it all worked really well.”

The Super Pit mine is one of the largest gold deposits in Australia. The board of Northern Star Resources recently approved a $1.5 billion expansion of the site’s mill to increase production from 13 million tonnes per annum (Mtpa) to 37Mtpa.

Works are due to be completed

Commerce in Australia.

Slattery touched on labour laws, taxes, and a dwindling talent pipeline.

The company is concerned about the Federal Government’s ‘same job, same pay’ reforms, which will require employers to pay labour hire workers the same rate as direct employees doing the same job.

Employers are worried the reform will further constrain an already tight – and expensive – labour market. This is particularly the case in the mining industry, where labour hire makes up a significant portion of the workforce.

BHP predicts that the reforms may harm its operations, including its Olympic Dam copper mine.

maybe up to $500 million in a worstcase scenario,” Slattery said.

“The hit to the value of any potential growth plans in SA could be anywhere up to $US2 billion (A$2.98 billion) and this would make it much harder for any South Australian investment case that has to compete with alternative options in other parts of the world.”

Slattery also stated that Australia’s tax competitiveness has declined since 2015, with the country’s tax now the third highest compared to other nations in the Organisation for Economic Co-operation and Development.

BHP has been candid in its stance against Queensland’s controversial three-tiered coal royalties system,

revenue and a record surplus to Queensland, giving the state’s recent budget the vitality it needs to tackle a range of cost of living issues.

But BHP and other miners argue it hurts the long-term competitiveness of the state.

“Stability and competitiveness in fiscal and policy settings will be incredibly important to Australia’s ability to secure new multi-billiondollar, multi-decade investments,” Slattery said.

In the same address, Slattery touched on some of the labour issues faced by the industry in Australia.

“The number of mining engineering graduates in Australia dropped by 74 per cent between 2015 and 2022,”

highest labour costs in the world –around 12 per cent higher than in the US.”

Slattery also pointed out that despite the increase in costs, labour productivity has declined by eight per cent.

“Today, in the foothills of a critical minerals boom, Australia has high-quality but immaturely developed resources, with a dwindling talent pool, and a less certain investment environment.

“We are at risk of losing our competitive edge, and with it our future prosperity.

“We need to find new ways of doing things, and work more closely together – across governments, industry and business.”

– Fitted with Liebherr Mining’s most advanced innovations

– Designed to support greenhouse gas emission reduction targets: Liebherr Power Efficiency comes as standard to reduce fuel consumption, diesel engine is Tier 4/Stage V compliant, electric-drive powertrain already in development

– Strong parts commonality with existing excavator portfolio to reduce lifecycle costs and to simplify maintenance

– New attachment design reduces overall machine weight resulting in faster cycle times and increased Approved Rated Suspended Load (ARSL)

– Introducing the latest cabin generation: enhanced ergonomics, large touch screens, and a new and improved control panel design

RIO TINTO, ANGLO AMERICAN AND GLENCORE HAVE REPORTED PROGRESS THEY HAVE MADE TOWARDS MEETING THE GLOBAL INDUSTRY STANDARD ON TAILINGS MANAGEMENT.

For the first time, major miners Rio Tinto, Anglo American and Glencore released information to the public on their tailings facilities and how they plan to meet the global industry standard on tailings management (GISTM).

Rio Tinto

The major released information on 14 of its global tailings facilities, all of which have been rated as ‘very high’ or ‘extreme’ based on the potential consequences in the event of a failure.

“Since the tragic failure of the tailings facility at Brumadinho in Brazil in 2019, the entire industry has been working to improve the way we manage tailings facilities,” Rio Tinto chief technology officer Mark Davies said.

“Responsible tailings management is critical to ensure the safety of our people and communities and to protect the environment. It is fundamental for our business and social license. We have made considerable progress since August 2020 towards conformance with the GISTM. We have completed most of the work and have detailed plans to complete outstanding items.

“GISTM has meant a steep change in how the industry manages its tailings facilities. Good tailings management is also about transparent partnership, and we have been working with the local communities near our facilities to increase awareness of our management practices and how we can best work together to continue to keep people and the environment safe from harm.”

In May of this year, Rio and fellow major BHP invited expressions of interest for a range of new tailings technology partners.

Both companies said the ideas and technologies considered can be market ready for mining, can involve technologies previously applied in other resource-related industries, or can be original ideas at an early research and development stage.

Anglo American

Anglo American has set out its progress towards bringing its 12 tailings storage facilities that are currently within the two highest potential consequence categories in line with GISTM.

“We have made very significant progress towards conformance with the GISTM over the last three years, building upon our already high technical standards,” Anglo American chief executive Duncan Wanblad said.

“We continue our prudent approach to align with a number of specific GISTM requirements, as well as the social and community aspects that are already encompassed in our comprehensive social way management system. We are addressing the few outstanding areas and have set out the work needed to get us there.

“As an industry, we have a clear ethical imperative to do everything possible to ensure that tailings storage facilities are managed to the highest standards as we work together to build greater levels of trust with all our stakeholders. GISTM’s role in driving continuous improvement across the industry with full transparency is beyond doubt.”

Glencore Glencore also reported its conformance to GISTM for its tailings storage facilities with ‘very high’ or ‘extreme’ consequence classifications.

“We have taken a rigorous and technically robust approach to applying the GISTM, which goes beyond self-assessments and includes independent third-party assurance,” Glencore said.

“We welcome the greater transparency it has brought around the management of these important facilities. We are pleased with the progress we have made over the last three years.

“Based on our ongoing tailings storage facilities management systems and independent third-party assessments we have in place for our tailings storage facilities with ‘very high’ and ‘extreme’ consequence classifications, we believe that any gaps in conformance are identified and managed appropriately.”

Tailings are an important part of a mine’s lifecycle. But it is equally important that such a key aspect of mine waste management be properly maintained to avoid major consequences to the environment. AM

GISTM HAS MEANT A STEEP CHANGE IN HOW THE INDUSTRY MANAGES ITS TAILINGS FACILITIES. GOOD TAILINGS

MANAGEMENT IS ALSO ABOUT TRANSPARENT PARTNERSHIP, AND WE HAVE BEEN WORKING WITH THE LOCAL COMMUNITIES NEAR OUR FACILITIES TO INCREASE AWARENESS OF OUR MANAGEMENT PRACTICES AND HOW WE CAN BEST WORK TOGETHER TO

CONTINUE TO KEEP PEOPLE AND THE ENVIRONMENT SAFE FROM HARM.”

THIS YEAR HAS SEEN A PATTERN OF TAKEOVER OFFERS AND ACQUISITIONS AS ASX-LISTED MINING COMPANIES WORK TO EXPAND THEIR PORTFOLIOS.

Takeovers. Mergers. Acquisitions.

These words are making headlines in the resources sector seemingly every week in 2023 – so much so it’s hard to keep track of them all.

Australian Mining takes a closer look at three of the latest acquisitions completed in 2023.

Genesis Minerals put forward its offer for St Barbara’s Leonora gold assets in WA in mid-April.

The offer involved total consideration of $600 million, comprising of $370 million upfront cash, $170 million Genesis scrip, and $60 million Genesis scrip contingent upon first production of the Tower Hill project.

“The acquisition of St Barbara’s Leonora assets will position Genesis as a gold industry leader with a dominant position in WA’s world-class Leonora district,” Genesis managing director Raleigh Finlayson said.

“We look forward to integrating the assets and unlocking the significant synergies available in Leonora.

“Shareholders will ultimately reap the long-term benefits of more production at lower cost and lower risk from this prolific mining district.”

The purchase was initially unanimously recommended by the Genesis board, subject to no superior proposal emerging. However, another proposal by Silver Lake Resources emerged the following month.

Genesis responded by increasing its bid by five million shares, resulting in Silver Lake being unsuccessful in

engaging with St Barbara, despite its offer having considerably higher dollar value than the one from Genesis.

Silver Lake’s offer did not feature contingent consideration and was valued to $732 million (according to Silver Lake’s valuation), of $326 million in cash and 327.1 million of its ordinary shares.

St Barbara’s agreement with Genesis included reciprocal exclusivity arrangements, which included ‘no shop’, ‘no talk’ and ‘no due diligence’ obligations, and was subject to customary ‘fiduciary out’ exceptions in respect to the ‘no talk’ and ‘no due diligence’ obligations.

St Barbara ultimately rejected Silver Lake’s offer because it felt it wasn’t superior to Genesis’ proposal, and it didn’t satisfy the ‘fiduciary out’ exceptions to the ‘no talk’ and ‘no due diligence’ obligations.

But Silver Lake didn’t give up without a fight, increasing its bid to $722 million less than a week after Genesis increased its scrip component to $604 million compared to Silver Lake’s $614 million.

St Barbara indicated it would accept Genesis’ increased offer due to it being legally binding and fully funded. It did not respond to Silver Lake’s increased offer.

“Since the announcement of the Genesis proposal on April 17, Silver has provided two advanced and fully funded proposals to the St Barbara board,” Silver Lake said in a statement at the time.

“The improved Silver Lake proposal provides equivalent cash consideration to the Genesis proposal, in addition to continuing to provide St Barbara shareholders with immediate exposure to a larger gold business.

“Silver Lake confirms it remains ready and willing to engage with the St Barbara board to explore a transaction that has the potential to be beneficial to both sets of shareholders and create a genuine mid-tier gold producer with immediate gold production.”

Silver Lake’s offer may have been higher, but St Barbara remained committed to the Genesis deal that was on track for June 30.

“The binding Genesis transaction is fully and definitively documented, fully funded by a committed $400 million capital raising, not subject to due diligence, supported by a $25 million deposit and has received indications of support from 49 per cent of Genesis’ register,” St Barbara chair Kerry Gleeson said.

“Silver Lake’s latest proposal would still require termination of the binding Genesis transaction before the satisfaction of conditions attached to the Silver Lake proposal, including a Silver Lake shareholder vote.

“Silver Lake has waited until the 11th hour to demand that St Barbara entertain a disruptive and unrealistic two-week due diligence exercise without any indication that Silver Lake shareholders would ever approve the proposal themselves.”

Silver Lake then further revised its offer by improving conditionality.

“The implied value of the Silver Lake proposal is $718 million, comprising $370 million in cash and 327.1 million Silver Lake shares valued at,” Silver Lake said.

The St Barbara board continued to recommend that its shareholders vote in

favour of Genesis’ offer, saying there was “no material improvement in Silver Lake proposal for Leonora, which remains highly conditional”.

“Silver Lake has provided no evidence that there would be sufficient support from its shareholders to approve a transaction. Providing Silver Lake with access to due diligence would potentially expose St Barbara to a termination of the binding transaction agreement with Genesis,” St Barbara said.

Later in June, Genesis’ shareholders overwhelmingly voted in favour of the transaction and by early July St Barbara’s Leonora assets had been acquired by Genesis – with Finlayson describing the transaction as creating a leading Australian gold house that is fully focused on Leonora.

“Most importantly, we can now get on with the job of unlocking the unique synergies and delivering the long life, ‘margin over ounces’ Leonora business plan we have clearly articulated to shareholders,” Finlayson said.

Following its successful takeover of Breaker Resources, Ramelius Resources didn’t show signs of slowing its efforts in expanding its gold portfolio.

Early July saw Ramelius and Musgrave Minerals enter into a bid implementation agreement (BIA), in accordance with what Ramelius would offer to acquire all the issued ordinary shares of Musgrave through a cash and scrip off-market takeover offer.

Under the terms, Musgrave shareholders would receive one Ramelius

share for every 4.21 Musgrave shares held, plus $0.04 in cash for every Musgrave share held.

The offer values each Musgrave share at $0.34, based on the one-day volume weighted average price of Ramelius shares of $1.263 on June 30, and implies a total undiluted equity value for Musgrave of approximately $201 million.

The Musgrave board unanimously recommended that its shareholders accept the offer in the absence of a superior proposal.

Ramelius said it has the financial capacity, operational experience and exploration expertise to continue the work done by Musgrave, with a view to expanding the existing mineral resource and developing the WA-based Cue

project to maximise its value for both sets of shareholders.

Ramelius managing director Mark Zeptner said the company looked forward to welcoming Musgrave shareholders into Ramelius and encouraged them to accept the offer.

“Subject to the offer being successful, Ramelius is looking forward to continuing drilling across the tenement package to expand the existing resource, and ultimately developing the Cue project into a high-grade satellite mine for the Mt Magnet production centre to maximise value for all shareholders,” Zeptner said.

Musgrave Minerals managing director Robert Waugh said the company’s board was pleased to endorse Ramelius’ cash and scrip offer.

“Ramelius is a reputable and wellrespected WA gold miner with a track record of operational excellence and delivering strong capital returns for shareholders,” he said.

“We are confident that the Cue project will be in good hands, should the offer be successful.

“We would look forward to seeing the project contribute to the ongoing success of Ramelius’ Mt Magnet operations.”

The BIA took effect as Musgrave knocked back a competing offer from Westgold Resources.

In early June, Musgrave’s board unanimously urged shareholders to reject Westgold’s takeover offer for an implied value of $177.3 million, equal to one Westgold share for every 5.37 of Musgrave’s shares.

Westgold said this offer represented a 30.5 per cent premium to Musgrave’s five-day volume weighted average price at the time.

“The combination of Musgrave’s assets with our regional infrastructure and operating teams will fast-track and de-risk the development of Musgrave’s Cue gold project and provides shareholders immediate exposure to a much larger, established WA gold producer,” Westgold managing director Wayne Bramwell said.

In rejecting the offer, Musgrave’s board cited factors such as the offer being opportunistic, highly conditional and uncertain given Musgrave’s potential. The board told shareholders that Westgold’s interest affirmed the Cue project’s quality.

financially robust project,” Musgrave non-executive chairman Graham Ascough said.

In early July, Westgold advised the market that it did not intend to increase its takeover offer for Musgrave in the wake of Ramelius’ superior offer.

Wyloo Metals, owned by WA mining magnate Andrew Forrest, first made an $760 million on-market takeover offer for Mincor Resources in late March.

Wyloo was already Mincor’s largest shareholder with a 19.9 per cent stake, but a full takeover would involve Wyloo gaining control of Mincor’s Kambalda concentrator that supplies BHP’s nickel smelter in Kalgoorlie, WA.

“The offer price of $1.40 cash per share implies an equity value for Mincor of approximately $760 million on a fully diluted basis and represents a 35 per cent premium to the closing price of Mincor shares on March 20, the last trading day prior to this announcement, of $1.04 per share,” Wyloo said at the time.

The Mincor board recommended that its shareholders take no action towards the offer until they received the directors’ formal recommendation, which was granted in late April.

However, a week after Wyloo made its offer, quality issues were found after nickel supplied by Mincor to BHP’s Kambalda concentrator did not meet necessary standards.

Mincor was seeking discussions about amendments to the off-take terms to provide it with ongoing flexibility regarding product specification requirements, and certainty to its ability

agreement specifications.

“Given the lack of certainty regarding future acceptance of any off-specification product and the incomplete status of potential solutions, Mincor has decided to withdraw its guidance,” Mincor said.

Mincor said it would continue to deliver on-specification ore to BHP as the companies worked together to improve orebody knowledge. It would also stockpile any off-specification and will blend it with other Mincor ore sources at a later date.

offer was its “best and final” and it would not be increased in the absence of a competing proposal..

“Wyloo notes Mincor’s operations and guidance update announced to the ASX and confirms that it was unaware of the material information contained within that announcement,” Wyloo said.

“As a result of these developments, Wyloo has determined that the current offer price of $1.40 per share is best and final and will not be increased, in the absence of a competing proposal.”

A month later, Wyloo extended the offer period for its on-market takeover bid to May 22, unless the offer was further extended or withdrawn altogether. Wyloo the following week announced a final extension notice to July 5.

“Wyloo confirms its intention that if it acquires an interest and voting power in 90 per cent or more of Mincor and is entitled to proceed to compulsory acquisition of Mincor, it will proceed with compulsory acquisition and seek to have Mincor removed from the official list of the ASX,” Wyloo said in a statement, urging remaining shareholders to sell their shares before Mincor was delisted.

Mincor echoed similar sentiments.

“The Mincor board reiterates that no potentially superior proposals were under consideration at the time of the target’s statement and none have emerged since,” the company said in late June.

Wyloo proceeded with a compulsory acquisition in late July, saying the deal would turn it into an integrated nickel producer.

“Combined with its Canadian assets, Wyloo’s nickel portfolio now boasts an impressive combination of production, processing, development and exploration projects – all in the Tier 1 jurisdictions of Australia and Canada,” Wyloo said.

In early August, Wyloo Metals chief executive Luca Giacovazzi said the quality issues were under control.

“Our blending is a lot better now,” he said. “We haven’t had a delivery rejected by BHP since we acquired the business.” New takeovers and acquisitions will no doubt continue to make waves, and the resources sector will have to see how plays out in the final months of 2023. AM

Minova offers a full portfolio of solutions for underground operations including; ground support, underground infrastructure and maximising ore recovery. We work with you, to ensure the best outcome for your mine

MEET US AT GROUND SUPPORT 2023

BOOTH 2 | 10 - 12 OCTOBER | PERTH WA

THIN SPRAY LINERS & SHOTCRETE

ROCK BOLTING & ANCHORING CAVITY FILLING

STRATA CONSOLIDATION & WATER SEALING

PROJECT APPLICATIONS TEAM

SPECIALTY MINING GROUTS

WYLOO METALS HAS UNDERLINED ITS STANDING AS A KEY PLAYER IN THE NICKEL SPACE.

yloo Metals made a statement of intent after acquiring Mincor Resources on its path to becoming an integrated nickel producer.

The acquisition means Wyloo Metals has a nickel portfolio that spans production, processing, development, and exploration projects in the Tier 1 jurisdictions of Australia and Canada. Australian Mining sat down with Wyloo Metals chief executive officer Luca Giacovazzi to discuss the acquisition and what it means for the future of the company.

Could you tell us about the company’s background?

We were created about four years ago to look at metals that would play a role in the decarbonisation story and that theme. Over the years, our portfolio

WWe have a couple of exploration projects in Western Australia and Quebec (Canada). And outside of that we run an investment portfolio, with Hastings Technology Metals and Greatland Gold being the two main ones.

Can you take us inside the Mincor acquisition?

With Mincor, it’s funny that it officially came after Eagle’s Nest (in Canada) but, really, it actually came before because we’ve always been a large shareholder in Mincor.

We made our first Mincor investment in 2018 and during the recent acquisition, which reached 90 per cent, it was really coming kind of full circle back to one of the first investments we had made.

It was all around the theme of nickel sulphides.

The reason we’re so interested in that

Eagle’s Nest but also brought us back to Kambalda (WA) and Mincor.

Now we’ve got this unique portfolio where we’ve got a producing nickel area and a great development project in Canada with Eagle’s Nest.

What will change at Mincor after the acquisition?

The team in the mines are really starting to find their rhythm, which is great. When you see a mine running well it is a beautiful thing; it’s like watching ballet dancers where everything is in sequence.

The main thing that changes for Mincor is a mindset shift because they’ve come from being a junior mining company to one that’s now quite focused on growth.

That’s going to be quite a big shift for them but I’ve been pleasantly surprised with the enthusiasm they’ve had for it.

We love that Kambalda is such a prolific nickel base and it’s got so much

(definitive feasibility study) that they’ve been mining towards which will continue.

The only thing is we would love to go through the portfolio and review some of the old mines that were closed, but it’s not too much of a deviation from what Mincor is already doing.

Why was it important to make these acquisitions now?

When it comes to nickel sulphides, you’ve kind of got to hit the nail on the head because they’re scarce and they’re quite difficult to explore for.

When you think about the nickel sulphides development projects around the world, you can almost count them on one hand. So when we were looking into the space, the first step was that we saw a growing market for it and then we had to look at potential sources of nickel could come from.

We like the sulphides because it is a shorter, less energy-intensive path to a battery material, which makes it better suited over laterites that are really more suited to the stainless-steel sector and that has historically been the market for those.

We wanted whatever we were doing as a mining company to make a difference and support the world’s

journey to decarbonisation, and that led us down this path. We’ve really started to delve deep into that in the last couple of months.

What might people not understand about the market?

I am not sure a lot of people appreciate how the nickel market is structured, and I think it’s the bit that has always made me really interested in the space.

When I think about the lithium market and the opportunity that’s happening in electric vehicles and how big that market is, we’ve got to remind people we make 80 million cars a year, it’s a multi-trillion dollar market that is being disrupted.

It’s not a small market and that is what we’re trying to feed into. It’s probably one of the biggest markets in the world that is being disrupted.

It doesn’t happen often in lifetimes; it’s a huge economic shift.

Lithium is really starting at a zero base and is having to build itself up to become a bulk commodity, but with nickel there is already a big market.

Nickel is not coming from a zero base, but it is certainly heading into a world where it is materially undersupplied and that’s what makes us really interested in it.

What will be the major shifts in the market?

You’ve seen the mad scramble to lock up these commodities and lock up supply.

With electric vehicles, we’re talking about single-digit percentages now, but when the world phases out internal combustion engines there will be a mandate for car companies to shift, and how much nickel is required to meet that shift is incredible.

And that’s just talking about electric vehicles, not the world’s journey to decarbonise more broadly. The shift to greener economies is huge.

I think that is what the world and politicians are really starting to

understand, that the shift won’t happen without minerals.

So I think that is a major opportunity for the mining sector to rewrite the narrative where we’ve probably allowed ourselves to be branded as part of the problem, but really we’re a big part of the solution.

How can Australia take advantage of the decarbonisation shift?

This change in the world, the decarbonisation shift is the biggest shift in the economy since the industrial revolution.

That only happens once in a lifetime, so I think as Australians and policy-makers we need to make sure we are taking advantage of this opportunity.

We’ve got an advantage over everyone else in the world because we’ve got such a strong mineral endowment, so we need to position ourselves to take advantage.

I always think about it as step one to doing something more potentially, and if we take that first step maybe we can be pioneers.

We should never underestimate what Australia can achieve if we’re brave enough to have a crack at these things. AM

WHEN IT COMES TO NICKEL SULPHIDES YOU’VE GOT TO HIT THE NAIL ON THE HEAD BECAUSE THEY’RE SCARCE, THERE AREN’T A LOT OF THEM, AND THEY’RE QUITE DIFFICULT TO EXPLORE FOR.NICKEL ORE FROM THE KAMBALDA OPERATION IN WA.

On November 1 2022, the global mineralprocessing-related business of the Schenck Process Group, SP Mining, was acquired by global high-tech engineering group Sandvik AB.

Sandvik AB provides enhanced productivity, profitability and sustainability solutions to the manufacturing, mining and infrastructure industries through its three business areas: manufacturing and machining solutions, mining and rock solutions, and rock processing solutions.

Each area has several divisions that are responsible for the research and development, production and sales of its respective products and services.

Since the acquisition, Sandvik has been focused on bringing together its expertise in crushing with the screening, feeding, weighing and loading knowhow of Schenck Process Mining.

According to Sandvik, the union between its rock processing solutions business area and SP Mining will allow

it to provide even more value to the mining industry.

SP Mining president Asia Pacific Terese Withington said the scale of Sandvik’s operations and commercial reach will help to accelerate the combined innovation portfolio of Sandvik rock processing solutions and SP Mining.

Withington said the company aims to deliver even better digitalisation, sustainability and productivity solutions.

“Since we became part of Sandvik’s rock processing solutions business

late last year, we have been working through the integration process which will eventually see SP Mining

become a seamless part of the Sandvik organisation,” she said. “Our Australian operations are the largest part of SP Mining’s global business, employing around 450 industry professionals. As such, Australia is playing a key role in the overall integration.”

The company reached a significant integration milestone in August with around 50 of its Australian employees moving from their combined sales, engineering, services, and research and development facility in Beresfield, New South Wales, to the Sandvik Hunter Valley site in Heatherbrae.

The Heatherbrae complex houses several Sandvik divisions and, according to Withington, the move provides excellent opportunities for the business.

“The scale of the Heatherbrae complex is impressive,” she said. “It caters well to the needs of our people as well as to our future growth ambitions.

“This is a very positive move, which will bring our people even closer to our customers in the Hunter region.

“As we move through our integration, we continue to look forward to servicing the needs of our customers and remain fully focused on the delivery of highquality equipment, consumables, OEM spare parts and services to help them achieve their business objectives.” AM

THE SCALE OF THE HEATHERBRAE COMPLEX IS IMPRESSIVE. IT CATERS WELL TO THE NEEDS OF OUR PEOPLE AS WELL AS TO OUR FUTURE GROWTH AMBITIONS.”SP MINING PRESIDENT ASIA PACIFIC TERESE WITHINGTON. L–R: BRIAN MORANTE, AARON MEREDITH, MARTIN BURGMAN AND RAMONA MYSLIWITZ.

Australian Mining managing director Jon Price to chat about the journey of RVT and what lies ahead.

How do you reflect on RVT’s journey since its ASX listing?

When we look back at the IPO (initial public offering), it was in quite a tough market. We got a lot of high-net-worth support, not as much institutional support as we would’ve liked but strong support from Horizon, who spun the project into its new life.

I think one of the biggest things is the thematic value of vanadium as a commodity and the opportunity for Australia to gain some significant market share in vanadium in the global market given it is a critical mineral.

I think there are several factors and there always are. It’s not like we’ve skyrocketed but the buying we are seeing is people getting on board the vanadium train and an understanding that there is money to be made and a new industry to create.

How did an early pre-feasibility study benefit the company?

It’s very unusual for a company to IPO with a PFS (pre-feasibility study) already done, because normally they have to raise money to get a PFS done but we did a farm out to create an earn-in joint venture with a private company.

RICHMOND VANADIUM IS AIMING TO POSITION AUSTRALIA AS A MAJOR VANADIUM PLAYER. AUSTRALIAN MINING SAT DOWN WITH MANAGING DIRECTOR JON PRICE TO DISCUSS A NEW PROJECT.

It attracted a lot more risk-tolerant investors because they saw there was a financial model and they saw financial metrics so it essentially de-risked the IPO a bit and offset that a lot of people are still coming up the learning curve on Vanadium.

How is the year shaping up for RVT?

We’re in a rapid expansion phase where we want to have the project up and running and take the first mover advantage and kickstart not only the vanadium mining industry but also the electrolyte-making industry and batterymaking industry in this country.

We’ve got a big window of opportunity because the Queensland Government is incredibly supportive and the increasingly supportive Federal Government deploying funds in the critical mineral space and particularly into the thematic space, and while the window of opportunity is there we want to make the most of it.

We want to create a value chain that stays in the country for a change from raw material to end product. That’s what our driver is.

It’s pretty refreshing for this country, which is known for shipping bulk material offshore and buying it back at a lot higher price as you go downstream.

Australia’s vanadium resources are the third highest in the world and Australia’s reserves are the second highest in the world, but we don’t produce a kilogram of it. So it’s high time that changed and we’re working hard to be part of that solution.

a concentrate and we’re able to get our concentrate grade up very high because of the nature of the material.

The issue we must face is calcium. There are a lot of shells and ancient calcium that we must deal with.

Are there misconceptions about Australia’s abilities in this space?

I think what’s not recognised is Australia’s competitive advantage all the way along the supply chain.

Take us

It sits in north-west Queensland between Townsville and Mount Isa, which is essentially an ancient shoreline.

So it’s unique in its location and how it was formed. It’s called supergene enriched vanadium oxide deposit. Most of the world’s and Australia’s resources are titanium magnetite hard rock, which has a completely different processing pathway and a completely different concentration pathway.

We are a shallow, easy mining exercise with simple processing, which is essentially physical separation to get

product to electrolyte to battery, and we’re already doing it.

It’s more of a scaling-up exercise. It’s not like we don’t have the technology.

At the moment, they’re importing vanadium at a much higher price than we’re going to be selling, so that’s the dynamic.

It’s not like iron ore, that’s a different kettle of fish, it’s not like aluminium where you need billions of dollars’ worth of infrastructure.

Vanadium is working right now. There are a lot of brilliant electrical companies building gensets, building battery backs, they’re already doing the work.

Our partners have a codified design of the steel sack, which we want to on-sell to anyone that wants to make batteries and get into the space, because that’s going to lead them onto the grid, fix the grid and get Mum and Dad’s power bill down.

How does the global vanadium market look?

China produces 40,000 to 50,000 tonnes of the 140,000 tonnes globally. They dominate production in terms of scale, but they also dominate in terms of electrolyte-making and battery-making.

What I mean by China controlling the market is they’re net importing now whereas they used to control the market because they had a lot of export.

South Africa is producing it, Brazil through Largo Resources is producing it, Russia is producing it, but we don’t really know there. It’s very opaque within China and Russia about what they’re doing. The market is ultimately quite opaque but is becoming more transparent as it becomes more global in its market share.

What is the outlook for the vanadium market?

The beauty of the vanadium battery is it is all vanadium and it’s all liquid, there are no metal electrodes, and it is all liquid-to-liquid. That’s why they don’t catch fire because they don’t have any thermal runaway.

That’s why they last 30 years and the electrolyte is fully recyclable, it has an infinite life and doesn’t degrade. So the benefits for the grid to scale against other technologies are that it is safer and more economical as you scale up.

It has a 100 per cent discharge capacity and it is a fantastic safe and very economically competitive alternative for grid-scale energy.

Demand is going to double globally in the next three or four years to at least 300,000 tonnes, and we want to be able to meet that supply or be part of the solution for meeting that supply.

Australia could potentially have a 40 per cent market share, and that’s where we should be aiming. AM

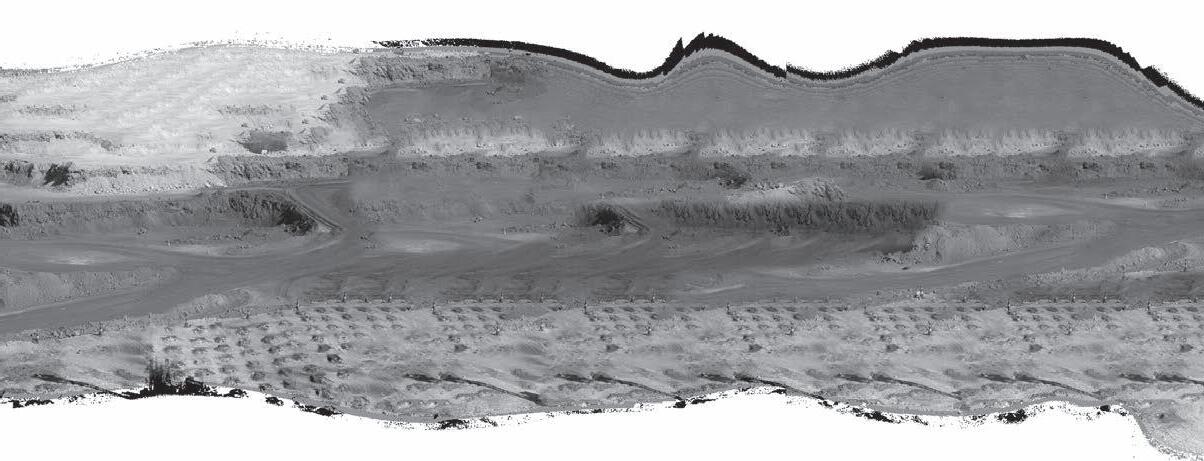

The mining industry is one of the main pillars of economic growth in Papua New Guinea (PNG), which is home to many new and exciting project developments.

Miners with PNG operations are on the path to potentially see great success.

Newcrest

The Australian miner wholly owns its Lihir gold operations located in Niolam Island, 900km from the PNG capital of Port Moresby.

Lihir is one of the world’s largest producing gold mines, with ore reserves of 22 million ounces (Moz) of gold and measured and indicated mineral resources of 42Moz.

The project’s pre-feasibility study for Phase 14A was approved by the Newcrest board in late 2021, which the company described as a “key milestone towards realising the full potential of (the) operational asset”.

Lihir’s Phase 14A aimed to bring forward higher grades to improve gold production and operational flexibility by establishing an additional independent ore source at the site.

Newcrest continued to progress the Phase 14A feasibility study during the 2022 financial year (FY22) with ground support, drainage works and shotcrete works completed, and the procurement of mobile fleet equipment, specialised civil engineering equipment and materials.

“Phase 14A is another step forward in realising the full potential of Lihir with the cutback expected to deliver (approximately) 400koz (thousand ounces) of incremental high-grade gold production over the next four years from an additional ore source that is now well

supported by geotechnical drilling,” Newcrest said in its December 2022 quarterly report. “Ground support works continued in Bench 1 during the quarter and mining is well underway in Bench 2. First high-grade ore from Phase 14A is expected to be delivered from FY24.”

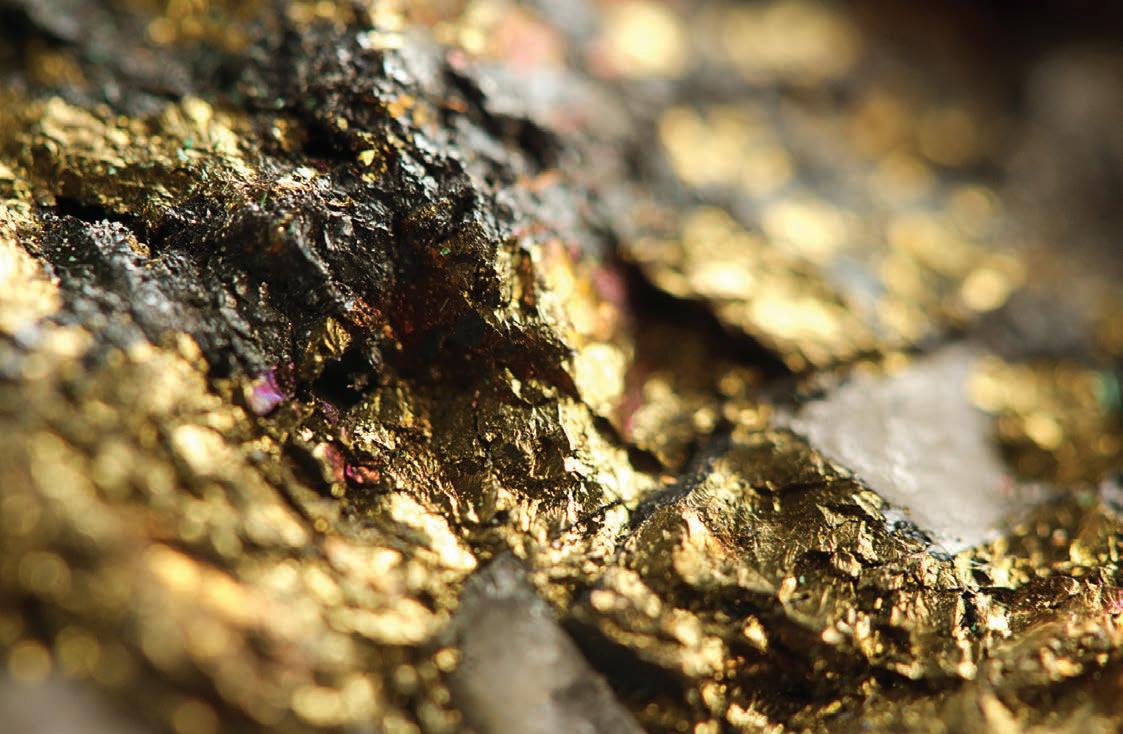

PAPUA NEW GUINEA HAS ALWAYS HAD A STRONG MINING PRESENCE. AUSTRALIAN MINING EXAMINES SOME OF THE LATEST DEVELOPMENTS.PNG IS ALSO HOME TO CONSIDERABLE COPPER RESERVES. MINING HAS LONG BEEN A MAJOR DRIVER OF THE PNG ECONOMY.

Lihir has continued to see great success in 2023, as was evident in Newcrest’s June quarterly report that included highlights such as a record safety performance with no recordable injuries for a second consecutive quarter.

“Newcrest’s all-in sustaining cost (AISC) of $1196 per ounce for the quarter was 20 per cent higher than the prior period, driven by higher capital expenditure mainly at Lihir,” Newcrest said in its report.

Gold production at the site equalled to 182koz, which was eight per cent higher than the previous period due to higher gold head grade and higher mill throughput.

Lihir’s overall performance was below expectations, however, with mining and milling operations affected by extreme rainfall following a prolonged period of drought.

“Medium-term weather forecasts indicate that rainfall levels in the September 2023 quarter will be more aligned with the long-term average,” Newcrest said in its June quarterly report.

“As a result, mining volumes are expected to increase in FY24, supported by the ongoing benefits from the mine improvement program and further productivity improvements with two new large shovels expected on site in the September 2023 quarter.

“Lihir’s AISC of $1555 per ounce was 16 per cent higher than the prior period mainly due to higher sustaining capital expenditure, including mobile fleet procurement. This was partly offset by lower site operating costs for the quarter, with higher spend in the prior period relating to the bi-annual plant shutdown in March 2023.”

The PNG Independent Consumer and Competition Commission (ICCC) also recently granted clearance for US gold giant Newmont to proceed with its acquisition of Newcrest.

“We appreciate the ICCC in Papua New Guinea carefully reviewing and clearing our proposed acquisition of Newcrest,” Newmont chief executive officer Tom Palmer said.

“We remain committed to building strong, mutually beneficial and longlasting relationships with PNG’s government and local communities.”

Following the recent sale of its Australian-based Leonora assets to Genesis Minerals, St Barbara appears to be focusing elsewhere for gold.

Its Simberi operation, located in the PNG province of New Ireland, has delivered strong results for the gold miner and is projected to improve over time.

“Simberi produced 25,189 ounces of gold in the quarter, 55 per cent higher than the March quarter and the best production quarter since Q4 June FY20,” St Barbara said in its June quarterly report, while adding that the Simberi operations delivered 78,320 ounces of gold for FY23.

The June quarter’s ounces were produced at an elevated average milled

“Grades were higher compared to the previous quarter due to better grade ore zones that outperformed against model expectations,” St Barbara said.

This result was achieved within the FY23 guidance of 70,000–80,000 ounces and an AISC of $2208 per ounce.

St Barbara’s June 2023 quarter report also noted that results from the Simberi operations were the highest it had recorded in FY23, with it being its highest production quarter since the June 2020 quarter.

It also generated $3 million in operating cash flow, its third consecutive quarter of positive cash flow.

“St Barbara is now well capitalised to focus on advancement of the strategy to realise value from the development potential at each of Simberi and Atlantic, and I look forward to this next important phase,” St Barbara managing director Andrew Strelein said.

The Caterpillar (Cat) supplier’s journey in PNG began in 1949, and Hastings Deering delivers Cat products and services to the region’s mining industry.

The company operates across six PNG sites: Kimbe, capital of the West New Britain province; Kokopo, capital of the East New Britain Province; Lae, capital of Morobe Province; Lihir Island, largest island in the Lihir group of islands; Tabubil, in the Star Mountains area of the North Fly District of the Western Province; and the national capital of Port Moresby.

Hastings Deering employs 300 people across these six PNG operations.

“Since our journey began in Papua New Guinea in 1949, Hastings Deering has been delivering quality Cat products and services to our customers,” Hastings Deering said.

“Today we supply premium equipment and services to a range of industries, including mining, construction, forestry, materials handling and government.

“Technology is also allowing us to make significant improvements to our

downtime and get the best out of their machines.”

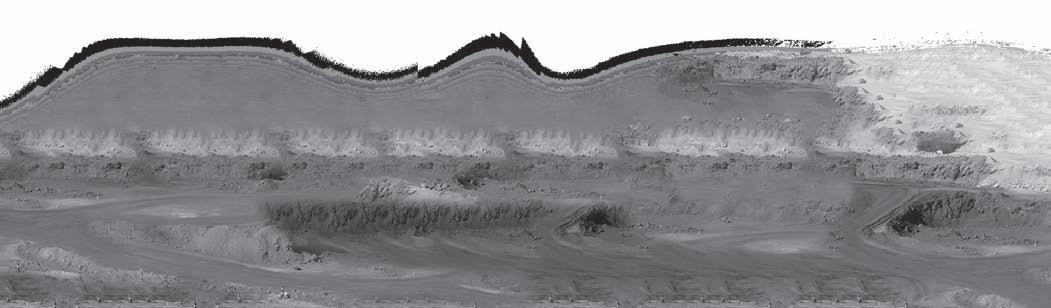

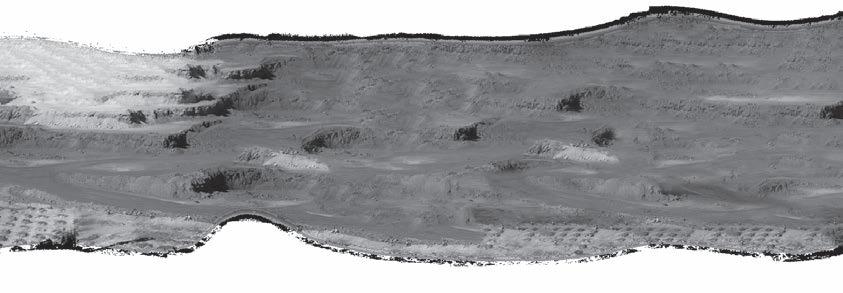

Located in the country’s Western Province, Ok Tedi is the longest running open-pit copper, gold and silver mine in PNG.

According to Ok Tedi Mining, which operates the site, up to 240,000 tonnes of overburden (waste rock) is mined each day from a pit covering about 2.6km2, and about 60,000 tonnes of ore is mined each day and delivered to the mill for processing.

Oki Tedi’s copper production was 13 per cent higher in 2022 than the previous year due to an increase of 11 per cent in ore milled, with 2021 affected by residual fire damage in late 2020.

The site’s gold production was 17 per cent higher in 2022 than the previous year, which was attributable to higher head grade and increased processing throughput, and its mine production (total material movement) increased by 10 per cent to 104.7 megatons (Mt), with COVID-related labour shortages experienced in 2021 largely addressed.

“Production levels are now back in line with pre-pandemic 2019 levels,” Oki Tedi said in its 2022 annual report.

Since acquiring the Kainantu gold mine in 2014 and restarting it in 2016, K92 Mining has been focused on its operation and expansion.

The Canadian-based gold miner has delivered six consecutive years of production growth, achieving 123koz of gold equivalent in 2022.

More recently, K92 Mining recorded strong June 2023 quarterly production of 30,794 ounces gold equivalent, 1.52 million pounds (lbs) of copper and 34,001 ounces of silver.

This represents an 18 per cent increase from K92 Mining’s June 2022 quarter and a 43 per cent increase from its March 2023 quarter.

June 2023 quarterly sales equalled to 28,141 ounces of gold, 1.65 million pounds of copper and 36,253 ounces of silver.

“The second quarter of 2023 has demonstrated that we have moved beyond the localised geotechnical challenges encountered in the second half of (the March quarter) and the initial part of (the June quarter), with the operation delivering near-budget production and showing that Kainantu production is well positioned for the balance of 2023,” K92 chief executive officer John Lewins said.

“As we have been guiding since the beginning of the year, the second half of 2023 is expected to be our strongest, driven by stope sequence and operational flexibility significantly increasing through the remainder of the year.” AM

Much like Australia, Alaska has established itself as a global gold mining hub, with several companies mining multi-million-tonne deposits across ‘the great white north’. What is it about Alaska that lends itself to gold prosperity, and why would an emerging Alaskan-focused exploration company be a worthwhile investment proposition?

Felix Gold managing director and chief executive officer Anthony Reilly said it best.

“The Tintina gold province, where our Treasure Creek project is located, has delivered 100 years of gold production throughout the area, so it’s quite prolific,” Reilly told Australian Mining.

“The Mine Discovery Fund (Felix Gold’s founding entity and largest shareholder) were really keen to be involved in this region, so the private

investment firm put a package together, which is now one of the largest claims holdings in the belt.”

Located next door to Kinross Gold’s multi-million-ounce Fort Knox gold mine, Felix Gold has established a simple strategy to discover, delineate, mine, and explore the potential to process with Kinross or toll treat its gold tonnes.

“Ideally, we won’t need to spend significant capital on processing

we wouldn’t be able to do that if we were of a commercial scale.”

The Fort Knox mine has a 16 milliontonne-per-annum mill that is operating at only 55 per cent capacity and receives a head grade of less than 0.65 grams per tonne (g/t) gold, considerably less than assays returned by Felix.

After commencing a maiden drill program at Treasure Creek in April 2022, Felix Gold announced it had made a discovery at the Northwest (NW) Array prospect in early August last year.

This included an 89.9m intersection at 1.2g/t gold from a depth of 32m, and 33.5m at 1.63g/t from a depth of 1.5m.

This seemingly opened the floodgates for more high-grade intersections at Treasure Creek, with a 3.1m at 9.92g/t gold intersection announced in mid-September 2022 and a 6.1m at 3.74g/t, including 1.5m at 8.73g/t gold intersection, announced later that month, as well as many more high-grade announcements to close out 2022.

infrastructure and building a new mill if we could partner with our next-door neighbours,” Reilly said. “And I don’t know what scenario would exist where

By the end of last year, Felix Gold had enough evidence to feel confident that a large-scale hydrothermal gold system was presenting in various clusters.

Treasure Creek had also shown the potential to host antimony, a globally

THE TINTINA GOLD PROVINCE, WHERE OUR TREASURE CREEK PROJECT IS LOCATED, HAS DELIVERED 100 YEARS OF GOLD PRODUCTION THROUGHOUT THE AREA, SO IT’S QUITE PROLIFIC.”A MAP OF ALASKA AND THE FAIRBANKS GOLD DISTRICT THAT INCLUDES THE TREASURE CREEK PROJECT. FELIX GOLD’S TREASURE CREEK PROJECT AREA.

recognised critical mineral used in the manufacturing of smartphones and computers. Antimony’s anticorrosion and fire-retardant properties also make it a key material for the defence industry.

Last year’s 14,000m drill program has enabled Felix Gold to calculate 3.6 million ounces of JORC-compliant exploration targets to underpin its 2023 drilling efforts, where an infill drill program commenced in May.

Felix Gold announced its second batch of assays from infill drilling in late-July, demonstrating the continuation of shallow gold mineralisation at NW Array, including a 30.5m intersection at 3.02g/t gold from a depth of 7.6m. Drilling had also intersected high-grade stibnite (the mineral that hosts antimony), including a 6.1m hit of more than five per cent stibnite (the upper limit of laboratory testing) from a depth of 30.5m.

Having completed the required exploration, Reilly said the goal for Felix Gold was to release a maiden mineral resource estimate this year.

“The infill drilling program has just completed and we’ll be receiving further assays back through August,” he said. “We’ll then interpret and model that data and we hope to release a maiden resource for Treasure Creek in the fourth quarter of this year.

able to put our stake in the ground and say, ‘This is what we’re starting with’.”

so far, with the release of its maiden resource Felix Gold is optimistic Treasure Creek has the endowment to support a bona fide gold-antimony

mine. It’s just a matter of discovering and delineating it.

Felix Gold also has a mining-friendly Alaskan Government by its side, as well as relevant infrastructure to tap into when Treasure Creek is mine-ready.

Reilly said given what is eventuating at Treasure Creek and the

profile of operating gold mines nearby, the project would likely become a bulk mining operation.

“We won’t be mining high-grade veins; Treasure Creek is a large system,” he said. “When you break it all down, it’s a bulk mining operation and it’s going to be mined right alongside a

high-capacity, high-throughput mill. Treasure Creek mineralisation is shallow near surface, so it’s open-pitable and quite cheap from an operating expense perspective.

“True to its name, our team is optimistic that Treasure Creek is going to deliver.” AM

ADAPTING EPIROC’S AUTONOMOUS PIT VIPER DRILL RIGS TO A MULTI-PASS COAL OPERATION SEEMED LIKE A TALL ASK AT FIRST, BUT THE SWEDISH OEM SILENCED THE CRITICS.

One million isn’t always a big number in the mining industry.

But in the case of a recent milestone for Epiroc and Thiess, it was a huge one.

The two companies recently celebrated a landmark moment at the Lake Vermont mine in Queensland, where Epiroc’s autonomous Pit Viper rigs drilled more than one million linear metres with no on-board operator. This is an achievement that included many firsts.

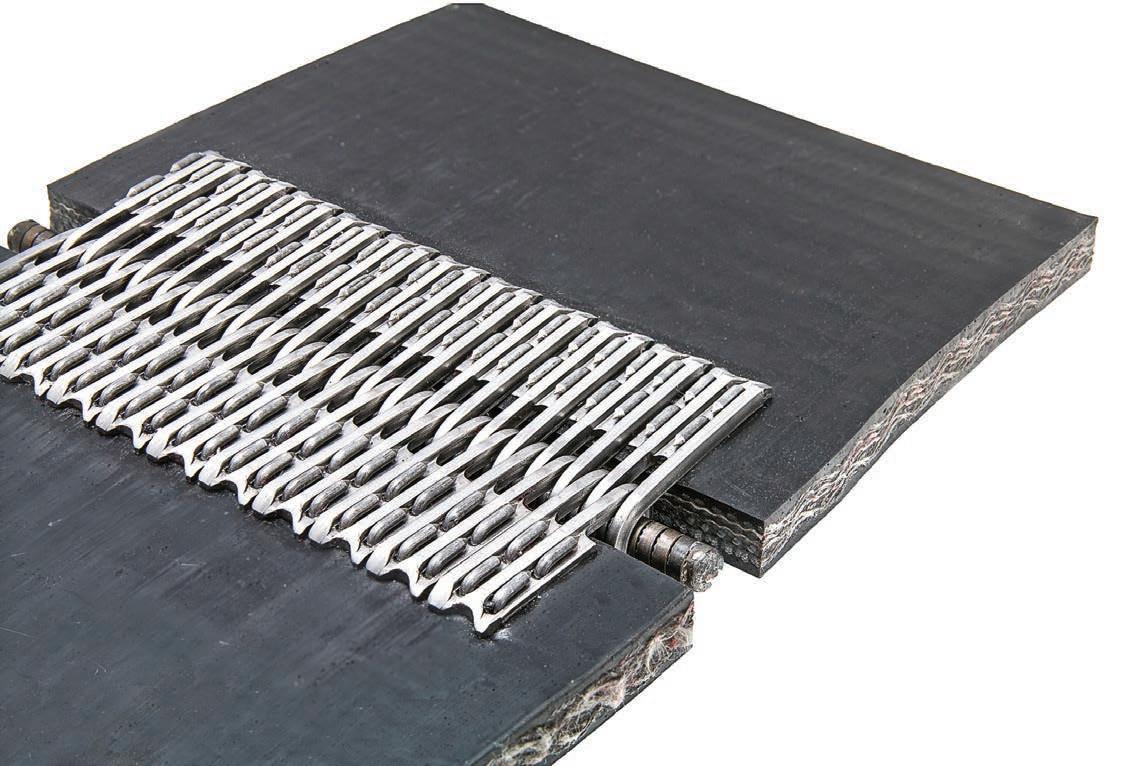

While Epiroc was the first original equipment manufacturer (OEM) to bring a fully autonomous drill rig to the mining market, Thiess was the first mining services provider to deploy an Epiroc Pit Viper fitted