N4 Opportunity Assessment

Distribution System Operator and Beyond: Optimising Planning and Regulation for Demand Management and Distributed Energy Resources

Final Technical Report

RACE for Networks

Research Theme N4: DSO and beyond: Optimising Planning and Regulation for DM and DER

ISBN: 978-1-922746-44-3

Industry Report

An Opportunity Assessment for RACE for 2030 CRC

August 2023

Citation s

Cantley-Smith, R., Ben-David, R., Briggs, C., Dwyer, S., Hargroves, C., Kallies, A., Khalilpour, K., Kraal, D. and Liebman, A. (2023). Opportunity Assessment: DSO and beyond: Optimising Planning and Regulation for DM and DER. Prepared for RACE for 2030 CRC.

Project partners

Acknowledgements

Project team

University of Technology Sydney

• Rowena Cantley-Smith (Project Leader)

• Chris Briggs

•

• Scott Dwyer

Kaveh Khalilpour

Royal Melbourne Institute of Technology

• Anne Kallies

Curtin University

• Charlie Hargroves (Project Manager)

Monash University

•

Ariel Liebman

•

Ron Ben-David

•

Diane Kraal

The authors would like to thank the stakeholders involved in the development of this report, in particular the interviewees and the industry reference group members who have given so generously of their time, including Energy Consumers Australia, Western Power, NSW Department of Planning & Environment, SA Department of Energy and Mining, Energy Consumers Australia, and Plico Energy. Whilst their input is very much appreciated, any views expressed here are the responsibility of the authors alone.

Acknowledgement of Country

The authors of this report would like to respectfully acknowledge the Traditional Owners of the ancestral lands throughout Australia and their connection to land, sea and community. We recognise their continuing connection to the land, waters and culture and pay our respects to them, their cultures and to their Elders past, present and emerging.

What is RACE for 2030?

RACE for 2030 CRC is a 10-year cooperative research centre with AUD350 million of resources to fund research towards a reliable, affordable and clean energy future. racefor2030.com.au

Disclaimer

The authors have used all due care and skill to ensure the material is accurate as at the date of this report. The authors do not accept any responsibility for any loss that may arise by anyone relying upon its contents.

2 N4 Opportunity Assessment – DSO and beyond

GLOSSARY

ACCC Australian Competition and Consumer Commission

ADR Automated demand response

AEM Australian Energy Market

AEMA Australian Energy Market Agreement

AEMC Australian Energy Market Commission

AEMO Australian Energy Market Operator

AER Australian Energy Regulator

AES Autonomous energy systems

ARENA Australian Renewable Energy Agency

BEV Battery electric vehicles

C - CEM Consumer energy market

CER Consumer energy resources

CRC Cooperative Research Centre

DEIP Distributed Energy Integration Program

DER Distributed energy resource

DER - AO Distributed energy resource asset owner

DM Demand management

DMIS Demand management incentive scheme

DNSP Distribution Network Service Provider

DRSP Demand response service provider

DSM Demand-side management

DSP Demand-side participation

DSR Demand-side response

DUoS Distribution use of System

ECA Energy Consumers Australia

Energy Ministers Forum for Australia’s Energy Ministers (replaced COAG)

ERF Emissions Reduction Fund

ESB Energy Security Board

ESS Energy storage system

EV Electric vehicle

FCAS Frequency Control Ancillary Service

FCEV Fuel-cell electric vehicles

G2V Grid to vehicle

ICE Internal combustion engine

IEA International Energy Agency

IRG Industry reference group

N4 Opportunity Assessment – DSO and beyond 3

ISP Integrated system plan

KPI Key performance indicator

LV Low voltage

MV Medium voltage

NECF National Energy Customer Framework

NEL National Electricity Law

NEM National Electricity Market

NEO National Energy Objective

NERL National Electricity Retail Law

NERO National Energy Retail Objective

NERR National Electricity Retail Rules

NREL National Renewable Energy Laboratory

NUoS Network use of System

OA Opportunity assessment

OEM Original equipment manufacturer

PDRS Peak Demand Reduction Scheme

PHEV Plug-in hybrid vehicle

PV Photovoltaics

RACE Reliable Affordable Clean Energy for 2030 CRC

RERT Reliability and emergency trader

REZ Renewable energy zone

RIT - D Regulatory investment test distribution

RIT - T Regulatory investment test transmission

RTPV Rooftop photovoltaic

STPIS Service target performance incentive scheme

TMIS Transmission management incentive scheme

ToU Time of use

TUoS Transmission use of System

V2G Vehicle to grid

V2H Vehicle to home

V2X Vehicle to “x–“ generic term for vehicle to grid, to home, to premises, etc.

VGI Vehicle grid integration

VRP Voltage stability, reliability and power loss

WDRM Wholesale demand response mechanism

WEM/SWIS Western Australian Wholesale Electricity Market/South West Interconnected System

ZLEV Zero and low carbon electric vehicles

4 N4 Opportunity Assessment – DSO and beyond

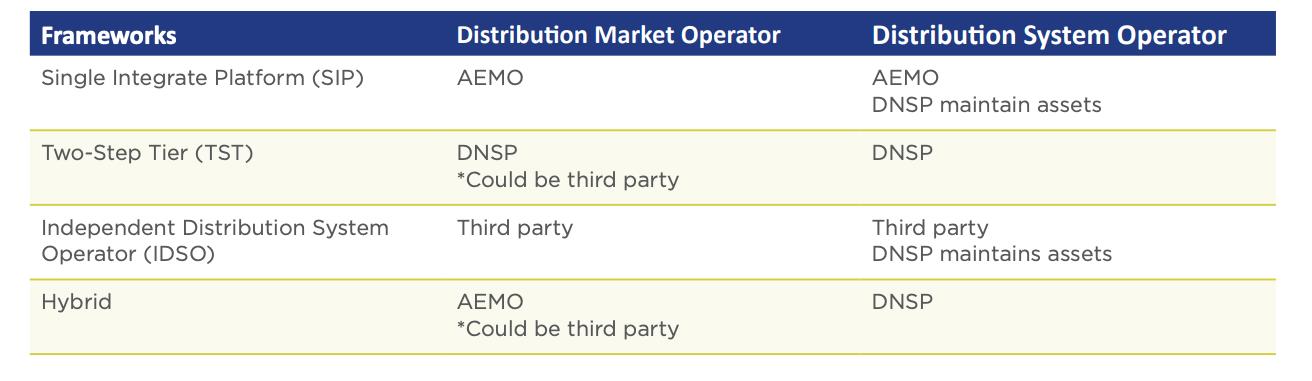

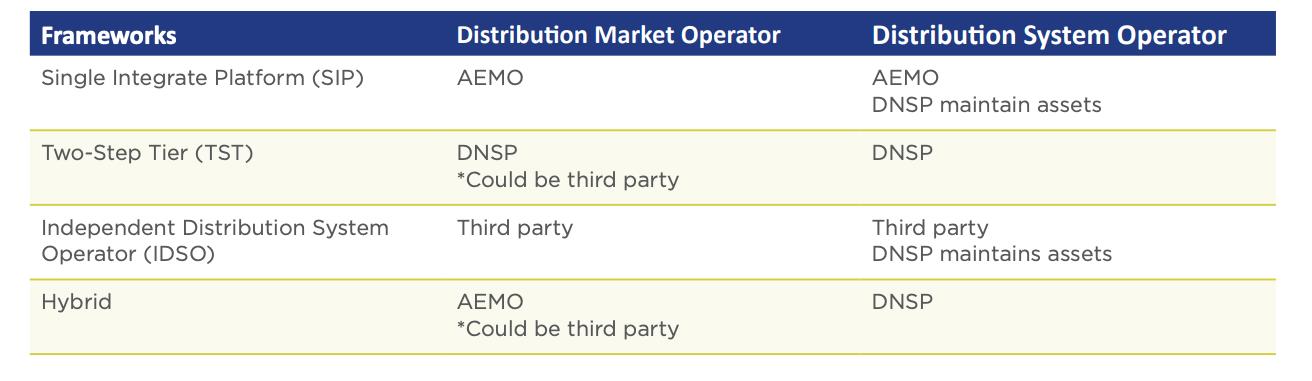

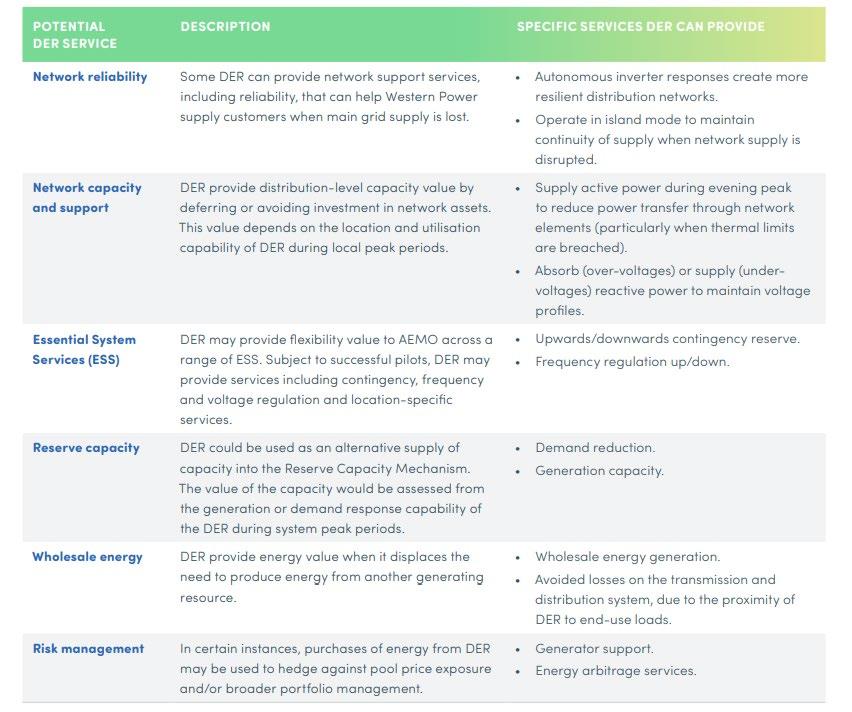

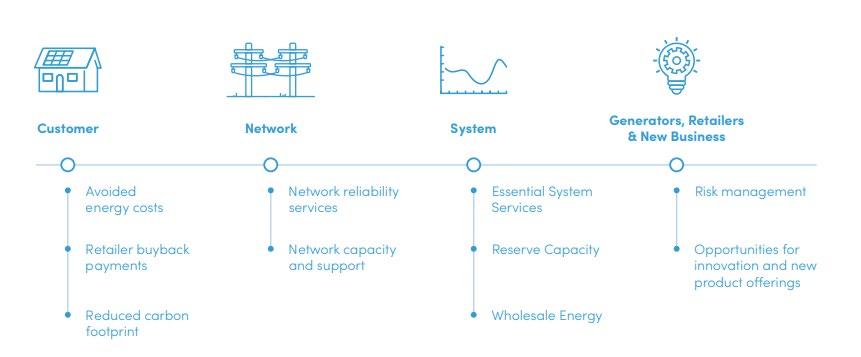

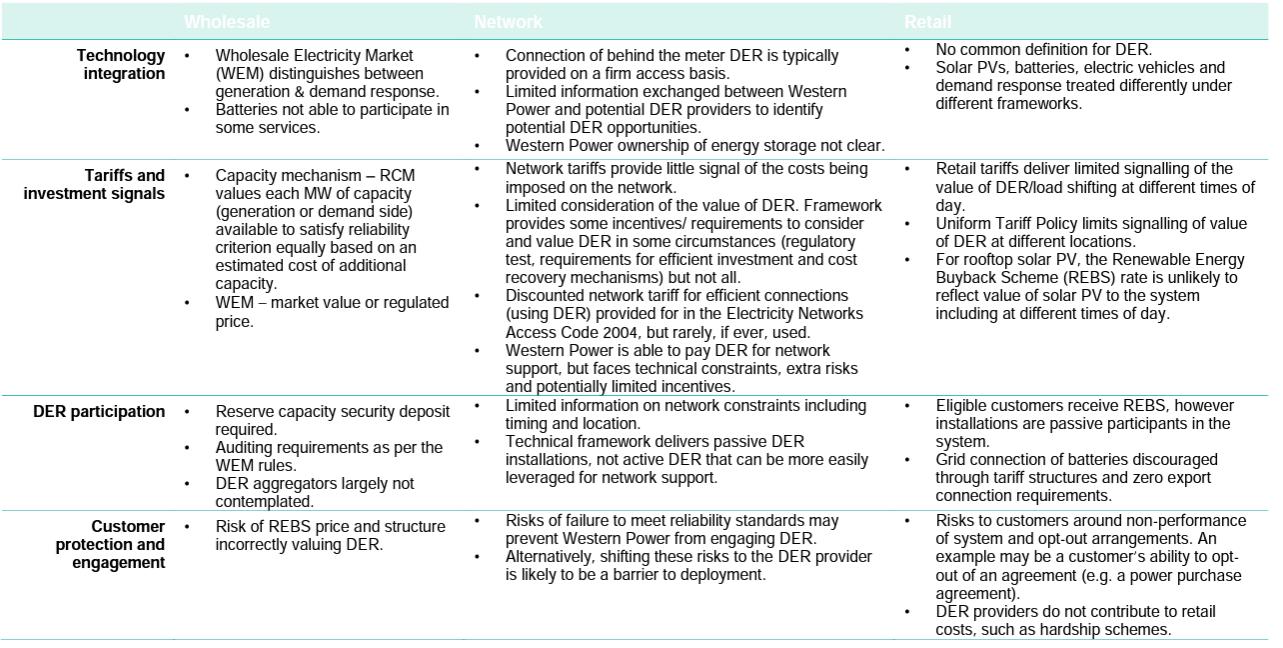

N4 Opportunity Assessment – DSO and beyond 5 CONTENTS 1. RESEARCH RESULTS AND DISCUSSION 7 1.1. Regulatory barriers and opportunities 7 1.2. Regulatory opportunities: Transformative, comprehensive reforms 11 1.3. Competition and implementation costs 11 1.4. Identifying and managing DER-induced risks 13 1.5. Whose demand is being managed? 13 1.6. Distributed energy resources or consumer energy resources: Whose resources are they? 14 1.7. Who are the stakeholders in the ESB/AEMC/AEMO/AER two-sided energy market? 15 1.8. DNSP, tariff design, and the consumer gap 16 1.9. The DSO: A new market participant or a new role for an existing one? 16 1.10. Implications for the future role of a DSO 17 1.11. A growing chorus: The need for greater focus on consumer realities 18 1.12 DM and DER funding incentives 19 2. T HE R EGULATORY F RAMEWORK 19 2.1. Definitions 20 2.2. Distributed energy resources 23 2.3. Distribution system operator 24 2.4. The national electricity market regulatory framework 26 2.5. Market institutions and related bodies: Governance, regulatory, and operational 26 2.6. Central harmonised national legislation and rules 27 2.7. Sub-national electricity market legal frameworks 32 3. W ORK PACKAGE 1: D ISTRIBUTED ENERGY RESOURCES 34 3.1. DER overview 34 3.2. Challenges and opportunities 34 3.3. Whose energy resources are they? 35 3.4. Different jurisdictional approaches to planning for DER 36 3.5. DER and DM incentives and funding in Australia 36 3.6. DERs and EVs 47 4. W ORK P ACKAGE 2: M AXIMISING CUSTOMER VALUE FROM EXISTING D EMAND M ANAGEMENT REGULATORY INCE NTIVES 49 4.1. What is demand management? 49 4.2. Managing final demand: Improving energy efficiency to avoid or reduce end-use consumption 50 4.3. Managing demand in the NEM: Improving energy efficiency in electricity networks 50 4.4. Demand management incentive scheme (DMIS) 53 4.5. Sub-national DM programs 53 4.6. Outcomes of DM regulatory reforms 53 4.7. Who has responsibility for demand management? 54 4.8. What is the current scale of the DM market and cost of DM in Australia and overseas? 55 4.9. What is Australian industry current practice and best practice for DM? 57

6 N4 Opportunity Assessment – DSO and beyond 4.10. What are plausible, potential benefits and costs of DM for customers in terms of bill reduction and carbon emission abatement? 59 4.11. International experiences: Demand management 61 4.12. What is the role of technology in facilitating and maximising consumer-focused DM? 61 4.13. Which DM regulatory incentives maximise customer value, and how can we measure/evaluate the customer value effectiveness of DM? 63 5. W ORK P ACKAGE 3: A NALYSIS OF D ISTRIBUTION S YSTEM O PERATOR FUNCTIONS TO ENHANCE CUSTOMER OUTCOMES 65 5.1. An Introduction to DSO models and benefits/risks to consumers, competition and implementation 65 5.2. Accountability for a future DSO 68 5.3. KPIs for a future DSO 69 5.4. DSO and harnessing DM and DER 70 5.5. DSO and system planning 71 5.6. What is the role and function of innovative technologies such as autonomous energy systems in distribution systems, and who is responsible for such systems? 71 6. W ORK PACKAGE 4: O VER THE HORIZON 74 6.1. Regulatory state of flux 74 6.2. Jurisdictional differences in DER approaches 75 6.3. Long-term objectives 75 6.4. System planning process for future markets 76 6.5. DNSP, tariff-design and the consumer gap 76 6.6. Planning for a high DER future: Challenges and opportunities 77 6.7. Planning for a high DER future: The WA DER Roadmap 80 6.8. Victoria’s approach to harnessing DER 86 6.9. Customer protection and engagement in a high DER future 87 A NNEX 1: R ESEARCH FRAMING QUESTIONS 89 A NNEX 2: S TAKEHOLDER ENGAGEMENT AND FEEDBACK 93

1. RESEARCH RESULTS AND DISCUSSION

The growth in uptake of rooftop solar PV continues at pace throughout Australia. Individual and community interest and investment in batteries, EVs and other forms of DER is likewise on the rise. Experiences from both international and several Australian jurisdictions confirm that a high DER, decarbonised energy future in which safety, security, and reliability of power systems, energy efficiency and emissions reductions, and value and benefits to consumers feature equally is achievable. This discussion builds on the findings and discussions set out in the Summary Report. Together they provide a comprehensive discussion of key issues that require further thinking and research that forms an integral part of the various future research projects set out in the roadmap.

1.1. Regulatory barriers and opportunities

The need for regulatory definitions, roles and responsibilities

The current national regulatory framework fails to fully address fundamental issues such as the introduction of a new market participant or institutions DSO and/or DMO with DER orchestration, participation and aggregator roles, functions, and responsibilities into the NEM and NERM. The existing national regulatory DSO definition, for example, sets out the national electricity rules, but fails to adequately provide for the current and emergent high DER market paradigm. Individual jurisdictional responses already in place, such as those in Western Australia, provide practical insights that can be drawn upon to inform the substantial amendments to the current national regulatory arrangements. Further essential regulatory amendments include energy efficiency and DM definitions and a DER definition that details the growing range of DER and DER asset ownership, in particular consumerowned DER.

Ratcheting up the pace of regulatory change driving complexification

The review and analysis to date show a range of current, emergent, and prospective governance, legal, and operational issues arising from the rapid change underway in policy and regulatory framework across the Australian energy market. This includes:

• AEMC approved rules changes that have, or are about to, come into effect 1

• The issuance of guidelines and other related regulatory instruments by the AER 2

1 AEMC: National Electricity Amendment (Regulated stand-along power systems) Rule (effective at of 1 August 2022) https://www.aemc.gov.au/sites/default/files/202202/SAPS%20NER%20amending%20rule%20final%20 2022.pdf. See response by AEMO, e.g., regarding the process and system changes required to implement and support new market and power system arrangements under the Integrating Energy Storage Systems Final Rule Determination: DRAFT IESS implementation strawperson: Integrating Energy Storage Systems project (July 2022) https://aemo.com.au/-/media/files/initiatives/submissions/2021/iess/integrating-energy-storage-systems implementationstrawperson draft.pdf?la=en; AEMO, 2022 Integrated System Plan For the National Electricity Market (June 2022) https://aemo.com.au//media/files/major-publications/isp/2022/2022-documents/2022-integrated-system-plan-isp.pdf? la=en

2 See eg: AER’s consultation initiated on Incentivising and measuring export services performance (commenced 5 August; to be completed December 2022) as part of key obligation on AER under its Access, pricing and incentive arrangements for distributed energy resources Rule change; see AER, Consultation paper Incentivising and measuring export service performance (August 2022) https://www.aer.gov.au/system/files/AER%20-%20Consultation%20paper%2020Incentivising% 20and%20measuring%20export%20service %20performance%20-%20August%202022.pdf; AER, DER integration expenditure guidance note (June 2022) https://www.aer.gov.au/networkspipelines/guidelines-schemes-models-reviews/assessing-distributed-energy-resources-integration-expenditure-guidance-note/final-decision

N4 Opportunity Assessment – DSO and beyond 7

• Ongoing actions of AEMO concerning ESB Post-2025 reform initiatives, 3 such as flexible demand and advancing the integration of utility-scale renewables and DER into the market 4

• Decisions by the energy ministers, all of which have far reaching consequences for current and future energy markets in Australia 5 and

• Growing levels of re-engagement by federal and state/territory governments in the energy sector, including legislative deviations enacted by several jurisdictions that enable departure from the existing regulatory framework governing the NEM 6

State legislative frameworks are also changing. In addition to the advanced state of DER in WA, 7 other jurisdictions are advancing their policy and regulatory response positions on DER and DM (e.g. Victoria’s recently released DER initiative Harnessing Victoria's Distributed Energy Resources). 8 In a similar vein, NSW’s enactment of the Electricity Infrastructure Investment Act 2020 created a new independent entity the consumer trustee ‘to look after the long-term financial interests of NSW electricity customers to improve the affordability, reliability, security and sustainability of electricity supply … through long-term planning and well-structured procurement processes’. 9

In general terms, the escalating pace of regulatory changes is leading to more, not fewer, questions about the emergent energy market and the extent to which consumer benefits are being recognised, offered and guaranteed. As a consequence, many of the regulatory issues identified in this opportunity assessment involve definition; conceptual and technological considerations remain unresolved. This issue will need to be addressed in any further research projects, especially in light of current and anticipated forthcoming regulatory developments occurring throughout the various participatory jurisdictions of the NEM.

Moreover, the complexification and magnitude of the existing regulatory framework (e.g. policies, laws, regulations, rules, industry codes and so on) present as significant barriers to a successful energy transition that warrant planned, holistic regulatory change. Nowhere is this more pressing than in

3 ESB’s Post-2025 Market and DER Implementation Plan, Integration of distributed energy resources (DER) and flexible demand, https://esbpost2025-market-design.aemc.gov.au/integration-of-distributed-energy-resources-der-and-flexible-demand#delivering-the-derimplementation-plan

4 See e.g., AEMO, NEM market suspension and operational challenges in June 2022 (August 2022 ) https://aemo.com.au//media/files/electricity/nem/market_notices_and_events/market_event_Reports/2022/nem-market-suspension-and-operational-challenges-injune-2022.pdf?la=en; Updated 2021 Electricity Statement of Opportunities (April 2022) https://aemo.com.au//media/files/electricity/nem/planning_and_forecasting/nem_esoo/2022/update-to-2021-electricity-statement-of-opportunities.pdf? la=en. See also AMEO involvement in ESB Post-2025 reform initiatives

5 See eg, Energy Ministers, Meeting Communiques (8 June 2022) and (11 August 2022) https://www.energy.gov.au/government-priorities/energyministers/meetings-and-communiques.

6 See e.g., NSW: Electricity Infrastructure Investment Act 2020; Victoria: National Electricity (Victoria) Act 2005 (amendments introduced in 2020).

7 Energy Transformation Taskforce, DER Roadmap (WA Government, April 2020) https://www.wa.gov.au/system/files/202004/DER_Roadmap.pdf.See also subsequent Report, including: Energy Policy WA, Leading Western Australia’s brighter energy future Energy Transformation Strategy Stage 2: 2021-2025 (WA Government, July 2021), https://www.wa.gov.au/system/files/2021-07/Energy-TransformationStrategy-Stage2-July2021.pdf; Distributed Energy Resources Roadmap April 2022 Two-year Progress Report: April 2022 (WA Government, 2 June 2022), https://www.wa.gov.au/government/publications/distributed-energy-resources-roadmap-two-year-progress-Report

8 Victorian Government, Harnessing Victoria's Distributed Energy Resources (2022) https://www.energy.vic.gov.

au/data/assets/pdf_file/0033/568284/Harnessing_Victorias_Distributed_Energy_Resouces.pdf. See further DELWP, Distributed energy resources, https://www.energy.vic.gov.au/renewable-energy/distributed-energy-resources

9 NSW Government, https://www.energyco.nsw.gov.au/industry/consumer-trustee See also AEMO Services, https://aemoservices.com.au/consumers/our-role-as-consumer-trustee

8 N4 Opportunity Assessment – DSO and beyond

traditional retail electricity markets and their adverse consequences for consumers. Often referred to as the retailer–distributor–consumer interface, the integration of the accelerating quantity of individually owned and community-owned DER into established power systems is challenging at many levels, including technical, economic and regulatory. Such challenges can be characterised in many ways. Relevant to this opportunity assessment, challenges to the retailer–distributor–customer interface include essential services, the social contract and/or licence. As an essential service, supply of, and access to, energy services have long been critical elements of the social contract between the state and its citizens. The concept of social licence is increasingly being used where private entities, rather than the state, are providing essential energy services. Regardless of the definition such a relationship with energy consumers is one that involves extensive responsibilities that are not always met. Articulated in part by legislative objectives (e.g. the national electricity objective (NEO) and national electricity retail objective (NERO)), these relationships are further proscribed by a range of legal rules (e.g. contract law, torts, and corporations law) that simply add to, rather than decomplexify, the operationalisation of the regulatory framework –

• Consumers’ lack of choice. Consumers face the challenge of a practical lack of choice when it comes to selecting an energy service provider. More often than not, consumer choice is illusory. Most consumers do not have a real choice as they cannot take their business elsewhere, even when prices rise. In a fully contestable market, competition drives price to the middle, averaging out the differences. This means that price-point choice assumptions become irrelevant.

• Inconsistent stakeholder relationships across participatory jurisdictions. The relationship between the key stakeholders differs across participatory jurisdictions. For example, in Victoria the distributors control smart meters, whereas in other jurisdictions the retailers have regulatory oversight.

• Disconnect between distribution networks and customers. Although distribution is central to facilitating and enabling DER and DM, for the most part, DNSPs have no direct relationship with end-users (e.g. end-users interact/engage contractually with retailers, not the assigned distributor). Thus, there is a disconnect between distributors and customers in the context of tariffs where the latter are designed and set for distribution but stated as being created to stimulate or encourage consumer behavioural changes.

Growing lack of national regulatory cohesion

Australian states and territories (the participatory or territorial jurisdictions) are increasingly engaging in activities that deviate from the national regulatory framework, resulting in regulatory fragmentation across the NEM. To date, sub-national legislation has been more agile in responding to the challenges associated with the energy sector’s decarbonisation transition and driving the emission reductions necessary to achieve net zero. However, Australian states and territories are actively setting their own agendas on several matters that directly affect the NEM and NERM. This has already included Victoria’s

N4 Opportunity Assessment – DSO and beyond 9

decision to only have a limited regulatory engagement with the national energy customer framework (NECF) and national energy retail rules (NERR). Some of these are unsurprising.

Western Australia’s introduction of its own DER Roadmap in 2019/2020 is unremarkable as, based on geography, WA has always operated its own separate electricity market. Western Australia, while party to the Australian energy market agreement (AEMA), does not participate in the NEM. Instead, the regulatory framework for WA’s electricity market is set out in a range of state-based laws and regulations. 10 This includes the WA DER Roadmap and related laws. 11 It also includes the different ways in which networks are approaching solar exports and constraints. The Northern Territory, which, like WA, is not physically connected to the NEM, also operates its own regulatory framework but has adopted some of the NEM rules. However, even within the NEM participating states, both Victoria and NSW legislated in 2020 to coordinate infrastructure investment in renewable energy zones that comprises large-scale renewable energy generation, grid-scale battery and pumped-hydro storage and networks outside the NEM frameworks in order to accelerate and facilitate their own jurisdiction’s energy transition. 12

A notable development in NSW is changes to the electricity regulatory framework effected through the introduction of the Electricity Infrastructure Investment Act 2020 (NSW). 13 In 2021, a subsidiary body of AEMO AEMO Services was appointed to this role by the NSW Minister for Energy, and the EnergyCo (Energy Corporation of NSW) was appointed to the role of infrastructure planner for renewable energy zones (REZs) in NSW. 14 Both Victoria and NSW have also introduced further changes through the creation of REZs. While primarily focusing on the opportunities of grouping renewable energy generation, storage, and transmission into identified geographic locations, the physically connected nature of the electricity systems means that such changes will also impact on distribution and endusers. 15 Future impacts of such changes on the parts of the regulatory framework governing DM and distribution networks will require further consideration

Existing and emergent differences in public/private ownership of assets across jurisdictions are also challenging the structure and content of the existing regulatory framework. Public/private ownership and market participant changes are underway, with several state governments deciding to assume the primary role in generation and/or greater engagement in other parts of the sector (e.g. Victoria and NSW). Others are maintaining public ownership or control of energy assets (e.g. WA). A key impact of this increasing devolution and decentralisation is that multiple jurisdictional models of energy market governance and regulation will need to be contemplated in the research projects set out in the Summary Reports’ research roadmap.

Overall, jurisdictional variance throughout the market is increasing rather than decreasing. This challenges any assumption that the collaborative federalist approach that underpinned the

10 See https://www.wa.gov.au/organisation/energy-policy-wa/wa-energy-legislation

11 See https://www.erawa.com.au/electricity

12 See National Electricity (Victoria) Amendment Act 2020 (VIC) and Electricity Infrastructure Investment Act 2020 (NSW)

13 Electricity Infrastructure Investment Act 2020 (NSW), ibid.

14 See further; EnergyCo, https://www.energyco.nsw.gov.au/; AEMO Services, https://aemoservices.com.au/

15 See e.g., NSW, Renewable Energy Zones, https://www.energyco.nsw.gov.au/renewable-energy-zones; Victoria, Renewable Energy Zones, https://www.energy.vic.gov.au/renewable-energy/renewable-energy-zones

10 N4 Opportunity Assessment – DSO and beyond

establishment of the interconnected NEM in 1998 will automatically continue into the future. 16 Australian states and territories, through the Energy Ministers Forums, for example, may not shift away from supporting a harmonious national regulatory framework for the NEM, but as decentralised markets evolve, further attention needs to be given to regulatory questions surrounding the nature and scope of the foundational collaborative federalist laws and AEMA that underpin the current NEM and NERM.

1.2. Regulatory opportunities: Transformative, comprehensive reforms

Regulatory challenges can also be seen as transformative opportunities. This opportunity assessment’s clear message is that, while the current regulatory framework is a significant barrier, it can also be amended to become a critical enabler of Australia’s decarbonisation transition and the realisation of net zero emissions. Consequently, the current uncertainties, risks, and challenges resulting from the combined impacts of decentralisation of the power system, accelerating DER uptake, new DER and DM technologies, introduction of a DSO and/or DMO, and decarbonisation imperatives present a once-in-ageneration opportunity for pursuing coordinated and enduring regulatory reforms across the NEM and the NERM.

Further regulatory opportunities identified include an in-depth review of NEM and NERM policy settings, governance and decision-making structures, regulatory frameworks, control strategies, consumer-facing retail business models and network service models, and asset and ownership diversity across the entire supply chain. By far the most significant drivers of all these trends are individual consumer decisions and the confidence consumers have in their ability to make decisions that are indeed in their best interests – that is, that the system can be trusted to deliver them fair choices.

Unlocking the value of such benefits for consumers, whilst also ensuring that the power system remains safe, secure, and reliable is critical to ensuring the much-needed regulatory reforms are fit-for-purpose: a consumer-focused, decentralised, decarbonised high DER future. Securing such outcomes requires further collaborative thinking on how best to reform the existing regulatory framework to avoid or minimise regulatory fragmentation across the nine jurisdictions of the AEM. It also needs to ensure that challenges are managed and transformed into opportunities and benefits.

1.3. Competition and implementation costs

Since the NEM’s inception, the central and legislated objective of its regulatory authorities (sometimes called the ‘market bodies’) has been to promote efficient investment in, and use of, the energy system. With the exception of network regulation (given networks’ status as natural monopolies), the regulatory authorities have equated the promotion of efficiency with the promotion of competition. As a result, competition came to be seen as a regulatory objective in its own right in the contestable parts of the energy supply chain of generation and retail.

Before considering the competitive consequences of DER, DSO and DM, it is worth considering why efficiency was made the central objective of the NEM back in 1998 and whether those conditions remain intact today and going forward.

16 Kallies, A. (2021). The Australian Energy Transition as a Federalism Challenge: (Un)cooperative Energy Federalism? Transnational Environmental Law, 10(2), 211-235. doi:10.1017/S204710252000045X.

N4 Opportunity Assessment – DSO and beyond 11

In the 1980s and 1990s, when the energy sector was corporatised, disaggregated and privatised, the production, distribution and consumption of energy looked entirely different from how it looks today. Back then, the inputs and outputs of the energy supply chain were largely known with certainty and demand effectively inelastic. In other words, the energy system (and market) comfortably rested in steady-state. There was nothing for regulators to do other than promote the efficient use of known inputs to produce readily identifiable outputs. In this sense, the regulatory task was straightforward. In response, regulators became narrowly focused and proficient taskmasters of the energy markets they oversaw.

Sometime over the past decade, the steady-state nature of the energy system (and market) ended. The so-called ‘energy transition’ had begun. Almost by definition, the energy transition represents a period of great uncertainty for regulators designed to manage the neat steady-state conditions of the 1990s’ energy market. During the transition, it is impossible to know the nature and mix of inputs that will be required to meet the uncertain mix of outputs that energy users (and producers and storers) will require in the future. The energy system and market are now replete with unknowable variables. These unknowable variables include the roles to be played by DER and DM.

It is likely that a new steady-state will emerge one day (though even this observation is open to inquiry). When that will be, and how it will look, is unknowable for now. It would be foolhardy for policy-makers, regulators, researchers or advocates to presume otherwise.

So where does this leave energy regulators and their regulatory frameworks that are focused exclusively on promoting efficiency? How can regulators solely focus on efficiency when they can know neither inputs nor the outputs required? And, therefore, where does it leave the regulators’ previous assumption that their focus on efficiency can be equated with the promotion of competition?

The answers to these questions are far from obvious. Nonetheless, a great deal of regulatory effort remains bound to the assumption that competition is a worthwhile objective in its own right. The dominant regulatory response to many of the new challenges facing the energy system involves growing the regulatory framework to enable market-based solutions to accommodate new technologies, products, services and business models. Little recognition appears to be given to the complexity involved in coordinating all these markets and sub-markets. It simply assumes that cost reflective price signals will smoothly flow up, down and across these markets to coordinate investment and usage decisions that will ultimately prove to be efficient. This regulatory article of faith will be tested by the energy transition, particularly as previously passive consumers are co-opted into becoming market participants who actively trade their consumption, energy production, and stored energy with vastly more sophisticated commercial parties.

Given the emphasis on market-based solutions by the current cohort of regulatory authorities, we must recognise that –

• if price signals are not genuinely cost reflective

• if their transmission between markets encounters frictions

• if market participants (of all sorts) do not respond ‘rationally’ to price signals and

• if market power emerges anywhere in the inter-linked markets,

12 N4 Opportunity Assessment – DSO and beyond

then the implementation cost of market-based solutions will rise potentially substantially and rapidly. Once again, it is far from obvious who will bear these costs. For example, they may be expressed in terms of higher prices, stranded assets, or both. Those stranded assets may be owned by large corporate entities or small players (eg. households). The political economy associated with these costs, and the potential damage to community confidence in the energy transition, must not be ignored in the design of regulation.

The role, relevance and utility of markets, competition and price signals and therefore the design of regulation will be a central consideration for many of the projects to be progressed under the N4 work stream.

1.4. Identifying and managing DER-induced risks

Responding to the challenges of energy system decentralisation and growing levels of DER requires identification of risks and a greater understanding of how, where, and when high DER penetration induces security, reliability and safety risks across electricity networks. There is no panacea for managing such risks. Managing and integrating high levels of DER into existing power systems requires a suite of responses, including:

• Improving inverter standards (capability, communications, compliance)

• Exploring cost-effective distribution network storage opportunities

• More suitable voltage standards and frequency load shedding arrangements to deal with localised voltage fluctuations and two-way power flows

• Further investigative trials of tariff structure reforms and investment incentives

• Valuing decarbonisation processes and emission reductions, as well as evaluating the success of intended outcomes

• Focused coordinated planning and regulatory reform to facilitate greater DER participation (e.g. adoption and update of new DER, such as EVs) and control over sizeable amounts of individually owned/operated DER devices, and to ensure consumer protections and intra-end user equity.

Further thinking is required on how best to achieve a suitable balance between what appear to be, at first glance, competing technical, economic, environmental and social objectives. From the consumer perspective, for example, this entails matters such as unlocking and ensuring benefits and value to consumers (e.g. lower bills, DER investments, compensation for provision of DER services) and securing consumer protections and engagement (e.g. protection and ownership of customer data and information, public consultation, fora, etc.). From the NEM perspective, it comprises challenges such as identifying, managing and responding to DER-induced risks across power systems to ensure security, stability, and reliability (e.g. load-risk response measures, including improved inverter and voltage standards, transitional emergency response mechanisms, voltage fluctuations and growth in two-way power flow).

1.5. Whose demand is being managed?

The subsequent DM discussion in Work Package 2 highlights a range of considerable benefits flowing from existing industry/system focused DM measures.

N4 Opportunity Assessment – DSO and beyond 13

Within the context of the current dynamic transitional developments across the energy sector, further questions are emerging concerning demand management and existing regulatory measures. This includes the changing nature of what is to be ‘managed’ in the traditional demand-end of the electricity transaction, and the variable roles/functions of existing market stakeholders. As DER continue to grow, this will also entail addressing questions about distributed supply of electricity into the grid and the interface with system stability. Examples include recent regulatory changes that have enabled AEMO or a DNSP to disconnect small-scale distributed solar units (without the owner's permission) to maintain system stability, and the role of network export tariffs (e.g. charging owners of DER for use of the network when exporting their electricity into the grid). These examples show a focus on demand management as a network service where system stability appears to be the primary objective over and above others. The diversity of responses to this issue is also worth mentioning. For instance, pilot projects are underway in which some owners are being paid to enable DNSPs to curtail exports Synergy, for instance, is exploring the opportunity of compensating owners of RTPV solar of DER services of this kind, with export constraints being developed as a value stream for end-users

It is also worth noting the potential challenge for DM resulting from increased demand in the system, either locally or generally. As discussed earlier in this report, the various DM definitions are predicated on the objective of reducing energy demand or load shifting. However, due to low and falling demand in the middle of the day, DM may increasingly also involve increasing electricity demand at certain times in order to manage system reliability. The relationship between DM and DER raises further questions regarding potential impacts on DM of ongoing investment in DER as well as large-scale batteries and local community renewable energy and storage projects (such as neighbourhood batteries). Network costs, and the wholesale and FCAS markets, will also be impacted. Questions such as these warrant further attention in the current regulatory discussions being championed by various Australian governments, energy ministers, the ESB working groups, market institutions and other regulatory bodies.

1.6. Distributed energy resources or consumer energy resources: Whose resources are they?

Existing and emergent DER assets give rise to several findings. Recent commentary from energy market institutions and other bodies is starting to question the accuracy of existing terminology and understandings of DER. For example, it is being suggested that DER should really be called consumer energy resources (CER). In Victoria, it has been noted that some organisations have adopted the term CER to emphasise that these resources are owned by consumers, and to encompass a broad range of technology into the definition. 17

At the very least, a clear distinction needs to be made between DER generally and CER, as in regulatory terms, DER are still largely described in separate, generalised terms. The ESB’s Post-2025 Market Report illustrates this where DER are described broadly as “small-scale rooftop solar, batteries, smart appliances, business equipment and systems, and EVs”. The implicit assumption in the ESB’s post-2025 energy market vision is that consumers will efficiently respond to cost-reflective price signals in a way 17

14 N4 Opportunity Assessment – DSO and beyond

2,

Victorian Government, Protecting consumers of distributed energy resources (DER): Consultation Paper (October 2022)

https://engage.vic.gov.au/protecting-consumers-of-der

that optimises the overall operation of the electricity system (and minimises the need for surplus investment). However, this does not always hold true. For example, private or business fleet EV owners may need to use their vehicles for their own purposes. This means that such DER may not be suited to being contracted to provide system services. The appropriate balance between automated and active consumer-controlled demand response warrants urgent attention.

A related question concerns what such a definitional change means in regulatory terms (e.g. the changing nature of demand and supply and their impacts on the retail/distribution and wholesale markets, as well as the changing roles and corresponding responsibilities of current consumers and other market participants in new regulatory settings). This alone suggests an urgent need for a comprehensive rethink and redesign of the prevailing energy regulatory framework. The definition of what a ‘consumer’ is will likely need to be reviewed as the terminology of consumer/producer may not sufficiently capture the new roles end-users assume in the market.

One of the issues from the energy system’s perspective is the lack of visibility of the behaviour of these systems and therefore the demand for orchestration, which in turn raises questions of what type of access to DER is required. This, and the other uncertainties listed below, warrant further consideration and research:

• What is or could be a DER (single, multiple/hybrid)?

• Who owns DER?

• Who can access another party’s DER?

• Does access mean all DER or just one selected DER?

• Who is responsible for DER failure or damage?

• Are Time of Use (ToU) tariffs, which aim to facilitate changes in end-user behaviour, equally effective in the context of rapidly rising quantities of DER? 18

• What would consumers be willing to accept in exchange for the imposition of export limits on their DER (e.g. payment for an agreement to restrict RTPV solar export capacity through measures such as orchestration and dynamic operating envelopes)?

1.7. Who are the stakeholders in the ESB/AEMC/AEMO/AER

two-sided energy market?

A fundamental question concerns who the relevant stakeholders in these dynamic new energy markets are, how their relationships are defined, and what their respective rights and responsibilities are. In response to rising DER, for instance, current end-users are increasingly able to elect to switch between demand and supply roles (e.g. generators, storers and suppliers versus consumers of energy). Likewise, retail and network service providers are increasingly engaging in buying and supplying DER-generated electricity back to the wholesale market, that is, switching roles/functions from facilitating supply to end-users to facilitating supply into the wholesale and FCAS markets. This also highlights several key conceptual and definitional challenges.

For instance, does the ESB’s Post-2025 Market Report’s terminology of ‘flexible demand’ adequately reflect these changing circumstances? As the AER’s final DER integration expenditure guidance note

18 See eg, AEMO’s and WA Distributed Energy Resources (DER) Registers https://aemo.com.au/energy-systems/electricity/der-register; See also AEMO, Renewable Energy Integration – SWIS update (2021) https://aemo.com.au/energy-systems/electricity/wholesale-electricity-marketwem/system-operations/integrating-utility-scale-renewables-and-distributed-energy-resources-in-the-swis

N4 Opportunity Assessment – DSO and beyond 15

makes clear, the expansion of DER and decentralised energy generation is customer driven. With more and more DER being located, usually on the consumers’ side of the electricity meter, consumers are demonstrating a willingness to assume a small-scale producing role albeit a passive one in the power system. Indeed, PVRT solar capacity is anticipated to double or triple by 2040. 19 Even so, becoming a prosumer does not automatically mean an active engagement with the market beyond exporting surplus electricity. Some DSM discussions are built on assumptions of proactive and engaged prosumers. Others advocate that future high DER markets will be characterised by fully automated demand responses.

1.8. DNSP, tariff design, and the consumer gap

Distribution businesses are responsible for maintaining distribution network safety and reliability, along with planning and designing network extensions and upgrades to meet our customers’ current and future electricity needs under the current pricing proposals. 20 The question of how to support the system planning process to be agile in the face of rapidly changing technology and market conditions is addressed subsequently in this opportunity assessment (see Section 6.5). A key finding highlighted in that discussion is the need to address the ‘consumer gap’. One example is the failure of network pricing and generation signals to reach small to medium business customers and household customers (e.g. network use-of-system (NUoS) charges comprise about 40% of the consumer retail bill). The remaining charges, which relate to wholesale generation, metering, environmental and retail margins are not detailed on these customers’ retail bills.

1.9. The DSO: A new market participant or a new role for an existing one?

As discussed subsequently in this report, the national electricity rules contain a specific definition of a distribution system operator (DSO), which is further defined as a ‘special participant’ (see NER, Ch 10).

The NER also set down a dedicated role for a DSO operating exclusively in the context of power system operating procedures (see NER, Ch 10, and Ch 4– Rule 10). In Australia, experience to date suggests that DNSPs have already integrated the role of DSOs into their operations and registered accordingly with AEMO. Further details are available on the NEM Registration and Exemption List published by AEMO. 21

A number of questions will need to be addressed in regard to this role. First and foremost, is there a need to extend the functions of the DSO in the NER? If there is to be a distinct role for a DSO, independent of the functions of a network, how should the current energy laws be amended to identify this regulated body’s new functions? Should this role and its functions be vested in existing institutions such as AEMO, or should a new entity be created altogether?

Regulatory questions also remain about the future role of aggregators. Over and above related questions concerning the preferable ownership structure and business model for a DSO, several important, related considerations are not highly visible in the current dialogue. These include What does a DSO look like, what does, or should, a DSO do, and how should it be regulated? For instance,

19 AER, DER integration expenditure guidance note (30 June 2022) https://www.aer.gov.au/networks-pipelines/guidelines-schemes-modelsreviews/assessing-distributed-energy-resources-integration-expenditure-guidance-note/final-decision

20 Australian Energy Regulator. Pricing Proposals and Tariffs, https://www.aer.gov.au/networks-pipelines/determinations-accessarrangements/pricing-proposals-tariffs.

21 See AEMO, https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/participate-in-the-market/registration

16 N4 Opportunity Assessment – DSO and beyond

should a DSO and its role be similar to that of the system operator of the wholesale market AEMO operating a DER market and bilateral contracts? Or do the existing retail/distribution market and existing consumer contracts dictate a different approach? Moreover, should such an entity’s activities be regulated, and if so, should this be by the AER or jurisdiction-based regulatory bodies such as IPART (NSW) and ESCV (Victoria)?

Against all these uncertainties, there is an even greater lack of clarity as to how any of these changes ultimately benefit consumers. This entails meeting both the current needs and long-term obligations set out in the national energy market objectives. The far-reaching consequences of the energy ministers’ agreement to introduce an emissions mitigation obligation into the market objectives are far from clear in both practical and temporal senses. They also remain opaque in terms of sharing the burden of the responsibility and costs associated with emissions mitigation activities, and the relationship with existing sub-national emissions mitigation measures. These issues are underpinned by an implicit assumption that the access to affordable energy services is still widely understood as essential, regardless of the private/public character of market participants.

1.10. Implications for the future role of a DSO

Questions identified during this opportunity assessment’s research and engagement activities concern the appropriate role of distribution network businesses in this new energy system, include

• How should network services evolve to support, integrate and make use of DER? What role do (real-time) prices play? Are there other feasible orchestration options?

• Who should be responsible for planning and managing the relationship between the distribution network and DER?

• How do we ensure customers investing in DER have the correct information, incentives and support to guide the efficient adoption and use of DER?

• What is the role of the network owners and operators in procuring DER-based and DM-based support services?

• What are the relationships and risk allocation approaches between distribution networks and those entities with direct control of DER (such as customers or their agents) to contribute to a secure, stable, reliable and affordable electricity system for all?

These issues have led many people to propose creating new entities or and/or evolving roles to address these challenges. A key proposal relates to the DSO. Similar to DER, the interpretation of what a DSO is varies, but a common definition from a comparative study undertaken in 2018 is that it is ‘the entity responsible for planning, and operational functions associated with a distribution system that is modernised for high levels of DER’. 22 This definition is considerably wider than the ones provided for in the national electricity rules, in particular in light of the planning functions and the express reference to DER.

Much of the debate in Australia about roles and responsibilities of the DSO has focused on the dispatch or orchestration function, for instance, controlling when DER should be turned on and off or ramped

N4 Opportunity Assessment – DSO and beyond 17

–

22 Newport Consortium, Coordination of Distributed Energy Resources; International System Architecture Insights for Future Market Design (Report prepared for AEMO, 2018).

up and down. However, other equally important issues relate to the distribution network business's role in planning and operating a distributed network with high levels of DER for the benefit of all customers. Further thinking is required on these issues and includes:

• Planning for DER, in particular planning and implementing an optimal mix of DER, DM and network infrastructure

• Providing price signals and other financial incentives to promote efficient development and use of DER and

• Procuring and/or owning DER and the services they can offer to provide network support and to deliver better outcomes for customers.

1.11. A growing chorus: The need for greater focus on consumer realities

Affordability, fairness, equity and comprehensibility are integral components of the energy transition. Even so, it is far from clear whether the vast body of the Australian energy market’s existing regulatory framework including the NEM takes into account consumer realities. Not just the national energy regulatory framework is widely considered to no longer be fit-for-purpose in the face of rising DER and decentralised energy markets. Questions are being raised about the disconnect between the expectations that consumers will actively and constructively support the energy transition, and the likelihood that such widespread changes will actually eventuate. This includes the role they are expected to play in managing their own energy use and if relevant, the behind/at-the-meter generation for their own benefit, as well as supporting and benefitting the system and market participants operating across it.

In a 2022 speech to the ACCC/AER’s Regulatory Conference the Future Regulation of the Energy Sector, ECA’s CEO Lynne Gallagher clearly enunciated the failings of the current regulatory framework. In doing so, she identified the disconnect between the government and industry approaches to the current and proposed developments across the system and the implicit assumptions relied upon concerning the role of consumers in these new and emergent energy market paradigms:

“There are countless numbers of dedicated policy-makers, engineers, economists and people in industry working to ensure that the power system safely and reliably delivers electricity, today and tomorrow. What is yet to receive the same attention is a plan for reshaping demand so that we have a least-cost electricity system as well as one in which the energy bills of households and small businesses are affordable: A plan that reflects the role we are asking consumers to play and creates opportunity for all households and small businesses, rather than deepening inequity.” 23

The sharp rise in energy prices that occurred in 2022 focused attention on key issues directly impacting consumers: affordability, fairness, and equity. For example, the AGL Energy Customer Council recently observed that, while the ESB is currently working to develop an energy framework that ensures Australians maintain access to reliable and adequate supply as the energy markets transform, this approach is not comprehensive. A notable “key component missing from the ESB work stream is active

23 See ECA, Speech to the ACCC/AER Regulatory Conference 2022 – Future regulation of the energy sector (August 8, 2022) https://energyconsumersaustralia.com.au/news/speech-to-the-accc-aer-regulatory-conference-2022-future-regulation-of-theenergy-sector

18 N4 Opportunity Assessment – DSO and beyond

and vibrant engagement with consumers to create a vision of energy fairness in the new energy world”. 24

1.12 DM and DER funding incentives

Demand management incentives in Australia range from the Australian Energy Regulator’s supply-side DMIS and DMIA offerings to those of other federal supply-side funders, such as ARENA and the Clean Energy Finance Corporation. As discussed in Work Package 1 below, the states and territories vary: the largest states (NSW and Victoria) offer potential demand-side funding incentives for DER from sources such as the Climate Change Fund and the Sustainability Fund, respectively, while the ACT and South Australia offer demand-side incentives, and the remaining sub-national governments offer supply-side funding incentives.

Pre-Albanese Government tax incentives are not specifically either supply or demand-side incentives and offer the R&D tax incentive (which is similar in intent to the DMIA). Then there is the concessional tax treatment for ESICs. The state and territory tax incentives and subsidies focus more on the demandside such as on public charging station infrastructure and direct fiscal support to lower EV costs. Despite the range of DM incentives identified, none had the effect of increasing DER in the form of EVs in Australia. As mentioned above, statistics show that business fleet uptake of ZLEVs in Australia was only 1.2% in 2020 around 400. 25 As to the effectiveness of the new FBT exemptions for EVs, a review is legislated for 2025. It has been noted that, in 2019, the ARENA–funded Distributed Energy Integration Program examined how the DMIS and DMIA network incentives could evolve so that consumers get the best value from the innovations of DER. The report suggests that incentives should focus on the demand side for consumers, and be equitable and affordable. This is why the October Budget 2022-23 inclusion of demand-side, climate-related funding and schemes are important and of interest.

2. THE REGULATORY FRAMEWORK

Regulation is a generic term that includes legislation, regulations and statutory rules, as well as delegated legislation (where decision-making or other powers are given by government to someone else), industry codes and standards, and other regulatory tools created at national, state/territory and local levels. Shaping those regulations are policy frameworks within which regulation is developed and implemented.

The regulatory framework can encourage or hinder the development of DM, DER, and DSO. It can influence their respective roles as contributors to the decarbonisation transition across the national energy market, and constrain or enhance the maximisation of consumer benefits and value associated with such changes. This section of the report provides an overview of the current regulatory environment in which the energy transition is taking place It also provides an overview of the regulatory complexities of the NEM.

24 AGL Energy Consumer Council Open Letter (14 July 2022) https://www.agl.com.au/content/dam/agl-thehub/220714-agl-energy-customercouncil.pdf

25 National Transport Commission

N4 Opportunity Assessment – DSO and beyond 19

2.1. Definitions

This research is concerned with a number of terms that are defined differently across the regulatory framework, literature, and policy publications. For the purposes of this report, most of the terms used and their definitions are those set out in the NER and the NERR. These are identified and discussed at relevant points throughout this report. The following discussion sets out key theme-based terms and definitions used throughout this report: (i) consumers, (ii) DM, (iii) DER, and (iv) DSO.

Despite the thousands of pages of regulations that comprise the national energy market regulatory framework, energy consumers are not specifically defined.

(i) Consumers: end-users

In the absence of an express statutory definition in the national energy regulatory framework, for the purpose of this report the term ‘end user’ is applied, in a generic sense, to all consumers: households and businesses.

(ii) Australian consumer law and consumers

The regulatory framework for energy consumers is founded on two key sets of laws: (a) the National Energy Customer Framework (NECF) 26, and (b) Australian Consumer Law (ACL). 27 As the main law for consumer protection and fair trading operating throughout Australia, the ACL regulates the sale of

Box 1: Australian Consumer Law, Section 3: Meaning of consumer

Acquiring goods as a consumer

(1) A person is taken to have acquired particular goods as a consumer if, and only if:

(a) the amount paid or payable for the goods, as worked out under subsections (4) to (9), did not exceed:

(i) $40,000; or

(ii) if a greater amount is prescribed for the purposes of this paragraph that greater amount; or

(b) the goods were of a kind ordinarily acquired for personal, domestic or household use or consumption.

Acquiring services as a consumer

(2) A person is taken to have acquired particular services as a consumer if, and only if:

(a) the amount paid or payable for the services, as worked out under Subsections (4) to (9), did not exceed:

(i) $40,000; or

(ii) if a greater amount is prescribed for the purposes of subsection (1)(a) that greater amount; or

(b) the services were of a kind ordinarily acquired for personal, domestic or household use or consumption.

26 See AMEC, The National Energy Customer Framework, https://www.aemc.gov.au/regulation/energy-rules/national-energy-retailrules/regulation.

27 See The Australian Consumer Law, https://consumer.gov.au/

20 N4 Opportunity Assessment – DSO and beyond

goods and services to consumers. This is complemented by the NECF, which operates to regulate the sale and supply of energy (electricity and gas) to customers in the retail market and contains a range of consumer protections. As discussed subsequently, not all states and territories are party to the NECF. However, both the sale and supply of goods and services to consumers in all Australian jurisdictions are governed by the ACL. Thus, while the term ‘consumer’ is not separately defined in the NEM and NERM regulatory frameworks, it is defined in Section 3 of the Australian Consumer Law in terms of the acquisition of consumer goods and services. 28 This is set out in Box 1.

(iii) Allconsumersarecustomers,butcustomersarenotalwaysconsumers

The term customers is used in two specific contexts that accord with the varying definitions set down in the NER and NERR. Firstly, the term is used in the NER to refer to registered participants who are buying electricity in the wholesale electricity market. More specifically, a customer is defined in the NER as: A person who: 1. engages in the activity of purchasing electricity supplied through a transmission system or distribution system to a connection point, and 2. is registered by AEMO as a Customer under Chapter 2 29 Such customers are not end-user consumers.

Secondly, according to the AEMC, consumers in the ‘energy market normally engage with an electricity or gas retailer who in turn arranges for the delivery of electricity or gas and then bills them for the supply’. 30 Immediately following this explanation, the AEMC uses the term ‘customers’ in setting out the various costs that make up an electricity bill, such as wholesale energy costs (electricity generation), regulated network costs (transmission and distribution), environmental policy costs, and retail costs (operating costs and margins). 31 This switch in terminology accords with the NERR’s classification of customers into two groups of energy consumers: retail customers and distribution customers. 32 Retail customers are further distinguished as either residential customers or business customers. Distribution customers are classified as small and large customers, with a further distinction made between two types of small customers: small market offer, and non-market offer customers. 33 These customers are end-users in the sense that they are final end-users consumers of electricity.

(iv) Demandmanagement

The term ‘demand management’ (DM) has had varying applications since the NEM’s establishment in 1998. Until recently, DM in the NEM framework referred predominantly to the operator’s task of matching supply and demand in the wholesale market and that of networks to manage constraints. With the introduction of the demand management incentive scheme (DMIS) and the demand management innovation allowance (DMIA) into electricity distribution networks, DM now has a broader definition and application. These developments form part of the subsequent discussion in Work Package 2. As explained below, this understanding of DM is different to demand-side management by end-users

28 See Federal Register of Legislation, https://www.legislation.gov.au/Details/C2022C00212/Html/Volume_3#_Toc109308083

29 NER Version 199 Summary, 11 March 2023, https://energy-rules.aemc.gov.au/ner/468.

30 See AEMC, https://www.aemc.gov.au/energy-system/retail/consumers

31 See AEMC, https://www.aemc.gov.au/energy-system/retail/consumers

32 NERR, Div 3, s 6. See Current Version 37, 1 March 2023, https://energy-rules.aemc.gov.au/nerr/464.

33 NERR, Current Version 37, 1 March 2023, https://energy-rules.aemc.gov.au/nerr/464.

N4 Opportunity Assessment – DSO and beyond 21

(v) Consumeragency:Demand-sideparticipationbyconsumers

From the end-users’ perspective, demand management has long been understood as relating to consumer participation in their own demand decisions, changing the timing of their electricity consumption, and/or reducing the amount of energy consumed in various way (e.g. by peak shifting, electricity conservation, fuel switching, utilisation of distributed generation, and energy efficiency). Behavioural changes in energy consumers’ demand preferences for electricity is reflected in several definitions contained in the regulatory framework, notably demand reduction, demand-side participation (DSP) and demand-side response (DSR). These are set out in Figure 2.1 below.

These terms and definitions in the existing regulatory framework highlight the long-recognised notion that most consumers are free to make their own decisions about electricity consumption. The capacity of end-users to decide how and when to reduce or change their electricity demand consumer agency is an increasingly important objective in the context of increasing DER and actively engaged end-users. Awareness of their growing flexibility and ability to trade this flexibility using new technologies drive the energy transition towards an end user-centric, decentralised electricity market. An important question for the future highly distributed, transitioning market is whether existing definitions sufficiently capture the value of demand management undertaken by end-users. The report further discusses the different perspectives market instruments provide and query whether these sufficiently consider whose demand is being managed and who is responsible for managing it (e.g. demand management of the system, market participants and end-users). These and related matters are explored further later in this report.

Demand reduction

• A change in consumer behaviour to reduce the amount of energy consumed (e.g. switching off lights when they are not needed)

Demand side participation (DSP)

• When consumers make decisions regarding the quantity and timing of their electricity consumption in line with the value they place on using electricity services. If consumers make informed choices about the quantity and timing of their electricity use, they can reduce demand when prices are higher, which can lead to less money being spent on poles and wires as long as reduced demand happens at the right time and place. Demand-side participation options are available to consumers (or to intermediaries acting on behalf of consumers) to reduce or manage their electricity use. Examples include peak shifting, electricity conservation, fuel switching, utilisation of distributed generation and energy efficiency.

Demand side response (DSR)

• An active, short-term reduction in electricity demand by consumers who decide to respond to price signals throughout the day by shifting their electricity use to another period, or to use another type of generation, or to simply not use electricity at specific times.

22 N4 Opportunity Assessment – DSO and beyond

Figure 2.1. Demand management by end-users

2.2. Distributed energy resources

Distributed energy resources are defined in a number of ways. For example, the Australian Energy Market Commission suggests that a DER is “a small-scale unit of power generation or storage that operates from homes and businesses and is connected to a larger power grid at the distribution level”. 34 According to the Australian Energy Regulator, DER include “rooftop solar, batteries, electric vehicles and energy management systems”. 35 Another key market institution, the Australian Energy Market Operator, defines DER as follows:

“Distributed Energy Resources or DER are consumer-owned devices that, as individual units, can generate or store electricity or have the ‘smarts’ to actively manage energy demand. When aggregated and operating together at scale through micro-grids and virtual power plants (VPPs), these devices have huge potential to exchange consumer value by contributing to a reliable and secure energy supply. Examples of DER devices include:

• Rooftop solar photovoltaic (PV) units

• Wind generating units (at residential or commercial premises)

• Battery storage system

• Hot water systems, pool pumps and air conditioner

• Smart appliances

• Electric vehicles.” 36

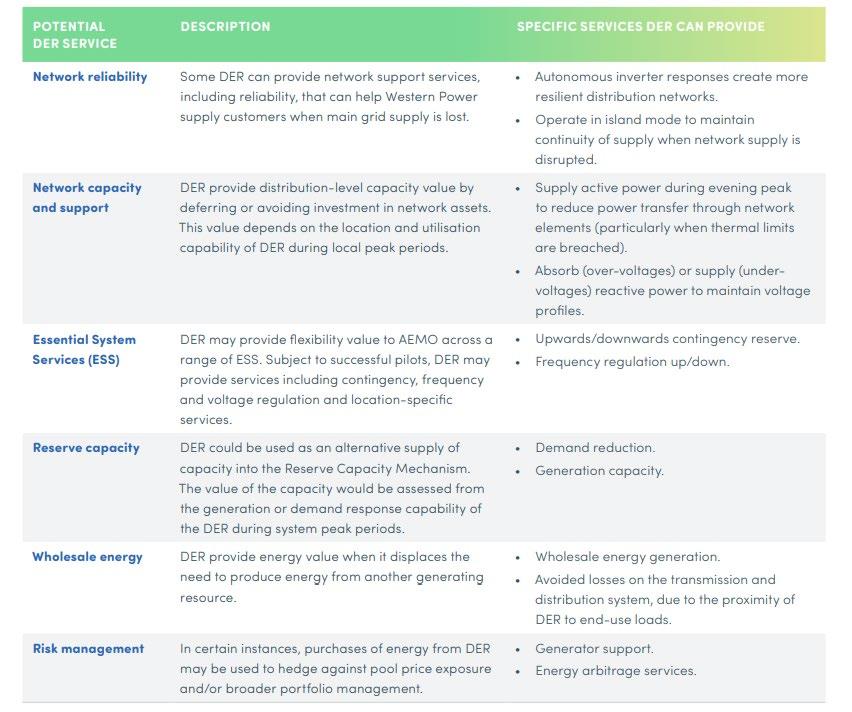

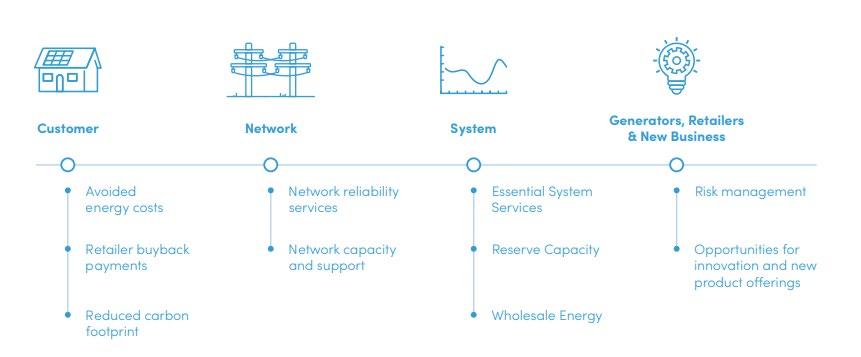

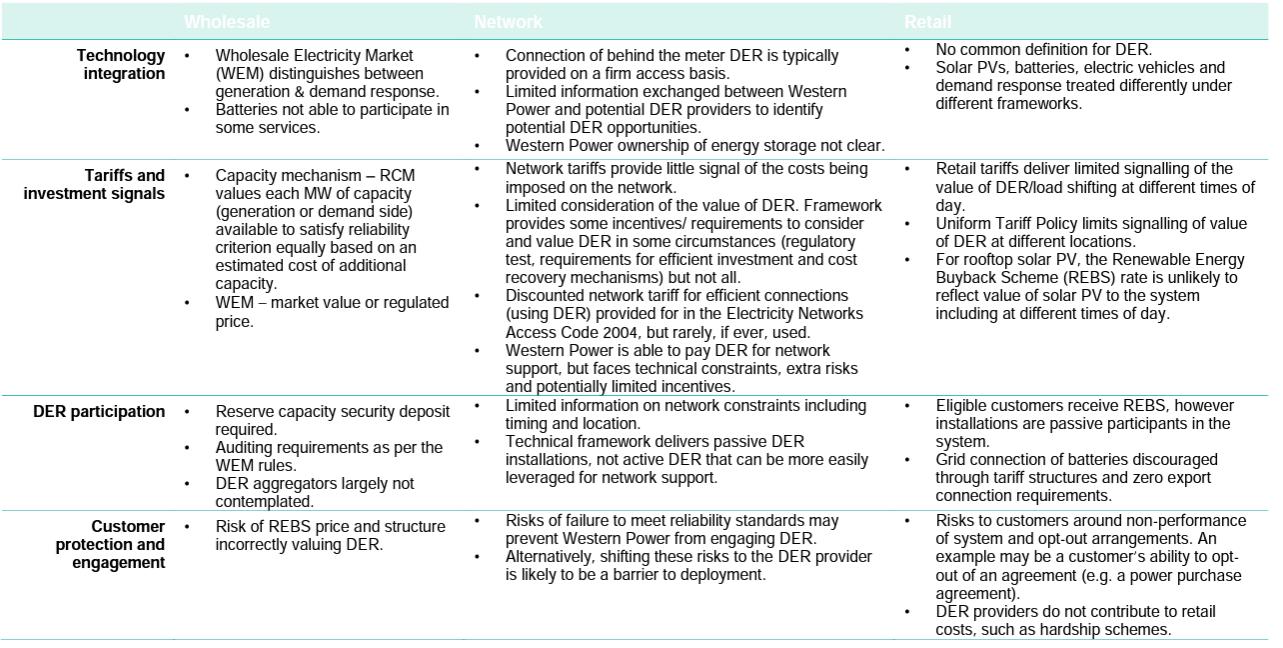

In Western Australia, DER is defined in the WA Roadmap as small-scale devices, including rooftop solar systems, batteries, electric vehicles, microgrids and other DM technologies ‘that can either use, generate or store electricity, and form a part of the local distribution system, serving homes and businesses’. 37 Technologies can be used by consumers ‘at their premises to manage their electricity demand (e.g. hot water systems, pool pumps or smart appliances)’. 38 The WA DER Roadmap further categorises DER according to which side of the meter the resources are located, and whether DER is passive or active. It also identifies DER by reference to the services it can provide and the value that can be unlocked across the power system. A brief explanation of these is set out below.

(ii) Behind-the-meter DER

• Located on the consumer side of the meter and operated for the purpose of supplying all or a portion of the consumer’s electricity

• Includes renewable generation (rooftop solar), energy storage, electric vehicles (EVs)

• May be capable of supplying power into the system or providing a demand management service.

(iii) In-front-of-the-meter DER

• Connected directly to the distribution network

• Includes some types of renewable generation (e.g. small solar PV and wind farms)

• Grid-scale batteries (e.g. community batteries).

34 AEMC, What are Distributed Energy Resources, https://new-energy-guide.aemc.gov.au/teach-me-the-basics#what-are-distributed-energyresources

35 AER, DER integration expenditure guidance note (30 June 2022) https://www.aer.gov.au/networks-pipelines/guidelines-schemes-modelsreviews/assessing-distributed-energy-resources-integration-expenditure-guidance-note/final-decision

36 AEMO, https://aemo.com.au/initiatives/major-programs/nem-distributed-energy-resources-der-program/about-the-der-program

37 Energy Transformation Taskforce, DER Roadmap (Western Australia, 2019)6.

38 Ibid.

N4 Opportunity Assessment – DSO and beyond 23

For WA, the experience to date is that most existing behind-the-meter DER can be described as passive in the sense that it is simply responding to available resources or pre-set internal programming and settings such as rooftop solar PV generation. 39 In contrast, active DER is understood in terms of adaptive/responsive behaviour characteristics, whereby DER adapts/responds to control signals from an external party or system. 40

According to the Victorian Government, “distributed energy resources (DER) are resources owned by consumers to generate, store, manage or sell energy. They include solar photovoltaic panels (solar PV), home or neighbourhood batteries, thermal energy storage (e.g. water heaters), electric vehicles and chargers, smart meters, home energy management technologies, and smart energy devices (e.g. controllable air conditioners).” 41

Similarly, other market bodies Energy Consumers Australia and the Energy Security Board are increasingly describing DER as customer energy resources (CER). The AEMC/ESB Board Chair Anna Collyer has explicitly identified the importance of rebranding DER as CER, and comments that “Work on CER is complex and requires extensive collaboration with stakeholders so we can understand customer preferences and behaviour to ensure the system works for all customers to help us make the best rules that provide the most benefits to the most people.” 42

A range of additional and alternative definitions is used by different stakeholders. For instance, DER has been defined in the literature as ‘localised generation or load assets.’ 43

One of the adverse outcomes of the application of a term such as DER in different contexts and by different stakeholders is that it adds inconsistency and complexity to an already overly complicated regulatory framework. Adopting a singular agreed definition for important terms such as this one across all jurisdictions of the NEM will benefit everyone.

2.3. Distribution system operator

A DSO is separately defined in the NER as “A person who is responsible, under the Rules or otherwise, for controlling or operating any portion of a distribution system (including being responsible for directing its operations during power system emergencies) and who is registered by AEMO as a distribution system operator.”

In the NEM, all registered DSOs 44 are also registered as distribution network service providers and the terms are often used synonymously, although the role of a DNSP is wider than that of a DSO. The rules do not prevent the emergence of independent DSOs.

39 DER Roadmap, above n 241, 17.

40 DER Roadmap, above n 241, 17.

41 Victorian Government, Harnessing Victoria’s Distributed Energy Resources (2022) 5.

42 M Hogath (23 May 2022) Customer versus Distributed: what’s in a word? https://wattwatchers.com.au/customer-versus-distributed/

43 See eg, Ashton, R., Kains, B., Pick, G., Walgenwitz, G. (2021). Distributed energy resources for primary industries - Exploring barriers to deployment. Sydney: Australian Alliance for Energy Productivity for NSW Department of Primary Industries, Glossary, vii https://www.dpi.nsw.gov.au/__data/assets/pdf_file/0003/1321797/energetics-distributed-energy-resources.pdf

44 Defined as ‘special participants’ and registered under this section in the AEMO, NEM Registration and Exemption List, published by AEMO here:https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/participate-in-the-market/registration

24 N4 Opportunity Assessment – DSO and beyond

Currently, the NER sets down a dedicated role for a DSO operating exclusively in the context of power system operating procedures (see Box 2 below). 45

The value of outsourcing this very specific role is unclear. Consequently, the question for the Australian system is not only whether we need to redefine a DSO, but also what responsibilities beyond the limited list in Rule 4.10 of the NER should be allocated to it or created and integrated into the regulatory framework of the NEM.

Box 2: Extracts from NER, Ver 199 (11 March 2023), Clause 4.10

CLAUSE 4.10.3

Operating interaction with distribution networks

(a) AEMO and each distribution system operator must maintain effective communications concerning the conditions of its distribution network and the transmission network or other distribution network to which that distribution network is connected and to co-ordinate activities where operations are anticipated to affect other transmission networks or distribution networks.

(b) AEMO must use its reasonable endeavours to give at least 3 days' notice to all affected distribution system operators prior to a transmission network service provider carrying out switching related to a transmission network which could reasonably be expected to affect security of supply to any distribution network.

CLAUSE 4.10.4

Switching of a distributor's high voltage networks

(a) A distribution system operator must use reasonable endeavours to give AEMO at least 3 days' prior notice of plans to carry out switching related to the high voltage network which could reasonably be expected to materially affect power flows at points of connection to a transmission network. The distribution system operator must also notify AEMO immediately prior to carrying out any such switching.

(b) A distribution system operator must provide confirmation to AEMO of any such switching immediately after it has occurred.

CLAUSE 4.10.5

Switching of reactive power facilities

(a) AEMO may instruct a distribution system operator to place reactive plant belonging to or controlled by that distribution system operator into or out of service for the purposes of maintaining power system security where prior arrangements concerning these matters have been made between AEMO and the distribution system operator .

(b) Without limitation to its obligations under such prior arrangements, a distribution system operator must use reasonable endeavours to comply with such an instruction given by AEMO or its authorised agent.

CLAUSE 4.10.6 Automatic reclose

(a) A Network service provider or a distribution system operator may request AEMO to disable or enable automatic reclose equipment in relation to a particular transmission network or distribution network circuit or a feeder connecting its distribution network to a transmission network which has automatic reclose equipment installed on it.

(b) If a distribution system operator makes such a request, then AEMO must use reasonable endeavours to comply with the request as soon as reasonably practical.

(c) AEMO is not responsible for the consequences of automatic reclosure in relation to a circuit or a feeder and the distribution system operator must indemnify AEMO against any loss or damage arising out of AEMO complying with such a request unless the loss or damage is due to the failure by AEMO to comply with the request within a reasonable period of time.

N4 Opportunity Assessment – DSO and beyond 25

45 NER ch4 rule 10

2.4. The national electricity market regulatory framework

The Australian energy market and its constituent markets the national electricity market, the national gas market, and national energy retail market are undergoing wide-ranging reforms. These include the ESB Post-2025 DER Implementation Plan 46 (which is developing a 3-year roadmap for flexible demand and better integration of DER), the AER’s Framework for assessing distributed energy resources integration expenditure, 47 the AEMC’s Access, Pricing and Incentive Arrangements for Distributed Energy Resources Rule determination', 48 and ongoing work by various market institutions and bodies on two-sided markets. The following regulatory framework review sets out key aspects of the regulatory framework within which these and the multitude of other regulatory changes are taking place.

2.5. Market institutions and related bodies: Governance, regulatory, and operational

The following table (Table 2.1) provides an overview of the market institutions and related bodies, briefly indicating their key function/s and legal basis.

Institution Functions Laws

AEMC Rule-making body for the NERR, as it is for the national electricity rules (NER) and national gas rules (NGR); established in 2005 by the South Australian parliament under the Australian Energy Market Commission Establishment Act 2004 (South Australia)

AEMO Statutory body established to replace NEMMCO. Responsible for day-today wholesale NEM operations, including spot market. 49 Further functions in NGM and WA; in 2021, AEMO appointed as NSW Electricity Consumer Trustee. 50

AER Statutory body established under the auspices of the ACCC; initially wholesale market regulation; regulatory functions extended to retail markets as part of NERL, etc. 51

Energy Consumers Australia

Statutory body for consumer interests. Initially established as National Electricity Consumers Advocacy Panel 52

Energy Ministers Main governance body (previously COAG) 53; established in 2020 and replaced in 2022 with the Energy and Climate Change Ministerial Council

AEM Commission Establishment Act

2005; NEL

NEL; Electricity Infrastructure Investment Act

2020 (NSW)

NEL; Competition and Consumer Act

2010 (Cth)

NEL

NEL

46 https://www.energy.gov.au/government-priorities/energy-ministers/priorities/national-electricity-market-reforms/post-2025-marketdesign/der-implementation-plan-design-and-implementationprocess#:~:text=National%20Cabinet%20endorsed%20the%20Post,flexible%20demand%20into%20energy%20markets.