5 minute read

Colliers’ Industrial and logistics property

INDUSTRIAL AND LOGISTICS PROPERTY UPDATE

Colliers’ Gavin Bishop, Head of Industrial Capital Markets, and Luke Crawford, Director of Industrial Research, explain to MHD the important developments for Q3 2021.

2021 has set new benchmarks for the Australian industrial and logistics sector as leasing and investment demand reach new heights. Leasing demand is forecast to well exceed four million sqm for the 2021 calendar year, up from the previous record of 3.3 million sqm in 2020, while investment volumes have already surpassed $12 billion, which is well above the previous high of $7.0 billion set back in 2016.

“As a result of the record levels of occupier and investment demand, the sector completed its best year on record, providing a total return of 23.2 per cent in the year to June 2021,” Luke Crawford, Director of Industrial Research at Colliers, says. “This is above the previous record set back in late 1988, and the performance spread over the retail and office sectors is currently at record highs.”

As reported in Colliers’ Industrial Research and Forecast Report for the second half of 2021, the flow-on effect from lockdown management strategies has accelerated online shopping, which has increased by almost 30 per cent year-on-year to August 2021. As a result, online sales now represent 13.9 per cent of total retail sales, and Colliers’ research forecasts suggest this will grow to approximately 18 per cent by 2025.

LEASING DEMAND IS AT RECORD LEVELS WITH A QUARTER TO RUN

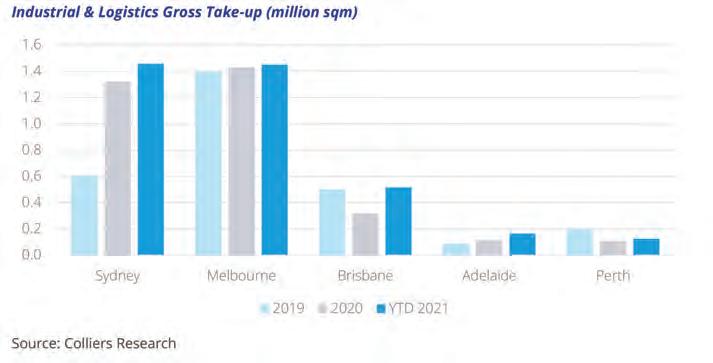

In the first nine months of 2021, almost 3.7 million sqm leased nationally (>5000 sqm) and has already surpassed the 3.3 million sqm of take-up recorded in 2020, which was a record year in itself.

“It has been a phenomenal result for the sector as occupiers scramble to find warehouse space,” Luke says. “Sydney and Melbourne markets have underpinned the strong result for 2021. However, we have also seen a sharp rise in leasing activity in the Brisbane and Adelaide markets, which reflects the improvement in local economic conditions.”

The report states that occupier demand has been most pronounced for prime space, with substantial take-up being recorded for pre-lease and speculative space. Over 1.5 million sqm of take-up in 2021 has stemmed from pre-lease or speculative developments, representing 41 per cent of total demand.

VACANCIES FALL FURTHER

At a national level, vacancy rates for facilities >5000 sqm have fallen to 2.8 per cent in Q3 2021 from 3.5 per cent in Q2 2021 and 5.1 per cent in Q3 2020. “The fall in the national vacancy rate over the quarter was underpinned by a large fall in the Brisbane market while vacancies in Sydney and Melbourne remain at historical lows,” Luke says.

Colliers research forecasts that despite the increase in speculative construction, vacancy rates are expected to remain below 4.0 per cent in 2022, placing further upward pressure on rents. Over the past 12 months, rental growth has increased 4.3 per cent nationally for prime space and 5.2 per cent for secondary. “While the national rate has been strong, there have been selected markets where rental growth has well exceeded 6.0 per cent and includes the Central West in Sydney and South East in Melbourne,” Luke says.

Heightened demand has prompted a surge in speculative developments

Colliers’ Report states that developers and institutional groups have progressed speculative developments with leasing demand currently running at record levels. Over one million sqm of speculative developments are currently under construction along the East Coast, 30 per cent of which will reach completion in Q4 2021, and the balance will complete in 2022. Melbourne accounts for the largest share of speculative space under construction at 52 per cent of the

Colliers’ research shows new benchmarks in the industrial and logistics market for the 2021 calendar year.

national total, followed by Sydney at 35 per cent. For Brisbane, speculative completions in 2021 have increased 57 per cent on the levels recorded in 2020 and are forecast to accelerate further in 2022 with several large facilities in the pipeline.

PORTFOLIOS HAVE DOMINATED TRANSACTION ACTIVITY

Strong occupier trends and favourable structural changes more broadly have led to a significant re-weighting of capital towards the industrial and logistics sector. As a result, in the nine months to Q3 2021, over $12 billion in industrial and logistics transactions have occurred (>$10 million), compared to $5.5 billion for the entire 2020 calendar year.

Gavin Bishop, Head of Industrial Capital Markets at Colliers says, “Where 2020 was the year of sale and leasebacks, 2021 is the year of portfolio transactions with $8.4 billion trading from portfolios in the first nine months of 2021, representing 70 per cent of total investment activity.

“Investors are actively seeking scale and are willing to pay a premium to acquire portfolios. We have seen this multiple times throughout the year where price expectations have been well exceeded.”

Another trend highlighted in the report was the pick-up in fund through arrangements with approximately $840 million trading from such deals so far in 2021. “We estimate that there is upwards of $50 billion in capital looking to enter the sector, and as a result, groups are needing to be creative to meet their investment mandates,” Gavin says. “This is also why we have seen several groups focus on a build-to-core strategy.”

YIELDS TO SHARPEN FURTHER

The rate of yield compression within the sector continues to beat expectations, with Colliers finding that almost 110 basis points of firming was recorded in the prime market in the 12 months to Q3 2021. The national weighted prime yield now measures 4.39 per cent, while it’s higher at 5.23 per cent for secondary. Prime core markets are well under this level, with selected assets trading below 3.5 per cent in key East Coast markets.

“Recent sales evidence has provided significant upside to industrial and logistics values for Q4 2021 and into 2022,” Gavin says. “We expect there is more scope for compression over the next six months before stabilising thereafter. In combination with a pick-up in rents, capital values are expected to grow substantially over the next 12 months.” ■