SOYABEANS

20 A tale of two giants Brazil and the USA are the world’s top suppliers of soyabeans. What does the future hold for these two giants?

Impact of climate change

South America is a leading producer of vegetable oils but climate change has affected production and yields

26 A new perspective on enzymatic biodiesel

The need to source lower value feedstocks for biodiesel and renewable diesel is making the enzymatic biodiesel process a viable and economic technology

29 Global round-up of news

OFI reports on some of the latest projects, technology and process news and developments around the world

31 Soya in focus in US trade war

As the world’s largest importer of edible oils and the top soyabean oil consumer, China holds a significant position in global vegetable oil trade, highlighted by its current conflict with the USA over trade tariffs

Surfactants/China 33 Surfactants market outlook

China is a major producer and consumer of surfactants, with rising incomes and changing lifestyles driving increased consumption of personal care products, household cleaners and detergents, as well as growing industrial applications

China, Canada announce retaliatory duties on USA

lanches probe into US

production of

Photo: US Library of Congress

Photo: Adobe Stock

Photo: Adobe Stock, AI generated

EDITORIAL:

Editor: Serena Lim serenalim@quartzltd.com +44 1737 855066

Assistant Editor: Gill Langham gilllangham@quartzltd.com +44 1737 855157

ADVERTISING: Mark Winthrop-Wallace markww@quartzltd.com +44 1737 855114

PRODUCTION:

Production Editor: Carol Baird carolbaird@quartzltd.com

CORPORATE:

Managing Director: Tony Crinion tonycrinion@quartzltd.com +44 1737 855164

SUBSCRIPTIONS: Jack Homewood subscriptions@quartzltd.com +44 1737 855028

Subscriptions, Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK

SUBSCRIPTION RATES:

Print & digital: Single issue – £45

1 year – £182 (UK), £210 (overseas)

2 years – £328 (UK), £377 (overseas)

3 years – £383 (UK), £440 (overseas)

Digital only: Single issue – £29

1 year – £170

2 years – £272

3 years – £357

© 2025, Quartz Business Media ISSN 0267-8853

WWW.OFIMAGAZINE.COM

A member of FOSFA

Oils & Fats International (USPS No: 020747) is published eight times/year by Quartz Business Media Ltd and distributed in the USA by DSW, 75 Aberdeen Road, Emigsville PA 17318-0437. Periodicals postage paid at Emigsville, PA. POSTMASTER: Send address changes to Oils & Fats c/o PO Box 437, Emigsville, PA 17318-0437

Published by Quartz Business Media Ltd Quartz House, 20 Clarendon Road, Redhill, Surrey RH1 1QX, UK oilsandfats@quartzltd.com +44 1737 855000

Printed by Pensord Press, Merthyr Tydfil, Wales

The Trump effect

It has only been some three months since Donald Trump started his second term as US president but the impact of his trade and political policies are already reverberating around the world.

For the oils and fats sector, new US tariffs on goods from China, Canada and Mexico – and reciprocal measures from these countries – will have a major effect on the soyabean and rapeseed markets (see p4).

The Canola Council of Canada says 25% US tariffs on Canadian products will have a devasting impact on its canola farmers, crushing and exports. And China’s retaliatory 15% tariffs on a range of US agricultural products – said to cover US$21bn worth of goods including soyabeans, wheat, corn and beef – will hit US soyabean farmers.

Although China has reduced its dependence on US soyabeans in recent years, it still bought some US$11bn worth of them in 2024, about half of the US export total, World Grain wrote on 3 March. Who will blink first? China with its heavy dependence on soyabean imports for food and feed (see p31), or American farmers who are a significant constituency for the US president.

The shipping industry is also feeling the Trump effect, with the US Trade Representative Office proposing million dollar fees on Chinese vessels entering US ports and Trump welcoming the sale by Hong Kong-based conglomerate CK Hutchison Holding of its ports unit to a US consortium (see p14). The unit operates two major ports at either end of the Panama Canal, which Trump had vowed to “take back”. The president has previously complained about the presence of Chinese companies at the waterway, which is vital to the US economy and key to its exports to Asia, including of US grain and soyabeans.

Another critical area of Trump influence is the environment. On his first day in office on 20 January, Trump signed an executive order withdrawing the USA from the Paris Agreement on climate change. While it will take a year before the country is officially out of the pact, the impact of the withdrawal and Trump’s pledge to “drill, baby, drill” will discourage some countries from putting climate change mitigation at the top of their agendas.

In the USA, the future of renewable diesel and sustainable aviation fuel (SAF) is also more uncertain, as the new Clean Fuel Production Credit (CFPC) programme to replace biofuel tax credits still needs to be finalised by the Trump administration. If history is any indicator, Trump is more likely to scale back the CFPC or shift support towards fossil fuels.

Trump’s temporary suspension of foreign and military aid to Ukraine to force peace talks with Russa may also bring an end to their war closer, although at what cost to the leading sunflowerseed producer is unclear.

And finally, will tallow and animal fats get a boost from the appointment of Robert F Kennedy Jr as US Health and Human Service Secretary? Kennedy has been a vocal critic of seed oils – such as canola, soyabean and sunflower oils – claiming they contribute to chronic diseases, and has advocated for their removal from the American diet.

With such wide-ranging effects in such a short space of time since Trump took office, the only certain thing that can be said about his second term as US president is that there will be more uncertainty for the market to factor in.

Serena Lim, OFI Editor serenalim@quartzltd.com

GEV E TA ELB SLIO

CMB TECHNOLOGIES

Transesterification | Enzymatic Biodiesel production | Glycerolisis

Methylester fractional and total distillation

Special Dry degumming & bleaching | Deacidification | Oil washing | Pre-treatment

You choose the feedstock(s), We build your best Biodiesel Plant.

CMB: your trusted partner for your Biodiesel Plants.

CMB S.p.a. Cisterna di Latina, Italy

CMB Malaysia Engineering For Oils And Fats SDN. BHD. Kuala Lumpur, Malaysia

CMB India Engineering For Oils And Fats LTD. Mumbai City, India

IN BRIEF

CHINA: China has set higher grain and oilseed production targets and increased its 2025 budget for storing agricultural commodities in a bid to secure its long-term food security, Reuters wrote on 6 March.

In a 5 March announcement, China set a production target of around 700M tonnes for 2025, compared with its 650M tonne 2024 target after a record 706.5M tonne harvest last year.

The country has also raised its 2025 budget for stockpiling grain, edible oils and other materials by 6.1% compared to the previous year to CNY131.66bn (US$18.12bn). In addition, China planned to increase construction and improve the connectivity of storage facilities for grain, cotton, sugar, meat and fertiliser, the report said.

The world’s leading importer of agricultural goods for its 1.4bn people, China imported more than 157M tonnes of grains and soyabeans in 2024 but was aiming to cut its dependence on supplies that mainly came from Brazil and the USA, the report said.

According to customs data, the total value of China’s agriculture imports in 2024 dropped by 8% to US$215bn due to increased domestic agricultural output.

The country imported around 80% of its soyabean needs, and said it would expand coverage of full-cost and production income insurance for soyabeans, to encourage farmers to plant the oilseed. It would also continue efforts to lower the use of soyabean meal in livestock feed. The use of low-protein animal feed or alternative meals such as rapeseed or cotton had been explored for several years to reduce China’s demand for imported soyabeans, the report said.

China, Canada announce retaliatory duties on USA

China and Canada have imposed retaliatory tariffs on the USA in response to US President Donald Trump's plan to impose sweeping 25% tariffs on goods from the two countries – first announced in February – along with a doubling of 10% additional tariffs on China to 20%.

China’s countermeasures, which came into effect on 10 March, include 10% tariffs on US soyabeans, pork and beef, as well as duties on oilseeds and vegetable oils.

Canada announced 25% tariffs against US$30bn worth of US goods including vegetable oils and margarine, effective 4 March. The country also plans to apply tariffs on additional imports from the USA on 2 April, following a public comment period.

The 2 April is when the US tariffs on Canada and Mexico are set to take effect, following a one-month delay announced by Trump on 6 March when he exempted anything falling under the existing US, Mexico and Canada (USMCA) trade agreement.

China, Mexico and Canada are among the USA’s biggest trading partners, with the three countries making up more than 40% of US imports last year, according to the BBC.

China’s foreign ministry spokesman Lin Jian said trying to exert maximum pressure on China

was “a miscalculation and a mistake”, CNN Business reported on 4 March. “If the USA... persists in waging a tariff war ... the Chinese side will fight them to the bitter end," he said.

On 12 March, the USA also imposed tariffs of up to 25% on imports of steel and aluminium from the EU. In response, the European Commission (EC) said it would introduce countermeasures in two stages. It would reintroduce measures put in place during the previous Donald Trump presidency on 1 April and implement new tariffs by 13 April. The measures include tariffs on steel and aluminium, textiles and agricultural products including poultry, beef and vegetable oils and fats.

"As the US are applying tariffs worth US$28bn, we are responding with countermeasures worth €26 billion," EC President Ursula von der Leyen said in a statement on 12 March.

The Organisation for Economic Co-operation and Development (OECD) said the escalating trade tariffs would hit world growth and raise inflation, halving its growth outlook for Canada, the BBC reported on 17 March. Canada's growth rate would slow to 0.7% this year and in 2026, compared with its previous forecast of 2% for both years, the OEDC said. The OECD also downgraded growth in the USA, with a figure of 2.2% for this year, down from previous forecasts of 2.4%.

China imposes tariffs on Canadian canola

China announced on 8 March that it was imposing 100% tariffs on Canadian rapeseed oil and meal, leaving the country and new prime minister Mark Carney to juggle trade wars on two major fronts, CEO Morning Brief reported on 10 March.

The Chinese measure, effective on 20 March, was in response to Canadian tariffs on Chinese-made electric vehicles, steel and aluminium introduced last year, the report citing Bloomberg said.

Canada is also facing 25% tariffs on its exports to the USA, including canola seed, oil and meal (see above).

“Canadian canola farmers are facing an unprecedented situation of trade uncertainty from our two largest export markets only weeks before planting begins,” Rick White, the president and CEO of the Canadian Canola Growers

Association, said on 8 March.

China is Canada’s leading export destination for canola, a specific variety of rapeseed with lower levels of erucic acid and glucosinolates.

Although China’s move was sweeping, no tariffs were imposed on canola seed, which China imported in larger volumes than its oil and meal, CEO Morning Brief said. China also had an ongoing

anti-dumping probe into Canadian rapeseed imports, leaving open the possibility of further measures.

China’s inbound shipments of rapeseed totalled 6.39M tonnes last year, almost all of which came from Canada, the report said. According to Chinese customs data, China also imported about 2.74M tonnes of canola meal last year, with the USA as the top supplier.

Photo: Pixabay

Accelerate It.

Develop, scale and commercialize with CPM|Crown – the proven, single-source partner for product and process optimization.

Bring new products to market faster and more sustainably with Crown. As a leader in oilseed extraction for 70+ years, Crown’s technical expertise, guidance, proven technologies and Global Innovation Center transform your ideas for protein concentrates, food/beverage, botanicals and other new product segments into profitable realities. With Crown’s full-scale, state-of-the art pilot plant, analytical lab and training facilities, you can test product and process feasibility, run benchtop scale to custom processing and commercialize with efficient, continuous operations backed by Crown’s Lifecycle360™ single-source support services. Partner with Crown to accelerate your market opportunity.

Start up, scale up and expand with CPM|Crown’s expertise.

Feeding, Fueling and Building a Better World.

IN BRIEF

UKRAINE: The total cost of reconstruction and recovery in Ukraine is estimated at US$524bn over the next decade, almost three times the estimated nominal GDP of Ukraine for 2024, according to a joint report by the government of Ukraine, World Bank Group, the European Commission (EC) and the United Nations.

Rebuilding the country's agriculture sector following Russia's invasion in 2022 was expected to cost more than US$55bn, while total losses suffered by the sector was estimated at around US$80bn, the updated Rapid Damage and Needs Assessment (RDNA4) published on 25 February said.

Ukraine is a leading exporter of wheat and corn, and the world's top supplier of sunflowerseed, meal and oil. A US Department of Agriculture World Agricultural Supply and Demand report projected the country producing 12.9M tonnes of sunflowerseed in the 2024/25 marketing year, down 16.7% from a year ago.

The country remains the EU’s leading sunflowerseed oil supplier, according to latest EC figures, reported by Germany’s Union for the Promotion of Oil and Protein Plants on 13 February.

From 1 July 2024 to 2 February 2025, the EU-27 imported around 1.24M tonnes of sunflowerseed oil. Ukraine delivered 1.17M tonnes of this oil, represented a 94% market share.

Lithuania halts transit of Belarusian rapeseed oil

Belarusian rapeseed oil shipments through Lithuania have been suspended following media investigations which revealed rapeseed from Russian-occupied territories in Ukraine had been processed in Belarus and sold to the EU, stateowned public broadcaster Lithuanian National Radio and Television (LRT) wrote on 19 February.

Thousands of tonnes of rapeseed oil processed by Belarusian oils and fats producer Agroprodukt have been passing through Lithuania by rail, according to a 19 February report by Lithuanian news website 15min.lt in conjunction with the Belarusian Investigative Center (BIC), Latvian television channel TV3 and Ukrainian investigative project Skhemy.

LTG Cargo, the freight arm of state-owned railway company Lietuvos Geležinkeliai (Lithuanian Railways, LTG), said it had launched an internal investigation and stopped rapeseed oil shipments after the media started looking into

the origin of Agroprodukt’s raw materials, LRT wrote. As a result, eight wagons of rapeseed oil heading to the port of Klaipėda from Belarus were detained at Lithuania’s Kena checkpoint in the week prior to the report.

Almost 50,000 tonnes of Agroprodukt oil transited Lithuania in 2024, according to LTG Cargo data. However, this figure was likely to be much higher, with three companies – Gen Cargo, Baltijos Pervežimai and Baltic Cargo Agent – involved in the shipment of these cargoes in Lithuania last year, leaked data from Belarusian Railways show.

Belarusian oil has been imported by the EU without restriction until the European Commission introduced duties on EU imports of grain, oilseeds and their processed products from Russia and Belarus on 1 July 2024.

EU countries bought 90,400 tonnes of rapeseed oil from Belarus worth US$70.8M in the first half of 2024, four times higher than in 2021.

New Epax plant to expand marine oil range

Norwegian marine ingredient company Epax is investing US$10M in a new facility in Aalesund, Norway, to expand its range of marine oils, Nutra Ingredients reported on 12 February.

The 5,000 tonnes/year plant – due to be operational in early 2026 – would use new Epax fractionation technology to modify fish oil from North Atlantic pelagic fish species, a rich source of omega-9 and omega-11 fatty acids.

“Our team has engineered a method to isolate and up-concentrate fatty acids from North Atlantic fish", which was typically challenging due to the fatty acid composition of that fish type, Epax global marketing director Thomas Gulbrandsen said.

In 2012, Epax launched its NovusLipid category to commercialise new fish oils, a key component of which was exploring the use of omega-11 cetoleic acid and omega-9 gondoic acid commonly found in pelagic fish which inhabit the open waters of the North Atlantic,

typically at or near the surface. These longchain monounsaturated fatty acids had shown potential in nutraceutical applications targeting skin and metabolic health, as well as beauty and personal care products, the report said.

Indian February edible oil imports fall to lowest level in four years

India's edible oil imports in February fell to their lowest level in four years, dragging stocks to their lowest level in three years, a 11 March Reuters report quoted the Solvent Extractors' Association of India (SEA). Imports of soyabean oil fell 36% to 283,737 tonnes in February and sunflower oil imports fell 20.8% to 228,275 tonnes, the SEA said. In total, the country's February vegetable oil imports fell by 12% to 899,565 tonnes, the lowest since February

2021. Edible oil stocks in India amounted to 1.87M tonnes on 1 March, the lowest figure in more than three years.

Palm and soyabean oil imports were likely to improve in March, as the industry was trying to build stocks, said Rajesh Patel, managing partner at GGN Research.

The world's largest edible oil importer meets almost two-thirds of its vegetable oil demand through imports, according to Reuters, which wrote earlier on 21 February

that India was likely to raise vegetable oil import taxes to help oilseed farmers suffering from a crash in domestic oilseed prices.

In September 2024, India already imposed a 20% basic customs duty on vegetable oils, with 5.5% duties on crude palm, soyabean and sunflower oils rising to 27.5%, and a 35.75% import tax on refined grades of the three oils.

The SEA said farmers needed support to maintain their interest in oilseed cultivation.

Photo:

Indonesian deforestation rises for third year

Deforestation in Indonesia increased for a third consecutive year in 2024, The Jarkarta Post report reported on 1 February.

Using satellite imagery and field work, local environmental non-governmental organisation (NGO) Auriga Nusantara said 261,575ha of primary and secondary forests were lost across Indonesia in 2024, over 4,000ha more than in 2023.

Most deforestation was legal, taking place in areas opened for development by the government.

Auriga Nusantara chair Timer Manurung

IN BRIEF

WORLD: Global derivatives and commodities exchange CME Group launched a range of cast-settled micro grain and oilseed futures contracts on 24 February which are one-tenth the size of its corn, wheat, soyabean, soyabean oil and soyabean meal contracts.

“Smaller-sized contracts will provide additional flexibility for market participants to manage their agricultural portfolios,” CME managing director John Ricci said on 30 January. Leading industry players, including Interactive Brokers, Saxo and Phillip Nova, had shown support for the launch, CME said.

WORLD: Global sustainability organisation the Roundtable on Sustainable Palm Oil (RSPO) has launched its new certification, trade and sustainability system.

The new Palm Resource Information and Sustainability Management (prisma) system aimed to improve trade and compliance with current and emerging global regulations by providing real-time data and analytics, the RSPO said on 3 February.

As well as helping RSPO members to input key data, streamline information management and improve supply chain efficiency, the RSPO said the new system also allowed trade transactions to be conducted.

said there was an “urgent” need to protect forest in Sulawesi and in Kalimantan, where the new capital was being built and the highest losses were recorded.

However, Ade Tri Ajikusumah, a senior official at Indonesia’s environment and forestry ministry, was quoted as saying that the deforestation figure had not accounted for reforestation on more than 40,000ha of land. He also explained that development around Indonesia’s new capital involved land that had already been released from “forest status”.

Against this backdrop, Indonesian environmentalists had raised concerns over government plans to convert millions of hectares of forests for food and energy use, The Jakarta Post wrote.

On assuming office in October 2024, Indonesian President Prabowo Subianto had pledged to expand production of bio-based fuels to reduce fuel imports as part of a bid to boost the country’s food and energy self-sufficiency, the report said.

Environmental groups have warned the plans would impact the country’s forests.

COFCO signs sustainable soya trade deal

Global agribusiness COFCO International has agreed to supply Modern Farming and China Shengmu Organic Milk with 1.5M tonnes of deforestation- and conversion-free certified soyabeans between 2025 and 2030.

The two subsidiaries of global milk producer Mengniu Group manufacture and distribute dairy products in China under the Mengniu brand.

The soyabeans would be delivered from Brazil to China, with on-farm audits ensuring sustainable water management, biodiversity conservation and ethical labour standards in compliance with the COFCO International Respon-

sible Agriculture Standard, COFCO said on 2 February.

COFCO International is the overseas agriculture business platform for China’s largest food and agriculture company, COFCO Corporation,

and is active in global grains, oilseeds, sugar and cotton supply chains. The company has commited to eliminating deforestation from its global soyabean and corn supply chains by 2025.

FDA delays 'healthy' label rule introduction

The US Food and Drug Administration (FDA) has delayed the introduction of its new 'healthy'' label rule by about two months, CNN reported on 24 February.

In December, the FDA finalised a rule updating the nutritional requirements a human food item had to meet to claim on its packaging that it was 'healthy', the report said.

The rule was initially scheduled to be implemented on 25 February 2025 but US President Donald Trump issued a memorandum in January putting a freeze on new rules until a department or agency head appointed or designated by the president reviewed and approved the rule.

The ‘Regulatory Freeze Pending Review’ memorandum also instructed agencies to postpone the effective date for any rules that had been published in the Federal Register but had not taken effect, CNN wrote.

The use of 'healthy' labelling is voluntary for

food manufacturers, and foods that meet the new requirements can start using the label once the rule is effective.

'Healthy' foods must contain a certain amount of a key food group – such as fruits, vegetables, whole grains, lean meats or low-fat dairy – and must limit added sugars and saturated fats.

About 5% of all packaged foods in the current marketplace are labelled as 'healthy,' according to the final rule.

However, some foods that could previously carry the healthy label, such as white bread and heavily sweetened cereal and yogurt, would no longer qualify, the report said.

Foods qualifying under the new rule included nuts, seeds, salmon, olive oil and some peanut butters and canned fruits and vegetables.

The FDA was also working on designing a packaging symbol to to help consumers more easily identify foods considered as healthy.

Photo:Adobe Stock

Half of adults to be obese or overweight by 2050

More than half of all adults around the world are predicted to be overweight or obese by 2050, according to a new study of global data reported by the BBC on 4 March.

The study, published in The Lancet and covering more than 200 countries, also predicted that a third of children, teenagers and young adults would be overweight or obese by 2050. By 2021, almost half the global adult population – 1bn men and 1.11bn women aged 25 or older – were overweight or obese, double the proportion living with these conditions in 1990. If trends continued, global rates of overweight and obese adults would rise to about 57.4% for men and 60.3% for women by 2050, the study said.

The countries with the highest number of overweight or obese citizens in 2050 would be China (627M), India (450M) and the USA (214M). However, population growth would

mean the number in sub-Saharan Africa would increase by more than 250% to 522M.

The authors acknowledged the study did not consider the potential impact of new weight loss medications and that they could play a significant role in the future.

The study said rates of obesity in children and younger teenagers had increased from 8.8% to 18.1% between 1990-202, while the rate among younger adults (under 25s) more than doubled from 9.9% to 20.3%. By 2050 one in three young people would be affected.

The co-lead author of the report, Dr Jessica Kerr of the Murdoch Children’s Research Institute in Australia, was quoted as saying the figures presented a real challenge to health care systems in the future. “But if we act now, preventing a complete transition to global obesity for children and adolescents is still possible.”

Kazakhstan sunflowerseed to nearly double

Kazakhstan’s sunflowerseed production in 2024/25 is expected to almost double compared to the previous year, according to a report by the US Department of Agriculture

(USDA) citing annual agricultural statistics published by the National Bureau of Statistics of Kazakhstan on 30 January.

At 1.8M tonnes, sunflowerseed production was forecast

to be 75% up on the five-year average, the USDA’s Foreign Agricultural Service (FAS)’s February World Agricultural Production report said.

Yields were estimated at 1.46 tonnes/ha – a rise of 33% – and harvested area was estimated at 1.3M ha, an increase of 11% compared to the previous year, respectively.

The USDA said the bumper crop was due to a significant rise in planted area and higher-than-normal yields. Overall growth in the last decade was driven by more efficient use of modern technologies, access to improved seed varieties and favourable domestic prices.

IN BRIEF

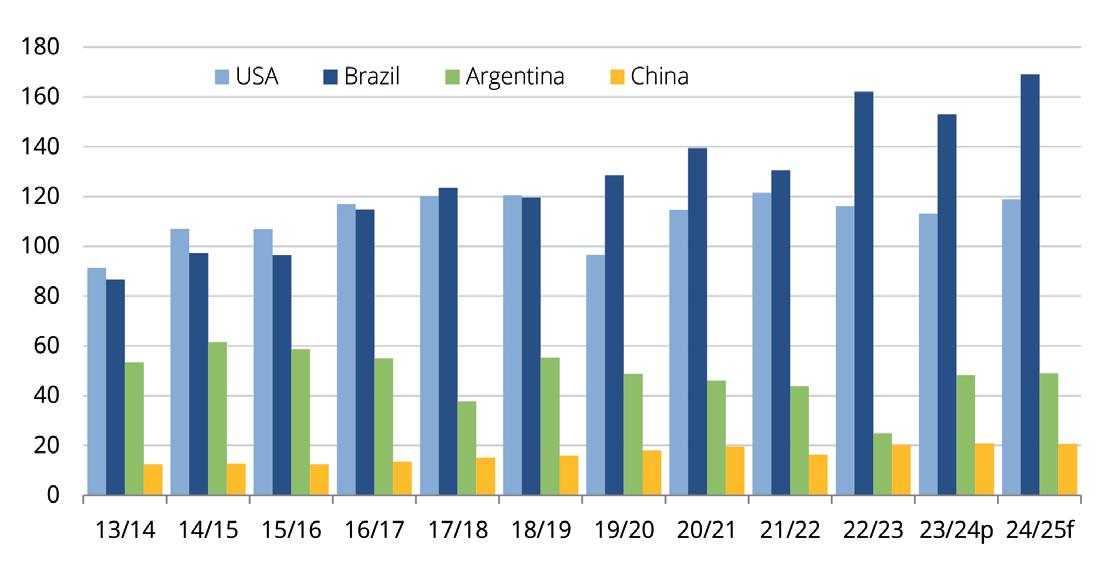

SOUTH AMERICA: Soyabean production in Brazil looks set to reach a record level in 2024/25 while yields in Argentina are expected to fall, according to a report by the US Department of Agriculture (USDA).

At 169M tonnes, Brazilian soyabean production in the period was expected to be 10% higher compared to the previous year and 18% above the five-year average, the USDA’s Foreign Agricultural Service (FAS)’s February World Agricultural Production report said.

Harvested area was estimated at a record 47.4M ha, 3% higher than the previous year and 13% above the five-year average.

Yields were estimated at 3.57 tonnes/ha, a 7% increase compared to the previous year and 5% above the five-year average.

Overall yield expectations in Brazil were positive but could be impacted by heat and dryness in southern parts of the country, including Rio Grande do Sul state and parts of Paraná state, although recent rainfall in Rio Grande do Sul had reduced some crop stress.

Soyabean production in Argentina in 2024/25 was forecast at 49.0M tonnes, up 2% from the previous year. Yields were forecast at 2.83 tonnes/ha, 4% lower than the previous year’s volume due to hot and dry conditions.

Olam Group to sell 44.58% stake in Olam Agri

Global food and agribusiness company

Olam Group is set to sell 44.58% of its stake in Olam Agri Holdings to Saudi Agricultural and Livestock Investment Co (SALIC).

Three years after the transaction's completion, Olam Group said it would sell its remaining 19.99% stake in Olam Agri to SALIC.

Olam Agri specialises in the processing and trading of animal feed, grains, oilseeds, rice and other products, handling 40M tonnes of commodities in 2023.

The company sources, trades, ships, distributes and processes grains and oilseeds such as wheat, maize, barley, rye, flaxseed, sorghum, chickpeas and soyabeans.

Its oil portfolio includes palm, rapeseed, soyabean and sunflower oils and it serves sectors from food manufacturing to personal care. The company also operates edible oil processing and refining plants in Nigeria and Mozambique, where it refines crude vegetable oils and markets refined, bleached and deodorised palm oil, palm olein and

to SALIC

refined soyabean oil.

Established in 2009, SALIC aims to achieve food security for Saudi Arabia through domestic and international investments.

SALIC CEO Sulaiman AlRumaih said the full acquisition agreement of Olam Agri aligned with SALIC’s strategic objectives of diversifying sources of essential commodities, strengthening supply chain integration, and enhancing logistical efficiency across its local and international investments.

Photo: Adobe Stock

BIOFUEL NEWS

IN BRIEF

FINLAND:

Renewable fuels producer Neste has reported an increase in sustainable aviation fuel (SAF) sales despite a challenging market.

Announcing its fourth quarter 2024 results, Neste CEO Heikki Malinen said the company’s renewables segment had been negatively impacted by new competitors and increased production capacity, with a decline in renewable fuel sales prices and intensified demand for waste and residue raw materials.

Weakening fossil diesel prices also had a negative impact on sales prices, resulting in Neste’s sales margins falling significantly below previous years’ levels.

Fourth quarter comparable sales margins for renewables was US$242/tonne, down from US$813/tonne in the same 2023 period. Full year 2024 comparable renewable sales margins was US$377/tonne, down from US$863/tonne the previous year. Fourth quarter sales volumes totalled 926,000 tonnes, up from 870,000 tonnes in the same 2023 period. SAF accounted for 195,000 tonnes of fourth quarter sales in 2024, up from 40,000 tonnes the previous year.

The share of waste and residue inputs was 90% of total renewable materials inputs in 2024, compared to 92% in 2023.

Canada launches probe into US renewable diesel

The Canada Border Services Agency (CBSA) said on 6 March that it had launched an anti-subsidy and anti-dumping duty probe into US renewable diesel imports following a complaint by Canadian biofuels producer Tidewater Renewables.

The Tidewater complaint filed at the end of last year alleged that due to increased dumped and subsidised imports from the USA, it had suffered lost market share and sales, price undercutting and depression, and reduced profitability.

The CBSA said it would investigate if the imports were being sold in Canada at unfair prices and/or were being subsidised, and would make preliminary decisions by 4 June.

Alongside the CBSA probe, the Canadian International Trade Tribunal (CITT) would begin a preliminary investigation to determine if the

imports were harming Canadian producers and would issue a decision by 5 May.

Tidewater said on 6 March that it expected provisional duties to be imposed at the Canada-USA border within 90 days. Final duties, which would be in place for five years, could be imposed by September following a ruling by the CITT, Tidewater said. It added that the duties imposed would be in addition to any trade actions taken by the Canadian government against the USA in relation to their ongoing trade war.

The USA has announced 25% tariffs on all Canadian goods and 10% tariffs on its biofuels (see p4). In response, Canada has imposed 25% duties on US goods and is also planning a second round of tariffs which would include US biodiesel, subject to a comment period until 2 April.

EU court dismisses challenge to SAF rule

The General Court of the EU (EGC) has dismissed a legal challenge brought by European biofuel producers over the exclusion of cropbased biofuels from the EU sustainable aviation fuel (SAF) regulation, Ethanol Producer magazine wrote on 28 February.

In its decision on 27 February, the court dismissed a 2024 legal challenge by EU renewable ethanol association ePURE and biofuel producer Pannonia Bio over the ReFuelEU Aviation regulation’s exclusion of crop-based biofuels.

ReFuelEU requires EU airports and fuel suppliers to ensure that at least 2% of aviation fuels are “green” by 2025, rising to 6% in 2030, 20% in 2035, 34% in 2040, 42% in 2045 and 70% in 2050. The regulation had been criticised by many in the biofuels industry for excluding cropbased aviation fuels, the report said.

In May 2024, the US Renewable Fuels Association (RFA), Growth Energy, the US Grains Council and SAF technology company LanzaJet

sought to intervene in the challenge in support of ePURE and Pannonia Bio.

In its ruling, the EGC said that ePURE and Pannonia Bio did not have a legal right to bring the challenge, the report said. The court also dismissed a challenge to the FuelEU Maritime regulation for excluding crop-based biofuels.

bp slashes renewable energy investments, boosts oil and gas spending

Global energy giant bp announced on 26 February that it is slashing planned investments in renewable energy but boosting oil and gas spending to US$10bn/year in a bid to increase cash flows and returns.

Annual investment in energy transition would be cut by more than US$5bn from its previous forecast, to between US$1.5bn-US$2bn/year. bp now aims to increase oil and gas production to between 2.3M-2.5M barrels of oil equivalent/day in 2030, Reuters wrote on 26 February. In 2020, the firm had pledged to cut oil and gas output by 40% while rapidly grow-

ing renewables by 2030 but, across the energy sector, major players were shifting their response to lowering carbon emissions, with a re-focus on oil and gas, Reuters wrote.

bp already announced in June 2024 that it was scaling back plans to develop new sustainable aviation fuel (SAF) and renewable diesel projects at its existing sites.

According to a bp spokesperson quoted in a 21 June Biobased Diesel Daily report, three projects to be assessed were in Kwinana, Australia; Castellon, Spain; and Rotterdam, the Netherlands.

The Kwinana project on the site of

bp’s former Kwinana oil refinery has now been paused, according to a 4 February Bloomberg report. The project was set to be the first of five bp plants worldwide to turn biomass, including used cooking oil, into SAF and renewable diesel, Boiling Coal wrote on 3 February.

bp is also the sole owner of industrial-scale sugarcane and ethanol business bp Bunge Bioenergia SA, and announced in August last year that it was buying a 15% stake in Chinese biofuel firm Lianyungang Jiaao Enproenergy, which is building a SAF plant in Lianyungang.

Photo: Adobe Stock

Efficient high temperature energy solutions with steam and thermal oil.

Services by GekaKonus:

Engineering | Design | Consulting

Commissioning | After Sales Service

GekaKonus GmbH · Siemensstraße 10 · D-76344 Eggenstein-Leopoldshafen Tel.: +49 (0) 721/94374-0 · Fax: +49 (0) 721/94374-44 · info@gekakonus.net · www.gekakonus.net

Brazil to keep B14 biodiesel blending

Brazil would not be increasing its mandatory biodiesel blend to 15% in March as expected but would maintain the current 14% blend due to the price of soyabean oil and concerns about food inflation, Energy Minister Alexandre Silveira said in a 18 February Reuters report.

The bulk of biodiesel in Brazil is produced from soyabean oil.

If the blend had increased to 15%, biodiesel sales would have increased by 1.2Mm³, bringing total demand in 2025 to 10.2Mm³, Reuters wrote. With the continuation of the 14% blend throughout 2025, annual growth in sales was expected to total 600,000m³, agribusiness consultancy StoneX said.

EU duties on China now official

The European Commission (EC)’s anti-dumping duties on imports of hydrotreated vegetable oil (HVO) and fatty acid methyl ester (FAME) from China officially came into force with their publication in the EU Official Journal on 10 February.

The measures were introduced following an anti-dumping investigation into the impact of biodiesel imports from China on the EU biodiesel industry, the Directorate-General for Trade said on 11 February. Chinese exports into the EU market would be subject to an anti-dumping duty of between 21.7% and 35.6%, except for EcoCeres, which would be subject to a 10% duty.

In its decision, the EC made it clear that Chinese exporters would not be allowed to circumvent the duties by channelling their biodiesel through other Chinese exporters who had received lower duties, the European Biodiesel Board (EBB) said on 11 February. The association said protection against Chinese biodiesel imports was not “perfect” as sustainable aviation fuel (SAF) was excluded from duties but added that SAF imports would be closely monitored thanks to a dedicated, code-based system.

Commercial production of bio-acrylic acid

South Korean chemical company LG Chem is set to produce 100% plant-based bio-acrylic acid derived from vegetable oils on a commercial scale in the second quarter of this year.

With an initial production capacity of 100 tonnes/year, LG Chem said it planned to scale up production if demand for eco-friendly raw materials increased.

Bio-acrylic acid is suitable for use in a range of materials, including cosmetic ingredients in direct contact with the

IN BRIEF

GERMANY: German engineering firm thyssenkrupp Uhde has launched new enzymatic esterification technology in partnership with industrial enzymes company Novonesis.

Designed to operate at lower temperatures, the process produced bio-based and bio-degradable esters for use in a range of food, personal care, household care and technical applications, the company said on 5 February.

This would allow clients to enter new markets for biobased products.

Following a successful pilot, the firm said the technology was now ready for scale-up and industrial application, with an add-on retrofit package available to allow existing plants to run both conventional and enzymatic esterification processes.

MALAYSIA/INDIA: On 26 February, KLK OLEO announced that it had established a new representative in Mumbai to tap into the growing Indian market.

The oleochemicals manufacturing division of plantation group Kuala Lumpur Kepong Berhad (KLK) produces basic oleochemical products, such as fatty acids, glycerine, fatty alcohols and fatty esters, as well as specialities, such as methyl ester sulphonates (MES), surfactants and phytonutrients.

skin, super absorbent polymers (SAP) for nappies, adhesives for electronics and vehicles, coating materials and eco-friendly paints.

Although attempts to develop bio-acrylic acid technology had been made worldwide, none had been used commercially to date, LG Chem said on 13 February.

The bio-acrylic acid was made using the organic compound, 3-hydroxypropionic acid (3HP), as a precursor. The 3HP strain was made via a microbial fermentation

process, with both the 3HP strain and fermentation technology attaining the US Department of Agriculture (USDA)’s certified biobased product label last year, the company said.

Starting with prototype production, LG Chem said it planned to promote the product in North America and Europe.

The cosmetics industry, which increasingly demanded plant-based and naturally-derived ingredients, was expected to be a key market for bio-acrylic acid, it added.

Significant rise in castor yields reported

German chemical and biotech giant BASF has reported a significant rise in castor yields under its sustainable castor Pragati programme that it runs with other companies.

Castor oil and its derivatives play an important role in the chemical industry as raw materials in the production of plastics, coatings and paints, pharmaceuticals and other materials.

BASF said on 4 February that more than 8,000 farmers working on over 9,000ha of mostly semi-arid land were now certified under the Pragati programme, which it founded in May 2016, along with speciality chemicals firm Arkema, oleochemical company Jayant Agro-Organics and implementation partner Solidaridad.

Pragati is the Hindi word for progress and the project was driven by a baseline survey of more than 1,000 castor farmers in Gujarat, India.

The goal was to enable sustainable castor crop production through good agricultural practices to increase yield and

farmer income; efficient use of water resources; maintenance of soil fertility; adoption of good waste management and health and safety practices, and respect for human rights.

Around 100,000 tonnes of certified castor seeds were being cultivated in the 2023/24 crop cycle, compared to 74,500 tonnes the previous year, while farmers certified under the SuCCESS Supply Chain Code had achieved 57% higher yields than the yield published by the local government for the region, BASF said. As part of

the programme’s third phase (2023-2026), BASF said there had been an increased focus on fostering the involvement of women in castor farming, with more than 1,100 women from 17 project villages joining the scheme in 2024.

▪ The International Sustainability & Carbon Certification (ISCC) scheme announced on 18 February that it had awarded the first ISCC EU low ILUC (indirect land use change) certificate to Kenya’s Janari Farms for growing castor on degraded land for Italian energy firm Eni to produce biofuels.

Amazon trials bio-delivery bags in Spain

US online shopping giant Amazon said on 16 January that it is trialling the use of bio-based delivery bags in Spain made from vegetable materials produced in Europe, including corn starch and vegetable oils,

Developed by materials specialists at Italian company Novamont – part of Versalis (Eni) –with support from Amazon’s materials experts, the first trials of the new bags were being piloted for Amazon Fresh orders in Valencia.

Amazon said its bio-based bags were durable, food safe and weather-resistant and the new material, Mater-bi, could progressively replace fossil-based plastic bags used by food retailers and manufacturers. The bags could potentially be recycled into new bags and as they were biodegradable, they did not generate microplastics. Amazon said it would use the results of the trial to assess if the new bio-based bags could be used on a wider scale.

Photo:

BASF

TRANSPORT NEWS

US fees target Chinese ships and operators

The US Trade Representative (USTR)’s office has proposed charging up to US$1.5M for Chinese-built vessels entering US ports as part of its investigation into China’s growing domination of the global shipbuilding, maritime and logistics sectors, Reuters reported on 24 February.

In a 16 January report, USTR said a probe launched during the administration of former President Joe Biden found that China had increased its share of global shipbuilding tonnage from 5% in 1999 to over 50% in 2023 due to massive state subsidies and preferential treatment for state-owned enterprises that were squeezing out private sector international competitors.

The proposed charges would add to supply chain uncertainty and raised a range

IN BRIEF

BRAZIL: On 30 January, Brazilian shipping company

Wilson Sons said it had received approval from the Brazilian Agency of Petroleum, Natural Gas and Biofuels to conduct the country’s first tests on the use of hydrotreated vegetable oil (HVO) in the maritime sector. Marine fuel supplier efen would import HVO for testing on Wilson Sons’ tugs at the Açu Liquid Bulk Terminal (TLA), owned by Vast Infraestrutura, at the Port of Açu, Rio de Janeiro state.

Vast was also studying the potential of using a yet-tobe built TLA tank structure to store and add bio-components to marine fuels.

of complicated questions, such as how the fees would affect a China-linked bulk carrier that arrived empty to load American grain or soyabeans for export, John McCown, an analyst with the Center for Maritime Strategy, said in a 24 February FreightWaves report.

“What happens to an empty Panamax vessel that arrives to load grain from the Midwest? With the fees, we’re suddenly less competitive than Brazil.”

The USTR proposals were published in a Federal Register notice on 21 February. They include port entrance fees of up to US$1M/vessel owned by Chinese maritime transport operators, or a US$1,000/ tonne charge of a vessel’s cargo capacity.

Non-Chinese maritime transport oper-

ators using Chinese-built ships would pay up to US$1.5M for each port entry.

Those with more than 50% Chinese-built fleets would pay US$1M for each vessel entry, regardless of origin. The fee would fall to US$750,000 if the Chinese fleet percentage was between 25% and 50% and to US$500,000 if below 25%.

A second set of fees in similar amounts could apply to maritime operators with vessels on order from Chinese shipyards to be delivered over the next two years.

The remedies would also require at least 1% of US exports to be shipped on US flagged vessels for the first two years, rising to 3% after two years and 5% after three years, when 3% of US exports would have to be shipped on American-built ships.

New grain, soya terminal in Saudi Arabia

National Grain Company opened a new grain and soyabean terminal at Yanbu Commercial Port in Saudi Arabia on 22 December.

The Yanbu Grain Handling Terminal could handle up to 3M tonnes/year of grain – including barley, corn and soyabeans – and was the first regional centre for grains in Yanbu port, World Grain wrote on 24 December.

The terminal has a storage capacity of 156,000 tonnes – including 12 silos with a total capacity of 96,000 tonnes and a flat warehouse with 60,000 tonnes of capacity – a 650m conveyor belt and has a ship grain unloading capacity of 800 tonnes/hour.

National Grain is a joint venture between Saudi shipper Bahri and the Saudi Agricultural and Livestock Investment Co (SALIC), which was established in 2009 to secure food supplies for Saudi Arabia through mass production and investments.

Abdulrahman Al-Fadley, SALIC board chairman and Saudi Arabia’s minister of environ-

ment, water and agriculture, said the terminal would help boost the origination and discharge of grains to Saudi Arabia and enhance supply chain capabilities.

China sells Panama Canal port terminals to US consortium

Hong Kong-based logistics company CK Hutchison has announced that a consortium – including US investment firm BlackRock – will buy an 80% stake in its business that controls two ports at the Panama Canal, The Guardian wrote on 5 March.

The US$14bn sale of the stake in Panama Ports Company, which owns and operates Balboa and Cristóbal ports on either side of the waterway, follows US President Donald Trump’s earlier comments that he wanted to end what he claimed was China’s influence over the Panama Canal.

However, CK Hutchison said the deal was unrelated to Trump’s vow to “take back” the canal.

“The transaction is purely commercial in nature and wholly unrelated to recent political news reports concerning the Panama ports,” the company’s co-managing director Frank Sixt was quoted as saying.

However, Trump claimed the deal as a victory in his address to a joint session of Congress on 4 March, NBC News reported the next day. “My administration will be reclaiming the Panama Canal, and we’ve already started doing it,” he was quoted as saying. “Just today, a large American company announced they are buying both ports around the Panama Canal.”

CK Hutchison has been operating the ports of Balboa and Cristóbal at the canal’s

Pacific and Atlantic entrances for more than two decades, The Guardian wrote. Other ports at the canal were operated by firms from the USA, Taiwan and Singapore.

In February, Marco Rubio visited Panama during his first overseas trip as US secretary of state, securing a commitment from Panama president José Raúl Mulino to exit China’s belt and road infrastructure-building programme, The Guardian said.

He also pressed for free passage of US vessels through the canal,

About 5% of world trade is transported via the waterway and the USA is the largest user of the canal, which is vital for US grain and soyabean exports to Asia.

Photo: Adobe Stock, AI generated

BIOTECH NEWS

Bayer and groups seek to shield from cancer claims

German chemical giant Bayer and a coalition of agricultural groups are seeking to shield themselves from lawsuits claiming Bayer's glyphosate-based Roundup weedkiller causes cancer, AP News reported on 10 February.

Legislation pending in Iowa and at least seven other US states would protect pesticide companies from claims they failed to warn their product caused cancer if the product label otherwise complied with the US Environmental Protection Agency (EPA)’s regulations, the report said. Similar attempts to legislate on the issue failed during 2024 legislative sessions in Iowa, Missouri and Idaho.

Bayer and the coalition launched a broader media campaign this year highlighting the importance of Roundup for US agriculture, AP News wrote. The coalition includes Modern Ag Alliance, a group of agricultural organisations

supporting Bayer's efforts and Protecting America Initiative, an organisation concerned about China's influence on the US economy.

Campaigners against the pending legislation say it would limit the rights of people to hold companies accountable if their products caused harm, according to AP News

Bayer has always disputed claims that Roundup causes a form of cancer - non-Hodgkin lymphoma but the company has been issued with around 177,000 lawsuits involving the weedkiller and has set aside US$16bn to settle cases.

The company has said those legal costs were “not sustainable” and it was looking for relief from lawmakers concerned about the possibility that Roundup could be taken off the US market, the report said. The weedkiller is designed to work with seeds, such as corn, soyabeans and cotton, genetically modified to be resistant to it.

New sorghum variety outperforms soyabean

A US research team at the Center for Advanced Bioenergy and Bioproducts Innovation (CABBI) has developed a new sorghum variety that outperforms soyabeans in oil production.

The team developed a sorghum which could accumulate up to 5.5% dry weight triacylglycerols (TAG) in its leaves and 3.5% dry weight in its stems under field conditions – 78 times and 58 times higher levels than in unmodified sorghum, respectively.

With this level of production, the sorghum variety could provide about 1.4 times more oil/ha than soyabeans, the researchers said in their new study, published in Plant Biotechnology Journal.

Sorghum grass is heat and drought tolerant

tion, the researchers used a ‘push-pull-protect’ strategy, which CAABI researchers had previously used to increase vegetative oil accumulation in other plants. Genes were introduced to ‘push’ more carbon from photosynthesis into oil production, ‘pull’ fatty acids into TAG molecules and ‘protect’ the stored oil from breaking down.

IN BRIEF

BRAZIL: Energy company

Acelen has partnered with plant micropropagation research and development specialist MulticanaPlus to develop macaúba as a biofuel feedstock, Biofuels Digest wrote on 11 February.

Native to Brazil, macaúba is adapted to semi-arid conditions and low-quality soils and its fruits can be processed into pulp oil, kernel oil and residual biomass.

Acelen said it would plant macaúba trees on 180,000ha of land in the project and clone genetically identical copies of superior plants to reproduce characteristics such as resistance to stress and high production potential.

MulticanaPlus CEO Alewijn Broere said the firm had experience in plant cloning through somatic embryogenesis, which it had used to produce coffee and cocoa seedlings.

MEXICO: The government announced on 5 February that it had officially repealed its proposed ban on US imports of genetically modified (GM) corn after a trade dispute panel ruled this violated the US-Mexico-Canada (USMCA) pact, World Grain wrote on 7 February.

Unlike oil-rich seeds and fruit from plants like oil palm, TAG typically only accumulates in a plant’s vegetative leaves and stems as a stress response to membrane damage.

The team focused on sorghum for its high efficiency at photosynthesis, heat and drought tolerance, and well-understood genome.

Calyxt says seedless hemp offered improved yields and quality

To develop sorghum for vegetative oil accumula-

The researchers said they would continue to study ways to further raise oil yields to meet CABBI’s goal of growing crops that were 10% TAG by dry weight.

Two measures were repealed – the ban on GM corn in dough and tortillas for human consumption, and an instruction to Mexican agencies to phase out its use in other food uses and animal feed, the report said.

The ban had been due to come into force this year.

Syngenta acquires Novartis' genetic strains for agriculture

Global crop protection and seed company Syngenta has acquired natural compounds and genetic strains for agricultural use from Swiss-US multinational pharmaceutical corporation Novartis.

The move would give Syngenta access to a source of novel leads for agricultural research and offered integrated capabilities in bio-engineering, data science, fermentation, downstream processing and analytics,

the company said on 26 February.

As part of the deal, expected to close on 1 June, Syngenta said it would lease the Novartis fermentation pilot plant and science laboratories in Basel, Switzerland. Novartis would maintain exclusive rights to its repository for pharmaceutical use.

The acquisition followed a research collaboration between Syngenta and Novartis, which has been ongoing since 2019, and

the opening of Syngenta’s new biologicals production facility in Orangeburg, South Carolina, USA, which would support growing demand for science-based and novel biological solutions in North and Latin American markets, Syngenta said.

Since acquiring Italy’s Valagro in 2020, Syngenta has been expanding its focus on biologicals, including bio-controls, bio-stimulants and nutrient use efficiency products.

Photo: Adobe Stock

Greater price volatility

A raft of conflicting fundamentals including weather, geopolitical factors farmers’ responses to shifting price signals and competition between food and fuel demand are buffeting the vegetable oil markets

John Buckley

Vegetable oil markets have been buffeted by a raft of conflicting fundamentals since the turn of the New Year –erratic weather, geopolitical upheaval, competition between food and fuel outlets and attempts to guess Northern Hemisphere farmers’ spring planting responses to shifting price signals. With so many ‘unknowns’ in the mix, price volatility seems likely to continue for some months yet.

On the supply side, the market focus has been frequently fixed on the two largest components – palm oil and soyabeans – both of which have encountered weather issues.

For palm oil, it has been incessant rains and floods slowing and reducing Malaysian production potential, always down in the Northern Hemisphere winter months but now seen likely to reduce stocks to their lowest level for almost three years.

While prices have risen (see Figure 1, above), response has been partially restrained by consumers’ reaction to the unusual premium commanded by palm over its soft oil rivals, causing some buyers to switch allegiance from this traditional ‘value’ commodity. Top customer India –whose January palm oil imports were their lowest since 2011 – has even taken in more soyabean and sunflower oils than palm at times – an unusual trend.

Palm oil’s strong price has also owed much to top producer Indonesia’s decision to raise its already large consumption in its burgeoning biofuel sector. Although there were signs its government might restrain or postpone a long-forewarned move to a 40% palm oil blend in diesel (B40), the move towards this target appeared to be imminent, potentially soaking up what used to be regular surpluses. Indonesian exports have already fallen by over 8% in

the last calendar year, the Indonesian Palm Oil Association (GAPKI) recently noted.

Palm oil’s influence is, not surprisingly, being felt across other vegetable oil sectors. Not only is it the most widely used oil (about 35% of the world total), palm has long been counted on to contribute to the largest portion of supply growth – almost 40% in the past 15 years.

On the optimistic side, the US Agriculture Department (USDA)’s recent monthly outlook continued to forecast global palm oil production of 79.5M tonnes, an implied annual growth of under 3.3M tonnes against negligible gains in two of the previous three seasons. Some analysts think its disappointing performance in recent months suggests this might be over-stated but others believe some recovery is likely in the second half of 2025 if the weather normalises. Against that, and despite recent importer reaction to higher palm oil costs, global consumption has been forecast to grow almost as fast – if Indonesia’s biodiesel expansion comes to full fruition.

The Food and Agriculture Organization of the United Nations (FAO)’s average monthly cost of cooking oils rose by a hefty 35.7% from 2024’s February low to the end of November.

The December/January period saw some reversal however, as palm oil began to suffer demand destruction, led by India. India’s February palm oil imports did stage a steep 36% recovery in the wake of a temporary dip in costs. Until the production outlook – and the biofuel factor – become clearer, palm oil seems

likely to remain a key source of price volatility.

Soya to the rescue?

At the turn of the year, consumers had been counting on a record world soyabean crop to blunt the impact of disappointing supplies of palm, rapeseed and sunflower oils. That prospect seems to be still on track but soyabean’s contribution has been scaled back somewhat by hot dry weather in Argentina (crop trimmed from 52M tonnes to 47-49M tonnes) and harvest delays from excessive rains in Brazil (recently in a wide crop range from 169M-172M tonnes against earlier hopes of up to 175M tonnes).

While Latin American weather risk has been a key factor supporting soyabean price gains for much of 2025 to date, it did seem to be easing as we went to press in early March after some improvement in conditions for major producers Argentina and Brazil.

Runaway soyabean bulls have also been checked by the new US administration’s moves to impose steep new tariffs on imports of goods, including an extra 20% punitive levy on its largest soyabean customer China.

China has retaliated with a 10% tariff on US soyabeans and the suspension of import licenses on three US firms supplying the crop. US traders think it is inevitable that US soyabean sales to China will suffer as the country switches to Brazil and other Latin American suppliers.

However, the impact on market sentiment might be delayed by seasonal

Source: John Buckley/Bursay Malaysia

Figure 1: Bursa Malaysia palm oil futures prices (US$ equivalent/tonne) from 2015

factors. With the Brazilian harvest well underway and Argentina’s round the corner, the USA would normally expect to see a few months of reduced export business at this time of year, and much could change in the volatile arena of trade politics before the next US crop arrives.

One factor helping to stabilise, even at times firm up, the weaker soyabean futures prices seen late last year has been speculation that the US 2025 soyabean crop will be planted on a significantly smaller area.

Soyabean prices recently dropped significantly against this time last year (see Figure 2, following page), while those of its main land rival maize, have risen substantially.

Having also been drawn into the tariff imbroglio, the USA’s second largest soyabean customer – Mexico – might also be having thoughts about where to source soyabean imports. Mexico also plays a larger role in the corn market as the USA’s top outlet for grain.

A recent poll of analysts by news agency Bloomberg found the average estimate for US soyabean planted area was 84.4M acres (34.2M ha) against last year’s 87.1M acres (35.2M ha).

The lowest of the ranges quoted, multiplied by the average yield of the past two years, would take the crop down to little more than 113M tonnes against last year’s 118.8M tonnes. The USDA’s late February annual Outlook Forum surprised the market with an even smaller 84M acre (33.9M ha) forecast, although it indicated that could be offset by better yields.

Biofuels factor

There were also signs at the turn of this year that a key driver of firming vegetable oil costs – demand competition from the fuel sector – might be less severe than earlier thought under the influence of the more climate-change sceptical Trump administration.

However, this is a factor cutting both ways. It is potentially bearish for Canadian rapeseed producers, whose largest export market for canola oil and meal could be hit by new tariffs imposed by their southern neighbour. For the USA, it could be more bullish if biofuel producers filled the ensuing rapeseed oil gap with more home-produced soyabean oil, unless a Trump-inspired pullback from biofuels reduces vegetable oil needs in this sector. Just to complicate matters further, there

were proposals late last year to change US tax credits for biodiesel blending to a producer tax credit with carbon-intensity and country of origin restrictions, a move that some analysts say could put Canadian canola and biofuel producers/refiners at a disadvantage, and also affect demand for US soyabean oil as well. US soyabean oil was recently forecast to supply 6.17M tonnes to US fuel manufacture (up almost 9% in just two years).

Another linked factor is the possibility that the USA will allow a higher blend of maize in fuel ethanol production for a longer period each year (fuel already uses 140M tonnes of maize, well over 40% of

the USA’s giant maize crop). Some analysts say this could potentially reduce demand for soyabean oil in biodiesel, resulting in less pressure on vegetable oil supply and costs.

The biofuel sector must also keep an eye on the energy market’s response to fast-moving geopolitical issues.

The value of crude oil was already under downward pressure for months before the US president said he would free up domestic drilling. Since then, the energy market has had to absorb the possibility of an unharnessed Russia, not to mention the Trump tariff risk of economic damage undermining demand.

INTERNATIONAL MARKET REVIEW

Canola reversal?

Until recently, US biofuel demand for rapeseed oil had been encouraging Canadian plans to massively expand its canola crop and crushing capacity. This led some analysts to predict a persistent hike in the cost of the oil, not just in Canada but around the world, a potentially interesting challenge for consumers in the EU where rapeseed is still the leading vegetable oil.

There have already been signs that Canada’s canola boom might be deflating or at least slowing now that the USA seems a less secure market for investors.

At least three 1M tonne+ projects (FCL/ AGT, Ceres Global and Northgate) have been either paused or shelved for the time being, while the future of Viterra’s planned new 2.5M tonnes facility has been described as uncertain.

Cargill, in contrast was reported to be going ahead with its already halfcompleted new 2.5M tonne plant.

US imports of Canadian canola oil and meal were worth US$8.6bn in 2023 and US$7.7bn in 2024. Canola is the single largest source of Canadian farm crop cash receipts and is grown by almost 40,000 farmers. The Canadian Canola Growers Association (CCGA) said in March that “the damaging blow caused by [US] tariffs will be felt by every canola farmer, starting with the price they receive at delivery and will extend to the full range of their operations, ultimately reducing farm profitability”.

Although official statements suggest Canadian canola crush will still rise in 2024/25, it has already begun to flag in recent months. Some analysts say that would have happened anyway as last year’s disappointing Canadian crop would have struggled to cover projected crushing and exports without slashing stocks to unsustainable levels. Still, a big question mark has been raised over canola’s onceglowing longer-term prospects.

What effect might this have on Canada’s canola planting? A recent outlook from Farm Credit Canada for 2025/26 suggests that despite canola’s unusually low global stock/use ratio, there is more price upside for cereals than for oilseeds, especially if large soyabean crops do successfully rein the oilseed sector in.

As well as the Trump tariff factor, there is also the ongoing question of potential demand loss in Canada’s once key rapeseed export market, China, where an anti-dumping investigation is still ongoing.

Other producers

The 2024 crop setbacks for rapeseed and sunflowerseed have helped keep

overall vegetable oil costs up, pointing to a 2024/25 seasonal ‘carryover’ stock drawdown to lower than usual levels. This leaves less cover against unwelcome weather events and a possibly more nervous market, up to harvests in the third quarter of 2025, when the new season starts.

In the Northern Hemisphere, most

European canola has already been autumn sown. Europe may have planted a similar or slightly larger area than last year, if other member states have followed top producer France’s lead.

Indian rapeseed production may be negatively affected by recent hotter than usual weather, which could have repercussions on its domestic oil supply and its import needs. China’s also large crop remains a mostly internal affair.

Sunflowerseed crops will not be put in the ground until March/April but may invite a positive response from the main European producers if recent firmer prices persist.

Early reports from Ukraine’s farm ministry suggest the country may sow less sunflowerseed this spring.

Although exports from the Black Sea region have weathered the Russia/ Ukraine conflict better than might have been expected this past year, vegetable oil supply from this region could remain a bit of a wild card in early 2025, depending on whether recent attempts at a peaceful settlement to the war come to fruition. ● John Buckley is OFI’s market correspondent

Source: John Buckley/CBOT

Figure 2: Chicago Board of Trade (CBOT) soyabean futures (US$ cents/bushel) from 2015

Source: John Buckley/Euronext

Figure 3: Euronext (Paris) rapeseed futures prices (€/tonne) from 2021

Source: John Buckley/FAO

Figure 4: FAO vegetable oil price index

Annual averages prior to 2024, then monthly

SOYABEANS

A tale of two giants

Brazil and the USA are the world’s top suppliers of soyabeans. While Brazil is the leading producer, the USA enjoys a competitive advantage in logistics. What does the future hold for these two giants? Tiago Vicente

Soyabeans are a fundamental commodity for global food security, with the Americas being the primary region responsible for their supply, and Brazil and USA leading global production.

Brazil

Over the last century, the evolution of soyabean production in Brazil has been remarkable. Initially cultivated in the southern region of the country, soyabean production has expanded over the years, becoming Brazil’s leading agricultural crop. The oilseed also accounts for approximately 23% of national agribusiness GDP and nearly 6% of Brazil’s overall GDP.

Today, Brazilian soyabeans are grown in 11 states, with Mato Grosso being the largest producer in terms of both quantity and planted area.

Since the 2012/2013 harvest, Brazil has surpassed the USA as the world’s largest soyabean producer, and the coming 2024/25 season will be no different.

According to the Brazilian Institute of Geography and Statistics (IBGE), the country is expected to have one of its largest harvests ever this season at 167.3M tonnes. This figure represents an increase of nearly 15% compared to 2023/24.

Driven by high external demand, Brazil is not only the largest producer but also the world’s largest exporter of soyabeans.

According to the National Association of Cereal Exporters (ANEC), Brazil closed 2024 exporting 97.299M tonnes, the main destination being China.

Currently, the soyabean market is essential to Brazil’s economy. Even as it competes for planted area with other grains, such as corn in the midwest region and rice in southern Brazil, soyabeans remain a versatile crop. They can be used in the animal nutrition market as a protein source, in vegetable oil production, and in biodiesel manufacturing. The latter plays a significant role in the future of oilseed production.

With a focus on sustainability, the Brazilian government, in partnership with the Ministry of Mines and Energy (MME), launched the Renovabio programme in 2016. Its objective is to expand and regulate the biodiesel market, promoting not only economic but also social benefits.

Among its many functions, Renovabio assists in regulating the blending of vegetable oils and fats in biodiesel production.

In 2024, Brazil operated under the B14 standard stipulating that 14% of the raw materials used in biodiesel production are required to come from vegetable or animal oils and fats. With this percentage, the Ministry of Agriculture and Livestock stated that the measure would prevent the emission of 5M tonnes of CO₂ into the atmosphere and reduce fossil fuel imports.

For 2025, the government has set a target to increase the blending rate by 1%,

reaching B15 by March.

At first glance, this percentage increase may seem small but, according to ANP data, national biodiesel production exceeded 7.5bn litres in 2023. Of this production, 70% of the mandatory mixture of vegetable or animal oils and fats came from soyabean oil, due to its abundance. In 2025, this 1% rise in the blending rate could represent an increase in local demand of nearly 6M tonnes for soyabean crushing, ANP says.

Other raw materials used in biodiesel production include beef tallow, used cooking oil, palm oil and cottonseed oil.

However, Brazil faces some bottlenecks that hinder its comparative advantage over its main competitor. The biggest challenge lies in logistical costs.

With its vast territorial expanse, Brazil is currently the fifth largest country in the world. In the agricultural context, if managed properly, this territory could offer many opportunities.

However, the country relies almost exclusively on road transportation for local operations and exports.

Because suppliers are highly dependent on a transportation model in which the primary input is still fossil fuel, their operations are vulnerable to external factors such as trade wars, political instability and currency fluctuations.

With such rudimentary logistics, Brazilian products intended for export often lose competitiveness compared to their rivals.

Most of Brazil’s soyabeans are produced

Photo:

oilRoq GmbH is a highly specialized engineering company with an experience of 40 years. We design and deliver enre process plants in oleochemical, food, edible oil and fat modificaon industry like:

SOYABEANS

Source: Conab, Brazil

5% (B5), or 20% (B20). In addition, the USA excels in ethanol production derived from corn.

In Brazil, the biofuel market is significant, particularly ethanol production based on sugarcane. However, unlike Brazil, the USA faces a politically unstable scenario. Its relationship with its largest soyabean market, China, could become a decisive factor for its exports.

US President Donald Trump, who took office on 20 January after being reelected for a second term, has imposed an additional 20% tariff on all Chinese goods entering the USA.

Source: US Department of Agriculture, National Agricultural Statistics Service

2: USA – soyabean planted area by county for selected states, 2023

in the midwest region, with distances exceeding 1,600km to reach the main export ports, such as from Mato Grosso state to the port of Santos, São Paulo. The scenario becomes even more challenging when the exported product is oil or meal, where nearly 40% of the offer value (cost and freight – CFR basis) is attributed to logistical costs.

USA

It is often said that Brazil is a soyabean country that also grows corn, while in the USA, the opposite is true. Even with a strong corn culture, the USA is currently the world’s second largest producer of soyabeans.

According to the US Department of Agriculture (USDA), the US soyabean harvest is projected to reach 124.81M tonnes in 2025. This production will take place on an area of 34.8M ha (86.1M acres), a rise of 3% compared with 2024 and setting a record for the country.

Comparing the two countries, Brazilian disadvantages are the USA’s strengths,

starting with logistics.

In addition to its extensive road network, the USA has a railway system of over 250,000km, spanning more than 23 states. This makes US logistical costs extremely competitive overall, especially when compared to Brazil.

Furthermore, the USA has the largest waterway network in the world, essential for transporting grains from the soyabean belt in states such as Indiana, Illinois, Iowa, Missouri, Nebraska and Kansas to ports in the south and southeast. Additionally, the USA has more ports with better infrastructure compared with Brazil, where the main concentration of ports is in Santos, São Paulo and Paranaguá, Paraná. When it comes to biodiesel, the USA also leads and is the largest producer in the world. According to the International Energy Agency (IEA), the USA produced approximately 14.5bn litres of biodiesel in 2023, soyabeans being the main feedstock.

According to the agency, most US biodiesel is consumed as blends with petroleum diesel in proportions of 2% (B2),

As retaliation, the Chinese market may limit its soyabean imports from the USA, potentially opening a window of opportunity for South American soyabeans, particularly from Brazil and Argentina, both of which have promising expectations for the next production cycle.

Conclusion

Soyabean production is essential to the Brazilian economy, whether due to the country’s export needs, job creation or domestic consumption. Projections by the Ministry of Agriculture indicate a potential 35% growth in soyabean production in Brazil over the next 10 years.

Simultaneously, there may be an increase in demand – estimated at more than 165% for soyabean oil over the next decade –with the growth of biodiesel production in the country, according to the Brazilian Association of Vegetable Oil Industries (Abiove).

With its tropical climate and one of the largest reserves of freshwater on the planet, Brazil has a significant comparative advantage over its main competitor.

However, the country still faces significant instability in terms of sustainability, illegal deforestation and, most critically, competitive logistics. These issues are crucial, especially for a country whose primary focus is exports. These issues could jeopardise sales in the long term as importers’ regulations grow increasingly stringent and freight costs continue to rise.

In the USA, greater mechanisation and advancements in soyabean production systems are observed, along with one of the best logistical structures globally. However, with the recent change in government, there is a possibility that there may be conflicts with China, the world’s largest soyabean importer, which could cut back its imports from the USA. This could present an opportunity for Chinese imports of Brazilian soyabeans. ● Tiago Vicente is an oilseeds specialist at Latin American commodity broker Aboissa

Figure

Figure 1: Brazil – soyabean planted area and production, 1990/91–2024/25

SOUTH AMERICA

South America is a leading producer of vegetable oils but climate change has affected production and yields; governments and farmers must adopt strategies to mitigate these effects and ensure sustainable harvests in the future

Júlia Vilela, Keywe Bonfim, Leonardo Novais, Felipe Di Marco, Maila Dias

In recent years, global agriculture has undergone profound changes driven by economic and environmental factors.

The production of vegetable oils has been significantly impacted by these pressures and the effects of climate change have become a critical variable, drastically altering agricultural practices, especially in vulnerable regions like South America. Understanding these climatic phenomena is essential for ensuring the sector’s sustainability.

South America stands out as a leading producer of vegetable oils, such as soyabean, palm and sunflower oils, alongside niche products like peanuts and corn.