AUSTRALIA’S BRIGHT COPPER FUTURE NEW SHARK IN TOWN WHY GOLD CAN SHINE BRIGHTER IN 2023 HOW PILBARA MINERALS BUILT A LITHIUM EMPIRE VOLUME 17 NUMBER 2 | 2 023 Australian Resources & Investment GRAPHITE’S TIME TO SHINE Charging up decarbonisation

United. Inspired.

The world needs metals and minerals for the energy transition and we need cities that can cope with a growing population in a sustainable way. To succeed we need to speed up the shift towards a more sustainable mining and construction industry. We at Epiroc accelerate this transformation

– 4 –

See how we accelerate the transformation

TOM

Tom.Parker@primecreative.com.au

For the world’s decarbonisation to occur, and for global net-zero goals to be met, it is key that new mines are developed as much as brownfield operations are extended. This will require contributions from a range of commodities in countries across the world. As an established and stable mining jurisdiction, Australia has the opportunity to be a frontrunner not only in exporting minerals to the world but by also being a pioneer of change.

In its 2023 Tracking the Trends report, Deloitte considers three key themes that will underpin the resources sector this year and beyond.

These include: the strategic advantages available through natural capital; mining’s role in a circular economy; and the need to drive down embodied carbon in mining.

Investors and policymakers are treating the resources industry differently today than in the past, and this is requiring a step change in thinking for many mining companies. This is particularly so in Australian mining, where companies are no longer getting away with ‘greenwashing’ or errant reporting.

As investors pry for greater transparency, governments are calling for greater emissions reduction.

The Australian resources industry is having to change the way it does things, but with change comes opportunity and in reconfiguring their operations, companies can unlock value in new, innovative ways.

In the April edition of Australian Resources & Investment, we shine a light on two commodities critical to the world’s energy transition: graphite and copper.

Renascor Resources believes “graphite is the next lithium” and with supply shortages looming amid rising demand, prices could climb to new highs in the years to come.

We sit down with Renascor managing director David Christensen to talk about the company’s progress towards becoming a near-term graphite producer, while we also feature International Graphite, which is developing its Collie downstream plant and Springdale graphite project in WA.

The world is going to need all the copper it can get in the future, and as a growing copper miner, Aeris Resources has an important role to play in the years ahead. We chat to Aeris executive chair André Labuschagne about how the company looks to uplift its suite of projects across Australia. Elsewhere, we highlight the success of Australia’s soon-to-be halloysite-kaolin producer, Andromeda Metals, contemplate what lithium prices will look like in 2023, and chat to emerging ASX-listed gold companies Flynn Gold and Adelong Gold. Happy reading.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER CHRISTINE CLANCY

EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

MANAGING EDITOR

PAUL HAYES

Tel: (03) 9690 8766

Email: paul.hayes@primecreative.com.au

CLIENT SUCCESS MANAGER

JUSTINE NARDONE

Tel: (03) 9690 8766

Email: justine.nardone@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGER DAVID GOLDBERG Mob: 0434 792 225 Email: david.goldberg@primecreative.com.au

SALES ADMINISTRATOR EMMA JAMES Tel: (02) 9439 7227 Mob: 0414 217 190 Email: emma.james@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

GRAPHIC DESIGNERS KERRY PERT, LOUIS ROMERO

FRONT COVER Renascor Resources managing director David Christensen at ALS Metallurgy.

Image: Renascor Resources

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA

379 Docklands DR, Docklands, VIC 3008, Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2021 All rights reserved. No part of the publication may be reproduced or copied in any form or by any means without the written permission of the publisher.

Tom Parker Editor

PRINTED BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337 Published 12 issues a year

WWW.AUSTRALIANRESOURCESANDINVESTMENT.COM.AU

– 3 –AUSTRALIAN RESOURCES & INVESTMENT

PARKER

COMMENT

Australia sets itself up Australia has the opportunity to be a key player in supplying the world’s green energy transition across a range of commodities.

THE FEATHERSTONE REPORT 6 Why gold can shine brighter in 2023 FEATURED 10 A nalysis with Regina Meani 12 ‘ Graphite is the next lithium’ 16 Australia’s bright copper future COPPER 18 Cloncurry: Australia’s key copper district LITHIUM 20 Why 2023 is a pivotal year for lithium prices HALLOYSITE-KAOLIN 24 N ew shark in town GOLD 26 A near-term gold producer steeped in history 28 A n early-mover in north-east Tasmania ESG 30 New era for tailings management DECISION-MAKER 34 H ow Pilbara Minerals built a lithium empire 36 Elevating Mincor RARE EARTHS 38 A rare earths project backed by centuries of experience INDUSTRY INSIGHT 40 Mine of the future MINING SERVICES 44 Instigating mining’s new frontier 46 An evolution like never before FOLLOW THE LEADERS 48 The latest executive movements in the resources sector EVENTS 50 What’s happening in the resources industry?

CONTENTS 18 40 – 4 –

IN THIS ISSUE

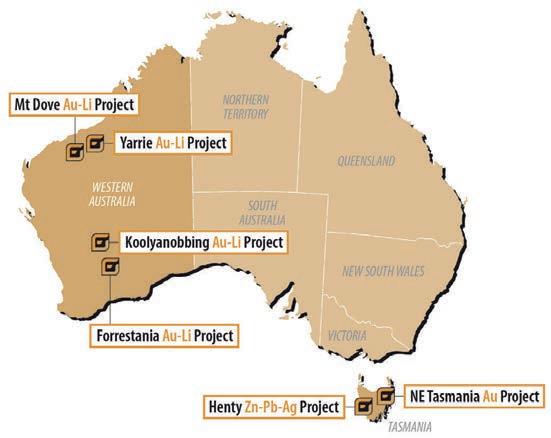

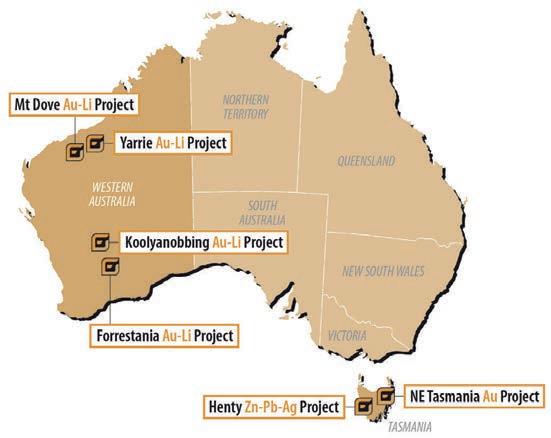

ASX: FG1

TASMANIA

• 10 granted Exploration Licences

• 1,465 km2, 100% Flynn Gold

• Northeast Tasmania - under-explored extension of Victorian goldfields

• Western Tasmania – Henty Zinc/Lead/Silver project with multiple drill targets

OUTSTANDING GOLD RESULTS AT GOLDEN RIDGE PROJECT, NE TASMANIA

• Gold anomalism over 8km strike evidenced by latest drilling and historical workings

• Significant gold mineralisation recorded in drilling at Trafalgar, Brilliant, Link Zone and Kensington Prospects

• High-grade gold mineralisation (up to 152.5g/t Au) in multiple vein zones over an open strike length exceeding 200m intersected at Trafalgar

WESTERN AUSTRALIA

• 27 tenements and applications

• 1,260 km2, 100% Flynn Gold

• Pilbara – holdings close to significant gold and lithium deposits

• Yilgarn – holdings close to world class lithium and nickel deposits

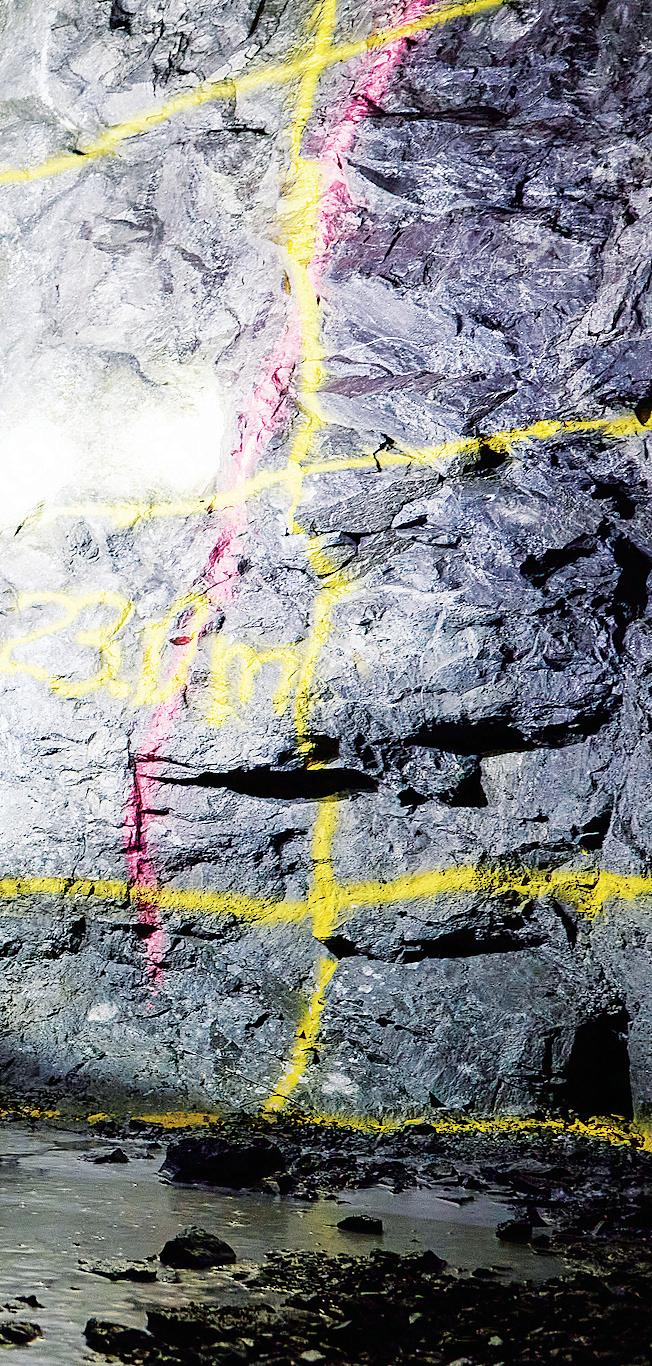

Li Au Lithium 7.0 Gold 196.966 3 79 www.flynngold.com.au Quartz-sulphide (pyrite-arsenopyrite-pyrrhotite-galena-sphalerite) vein in TFDD005 at 121m (0.7m @ 152.5g/t Au)

WHY GOLD CAN SHINE BRIGHTER IN 2023

BY TONY FEATHERSTONE

Currency-hedged Exchange Traded Funds limit risk for exposure to gold bullion.

Prominent investment commentator Mohamed A. El-Erian recently outlined three possible scenarios as central banks wage war on inflation.

The first was “orderly disinflation”. Inflation in the US retreats steadily towards the Federal Reserve’s 2 per cent target without hurting economic growth or jobs. El-Erian puts the probability of this scenario at 25 per cent.

The second scenario was “sticky inflation”. Rapid increases in interest rates would drive inflation lower before it got stuck at 3–4 per cent. Central banks would have to choose between further rate rises that could crush the economy, or persistently higher inflation. The probability of this scenario – the likeliest of the three – was 50 per cent.

The third scenario was “U inflation”. After falling this year, inflation would rise next year as China’s economy strengthened and the US labour market remained tight. El-Erian, chief economic adviser at Allianz, said this probability was 25 per cent.

El-Erian’s view on inflation is fascinating for market watchers, including those interested in gold. The precious metal’s reputation as a hedge against rising inflation is well known, although rarely as clear-cut as many investors believe.

El-Erian’s base case for inflation aligns with my own view that inflation will prove harder to bring down than financial markets expect.

During the early stages of COVID, I argued that higher inflation was not just a transitory

response to supply-chain bottlenecks, but it was also a response to inflationary forces that had been building for years.

Two of those forces are deglobalisation and an ageing global population. Rising geopolitical risks – notably Russia’s invasion of Ukraine and fears that China could invade Taiwan this decade – have encouraged Western companies to “reshore” more aspects of their supply chains. That is, to favour localisation over globalisation.

Deglobalisation makes some sense from a geopolitical perspective. Relying on

manufacturing or commodity supply from autocratic nations has become a bigger gamble in recent years. Moving production back to democracies is less risky.

But deglobalisation is inflationary. It costs more to make goods in the US than it does in China.

The essence of globalisation is about producing goods where they are cheapest to supply: deglobalisation turns that logic on this head.

The ageing population will be another contributor to persistent higher inflation, even

– 6 –FEATHERSTONE REPORT

THE Featherstone REPORT

When the US dollar falls, the price of gold tends to rise, and vice versa.

though markets debate this phenomena far less than they should. In theory, an ageing population means fewer people in the full-time workforce and adds to labour-market tightness. That, in turn, adds to higher wage pressure and inflation.

Like many correlations, the relationship between an ageing population and higher structural inflation is not straightforward. People these days tend to work longer, retire later and take on part-time jobs in retirement. But an ageing population will surely weigh on growth in labour supply in coming years.

PROSPECTS FOR GOLD

El-Erin’s central scenario suggests falling inflation this year as interest rate rises slow consumer demand. This supports gold as falling inflation enables central banks to slow the pace of rate rises and cut rates in 2024.

Expectations of falling interest rates will lead to a weakening of the US dollar. The inverse relationship between the tradeweighted US dollar and the price of gold is well-established. When the US dollar falls, the price of gold tends to rise, and vice versa.

A falling US dollar increases the value of other countries’ currencies, which increases demand for gold and other commodities. Also, as the value of the US dollar falls, investors look for alternative investments as a store of value. Gold is a key store of value.

Of course, the price of gold is affected by factors beyond the US dollar. Gold supply and demand are critical, as are yield differentials. When interest rates fall, yields fall with them, making gold (which doesn’t provide yield) relatively more attractive.

My base case is for a gradual fall in the trade-weighted US dollar index this year, amid

expectations that inflation has peaked and that interest rates have almost peaked.

After rallying for much of 2022, the US dollar index began to retreat in November. The market started to price in “peak inflation” and a slower pace of rate hikes. As the US dollar fell late last year, the US-dollar gold price rallied in early-2023.

The US Federal Reserve has lifted rates more aggressively than other central banks, and in March 2023 signalled that more rate rises are likely.

That pushed the US dollar index higher, but it also suggests expectations for US rate rises are getting much closer to their peak. If rates keep rising, economies will be crushed.

Although inflation will fall this year, I agree with El-Erin that inflation rates will settle at 3–4 per cent for longer. For most of the last decade, inflation was below 2 per cent and Australians enjoyed record-low interest rates.

A higher base level for inflation will support

gold’s status as an inflation hedge. Also, as economic and market uncertainty remains high, demand for gold will be well supported this year.

The result is an unusual situation of a gradually retreating US dollar in the second half of 2023 supporting a higher gold price in the short term; and higher-than-usual inflation and market volatility supporting gold as an inflation hedge and store of value in the medium term.

To be clear, I’m not suggesting a large rally in the gold price this year. Much could go wrong in the fight against inflation, requiring more rate rises than markets currently expect and higher rates for longer. That would help the US dollar and hinder gold.

But the case to increase portfolio allocations in gold is strengthening. I’ve long argued that most investors should have at least 5 per cent of their portfolio in gold, and modestly increase or decrease that allocation

– 7 –AUSTRALIAN RESOURCES & INVESTMENT

A higher base level for inflation will support gold’s status as an inflation hedge. Also, as economic and market uncertainty remains high, demand for gold will be well supported this year.

There are many factors that dictate the gold price, but the overarching gold sentiment is positive for 2023.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at January 11.

according to market conditions. Current conditions favour a slightly higher portfolio allocation to gold.

ETFS FOR GOLD EXPOSURE

Investors have three main choices for gold exposure: buy gold equities; buy Exchange Traded Funds (ETFs) that invest in gold bullion; or buy gold bullion directly.

I prefer ETFs that provide exposure to gold bullion over buying gold equities directly. Well-chosen gold equities can be a great investment and generate higher returns than gold bullion (due to additional gains from the company).

But gold equities come with company and equity-market risk. The price of gold might rise, but gold equities can still fall sharply if global equity markets tumble, amid inflation and interest-rate uncertainty.

Gold ETFs provide pure exposure to gold bullion. It’s more convenient to get that

exposure via a gold ETF on the ASX that is bought and sold like a share, compared to owning, handling and storing gold bullion directly (which some still prefer).

Investors who believe gold is heading higher this year – and that gold ETFs are the best tool for gold-bullion exposure – face another key decision: currency protection. Should investors hedge their exposure against movements in the AUD/USD exchange rate?

The short answer: yes. The case for Australian investors, generally, to hedge their international investments this year, is rising.

If the Australian dollar rises 5 per cent against the Greenback, the value of your offshore US-dollar investments would fall by 5 per cent when converted into your local currency, all things being equal. In theory, the reverse is also true if the Australia dollar falls against the Greenback.

Australian investors who have US-dollardenominated investments, and believe the Australian dollar will strengthen this year as the US dollar gradually weakens, should consider hedging their gold-bullion exposure.

ETF issuer BetaShares offers a currencyhedged Gold Bullion ETF (ASX:QAU) for investors who want to eliminate currency risk in their gold exposure and seek cost-effective exposure to the gold bullion price via the ASX.

VanEck Australia has an interesting new gold ETF: the VanEck Gold Bullion ETF (ASX: NUGG). The ETF provides exposure to Australian-sourced gold, has low fees and can be redeemed for physical gold. NUGG is unhedged.

The ETF Securities Physical Gold ETF (ASX: Gold) also provides exposure to gold bullion. The ETF is unhedged for currency movements, meaning investors are also trading a view on the direction of the Australian dollar against the US dollar.

– 8 –

FEATHERSTONE REPORT

Interest rates have been climbing, but this is not expected to sustain long-term.

ETFs are becoming an increasingly popular investment medium, including in gold.

Production bores Artesian bores Monitor bores Dewatering Down hole hammer Cement grouting www.aquatechdrilling.com.au P 0490 282320 P 0438 800 389 E admin@aquatechdrilling.com.au Aquatech rigs have the capabilities to drill up to 1000 metres. With 3 rig sizes available they can cater for domestic, agricultural and large mining contracts. WATER BORE SPECIALISTS Providing long term drought resilience throughout Western Australia

— ANALYSIS — WITH REGINA MEANI

Uranium: Our underutilised resource

Australia has been mining uranium since the 1950s, but there have been restrictions on its usage and its purposes after export.

The Australian Government’s Environment Protection and Biodiversity Conservation Act 1999 (the Act) bans local nuclear energy, meaning Australia has no nuclear power-producing electricity.

The ban has cost Australia substantial global investment and the advancement of scientific collaboration on new nuclear technologies. But this ban can be reversed with a single amendment to the Act.

Uranium currently provides around 10 per cent of the world’s power, providing electricity to billions of people in more than 30 countries.

Australia has about 28 per cent of the world’s uranium resources and in 2021 was fourth to Kazakhstan, Namibia and Canada in production. As Russia’s war with Ukraine enters its second year, disruptions to European and US energy supplies have brought forward new constructions and additional incentives for nuclear power.

Russian uranium conversion accounts for 38 per cent of global capacity, while its enrichers are responsible for nearly half of the world’s supply.

But uranium has multiple applications.

In Australia, small special-purpose nuclear reactors have been making a wide range of radioactive materials (radioisotopes) at low cost. These radioisotopes play a significant part in medicine, food production,

livestock, and in the industrial and mining industries. A little-known example is that most household smoke detectors have a radioisotope derivative.

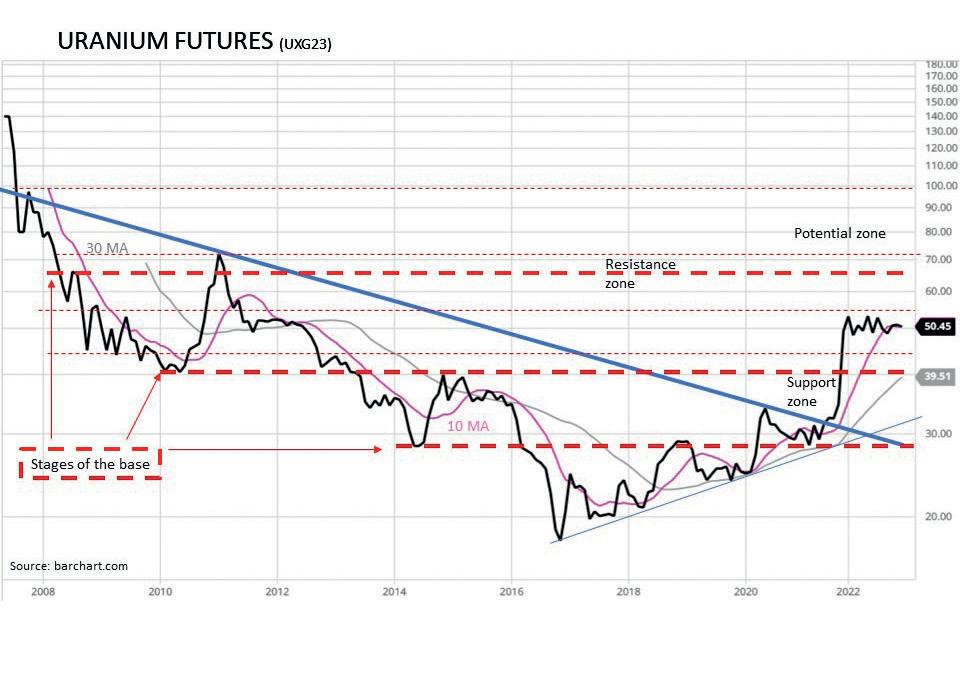

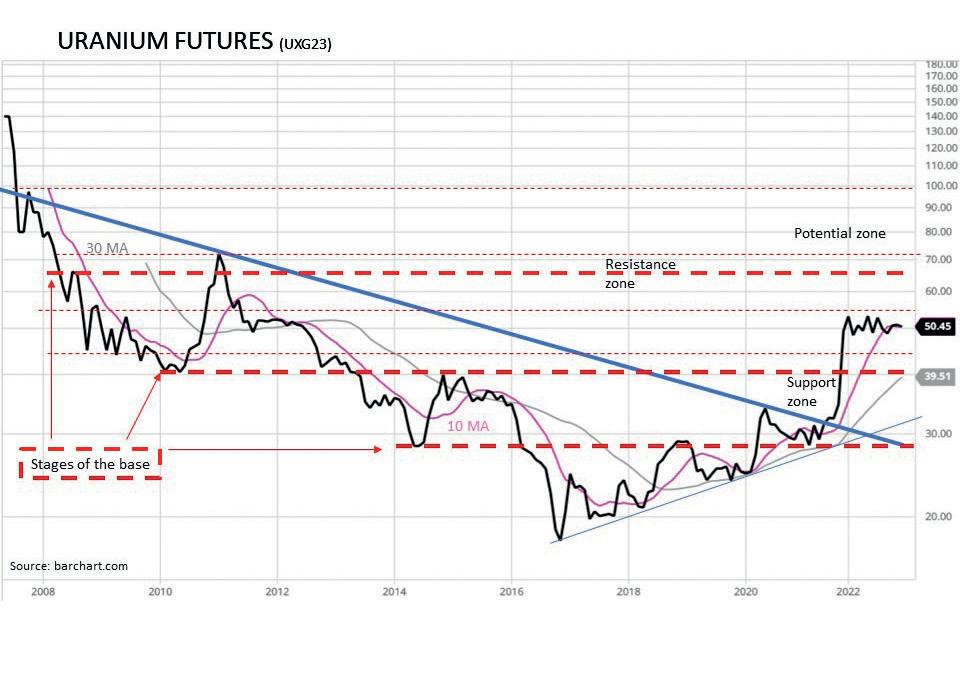

Uranium futures peaked at $US148 per pound (lb) in May 2007. From there the price initially fell dramatically into 2008 before commencing a downward sloping phase reaching a low point of $US17.75/lb in November 2016.

The price formed the preliminary stages of a base until September 2021, when the price broke away and continued its upward trend to head towards the $US55–65/lb resistance zone.

Support is located around $US46.50/ lb, and in the event this level is breached, back-up is in the $US30–40/lb zone. To initiate the next stage of base completion, the price needs to break away above $US54/lb before gaining the potential to head towards and beyond $US60/lb, then towards $US70/lb and possibly $US95/lb.

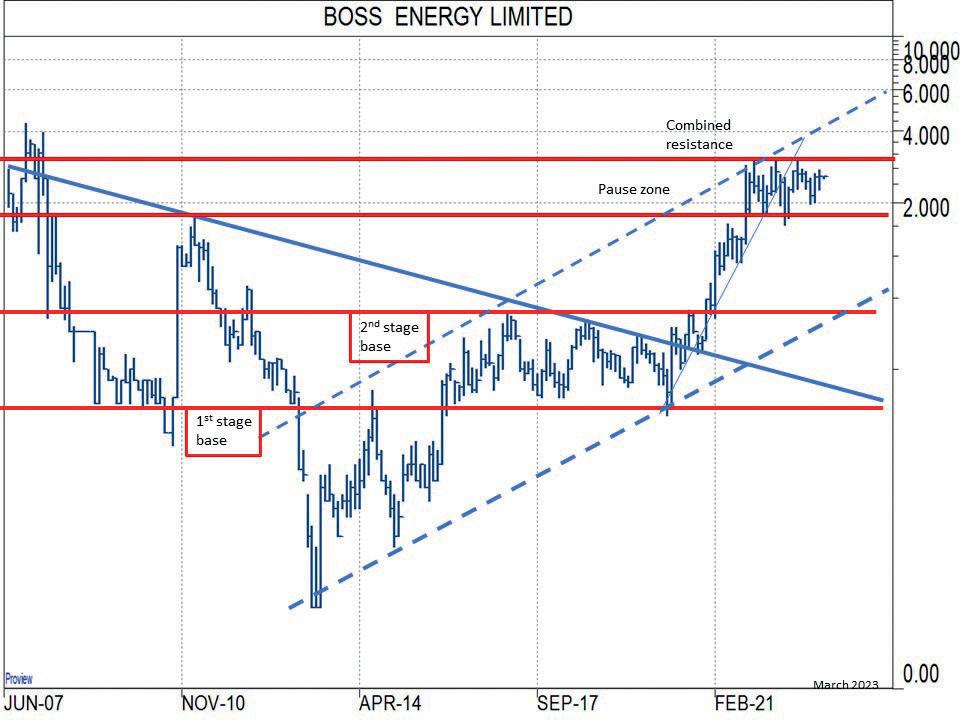

Boss Energy is focused on the restart of its Honeymoon uranium project in South Australia, with first production targeted for the fourth quarter of 2023. SA is a Tier 1 mining jurisdiction, with established export pathways to international energy markets.

Boss’ position is unique, with Honeymoon having a resource base of 71.6 million pounds of contained uranium oxide and a large inventory of 1.25 million pounds of physical uranium. This has been stockpiled to provide offtake flexibility and de-risk contract delivery during the project’s commissioning phase.

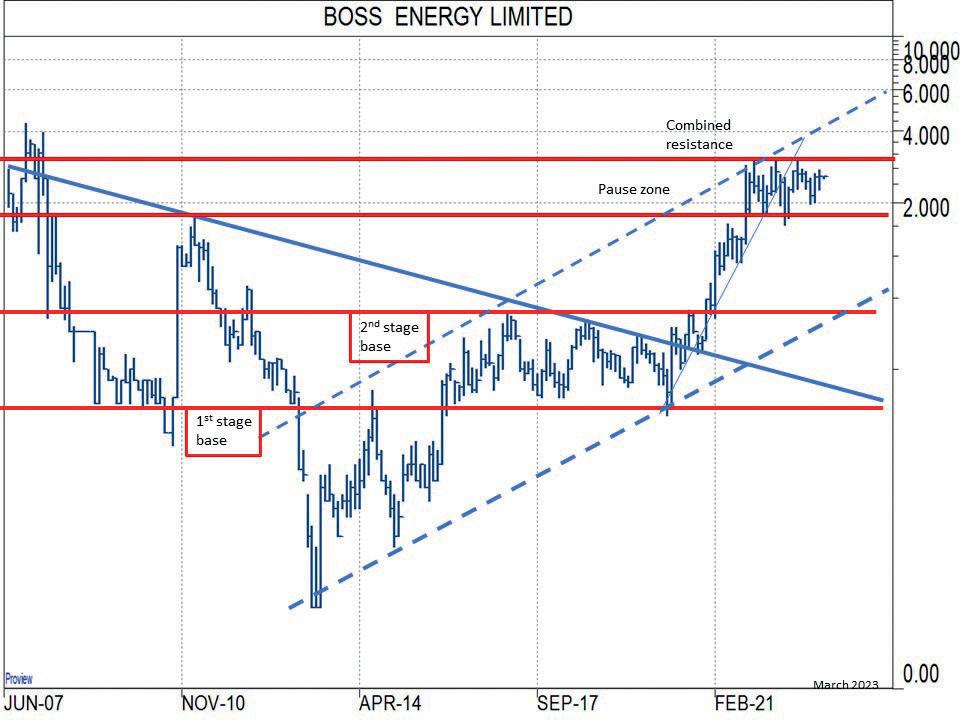

The Boss share price has anticipated the uranium price trends, finding pivotal lows

ANALYSIS WITH REGINA MEANI

– 10 –

Uranium futures reached a low point of $US17.75 in November 2016.

in June–July 2013 and completing the second stage of its basing process in December 2020. From there the price rose rapidly to achieve its initial objective of $2.80 in September 2021 where a pause/sideways action developed in reaction to overbought conditions and resistance.

The action has been largely confined between $1.80 and $3.10, with the price swings tightening more recently to between $2.25 and $2.75. These levels are short-term

identifiers for the next price move, above $2.75 for a test of $3.10 and below $2.25 for a drop to the lower parameters between $1.80 and $2.

The pause phase is likely to continue its influence over the price movements, but the base indicates the potential for the upward path to be resumed into the $4–5 area and conceivably beyond.

Another company exploring for uranium in Australia is Toro Energy.

The company’s centrepiece is the Wiluna uranium project located in the northern goldfields of Western Australia. Wiluna consists of the Centipede, Millipede, Lake Maitland and Lake Way deposits. The company has received federal and state government environmental approvals for mining uranium at the project.

In addition, Toro Energy holds exploration interests in Namibia and Africa, and an investment in Canadian-based uranium explorer Strateco Resources.

The Toro price followed the uranium price closely until January 2018, but from that point the price diverged and continued its downward path, unable to base in a similar fashion as uranium.

The share price reached a pivotal low in March 2020, supporting a significant recovery and gaining almost nine times its price within a 12-month period. After stretching into overbought conditions, the price halted and entered a volatile phase which is still influencing the price movements.

A near-term rise through $0.02 would indicate the potential to return the price to a less volatile phase, but until this level is broken the price is at risk of retesting its lows, creating a buying opportunity going forward.

Once the $0.02 level is cleared the price would likely head towards $0.04, with the prospect of moving beyond.

Based in Sydney, Silex Systems is engaging in the research and development, commercialisation and licence of SILEX laser uranium enrichment technology in Australia.

The Separation of Isotopes by Laser Excitation (SILEX) process is currently the only third-generation enrichment technology at an advanced stage of commercialisation. The process provides much higher enrichment process efficiency compared to earlier methods, potentially offering significantly lower overall costs.

In February this year, the company found very strong support for an equity raising that will allow the acceleration of their commercialisation activities. This comes at a time of increasing impetus to improve global nuclear supply chain security and to support a smooth transition toward decarbonisation.

Following the capital raising, the price for Silex dropped back towards support, which is located around $3 with back-up around $2.60.

As the pullback phase continues, buying opportunities are likely to develop as we anticipate that once the uptrend resumes the price would head through resistance at $5.80–6 and potentially beyond.

AUSTRALIAN RESOURCES & INVESTMENT

– 11 –

The Boss Energy share price anticipated uranium price trends, finding lows in June–July 2013.

The Toro Energy price followed the uranium price closely until January 2018.

‘Graphite is the next lithium’

Renascor Resources, International Graphite and Quantum Graphite are three Australian-focused ASX-listed companies advancing strategies to be part of a graphite future. We take a closer look at their attributes.

One of the key raw materials in the green energy transition is graphite, but while Australia is a key producer of other battery metals such as lithium, nickel and manganese, there are no active Australian graphite mining operations.

Graphite is used as an input for anodes – one of two electrodes that make up a lithium-ion battery, with cathodes – made up of metals such as lithium, nickel and cobalt –the other electrode.

According to Benchmark Mineral Intelligence, demand for anodes grew by 46 per cent in 2022, while supply of flake graphite – the most geologically common form of natural graphite – enjoyed 14 per cent growth last year.

This created a supply–demand imbalance, with Benchmark observing a 25 per cent rise in the price for -100 mesh flake graphite.

The lithium-ion battery anode market also became flake graphite’s biggest end user in 2022, running ahead of traditional applications in foundry and refractory industries.

And the good news doesn’t stop there, with more incentives emerging for future graphite producers.

“Rising prices on strong anode demand are expected to incentivise new supply in 2023, where four new mines are anticipated to join the flake graphite market,” Benchmark senior analyst George Miller said.

“Alongside expansions at current mines in both China and Africa, supply is set to grow by around 15 per cent.”

Miller said the -100 mesh graphite market, the preferred mesh size for anode manufacturing, is set to experience a deficit in 2023, which might see advancements in the types of anode feedstock.

“This might include milling of larger mesh sizes to suit the battery market or the use of different mesh sizes to stymie a supply deficit,” he said. “Sustaining a raw material shortage in the natural graphite anode value chain risks curtailing natural graphite anode market share.”

Several Australian companies are looking to ignite the local graphite industry. Some are not only focused on producing raw materials, but also developing a downstream offering as well. Australian Resources & Investment profiles three of those companies.

RENASCOR RESOURCES

With a market capitalisation of more than $500 million, Renascor Resources is the highest profile Australian graphite company on the ASX. This is due to the significance of its vertically integrated Siviour battery anode material (BAM) project in South

FEATURED

– 12 –

International Graphite’s Springdale graphite project in WA.

Australia, which comprises a proposed mine and concentrator near Arno Bay on the Eyre Peninsula and a planned downstream purified spherical graphite (PSG) facility in Port Adelaide.

The Siviour mine area is massive, holding the world’s second largest proven graphite reserve and the largest graphite reserve outside of Africa. This could support a mining operation for 40 years.

Siviour received Program for Environment Protection and Rehabilitation (PEPR) approval in November 2022 – the second step in a two-step assessment process from the South Australian Government.

The PEPR approval enables Renascor to process up to 1.65 million tonnes of ore per annum, allowing the production of 150,000 tonnes of graphite concentrates per annum.

Renascor has the backing of the Australian Government through a $185 million loan facility, while the company was also successful in raising $70 million through an institutional placement in December 2022. This was priced at $0.275 per share.

Renascor managing director David Christensen said upstream development would be the company’s initial focus, as that’s where he sees market demand.

“The gap in (graphite) material right now is really on the upstream and that’s largely because the customer base has grown significantly on the anode side and on the midstream processing side to feed battery companies, but the mines haven’t caught up,” he told Australian Resources & Investment

Once flake graphite concentrates are produced from Renascor’s Siviour openpit mine and processing plant on the Eyre Peninsula, further processing at the Port Adelaide facility would deliver a midstream PSG product to support battery anode manufacturing.

Christensen provided further analysis of current graphite dynamics.

“If we see where we are with graphite right now, China produces two thirds of the world’s graphite but processes 100 per cent of the graphite that goes into anodes and then produces about 90 per cent of the anodes,” Christensen said.

“And they’ve really built up their processing capacity, both on the midstream … and on the anode side, and for that matter on the battery and the EV (electric vehicle) side as well.

“There may be even overcapacity there, but there’s undercapacity certainly in China on the flake graphite, so China has now become a net importer of flake graphite, and that’s really

what’s causing the increase in the price. The reason they’re a net importer is because they need to feed the lithium-ion battery sector.”

Given its bright future as a battery anode material, Christensen compared graphite’s prospects to another battery metal key to the EV sector.

“What we tell people is graphite is the next lithium, and the more people that figure it out the better because I think we’re going to see not just our prices, but a number of prices go up relatively quickly fuelled from the supply gap,” he said.

“So it’s a great opportunity and I think there’s a lot of ASX companies who look like they have some pretty exciting resources.”

INTERNATIONAL GRAPHITE

Founded in 2018, ASX-listed International Graphite was built on the premise that the graphite industry would need more downstream processing capacity outside of China as the demand for battery anode materials increased.

The company is developing a mineto-market business model, whereby raw materials would be mined from the Springdale graphite project in WA and fed into a downstream processing plant in the emerging renewable energy hub of Collie.

International Graphite successfully commissioned its micronising facility in September 2022, which the company believes is the most advanced known pilot-scale graphite micronising and spheroidising plant to be installed and operated in Australia.

Micronising is the critical first step in the downstream processing of battery anode materials.

“What micronising does is essentially takes a fine concentrate, which might be 100–150 microns in size, somewhere in that order, and essentially grinds it down to a 20-micron size,” International Graphite managing director and chief executive officer Andrew Worland told Australian Resources & Investment

“Generally speaking, somewhere in the vicinity of 20 microns is what’s needed to progress a micronised graphite product through the battery anode process. You then spheroidise the micronised graphite and purify it, which involves taking a concentrate grade, let’s say 95 per cent, up to battery grade of 99.95 per cent.

“The final step is coating, and then you have a high-value product which is available for battery manufacturers.”

International Graphite’s Collie facility will also act as a centre for research and development (R&D) to explore the possibility of producing a finished battery anode material product.

The company acquired the Springdale project from Comet Resources in April 2022, with Comet seeing the value in International Graphite’s downstream potential. This was also reflective of broader investor sentiment.

“Where the industry was moving to more broadly from an investor perspective, was the value of a company was not being reflected in the mining assets but being reflected in the extent to which companies had explored downstream processing of their own materials,” Worland said.

“So Comet formed the view that merging the asset (Springdale) with our downstream processing IP (intellectual property) would yield a very nice consolidated business entity

– 13 –AUSTRALIAN RESOURCES & INVESTMENT

Renascor Resources’ Siviour graphite project is located on the Eyre Peninsula, South Australia.

that was all held in Western Australia and offered the benefits of ESG (environmental, social and governance) to the global marketplace. That was the basis of listing in April 2022.”

International Graphite commenced trading on the ASX following a $10 million initial public offering (IPO), and within a month the company had unveiled a larger graphite R&D facility in Collie and announced a new memorandum of understanding (MoU) with ZEN Energy to explore renewable energy options for its downstream facilities.

Drilling saw International Graphite identify several high-grade discoveries at Springdale throughout 2022, including Springdale Central and Springdale South.

In October 2022, the company finalised a $2 million financial assistance agreement with the WA Government to support the development of its Collie downstream facilities.

Worland said International Graphite could potentially commence importing concentrate before its Springdale project comes online.

“We can get that (our micronising plant) started on imported concentrates, and it may be, in time, a facility that we use to divert some Springdale material to as well,” he said.

“We’ll use that micronising facility to develop a customer base and generate cash flow into the company in 2024, before the feasibility study for Springdale and the feasibility studies for the battery anode material plant in Collie have been developed and completed.”

International Graphite’s strategy doesn’t stop there, with the company taking a holistic view at its development to find the best pathway forward.

“One of the challenges that all development-stage resource companies have in looking to get downstream is the timing to market,” Worland said. “This is certainly the case within the graphite industry.

“It takes a lot of integration of facilities and of course there’s a qualification process which is reasonably unique to graphite from a battery anode perspective that all companies need to go through. This does delay your market entry point.

“What we think is a very nice way to bridge that market entry is through establishing this micronising facility, which will be profitable very quickly. This will generate cash flow for the business that will help develop the feasibility work that we need to complete for Springdale and Collie.

“Just as important as cash flow is the market intelligence in customer networking. It’s the experience in sales and logistics that is something that doesn’t sit within any development-stage companies at this point in time. It’s a skill set that we’ll have through operations that others won’t.”

QUANTUM GRAPHITE

The Uley mine in South Australia was the sole Australian graphite producer when it was up and running between 2014–15. Uley was placed on care and maintenance in December 2015 by Valence Industries, before the company was rebranded as Quantum Graphite in July 2017.

Quantum Graphite is advancing Uley to a restart – as Uley 2 – where it aims to produce 55,000 tonnes per annum (tpa) of flake graphite from its processing plant. This would be generated from 500,000tpa of feed. The expected mine life is 12 years.

The company has been undertaking significant site works at Uley 2 before installation of the new processing plant commences, which involved remediation of the Uley legacy plant.

Recent achievements for Quantum Graphite include the renewal of its Mikkira exploration licence until October 2027. Mikkira covers much of the southern tip of the Eyre Peninsula and includes Uley 2, as well as other prospects such as Salt Lake, Homestead, Kacey and Fishery.

In November 2022, Quantum Graphite announced the successful completion of an energy storage project undertaken at INEMET in Freiburg, Germany. This involved testing and measuring the thermal performance of QSP’s flake graphite-based storage media under the same temperatures of the longduration energy storage (LDES) battery developed by Sunlands Co.

QSP is a joint venture between Quantum Graphite and Sunlands Co. focused on the manufacture of flake graphite-based thermal storage media, with the flake to be exclusively sourced from Uley 2.

Thermal storage uses heat to store energy for later use, which offers a renewable source of energy and potentially reduces the reliance on fossil fuels for energy generation.

Quantum Graphite non-executive director David Trimboli said the findings from the INEMET test work program were significant.

“These results now settle the scope of QSP’s manufacturing of Uley media blocks,” he said. “The big news is the uniformity in the heat storage results. This enables QSP to achieve efficiencies of scale in the size and type of Uley media blocks regardless of the configurations required by Sunlands Co. for its various LDES cells.

“Operationally the capability to utilise all the Uley 2 flake product range hands QSP significant operational control over the procurement process (eg timing, general market conditions etcetera) of Uley 2 flake inventory.”

Quantum Graphite launched a takeover bid for graphite explorer Lincoln Minerals in August 2022, which was still active at the time of publication (mid-March 2023) and had been extended four times by Quantum.

In a letter to its shareholders in late February, Lincoln Minerals said Quantum Graphite’s offer remained unsatisfactory, while highlighting its own attributes where it is fully funded for 2023 exploration.

Drilling at the Koppio graphite project and Kookaburra Gully graphite deposit was set to commence in March.

– 14 –FEATURED

Graphite has a bright future as a key ingredient in lithium-ion batteries.

Australia’s bright copper future

After retreating to a 20-month low in July 2022, copper prices rebounded in the months following and nudged $US4.30 ($6.43) per pound in January.

Fitch Solutions said copper prices would be supported this year by China’s pivot away from a zero-COVID policy.

“With our expectations for Chinese demand to recover in the coming months, copper prices will remain supported and edge higher in 2023,” Fitch said in a February report.

“We highlight political and community unrest in Latin America that are likely to keep the copper market tight.”

Fitch indicated social unrest in Peru following the ousting and arrest of former president Pedro Castillo in December 2022 had heightened risks for mining operations in the world’s second-largest copper-producing nation.

“Additionally, operational setbacks and regulatory headwinds in neighbouring Chile and the prospect of a mine shutdown in Panama as the government there seeks a bigger share of profit will further keep the region’s copper supply at bay,” Fitch said.

The long-term demand profile for copper

is significant amidst the green transition as the base metal is a highly efficient conduit for renewable energy systems such as solar, wind, hydro and thermal energy.

And geopolitical concerns in South America have solidified Australia’s position as a stable jurisdiction and partner for copper buyers globally.

There are a host of Australian-focused copper mining and exploration companies that have a key role to play in the years to come, including mid-tier copper producer Aeris Resources.

Aeris produces copper from its flagship Tritton operations in the Cobar region of NSW, its Jaguar mine in the Eastern Goldfields of WA as well as its North Queensland copper operations.

The company achieved approximately 27,300 tonnes of copper equivalent production from its operations in the half-year to December 31, and growth projects are advancing on a number of fronts.

This includes multi-faceted exploration at Tritton, where airborne electromagnetic surveying is being complemented by drilling

programs.

Mining from Tritton’s Avoca Tank and Budgerygar deposits will displace 1.1 per cent copper grades with 2.5 per cent and 1.8 per cent, respectively, in the coming months. Budgerygar is currently in production while Avoca Tank is set to come online in the June quarter of 2022.

Aeris executive chair André Labuschagne said the company’s aspiration is to turn Tritton into a 30,000-tonne, 10-year mine life operation.

“How we will do this (achieve 30,000 tonnes) is we are progressing out of low-grade underground mining at Tritton at depth to higher-grade deposits being Avoca Tank and Budgerygar,” he told Australian Resources & Investment.

“The next step would be bringing in Constellation which is a new discovery we did two years ago and bring that into the pipeline of production.”

Aeris announced its Constellation discovery in November 2020 and the company has been bolstering the prospect ever since, with a maiden Constellation resource announced in December 2021 and a mineral resource update revealed in August 2022.

The updated mineral resource estimate (MRE) demonstrated Constellation’s potential to produce 6.7 million tonnes of ore at 1.85 per cent copper, 0.58 grams per tonne (g/t) gold and 2.9g/t silver. This equates to approximately 123,000 tonnes of copper, 125,000 ounces of gold and 620,000 ounces of silver production.

Labuschagne said Tritton’s deposits continue to surprise.

“What we’ve found with all these (Tritton) deposits has been that they keep extending at depth,” he said. “So at Murrawombie, two years ago we thought we only had about two years left and now we think there’s three or four years left because we drilled a hole deep underground and we discovered that it continues.

“So for Tritton, it’s about turning the operation into a hub-and-spoke model, basically mining three or four mines at a time delivering 30,000 tonnes of copper. Now if you

– 16 –FEATURED

Through its suite of Australian copper operations, Aeris Resources has an important role to play to support a ballooning copper demand profile.

Aeris has added several mines to its portfolio in recent years, including Jaguar, Mt Colin and Stockman.

generate 30,000 tonnes of copper out of Tritton, you’ll generate good cash and that’s the aim –you’re turning Tritton into a Tier 2 asset.”

Labuschagne said Aeris’ Jaguar and North Queensland operations also had an important role to play in a copper future, while the emerging Stockman copper-zinc project in Victoria would also add important tonnes to the company’s output.

Aeris acquired these three assets through its acquisition of Round Oak Minerals in 2022.

As for the global copper outlook, Labuschagne said there might not be enough supply to meet lofty future demand forecasts.

“I do have a view that we will not be able to produce copper fast enough if what the government and industry are planning on renewables works out,” he said.

“So what does that mean? There will be a deficit. And what does that mean? The price will go up, but I do think the capital investment cannot go fast enough to deliver the supply we would need if everyone could achieve their targets.”

While Fitch expects the copper price to average $US8500 per tonne ($US3.86 per pound) in 2023, this will steadily increase year-

by-year before reaching an expected $US10,400 per tonne ($US4.72 per pound) in 2028.

“We forecast global copper consumption … to rise in 2023 with 3 per cent growth, amid a more positive economic outlook for China, increased demand from the autos sector and the acceleration of the low-carbon energy transition,” Fitch said in a January report.

“Over the rest of the coming decade, however, we anticipate strong demand growth driven by the power and construction

industries, rising electric vehicle production and a broadly upbeat global economic growth outlook.

“We expect global copper demand to increase from 26.5 million tonnes in 2023 to 34.9 million tonnes in 2031, averaging 3.1 per cent annual growth.”

There’s no doubting copper has an important role to play in the years ahead, and Australian copper producers such as Aeris Resources are set to benefit significantly from a ballooning demand profile.

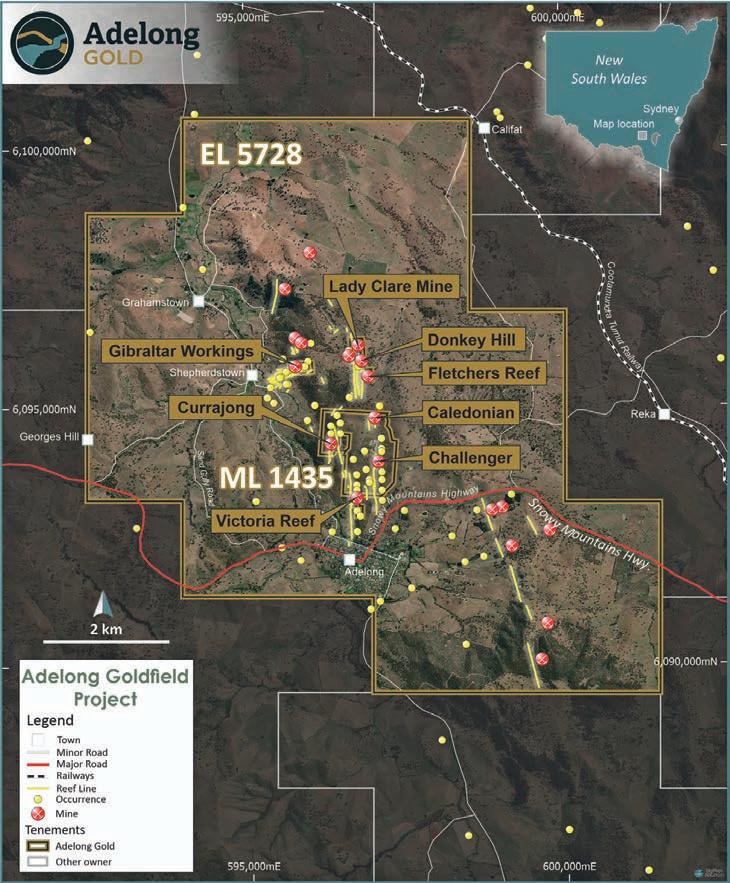

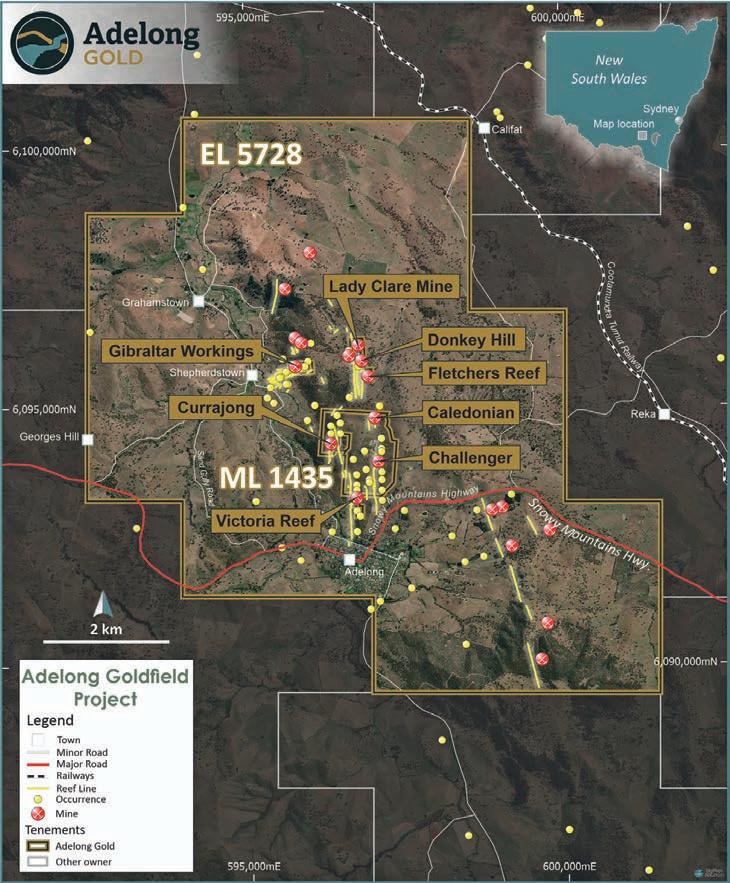

The Adelong Gold Project

Aeris Resources’ Tritton copper operation in NSW.

Aeris Resources’ Tritton copper operation in NSW.

An Attractive Development Opportunity 800k oz historical production 170k oz total JORC resource On-going exploration expected to expand resource further Scoping study confirms a viable project Processing plant on site with 100% ownership Strategy of resource exploration, plant upgrade and re-opening of mine Located in the township of Adelong, Southern NSW Hole intersected 5m@ 9.16g/tAu adelonggold.com.au ASX ADG – 17 –AUSTRALIAN RESOURCES & INVESTMENT

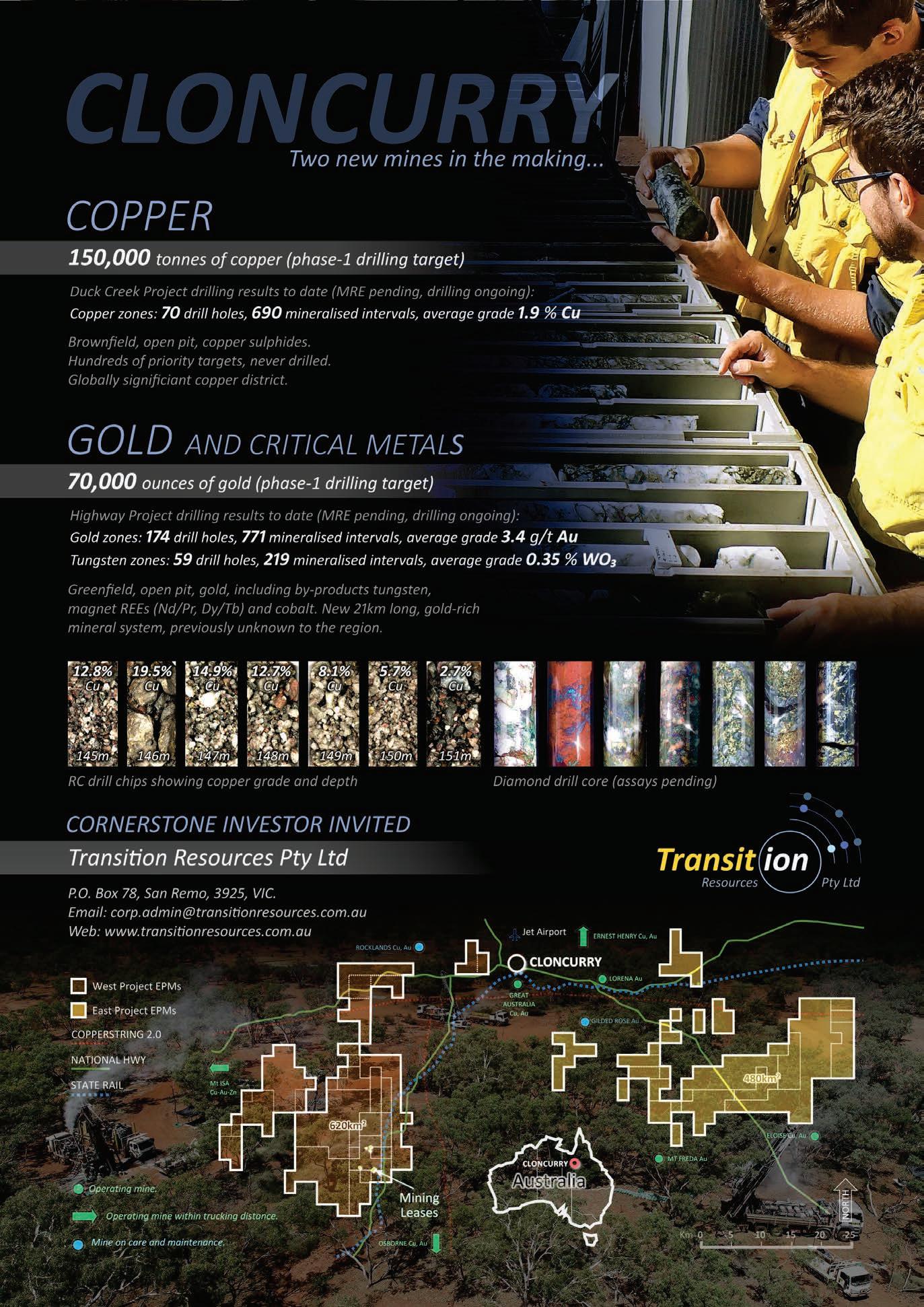

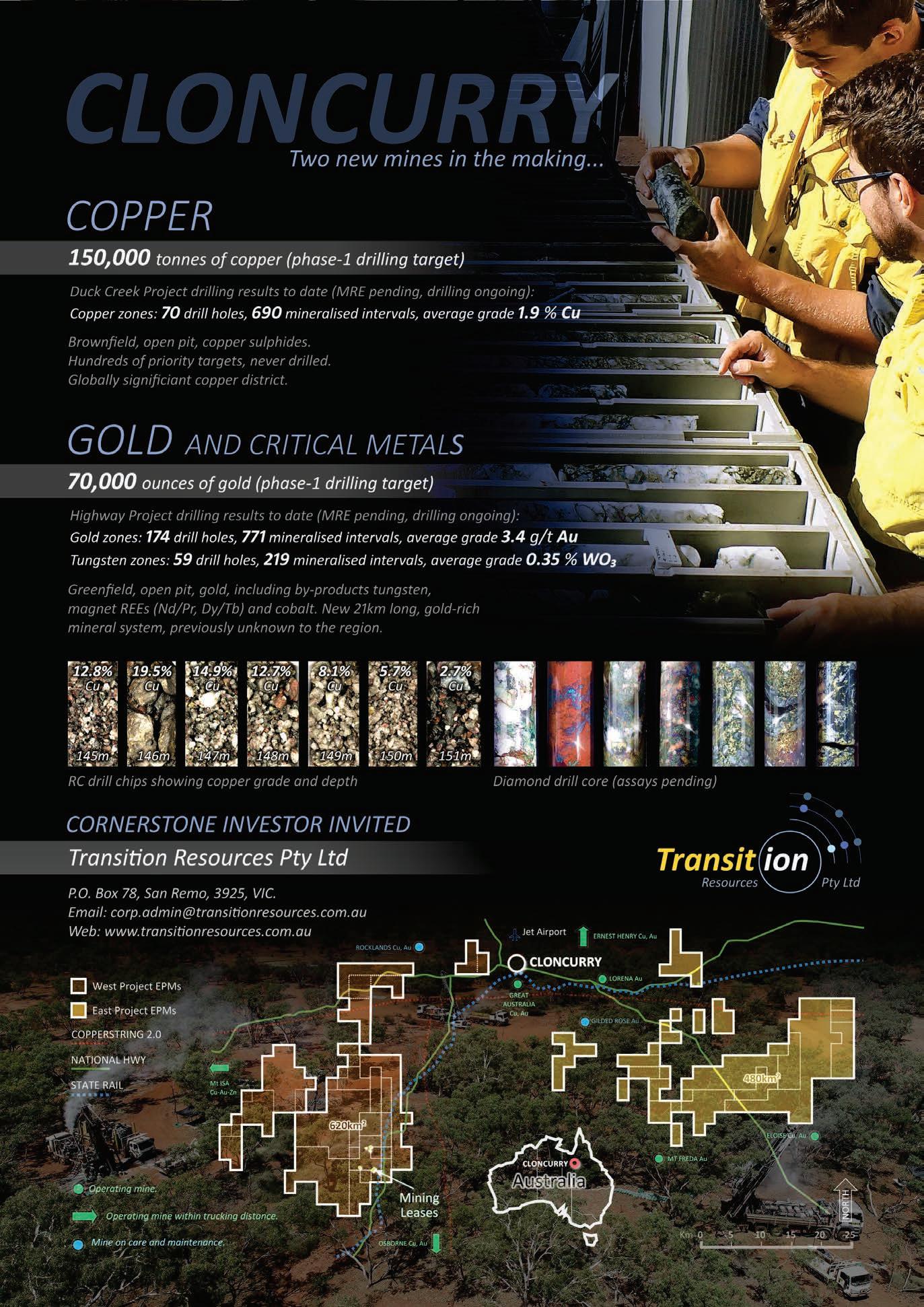

Cloncurry: Australia’s key copper district

Transition Resources has spent just over four years exploring the highly prospective Cloncurry region near Mount Isa. The investment has paid off with the company recently unearthing a rare copper discovery.

Cloncurry is historically one of Australia’s richest areas for base and precious metals production. That’s why it was a surprise to Transition Resources when it began acquiring ground in the area in 2017 only to discover that many tenements sat uncontested.

Cloncurry, along with Mount Isa, sits within the North West Minerals Province (NWMP) in Queensland.

Transition now boasts more than 1100 square kilometres of highly prospective exploration and mining tenements in two project areas east and west of Cloncurry.

Transition founder and managing director David Wilson said the company’s initial strategy was to take a closer look at some of the unique geological prospects in the region,

in hopes of identifying new deposits such as its Success cobalt mine, which has yielded ore at up to 50 per cent cobalt.

“The Cloncurry district – and the NWMP more generally – is a highly attractive exploration destination for a range of metals including rare earth elements, critical metals, base metals, precious metals, and actinides,” he told Australian Resources & Investment.

“However, the NWMP still remains remarkably underexplored and significant exploration opportunities exist.”

Transition’s investment into the region paid off when the company unearthed significant copper and gold deposits in its new turf.

Wilson said that while Transition had many project opportunities, it was currently

focused on a handful of its advanced prospects in the region.

The Highway project in west Cloncurry is a 750m-long zone of high-grade gold with significant by-products of tungsten, cobalt, and rare earths.

“We subsequently linked the Highway project to a 21km-long gold-rich mineral system which was previously unknown to the region,” Wilson said. “This is likely to host swarms of deposits similar to the Highway discovery.”

Transition now plans to progress the Highway discovery towards a decision to mine.

The company also owns a number of tenements around Duck Creek in the NWMP, many of which have yielded exciting copper discoveries.

“Our Duck Creek tenements include some of the most densely mineralised areas of the Mount Isa Inlier,” Wilson said. “We’ve identified over 550 historical prospects and dozens more are being identified every year as we continue exploration.”

Though Duck Creek has historically been heavily explored, prior drilling was quite limited and typically localised to just a handful of prospects.

“The historical view has been that Duck Creek mineralisation is shallow, so earlier explorers drilled very few holes below 50m from the surface,” Wilson said. “Our recent drilling efforts have intersected high-grade copper sulphides as deep as 280m, and it remains open at depth.

“But our most important zones have been intersected at depths less than 200m below surface, which offers cheaper open-pit mining options. The average copper grades so far are roughly double those of most undeveloped copper prospects in Cloncurry.”

Internal modelling indicates the resource scale at Cloncurry is already enough to

– 18 –COPPER

Transition has experienced plenty of exploration success in the Cloncurry region.

support a hub-and-spoke, mine-and-haul development model. But Transition believes its exploration results so far provide evidence of a more substantial system at depth.

Wilson said there was a lot more to its recent Duck Creek discovery than just luck.

“Transition’s success follows four years of exhaustive research and development,” Wilson said. “We are now converting this new knowledge into commercial opportunities.”

The Duck Creek discovery hasn’t changed Transition’s plan moving forward. Instead, it’s cemented the company’s existing strategy.

“Our plan from the outset has been to define sufficient shallow sulphide resources to support near-term mining at the Duck Creek tenements,” Wilson said.

“The new copper discoveries mean that Transition should soon be able to define mineral resources that will support mine planning.”

Transition has also identified a 250m-long zone of shallow, high-grade rare earth elements (REEs), including high-grade magnet REEs, from drilling at the Toolebuc prospect in its east Cloncurry tenements.

“Mineralisation at Toolebuc remains open and the system is not yet understood,” Wilson said.

“Geophysics has identified a large, 2kmwide conductive anomaly that aligns with a circular magnetic anomaly immediately east of the identified REE zone. These represent immediate ongoing drilling targets.”

Wilson said as one of Australia’s largest copper-producing regions, Cloncurry has an important role to play in global decarbonisation.

This has seen the region become a hotbed for consolidation, with recent deals including Evolution Mining buying the Ernest Henry copper-gold mine from Glencore, Harmony Gold’s acquisition of Copper Mountain’s Eva copper project and Aeris Resources’ acquisition of Round Oak Minerals.

“Cloncurry has a rich history of copper production which has ebbed and flowed in concert with commodity cycles for more than 120 years,” Wilson said.

“As the global investment community embraces the link between copper and a lowcarbon future, producers are wondering how they will meet future demand.”

Wilson said the looming copper supply squeeze, along with Glencore’s recent copper divestments, were creating opportunities for smaller explorers in the region.

“We’re seeing small to mid-tier groups positioning for future growth, each wanting to be the next big copper producer,” Wilson said. “There are larger groups like Evolution, Harmony Gold and Aeris moving into the area through acquisitions.

“This is happening because organic growth – such as through the discovery of new deposits – is no longer a reliable business model. New discoveries are getting harder, which is what makes our Duck Creek and Highway discoveries so exciting.”

As it stands, Transition has 50 shareholders (12 of whom are staff) and a current market capitalisation of $55 million. The fact most staff are also shareholders speaks to the company’s commitment and passion.

“Everyone here is fully invested in the company’s success for the sake of its shareholders,” he said.

With hundreds of prospects yet to be tested, including multiple targets identified at depth, as well as a handful of bountiful discoveries, Transition has an exciting pipeline of projects in the Cloncurry region.

And the company has even hinted at a potential ASX listing either late this year or early next.

– 19 –AUSTRALIAN RESOURCES & INVESTMENT

Transition holds more than 1100 square kilometres of exploration and mining tenements in the Cloncurry region.

Transition is exploring for a range of commodities in the Cloncurry region, including gold, copper and rare earths.

Why 2023 is a pivotal year for lithium prices

Supply chain insecurities have created a potentially transformative opportunity for Australia, Alexandra Colalillo writes.

Five years ago, the lithium industry’s primary concern was insufficient investment.

As investors paid increasingly more attention to developments in the sector, we have seen lithium prices soar since 2021 on the back of booming global electric vehicle (EV) sales. This saw the total spot value of lithium consumption reach $35 billion in 2022, up from $3 billion in 2020.

The scale at which price hikes continued throughout 2022 was unprecedented, despite the expectation that lithium demand would continue to outpace supply.

These prices were buoyed by ongoing global supply shortages from outpaced demand for EVs and renewable energy storage systems, coupled with supply-chain disruptions.

Market dynamism has been compounded by an over-reliance on China, which controls almost 60 per cent of the world’s capacity for refining and processing battery metals, and the invasion of Ukraine, which has seen economic

sanctions enacted against Russia, one of the world’s key suppliers of lithium products. However, these insecurities have created an economically transformative opportunity for Australia on a scale that surpasses the country’s previous dominance in commodities. Not only is Australia the world’s largest exporter of iron ore, liquefied natural gas (LNG) and coal but spodumene concentrate – a raw form of lithium – is now on the list.

What will be the decisive factor affecting the lithium market in 2023?

Demand for EVs is forecast to rise by over 40 per cent over the next two years, which will continue to support prices. But future price uncertainty is governed by a number of other factors: whether supply growth is able to keep up with demand, the emergence of new lithium mines with project execution success, geopolitical and economic instability, and the rise of alternative battery technologies.

Considering these factors, the lithium outlook remains positive, with average prices in 2023 likely to fall by approximately 8 per cent from 2022.

FACTORS KEEPING PRICES AFLOAT

By 2040, the International Energy Agency expects demand for lithium to grow more than 40 fold if the world is to meet its Paris Agreement goals. Lithium demand will therefore continue to grow as more countries pledge to reduce carbon emissions and invest in EVs and energy storage systems, both of which rely heavily on lithium-ion batteries.

As the world’s largest electric vehicle market, China is expected to remain the largest lithium consumer in the coming years, with demand on track to grow to 180,000 metric tons by 2030. As battery supply chains begin to develop, demand for lithium is also set to pick up considerably in the rest of Asia, Europe, North America, and India.

In fact, half of all new cars sold in the US are set to be electric by 2030, with similarly ambitious plans in place across the Western world.

To support these plans, policies such as the US’ Inflation Reduction Act have increased EV tax credits to $7500 on qualified vehicles through to 2032, a move designed to bolster demand. The Act also contains new sourcing requirements, explicitly offering subsidies for automakers that diversify their EV battery supply chains out of China.

This Act, coupled with US tariffs on imported goods that contain lithium

LITHIUM

– 20 –

By 2040, the International Energy Agency expects lithium demand to grow more than 40 fold.

from China, has made it more expensive for US companies to manufacture EV batteries, propelling lithium prices in 2023. If geopolitical tensions continue to escalate, it could lead to further supply-chain disruptions, contributing to continued price volatility.

FACTORS PLACING A DOWNWARD PRESSURE ON PRICES Demand

China’s decision to withdraw its decadelong subsidies for EV purchases as of January 2023 has exacerbated affordability issues and ultimately softened demand. In response, automakers have increased EV discounts in order to maintain sales. Companies such as Tesla have already cut prices by 12 per cent since September 2022. Subsidy withdrawals coupled with China’s surging COVID-19 cases will continue to dampen demand over the next six months.

We saw lithium carbonate prices fall in China to a 13-month low of CNY362,500 ($77,660) per tonne in early March, the lowest since June 2022 and over 20 per

cent down since their all-time high of CNY600,000 ($128,542) per tonne in November 2022.

Beyond 2023, two additional demand factors are at play.

First, advancements in alternative battery technologies, such as solidstate batteries, are seen as a potential replacement for lithium-ion batteries due to their higher energy density, longer lifespan and increased safety. Companies including BMW, Dyson and Toyota are already investing in solid-state battery technology; however, it could take several years before they become commercially viable and for lithium-ion batteries to be replaced on a large scale. EV batteries also typically have a 10-year function life, with the potential to create a large challenge for future waste management.

Second, while there is a global push to utilise critical minerals like lithium in order to decarbonise, the impact of mining this commodity carries environmental and contamination risks given current practices are energy and chemically intensive.

Supply

While the lithium supply shortage remains, we could expect prices to fall from a supply wave that may hit the market in 2023, prompted by a boost in production capacity from existing and near-term producers in Australia and South America’s ‘lithium triangle’ of Chile, Argentina and Bolivia, which together hold the majority of the world’s known lithium resource. Chile alone is responsible for a quarter of world production and holds more than 40 per cent of global reserves, followed by Bolivia (24 per cent) and Argentina (21 per cent).

Australia was the world’s largest lithiumproducing country in 2022, with its largest lithium mine, Greenbushes, contributing 40 per cent of global supply.

Greenbushes, among other growing hard-rock lithium operations in Western Australia and the Northern Territory, is subject to future expansions, including for lithium chemicals. As a result, projected global output of lithium carbonate from top producer, Australia, is expected to reach 915,000 tonnes in 2023, a 3 per cent rise from 2022’s estimate. Lithium shortages

– 21 –

AUSTRALIAN RESOURCES & INVESTMENT

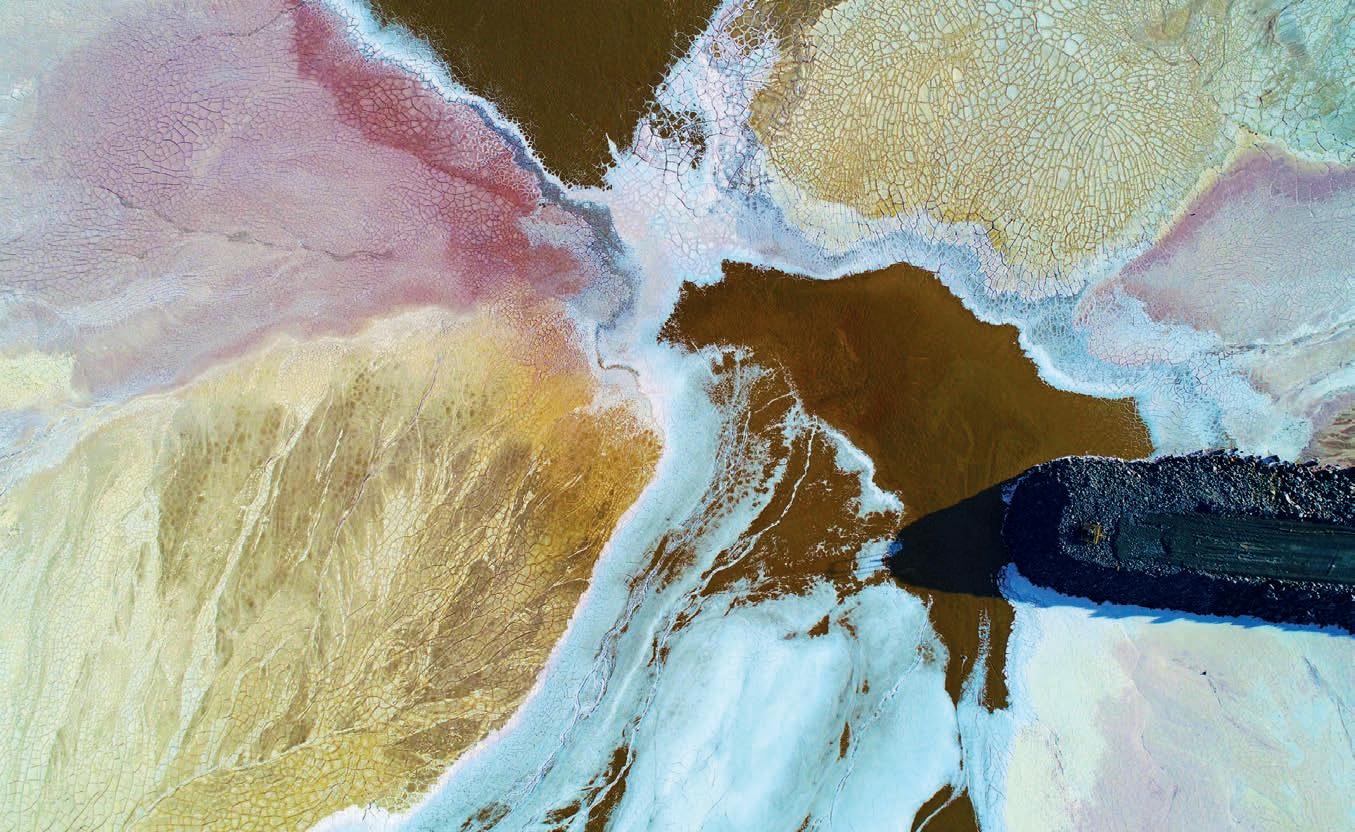

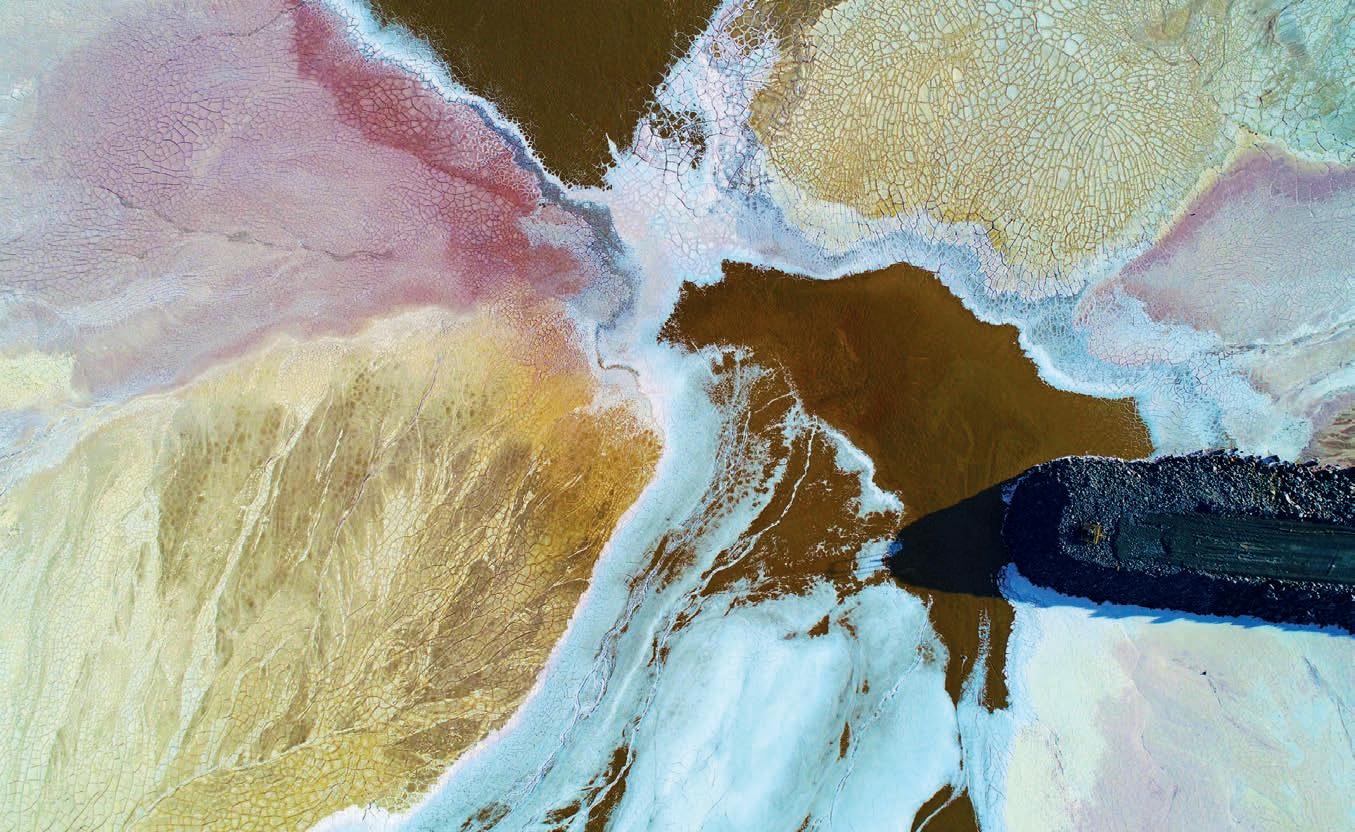

A brine pool for lithium mining. Lithium brine is primarily produced in Chile, Argentina, China and the US.

are expected to ease as this supply comes online, placing a downward pressure on prices.

Despite a broad agreement pointing to a major increase in lithium supply in 2023 following a wave of expansions and emerging projects, the divisive question is whether they will successfully deliver and meet sustained demand forecasts.

Discussions about hopeful expansions rely on top producers from Chile, China and Australia. However, if these larger players hit hurdles in launching volumes of lithium supply due to the complex extractive industry, global production forecasts are expected to be pegged between 22–42 per cent in 2023.

Concern is also channelled toward the less-established producers who are subject to tough regulatory, technical and commercial challenges. While the emergence of new lithium mines in countries such as Canada and the US are on the horizon, these challenges, as well as seeking a knowledgeable labour force, are likely to delay the time in which these mines become operational.

DOES THIS PRESENT AN OPPORTUNITY FOR AUSTRALIA?

Australia is in great stead to position itself as a critical minerals mining and refining superpower due to the scale of our wind and solar resources, sparsely populated continent and financial market stability. These factors, combined with the country’s energy independence, supply-chain security and critical geostrategic consideration, presents a large opportunity for Australia.

With the rising global commitment toward decarbonisation, Australia is at the beginning of a global significant investment boom, with its top-five ASX-listed lithium firms holding a collective market capitalisation in excess of $50 billion.

Australia is already the world’s largest producer of hard-rock lithium spodumene and by 2024, Australia is expected to account for 10 per cent of global lithium hydroxide monohydrate (LHM) production. Given China currently processes 60 per cent of the world’s LHM, almost all sourced from Australian lithium spodumene mines, this emphasises the strategic opportunity for Australia to value-add before export.

The development of these lithium processing and associated downstream industries in WA will also benefit the economy, projected to create up to 52,000 Australian jobs in the state by 2050.

– 22 –LITHIUM

Alexandra Colalillo is an economist in her independent capacity and a manager at a global professional services firm. A key part of Alexandra’s role involves assisting mining organisations respond to risk and fluctuating economic conditions to minimise financial and operational uncertainty.

Australia is the world’s largest lithiumproducing country.

Connecting talent with industry. powered by careerone hiring.australianresourcesandinvestment.com.au ADVERTISE JOBS TODAY

New shark in town

Now that Andromeda Metals has received final regulatory approvals from the South Australia Government, the company is set to commence constructing its Great White halloysite-kaolin project.

Australia is the world’s biggest lithiumproducing country, while the country also ranks among the top producers of four other essential commodities: iron ore, bauxite, rutile and zircon.

While miners climb over one another to be the biggest and the best, grappling with the whims of consumer demands, others have carved their own path.

In recent years, Andromeda Metals has been advancing its Great White project as it looks to become Australia’s first halloysitekaolin producer.

Halloysite-kaolin is considered the most researched clay mineral in the world. It’s exceptionally rare, and highly valuable thanks to its unique tubular microstructure.

Now that the SA Government has approved the project’s Program for Environment Protection and Rehabilitation (PEPR) – the second and final regulatory approval – the company is poised to commence constructing Great White.

“We are very excited to have received approval of the PEPR as it brings Andromeda closer to becoming a globally significant producer of halloysite-kaolin products,” Marsh said.

“With this important regulatory milestone now achieved, Andromeda is poised to progress towards construction, as we advance funding discussions which will enable a final investment decision,” he said.

Approval of the PEPR permits the processing of up to 300,000 tonnes per annum (tpa) of ore equating to the production of 150,000tpa of halloysite-kaolin.

The PEPR also enables the staged development of Great White along with the mine’s first 13 years of production.

Prior to achieving its PEPR approval, Andromeda had been hard at work laying the corporate groundwork for Great White production.

In March 2021, Andromeda executed an agreement with Japanese porcelain manufacturer Plantan Yamada for its Great White CRM product, which will see the company purchase 5000 tonnes per annum of halloysite-kaolin at $700 per tonne for use in ceramics.

Then in August 2022, Andromeda and Plantan Yamada signed an additional offtake agreement involving the supply of up to 43,000 tonnes of the Great White KCM 90 product.

Plantan Yamada will receive halloysitekaolin across the first three years of Great White’s operation with price reviews at 12 months and the potential for further extension.

The Japanese porcelain manufacturer had been analysing and testing samples at laboratory, pilot scale and full commercial scale over the prior three years including a 40tonne batch of Great White material.

This was the second binding offtake agreement for the Great White KCM 90 product, with Andromeda signing a binding offtake term sheet with Vietnam and Hong Kong-based Asia Mineral Resources in July 2022 for the supply of up to 38,500 tonnes of KCM 90.

In June 2021, Andromeda also established an offtake partnership with Jiangsu Mineral Sources International Trading Co. for its Great White PRM product.

This will see the Chinese commodity trading house purchase 70,000 tonnes per annum of Andromeda’s halloysite-kaolin product for more than $700 per tonne to be used in the coatings and polymers market. This is distinct from the CRM and KCM 90 products to be sold to Plantan Yamada and Asia Mineral Resources.

HALLOYSITE-KAOLIN

– 24 –

Andromeda recently received PEPR approval for Great White, paving the way for construction to commence.

When Marsh spoke to Australian Resources & Investment in a February 2022 feature, he discussed some of the challenges with selling halloysite-kaolin, and how his relationships in the field gave Andromeda a commercial advantage.

“We chose ceramics first because we knew it had the halloysite which is where it’s highly valued,” he said.

“I’ve been selling this stuff for 30-odd years and I’ve got a list of customers that I’ve been involved with over that time.

“So that gave us a huge head start. Plus I knew exactly why these buyers would value it and how much it was worth for them, because they would never tell you that themselves.”

Marsh said much of hallowysite-kaolin’s complexity comes down to selling the product, and the fastidious analysis and decision process buyers go through before signing off on any offtake deals.

“It’s a very hard material to market because there’s no index pricing for this stuff. In China alone, there’s over 10,000 users of this material and they’ve all got their own different formulations, their own processes, their own people who work different ways,” Marsh said.

“You also don’t talk to the buyers, you talk to the technical people and say, ‘here’s our product, this is its chemistry, this is its particle size, this is how it’s going to perform, and this is how to use it in your application’ and convince them how they can use it.”

Despite the strict authentication process for commercially-viable and high-quality halloysite-kaolin, Andromeda’s product jumped through all the hoops potential buyers could throw at it.

Andromeda sees further potential to commercialise halloysite-kaolin in industries such as construction, agriculture, healthcare,

EXPRESSIONS OF INTEREST PARTNERSHIP / SALE

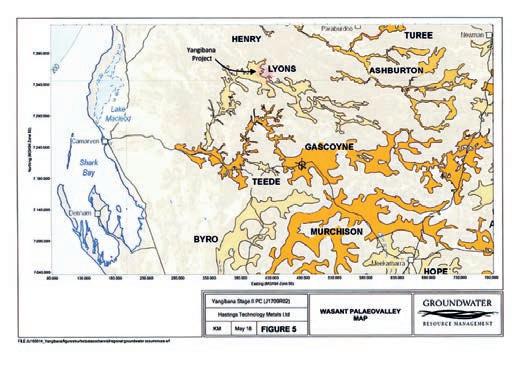

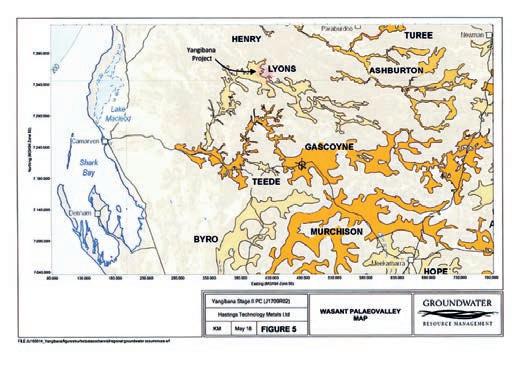

containing critical minerals in REEs indicated by surface sampling.

Three tenements with two granted and one pending application are situated on the Main Road from Carnarvon to Meekatharra. This includes mostly sealed bitumen to Meekatharra, a mostly sealed main road to Geraldton port, while station tracks just north of the Gascoyne River give access to the northern tenement areas.

This is a greenfield site surrounded by companies as Kingfisher Mining, PVW Resources and Krakatoa Resources, as well as Odessa Minerals and others who have reported significant finds on their tenements.

State and Federal Governments offer assistance including drilling subsidies. Russell Mining feels that a company with sufficient size to enable drilling to the basement of the underlying Paleo Valley and who is experienced with intrusive such as carbonatites would suit the company’s needs in helping explore this exciting project.

Victor

Victor

K Russell. Director.

ENQUIRES TO Victor Russell at kimvickr@gmail.com

SUBMISSIONS TO Aiden Rando

cosmetics and nanotechnology.

The company will proceed with early-stage site preparation for Stage 1A construction of Great White in the coming months, with further funding to be raised to support this.

With international buyers lining up, and the last of its regulatory approvals in place, Andromeda’s Great White project is set to make a major splash in the market.

There’s plenty of work still to be done, but Andromeda has plenty of reasons to celebrate its achievements so far, paving the way for a halloysite-kaolin industry to be established in Australia for the first time.

AUSTRALIAN RESOURCES & INVESTMENT

Andromeda is looking to become Australia’s first halloysite-kaolin producer.

The Directors of Russell Mining are seeking expressions of interest for their Landor Project in the Gascoyne Province,

– 25 –

A near-term gold producer steeped in history

Australian Resources & Investment showcases the emerging Adelong gold project and its near-term potential to join the NSW gold-producing ranks.

Ever since Adelong Gold acquired its namesake gold project in New South Wales in May 2020, the company has been advancing the asset on a number of fronts.

The Adelong gold project produced for a short period of time before the company acquired it, however as Adelong managing director Peter Mitchell suggested, there were some issues with the previous operation.

“Adelong had not been developed properly with the right scale, equipment and mine plan so the project needed to be revamped,” he told Australian Resources & Investment

“It didn’t mean that the project itself shouldn’t work. The metallurgy was really good – every record showed it was getting plus-95-per-cent recoveries of gold in various process technologies. So we knew we could do it better, but we had to clean the slate and rethink how best to develop the project.”

In restrategising the Adelong gold project, Adelong Gold looked at the project’s economic potential, which supported the need for greater scale and resource expansion.

“We’ve built up a bigger resource base, larger-scale production, and designed this around what would be economic,” Mitchell said.

This saw Adelong Gold reconsider the project’s processing and tailings strategy,

with the company’s sights set on maximising its mining footprint to enable more deposits and more ore streams.

Adelong’s flagship deposit, Challenger, was mined by the previous owner and has an active mining permit in place. Elsewhere, Adelong is represented by the Currajong and Caledonian deposits, as well as several other emerging prospects, with the company holding exploration permits spanning 70 square kilometres.

Since acquiring Adelong, Adelong Gold has increased the resources and average grade by 35 per cent and 18 per cent, respectively. The project has a current JORC resource of 1.55 million tonnes at 3.41 grams per tonne (g/t) gold, which equates to 169,700 ounces of gold.

Mitchell said in order to accommodate greater scale at Adelong, the company is exploring the option of building a 240,000tonne processing plant, however not all of this capacity may be used initially.

“Initially, we were looking to start it (the processing plant) on one shift,” he said. “In other words, we’re planning to treat 120,000 tonnes the first year, which is what the development consent allows us to do.

“Then we plan to expand the throughput when we incorporate our other resources with approvals.”

Adelong Gold released an updated scoping study in late October 2022, which demonstrated $11.9 million of initial capital costs for a five-year mine life, with the potential to produce 81,082 ounces.

This would generate net cash flow of $69.2 million at an internal rate of return (IRR) of 72 per cent when all capital and operational expenditure is considered.

Perhaps most significantly given Adelong’s scale potential, the updated scoping study only considered 55 per cent of the JORC resource, highlighting the untapped upside of the project.

Mitchell said Adelong has “all the makings of a good mine” and that the immediate focus would be continued exploration and bolstering the resource.

“We’re satisfied that we can do it, so we’re now looking at exploration,” he said. “Anything we find now will just go straight to the bottom line – with the last resource we added $17 million. So if we get a few of those, then we’ve got a really solid project.”

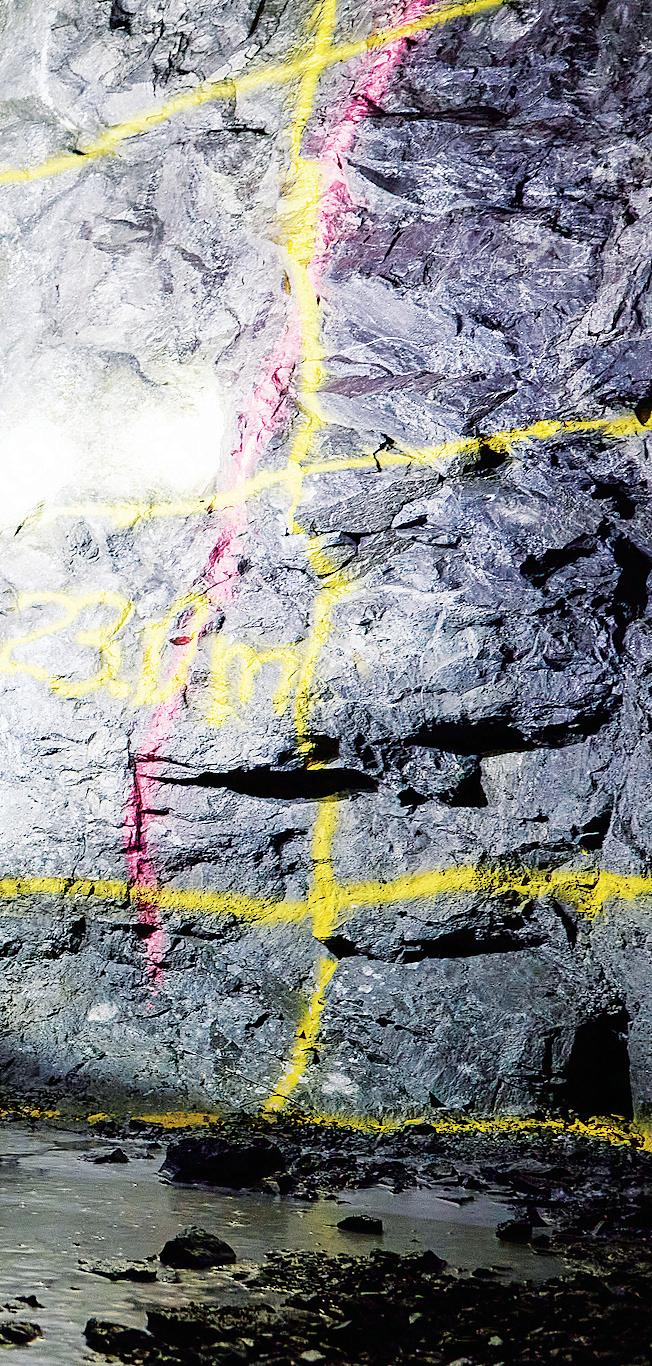

Adelong commenced a drill program at its Gibraltar prospect in March, which is following up a successful drill program completed in October 2022.

Significant assays from the October program included 3m at 12.57g/t gold from 20m, including 1m at 34.6g/t, and 1m at 18.55g/t gold from 78m at drill hole 3DGIB007.

– 26 –

GOLD

Adelong Gold is developing a range of prospects at its namesake project, including Challenger, Gibraltor and Caledonian.

Drill hole 3DGIB008 delivered 6m at 2.79g/t gold from 90m, including 1m at 8.58g/t.

Mitchell said Gibraltar, which has the potential of a porphyry system, is one of Adelong’s most exciting prospects.

“Drilling has shown, for the first time, very wide zones of pervasive mineralisation indicating the potential of the Gibraltar area to generate a large tonnage resource,” he said. “It has the sniff of a porphyry system and part of our March program is to drill some holes deeper below where we drilled last time and see what it looks like.

“When I first looked at Gibraltar and started drilling it, I was looking for a 50-60m open cut mine. But now that we’ve got some good results, we’re going to drill a couple of deeper holes to see what the trend is. If it’s really good, we’ll stick one hole below it all.”

Gibraltar, which has produced 140,000 ounces of gold in the past, not only forms part of today’s Adelong project, but also forms part of the broader Adelong Goldfield which has historically produced more than 800,000 ounces.

“Historically, this area has been mined in the 19th and 20th centuries at a grade of 31 grams per tonne – over one ounce to the ton,” he said. “But we can mine it down to two, three or four grams per tonne. Our economic cut off is one gram per tonne.

“We can do things the old timers could never do and there are a lot of resources that have never been mined because they could not deliver the high grades required to be economic. We’ve got three-and-a-half kilometres of strike of a mineralised body which has historically only produced 6000 ounces and largely remains untested.

“Some drilling done in the southern part (the Sawpit deposit) of Adelong is showing good widths and grade. These are the kinds of targets we’ve got for going back and really opening up this area for more potential.”

An expanding Adelong gold project means Adelong Gold will require further approvals to mine the additional deposits. The company is in communication with the local councillors about Adelong Gold’s longterm mining prospects and has support from the local community for the project.

As Adelong Gold continues to understand the scale of its Adelong gold project, it can have confidence in the fact it has built the foundations to be a near-term gold producer. And with a passionate and committed board of directors leading the way, Adelong Gold is setting itself up for an exciting future.

– 27 –AUSTRALIAN RESOURCES & INVESTMENT

The Adelong gold project is located near the town of Adelong in NSW.

Adelong Gold’s exploration and mining licences.

An early mover in north-east Tasmania

Australian Resources & Investment sat down with Flynn Gold, an ASXlisted company with a suite of exciting projects in the emerging gold province of north-east Tasmania.

Flynn Gold has delivered significant exploration success at its gold projects in north-east Tasmania, highlighted by continuous high-grade assay results from the Trafalgar prospect at its Golden Ridge project.

Some of the most impressive results include 1.2m at 65 grams per tonne (g/t) gold from 57.5m, including 0.5m at 143g/t gold in drill hole TFDD003; and 1.25m at 106.6g/t gold from 119.8m, including 0.7m at 152.5g/t gold in drill hole TFDD005.

In January, Flynn Gold announced drill hole TFDD005B had intersected 14.7m at 5.5g/t gold from 109.4m, including 0.6m at 109g/t gold.

These results have marked the birth of a new gold prospect not only significant to Flynn Gold but to the broader Tasmanian mining industry. And it was something Flynn Gold technical director Sam Garrett and exploration manager Sean Westbrook anticipated when they first pulled together the company’s north-east-Tasmanian assets.

“Sam and Sean identified opportunities which were overlooked as far as gold in north-east Tasmania goes,” Flynn Gold chief executive officer Neil Marston told Australian Resources & Investment.

“Sam and Sean are both Tasmanian locals – they were raised in Tasmania and have family there – so they know the background of that part of the world pretty well, and particularly after the discovery of high-grade gold in Victoria around places like Fosterville, there was a lot of encouragement to go and secure old goldfields in north-east Tasmania.”

This part of Tasmania holds a number of geological similarities with Victoria, both hosting orogenic and intrusion-related gold systems (IRGS). Victoria has several operating gold mines, including Fosterville, Costerfield and Stawell, but there are no gold operations up and running in north-east Tasmania. This is not reflective of the endowment, with north-east Tasmania still underexplored.

In fact, while $222 million was spent on exploration in the Victorian goldfields in 2021–22, approximately $32.8 million was spent on exploration in Tasmania over this period, with most of this spent on areas outside of the north-eastern part of the state.

Marston said through Garrett and Westbrook’s foresight, Flynn Gold has established an early-mover advantage in north-east Tasmania, with a 1134-squarekilometre landholding at its disposal.

“The most important thing is we’ve picked up most of the gold prospective tenure in that part of north-east Tasmania east of the Tamar River,” he said.

“Apart from some ground around the Mathinna goldfields, we’ve certainly got the rest of the ground north and south of that which has historically produced gold.