1951 December 2022 Heimtextil 2023 / Annual Fact File 2022

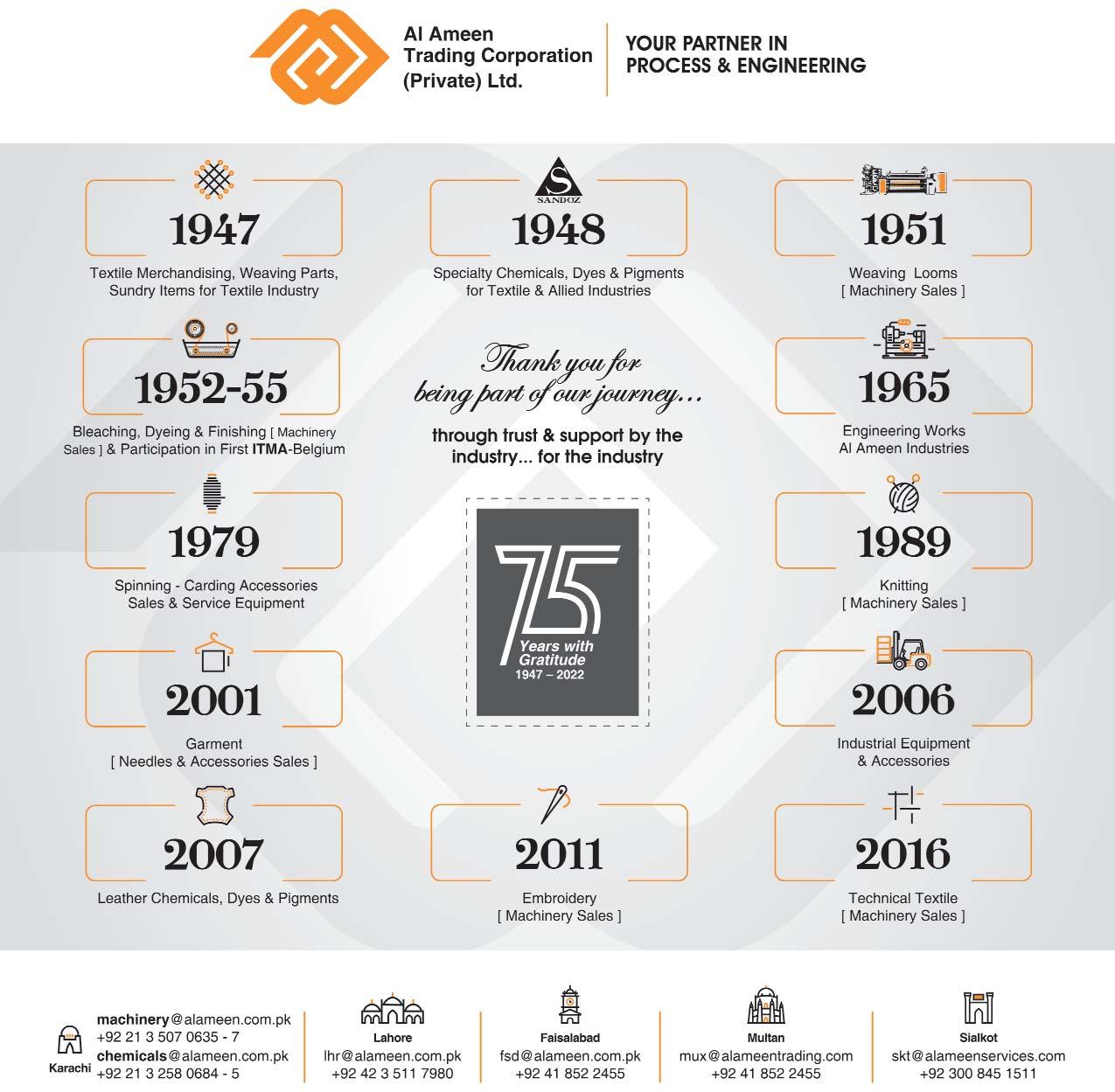

Established

INTEX SOUTH ASIA 2022

Dates: December 8th to 10th 2022. Venue: New Delhi, India.

Index 2023

Dates: April 18th to 21st, 2023. Venue: Palexpo, Geneva, Switzerland.

IGATEX Pakistan 2023, Karachi

Dates: September 7st to 9th 2023.

Venue: Expo Centre, Karachi.

Techtextil 2023 North America

Dates: May 10th to 12th, 2023 Venue: Georgia USA.

ITME INDIA 2022

Dates: December 8th to 13th 2022. Venue: India Expo Centre & Mart. Noida, India.

DOMOTEX asiaCHINAFLOOR 2023

Dates: May 29th to 31st 2023. Venue: NECC, Shanghai, China. Heimtextil 2023, Frankfurt

Dates: January 10th, to 13th, 2023 Venue: Frankfurt am Main.

FESPA 2023

DOMOTEX Hannover 2023

Dates: January 12th to 15th 2023. Venue: Hannover, Germany.

Dates: May 23rd to 26th 2023. Venue: Munich, Germany.

iCADEX Pakistan 2023, Karachi

Dates: September 7st to 9th 2023. Venue: Expo Centre, Karachi.

Istanbul Yarn Fair

Dates: February 16th to 18th 2023. Venue: Istanbul, Turkey.

ITMA 2023

Dates: June 8th to 14th, 2023. Venue: Milan, Italy.

62th Dornbirn GFC Global Fiber Congress

Dates: September 13th to 15th 2023. Venue: Dornbirn Austria.

ITM 2024

Dates: June 4th to 8th, 2024. Venue: Istanbul, Turkey.

HIGHTEX 2024

Dates: June 4th to 8th, 2024. Venue: Istanbul, Turkey.

Textile Asia 2023, Karachi

Dates: March 11th to 13th 2023. Venue: Expo Centre, Karachi.

ITMA ASIA + CITME 2023

Dates: November 19th to 23rd, 2023. Venue: NECC, Shanghai, China.

JIAM 2024 OSAKA

Dates: Nov. 27th to Nov. 30th 2024. Venue: Osaka, Japan.

2 Calendar of Events

PAKISTAN TEXTILE JOURNAL - December 2022

Founded in 1951 by Mazhar Yusuf (1924-2009)

Publisher Nadeem Mazhar

Editor in Chief Amina Baqai

Associate Editor Nimrah Nadeem

Associate Editor

Shahnawaz Khan

Production Manager Mazhar Ali

Hony-Editorial Board

Dr. Hafizur Rehman Sheikh Ph.D (UK) F.T.I. (UK)

Syed Mahfooz Qutab C.TEX, F.T.I (U.K), B.Sc. Fellow I.C.T.T Atlanta, GA; (USA)

Mian Iftikhar Afzal B.S.N.C State, M.Sc. (Leeds) C.TEXT.F.T.I (UK)

Dr. Zubair Bandukda PhD (Textiles), CText ATI

Editorial & Advertising Office B-4, 2nd Floor, 64/21, M.A.C.H, Miran M. Shah Road, Karachi - Pakistan Tel: +92-21-34311674-5 Fax: +92-21-34533616 Email: info@ptj.com.pk URL: http://www.ptj.com.pk

PTJ Europe Ltd. Correspondence & Mailing address: 93 Fleming Place, Bracknell, RG12 2GN, United Kingdom Tel: +44 792 2228 721

Available on Gale and Factiva affiliated international databases through Asianet Pakistan

Printed at: Color Plus Korangi, Karachi.

Published by Nadeem Mazhar from D-16, K.D.A. Scheme No.1. Karachi.

Vol. LXXI No. 12 December 2022 Rs. 565.00

EDITOR’S PAGE . . . . . . . . . . . . . . . . . . . . . . . . . . .7

2022 was a year of uncertainty and full of challenges for the textile industry

TEXTILE BRIEFS . . . . . . . . . . . . . . . . . . . . . . . . . . .8

NEWS & VIEWS . . . . . . . . . . . . . . . . . . . . . . . . . .10

AROUND THE WORLD . . . . . . . . . . . . . . . . . . . . . .14

SPECIAL CORPORATE NEWS Archroma and Panatronix embark on close partnership towards eco-conscious denim cleaning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18 FEATURES The LYCRA Company introduces THERMOLITE® EVERYDAY WARMTH technology . . .20 Autoconer X6: Excellent splice quality with open prism technology . . . . . . . . . . .22 Heimtextil 2023 Heimtextil 2023 experiences strong international demand . . . . . . . . . . . . . . .24 Pakistani student wins prestigious competition for textile designers . . . . . . . .26 Exhibitors from Pakistan at Heimtextil 2023 . . . . . . . . . . . . . . . . . . . . . . . . .28

REPORTS 18 24

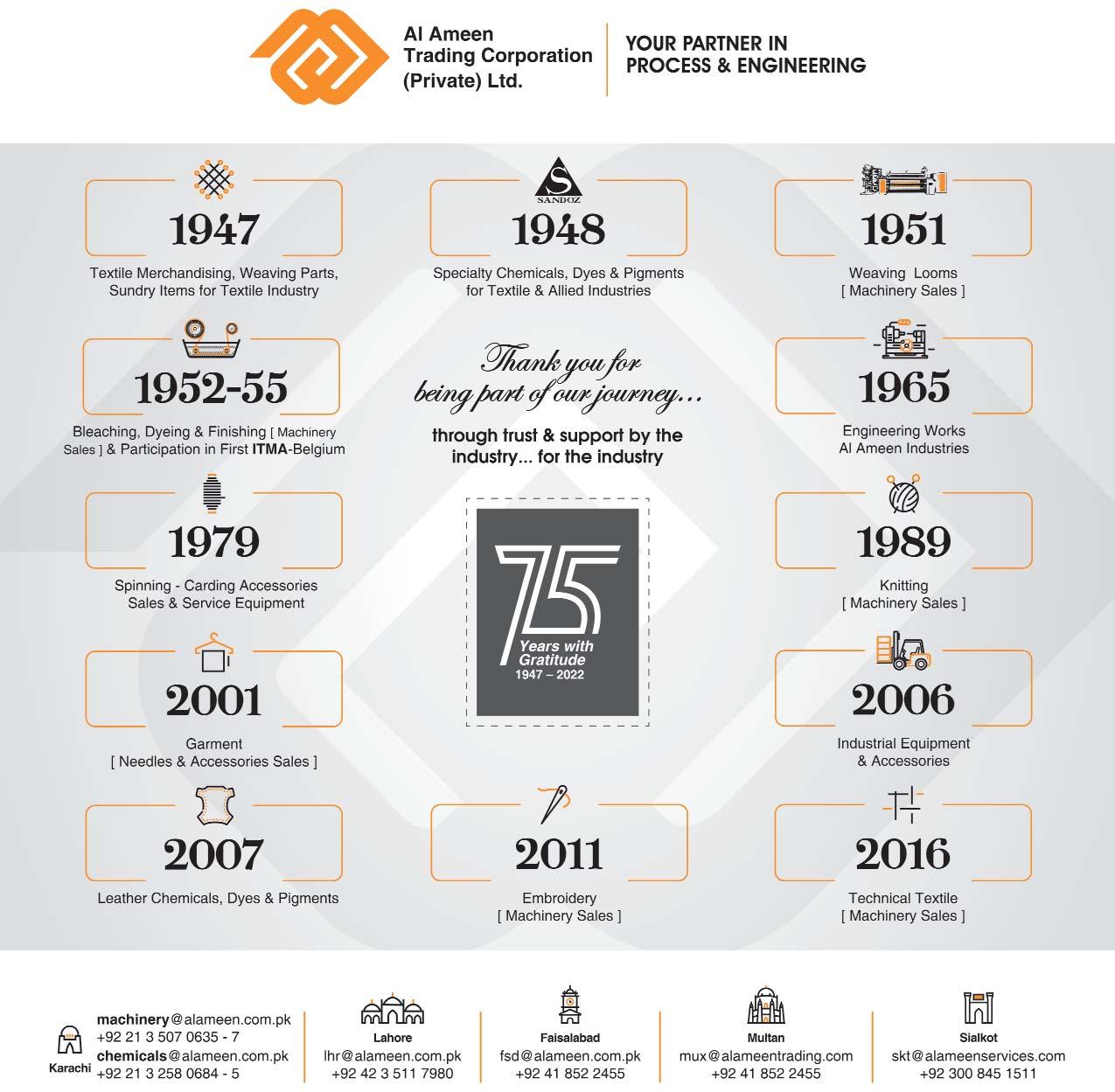

Registered Office: Dairy House, Money Row Green, Holyport, Maidenhead, Berkshire, SL6 2ND, UK Registered no. 09141989 Artistic Milliners’ Cotton Projects team wins Ryan Young Climate + Award 2022 . .30 Al Ameen celebrates 75th Anniversary with a commitment to transparency and satisfying services . . . . . . . . . . . . . . . . . . . . . . . . . .21

ANNUAL FACT FILE 2022

Table 1: World Cotton Supply, Use and Trade . . . . . . . . . . . . . . . . . . . . . . . . .39

Table 2: World Merchandise Trade and Textile & Clothing Exports . . . . . . . . . .40

Table 3: Merchandise Trade, Textile & Clothing Exports . . . . . . . . . . . . . . . . .40

Table 4: World Export of Textiles & Clothing . . . . . . . . . . . . . . . . . . . . . . . . .40

Table 5: World Export of Textiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .41

Table 6: World Import of Textiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .41

Pakistan

Table 1: Facts About Pakistan Textile Industry . . . . . . . . . . . . . . . . . . . . . . . .42

Table 2: Share of Pakistan Textile Industry Exports . . . . . . . . . . . . . . . . . . . . .43

Table 3: Pakistan Textile Industry 2020 – 2021 . . . . . . . . . . . . . . . . . . . . . . . .43

Table 4: Export of Pakistan Textiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .43

Table 5: Export of Raw Cotton . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .44

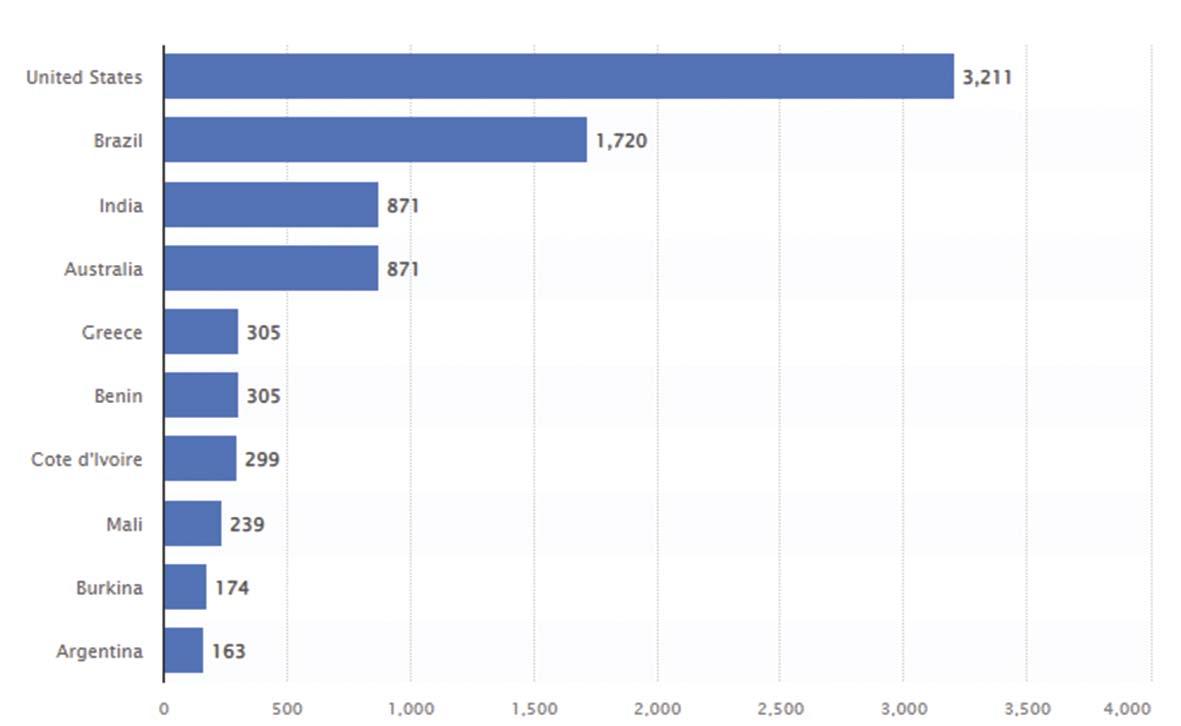

Table 6: Country-wise Export of Cotton Yarn . . . . . . . . . . . . . . . . . . . . . . . . .45

Table 7: Country-wise Export of Cotton Fabrics . . . . . . . . . . . . . . . . . . . . . . .46

Table 8: Country-wise Exports of Textile Made-ups . . . . . . . . . . . . . . . . . . . . .47

Table 9: Country-wise Export of Readymade Garments . . . . . . . . . . . . . . . . . .48

Table 10: Country-wise Export of Knitwear (Hosiery) . . . . . . . . . . . . . . . . . . .49

Table 11: Country-wise Export of Towels . . . . . . . . . . . . . . . . . . . . . . . . . . . .50

Table 12: Country-wise Export of Bedwear . . . . . . . . . . . . . . . . . . . . . . . . . .51

Table 13:Import of Viscose Fibre in Pakistan . . . . . . . . . . . . . . . . . . . . . . . . .52

Table 14: Country wise Imports of Viscose Fibre in Pakistan . . . . . . . . . . . . . .52

Table 15: Country-wise Export of Textile Made-ups (Excl. Bedwear and Towels) .52

Table 16: Textile Exports by Major Categories . . . . . . . . . . . . . . . . . . . . . . . .53

Table 17: Pakistan Cotton Textile - Average Unit Value . . . . . . . . . . . . . . . . . .54

Table 18: Imports of Textile Machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . . .55

Table 19: Import of Textile Machinery in Pakistan (Major Items) . . . . . . . . . . . .56

Bangladesh

Table 1: Bangladesh Garment Factories and Employment . . . . . . . . . . . . . . . .57

Table 2: Share of Export of RMG and Total Export of Bangladesh . . . . . . . . . . .58

Table 3: Main Apparel Items Exported from Bangladesh . . . . . . . . . . . . . . . . . .59

Table 4: Total Apparel Export from Bangladesh (Fiscal Year Basis) . . . . . . . . . .59

Table 5: Total Value of Apparel Exports from Bangladesh . . . . . . . . . . . . . . . .60

India

Table 1: India’s Exports of Cotton Textile . . . . . . . . . . . . . . . . . . . . . . . . . . .61

Table 2: India’s Country wise Exports of Cotton Textile . . . . . . . . . . . . . . . . .61

Table 3: India’s Exports of Cotton Yarns . . . . . . . . . . . . . . . . . . . . . . . . . . . .62

Table 4: India’s Exports of Cotton Fabrics . . . . . . . . . . . . . . . . . . . . . . . . . . .62

Table 5: India’s Exports of Cotton Made-ups . . . . . . . . . . . . . . . . . . . . . . . . .63

Table 6: India’s Exports of Raw Cotton . . . . . . . . . . . . . . . . . . . . . . . . . . . . .63

European Union

Table 1: EU (28) Imports of Textile and Clothing . . . . . . . . . . . . . . . . . . . . . .64

Table 2: EU (28) Export of Textiles and Clothing . . . . . . . . . . . . . . . . . . . . . .64

Table 3: EU (28) Export of Textiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .65

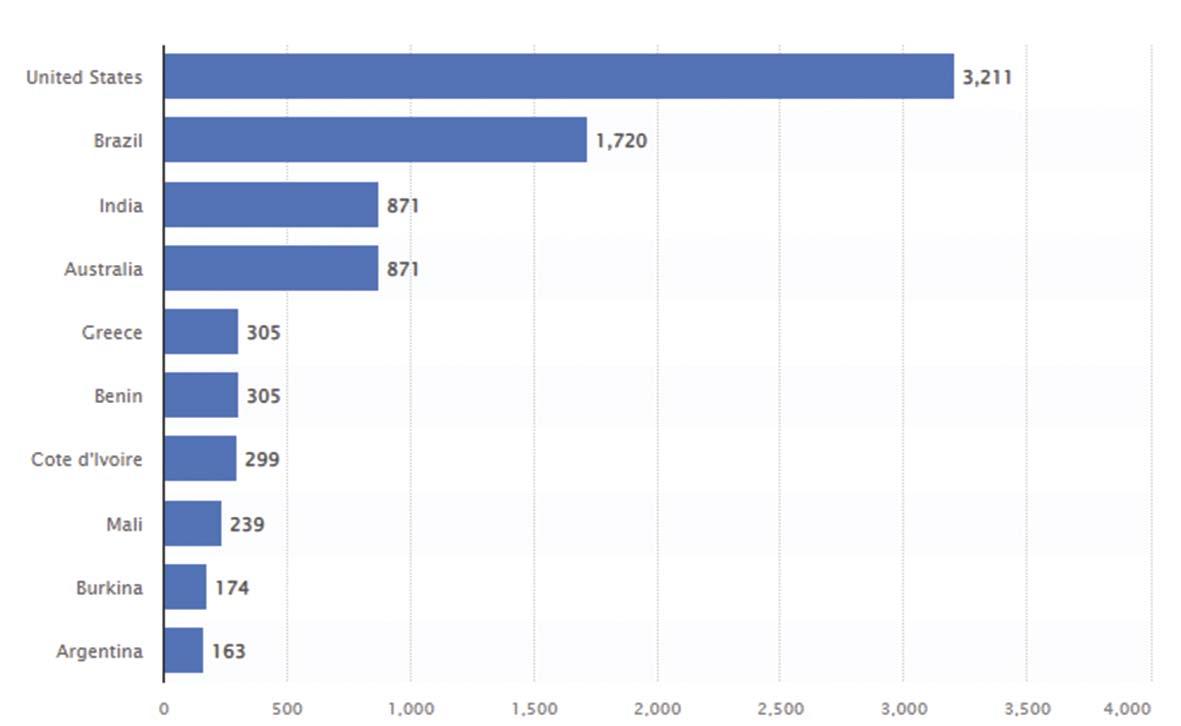

USA

Table 1: USA Imports of Textile and Clothing . . . . . . . . . . . . . . . . . . . . . . . . .66

Table 2: USA Export of Textiles and Clothing . . . . . . . . . . . . . . . . . . . . . . . . .66

Table 3: USA Export of Textiles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .67

Table 4: USA Import of Textile and Apparel . . . . . . . . . . . . . . . . . . . . . . . . . .68

Table 5: USA Export of Textile and Apparel . . . . . . . . . . . . . . . . . . . . . . . . . .70

30 32

20 22 24

32

2022 was a year of uncertainty and full of challenges for the textile industry

Pakistan’s textile industry witnessed remarkable growth and record-breaking export performance in 2021. One of the main reasons for this outstanding performance was the successful management of the Covid 19 pandemic by the government against competing countries such as India and Bangladesh. But, unfortunately, the performance in 2022 has been disappointing. Since the beginning of the current fiscal year, textile exports have continued to fall, down by 5 per cent to $7.35 billion in July-November and by 15 per cent and 25 per cent in October and November.

While the global recession and the war in Ukraine can be attributed to the decline in the global demand for textiles, Pakistan’s textile industry issues are mostly indigenous. Primarily, Pakistan is facing a severe shortage of the primary raw material cotton due to the loss of the crop due to devastating floods. To exacerbate the situation, because of the declining value of the Pakistani Rupee and the dwindling exchange reserves, the State Bank of Pakistan imposed restrictions on imports to curb the unabated outflow of foreign exchange.

Because of the potential demand, Pakistan’s textile players have invested heavily in the last 2-3 years due to the TERF (temporary economic refinance facility) and LTTF (long-term financing facility) long-term concessionary loans provided to the textile sector. Despite significant investments by the textile industry, the recent fall in exports has resulted in an excess capacity that has significantly reduced margins. Furthermore, the precarious energy situation and its increasing cost are playing havoc with the industry. Making an already difficult situation worse, the State Bank of Pakistan has severely hampered imports to curb the flight of exchange reserves, creating a severe shortage of all imported inputs and a steep increase in their cost. Shortage of chemicals, spare parts and other imported inputs has created a crisis for the industry. It is impossible to run the factories efficiently due to the lost orders, energy crisis and hyper inflation. Many mills are temporarily closed due to these shortages and crises. Hundreds and thousands of workers stand to lose their jobs if the situation is not arrested soon. The Pakistani Rupee has lost more than 27% of its value in the last 12 months alone.

On the other hand, working capital for export refinance, which is needed to keep the engine running, is out of reach and expensive due to the SPB increase in the policy rates to curb inflation. As a result, limits on export refinance schemes remain static despite the increasing costs for textile firms. The situation is alarming, and no immediate solution seems to exist.

That is why it is remarkable that a record number of home textile manufacturers are exhibiting at the Heimtextil exhibition organised by Messe Frankfurt, Germany, from January 10-13. More than 267 Pakistani exhibitors, an all-time high, shall be present at the Heimtextil exhibition to display their wide range of home textile products. This participation will be a barometer for the future of the textile industry. The world’s leading buyers will be present at Heimtextil to access the capacity of Pakistani exporters to meet the global demand for textiles. In many ways, this will indicate the direction for the industry and the policymakers in Pakistan. Pakistan Textile Journal will be present at the Heimtextil to inform our readers of the current situation in the global markets. An exclusive report will ensue in our next issue to share our findings with our readers in Pakistan and abroad. We wish exhibitors from Pakistan at Heimtextil the best and congratulate them for their record-breaking participation despite incredible odds.

7 Established 1951 December 2022 Heimtextil 2023 / Annual Fact File 2022 December 2022

EDITOR’S PAGE

Jan 10-13 2023 Frankfurt

1Pakistan textile exports registered a decline of over 11 per cent Month on Month (MoM) basis in October 2022 to $1.36 billion due to global economic slowdown.

2APTMA has urged Prime Minister for intervention to save export-oriented textile industry of Sindh and Balochistan from total closure due to unavailability of gas.

3Pakistani textile manufacturers met global brands to explore solutions to boost supply chain resilience in Pakistan. The meeting took place on the sidelines of the Sustainable Apparel Coalition Annual

Meeting 2022 currently being held in Singapore.

4According to statistics Pakistani men’s apparel exports to China amounted to $21.03million, up more than 17% in the first 10 months of 2022 as compared with the same period in 2021.

5Textile exporters in Pakistan hope for revival after dull Christmas season as a buying freeze abroad has hit all segments, from apparel, denim and knits to home textiles, though they hope things will get better in the coming months.

6Pakistan’s textile exports in October 2022 have slashed by 15.2 percent to $1.357 billion over the corresponding month a year ago. Over the previous month too, its exports declined by 11.1 percent, with major decline in cotton cloth, knitwear, bedwear, towels, and readymade garments.

7German company Kik has signed a Bangladesh-style international accord for the protection of industrial workers in Pakistan. The agreement envisages mechanism to file complaints against lack of safety rules in industrial units.

8Canada is an importoriented country and the business community of Pakistan has a good opportunity to tap this potential market for trade and exports. The Pakistani private sector can set up a base in Canada and capture the North American market.

9PCGA has reported that cotton production remained 40.28pc less than the last year’s harvest by Dec 1, an alarming drop of 2.9m bales. Last year, Pakistan produced over 7.168m bales before the start of December against 4.28m bales this year.

1Wool prices strongly rebounded recently at Australian wool auctions. After many months of selling under uncertain demand and weak prices, the abandonment of the COVID zero policy this week in China had immediate effect.

2Readymade garment (RMG) exports from Bangladesh increased by 15.61 per cent to $18.331 billion in the first five months of fiscal 2022-23 (July-June) compared to exports of $15.856 billion in JulyNovember 2021, as per provisional data by the Export Promotion Bureau.

3The (BGMEA), in partnership with Bangladesh Apparel Exchange (BAE), has launched the first ever Made

in Bangladesh Week – a global event to help boost equitable growth in the apparel industry.

4The Bangladesh government is trying to raise annual export earnings from leather and leather products to $10 billion by 2030. The financial institutions of the country are supporting the development of such industries. The government also is providing necessary support.

5China’s textile industry posted stable revenue growth in the first three quarters of the year. Textile companies with an annual main business revenue of at least 20 million yuan (about 2.76 million U.S. dollars) raked in 3.86 trillion yuan in revenue in the period.

6The growth momentum picked up by the Indian manufacturing sector in the last few months is likely to be sustained for the next six to nine months, as assessed by the Federation of Indian Chambers of Commerce & Industry (FICCI).

7Tens of thousands of Indonesian textile workers are on the chopping block as the industry faces a steep drop in exports while imported clothing eats away at its domestic market share.

8In the January–October 2022 period, Turkiye’s exports increased by 15.4 per cent and exceeded $209 billion and then $253 billion in the last 12 months. The ready-to-wear clothing

segment ranked as the third sector with the most exports at $1.7 billion, preceded by chemicals and automotive.

9Innovate UK, part of UK Research and Innovation (UKRI), is leading a new £4 million (US$4.75m) project that aims to accelerate ‘closed-loop recycling’ in the apparel and textile sectors.

The value of US apparel imports from the ASEAN countries is steadily increasing and by September this year it surpassed the last year’s shipment figure. The value of import during January-September 2022 stood at $24.455 billion compared to $23.958 billion in calendar year 2021.

10

8 PAKISTAN TEXTILE JOURNAL - December 2022

Textile Briefs National

Textile Briefs International

International Accord on Health & safety offers services to Pakistan textile industry

International Accord on Health and Safety in the Textile and Garment Industry Executive Director Joris Oldenziel offered services to the textile industry of Pakistan without charging the local textile manufacturers. There is no fee for participation in the Accord programme by the local suppliers. The Accord charges fee from the international brands and buyers.

Joris Oldenzie heading a trade delegation to the All Pakistan Textile Mills Association (APTMA), including Ms. Veronique Cremer, Head of Policy and Advocacy, and Zulfiqar Shah, consultant of International Accord.

Oldenziel said the Accord was created to ensure that workers operate in a safe working environment without fearing building safety accidents and other workplace safety issues.

He said the programme was started in Bangladesh in 2013. It was followed by the establishment of International Accord programmes in other countries based on key principals of accountability, transparency, independence, workers participation and inclusive governance. He said more than 180 international brands are signatory to the Accord at present.

Association’s Chairman (Northern Zone) Hamid Zaman said that APTMA

member mills were 100 per cent compliant corporate entities and the performance of industries was strictly monitored by international and national agencies. He said the textile industry in Pakistan was fully compliant to the international and local sustainability standards like SA 8000, Oeko Tex made for green, Step etc.

He added, the textile mills were contributing to the implementation of Sustainable Development Goals besides ensuring compliance with 27 conventions of GSP plus status relating to social, gender, environment, and other aspects.

PYMA rejects 5% duty on yarn

The Pakistan Yarn Merchants Association (PYMA), rejected the Economic Coordination Committee’s (ECC) decision to impose 5% regulatory duty (RD) on Polyester Filament Yarn, the primary raw material of textile industry.

Blaming the government for taking this anti-industry measure, PYMA warned that the move will lock around 0.8 million power looms, the lifeline of Pakistan’s textile industry. PYMA Senior Vice Chairman Sohail Nisar strongly protested against ECC’s decision to impose RD on yarn and appealed to Prime Minister Shehbaz Sharif and Finance Minister Ishaq Dar to suspend the ECC’s decision to save the Small and Medium Enterprises (SME)’s from destruction.

Speaking to the media, A Research Analyst on Textile, Nasheed Malik said, “The government is imposing the RD on

yarn in a bid recover its lost revenue caused by the shrinking demand for textile from major buyers Europe, the UK and US. This is challenging for the textile industry’s competitiveness.

“The EU and UK are suffering from inflation while the US has excessive inventory,” observed Malik, adding that, “The US had already made procurements keeping in view the international supply chain disruptions on account of Covid-19. However, the supply chain has corrected itself with the course of time.”

The textile exports dropped by 19% year-on-year to $1.40 billion during November 2022, however, it grew 3% month-on-month. During the five months of fiscal year 2023, Pakistan’s textile exports were recorded at $7.4 billion, a decrease of 4% year-on-year.

The PYMA leaders warned that they will continue their protest against the ECC’s imposition of 5% RD on yarn until the decision is withdrawn. PYMA, along with the power loom owners of Karachi, Hyderabad, Tando Adam, Lahore, Multan, Faisalabad and the Pakistan Art Silk Factories of Gujranwala, are protesting the imposition of RD.

Export-oriented textile sector sends out an ‘SOS’

All Pakistan Textile Association (APTMA) has urged Prime Minister for intervention to save export-oriented textile industry of Sindh and Balochistan from total closure due to unavailability of gas.

PAKISTAN TEXTILE JOURNAL - December 2022 10 News & Views

Zahid Mazhar, Chairman APTMA Southern Zone has urged the Prime Minister Mian Shehbaz Sharif and Chief Minister of Sindh Syed Murad Ali Shah for their intervention to save export-oriented textile industry of Sindh and Balochistan from the closure due to denial of gas from November 15, 2022 to February 28, 2023.

He said the export-oriented textile industries of Sindh and Balochistan, contributing more than 54 percent in total exports of Pakistan, have been served notices of gas closure without taking in confidence the real stakeholders in respect of gas closure for three and half months even though the two provinces are producing more than 80 percent of gas produced in the country.

He further said: “Almost all of our member mills are using natural gas as fuel for generation of electricity to meet their energy requirements and or to run their processing units. Hence if they will be forced to consume only 50 percent of

their load, they will not be able to run their mills smoothly and fulfil their export commitments on time resultantly they would lose their hard-earned foreign buyers while foreign exchange earned by the country through exports would also be curtailed,” he concluded.

Global textile brands discuss achieving net-zero

A delegation of Pakistani textile manufacturers met global brands like

H&M and Gap to explore solutions to boost supply chain resilience in Pakistan. The meeting took place on the sidelines of the Sustainable Apparel Coalition Annual Meeting 2022 held in Singapore.

The session was hosted by Net Zero Pakistan, which is an initiative of the Pakistan Environment Trust (PET). The Net Zero Pakistan programme aims to form a national coalition of pioneering companies, public institutions, and sectoral experts that are banding together

News & Views

Zahid Mazhar, Chairman APTMA Southern Zone

to deliver the goal of net zero carbon for Pakistan by 2050.

The meetings come just a few days before a Pakistani delegation is set to travel to Egypt for the 2022 United Nations Climate Change Conference (COP27). Given this year’s devastating climate related floods in Pakistan, COP27 may be the most important climate conference in Pakistan’s history. The delegation to COP27 will be fighting for immediate climate assistance, and will make the case for climate reparations to third world countries, and Pakistan’s recent climate disaster will be a central talking point.

In this context, the Sustainable Apparel Coalition Annual Meeting is a significant indicator of how far private industry in Pakistan is willing to commit to the idea of net-zero. While world leaders are expected to be sympathetic to Pakistan’s plight at COP27, they will also demand that Pakistan cut down emissions. The textile industry will also be looking closely given the floods also resulted in a large segment of Pakistan’s cotton crop suffering earlier in the year.

About 30% of Pakistan’s textile production capacity for exports has been hampered because of cotton and energy shortages. Pakistan’s textile sector, which exports about 60% of its production, is also facing poor demand in the domestic market due to fragile economic conditions.

Men’s apparel export to China from Pakistan goes up by 17%

Pakistani men’s apparel exports to China amounted to $21.03million, up more than 17% in the first 10 months of

2022 as compared with the same period in 2021, as per the General Administration of Customs of the People’s Republic of China (GACC).

According to the GACC, men’s or boys’ apparel increased by 15.29% worth $11.85 million while last year in the same period it was $ 10.28 million. Data further showed that men’s or boys’ trousers, and breeches, made of cotton increased by 6.42% and crossed $6.49 million in the first 10 months of 2022, whereas in the same period last year it was $5.58million.

The bilateral trade in textile sectors improved very fast. Women’s garments exports from Pakistan to China crossed $8.32 million while home textiles crossed $6.74 million, witnessing an increase of 29% as compared with last year in the same period which was $5.25 million.

Asif Muhammad Sulehri CEO of Brizbane Group of Companies and textile exporter told China Economic Net that three major factors are behind the increasing export of Men’s clothing to China.

Pakistan is a major producer of cotton crops, and it is cheaper as compared to China so it has a benefit over them, he said, adding that Pakistan has cheap labor compared to China which is costeffective for men’s apparel exports to China. In January 2020, Pakistan and China entered into the second phase of the China-Pakistan Free Trade Agreement (CPFTA2), under which China has eliminated tariffs on 313 priority tariff lines of Pakistan’s export and out of the 313 high-priority products that Pakistan can now export without duty payments to China, 130 are from the textiles sector.

The reduced tariffs on textile products, an expected surge in Chinese investment into Pakistan, and the potential shift of production base from China to Pakistan, may change the regional dynamics of textiles trade.

“Under the CPFTA2, many Pakistani textile products will now enjoy duty-free access to China, which has extended similar tariff reductions to other trading partners. Tariffs on readymade cotton garments (HS codes 61, 62, and 63), have been massively reduced, and men’s ensembles of cotton (HS code –62032200). Pakistan’s top world export, were traded with China at 17.5 percent (MFN rate) which was reduced to 12 percent under Phase-I of FTA and has dropped to 0 percent in Phase-II of FTA,” Asif concluded.

Textile exports drop 15.2pc to $1.357 billion in October

Pakistan’s textile exports in October 2022 have slashed by 15.2 percent to $1.357 billion over the corresponding month a year ago. Over the previous month too, its exports declined by 11.1 percent, with major decline in components including cotton cloth, knitwear, bedwear, towels, and readymade garments. In October 2021, textile group exports were $1.6 billion, while in the previous month of September 2022, it was at $1.53 billion, the Pakistan Bureau of Statistics (PBS) said recently.

In July-October 2022/23, the textile sector’s total exports declined by 1.34 percent to $5.94 billion from last year’s exports of $6.02 billion. During the month under review, cotton cloth exports reduced by 16.5 percent to $169.6 million against $203.1 million in September 2022, while compared with October 2021’s exports of $183.6 million, it went down by 7.65 percent.

Over the previous month, knitwear exports in October 2022 were down by 10.25 percent to $391.7 million, bedwear by 18.8 percent to $217 million, towels 8.8 percent to $79.58 million, readymade garments by 0.5 percent to $275.6 million, and cotton yarn sales by over 35 percent to $49.1 million.

Likewise, over the corresponding month of last year (October 2021), cotton cloth exports shed 7.65 percent,

News & Views 12 PAKISTAN TEXTILE JOURNAL - December 2022

knitwear 14.32 percent, bedwear 24.6 percent, towels 3.04 percent, readymade garments 7.4 percent and cotton yarn exports declined 53.8 percent. The energy shortage and its high tariffs, high financing costs, and a slowdown in the global economy were a few key challenges facing the sector. The recent devastating floods have also destroyed cotton crops and it could be a challenge for the industry.

Textile sector’s exports in the last financial year (July-June FY2021-22) were at a historic high of $19.35 billion, with an increase of over 25 percent against FY21’s exports of $15.4 billion.

German firm inks deal on workers’ safety

German company Kik has signed a Bangladesh-style international accord for the protection of industrial workers in Pakistan. The agreement envisages mechanism to file complaints against lack of safety rules in industrial units.

The agreement was signed by Kik CEO Patrick Zahn and representatives of Pakistan’s textile industry, labor protection organizations, Employers Association of Pakistan and other stakeholders at a ceremony held at a local hotel recently. Germany’s Consul General in Karachi Dr. Ruediger Lotz was also graced the occasion.

Besides providing training to workers and making the supply chain safe for them, the international accord also envisages a mechanism to file complaints against non-implementation of safety rules. Workers and laborers would be able to report violations directly to Kik’s representatives. Moreover, health and safety committees will also be formed in industrial units to provide safe and healthy environment to workers.

Consul General Dr. Ruediger Lotz said that the international agreement between Pakistan’s textile industry and Kik is an important milestone that would help speed up development of

Pakistan’s textile and garment sector and ensure the safety of workers associated with this industry.

“This is an important development for Pakistan in the context of Germany’s new Supply Chain Act and that Kik is committed to achieving long-lasting results in coordination with its partners in Pakistan,” he said.

Kik CEO Patrick Zahn said that his company has been operating in Pakistan since 2017 for workers safety. However, seeing the best results of the international accord in Bangladesh, an agreement of this type has been made with the industrial sector of Pakistan, which is an independent and legal agreement with Pakistan’s textile industry and trade associations. Its aim is to make Pakistan’s textile and garment industry safe, socially responsible, and strong.

Cotton production plunges to just 4.8 million bales

Cotton production has dropped by more than 40 per cent mainly because of climate change and floods. The foreign exchange-starved Pakistan will have to import about 7 million cotton bales to meet the textile industry’s demand this season. Total white lint production is expected to be barely 4.8m bales this year, raising the cotton import demand to 7m bales, while so far import contracts of around 5m bales have been signed.

The Pakistan Cotton Ginners Association (PCGA) has reported that cotton production remained 40.28pc less than the last year’s harvest by Dec 1, an

alarming drop of 2.9m bales. Last year, Pakistan produced over 7.168 m bales before the start of December against 4.28 millo bales this year. During this period, the export of cotton was 4,900 bales, which is 11,100 bales or 69.38 pc less than the export of 16,000 bales in the same period last year. Textile mills bought over 3.568 m bales against 3.19 m bales or 46.56pc less than last year’s purchases of around 6.7m bales.

Ginners have a stock of 0.767 m bales, 49.25pc higher than last year’s stock of 0.473m bales.

Karachi Cotton Brokers Forum chairman Naseem Usman told to media that the country will be able to produce barely 4.8m bales this season and 6 to 7m bales will have to be imported to keep the textile factories running. Quoting cotton importers, he said that so far import agreements for about 5m bales had been made.

PCGA leader Javaid Suhail blames climate change, particularly heavy rains and floods in monsoon, for the drastic decline in cotton production. “At least 79pc cotton area, especially in Sindh, was hit by floods as gates of ginning factories could not open there this year.”

Only 2.01m hectares could be brought under the crop both in Punjab and Sindh against the combined 2.53m hectares target this season. Khalid Mahmood Khokhar, a farmers’ leader, said that cotton growers also didn’t follow good agriculture practices, while extension staff also misguided them about the use of herbal pesticides leading to a drop in crop output.

News & Views 13

Patrick Zahn, Kik CEO

Consul General Dr. Ruediger Lotz

AUSTRALIA

Wool prices strongly rebound

Wool prices strongly rebounded recently at Australian wool auctions. After many months of selling under uncertain demand and weak prices. The COVID zero policy in China had immediate effect, which saw many Chinese factories push bids into traders for consideration. This made selling of local buyer stocks much easier but as enquiry continued at volumes well above those local stocks, exporters were then faced with the conundrum of forward selling with market risk exposure, the Australian Wool Innovation (AWI).

“This policy decision by the Chinese central government was the first step needed to recover that nation to the dominant demand destination and price setter in the Australian market. For many months, other wool using countries have been helping the larger four or five Chinese users lead the spot price making and taking a higher than normal percentage of wools on offer into their inventory. With exception of some good Italian orders for the best 15-19-micron wools, and some low spec and quality types, this week was dominated by the Chinese purchasing activity,” AWI commentary said.

To give impetus to this week’s good gains, it remains to be seen if the consumers of China deem it safe enough to hit the retail shops and choose to spend.

BANGLADESH

Garment exports increase upto 15.61% in July-Nov 2022

Readymade garment (RMG) exports from Bangladesh increased by 15.61 per cent to $18.331 billion in the first five months of fiscal 2022-23 (July-June) compared to exports of $15.856 billion in July-November 2021, as per provisional data by the Export Promotion Bureau. Exports were 4.36 per cent higher than the target of $17.566 billion for JulyNovember 2022.

Knitwear (Chapter 61) exports witnessed a lower growth compared to woven RMG exports. Exports of knitwear increased by 12.55 per cent to $10.113 billion in July-November 2022, as against exports of $8.985 billion during the same months of the previous fiscal. Exports of woven apparel (Chapter 62) increased by 19.61 per cent to $8.217 billion during the period under review, compared to exports of $6.870 billion during JulyNovember 2021, as per the data.

Home textile exports (Chapter 63, excluding 630510) decreased by 7.98 per cent to $518.63 million during the period under review, compared to exports of $563.6 million during July-November 2021.

Woven and knitted apparel, clothing accessories and home textile exports together accounted for 88.24 per cent of Bangladesh’s total exports of $21.946 billion during July-November 2022.

RMG exports from Bangladesh had witnessed an increase of 35.47 per cent to $42.613 billion in fiscal 2021-22 compared to exports of $31.456 billion in fiscal 2020-21. Bangladesh had achieved an all-time high in terms of value of RMG exports in 2021-22. The total exports also breached the target of $43.500 billion with 19.73 per cent rise during the period. However, the growth in textile exports slowed down during the recent months due to global economic challenges. Bangladesh succeeded to out perform in terms of textile exports despite economic challenges during November 2022.

Bangladesh aims $10bn annual export revenue from leather items by 2030

The Bangladesh government is trying to raise annual export earnings from leather and leather products to $10 billion by 2030, Commerce Minister, Tipu Munshi recently told an international trade show on leather in Dhaka. The figure is around $1 billion now.

Product diversification and maintaining high quality has become essential now in the ongoing global situation. The leather industry is being shifted from countries such as Vietnam and China. It is an opportunity for Bangladesh, and leather industry should be taken forward through the production of quality goods. The financial institutions of the country are supporting the development of such industries. The government also is providing necessary support.

CHINA

Textile sector logs growth in first 9 months

China’s textile industry posted stable revenue growth in the first three quarters of the year. Textile companies with an annual main business revenue of at least 20 million yuan (about 2.76 million U.S. dollars) raked in 3.86 trillion yuan in revenue in the period, up 3.1 percent year on year, according to the Ministry of Industry and Information Technology. The total value-added output of these companies went down 0.4 percent year

Around the World 14 PAKISTAN TEXTILE JOURNAL - December 2022

on year during the period. The combined sales of main retailers amounted to 12.38 trillion yuan in the January-September period, up 3 percent from a year earlier.

The country’s textile and garment exports totaled 248.4 billion U.S. dollars in the same period, an increase of 9.1 percent year on year.

INDIA

Average capacity utilisation for manufacturing over 70% says FICCI

The momentum picked up by the Indian manufacturing sector in the last few months is likely to be sustained for the next six to nine months. The Federation of Indian Chambers of Commerce & Industry (FICCI) reveals that existing average capacity utilisation in manufacturing is over 70 per cent, which reflects a sustained economic activity in the sector.

The future investment outlook also slightly improved as compared to the previous quarter as close to 40 per cent respondents reported plans for capacity additions in the next six months, by as much as over 15 per cent on an average, according to a press release by the FICCI.

The FICCI’s latest quarterly survey on manufacturing reveals that after experiencing revival of the Indian economy in FY 2021-22, momentum of growth continued in subsequent quarters of Q1 (April-June 2022-23) and Q2 JulySept (2022-23) with over 61 per cent respondents reporting higher production levels in Q2 (July-Sept 2022-23). This is significantly more than the percentage of respondents experiencing higher growth in Q2 of the last few years including preCOVID years. This assessment is also reflective in order books as 54 per cent of the respondents in Q2 (July-Sept 202223) had higher number of orders.

High raw material prices, increased cost of finance, cumbersome regulations and clearances, shortage of working capital, high logistics cost due to rising fuel prices and blocked shipping lanes, low domestic and global demand, excess capacities due to high volume of cheap imports into India, unstable market, high power tariff, shortage of skilled labour,

highly volatile prices of certain metals, and other supply chain disruptions are some of the major constraints which are affecting expansion plans of the respondents.

TURKIYE

Ready-to-wear clothing exports valued at $1.7 bn in 2022

In the January to October 2022 period, Turkiye’s exports increased by 15.4 per cent and exceeded $209 billion and then $253 billion in the last 12 months. The ready-to-wear clothing segment ranked as the third sector with the most exports at $1.7 billion, preceded by chemicals and automotives. Exports in October reached $21.3 billion, increasing by 2.8 per cent, as per the General Trade System (GTS) records.

The Turkish Exporters Assembly (TIM) announced the export data for October in Istanbul with the participation of trade minister Mehmet Mus. TIM chairman Mustafa Gultepe said that despite the contraction signals in global economies, the export family showed a successful performance in October.

“With this result, we have achieved the highest October export of all time. Our exports exceeded $209 billion in 10 months and $253 billion in 12 months. We see a 15.4 per cent increase in 10month exports compared to last year. We have broken monthly export records in all of the last 12 months. In October, our top five sectors were automotive with $2.7 billion, chemicals with $2.6 billion, ready-to-wear with $1.7 billion, steel with $1.4 billion, and electrical and electronics with $1.3 billion,” said TIM chairman Mustafa Gultepe.

Gultepe reported that 38 cities increased their exports in October, and the top five cities with the most exports were Istanbul, Kocaeli, Bursa, Izmir, and Gaziantep.

Turkiye exported to 217 countries and regions in October. The top three export countries were Germany, Iraq, and the US. In October, 1,806 new companies joined export family. The increase in

Around the World 15

average kilogramme unit export value continues. Compared to October last year, the kilogramme unit value increased by 18.7 per cent to $1.64.

Gultepe reminded that contraction continue to come from global economies, especially Europe and the US, which are Turkiye’s largest markets. Explaining that import demand was suppressed in these markets due to reasons such as high energy prices, inflationary pressure, interest rate policies, and cutting household expenditures and the euro/dollar parity reflected negatively on our exports.

UNITED KINGDOM

Innovate UK project targets textile recycling Premium Article

Innovate UK, part of UK Research and Innovation (UKRI), is leading a new £4 million (US$4.75m) project that aims to accelerate ‘closed-loop recycling’ in the apparel and textile sectors.

The government research body is inviting applications from companies with solutions that can feasibly reduce landfills waste by increasing the proportion of post-consumer textiles that are recycled and fed back into fashion supply chains.

“The aim of this competition is to fund a research and development activity demonstrator. This will demonstrate new technologies, services, processes and business models capable of addressing the recycling and sorting challenges,” UKRI said in a statement.

USA US' Textile Exchange Conference 2022 prioritizes climate change

The Textile Exchange Conference 2022, which was held from November 14–18, 2022 in Colorado Springs, aimed to map out a ‘pathway to positive impact’ which included reducing the textile industry’s emissions enough to help limit global warming to 1.5°C. The event also focused on delivering beneficial outcomes for soil health, water, and biodiversity.

The event, which was attended by 984 people in-person and 829 online, was hosted by Los Angeles-based environmentalist Leah Thomas, founder of the non-profit Intersectional Environmentalist. The three-day event offered many key takeaway for participants to consider regarding the future of the textile industry, according to a press release by the organiser.

There were discussions on how brands can prioritize biodiversity beyond the sourcing gate and ensure due diligence in supply chains as climate, nature, and community can no longer be seen through separate lenses.

Data was recognized as a powerful ally for guiding decisions, but needs to be framed with on-the-ground experience. “There really is no substitution for going out into the field and seeing what is happening on the ground. Only then can you put data in the frame of reality and start to see where things don’t add up,” Textile Exchange’s COO Claire Bergkamp said in the session Responsible Use of Data.

Sessions at the conference explored how policy and non-financial disclosure can regulate the industry but defining what these systems should look like will require input from stakeholders across the sector. It was noted that the goal of full transparency requires the buy-in and cooperation from all players in the supply chain, and attention should be paid to ensure that no one is harmed or put at a disadvantage by disclosure.

Climate change was recognized as a business risk, and it was agreed upon that solution building required stakeholders from all backgrounds, geographies, cultures, and stages of the supply chain. The importance of scalability, especially for known solutions like textile-to-textile recycling and regenerative agriculture, was highlighted.

US importing more apparel from ASEAN; value over $24 billion

The value of US apparel imports from the ASEAN countries is steadily increasing and surpassed the last year’s shipment figure. The value of import during January-September 2022 stood at $24.455 billion compared to $23.958 billion in calendar year 2021, which could be an indication of shift in apparel sourcing from China.

Cambodia, Vietnam, Thailand, Indonesia, and Malaysia are major apparel exporters among ASEAN countries.

The US apparel import from ASEAN countries was $20.464 billion in 2017, which increased to $21.473 billion in 2018 and further to $23.033 billion in 2019. However, it slipped to $21.126 billion during the COVID year 2020, according to survey.

On a quarterly basis, the US apparel import from ASEAN nations crossed the $8-billion mark for the first time in JulySeptember 2022. The value was $5.488 billion in Q2 2021, $6.524 billion in Q3 2021, and $6.341 billion in Q4, 2021. This year, the figure jumped to $7.583 billion in Q1, $7.996 billion in Q2, and $8.875 billion in Q3, as per research data.

In terms of monthly imports, the value breached the $3-billion mark in August and September this year.

Around the World 16 PAKISTAN TEXTILE JOURNAL - December 2022

Archroma and Panatronix embark on close partnership towards ecoconscious denim cleaning

Archroma, a global leader in specialty chemicals towards sustainable solutions, and Panatronix, an Italian leader in ultrasonic cleaning for the textile denim industry, joined forces to launch an eco-advanced alternative to the denim fabric washing process.

Water use and wastewater are some of the biggest sustainability challenges in denim manufacturing. The industry uses billions of liters of water throughout the whole textile processing from dyeing to specialty chemical finishes that are applied to textiles in multiple water baths.

The denim industry is therefore working very fast to reduce its water consumption. To combat these issues, Archroma and Panatronix have decided to team up and develop an alternative to the traditional yarn washing process and its subsequent high-water consumption and contamination.

Thanks to the use of our pre-reduced aniline-free* Denisol® Pure Indigo and low sulfite-content Diresul® RDT liq, followed by Panatronix ultra sonic technology on the washing boxes in the denim process, customers will be able to save huge amounts of water.

This partnership will also allow to create a final garment with no impurity, aiming to achieve compliance with major eco-regulations, with the same level of fastness and properties.

The breakthrough alternative to the fabric cleaning concept presented by Panatronix technology and Archroma combines the use of the following systems that will provide big saves of water and will reduce the water footprint.

PURE INDIGO ICON – an anilinefree* indigo system that produces authentic denim without compromising our planet

PURE UNDERTONES - A sulfur bottoming system that brings a new layer of color creativity to your aniline-free* indigo denim

DENIM VIBE - A sulfur-based system to efficiently create bright

ocean blue denim without wasting an ocean of money and water

INDIGO REFLECTION - A coloration system that behaves like indigo but with a more sustainable and efficient process

*Below limits of detection, according to industry standard test methods

Candiani has been the first denim mill to take up this challenge and use the new Panatronix innovative machine and technology together with Archroma Diresul® RDT dyes.

18 PAKISTAN TEXTILE JOURNAL - December 2022

Panatronix machinery installed on slasher washing box at Candiani (Photo: Candiani)

The LYCRA Company introduces THERMOLITE® EVERYDAY WARMTH technology for socks

Solutions that help keep feet warm

The LYCRA Company, a global leader in developing sustainable and innovative fiber and technology solutions for the apparel and personal care industries, today announced the launch of THERMOLITE® EVERYDAY WARMTH technology for socks. The company’s latest innovation will transform how brands deliver an everyday sock solution that provides functional performance and offers lightweight warmth and comfort for consumers.

THERMOLITE® EVERYDAY WARMTH technology for socks is unique in that it traps the wearer’s body heat and stores it in hollow fibers in the sock to provide warmth without excess weight. Consumers will appreciate the key benefits that this warming technology can bring to their garment-wearing experience.

The LYCRA Company has defined fiber blends for the everyday sock to help

keep the wearer comfortable while temperatures drop indoors or outdoors. Through a proprietary, standardized measurement technique, values have been established that measure the degree of warmth for socks, helping to ensure that consumers’ feet stay warm.

“We’re laser-focused on producing high-quality fibers that empower our customers to create comfortable garments that deliver lasting performance,” Sybille Bald, Legwear Strategic Marketing Director at The LYCRA Company. “As the temperatures drop and people lower their thermostats to save energy, socks that help keep feet warm will become a critical component of daily attire. The launch of THERMOLITE® EVERYDAY WARMTH technology for socks enables brands to differentiate their products while providing consumers in colder environments the warmth they require.”

About The LYCRA Company

The LYCRA Company innovates and produces fiber and technology solutions for the apparel and personal care industries. Headquartered in Wilmington, Delaware, The LYCRA Company is recognized worldwide for its innovative products, technical expertise, sustainable solutions, and unmatched marketing support. The LYCRA Company owns leading consumer and trade brands: LYCRA®, LYCRA HyFit®, LYCRA® T400®, COOLMAX®, THERMOLITE®, ELASPAN®, SUPPLEX®, and TACTEL®. The LYCRA Company’s legacy stretches back to 1958 with the invention of the original spandex yarn, LYCRA® fiber. Today, The LYCRA Company focuses on adding value to its customers’ products by developing unique innovations designed to meet the consumer’s need for comfort and lasting performance.

THERMOLITE® is a trademark of The LYCRA Company.

20 PAKISTAN TEXTILE JOURNAL - December 2022

Features

The LYCRA Company introduces THERMOLITE® EVERYDAY WARMTH technology for socks.

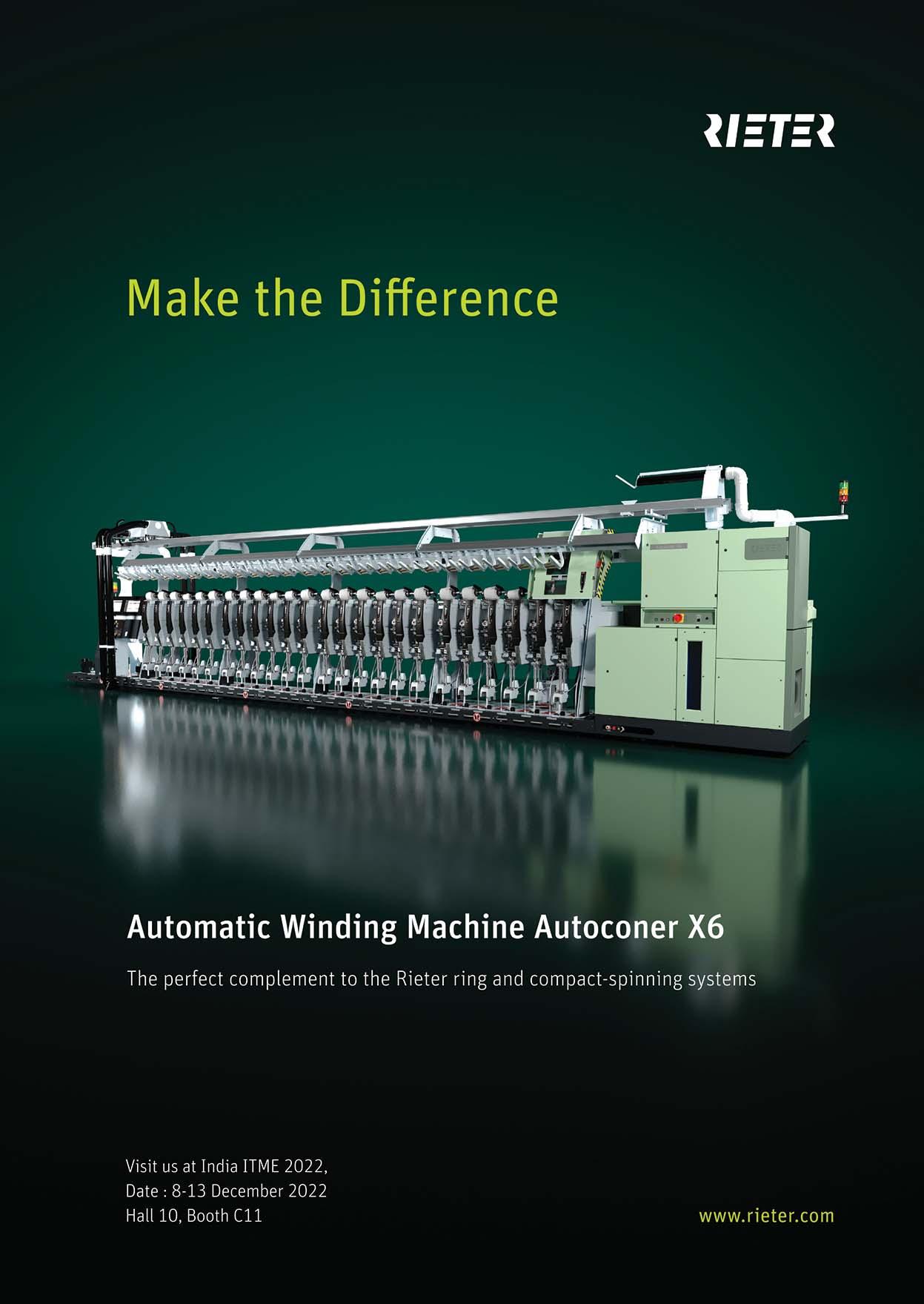

Autoconer X6: Excellent splice quality with open prism technology

The latest open prism technology for splicing covers a universal range of applications. It is easier to handle, as fewer time-consuming adjustments are needed. Splices are more even and possess greater strength. This is also good news for elastic yarns. For customers the real highlight comes at the end, when the splice zone exhibits an impressive elasticity in the fabric.

Yarn splicing is one of the central functions of the winding machine. Splicing takes place not only when a quality cut is made, but also every time a cop is changed. For this reason, splice quality and process reliability are key issues in spinning mills. The latest open prism technology in the automatic winding machine Autoconer X6 represents a big step forward in this regard.

The main advantage of the open prism technology is that it can be applied universally. With only two prisms spinning mills can splice the entire spectrum of cotton yarns – carded, combed or compact – as well as blends The prism OZ1 covers the count range from Ne 30 to Ne 120 and finer, the prism OZ2 mainly covers the coarser count range from Ne 3 to Ne 40. These two open prisms are also used for the splicing of

cotton-based elastic core, duo-core and multi-core yarns in combination with the Elastosplicer.

Excellent splice quality

The open prisms OZ1 and OZ2 ensure strong splice joints for warping, weaving and knitting with yarn-like appearance. Compared to conventional covered prisms the average splice strength is higher and more even. Using the new open prism a Turkish customer increased the average splice strength by approximately 7% for his 100% cotton yarn with count Ne 24. The splice process itself is more stable while the fault rate and number of splice cuts are reduced. This results in an efficient process and optimum splice quality.

Special advantages for elastic applications

Customers producing cotton based elastic core, duo-core and multi-core yarns benefit particularly from the open prisms in combination with the Elastosplicer. Great improvements have been achieved both in splice quality and in the splice process. An Indian customer achieves an average splice strength of 89% for a cotton/elastane yarn Ne 14 with fully embedded Lycra ends and

elastic splice zone with open prism dry splicing. These improvements can be measured up to the final fabrics: customers positively highlight the elasticity of the splice zone in the fabrics. In addition, the splice joints could be dyed well for a uniform appearance. Most elastic yarns have been spliced without the usage of water or only using little water.

Easy handling and less maintenance

The system is easy to handle for operators. The settings are nearly the same for a wide yarn count range. Mechanical and central adjustments are reduced, and the open design requires less cleaning and maintenance. Customers are successfully working with only one scissor distance ‒ this means that no time-consuming settings per spindle are necessary. However, if minor adjustments are still necessary, these can be made centrally on the operating unit at the touch of a button. The universality of the Autoconer splicing principle allows the new open prism technology to be used as a retrofit for machines up to the winding machine Autoconer 338. As a result, customers with older models also have the possibility to boost their splicing performance.

22 PAKISTAN TEXTILE JOURNAL - December 2022

Features

Back on track: Heimtextil 2023 experiences strong international demand

Planning for the next Heimtextil in January 2023 is in full swing. The industry expects an internationally unique platform for home and contract textiles, interior design and trends at the start of the 2023/24 season.

During the one-time Heimtextil Summer Special that just ended, the industry's great need for personal encounters, tactile impressions and creative input became apparent. The next Heimtextil, leading international trade fair for home and contract textiles, will start the new season as the first event of the year from January 10 to 13, 2023.

Over 2,200 international exhibitors from 50 countries have registered for the event. The internationality of the event is also remains high. Among the participating companies are promising names from all over the world, such as ADVANSA Marketing GmbH (D), Alfred Apelt GmbH (D), Aznar Textil, SL (E), Essenza Home (NL), Gul Ahmed Textile Mills Ltd. (PK), Lameirinho - Indústria Têxtil, S.A. (PT), Lenzing AG (A),

Marburger Tapetenfabrik (D), Norvigroup Denmark A/S (DK), Microcotton Inc (US), OBB Oberbadische Bettfedernfabrik GmbH (D), Standard Fiber LLC (US), Tanriverdi Mensucat San. A.S.(TR), Trendart (CH), Trevira GmbH (D), Trident Limited (IND), Velamen S.A. (E) or Zorel Tekstil (TR).

The industry participants are courageously meeting the major challenges and are using Heimtextil to further internationalize their clientele. Under the current market challenges, the industry shows a great desire for inspiration and new approaches to solutions, as well as for creating new customer relationships all over the world. Heimtextil 2023 provides the perfect range of relevant market players and complements the benefits for buyers with an extensive supporting program.

Highlights at Heimtextil 2023

Thematically, the overarching theme of sustainability will also be clearly visible at Heimtextil 2023. With the exhibitor

guide, "Green Directory" as well as the "Green Village", that offers a platform for discussion with the seal providers, Heimtextil offers important points of orientation in the jungle of the many sustainable offers. The popular trade fair tours "Green Tours" will also once again take interested visitors to curated exhibitors to learn more about their sustainability strategy and their products.

Last but not least, the impressive "Future Materials Library" will be presented again as part of the Trend Space at Heimtextil 2023. The international collection of material innovations in the interior sector is curated by the future agency FranklinTill, which is also responsible for the conception of the Trend Space at Heimtextil 2023. The spectacular design and trend area will set the scene there for Heimtextil Trends 23/24, which will be developed beforehand by the international design offices stijlinstituut amsterdam (Netherlands), FranklinTill (Great Britain) and SPOTT Design & Business (Denmark).

24 PAKISTAN TEXTILE JOURNAL - December 2022

Heimtextil 2023

Under the title "Textiles Matter", Heimtextil Trends 23/24 sets standards for the future-oriented and sustainable textile furnishings of tomorrow. The focus is particularly on the subject of the circular economy. By adding materials to a utilization cycle again and again, the need for new raw materials is reduced on the one hand and the production of waste on the other. In the technical cycle, inorganic materials, such as nylon, polyester, plastic and metal, can be recycled with no loss of quality. In the biological cycle, organic materials, such as linen and bast fibres, are returned to nature at the end of their useful life. This is the basis of the four trend themes: ‘Make and Remake’, ‘Continuous’, ‘From Earth’ and ‘Nature Engineered’.

A new feature is that the Trend Space will be presented in Hall 9.0. Circular economy also characterizes the staging of Heimtextil Trends 23/24 itself: With the "Material Manifesto", the responsible trend office FranklinTill commits itself to a design of the area that is as sustainable as possible with predominantly recycled materials and elements as well as a strict waste avoidance strategy.

Interior.Architecture.Hospitality, the specialist program for interior designers, architects and hospitality experts, will once again take place at Heimtextil 2023 on a large scale and in the usual high quality. The program includes the Interior.Architecture.Hospitality

LECTURES, in which renowned architects and well-known hotel experts will present their work and discuss current industry topics such as sustainability, as well as the

Interior.Architecture.Hospitality TOURS, which will take participants to curated highlights and innovative textile solutions from the contract sector. The Interior.Architecture.Hospitality DIRECTORY will once again list all the suppliers of contract textiles. In addition, the identification of the respective trade show booths ensures an effective trade show visit for the target group.

Another highlight is the Interior.Architecture.Hospitality LIBRARY. Launched in 2020, it is a material library for functional textiles. The library can also be found online at www.textile-library.de. A brand new edition will be published for Heimtextil 2023. The jury of the library will be expanded to include application experts or interior designers. Exhibitors with products for use in the property can submit them for the respective property,

which will be selected by a panel of experts. The concrete naming and labeling of these 15 functional properties ensures an even more precise highlighting of the objects on offer in 2023.

DecoTeam, the community of interests of German home textile suppliers, is offering a far reaching event program as part of Heimtextil 2023. The focus will be on the topic of online marketing, with keynote speeches by Monika Winden and a subsequent YouTube workshop. A panel discussion with interesting discussion partners will also provide exciting insights into the topics of sustainability and social media marketing.

With the Heimtextil Conference Sleep & More, visitors* in 2023 will again be offered a top-notch lecture program for the areas of health, sustainability and the hotel industry. Over the course of four days, experts will speak about the latest findings, developments and trends in the field of healthy sleep from various perspectives of the industry.

With the "New & Next" program for young talents, young talents and start-up companies are given the opportunity to present themselves in the environment of the international industry. The fresh ideas and products of the New & Next exhibitors make a valuable contribution to the multi-faceted Heimtextil spectrum.

Heimtextil 2023 25

Heimtextil 2023: Pakistani student wins prestigious competition for textile designers at Heimtextil exhibition

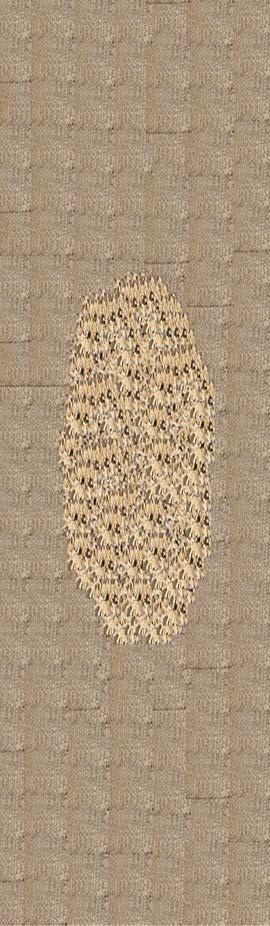

Ume Kulsum Ali Akber student of Indus Valley School of Art and Architecture Karachi Pakistan, is one of the three winners of this prestigious competition this year. Her project “Discarded Treasures” is based on converting textile waste that eventually goes into landfills into beautiful traditional rugs “Dhurries.” Ume Kulsum will display her work at the New & Next Area in Hall 9.0.

Heimtextil takes place every year in Frankfurt and is the world´s largest trade fair for home and contract textiles. Exhibitors from all over the world present their latest ideas and textile products to the international trade press and trade visitors. The perfect chance to present your university and the best student designs in our Newcomer Competition!

Heimtextil has organized the "New & Next University Competition" exclusively

for national and international universities with a focus on textile design. The winners will present their university and selected student work exclusively and free of charge at Heimtextil in Frankfurt.

‘Discarded Treasures’

by Ume Kulsum Ali Akber

Pakistan is the hub of the textile industry and the sheer volume of industries results in a significant amount of textile waste that goes largely unused/scrapped or contributes to the pollution in the country by being thrown into landfills. “We must realize that not only plastic, but textile waste is a major contributor of waste in our environment. Most synthetic fabrics may also not decompose at all and can pollute our Earth forever. Therefore, I decided to make use of textile waste that may be overlooked as a ‘harmful waste material,” said Ume Kulsum.

“My concept of this project is recycling and the source of inspiration are the textures of different kinds of stones that I have found in nurseries, beaches, streets, parks and gardens. Being a developing country, Pakistan also faces the burden of having to deal with waste sent from other developed countries. This abundance of textile waste, therefore, presents a unique and interesting opportunity, whereby I can fulfil my social responsibility of sustainability while creating inexpensive exclusive home-based products such as dhurries (traditional rugs).”

She said, “I have specifically focused on pre-consumer waste for my thesis. The factories produce 7% waste of the total production of woven cloth and another 10% is wasted from the remaining material that goes for other processes such as dyeing and stitching. Upon further investigation in multiple

26 PAKISTAN TEXTILE JOURNAL - December 2022 Heimtextil 2023

factories, I have also found out that there are three different categories of cloth i.e. A, B and C. The ”C” quality cloth, being the lowest quality cloth owing to defects such as rips, colour blemishes, and weave pattern irregularities, is thrown away in landfills or is given to labourers who make use of this cloth to make rag rugs, that are often sold in places such as Sunday Bazaar.”

This is not only an environmentally friendly option for the textile mill owners to make use of the waste but also carries an economical incentive. The beauty of utilizing this waste for production is in the fact that textile waste has several color variations. This range of colors in the waste allows the user to utilize an aesthetically pleasing palette without the need for much dyeing.

Ume Kulsum Ali Akber said,”It was due to this reason that I have only dyed 10% of the fabrics used in my dhurries, whereas the remaining 90% was already dyed. Further adding to the socially responsible aspect of my products, the warp on the handloom (khadi) is also made of recycled materials namely the left-over threads of the previous batches of students at my university. I believe that if these textile owners had more

awareness to make use of even tiny “qatrans” (meaning small fabric pieces) it would be largely beneficial for them to look into utilizing this waste. Furthermore, my other samples consist of waste t-shirt yarn in both warp and weft.”

Ume Kulsum Ali Akber has visited Liberty Textile Mills, MJ Textile Mills, Creative Knits, Adamjee Textile Mills, and Zadaf Pvt Ltd. She added, “I have experimented with the jersey fabric for my dhurries since it will lead to a more refined dhurrie owing to the fact that jersey material sheds the least number of threads when cut into yarn. My products are home based because people might not be comfortable wearing something made from waste. My products are different from the ordinary rag rugs through experimentation and exploration of colors, textures, and weave structures.”

She revealed: “The dhurries do not utilize the traditional dhurrie making techniques. Instead, they are made on a handloom consisting of larger loops of threads that replace the needles of the hand loom. This has allowed me to easily use thick t-shirt yarn as the warp and streamline a process that would generally take four times as long.”

This economical set up can easily be replicated by textile owners resulting in economic gain for factories while helping to save the environment by reducing the waste that goes into landfills. Warp inside Loops of threads instead of needles (Loops playing the role of the eye of the needle)

She concluded: ”My goal is to create awareness of the waste that is affecting our environment and as a responsible citizen and textile student, I hold myself responsible to protect the environment while providing economic benefits to the country and bringing out better and aesthetically pleasing designs. It is absolutely essential to take these steps before we further damage our environment. I am grateful to Messe Frankfurt for giving me the opportunity to display my work at Heimtextil exhibition. This opportunity and recognition are very important to me. My mentors were my teachers at the Indus Valley School of Design and Architecture, Ms. Imrana Shahryar and Mrs Shahnaz Ismail who kept pushing me to do my best and never allowed me to give up. It is a privilege to represent my institution, IVS and my country Pakistan at Heimtextil.”

Heimtextil 2023 27

Exhibitors from Pakistan at Heimtextil 2023

Exhibitor Name Location

A. Essak & Sons Home Textiles

Exhibitor Name Location

10.1, C58 Decent Textiles 10.1, C40

A.B. Export Pvt. Ltd. 10.3, C49 Delin Tex 10.3, E22

A.E. Fabrics (Pvt.) Ltd. 10.3, D59 Dhedhi Brothers 10.0, D35

A.I.Textiles 10.1, D51 Diamond Export Industries (Pvt.) Ltd 10.3, E45

A.N. Textiles 10.1, D10 DIN Textile Mills Ltd. 10.0, C29

A.R.M Textile 10.3, F61 Elegant International Corporation 10.3, D31

AA Fabrics (Pvt.) Ltd. 10.0, D23 Ellahi Fabrics 10.0, C29

Aamir Enterprises 10.3, D31 Esmail Towels & Textiles 10.3, F56

Abdul Ahad Textile Mills (Pvt) Ltd. 10.3, F22 Esquire Garments 10.3, D31

Abdur Rahman Corporation (Pvt.) Ltd. 10.1, C77 ESS ARR Exports (Pvt.) Ltd 10.0, D23

Abubakar Ali Textiles 10.3, F31 Essatex Industries 10.1, E20

Adamjee Textile Mills (Pvt) Ltd. 10.3, A41 Eurotex 10.3, F69

Adnan Apparel 10.3, F21 F.B Industries 10.3, E41

Afino Textile Mills (Pvt.) Ltd 10.3, D31 Faisal Fabrics Ltd. 10.0, A74

Afroze Textile Industries (Pvt) Ltd. 10.2, C21 Faisal Mustafa Textile Mills (Pvt) Ltd. 10.0, C20

Ahmad Weaving 10.0, B80 Faisal Spinning Mills Ltd 10.2, C91

Ahmed Fine Textile Mills Limited 10.3, F63 Fashion Art International 10.2, C30

Al Barka Fabrics (Pvt) Ltd. 10.1, A21 Fashion Knit Industries 10.1, A51

Al Ghani Terry Mills (Pvt.) Ltd. 10.0, B60B Fatima Towel Industries (Pvt) Ltd. 10.3, F41

Al Hadi Textile (Pvt.) Ltd. 10.3, B39 Fatima Weaving Mills (Pvt) Ltd. 10.2, C31

Al Karam Towel Industries (Pvt) Ltd. 10.1, B56 Fazal Sardar Textile Mills 10.0, C23

Al Quresh Fabrics (Pvt) Ltd. 10.1, D57 Feroze1888 Mills Limited 10.2, C13

Al Raheem Textile 10.3, E44 Fine Towels 10.0, C29

Alfalah Textiles 10.0, D10 Friends Cotton Products 10.1, E27

Al-Ghousia Industries 10.0, C29 Gadoon Textile Mills Limited 10.3, F50

Ali Textiles 10.0, B18 Ganitex International 10.3, E49

Ali Textiles 10.0, D23 General Textile Corporation 10.0, B61B

Al-Karam Textile Mills (Pvt) Ltd. 10.2, A51 Genius Textiles Network 10.3, F59

Al-Rahim Textile Industries Ltd. 10.2, C35 Ghazali Textile Industries 10.0, B77B

Al-Rehman Exporters 10.0, C29 Ghia Industries 10.0, D23

Al-Rehman Global Tex (Pvt.) Ltd. 10.3, E35 Gohar Textile Mills (Pvt) Ltd. 10.1, A55

Anwartex Industries Pvt. Ltd. 10.1, E24 Grace Knitwear (Pvt) Limited 10.1, A76

Arham Enterprises 10.3, E29 Gul Ahmed Textile Mills Ltd. 10.2, A41

Arshad Corporation (Pvt) Ltd. 10.1, B40 H.A.R. Textile Mills (Pvt) Limited 10.0, B60A

Arzoo Textile Mills Limited 10.1, B33 Habib Calico Weaving Ind. (Pvt) Ltd. 10.1, C83

Asacotex 10.1, C63 Haji Rafiduddin Waliuddin 10.0, A61C

Asad Enterprises 10.3, F40 Hamza Textile 10.1, E08

As'habi Textile Mills 10.2, B35 Hamza Weaving Factory 10.3, F41

Ashar International (Pvt) Ltd. 10.1, C10 Haroon Corporation (Pvt.) Ltd. 10.0, A22

Ashraf Textile Industries 10.3, D41 Haroon Fabrics (Pvt) Ltd. 10.1, A85

Asia Tex Corporation 10.3, D31 Hasham Towel 10.1, C23

Aspen Textile (Pvt.) Ltd 10.0, B61A Hassan Textile Mills Pvt. Ltd 10.3, D31

Ayaan Textile Industries 10.0, C29 Hassan Textiles 10.3, E35

Ayoob Textiles Mills Ltd. 10.3, E50 HBR Textile Industries 10.1, D50

Azam Textiles 10.1, E25 Hilton Enterprises 10.0, C29

Aziz Sons 10.0, B29 Home Fusion 10.3, E40

B.A Textile 10.3, F75 Homecare Textiles 10.1, B69

Bari Textile Mills (Pvt) Ltd. 10.2, B25 Hometex Corporation 10.3, F33

Best Exports (Pvt) Ltd. 10.0, A51C Hudabia Textile 10.3, E59

Bilal Textile 10.0, C29 Huqas Apparel 10.3, F27

Bilaltex 10.3, E46 Hussain Home Textile 10.0, A61B

Bismillah Textiles Ltd. 10.1, B20 Hussain Textiles 10.1, E24

Canariatex Private Limited 10.1, E44 IBL Frontier Markets Pvt. Ltd. 6.0, D70

Castle Industries 10.3, F56 Ideal Fashion Industries 10.3, E57

Chaudhry Fabrics 10.0, C29 Ihsan Cotton Products (Pvt.) Ltd. 10.1, D21

Chawala Enterprises 10.0, A61D Iman Home Textiles (Pvt.) Ltd. 10.0, C29

Classique Textile (Pvt.) Ltd. 10.3, E23

Imperial Towel Industries (Pvt) Ltd. 10.1, C02

Colony Textile Mills Limited 10.0, C29 Indus Home Limited 10.3, B41

Continental Home Textiles (Pvt) Ltd. 10.1, D65 Indus Valley School of Art and Architecture 9.0, E52

Continental Towels (Pvt) Limited 10.3, F17

International Textile Limited 10.3, B45

Cotton Empire (Private) Limited 10.3, B63 Ismail Fabrics 10.3, F41

Dalal Industries (Pvt) Ltd. 10.1, A17 J. Sons Industries 10.3, D31

Danial Fabrics (Pvt) Ltd. 10.0, C29 J.K. Group of Companies 10.0, A61A

28 Heimtextil 2023 PAKISTAN TEXTILE JOURNAL - December 2022

Exhibitors from Pakistan at Heimtextil 2023

Exhibitor Name

Location

Exhibitor Name

Location

Jamal Fabrics (Pvt) Ltd. 10.3, B21 Polani Textiles 10.3, C27

Kam International 10.2, A85 Popular Fabrics Limited 10.0, D23

Kamal Ltd. 10.2, A71 Qasim Weaving 10.0, C29

Kamal Mills Pvt. Ltd. 10.2, C70 Rainbow Hosiery Pvt. Ltd. 10.3, E58

Kamal Textile Mills 10.1, D83 Rainbow Industries 10.0, A30

Kausar Processing Industries (Pvt) Ltd. 10.1, C20 Ranyal Textiles 10.0, B58A

KB Enterprises 10.0, A51B Rehbar Majeed Textiles Private Limited 10.0, C29

Khurshid Textiles 10.1, E58 Reliance Weaving Mills Ltd 10.3, E19

KN Terry Tex 10.3, E48 Riaz Enterprises (Pvt) Ltd. 10.3, F28

Kohinoor Textile Mills Limited 10.2, B61 Rizwan Enterprises 10.3, B31

Laiq Rehman Textile Mills Pvt. Ltd. 10.3, F05 Rizwan International Pvt. Ltd. 10.0, D24

Lakhany Silk Mills (Pvt) Ltd. 10.1, C67 Roomi Fabrics Ltd 10.3, A09

LAL Industries 10.1, B64 Roomi Tex 10.2, B71

Latif International (Pvt) Ltd. 10.0, C29 Rustam Towel (Pvt) Ltd. 10.1, C52

Latif Textile Mills (Pvt.) Ltd. 10.0, D40 S & S International 10.0, C29

Liberty Mills Ltd. 10.2, B30 Saad Textile Mills (Pvt) Ltd. 10.1, B50

Linen Home Ltd. 10.0, D24 Sadaqat Limited 10.2, A61

Lucky Impex 10.3, C43 SAH Enterprise Inc. 10.3, E21

Lucky Textile Mills Limited 10.2, C13 Sajid Textile Industries (Pvt) Ltd. 10.1, B83

M Hassan Din and Sons 10.0, C29 Salam Textile 10.3, F20

M. Yahya M. Yousuf Bari 10.2, C26 Saleem Textile 10.0, C32

M.K. International 10.3, C21 Salman Textiles 10.0, D23

M.K. Sons (Pvt) Ltd. 10.2, C71 Samaavia Industries 10.0, C29

M/S Wamzak Corporation 10.3, D53 Samira Fabrics (Pvt) Ltd. 10.0, A51A M/s.GPS Pakistan (Global Product Solutions) 10.1, D53 Sapphire Textile Mills Ltd 10.2, C34

Magna Processing Industries (Pvt) Ltd. 10.0, A59 Saya Weaving Mills (Pvt) Ltd. 10.2, B75

Maguari Textile 10.3, F42 SBES Enterprises 10.3, F26

Mahee International 10.0, D31 Shaddan Enterprises 10.0, A78

Maheen Textile Mills (Pvt.) Ltd. 10.1, D61 Shahab Textiles 10.3, F44

Mahmood Textile Mills Ltd. 10.0, B61C Shehzad Enterprises 10.3, E11

Maltex Exports 10.0, C29 Shiwani Textile 10.0, B60C

Mega Cotton Textiles 10.3, E43 Siddiqsons Limited 10.0, B60D

Meher Spring Pvt Ltd 10.1, E84 Silver Textile Factory Private Limited 10.1, B83

Mestex Linens (Pvt) Ltd. 10.0, C76 SilverFox Textiles Private Limited 10.0, C29

Mian Ghous Bux (Pvt.) Ltd. 10.1, E31 Sitara Textile Industries Ltd. 10.1, B61

Mirtex International Company 10.0, C29 Sky Industries 10.1, B11

MNH Textiles 10.3, D31 Sohail Weaving Industries 10.0, B77A

Mount Fuji Textiles Limited 10.1, C85 Star Fabrics 10.3, F71

MRC Textiles (Pvt.) Ltd 10.0, D40 Subhan Textiles 10.3, D31

Mubashar Corporation (Pvt) Ltd. 10.3, F57 Subhantex Pvt. Ltd. 10.3, D31

Mubeen Maqbool Industries 10.0, B58B Sublime International 10.3, F67

Multan Industries 10.3, E17 Sufi Weaving Industries (Pvt) Ltd. 10.1, E18

Multimat Int. 10.0, D39 Sylvana Pakistan 10.0, C29

Mustaqim Dyeing & Printing Industries. 10.2, B13 Tee Zee Textile 10.0, C29

Nael Textiles Pvt. Ltd. 10.3, E35 Terry Tex International 10.0, D40

Naseem Fabrics 10.1, E77 Tex World - Bath Fashion 10.1, C32

Naveed Brothers Textile Mills 10.0, C29 Texcot International 10.3, C65

Naveena Industries Ltd. 10.3, F15 Texlynx Global Pvt. Ltd. 10.1, B33

Nawaz Fabrics 10.1, E40 Textile Channel 10.1, D55

Nazeer Dyeing & Bleaching 10.1, B79

Three Stars Hosiery Mills (Pvt) Ltd. 10.1, D18

Nazu International 10.0, D24 Towellers Limited 10.1, A63

Neelum Fabrics 10.0, C29

New Zeenat Textile Mills 10.1, E56

Niagara Mills (Pvt) Ltd. 10.1, B48

Nimra Textile (Pvt) Ltd. 10.2, C50

Nishat Chunian Limited 10.2, C93

Nishat Mills Limited 10.2, C14

Nishitex Enterprises 10.1, C47

UMMI Textile (Pvt.) Ltd. 10.3, F32

Unibro Industries Limited 10.1, A61

Union Fabrics (Pvt.) Ltd. 10.3, A45

Union Textile Industries 10.1, E33

United Textile Printing Industries (Pvt) Ltd. 10.1, C53

United Towel Exporters (Pvt) Ltd. 10.2, B14

Usman & Sons 10.3, D31

Noor Fatima Fabrics (Pvt) Ltd. 10.1, C21 Waqas Textile 10.1, E71

Noorpur Industries 10.1, D40 Weavers International 10.1, C46

Orient Textile Mills (Pvt.) Ltd. 10.2, A31 Wintex (Pvt.) Ltd 10.3, D31

Pak Home Textile 10.0, D23 Wintex Exports (Pvt.) Ltd. 10.1, C08

Patel Exports 10.0, D40

Yunus Textile Mills Ltd. 2 Booths

Patel Towel Industries 10.3, F41 Zafar Fabrics (Pvt) Ltd. 10.1, B15

Paul Textiles & Towel Industries 10.1, C92 Zaman Textile Mills Ltd. 10.3, D43

Pearl Fabrics Company 10.1, D77 ZIS Textile Pvt. Ltd. 10.0, A26

Planet Textile Industries 10.3, E55

29 Heimtextil 2023

Artistic Milliners’ Cotton Projects team wins Ryan Young Climate + Award 2022 in Climate Leader (Team category)

The awards were announced and presented at the 2022 Textile Exchange Conference, in Colorado Springs, U.S. on 15 November, 2022.

Artistic Milliners’ Cotton Projects team has been selected as a winner for Textile Exchange’s Ryan Young Climate+ Award 2022 in the Climate Leader Team category. The team’s collaborative, farmcentric and forward-thinking approach was highlighted as an example in the industry.

The late Ryan Young, (Textile Exchange COO from 2017-2020), is the inspiration behind Textile Exchange’s Climate+ Strategy, which is for the organization to serve as “a driving force for urgent climate action,” with a goal of 45% reduced CO2 emissions from textile fiber and material production by 2030. “Climate Leader” awards are dedicated to individuals, teams, or departments within an organization displaying an overall commitment to meeting the Climate+ strategy goals.

A statement from La Rhea Pepper, CEO, Textile Exchange read, ‘We would