7 minute read

Probit analysis for financial attitude: case of Kazakhstan By Maya Katenova

probit analysis for financial attitude: case of Kazakhstan

by Maya Katenova

Advertisement

Both 2015 and 2019 surveys were performed by KIMEP University student groups as a class project in spring semester of each year, using face-to-face and paper-and-pencil surveys in different cities and towns of Kazakhstan. Excluding invalid and unsuitable answers for the analysis, the total number of survey responses resulted were 830 for 2015 and 983 for 2019 studies respectively. One of the weaknesses of survey data may be the possibility of mindless responses and random guess works. To reduce possible distortions of mindless answers and random guess works, we cut the middle portion of the literacy scores (2 and 3 points out of 5 points).

The results provided us with a total sample of 529 observations for 2019 survey and 443 observations for 2015 survey. Then, we transform the data into 0 and 1 binary observations since we are still not sure the exact differences in financial knowledge between 0 and 1 and between 4 and 5 for literacy scores. We assigned 0 for the literacy scores of 0 – 1 and 1 for the literacy scores of 4 – 5. We simply treat the continuous knowledge difference as a latent variable, and the observation of respondents’ knowledge as two discrete alternatives, financially “illiterate” and “literate.” These trimmed binary data are analyzed for a series of probit analysis to find out the probability of being financially literate based on individual’s personal profiles and the probabilities of choosing proper financial attitude/behavior based on the level of basic financial literacy level, controlling the impacts of personal profiles. The following hypotheses are investigated:

H1: Personal profiles such as gender, education level, ethnicity, hometown, marital status, and income will influence the probability of answering correct on the basic financial literacy questions.

H2: The higher the level of basic financial literacy a person has, the higher the probability of making better financial decisions for retirement plan and delinquency in payment, and the more frequent in making money-related decisions.

In 2019 survey, Business Education and Hometown are significant for positive impact on basic financial literacy level. A person with more than one year of business education and/or residing in a city is most likely acquired higher level of financial knowledge. Gender, Ethnicity, Marital Status, and Income do not impact significantly on the level of financial literacy.

The 2015 survey shows, however, that females are more likely to have lower scores in financial literacy which is evidenced in many previous studies. There are no significant differences in financial knowledge between Kazakhs and non-Kazakhs, between village and city dwellers, and between Single and NonSingle. The marginal impacts of these variables assuming other variables are in the mean levels are provided in the δP/δX columns.

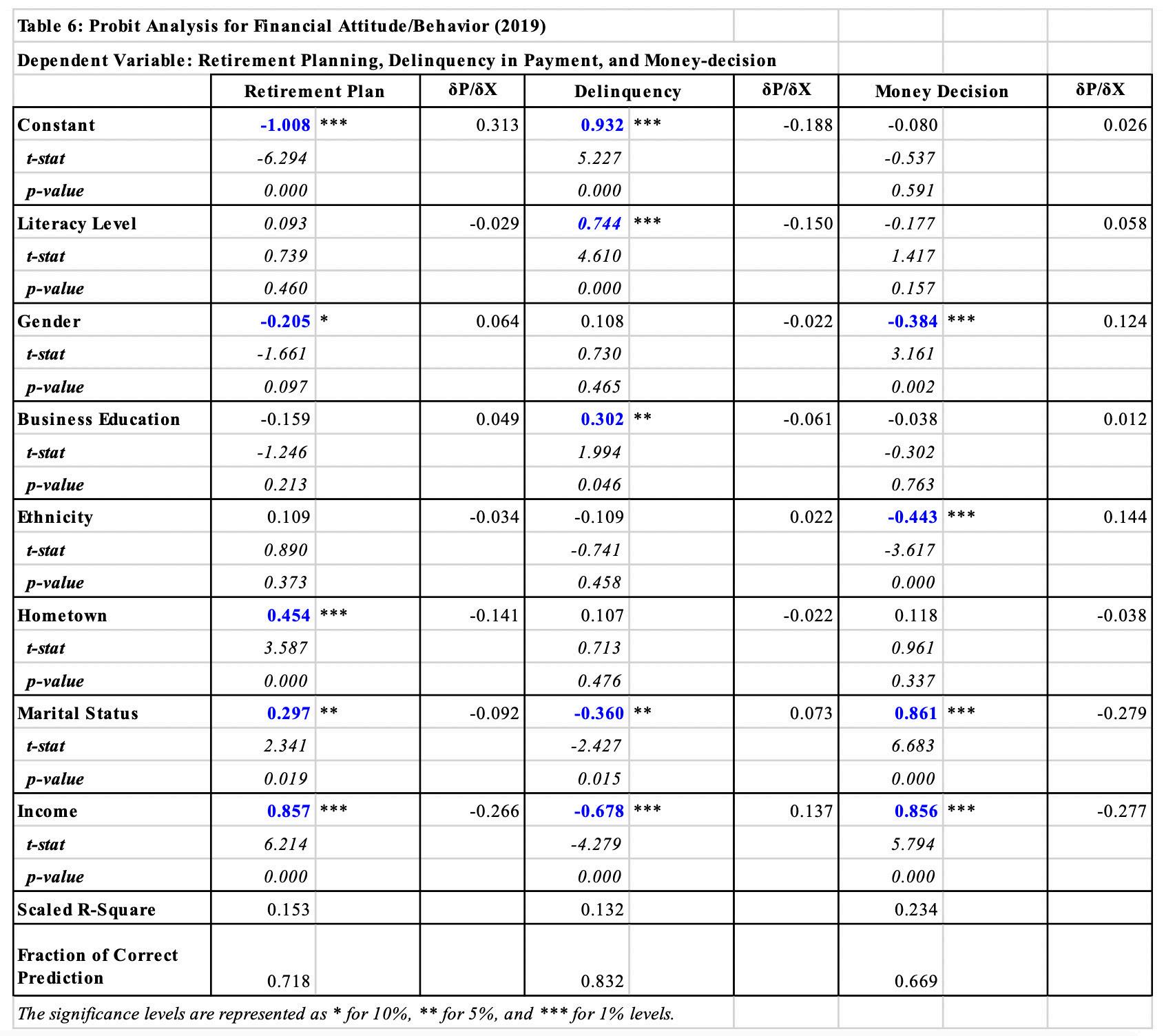

In the 2019 survey, the probability of Retirement Plan is significantly negatively impacted by Gender and positively impacted by Hometown, Marital Status, and Income. Females are less likely to have a retirement plan while those who are living in cities, married or non-single, and higher income are more likely planned retirement. The marginal impact of Income is the highest, showing the movement from higher income group to lower or no income group reduces the probability of retirement plan by 24%. Interestingly, the Literacy Level and Business Education have no significant impacts on retirement plan. Again, we suspect that large number of students who have more financial knowledge and higher business education but not yet planned for retirement are sampled in this survey. The Delinquency in Payment is significantly positively impacted by Literacy Level and Business Education, but significantly negatively impacted by Marital Status and Income. A person with higher financial knowledge and higher financial literacy is most likely never or rarely delinquent in payment. However, a person in the higher income group and/or married/non-single has higher probability of delinquencies in payment.

This high probability of delinquency for higher income group may be due to the unexpected deterioration of economy caused by oil price collapse in 2014 and substantial currency depreciation in 2015. Gender, Ethnicity, and Hometown do not impact the probability of being planned on retirement. Strong marginal impacts are observed in the level of financial literacy (15%) and Income (13.7%).

Those who are females, and/or non-Kazakhs are making less money-related decisions compared to males and Kazakhs, and those who are married or non-single and make higher incomes most likely make frequent money-related decisions. Financial Literacy level and the level of Business Education do not differentiate in making the frequency of money-related decisions. Again, as in Retirement Plan, we suspect that large number of students were sampled in this survey. In addition, the Hometown also did not impact the probability of making frequent money-related decisions.

In the 2015 survey, the probability of being prepared for Retirement Plan was impacted significantly negatively by Business Education, and significantly positively by Marital Status and Income. A person with higher business education level is most likely not planning for retirement. Together with the non-significance of Literacy Level in 2015 and 2019 surveys and non-significance of Business Education in 2019 survey, we can interpret that the retirement plan is not influenced by business education nor financial literacy level. Rather, the married/non-single person and/or higher income earner is strongly likely to prepare the retirement plan. The marginal impact of the Income is the highest on Retirement Plan by showing -0.372. Assuming other variables are in the mean values, a person whose income is less than $25,000 or zero is not prepared for retirement at 37% more probability compared to a person with higher than $25,000 income.

The Delinquency in payment was significantly negatively impacted by Literacy Level, Ethnicity, Hometown, and Marital Status. Interesting point in here is that a person with higher Literacy score tends to delinquent in payment more frequently than a person with lower Literacy score. This result is opposite of our expectation and conflicting with the result shown in 2019 survey. This result may indicate the experiences of massive loan defaults and economic hardships after the financial crisis of 2008-2009. Non-Kazakhs, those who reside in cities, and those who are married/non-single are more frequently delinquent in payments. Females are less likely delinquent in payment compared to males in 2015 survey.

Non-Kazakhs are making more money-related decisions compared to Kazakhs in the 2015 survey, which is an opposite finding of the 2019 survey. Married/Non-Single people are making more money-related decisions compared to single people which are consistent with the result in 2019 survey. Again, Literacy Level and Business Education do not influence on the probability of making frequent money-related decisions.

A summary of the relationships between financial attitude/behavior and literacy level/personal profiles are shown with binary signs, positive attitude/behavior (+) and negative attitude/behavior (-).

Literacy Level and Ethnicity do not influence on the probability of making a Retirement Plan. However, Marital Status and Income Level move the positive attitude toward Retirement Plan. The influence of Gender, Business Education, and Hometown on the probability of Retirement Plan are not continuous, significant in one year and insignificant in another year. However, the non-significant influence of Gender and Business Education in one year show the same signs as the year with significant influence. Those who are males and with low business education level are likely to have a retirement plan. The significant negative sign for constant means that a person is most likely not planned retirement if the person is with low literacy and business education levels, who is male and Kazakh, lives in village and is single, and earns none or low income.

The Literacy Level shows conflicting results between two years in Delinquency in Payments behavior. Highly literate people delinquent less frequently in 2019 while the opposite is true in 2015. Singles are less likely delinquent in payments compared to married/non-single people in both surveys.

Literacy Level, Business Education, and Hometown are not significant in influencing the frequent decisionmaking of money-related decisions. Married/non-single people make more frequent money decisions compared to singles in both surveys. Ethnicity shows conflicting results between two years, Kazakhs make more money-related decisions compare to non-Kazakhs in 2019 survey, and the opposite is true in 2015 survey. The impacts of Gender and Income are not continuous. Only in 2019 survey, Males and highincome earners make more frequent money-related decisions.

Maya Katenova author

Maya Katenova, DBA, PRM, DipPFM, Assistant Professor of Finance, KIMEP University. Maya teaches bachelor students as well as master students including Executive MBA students. She has received a Teaching Excellence Award in 2017. Courses taught in her portfolio include such courses as Financial Institutions Management, Ethics in Finance, Financial Institutions and Markets, Principles of Finance, Corporate Finance and Personal Finance. She supervised Master Thesis Dissertations of several students and has numerous publications in different journals including high quality (Q1-Q2) journals. Research interests are mostly related to financial literacy and retirement planning as well as corporate social responsibility and global ethics. Maya is Professional Risk Manager and is planning to teach Risk Management in future. Her future career is strongly connected with Risk Management Conferences, symposiums and workshops.