Harnessing digitalisation for future success

How to harness digitalisation for future success

ifm started over 50 years ago as a sensor company that wanted to do things differently and make technology work for everybody. We’ve kept to this value and run our business as a family does – keeping close to our customers and focusing on a full solutions platform along with quality reliable products and customer service.

ifm started over 50 years ago as a sensor company that wanted to do things differently and make technology work for everybody. We’ve kept to this value and run our business as a family does – keeping close to our customers and focusing on a full solutions platform along with quality reliable products and customer service.

Our goal has always been to protect what’s important to our customers. This hasn’t changed. From mine to port, our automation technology has benefitted customers in the Australian mining industry for many years.

Our goal has always been to protect what’s important to our customers. This hasn’t changed. From mine to port, our automation technology has benefitted customers in the Australian mining industry for many years.

Smart Process instrumentation enabling data-driven decision making for condition-based maintenance.

Collision Awareness systems improving safety around heavy mobile equipment.

Lower your energy costs

Reduce product wastage

Improve efficiencies

Vibration Monitoring maximising asset operational uptime and minimising maintenance costs.

Gain a higher product quality

Reduce downtime

Anomaly Detection enabling enhanced predictive maintenance of critical assets

Sensor2Cloud to collect and monitor from remote assets.

Talk with our team about how we can help to: To

HANDLE WITH CARE

THE BEST IN BULK MATERIAL HANDLING

Rugged performance meets superior efficiency.

United. Inspired.

Scooptram ST14

Don’t let it’s compact size fool you. The Scooptram ST14 is a flexible and highly productive 14 metric tonne hauling rig for mid-sized operations. It comes packed with features that make it powerful yet fuel efficient - like the load-sensing variable displacement hydraulic pump and low emission EPA Tier 4 final/EU Stage V engine. Achieve maximum productivity thanks to the new transmission and best operator visibility in it’s class. Take your mining operations to new levels with the Scooptram St14. epiroc.com/en-au

PAUL HAYES paul.hayes@primecreative.com.au

TOWARDS A SUSTAINABLE FUTURE

IMARC 2023 GIVES MINERS THE IDEAL CHANCE TO COME TOGETHER TO COLLABORATE ON INDUSTRY TRENDS, INVESTMENT AND INNOVATION.

Entering its 10th year, the International Mining and Resources Conference (IMARC) has long been seen as a key international forum to facilitate continuous improvements and initiatives that are transforming the landscape of the industry.

“One of the great features of IMARC is how it brings out the best in a global industry that shares so many common challenges that can only be addressed at an industry level,” event director Paul Phelan said.

“It is therefore highly collaborative by nature and brings together a wide range of expertise and experience, sharing industry best practice and lessons learnt.

“Unlike many conferences, where it is about sitting and listening to speakers, IMARC facilitates meaningful discussions and leads to real partnerships and real solutions.”

This edition of Australian Mining shines a huge light on the country’s largest mining conference, set to take place in Sydney at the end of October, with a preview of the event, as well as a sneak peak of what many of the industry’s key players will be discussing and what they will have on display.

Described as the conference “where the most influential people in the mining industry come together, delivering ideas, inspiration and serving as a meeting ground for industry leaders”, this year’s IMARC is set to more than deliver on that promise.

CHIEF EXECUTIVE OFFICER JOHN MURPHY

CHIEF OPERATING OFFICER CHRISTINE CLANCY EDITOR PAUL HAYES Email: paul.hayes@primecreative.com.au

ASSISTANT EDITOR ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS KELSIE HARFORD

Email: kelsie.harford@primecreative.com.au

OLIVIA THOMSON Email: olivia.thomson@primecreative.com.au

Elsewhere in this issue, we train our spotlight bulk material handling.

It can sometimes be easy to forget that once all of those precious ores and minerals are taken from the ground they need to be moved from point A to point B (and usually far beyond).

That process can be a complicated and even dangerous one, and that’s why we look at the some of the latest innovations, techniques and products that make the process as smooth as possible.

We also hear from some of the industry’s key decision-makers, learn about a new BHP research project designed to address issues of workplace culture, and continue to cast our eye to the mining sector of Australia’s closest neighbour, Papua New Guinea.

FRONT COVER

Astec Australia is a fully integrated business that provides quality new and used equipment, original manufactured parts, service and maintenance, and training support to the mining and bulk materials handling sectors. Founded in 1972, Astec has been servicing the Australian region since 1995.

“Ultimately, our goal is to design and build state-ofthe-art equipment which makes it possible for our customers to supply their customers with industry-leading results profitably,” the company said on its website.

Paul Hayes Managing Editor“For our customers, we will continue to be the most innovative company in our industry, offering the world’s most advanced, productive, durable and environmentally friendly products, coupled with training and education, service and support that is far beyond anything offered by our competition.”

Cover image: Astec

TIM BOND Email: tim.bond@primecreative.com.au

CLIENT SUCCESS MANAGER JANINE CLEMENTS Tel: (02) 9439 7227 Email: janine.clements@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027 Email: jonathan.duckett@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au © Copyright Prime Creative Media, 2016

20 INDUSTRY INSIGHT

A record-setting year

While the 2023 financial year may have produced a mixed bag for mining, a number of key players reported impressive results.

26 DECISION-MAKER

Adapting to change

Australian Mining was on hand when Rio Tinto CEO Jakob Stausholm recently discussed the company’s past, present and future.

30 INTERNATIONAL MINING

Reaching across the Pacific

A trommel powerhouse

The MDS M515 mobile track trommel is the jack of all trades when it comes to clearing up a mine site.

54 BULK MATERIAL HANDLING

A paragon in energy-efficient conveying Fenner Conveyors is helping the mining industry decarbonise operations with its green series of conveyor products.

BULK MATERIAL HANDLING

Titan of industry

The new Titan side tipper truck unloader is designed to help remove inefficiencies in bulk material handling.

86 WORKPLACE CULTURE

Empowering on-site change

BHP is working with Monash University to improve physical and psychological safety at its South Flank mine in WA.

5

8

112

114

THE LATEST MINING AND SAFETY NEWS

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

THIESS SECURES $240 MILLION CONTRACT

AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

Thiess Group was awarded a $240 million nickel mining contract with PT Halmahera Sukses Mineral in Central Halmahera, Indonesia, in September.

The contract marks Thiess’ second successful venture in the Indonesian nickel market this year after securing the largest nickel player on Halmahera Island, Weda Bay Nickel.

“We are excited by this new contract award, which underscores Thiess’ expertise and strong track record in the Indonesian mining industry,” Thiess executive chair and

chief executive officer Michael Wright said. “It reaffirms our commitment to providing safe, sustainable and innovative solutions to our clients while contributing to the growth of Indonesia’s nickel industry, a metal critical to enabling the global energy transition.”

The mine is situated just 6km from another Thiess operation, which the company said will lead to the consolidation of its regional footprint and operational efficiency.

BELLEVUE CONTINUES TO SEE GOLD

Bellevue Gold encountered highgrade mineralisation while it conducted infill drilling in preparation for the start of mining at its flagship Bellevue gold project.

The Bellevue gold project is a historic gold mining operation located approximately 40km north of Leinster in the northern Goldfields region in Western Australia.

Infill drilling was conducted there in preparation for the start of mining. It has returned high-grade results from the Bellevue South area and the Armand Main area. At the upper Armand work area, five

development levels were opened, and long hole stoping was expected to start in early August. This area will contribute to a major portion of early stoping and development ore while access to the higher-grade Armand Main is established.

At the Bellevue South area, ore driving has started from the southern decline by focusing on developing the 1115 and 1095 levels. High-grade development ore has been intersected as expected in the resource model, with both levels encountering consistent zones of mineralisation.

During its three-and-a-half-year contract, Thiess aims to deliver full mining operations, including mine development, haul road construction, ore loading and hauling.

The company said it remains committed to operational excellence and contributing positively to the communities and environments in which it operates.

“This contract win aligns with Thiess’ strategy to diversify our commodities portfolio,” Thiess Group executive – Asia Cluny Randell said.

“Our focus on safety, technological advancement and inclusion sets us apart. We are excited to continue building strong partnerships in the Indonesian nickel sector.”

The company said it will continue its commitment to health and safety, with comprehensive measures to be put in place to ensure the safety and wellbeing of the team.

Thiess has also committed to continuing its dedication to diversity, equity and inclusion by launching its female operator training program, aimed at fostering greater female participation in the mining workforce.

“The Bellevue South lode is a significant component of the production schedule for the 2024 financial year (FY24). Alongside Bellevue South, the Armand, Marceline and Deacon work areas are the other contributors to the FY24 production schedule,” the company said.

“The mining ramp up is proceeding according to the schedule and stoping activities will provide ROM (run of mine) material in advance of gold production, which is expected to occur in the December 2023 quarter.”

Bellevue Gold managing director Darren Stralow said the results provide a valuable insight into what the company can expect as mining ramps up.

“The grades are well above those in the reserve estimation and demonstrate why we are very confident about meeting our key targets as we move into production,” Stralow said.

“The project remains comfortably on time, with first production set for the coming quarter, and our focus is on meeting our targets and ramping up in line with our strategy.”

DOLPHIN TUNGSTEN MINE REOPENS

The Dolphin tungsten mine officially re-opened in August after being closed for three decades.

The mine is located near Grassy, a town on the south-east coast of King Island in the Bass Strait between Victoria and Tasmania. It first operated between 1917 and 1992, but closed due to low tungsten prices, with approximately 50 per cent of the known mineral resource unmined.

Group 6 Metals, an Australian resources exploration and development company, has since recommenced operations at the mine and began commercial

production of tungsten concentrate this year.

Tasmanian Resources Minister Felix Ellis said the reopening of the Dolphin mine has been years in the making.

“With around 95 full-time jobs expected to be supported through this operation, the mine will be King Island’s single biggest employer, keeping roofs over the heads of local families and meals on their tables,” Ellis said.

“It also provides a further economic boost to the local community with flow through to local businesses. Around $5 million will

go into the local economy directly through salaries alone and, for the broader state, around $30 million is expected to be returned to the Tasmanian taxpayer through mining royalties and other payments.”

Ellis said tungsten is a critical mineral due to the fact it is essential for steelmaking, electronics and defence manufacturing, to name a few areas.

“The Dolphin mine is known for hosting the highest-grade tungsten deposit of significant size in the western world,” Ellis said. “In recent years, the tungsten prices have surged significantly, and it is now

classified as a critical mineral by the Australian Government, and others globally.

“The world cannot do without critical minerals, and Tasmania is blessed to have a number of these minerals in abundance. This is also exactly why Tasmania is supporting industry by developing our own critical minerals strategy.”

The Australian Bureau of Statistics announced in June that exploration expenditure in Tasmania had grown significantly, with the latest ABS data showing $44.5 million was spent in the 12 months to March 2023.

August, appointing Rob Brauer, Jason Preston and Rob Kirman as receivers and managers.

The three receivers assumed control of the Kalium Lakes operations, which are set to continue on while an assessment of sale or recapitalisation options is undertaken.

Cheryl Edwardes, Brent Smoothly, Simon Wandke, Robert Adam and

non-executive directors following the announcement.

“The strategic process announced by Kalium Lakes on June 14 2023 is well progressed with wide interest received,” the company said in a statement.

“The receivers will continue the strategic process and immediately pursue the conclusion

process concludes.”

Kalium Lakes delivered the first batch of sulphate of potash (SOP) at its Beyondie project in Western Australia in what was believed to be an Australian first in October 2021.

“Kalium Lakes has delivered another major milestone for the Beyondie SOP project, producing

2014,” Kalium Lakes then-chief executive officer Rudolph van Niekerk said at the time.

“It has been a remarkable journey to reach this stage and we thank everyone who has contributed to the success of the project during the past seven years, particularly our longterm shareholders, management team and employees.”

BHP EXPLORES FOR MORE ORE

BHP and mineral scanning technology company Orexplore Technologies will collaborate for a field deployment at the Carrapateena copper mine in South Australia.

Valued at $1.55 million, the agreement will see Orexplore deliver site-based drill-core and sample digitisation services. The work will focus on unlocking new rock mass characterisation and geomatallurgical information to advance short- and medium-term mining and operational planning and decision processes.

As part of the agreement, Orexplore will utilise its Smart Domaining (SDM) solution to improve orebody knowledge across the site.

“We are proud to be deploying our technology into BHP’s Carrapateena mine and excited to continue our work with BHP’s team,” Orexplore managing director Brett Giroud said.

“Orexplore is working in close collaboration with the BHP team that is leading the way in the successful adoption of transformational technologies such as the Orexplore

technology platform. We are advancing our mission to improve the sustainability of the mining industry through delivering new technology tools to the field in support of geology and mining professionals transforming their processes and ways of working.”

Orexplore will work with the BHP operations team to embed new information flows into the processes and systems as part of the installation of three GeoCore X10 units at the site.

“This agreement further demonstrates increasing global demand for non-destructive, 3D information sourced rapidly from the field to inform decision processes, drive traditionally siloed collaboration around digital models, and create value within an operating mine,” Giroud said.

“This unique combination powers the company’s broad solution suite that is delivering new value to customers, from exploration to ESG solutions.”

Horizon Minerals and Dundas Minerals have entered into a binding agreement to acquire the Windanya and Baden-Powell/Scotia gold projects in the Kalgoorlie region of WA. Dundas Minerals has also made an application to acquire three prospecting licenses in its own right, contiguous to Horizon’s Banden Powell/Scotia tenements.

“The option to acquire these advanced stage gold exploration

projects in the Kalgoorlie region of Western Australia is an exciting opportunity for Dundas Minerals,” Dundas Minerals managing director Shane Volk said.

“Given the competition for these projects, Dundas is pleased that Horizon viewed us as a worthy partner. We are keen to commence the first phase of exploration in coming weeks.”

The Windanya project is located approximately 50km north of Kalgoorlie, while the Powell/Scotia project is adjacent to the Goldfields Highway, about 60km north of Kalgoorlie. The projects became available due to Horizon’s focus on advancing its Cannon, Penny’s Find and Rose Hill gold projects towards production.

“Being so near to Kalgoorlie, the Goldfields Highway, and several

gold plants, the economics of advancing a gold deposit from within these project areas into production, and generating income for the company are favourable,” Volk said.

Dundas is finalising plans for its first phase of exploration at both projects, which will comprise soil and/or auger sampling programs covering multiple targets ranked by prospectivity.

By utilising the latest technologies we provide an advanced combination of innovative solutions which optimise our customers mining operations performance, sustainability, availability and safety, around the globe.

We supply:

• Wear parts and solutions for mineral processing, mobile and fixed plant operations

• Digital and equipment connectivity

• Asset condition and performance monitoring

• Design, engineering and manufacturing solutions

bradken.com

GOLD ROAD BREAKS RECORDS

Gold Road Resources recently released its half-yearly results, reporting record profits. Revenue from gold sales totalled $229 million, up from $196.5 million the previous financial year (FY22).

Gold sales reached 80,115 ounces, outstripping the 79,606 ounces sold the same period in 2022, with production benefiting from record throughput rates.

“The six months to 30 June 2023 has broken several financial records

for Gold Road,” managing director and chief executive officer Duncan Gibbs said.

“The strong result reflects the consistent performance of the processing plant, a supportive Australian dollar gold price and Gold Road’s production being fully unhedged.”

Gold Road’s earnings before interest, taxes, depreciation and amortisation (EBITDA) for the six-month period totalled $122.6

GLENCORE SHOWS OFF MT ISA ASSETS

million, with a margin of 54 per cent. Operating cash flow for the six months to June 30 was $110.3 million, smashing the $69.5 million of the previous June 30 period in 2022.

The consolidated net profit after tax for the six months was $55.7 million, compared to the June 2022 after tax profit of $39.9 million.

Gold Road ended the half year with cash and short-term deposits of

$152.6 million, far above the $74.4 million from FY22.

Additionally, Gold Road’s Gruyere exploration project in WA is on target to achieve the restated 2023 annual guidance of 320,000 to 350,000 ounces of gold.

Gold Road also reported a strong exploration and investment portfolio, with strategic listed investments in De Grey Mining and Yandal Resources valued at $416.1 million on 30 June 2023.

Australian Prime Minister Anthony Albanese visited Glencore’s Mt Isa mines in August to discuss the importance of metals and minerals.

The copper-zinc mines are located in Mount Isa, Queensland, and are home to the only copper smelter and refinery in the state.

Glencore head of zinc and copper business Sam Strohmayr said the

company had been looking forward to welcoming the Prime Minister to the site.

“We were delighted to host the Prime Minister and pleased that he was able to take time to visit our zinc operations,” Strohmayr said at the time.

“We were also grateful to have the opportunity to discuss the increasing importance of metals and minerals

in Australia and the contribution our operations make to the region.

“Mt Isa is one of Australia’s most successful mining towns and this is in large part to the support we get from the community.”

Glencore’s Queensland metals business employed over 4400 people in 2022 and contributed $2.4 billion to the economy. This included $1.7 billion

spent on goods and services, which allowed the company to work with approximately 2130 local suppliers.

In 2022, Glencore spent $1.25 billion in investment commitments in transition metals, including spending $475 million to acquire the remaining 56.25 per cent interest in the MARA copper project in the Catamarca province of Argentina.

CONTEMPORARY

BHP HOUSING APPROVED IN KALGOORLIE

City of Kalgoorlie-Boulder councillors have voted to lease council land to BHP for temporary worker accommodation, with a total of 1152 new rooms to be built.

Located in Somerville, the three-year lease agreement is touted to bring in $1.3 million a year to the council in rent and rates.

The camp has also been granted three one-year options after the initial leasing period.

BHP will now seek building approval for the camp, which will house

workers for the construction of a furnace rebuild for the company’s nickel smelter as part of its Nickel West division.

“This is a big decision for the city, and we want to do what is best for our community long term,” KalgoorlieBoulder mayor John Bowler said.

“BHP have advised that 60 per cent of its workforce for its Kalgoorlie nickel smelter renewal project would be housed in the temporary village and this would not only ease the burden on residential

RIO RELEASES TAILINGS FACILITY DETAILS

Rio Tinto released information on 14 of its global tailings facilities, along with its progress toward conforming to the Global Industry Standard on Tailings Management (GISTM).

Under GISTM classifications, the 14 facilities have been rated as very high or extreme, based on the potential consequences in the event of a failure.

“Since the tragic failure of the tailings facility at Brumadinho in Brazil in 2019, the entire industry

has been working to improve the way we manage tailings facilities,” Rio Tinto chief technology officer Mark Davies said.

“Responsible tailings management is critical to ensure the safety of our people and communities and to protect the environment. It is fundamental for our business and social license. We have made considerable progress since August 2020 towards conformance with the GISTM. We

housing but also have significant benefits for the local economy.”

BHP’s submission was recommended to the council due to the significant financial return it could create in terms of future services for ratepayers.

These funds will be held in city’s future projects reserve for the development of the area as traditional residential housing. Kalgoorlie-Boulder deputy mayor Glenn Wilson told the ABC the camp is necessary to reduce pressure on the city’s housing market.

“We’ve already got $900-a-week rents in Lamington and that will only increase, putting further strain on family budgets,” he said.

BHP’s WA operations supply nickel to world markets for use in electric vehicle batteries and other growing technologies, with an aim to support global decarbonisation.

BHP employs 2500 people across its Nickel West operations, a large portion of which consists of fly-in, flyout (FIFO) workers.

have completed most of the work and have detailed plans to complete outstanding items.

“GISTM has meant a steep change in how the industry manages its tailings facilities. Good tailings management is also about transparent partnership, and we have been working with the local communities near our facilities to increase awareness of our management practices and how we can best work together to continue

to keep people and the environment safe from harm.”

In May of this year, Rio and fellow major BHP invited expressions of interest for a range of new tailings technology partners.

Both companies said the ideas and technologies considered can be market-ready for mining, can involve technologies previously applied in other resource-related industries, or can be original ideas at an early research and development stage.

FOLLOW THE LEADERS: THE LATEST EXECUTIVE APPOINTMENTS

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, INCLUDING AT FORTESCUE METALS GROUP, RED 5 AND RIO TINTO.

There has been more movement at the top for Fortescue, with three executives announcing their resignation in August and September.

Chief executive officer (CEO) Fiona Hick, chief financial officer (CFO) Christine Morris, and non-executive director Guy Debelle left the company within days of each other. According to the iron ore major, Hick’s departure was a mutual decision.

“We thank Fiona for her valuable efforts since joining Fortescue just under six months ago and wish her all the best with her future pursuits,” Fortescue executive chairman Andrew Forrest said.

Morris resigned from her position after two months and was replaced by group manager finance Apple Paget.

Debelle left Fortescue in September following a four-week notice period.

“I’m moving on,” Debbe told the Australian Financial Review. “I’ve had a great time, learned a lot at Fortescue, it was a great experience but onto other stuff now.”

Red 5 has appointed mining executive David Coyne as its new CFO, allowing

acting CFO Patrick Duffy to transition back into the role of chief corporate development officer.

Coyne has over 30 years of experience in the mining, engineering and construction industries in Australia and internationally.

Red 5 managing director Mark Williams said Coyne is an “outstanding addition” to the company.

“David is well regarded across the mining industry as an accomplished chief financial officer and senior executive and brings a high-level of financial and commercial acumen that will help us maintain a disciplined focus on cost management. David is also well versed in corporate governance and compliance matters,” Williams said.

Tony Mason has joined the ranks of Whitehaven Coal, joining the board of directors as Dr Julie Beeby prepares to depart.

Mason joins as an independent non-executive director with over four decades of experience in the coal mining sector. He has previously worked with some of the largest mining companies in Australia, including Rio Tinto and North Broken Hill.

“We are pleased to expand the experience of the board and welcome a new director who brings significant industry knowledge, commercial acumen and a strong intellect to contribute to strategic discussions and assessments of market dynamics,” Whitehaven chairman Mark Vaile said.

Beeby will step down from her role as non-executive director effective October 26 after serving on the board since July 2015.

“Julie has made a great contribution to the business over the past eight years,” Vaile said.

“With her coal industry experience together with her focus on good governance and consideration across our range of stakeholders, her active contributions to discussions around the board table have been greatly appreciated.”

Rio Tinto has appointed a new CEO of its aluminium business. Jérôme Pécresse will join the company from October 23.

Pécresse will succeed Ivan Vella, who will begin serving as IGO’s CEO in December following the sudden passing of Peter Bradford in October 2022.

Rio Tinto CEO Jakob Stausholm said Pécresse will make a diverse contribution to the company during a critical time for the global mining industry.

“Jérôme brings a wealth of experience across renewable energy, mining, business development and strategy, ideal for shaping our industry-leading aluminium business for a low-carbon future,” Stausholm said.

Pécresse said Rio Tinto’s aluminium business has a key role to play in delivering its strategy, as well as supplying materials needed in a lowcarbon world.

“I am thrilled to be joining Rio Tinto to continue building a stronger and more sustainable global aluminium business with our team around the globe,” Pécresse said.

Pécresse joined General Electric (GE) as CEO of renewable energy when the company completed its acquisition of Alstom’s power and grid businesses for €12.35 billion ($20.76 billion).

Prior to beginning his time at GE and Alstom in 2011, Pécresse spent 13 years in the mining and metals processing industry at Imerys in various roles before becoming its chief operating officer. AM

Unleashing a world of opportunity

Schenck Process Mining has become part of Sandvik Rock Processing Solutions

Combining Sandvik’s expertise in crushing with the screening, feeding and loading know-how of Schenck Process, has strengthened our capacity to deliver high quality equipment and aftermarket support.

We are now better positioned than ever, to develop innovative solutions to the challenges of our industry.

A RECORD-SETTING YEAR

following its $9.63 billion acquisition of OZ Minerals.

$US4.3 billion,” chief executive officer Dino Otranto said.

Major miners made some major moves in the 2023 financial year (FY23), with BHP finalising its acquisition of OZ Minerals and Newcrest preparing to be taken over by Newmont.

But the real records came from the financial results, with Whitehaven Coal and Red 5 producing bumper earnings.

However, miners such as BHP and South32 recorded decreases in profits made in FY23.

BHP

The Big Australian achieved production records at Western Australia Iron Ore (WAIO), as well as Olympic Dam and Spence. Its full year production guidance was also achieved for copper, iron ore, metallurgical and energy coal, and nickel.

The major miner recorded a total revenue of $US53.8 billion; however, this decreased by $US11.3 billion from the

“Our financial results for the year were strong, underpinned by reliable production together with capital and cost discipline as we managed lower commodity prices and inflationary pressures,” BHP chief executive officer (CEO) Mike Henry said.

“Our balance sheet is robust and deliberately positioned to support portfolio growth in commodities the world needs for population growth, urbanisation and decarbonisation.”

Henry said BHP is committed to building an inclusive and highperforming culture, and a more sustainable business.

“Today, more than 35 per cent of our employees are female and we have increased Indigenous employee representation globally,” he said.

“We are taking action to reduce our operational greenhouse gas emissions through renewable electricity supplies and supporting the development of electric trucks, trains and light vehicles.”

“We are investing strategically in new ideas, technologies and countries through exploration and early-stage copper and nickel prospects to capture future growth opportunities,” Henry said.

Fortescue

Fortescue announced that it had achieved underlying net profit after tax (NPAT) of $US5.5 billion, marking its third highest underlying earnings in the company’s two-decade history.

Other financial highlights included delivering underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) of $US10 billion, with an underlying EBITDA margin of 59 per cent, as well as recording a strong balance sheet with cash of $US4.3 billion and net debt of $US1 billion.

Operational highlights included a total recordable injury frequency rate (TRIFR) of 1.8 and record iron ore shipments of 192 million tonnes at the top end of market guidance.

“The team has delivered a fourth consecutive year of record operational performance for FY23, contributing

“Fortescue celebrated a number of significant milestones during the financial year including first production at our Iron Bridge magnetite project, and first ore mined from the Belinga iron ore project in Gabon as part of the early-stage mine development.

“Reflecting our ongoing commitment to delivering enhanced shareholder returns, the board has declared a fully franked final dividend of $1 per share, bringing total dividends declared for FY23 to $1.75 per share. This represents a 65 per cent payout of underlying net profit after tax.”

Red 5

Red 5 delivered record gold production of 165,544 ounces for FY23, which contributed to a gross sales revenue of $422.7 million, a 156 per cent increase from the previous year.

An underlying EBITDA of $96.1 million and a net loss after income tax of $8.7 million was also recorded, which was said to have reflected the ramp-up of the mining done at the King of the Hill (KOTH) site in Western Australia, as well as

WHILE THE 2023 FINANCIAL YEAR MAY HAVE PRODUCED A MIXED BAG FOR MINING, A NUMBER OF KEY PLAYERS REPORTED IMPRESSIVE RESULTS.BHP ACHIEVED PRODUCTION RECORDS AT ITS OLYMPIC DAM SITE IN SA. (IMAGE: BHP)

Westgold Resources

Westgold broke up its FY23 into two parts: the first half was about stabilising and resetting the company, and the second half was about building cash.

The gold miner consolidated its operations to four underground mines and three processing plants. Through this, 257,116 ounces of gold was produced from its Bryah and Murchison operations in WA, a decrease from FY22’s 270,884 ounces.

However, Westgold delivered $654 million in revenue, a $6 million increase from FY22. It also reduced its TRIFR by 63 per cent, recording a rate of 8.37.

“With new vigour, Westgold’s safety

WESTGOLD CONSOLIDATED ITS OPERATIONS TO FOUR UNDERGROUND MINES AND THREE PROCESSING PLANTS DURING FY23.

Improving mine site maintenance for better efficiency.

“Our three mining operations continue to perform in line with the mine plan, and the processing plant is performing well above nameplate capacity, putting Red 5 on track to achieve our stated production and cost guidance for FY24.”

Newcrest

The Australian gold miner had a “transformative” FY23, most notably due to it being acquired by Newmont for $26.2 billion.

“In FY23 we produced 2.1 million ounces of gold and 133 thousand tonnes of copper, with a significantly improved free cash flow of $404 million and

South32

South32’s statutory profit after tax decreased by $US2.8 billion to a loss of $US173 million in FY23.

Despite the profit slump, South32 increased its supply of commodities critical for a low-carbon future.

“During the year, we delivered strong production growth in commodities that are critical for a low-carbon future. We set three annual production records and realised the benefit of our recent portfolio improvements, increasing aluminium production by 14 per cent, base metals by 17 per cent and manganese by four per cent,” South32 CEO Graham Kerr said.

“This growth, coupled with our continued focus on cost efficiencies, underpinned one of our largest underlying financial results, with underlying EBITDA of $US2.5 billion. This was achieved despite lower commodity prices and industry-wide inflationary pressures.”

statutory and underlying profit of $778 million,” Newcrest interim CEO Sherry Duhe said.

“Our balance sheet remains in excellent shape, sitting comfortably within all our financial policy targets as we continued to invest in our organic portfolio of value generating projects. On the safety front, our injury rates decreased by 26 per cent compared to last year.

“However, we were deeply saddened by the tragic fatality at our Brucejack mine in October and a serious injury at Cadia in June. These incidents

Mineral Resources

Safety was at the forefront for MinRes in FY23. Managing director Chris Ellison said the tragic death of a contract employee, who lost his life during construction at the Kens Bore site in June, affected everyone at the company.

Ellison said MinRes is determined to learn from the tragedy and safety remained a top priority, with the company recording a TRIFR of 2.08.

Financial highlights for MinRes included its underlying EBITDA increasing 71 per cent to $1.8 billion,

“MinRes continued to execute our high-growth strategy and I’m proud of what our team achieved on the major development projects that will set up MinRes for decades to come,” Ellison said.

“Our flagship Onslow iron project made enormous progress. All major approvals have been received, construction is on track and the project will start generating cash in 12 months.

“In lithium, we demonstrated agility by restructuring our joint ventures in response to the evolving market. The expansion of the Mt Marion plant was completed and a major exploration program revealed strong underground potential.”

MinRes’ $497 million takeover of Norwest was also completed in early June.

Lynas Rare Earths

The rare earths producer achieved a NPAT of $310.7 million, revenue of $739.3 million and a EBITDA of $377.7 million.

“FY23 was another very productive year for Lynas,” CEO Amanda Lacaze said. “Operational performance was particularly strong, with record concentrate production.

“Whilst strong, (our financial) results were lower than those in FY22 when market prices were at record highs.

“During the year, we invested $595 million in capital projects and completed the year with a cash balance of $1 billion, providing funding certainty for completion of our key growth projects.

“We are well positioned to supply our strategic customers

Whitehaven Coal

The coal producer delivered a record NPAT of $2.7 billion for FY23, a 37 per cent increase from FY22. It also recorded an EBITDA of $4 billion, a 30 per cent increase from FY22.

Whitehaven’s record revenue of $6.1 billion was underpinned by an achieved average coal price of $445 per tonne, compared to the $4.9 billion revenue and an average price of $325 per tonne in FY22.

“Record coal prices and our portfolio of high-quality thermal and metallurgical products allowed Whitehaven to optimise the sales mix for FY23 and maximise our exposure to the strong gC NEWC thermal index,” Whitehaven CEO Paul Flynn said.

“With strong underlying market demand for high-CV, high-quality thermal coal and metallurgical coal, coupled with forecast supply tightness, we recognise the opportunity and importance to improve operational performance.”

Northern Star Resources

The miner delivered 1.5 million ounces of gold within its FY23 guidance and sold them at an all-in sustaining cost of $1759 per ounce. It also produced a revenue of $4.1 billion, an underlying EBITDA of $1.5 billion and statutory NPAT of $585 million.

“Northern Star generated a record $1.223 million in cash earnings in the past financial year, the result of our focus on safely delivering operational excellence in parallel to adhering to a disciplined approach to investing shareholders’ funds,” Northern Star managing director Stuart Tonkin said.

“This full-year result also reinforces Northern Star’s strategy to identify growth opportunities

within our strongly endowed geological terrains that can deliver superior returns to shareholders.

“Combined with the on-market share buy-back that was launched during the year, we have increased our capital management returns to shareholders since Northern Star’s creation in FY12 to $1.4 billion.”

Pilbara Minerals

Pilbara Minerals saw a 64 per cent increase in the production of spodumene concentrate, recording 620,000 tonnes, up from FY22’s 377,000 tonnes.

This jump in production led to a 68 per cent increase in sales, with Pilbara Minerals selling 607,500 tonnes of spodumene concentrate, up from FY22’s 361,000 tonnes.

These production and price increases resulted in a 242 per cent boost in group revenue, equalling to $4.1 billion for FY23, along with a 307 per cent increase in EBITDA to $3.3 billion, up from FY22’s $800 million.

“The FY23 period has been an exceptional year for Pilbara Minerals across all fronts,” Pilbara CEO Dale Henderson said.

“Strong operational performance within a healthy pricing environment for lithium products has translated to an impressive set of financial outcomes for the business and our shareholders.”

Despite some miners seeing a decrease in their revenue, many were able to celebrate key financial and operational milestones, like high production in areas such as gold, leading to records being hit.

What FY24 holds for the major miners is yet to be seen, but it looks like it could be a positive period for the sector. AM

SCHENCK PROCESS MINING TO BECOME SANDVIK

The next step in the integration of SP Mining (the mining-related business of Schenck Process acquired by global high-tech engineering group Sandvik), has seen SP mining entities change their names to reflect the new ownership.

On October 1, Schenck Process Australia Pty Limited, which became a wholly owned subsidiary of Sandvik in November last year, became Sandvik Rock Processing Australia Pty Limited.

The Australian entity is the largest part of SP Mining’s global business, employing close to 450 people.

Since the acquisition, Sandvik has been focused on bringing together its expertise in crushing with the screening, feeding, weighing and loading know-how of Schenck Process Mining.

Solutions to allow our customers to access our combined expertise in crushing, screening, feeding, weighing and loading,” Withington said.

“Together we aim to deliver even better digitalisation, sustainability and productivity solutions to our industry.

“The end goal of our integration is to allow our customers to place combined crushing, screening, feeding, weighing and loading orders with our new legal entity.”

Withington said the scale of Sandvik’s operations and commercial reach will help to accelerate the combined innovation portfolio of Sandvik Rock Processing Solutions and SP Mining.

“We look forward to continuing to service the business needs of our customers and remain fully focused on the delivery of high-quality

According to Sandvik, the union between its rock processing solutions business area and SP Mining will allow it to provide even more value to the mining industry.

“Since we became part of Sandvik’s rock processing solutions business

“As such, Australia is playing a key role in the overall integration.”

The company saw a key integration milestone in August with around 50 of its Australian employees moving from combined sales, engineering, services and research and development facility in Beresfield, NSW, to the Sandvik Hunter

THE MOVE IS PART OF AN INTEGRATION PROCESS THAT WILL ULTIMATELY SEE SP MINING BECOME A “SEAMLESS PART OF THE SANDVIK ORGANISATION”.SP MINING PRESIDENT ASIA PACIFIC TERESE WITHINGTON. THE NAME CHANGE WILL ALLOW SCHENCK TO BECOME A PART OF THE SANDVIK ORGANISATION WITHOUT ANY CONFUSION.

SAFETY RELIABILITY PRODUCTIVITY

Industry-leading engineering solutions for metalliferous underground and open pit mobile mining machinery. We design and manufacture high-quality components/ parts/assemblies for the world's best mining equipment. At MASPRO, we optimise parts for safety and reliability so you can drill more metres, move more ore and push your machinery to the limits in harsh mining conditions. maspro.com.au

ADAPTING TO CHANGE

AUSTRALIAN MINING WAS ON HAND WHEN RIO TINTO CEO JAKOB STAUSHOLM TOOK TO THE STAGE AT THE MELBOURNE MINING CLUB TO LOOK AT THE COMPANY’S PAST, PRESENT AND FUTURE.

With a strong 150year history, Rio Tinto has had its fair share of success all over the world.

To discuss some of the miner’s highs and lows, as well as what’s in store for the future, Rio Tinto chief executive officer (CEO) Jakob Stausholm recently sat down for a discussion at the Melbourne Mining Club.

Rebuilding trust

When Stausholm became CEO of Rio Tinto in January 2021, he outlined four main objectives the company would work towards in the foreseeable future: being the best operator; excelling in development; having impeccable environmental, social and governance (ESG) credentials; and having a strong social license.

One particular objective – to have impeccable ESG credentials – came at a very crucial time for the major miner.

In May 2020, Rio Tinto was searching for iron ore when it blasted two rock shelters, known as Juukan Gorge, in Western Australia.

The incident occurred despite the Traditional Owners of the land, the Puutu Kunti Kurrama and Pinikura people (PKKP), warning of the site’s significance. Since that time, Rio Tinto has aimed to increase transparency around its approach to cultural heritage protection.

“I’m always very careful when making such an assessment because, ultimately, it’s the Traditional Owners who should make that assessment,” Stausholm said of the progress made to repair its relations with First Nations people.

“I was actually very proud to see how (Rio Tinto) had felt, this feeling

that we really must do better here, and that people are prepared to really weigh in and realise what we have got to learn here.”

Stausholm said the PKKP has been instrumental during this rehabilitation process.

“They’ve really invented the concept of co-management of the land,” Stausholm said.

“If you think about it, if you build the right relationships and you really co-develop things, that’s how you create sustainability.

“This year, we have started construction on the Western Range project, which is co-developed with the Yinhawangka people.

“Mine planning today has changed quite a lot in discipline from what it was in the past, and that’s a good thing.”

Improving workplace culture Rio Tinto commissioned a report into workplace culture in 2021 after serious incidents in the mining industry made headlines around Australia.

The report, written by former Australian Sex Discrimination Commissioner Elizabeth Broderick, was released in February 2022.

“In our executive team, we discussed whether this could happen on our mine, and I think the answers were not very convincing. So we realised we need to dig deeper into the issues,” Stausholm said.

“When (Broderick) came out with the report, no matter how disturbing it was, it was really a gift for us because it was factual. Nobody disputed it.”

Rio Tinto’s report was publicised to help aid dialogue with the company’s 50,000 staff members. It outlined 26

recommendations as to how Rio should prevent and respond to discrimination and unacceptable workplace behaviour.

“We were sitting with the report, and we suddenly realised we cannot have the open dialogue without putting it out,” Stausholm said. “It was the only thing we could do to move on internally.”

The report will continue to serve as a guide for Rio Tinto in having these discussions in all corners of the company.

“First, you must recognise that these things are important. Secondly, you need to have a dialogue, and we were not talking about these issues,” Stausholm said.

“But with the report, it was kind of a license to start having the discussions in the offices and on the sites.”

Growing its businesses

Rio Tinto released its results for the first half of 2023 in late July. The company saw an improvement in operational performance but a significant dip in profits compared to 2022.

The major generated $17.3 billion in earnings before interest, tax, depreciation and amortisation for the first half of 2023, a 25 per cent dip on 2022.

A 10 per cent fall in total sales revenue – to $39.3 billion – led to a dividend payout of $2.62 per share, down 34 per cent from the first half of 2022.

Despite a dip in profits, Rio Tinto saw improved operational performance, highlighted by its Pilbara iron ore

operations returning a seven per cent lift in production and shipments.

“If you can make profitable growth, you create value to the shareholders and you start seeing it, (such as) the iron ore business showing production growth five quarters in a row. We are coming out stronger,” Stausholm said.

Mergers and acquisitions

March 2022 was a big month for Rio, as it took ownership of the Rincon lithium project in Argentina, its first acquisition in a long time.

“When we bought (Rincon) a year and a half ago, it was our first acquisition in 10 years, and that’s not necessarily a good thing,” Stausholm said.

“I don’t think we need a big acquisition right now, partly because it tends to disturb your focus.

“What we are trying to do is build a smaller portfolio, acquisitions that actually shape the portfolio in a helpful way.”

A key example of this mindset is Rio Tinto’s new joint venture (JV) with Corporación Nacional del Cobre de

MDS M515 TROMMEL

• Ideal for processing overburden, riprap/armour rock, limestone mixed with fines, clay and sticky materials

• High capacity, handling up to 500 tons per hour and up to 800mm sized rocks

• Hydraulically adjustable chassis riser for greater stockpile capacity and ease of access

• A tracked machine that’s perfect for moving from site to site

WE HAVE STARTED CONSTRUCTION ON THE WESTERN RANGE PROJECT (IN WA), WHICH IS CO-DEVELOPED WITH THE YINHAWANGKA PEOPLE. MINE PLANNING TODAY HAS CHANGED QUITE A LOT IN DISCIPLINE FROM WHAT IT WAS IN THE PAST, AND THAT’S A GOOD THING.”

Chile (Codelco), the world’s largest copper producer, and its purchase of PanAmerican Silver’s stake in Agua de la Falda, a company with Chilean exploration tenements.

“(The JV is) at the exploration phase, but it’s a very interesting copper deposit. It’s interesting to work closely together with a great company like Codelco,” Stausholm said.

“We do a lot of explorations under the radar, which are so small that you don’t see them, but they are definitely opportunities. You want to try to be a little bit counter cyclical.

“The reality is there’s a lot of hype around lithium and copper right now, so it’s very difficult to go in and buy a lithium or copper company, because you buy it and then you work for 10 years to justify what you’ve paid for it, and you haven’t really created any value.

“But with technology and very often exploration expertise, there might be easier ways to get in.”

Decarbonisation of operations

To strengthen its alignment with the Paris Agreement and to achieve net-zero emissions by 2050, Rio aims to reduce its Scope 1 and 2 emissions by 15 per cent by 2025 and 50 per cent by 2030.

“In this half-year result, we’ve got the first mine in the world to be 100 per cent on biodiesel at our Boron site in California,” Stausholm said. “We are both a mining and processing company

and 80 per cent of our Scope 1 and 2 emissions are actually in processing.

The key thing is to solve the emissions and processing, and we are making huge technological breakthroughs.”

As Rio Tinto looks ahead to the future, Stausholm was clear that the company would continue to practice adaptability, which he believes is its core strength.

“Being successful in mining is a holistic discipline,” Stausholm said. “You have to get many disciplines right ... (and have) that ability to adjust and accept that the world is changing. AM

UP TO THE CHALLENGE.

Move more with volvo

Unlocking Volvo’s Rigid Haulers into the Australian Market

With a focus on helping customers achieve production targets faster – and using less fuel in the process, Volvo’s new rigid haulers are made for surface mining and quarrying applications where operation costs and safety are crucial. The R100E is an entirely new 95-tonne rigid hauler that combines market and customer knowledge with proven components, innovative technologies, and a striking new design.

Its power, efficiency, safety, and sustainability combination set new industry standards, making it a top choice for quarry and mining professionals worldwide.

Big Enough to Trust, Small Enough to Care

CONTACT YOUR LOCAL BRANCH FOR MORE INFORMATION

REACHING ACROSS THE PACIFIC

Aeconomic pillars of the country, mining has found a successful home in Papua New Guinea (PNG).

One company that understands this situation well is Hastings Deering, one of the top suppliers of Caterpillar (CAT) products and services to the Pacific nation’s mining sector.

Hastings Deering’s journey in PNG began in 1949, and it has been delivering CAT products and services to the country’s mining industry since that time.

300 employees supporting five business centres located in Port Moresby, Lae, Tabubil and Kimbe, with an operations centre at Lihir Island supporting Australian gold miner Newcrest.

“We have many aspects to our business, with our key objective being to support Caterpillar equipment owners with parts and service support in mining, general construction, power generation and marine industries,” Hastings Deering PNG area manager

Caterpillar line-item parts and access to the Caterpillar global dealer network, we are well positioned for parts distribution to our customer needs.”

Hastings Deering has an in-house training centre in PNG that produces certified CAT technicians through apprenticeships in mechanical and autoelectrician trades.

“The training team based out of Port Moresby and Lae has grown the number of opportunities and offerings in recent

has focused on literature and numeracy testing and parts-warehouse training, being accredited for NC1 and NC2 (National Certificate) for DHEF (Diesel Heavy Equipment Fitting) 1 and 2 and registered with the PNG Department of Higher Education Research Science and Technology.”

The in-house education capability specialists and training staff are taught at a global level under Caterpillar’s standards. To that end, Hastings Deering recently invested more than $250,00 in a state-of-the-art Caterpillar simulator that enables virtual training on excavators and track-type tractors.

Dare is proud of the work the Hastings Deering PNG team has done, especially the changes implemented over recent years to increase the safety of its employees and customer service, an approach that sits at the centre of the company’s continual improvement strategy.

“Our team in Papua New Guinea is doing an incredible job engaging with the local communities and we are very proud of the amazing partnerships they have built,” Dare said.

One of these partnerships is with the Hunters, a professional rugby league club in PNG. Dare said the team aligns with the values of Hastings Deering, embracing diversity, equality and inclusiveness.

“Rugby league is an institution in PNG and the Hunters have the largest footprint for this sport in PNG, so this partnership allows us to connect with our employees, customers and the broader PNG community,” Dare said.

HASTINGS DEERING IS BRINGING MORE THAN JUST CATERPILLAR MACHINERYTO PAPUA NEW GUINEA’S MINING SECTOR. HASTINGS DEERING HAS A ROBUST IN-HOUSE TRAINING CENTRE IN PNG THAT PRODUCES CERTIFIED CAT TECHNICIANS THROUGH APPRENTICESHIPS. HASTINGS DEERING HAS A PARTNERSHIP WITH THE HUNTERS, A PROFESSIONAL RUGBY LEAGUE CLUB IN PNG.

Hastings Deering’s PNG division also sponsors the Port Moresby Kart Club, a go-karting organisation that televises the races across PNG.

“In addition to donating CAT merchandise for prizes, the Hastings Deering PNG team also put on a free barbecue at a recent race, which provided a great opportunity to support and network with the community,” Dare said.

Hastings Deering’s PNG team recently worked with not-for-profit group Buk bilong Pikinini (which roughly translates to ‘books for children’) to create a reader for the book series, When I grow up

The latest in the series, When I grow up I want to be a heavy equipment operator, includes images of children visiting Hastings Deering’s Port Moresby branch.

“Buk bilong Pikinini has published 18 picture books as part of the When I grow up series to ensure PNG children can recognise themselves and their culture in the books they publish,” Dare said. Other PNG causes Hastings Deering is committed to includes the Wild Cats, a Port Moresby netball team that is wholly made up of Hastings Deering PNG employees and their children, and the Port Moresby

annual corporate blood drive since 2015 through sponsorship and a business wide blood donation campaign,” Dare said.

“The Port Moresby General Hospital is the largest hospital in PNG and the impact of this cause has been far-reaching.”

Indeed, with its support of so many causes in PNG, Hastings Deering’s impact in the Pacific nation can also be

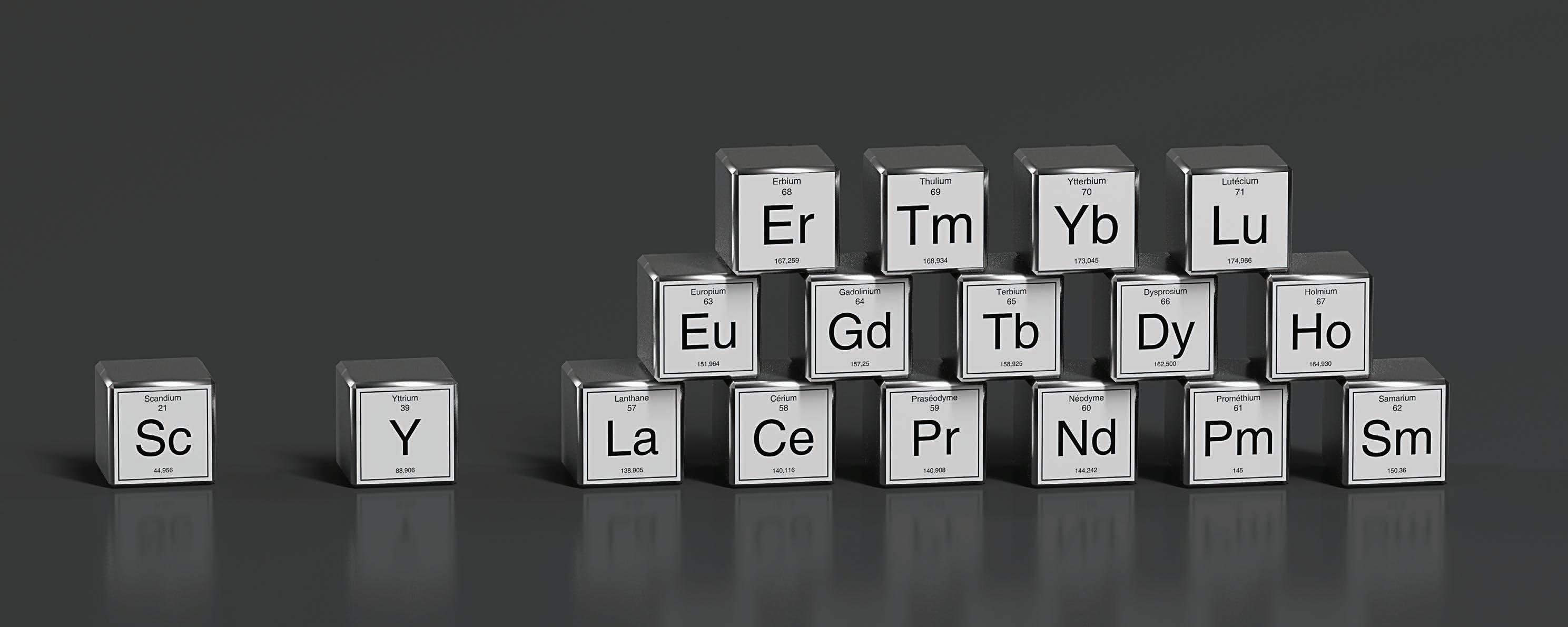

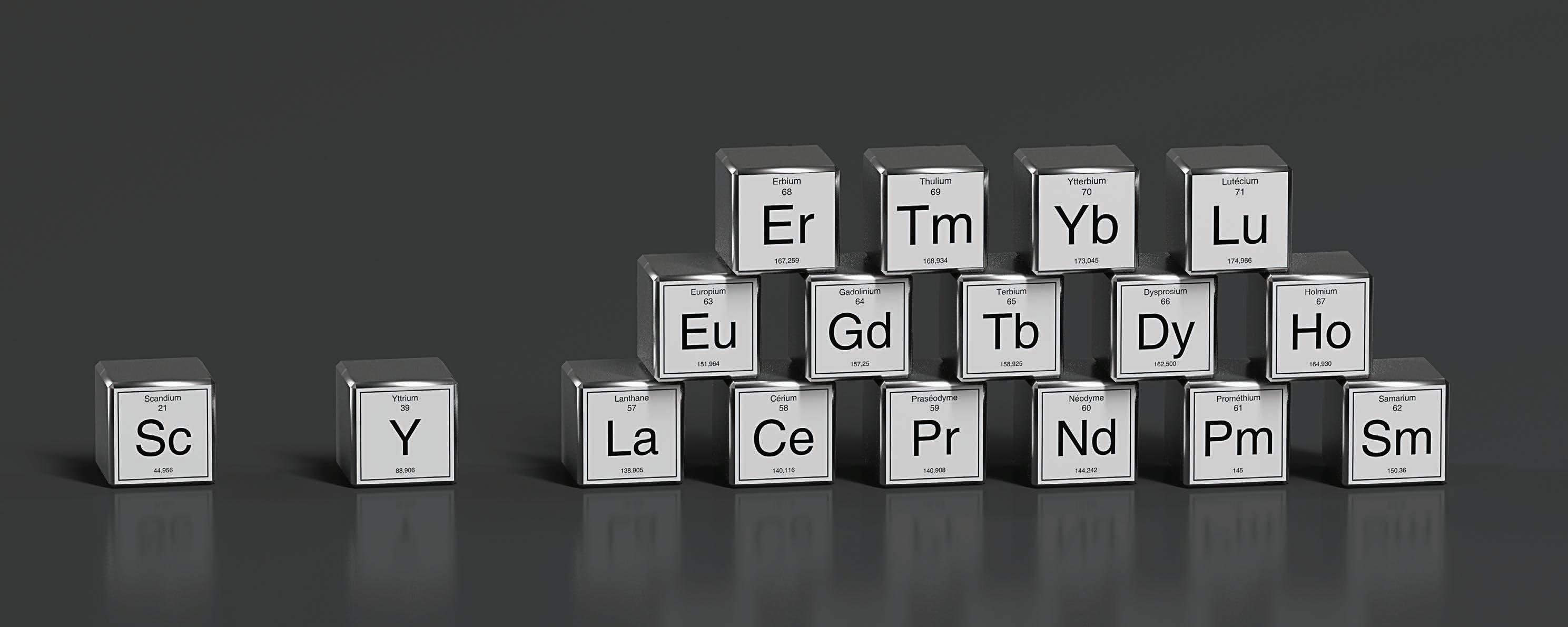

A CRITICAL GENERATION

Every five years, the Federal Government is required to release an Intergenerational Report.

The reports are a way of assessing how government policies will work over the next 40 years, while mapping out Australia’s outlook for the economy and how this will change future federal budgets.

The 2023 Intergenerational Report may be the most important one yet, as it projects how the world’s shift to net-zero will impact the Australian mining industry.

Critical minerals

If the world is to reach net-zero emissions by 2050, reports indicate that the global demand of critical minerals will need to increase by a massive 350 per cent by 2040.

Australia holds many of these critical minerals in its soil. In particular, the country can give the world access to stockpiles of lithium, cobalt and rare earth elements.

“(These minerals) are key inputs to clean energy technologies,” the Intergenerational Report stated.

“With abundant wind, sun and open spaces, Australia also has the potential to generate green energy more cheaply than many countries.”

The report projected substantial growth in the critical minerals sector. Lithium, in particular, was highlighted as a standout, with export volumes expected to double over five years from 2022.

“Australia is already the world’s largest producer of lithium (spodumene concentrate) and is well placed to meet future global demand of lithium,” the report stated.

Lithium is a crucial component of battery manufacturing, especially the lithium-ion batteries that are found in cellular phones, laptops and solar power back-up storage. Australia currently produces nine out of the 10 minerals used in these batteries.

The 10th mineral, graphite, is not yet developed in the country but Australia is seeking to develop refineries for future production.

But by far the biggest consumer of lithium is the electric vehicle.

“Making a 55-kilowatt-hour (kWh) battery and associated systems for a small electric car typically requires over 200kg of minerals, including copper, lithium, nickel, manganese, cobalt and graphite,” the report stated. “This compares to 35kg of copper for the powertrain of a comparable internal combustion engine.

“Electric vehicles and static battery storage have already displaced consumer electronics as the largest consumers

of lithium and are set to overtake stainless steel as the largest end use of nickel by 2040.”

Global sales of electric cars exceeded 10 million in 2022, and those numbers are only projected to grow. Australia already supplies over 50 per cent of total global lithium and if the electric car trend continues, it is set

to supply a lot more. In fact, the year 2028 could see Australia supply 4.5 million tonnes to the world’s netzero effort.

“Global demand for lithium is projected to increase significantly over the next 40 years, significantly expanding Australia’s potential export market,” the report stated.

“Even if global action is only sufficient to limit temperature increases to 3°C, global demand for lithium is projected to quadruple.

“If global actions are consistent with limiting temperature increases to 1.5°C, global lithium demand could be more than eight-times larger than current levels by 2063.”

As new green industries and technologies gain momentum, Australia’s critical minerals industry is set to thrive.

“Climate change and global climate action will have profound impacts on the economy, reshaping Australia’s industry mix and requiring effective mitigation and adaptation to manage the impacts of higher temperatures,” the report stated.

“Australia’s industrial response could harness mineral reserves and abundant sources of renewable energy to supply critical minerals, hydrogen and green metals needed for modern, sustainable economies and to materially affect global climate trajectories.

“The Australian critical minerals industry has the potential to scale up and meet a significant share of this anticipated demand.

“Australia has the scale of resources, established industry, technical expertise and track record as a stable, reliable and responsible supplier to support the scale of investment required.”

Coal

As one of the world’s largest exporters of coal, Australia is well placed to continue to meet demand for decades to come.

However, the market has been dealt a challenging hand in the past year.

The Russia–Ukraine war has been the main driver of price volatility for the coal industry, forcing investment plans to focus on maintaining production capacity in the sector. The shift to netzero is also affecting the coal sector.

“The net-zero transformation will impact global energy and resources markets as global demand for lowemission commodities increases,” the report stated.

“While the transition to renewables will boost demand for many of the minerals mined in Australia, creating new growth opportunities, global demand for fossil fuels is projected to decrease over time as global trading partners act to reduce emissions.”

This is especially true for thermal coal which, according to the report, is set to see the largest reduction in global demand.

“If global action limits temperature increases to 1.5°C, the associated reductions in global demand for thermal coal could reduce Australia’s exports to less than one per cent of current levels by 2063,” the report stated.

“Global demand for Australian thermal coal exports is expected to decline as our trading partners move toward netzero emissions.

“However, Australia has some of the world’s largest reserves of critical minerals such as lithium, cobalt and rare earth elements. These are some of the essential ingredients in global emissions reduction as inputs for electric vehicles, batteries and renewable energy generation technologies.”

It is clearer than ever that the world needs Australia’s critical minerals industry to hit net-zero. And with its track record of producing the quantities needed, the country is in position to deliver. AM

READY TO ROLL AT IMARC

Entering its 10th year, the International Mining and Resources Conference (IMARC) has long been seen as a key international forum to facilitate continuous improvements and initiatives in the mining sector.

Conversations around sustainability, net-zero and low carbon emissions are all-important, now more than ever, and that conversation can only happen when the world gets together in one place.

Juergen Wallstabe from the GermanAustralian Chamber of Industry and Commerce said IMARC provides an opportunity to showcase how Germany’s emphasis on environmental protection has led to stringent regulations for mitigating environmental harm.

“Germany’s commitment to remediating and restoring abandoned mining sites demonstrates our dedication to healing environmental wounds,” he said. “IMARC offers a chance to share our experiences and learn from others facing similar challenges.”

Energy security is once again a key term in Europe, partly driven by the ongoing war in Ukraine and its impact on reliable energy supply, but also as a result of shifting political environments in countries like Germany.

And to secure reliable energy for many generations to come, countries across the

continue to be a key player in securing a steady supply of critical minerals,” Wallstabe said.

“Wind turbines need steel, copper and strong magnets with rare earths minerals. Batteries consist of a wide range of critical minerals like lithium,

platinum, iridium or candium.

“All resources that Europe struggles to produce in sufficient quantities.”

IMARC spokesperson Paul Phelan is looking forward to having Germany so strongly represented at the event.

“It is clear that Germany’s public

institutions and companies actively exploring novel technologies to enhance resource extraction efficiency, reduce environmental impacts, and improve worker safety,” Phelan said.

“IMARC offers an opportunity to witness how a technological giant like

THE 2023 INTERNATIONAL MINING AND RESOURCES CONFERENCE WILL HELP TO FACILITATE THE CONVERSATION FOR SUSTAINABLE AND INNOVATIVE MINING OPERATIONS.

IMARC IS DESIGNED TO PROVIDE A FORUM TO EXPLORE OPPORTUNITIES AND TO SHOWCASE THE BEST AND LATEST KNOWLEDGE, INNOVATION AND GROWTH THAT BENEFITS THE WHOLE VALUE CHAIN.”CANADA AND GERMANY ARE JUST TWO OF THE COUNTRIES REPRESENTING THEIR MINING INDUSTRIES AT IMARC. SUSTAINABILITY IS A GLOBAL EFFORT, AND THE TOPIC WILL TAKE CENTRE STAGE AT IMARC 2023.

another mining superpower, will also be in attendance.

Canada Mining Innovation council chief executive officer Carl Weatherell said leadership of the mature mining countries such as Canada and Australia is critical to achieving the mining industry’s global environmental goals.

industry’s energy use, water use and environmental footprint by 50 per cent by 2027, the major players have not only an opportunity but a responsibility to work together on innovations that reduce waste, lower costs and mitigate environmental impacts across all aspects

leaders in the mining industry, with decades of experience and innovation behind them, so they have a natural role in leading mining’s transformation to a more responsive, sustainable and resilient industry.

“It’s incumbent on the two countries

industry in terms of how we collaborate, who we collaborate with, and what we work together on.”

IMARC chief operating officer Anita Richards said the 2023 event is the ideal opportunity for countries like Canada to attract investment, showcase their expertise and engage with mining and METS (mining equipment, technology and services) companies, investors and suppliers to collaborate and develop business opportunities.

“For its part, Canada has a great story to tell as a stable and attractive destination for global investment in the resources the world needs for a cleaner future, and the expertise and leadership it can offer to a transitioning global industry,” Richards said.

“IMARC is designed to provide a forum to explore these opportunities and to showcase the best and latest knowledge, innovation and growth that benefit the whole value chain.

“Standing alongside Australia as one of the world’s largest mining nations with significant role in the future of resources, Canada has always been a strong partner of IMARC throughout our 10-year history and we are delighted to welcome them back once again.” AM

REVOLUTIONISING IRON ORE PROCESSING

IN THE DYNAMIC WORLD OF MINING, DERRICK CORPORATION HAS BECOME SYNONYMOUS WITH INNOVATION.

ith a legacy rooted in Australian iron ore processing since the 1950s, Derrick Corporation continues to reshape the industry with cutting-edge solutions.

At the forefront of its offerings is the SuperStack technology, a major advancement that has helped redefine the way iron ore beneficiation plants operate. Derrick Corporation’s trajectory through the annals of iron ore processing has seen the company consistently grow its offerings to stay ahead of the everevolving mining landscape.

Today, its contributions resonate louder than ever as it introduces its SuperStack technology, a vibratory screening machine armed with frontto-back screen panels that provides unparalleled screening capacity, efficiency, and user-friendliness.

“This innovative approach challenges conventional methods of classification, ushering in a new era of efficiency, sustainability and optimised resource utilisation in iron ore processing,” Derrick Australia general manager Garth Hay told Australian Mining

The SuperStack technology offers a host of advantages, and one of its most significant is its enhanced efficiency.

Winefficiencies and sub-optimal outcomes, SuperStack provides a more precise and efficient classification process.

The front-to-back screen panels ensure a thorough separation of particles, leading to higher-quality end products that meet stringent industry standards.

“The SuperStack technology is more than just a technical solution,” Hay said. “It is a statement of commitment to the environment.

“Sustainability has emerged as a central theme in the mining industry and SuperStack is designed to align perfectly with this ethos. Its environmentally conscious design underscores Derrick Corporation’s dedication to responsible and ecofriendly mining practices.”

A key feature of SuperStack is its ability to optimise resource utilisation. By reducing the generation of ultrafines in grinding circuits, the technology not only enhances the quality of the final product but also minimises wastage.

This reduction translates to tangible cost savings and increased operational efficiency, making SuperStack a crucial tool for iron ore processors aiming to maximise their bottom line while minimising their environmental footprint.

“To understand the real-world impact of SuperStack, one need only look at the success story of ArcelorMittal Nippon

Like many players in the industry, AM/NS India faced the challenge of increasing plant capacity without compromising product quality.

Traditional classification systems fell short, jeopardising pellet quality and the integrity of critical infrastructure like slurry pipelines.

“In the face of these challenges, AM/NS India turned to Derrick for a solution,” Jain said.

“Our SuperStack technology stood as the answer to AM/NS India’s pressing needs. Notably, this solution promised an environmentally conscious approach, aligning seamlessly with AM/NS India’s commitment to sustainable practices.

“Through a comprehensive

the exceptional capabilities of their technology.

“Derrick’s wealth of experience in closed grinding circuits and pipeline protection applications added further value to the proposition.”

With the installation of SuperStack machines, the plant saw a 15 per cent increase in mill capacity. Pellet quality soared and the integrity of Asia’s longest continuous slurry pipeline was fortified, ensuring uninterrupted operations. But Derrick Corporation’s contributions extend beyond its SuperStack technology.

“Our iron ore product offerings have consistently elevated the industry’s standards,” Hay said.

“As mining evolves and challenges become more complex, Derrick’s commitment to innovation ensures that our products will continue to shape the future of iron ore processing.”

Derrick Corporation’s legacy is etched in the fabric of iron ore processing. Its journey from the 1950s to the present day has been marked by innovation and unwavering commitment to progress.

The introduction of the SuperStack technology is a testament to its dedication to redefining industry norms and providing solutions that not only enhance operational efficiency but contribute to a more sustainable and responsible mining future.

With SuperStack leading the way, Derrick Corporation continues to be a driving force in revolutionising iron ore processing on a global scale and a reliable partner to responsibly maximise resource efficiency for a greener world. AM

ENERGISING DECARBONISATION

As the resources sector evolves, every facet of the mining value chain is looking for ways to meet its decarbonisation targets.

As a global multi-energy company that has been supplying mines their energy needs for many decades, TotalEnergies has the knowledge and expertise to help companies meet their decarbonisation goals.

“We can leverage our international network to work with a mining company across different countries, products and applications to ensure we have the right product available at the right place and time,” TotalEnergies vice president – global mining segment Dirk de Bruyn said.

“Having the ability to coordinate across customers and regions means we can minimise the costs involved in introducing a new energy supply chain.”

TotalEnergies already supplies fuels and lubricants and offers training, among other essential services to ensure mines are running productively and sustainably.

“Our integrated business model is our strength and is what sets us apart,” de Bruyn said. “We guarantee our customers efficiency, profitability and innovation.

“Thanks to our integrated model, we can reinvent and diversify our energy offering to favour renewable and decarbonised energies and promote the economical and rational use of fossil fuels.”

Currently active in more than 130 countries, TotalEnergies has established itself as a trusted partner for mining companies across the globe. The company’s considerable reach means it can provide solutions to help mines meet their decarbonisation goals within a quick turnaround time.

“Our expansive market presence allows us to have direct global contractual relationships with many of our customers,” de Bruyn said.

“The market proximity allows us to work together to ensure the best operational performance and provide solutions to reduce our customers’ cost of ownership and carbon emissions.

“As a major player in energy transition, we are committed to working towards our ambition of netzero by 2050, together with society.

“We are building the future today by leveraging our strengths. Low-carbon energies will dominate our production and sales mix by 2050.”

To reach net-zero, TotalEnergies is aiming to eliminate the equivalent of 100 million tonnes of CO2 per year through developing a carbon storage service and an industrial e-fuels business.

“It takes a lot of time, cost and effort to develop new solutions,” de Bruyn said. “Our customers appreciate that we have a multi-energy offer that is expanding globally.

“Setting up trials, negotiating new contracts and developing trust can take

a long time, but our direct relationships allow us to transfer best practice across sites and even continents.

“That is essentially valuable to multinational mining companies.”

TotalEnergies will be attending this year’s International Mining and Resources Conference (IMARC) and is looking forward to connecting with the wider mining industry and showing off its recent achievements.

“The presentations at the event will enable us to gain and share insights into

progressing ESG (environmental, social and governance) and environmental resilience and learn about the challenges faced by the industry as a whole,” de Bruyn said.

“The team is looking forward to engaging in fruitful discussions with industry leaders and sharing our multienergy solutions that can support and accelerate mining’s energy transition.” de Bruyn said TotalEnergies’ presence at IMARC would help to further support the company’s decarbonisation mission.

“IMARC is an important event to network and connect with existing global, regional and local clients, as well as showcase the capabilities of TotalEnergies,” he said.

“Through our participation, we hope to educate future mining prospects and discuss with these customers the road to energy transition.

“Having the opportunity to meet face-to-face works wonders for building networks and connecting directly with customers, and we are looking forward to building these networks and fostering deeper collaborations.” AM

THANKS TO OUR INTEGRATED MODEL, WE CAN REINVENT AND DIVERSIFY OUR ENERGY OFFERING TO FAVOUR RENEWABLE AND DECARBONISED ENERGIES AND PROMOTE THE ECONOMICAL AND RATIONAL USE OF FOSSIL FUELS.”TOTALENERGIES IS COMMITTED TO HELPING MINING COMPANIES MEET THEIR DECARBONISATION GOALS. TOTALENERGIES VICE PRESIDENT – GLOBAL MINING SEGMENT DIRK DE BRUYN.

Tailored for mining conveyor pulleys

l Optimised design for new pulleys

l Compatible with existing pulley arrangements

l Reliable bearing life

l Simple, robust, easy to install and align

l Ease of maintenance

Specifically designed & developed for conveyor pulleys in Australian mining, minerals processing and bulk materials handling. A reimagining of the traditional SSN and SDD TAC housing ranges.