BIOCHAR GREEN IRON RESEARCH

Insights from the Luleå University of Technology.

Green iron corridors: a new advent of steel production.

The future of US Steel remains uncertain.

Potential impacts of a global green iron trade.

Insights from the Luleå University of Technology.

Green iron corridors: a new advent of steel production.

The future of US Steel remains uncertain.

Potential impacts of a global green iron trade.

Metals offers the entire steel value chain an exceptional opportunity for curbing their CO2 emissions.

The unique combination of its historic and recently developed product portfolio, make John Cockerill one of the industry’s most relevant suppliers of equipment for both the hot and cold phase of the steelmaking and processing industry.

Our three distinct business segments are addressing todays and tomorrow’s challenges supporting sustainable and green steel production:

Our new upstream offering related to DRI (Direct Reduced Iron), EAF (Electric Arc Furnaces) technologies and the use of hydrogen in steelmaking. Next to offering indirect electrification (DRI-EAF&H2-DRI-EAF),John Cockerill is also working on Volteron®: A first-of-a-kind iron reduction and steel processing route via direct cold electrolysis. This CO2 free steelmaking process, has been co-developed with the world’s leading steelmaker ArcelorMittal.

Regrouping our historical downstream product portfolio, this segment also includes:

¡ the Jet Vapor Deposition (JVD®) technology set to replace today’s hot-dip or electro galvanizing processes. This novel high-productivity vacuum coating technology provides previously unknown coating flexibility and possibilities, all while offering lower CAPEX and OPEX.

¡ our E-Si® equipment & processing lines specifically designed to produce high-quality Non-Grain Oriented (NGO) steel in response to the need for electrical steel meeting precise metallurgical properties, essential to support the shift towards green mobility.

This segment not only embraces all services and after-sales activities but will be strongly focusing on downstream furnace electrification (reheating and processing line furnaces), as well as hydrogen combustion, and the optimization of plant operations, including energy audits and the modernization of steel production equipment and installations.

EDITORIAL

Editor

Matthew Moggridge

Tel: +44 (0) 1737 855151

matthewmoggridge@quartzltd.com

Assistant Editor

Catherine Hill

Tel:+44 (0) 1737855021

Consultant Editor

Dr. Tim Smith PhD, CEng, MIM

Production Editor

Annie Baker

Advertisement Production Carol Baird

SALES

International Sales Manager

Paul Rossage

paulrossage@quartzltd.com

Tel: +44 (0) 1737 855116

Sales Director

Ken Clark

kenclark@quartzltd.com

Tel: +44 (0) 1737 855117

Managing Director

Tony Crinion

tonycrinion@quartzltd.com

Tel: +44 (0) 1737 855164

Chief Executive Officer

Steve Diprose

SUBSCRIPTION

Jack Homewood

subscriptions@quartzltd.com

Tel +44 (0) 1737 855028

Fax +44 (0) 1737 855034

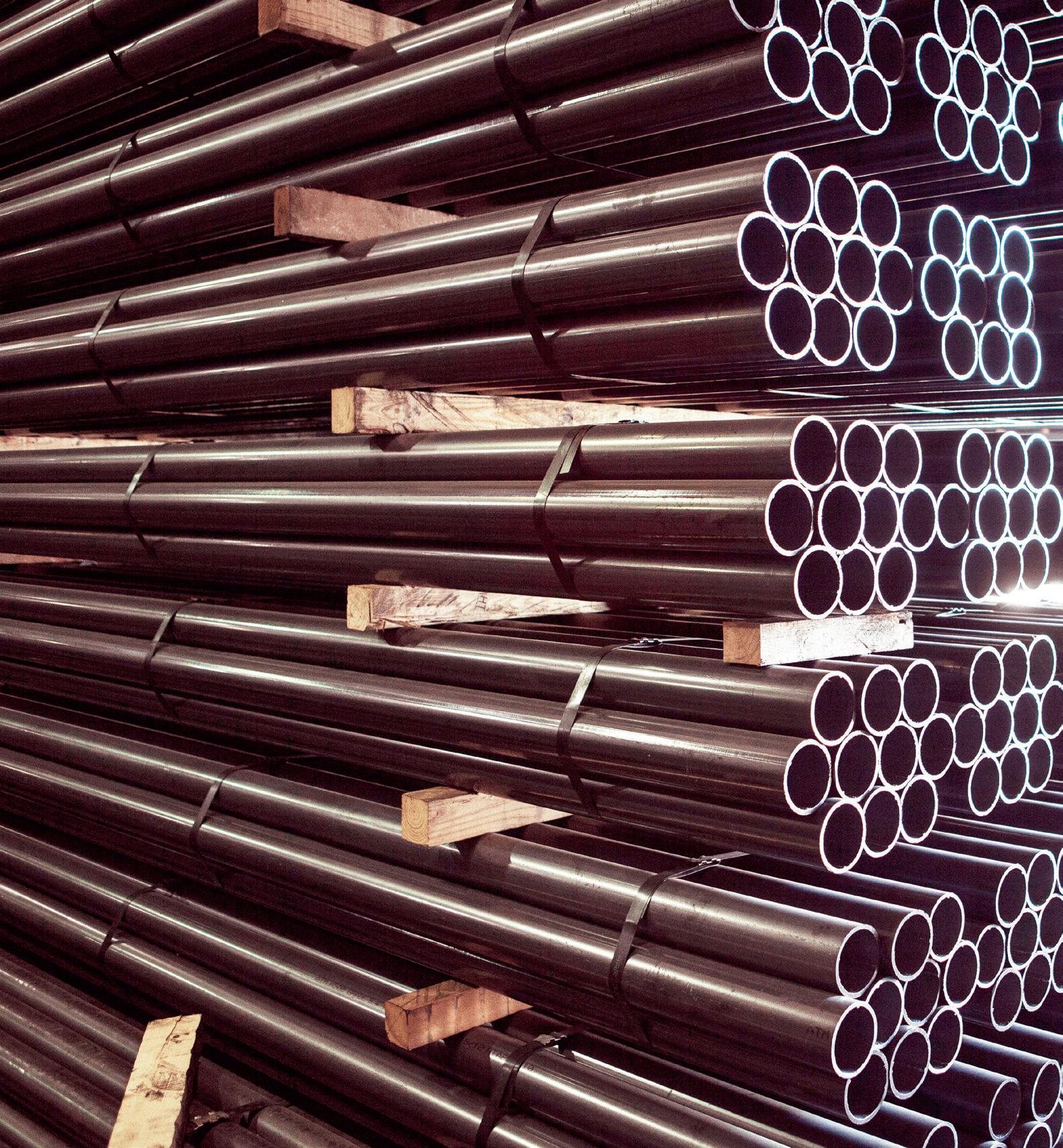

Front cover photo courtesy of KOCKS

The KOCKS PWW 530/4, featuring 4-roll stands, installed at voestalpine Tubulars for the precise production of seamless hollow sections.

Catherine Hill Assistant editor catherinehill@quartzltd.com

In 1995, PhD student Suzanne Simard published her doctoral thesis: ‘Interspecific carbon transfer in ectomycorrhizal tree species mixtures’, which investigated the fungal webs of communication encountered in paper birch and Douglas fir trees. Two decades later, and now firmly established as a leading ecologist in the field of forestry and plant intelligence, Simard resides in the digital subterranea of Google as the woman who found out trees could talk. ‘Mother trees’, says Simard, act as central hubs, controlling vast underground mycorrhizal networks, sending warning signals and transferring their nutrients to neighbouring plants in their final months of life. Simard’s investigations into the interconnectivity of forests formed the basis of her book, ‘Finding the Mother Tree: Uncovering the Wisdom and Intelligence of the Forest’, published three years ago. In interviews, Simard has stressed that the usage of the word ‘mother’, which not only anthropomorphises its subject, but leans into the expansive cultural implications of ‘mothering’ and ‘motherhood’, is very much intentional. ‘‘If we can relate to it,

then we’re going to care about it more’’. Activists and conservationists like Simard, are left to toe a blurred line; between using interrelation as a weaponised tool to enact empathy, and the acceptance to view the disquieting reality of climate change as a viewpoint that doesn’t require weighted rhetoric, and is instead, compelling on its own scientific terms. In any case, shifts in thinking are taking place. Steelmakers are increasingly turning to more holistic approaches of production to establish a ‘green value chain’ that extends beyond the processes used in the mill, to the Romanesque ochre trenches of iron ore mines, and the ways in which material is extracted, converted, and applied. The finite nature of iron ore poses existential questions to the current configurations of the industry. Much like the networks that bind together Simard’s birch and fir trees, we are confronted by complex systems that simultaneously mimic the profound basis of connection so crucial to our own relationships, and expose our failure to protect them. ‘‘We’re at the last stems’’, Simard said recently. What remains, is our responsibility to defend.

Just as athletes rely on their teammates, we know that partnering with our customers brings the same level of support and dependability in the area of manufacturing productivity. Together, we can overcome challenges and achieve a shared goal, optimizing processes with regards to economic efficiency, safety, and environmental protection. Let’s improve together.

Do you want to learn more? www.endress.com

To be the premier partner in the metals industry, driving advanced technologies adoption and ensuring success throughout their lifecycle with dedicated and innovative services

The Towers & Structures business unit of Nucor Corporation, a Charlotte, North Carolina-based recycledcontent electric arc furnace steelmaker, will build its fourth overall and third new utility structures production facility in Brigham City, Utah. According to Nucor, the Utah plant will join two others it currently is completing in Decatur, Alabama, and Crawfordsville, Indiana.

Source: Recycling Today, 12 January 2025.

The Steel Authority of India and John Cockerill India will be investing nearly Rs 6,000 crore to set up a downstream plant for cold-rolled grainoriented and cold-rolled non-oriented electrical steel. Operations are slated to begin between 2027-2029 with a production target of 1.5Mt/ yr. The project is a result of a MOU signed in November 2022 between SAIL and John Cockerill India, with a joint goal to work on green steel technologies.

Source: Manufacturing Today, 13 January 2025.

Thyssenkrupp has said that a planned green steel site worth around €3 billion could go ahead even if government ambitions to build up a worldleading hydrogen industry fail. German opposition leader Friedrich Merz, tipped to become chancellor in next month's election, said that a fast shift to hydrogen

was unrealistic. While the government is in charge of ensuring a timely ramp-up of hydrogen infrastructure and supply to secure Europe's steel sector, the group's planned green steel site in Duisburg was not dependent on it, Thyssenkrupp said.

Source: Reuters, 14 January 2025

Ukraine has stopped production at its coking coal mine in Pokrovsk, which feeds the country’s steel industry, because of the proximity of advancing Russian forces, two industry sources told Reuters on Monday. The facility in the embattled city of Pokrovsk is Ukraine’s only mine that produces coking coal needed for the country’s once giant steelmaking industry, which has withered since Russia’s February 2022 invasion.

Source: Mining.com, 13 January 2025.

Swedish steelmaker SSAB has pulled out of $500 million green steel award negotiations. The Swedish company sought to make iron using green hydrogen in Mississippi, as part of the Biden administration’s $6 billion Industrial Demonstrations programme. While SSAB ‘continues the

Nord Steel, which operates three steel fabrication units in Lithuania, has committed to designing, manufacturing, and delivering three advanced green hydrogen storage tanks to the Klaipėda port for €1.4 million. These include a 40-bar green hydrogen buffer tank and two hydrogen storage tanks. "This project, which we undertook with a clear vision for the future, is not only an important step in the development of Klaipėda Port's infrastructure, but also a significant investment in long-term sustainable solutions that will shape a more modern, cleaner and innovative transport and industrial ecosystem’’, said Algis Latakas, general director of Klaipeda State Seaport Authority.

Source: Baltic Times, 13 January 2025.

technical development of decarbonization projects in the US, including Hybrit,’ it is no longer negotiating with the Department of Energy’s Office of Clean Energy Demonstrations to complete its funding agreement, the company said in a statement to Canary Media. Source: Fuel Cell Works, 14 January 2025.

Brazilian mining company Vale and the Jubail and Yanbu Royal Commissions have signed an agreement to reserve land for a green steel

megahub in the industrial city of Ras Al Khair in Saudi Arabia. The project will be implemented in two stages. It has the potential to produce

ArcelorMittal Nippon Steel India, a joint venture between ArcelorMittal and Nippon Steel, has said that it is set to commission two production lines at its Gujarat-based facility this year to produce advanced automotive steel products. The company said that once operational, the production of the two units will substitute imports of high-end steel required by the entire automotive sector, promoting 'Atmanirbhar Bharat', a slogan coined by the current government of India, meaning ‘self-reliance’.

Source: The Economic Times, 19 January 2025.

ArcelorMittal Duisburg will stop purchasing pig iron from Thyssenkrupp Steel due to environmental concerns, Kallanish has reported. ArcelorMittal has decided not to extend the current contract, which runs until September 2027. The company cited high carbon costs associated with the supply. This is another negative factor in addition to the challenging market conditions for wire rod, the main product produced by the plant. ArcelorMittal is currently testing a number of alternative options after the contract expires.

Source: GMK Center, 20 January 2025.

ArcelorMittal is pressing ahead with the commissioning of its hydrogen furnaces in Kraków, despite pausing any financial decisions on green hydrogen-ready direct reduced iron plants last November. The project represents an investment worth $12.6m. However, the world’s secondlargest steelmaker previously said it would delay final investment decisions on decarbonization projects after the European policy, energy and market landscape had not moved in a ‘favourable direction.’

Source: H2 View, 21 January 2025.

Building and engineering company Sir Robert McAlpine has been appointed as main works contractor for Tata Steel’s £1.25 billion green steel plant in Port Talbot. Sir Robert McAlpine will manage

up to 12Mt of direct reduced iron per year. The hub will serve local, regional and international markets and will contribute to the realization

Anglo American is partnering with the University of Birmingham and venturebuilder Cambridge Future Tech to launch PeroCycle, a new venture aimed at developing and commercializing carbon recycling technology for implementation in steelmaking. PeroCycle will build upon innovations made at the University of Birmingham’s School of Chemical Engineering by Professor Yulong Ding and Dr Harriet Kildahl, who pioneered an in-process carbon recycling method with the use of a double perovskite material. The use of the material enables the in-process splitting of carbon dioxide into carbon monoxide at considerably lower temperatures than current methods.

Source: Green Car Congress, 24 January 2025.

the main, civil, structural, and building works for a new electric arc furnace-based steel production facility. The facility will produce around 3Mt/yr. The project is set to be completed in three years and

of Saudi Arabia’s industrial ambitions in line with its Vision 2030 programme.

Source: GMK Center, 17 January 2025.

will involve the construction of a new electric arc furnace, ladle furnaces and associated works.

Source: Manufacturing Management, 29 January 2025.

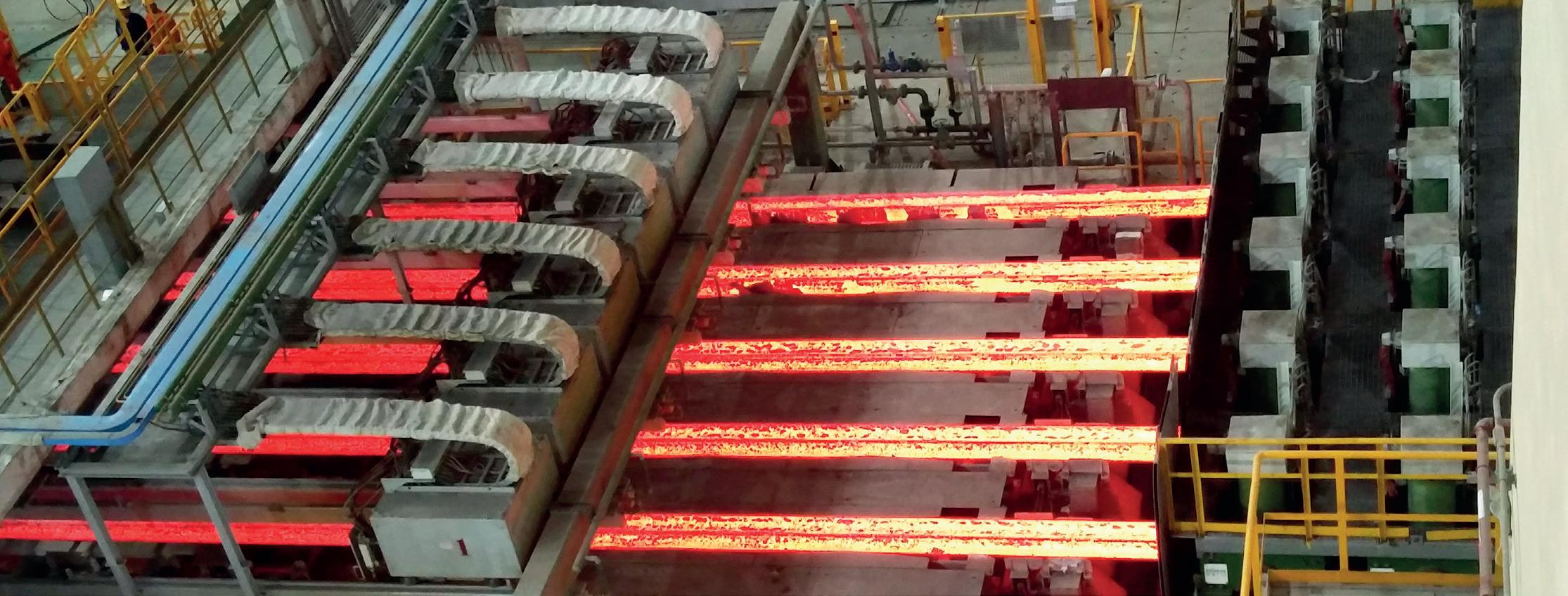

Czech steelmaker Liberty Ostrava, a subsidiary of British Liberty Steel, which is up for sale, has resumed production at its hot strip mill after more than a year’s break. “This is another important milestone for us. The production of flat products such as coils, sheets, and steel strips, i.e. traditional steel mill products, which we are now reintroducing to the market, is returning to Liberty’s portfolio,” said Tomáš Mishinger, director of machinery trade.

Source: GMK Center, 29 January 2025.

‘DANIELI’ 600,000 TPY LIGHT & MEDIUM FLEXIBLE SECTION ROLLING MILL (2011)

120TPH Furnace, Breakdown Mill, Ultra-Flexible Reversing Mill, Continuous Finishing Mill, Automatic Stacker for Beams at Stahl-Gerlafingen, Switzerland

‘NKK-SMS’ COMPACT STRIP PRODUCTION PLANT (1995/2011)

150T Heat Size Electric Meltshop, Thin Slab Cast & Rolling, Thick Slab Caster & (2014) Skin Pass Mills at Hyundai Steel Dangjin, South Korea.

‘HAEUSLER’ 60,000 TPY LSAW WELDED PIPE PRODUCTION LINE (1991/2014)

Plate Edge Milling, 3-Roll Bending, Inside & Outside Welding, Copander, Testing Equipment and more at Hyundai RB Ulsan, South Korea.

‘CONCAST-DAVY-UNITED-FATA’ SLAB CASTER, HOT STRIP MILL & COLD ROLLING COMPLEX (1990s)

Slab Caster, Hot Strip Mill, Tandem Cold Mill, Annealing & Coating Lines at CAP Acero Huachipato, Chile.

Strategic Resources, a mineral development company, has announced a collaboration agreement with Tacora Resources to explore using Tacora’s iron ore concentrate for Strategic’s planned highpurity iron pelletizer project at Port Saguenay. The agreement allows Strategic to potentially purchase up to 25% of Tacora’s expanded throughput capacity, which could provide 25% to 40% of the required iron ore concentrate feed for the project. This collaboration aims to enhance the development of clean, green steel inputs in Canada and support the transition to a low-carbon economy.

Source: Tip Ranks, 29 January 2025.

ArcelorMittal and LanzaTech Global have announced that ethanol from the former’s Steelanol facility in Ghent reached a production milestone with the first barge load having been shipped. Ethanol produced can be sold straight into fuel markets or purified and transformed for use in a variety of consumer products such as garments, personal care, and packaging.

ArcelorMittal South Africa has shut down its steelmaking operations in Newcastle and Vereeniging, despite earlier

Chinese-owned steel manufacturer Disco Zimbabwe has announced the production of its first reinforced steel bars (rebars), marking a ‘significant milestone’ in Zimbabwe’s industrial sector. The rebars, essential for construction projects, are

JFE Steel and JSW Steel have completed the acquisition of Thyssenkrupp Electrical Steel India through their joint venture JSW JFE Electrical Steel. The purchase price is estimated at $457 million. The company, which was owned by Thyssenkrupp, will focus on the production of granular electrical steel (GOES). This

This achievement advances LanzaTech and ArcelorMittal's collaborative plan to create a robust European supply chain for regionally produced sustainable ethanol. Ethanol production began in 2023, and the facility is the first of its kind in the European steel sector.

Source: MSN, 30 January 2025.

reports that the government was considering a rescue package for the company.

In a 10-page letter to trade unions, including the National Union of Metalworkers of South Africa and Solidarity, ArcelorMittal said it had no plans to reverse its shutdown decision, which resulted in 3,500 direct and indirect job losses. Source: Daily Maverick, 1 February 2025.

being manufactured locally as part of the company’s efforts to support Zimbabwe’s infrastructure development and reduce reliance on imports.

Source: The Zimbabwe Mail, 3 February 2025.

will allow the joint venture to enter the Indian market for these products ahead of schedule. JFE Steel and JSW Steel aim to meet India’s growing medium- and long-term demand for GOES while creating an integrated production and sales system.

Source: GMK Center, 5 February 2025.

London’s High Court has ruled that a company in Sanjeev Gupta’s metals empire owes $53 million to a joint venture between ArcelorMittal and Nippon Steel. This judgment came after Gupta, who is battling many legal claims from creditors and a criminal prosecution for failing to file accounts on time, told the court his company was unable to participate in a trial held last November due to an inability to continue to pay legal fees.

Source: The Financial Times, 30 January 2025.

British industry minister

Sarah Jones has hosted a roundtable to finalise the UK government’s upcoming Steel Strategy at Sheffield Forgemasters. Following on from the inaugural meeting of the UK’s new Steel Council in January, the roundtable of more than 30 CEOs and industry leaders focused on steel demand over the next five- and 10-year terms, and is one in a sequence of followup events.

Source: The Manufacturer, 31 January 2025.

voestalpine Tubulars in Austria has successfully commissioned the profile rolling mill engineered by Friedrich KOCKS GmbH & CO KG. Following the completion of all work and successful commissioning, the new equipment is now fully integrated into the hot tube rolling mill at the Kindberg site in Styria.

The award of the contract was preceded by an intensive technological dialogue on the

design and construction of a solution for rolling seamless hollow sections. The centerpiece of the profile rolling mill, called PWW 530/4, consists of four consecutive 530 mm stands, each equipped with two horizontal and vertical rolls facing each other. These four rolls in the stands are individually driven. Based on KOCKS’ 3-roll stand design, they feature caliber adjustment and aim to allow for fast roll changes, providing flexibility

in production planning. The scope of supply also includes the corresponding equipment for the roll shop.

voestalpine Tubulars is now able to produce hot-rolled square and rectangular hollow sections up to large formats and wall thicknesses.

For further information, log on to www.kocks.de

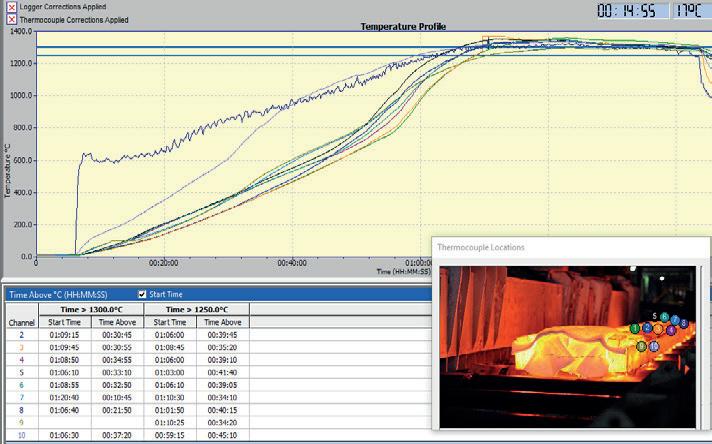

AMETEK Land, a manufacturer of monitors and analysers for industrial non-contact temperature measurement, has released a new video demonstrating its technology live within a UK steel plant.

Filmed at Marcegaglia UK’s Sheffield steelworks, it provides insights for customers wanting to see how LAND’s products solve challenges in industrial environments.

The video is narrated by Marcegaglia UK’s Phil Smales, who guides viewers through the stainless-steel melt shop, explaining how the mill operates, and showing where the LAND solutions are used in the process.

James Cross, AMETEK Land’s head of industry management, commented: “I feel like we’re part of the digital ecosystem that helps with the operation and efficiency of the Marcegaglia UK plant, and we’re proud to be a part of that. We’ve developed a great partnership with the team, and I’m delighted that, with this new video, customers can see for themselves the difference that we’re making. It’s the first video of this kind that we have produced, and one we believe will help industrial plant operators understand how we can forge a similar collaboration with them, meeting their own unique steel production challenges.”

Phil Smales added: “The main challenges are keeping tight control on temperatures and the materials. The LAND team look at our processes and comes up with ideas or equipment that could enhance our processes in our plant for future operations.”

Part of Marcegaglia, a global industrial group, Marcegaglia UK is the largest precision tube manufacturer in Great Britain, delivering carbon steel product solutions worldwide.

For further information, log on to ametek-land.com/industries/steel

Fives has partnered with a European tube manufacturer to develop a new OTO flying plasma cut-off system. The advanced technology can cut a wide range of tubes with different thicknesses.

The OTO plasma cut-off is a solution that uses a high-temperature jet of ionized gas to melt and remove material along the cutting path, aiming to create a smooth and precise surface. Compared to conventional saw or blade cutting, the plasma solution enables cuts on a wide range of tubes (CHS, RHS, SHS, SPECIAL). It significantly reduces mechanical stress and equipment wear and eliminates the need for blade replacement, says Fives.

Fives is currently testing both a traditional and an automated system for its OTO tube mills. The automation technology works with robots, making it particularly suitable for high-capacity production and complex cuts. The robots can perform curved, angled, and 45-degree cuts, even on irregular tubes. This allows maximum flexibility to adapt to different production formats, which minimizes operator intervention.

The solution will soon be available on the market to meet customer needs.

For further information, log on to www.fives.com

Experience the future of plant operation in the metals industry with integrated solutions featuring cutting-edge sensor and control technology, AI-fueled processes, and predictive maintenance. Manage entire plant complexes from centralized operator stations, on site, or even off site, while benefitting from minimal integration efforts. Concentrate fully on your core operations and run your plants at a previously unimaginable level

A Chinese steel producer located in the northeastern part of China has placed an order with Primetals Technologies for a new 6-strand bloom casting machine. The equipment will be implemented later this year.

Primetals Technologies will supply the complete mechanical equipment along with full Level 1 and Level 2 automation systems.

The caster will enable the production of high-quality blooms for export markets, focusing on premium rails and wire rod, including steel

cord used for tire reinforcement. It will feature the largest curved copper tube mold ever implemented by Primetals Technologies. The DynaFlex hydraulic oscillator, which the company claims allows for flexible adjustment of the mold-oscillation parameters, is another key mechanical feature.

The fully automated roll-gap control system DynaGap Soft Reduction aims to minimize centerline segregation, enhancing internal strand quality. The bloom caster will also be equipped

with Dynacs 3D, a secondary-cooling model that calculates the full 3D temperature profile along the entire strand, facilitating optimal adjustments of secondary-cooling setpoints. Mold level stability will be controlled by the automatic LevCon control system, which includes autostart casting functions and auto-adaptive dynamic bulging compensation.

For further information, log on to www.primetals.com

As part of a strategic partnership with TVARIT GmbH, a specialist in AI solutions, PSI is integrating TVARIT’s metals-specific hybrid AI models into the PSImetals Service Platform. This will enable AI-driven solutions to be provided more quickly in the future, improving and accelerating customers’ digitalization processes, says PSI.

TVARIT provides Hybrid AI Models specifically for the metals industry. PSI developed the digital twin technology, which knows and tracks production data in real time across the entire production management chain. These models will be integrated into the PSImetals Service Platform to further use the production data to enhance the decision-making process in specific production management processes. This, claims PSI, will optimize metals production processes including production, quality management and decarbonization services.

“With PSI as a strategic partner, TVARIT takes a significant step forward in driving AI-powered Industry 4.0 transformation within the metals industry. By bridging data silos, this collaboration enables seamless end-to-end process optimization. Together, we aim to unlock hidden profitability, achieve exceptional quality standards, and empower metals producers to enhance sustainability and competitiveness,” stated Vikas Goel, vice president of operations at TVARIT GmbH.

For further information, log on to www.psi.de

Swedish company GreenIron details the mechanisms that underpin its ambitious goal: decarbonizing iron and steel production.

THE iron and steel industry is undergoing a significant transformation. As global industries push towards net-zero emissions by 2050, the urgency to innovate has never been greater.

Traditional steelmaking, while foundational to economic development, remains one of the largest contributors to global carbon emissions, responsible for nearly 8%* of annual CO2 emissions [claims of the global steel industry’s annual CO2 emissions tend to vary from 7% to 11%]. This reality demands a shift not only in energy use but in the very processes at the heart of steel production.

At GreenIron, we are redefining the way iron is processed, providing a pathway towards a more sustainable and circular economy.

The challenge: decarbonizing iron and steel production

Direct Reduced Iron (DRI) presents a promising decarbonization pathway, offering a low-emission alternative to traditional blast furnaces. Yet, many existing DRI facilities still rely on natural gas, limiting their climate benefits. The transition

to hydrogen-based DRI, though still early, is rapidly gaining traction as the key to carbon-neutral steelmaking – and GreenIron is at the forefront with a flexible, hydrogen-ready solution that scales sustainably.

The GreenIron process: a game-changer for CO2-free iron production

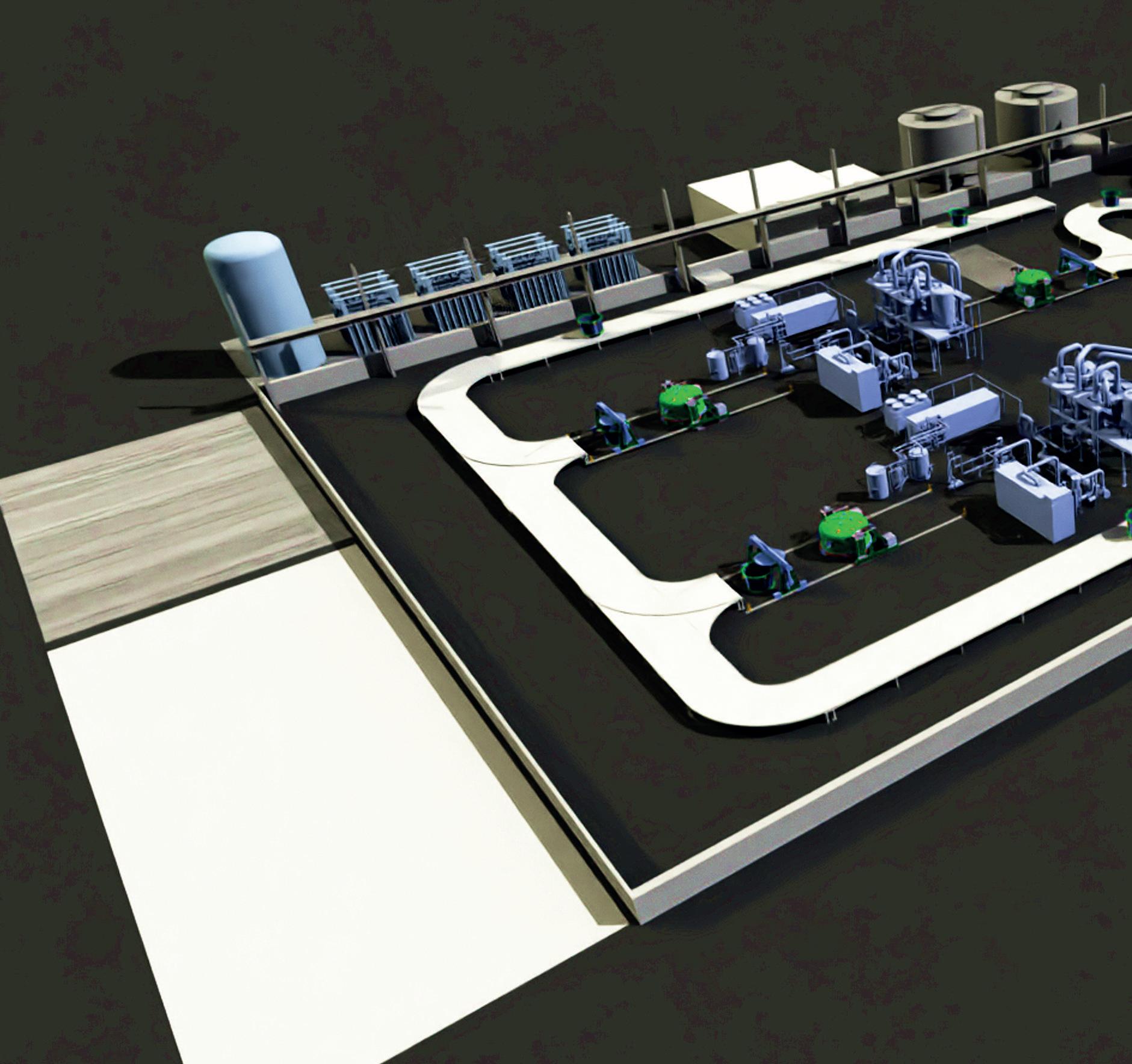

GreenIron’s innovative process tackles the challenges of decarbonising iron production by enabling fossil-free iron reduction using 100% renewable energy and hydrogen. Unlike traditional DRI methods that rely on large-scale infrastructure and continuous gas supply, GreenIron’s solution is both flexible and scalable – designed to adapt to real-world demands while supporting sustainable production.

Key features of the GreenIron process:

� Feedstock flexibility: the process can handle various materials, including iron ore fines, pellets, and metal by-products such as mill scale and slags. This adaptability bridges the gap between virgin iron production and recycling, making it a

versatile solution across different industries.

� Modular and scalable design: our modular system design allows production to be tailored to local conditions and individual customer needs, avoiding high costs and hence risk associated with large-scale, capital-intensive infrastructure.

Modular expansion for scalable growth

GreenIron’s modular design allows a prosite

and provides a cost-effective, demand-driven pro-

GreenIron’s modular design allows a production site to start with a single GreenIron furnace and gradually increase capacity by adding more furnaces as demand grows. This decreases the need for large initial investments and provides a cost-effective, demand-driven production set-up, reducing financial risk.

Flexible batch process for maximum adaptability

With GreenIron’s batch process, the type of materials being processed can change from

hour to hour, providing flexibility in operations. In addition, the furnaces can be easily started and stopped in response to energy availability, enabling optimal energy use and mitigating risks during periods of fluctuating power supply.

The outcome: a CO2-free reduction process that supports circular value chains and empowers steelmakers to secure sustainable iron inputs for their operations – without compromising flexibility or growth potential.

The GreenIron process is a catalyst for change across the value chain. Below are some of the key applications and advantages of this technology:

� Production of fossil-free iron for green steel: GreenIron’s process supplies the iron units essential for carbon-neutral steel production, making it ideal for both greenfield projects and retrofits.

� Utilisation of by-products: by enabling the reduction of industrial waste and by-products like mill scales, filter dusts, and slags, we contribute to closing material loops and enhancing

resource efficiency.

atives:

Support for circular economy initiby reducing reliance on virgin raw materials and making use of residues, the GreenIron process aligns perfectly with the circular econo-

my’s objectives.

The role of partnerships in scaling GreenIron’s solu-

tion

partnerships are central

energy suppliers, recycling

A technology’s true impact lies in its adoption, which is why partnerships are central to GreenIron’s growth strategy. By collaborating with iron ore producers, energy suppliers, recycling companies, foundries and steelmakers, we create ecosystems that enable sustainable operations.

Our recent Memorandum of Understanding (MOU) with Vale, one of the world’s largest mining companies, exemplifies this approach. Together, we’re working to establish a direct reduction facility in Brazil and expand operations in Sweden, where Vale supplies iron ore agglomerates to our commercial facility in Sandviken.

this approach. Together, we’re

This partnership highlights how strategic collaboration can accelerate decarbonization across the metals supply chain, ensuring access to critical inputs such as hydrogen and renewable power – essential for supporting largescale green steel initiatives.

This partnership highlights how decarbonization across the metals scale green steel initiatives.

A Reducing & Sizing Block for long products keeping its promises. Achieve your goals with KOCKS RSB®

finishing size in round or hexagonal dimensions up to 160mm

increase in production up to 20%

up to 10% energy savings in the mill line

The broader industry transformation: where are we headed?

The GreenIron process is part of a larger wave of innovation transforming the steel industry. The transition from coal-based to hydrogen-based ironmaking represents one of the most significant shifts in the sector’s history.

Key trends driving this change include:

� Green hydrogen investments: Global regions are rapidly scaling up hydrogen infrastructure.

� Carbon Border Adjustment Mechanisms (CBAMs): EU regulations penalise imports with high carbon footprints.

� Focus on Scope 3 emissions: Producers must address emissions throughout their supply chains.

Challenges ahead and the path forward

Despite these advances, the road to zero-carbon iron and steel is not without its challenges. The cost and availability of green hydrogen, regulatory uncertainty, and infrastructure requirements remain barriers to rapid adoption.

To support the development of green industrial value chains, policies must address external dependencies that impact companies’ transfor-

mation efforts. Key focus areas include:

� Permitting processes: streamline and make them more predictable through clear guidelines and stronger collaboration between stakeholders.

� Climate-focused procurement: implement standardised climate criteria to drive demand for low-carbon materials.

� Risk sharing for local investments: national mechanisms should support municipalities making industrial-related investments.

� Aligned targets: all actors must work towards shared goals that consider environmental and socio-economic impacts.

� EU climate policy: uphold commitments under Fit for 55 and the EU Emissions Trading System (ETS).

� Local value sharing: ensure communities benefit from renewable energy projects to foster acceptance.

The transformation of the iron and steel industry will require collaboration across all sectors, from governments, communities to private enterprises.

The vision will become reality With the right policies, partnerships, and techno-

logical advancements, the vision of a sustainable and circular steel industry can become a reality. By addressing these key areas, we can create a policy environment that accelerates the green transition while ensuring socio-economic sustainability.

Companies that prioritise innovation, like GreenIron, are proving that it’s possible to overcome hurdles – particularly by offering modular and flexible solutions that lower risk.

At GreenIron, we believe the time for change is now. By offering a modular, flexible, and CO2-free solution for iron reduction, we’re helping lead the way toward a sustainable future. Through innovation and collaboration, we’ll remain at the forefront of this industry-wide transformation.

In a world where decarbonizing the steel industry is top-of-mind for all steelmakers, the journey to global fossil-free steelmaking is both ambitious and necessary; and with a clear vision, strong partnerships, and the right tools, a climate-neutral metals and mining industry by 2050 is well within reach. �

Performances, operational reliability and quick startups are the result of 20 years of continuous research and development activities, carried out at the Danieli research center and onsite together with partnering customers. Depending on plant configuration, MIDA QLP can make use of more than 30 Danieli patents covering technological layouts, production equipment and Danieli Automation solutions, such as power, instrumentation and intelligent digital controls.

— The most efficient, digitally controlled electric steelmaking with no impact on the power grid.

— 10 m/min casting speed, allowing up to 1.5-Mtpy productivity on one casting strand, 23.5 hours out of 24 of continuous endless-casting operation.

— No gas-reheating furnace, and no induction heating during casting.

— Danieli Automation robotics and artificial intelligence for zero-men on the floor.

— Least power-consuming process with the lowest carbon footprint.

— The most competitive plant in terms of CapEx and OpEx.

With the order placed by CMC Steel for its fourth new, MIDA QLP hybrid-ready minimill, the Danieli scorecard hits 26 plants for long-product endless casting-rolling, out of 115 total minimills.

PLANTS

The outrage over former President Joe Biden’s announcement on 3 January to block the proposed US Steel/ Nippon merger has escalated with Nippon Steel saying it was taking legal action against the US government.

By Manik Mehta*

BIDEN explained his decision to block the controversial $14.3 billion acquisition of US Steel was to protect national security interests and supply chains.

The merger deal, announced more than a year ago, was controversial from the start, with both political parties expressing their opposition to the control levers of a company, once considered an icon of the US industry, falling into the hands of a foreign company.

The United Steelworkers (USW), the steelworkers’ union, which had also opposed the merger deal, applauded Biden’s decision as the ‘right move for our members and our national security’.

David Burritt, the president/CEO of

US Steel, who had campaigned for the merger with Nippon Steel, criticized Biden’s decision as ‘shameful and corrupt’. The Committee for Foreign Investment in the United States (CFIUS), which reviewed the merger deal and assessed its risks to national security, failed to reach a consensus on whether the deal would pose a national security risk and left it to the President to decide.

Both the merger partners had argued, while the deal was being reviewed by the CFIUS, that the merger was necessary to provide the investment needed for US Steel’s domestic steel operations, with the latter warning that it could be forced to shut down the mills represented by USW,

*US Correspondent, Steel Times International

if it did not get the $2.7 billion investment planned by Nippon Steel as part of its proposed purchase. US Steel also warned that the deal’s rejection could frighten away foreign investment in other US industries.

The two companies had said in a joint statement that they were confident that their merger would revitalize communities that rely on American steel, including in Pennsylvania and Indiana, provide job security for the American steelworkers, enhance the American steel supply chain, help America’s domestic steel industry compete more effectively with China and bolster national security.

In their 6 January lawsuit, both claimed that Biden’s executive order to

filed a separate lawsuit against Lourenco Goncalves, the CEO of rival steelmaker Cleveland-Cliffs, and Dave McCall, the president of the United Steelworkers (USW) union, for their actions to try to block the deal which, the lawsuit alleged, are ‘anticompetitive and racketeering activities illegally designed to prevent any part other than Cliffs from acquiring US Steel as part of an illegal campaign to monopolize critical domestic steel markets’. The lawsuit, which is aimed to stop Cliffs and USW from acting together, also seeks

could discourage the much-needed foreign investment in other US industries, and that the ultimate result will be a setback to US Steel’s future competitiveness. One expert, familiar with the internal dissonance within the Biden administration over blocking the merger deal, described the decision as ‘bad’, saying that it would not actually protect union jobs and could do great harm to the company.

US Steel, which needs an infusion of fresh investment to upgrade its facilities, had pinned its hope on the acquisition

block the merger was issued for ‘purely political reasons’. In a statement, the two companies described their legal actions as a continuation of their ‘commitment to completing the transaction – despite political interference’. The lawsuit comes as no surprise, with both companies calling Biden’s order ‘a clear violation of due process’ and seeking appropriate action to protect ‘our legal rights’. Biden, they said, had ‘ignored the rule of law to gain favour with [the United Steelworkers union] and support his political agenda’. However, the deal was also opposed by President Donald Trump and Vice President J.D. Vance had also opposed the deal, with Trump saying that he would block it if it was not dead by the time he assumed office. There is bi-partisan belief that US Steel, once a prized jewel of the American steel industry, should not fall into foreign hands.

Besides the lawsuit initiated against the US government, the two companies

‘substantial monetary damages for their conduct’.

But USW President McCall again praised Biden’s action and denounced the lawsuit.

To recall, US Steel had stated in August 2023 that it had received several offers for purchasing the company, including one $7.3 billion offer from ClevelandCliffs which had overtaken US Steel to become the second biggest American steelmaker behind Nucor; however, talks with Cleveland-Cliffs had broken down. Cleveland-Cliffs’ offer, by comparison, was about half of Nippon Steel’s offer of $14.7 billion.

The USW, on its part, opposed the deal because it felt that Nippon had not given it sufficient guarantees protecting unionized jobs at some of the company’s older mills staffed by union members, and urged US Steel to continue to ‘support good jobs, healthy communities and robust national and economic security well into the future,’ the union said in a statement.

Some experts fear that Biden’s action

by Nippon Steel; the former is also aware that even if another rival like Nucor Corp. or Cleveland-Cliffs expressed interest in acquiring part or all of US Steel, antitrust concerns could prevent such deals which could give a strong monopolistic position to that buyer.

Meanwhile, Cleveland-Cliffs, which had unsuccessfully tried to buy out US Steel, issued a statement with Lourenco Goncalves, chairman/president/CEO, saying that Nippon Steel-US Steel continued to play the ‘blame game’ in a desperate attempt to distract from their own failures. He called the lawsuits a ‘shameless effort to scapegoat [sic] others for US Steel’s and Nippon Steel’s self-inflicted disaster’.

“Cleveland-Cliffs and the USW were not the only ones who recognized the adverse national security implications of this acquisition. This deal drew instant bi-partisan opposition, including from President Trump, who vowed multiple times that he would block the deal,” the Cleveland-Cliffs statement said. �

Benefits:

Utilizes cutting-edge optics and laser scan technology providing an exceptionally high sampling rate

Practically unrivalled measuring accuracy

Reliable measurements in even the harshest of environments (oil, dust, steam etc.)

Easy to handle and is almost maintenance free

Big installation flexibility of 1, 2 and 3 axis gauges for products as small as ø 0.012 mm – 520 mm

Having led Argentina for just over a year, Javier Gerardo Milei has set in place a number of controversial economic policies which have had a sizeable impact on the domestic steel industry.

By Germano Mendes de Paula*

JAVIER Gerardo Milei is an economist, politician and professor, having served as Argentina’s 52nd president since 10 December 2023. As the leader of the Libertarian Party and the coalition La Libertad Avanza, he was elected with 55.65% of the votes in the second round, making him the president with the highest proportion of votes in the country’s history. Milei has been characterised in various ways, including right libertarian, farright, ultra-conservative, ultra-liberal, and right-wing populist. He identifies himself as an anarcho-capitalist, which essentially translates to advocating for minimal government. A year into his presidency, it is pertinent to examine the macroeconomic landscape and its impacts on the steel industry.

Milei’s electoral campaign highlighted the dollarisation of the economy and the closure of the Central Bank as pivotal

points. However, these measures have not been implemented. The country’s low dollar reserves and international scepticism complicate bond sales in US currency. Early in his administration, Milei enacted a 50% devaluation of the Argentinian peso as part of an inflation-reduction strategy. Following this initial devaluation, the government has adjusted the rate by 2% each month. When Milei promised to close the Central Bank, he communicated an intention to stop the currency issuance that contributed to the inflationary cycle.

Milei has executed significant fiscal adjustments. By November 2024, government spending decreased by 27% compared to 2023, when adjusted for inflation. The average amount of pensions and social security benefits dropped by 17%, with civil servant payrolls falling by 19%. Investment in public works plummeted by over 77%, and the public

workforce shrank by 36,000 positions from January to November 2024.

Argentina’s poverty rate rose to nearly 53% in H1 2024, according to official statistics. This marked a sharp increase from 41.7% in H2 2023 and more than double the rate of 26% seven years prior, illustrating the severe social consequences of Milei’s economic policies.

Upon Milei’s election in 2023, Argentina had one of the highest annual inflation rates in the world at 211%. Monthly prices were escalating by 13% and surged to 25.8% in December 2023, following a significant currency devaluation enacted by his administration. However, as of November 2024, monthly inflation has decreased to 2.4%, the lowest value since July 2020, even though it still accumulated to 166% y-o-y and 112% for 2024.

In 2024, the Argentinian stock market experienced a 172.5% increase in pesos,

* Professor in Economics, Federal University of Uberlândia, Brazil. E-mail: germano@ufu.br

leading gains among 20 global exchanges. When measured in dollars, the Merval index rose by 113.8% based on the exchange rate at the year’s end. This discrepancy is due to the dollar appreciating (in nominal terms) by 27% against the peso. Nevertheless, the gap between the official and parallel exchange rates has narrowed from 200% to less than 20%, a significant improvement attributed to Milei’s policies, which included greater flexibility for exporters to convert their revenues in the parallel market.

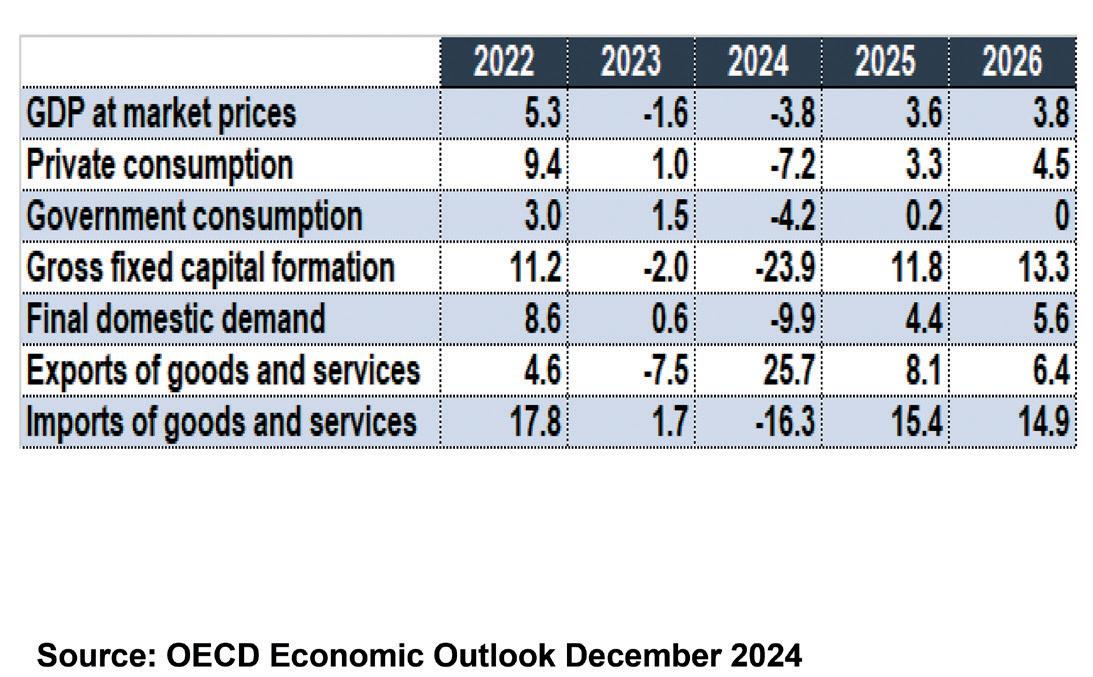

According to the OECD, Argentina’s GDP was projected to diminish by 3.8% in 2024, followed by growth of 3.6% in 2025 and 3.8% in 2026 (see Table 1 for additional macroeconomic data). Given the extensive macroeconomic shock, a GDP reduction of less than 4% in 2024 can be viewed as a relatively favourable outcome.

The steel industry performance

As reported by the Argentinian Chamber of Steel, cement shipments in the construction sector fell by 25% y-o-y from January to November 2024. The automotive industry also faced an 18% decline in production in the same period. Conversely, the agricultural machinery sector maintains

positive prospects for the wheat harvest, with preliminary results indicating higher yields than the previous cycle. Similarly, shipment levels to regions engaged in energy activities remain stable, with positive levels for 2025.

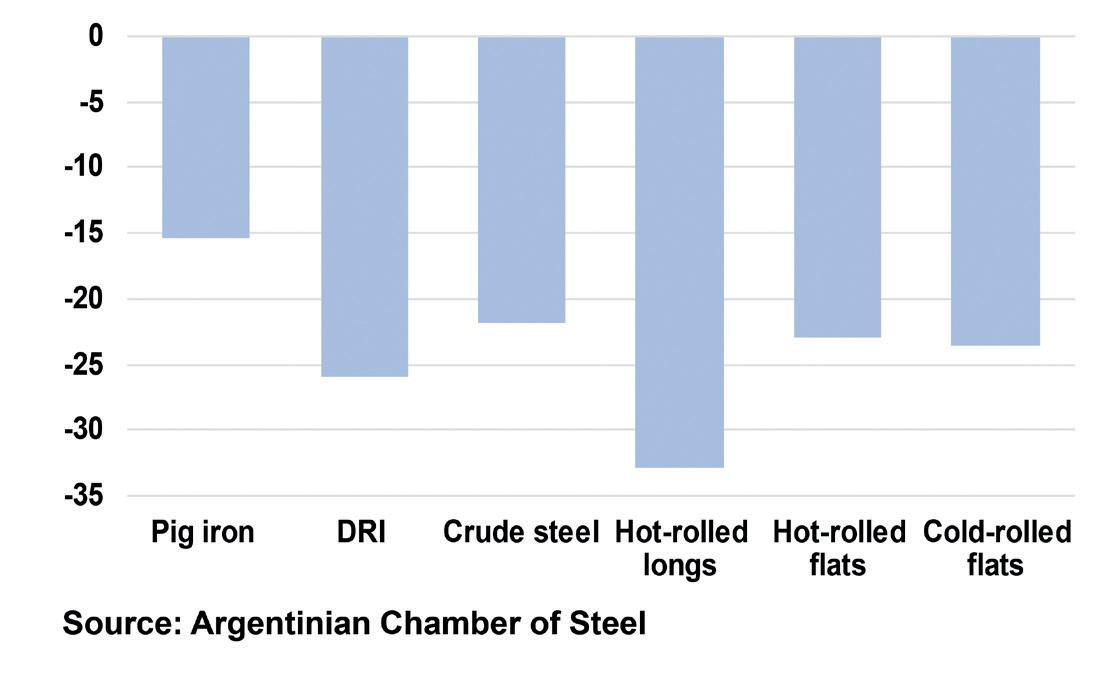

Graph 1 compares the production of steel inputs and products in Argentina from December 2023 to November 2024 with the same previous period. Notably, pig iron production decreased by 15.4%, while DRI output fell by 25.9%. Crude steel production dropped by 21.8%, with hot-rolled longs (including seamless tubes) contracting by 32.9%, hot-rolled flats by 22.9%, and cold-rolled flats by 23.5%.

In 2024, ArcelorMittal Acindar, the leader of long steel products, which was the most impacted market segment, temporarily halted operations at its Villa Constitución mill three times. The first interruption occurred from 18 March to 15 April due to a sales drop of approximately 35%-40%, reflecting the challenging conditions in the domestic economy. In June, the company announced a shutdown of its DRI unit, melt shop, and rolling mills, expecting all units to resume operations starting midJuly. Moreover, in December, it suspended 700 workers at the Villa Constitución mill, indicating a serious downturn in production, which would amount to only 600kt being produced in 2024, against 1.1Mt in 2023 and 1.2Mt in 2022.

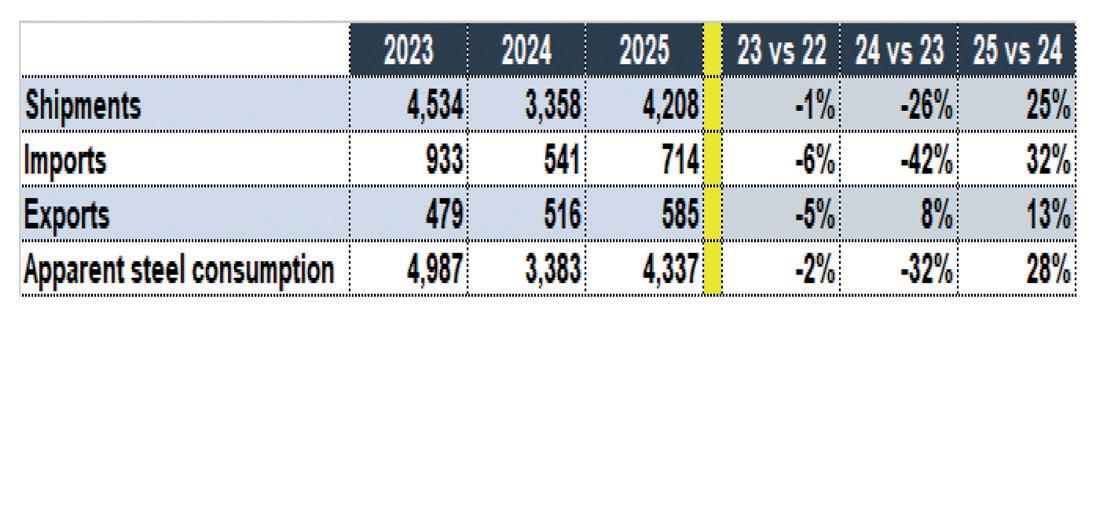

By late October 2024, the Argentinian Chamber of Steel projected that the country’s steel shipments would decline by 26% y-o-y for 2024, followed by a 25% recovery in the subsequent year (Table 2). For apparent steel consumption, the anticipated figures are a 32% drop and a succeeding increase of 28%. However, even with strong growth, steel use in 2025 would be 13% lower than the level registered in 2023. Imports are expected to decrease by 42% in 2024, followed by an increase of 32% in 2025, while exports are forecasted to grow by 8% and then 13%. All data in this paragraph refers to rolled steel.

In conclusion, the impact of Milei’s macroeconomic shock has severely affected the steel industry. This, to a large extent, can be explained by a projected decline of 23.9% in gross fixed capital formation for 2024, according to OECD (Table 1). It is noteworthy that four of the five largest steel companies operating in Argentina –Ternium, Tenaris, ArcelorMittal Acindar, and Gerdau – also work internationally, while Acerbrag is part of the diversified Brazilian group Votorantim. Therefore, these enterprises do not rely solely on Argentina for their revenues and profits. While the situation in 2024 was challenging, there appears to be a sense of optimism that the worst may be over, with expectations that 2025 will bring significant improvements. �

India’s finished steel demand outpaced the growth rate in major steel-consuming countries in the calendar year 2024, driven by an increased governmental focus towards steel-intensive construction in the housing and infrastructure sectors, along with robust demand from engineering, packaging, and other segments. By Dilip

Kumar Jha*

CRISIL, an S&P Group credit rating agency, estimated India’s finished steel demand to have risen by 11% in 2024, marking the second consecutive year of double-digit growth after a 13.5% expansion recorded in the previous year.

This upward trajectory has been supported by strong finished steel production, which grew by 12.7% year-onyear to reach 139Mt in the financial year 2023-24. This positive trend is attributed to supportive government policies that have stimulated robust demand growth, as well as significant investments in expanding steel production capacity. India’s Steel Policy aims to achieve 300Mt of production capacity and 265Mt of demand by 2030.

Global steel demand is estimated to have registered a de-growth of approximately 1% in 2024. Demand in China, the largest steel producer and consumer, is projected to have fallen by about 3.5%, driven by reduced demand from the real estate sector, despite favourable policy changes and the release of support packages. Steel demand

Source: Crisil, a S&P Group credit rating agency

Source: Joint Plant Committee, India’s Union Ministry of Steel

in Europe, Japan, and the United States also showed a decline of 2–3%. However, demand growth in developing economies such as India and Brazil helped prevent a steeper global decline. Demand is estimated to have increased by 11% in India, 5.6% in Brazil, and 2.7% in other steel-consuming emerging economies.

Sehul Bhatt, director (research) at Crisil Market Intelligence and Analytics, stated, “In 2024, supply growth from India’s mills was moderate at 5.2%, due to extended periods of planned and maintenance shutdowns. Aggregate crude steel production by the top seven players increased by 0.05%, while finished steel

production rose by 0.5%. However, crude and finished steel production from medium and small players increased by 14% and 11.3%, respectively, underscoring the consistent demand growth from long steel end-users.”

Crude steel production grew from 109.14Mt in FY 2019-20 to 144.29 Mt in FY 2023-24, registering a robust growth of 13.4% over the previous year (127.197Mt in FY2022-23). The domestic steel industry’s capacity expanded from 142.29 in FY 2019-20 to 179.515Mt in FY 2023-24, supporting the production growth. Capacity utilization increased to 81% during the same period.

But India’s steel story isn’t merely about expansion in capacity, it is equally about rising domestic consumption. Total finished steel consumption grew from 100.17Mt in FY 2019-20 to 136.29Mt in FY 2023-24, indicating a strong domestic demand with a growth rate of 13.7% over the previous year. Industry projections, including a conservative 6% CAGR in steel demand

through FY 2026-27, suggest that India’s steel sector is poised to meet, and perhaps exceed, demand.

To boost steel production, a key initiative is the Production Linked Incentive (PLI) Scheme, aimed at attracting capital investments and reducing imports, with an anticipated INR295 billion investment and an additional capacity creation of 25Mt for specialty steel.

Growth trend for 2025

Domestic steel demand has been growing

at the fastest pace since FY 2021–22 in the post-global financial crisis era, largely driven by the central government’s capex initiatives. However, this growth hit a roadblock in the current fiscal year, as government capex declined by 12.3% yearon-year during April to November 2024. With private capex activity expected to remain subdued due to subpar economic growth, the outlook for steel demand growth hinges on a significant recovery in government spending. Unless government capex sees a meaningful rebound in FY 2025–26 (April-March), domestic steel demand growth may decelerate.

Steel demand in India is projected to continue outpacing other major steelconsuming economies with an estimated growth of 8–9% in the calendar year 2025. This growth will be driven by a shift toward steel-intensive construction in the housing and infrastructure sectors, along with stronger demand from engineering, packaging, and other segments.

Crisil estimates global steel demand in 2025 to increase by 0.5–1.5%, supported by easing financing conditions and pent-up demand in key steel-consuming economies, which will bolster manufacturing activities. Anticipated recoveries in residential construction in regions such as the European Union, the United States, and Korea, driven by improved financing conditions, will also contribute to this growth. India will remain a leader in demand growth among major economies.

The imposition of a safeguard duty, as proposed by the domestic steel industry, could have a positive bearing on steel prices in 2025. If implemented by the end of February, steel prices in 2025 are expected to be significantly higher than in 2024, with the impact being more pronounced in the first half of the year.

Domestic steel prices, however, have been under pressure due to the decline in global steel prices. Steel prices have a potential upside of 4% to 6%, contingent on the implementation of the safeguard duty. As mills ramp up production volumes from newly commissioned capacities, the resulting increase in supply may keep flat steel prices under pressure, although they are still expected to remain higher than the 2024 average. Intense competition among mills to capture market share could, however, limit price increases. �

Steel Times International is a leading publication serving the global steel industry and offering its readers a strong focus on all aspects of the production process embracing both basic oxygen and electric steelmaking.

Choose your subscription package...

8 print copies and a printed copy of the Steel Times International Directory

Digital copy of the magazine delivered to your inbox every month

Four special digital only issues per annum

Access to our digital archive of past issues and webinars

Weekly Steel Times International newsletter

Printed A1 annual wallplanner

PLUS access to all digital issues of Furnaces International

With a digital subscription you will receive all the benefits of the Print + Digital option, excluding print copies!

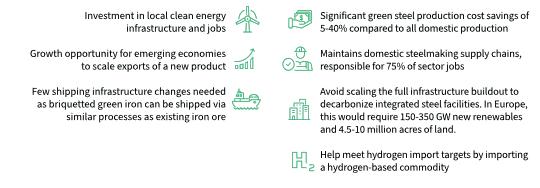

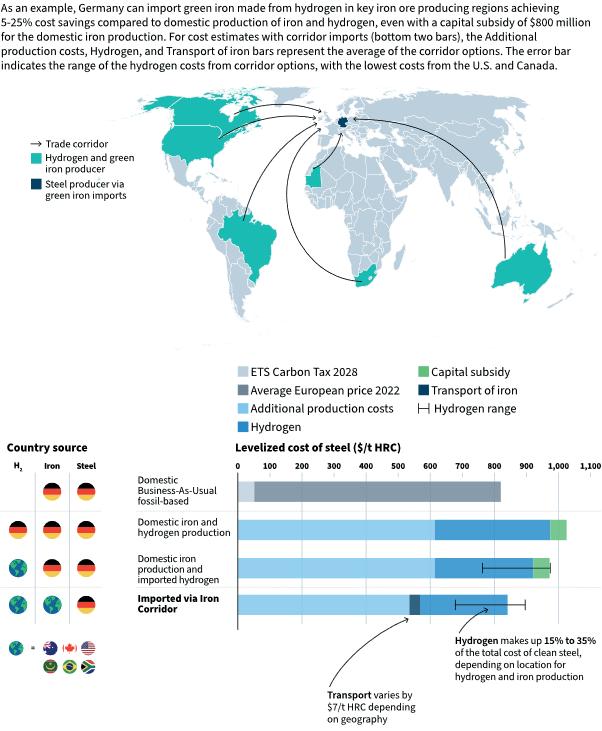

This article assesses the potential impact of a global green iron trade in terms of shifting energy demand between regions and in terms of cost savings by comparing three scenarios for a global near-zero GHG steel industry. By Süheyb Bilici, Georg Holtz, Ole Zelt, Alexander Jülich, Annika Tonjes1, Robin König, Stefan Kronshage, Andreas Meurer2, Zhenxi Li3, Hilton Trollip, Bryce McCall4, Saritha Sudharmma Vishwanathan5, and Stefan Lechtenböhmer6

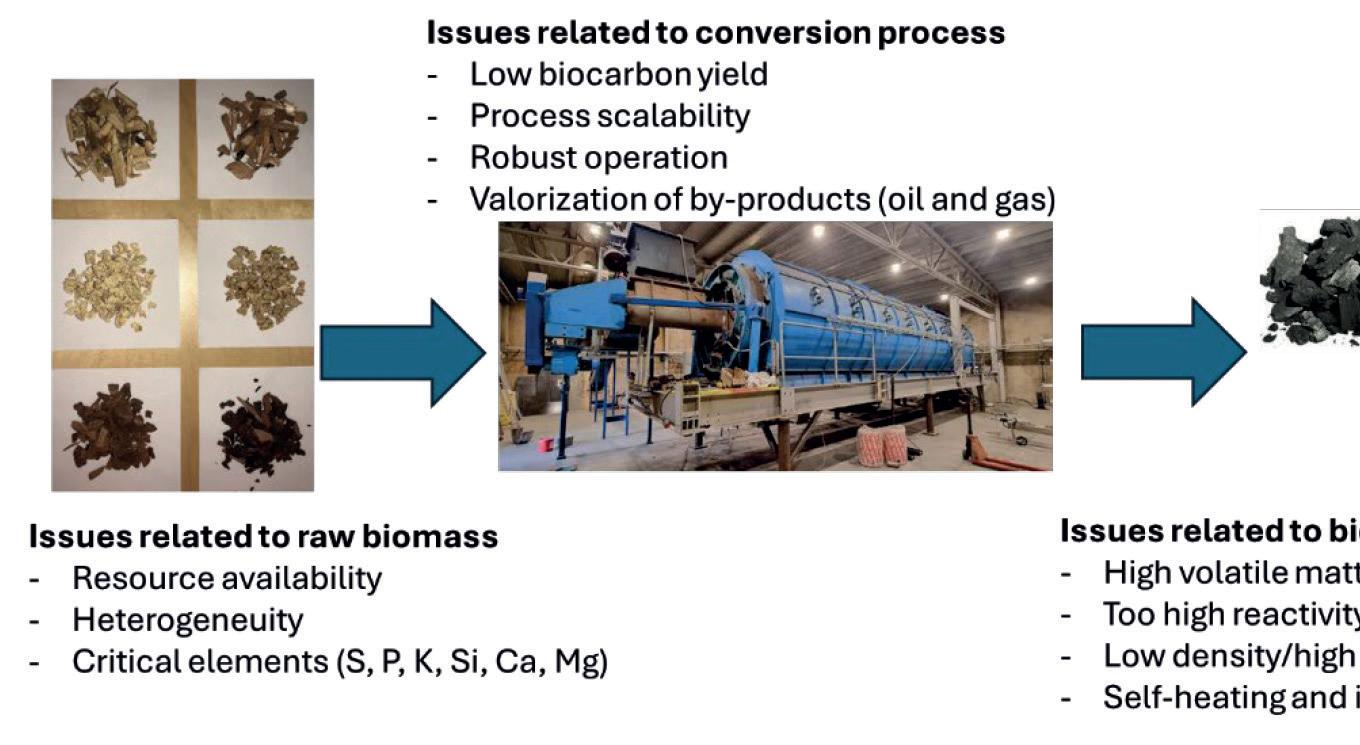

IN 2021, direct emissions from the industry sector made up about 21% of global emissions. The steel industry alone is responsible for 7% of the global energyrelated CO2 emissions, including industrial process emissions. The primary production of crude steel is a high-temperature process that includes the reduction of iron ore to iron and the further processing of iron to crude steel. The current state of the art in primary crude steel production relies on the use of fossil fuels, both as a reducing agent and for direct energy use. However, several CO2 emission reduction options for the steel sector are emerging, including increased recycling and material efficiency, carbon capture and storage (CCS) and hydrogen-based direct reduction of iron ore. The latter process has been the subject of numerous project announcements, including first investment decisions by major steel companies in Europe. This technology requires (green) hydrogen to reduce iron ore to Direct Reduced Iron (DRI), with few to no associated CO2 emissions. It is anticipated that this process will play a pivotal role in the global steel transformation.

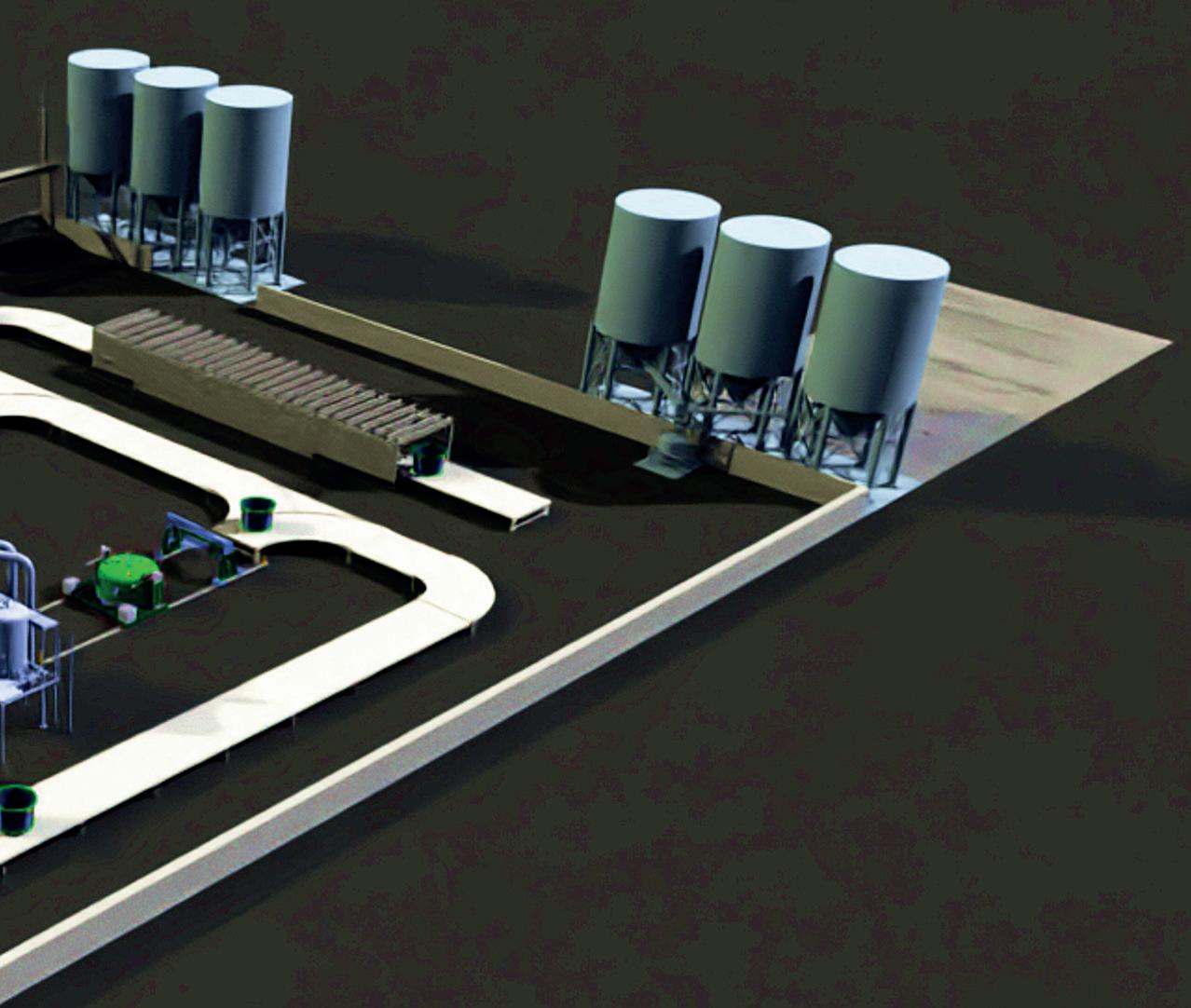

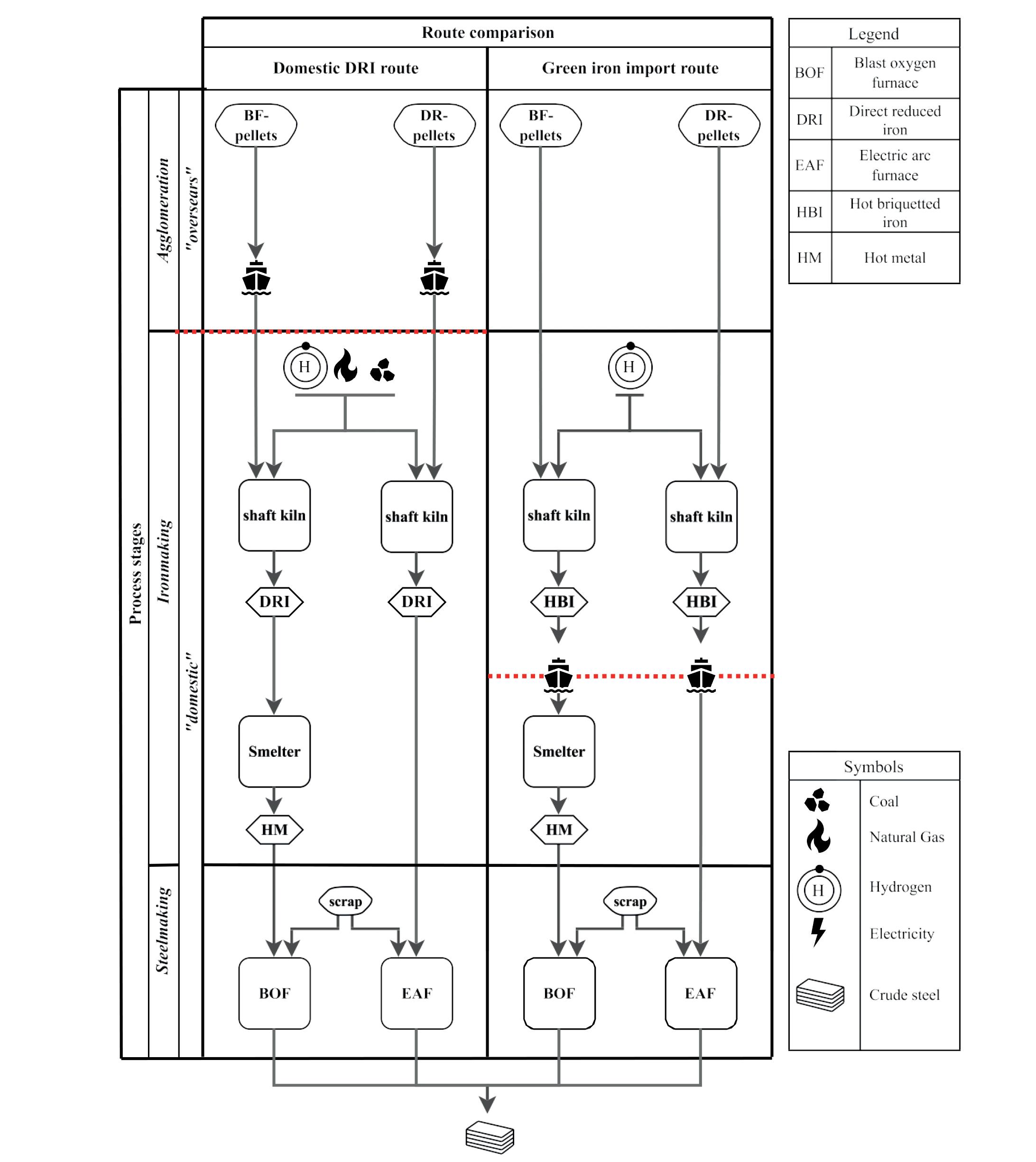

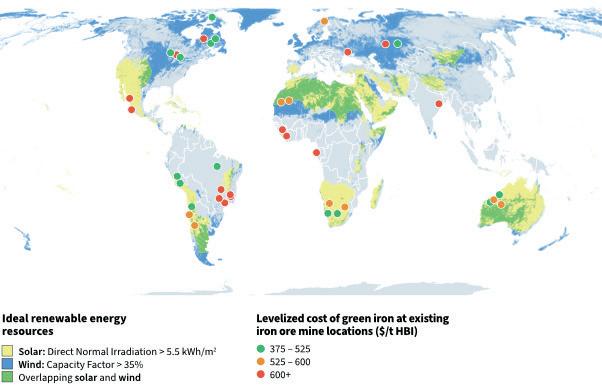

The necessity to produce green hydrogen at scale and affordably for the direct reduction of iron ore raises the question of where in the world DRI production with green hydrogen will be concentrated in the future. The currently dominant technology for iron reduction, the blast

furnace, produces hot liquid metal which is subsequently processed into steel on-site. In contrast to liquid hot metal

from the blast furnace, DRI produced in a shaft furnace exists in a solid state and can be transported at reasonable costs

1. Wuppertal Institute for Climate, Environment & Energy, Wuppertal, Germany

2. German Aerospace Center (DLR), Institute of Networked Energy Systems, Stuttgart, Germany

3. Environmental and Energy Systems Studies at Faculty of Engineering, Lund University, Lund, Sweden

4. Energy Systems Research Group. Chemical Engineering Department, University of Cape Town, Cape Town, South Africa

5. National Institute for Environmental Studies, Tsukuba, Ibaraki, Japan, and the Indian Institute of Management-Ahmedabad, Ahmedabad, Vastrapur, Gujarat, India

6 University of Kassel, Kassel, Germany

as Hot Briquetted Iron (HBI) over long distances. The transportability of HBI as a bulk commodity allows the spatial decoupling of the iron reduction step from the steelmaking step. This may contribute to the global steel transformation by introducing an additional spatial dimension. Rather than transitioning from coal-based blast furnaces to hydrogen-based shaft furnaces for DRI production at the same production site, steel companies may decide to invest in shaft furnaces in global ‘sweet spots’, which are rich in renewable energy and, in the best case, also possess significant iron ore resources. Subsequently, the DRI could be transported in the form of

potential of relocation of energy-intensive industrial processes due to differences in the costs of renewable electricity production and analyse the concept of green iron export and its economic feasibility for Australia and South Africa. Lopez et al examine various steel supply chain configurations for European countries and address green iron import options from Australia, South Africa and Mauritania. The international green iron trade is inspected by Agora Industry and the Wuppertal Institute and its implications for importers and exporters are addressed in terms of employment, production costs and value creation. There are also several

HBI from global sweet spots to steelmaking facilities around the globe. This approach could help to reduce the associated costs of hydrogen-based steel production for steel companies. Eventually, a global green iron trade could emerge in the future, resulting in a near-zero global steel industry that differs significantly from the current state of affairs in which no such relocations are considered.

Several studies have examined the

scenario studies and roadmaps that explore how different mitigation options could be applied in global pathways towards a net-zero steel industry, but without any consideration of a global green iron trade. Agora Industry and the Wuppertal Institute consider global green iron trade in their Global Green Iron scenario and discuss its implications for the global decarbonization pathway, but do not break this down to regional decarbonization pathways. To the

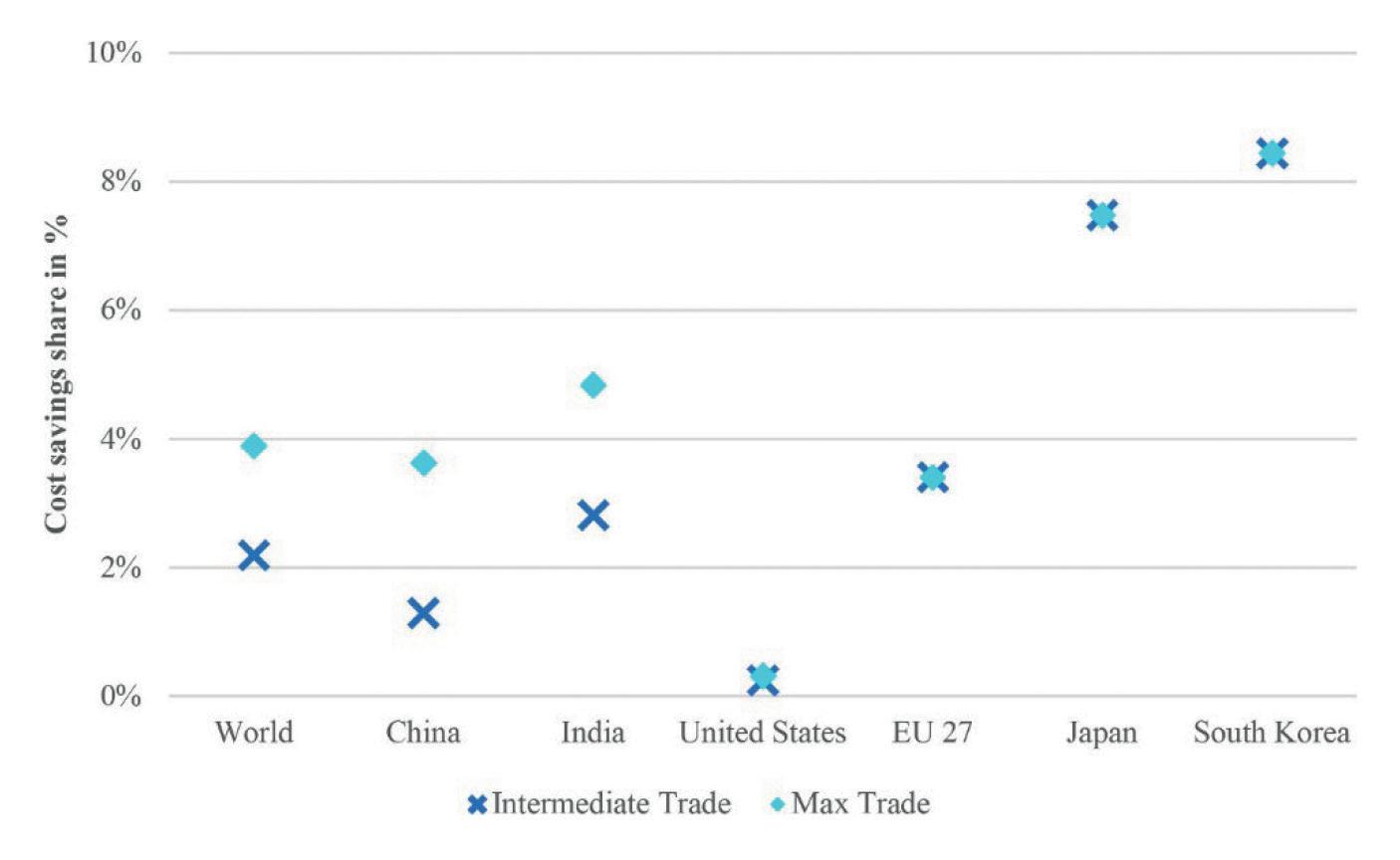

author’s knowledge, no published global scenario exists to date that considers the global green iron trade as an element of a regionally differentiated global steel decarbonization pathway. Hence, the potential magnitude of a global green iron trade, its potential impacts with regards to relocation of energy demand between regions as well as with regards to global costs of the steel transformation towards near-zero emissions have not yet been analysed. This study addresses the research gap. By comparing three scenarios – Domestic, Intermediate Trade and Max Trade – it assesses the potential of a global green iron trade and its impact on the global steel industry transformation to nearzero emissions by 2050.

Scenarios can serve various purposes, from prediction through exploration of potential futures to normative description of desirable futures. Long-term scenarios do not aim to predict, but rather serve to depict alternative futures – often constructed as back casting scenarios based on specific future targets – to assess their respective impacts and to foster debate. Three scenarios that contrast alternative pathways for the global steel industry are presented in this article and their respective impacts are assessed. All three scenarios are based on regional near-zero technology pathways from the literature which is combined to form a global picture with the ambition of describing transformation pathways for the global steel sector, which achieve near-zero emissions by 2050.

The technology pathways for the main steel producing regions are used as the key basis for the scenarios. They are collected from various sources, such as studies, articles, government reports and policies detailing steel decarbonization pathways. Roadmaps from stakeholders such as steel associations and governments have been preferred over scientific studies in the selection of regional technology pathways in order to address the regional differences and the strategic considerations of actors to the largest extent possible. From the pathways described in these sources, those which best match the ambition level of achieving near-zero emissions by 2050 were selected. Where no sufficiently ambitious pathway

could be found in the literature for a region, a technology pathway was generated based on available policy documents or press releases of steel companies. Technology pathways have been finalized by adjusting them based on current policy and our own expertise.

A core strategy to achieve near-zero emissions by 2050 would result in a more efficient use of steel compared to

today. To reflect this, regional studies that include material efficiency strategies in their pathways towards a near-zero steel industry in 2050 are selected, if available. Chen et al., Green Energy Strategy Institute et al., Material Economics and the United States Department of Energy provide regional near-zero technology roadmaps that match the above-mentioned selection criteria for

China, South Korea, the EU 27 and the United States, respectively. Technology pathways from these studies have been adopted without major adjustments. The selected regional decarbonization pathways follow different technology paths due to differences in fossil energy endowments, economic development levels and steel demand trends. The EU, the US and China are regions with stabilizing or even

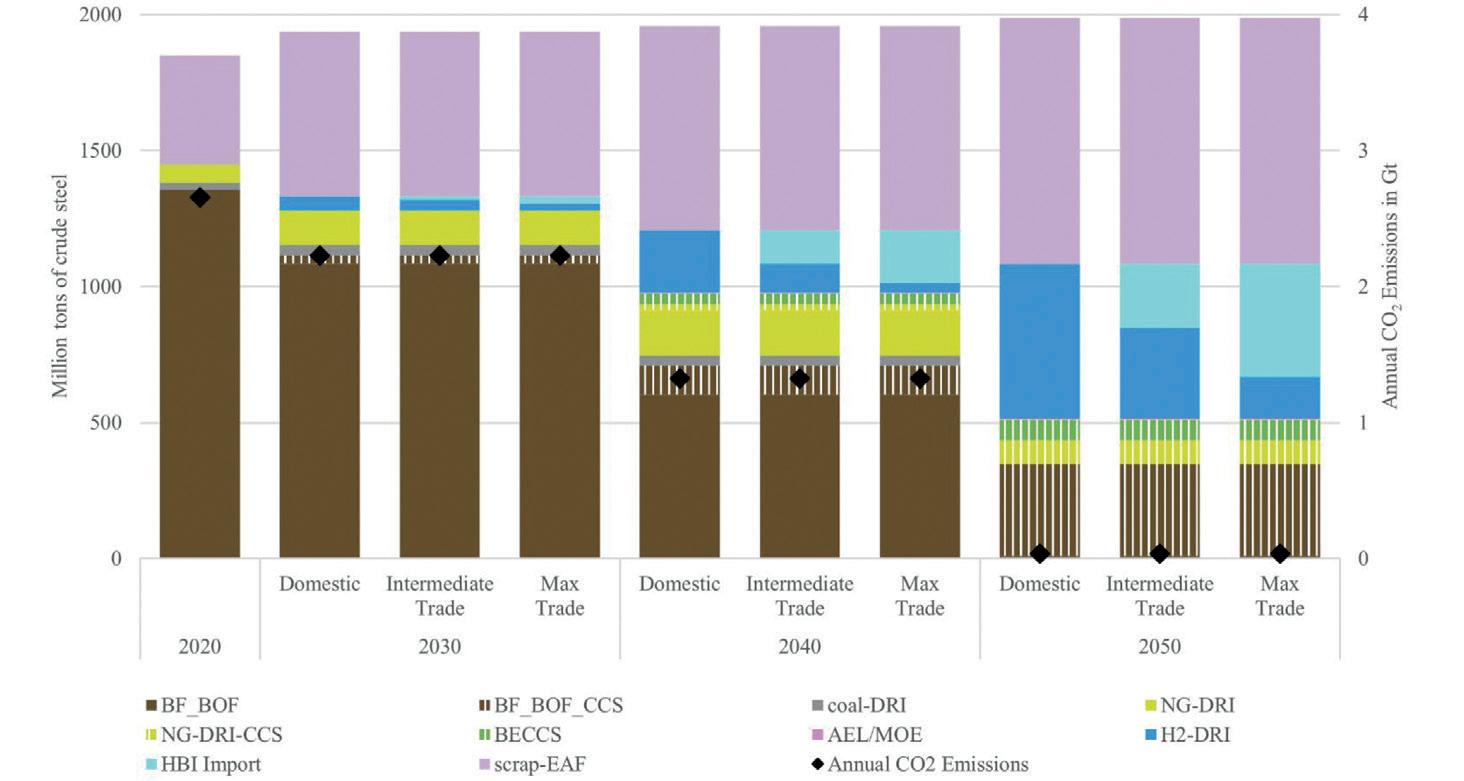

decreasing (China) crude steel demand, which can increasingly be met by scrap recycling. Therefore, secondary steelmaking plays an increasing role in these regions. In contrast, India faces a significant increase in crude steel demand and features the most cost-effective crude steel (CS) production with DRI using domestic thermal coal. Due to the resulting slow increase in scrap availability in India, demand growth is satisfied by primary production, mainly from conventional processes until 2030 and from fossil-DRI routes between 2030 and 2040. After 2040 the latter will be transitioned to green hydrogen. With scrap availability being expected to remain at current levels, decarbonization of primary production is expected to be driven by H2-DRI in Japan and South Korea. Existing conventional production technologies are either retrofitted with CCS or shut down in these regions, according to the selected technology pathways. Fig 1

Deduction of technology pathways for the Intermediate Trade and Max Trade scenarios

The technology pathways of the Intermediate Trade and Max Trade scenarios are derived from the Domestic scenario and additional assumptions on the substitution of domestic H2-DRI production with green iron imports, while total steel production and the role of other routes remain unchanged. In the Max Trade scenario, economic efficiency of steel production is the key factor for the future development of green iron markets.

It is assumed that all HBI-importing regions – i.e. China, EU 27, India, Japan, South Korea, the United States and the rest of the world (RoW) – take advantage of cost-efficient DRI production in global sweet spots as soon as possible. Consequently, they will begin importing green iron in the late 2020s, creating an increasing demand in the emerging global green iron market. It is assumed that the global sweet spots (Australia, Brazil, South Africa) will only be able to meet half of the demand for green iron by 2030 due to the limited pace at which the renewable energy and hydrogen production capacity required for green iron production can be built. With imports meeting half of their green iron demand by 2030, the other half is produced domestically in HBI-importing regions. After 2030, it is assumed that the global sweet spots will be able to increase

supply of green iron to an extent that all additional green iron demand of HBIimporting regions can be met. Since there is no differentiation of green iron import strategies between regions, the emerging global green iron trade is assumed to equally expand to all HBI-importing regions with the same pace.

In the Intermediate Trade scenario, it is assumed that a global green trade will initially (until 2030) include only those HBI-importing regions that have high domestic hydrogen costs, limited renewable energy potential in the proximity of existing steel plants and thus great benefits from importing green iron – i.e. the EU 27, Japan and South Korea. These regions are thus assumed to follow the same import strategy as in the Max Trade scenario. But, the Intermediate Trade scenario differs from the former scenario with regards to the green iron import strategies of HBI-importing regions like China, India, the United States and the rest of the world. They are assumed to focus on expanding their domestic capacity for green iron production for reasons of self-sufficiency and strategic independence, in particular before 2030.

With the EU 27, Japan and South Korea being the only green iron importing regions with growing but limited green iron demand until 2030, it is assumed that green iron trade will initially develop through bilateral agreements between importing and exporting regions. After 2030, it is assumed that these bilateral agreements will give rise to a global green iron market, whose increasing liquidity will facilitate price reductions. Despite continuous ambitions for self-sufficiency in China, India, the United States and the rest of th world, it is assumed that the emerging global green iron market will attract half of the additional demand for green iron in these regions, while the other half will be met by domestic production through further capacity expansion and use of domestic renewable energy. The global import volume of green iron is calculated from regional technology pathways in the WISEE EDM Global Steel Model (GSM) – visit https://www. i2am-paris.eu/detailed_model_doc/wiseeedm for more information – and this is assumed to define the amount of green iron, which is globally traded. In the next

step, the GSM distributes the global green iron trade volume to the HBI-exporting regions – Australia, Brazil and South Africa – according to their market shares in global iron ore trade in 2020.

There are several studies that analyse the decarbonization pathways of the iron and steel industry in a global context, such as Agora Industry and Wuppertal Institute Bataille et al., IEA Net Zero Steel Initiative, Yu et al. In terms of global CS production volumes, our scenarios, together with IEA and Yu et al., show the lowest value for 2050 (1987Mt CS) among the compared scenarios, rooted in optimistic assumptions concerning material efficiency. In contrast, global CS production increases to 254Mt/yr, 2200Mt/yr and 2150Mt/yr in Net Zero Steel Initiative, Bataille et al. and Agora Industry and Wuppertal Institute, respectively. A higher level of CS production makes a deeper structural shift in the technology mix necessary, in order to achieve near-zero emissions by 2050. As a consequence, the level of DRI production would be higher when global CS production is assumed to be higher. This implies that the potential scale of global green iron trade may be greater than addressed in this study.

Another notable difference is the reduction in annual CO2 emissions by 2030 between the scenarios. Emission reduction shares vary from 17% to 47% between the scenarios examined, with the Tech Moratorium scenario in the Net Zero Steel Initiative and our scenario study. Figs 2, 3,4 and 5

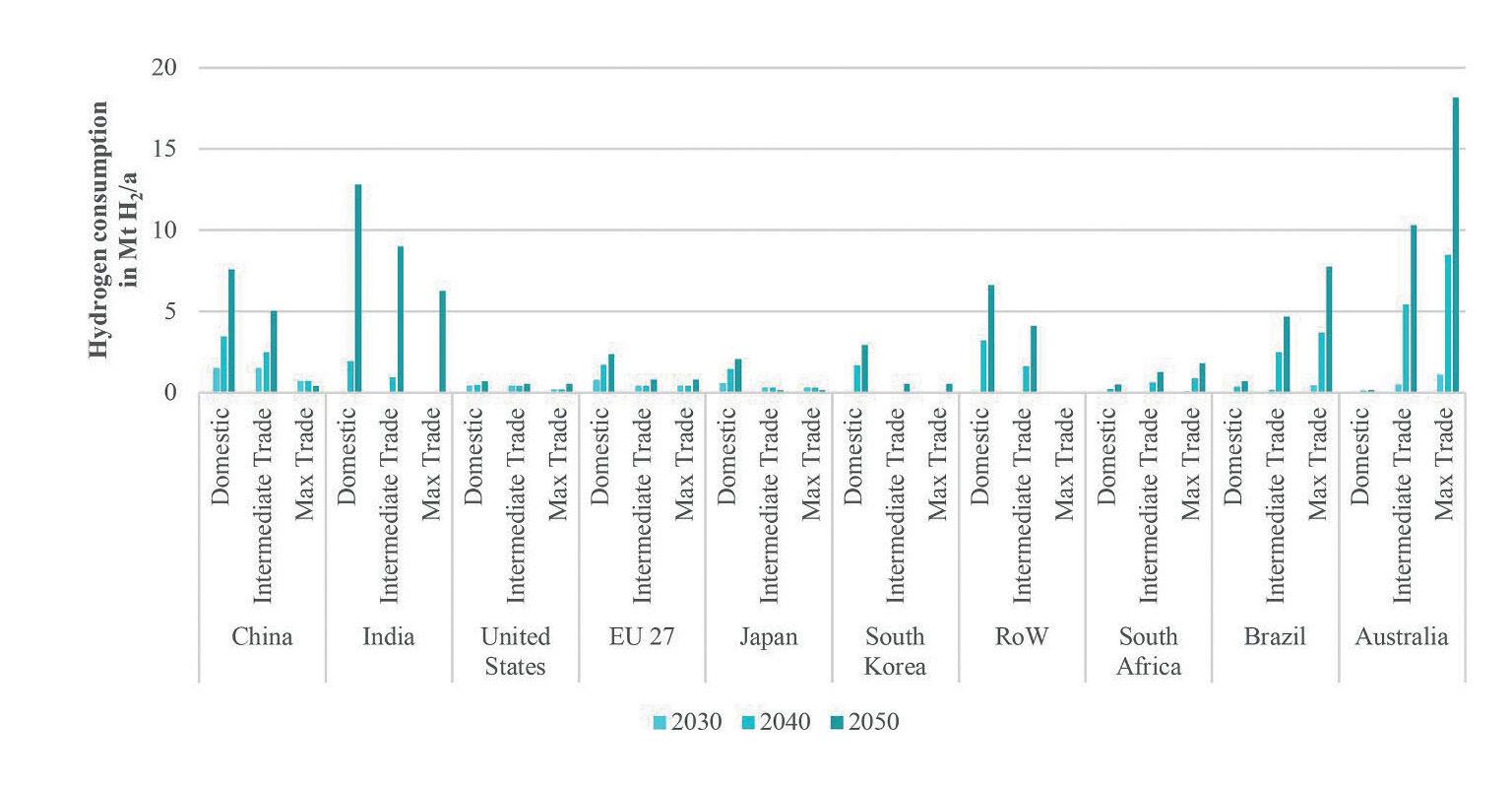

A potential challenge implied by the trade scenarios is that the renewable electricity required to produce H2-DRI for a large share of the global steel industry must be generated in a few exporting countries only – Australia, Brazil and South Africa, according to the scenarios. This implies the need for a very rapid scale-up of renewable electricity production in these countries. Producing 165-290Mt of green iron for export in Australia in 2050 would require 575-1025 TWh of green electricity only for this purpose, which is 2.1-3.8 times today’s electricity consumption in the country. Similarly, producing 65-115Mt of green iron in Brazil and 12-22Mt in South Africa would require 230-410 TWh green

electricity in Brazil and 45-80 TWh in South Africa, which amounts to 40-72% and 2035% of today’s electricity consumption in these countries, respectively.

These three countries possess a significant potential for renewable electricity production. In Australia, only 3-19% of the on- and offshore area suitable for green electricity production would be required to produce sufficient amounts of green electricity for DRI production according to the scenario (own elaboration based on COAG and Feitz et al). In the case of Brazil, the estimated potential for offshore wind alone exceeds the total electricity demand by more than 150% with currently feasible technologies. But the main challenge is to tap this potential in a comparably short time frame, considering that electricity demand for green iron exports comes on top of the renewable electricity required to replace fossils in the power sectors. In particular countries such as Brazil and South Africa, whose domestic electricity demands are expected to grow significantly until 2050 (200% - 480% in Brazil, 120% in South Africa), face the challenge to ramp up renewables fast enough to cover additional demand and phase out fossil fuelled power generation at the same time. In this context and from a systemic

perspective, green iron exports and their additional electricity demand only provide GHG mitigation benefits if it is ensured that this does not (directly or indirectly) extend the use of fossil fuels in power generation. Scaling up renewables at a rapid pace while avoiding unintended effects on fossil-based power generation brings up challenges for these countries.

Australia does not have a continentwide electricity grid and hence a subnational perspective is appropriate to avoid escalating infrastructure costs. As a consequence, the scale-up of renewables for green iron export would be mostly decoupled from dynamics in the domestic electricity system – except capital and engineering capacities required. Iron ore mines are concentrated in the northwestern part of Australia and hence a focused and massive ramp-up of renewable electricity and electrolyser capacity would be required in that area. In Brazil, the region Minas Gerais possesses 87% of steel production and 54% of iron ore production. In addition, protected areas of the Amazon, the Pantanal and the indigenous population are not located in this region. The region is well connected to the national electricity grid – hence the scale-up of renewables for green iron export needs to be

integrated into an overall electricity system transformation in order to avoid increased fossil-based electricity production.

The planned renewable electricity production in Brazil for 2050, about 2500 TWh according to EPE, would be sufficient to cover the expected domestic demand, 810-2100 TWh according to EPE, but could be exceeded if the additional electricity demand for green iron exports comes on top. Hence, the scenario might imply the need to ramp up renewables faster than currently planned.

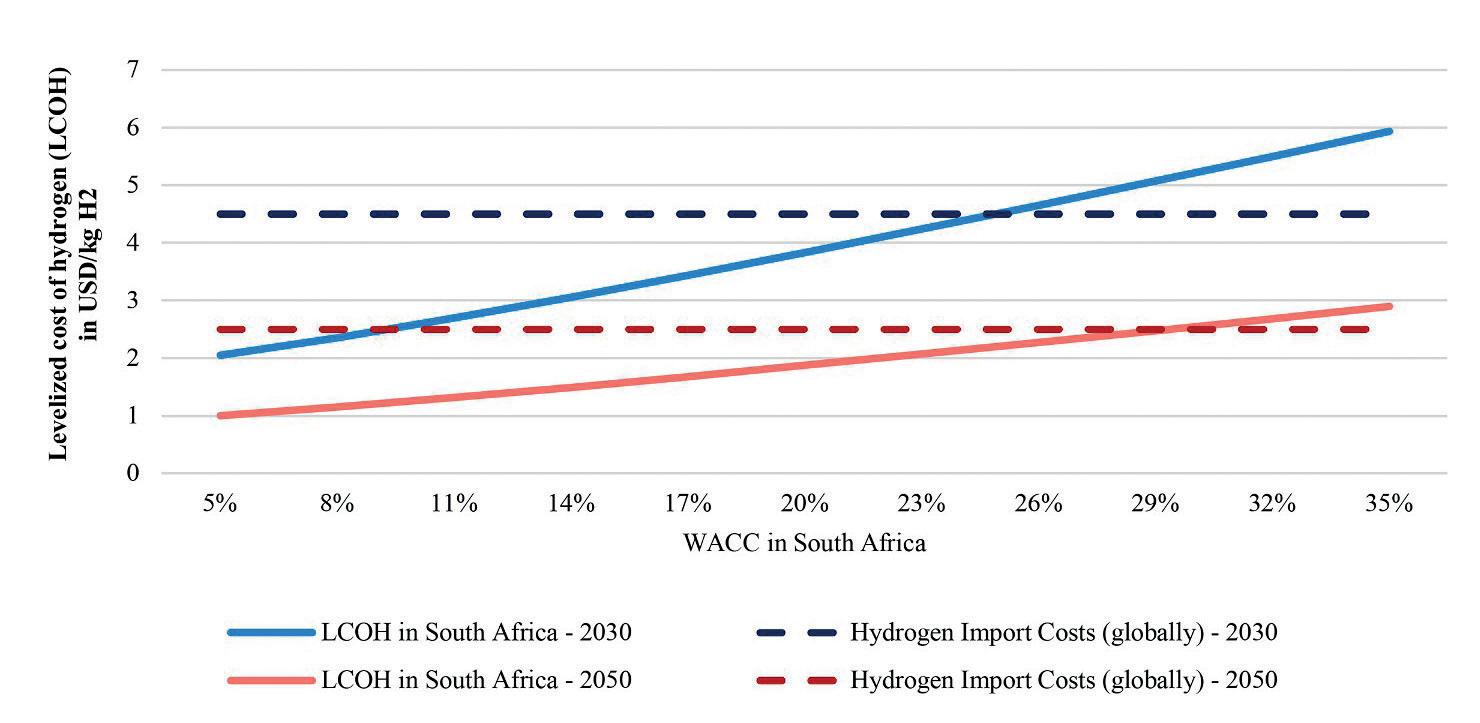

Considering the investments in renewable electricity generation, transmission lines, hydrogen storage and DR plants, green iron production is a capital cost-intensive investment. Although the global ‘sweet spots’ have favourable conditions for renewable electricity and iron ore reserves, high financial risks could discourage investments for H2-DRI production in some of these regions. Cost calculations for South Africa as an example shows that a weighted average cost of capital (WACC) higher than 25% in South Africa would make the investments for hydrogen production unviable from a purely economic perspective, as the levelized cost of hydrogen (LCOH) in South Africa would then be higher than the estimated

hydrogen import costs in potential HBIimporting regions in 2030, as illustrated in Fig. 6. This signifies that very high financial risks in global ‘sweet spots’ could economically favour domestic production of DRI in today’s major steel producing regions based on iron ore and hydrogen imports.

Concerning major potential HBIimporting regions such as China, India and the EU, dependencies on single or few HBI-exporting countries for a strategically important industry such as the steel industry might be of importance, besides cost considerations. China has a high ambition on guaranteeing energy security and increasing self-sufficiency. Although, in 2020, China imported 82% of its iron ore consumption, it also produced 270Mt of raw iron ore domestically. With steel production set to decrease, China’s iron ore demand will decrease to 170-280Mt in the trade scenarios. This opens up possibilities to increase the share of domestic iron ore in steel production through maintaining the absolute level of domestic iron ore production while reducing imports. However, China needs to import only 40115Mt of DRI in the trade scenarios – a level that might be acceptable from a selfsufficiency perspective.

India’s steel consumption will increase significantly up to 2050, according to our scenarios. Today, India is a net exporter of iron ore and it has abundant iron ore reserves to cover its future demand domestically, if mining activities can be scaled up at a sufficient pace. India also features low-cost solar potential and thus, in principle, could even become a green iron exporter in the long term. Like other growing countries such as Brazil and South Africa, the main challenge is to scale up green electricity capacities sufficiently fast to decarbonize a growing electricity demand while producing green hydrogen for the steel industry simultaneously. Green iron import, as envisaged in the trade scenarios, could provide some relief to this challenge, but would come with cutbacks to self-sufficiency, which would counter current strategies targeting strong domestic production costs.

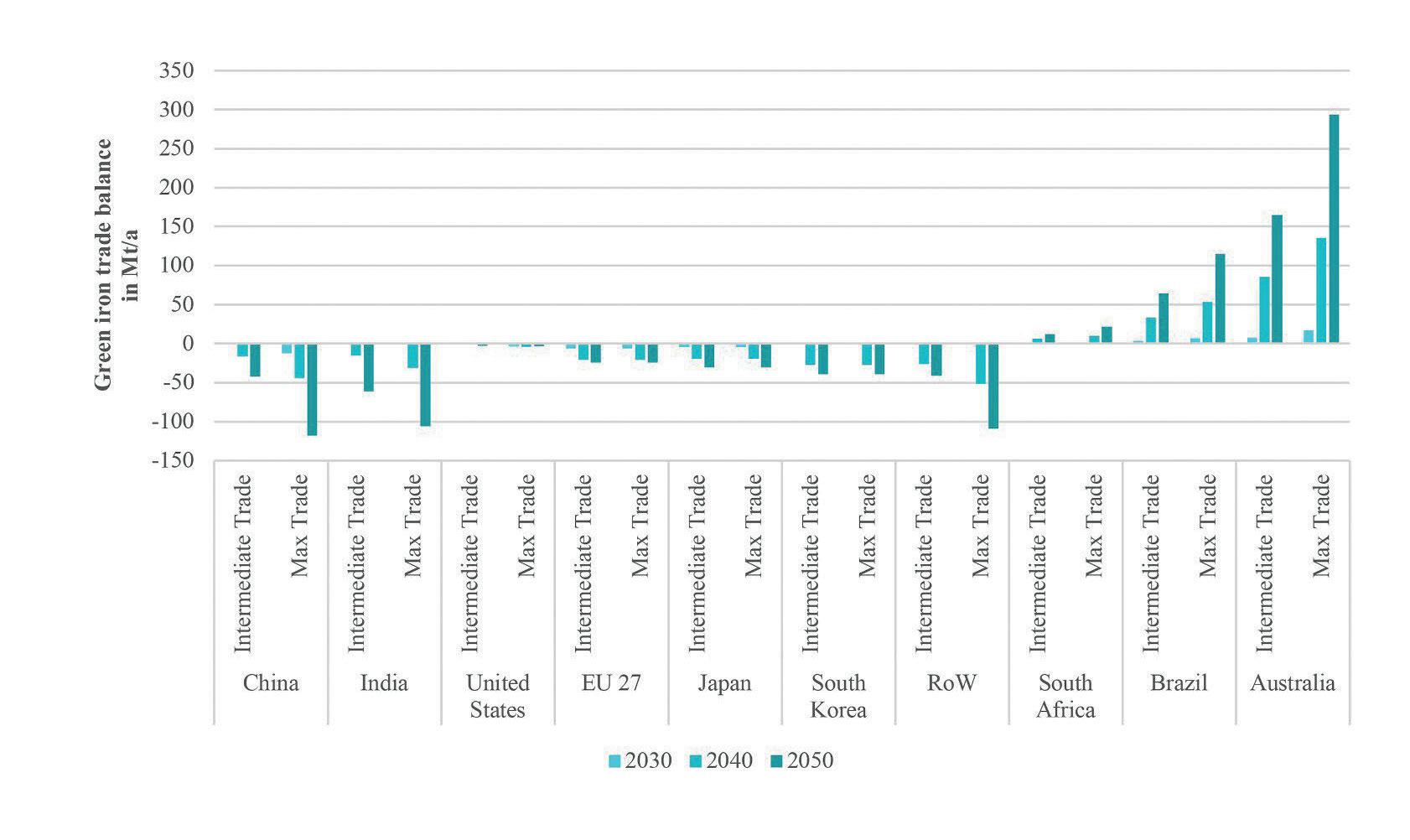

The magnitude of green iron imports varies across scenarios, as shown in Fig. 6 The volume of green iron imports into the EU 27, Japan and South Korea reaches 95 Mt/yr by 2050 and is assumed to take place equally in both trade scenarios. The global

green iron trade volume is contingent upon the assumptions made regarding the import volumes of other HBI-importing regions. In the Intermediate Trade and Max Trade scenarios, the global green iron trade volume reaches 240Mt/yr and 430Mt/yr, respectively, by 2050. In relation to global green iron production, which is 590Mt/yr in 2050 in both scenarios, 39% and 73% of green iron production is traded in 2050 in the Intermediate Trade and Max Trade scenarios, respectively. The export volume of iron ore of HBI-exporting regions decreases in both trade scenarios. In 2020, Australia, Brazil and South Africa exported 873Mt/yr, 343Mt/yr, and 66Mt/ yr of iron ore, respectively. Assuming a constant rate of iron ore production until 2050, 26% and 47% of iron ore production is used to produce and export green iron in the Intermediate Trade and Max Trade scenarios, respectively (Fig. 6). These results demonstrate that the quantity of iron ore processed to HBI in the HBI-exporting regions in the trade scenarios is significantly below their current iron ore export volume. The current iron ore mining capacities hence do not constrain the potential of global green iron trade to reach a trade volume of 240-430Mt/yr in 2050, as presented in this study.

In summary, the global green iron trade starts in the late 2020s and grows

significantly until 2050, resulting in a global trade volume of 10-25Mt/yr in 2030, 125-200Mt/yr in 2040 and 240-430Mt/ yr in 2050 in the trade scenarios. In the Max Trade scenario, China, India and RoW are the regions with the largest annual HBI imports in 2050, accounting for more than 100Mt/yr in each region, while South Korea, Japan and the EU 27 together import 95Mt/yr in 2050. In the Intermediate Trade scenario, the annual green iron import volumes demonstrate a more uniform distribution between the regions. The green iron import volumes of China, India and RoW in the scenario account for 42Mt/yr, 61Mt/yr and 41Mt/yr in 2050, respectively, while the import volumes of the EU 27, South Korea and Japan remain equal between the trade scenarios at 25Mt/ yr, 39Mt/yr and 31Mt/yr, respectively.

Australia, Brazil and South Africa are the HBI-exporting regions, with Australia being the largest exporter with an annual export volume of 165-290Mt/yr in 2050, followed by Brazil with 65-115Mt/yr and South Africa with 12-22Mt/yr. Fig 7

Further research is required to better understand the practical potential of green iron exports or imports on the regional level. Since our study only considers domestically produced H2-DRI being