Southwest Edition (AZ, NV. and NM.)

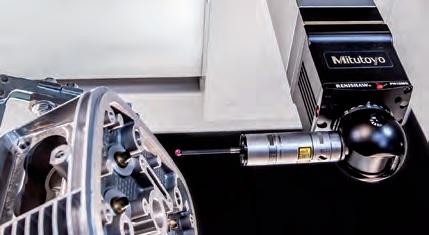

EVP Now Offers Wire EDM Services With Their New State Of The Art GF Machining Solutions CUT P 550 Pro

Serving the Aerospace, Semiconductor & Defense industries

Southwest Edition (AZ, NV. and NM.)

EVP Now Offers Wire EDM Services With Their New State Of The Art GF Machining Solutions CUT P 550 Pro

Serving the Aerospace, Semiconductor & Defense industries

Banterra’s Machine Tool Finance team, with more than a hundred years of experience, understands the challenges of running small to mid-size businesses. The things you do, day in and day out, is truly the backbone of America and as your lender, we are right there with you to support your capital needs and doing what it takes so you can compete with the world in your industry.

Industry-leading service with local decisions

Bank commitment to Made In USA and Made In Arizona values

World-class deposit products including Treasury Management

Loan products designed speci cally for machine shops

By many indicators, the U.S. economy remains on strong footing, fueled in part by continued healthy investment in equipment and software, according to the Q4 update to the 2024 Equipment Leasing & Finance U.S. Economic Outlook.

This same report, however, goes on to say, “The manufacturing sector continues to struggle. Both shipments and new orders of core capital goods are sluggish, industrial production is soft, the ISM Purchasing Managers Index for Manufacturing has contracted for 22 out of the last 23 months, and manufacturing employment has fallen by 50,000 workers in 2024 (including 34,000 in the last two months). Another source, Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, comments, “We’ve been in decline now for three months, and I don’t see a manufacturing recovery until January.”

By the time this magazine is delivered, the outcome of the election will be known. What will the result of the election mean to those of us in manufacturing?

The Harris strategy places a strong focus on climate related initiatives, worker protections (i.e. Unions), and increasing corporate taxation. Said Harris, “We’re going to have to raise corporate taxes, and we’re going to have to make sure that the biggest corporations and billionaires pay their fair share.”

If elected, Harris would likely push for expanded regulations that directly impact manufacturing, particularly in energy-intensive industries. This could include more federal incentives for green technology investment as well as stricter emissions regulations and carbon taxes, driving up compliance costs for industries that rely on fossil fuels.

Harris advocates for raising corporate taxes, including a corporate tax rate increase from the current 21% to as high as 28%, which could reduce after-tax profits and limit the funds available for reinvestment.

As an advocate for workers’ rights, Harris’s policies would likely increase the federal minimum wage, expand paid family leave and strengthen union rights.

A second Donald Trump term could revive many of the business-friendly policies that defined his first term in office. This includes deregulation, maintaining lower taxes, and reintroducing more aggressive trade policies designed to protect American manufacturing.

Trump is expected to continue pushing for lower corporate taxes and other probusiness tax reforms, including making the tax provisions enacted under the TCJA permanent. For manufacturers, these policies would likely result in higher after-tax profits, giving businesses more flexibility to invest in new technologies or expand production capacity.

With Trump in office, manufacturing could expect to see a rollback of environmental regulations, loosening labor laws, and streamlining permitting processes, making it easier for manufacturers to expand or modernize facilities.

Trump’s trade policies are intended to protect American jobs and industries through significant tariffs and other trade barriers. While these protectionist policies could benefit certain manufacturers by reducing foreign competition, they could also raise costs for businesses that rely on imported materials or components, and would very likely lead to price increases for consumers.

Fortunately, the election cycle will be over soon, and we can only hope that policies enacted will indeed help our US manufacturing industry. Until next issue, I wish you the best, and God bless our troops.

Linda Daly,Publisher

EVP Now Offers Wire EDM Services With Their New State of the Art GF Machining Solutions CUT P

Photography by Takashi

www.a2zMFG.com

Published bi-monthly to keep precision manufacturers abreast of news and to supply a viable vendor source for the industry. Circulation: The A2Z MANUFACTURING has compiled and maintains a master list of approximately 8500 people actively engaged in the precision manufacturing Industry. It has an estimated pass on readership of more than 19,300 people. Advertising Rates, deadlines and mechanical requirements furnished upon request or you can go to A2ZMANUFACTURING.com.

The Publisher assumes no responsibility for the contents of any advertisement, and all representations are those of the advertiser and not that of the publisher. The Publisher is not liable to any advertiser for any misprints or errors not the fault of the publisher, and in such event, the limit of the publisher's liability shall only be the amount of the publishers charge for such advertising.

Designed and built for use with Haas ST and DS series CNC turning centers, the Haas Bar Feeder connects directly to the Haas control.

Robot Systems

• HRP-1 System – 7 kg capacity • HRP-2 System – 25 kg capacity

• HRP-3 System – 50 kg capacity

Pallet Pool Systems

• 3-Station for VF-2YT/SS, VM-2

• 6-Station for EC-400

• 6-Station for VC-400/SS

• 6-Station for UMC-1250/SS

• 10-Station for UMC-750/1000/SS

• 10- or- 20-Station for UMC-500/SS Automatic Parts Loaders

• Turning Center APL

• VMC APL

• Small UMC APL

Haas Bar Feeder

All-inclusive design, with plug-and-play capabilities to Haas lathes

• 4th- and 5th-Axis Rotaries

• Sub-Spindles

• Parts Catcher System

• Auto Door for Mills and Lathes

• Automatic Coolant Refill

Mill and lathe classes are scheduled every other month. Each course consists of 3 days of hands-on instruction led by a Haas Certified Instructor. Students will learn the basics of the Haas control, operation of machines, and Haas programming using G & M codes. Classes are free to all Haas CNC machine owners and operators. Classes are held Monday through Wednesday from 2:00 P.M. to 5:30 P.M.

Please join us for an upcoming session of the Haas CNC training. We recommend registering as early as possible as class sizes are limited.

Training is held at Haas Factory Outlet- Phoenix, a Division of Ellison Machinery facility located at 1610 S Priest Drive, #101 Tempe, AZ. To register and for additional information visit www.EllisonAZ.com or call 480-968-5877.

The NTMA/ Arizona Chapter welcomes the following new manufacturing members: Consolidated Precision Manufacturing, Kinetic Engine Systems- Walbar Operations, and KLK Incorporated. Joining as an

Industry Partner, Geiger Electric.

ATMA held their annual Fall Golf Tournament on September 20 at Grand Canyon University Golf Club. There was a sold-out field of 144 golfers and 32 sponsors representing over 80 companies. 1st Place team – JRT Hunt/ 2nd Place team – Usher Precision. Mark your calendars for the 10th Annual Ocotillo Golf Tournament on May 15, 2025!

Upcoming Events: November 7: ATMA

Lunch & Facility Tour at Foam Packaging Specialties. November 13: ATMA Strategic Planning Session at AZ Commerce Authority- open to the public. December 12: ATMA Annual Holiday Party- Martin Auto Museum.

All events and membership information can be found on our local website at arizonatooling.org

With its launch of SmartBox 2.0, Mazak takes safe and secure machine connectivity to the next level. Building on the company’s original SmartBox digital integration technology, Mazak has developed this latest version with several new features and enhanced connectivity. The new SmartBox 2.0 introduces MQTT and OPC communication protocols, which significantly improve data exchange and interoperability with a broad range of industrial systems. This version now also includes an industrial-grade edge compute PC as standard, advancing its capabilities for machine monitoring and analysis while incorporating advanced cybersecurity protection.

SmartBox 2.0 leverages MTConnect® technology to deliver real-time manufacturing data, allowing shops to optimize operations, boost efficiency

and quickly adapt to changing market conditions. The integration of edge computing addresses the challenges of real-time data processing by combining the benefits of decentralized cloud architectures with the efficiency of local network systems. This setup is particularly beneficial in industrial environments where cloud-based data transfer can be impractical due to latency issues, as SmartBox 2.0 enables data processing directly on the machine, offloading tasks from controllers to ensure low latency and high determinism.

Enhanced security is a key feature of SmartBox 2.0. It is equipped with an AES-compliant fully managed switch and an additional lean managed switch, providing top-tier security similar to that found in IT server rooms, but tailored for the demanding factory environment.

The device supports up to 10 machines for MTConnect monitoring and includes

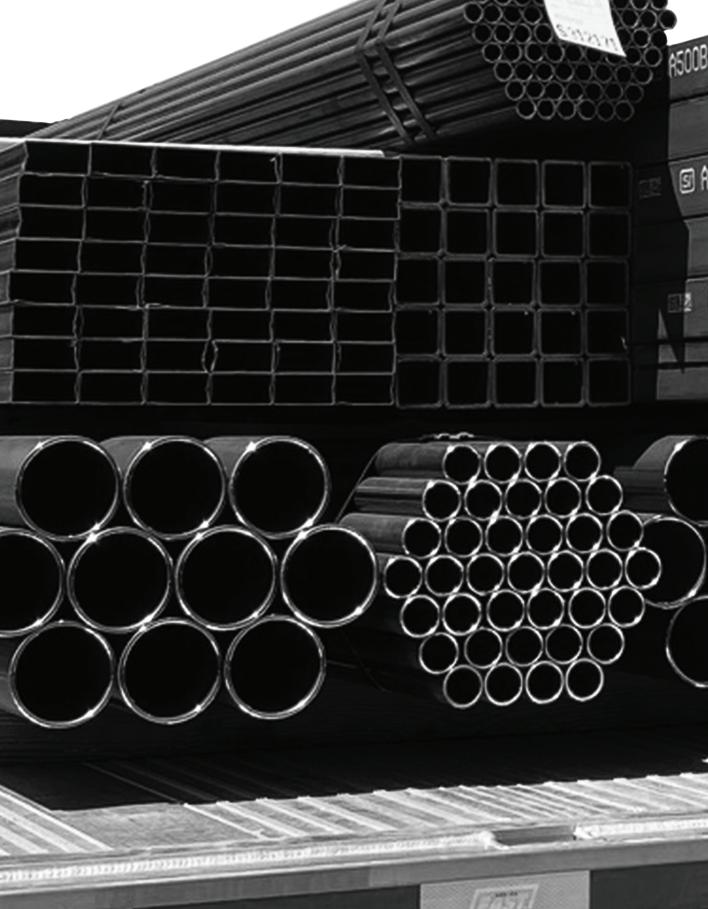

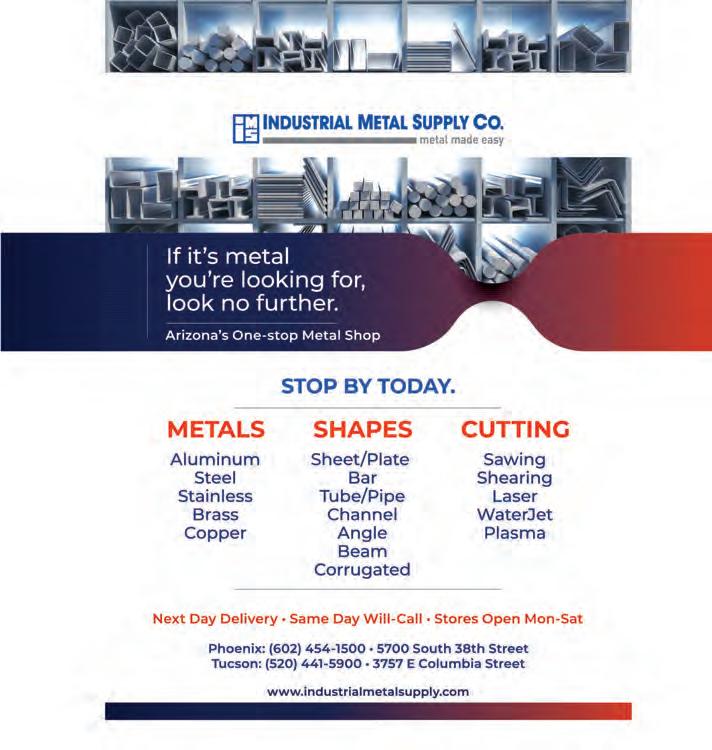

personal use, and business accounts. With the addition of Arizona Iron Supply, we can accommodate even larger industrial accounts and offer even more equipment and metal inventory to choose from.

We feel privileged to continue to serve Phoenix and surrounding areas. We can’t wait to show you how this development will improve your metal purchasing, metal recycling, and Rolloff Service experience.

Visit one of our two locations to see how this exciting change will benefit you! Davis Metals: (602) 267-7208 / 3322 E. Washington Street, Phoenix, AZ 85034 Arizona Iron Supply: (602) 244-9649 / 130 S 23rd St, Phoenix, AZ 85034

standard Industrial I/O interfacing, offering scalable connectivity for diverse manufacturing setups. Designed for universal compatibility, SmartBox 2.0 works with any machine regardless of make or model and mounts conveniently on the side of machines without the need for integration into the machine’s electrical cabinet. Additionally, multiple standard input/output ports facilitate easy connection of off-the-shelf sensors for comprehensive data collection and condition monitoring.

Mazak’s SmartBox 2.0 is set to redefine machine connectivity, providing manufacturers with cutting-edge tools to enhance operational efficiency and stay competitive in a rapidly evolving industry.

Mazak Corporation is a leader in the design and manufacture of productive machine tool solutions. Committed to being a partner to customers with innovative technology, its world-class facility in Florence, Kentucky, produces over 70 models of turning centers, Multi-Tasking machines and vertical machining centers, including 5-axis models, Hybrid Additive processing machines and Swiss Turning Machines. Continuously investing in manufacturing technology allows the Mazak iSMART Factory™ to be the most advanced and efficient in the industry, providing high-quality and reliable products. For more information on Mazak’s products and solutions, visit www.MazakUSA.com.

Metzfab’s facility was chosen due to their company growth, and the addition of several new state of the art pieces of equipment. Metzfab is always pushing technology and equipment limits in an effort to build and deliver the best parts to their customers.

Shaw Precision Grinding and Threadrolling, a Minority-Owned Small business, specializes in centerless grinding and thread rolling with quick turnaround.

Metzfab recently installed a new OMAX 80x 5 axis waterjet, a Bystronic Tube Laser system, a Bystronic ByStar Fiber Laser with full automation, multiple large high performance press brakes, and a fully automated robotic press brake. Installing soon is a new material finishing machine also coming from the Landmark Team.

The company has been in existence for several decades now, but recently changed ownership. Long term employee Chris Torres and his wife Jennifer, took over as sole owners in 2021 and they moved the business to its new location in 2023.

Chris says, “One of our specialties is thread rolling, and to my knowledge,

The Landmark Solutions open house event was a success, and we are all excited to continue our long term partnership with Metzfab. Everyone attending the event were impressed with the new equipment and technology, and how this has helped Metzfab grow and diversify their business.

BANK WITH PURPOSE.

Arizona MEP offers workshops designed to meet the business needs of m manufacturers

Arizona MEP Lean Green Belt Certification – Starting January 13th

Designed for leaders in charge of implementing and sustaining Lean activities, this 5-day workshop is loaded with practical examples, breakout sessions and a real-world project where key concepts are applied.

Overview with Lean Simulation – March 13th

Providing all employees with a basic understanding of Lean principles will improve your manufacturing operations. Employees will get the knowledge they need at this event.

Additional workshops will be posted on the website starting in December!

we are one of the only shops in Arizona that offers this service.”

The company also specializes in centerless grinding, particularly large bar grinding (up to 12’) and Jennifer says that they pride themselves on fast turnarounds. “Our customers tell us that our pricing can’t be beat and that our turnaround times are shorter than most shops they have worked with.”

You’ll often hear that you can’t get great pricing, quality and turnaround — well at Shaw Precision Grinding and Thread Rolling — you will consistently get this. To learn more, contact the company at: (602) 349-7921 or visit ShawPrecision.com

Hurco’s AI Innovations Set to Revolutionize the Industry, Ushering in a New Era of Speed and Precision

Hurco Companies, Inc made waves at the 2024 International Manufacturing Technology Show (IMTS), unveiling cuttingedge technological advancements that mark a turning point in the company’s ability to leverage emerging AI technology

directly into its core control software. Business owners and operators will be excited to learn that these innovations, born from relentless R&D efforts, position Hurco as a leader in machine tool technology. Visitors to IMTS were given an exclusive preview of the revolutionary AI-driven features that will define Hurco’s next-generation control systems, showcasing the company’s forward momentum and continued leadership in CNC control technology.

Hurco’s AI implementation isn’t just a buzzword— it’s real AI delivering real results. What once took several minutes to accomplish with conversational programming can now be done in just seconds. This breakthrough speeds up the machine tool operation process, transforming efficiency in unprecedented ways. Hurco’s AI technology is a real programming option embedded at the core of the control technology, enabling customers to achieve faster, smarter, and more precise outcomes.

“Our success stems from two key advantages,” said Greg Volovic, Hurco’s President and CEO. “First, our complete vertical integration—we own the entire CNC machine, control, and software. This gives us unparalleled agility in testing and integrating new

Added Value Services: Shearing, Saw Cutting, Welding MIG, TIG & ARC, Hole Punching, Notching, Bending, Metal Fabrication, and Plasma Cutting

We thank you for your business! Owners Doug & Jill Cone

technologies. Second, our unwavering commitment to innovation spans all economic cycles, supported by a robust balance sheet and disciplined financial strategy cultivated over many decades.”

Hurco Companies, Inc. is an international, industrial technology company that sells its three brands of computer numeric control (“CNC”) machine tools to the worldwide metal cutting and metal forming industry. Two of the Company’s brands of machine tools, Hurco and Milltronics, are equipped with interactive controls that include software that is proprietary to each respective brand. Web Site: www.hurco.com

FFG Americas is incredibly proud to announce the success of its 2024 Open House event, held this past August. This event drew a crowd of over 300 industry professionals, partners, and enthusiasts, eager to experience how FFG Americas “takes machine tools and machining further!”

The Open House provided an opportunity for attendees to explore top-notch machinery and technology. Guests were treated to plant tours and live cutting demonstrations across sixteen machines, including machines from MAG, FEELER, LEADWELL, and FFG

DMC. This event highlighted FFG’s latest advancements in precision machining, automation, and innovative manufacturing processes, and machines displayed included 2, 3, 4, 4+1, & full 5-axis.

Besides machine display, FFG’s strategic partners in CNC Controls, Spindles, Robotics, Cutting Tools, Tool Holders, Rotary Tables, Measurements, Probes, Workholding, Bar Feeding, and Equipment Finance also participated in this event to directly interface with guests and exhibited peripheral solutions to enhance the performance of CNC machine tools.

FFG now offers a complete product line of machining equipment and solutions from its 200,00 square feet Sterling Heights operation, ranging from the stand-alone machine to the fully integrated and automated machining line. “Our Technology Center demonstrates FFG’s continuous commitments and never-stopping efforts in serving the metal cutting equipment needs in the North American market.”, said Brian Prina, the President & CEO of FFG Americas.

“This Technology Center brings multiple FFG companies together under one roof to best support and service the North America market including machine demonstrations, training, and service parts.”

For more information about FFG Americas, its innovative machining solutions, and distribution network, please visit www.FFGAmericas.com or contact Paul Chen at Paul.Chen@mag-ias.com

Product SPotlight:

3020 South Park Drive ,Tempe, AZ

sales@stp-az.com • Tel: 602-426-9340

We Manufacturing Complex Intricate Parts Requiring Extreme Precision And Quality

We Are Built For High Production Parts And Can Handle Extremely Tight Tolerances

Electripure LLC a division of Integrated Energy Companies (IEC) a Salt Lake City UT based energies company, has officially launched their expansion into the Arizona market. Electripure is known strongly as an energy solutions and insights company. They offer specialized services in power bill analysis, power factor penalty identification, and power factor correction. They also offer utility power metering to help you get visual on how your facility is consuming power. Electripure’s real specialty is what is known as “Power Conditioning”. Over the last ten years in business Electripure has designed and built patented power conditioning units that can be tailored to your facilities power usage.

utility service entrance will help guide you and your team through the process with the overall goal to save you money.

The Federal Reserve reported that industrial production in March rose 1.4%, returning to growth after an unseasonably stormy February knocked it down 2.6%. The report shows total industrial production rose 2.5% at an annualized rate during the first quarter of 2021 despite the losses endured in February by manufacturing, mining, and utilities companies.

Motor vehicles and parts production, which fell 10% in February, rose 2.8% in March but remained depressed by a persistent shortage of semiconductors. Most durable goods indexes rose between 2% to 3%.

Quote from Isaac “Electripure is not a commissioned sales group. Our goal is to add cost savings to our business partners in their electrical utility use. We go to market much like the cable service providers do with their equipment. It’s a monthly lease program. We do this so that we (Electripure) can have continued engagement with our customers and provide any maintenance needs. Our metering services are accessible to our business partners through an online portal that is up and going 24/7.”

The industrial production gauge includes productivity in three sectors: manufacturing, mining, and utilities. Manufacturing production (which excludes mining and utilities output) rose 2.7% in March after falling 3.7% the month before. Mining production improved 2.7%, while utility output fell 11.4% thanks to unseasonably warm March temperatures. Manufacturing output rose 1.9% at an annualized rate.

In nondurable manufacturing, the index for the chemicals industry rose 4.1%, and petroleum and coal products rose 5.7%, although neither sector has fully recovered from severe weather damage—the Federal Reserve noted that some chemicals factories remain offline thanks to damage sustained from February’s winter storms. Most nondurable goods indexes rose between 0.9% and 3.0%.

Capacity utilization in manufacturing rose by 1.9 points, also reversing February losses.

The initial process will start with 1 week of “free metering” and a review of your last 6 months of billing. Yes, free metering. Why would we do that. This data collection process helps Electripure identify if you are a qualified business partner or not. Meaning if we can’t save you any money because you are either not a large enough power consumer or you are already running your facility at “efficiency”, then great!

Almost all market groups saw improvements in March, despite lingering challenges. The Federal Reserve’s index for other manufacturing, which includes publishing and logging, remained the same, but durable goods and nondurable goods indexes rose 3.0% and 2.6%, respectively.

Electripure has chosen to expand its business with “local representation” rather than providing services into Arizona out of the Utah market. Isaac Trujillo is the Director of Business Development for the Arizona territory and resides in Mesa AZ. He brings a solid background in electricity. Following his time serving in the US Army as a small engine mechanic (63J), Isaac has career experience working as a field electrician for commercial and residential contractors in his home state of New Mexico as well as operations management and project management in the EC business channel. His understanding of large switch gear and

If February was notable for its storminess, March was notable for its heat. The unseasonably warm month coincided with a roughly 10% drop in consumer energy products, and the 11.4% drop in utilitie s utilization was the largest recorded in the history of the index’s 48-year history.

Isaac can be reached at itrujillo@electripure. com or by phone at 602-809-7359. For more information and some case studies from some of our customers in Utah, please visit our web page at www. electripure.com

Metalworking fluids formulated to meet aerospace demands.

• Improve process stability on heat-resistant Super Alloys

• Easier robotic handling with cleaner parts

• Reduce costly maintenance interruptions

• Approved for Alloys of Aluminum, Titanium, Nickel, Chrome, and Steel

• Maximize gains from high pressure systems

• Enhance filtration system performance

Family Run For 35 Years

Competitive Pricing

3 Companies - 1 Ownership

The Space Valley Foundation believes space is for everyone

Last month, the Space Valley Foundation hosted an event to launch its rebrand, share its new database and website and drive community interest in New Mexico’s space ecosystem.

The first test of a new, lightweight F-35 helmet was successful, according to the prog ram office, a promising sign that the Pentagon can qualify and implement all three fixes to the jet’s escape system by the end of the year.

Called the Space Valley Foundation, the new nonprofit rebranded and restructured from the Space Valley Coalition, a former group of municipalities, educational institutions and aerospace-focused organizations that had sought to grow New Mexico’s commercial aerospace industry.

Recently, at Holloman Air Force Base, New Mexico, Lockheed Martin’s F-35 conducted the fir st test combining all three solutions designed to reduce the r isk of neck injury to F-35 pilots during ejection, according to spokesman Joe DellaVedova. Once the full gamut of testing is completed, hopefully by the end of the summer, the JPO can beg in implementing the two modifications to the ejection seat and issuing the new Generation III “light” helmet to the fleet, he said

The event included remarks from a variety of Space Valley partners, culminating with the foundation’s executive director, Bryce Kennedy. Kennedy told Albuquerque Business First the launch event had almost 250 registrants across a variety of sectors, many of which heard about the event via word of mouth. “We sent out, I think maybe 100 invitations, and it spread like wildfire,” he said adding they

The recent sled test, conducted with a 103-pound mannequin, is the latest sign that the JPO can make good on its promise to finish the three design fixes by November, allowing the military services to lift restrictions on lightweight pilots flying the F-35 Last year, Defense News first repor ted that pilots under 136 pounds were barred from flying the fifth-generation aircraft after testers discovered an increased r isk of neck damage to lightweight pilots ejecting from the plane. The US Air Force has also acknowledged an “elevated level of r isk” for pilots between 136 and 165 pounds.

had to keep increasing the number of tickets for the event.

To Kennedy, that is indicative of how hungry people are for the potential of New Mexico to be a collaborative place. He and Randy Trask, executive director of Q Station, believe SpaceValley’s mission encompasses everyone.

Trask explained the hardest part about a strategy like Space Valley’s is the goal of engaging a diverse group of businesses as part of the space ecosystem, including the unexpected such as arts, culture and tourism.

The prototype helmet tested weighs about 4.63 pounds, approximately 6 ounces lighter than the orig inal Gen III helmet, and is designed to ease some strain on smaller pilots’ nec ks during ejection

According to Kennedy, potential collaborators can be anyone from Los Alamos National Labs, to entities in White Sands, to LGBTQ theater companies working on spacerelated productions, all with whom he has had conversations.

Although the test was the fir st test of the new helmet, the JPO, Loc kheed Mar tin and seat-maker Mar tin Baker have conducted at least seven other tests with the latest version of the seat, which is equipped with two modifications designed to reduce r isk to pilots.The fixes to the ejection seat itself include a switch for lightweight pilots that will delay deployment of the main parachute, and a “head support panel,” a fabric panel sewn between the parachute r isers that will protect the pilot’s head from moving backward dur ing the parachute opening.

The long-term goal, Kennedy said, is promotional partnerships and packaging space-related projects, new and existing, under SpaceValley. This could include the Las Cruces Space Festival, alien-related events in Roswell, events at White Sands and Chaco Canyon to observe the night skies, and more, with the goal of leveraging brand recognition to bolster New Mexico’s space tourism economy.

The prog ram office has about another 10 tests planned, which will use a mix of low-, middle- and high-weight mannequins.

On Jan. 29, the then-coalition learned its $160 million National Science Foundation (NSF) grant application was not awarded. They did however receive a $1 million NSF Engines Development Award, keeping the coalition staffed

“This initial test had promising results and the F-35 enterpr ise is on a path to qualify the helmet . by the end of this summer,” DellaVedova told Defense News. “The lighter helmet expected to be fielded by the end of the year is in line with the seat timeframe as well.”

and helping grow its membership and board of directors.

The group wanted to take a new approach to connecting the Land of Enchantment’s space ecosystem.

Trask said a key component of this has been the foundation’s database, Orion Interlink, which will take a large language model, a type of artificial intelligence (AI), and incorporate it into a membership and participation structure.

Rather than have someone manually update company and event information, when an entity joins the foundation’s membership and database, it will build a profile, add relevant URLs, and the AI will scour the URLs, pulling, for example, events to then auto-populate a calendar. It can find out team changes, update contact info and continue to learn about the entity. “It’s like a Google with AI, but it’s concentrated just on our own ecosystem,” Trask said.

Eventually, the technology will grow from enabling people to find someone with specific expertise, or a company with a specific product, to providing analysis and feedback about the ecosystem. This analysis will answer whether there is a duplication of efforts, identify trends and more.

“Washington is starting to pay attention,” Trask explained. “Everyone sees a long-term strategy coming from New Mexico,” he added, saying the new database has the

potential to unite organizations working on accessing federal funding.Trask said phase one is the collection of organizations while the model is being built, and then as the model is ready, it will be introduced to the database to be able to start the information mining previously explained.

Space Valley is still working on the membership side, and Trask imagines it will include a few tiers, including a free community membership where everyone can join and have discounts on merchandise, knowledge of events and be the first to receive “cool information” about things that are happening in the ecosystem.

Next, they would offer a paid business membership, with a higher level of participation in the ecosystem. “A lot of times in New Mexico, we expect the government to fund everything. … It’s our responsibility to step up in the community and spearhead our own initiatives and figure out how to support them,” said Trask.

Lastly, Space Valley hopes to ignite children’s passion for space again.“What happened to the days where an 8-yearold could write in and become a junior astronaut and get a patch in the mail and get coloring books?” Trask said, adding this effort seeks to get K-12 students engaged early, and set on pathways in the space ecosystem through becoming a “Junior Space Valley astronaut.”By Molly Callaghan – Albuquerque Business First

Okuma’s MULTUS U3000 Multitasking Machine offers an ideal combination of power, speed, and process flexibility. A broad scope of machining functions and the ability to complete tasks in a single setup make this machine simple and efficient for producing a variety of parts. Combining powerful turning and milling capabilities, made possible with Okuma’s OSP-P300 control, equals one thing – increased production capacity.

Explore all of the powerful features of the MULTUS U3000, including:

• Full 5-axis contouring (available as an option)

• New compact B-axis spindle

• 240-degree B-axis range

• 30 hp milling motor spindle

• 12,000 RPM H1 milling spindle

• Wide range of ATC configurations available (40 to 180 tools)

Ellison Machinery is pleased to announce that Ben Schacht has joined the team to support customers throughout Arizona.

For the past several years, Ben has supported customers in the engineering and manufacturing industry. In his positions at TrueInsight (Altair Channel Partner) and GoEngineer (SOLIDWORKS Reseller), Ben helped customers with CAD design and simulation software solutions ensuring that customers could seamlessly transition from design to production.

In his latest role as Channel Partner Success Manager at A3D Manufacturing, Ben supported customers from A3D Manufacturing and their Channel Partner, Hawk Ridge Systems throughout the US and Canada with modern and traditional manufacturing methodologies, for prototype development and low- to high-volume production.

Prior to his employment in the manufacturing industry, Ben served our country in the US Army as a Sergeant E5 (NonCommissioned Officer), where he earned multiple honors for exemplary performance, including the Distinguished Honor Graduate Award in Warrior Leadership Training, and received

an Honorable Discharge upon completion of service.

Ellison Machinery Company, located in Tempe, Arizona, is the leading CNC machine tool distributor in Arizona and Southern Nevada. Please welcome Ben to the Ellison Machinery team. For more info, visit ellisonaz.com.

Th e City of Henderson is pleased to announce Haas Automation will start construction on its 2.4-millionsquare-foot

manufacturing facility this fall. The new facility will provide a second factory to meet the growing demand for the company’s products.

Haas Automation will be a significant player in Henderson’s economy. The company has already invested more than 100 million dollars in site acquisition and development and expects to invest more than 300 million dollars in construction over the next two years. In addition, Haas will attract other high-tech companies to the area and is expected to create hundreds of jobs in just the first two years.

Raytheon division of RTX Corp on the project, with both companies winning contract enhancements in June 2022 and Northrop Grumman receiving another one in March 2023. The early round of contracts back in 2021 also involved Lockheed Martin Corp.

The Missile Defense Agency, which has partnered with Japan’s Ministry of Defense on the GPI project, said it was confident in its decision based on the GPI concept’s technology maturity, high fidelity model performance predictions, detailed technical maturation plans and industryprovided cost and schedule proposals.

Northrop Grumman will configure missile for land, sea launches

Hypersonic missiles travel more than five times the speed of sound and maneuver in flight. The weapons can also travel above the earth’s atmosphere.

Northrop Grumman said its design’s advanced technologies include a seeker to track threats and improve accuracy, a reignitable upper-stage engine for threat containment and a dualengagement mode to engage threats at a variety of altitudes.

Northrop Grumman’s Chandler operation has been selected by the U.S. Missile Defense Agency to move ahead with production of a new missile that will be able to knock out hypersonic threats in midair.

Winning the award means Northrop Grumman is now the sole company working on the project to build the Glide Phase Interceptor, or GPI, which will be able to stop hypersonic weapons while they are in the glide phase, which is the middle portion of their flight en route to targets.

Up until now, Northrop Grumman was working concurrently with Tucson-based

While this project has narrowed down to one company, Northrop Grumman and Raytheon are also working together to develop a hypersonic missile for the U.S. military that combines Northrop Grumman’s engines with Raytheon’s air-breathing hypersonic weapons.

The two companies also teamed up on a $3.9 billion 2021 contract for the MDA’s Next Generation Interceptor program to develop a modernized interceptor that can take on the most complex long-range ballistic threats. By Jeff Gifford – Phoenix Business Journal

When it comes to working with ferrous alloys, harsh conditions make it difficult to keep metalworking fluids stable. Castrol Hysol® range helps combat these challenges and delivers long lasting fluids for system stability, with minimal maintenance and no compromise on quality. This means your metalworking systems maintain performance, so you can rely on them to work harder for longer.

Set up a trial and discover how Castrol Hysol can drive your metalworking operations forward in performance. Call us today at 888-castrol

www.castrol.com/us-industrial

#CastrolForward

Ba ttery maker Lyten will build a $1 billion lithium-sulfur battery factory near Reno, Nevada.

At full capacity, the facility will produce up to 10 gigawatt hours of lithium-sulfur batteries annually. The plant will make cathode active materials and lithium metal anodes, as well as assemble lithium-sulfur cells, enabling a 100% domestically manufactured battery.

The facility will initially create 200 jobs, growing to more than 1,000 jobs at full capacity. The facility’s first phase is expected to start shipping batteries in 2027, Lyten Chief Sustainability Officer Keith Norman said in an email. The company’s plan is to gradually ramp up production by two GWh per year.

The battery company has been forging partnerships with major auto and transportation companies such as Stellantis, FedEx and Honeywell, which invested in Lyten’s series B equity round last year. In 2020, Lyten also started working with the U.S. Space Force and the Defense Innovation Unit, according to its website.

The Nevada facility will span 1.25 million square feet and be located in the Reno AirLogistics Park campus, just 13.5 miles from Reno-Tahoe International Airport. The plant adds to Lyten’s footprint across the West — the company also operates a 3D graphene fabrication and pilot-scale lithium-sulfur battery manufacturing facility in San Jose, California, where its headquarters are located.

Lyten is working with Dermody Properties and the Reno-Tahoe Airport Authority to finalize contractual terms to break ground on the factory in 2025.

The company began shipping cells from its pilot San Jose plant for commercial evaluation by customers in Q2 2024, Norman said in the email.

“Since that time we have seen a rapidly growing global pipeline that already includes hundreds of interested potential customers across a wide range of markets, including micromobility, space, defense, and transportation,” Norman said. “The leading customers in our pipeline are requesting gigawatt scale annual supply, and we are currently working to convert that demand into conditional offtake agreements to be

supplied by the Nevada facility.”

The Nevada factory will produce battery cells that are fully compliant with the Inflation Reduction Act and the National Defense Appropriations Act, and will not be subject to Section 301 tariffs, the release stated.

Lyten expects $1.5 billion in IRA 45X tax credits for the Nevada facility, according to Norman.

“The current customer demand Lyten is seeing will require additional facilities in the US beyond the Nevada facility, which are already being planned, and we expect the full support from 45X for building U.S. battery manufacturing of lithium-sulfur to be multiples of the initial $1.5B,” Norman said.

For training its workforce, Lyten is partnering with local universities, including the University of Nevada-Reno and Truckee Meadows Community College, as well as the Nevada Native American and Tribal members.

Nevada is currently the only state where the entire lithiumion battery lifecycle exists, Bill Pellino, manufacturing industry practice leader at BDO USA, told Manufacturing Dive last year. The state is home to Tesla’s factory and General Motors and Lithium Americas joint $650 million investment in the Thacker Pass mine.

Buffalo, New York-based GTI Fabrication is quickly growing its footprint in Phoenix to focus on the clean energy sector. It has just signed on for a larger, second facility in Arizona.

The modular building and shipping container manufacturer fabricates enclosed containers for the residential, defense, battery and supply chain industries. Its clients include Confluence Energy, LG Energy Solution and Honeywell International Inc.

Although it has seen success from its shipping container business, GTI has experienced a boost in demand from energy storage over the past few years.

In October, GTI signed a six-year, full-building lease for a 530,307-square-foot building at Lakin Park in Goodyear, located at the southwest corner of Cotton Lane and MC 85 along the future State Route 30. It will use the facility for light manufacturing and assembly of battery casings.

The first building at Lakin Park, totaling 730,000 square feet, was scooped up by Qurate Retail Inc. in 2022. Lakin Park is being developed by Clarius Partners and Walton Street Capital and will total 4.5 million square feet at buildout.

GTI first expanded to Phoenix last year in an 80,000-square-foot space to focus on battery energy storage systems through GTI Energy LLC, according to the company’s LinkedIn page.

The company’s services will support the growing clean energy sector in the Phoenix region, which has attracted battery manufacturers LG Energy Solution and KORE Power, electric vehicle makers and a increasing number of energy storage projects.

Markham said GTI considered several options for its expansion. They looked for a facility for half a year but chose Lakin Park because of its existing power and air conditioning, office space, immediate availability and proximity to the West Coast, where they ship their product.

“Commensurate with Phoenix’s growth in the energy sector, GTI figured Phoenix was probably the optimal location to grow with that line of service,” Markham told the Business Journal. “This building happened to have everything they needed, move-in ready including a certificate of occupancy.”

The third quarter saw a slowdown in big industrial leases in the

Valley as more buildings are delivered, in turn bumping up the industrial vacancy in the region. The vacancy hit nearly 12% during Q3 while the net absorption of space totaled 3 million square feet, bringing the year-to-date total to 12.5 million square feet, according to Kidder Mathews research.

It will take some time for the areas with more new supply to fill up but experts expect that to happen over the next couple of years as demand remains steady in metro Phoenix for space. Manufacturing and clean energy, as well as logistics, are driving leasing such as the GTI deal.

“It’s good for the overall Phoenix absorption and it’s a good story to tell in that Phoenix is a really favorable place to do business given the constraints that some of our neighbors have,” Markham said.

The Valley had about 30 million square feet of space under construction in Q3, a strong construction pipeline that’s expected to continue into 2025, Kidder Mathews found. Most of the buildings under development are also more than 100,000 square feet each.By Audrey Jensen –Reporter, Phoenix Business Journal

1704 West 10Th St • Tempe, AZ 85281

Ph: 480-967-2038 • F: 480-829-0838 • www.PrecisionDie.com

and dedication to customer service are number one priorities. This type of expertise and dedication has fostered a reputation of excellence in the tooling and stamping industry.

Located in Tempe, Arizona, our 100,000 Sq. Ft. Facility contains state of the art equipment , with production capabilities ranging from simple geometries to complex forms with intricate details. Precision enjoys a world-class reputation supplying a variety of OEMs, managing their inventory levels, and making certain product quality and timely delivery are NEVER compromised.

For the last 50 years, Semicon West, one of the microelectronic industry’s biggest conferences, has been held in the San Francisco area. However, for the first time since its inception, next year it’s moving to Phoenix, Arizona, as the area becomes a hub for semiconductor manufacturing.

“Greater Phoenix is home to more than 75 semiconductor companies including SEMI members EMD Electronics, Intel, and Taiwan Semiconductor Manufacturing Company,” Joe Stockunas, president of SEMI Americas and host of the event, said in a statement announcing the change.

In just the last four years, the Phoenix metro area saw 14 major manufacturing announcements and was ranked number one in the U.S. for manufacturing construction.

Arizona’s semiconductor storyline begins in 1949, when Motorola opened a research lab in Phoenix that later manufactured transistors, a type of semiconductor. Then, ASM came to Phoenix in 1976, followed by Intel opening its first semiconductor factory in Chandler in 1980, becoming one of the state’s largest employers.

As major players in the industry started accumulating here, related companies and suppliers followed, building a strong manufacturing ecosystem in the region.

In May 2020 TSMC added to this mix, with plans to build three fabs in Arizona worth a combined $65 billion, the largest foreign direct investment

in the state’s history.

The state’s efforts and incentives to attract manufacturers combined with one of the nation’s strongest talent pipelines in the semiconductor industry, have helped draw mega projects like TSMC’s to Arizona.

“As we were considering different sites in the U.S., the Arizona team made a strong impression with their preparedness and understanding of the range of issues and criteria for our decision,” a TSMC Arizona spokesperson said. “The team assembled included top elected leaders in city and state government, economic development, utilities, and higher education.”

Gallego said the state’s partnership with Arizona State University and the school’s growing engineering program were some of the top reasons for “getting TSMC to commit to Phoenix,” the mayor said.

“ASU is a major partner on workforce development initiatives and is helping bridge the gap between when new technology is invented and when it’s made

and deployed,” Gallego said.

The number of semiconductor companies located in the greater Phoenix area.

The state has also partnered with Maricopa Community Colleges, where it sponsored the Route to Relief program and Semiconductor Quick Start courses, which aim to introduce people to the possibilities in the semiconductor manufacturing and trade industries.

“In partnership with the state, industry, and federal government, the City also launched a Registered Apprenticeship program, the first of its kind in the country, to help train the next generation of semiconductor technicians,” Gallego said.

TSMC plans to invest $5 million to train 80 facility technician

apprentices over five years. The pilot program was launched with a cohort of eight facilities technician apprentices, all of whom have become full-time TSMC employees and will be a part of an 18-24 month program consisting of on-the-job training and classroom instruction, according to the company spokesperson.

The company plans to expand the program to other fab technician roles beginning next year.

With the growing support of state and city officials, a rapidly developing talent pipeline and the increasing impact of major projects like the TSMC fabs, the area is seeing a “massive influx of semiconductor-related companies completing the industry supply chain,” said Chris Camacho, president and CEO of the Greater Phoenix Economic Council.

“GPEC has since located 39 semiconductor-related companies to the region, creating more than 7,700 jobs and over $37 billion in capital investment,” Camacho said.

One such company is Benchmark Electronics, which builds equipment to produce semiconductor chips. The company opened a new facility in Mesa, Arizona last year.

“To put it simply, we love being located near a lot of our customers,” said Ryan Rounkle, VP of the semiconductor capital equipment sector at Benchmark. CHIPS and Science Act incentives and the strong technical talent pool further supported the decision to move here, Rounkle said.

Our employees are efficiently skilled, pay attention to detail and take pride in high quality work.They set us apart from the competition by specializing in the ability to hold tight tolerances to .0001. CNC Universal Grinding up to 5 X 24”, We have 4 Swiss Turning Centers Machining up to 32mm. Long Bar Grinding for Screw Machines.

The Biden-Harris administration announced the launch of the National Science and Technology Council’s workforce center last week to address labor development challenges in the U.S. semiconductor industry.

The government will invest $250 million over ten years, which includes $11.5 million in seven different grant awards to education and technological institutions across the nation.

The center aims to fill job and skill gaps across semiconductor research, design, manufacturing and production, the release stated.

The Workforce Center of Excellence will be led by John Ratliff, executive director of the center and VP at nonprofit Natcast, according to the release. The center plans to serve as an interconnected and neutral third party that leverages data to focus on improving workforce access.

There will be three inaugural programs within the WCoE, each aimed at reshaping the semiconductor workforce ecosystem. The Amplifier Program will focus on creating equitable, worker-centered development practices that offer jobs with fair wages and the choice to join a union.

The Signals program will use data and research to track workforce trends and provide insights on talent supply and demand.

Thirdly, the Connections program will provide member services, tailored events and support to meet the specific needs of NSTC member organizations.

Among the seven awardees, the University of Illinois and the University of California, Los Angeles, will receive $2 million each. In Arizona, the Maricopa County Community College District will use about $1.8 million in funding to expand its semiconductor technician training and launch a program dedicated to preparing an additional 300 individuals for semiconductor technician careers in Arizona’s booming semiconductor industry.

The seven awardees include:

American Federation of Teachers Educational Foundation: $1.7 million

Idaho Technology Council: $1.2 million

Maricopa County Community College District

Rochester Institute of Technology: 1.5 million

Texas A&M University: $1.3 million

University of California, Los Angeles: $2 million

University of Illinois Urbana-Champaign: $2 million

Also among the seven institutions, the American Federation of Teachers Educational Foundation received $1.7 million in funding to partner with one of the nine workforce hubs created by the Investing in America Act.

Upstate New York’s workforce hub, which launched this summer, is working with AFTEF to help students prepare for technical careers in the semiconductor industry, a prominent sector in the state. The funding will help fill the workforce gap for two major chip projects — Micron Technology in Clay and GlobalFoundries in Malta — which both received billions of dollars in CHIPS and Science Act grants this year.

The White House has proposed $500 million in workforce efforts so far as many manufacturing industries, including semiconductors, face a skills gap. For the third year in a row, talent risk was cited as the biggest issue facing the chip industry over the next three years, according to KPMG’s 2024 Global Semiconductor Industry Outlook.

In July, the administration also invested $244 million to help modernize, diversify and expand the federal Registered Apprenticeship system in growing U.S. industries.

StandardAero shares soar in stock market debut

StandardAero’s valuation soared to nearly $11 billion after the Scottsdale-based aviation services provider made its stock market debut last month.

StandardAero Inc. began trading on the New York Stock Exchange

Free up existing talent to work on more meaningful tasks, and allow a machine to deal with the repetitive loading and unloading of parts.

Because your competition is already doing it. Automation is essential to control your costs, maximize your efficiency, and maintain a competitive edge –to ensure your future.

There is no one size fits all solution. We offer a number of automation systems designed to fit your specific needs. Choose from our wide selection of pre-engineered solutions.

under the ticker symbol “SARO,” raising more than $1.4 billion in its initial public offering of 60 million shares.

StandardAero’s stock opened in the late morning at $31, taking a big jump from the company’s upsized IPO price of $24 a share. The company initially priced its IPO of 60 million shares in a range of $20 to $23, according to a Sept. 27 regulatory filing.

Investors were bullish on StandardAero’s stock, pushing the share price as high as $33 before it closed at $32.80, up 36.5% from the $24 IPO price.

“This is an exciting milestone in the history of StandardAero and I would like to thank all of our employees for their great contributions to the success of our company,” Russell Ford, chairman and CEO of StandardAero, said in a statement provided to the Business Journal. “Our company strategy is to foster our next generation of growth and development. Together, we will continue to be a leading provider of MRO services well into the future.”By

Amy Edelen – Phoenix Business Journal

Manufacturing Job Pipeline

Headlines detailing mass layoffs and big projects pausing can be deceiving.

LG Energy Solution said it was temporarily halting plans for its second battery plant in metro Phoenix this year, and about a year ago, electric vehicle maker Lucid Group Inc. announced layoffs for about 1,000 workers.

But a close examination of Arizona’s recent history shows that it has made important strides in bolstering its manufacturing pipeline — in fact, the state was ranked No. 1 this year for manufacturing growth in the U.S. for at least 14 major projects that had been announced since 2020.

As for the manufacturing labor force, the Grand Canyon State has seen a softening with a decrease of 3,000 seasonally adjusted jobs in the past year and a half, but that

doesn’t amount to a huge impact considering the nearly 50,000 jobs added in the past decade, according to data from the Arizona Office of Economic Opportunity.

“It makes it look like we’re in a weak position but in reality that’s just broader business cycle issues,” said Jim Rounds, president of Tempe-based Rounds Consulting Group Inc.

Arizona reached 195,500 manufacturing jobs in 2022 — up from a drop-off to 150,000 after the Great Recession and nearing a modern high of more than 212,00 jobs reached in 1998. Most of those manufacturing jobs are concentrated in the Valley.

“You expect to see manufacturing slide a little bit in recessions, and historically you do see that, but it doesn’t pick up the fact that in relative terms we’ve been adding a lot of higher wage jobs and a lot of that has been in semiconductors,” Rounds said.

Arizona among first states to recover Covid job losses

Over the past decade, state leaders updated policies and expanded incentives to attract diverse companies and higher-paying jobs to combat future recessions — and it’s working. The state quickly recovered all jobs lost from the Covid-19 pandemic before other states and is still showing resiliency as the rest of the labor market cools off thanks to gains in some of Arizona’s strongest industries such as hospitality, construction, health care and government.

If the U.S. were to fall into a recession, as some pundits still suggest is possible, Arizona may only see a “modest” employment decline this time around, leading to fewer job openings as the state prepares to welcome thousands of new manufacturing jobs from multibillion-dollar investments

made by Taiwan Semiconductor Manufacturing Co., Intel Corp., LG Energy Solution, Amkor Technology Inc. and more. Outside influences could impact the timeline for those projects, but overall they’re expected to strengthen the state’s economy.

Manufacturing made up about 6% of Arizona and the Valley’s workforce as of July 2024, almost as much as the construction industry’s share of the workforce in the state. Those jobs are important because they create more employment and often have higher wages, leading to other spending in the economy.

Although not as high as the average weekly wages for industries such as information technology, the average weekly wage for manufacturing jobs in Arizona has been increasing, reaching $1,670 in the third quarter of 2023, a 4.7% increase from the same quarter in 2020.

Economist: ‘We might be duplicating efforts’

The Phoenix market ranked 11th for hottest labor markets in the U.S. based on pay growth, wages and hiring rates over the past year, according to an ADP survey of its members. It also ranked within the top 20 hottest labor markets for manufacturing based on a strong hiring rate, but its pay growth and new hire wages were lower ranked compared to other markets.

The market’s manufacturing boom is good news for the state’s coffers, but Arizona will need to continue focusing on how to fill those future jobs as it establishes itself as a key semiconductor hub.

Indeed, the Semiconductor Industry Association warned in a 2023 report that the U.S. could face a projected shortfall of 67,000 semiconductor industry workers — including technicians, computer scientists and engineers — by

Servicingourindustryandtrade customersinintelligenceheattreatingfor over60years.

cs@phxht.com

www.phoenix-heat-treating.com 602-258-7751

To help fill up the advanced manufacturing job pipeline across the state, workforce, education and economic leaders are focused on training and building the future workforce in emerging industries, although Rounds suggest a lot of those efforts have been siloed.

“It’s not a bad thing to have a lot of different groups working on different workforce development, but I feel like we’re not maximizing the benefits — we might be duplicating efforts,” Rounds said.

Arizona could also see a more robust workforce from a collective focus on securing and training workers on every level, including making sure as many students as possible obtain a high-school diploma, technical degree or university degree.

“We have to give opportunities to everybody if we’re going to maintain what we’re doing,” Rounds said. By Audrey Jensen – Phoenix Business Journal

Raytheon-Lockheed Martin joint venture wins contract for Javelin missile system

A joint venture between RTX Corp.’s Tucson-based Raytheon division and Lockheed Martin Corp. was recently awarded a $12,064,180 contract for work on the Javelin missile system.

The deal is a fiscal year 2024 production contract for Javelin missiles and associated equipment that has a total value of $1.3 billion. It’s the first follow-on to an indefinite delivery, indefinite quantity contract first awarded in 2023 to the joint venture. Since that time, several contract modifications have been awarded, including one earlier this year.

The Javelin system is described by Raytheon as a guided munition that can be carried by a single soldier and used against vehicles, bunkers and caves. Raytheon (NYSE: RTX) and Lockheed Martin have been working together on the Javelin system to supply the U.S. Army and Marine Corps,

as well as foreign military clients.

More than 50,000 Javelin missiles and more than 12,000 reusable Command Launch Units have already been produced by the joint venture, and the companies have said that the U.S. military expects to keep the Javelin system in its operational inventory through 2050. Raytheon said this latest award constitutes the largest single-year Javelin production contract to date.

“Now more than ever, Javelin is recognized as the most effective, combat-proven anti-armor weapon system in the world,” Andy Amaro, JJV president and Javelin program director at Raytheon, in a statement. “Through this contract, we will continue to produce and deliver this needed capability to support global ground forces in their efforts to protect and defend their interests and sovereignty.”

Ukraine among Javelin customers

Besides the U.S. military, the Javelin project has been supplying more than 25 international customers, including Australia, Estonia, Georgia, Indonesia, Ireland, Jordan, Lithuania, New Zealand, Norway, Oman, Poland, Qatar, Turkey and the United Arab Emirates. Raytheon said the contract includes 4,000 Javelins that will replenish rounds that have been sent to Ukraine, which has been fighting against an invasion by Russia since early 2022.

Work under the latest contract is estimated to be finished by August 2027. While Raytheon’s portion of the project is being done in Tucson, Lockheed Martin’s contract work is based in Orlando, Florida.

“With the increased demand for Javelin worldwide, our ability to ramp production to support our Army customer and global users is more important now than ever,” said Dave Pantano, JJV vice president and Lockheed Martin Javelin program director.

“This production contract demonstrates how Javelin’s mission-focused capabilities are helping to keep customers Ahead of Ready and defend against threats worldwide.”By

Jeff Gifford –

Phoenix Business Journal

Global electronics manufacturer and Apple Inc. supplier Foxlink Group plans to significantly grow its presence in Phoenix just two years after setting up shop in Arizona.

Through its subsidiary Foxlink Arizona Inc., the Taiwanese-based company announced this fall that it will further expand its manufacturing capacity here with 100 new jobs through a $20 million investment in the Grand Canyon State over the next 3 years.

“When looking to expand our manufacturing footprint in the United States, Foxlink needed a talent-dense hub known for innovation. That is exactly what we have found in Phoenix,” said Freddy Kuo, executive office special assistant at Foxlink.

Foxlink, founded in 1986, designs, manufacturers and sells connectors, cable assemblies, power management devices and battery packs to some of the leading manufacturers of communications devices, computers and electronics.

More international businesses have been expanding to Arizona to support growing industries such as microelectronics and clean energy, as well as major projects such as the $65 billion Taiwan Semiconductor Manufacturing Co. complex and Intel Corp.’s $20 billion expansion.

The company previously unveiled its Arizona plans for its first manufacturing facility in the U.S. in a nearly 170,000-square-foot building for green energy products including charging stations and battery assembly at the Phoenix Deer Valley Airport area.

FoxLink Arizona started work on its new plant in February 2022 and has since transitioned from assembling traditional circuit boards to focusing on green energy products.The facility will also support manufacturing for Foxlink’s other affiliates based in the U.S.

•

• 80,000 sq. ft. Facility With Extensive Inventory

• Stocking Stainless Steel, Aluminum Stock and Specialty Metals

New Mexico Manufacturing firms disappear; the workforce remains

There are fewer manufacturing firms in New Mexico than four years ago, but the workforce and wages in the industry have gone up.

In 2023, there were 1,609 manufacturing establishments in the state of New Mexico. That’s 5.35% fewer than in 2022, and 9.4% fewer than in 2020.

Although the number of manufacturing establishments decreased since 2020, there are still many manufacturing tradespeople in the state.

Employment within the manufacturing industry increased by 5.43% comparing 2020 employment to 2023 employment in the industry, despite a small dip between 2022 and 2023.

As part of the annual Manufacturing Companies List, Albuquerque Business First asked companies about what New Mexico can do for manufacturers in the state of enchantment.

What could New Mexico do to increase manufacturing opportunities in the state and bring or keep more companies here?

“New Mexico can promote its natural beauty, outdoor recreation and lower cost of living to attract business and workers. New Mexico can highlight its proximity to major markets, being within a 12-hour drive

from large cities, such as Los Angeles, Denver, Phoenix and Dallas, positions New Mexico to be a great manufacturing hub. New Mexico can upgrade its transportation infrastructure to make New Mexico an attractive location for manufactures who depend on efficient transportation.” – David Fair, CEO, OGB Architectural Millwork dba Santa Fe Flooring

“Improve the overall business friendliness of the state. Improve the service the state gives to businesses for necessary services like permitting and reduce the amount of money given directly to businesses. Don’t pick winners and losers.” – Jeff Alcalde, owner, Marpac Inc. By Jayme Sileo – Albuquerque Business First

“OGB has updated its estimating and engineering software allowing for better quality and productivity. OGB has also focused on cross training employees, this allows for more input from more employees leading to better quality and performance.” – David Fair, CEO, OGB Architectural Millwork dba Santa Fe Flooring LLC

“Automation added as volume increases.” –Jeff Alcalde, owner, Marpac Inc.

• We can help with your Milling or Wire EDM projects.

• A working demonstration tech center.

• Resellers of the entire Siemens NX, SolidEdge and SolidCAM software portfolio in ( AZ, NV, UT, CO, and NM)

• Let us show you how to increase your material removal rate by 70%!

• If you use SolidWorks, Inventor, or Solid Edge, you’re halfway there!

• Make the jump into the word of Integrated CAM; you’ll never look back.

Not your average shop/reseller; we use these tools every day.

480 420 7117 or info@turulengineering.com

New research from intelligent automation company ABBYY finds that manufacturers’ fear of missing out (FOMO) plays a significant factor in artificial intelligence (AI) investment, with 67% of manufacturing companies reporting they are worried their organization will be left behind if they don’t use it.

In addition, the ABBYY State of Intelligent Automation Report AI Trust Barometer found that the other big drivers for investment are to increase efficiency and customer service (65%) with 47% admitting pressure from customers played a part because clients expect it.

An overwhelming 87% of IT leaders in the manufacturing sector report that they trust AI to benefit their

business. Within this, the top most popular tools are generative AI such as large language models, chatbots, digital assistants and ChatGPT (71%), followed by machine learning (55%) and purpose-built AI such as intelligent document processing (52%).

However, there are concerns about the current and future use of AI, with lack of expertise and talent (43%) being the biggest worry among manufacturers – one of the highest compared with the other sectors surveyed. Technical complexity (37%) is also a concern for manufacturers, as well as legal and compliance risks (36%). Of those who do not trust the technology, the main fear was cybersecurity and data breaches (53%) and reliability and accuracy of data (51%).Despite this, 91% of IT leaders in manufacturing say they plan to increase investment in AI next year, with almost a quarter (24%) pledging to raise their budgets by 21-30%, perhaps due to the fact that 85% are already seeing results from AI use.

On the subject of ethical and trustworthy AI, 93% of manufacturers are confident their company is following all government regulations on the use of AI, yet only 59% admit they have policies in place that their product, security, and/or compliance teams adhere to.

Maxime Vermeir, Senior Director of AI Strategy at ABBYY, commented, “It’s interesting to see that IT leaders in manufacturing trust small language models the most, perhaps due to the issue of hallucinations and inaccurate information reported by generative AI and large language models.

He added, “Lack of expertise in implementing AI is a concern for manufacturers, and the skill gap may hinder their progress as AI becomes more widespread in other sectors. To effectively integrate AI, manufacturers should upskill employees through training, as well as investing in hiring specialists in AI.”

previously indicated that either Phoenix or Atlanta would be chosen. Ultimately, the company has decided to head west.

TuSimple, Knight Swift already testing driverless trucks in Arizona Phoenix is no stranger to autonomous vehicles. Waymo operates its driverless taxi service on Valley streets — beginning testing on Phoenix freeways this year — with automotive industry giant Magna planning to outfit Waymo’s vehicles at hits new facility in Mesa.

TuSimple has logged hundreds of driverless miles on Interstate 10. Phoenix-based Knight-Swift Transportation Holdings Inc. has deployed autonomous truck technology between Phoenix and Los Angeles. Additionally, Torc Robotics Inc., which is developing an autonomous driving system for tractor-trailers, added Interstate 40 in Arizona to its test zone.

Pittsburgh-based Aurora Innovation Inc., which is running autonomous trucking technology along two routes in Texas, plans to extend one of those lines all the way to Phoenix. Aurora announced it intends to expand its Fort Worth to El Paso lane to Phoenix in 2025.

It’s the first formal announcement of plans to scale its autonomous trucking technology out of the state of Texas. The company has tested vehicles on two routes in Texas — one between Dallas and Houston and the other being the aforementioned Fort Worth to El Paso lane.

Currently, those test vehicles operate with a driver behind the wheel in the event of an emergency, but the company has repeatedly reiterated that the Dallas to Houston route will be completely driverless by the end of this year. The planned Fort Worth to Phoenix expanded lane is planned to be available for testing in the first half of 2025, with plans for a driverless route later that year. A release from the company notes that the approximately 15 hour, 1,000-mile passage’s length is “particularly compelling for autonomy.”

The expansion is the first definitive statement on the company’s plans to scale past Texas. Despite raising $483 million in a public offering in August, the company does not expect to be cash flow positive until 2028. The company has previously teased a widespread Sun Belt expansion, estimated to occur over the next few years, and has

The route expansion was announced at the Aurora Partner Summit, a two-day event where the company is sharing updates and information with “over 20” commercial partners. The company has attained a slew of commercial partners over the past several years, including PACCAR, FedEx, Toyota, Uber, Volvo and Continental.

The summit includes regulators, first responders and law enforcement, the latter two of which will speak on how the state of Texas is preparing to handle the logistics of a driverless truck. Now, the company will need to engage with regulators and first responders from both New Mexico and Arizona.

Additionally, the company announced what it’s dubbed a “Partner Success Program” which will allow customers’ executives and drivers to ride in the cab of Aurora trucks to see the technology first hand.By Jake Dabkowski –Pittsburgh Business Times

Apprentices Grow Arizona’s Semiconductor Sector As Demand For Workers Surges

As a facilities technician apprentice for Taiwan Semiconductor Manufacturing Co., Alejandro Munoz is gaining exposure to the silicon chip industry and the various trades that support the company’s high-tech factories under construction in north Phoenix.

Prior to joining TSMC’s apprenticeship program, Munoz had been unsure of his career trajectory. He spent a year working at Intel, gaining initial exposure to the semiconductor industry and was later hired for a contracting job with a third-party company to work at TSMC’s site.

“Ever since I got into the semiconductor industry, it has been something that I’ve liked and I want to stay in it,” he said. “There’s not a lot of companies where you get to work inside a clean room and — with all the advanced technology — just learning about it interests me.”

Munoz is among an inaugural cohort of eight participants in TSMC’s facility technician apprenticeship program, which launched in April and is expected to run 18 to 24 months. TSMC invested $5 million in the program, which will train 80 apprentices over five years.

TSMC declined to provide specific pay rates for its apprentices, but the company said its employee salaries are above the average annual wage for Arizona’s manufacturing sector, which is $88,868 per year. In addition, apprentices receive company benefits and an option to complete an associate’s degree with tuition paid by TSMC.

In April, TSMC increased its investment in its Arizona chip factories, or fabs, from $40 billion to $65 billion as it plans to build a third facility by the end of the decade that will produce 2 nanometer chips to power smartphones, data centers and artificial intelligence applications.

Semiconductor companies with expansion plans on tap such as TSMC, Intel and Amkor, along with community colleges, universities, high schools and other industry-affiliated entities, are in a rush to train and hire workers amid an expected need for some 25,000 advanced manufacturing jobs earmarked for Arizona over the next decade and beyond.

TSMC is expected to start highvolume production at its first fab — now under construction in north Phoenix — in the first half of 2025, followed by operations to begin in its second fab in 2028. The company’s Arizona fabs are expected to employ more than 6,000 workers, up from the 4,500 it initially anticipated. The

company has hired more than 2,200 workers, the Business Journal previously reported.

TSMC apprentices gain expertise in four areas

TSMC’s facilities technician apprentices participate in a phased program in which they gain hands-on training in four departments: water, mechanical, electrical and gas, and chemical.

They spend 18 weeks in each department, combined with inclassroom training via Maricopa Community Colleges. Then, they pick a specialization and receive 2,000 hours of on-thejob training in that particular field, Jackson said.

“They get to spend time with journeymen, electricians and water technicians with 30 years of experience,” Jackson said.

“They get out in the field, get their hands dirty and learn realtime stuff and take not just what they’ve learned in the classroom — which is an important part of it — but they learn some of the little tips and tricks that occur in the field that may not get taught in the classroom.”

TSMC’s inaugural cohort is slated to graduate from the fi rst phase of the program by the end of 2025. Interest in the apprenticeship program is robust and the company expects a greater number of participants for its second cohort, Johnson said.

Leon Ntwarabakiga is part of TSMC’s first cohort of apprentices and is undergoing training in electrical and instrumentation and controls.

“It’s amazing, the things that I’m seeing already with electrical, and I can’t wait to see the rest

of the departments,” Ntwarabakiga said.

/davismetalsandsalvage

/company/davis-salvage-co.-l.l.c.

/davismetalsandsalvage

/davissalvage

Ntwarabakiga, like Munoz, was working as a contractor for a third-party company on TSMC’s site when he learned of the apprenticeship program and applied because of the company’s expertise in the semiconductor industry.

“Being able to work for a company like that with the innovations they have was a great opportunity for me,” he said.

Ntwarabakiga added that skills and information learned in the apprenticeship program span beyond the semiconductor industry.

“For anyone who’s looking for a career change, or someone who’s trying to build a career, I think this is a good program for them, he said. “This program gives you an opportunity to test everything and see what you like, and you get tons of support from mentors and experienced engineers and technicians.”

By Amy Edelen – Reporter, Phoenix Business Journal

The White House is investing $250 million over 10 years to establish a national semiconductor workforce training center, the U.S. Department of Commerce announced.

The National Semiconductor Technology Center’s Workforce Center of Excellence will bring together officials from the private sector, nonprofits, academia, government and labor organizations to accelerate industry best practices as well as strengthen recruitment and training for the next generation of semiconductor researchers, engineers and technicians, according to a Department of Commerce release.

The National Semiconductor Technology Center is a public-private consortium dedicated to semiconductor research and development.

“With the Department’s proposed investments of over $500 million in workforce efforts, this announcement is a critical milestone in our strategy to build a robust workforce in

the semiconductor industry to help fulfill the mission set forth by the CHIPS and Science Act,” Gina Raimondo, U.S. Secretary of Commerce, said in a statement.

As part of the announcement, Natcast, a nonprofit consortium that operates the NSTC, is awarding a total of $11.5 million to seven institutions — including Maricopa County Community College District (MCCCD) — to support workforce development efforts.

MCCCD will use its $1.8 million award to expand semiconductor technician training offerings and launch the Maricopa Accelerated Semiconductor Training program, building on the success of its Quick Start program.

The expanded programming will prepare an additional 300 workers in the Valley for careers as semiconductor technicians, according to the Department of Commerce.