VOL 41 NO 1

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The return of US president Donald Trump to the White House will have economic and political consequences around the world – from issues such as import duties and agricultural policies, to climate change and the war in Ukraine.

Due to take office on 20 January, Trump says he will impose a 25% tariff on all goods from Mexico and Canada on day one of his presidency, and charge China with an additional 10% tariff as he seeks to crack down on illegal immigration and drug smuggling into the USA.

US soyabeans are in the crosshairs, with exporters concerned that the tariffs will block their access to top global soyabean buyer China (see p4). However, China has already been moving away from US soyabean imports since the previous Trump administration imposed US$300bn worth of duties on Chinese goods in 2018. In 2024, China’s purchase of US soyabeans fell to an 18% share of its total imports, compared with 76% from Brazil, in contrast to 40% and 46%, respectively, in 2016, according to a 1 November Reuters report.

The tariffs could also restrict US imports of vegetable oils, prompting companies to build more crushing plants in the country. The US market has been flooded with cheaper global supplies of biofuel feedstocks such as used cooking oil (UCO) from China, tallow from Brazil and canola oil from Canada and it is still unclear if Trump will block imported oils from benefiting from renewable fuel tax credits. Combined with uncertainty over the continuation of incentives and tax credits, the US biofuels market will be focused on the short-term rather than long-term planning for now.

Trump’s choice of Robert Kennedy Jr to lead the Department of Health and Human Services is also controversial, given his views that vaccines cause autism and wifi technology leads to cancer. He has also advocated for eliminating ultra-processed foods and has written on social media that Americans are being “unknowingly poisoned” by products like canola and sunflower oil that are used in fast foods, the BBC wrote on 24 November.

Beyond the USA, Trump had campaigned on a promise to end the Russia-Ukraine war “in a day”. While short on specifics, an end to the war which began in February 2022 when Russia invaded Ukraine, will have an impact on the oilseed market, with the two countries accounting for nearly 80% of sunflowerseed production and close to 60% of sunflower oil output globally.

On the climate front, Trump will be focused on deregulation to boost economic growth, and he is expected to open more acreage to oil and gas extraction; roll back rules restricting power plant emissions; abolish a fee on methane; claw back clean energy subsidies; and end climate disclosure rules for corporations, the Washington Post wrote on 19 November. Along with his plans to withdraw the USA from the 2015 Paris climate agreement, the rest of the world will have to grapple with how to limit global warming to 1.50C above pre-industrial levels without the world’s biggest economy on board.

Overall, Trump’s election brings greater potential for chaos from a global point of view. “Markets and businesses … want certainty rather than upheaval,” Stephen Nicholson, global sector strategist for grains & oilseeds at Rabobank said in a 11 November World Grain report. “With Trump, there is a lot more uncertainty and policies could change more quickly.”

Serena Lim, serenalim@quartzltd.com

WORLD: Global agribusiness giant Cargill is set to cut its global workforce by 5%, according to a 3 December World Grain report.

The move followed the company’s weak financial performance this year and a restructuring of its business, the report said.

“To strengthen Cargill’s impact, we must realign our talent and resources to align with our strategy,” the company was quoted as saying.

“Unfortunately, that means reducing our global workforce by approximately 5%. This difficult decision was not made lightly. We will lean on our core value of putting people first as we support our colleagues during this transition.”

For fiscal year 2024 ended 31 May, Cargill recorded sales of US$160bn, down nearly 10% from US$177bn the previous year.

The privately-held company does not publish its annual earnings.

In Cargill’s annual report published on 13 August, company chairman, president and CEO Brian Sikes said ongoing challenges facing the global food system from disruptions caused by conflict, changing demographics, and volatile economic and environmental conditions had impacted the company.

According to a Reuters report in August, Cargill has set out plans to reduce its business units from five to three, with the remaining three focused on food, farming and trade and “special” businesses.

The re-election of Donald Trump as US President brings uncertainty for the US soyabean sector and the wider US agriculture industry due to his proposals to expand on aggressive trade tariffs introduced during his first term, Argus Media reported on 6 November.

Trump said he would sign an executive order imposing a 25% tariff on all goods coming from Mexico and Canada after being inaugurated on 20 January, the BBC wrote on 26 November. He also said he would be charging China an additional 10% tariff above any tariffs.

The tariffs on Mexico and Canada would remain in place until the two countries clamped down on drugs and migrants illegally crossing the border, Trump said in a post on his Truth Social platform. He also attacked Beijing for failing to carry out the death penalty for people caught dealing in the synthetic opioid fentanyl.

Reigniting trade tensions with China was a

primary concern for US agriculture markets, particularly for soyabean exports, as China was the largest buyer of US soyabeans, Argus Media said. US agricultural exports to China had already been declining in recent years, with Beijing turning to countries like Brazil for staple crops such as corn and soyabeans, the South China Morning Post wrote on 7 November.

In 2023, around US$33.7bn worth of US agricultural products were sold to China, the US Department of Agriculture's quarterly outlook published in August said. For fiscal year 2024, this fell to around US$27bn and was forecast at US$24bn for 2025.

In the 2023/24 marketing year, China’s purchase commitments for US soyabeans totalled 11.13M tonnes, Argus Media wrote. Its purchases of 2024/25 US soyabeans were behind pace earlier in the year, partially due to concerns about the election and US trade policy.

Leading coffee chain Starbucks was due to drop its range of extra virgin olive oil-infused coffee in the USA and Canada from early November, the BBC reported on 30 October.

However, the Oleato range would still be sold in some outlets in Italy, Japan and China.

The company made the announcement less than a week after it reported global sales falling by 7% between July and September 2024 compared to the previous year.

New CEO Brian Niccol –brought in to help turn the business around – said he would be making changes to its menu in a bid to win back customers and simplifying what he described as an “overly complex menu”.

Starbucks launched its Oleato range – which included an iced shaken espresso and a latte with olive oil and oat milk – in Italy in February 2023, extending it to the USA in January 2024. A Starbucks press release in 2023 said former CEO Howard Schultz came up

with the idea “after being introduced to the Mediterranean custom of taking a spoonful of olive oil each day”.

However, the drinks received mixed reactions, with some customers reporting stomach aches or bowel problems, the BBC wrote.

Consumer goods giant Unilever has completed the sale of its Russian subsidiary to Russian perfume, cosmetic and household products manufacturer Arnest Group.

The owner of brands including Dove soap and Hellmann’s mayonnaise said the sale included all of its business and four factories in Russia as well as its business in Belarus.

“Over the past year, we have been carefully preparing the Unilever Russia business for a potential sale. This work has been very complex, and has involved separating IT platforms and supply chains, as well as migrating brands to Cyrillic,” Unilever CEO Hein Schumacher said on 10 October.

“The completion of the sale ends Unilever

Russia’s presence in the country.”

Although Unilever was the first major European food company to stop imports into and exports out of Russia, the company’s continued presence in Russia following the invasion in February 2022 had been criticised by campaigners and Ukraine’s government, Reuters wrote on 10 October.

Achieve growth targets and pro tability by partnering with Crown. Bring sustainable plant-based proteins to market with Crown’s technical expertise and Global Innovation Center. From feasibility, trials and toll processing to commercial sized operations, Crown’s experience, R&D and full lifecycle process provide guidance and support at every step. For dehulling, de-oiling, white akes, and protein concentrates, Crown’s plant protein technologies and custom engineered solutions allow you to develop and produce consistent products with the highest protein quality. Partner with Crown to turn your plant-based protein ideas into pro table revenue streams. Premium plant protein is in high demand. Deliver it with CPM and Crown.

Human Food | Animal Feed | Aqua Feed Contact CPM and Crown today 1-651-894-6029 or visit our website at www.crowniron.com

&

EU/UKRAINE: Two-thirds of rapeseed imports into the EU were supplied by Ukraine in the first quarter of the current crop year, according to a 18 October report by Germany’s Union for the Promotion of Oil and Plant Proteins (UFOP).

From the beginning of the crop year to 6 October, EU27 imports of rapeseed totalled 1.41M tonnes, a rise of just over 17% compared to the previous year.

Demand for imports was high this season due to the bloc’s below average 2024 harvest, the report said.

Supplying 960,400 tonnes, a 68% share of imports and a 60% rise from the previous year, Ukraine remained the most important country of origin. However, the country is unlikely to sustain this export volume due to a 25% decline in its harvest compared to the previous year, according to research by Agrarmarkt Informations-Gesellschaft.

Australia was the EU’s second most important rapeseed supplier, delivering 351,800 tonnes and accounting for 25% of EU rapeseed imports. Supplying 56,200 tonnes, Moldova ranked third although most of its rapeseed was likely to have originated in Ukraine, the report said. Canada could increase its share of imports due to its bumper crop and the loss of China as an importing country.

The European Parliament (EP) voted on 14 November to delay the implementation of the EU Deforestation Regulation (EUDR) by one year.

Originally due to take effect on 30 December 2024, the law will ban the sale in the EU of seven commodities linked to deforestation – palm oil, soyabean, timber, rubber, coffee, cocoa and cattle. The law is now expected to come into force on 30 December 2025 for large companies and 30 June 2026 for micro and small enterprises.

The EP said the additional time would help operators around the world to implement the rules smoothly from the start without undermining the objectives of the law.

In its decision to delay the legislation, the EP also adopted other amendments proposed by lobbying groups, including the creation of a new category of countries posing “no risk” on

deforestation in addition to the existing three categories of “low”, “standard” and “high” risk. Countries classified as “no risk” – defined as countries with stable or increasing forest area development – would face significantly less stringent requirements as there is a negligible or non-existent risk of deforestation. The European Commission (EC) will finalise a country benchmarking system by 30 June 2025.

Before coming into force, the agreed EUDR text must be approved by both the European Commission and the EP and published in the EU Official Journal.

According to UN Food and Agriculture Organization estimates, EU consumption represents around 10% of global deforestation, with palm oil and soyabeans accounting for more than twothirds of the total. (See also 'EUDR delayed', p20)

Futures and options exchange

Bursa Malaysia launched a US dollar-denominated, Used Cooking Oil (UCO) FOB Straits (Platts) Futures Contract

(FUCO) on 16 December.

A total of 42 contracts, representing 1,050 tonnes of UCO was traded at the closing of the first trading day.

The launch of FUCO follows a licensing agreement with S&P Global Commodity Insights for Bursa Malaysia to use the Platts UCO FOB Straits price assessment for the calculation of the FUCO final settlement price.

"Currently, UCO transactions are primarily conducted on a spot or back-to-back basis, leaving many stakeholders vulnerable to price fluctuations," Bursa Malaysia said. "FUCO addresses this gap by offering a reliable and transparent platform for price discovery and hedging, helping stakeholders plan their operations and manage risks."

India’s Adani Group said it had enough cash flow to cover debt obligations as it sought to reassure creditors after billionaire founder Gautam Adani was indicted for fraud by US prosecutors, Business Standard reported on 25 November.

On 20 November, criminal charges were filed against Adani and other senior executives, alleging that they had been involved in a US$265M bribery scheme to win contracts for Adani’s renewable energy company, expected to yield more than US$2bn in profits over 20 years, the BBC

reported on the same day.

The group dismissed the allegations as baseless and said it would seek all possible legal recourse, Business Standard wrote.

Following the US Department of Justice criminal indictment and US Securities and Exchange Commission civil complaint, the group’s market value dropped by almost US$27bn at one point and one of its entities had been forced to cancel a US$600M bond offering, the report said.

An Indian multinational conglomerate founded by Gautam Adani in 1988 as a

commodity trading business, Adani Group’s businesses include food and beverage conglomerate Adani Wilmar as well as subsidiaries in sea and airport management, electricity generation, transmission, mining, natural gas, food, weapons and infrastructure.

Adani Wilmar is a joint venture between Adani Enterprises and Wilmar International and supplies a range of edible oils, vanaspati, speciality fats and oleochemicals. The company’s edible oil products include soyabean, palm, sunflower, rice bran, mustard, groundnut and cottonseed oils.

BRAZIL: Global agribusiness giant Bunge has achieved its 100% traceability and monitoring target for its direct and indirect soyabean purchases in priority regions of the Cerrado biome in Brazil, World Grain reported on 22 November.

Priority regions at risk of deforestation in the Cerrado included the Brazilian states of Maranhão, Tocantins, Piauí, Bahia and Mato Grosso.

Following on from its work in tracking and monitoring direct soyabean purchases from farmers in 2020, the company achieved 100% tracking and monitoring of its indirect purchases from local grain resellers in October using satellite monitoring, World Grain wrote.

Bunge said its Sustainable Partnership programme, which fosters socio-environmental governance in the soyabean value chain, had helped it reach its goal.

At the time of the report, more than 90 resellers had participated in the initiative in Brazil, the company said.

Since 2021, the initiative had shared knowledge, methodologies and tools with cooperatives and grain resellers to support them in structuring their own traceability, monitoring and supplier verification systems, Bunge said. This included access to verification systems such as satellite and farm-scale images, remote sensing, artificial intelligence and structured data for traceability and monitoring.

The Roundtable on Sustainable Palm Oil (RSPO) adopted major new standards at its 21st RSPO general assembly in Thailand on 13 November.

RSPO members voted to adopt the 2024 RSPO Principles and Criteria (P&C) and Independent Smallholder (ISH) Standard, which would take effect in 12 months following a transition period, the RSPO said.

Key improvements of the 2024 RSPO Standards included refining the approach to deforestation and environmental sustainability to ensure responsible land clearing, plus a new indicator on water consumption to address potential future water scarcity issues, the RSPO said. Other improvements included the introduction of human rights due diligence; strengthening smallholder inclusion; and streamlining the audit process for members, certification bodies and accreditation bodies.

Although welcoming the new standard’s provisions to halt deforestation, prohibit planting on peat and better protection of workers’ and communities’ rights, the Environmental Investigation Agency (EIA) said a range of challenges remained for the RSPO.

To date the RSPO had failed to ensure adequate compliance with its standard, and only half of RSPO-certified palm oil had been sold, the EIA said on 16 November. In addition, criteria around legality had not been significantly strengthened. As plantations only needed to be legal at the time of certification, they could have previously operated illegally and then subsequently legalised themselves, the EIA said.

There are also still exceptions to the ‘no deforestation’ rule in the new P&C which will potentially allow some forests to be cleared, according to the EIA.

EU olive oil production is set to increase by 32% in 2024/25 compared to last season after two challenging years, according to latest projections by the European Commission reported by Olive

Oil Times on 18 October.

This would bring estimated total production to 2M tonnes, compared with 1.53M tonnes in 2023/24 and 1.39M tonnes in 2022/23.

The EU is the world's larg-

est producer of olive oil, accounting for 69% of production. Drought and heatwaves in the previous two years had slashed production and doubled prices.

The expected surge in olive oil availability was likely to influence prices, which had fallen slightly since their peak in January 2024, Olive Oil Times wrote.

Meanwhile, a 10% rise in exports was expected for the new season while imports were set to drop by 7%.

Overall consumption in the EU could also rebound by as much as 7% if prices at origin continued to decrease and those reductions were passed on to consumers, Olive Oil Times wrote.

Global agribusiness giant ADM cancelled a conference call with analysts to discuss its third-quarter earnings due to more concerns about its accounting practices, World Grain reported on 6 November.

First announced in January, ADM was still working to correct issues with its financial reporting of transactions between its business units, the report said.

Despite cancelling the meeting sched-

uled to take place on 5 November, the company announced earnings results from the quarter ended 30 September, but said the published figures were “preliminary and unaudited”.

ADM said it would make formal corrections “as soon as reasonably possible” but did not expect the changes would have a “material impact” on the quarterly results.

The third-quarter results included ad-

justed net earnings forecast at US$530M. The Ag Services and Oilseeds and Nutrition segment posted an operating profit of US$480M, down 43% compared to the same quarter the previous year, due to softer than expected market conditions and the pace of planned improvement efforts.

Since announcing its accounting issues, ADM’s stock price had dropped by 25%, World Grain wrote.

INDONESIA: The Ministry of Energy and Mineral Resources (ESDM) says seven to nine additional biodiesel plants are needed to meet a target of blending 50% palm oil-derived biodiesel into diesel (B50), scheduled to be implemented by 2026, Indonesia Business Post reported on 11 November.

“The current domestic production of 15.8M kilolitres needs to increase by an additional 3.9M kilolitres to achieve the B50 goal,” ESDM Director of Bioenergy Edi Wibowo said at the Indonesia Palm Oil Conference in Bali on 7 November. A capital requirement of US$360M was needed for the new plants, without which B50 implementation might be delayed, he said.

B35 was introduced in Indonesia in February 2023, with a B40 programme set to roll out this month.

Meanwhile, Indonesian Palm Oil Association chairman Eddy Martono said at a press conference on 30 October that implementing B50 had the potential to reduce palm oil exports by up to 6M tonnes, which would lead to a slowdown in the drive to increase production.

THAILAND: Thai energy firm Bangchak Corporation is set to expand its used cooking oil (UCO) collection network as part of its plan to produce sustainable aviation fuel (SAF) at a new 1M litres/day facility near its refinery in Phra Khanong district, due to start operations in the first quarter of this year, the Bangkok Post wrote on 15 October.

The company had signed an agreement with New Biodiesel to buy UCO collected in southern regions of the country. Bangchak had also acquired a 45% share in Thanachok Vegetable Oil Co, which specialises in palm oil production and UCO collection.

The Court of Justice of the EU (CJEU) has upheld a December 2022 European General Court decision to retain countervailing duties on Indonesian biodiesel imports into the EU, putting an end to four years of litigation.

The CJEU rejected an appeal lodged by two Indonesian exporters against the 2022 European General Court decision, the European Biodiesel Board (EBB) said on 17 October.

In November 2019, the EU imposed five-year tariffs on Indonesian biodiesel ranging from 8-18% to counter subsidies giv-

en to producers in the country, Bloomberg wrote at the time.

Indonesian exporters appealed against the tariffs but the General Court rejected their claims in its December 2022 judgement.

Indonesian producers PT Pelita Agung Agrindustri and PT Permata Hijau Palm Oleo then appealed against the General Court’s decision, claiming that the judgement misinterpreted World Trade Organization (WTO) Panel reports.

“This [latest] ruling comes at a critical moment as the counter-

vailing duties will soon expire unless an expiry review investigation concludes there is a need to extend them for another five-year period,” EBB secretary general Xavier Noyon said. “The ruling marks a new milestone for EBB in its continuous battle to fight against unfair imports of biodiesel and restore a level playing field in the EU.”

The EBB said Indonesia had now brought this issue before the WTO, as it had anticipated the claims from Indonesian exporters would be unsuccessful before the EU courts.

Brazilian President Luiz Inacio Lula da Silva introduced a Fuel of the Future law on 8 October in a bid to increase the use of biofuels, a statement on the government website Planalto said.

The PL 528/20123 law increases the biodiesel blend in diesel – currently at 14% – by 1% annually from 2025 to reach 20% by 2030. It also establishes national programmes for green diesel and sustainable aviation fuel (SAF), and provides incentives for biomethane.

“[The law] will generate over BRL 260bn (US$46.9bn) in investments in agribusiness and the biofuels chain,” Minister of Mines and Energy Alexandre Silveira said.

Due to start in 2027, the National Program for Sustainable Fuel for Aviation will require air operators to use SAF to reduce greenhouse gas emissions (GHG) from domestic flights. The target will begin with a 1% reduction and will

increase to 10% by 2037. A National Program for Green Diesel and National Program for the Decarbonization of Natural Gas Producers and Importers and for the Promotion of Biogas would also be formed.

The US state of California has voted for a 30% carbon intensity reduction of its transportation fuel pool by 2030 and 90% by 2045 under updates to its Low Carbon Fuel Standard (LCFS), the California Air Resources Board (CARB) announced on 8 November.

The LCFS reduces air pollution and greenhouse gas (GHG) emissions by setting a declining carbon intensity target for transportation fuels used in California; producers that do not meet established benchmarks can buy credits from others that do meet targets.

California is responsible for driving the USA’s surge in renewable diesel capacity and production, according to a US Department of Agriculture Foreign Agricultural Service report ‘Renew-

able Diesel Production Growth Drastically Impacts Global Feedstock Trade’ published in June 2024. As renewable diesel did not have a blending limit, an influx of private investment had increased production capacities, spurred by the long-term demand stability created by the LCFS, the report said. Between 2020 and 2023, growth in Californian consumption of renewable diesel was more than double the consumption in the rest of the USA. Biomass-based diesel also accounted for about 60% of the California diesel pool, while the rest of the USA remained in the low single digits, the report added.

CARB said that, to date, the LCFS had replaced 70% of diesel used in the state with cleaner alternatives.

The US Environmental Protection Agency (EPA) has approved bio-manufacturing firm Locus Fermentation Solutions’ (Locus FS) expanded list of biosurfactants for consumer and industrial use.

Industrial-scale production of biosurfactants in the USA requires EPA Toxic Substance Control Act (TSCA) registration through a Premanufacture Notice (PMN) approval process.

Following the EPA’s granting of TCSA certification, Locus FS’ range of glycolipids had approval for use in all industrial and

THE NETHERLANDS: Finnish renewable fuels producer Neste shut down its refinery in the Maasvlakte area of the Port of Rotterdam, following a fire on 8 November.

Neste said production at the Rotterdam refinery would be down for several weeks, leading it to lower its 2024 renewable products and sustainable aviation fuel (SAF) sales volume figures.

In the its revised 2024 guidance, renewable products were expected to rise from 2023 to reach around 3.7M tonnes in 2024, including SAF sales of 0.35M-0.55M tonnes.

This compares to its previous guidance, which projected renewable product sales of 3.9M tonnes in 2024, including 0.35M-0.55M tonnes of SAF.

GERMANY: Chemical giant BASF announced a partnership on 5 November with biotechnology company

Acies Bio on a project to develop fermentation technology to produce fatty alcohols from methanol.

With the aim of developing a commercially viable technology to diversify raw materials for home and personal care products, BASF’s Care Chemicals division would use Acies Bio’s OneCarbonBio platform to convert methanol into a range of chemical raw materials.

consumer applications, including in agriculture, energy, industrial and consumer products, the company said on 17 October.

The approval included both linear and lactonic, and hydrolysed and non-hydrolysed versions of the company’s glycolipids.

“Expanding the list of TSCA-approved biosurfactants … broadens the availability of sustainable chemical alternatives. Demand from formulators seeking … eco-friendly biosurfactants has been and continues to be high,” Locus FS vice president of Global Regulatory Affairs &

Strategy Dr Maxwell Shumba said.

Locus FS’ Amphi sophorolipids biosurfactants are sourced from non-palm oil fatty acids and carbohydrates and do not contain 1,4-dioxane, formaldehyde, ethylene oxide (EO) or other Proposition 65 regulated trace chemicals.

The sophorolipids had cleaning properties and could act as emulsifiers, solubilisers and wetting or coalescing agents.

Locus FS also had REACH registrations from the EU European Chemicals Agency and the UK, it said.

Belgian start-up AmphiStar has launched a range of waste-based biosurfactants aimed at the personal and home care markets.

Sourced from local biowaste and side streams from agrifood processing, the AmphiCare and AmphiClean ranges were produced using microbial fermentation, the company said on 8 October.

The launch followed the company’s announcement in April that it had secured US$6.43M in funding from the European Circular Bioeconomy Fund, Qbic III and Flanders Future Tech Fund to launch the range. At that time, the company said it planned to build a 1,000 tonnes/year launch plant.

AmphiCare is designed for use in cosmetic products such as shampoos, makeup removers and other skincare products, while AmphiClean is aimed at the home care

market such as multi-surface cleaners, dishwashing products and detergents.

The company’s biosurfactant platform is based on the yeast organism Starmerella bombicola, which is used to produce over 25 specific variants of glycolipid biosurfactants. Feedstocks included conventional first-generation biomass feedstocks like glu-

cose and fatty acids derived from locally-sourced plant oil, and second generation biomass feedstocks such as crude glycerine and food waste.

Following the launch of its first commercial biosurfactant last year in partnership with sustainable cleaning product company Ecover, the company said it was looking to form further partnerships.

Japanese brewer and distiller Suntory Group is set to introduce polyethylene terephthalate (PET) bottles produced using paraxylene derived from used cooking oil (UCO) for select products.

The material would be used in about 45M PET bottles from November and there were plans to expand its use across Suntory’s product portfolio, the firm said on 28 October.

PET resin, the raw material for PET bottles, comprises 30% monoethylene glycol (MEG) and 70% terephthalic acid (TPA). Although Suntory had been using plant-derived materials for MEG in its Suntory Tennensui brand PET bottles since

2013, the use of UCO-derived paraxylene meant it could produce TPA at commercial scale, it said.

As part of its initiative, Suntory had set up a supply chain collaboration with corporations such as ENEOS and Mitsubishi to source bio-naphtha derived from UCO, including sourcing bio-naphtha from ENEOS’ sustainable aviation fuel (SAF) plant, due to become operational after 2027. In 2023, Suntory Holdings also announced a collaboration with ENEOS to collect UCO in Japan.

As of 2023, more than half of Suntory’s soft drink bottles sold in Japan used 100% recycled PET bottles, the company said.

Declining water levels in the upstream sector of the Paraná River in Argentina, due to the dry season, have disrupted water transportation and led to increased prices for soyabean oil and biodiesel in Brazil, Palm Oil magazine wrote on 7 October.

According to data from maritime agencies T&T and Antares, the depth of the Paraná River at San Lorenzo – a key hub for soyabean oil transportation – dropped to 9.44m on 20 September, the lowest level since January 2023. As a result, traders had been forced to reduce the capacity of tanker ships docking at Argentine ports by 5%-

UKRAINE: A Russian missile struck a grain ship docked at the Port of Odessa on 7 October, killing one person and injuring five crew members, Reuters wrote on 8 October, adding that the ship was the 21st civilian vessel to be damaged by Russia since it invaded Ukraine in February 2022. The strike followed an attack the previous day on a vessel carrying 6,000 tonnes of corn at the nearby Port of Pivdennyi.

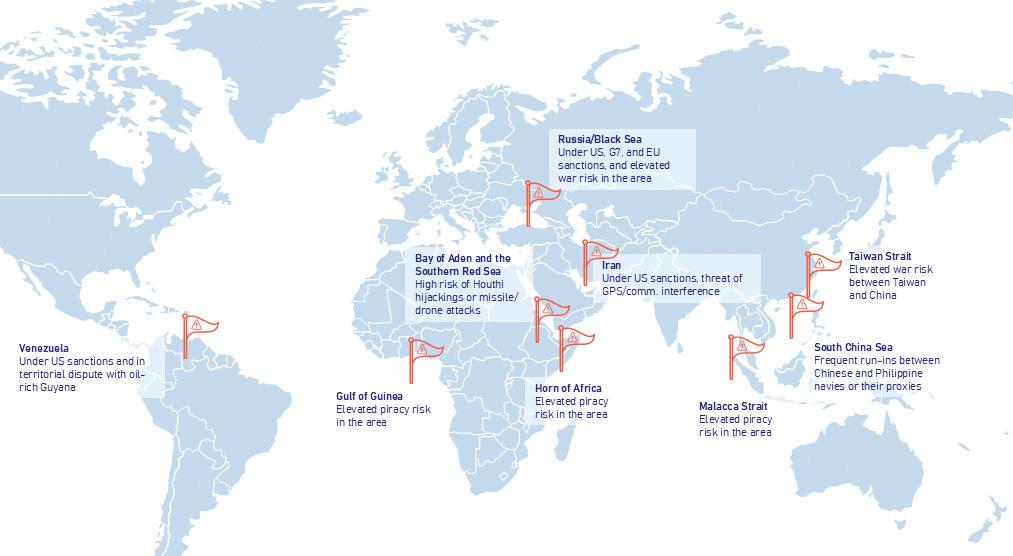

EUROPE: The Mediterranean Sea will become an emission control area (ECA) from 1 May 2025, under which ship sulphur content will need to be reduced from 0.5% to 0.1% unless a vessel scrubber is fitted, Riverside Tanker Chartering wrote in its November market report.

ECAs are sea areas where strict controls were established in 2005 to minimise airborne emissions from ships under the International Convention for the Prevention of Pollution from Ships. Specific emissions include sulphur oxide, nitric oxide, ozone depletion substances and volatile organic compounds.

Current ECAs are the Baltic Sea, North Sea, North American Area West, North American Area East, Hawaii and US Caribbean.

12.5%. Tanker ships reducing their capacity by 12.5%, for example, could only transport around 28,000 tonnes of soyabean oil, compared to the usual 32,000 tonnes.

Meanwhile, drought conditions had also affected key Brazilian rivers, with water levels at their lowest since records began in 1950, according to a 11 October Splash247 report.

On the Tapajos waterway, grain shipments were brought to a standstill, World Grain wrote on 11 October. Tapajos linked Brazil’s central and northern regions and was an important transport corridor for

leading agricultural states, including Mato Grosso – Brazil’s top soyabean producer –to ports in the Amazon region.

Brazilian port terminal firm Amport, which represents companies such as Cargill and Louis Dreyfus, told Reuters that barge convoys in the Tapajos had been halted since 4 October but were expected to resume in November if rainfall rose as forecast.

Drought conditions had also halted grain shipments in September through the Madeira River, World Grain wrote, a key corridor for Rondônia and Mato Grosso states.

The Port of Oshawa Grain Export Terminal in Ontario, Canada has received its first test shipments of soyabeans.

The joint venture between QSL and Hamilton-Oshawa Port Authority (HOPA Ports) was currently undergoing a C$35M (US$25.4M) expansion and modernisation project, HOPA Ports said on 16 October.

As part of the project – led by HOPA Ports and backed by a C$14M (US$10.07M) contribution from the government of Canada’s National Trade Corridors Fund – the terminal’s storage capacity had been increased to 20,000 tonnes and featured a vessel

loading rate of up to 12,000 tonnes/day. In addition, a new 700 tonnes/hour dual truck unloading structure would streamline deliveries and mini-

mise delays, HOPA Ports said. Upgrades at the terminal also included weather protection and a modern dust control system.

Singapore overtook Rotterdam as the largest global bio-bunkering port in the third quarter of 2024, according to Ship & Bunker data reported by Port News on 25 October.

Although Singapore had been the world’s largest conventional bunker port for decades, it had been slower to develop an alternative fuels market, with Rotterdam leading on both biofuel bunker blends and liquefied natural gas (LNG) as a marine fuel, the report said.

In third quarter 2024, Rotterdam’s biofuel sales fell to 137,175 tonnes, down by 41.4% from the previous quarter and by 25.1% year-onyear. Meanwhile Singapore’s jumped to 227,000 tonnes, up 26.4% from the previous quarter and by 67.5% year-on-year.

“Strong sales of bio-blended bunkers in Singapore could be one of the reasons for this decline [in Rotterdam],” Ronald Backers, head of liquid

bulk business intelligence at the Port of Rotterdam, was quoted as saying in a social media post.

The Netherlands government significantly reduced its subsidies for marine biofuel sales in 2024, Port News wrote.

However, the FuelEU Maritime regulation coming into force this year was expected to boost biofuel sales in Rotterdam, as well as Singapore, the report added.

▪ Biofuel supplier GoodFuels has halted deliveries to Singapore, as part of a consolidation of the firm’s global operations, Ship & Bunker wrote on 6 November. A company representative said after evaluating market conditions, the company had decided to focus on its activities in Europe and centralise operations at its headquarters in the Netherlands, while continuing to serve its clients base with physical biofuel deliveries in the Amsterdam/Rotterdam/Antwerp (ARA) region.

20-21 January 2025

Fuels of the Future 2025 Berlin, Germany www.fuels-of-the-future.com/en

30 January 2025

International Rendering Symposium, part of the International Production & Processing Expo Atlanta, Georgia, USA www.ippexpo.org/education-programs

13-14 February 2025

Black Sea Grain Europe 2025 Prague Marriott Hotel, Czech Republic https://ukragroconsult.com/en/ conference/black-sea-graineurope-2025/

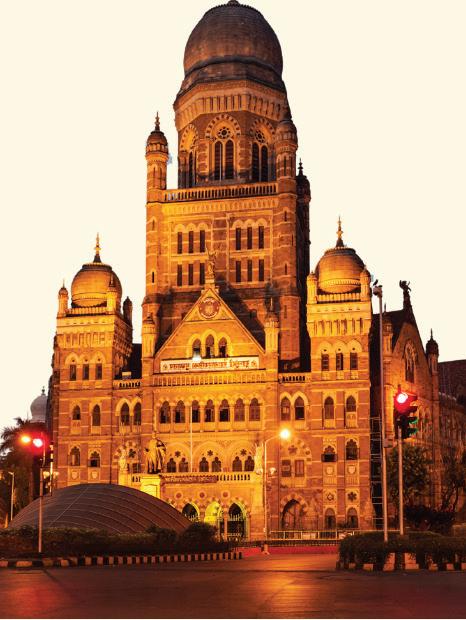

24-26 February 2025

Palm & Lauric Oils Price Outlook Conference & Exhibition (POC 2025) Shangri-La Hotel, Kuala Lumpur, Malaysia www.pocmalaysia.com

6-8 March 2025

Fats & Oils International Conference –Exhibition (FOIC)

JW Marriott Sahar, Mumbai, India https://foic.org.in/

10-11 March 2025

2nd The Future of Oilseeds: Prospects for Plant based Proteins? Frankfurt, Germany www.dgfett.de/meetings/aktuell/

16-18 March 2025

NIOP Annual Convention Omni Rancho, Las Palmas Resort & Spa California, USA https://niop.org/annual-convention-2024/ 18-20 March 2025

International Biomass Conference & Expo Cobb Galleria Centre, Atlanta, Georgia, USA https://ibce.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Home

2-3 April 2025

13th European Algae Industry Summit Antwerp, Belgium www.wplgroup.com/aci/event/europeanalgae-industry-summit/

For a full events list, visit: www.ofimagazine.com Information subject to change

Be part of the annual global gathering of the palm and edible oil industry professionals at the 36th Palm and Lauric Oils Conference & Exhibition (POC2025) organised by Bursa Malaysia Derivatives. This event will be held from 24-26 February 2025 at the Shangri-la Hotel, Kuala Lumpur, Malaysia.

POC2025 provides valuable networking opportunities and a platform for participants to deliberate on topics surrounding the supply and demand of major edible oils, receive updates on the latest price forecasts and discuss trade possibilities.

Participants can take advantage of this exclusive platform to connect with industry leaders, investors and decision-makers. Elevate your brand presence and engage with potential clients. Forge strategic alliances with key stakeholders to enhance your business position and shape the future of the industry.

Bursa Malaysia Derivatives (BMD), the organiser of POC2025, is a wholly owned subsidiary of Bursa Malaysia Berhad which provides, operates and maintains a futures and options exchange. BMD offers the most liquid and successful Crude Palm Oil Futures (FCPO) contract in the world, consolidating Malaysia’s position as the global centre for palm oil price discovery.

For further enquiries, please contact: Bursa Malaysia Derivatives Berhad E-mail: poc@bursamalaysia.com Website: www.pocmalaysia.com

7-8 April 2025

8th Leipzig Symposium

Leipzig, Germany www.dgfett.de/meetings/aktuell/

27-30 April 2025

AOCS Annual Meeting & Expo Portland, Oregon, USA https://annualmeeting.aocs.org/

4-7 June 2025

EFPRA Congress 2025 Riga, Latvia https://efpra.eu/events

9-11 June 2025

Sustainable Fuels Summit: SAF & Renewable Diesel & Biodiesel Chi Health Center, Omaha, Nebraska, USA https://few.bbiconferences.com/ema/ DisplayPage.aspx?pageId=Sustainable_ Fuels_Summit__SAF__Renewable_ Diesel__Biodiesel

10-11 June 2025

IGC International Grains Conference London, UK www.igc.int/en/conference/reginfo.aspx

11-12 June 2025

Oleofuels 2025 Barcelona, Spain www.wplgroup.com/aci/event/oleofuels

4-5 September 2025

12th High Oleic Congress Amsterdam, the Netherlands https://higholeicmarket.com/hoccongress-2/

12-15 October 2025

Euro Fed Lipid Congress and Expo Leipzig, Germany https://veranstaltungen.gdch.de/ microsite/index.cfm?l=11649&modus=

22-25 October 2025

North American Renderers Association Annual Convention Ritz Carlton Bacara, California, USA https://convention.nara.org

18-20 November 2025

MPOB International Palm Oil Congress and Exhibition (PIPOC 2025) Kuala Lumpur, Malaysia https://pipoc.mpob.gov.my/

‘outside’

John Buckley

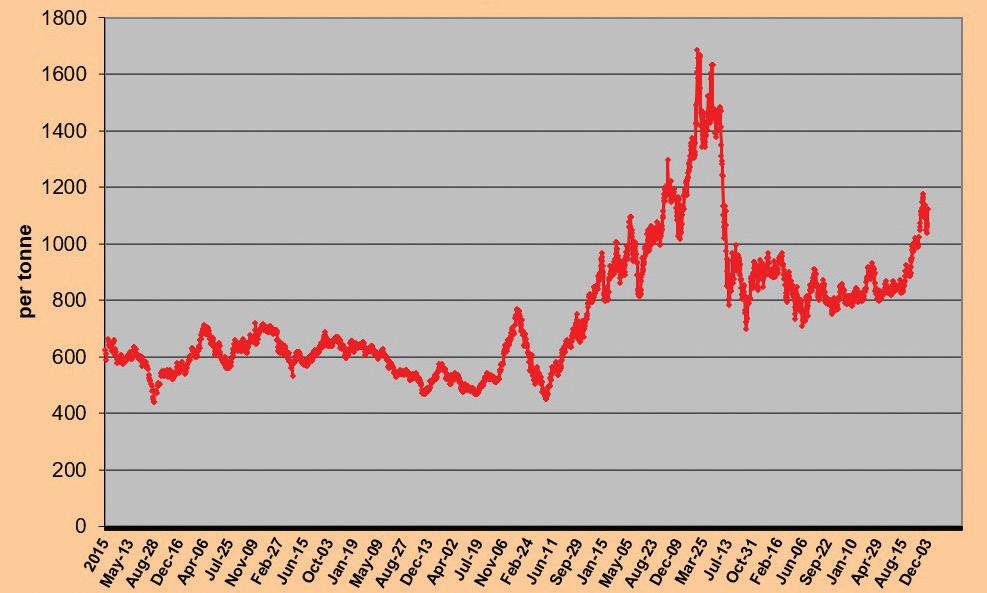

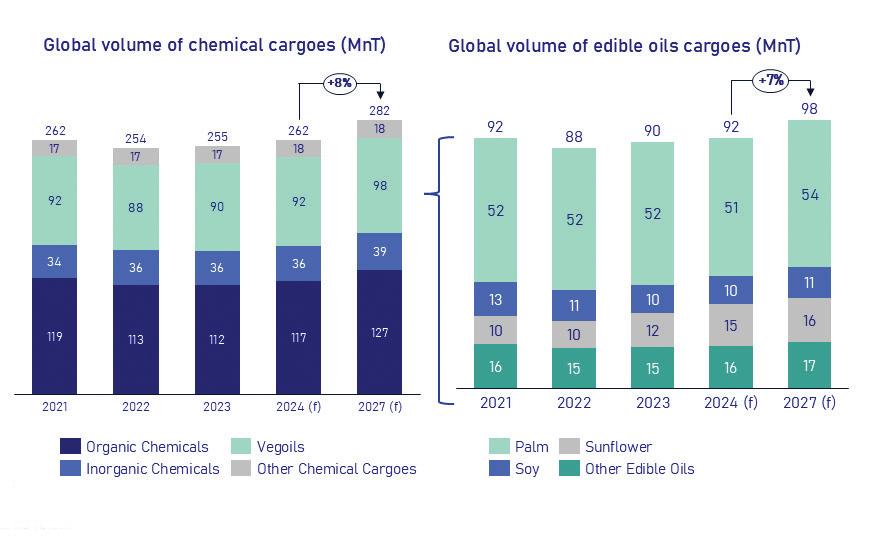

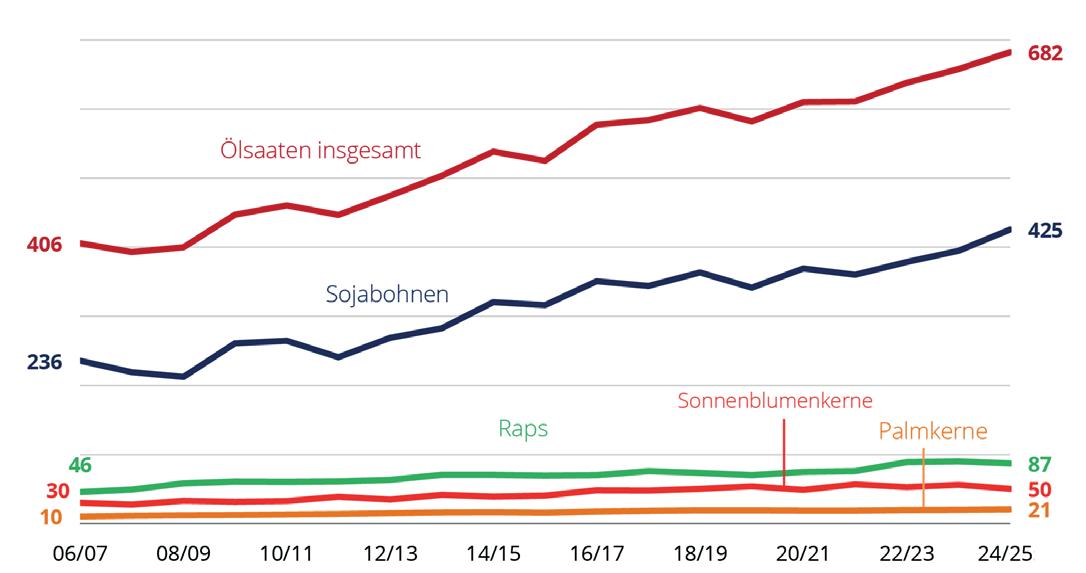

Smaller than expected 2024 crops, widespread geopolitical strife and growing competition for supplies from biodiesel users recently combined to push global average vegetable oil prices to their highest level since early 2023. A near-19% increase* since mid-year 2024 raised oil’s contribution to crush margins just as meal prices deflated. But will the oil boom last long enough to spur crush plant expansion?

All four major oils have contributed to the price upturn in recent months as weather issues trimmed crops. Not surprisingly, the biggest single influence on the supply side has been palm oil, with its 35% share of global vegetable oil consumption (versus soyabean’s 29%, canola’s 15% and sunflower’s 8.5%).

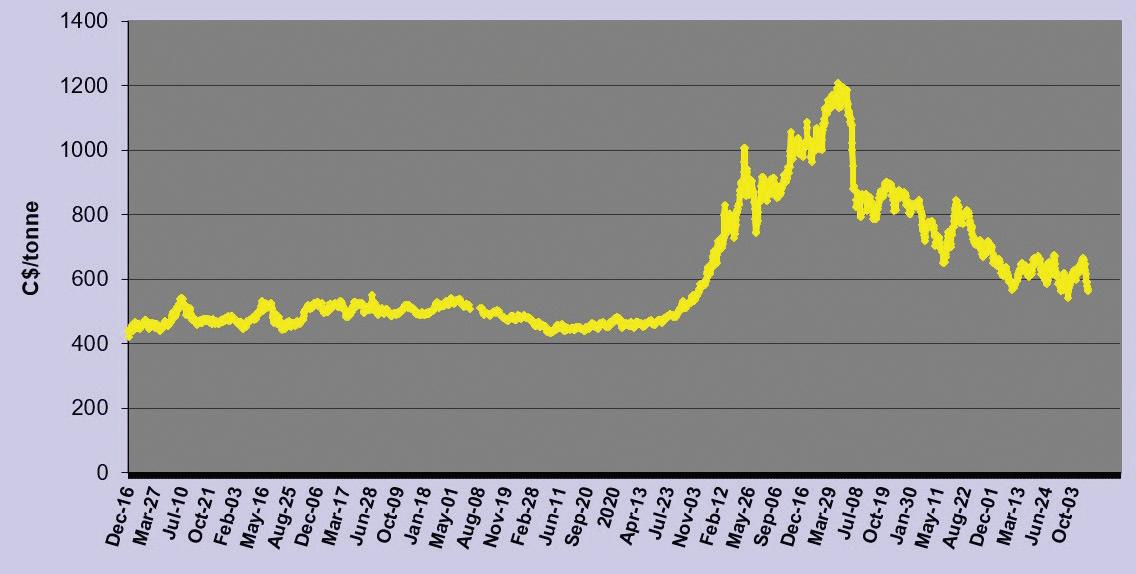

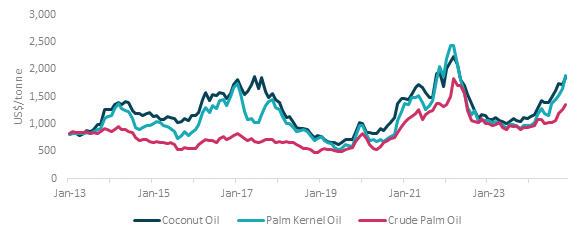

Under the twin pressures of disappointing Asian output and ever-expanding demand from the Indonesian biofuel sector, palm oil prices on the Bursa Malaysia futures market – which were trading the equivalent of US$800/tonne in mid-2024 – recently went as high as US$1,180/tonne, a level last seen in mid-2022 (see Figure 1, above).

The prospects for palm oil are mixed. A recent industry conference in Bali heard that global production could rally by well over 2M tonnes in the 2024/25 marketing year, mainly in Indonesia. However, second-largest producer Malaysia’s output looks less promising, expected to dip slightly alongside only modest growth in other, smaller producing countries. In early December, Malaysia’s situation appeared to be worsening under the impact of incessant rain and floods exacerbating the usual seasonal ‘wintering’ impact on yields and production. How that will pan out may not be clear until well into this year. Against the broader, potential recovery in palm supplies is the challenge of how the market will react to the oil’s increased use in biodiesel. Indonesia’s plan to up its blend from 35% to 40% from 2025 is expected to use an additional 3M tonnes, according to its palm body GAPKI. Analysts think that could increase prices further as early as first quarter 2025. Looking for longer term supply relief, traditional consumers will

not take comfort to learn that Indonesia would like to attain a 50% blend by 2028. Thanks to its already massive growth in consumption, Indonesia’s palm oil stocks have already fallen recently to their lowest level in five years.

There may be some restraint from more traditional food demand. As prices soared in the second half of 2024, demand had already begun to back off among some key importing countries. Malaysia’s October exports fell by over 11% and recent private estimates suggested November might see a similar drop. But here too, some mixed trends may be developing. Largest palm importer India, for example, was reported in early December to be facing problems sowing its main rapeseed/mustard crop under unusually hot conditions that could prompt a switch to less heat-sensitive crops. That could mean India having to raise its imports of vegetable oils, usually led by palm.

Another possible pointer to continuing imports is the limited ability of alternative oils to fill the gap – with prices for soyabean, sunflower and rapeseed oils all trending up in last quarter 2024. A few months back, the global oilseed pointers looked more encouraging. World soyabean production had jumped over 4% in the recently-ended 2023/24 season by an estimated 16M tonnes to a record 394M tonnes. The new (Oct 2024/Sept 2025) marketing year promises an even bigger crop of 425M tonnes (up 31M tonnes or 7.9%). But there are caveats.

The US crop, while at a near-record

high 121.4M tonnes (+8.1M tonnes), was recently shown to have been about 3.3M tonnes smaller than expected. This is a reminder that prospective Latin American crop increases of some 20M tonnes for 2024/5 are not yet guaranteed. As we went to press, these had only recently been sown after some delays from a dry spell. Fortunately, rainfall has recently improved markedly, putting a record harvest back on line. In fact, the USDA may even under-estimate Brazil’s potential by some 3M-4M tonnes if the more optimistic local analysts prove correct.

Even if all the major soyabean crops come through, the oilseed only yields an average 19% of oil, less than half that of some other major soft oilseeds like canola. The US Department of Agriculture (USDA) sees soyabean crush reaching 346M tonnes in 2024/25 to release 65.5M tonnes of oil (2.7M tonnes up on 2023/24). However, even accounting for the share taken by food use, total soyabean consumption forecasts point to a massive build-up in global soyabean stocks, from 112.4M tonnes to 131.7M by September 2025 (against 101M tonnes in 2022/23 and just 92.6M tonnes in 2021/22).

That means more soyabeans could be crushed if the price incentive is there and spare crush capacity can be made available. In the last few years, crush expansion has been focused heavily in Latin America, China and the USA. In the weeks and months ahead, the markets will be keeping their usual close watch on Latin American crop weather. Further forward, the focus u

Be the first to know.

e. taikoclaymkt@taikogroup.net

t. +603 7660 7716

w. taikoclaygroup.com

e office@taikogroup.eu

t +31 10 800 5479

turns to US soyabean planting intentions which the USDA’s annual baseline projections already suggest will shrink for 2025 – from 87.1M acres (35.2M ha) to 85M acres (34.3M ha) as maize takes back some of the area it reduced in 2024. However, plans could alter if the soyabean/ corn price ratio shifts before planting time.

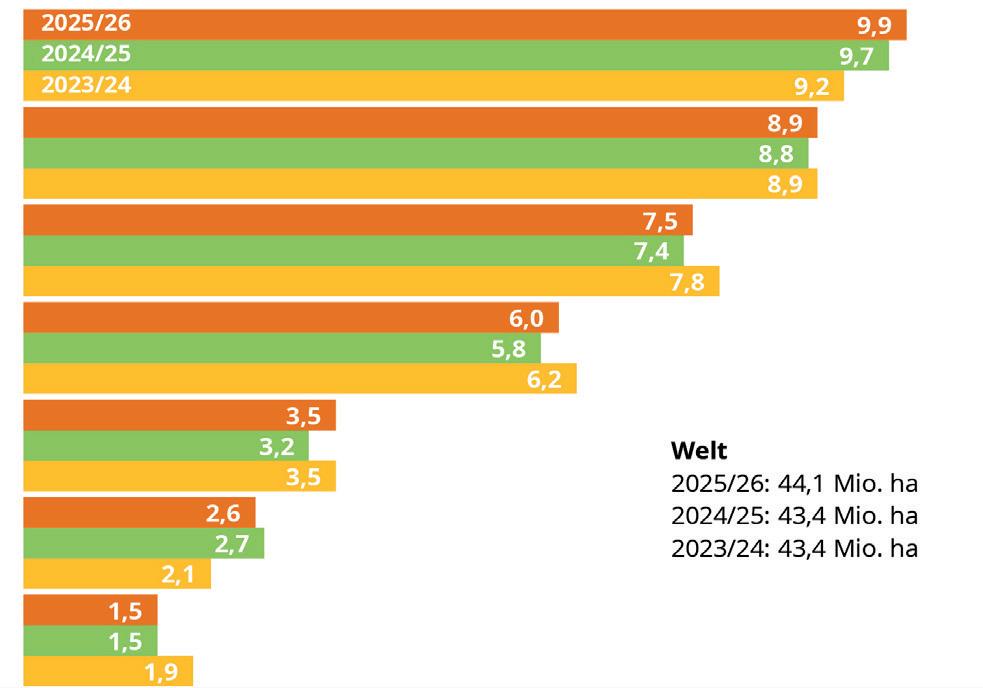

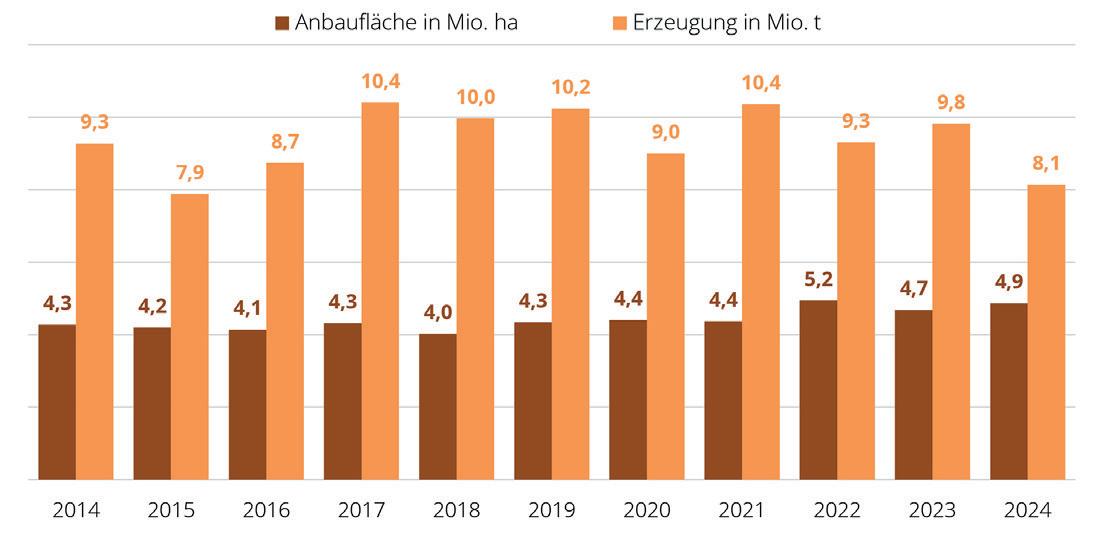

Until September, world prices of sunflower and rapeseed oils had been reversing increases made in earlier months, largely reflecting a slowdown in global sunflowerseed oil demand and the approach of seasonal rapeseed harvest pressure in Canada and Europe. However, a less encouraging picture has been emerging for both oilseeds recently. For sunflowerseed, the main issue has been disappointing crops in major exporter Ukraine and in Europe itself. Ukraine’s 2024 estimate was recently cut by 1M tonnes to total 12.5M tonnes, putting it 3M tonnes under 2023’s. Russia’s sunflowerseed crop was also seen falling by over 1M tonnes to some 16M tonnes. In the EU, constant problems with weather cut Bulgarian and Romanian yields to ‘disastrous’ levels, their lowest in 15 years, according to French analyst Strategie Grains. Hungary’s yield also dropped below normal while weatherdelayed crop development in France looked ominous for this key producer’s contribution. Strategie cut its total EU sunflowerseed crop forecast to 8.9M tonnes versus 2023’s 9.8M tonnes and the USDA’s 2024 forecast of 9.4M tonnes. Strategie also reduced its EU 2024 rapeseed crop estimate recently for the fifth month running, to just 16.7M tonnes, a drop of 16.5% from 2023’s near 20M tonnes and compared with the USDA’s 17.35M tonnes. Amid growing demand for rapeseed/canola oil, this suggests

a widening EU supply deficit and, with other gaps in the global balance sheet, a potential further rise in EU rapeseed prices.

Among other major suppliers, Canada’s hopes of a larger crop than 2023’s 19.2M tonnes were dashed with the final estimate from official body Statistics Canada of just 17.85M tonnes. With both exports and domestic crush up so far this season – and going faster than the pace required to keep within official forecasts – some analysts have already been talking of the need to ration supplies. It was noted that official body AAFC had already raised its seasonal average Canadian price forecast for canola by C$25/tonne to C$660/tonne, although this is under last season’s C$715/tonne.

Another large exporter, Australia’s next rapeseed harvest is on its way but was also seen lower than 2023/22’s 5.9M tonnes, already down sharply from the 2022/23 record of 8.5M tonnes. Overall, the supply fundamentals for forward cooking oil costs are mixed. On the demand side, the USDA estimates that total vegetable oil demand will grow at about 2.6% during the 2024/25 season against supply increases of just 1.9% Soyabeans will help grow world oilseed stocks but the price incentive from the product side – oil and meal - may need to stay high to get enough beans crushed.

In the meantime, palm oil production might pick up but not for many months, when the seasonal ‘wintering’ period of lower Asian harvests ends. Larger Latin American soyabean crops in first quarter 2025 might help restrain prices while EU rapeseed planting for 2025 is expected to increase and sunflower and soyabean acreages hold steady. However, all these harvests will depend on yields determined by distant, currently unknown weather. There is also the ongoing risk of interruption to exports of sunflowerseed from the still war-torn Black Sea region.

Commodity markets generally could attract greater interest from the speculative sector if instability in the Middle East and/ or Eastern Europe spooks funds into ‘buy’ mode – or other consumers join China in stock-building. The question is whether demand for major food commodities will maintain its long-term growth pace if costs rise further, especially if an economic slowdown in China influences a weaker global trend.

The falling cost of crude mineral oil will contribute to the mixed outlook, especially for the biofuel sector. The World Bank recently forecast a 6% drop in the price of Brent crude oil from 2024’s average US$80/barrel to US$73/barrel in 2025 (a four-year low) and a further 2% decline in 2026. The outlook is partly attributed to China’s flat-lining demand since 2023 amid slowing industrial production and rising sales of electric vehicles and liquefied natural gas trucks. The bank’s forecast also saw potential increases in crude oil output from suppliers outside war zones.

Adding another twist has been the incoming US government’s attitude towards climate change with all its possible negative risk for recently expansionist biofuel policies. Ironically, president-elect Donald Trump’s promised punitive tariffs on US imports of waste cooking oil have already set US domestic vegetable oil prices on a firmer tack that some analysts suggest will require faster US crush plant expansion for domestic oilseeds.

US biodiesel use of soyabean oil was expected to reach 6.35M tonnes this season – about 12% more than two years ago. Despite that, given the large soyabean supply, the USDA has (until recently at least) been forecasting that soyabean oil prices will average 9% less this season than last (about 43 cents/lb) and 34% less than in the 2023/24 marketing year.

A complication for this outlook has been the decision by acknowledged climate-change sceptic Trump to appoint a noted biofuel opponent to head the US Environmental Protection Agency. Another factor will be Trump’s proposed 25% tariff on imports from Canada. What effect will this have on Canada’s plans to expand canola crushing to supply rapeseed oil to its main customer, the US biofuel industry? Canada aims to expand crushing from just over 11M tonnes to 17M tonnes over the coming five years. The Winnipeg market was, not surprisingly, taking a bearish view of this news as we went to press (see Figure 2, above). ● *based on UN FAO index, monthly average food prices

John Buckley is OFI’s market correspondent

■ Horizontal agriculture

■ Local mechanical processing

■ Patented system of energy recovery

■ Complex approach including Physical Oil Re ning

■ Unique combination of extruders and screw presses

European oil and fats industry representatives are concerned and green groups are angry that the European Commission (EC) has delayed implementation of the May 2023 European Union (EU) deforestation regulation (EUDR) by a year.

However, industry groups in Malaysia and Indonesia are welcoming the delay as a sensible move, helping them prepare for the new regime.

The EUDR aims to ensure that seven key commodities – cocoa, coffee, palm oil, soyabean, cattle, rubber and timber – and some of their derived products placed on the EU market will no longer contribute to deforestation and forest degradation in the EU and elsewhere in the world.

With the delay, proving compliance will now only be mandatory for large companies from 30 December 2025 instead of the end of 2024, and from 30 June 2026 instead of 30 June 2025 for micro- and small enterprises.

Nathalie Lecocq, director general of the EU vegetable oil and proteinmeal industry association (FEDIOL), told Oils & Fats International (OFI) that postponing the EUDR was “bad news” for companies who had prepared for EUDR application.

“A lot of investments, financial commitments, will be lost. This affects importers and processors in our sectors, both in soya and palm supplies,” she said, with the Cocoa Coalition (including key players Ferrero, Mars, Mondelēz and Nestlé), that use these commodities, also

Reaction to the one-year implementation delay to the EU Deforestation Regulation (EUDR) has been mixed

Liz Newmark, Ahmad Pathoni, Andreia Nogueira

urging the EU in an October statement to resist further delay.

“In postponement discussions we stressed the need for a quick decision to provide legal certainty to operators and to avoid amendments [to the EUDR] as this would complicate the process and raise new implementation questions,” Lecocq said. As it stands, the regulation has “built-in reviews, which will take place as scheduled and may be used by some to adjust the regulation,” she said.

And although Lecocq welcomed the European Commission (EC)’s new guidance documents and new set of FAQs as “useful elements” to help FEDIOL members refine their implementation recommendations, “there are still some key areas of uncertainty, which we need to follow up for further clarifications,” she said.

“We are currently putting these points together for submission to the EC.”

However, it was not all doom and gloom: “The degree of readiness is not identical across all companies and supply chains,” she said. “If the additional time

is well used, it can provide opportunities for engagement across the supply chain, possibly for including actors that had been left aside due to the limited timeframe.”

Meanwhile, FEDIOL had a dedicated working group to help members comply.

“All companies involved were in the process of implementing and were more or less advanced in setting up procedures to comply...,” said Lecocq.

Moreover, many companies have been implementing no-deforestation or NDPE (no-deforestation, no peat, no-exploitation) policies voluntarily before EUDR entered into force, and were already committed to sustainable transformation of their supply chains, she said. That was a downside of the EUDR, which added a layer of complexity and bureaucracy, requesting them to change certain procedures and leading to a loss of efficiency, she added.

Investments and expenses needed to ensure EUDR compliance included premiums paid to growers, chain of custody adjustments, segregation and labour

oilRoq GmbH is a highly specialized engineering company with an experience of 40 years. We design and deliver enre process plants in oleochemical, food, edible oil and fat modificaon industry like:

costs, additional staff, IT set up and data collection and verification requirements.

Lecocq said the EUDR delay would probably benefit countries and commodities with complex supply chains and many small players: “It can be beneficial to seek solutions when the regulatory framework of the producing country is incompatible with the EUDR or proving complicated for EUDR compliance. The additional time needs to be effectively used to pursue these compliance efforts.”

Sahat Sinaga, executive director of the Indonesian Palm Oil Board and the Indonesian Vegetable Oil Manufacturers Association, said the delay was crucial for Indonesia to address key challenges in aligning its palm oil sector with the EUDR.

“One year is not enough for Indonesia to fully comply,” Sinaga told OFI, noting that large companies could need at least 1.5 years to meet the new requirements.

In 2023, Indonesia exported approximately 3.7M tonnes of palm oil to the EU, down 11.6% from the 4.13M tonnes exported in 2022.

Sinaga estimated that the cost of compliance with the regulation would be manageable for producers, at around Indonesia Rupiah IDR6M (US$380) per hectare.

The delay in implementing the EUDR shows a willingness to listen to concerns from producer countries like Indonesia, said Dida Gardera, deputy senior official for food and agribusiness coordination at Indonesia’s Coordinating Ministry for Economic Affairs.

“We’re not too worried,” Dida told the state-run Antara news agency last month.

“But because of the timing of its implementation, there is now a bit of a pause. With this one-year delay, they are showing goodwill and listening to the position of producer countries,” he said.

The delay, Dida added, suggests that the EU is also facing internal pressure, with many European businesses, particularly port operators, expressing concerns about the negative impacts of the EUDR.

Indonesia exports just under 10% of its palm oil to Europe, making it the fourth largest supplier to the continent, said the Indonesian agriculture ministry, which recorded a total national palm oil production of 51.98M tonnes in 2023.

The Central Statistics Agency (BPSBadan Pusat Statistik Indonesia) said the value of the country’s palm oil exports in 2023 reached US$25.61M. Palm oil also contributed 10.2% to the total value

of national exports, although the vast majority of the US$3.4bn exported in 2022 went to India.

Eddy Martono, chairman of the Indonesian Palm Oil Association (GAPKI), said Indonesia’s palm oil industry will use the delay to strengthen its sustainability practices and address concerns over deforestation.

One key challenge lies in bringing smallholder farmers, who account for a significant portion of Indonesia’s palm oil production, into compliance with the EUDR. Unlike larger companies regulated by a 2019 moratorium on new planting in primary forests and peatlands, smallholders operate under less stringent oversight, said GAPKI.

“The government is striving to ensure that smallholder palm oil is well documented, including with clear geolocation,” Eddy Martono told OFI.

Another point of contention is the EU’s non-recognition of existing sustainability certifications within its controls, such as Indonesia’s ISPO (Indonesian Sustainable Palm Oil), Malaysia’s MSPO (Malaysian Sustainable Palm Oil) and the international RSPO (Roundtable on Sustainable Palm Oil).

Malaysia also stands ready to comply with the EUDR, with much of its palm oil

sector already in alignment, according to Malaysian Plantations and Commodities Minister Johari Abdul Ghani.

“We are ready to comply with EUDR anytime,” Johari told OFI: “The majority of our major industry players have no issue complying with the regulation. The one-year extension will provide extra time for Malaysia’s smaller producers, who may need support in meeting the new requirements.”

In 2023, Malaysia exported around 1.07M tonnes of palm oil to the EU, which accounted for about 7.1% of Malaysia’s total palm oil exports. That was down from 2022’s export volumes of 1.47M tonnes, making up about 9.4% of total exports.

Currently, 92% of Malaysia’s 4.2M ha of medium, large and small plantations are certified under the MSPO certification, Johari said. For smallholders, covering around 1.5M ha, the government is actively working to ensure full compliance ahead of the 2026 deadline.

“Regardless of whether the EUDR is implemented sooner or later, we will proceed to make the MSPO standard compulsory for all industry players by 2026,” Johari said.

Meanwhile, the Malaysian Palm Oil Council (MPOC) said the delay provided much-needed breathing room for producers to navigate the complex requirements of the new law: “Malaysian palm oil exporters can comply with EUDR: this is not in doubt,” said Belvinder Sron, MPOC’s chief executive officer, in a statement. “This delay is a sensible decision to ensure that supply chains worldwide have the time to prepare the technical and bureaucratic processes demanded by EUDR.”

The postponement is also significant for Malaysian smallholder farmers, who make up a considerable portion of this country’s palm oil sector. Industry estimates suggest compliance with the EUDR could cost the palm oil sector US$650M annually, with US$260M of that burden falling directly on smallholders, the MPOC said.

The council stressed that the delay should be used to address key concerns, including securing exemptions for smallholders, establishing clear risk benchmarks for sustainable commodities like Malaysian palm oil, and recognising Malaysia’s existing MSPO certification as a compliance tool.

While relieved by the postponement, the MPOC reiterated its commitment to ongoing collaboration with the EU to ensure the EUDR’s eventual implementation is both “fair and practical.”

Another country welcoming the EUDR delay is Brazil, the world’s largest producer of soyabeans. The country exported US$47.3bn worth of the crop in 2024 (January-September) of which US$6.1bn was exported to the EU.

Brazil’s Ministry of Agriculture, Livestock and Food Supply (ministério da agricultura e pecuária – MAPA) told OFI that postponing the EUDR was a response to “concerns” from several industry partners, “including governments, trade associations and NGOs”, and it “was inevitable given that the European authorities themselves were unable” to implement it. “Adequate infrastructure for verifying traceability and compliance” was still missing, it noted.

MAPA warned that complex traceability using geolocation “is one of the greatest challenges, especially for small and medium-sized producers, because it is costly and disregards the complexity of Brazilian production chains”. For instance, the soyabean sector has “intermediate stages where the composition of batches is based on products from different sources, which are then stored together”, it said.

André Nassar, president of the Brazilian Association of Vegetable Oil Industries (Associação Brasileira das Indústrias de Óleos Vegetais – Abiove) argued the regulation should be changed to accept that up to 3% of a consignment of soyabeans is unverified as being forestfriendly, because segregation of soyabeans and soyabean meal “creates large costs in the logistics chain”. He said: “Physical segregation creates large costs in the logistics chain that could be avoided with a minimum accepted unverified proportion.”

As it stands, mixing deforestationfree commodities with commodities of unknown origin or non-deforestation-free commodities is not allowed. So, companies will be “at risk of being punished for having a minimum percentage of unverified soyabeans/meal”, he explained.

While happy with the delay, due to the huge “uncertainty” among the authorities of the member countries, Nassar is still concerned about the regulation’s country benchmarking system, which will decide if an exporting country is high or low risk for forest degradation – now to be completed by 30 June 2025 – six months before the EUDR implementation.

The EC believes a large majority of countries worldwide will be classified as low risk, meaning operators are only subject to simplified due diligence of their products and production, rather than the enhanced scrutiny demanded from high-risk countries, which could include Malaysia and Indonesia.

The EC believes a large majority of countries will be classified as ‘low risk’, meaning operators are only subject to simplified due diligence of their products

SD Guthrie International, present in more than 100 countries and one of the world’s largest producers of certified sustainable palm oil, sent its first shipments of 40,250 tonnes of EUDR-compliant palm oil to Europe and the UK.

Gary Lewis, sales director for KTC (Edibles) Ltd said it was “well prepared for incoming legislation… and to supporting [EU] customers with EUDR compliance”.

“We’ve also secured a supply of segregated EUDR-compliant soya oil with a system to make compliance as easy as possible for our customers,” he told OFI.

Lewis, also president of the UK’s National Edible Oil Distributors’ Association (NEODA), said KTC Ltd was broadly in favour of the delay, “given the significant challenges that still need addressing.” Postponement should be used to clarify, alleviate and find solutions to key issues surrounding implementation – notably potential constraints on supply and possibly escalating prices.

MAPA stressed that Brazil would be “truly satisfied” if it had the chance to discuss alternatives to intensify cooperation with the EU and other partners to develop effective actions to preserve forests and biodiversity, using Brazilian expertise and according to Brazilian environmental legislation.

Zainab Alhamwi and Thiago Prianti, advisors at the São Paulo, Brazil-based commodity broker Aboissa Commodity Brokers, argued that while the delay makes “long-term planning difficult and brought “investment risks for producers”, the time ahead will be useful for “main global producing countries outside the EU to talk and seek adjustments...”.

A EC spokesperson said the delay proposal was not a new law – it just gave parties additional time to meet its requirements.

“Our proposal concerns the timeline. The Commission remains fully committed to the objectives of the regulation as agreed. This also reflects our commitment to predictability for companies and international partners who have already invested intensive work in the preparations.

“All the preparation work remains valid, as we are not proposing any changes to the substance of the law,” the spokesperson told OFI. “Investment in early preparation will pay off as those companies will be particularly well placed to comply with their obligations in a smooth way.”

Some companies have already made the necessary steps to meet the new law. In September, Malaysia-headquartered

The delay is also expected to please the US oils and fats sector, with US Trade Representative Katherine Tai, US agriculture secretary Thomas Vilsack and US commerce secretary Gina Raimondo asking the EC to delay the legislation.

Environmental groups, however, are angry about the delayed EUDR. A joint statement ‘Hands off the EU Deforestation Regulation’ signed by 225 organisations –including Greenpeace, WWF and Oxfam – said the delay “undermines the EU’s credibility as a global leader in the fight against climate change, biodiversity loss and human rights violations”.

The delay would “effectively reward those companies continuing to profit from environmental destruction… while penalising those who have already spent resources to comply with the EUDR”.

In an October statement, another signatory, the Rainforest Alliance, added the delay sets “a dangerous precedent, leading to a potential reopening of all the crucial regulations and directives adopted as part of the EU Green Deal”.

To help partners become EUDR compliant, the Alliance is launching an EUDR deforestation risk assessment tool for non-certified supply chain actors and farmers to help assess their deforestation risks. It also called on the EC and EU member states and companies to provide appropriate support to smallholder farmers, so that EUDR compliance costs are not passed on to them. ● Liz Newmark in Brussels, Ahmad Pathoni in Jakarta and Andreia Nogueira write for International News Services, UK

Playing a key role in many everyday products, what is the supply and demand outlook for the unique lauric oils?

Julian McGill

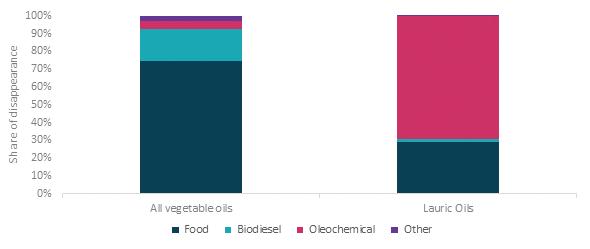

Coconut oil and palm kernel oil (PKO) –the lauric oils – account for under 6% of global vegetable oil consumption but are crucially important in a number of everyday products, such as confectionery and home and personal care products.

The reason is their unique chemical composition as they are the only source of lauric acids, which are the bedrock of the detergent and surfactants industry.

The unique functionality of lauric oils creates a distinctive end-use profile. For most vegetable oils, around 75% of vegetable oil demand is for food use with close to another 20% used as biofuels. The remainder includes a small proportion, mainly of palm stearin, used for oleochemicals and vegetable oil in feed.

For the lauric oils the situation is the inverse – close to 70% of lauric oils are used in oleochemicals, and food use only accounts for 30% of consumption (see Figure 1, below). But even in food use, lauric oils stand out as being uniquely suited to the production of fats for confectionery usage as moulding, coating or filling fats. No other oil can produce fats with the same mouthfeel. The result is that while coconut oil was once a widespread cooking oil, today it has

mostly been bid away for speciality fats uses outside of the Philippines, where a small proportion of lauric oils are used in biodiesel, due to a blending mandate based on coconut oil.

The distinct end-uses of lauric oils means they have the wildest price swings among vegetable oils. Most vegetable oils can be substituted, with the market switching between different oils depending on relative prices. Lauric oil buyers, however, have no alternatives, making them extremely vulnerable to supply disruptions.

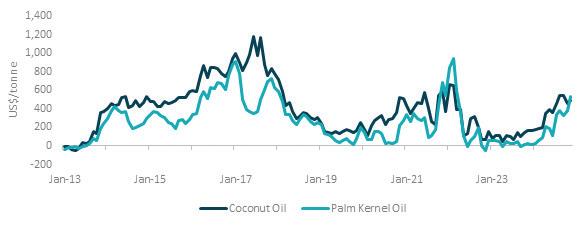

As with all agricultural commodities, PKO and coconut oil are subject to substantial weather risks. Figure 2 (opposite page) illustrates how weather shocks brought about by typhoons and droughts related to El Niño weather events resulted in a reduced supply of lauric oils and started rallies in prices.

The El Niño weather events also caused palm oil yields to fall and prices to increase, but not to the same extent. This can be seen most clearly in the spread

between lauric oils and palm oil prices (see Figure 3, opposite). As prices approached a US$1,000 premium over palm oil, endusers started to reformulate and reduce their consumption. This usually coincides with a recovery in supply, which means prices suddenly collapse back to parity with palm oil. In the industry, it is said that lauric oils prices move up like an escalator and down like an elevator.

Since Typhoon Haiyan in 2013, coconut oil prices have been at various premiums to PKO, but almost never at discount. Coconut oil has inherent characteristics which justify a higher price. For oleochemical use, it has the advantage of a higher portion of short chain fatty acids. For food users, it is a superior ingredient providing a better mouthfeel for ice cream coating and smell in non-dairy creamers. For all end users and consumers, coconut oil has a better reputation in terms of sustainability.

However, despite these advantages coconut oil fell to an unprecedented discount to PKO in 2022. A number of factors coincided to create this unusual pricing. The first was that Indonesian export taxes increased to record levels, inflating margins and creating large incentives to process PKO within Indonesia. This coincided with a period of weaker supply, severely curtailing export volumes. At the same time, coconut trees in the Philippines were benefitting from several months of ideal hot and humid weather, leading to an increase in both the supply and quality of copra. The result was an oversupply of coconut oil, flooding the market and pushing prices below PKO.

We are now at the point where prices are once again rallying, with PKO and coconut oil approaching premiums of close to US$600/tonne over palm oil. The reason is once again a shortage of supplies. Indonesian palm oil and PKO output declined in 2024, predominantly due to the lagged effect of regional droughts in 2023 in Indonesia. At the same time, after a long period of excellent coconut oil output, the Philippines is seeing weaker copra supply due to the natural cyclicality in output from trees and the impact of droughts at the start of 2023.

The outlook for lauric oils, however, has been muddied by the confusion caused by the European Deforestation Regulation (EUDR). PKO and most of its downstream derivatives are covered by the EUDR and the legislation poses a particular problem for PKO buyers, due to difficulties segregating sufficient volumes of kernels. Did the EUDR push up prices?

Anticipating widespread problems with the EUDR, there were large shipments of PKO and coconut oil to the EU to reach Rotterdam before the end of 2024. This was believed to have driven up prices. However, despite the announcement on 2 October that it was likely that the EUDR would be postponed, lauric oil prices did not decline – instead they continued to rise. The market appears to have taken the logical view that whether the stocks are held at origin or in the destination, that wouldn’t alter the supply and demand balance. Once the EUDR enters into force, buyers in Europe are certain to find that there is insufficient EUDR PKO. Importers may switch to other products not covered by the legislation, such as fatty alcohol ethoxylates.

Even outside of the EU, an increasing concern for buyers and processors is the recognition that the fundamental supply dynamics for lauric oil prices have worsened.

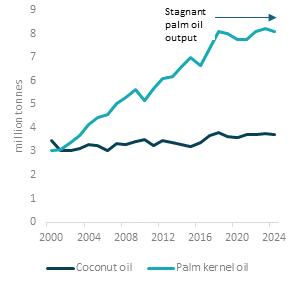

The oleochemical industry’s dependence on lauric oils has meant that for most of its history, the growth of the sector was constrained by raw material shortages. The expansion in the area under oil palm after 2000 also led to growth in the supply of PKO.

As Figure 4 (above right) demonstrates, coconut oil supply has barely increased in two decades, during which time PKO output more than doubled. This enabled much faster growth in oleochemicals and speciality fats, and also shifted the weight of the industry to Southeast Asia.

The issue today for buyers is that palm oil output is no longer growing.

The increase in supply was driven by area expansion and new plantings of oil palm have slowed dramatically due to a shortage of suitable land for planting, coupled with increased sustainability restrictions. At the same time, palm oil yields have been stagnant. There are opportunities to improve yields but these will require significant investments, dedication and discipline that will only yield ‘fruits’ after several years. At the same time, breeding efforts in oil palm seeds have focused on reducing the kernel content and increasing the oil content of the fruit, to improve profitability. This has meant a steady decline in the production of PKO relative to crude palm oil.

Could coconut supply increase? More than 90% of coconut area is under smallholders and many trees are ‘senile’ (over 60 years old) which have lower yields and are difficult and dangerous to harvest. Better agronomic advice and planting materials has been shown to significantly increase yields, but a shortage of seedlings and funding has held back progress.

Demand for the unique lauric oils continues to grow: consumption of confectionery and natural home and personal care products increases with higher incomes and populations.

Commitments by major producers to reduce the use of petrochemicals limits their ability to switch to synthetic fatty alcohol. At the same time, investment in processing in Indonesia – which now processes and consumes over 70% of PKO domestically – means PKO exports are being constrained.

With supply unable to expand, that means higher prices and a clear incentive to the market to solve this imbalance. The market for lauric oils will remain as exciting as ever. ● Dr Julian McGill is the managing director of Glenauk Economics, a consulting firm focusing on vegetable oils and their downstream derivatives in food, speciality fats, oleochemicals, feed and biofuels. Based in Kuala Lumpur, he is a globally recognised authority on the economics of the oil palm and lauric oils markets

Oils & Fats

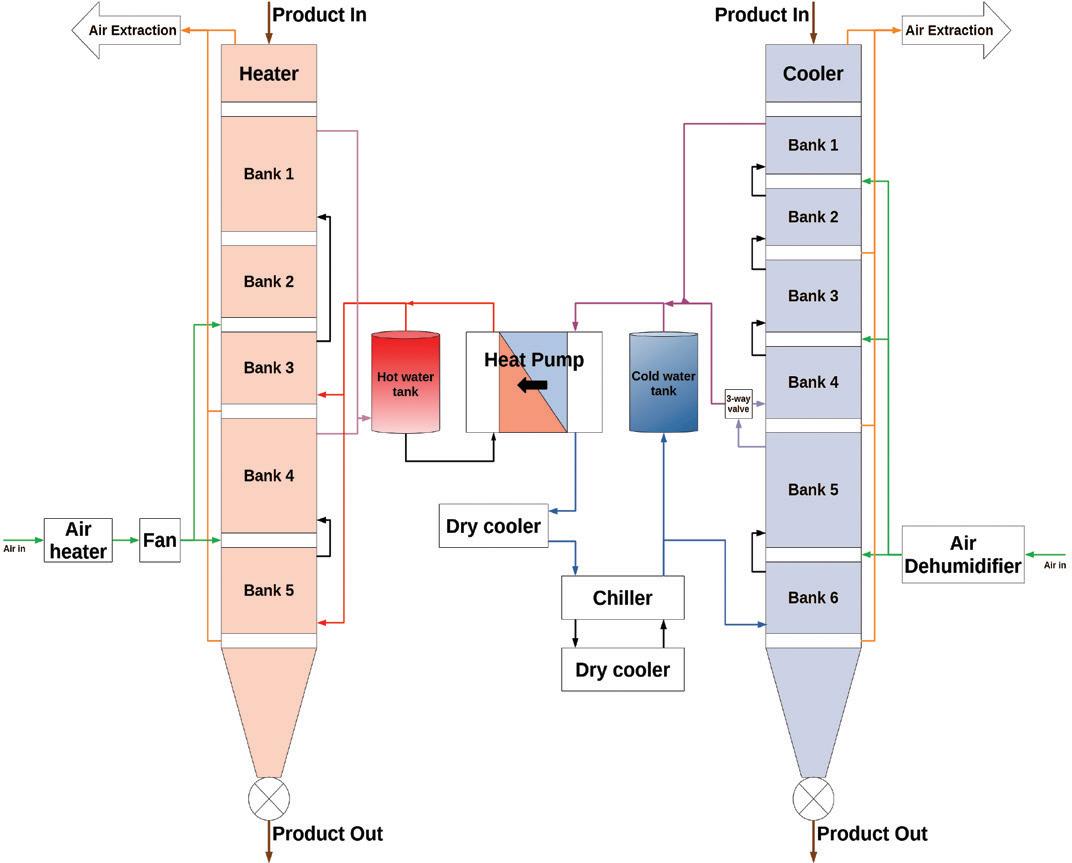

International reports on some of the latest projects, technology and process news and developments around the world

JAPAN: Japanese oils and fats company Fuji Oil Asia has signed an agreement with palm oil producer Johor Plantations Group (JPG) to build a speciality oils and fats refinery in Kota Tinggi, Malaysia, The Star wrote on 3 November. The refinery, with an initial development value of US$115M, was scheduled for completion by mid-2026. It would be part of the Integrated Sustainable Palm Oil Complex in Pasir Logok, Kota Tinggi, the report said.

Fuji Oil Asia sells vegetable oils and fats, industrial chocolate, and emulsified and fermented ingredients for confectionery and bakery.

URUGUAY: Biofuel producer Avalon BioEnergy is set to develop a sustainable aviation fuel (SAF) biorefinery in Uruguay with a projected cost of US$380M.

The project included plans for a 100,000 tonnes/year SAF production facility as well as a 50MW solar power plant to produce green hydrogen, the company said on 23 September.

Brazil’s privately-owned Grupo Potencial is planning to invest BRL600M (US$108.86M) to raise biodiesel output at one of its plants in Paraná state, Reuters reported on 8 October.

Potencial said the plant’s current capacity made it the