Utilizing live data to refine scrap.

How upcycling scrap unlocks routes to decarbonization.

Ambitious steps forward in understanding steel scrap.

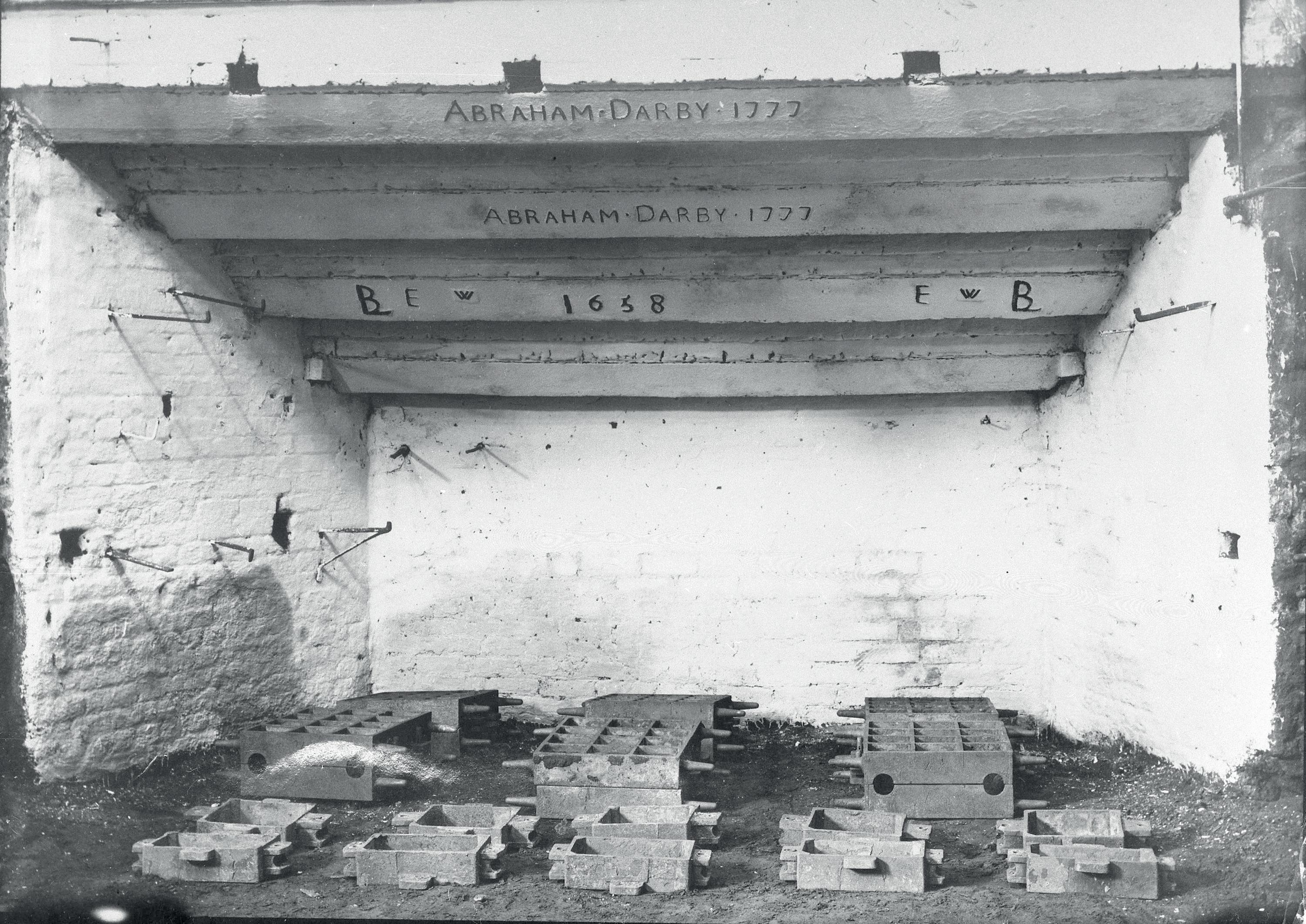

Uncovering lost dates: Darby’s Coalbrookdale furnace.

Utilizing live data to refine scrap.

How upcycling scrap unlocks routes to decarbonization.

Ambitious steps forward in understanding steel scrap.

Uncovering lost dates: Darby’s Coalbrookdale furnace.

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor Annie Baker

Advertisement

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

Catherine Hill Assistant editor catherinehill@quartzltd.com

America has elected Donald Trump as its 47th president, beckoning a new era of domestic and international politics, with reverberations across the intersectional fabric of American society. Policies proposed in Agenda 47 and Project 25 outline a significant shift in the American body politic, including expansions of presidential power, the execution of the US military for the largest mass deportation of illegal immigrants in history, and withdrawal from the Paris Climate Agreement. Implications for the steel industry are manifold; Trump’s campaign promised to prioritise American interests by implementing a general tariff of up to 20% on all imported goods, in a bid to reduce over-reliance on foreign products, with critics citing increased input costs, and retaliatory tariffs from other countries outweighing the short-term gain. Trump’s appointment of ‘fracking pioneer’ Chris Wright as energy secretary also signals a hard fracturing from Biden’s engagement with climate issues, with the president elect having previously referred to global warming as an ‘expensive hoax’. With an almost five million lead in the popular

vote, American voters have expressed an unmistakable appetite for an alternative set of values, ranging from the sociological, to the economic. There will be echoes of these changing sentiments across the globe, in patterns that are continuing to emerge, but visible in the increasing self-assurance of right-wing supporters, emboldened by a dichotomous rhetoric that offers uncomplicated solutions to categorical issues. The American steel industry has long prided itself on its high proportion of EAF-based production which symbolises both an intent to decarbonize and a basic recognition of the environmental backdrop in which developments take place. Under Trump’s leadership, governmental spending on nascent ‘green’ technologies are unlikely to retain the same impetus. Can two such opposing approaches comfortably exist? In the eyes of over 76 million voters, it is certainly possible. On January 20th, Donald Trump will take the oath of office at the US Capitol, arguably the most recognised symbol of democratic government in the world. Change, undeniably, now rests in his empowered hands.

Process improvement is like sailing.

With an experienced partner, you can achieve more.

Optimizing processes and maximizing efficiency is important to remain competitive. We are the partner that helps you master yield, quality and compliance. With real-time inline insights and close monitoring of cricial parameters, we support manufacturers to optimize processes, reduce waste and increase yield.

Do you want to learn more? www.endress.com

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

LanzaTech, a carbon recycling company transforming above-ground carbon into sustainable fuels, chemicals, materials, and proteins, has announced plans to develop a commercial-scale Carbon Capture and Utilization (CCU) facility at Herøya Industrial Park in Porsgrunn, Norway. The plant will produce ethanol and is expected to begin operations in 2028.

Source: Azo Cleantech, 1 November 2024.

South Korean steel giant POSCO Holdings is seeking to sell its entire stake in a Chinese stainless steel joint venture as it faces growing competition with Chinese steelmakers amid a supply glut. Industry sources have said that POSCO Holdings,

Cleveland-Cliffs has successfully completed its acquisition of Canadian steel company Stelco. The addition of Stelco enhances Cliffs’ position as the largest flatrolled steel producer in North America, diversifies Cliffs’ end-markets and expands its geographical presence in Canada, the North American steelmaker has said. Stelco will continue operations as a wholly-owned subsidiary of Cliffs, preserving the name and legacy of the business.

Source: Business Wire, 1 November 2024.

the parent of Korea’s top steelmaker POSCO, plans to sell its stake in POSCO

Zhangjiagang Stainless Steel Co. (PZSS), a JV with Shagang Group, China’s second-largest steel producer, also known as Shasteel.

Source: The Korea Economic Daily, 8 November 2024.

AM/NS India, a joint venture between ArcelorMittal and Japan’s Nippon Steel, is set to establish an integrated steel plant with 17.8Mt capacity, in the Anakapalli district of Andhra Pradesh. This would be one of the largest greenfield projects in recent times, the company has said. In the first phase of the project, ArcelorMittal Nippon Steel will establish a 7.3Mt/yr capacity blast furnace steel plant with an initial investment of Rs 80,000 crore. Source: The Economic Times, 3 November 2024.

Progress is being made on one of the world’s largest offshore wind plants being built on Teesside, supplied with steel produced by British Steel. SeAH Wind’s £900 million monopile manufacturing facility on the south bank of the River Tees at Teesworks is currently 90% complete. Once finished, the 800-metre-long building will be the world’s biggest monopile facility and the only one of its kind in the UK. Each week, the 40-metre-high building will annually produce two to four monopiles – the structures which form the foundations of offshore wind turbines. Source: British Steel, 4 November 2024.

A number of procurement agreements were signed between China Baowu Steel Group Corp and its global partners during the 7th China International Import Expo. A total of 10 global corporations reached deals with the Shanghai-based steelmaker, including the purchase of coking coal, manganese ore, chrome ore, and ferroniobium.

Source: China Daily, 11 November 2024.

Swiss Steel Group has introduced its lead-free machinable steel, 11SMn30+BX, a sustainable alternative to traditional leaded machinable steel, the company claims. Using boron instead of lead as an alloying element, the material aims to maintain workability while aligning with future regulatory standards. The addition of boron to free-cutting steel improves machinability if the metallurgical processes in the steelworks are properly controlled, Swiss Steel Group added.

Source: Green Car Congress, 10 November 2024.

A year on from the announcement of a £1.25 billion green transition for British Steel, it is claimed dozens of workers are quitting its Scunthorpe site every month. According to a report by the BBC, despite ongoing discussions, there is no announcement of a firm deal on the table regarding the future of the plant, leading workers to leave due to the job uncertainty.

Source: BBC, 11 November 2024.

Cleveland-Cliffs’ Middletown, Ohio steel mill is planning to switch to a greener production process. The Middletown plant will get up to $575 million from the Inflation Reduction Act to retire its old blast furnace and install two electric furnaces. Advocacy group Industrious Labs recently released a report, detailing the health impacts of steel mills across the nation including in Ohio. The report focused on the health effects of steel production. Hilary Lewis, steel director at Industrious Labs, said Cleveland-Cliffs action is an encouraging move in Ohio’s steel production.

Source: WYSO, 13 November 2024.

Petroleum company Petrobras and Brazilian steelmaker Gerdau have signed contracts for the supply of natural gas on the free market, serving the latter’s special steel production unit located in Rio Grande do Sul. “The expansion of the alliance between Petrobras and Gerdau in the free gas market demonstrates that Petrobras’ natural gas sales portfolio is increasingly competitive and attractive. We are investing more than $7 billion in new natural gas supply infrastructure, in addition to offering several flexible contracting options,’’ said the director of energy transition and sustainability at Petrobras, Maurício Tolmasquim.

Source: Alfajr News, 12 November 2024.

ArcelorMittal and Hewlett Packard (HP) have announced a strategic collaboration to advance the use of steel in Additive Manufacturing. Together, the partners will work to bring new steel solutions to a sufficient Technology Readiness Level (TRL), then leverage the ArcelorMittal Research Centre as an incubator for new applications developed in collaboration with customers. The move is intended to save customers the initial investment needed to evaluate and qualify the technology, up until the process can be transferred to a contract manufacturer for final industrialisation and production. Source: Metal AM, 12 November 2024.

Global trade unions are concerned about the cumulative loss of tens of thousands of jobs in the steel sector and related industries around the world, according to a report by global union federation IndustriALL. Representatives of the Trade Union Advisory Committee to the OECD (TUAC), IndustriALL and IndustriAll Europe, who took part in a meeting of the OECD Steel Committee, warned of the risk of deindustrialization in the countries of the organization and other countries.

Source: GMK Center, 14 November 2024.

ArcelorMittal has initiated the expansion of its Vega facility in São Francisco do Sul, Santa Catarina, Brazil. The new unit will produce Magnelis, a corrosion-resistant material developed by the company, marking the first time this product will be manufactured outside of Europe. The new continuous galvanizing and annealing line has increased the plant’s annual production capacity from 1.6Mt to 2.2Mt. Jorge Adelino, vice president of operations for ArcelorMittal flat steel in Latin America, noted that this is the largest private sector investment in Santa Catarina. Source: International Valor, 14 November. 2024.

European steel association EUROFER has continued to lobby the European Commission to curb scrap exports as the industry looks to decarbonize. On 12 November, EUROFER reiterated its view that the commission should ‘recognise steel scrap as a strategic secondary raw material under the critical Raw Material Act, ensure the robust implementation and effective enforcement of the revised EU Waste Shipment Regulation to ensure compliance with the EU environmental standards in third countries and avoid circumvention.’

Source: Argus Media, 12 November 2024.

A winding up petition has been lodged against a South Yorkshire steel firm amid major restructuring plans. A hearing at London's Business and Property Courts in November considered Harsco Metal Group Limited's claim that Speciality Steel UK Limited, a division of Liberty Steel, owes money and should be closed by the courts if it cannot pay creditors. Speciality Steel UK Limited, which has sites in Stocksbridge and Rotherham, previously shared restructuring plans which aimed to ‘significantly’ reduce its debts.

Source: BBC, 15 November 2024.

Steelmaker ArcelorMittal is considering closing two service centres in France as part of the restructuring of its Centres de Services business, the Journal de l’Economie has reported. This decision may affect 130 jobs and has provoked outcry from trade unions. In a statement in November, ArcelorMittal presented a project to reorganize its subsidiary

Officials from the US and Ukraine said the countries will partner on building small modular reactors (SMRs) to replace the latter's coalfired power generation, with the SMRs used to help Ukraine decarbonize its steel industry. A statement from the US State Department, released at the UN Climate Change Conference in Baku, Azerbaijan, on 16 November, said the countries will develop a roadmap to ‘rebuild, modernize, and decarbonize Ukraine's steel industry with SMRs.’

Source: yahoo!finance, 16 November 2024.

Acerinox, a manufacturer and distributor of stainless steel, has completed the acquisition of Haynes International, a US manufacturer and marketer of alloys. “We are thrilled to officially welcome Haynes”, Bernardo Velázquez Herreros, chief executive officer of

Telecommunications company China Telecom and joint iron and steel enterprise Meishan Iron and Steel have announced plans to partner on the development of a ‘5G smart factory’, which the companies claim will ‘open a new chapter of developing green and ecological steel culture, promoting the change of the steel industry from ‘labour-intensive’ to ‘technology-intensive”.

Source: Mobile World Live, 18 November 2024.

Acerinox, said. “Haynes has built a leading highperformance alloys business. Their addition to Acerinox

Austrian steelmaker voestalpine has said that its natural gas supply is secure even if Russian gas giant Gazprom stops deliveries to Austria altogether. Gazprom halted supplies to Austrian energy company OMV in midNovember after OMV won an arbitration case against Gazprom awarding it more than €230 million in damages and said it would recover that money by not paying Gazprom's invoices.

Source: Reuters, 18 November 2024.

strengthens our global position in this segment, creating opportunities for growth in the aerospace sector and in the attractive US market. This transaction will enable us to broaden the range of products that we offer.”

Source: Acerinox, 21 November 2024.

ArcelorMittal Service Centres, which specializes in the wholesale of metals and minerals. The company explained that it has faced a decline in activity among its industrial customers, especially in the automotive sector, and this trend has intensified in recent months.

Source: GMK Center, 21 November 2024.

The Italian Ministry of Business and Ukrainian steel and mining group Metinvest have signed a declaration agreeing to the construction of a steel plant in Piombino. The new plant, worth €2.5

billion, will contribute to the decarbonization of steel production and the strengthening of economic co-operation, the project participants have said. The plant is to be built on an area of 260 hectares, with a planned capacity of 2.7Mt of hot-rolled coils per year. Using Ukrainian raw materials, the production will help reduce Italy’s dependence on steel imports from outside the EU.

Source: GMK Center, 21 November 2024.

Bioengineering firm ByoMax has signed a non-binding Letter of Intent (LOI) with Green Steel WA to supply ‘ByoCoke’, a product made from waste biomass as a sustainable replacement for coal and coke, at the company’s Collie, Western Australia green steel plant. Green Steel WA is developing an electric arc furnace to recycle scrap and the state’s first green hydrogen directreduced iron (DRI) plant at the former coal mining town.

Source: AU Manufacturing, 25 November 2024

President-elect Trump has vowed to block Japanese steel firm Nippon Steel’s acquisition of US Steel. “I am totally against the once great and powerful US Steel being bought by a foreign company, in this case Nippon Steel of Japan,” Trump wrote in a social media post. He made the same promise on the campaign trail earlier this year.

Source: The Hill, 3 December 2024.

The Steel Authority of India Limited (SAIL), India’s largest public sector steel producer and a Maharatna company, has entered into a strategic collaboration with John Cockerill India Limited (JCIL), a subsidiary of the global John Cockerill Group. The two companies signed a Memorandum of Understanding (MoU) in Mumbai, aiming to leverage their collective expertise in innovation and sustainability within the steel industry.

Source: ET Energy World, 29 November 2024.

Singapore’s Meranti Green Steel plans to build a green steel plant in Thailand, said Sebastian Langendorff, the company’s chief executive officer, in an interview with S&P Global. The new facility, which will be located in the IRPC Eco-Industrial Zone in Rayong province, will have

South Korean steel conglomerate POSCO Group has announced plans to invest in Neuromeka, a domestic robotics company, to boost its steel business through factory automation. Neuromeka produces collaborative robots, which can work with humans in the same space without the need for safety fences, and industrial robots, which can move on three or more axes and are used in manufacturing with programmable and automated systems.

Source: SEAISI, 2 December 2024.

The European Commission (EC) is considering extending measures to restrict steel imports as part of an overall plan to protect the sector during its decarbonization process, a comment stated by the executive vice president of the European Commission Stéfan Séjourné. During a visit to ArcelorMittal’s plant in Ghent, Belgium, Séjourné,

a capacity of up to 2.5Mt of low-carbon hot-rolled coils per year. Construction is expected to begin in 2026, with investment approvals slated for completion in 2025, and the plant is scheduled to start-up in mid-2028.

Source: GMK Center, 4 December 2024.

Australian energy firm APA Group has opened a solar farm and battery storage facility at Western Australia's Port Hedland in a move designed to support mining giant BHP's emissions-reduction goals. APA's plant will power most of BHP's Port Hedland operations from January 2025, under the terms of a power purchase agreement signed between the two firms. Work on the project began last year, supported by a A$1.5m ($970,000) grant from Western Australia's Clean Energy Future Fund.

Source: Argus Media, 3 December 2024.

who is responsible for EU industrial policy, said that at the beginning of his term of office, the priority will be reducing high energy costs and fending off Chinese overcapacity at a time when European steelmakers are cutting carbon emissions.

Source: GMK Center, 4 December 2024.

DYSENCASTER®

HYDROGEN-READY AND ELECTRIC TUNNEL FURNACES

Performances, operational reliability and quick startups are the result of 30 years of continuous R&D activities, carried out at the Danieli research center and onsite together with partnering customers.

QSP-DUE can make use of more than 20 Danieli patents covering technological layouts, production equipment and Danieli Automation solutions, such as power, instrumentation and intelligent digital controls.

— The most efficient, digitally controlled electric steelmaking with no impact on the power grid.

— 6 m/min casting speed, allowing up to 4.5-Mtpy productivity on a single strand, with dynamic adjustment of slab thickness and width at any speed. In-mould fluidodynamic control with MultiMode Electromagnetic Mould Brake (MM-EMB) for no quality limitation.

— Hydro-MAB burners ready for 100% hydrogen operations and electric tunnel furnaces for carbon-free slab reheating.

— Split mill layout, intensive cooling and dynamic transfer bar reheating for true thermomechanical rolling and endless operation of ultra-thin gauges.

— Danieli Automation robotics and artificial intelligence for zero-men on the floor.

— Least power-consuming process with the lowest carbon footprint.

— The most competitive plant in terms of CapEx and OpEx.

— The highest production flexibility due to three rolling modes available in a single line.

QSP-DUE® ENDLESS CASTING-ROLLING PLANTS

SGJT and Yukun are enjoing their QSP-DUE plants operating in coil-to-coil, semi-endless and endless mode, based on HRC market requests. The Nucor Steel QSP-DUE plant is under construction.

15 QSP PLANTS

Carbon Clean, a supplier of carbon capture solutions, has announced the launch of its CycloneCC C1 series, marking the penultimate stage in the technology’s commercialisation. The CycloneCC C1 series is available in concentrations ranging from 3% to 20%, capturing up to 100kt of CO2 per year. The CycloneCC C1 unit is fully modular and columnless, and, according to Carbon Clean, achieves a height reduction of 70% compared to conventional solutions. Rotating Packed Bed (RPB) technology replaces every column used in a conventional plant, which reduces the steel required by 35% and lowers the unit’s carbon footprint, says Carbon Clean.

The unit footprint is up to 50% smaller than conventional carbon capture plants, claims the company, with its largest equipment sizes reduced by a factor of 10. Each unit is prefabricated, skid-mounted and delivered on road

truckable modules, with an aim to cut the costs associated with transport, logistics, site preparation and installation. CycloneCC C1 uses firstof-a-kind (FOAK) technology to reduce the total installed cost of carbon capture by up to 50% compared to conventional solutions.

Prateek Bumb, co-founder and chief technology officer of Carbon Clean, said: “The launch of the CycloneCC C1 series is a major milestone in the technology’s commercialisation. Repeatability is key to mass adoption, as demonstrated with solar panels and EV batteries. Carbon Clean is leading a similar transformation through eliminating the columns used in conventional carbon capture solutions. Delivering fully modular, columnless, replicable units with a substantially smaller footprint is a technological breakthrough. CycloneCC’s ‘Lego-block’, ‘plug and play’ design makes it simple and cost-effective to install, mak-

ing carbon capture financially and logistically viable to be deployed at scale. First-mover customers and early adopters will have the advantage of tangible decarbonization results while benefiting from a staggered approach to capital investment due to CycloneCC C1’s modular design.”

At the heart of CycloneCC C1 is the combination of two process intensification technologies: rotating packed beds (RPBs) and Carbon Clean’s proprietary APBS-CDRMax solvent. According to Carbon Clean, using RPBs to replace the columns used in conventional carbon capture solutions both reduces the size of the plant and accelerates the mass transfer process, increasing CO2 absorption.

For further information, log on to www.carbonclean.com

Global manufacturer of non-contact measuring technologies, ZUMBACH Electronic, has developed the PROFILEMASTER® SPS product family with high-speed versions, in answer to the growing demand for surface fault detection. This enhancement adds to the continued success of the PROFILEMASTER® SPS, says the company, by equipping it with the latest generation of highspeed cameras that enable the acquisition of full product contours, at a rate of 2000Hz. This new specification produces six times more contours within a specified length, enabling classification

of defects in addition to their detection.

New features are cited to include:

� Higher sampling rate up to 2000/second

� Higher resolution with full area of interest

� Improved optical path

� Improved stability in data acquisition

� Improved defect detection/analysis

� Better overall dimension control

� Improved defect visualization/

3D modelling

The new design enhancement aims to improve

the performance of the optical path of the cameras, optics and lasers and boosts the sampling rate from previously 500 per second, to up to 2000 per second, providing far greater resolution and surface detail. The new high-speed set-up enables the PROFILEMASTER® SPS product family to work under harsh light absorbing surface conditions of hot steel products.

For further information, log on to www.zumbach.com

Tenova, a developer and provider of sustainable solutions for the green transition of the metals industry, has announced a significant milestone for Nucor Steel Louisiana, USA. In August 2024, the ENERGIRON direct reduction (DR) plant of the steelmaker achieved what the company claims is a world production record of 330.3 tons per hour (tph) of cold direct reduced iron (CDRI), yielding 7,928 tons per day (tpd).

The 2.5Mt/yr DR plant, based on ENERGIRON technology, jointly developed by Tenova and Danieli, demonstrates increased production levels and improved operational reliability, says Tenova. It achieved over 98% operational reliability and

97.50% availability in 2024, underscoring the collaborative efforts between Tenova and Nucor.

“The most important factor that helped Nucor Steel Louisiana reach a world record production rate is our team and our culture. Each member of our team has played a crucial role in this achievement. It is their commitment and passion that has made achieving this record possible. When you can be inclusive and harness the collective efforts of individuals, there are no challenges that we cannot overcome. Here’s to our team and this remarkable achievement and to many more milestones ahead!” commented Calvin Hart, vice president and general manager of Nucor Steel

Louisiana.

“We are thrilled to recognize this remarkable achievement in our ENERGIRON Direct Reduction Plant,” said Stefano Maggiolino, Tenova HYL president and CEO. “This record is a testament to the continuous pursuit of operational excellence and our innovation in cutting-edge technology that enhances our direct reduction plants’ production capabilities while reducing the environmental footprint.”

For further information, log on to www.tenova.com

Maxcess, a supplier of products and services for automated web handling applications, has launched the new Tidland SmartSlit automated slitting system. Tidland SmartSlit ensures automatic and precise placement of slitting blades, says the company, eliminating the need for manual adjustments, and reducing set-up time.

“SmartSlit is ideal for tag and label producers and narrow web converters looking to

automate manual finishing operations or add finishing operations to their current lines. It is a safe, versatile, user-friendly solution to slitting operations, significantly enhancing productivity, and reducing operational costs,” said Richard Provencher, global product manager for Tidland slitting and winding. “Our automatic machinery movement minimizes manual hand adjustment and reduces safety concerns and operator errors.

Users get improved ergonomics and greater accuracy versus manual position alternatives. You can also store repeat jobs for reuse later. The best part is Tidland SmartSlit usually pays for itself in less than two years compared to manual systems on the market,” Provencher concluded.

For further information, log on to www.maxcessintl.com

Kyocera Unimerco, a specialist in cutting tool solutions, has introduced two new hydraulic chucks, the Hydro Chuck Uni and the Hydro Chuck HD, developed for precision drilling, milling, threading, and other machining operations.

Hydraulic chucks use a hydraulic mechanism to securely clamp tools such as drills, milling cutters, or thread cutters and other cutting tools. Pressurised oil ensures the tool is firmly held in place while simultaneously minimising disruptive vibrations, enabling stable and precise operation.

Kyocera Unimerco presents two hydraulic chucks, each for different applications:

� Hydro Chuck Uni aims to provide high precision across a wide range of machining tasks

� Hydro Chuck HD (Heavy Duty), has been specifically engineered for cutting (HPC) applications, and is capable of withstanding extreme torque

Both chucks are suitable for tools with various

shank types and diameters ranging from 6-32 mm, without the need for special sleeves or adapters. During operation, the hydraulic mechanism provides vibration damping and ensures a run-out accuracy of less than 0.003 mm, says the company. An adjusting screw allows for axial length adjustment.

Both chucks offer a balance grade of G2.5 at 25,000rpm/Umax < 1 gmm, and the tool shanks meet h6 quality standards.

For further information, log on to www.kyocera-unimerco. com

Seals are crucial for ensuring the efficiency and reliability of steelmaking operations. Contaminants and process fluid within the lubricant are detrimental to bearings, a well-known issue among operators and maintenance engineers. When examining a mill chock, it’s common to

see significant water spillage from the bearing, as they are often exposed to water during operations. Proper seals, sealing systems, and regular maintenance can significantly reduce or eliminate this problem. SKF sealing solutions are designed to endure these conditions, offering a way to

extend the lifespan of essential equipment and lower unplanned downtime and maintenance costs.

With the acquisition of Tenute SRL, SKF hopes to offer even more advanced solutions. Tenute’s proprietary skills and designs aim to enhance the

durability and performance of seals, ensuring they can endure extreme temperatures, high speeds, and heavily contaminated environments.

SKF sealing solutions offering includes heavy industrial shaft seals, hydraulic seals for heavy-duty cylinders, and a range of engineered solutions

for specific applications. By combining SKF’s knowledge with Tenute’s technology, customers can expect improved reliability, reduced maintenance costs, and enhanced OEE, says SKF.

Commenting on the acquisition, industry expert Robert Blachfellner stated, “The integra-

tion of Tenute SRL’s advanced sealing technology with SKF’s extensive industry experience is a game-changer for the steel sector.”

For further information, log on to www.skf.com

Are you searching for ways to enhance process reliability while minimizing maintenance expenses?

Look no further than SKF Seals. Our commitment to manufacturing excellence and improved Overall

Discover

Equipment Effectiveness (OEE) makes us the go-to solution for cost-effective and dependable machine operation.

At SKF Seals, we understand the importance of reliable processes in achieving operational efficiency.

Cleveland, Ohio-based Cleveland-Cliffs announced in early November that it had successfully completed the Stelco Holdings acquisition process after the former received the regulatory programme approvals for its Stelco acquisition under the Investment Canada Act and Strategic Innovation Fund.

By Manik Mehta*

CLEVELAND-CLIFFS, a leading North American steel producer, with focus on value-added sheet products, particularly for the automotive industry, is vertically integrated, including the mining of iron ore, production of pellets and direct reduced iron (DRI), and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling and tubing.

Cleveland-Cliffs maintained that the Stelco addition had further strengthened its position as North America’s largest flat-rolled steel producer, and would diversify Cliffs’ end-markets and expand its geographical presence in Canada. Stelco, Cliffs added, would continue operations as a wholly-owned subsidiary of Cliffs, ‘preserving the name and iconic Canadian legacy of the business’.

Lourenco Goncalves, chairman, president and CEO of Cliffs, called the acquisition a ‘transformative step forward for ClevelandCliffs’. “By bringing Stelco into the Cliffs family, we are building on our commitment

to integrated steelmaking and good paying union jobs in North America. This acquisition allows us to further diversify our customer base and lower our cost structure,’’ he said.

In keeping with Federal Securities Laws, Cliffs also cautioned that any forwardlooking statements would be subject to risks and uncertainties. The company

*US correspondent, Steel Times International

listed some risks including the continued volatility of steel, iron ore and scrap-metal market prices, disruptions of operations, and reduced demand for the company’s products.

Tariffs are worrisome, particularly, to USbased steel-consuming SMEs which have been affected by tariffs and, in effect, by higher import prices. The nation’s established steel producers, with trade unions also pitching in for higher steel tariffs to protect jobs, have worked closely with politicians, amid the feverish election campaigning, courting both producers and workers, and pledging to restrict the heavily-subsidized and polluted steel shipped by certain countries, including China.

Tariffs weigh heavily on steel-consuming industries, particularly the nation’s SMEs, which depend on imports. Their production costs have risen sharply following rising prices of imported metals and other raw

materials, as some participants attending the three-day World Trade Centre Association (WTCA) Forum 2024, held in New York at the end of October, told Steel Times International

John Drew, the chairman of the WTCA acknowledged in an interview that some SMEs had expressed concern about tariffs and, in effect, higher prices. “We were told that some SME members of the WTCA are worried over higher prices resulting from tariffs that have raised the overall costs of foreign supplies,” he said.

Indeed, some small companies told this correspondent that they faced issues with price-conscious consumers that seek relief from the high inflation that affected basic necessities. They argued that when the US government imposed a tariff on, say, foreign-made steel, it meant that US steel-importing companies had to pay an extra fee to import the commodity into the country.

The added tariff cost is then passed on to US manufacturers, who pass it to consumers through higher prices of products that contain steel, such as cars, washing machines and outdoor grills, etc.

After the US imposed a 25% tariff on steel imports in 2018, US-built cars cost more by about $400 per vehicle, cost of an average single-family home construction rose by about $7,000, and kitchen appliances by up to 7%.

Cheaper domestic steel? Not neccessarily

SME representatives also reject the argument that the added cost of tariffs make domestically-produced steel and products using steel cheaper by comparison. “That’s a simplistic view…a tariff raises the price of imported goods. However, domestic producers would raise their prices without fear of being undercut

by foreign competition. This means higher prices across the board, whether you’re buying imported or US-made products,” explained Richard West, a New York-based analyst.

Following the 25% tariff imposed by the US in 2018, according to a price analysis, prices of many items surged. Within a few months, prices of washing machines, both domestic and imported, rose 12%, with the extra cost being paid by US consumers.

But, as some argue, tariffs also deter US buyers from engaging in any large-scale imports of heavily-subsidized and polluted steel from China.

China’s exports face tariffs in other markets

China, as the world’s biggest steel producer, is also the biggest exporter of the metal. After its exports touched the level of 10Mt a month in 2016, exports started to decline following the imposition of tariffs, a slow-down in China’s manufacturing activities and the slump in China real estate development, which is a major source of steel consumption. While exports, meanwhile, have surged again this year and are expected to cross the 100Mt mark, touching almost the 2016 level, some analysts, for example, at the Macquarie Group, predict that the country’s steel exports would decline to about 96Mt next year.

China’s massive surplus of steel produced is dependent on demand in foreign markets, with the US being an important buyer until the onset of the tariffs.

But US steel tariffs are also encouraging other markets to follow the US example and stem the Chinese steel import tide. Thailand, for instance, imposed antidumping duties of 31% on hot-rolled coil and high-strength steel, the latter being used for critical infrastructure construction.

Even Mexico, which Chinese steel companies use to take advantage of the USMCA trade pact to penetrate into the US market, imposed a tariff on some Chinese steel exports late last year. Canada, Brazil and others have followed suit.

Chinese steel producers have, traditionally, turned their attention to another country when one country imposed trade restrictions. China is also eyeing the Indian market with its ambitious infrastructure plans that will generate huge steel demand. India, itself a major steel producer, may have to eventually buy some foreign steel if its insatiable demand for steel cannot be met from domestic production. Indeed, the Indian government also recently imposed tariffs ranging from 12% to 30% on some steel products from China and Vietnam.

While President Joe Biden’s administration has staunchly supported Ukraine and tried to mitigate the hardships of the Ukrainian people with humanitarian, economic and military aid, with an estimated overall $100 billion following Russia’s invasion, a muchanticipated event for the US industry is the Ukraine Reconstruction Conference 2025 to be held next July; Western companies, including American, hope that details of Ukraine’s reconstruction programme will then be revealed. Much of the country’s infrastructure has been damaged or affected by the ongoing war. Infrastructure projects are expected to generate strong demand for steel.

The Ukraine reconstruction plan will open up projects for Western and US companies to participate in the reconstruction of the war-ravaged country’s infrastructure, inherent with potential for steel and steelbased products. �

Tebulo Robotics specializes in the design and supply of innovative robotic solutions that operates under extreme conditions. With our many years of experience, knowledge in technology and driving forward advancements in engineering and robotics, we are able to offer a wide range of superior solutions that accelerate industrial processes.

Tebulo Robotics creates high quality robot applications that are the solution for making industrial processes faster, better, safer, cleaner and more productive.

Key features include:

• Coil dimensional control system,

• Weighing system

• Spray-paint marking system for visual product identification

• Automatic traceability system for the welded joint,

• Laser marking for the binding wire

• Exhausted coil recognition system

The New Horizontal Compactor Machine HCM400-4W is a fully automated horizontal compactor designed for tying multicoils.

The machine handles coils that weight between 1 and 5 tons and measure between 1200 mm and 1600 mm in diameter

The system achieves a complete loading and unloading cycle in just 2.5 minutes. The compactor can also be installed in wire rod mills ensuring a compacting cycle time of 33 seconds.

Combilift’s range of multidirectional forklifts, pedestrian reach trucks, straddle carriers and container loaders will allow you to maximize the capacity, improve efficiency and enhance the safety of your facility.

Contact Us Today

To find out how Combilift can help you unlock every inch of your storage space.

Mining companies Vale and BHP have reached a settlement with Brazilian authorities following the 2015 Mariana disaster. By Germano Mendes de Paula*

VALE and BHP, each owning 50% of the iron ore pelletizing company Samarco, finalised a definitive settlement of R$170 billion (approximately $30 billion) with Brazilian authorities in late October 2024, in regard to the Mariana disaster. The tragedy, which took place in November 2015, involved the rupture of a structure containing mining waste, resulting in the loss of 19 lives and a subsequent inundation of mud and mining byproducts that devastated large areas, sweeping away homes and contaminating rivers while impacting local ecosystems and communities. The pollution even reached the Atlantic Ocean’s coast in the state of Espírito Santo. Four years post-disaster, another tailings dam managed by Vale failed in Brumadinho, resulting in 270 fatalities. These tragedies prompted Brazilian authorities to legislate the gradual elimination of upstream tailings dams, which, while cheaper, are deemed more hazardous than downstream options. Both Mariana and Brumadinho are located in the

state of Minas Gerais, where Vale conducts extensive iron ore mining activities.

The agreement

Vale has not only confirmed the definitive settlement related to the Mariana disaster, but has also outlined expected cash disbursements for the next two decades.

This settlement encompasses both past and future obligations intended to support the people, communities, and environment affected by the dam failure. The obligations are categorised into three main areas: a) R$100 billion dedicated to instalment payments over 20 years to the federal government, the states of Minas Gerais and Espírito Santo, and municipalities for funding compensatory programmes and related public policies, adjusted for Brazilian inflation; b) R$38 billion linked to amounts already spent on remediation and compensation; and c) R$32 billion related to performance obligations by Samarco, covering individual indemnification, resettlement, and environmental recovery

initiatives.

Disbursements for Vale, BHP, and Samarco are expected to peak at R$22.8 billion in 2025, with a substantial R$12 billion disbursement in 2026, which will then decrease to an average of R$5.9 billion from 2027 to 2030 and further to R$5.1 billion during the years 2031 to 2043 (see Table 1). Samarco will be responsible for the net disbursement difference between the total agreement and contributions from Vale and BHP, starting its payments in 2025 and increasing from R$1.5 billion in 2028 to R$1.9 billion in 2029, reaching R$2.9 billion in 2030, and maintaining an average of R$5.1 billion from 2031 to 2043. This means that of the remaining R$132 billion to be disbursed, approximately R$73 billion (or 55%) will be funded by Samarco itself. Financial analysts have reacted positively to the implications for Vale. JP Morgan noted: “Minimum dividends are not at risk, but extraordinary dividends might be. After adjusting our models to incorporate Q3 results and new cash disbursements,

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

The Thermo Scientific™ ARL iSpark™ Plus Series OES Metal Analyzer uses single-spark acquisition to provide rapid elemental analysis—up to 15% faster than previous models. The increased speed and reliability minimize tap to tap times, save energy, reduce carbon footprints, and realize a faster return on investment.

Capable of providing ultra-fast, on-line analysis of nonmetallic inclusions, the ARL iSpark Plus adds to the versatility, dependability, and productivity of metal processing operations.

we expect Vale’s ability to pay minimum dividends to remain unchanged. From a credit perspective, Vale’s balance can remain conservative despite the increased settlement amount”. Itaú BBA Bank remarked: “This is a win for the government and society, as well as for Vale. If an agreement is indeed reached, it will be one of the largest settlements in Brazil’s history. We also welcome the potential end of one of the most significant overhangs on the stock in recent years. This will allow the incoming management to fully focus on the company’s short and long-term operating strategies”.

UBS added: “We see this as a positive for Vale (albeit widely expected) as it lifts a significant overhang and suggests relations with the Brazilian government and society more broadly may be starting to normalise. Vale’s view is that the closing of the settlement is an important indication that Brazil is the right jurisdiction for this case. The company believes the Brazilian settlement undermines the case in the UK, since the key argument was that the case needed to be moved to London because there was no solution being provided in Brazil”. Notably, the settlement announcement coincides with the beginning of hearings in the High Court in London for a separate multi-billion-pound lawsuit against Vale and BHP, representing approximately 620,000 alleged victims.

Samarco’s production

Financial analysts have primarily focused on Vale’s cash flow as it is a crucial determinant of the company’s valuation. However, for the steel industry, the outlook for Samarco’s production is more

interesting. Its production capacity is 30Mt/yr, and prior to the dam rupture, it produced about 27Mt/yr. Operations in the states of Minas Gerais and Espírito Santo were suspended until 2020, when the first recovery phase commenced, limited to 9Mt of annual production with some equipment operational. The second phase aims to escalate production to 15Mt/ yr, originally planned for Q1 2025, but is now set to start ramping up in December 2024. This increase required an investment of R$1.6 billion and the creation of 3000 jobs, all of which have been filled along 2024. Currently, the company generates approximately 15,000 jobs, both directly and indirectly. The third phase is expected to commence in 2028, with the goal of returning to pre-2015 production levels. Notably, the company has eliminated the use of tailings lagoons in its processes; instead, waste is now filtered and stacked dry in a designated area in Mariana, with a

smaller fraction being disposed of in a pit.

Samarco’s financial situation

By accelerating its production plan from the current 9Mt/yr to 15Mt/yr of pellets, Samarco anticipates a corresponding increase in revenue. In August 2024, the company projected that it would close the year with approximately $1.2 billion in revenue, and that the planned production increase could elevate sales to between $1.8 billion and $2.0 billion, assuming prices remain similar to current levels. Since resuming operations in 2020, Samarco has reportedly experienced cash surpluses that enabled it to allocate $2.2 billion for repair efforts following the catastrophe. The financing for the current expansion has also come from these cash reserves, offsetting the need for debt or additional shareholder contributions. Samarco claims to have been fully operationally independent since 2020. Nonetheless, although it has paid its debts to employees and suppliers, it is still under a reorganization plan. Indeed, it still faces substantial debt obligations with bondholders from notes issued prior to the 2015 disaster. In December 2023, as part of its recovery plan, Samarco issued new bonds worth $3.98 billion, scheduled to mature in 2031.

It took nine years to reach an agreement between Samarco (and its shareholders) and the Brazilian authorities regarding the Mariana tragedy. For the steel industry, this resulted in the suspension of Samarco’s operations until 2020. The company is now recovering to half of its installed capacity; it will only return to pre-accident levels in 2028. �

AMID a global economic slowdown, major importing countries have imposed trade restrictions such as safeguard duties, import taxes, and quotas to reduce dependency on imports and fulfil domestic demand with local products.

According to the Joint Plant Committee (JPC), a division of India’s Union Ministry of Steel, finished steel exports from India dropped to 2.31Mt in April-September 2024, a 36% decline from 3.6Mt in the corresponding period the previous year. Following a peak of 13.49Mt in the financial year (FY) 2021-22 (April-March), India’s finished steel exports declined steadily to 7.49Mt in FY 2023-24. If the current trend persists, steel exports are projected to fall to 4.62Mt for FY 2024-25, a decrease of 39% year-on-year.

In contrast, steel imports have continued to rise. During April-September 2024, India’s steel imports surged by 41% to 4.7Mt compared to 3.33Mt in the same

Source: Joint Plant Committee (JPC), Ministry of Steel, Indian government; Period from April to March; *April-September 2024

Source: Joint Plant Committee (JPC), Ministry of Steel, Indian government

period last year, resulting in a net import balance of 2.39Mt. This shift reverses the government’s goal of boosting exports and reducing imports, with imports now exceeding exports by a substantial margin. In response, the domestic steel industry

has called for protections against low-cost imports from China and intermediaries like Vietnam, seeking measures similar to the anti-dumping and safeguard duties imposed by the United States, European Union, Canada and other nations.

India’s steel exports fell sharply by nearly 36% in the AprilSeptember 2024 period as several countries heightened protectionist measures to curb cheap imports and protect local industries.

By Dilip Kumar Jha*

years. Italy emerged as the largest importer of Indian steel, with total volume rising to 1.04Mt in FY 2023-24, followed by Vietnam at 0.87Mt and United Arab Emirates (UAE) at 0.7Mt. Additionally, several Middle Eastern countries have increased their imports of Indian steel. In FY 2018-19, Vietnam was India’s biggest importer of steel at 2.4Mt, followed by Nepal at 1.9Mt, Italy at 1.3Mt, and UAE at 0.9Mt.

Meanwhile, India’s steel industry is already grappling with cheap imports from China and faces further challenges in meeting the European Union’s Carbon Border Adjustment Mechanism (CBAM)

The decline in India’s steel exports is primarily driven by two key factors: a contraction in global demand and the implementation of protective trade measures by multiple countries. According to the World Steel Association, global steel demand fell by 1.1% to 1,763Mt in 2023 during the January-August 2024 period, with production dropping by 1.5%. Amid a global economic slowdown, major steelimporting nations have increased trade barriers.

India’s steel sector now faces a challenging environment as numerous countries have introduced protective tariffs against low-cost imports and alleged unfair trade practices. The European Union, for example, has imposed anti-dumping duties of up to 25.3% on cold and hotrolled stainless steel, along with a 25% safeguard tariff on steel imports exceeding specified quotas. Similarly, Brazil, Mexico, and the United States have adopted similar measures, with the United States levying

anti-dumping and countervailing duties as high as 190.71% on stainless steel sheets and coils.

Several Asian countries, including Vietnam, Thailand, and Malaysia, have also introduced trade measures aimed at imports of hot-rolled coil and tinplate from India, China, and other sources. This global shift underscores a broad push to protect domestic steel industries from international competition and concerns about excess capacity. India remains susceptible to trade diversions due to a lack of comparable protective measures. The United States and Canada imposed 25% safeguard duties, while the European Union has enforced a 25% duty on imports beyond set quotas. Recently, countries such as Turkey, Indonesia, Malaysia, Vietnam, and Japan have taken swift actions to shield their markets.

There has been a substantial shift in shipment destinations over the past four

requirements, set to take effect in January 2026. The European Union’s safeguard measures, in place since 2018, have significantly reduced India’s export volumes to the EU, leading to considerable financial losses. Despite rising inventory levels over the past two years, India’s steel imports have continued to grow. “This is a matter of concern and points to the fact that imported steel is crowding out domesticallyproduced material to a large extent and, therefore, needs to be curbed with a high import duty”, said T V Narendran, managing director of Tata Steel.

Steel prices in the domestic market have been steadily declining, driven by falling international prices and low-priced steel dumping by China. The Indian Steel industry has been urging an increase in basic customs duty on steel imports to curb steel shipments from China, both direct and indirect. Meanwhile, the Ministries of Commerce and Finance are evaluating the situation to consider potential safeguard measures. �

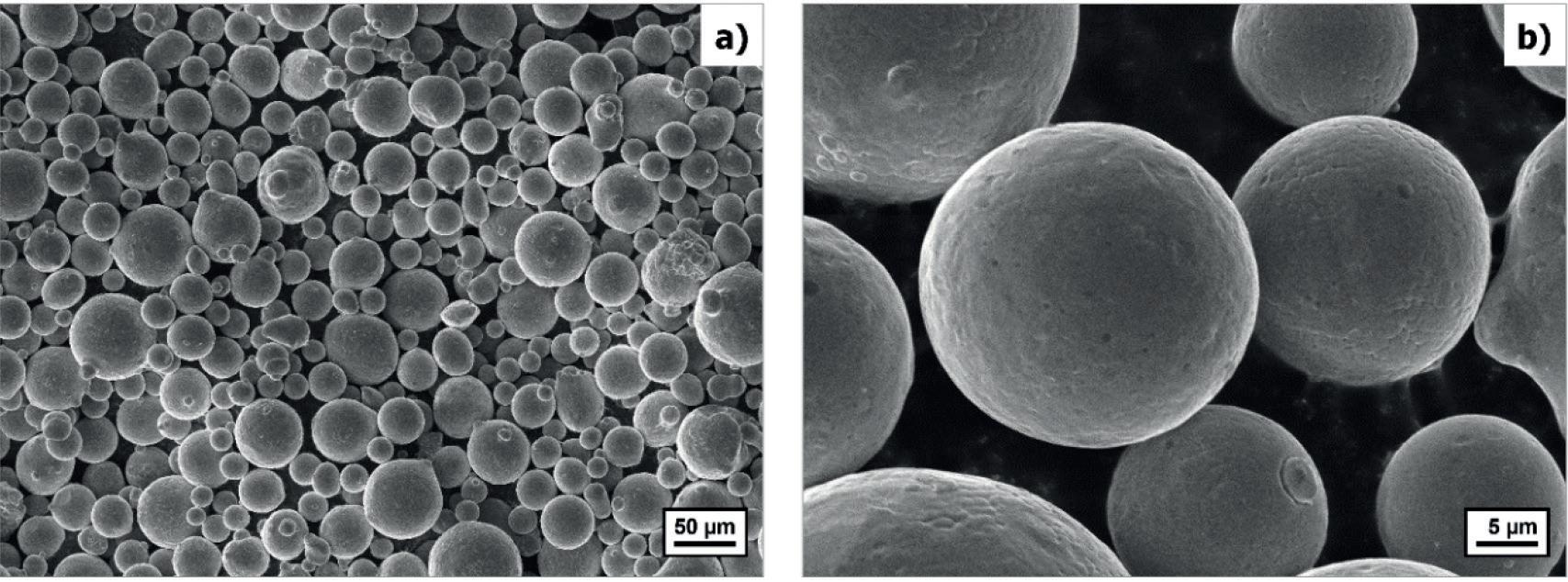

Upcycling steel scrap is a key step to achieve the sustainability of the steel sector. The University of Warwick’s Advanced Steel Research Centre, has been extensively researching technologies to enable steel scrap upcycling in the whole steel value chain to improve scrap quality for producing high-quality steels via scrap-based EAF steelmaking, and to understand the effects of residual elements on the downstream manufacturing process.

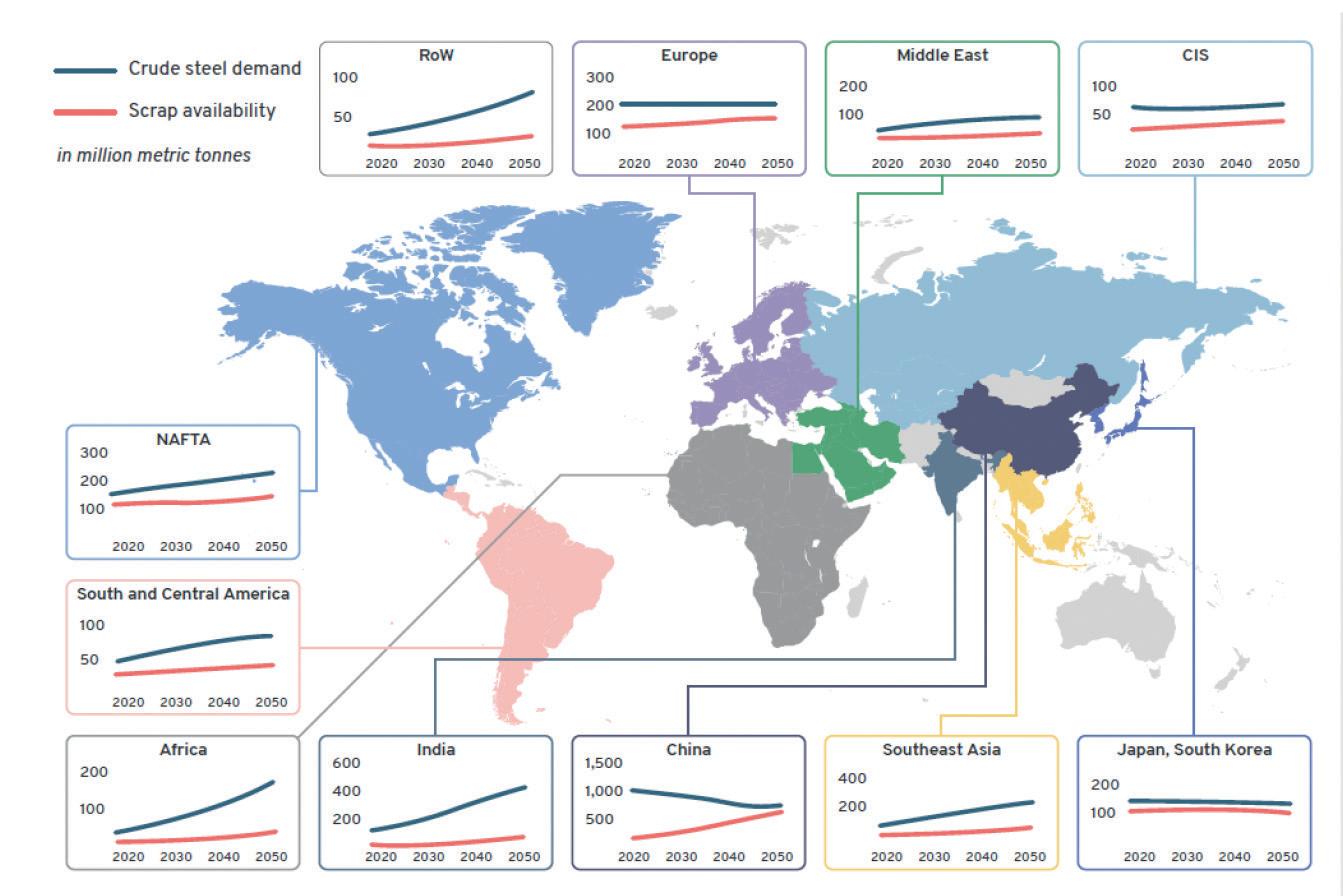

By Zushu Li and Claire Davis*

GLOBAL steel scrap supply, as estimated by the World Steel Association, stood at 400Mt in 2019, and will increase to 600Mt in 2030 and 900Mt in 2050.1) The scrap supply varies according to different territories, with developed countries/regions such as the USA, Europe and the UK being net scrap exporters. The UK exports 80% of the domestically generated 11Mt steel scrap per year. 2) In developing countries, the scrap supply increases alongside their economic development. Using China as an example, after experiencing a period of unprecedented economic growth, the scrap supply is estimated to significantly increase from 260Mt in 2022 to 600Mt in 2050, while crude steel production is estimated to decrease from 1,035Mt to 690Mt in the same period.3) Recycling 1t of steel scrap saves 1.4~1.5t of iron ore, 0.5~0.6t of coal, and up to 75% of the energy required for primary steel production. Because of its critical role in decarbonizing the steel sector, EUROFER (the European Steel Association) called on the European Union

to include scrap metal in the list of critical raw materials.4)

Steel is considered 100% recyclable, and scrap quality is not considered a big issue while steel manufacturing is dominated by the iron ore/fossil fuel-based integrated process. However, under the scenario of increased scrap supply and the transition to scrap-based EAF steelmaking resulting from the urgent decarbonization agenda, the residual elements in the scrap due to repeated recycling will gradually increase to a level that the steel scrap cannot be used to make higher or even equivalent quality new steels.4,5) For example, the current handling practice for end-of-life vehicles is to shred the whole vehicle in mass production and generate shredded scraps containing 0.20~0.35% Cu, which cannot be used to make high-quality automotive steels (such as exposed sheet steels requiring <0.08% Cu via the scrap-based EAF steelmaking route) unless significant dilution is made with ore-based metallics (OBMs).

Different countries/regions have their own scrap specifications or standards, classifying scrap into tens of types. All these classifications are primarily based on the scrap sources (e.g. old scrap, heavy scrap, rails, construction), processing methods (shredded materials, bales), dimensions, bulk density, and health and safety implications. Only the EU scrap specification lists the maximum value of residual elements for some types of steel scrap, other than that, no other scrap specifications/standards list the maximum residual element content let alone the full chemistry of the scraps. No international standard is available for steel scrap, which is probably because the scrap quality (e.g. residual element level) varies significantly with countries/regions. The scrap (e.g. rail scrap) in the countries/regions with the BFBOF integrated route being the dominant steelmaking process most likely have much lower levels of residual elements than those in the countries/regions with the EAF route being dominant.

*Professors Zushu Li and Claire Davis are both with the Advanced Steel Research Centre (ASRC) within the academic department WMG, at the University of Warwick, UK (z.li.19@warwick.ac.uk)

One of the key tasks for steelmakers is to make the right steel chemistry in the heavy end of the manufacturing process, which will be extremely challenging to achieve without knowing the chemistry of the scrap, the main metallic charge in scrap-based EAF steelmaking. To upcycle steel scrap, steel scrap specifications/ standards should have at least the residual elements and alloy element contents. However, considerable efforts have been made by the steel community, but it is still not successful in developing technologies to measure the chemistry of either bulk or loose scraps. Alloy elements in steel scrap are unknown and will distribute slag and dust (off gas) during steelmaking, which potentially causes issues with specifications and the recycling of slag and dust, with chromium and vanadium being exemplary elements. The waste of alloy elements also reduces the material’s efficiency as ferrous alloys are expensive and produce more CO2 emissions than the steel itself. This is the area requiring careful consideration.

While the residual elements in steel scrap are fundamentally causing the downcycling issues, removal of the residual

elements in the solid state and/or in the liquid steel has always been attractive. In the solid state, various methods have been developed to remove the residuals in the ‘free’ state, either in coating or as free objects intertwined with scrap. Because of the increase in the residual element levels in the steel itself, removal of residual elements in liquid steel, if successful, will be beneficial. Measures such as using chlorine, sulphide, solvent extraction and vacuum evaporation have been developed successfully in laboratories with some – like the sulphide method – being trialled at pilot scale, however, none of them have been industrialised for various reasons. In the future it might be possible that a method to remove residual elements can be implemented in the industry with technology advancements.

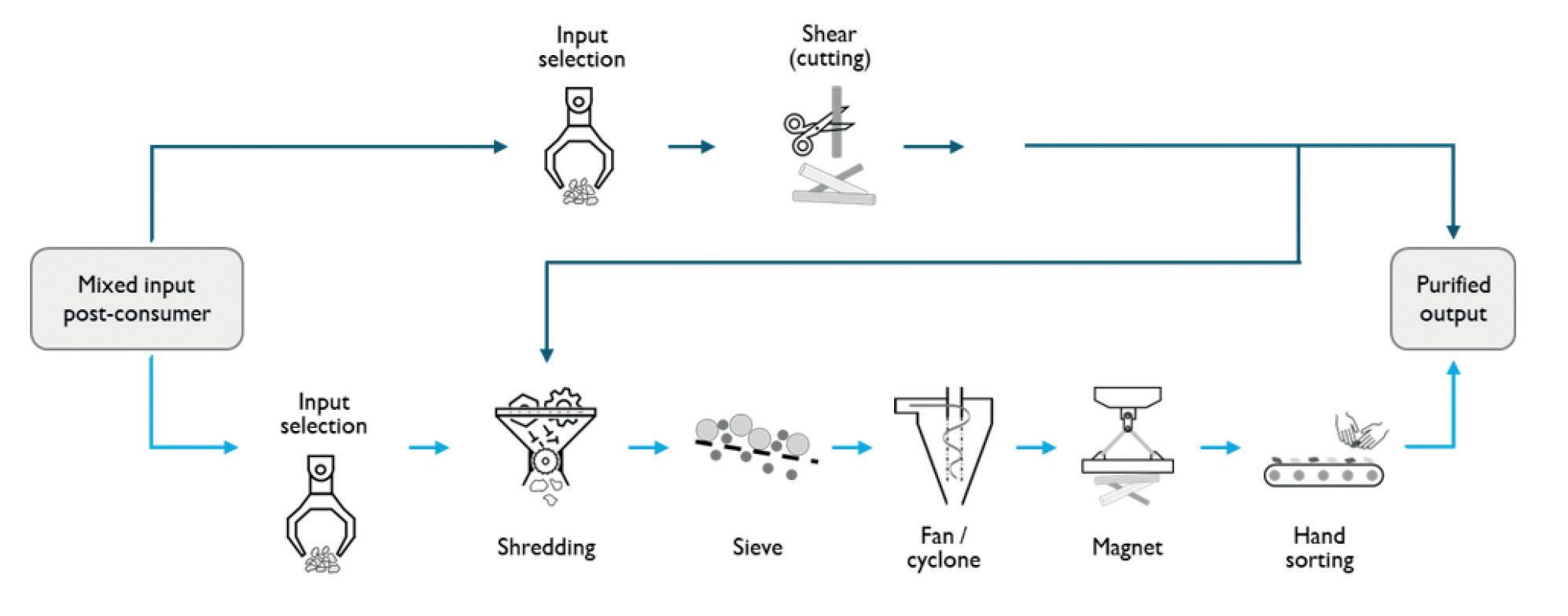

While the removal of residual elements in a solid state and/or in liquid steel is not practical now, attention has been shifted to improve the scrap quality from the beginning, that is in the stage of scrap sorting. Significant changes are required to improve the current scrap sorting processes, including clear control of the

scrap sources, and intensified scrap sorting. In the long-term, designs for disassembly, materials passport, selective disassembly, and, for certain steel grades, closed-loop recycling, are potential routes to follow to significantly improve scrap quality.

The residual element level is only one side of the scrap quality issue. Other important factors include the consistency of the scrap quality, compatibility with steel chemistry and sterile content. The sterility in the scrap increases energy consumption, flux consumption, yield loss, and cost. Steelmakers should place more attention on scrap value rather than scrap price in the scrap-based EAF route. Artificial intelligence has started to find its application in scrap sorting and quality control in combination with advanced analytics. Our research mainly focuses on the computer visionbased algorithm development for object detection for scrap recyclers to selectively remove non-steel items on the conveyor belt such as ‘copper meatballs’, and another application is to provide a tool for scrap quality estimation when scrap comes into the steelmakers’ scrap yard (weighing bridge) and during scrap charging. This

In-Line Profile Measurement Systems for Hot / Cold Steel Applications with increased sampling rate up to 2 kHz.

10+ Years

Over 10 years of

Benefits:

Best measuring accuracy thanks to temperature-stabilized measuring systems

New algorithms for surface inspection and defect detection

Defect detection based on multiple maps and surface properties (reflectivity and intensity)

Detects process problems at an early stage

Quick maintenance and easy cleaning

Profile measuring solutions with global references

area requires significant efforts as currently there are no effective tools to measure scrap quality either in loose materials or in bulk materials.

Scrap melting has long been studied, however, in scrap-based EAF steelmaking, this topic will become more challenging due to current decarbonization targets. In BOF steelmaking, the carbon content of hot metal will help melt steel scrap. In scrap-based EAF steelmaking with the addition of hydrogen direct reduced iron (HDRI), the lack of carbon will extend the melting of scrap and HDRI, and at a higher temperature, a focus area of our study.

Increasing the residual element content in steel can affect every stage of its downstream production and use. During and after the solidification of steels with residual elements, in the higher temperature region (>1200 °C), interdendritic segregation of P, S, Si and Mn can cause a hot-tearing problem, while for the lower temperature region (<1200°C), inter-granular fracture can occur due to embrittling precipitates (fine (Fe,Mn)S or Nb(C/N) or copper-oxy-sulphide/coppersulphide particles), surface hot-shortness due to Cu, and hot cracking due to solidstate segregation of Sn. By optimising the cooling rate, the deformation temperature (for strand straightening operations during continuous casting), strain rate, chemical composition and the above-mentioned hotductility problems, can be minimised.6)

During the steel reheating phase (~1200 °C), the preferential oxidation of iron will leave the noble element Cu in the liquid metallic state at the oxide-steel interface and along the austenite grain boundary. This is intensified by the presence of Sn

and Sb through reducing the solubility of Cu in the austenite phase and forming a low-melting point liquid phase. Upon deformation (hot rolling), the steel cracks in the form of surface hot shortness.7)

Residual elements such as Cu, Sn, Ni may significantly slow recrystallisation, which can increase the deformation resistance and rolling loads during hot rolling. In a recrystallisation kinetic study of low carbon steel (0.17%C) using dilatometry, the addition of residual elements (0.58 wt% Cu, 0.30 wt% Ni, 0.06 wt% Sn) greatly reduces the start and finish temperatures of recrystallisation at varying cooling rates from 0.05 to 50 °C/S and increases hardenability due to the residual elements.8)

Microstructure examination under varying cooling rates revealed that the residual elements can distribute in the steel matrix (e.g. ferrite phase) in the form of atomic or precipitates, along the grain boundaries, and concentrating on specific phases such as the cementite phase, which reveals the mechanisms of residual elements affecting the strength and formability of steels.8,9)

Extensive research facilitates the development of effective strategies for minimising the detrimental impacts of these residual elements, through improved scrap sorting, advanced alloy design, and optimized thermomechanical processing techniques. One important strategy is to utilise the presence of residual elements in a positive way to reduce the need for deliberate alloying additions, for example, if the effects of residual elements on strengthening and recrystallisation control are well understood, it could lead to a reduction in the amount of Nb required for those specific effects.

In summary, upcycling steel scrap will play a key role in achieving steel sustainability. Significant efforts are needed to ensure that scrap quality is compatible with steel chemistry, and understanding the impact of residuals on processability and steel properties can help adjust process parameters and develop new alloys with higher residual element levels. �

References

1. 2021 fact sheet – scrap use in the steel industry. https://worldsteel.org/wp-content/ uploads/Fact-sheet-on-scrap_2021.pdf.

2. R. Hall, W. Zhang and Z. Li (2021). Domestic scrap steel recycling – economic, environmental and social opportunities (EV0490). University of Warwick.

3. G. Wang et al. SSCAE. Vol26(3) 2024. DOI 10.15302/J-SSCAE-2024.03.004.

4. https://www.eurofer.eu/press-releases/ ensuring-access-to-critical-materials-for-steeland-wind-sectors-essential-for-eu-clean-techeconomy

4. S. Spooner, C. Davis and Z. Li: Ironmaking & Steelmaking 2020, pp.1100-1113.

5. K. E. Daehn, A. C. Serrenho, J. M. Allwood: Environmental Science & Technology. 2017 (51), 6599-6606.

6. I. Kapoor, C. Davis and Z. Li: Ironmaking & steelmaking, 2021, VOL. 48, NO. 6, 712–727.

7. I. Kapoor, C. Davis and Z. Li: Steel Research International. 2024. DOI:10.1002/ srin.202400116

8. J. Duan, D. Farrugia, J. Poplawsky, C. Davis and Z. Li: Materialia 2024. https://doi. org/10.1016/j.mtla.2024.102141

9. J. Duan, D. Farrugia, C. Davis and Z. Li: Ironmaking & Steelmaking. Vol 49(2022). Pp.140-146

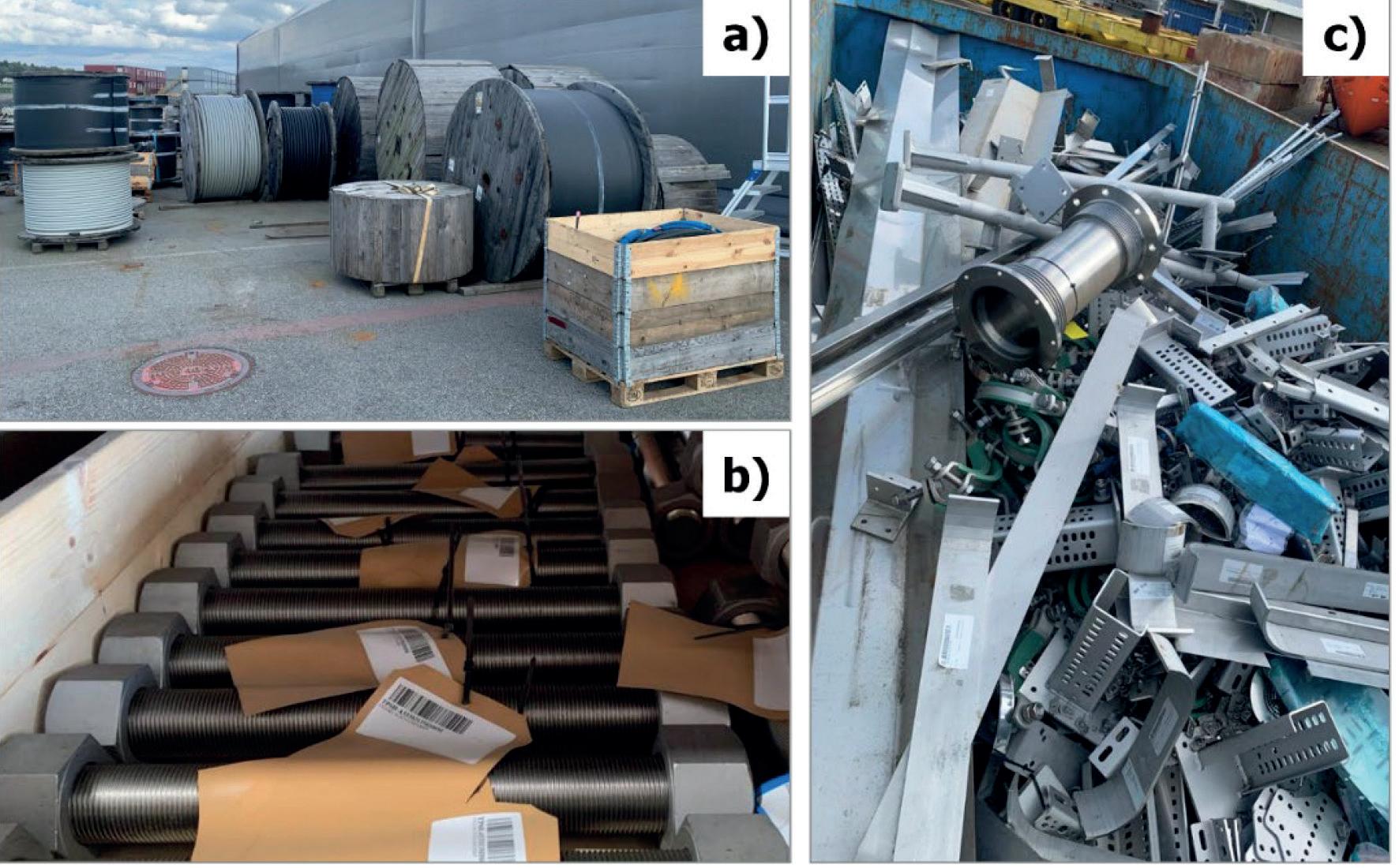

Steel scrap has the potential to become the raw material to meet close to half of global steel demand. However, to unlock its full capability, steelmakers must invest in a combination of innovative sorting processes, and inline analytics. By Heiner Guschall*

ECONOMISTS are predicting that available steel scrap will increase until 2050. This prediction is based upon the mean lifecycles for steel-based products and their cyclic entry into the scrap market. Most available scrap is situated in the northern hemisphere. Europe and the USA have enough domestically available steel scrap to support over 90% recycled steel. In contrast the southern hemisphere has the iron ore deposits and low-cost energy resources to support a hydrogen reduction process to meet their steel product demand. One quarter of the sector’s CO2 emissions arise from transporting raw materials across the globe. If steelmaking is to have a lowcarbon future, then we should accept and work with consuming raw materials that are domestically available.

scrap

Steel scrap has a history of being downcycled from high-quality end-of-life products, which are melted into longproducts with lower chemical requirements. If Europe is to transition steel into a lowcarbon emissions product, the downcycling must be reversed.

This goal is not only feasible but also economically advantageous. Efficient decontamination is an established process, but not universally used. If this step is supported with an integrated online analysis, steelmakers will have a raw material with high Fe levels (up to 98%) that can be consumed effectively and charged into a furnace with an accurately established chemical makeup in its ‘cold’ condition. The control of scrap quality is managed by commercial enterprises with

business models driven by throughput and profit. Unless consumers of this scrap demand better quality, quantity will continue to determine value. The result of this focus on quantity over quality has seen an observable decline in density (in the case of shredded scrap), increased contamination, and a reduced Fe content over the past years. The demand for improved consumer products has seen a growth in the use of non-ferrous metals to enhance product automation. This increased consumption of non-ferrous materials has added a layer of complexity to the decontamination of these enhanced end-of life products.

Over the last 20 years, the mean Fe content of steel scrap has frequently reduced to less than 90% and the mean melt Cu has increased to 0.37% for

*Founder, co-partner, and managing director of SICON GmbH, a company that has specialized in the processing of ferrous and non-ferrous metals for over 25 years.

shredded scrap. If nothing changes, melt Cu will reach 1% by 2050 (Cambridge University). As Cu and other elements are alloyed in the steelmaking process they cannot be successfully removed from steel once it has been melted. This contamination presents a cumulative issue upon each cycle of the recycling process, making it increasingly difficult to blend or dilute.

Decontaminating steel scrap by innovative refining techniques

The quality and chemistry of steel scrap is critical to efficient production. According to EU scrap grade specifications, the copper content in grade E40 should be a maximum of 0.25%, yet it currently stands at 0.37%. Since copper and other critical elements cannot be efficiently removed from liquid steel, blending in high-cost raw materials, such as scrap grade E8 or DRI/HBI, becomes necessary. Innovative techniques in scrap

processing and advanced online analytics offer the key to escaping this cycle of quality degradation and will sate the demand appetite for higher scrap input rates. These easily implementable tools are essential for the quality control of raw materials while delivering economic opportunities.

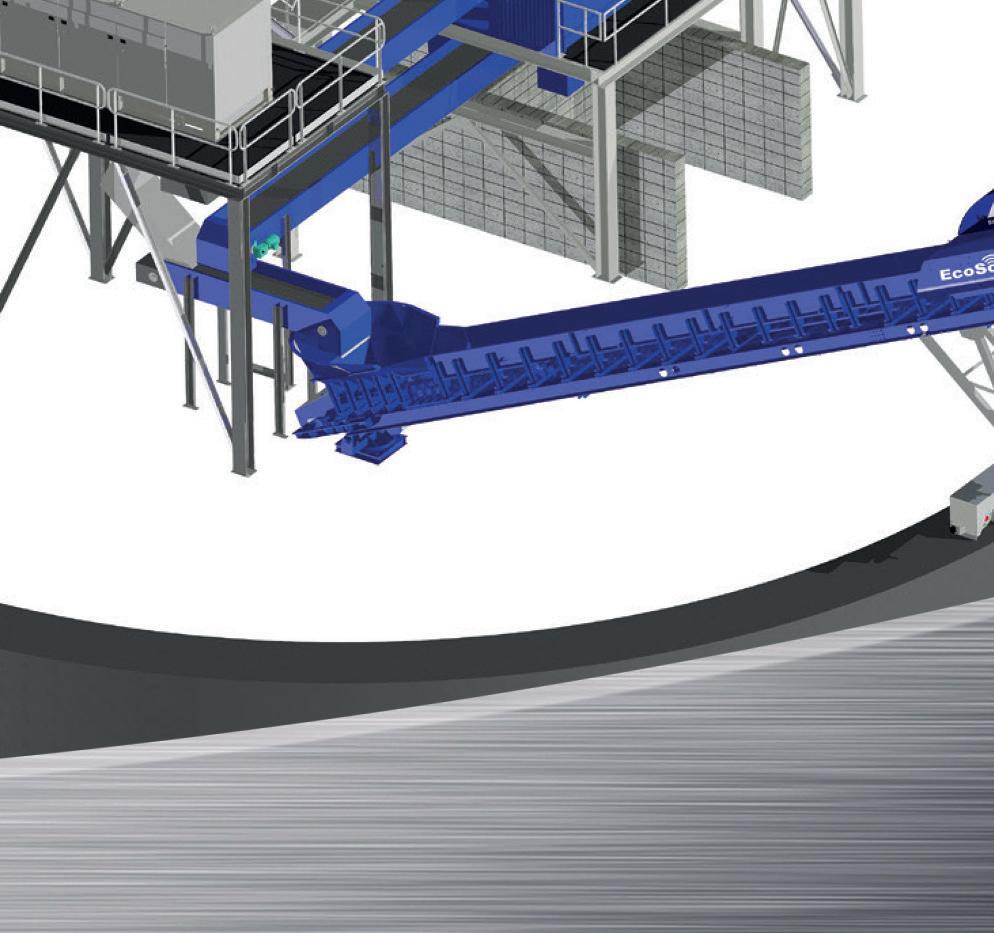

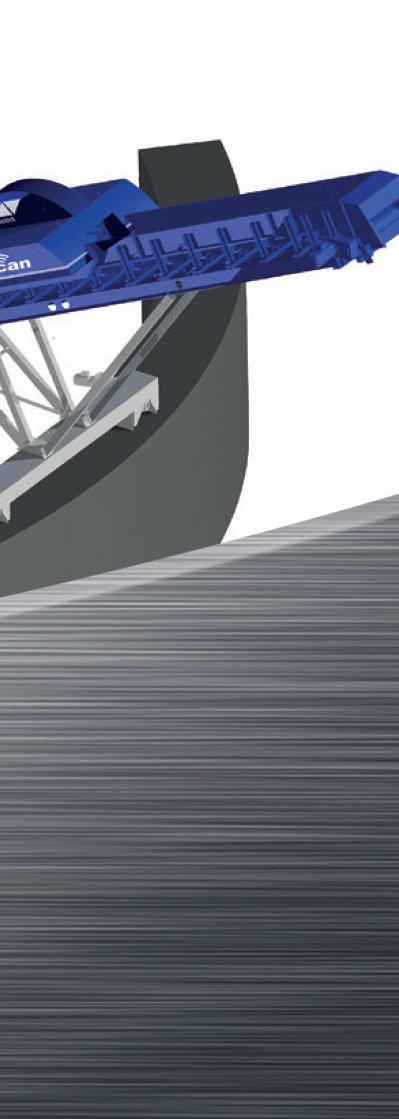

SICON GmbH, offers a range of modular tools referred to as ‘Refining’ and focuses on grades E40, E46 and E1 (HMS 1/2). The range includes ScrapTuning®, EcoScan® Online, and HMS Cleaning Advanced.

The necessity for implementing such procedures in raw material preparation varies depending on the plant, location, and production programme. In general, the scrap mix is based upon subjective specifications and not objective, measured properties. AI-based predictive models for scrap quality work well if the steel scrap has no attached materials, copper wires, aluminium castings or weight-reducing plastics. AI solutions can be used to support

analyses coupled to a steel scrap blending facility.

The ScrapTuning® and HMS Cleaning Advanced tools pursue three main objectives:

a) Concentrating the metallic Fe

b) Complete decontamination from inert materials, non-ferrous metals, non-metallic components, and composite materials

c) Isolation and separation of steel scrap particles with high inherent residual content (Cu, Ni and Cr)

Sicon HMS Cleaning Advanced has proven effective in numerous steel plants to decontaminate sheared scrap. In its standard configuration, HMS Cleaning Advanced includes uniform dosing, screening, and iron separation. The cascading screening ensures that the shearing scrap is tumbled, enhancing decontamination. The isolated contaminants contain high-value nonferrous metals, easily sold to recover operating costs.

Current magnetic separation facilities are inefficient and require stronger magnetic fields with enough space to support effective separation of the magnetic from non-magnetic materials. This approach increases efficiency to 99%.

The scrap sector often uses pressing operations to compact loose light gauge scrap into dense bundles. This increase in density reduces transport costs for the supplier and improves basket density for the steelmaker. The downside is that contaminants cannot be removed, and the bundle’s chemistry is unmeasurable. To resolve this issue, a newer configuration of HMS Cleaning Advanced includes a slowrunning pre-shredder. The EcoRip® Neo, is part of the Sicon portfolio and specifically designed to address the challenges of scrap bundles via delivering steel scrap at the desired densities, offering complete decontamination and the ability to analyse 100% of the raw material.

Pre-treatment with the EcoRip® Neo homogenizes shearing scrap and further improves cleaning efficiency. This process sequence increases the liquid steel yield in steel plants. An additional step is available for flat-steel producers, which is based upon an AI-based optical inspection, automatically sorting undesirable components. The AI and sorting algorithm are trained and optimized depending on production needs.

• Efficient cleaning of HMS 1/2 at throughputs of up to 300 tph

• Separation efficiency > 99%

• Integration of AI-based quality improvement and online analysis (EcoScan® Online)

• Realization with all necessary conveying equipment up to the meltshop

• Refining of Shredded Scrap to remove all unwanted impurities

• Generation of a Crafted Scrap based on meltshop requirements

SICON GERMANY

Vordere Insbach 26 | 57271 Hilchenbach

Tel.: +49 (2733) 811 76-0 | info@sicon.eu

www.sicon.e u

An essential and integral part of HMS Cleaning Advanced is the continuous massbalancing of material flow. This enables rapid supplier assessment, and a measurable control of quality. Precise data is preferable to visual inspection during the unloading stage. Steel plants importing by sea can accurately process and measure scrap quality at a rate of 300 tph, allowing for complete deliveries to be cleaned and assessed during vessel discharge. As previously noted, the copper content in scrap presents an increasing problem. ScrapTuning® for Shredded Scrap is designed to turn fluctuating supplier quality into a quality-controlled raw material without the need for an in-house shredder. Shredded scrap is cleaned in multiple stages. Only the magnetic separation stage, using polishing magnets, is generally insufficient. Sicon has designed a magnetic cascade with innovative underflow separation, requiring an advanced magnetic design (MagSpin). This process is supported by an additional air separation stage, to isolate and recover the final non-magnetic contaminants, resulting in a melt Cu content of 0.16 to 0.20%.

An additional cleaning stage is also available to reduce melt copper to a maximum of approximately 0.12%. The Sicon EcoFlip™ is a combination of AIbased optical recognition and integrated XRF analysis. The Sicon EcoFlip™ separates alloyed scrap parts above the residual threshold.

Optimized processing and sorting technology alone is not sufficient. Inline

analysis should follow the refining process. Comprehensive and continuous analysis of the scrap composition is crucial. While the approach of inline analytics is not new, techniques and process integration have improved, significantly enhancing performance criteria. Previous negative experiences and high maintenance costs have tarnished the reputation of inline analytics. The modern approach is XRFbased analysis, replacing radioactive neutron sources. This method ensures high precision through a higher count rate for surface elements, even at low concentrations. Simple and fast calibration enhances operational security and measurement stability, keeping costs per ton under €0.50. Online analytics is no longer a luxury but an absolute necessity. By combining sorting with final analysis, scrap quality can meet the limits set by the melting plant based on production planning, identified as ‘crafted scrap.’ Flexible adjustments to target quality are possible. This process overturns traditional thinking and creates the opportunity for the steelmaker to measure chemistry, density and Fe content in the charging basket.

In EAF steelmaking, steel scrap accounts for over 75% of operational costs and its inconsistent chemistry is responsible for it being limited mainly to long products with wider chemical specifications. Moving steel scrap from a subjective physical inspection to a measured objective specification allows steel plants to assess the true value of the raw materials they are consuming. The XRF-based solution, with EcoScan® Online, has proven to be a very precise and reliable solution in numerous facilities.

The combination of refining and innovative online analytics will increase scrap utilisation to the maximum. This is not only a step toward more sustainable steel production, but also an example of the industry’s innovation potential in the decarbonization process.

The steel sector should consider their answers to the following questions:

1. Can steel scrap be engineered to remove the contaminants?

2. Is the technology to achieve this proven?

3. Is the investment to develop a ‘crafted scrap’ lower than developing a (green) hydrogen-based reductant?

One crucial aspect to consider is the substantial CO2 reduction. By using optimally cleaned and refined sheared scrap instead of the commonly utilized HMS 1/2 grades, CO2 emissions can be reduced by approximately 170 kg per ton of crude steel. This calculation assumes a reduction of foreign substances by about 10%, with additional potential savings in transport and other areas not yet factored in.

George Bond, a veteran of the UK steel industry summarized: “Years of successful steelmaking is based upon blending variable iron-ore chemistries into a planned chemistry furnace charge. If steel scrap is to succeed in replacing iron-ore, it must become a fully measured and specified raw material that can be blended into a planned cold charge.” �