TOM PARKER

Tom.Parker@primecreative.com.au

The gold price has made itself at home up around $US2000 per ounce in 2023, amid growing economic uncertainty worldwide.

While this will please Australia’s gold producers, there are other pressing local issues that need to be addressed.

The 2023–24 budget has allocated $57.1 million to supporting international critical minerals partnerships, which complements the $2 billion Critical Minerals Facility established in 2021. Managed by Export Finance Australia (EFA), this facility provides funding for early-stage critical minerals projects.

But Australia’s broader critical minerals roadmap won’t become clear until Federal Resources Minister Madeleine King releases Australia’s critical minerals strategy for 2023.

It’s understood King’s paper will focus on Australia’s downstream processing opportunities to complement the country’s established mining credentials.

In the June–July edition of Australian Resources & Investment, we celebrate some of the critical minerals projects that will be key suppliers to a decarbonised future.

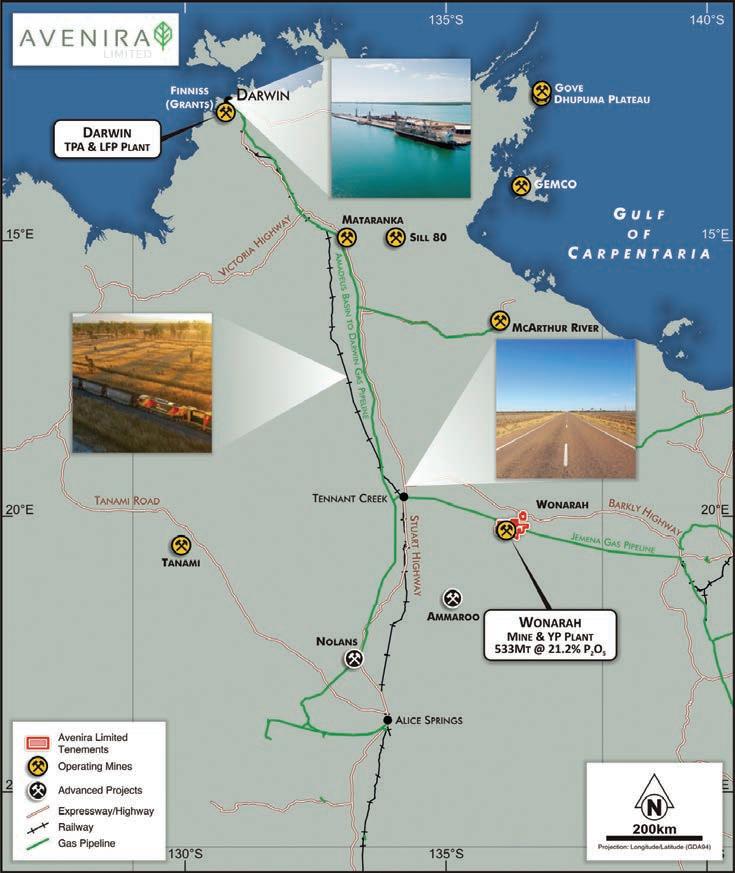

This includes Avenira, which is aiming to build one of only three LFP cathode manufacturing plants outside of China. This will be located in Darwin and take feed from Avenira’s Wonarah phosphate mining operation also located in the Northern Territory.

The LFP plant will produce a battery-grade cathode product for battery manufacturers worldwide – a product set to increase in demand in the years to come.

Other emerging critical minerals producers featured include Future Battery Minerals, which late last year made a significant lithium discovery at its Kangaroo Hills project in WA. The company also owns the promising Nevada lithium project in the US.

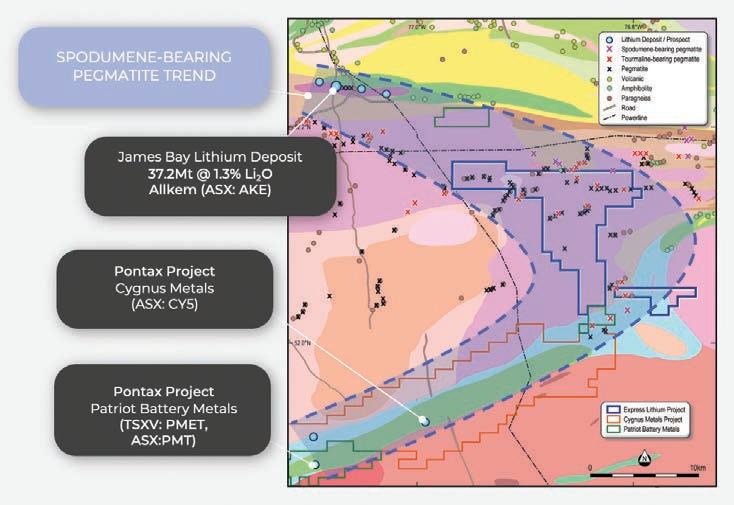

Recharge Metals recently acquired its Express lithium project in the James Bay region of Canada, which is becoming increasingly hot property as companies see the region’s significant hard-rock lithium potential.

Express is located near some of the world’s most promising lithium projects, including Allkem’s James Bay deposit and Cygnus Gold’s Pontax project.

Rare earths also have a key role to play in a decarbonised future. We spotlight four ASX-listed rare earths explorers that are worth keeping an eye on.

Elsewhere, we explore the journey of South32 since it was demerged from BHP in 2015, shine a light on some promising mining tech stocks and recap the recent RIU Sydney Resources Round-up in May, where 90 ASX-listed exploration companies showcased their achievements and project developments.

Happy reading.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER CHRISTINE CLANCY

EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

MANAGING EDITOR

PAUL HAYES

Tel: (03) 9690 8766

Email: paul.hayes@primecreative.com.au

CLIENT SUCCESS MANAGER

JUSTINE NARDONE

Tel: (03) 9690 8766

Email: justine.nardone@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGER DAVID GOLDBERG Mob: 0434 792 225 Email: david.goldberg@primecreative.com.au

SALES ADMINISTRATOR EMMA JAMES Tel: (02) 9439 7227 Mob: 0414 217 190 Email: emma.james@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

GRAPHIC DESIGNERS KERRY PERT, LOUIS ROMERO

FRONT COVER

Past mining at Avenira’s Wonarah phosphate project in the Northern Territory.

Image: Avenira

SUBSCRIPTION RATES

Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA

379 Docklands DR, Docklands, VIC 3008, Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2021

All rights reserved. No part of the publication may be reproduced or copied in any form or by any means without the written permission of the publisher.

Tom Parker EditorPRINTED BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337 Published 12 issues a year

As gold enjoys a resurgence in 2023, it’s other golden opportunities that Australia must capitalise on.

Mining technology is one of the great stories in Australian industry. From software to data, automation, and even space research, mining tech has a big future.

Woodside Energy Group’s work with NASA to develop robotic technology is an example. Woodside has one of eight NASA Robonaut 2 anthropomorphic systems in the world for testing.

Transferring technology from the resource sector to Australia’s space industry is highly innovative. Our mining and energy sectors are used to working in harsh environments (space is as harsh as it gets) and are world leaders in robotic technology in their field.

We can expect to see greater collaboration between the local mining and space sectors in the next few years as Australia leverages its strengths in resources to fast-track the development of a thriving local space industry, especially in Western Australia.

Woodside and Rio Tinto are already supporting the Australian Remote Operations in Space and Earth (AROSE) Trailblazer

Stage 1 through their terrestrial robotic and automation capabilities. Trailblazer will see Australia build, design, test and operate a lunar rover for NASA’s return to the Moon.

IMDEX and RPMGlobalAlthough fascinating, the work of Woodside, Rio Tinto and other large mining companies in space-related collaborations is small in the scheme of things – at least for investors. Nobody buys large mining stocks for their technology collaborations.

Australian investors who want space exposure typically buy giant offshore stocks; Lockheed Martin Corp, Boeing or Northrop Grumman, for example. Or they speculate

on a handful of ASX-listed micro-cap stocks developing space technologies.

Even so, the work of Australian mining companies in space technology highlights how much latent tech capability exists in the resource sector, as well as how technology within companies could be commercialised to create new shareholder wealth.

That trend is well underway, as mining services companies launch new brands

and capabilities around their technology businesses. No doubt they have watched the success of IMDEX and other specialist miningtech firms on the ASX.

Creating a standalone, branded tech division is the best way for some mining services companies to get greater market recognition for their technology and data capabilities.

ASX-listed mining services company Perenti has launched ‘idoba’, a promising new tech-driven service that leverages the company’s in-house technology and data expertise for its clients.

Boart Longyear, another ASX-listed mining services stock, this year launched Veracio as a wholly owned technology subsidiary. After years of problems, Boart Longyear has muchneeded momentum. Veracio has excellent technology through its TruScan product and long-term growth potential.

The next step is spinning out these and other businesses as standalone ventures and raising capital through an initial public offering (IPO) or demerger.

The time is right, assuming equity markets hold up this year. It’s likely there is latent demand for quality mining-tech companies from small-cap fund managers and other investors that want exposure to this fastgrowing sector.

Australia’s mining engineering, technology and services (METS) sector contributes $92 billion to the nation’s economy, according to METS Ignited. The sector’s projected growth is expected to add another $50 billion to the economy by 2030.

The METS sector has averaged annual growth of 7 per cent, and as Australia’s economic growth slows this year (and possibly even flirts with recession if interest rates keep rising), the sector stands out for investors.

METS, of course, is much broader than technology. But the sector’s size, success and projected growth raise important questions: Why are there so few specialist mining-tech stocks listed on the ASX? How can investors get exposure to this sector?

Here are two ways to play the mining-tech trend on the ASX.

One of this market’s great small-cap companies, Perth-based IMDEX is a key choice for local investors seeking specialist miningtech exposure.

IMDEX helps drilling contractors find, define and mine orebodies. Real-time data enables miners to make faster, better decisions.

IMDEX shares tumbled in early 2020 as the market reacted to COVID-19. Investors feared commodity prices would sink and mining activity would slow. IMDEX relies heavily on exploration spending, which was expected to stall during COVID-19.

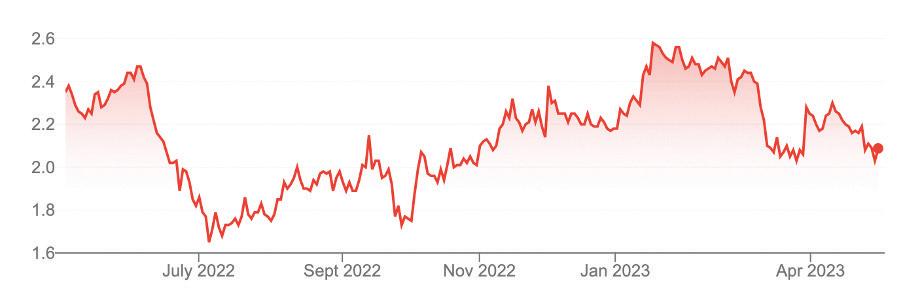

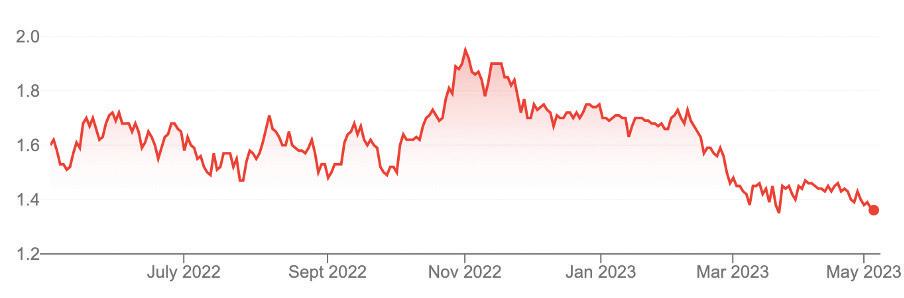

But from its 2020 low of around $0.80, IMDEX rallied to almost $3 in early 2021 as the market realised it had overreacted to COVID19’s effect on the METS sector.

IMDEX has since eased to $2.08 (in early May), in line with broader weakness in smallcap stocks. Small-cap investors should keep an eye on IMDEX at that level.

IMDEX has four attractions for investors.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at May 9.

Firstly, it’s leveraged to rising mining activity. If, like me, you believe the commodity supercycle is still in its early stages (largely due to supply constraints), companies leveraged to higher mining activity are appealing.

Secondly, IMDEX is transforming its business model. More of its revenue is coming from higher-margin, recurring tech services, and less from its drilling consumables market – a trend that should continue.

Thirdly, IMDEX can broaden its ‘touchpoints’ in the mining value chain. The company’s BLAST-DOG blast-hole drilling technology has good potential.

Although it’s early days for BLAST-DOG, the technology could increase IMDEX’s exposure to the production phase of mining, and gradually reduce its reliance on the more cyclical exploration phase. If successful, that could help re-rerate IMDEX by attracting a higher valuation multiple.

The fourth attraction is acquisitions. March saw IMDEX complete its acquisition of Devico AS for $324 million. The Norwegian company is a global leader in drill-site technology, including for sensor and directional drilling.

RPMGlobal is the other main choice in smallcap mining tech stocks on the ASX.

The Brisbane-based company provides software for mine scheduling, budgeting, simulations and asset management, and trains employees on how to use the software. Its advisory business consults on the technical and economic assessment of mines.

Established more than 50 years ago, RPMGlobal has 24 offices overseas and a global client base, with some of the world’s largest mining companies using its software.

RPMGlobal used its March 2023 half-year review to reaffirm its EBITDA guidance of $14.2 million for FY23. The company also confirmed total revenue for FY23 would be $96.4 million, from earlier guidance of $101 million.

A hot labour market has made it harder for RPMGlobal to source employees, particularly in its advisory business, and greater use of contractors has put pressure on costs.

These short-term headwinds have seen RPMGlobal fall from a 52-week high of $1.95 in November last year to $1.36 in early May 2023. Like IMDEX, RPMGlobal is well down this year.

In its half-year review, RPMGlobal said it was “excited about the magnitude of opportunities entering the company’s software pipeline”. Progress in the Indonesia mining-tech market and southern Asia were other highlights.

RPMGlobal has long-term growth potential in the booming environmental, social and governance (ESG) advisory market in mining. Broadening its revenue base in clean-energy mineral projects – and acquisitions – is another source of growth.

Capitalised at $309 million, RPMGlobal does not suit conservative income investors; however, the company has more substance than many similarly-sized tech companies on the ASX – and a global footprint in a growth market.

Software-as-a-service is a great business model when it works. Mission-critical software in mine operations has high switching costs and provides recurring, higher-margin revenue. Just over a third of RPMGlobal’s revenue is recurring.

The company is well-positioned for strong mining activity in the next few years – and for greater uptake of mining-tech services, particularly mobile solutions – but you wouldn’t know that by looking at RPMGlobal’s share price this year.

Growing concern about climate change has seen global sentiment swing away from fossil fuels such as oil, gas and coal, but while global energy consumption is increasing each year, alternatives cannot yet supply enough to meet industry and population demands.

This means we will still need to rely on fossil fuels over the short-to-medium term. In the case of oil, we investigate the effect its price has on an explorer, producer, distributor, and a user.

The oil price has walked a volatile path in recent years, which can, for the most part, be attributed to global unrest.

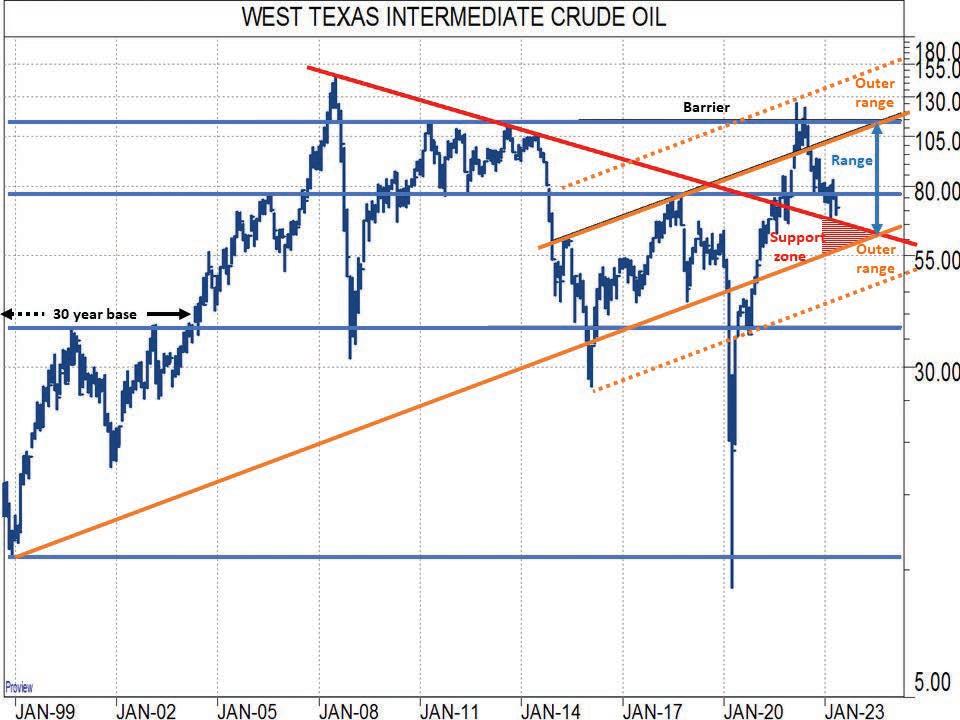

From the mid-1970s until mid-2004, the per-barrel price reached highs of around $US40 and lows just above $US10; however, the price broke away from this broad phase in the last quarter of 2004 and began a surge that would see the price reach over $US145 by July 2008.

The oil price fell to $US31 in December of 2008, before rebounding strongly to produce a rising pause action from $US72 in 2009 to $US86 in May 2010 before launching higher to halt at a double deflection point at $US113 in April–May 2011.

The $US100–110 zone remained a barrier through to June 2014, with a

final deflection precipitating a rapid price decline into the previous base, this time at a lower level around $US26 in February 2016.

The oil price was supported through 2016 and 2017 and rose to locate a barrier around $US75 halting the price between June and October 2018. This became another deflection point, with the price plunging to reach a low around $US9 in 2020.

A pivotal turning point was produced and oil rose dramatically to pause in the later stages of 2020 at around $US40 before continuing its upward path to reach a secondary peak at $US125 in March 2022.

Divergent momentum caused the price to fall and seek trend support at $US66 in March this year. It has now become wedged between that support and resistance in the $US83–85 area.

It is likely that more churning may occur in the $US65–85 range, with the risk of breaking lower diminishing over time. In such a case, back-up support would be in the $US55–60 zone.

There is also potential for the oil price to break higher through $US85 to head towards $US95–100.

Following its merger with BHP Petroleum, Woodside Energy Group is the largest Australian independent oil and gas exploration and production company.

Woodside’s Australian oil assets include the Ngujima-Yin floating production storage and offloading (FPSO) oil production

facility located over the Vincent oil field in Western Australia; the Okha FPSO vessel, an oil production facility moored to a riser turret located north-west of Dampier, WA; and the Pyrenees project, which consists of six conventional oil fields in the Carnarvon Basin, north-west of Exmouth, WA.

The Woodside share price was hurt by the oil sell-off in early 2020, producing a pivotal reversal in March that led to a volatile upward trend which has carried the

price from its low point around $15 to reach its previous barrier zone at $39–40. The price stopped at the barrier in November 2022 and oscillated down to test support in the $28–31 area.

These price oscillations are likely to continue between support and resistance in much the same manner as the oil price, with a breakaway through $40 triggering another stage higher. The risk would be a drop below $25.

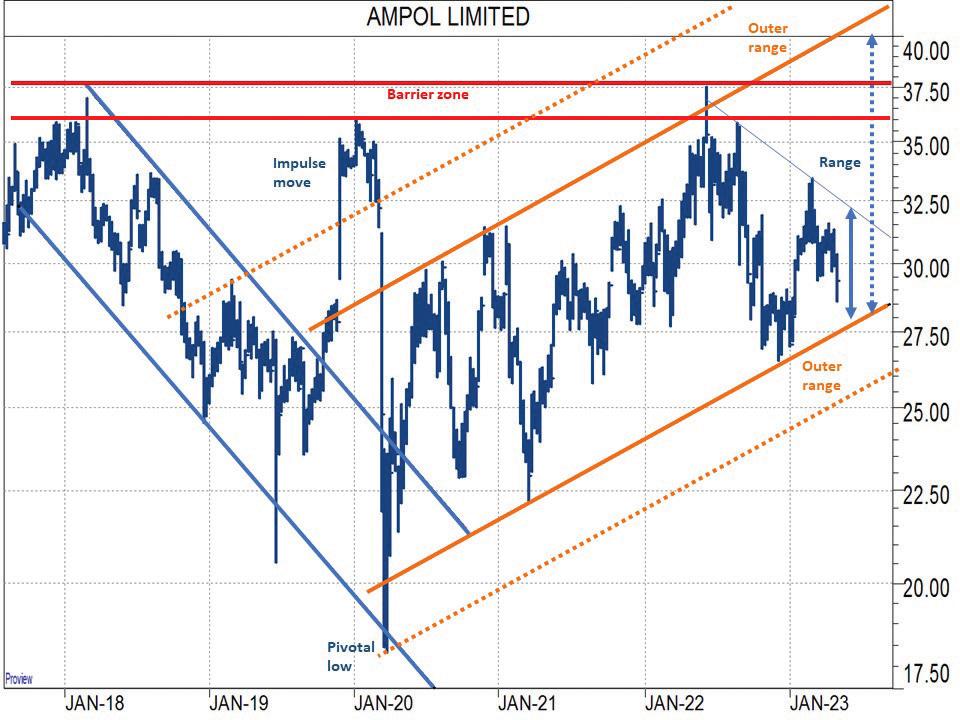

Australia’s leader in transport fuels, Ampol (previously Caltex Australia), supplies the country’s largest branded petrol and convenience network, as well as refining, importing, and marketing fuels and lubricants.

The company supplies fuel to diverse markets across Australia, including defence, mining, transport, marine, agriculture, aviation, and other commercial sectors.

The Ampol share price experienced heightened volatility in 2018, producing an impulse move during the later part of 2019 which saw the price catapult to test resistance in the $35–37 area, where it failed.

The Ampol price fell dramatically in early 2020 in line with the oil price, finding a pivot at $18.32 into a new upward path. This allowed the price to rotate higher and retest its former barrier, with a spike up to $37.55 in June 2022.

From here the price swung lower within the trend towards support around $26 with the action re-engaging former guidelines to allow more fluctuations between $26 and $37, with a breakaway through $39 prompting the next major upswing.

Lindsay Australia’s major activities are road transport, logistics, warehousing services, and specialist services to rural suppliers, with an emphasis on the horticultural industry.

Since its establishment as Lindsay Brothers Transport in 1953, Lindsay Transport has become one of Australia’s largest transport companies, delivering more than two million tonnes of freight to over 3200 customers. The company’s diversity seems to have limited the impact of oil prices.

A fluctuating share price for more than 20 years built a large price base for Lindsay Australia.

Completing the base in August 2022, the price hurtled higher along an exponential curve, exceeding initial expectations to around $1.10. The price stretched to $1.38 on May 1 this year and paused in overbought conditions.

The price has support at $1.10–1.15 and then, more importantly, in the $0.80–0.90 area. Beyond the pause phase, the stock retains the ability from the base to retest the $1.38 level and continue higher through $2.

ARI shines a light on three ASX-listed rare earths explorers and highlights the emergence of the ionic clay-hosted rare earths deposit.

While China has long dominated the world’s rare earths production, processing and manufacturing of rare earths magnets, the market is changing and other countries are putting themselves in focus.

The hallmark of a successful mining company is the strength of its relationships, and emerging rare earths jurisdictions are looking beyond China when commercialising their product.

Lynas Rare Earths – Australia’s only rare earths producer – has shared a longstanding partnership with Japan, with the latter a trusted buyer and financier of the Perthbased miner.

What started in 2011 with $US250 million of debt and equity financing from Japan Australia Rare Earths B.V. (JARE), was reinforced in March when JARE made a $200 million investment in Lynas and forewent $US11.5 million of debt owed by Lynas.

As part of the agreement, Lynas will update its existing supply rights to reflect continued growth in the Japanese rare earths market, prioritising Japan in its rare earth shipments.

Two other near-term Australian rare earths producers, Hastings Technology Metals and Arafura Rare Earths, have established ties with European, US, Canadian and Korean partners.

This includes partnerships with automakers such as Hyundai and Kia, renewable energy players Siemens Gamesa and General Electric (GE), chemical companies, trading houses and downstream processors, carving out new commercial pathways for the companies and its peers to follow.

Three emerging ASX-listed companies aspiring to be rare earths producers include Meteoric Resources, Larvotto Resources and Eastern Metals, each of which have made significant progress in the last 12 months.

We take a closer look at their attributes and potential.

Meteoric’s stock soared from $0.020 per share in December 2022 to as high as $0.18 per share in late-April following its acquisition, expansion and delineation of the Caldeira ionic clay rare earths project in the Minas Gerais state of Brazil.

The company announced its maiden mineral resource for Caldeira in early May, demonstrating what it believes is the world’s highest-grade ionic clay rare earths deposit.

“Until today, the highest known ionic clay deposit in the world was a deposit called Penco in Chile,” Meteoric executive chair Andrew Tunks told Australian Resources & Investment

“Penco has a resource of about 20 million tonnes (measured and indicated) and a grade of about 2200ppm (parts per million). Our announcement was significant because one, Caldeira is 400ppm higher – about 20 per cent more than their grade – and its 400 million tonnes, it’s nearly half a billion tonnes.

“Typically, you get small high grade, or large low grade, so it’s a really rare combination for Caldeira to be both large and the highest grade.”

Caldeira’s maiden mineral resource was derived from 1379 drill holes. The average drill depth in the resource is 6.9m and 85 per cent of all holes generated total rare earth oxide (TREO) grades above 1000ppm.

With Caldeira’s maiden mineral resource in the inferred category, Meteoric will now focus on upgrading the project.

“Before you can do any studies, for example a feasibility study, you need to upgrade the understanding of your resource, and that typically means closing up the drill spacing,” Tunks said.

“To get from inferred to indicated, and then from indicated to measured resource categories, we need to complete approximately 100,000 metres of drilling, so there’s a lot of drilling and we’ll be commencing that program as soon as we can.

“In the interim, we will continue and expand the current diamond drilling to collect additional samples for metallurgical testwork. There has been preliminary metallurgical testwork done, it’s quite positive, but we need a significantly larger metallurgical program testing for variation across the project and with depth.

“So really the first year is going to be about drilling, drilling, drilling, and improving our resource categories and at the same time, growing our team. We’ve just appointed a new CEO, Nick Holthouse, who has rare earths experience as COO of Hastings Technology Metals.”

Outside of China and Myanmar, rare earths mining has typically taken place in hard-rock environments. This is how Lynas has mined its rare earths since entering production in 2011.

Meteoric has a unique opportunity in that its rare earths are hosted in ionic clays, with Tunks suggesting that “nature has already done the work for us”.

“Like Lynas, clay-hosted rare earths were originally hosted in hard rock, but through the action of time and oxygen they have weathered at the surface and all the granite has now turned into clay,” he said.

“During that weathering process, the minerals that hold the rare earths have been broken down, and the rare earths have been released into the clay.”

Hard-rock rare earths deposits are typically much higher grade than their clay-hosted peers, but processing this ore is typically more onerous. While clayhosted processing practices are still early stage, with further research required to understand the metallurgy, there is evidence to suggest this method is less costand carbon-intensive.

Another ASX-listed company with a potential clay-hosted rare earths project at its disposal is Larvotto Resources.

In April, the company announced it had intersected bonanza-grade rare earths at the Merivale South prospect within its Eyre project in WA.

The company’s share price surged from $0.135 per share to as high as $0.33 per share after aircore (AC) drilling at Merivale South intersected up to 1.26 per cent TREO. This highlighted the potential of a 3km-long TREO anomaly that sits within a broader 8km-long anomaly.

Larvotto completed two drill lines 500m apart along the 3km-long anomaly, with the zone remaining open in all directions, particularly to the west.

Maiden composites led to the discovery of 3466ppm TREO over 6m, before Larvotto undertook 1m resamples and discovered results as high as 1.26 per cent TREO (12,611ppm).

When asked if the assay results surprised him, Larvotto managing director Ron Heeks said he was always optimistic about the geochemical indications.

“We had a very good geochem anomaly and we had a coincident thorium radiometric anomaly at Merivale South, which meant given the area hadn’t had a single drill hole in it, we needed to test it and see what the anomaly meant,” Heeks told Australian Resources & Investment

“It came back very strong, and I’d like to be able to talk more about the skill that went into it, but it’s fair to say we didn’t overthink it.

“I was always positive on the prospect because of the level of the anomaly, and I was

looking at a lot of companies around us who were following up anomalies at 100–200ppm, and we were up around 700–800ppm. So that was pretty interesting.”

Heeks said while early exploration indicated the rare earths at Merivale South are hosted in ionic clays, Larvotto will need to conduct metallurgical testing to determine the optimal process route.

Once Larvotto has an understanding of the processing options, the company will aggressively drill and explore the tenement to further understand the scale and nature of the rare earths. And with more than 35 years’ experience in building mines, the project is then rapidly falling into Heeks’ sweet spot.

“If they are clay-hosted rare earths, which I’d like to think they are, then we’ll immediately get into a pretty serious drill program to determine what we’ve got, and at the same time, commence very active metallurgy to determine what we have to do to extract the rare earths.

“I think these deposits can be drilled out very quickly, and then it’s about what you have to do with the metallurgy. Is it going to be simple or not?

“You also need to think about how many consumables you are going to use. Water won’t be a problem for us, there should be no significant issues environmentally and with native title.

“But above all, it gets down to what the metallurgy is going to tell you. That’s the beginning and end of the problem.”

Rare earths are just one set of minerals Larvotto is exploring at its Eyre project, with a multi-commodity focus also showing potential for lithium, nickel, gold and platinum group elements (PGEs).

Lithium, in particular, has attracted lender attention with Larvotto receiving a $3.4 million cornerstone investment from Canadian institutional fund Lithium Royalty Corp. and Waratah Capital in October last year.

This came following a successful lithium geochemistry campaign at Eyre’s Merivale prospect that defined a lithium anomaly across 4km with a high-grade centre over 1km. The maximum grade identified was 126ppm lithium.

In April this year, Larvotto announced an AC drill program had identified at least nine pegmatites associated with the lithium anomaly. A broad anomaly containing more than 1000ppm nickel was also identified. This could span more than 1km in length.

Eastern Metals is exploring a suite of NSW and NT base and precious metals projects, and as the Browns Reef and Home of Bullion deposits have shown promise, a new rare earths prospect has also emerged.

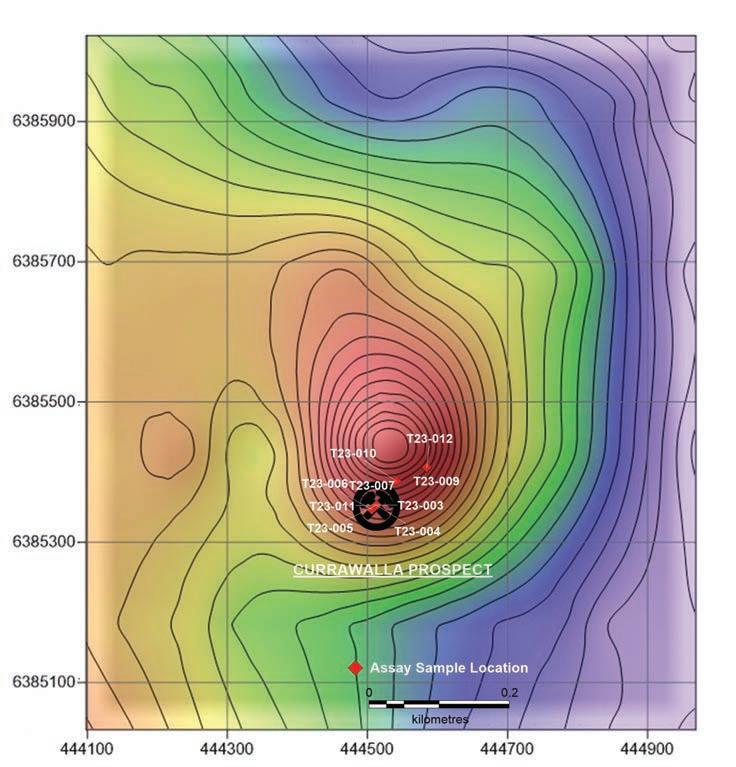

The Tara project consists of the Currawalla mine which had been historically explored for base and precious metals. When Eastern Metals carried out portable XRF (pXRF) testing at Tara it didn’t identify base or precious metals but instead discovered high-grade rare earths.

Samples from high pXRF readings were submitted for laboratory analysis and returned assays up to 3.38 per cent TREO.

Eastern Metals executive chair Bob Duffin said these readings were strong enough to indicate the company could be onto a significant rare earths discovery.

“The Tara project is in an environment where there are no rare earth deposits,” Duffin told Australian Resources & Investment. “The trend from Currawalla goes off our tenement onto vacant ground both to the south and the east.

“We lodged an exploration licence application to cover the extensions of that structure and that application has been recommended for grant, so we’ve now got quite a significant tenement position south of Cobar in an area where we’ve got rare earths readings that have been checked and reproduced by conventional assays.

“We’re not simply relying on the portable XRF results, so that’s looking pretty positive.”

To follow up its rare earths findings, Eastern Metals will return to Tara and extend its mapping of the prospect.

“There is a coincident aeromagnetic anomaly associated with the project’s old workings, which gives us comfort that there will be good tonnage potential to whatever it is that’s causing this anomaly and the body of rare earth mineralisation,” Duffin said.

“So, we’re pretty excited about this. What I’ve learnt in my career is nothing beats high grade, no matter what the commodity, and these grades are very high.”

Duffin said that when Eastern Metals listed on the ASX and launched its IPO (initial public offering) in October 2021, it was very much focused on delineating its Browns Reef and Home of Bullion deposits.

But these rare earths findings have changed the company priorities, with Eastern Metals to focus on Tara for at least the next few months.

Duffin said the company would carry out a three-phase exploration program at Tara, which starts at Currawalla.

“Firstly, we will concentrate on Currawalla and its immediate environment because that’s where we got the high-grade rare earths mineralisation,” he said.

“The second phase of our work program is to follow up some high-quality aeromagnetic data available for much of the new ground that we’ve applied and will be granted – we’ve been advised of that by the regulator.

“The Currawalla mine is associated with an aeromagnetic anomaly, and there are a number of other similar aeromagnetic anomalies within the granite terrain in our Tara licence, and our new license which we’re going to call Black Range. So, we will follow up these and do that in parallel with our work at Currawalla.

“The third leg of our program will see us extend that exploration coverage elsewhere into the new Black Range license area.”

Duffin said Eastern Metals would be drilling at Currawalla in the near future.

The ASX might have a few notable rare earths stayers, but there’s also a host of new rare earths players worth monitoring. This includes Meteoric, Larvotto and Eastern Metals, three companies that have made significant ground over the last 12 months.

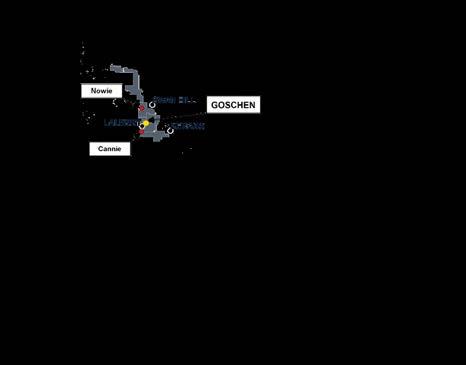

VHM holds one of the largest rare earths inventories in Australia. ARI chatted to VHM managing director Graham Howard about how the Goschen project is coming along.

VHM is rapidly building a new industry in the emerging mining jurisdiction of Victoria, with a suite of adjacent projects set to form multiple hubs as part of a rare earth and mineral sands district.

The company had already defined a significant rare earths deposit at its Goschen project but has since lifted the lid on two additional nearby projects that will further expand its mining future.

VHM announced its maiden inferred mineral resource estimate for the Cannie project in mid-May, containing 192 million tonnes (Mt) at 3.1 per cent total heavy mineral (THM) grade. This boosts the company’s total resource inventory by 30 per cent to 820Mt.

Cannie has added 176,000 tonnes of rare earths, 1.4Mt of zircon, 0.9Mt of rutile and 1.4Mt of leucoxene. In combination with the Goschen project, the total mineral inventory now boasts 5.1Mt of total zircon, 2.7Mt of total rutile and 2.9Mt of total leucoxene.

The higher-grade nature of the Cannie resource has also increased VHM’s total rare earths inventory from 413,000 tonnes to 589,000 tonnes.

Cannie, located only 13km south of Goschen, demonstrated its high-grade potential early in the drilling program, with the first 17 drill holes averaging 4.9 per cent THM across an average width of 2.7m.

VHM used 38 drill holes for the Cannie inferred resource estimate, with results pending from a further 104 holes at the project. These additional drill holes will increase confidence in the resource and potentially expand it further.

“We’ve intersected some pretty special grades at Cannie, which are very high in TREO (total rare earth oxide) and very high in rutile and leucoxene, which is a slightly different composition to what we discovered at Goschen,” VHM managing director Graham Howard told Australian Resources & Investment.

“We’re seeing a different titania mineral assemblage at Cannie, and we’re also getting some pretty good zircon grades there too.”

VHM recently released a refreshed Goschen definitive feasibility study (DFS), which demonstrates a project with a net-present value (NPV) of approximately $1.5 billion and a 44 per cent internal rate of return (IRR).

“The DFS is based on a process facility that has only five-million-tonnes-per-annum of throughput using conventional mining technology and shallow pits down to 30 metres in sand at Goschen,” Howard said. “And we’re backfilling those pits straight away with sand from the process plant.”

The Goschen project is designed to be progressively rehabilitated at it produces, meaning there are no surface tailings, no permanent waste dumps and no visual scars.

This lends to stronger environmental, social and governance (ESG) credentials and reduced legacy issues down the track.

Goschen is also unique in that its multicommodity profile means VHM can benefit from multiple revenue streams to support its bottom line.

“When we look at the overall process, the two commodity streams are the rare earths, and the zircon and titania,” Howard said.

“The zircon and titania are effectively paying for the mining, processing and logistics costs of the project. We’re able to produce rare earths at exceptionally low operating costs compared to our peers, and that sets this project apart.”

Howard and his VHM team have been spending plenty of time on the road to understand the company’s unique marketplace, while gathering insights into the projected rare earths shortfall in the years to come.

“The world is very focused on supply issues for rare earths in the timeframe of 2025–26, just as our Goschen flagship project is

being commissioned and coming on stream,” Howard said. “So we’re entering a perfect time to be producing zircon and titania and most importantly, rare earths, which will generate around 75 per cent of our revenue.

“We’ve got the big four which are needed for the permanent magnets that are driving the electrification of vehicles and wind turbines as part of global decarbonisation.”

The big four are the rare earth elements, neodymium, praseodymium, dysprosium, and terbium, each of which are listed on the US critical minerals list.

Time away has also enabled VHM to continue offtake discussions with potential partners.

VHM already has the backing of leading Chinese rare earths mining and processing company Shenghe Resources, with which it has signed a memorandum of understanding (MOU) for a take-or-pay offtake agreement over an initial three-year term.

If converted to a binding agreement, this would enable Shenghe to purchase 60 per cent of the Goschen product, whether this is the zircon-titania heavy mineral concentrate or the rare earth mineral concentrate for the first three years of production.

Further processing of the concentrate through a hydrometallurgical (hydromet) circuit will produce a rare earth mineral carbonate, which provides VHM offtake flexibility.

“The hydromet circuit should be switched on within six months of the commissioning of the first phase of the plant,” Howard said. “This will effectively give us a new, higher value product that is not yet committed to any party.

“While we were overseas as part of an Austrade delegation, discussions have shown

there is a great deal of global interest in this higher-value product.

“This changes the dynamics a bit. So what we’re doing is working with all our parties to understand their requirements. What is abundantly clear with the geology and the Cannie announcement is we have a series of major projects here.

“I call them project hubs, which can be brought online as corporations or nations require.”

The company is also in discussions with European, North American, South-East Asian and Japanese corporations about potential offtake agreements.

Howard said VHM’s permitting process is advancing on-schedule, with the company finalising adequacy review of the Environmental Effects Statement (EES). This will be assessed by the Minister for Planning who will then authorise the document for public exhibition.

This paves the way for ministerial approval to build the mine, which VHM hopes to achieve by the end of 2023.

Howard said VHM has put a lot of effort into front-ending the approvals process so that there are no hiccups down the track when Goschen is constructed and brought into production.

VHM is also establishing its social licence to operate, underpinned by recent MOUs signed with the Swan Hill and Gannawarra councils.

“The agreements with the local shires demonstrate the broad community support we have been receiving for this project,” Howard said. “Since 2018, all of the studies we’ve completed indicate that the Goschen project is low impact compared to similar projects.”

The construction and operation of the Goschen project is also expected to add more than $2 billion to the Loddon-Mallee economy and an estimated $1.3 billion to the Victorian economy across its planned 20+ year mine life.

VHM was already onto something significant with its Goschen project, and the addition of the prospective Cannie and Nowie projects has confirmed the emergence of a new critical minerals province in northwest Victoria.

And with detailed engineering work underway at Goschen, continued exploration at Cannie and Nowie, as well as ongoing approvals and offtake discussions, investors can expect a strong newsflow from VHM across the next 12 months.

Every new announcement will further derisk what is destined to be a near-term rare earth and mineral sands operation to support the world’s decarbonisation.

ARI was on hand for a recent fireside chat with South32 CEO Graham Kerr, who reflected on how the major mining company has gotten to where it is today.

South32, which was demerged from BHP in 2015, describes itself as a “globally diversified mining and metals company” and is now transitioning to become a key manganese producer in the US.

The company’s future is certainly bright, but chief executive officer Graham Kerr admitted South32 initially had a portfolio that could only be described as a “mixed bag”.

“Within BHP, there are lots of assets that have a lot of opportunity for development in the future that weren’t quite getting the love or systems they needed,” he said during a fireside chat at a recent Melbourne Mining Club luncheon.

“For me, the demerger was a great opportunity for both companies to be better than what they were together. (And) both companies have continued to change and evolve.”

South32’s commodity mix included energy coal, metallurgical coal and manganese, with nickel, lead, silver, zinc and aluminium also featuring in the portfolio.

It was from this position that Kerr and his colleagues set about finding potential in base metals.

Eight years on, the company’s portfolio has changed a lot since Kerr sat in the first South32 meeting with then-chairman David Crawford.

“We certainly had a belief for what assets belonged in South32 and what assets didn’t belong in South32,” Kerr said.

“If you take a step back, what we did actually recognise is if you look at the world today, with a lot of the M&A activity that occurred in the prior two decades, most of the mid-tier mining companies had disappeared.

“So part of the advantage of South32 was it’s a mid-tier-sized mining company … and for a mid-tier company, you only need one or two great discoveries or one or two great acquisitions and you can fundamentally change the nature of the group and create a lot of value for your stakeholders.

“It was clear some commodities had a more attractive future than others. We talked about wanting copper and we did talk about expanding our zinc and nickel presence, and those commodities in particular have been far more attractive in a world of decarbonisation.”

Those discussions laid the foundations for South32 as the company transitioned its portfolio and projects to be largely based in the Americas.

The US Government’s recent endorsement of the Hermosa project, located in southern Arizona, has meant South32 could become the country’s primary manganese producer.

Hermosa, which has the potential to produce manganese and zinc, has been added to the FAST-41 project list, which is designed to create better processes for complex critical infrastructure projects. Hermosa is one of the first mining projects

to join the program, which could assist it with obtaining federal permits for the development of South32’s Taylor and Clark deposits, both of which are located within the Hermosa project.

According to Kerr, once the Taylor and Clark projects are up and running, South32’s portfolio composition will rise to 85 per cent base metals, with majority of the company’s value in the Americas.

“The inclusion of Hermosa as the first mining project added to the FAST-41 process is an important milestone that recognises the project’s potential to strengthen the domestic supply of critical minerals in the US,” Kerr said. “The project presents a significant opportunity to sustainably produce commodities critical to a low-carbon future.”

South32 is advancing a Clark feasibility study, with a pilot plant recently commencing production. A feasibility study for the Taylor

deposit is expected to be completed later this year.

A key part of the project will see South32 engage with local communities to ensure the project has flow-on benefits to the surrounding area.

“Becoming a covered FAST-41 project will make the rigorous federal environmental review and permitting process for this project more transparent, predictable and inclusive for all stakeholders,” South32 Hermosa president Pat Risner said.

“We are committed to working closely with the US Forest Service, cooperating agencies, Native American tribes, and local stakeholders in Santa Cruz County in Arizona to develop this project in a way that benefits the community, minimises impact on the environment, and creates opportunities across the region.”

Alongside its US assets, South32 also has growth options in South America, including a bright future for its Sierra Gorda copper mine in Chile.

South32 purchased a 45 per cent stake in Sierra Gorda in February 2022, but while the company has long been keen to boost its copper presence, it took time to warm up to Sierra Gorda.

“How many people in the room have watched Shrek with their kids before?” Kerr asked the Melbourne Mining Club audience.

“There’s a bit where the donkey is talking to Shrek and says, ‘Shrek, you’re like an onion. You’ve got to take the layers off the onion to understand what you’ve actually got’.

“When the business development team first brought Sierra Gorda to me, I was probably like most other people in the market and thought, ‘This is a challenged asset. It’s got a history of having a challenging ramp-up and there’s very little information in the marketplace about it’.

“Every challenge we gave to the business development team to take a layer off that onion, they came back with more positive results.

“In the end, we became convinced that it was the right thing to do.

“We’ve had it for about a year now and we’re really happy with the acquisition. We’ve been really surprised by the upside in the asset and the quality of the people.”

Alongside its Chile presence, South32 is also involved in earn-in agreements with two emerging copper exploration projects in Argentina – Chita Valley and Don Julio.

South32 recently exercised its earn-in right to acquire a 50.1 per cent interest in the Chita Valley project following a threeyear exploration partnership with Minsud Resources Corp.

The major miner signed an earn-in agreement with Sable Resources to explore Don Julio in 2021, with drilling advancing at the project.

Kerr said Argentina could be a copper jurisdiction to keep an eye on in years to come.

“Argentina’s become an interesting location,” he said.

“When we first started doing some work there, we were probably the only ones. You’ve got BHP there, you’ve got Barrick there, you’ve Glencore there – everyone’s sort of pouring money into that jurisdiction at the moment.

“If you look at where it is, it’s on the other side of the Chile mountains where basically all the copper is.

“So I think that’s an area that’s going to develop pretty quickly.”

Whether it’s the Hermosa project in the US, a suite of emerging projects in South America, or any other ‘futurefacing’ asset in South32’s portfolio, the company has plenty of avenues to be part of the world’s decarbonisation narrative in the years to come.

And given South32’s strong track record of project execution and expansion, the company’s shareholders can rest assured their stock is in the right place.

Global lithium consumption is driven overwhelmingly by the demand for rechargeable batteries, particularly in electric vehicles (EVs). With the global push for green energy, demand for lithium has understandably skyrocketed in recent years, and demand is projected to further spike in the next decade.

This is so much the case that major miners are spending hundreds of millions on developing their lithium assets, particularly in Western Australia.

Australia is uniquely situated when it comes to lithium production. But should we be content with being the world’s lithium quarry, or is there more we could be doing?

The Australia’s Identified Mineral Resources report highlights Australia’s lithium standing, tracking the country’s known mineral resources from the 2021 calendar year while shedding light on some important trends.

Australia came in at number two in the world for known lithium resources in 2021, falling just short of Chile. But Australia ranks number one in the world for lithium

production, responsible for producing 53 per cent of the world’s supply in 2021.

At the time the Geoscience Australia report was written, the price of spodumene concentrate had risen from $US626 per tonne in 2020 to $US1295 in 2021. In November 2022, spodumene prices averaged about $US6100 per tonne.

But these highs aren’t expected to be sustained. According to the March Resources and Energy Quarterly, while the Australian Government expects lithium prices to average $US4350 per tonne in 2023, it expects the battery metal to plateau to an average of around $US1700 per tonne by 2025 as more suppliers enter the market.

In the foreword of the Australia’s Identified Mineral Resources report, Federal Minister for Resources Madeleine King said Australia was blessed with a rich endowment of all the resources needed to make batteries, solar panels and wind turbines.

“Our lithium sector is going from strength to strength as global demand surges with the uptake of EVs,” she said.

“We currently produce more than 50 per cent of the world’s lithium from Western Australian mines.”

The problem – as some would call it – is we currently export lithium in massive amounts. Exports generated $5.3 billion in earnings in 2022, and soaring prices mean that figure is set to more than triple to $18.6 billion this year.

With cash coming in like that, why do anything differently? Well the Federal Government is now calling onshore lithium processing a matter of “national sovereignty”.

“Lithium has an extraordinary capacity, we need to not just dig it up,” Prime Minister Anthony Albanese said at the National Press Club in February.

“I want to make sure we use the lithium and nickel and other products that we have to make batteries here. That’s part of the vision of protecting our national economy going forward.

“I think we should be making solar panels here. I think we should be making so many more things here in order to protect our national sovereignty.”

A series of international messes in recent years has taught people the value of a resilient supply chain.

According to the International Energy Agency (IEA), China currently processes 60 per cent of the world’s lithium chemicals, and 80 per cent of the world’s lithium hydroxide.

Fortunately for us, China sources the spodumene it needs to support its gargantuan EV industry almost exclusively from Australia. Less fortunately for us, however, is the Chinese Government recently ended cash subsidies for households purchasing EVs.

This means that hyper-production at the end of 2022 has resulted in unsustainably high inventories of batteries and EVs, resulting in vendors being forced to sell at high discounts.

All of this drives down the price of lithium and adds more weight to Prime Minister Albanese’s warning about protecting the national economy. Minister King already touched on this in her foreword where she discussed Australia having all the materials it needs to produce its own sustainable energy products.

National sovereignty aside, lithium hydroxide delivered to China was fetching an average of $US65,000 per tonne in February 2023, meaning there’s economical upside to refining our own lithium.

Although the majority of Australian spodumene goes offshore, there are a handful of lithium hydroxide refineries in the country.

Kwinana in WA was commissioned in 2022 and is jointly owned by IGO and Tianqi. It was the first lithium hydroxide monohydrate plant in the country. The operation’s two production trains have a capacity of 48,000 tonnes per annum, with a third train due by 2024.

Another such project is the Kemerton plant owned by Mineral Resources (MinRes) and Albemarle, which is also in WA.

Albemarle recently commissioned two additional, wholly-owned, processing trains at Kemerton, which will double the plant’s lithium hydroxide production to 100,000-tonnes per annum. The expansion will make Albemarle the largest lithium producer in the country.

On top of that, Albemarle told the market in an earnings call that it is evaluating a broad range of additional lithium acquisitions, to go alongside its attempted $5.2 billion takeover of Liontown Resources.

Liontown has suggested that it’s considering an integrated lithium hydroxide refinery of its own once it gets its Kathleen Valley project up and running.

Wesfarmers also has its own lithium refinery in Kwinana, which it plans to build by 2025 with partner Sociedad Quimica y Minera de Chile (SQM), the second largest lithium producer in the world behind Albemarle.

So why do these major international players suddenly have a interest in moving their lithium operations further downstream on Australian soil?

It may be to pick up the slack left by the Chinese market, or to better support an expansion into the US and European EV

market. The non-insiders can only speculate for now, but it’s certainly interesting.

But lithium – something of a poster child of renewables – is far from the only option when it comes to sustainable resources. Some miners, like BHP, say lithium isn’t for them.

“There’s a number of dimensions for lithium that don’t quite match up with those requirements from a BHP perspective,” BHP chief executive officer Mike Henry said at a shareholder Q&A in March.

The Big Australian is instead choosing to prioritise copper, another mineral the world needs to meet electrification and power supply needs.

“Copper’s a bigger industry, both now and in the in the future,” Henry said. “The underlying assets can be quite largescale, which is wholly aligned with BHP’s capabilities.

“We believe that it’s going to afford better margin potential for the company over time.”

Henry said the company was also choosing to focus on nickel, another future-facing commodity.

“Electric vehicles actually use a lot more nickel than lithium, and we believe that nickel demand for batteries is going to be pretty durable,” he said.

BHP recently grew its exposure to copper and nickel through its acquisition of OZ Minerals, which owned copper assets in South Australia (Carrapateena and Prominent Hill) and a copper-nickel asset in Western Australia (West Musgrave).

You can be rest assured green-energy materials such as lithium, copper and nickel are going to drive Australia’s upstream and downstream narratives in the years to come. It will be interesting to see how the pendulum swings.

“In October 2021, our share price went up 200 per cent within a week, which was when Tesla announced they’d be moving all their standard range vehicles to LFP batteries.”

Brett Clark and his team at Avenira have been building a business model around an integrated supply chain that connects one of Australia’s largest phosphate deposits with an LFP (lithium iron phosphate) cathode plant in Darwin. Avenira has partnered with Taiwanese battery material pioneer Aleees to plan and design the plant, which is set to be one of only three licensed LFP cathode manufacturers outside of China.

The local and international interest in Avenira’s LFP plant is growing, partly driven by the electric vehicle (EV) sector’s diversification, where EV manufacturers are phasing out the use of NCM (nickel, cobalt and manganese) batteries for standard range vehicles and smaller personal transportation devices like e-scooters and e-bikes.

Clark, Avenira’s chair and chief executive officer, explained in more detail.

“After Tesla, many major vehicle manufacturers in the world, such as Volkswagen, Ford, Stellantis, Mercedes and BMW, announced that they’d be moving standard range vehicles to LFP batteries,” he told Australian Resources & Investment.

“One of the reasons for this was the predominance of EV battery fires in NCM battery EVs. NCM batteries, have thermal stability problems and need to be cooled, unlike LFP batteries.”

While NCM batteries have historically had a higher energy density than LFP batteries, the latter is catching up. Some LFP batteries now reach up to 85 per cent the energy density of their NCM counterparts.

There are other advantages, too.

“From an ESG (environmental, social and governance) perspective, LFP batteries are more recyclable – you’re not recycling cobalt, nickel and other toxic materials,” Clark said.

“They’re also cheaper to manufacture and they have other recharging properties which means you can get about 30 to 40 per cent more recharge cycles from them compared to traditional NCM batteries.”

Clark said Avenira expects the ex-China NCM and LFP cathode market share to be 50:50 by 2030 – insights derived from Benchmark Mineral Intelligence. And there is potential for further growth beyond 2030 as the green transition continues.

Phosphate mining at Avenira’s Wonarah project in the Northern Territory is nearing a trial phase, paving the way for a final investment decision (FID) to be made in the September quarter of 2023. The commencement of DSO (direct shipping ore) mining is planned for the second half of 2023. The DSO operation aims to ramp up to 40,000–50,000 tonnes of saleable ore product (SOP) per month, with the DSO phosphate product to be sold to a South-East Asian thermal phosphoric acid producer for further processing.

In two years’ time, Northern Territory-focused Avenira could be one of only three LFP cathode manufacturers outside of China, providing a key battery-grade material for global electric vehicle manufacturers.Avenira’s Wonarah phosphate project in Northern Territory.

While DSO production is taking place at Wonarah, and Avenira is generating first cashflow, the company will work alongside Aleees to advance the LFP plant in Darwin.

Having released a scoping study for the plant – which demonstrated its technical and commercial viability – Avenira is scheduled to commence the bankable feasibility study (BFS) in the September quarter of 2023. Avenira has appointed leading global engineering firm Bechtel to complete the BFS.

Subject to approvals, Avenira hopes to commence construction on the LFP plant in the second half of 2024, which could allow first LFP cathode production in 2025.

Once production has commenced, Avenira will aim to ramp up the plant to 10,000 tonnes per annum of battery-grade LFP production as soon as possible.

“Depending on how we negotiate offtake agreements and the uptake of those offtake agreements, which could be with a variety of partners, such as EV manufacturers and battery cell manufacturers, we may also decide to commence the second and third LFP trains,” Clark said.

“Each train will add another 10,000 tonnes per annum, respectively, and would commence a few months after the commissioning of each train to keep the construction and commissioning teams running from one train to the next. There’s a lot of efficiencies to be realised around how we schedule that.”

The LFP plant will be further de-risked by the fact it replicates Aleees’ operating LFP battery cathode material plant in Taiwan, on which Avenira and Bechtel completed due diligence in August 2022.

“Prior to 2015, Aleees were the largest LFP cathode material manufacturer globally,” Clark said. “But China has moved ahead massively around LFP cathode production since then through a lot of subsidies and low-entry costs from a capex (capital expenditure) point of view.

“We believe the plant has low technical risk in terms of implementation, commissioning and project development, and will be well suited to Darwin.”

Having achieved DSO production from Wonarah and first LFP cathode production from its Darwin plant, Avenira will then aim to produce a thermal phosphoric acid product from an additional processing facility at Wonarah.

This midstream product will then be used as feedstock for the Darwin LFP plant. Prior to the thermal phosphoric acid plant coming online, Avenira would source thermal phosphoric acid from

Aleees’ existing supply chains to feed the Darwin facility.

“The key thing for us as a company is to make a value-added product,” Clark said. “This starts off with direct shipping ore, before moving to an LFP cathode manufacturing facility in Darwin. Then we build out our phosphoric acid process as well.

“So we’re focused on integrating downstream manufacturing and dealing in materials that are going to be in continuous and growing demand in ex-China supply chains.”

Avenira’s aspirations are further supported by a Northern Territory Government that has indicated it is open for business.

“The Northern Territory Government has been proactive in tailoring solutions for companies who want to set up in the Northern Territory,” Clark said.

“Darwin is close to the markets we will ultimately deal with and has great existing infrastructure with rail, gas and port facilities in place.

“Northern Territory energy is also among the cheapest in Australia, and it doesn’t rely on other states providing it, so that adds security.”

Avenira plans to power its Wonarah and Darwin operations on a combination of solar, wind and gas. Above all, onshoring mining and downstream processing practices means Avenira incurs fewer transport and logistical costs, making its integrated LFP supply chain more economical.

“The view that we’re getting from the global markets is that cathode material should be manufactured close to upstream materials, whereas battery cell manufacturers should be close to the electric vehicles and energy storage system manufacturers,” Clark said.

Avenira is building its vertically-integrated LFP operation at a time when geopolitical diversification is key to the success of the global battery supply chain and green transition more broadly.

It’s an operation that showcases the Northern Territory’s business focus and Australia’s rising downstream interests.

ARI sat down with Future Battery Minerals’ executive chair Mike Edwards to chat about the company’s exciting lithium discovery at Kangaroo Hills.

With a foot in Western Australia and Nevada – two of the world’s most exciting lithium jurisdictions – Future Battery Minerals (FBM) is poised to play an important role in the world’s green transition.

The company made an exciting lithium discovery in November 2022 at its Nepean nickel project in WA called Kangaroo Hills, which was the culmination of a diligent exploration journey for Future Battery Minerals’ technical director Robin Cox.

“In November last year, our technical director Robin Cox was drilling a couple of IP (induced polarisation) targets to the north of our Nepean nickel project,” Future Battery Minerals executive chair Mike Edwards told Australian Resources & Investment.

“That area has pegmatites everywhere and every time we drilled a pegmatite, Robin would assay for lithium, but we had never

really hit anything of significance. Then we hit a relatively narrow, high-grade spodumenebearing pegmatite.

“This showed to us that we’re in an area where fractionation has occurred, and the pegmatites have changed from barren pegmatites to high-grade spodumene.”

Future Battery Minerals rode the momentum of the lithium discovery to raise $2.65 million in early December, which allowed the company to hit the ground running in January.

“We drilled at both Nevada (FBM’s US lithium project) and Kangaroo Hills,” Edwards said. “Robin and his team had been mapping the whole Kangaroo Hills area and we found some significant outcrops of high-grade spodumene-bearing pegmatite which helped us target the first phase of drilling there.

“We completed that drilling in midFebruary, the results came out mid-March, and

we hit 29 metres at 1.36 per cent lithium. This was only from 38 metres deep, so very shallow, wide and high-grade mineralisation.”

Following these results, Future Battery Minerals quickly carried out another drill program at Kangaroo Hills, with results released in early May. These holes were step outs north, east and south from drill hole KHRC011 which delivered the 29m intersection.

As announced in early May, drill hole KHRC017 would intersect 27m at 1.32 per cent lithium oxide from 64m, including 4m at 2.5 per cent lithium oxide, while several other drill holes would intersect thick high-grade lithium mineralisation as shallow as 8m below surface.

Edwards said drilling had demonstrated a pegmatite that is shallowly dipping to the north with a width of 200m and a strike length of more than 300m. This has been followed up

by more diamond drilling to further confirm the pegmatite’s orientation and provide bulk sample for early-stage metallurgical testwork.

Kangaroo Hills sits within a Tier 1 lithium province in the WA Goldfields. This region also hosts the likes of Mineral Resources’ Mt Marion lithium operation, Covalent Lithium’s Mt Holland lithium mine and Global Lithium Resources’ emerging Manna lithium project.

“We’re in a pretty hot part of the world and it’s very accessible,” Edwards said. “There’s main roads all around us, big players all around us. It’s a very strategic part of the world.”

Future Battery Minerals took possession of its Nevada lithium project in June 2022, seeing this as a strategic opportunity to establish a presence in this miningfriendly jurisdiction.

“Nevada was really starting to gain a lot of interest and there’s a lot of big companies that started investing there,” Edwards said. “We managed to pick up four very strategic packages of land relatively cheaply.”

The Nevada lithium project is different from Kangaroo Hills in that lithium is hosted within clays instead of hard rock, which Edwards said lends to more cost-effective exploration.

Future Battery Minerals completed its maiden reverse circulation (RC) drill program at Nevada in March 2023, with thick highgrade lithium claystone intersected at the Western Flats and San Antone East prospects.

“The interesting thing about Nevada and the reason it’s become such a hot part of the world, is it’s one of the only places in the US where there’s lithium,” Edwards said.

“Nevada is the most mining-friendly state in the US and hence, all these big companies are now really starting to focus on Nevada. You can’t pick up any more ground there at the moment.”

Edwards said FBM is surrounded by major companies looking to capitalise on Nevada’s rich lithium reserves. This includes American Lithium Corporation and its TLC project, which boasts a measured and indicated resource of 8.83 million tonnes (Mt) lithium carbonate equivalent (LCE).

American Battery Technology Corporation’s Tonopah Flats project is also nearby, which has an inferred resource of 15.8Mt LCE, as well as the only lithium-producing mine in the US –Albemarle Corporation’s Silver Peak mine.

“Lithium clays are relatively new, but once you get onto them, they’re easy to define,” Edwards said. “They’re like coal seams –they’re wide but they’re low grade, so the key with these deposits is the processing, and it’s the extraction of the lithium from the clays.

“That’s where all the time, energy and money is going at the moment – these big billion-dollar American companies doing research into the extraction of lithium from those clays.”

Future Battery Minerals’ maiden drill program at Nevada intersected lithium mineralisation of up to 109.7m at 766 parts per million (ppm) from 135.6m depth, including 29m at 1010ppm lithium. These results were announced in mid-April.

Edwards said these were significant results compared to the company’s neighbours –made even more impressive by it being a first

pass drill program. FBM aimed to commence follow-up drilling at Nevada in early June.

Alongside its Kangaroo Hills and Nevada projects, Future Battery Minerals also has a suite of nickel sulphide assets, including its Saints and Leinster projects, both of which are located on the Norseman-Wiluna Greenstone Belt in WA.

FBM released a Saints scoping study in April, which demonstrated the project’s potential to support a simple toll treatment operation within close proximity of several third-party concentrators operating in the Leinster-Kalgoorlie-Kambalda region.

Metallurgical testwork from saleable concentrate returned grades of 10–14 per cent nickel with excellent recoveries of 80–87 per cent nickel, 95 per cent copper and 84–92 per cent cobalt.

The operation would be centred on the St Patricks and St Andrews deposits, with an estimated $10–12 million of capital needed to develop the mine.

In early May, FBM announced it was selling its Nepean nickel project to Rocktivity Nepean for $10 million. This will further support the company’s exploration efforts at Kangaroo Hills and Nevada.

Future Battery Minerals not only has exposure to two of the most important materials for the world’s green transition – lithium and nickel – but holds assets in strategic, Tier 1 jurisdictions.

And with plenty of high-grade ground to follow up at Kangaroo Hills and Nevada, there will be plenty of news to come out of the FBM camp in the next 12 months and beyond.

With its recent acquisition of the Express lithium project in the geologically bountiful region of James Bay, Canada, Recharge Metals is set for an exciting future.

Geoscience Australia’s recent report, ‘Australia’s Identified Mineral Resources’, ranked the country as number one in the world for lithium production, and number two for known lithium resources.

Overall, Australia accounted for 53 per cent of the world’s lithium supply in 2021.

Global lithium consumption is largely driven by the demand for rechargeable batteries, particularly in electric vehicles (EVs), and EV sales are projected to balloon over the next decade and beyond.

But while many companies rush to Western Australia for lithium, others, like Recharge Metals, have their sights set internationally.

Recharge Metals recently acquired the Express lithium project in the highly prospective James Bay region of Quebec, Canada, covering two contiguous claims across a 74-square-kilometre project area.

“What makes James Bay so unique is that it’s a relatively tight cluster of worldclass lithium projects, and Express is located right in the middle of it,” Recharge managing director Felicity Repacholi-Muir told Australian Resources & Investment

“Quebec is looking like it’s going to be one of the leading areas for not just lithium production, but also subsequent exploration of additional lithium projects.”

Just 12km to the north-west of Express is Allkem’s James Bay deposit, a mine capable of producing 321,000 tonnes of spodumene concentrate per year. And 15km south-west is Cygnus Metals’ Pontax lithium project, which is returning high-grade assays of up to 5 per cent lithium oxide.

Cygnus recently acquired an additional 9km of strike on the Chambois Greenstone Belt which Express’ smaller claim block is located on, meaning Cygnus now closely neighbours the project. This demonstrates the growing competitiveness of the region, and Recharge Metals’ intelligence to establish ground.

Located to the north-east of Express is the Corvette project, owned Patriot Battery Metals – a company chaired by former Pilbara Minerals boss Ken Brinsden.

“The James Bay region itself is becoming particularly important in the lithium world,” Brinsden told the Resources Rising Stars Summer Series late last year.

“There has already been some discoveries, and there may well be more. But it’s a great place to be building a mine.”

Prior to Recharge’s acquisition, the Express project had never been explored for lithium.

“It’s a unique area to be in,” RepacholiMuir said. “We’re first on ground for lithium exploration, which offers a whole host of opportunities, but we’re also in a renowned and highly prospective area.

“It’s not very often you see these kinds of grassroots projects just down the road from major lithium production hubs.”

While no exploration has taken place at Express, outcropping pegmatites are evident from satellite imagery, with high-priority pegmatites identified by the local government. This has led to the

region being named the ‘spodumene suite’ by Quebec’s Ministry of Natural Resources and Forests.

Canada is considered a Tier 1 mining jurisdiction. Quebec, in particular, ranks eighth in the world for mining investment attractiveness, above South Australia, New South Wales, Queensland, Victoria and Tasmania, according to the Fraser Institute’s latest annual survey of mining companies.

“It’s a lot simpler to raise funds to get a project off the ground when you’re working in a mining jurisdiction like Canada,” Repacholi-Muir said. “Lithium – with the electric vehicle market – is a fantastic commodity to get into. When you can pick up a project in an emerging worldclass lithium province in a Tier 1 mining jurisdiction, it’s simply too good to pass up.

“It ticked a lot of boxes for us and our shareholders.”

The lithium price has pulled back this year following the record highs of 2022 due to a drop in demand from China, but the battery metal is still trading at 18month highs.

According to the International Energy Agency (IEA), China currently processes 60 per cent of the world’s lithium chemicals, and 80 per cent of the world’s lithium hydroxide.

China sources much of the spodumene concentrate it needs to support its enormous EV industry from Australia, but the Chinese Government recently ended cash subsidies for households purchasing EVs. This has resulted in unsustainably high inventories of batteries and EVs, vendors being forced to sell at discounts, and lower demand for spodumene.

But China is not lithium’s growing market.

As Australian miners look to onshore lithium processing, they are turning to Europe and North America as more reliable long-term partners.

This means the Express project, being situated in Canada, is in an even more supreme location given North America’s growing EV industry.

And just because Express is new doesn’t mean its untouched.

The James Bay region has been historically explored for gold, which means an array of geological data –some of which refers to pegmatites in the land – is already available to aid lithium exploration.

“We’re also well supported by the excellent infrastructure in the area,” Repacholi-Muir said.

“We are less than 12km from the main highway and 15km from a well-resourced logistics hub with accommodation.

“What also puts the area in a unique position is its ability to produce lithium with green energy due to Quebec’s extensive hydropower network, which is key when you’re

looking towards greener production for operations.”

In purchasing the Express project, Recharge Metals engaged a major stakeholder in the North American lithium space, DG Resource Management (DGRM), who first identified the Express project.

“The DGRM team is really well-versed in identifying prospective projects, so it’s exciting for us to have a relationship with them,” Repacholi-Muir said.

“They also identified Patriot’s Corvette project, which has been getting some amazing results of late.

“The fact that they’ve come on board with Express with quite a significant stake at 18.8 per cent really bodes well for the project.”

DGRM has a geological consulting arm, Dahrouge Geological, which will lend its services to Recharge for the development of Express.

“We’re working really closely with the Dahrouge team, who is well-versed in exploration for spodumene bearing pegmatites, and who know the geological terrain of Quebec,” Repacholi-Muir said.

“Our initial exploration activities will be boots-on-the-ground field mapping and surface sampling. That’ll be a helicopterborne program.

“We will be traversing the project and going to all of these key target areas with the aim of identifying spodumenebearing pegmatites, which we’re fully funded for.

“Once that’s done, a drilling campaign is set for later in the year.”

The RIU Sydney Resources Round-up showcased the exploration companies that will be key to a net-zero future.

Across three days in May, the 2023 RIU Sydney Resources Round-up offered a platform for 90 ASX-listed resource companies to showcase their achievements and project developments before brokers, investors and delegates.

Gold and critical minerals were key focuses of this year’s conference, while keynote presentations offered analyst insights into the emerging trends affecting the mining and exploration industries.

In the final presentation of day one, commodities advisory firm CRU unpacked the future of critical minerals, first by juxtaposing the demand outlook for battery metals against the demand outlook for coal and iron ore.

CRU foresees lithium demand increasing 18.5 per cent between 2022 and 2027, with neodymium-praseodymium (NdPr) rising by 10.5 per cent, cobalt by 9.4 per cent and nickel by 7.7 per cent across this time period.

But the demand for thermal coal, metallurgical coal and iron ore are all expected to decline between 2022 and 2027, with thermal coal the biggest drop at more than 5 per cent.

CRU senior consultant David Royle explained why the world is favouring critical minerals.

“So why has demand (for critical minerals) taken off in recent times?” he said. “In short, it’s decarbonisation and geopolitics.”

Royle explained that more countries are implementing emissions trading schemes or carbon tax regimes in an effort to decarbonise.

“Australia has recently legislated a 43 per cent emissions reduction target to be achieved by 2030, which will be enforced by the recent safeguard mechanism,” he said. “This is clearly going to require a whole lot more green metals in order to become a reality.”

Royle said geopolitics has become “inextricably linked” with the critical minerals sector in the wake of global geopolitical crises.

“The war in Ukraine has exposed the vulnerability of supply chains and governments have become a bit more protectionist in order to try to boost domestic energy security,” he said.

“China is clearly the key midstream processor of metals and minerals. A disruption in trade with China would be catastrophic to Australia’s decarbonisation goals and the overall economy.

“There is also some legislation that has been passed to try to boost downstream domestic production of critical minerals.”

This includes the Inflation Reduction Act in the US, which Royle said “doesn’t do much for inflation” but does create tax incentives for original equipment manufacturers (OEMs) to build up battery manufacturing and incentivises upstream mine development for free-trade partners such as Australia.

While governments can play their part to support increased critical minerals production, Royle said the bucks stops with the mining industry, who have the deposits and expertise to unlock minerals from the ground.

Royle also discussed how the electric vehicle (EV) industry is accelerating the global critical minerals narrative and the key role Australia has to play in not only supplying the raw materials for green technologies but also developing a downstream industry.

“Not only lithium, but Australia has all the composite materials to get to pCAM (precursor cathode active material) or CAM (cathode active material) refining,” he said.

“High levels of value add can be achieved by developing downstream capabilities.”