YTD:

The S&P hits all-time highs: what caused this success and will it continue?

Elliot Weiss, ‘26

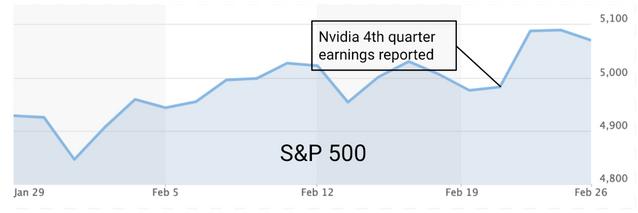

Recently, the stock market has been on a roll, hitting an all-time high and completing a large recovery from the bear market of 2022 At the time of this writing, the S&P 500 is up 30% since the beginning of 2023, and 7% since the beginning of the year This comes at a time when there seems to be more risk factors than ever in the global stock market, including inflation and the wars in Ukraine and Israel. Given all of this, how is it that the market is doing so well, and will this rally continue through 2024?

While there are many reasons for the recent stock market rally, the two that stand out are emerging technology in artificial intelligence (AI), and the prospect of central banks cutting interest rates

In November 2022, AI startup OpenAI released a new product, ChatGPT This began what some have called an AI ‘gold rush’, with many companies, like Microsoft, Google, and Meta releasing AI products This technology revolution has majorly benefited many companies, with the largest example being, the

relatively unknown computer chip company, Nvidia In addition to making computer chips for video games, Nvidia now dominates the market for chips used in training AI models Since October 2022, Nvidia’s stock price is up 600% In their last reported earnings, their stock went up around 15%, causing the tech-focused NASDAQ index to increase by 2.5% percent. Like all advancements in technology, this is all giving muchneeded optimism to investors, who are now willing to take larger risks on expensive stocks, hoping for outsized returns.

Whereas AI is a relatively tangible factor affecting markets, the other major contributor, is a lot more abstract Markets are now hoping for the Federal Reserve, the central bank of the United States, to cut interest rates To understand this, we have to look back to the beginning of the Covid-19 pandemic When the world shut down in March, 2020, there was widespread fear of an economic collapse In order to solve this, The Federal Reserve,

WHAT'S NEWS

Contents

Stock Market

CanTeslaMoveHigher?

The S&P has hit all-time highs: what caused this success and will it continue? (1)

Nvidia’s huge year (2)

How have fourth quarter earnings reports affected the market (3)

A Children’s Place: down 52% in a matter of days (3)

Economics

The minimum wage debate (4)

Interest rates: what are they? (4)

Business and Sports

Lewis Hamilton leaves Mercedes to sign with Ferrari (5)

Cryptocurrency

Bitcoin spikes past $47,000 to record highs (6)

What is an NFT? (6)

Cryptocurrency mining (7)

How will the new Apple Vision Pro affect the Metaverse (8)

Real Estate

China’s property crisis causes global ripple (9)

Why billionaire sports owners are snapping up so much real estate (9)

Entrepreneurship

Giving Magic interview (10)

Startup Spotlight: a look into Intuitive (11)

History of Finance

How World War II transformed America's economic landscape (12)

The evolution of capitalism and its impact on economies (13)

Environment

How ESG ratings are revolutionizing the business world (13)

The war in Israel's effect on the Environmental Stock Market (14)

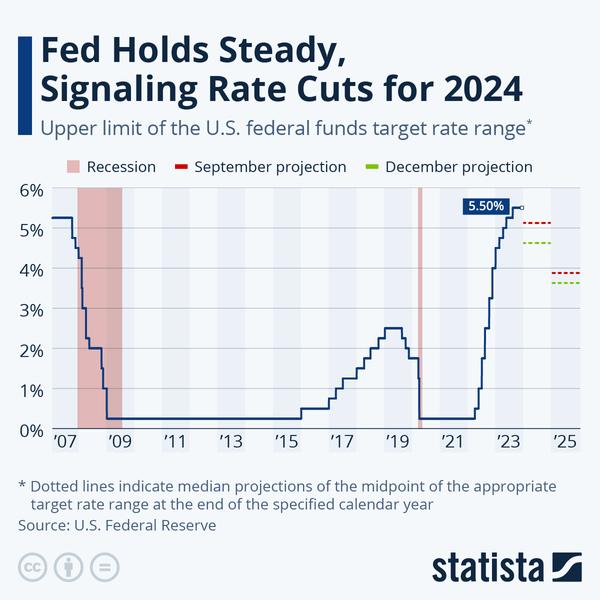

which is tasked with stabilizing the US economy, started cutting what is called the effective federal funds rate This is the interest rate at which banks lend money to one another When this interest rate goes down, the interest rates on other loans, like mortgages and credit cards tend to go down. By cutting interest rates during Covid, they tried to encourage borrowing, thus injecting borrowed money into the US economy.

This strategy, despite being effective during lockdowns, had an unintended side effect of massively increasing the inflation rate The inflation rate peaked in June 2022, at 9 1% For reference, the Federal Reserve targets 2% inflation In response, The Fed began raising interest rates with the hopes of slowing down the economy, thus bringing down inflation

The risk of doing this is that it can push the economy into a recession Now that inflation seems to be cooling, and the risk of a recession seems to be growing, there is growing expectation that the Fed may finally begin to lower interest rates in June If this occurs, it will likely drive the economy higher, causing the stock market to further rally.

While AI and interest rates are both exciting to investors, there are growing worries that the stock market may end up being disappointed. With regards to AI, some have warned that it may take longer

than expected to produce profits; even Nvidia is currently trading at a price 66 times higher than its profits Many have described AI as a bubble,where current excitement will lead to an overvaluation of AI stocks. As for interest rates, there is still a large risk that the Fed doesn’t cut rates as soon as expected, leaving investors disappointed. And, even if rates are cut, there is a risk that this could cause inflation to pick back up . Overall, while there seems to be much optimism in the markets today, it is important to recognize the risks involved with betting on a major market surge

Nvidia’s huge year

Nathan Hiltzik, ‘25

investors worldwide, and this momentum shows no signs of stopping or slowing down Nestled amidst the illustrious tech landscape of Silicon Valley, Nvidia's humble beginnings in a chain diner stand as a testament to its remarkable rise in the market Nvidia was not always the company as we know it is today It was once primarily known for catering to the gaming industry with high-end chips Nvidia has transitioned into an AI juggernaut, commanding a valuation exceeding 1 trillion dollars alongside tech giants like Apple, Microsoft, Amazon, and Alphabet.

As an American semiconductor company, Nvidia specializes in manufacturing cutting-edge graphics processing units (GPUs), pivotal components essential for training and operating AI systems. The high demand for these GPUs stems from the rapid growth of AI technologies, with big tech firms fighting for supremacy in the AI race and rolling out innovative products like ChatGPT; when these vast companies like ChatGPT expand, so does Nvidia Its strategic focus on GPU technology, distinguished from prevailing CPU technologies, has propelled its market differentiation and competitive edge Leveraging parallel processing capabilities, Nvidia's GPUs facilitate swift data crunching, a critical Nvidia's meteoric rise in the stock market has captured the attention of

How have fourth quarter earnings reports affected the market?

David Daniell, ‘27In the esteemed world of finance, where the highs and the lows are low, one may ask oneself: What are the secrets to making money in the market? Why do stocks go up and down? More specifically, how do company reports affect stock prices?

For context, quarterly reports are financial snapshots issued by public companies every fiscal quarter (3 months) which provide information on how a company performed during that period. It has information including the company's revenue, its earnings per share, its net income and various other accounting metrics Companies file these reports because the Securities Exchange Commission forces all publicly traded companies to be transparent about their performance These reports, obviously, directly affect company stock prices For example, if a company reports significantly better performance compared to the previous fiscal quarter, its stock price will likely rise On top of this, if there are enough positive reports in a singular sector, investor views will shift more in favor of that sector, causing businesses in that industry to succeed. From a macro perspective, the quarter reports can give an idea of how an economy at large is faring.

In the current market, fourth quarter reports recently released were arguably the most important of the year as they helped answer one key question in the AI market: is the market in an AI bubble? A “bubble” surrounds an equity type when its value is overinflated, often driven by speculative investment rather than intrinsic value These bubbles pop when the intrinsic value of the equity is realized, driving its price down to its “fair” value, leading to significant losses for previous owners of the equity

The question surrounding AI was largely answered when Nvidia, an AI giant, released its earnings report Days before releasing the report, Nvidia’s stock price fell by roughly seven percent, begging the question of whether the potential AI bubble had burst However, Nvidia’s unbelievable quarterly report re-established investor faith and both showed the public that there wasn’t a bubble surrounding AI as well as shot Nvidia’s stock price up 16%.

Overall, positive quarter 4 reports have increased investment into the current bull market. Investors are now watching closely in hopes of finding sustainability in this new growth Others caution that unforeseen events could quickly change the trajectory of this bull market Now as mixed-opinions swirl, the market remains highly dynamic with current investors attempting to balance their optimism with a watchful eye on potential market risks

A Children’s Place: down 52% in a matter of days

Alex Sultan, ‘25

Fourth quarter earnings can cause a stock’s share price to either plummet or shoot up One stock in particular that got affected by its fourth quarter earnings is The Children’s Place (PLCE) On the evening of February 8th, PLCE was trading at a share price of $19 74 at the close of the market However, on the morning of February 9th, when the market opened, PLCE’s share price plummeted to a measly $9 45 Despite

this crash, PLCE had a resurgence on Thursday morning, February 15th; on this morning, PLCE opened at a whopping $26 31 - its highest share price in over three months

In most cases, individual stocks' share prices don’t fluctuate this much in such a short period However, this case was different: fourth quarter earnings had just been released. PLCE wasn’t looking too good before their fourth quarter earnings had been released as they had reported just a 1.5% sales increase over the past year. Analysts were expecting a total revenue of about 462.5 million on the year. Although this seems like a lot, for a stock as big as PLCE, this wasn’t out of the ordinary - if anything, this was PLCE underperforming However, when fourth quarter earnings were released, their true revenue was closer to about $455 million Although this $7 million doesn’t seem like such a big difference, this difference meant that PLCE had lost $2 90 pre share, causing their share price to plummet

So why did PLCE’s share price shoot back up after falling by 52 2%? This happened mainly because of something called a “big bath” This is when a company will pile as many losses as possible into a single quarter in order to make future quarters look better in comparison. This can cause companies’ share prices to go up despite having a poor quarter, as they have good future prospects. Despite this, PLCE’s share price is now sitting below $15. Although the “big bath” positively affected PLCE, it only lasted for about a week

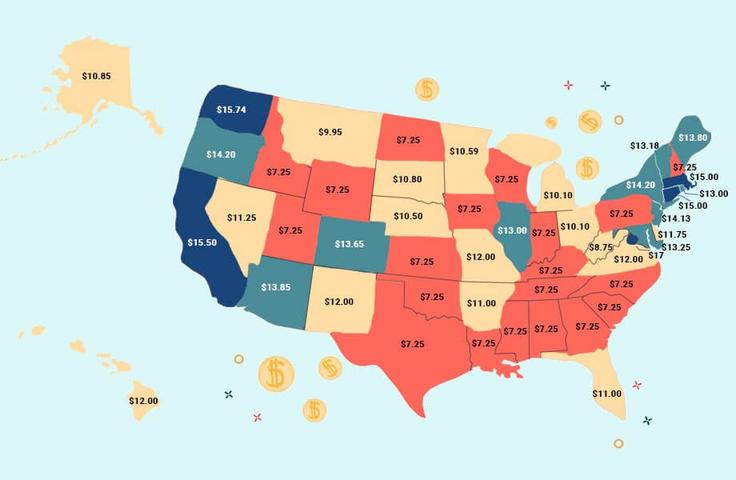

The minimum wage debate

Ezra Gonen, '27One of President Joseph Biden's key campaign promises was to raise the federal minimum wage to $15 per hour. However, as of February 2024, this promise remains unfulfilled, highlighting a longstanding disagreement among economists regarding the potential impacts of such an increase

Classical economists, rooted in traditional economic theory, argue that raising the minimum wage could have unintended consequences, particularly for those it aims to benefit They contend that the fundamental law of supply and demand applies to labor markets, suggesting that an increase in the minimum wage would lead to higher labor costs for businesses In response, businesses may opt to reduce their workforce or substitute unskilled workers with more productive, albeit higher-paid, skilled workers. This phenomenon,

Economics

THE RAMAZ BUISNESS JOURNAL

known as "labor substitution," could result in fewer job opportunities for unskilled workers, ultimately undermining the intended goal of the wage increase

Conversely, modern economists offer a contrasting perspective, emphasizing the complexities of real-world labor markets They argue that the classical view oversimplifies the dynamics of supply and demand, particularly in industries where businesses possess significant bargaining power In such markets, unskilled workers may lack the ability to negotiate higher wages, even in the absence of a minimum wage increase

Therefore, modern economists contend that raising the minimum wage can empower unskilled workers by setting a floor on wages and ensuring they receive fair compensation for their labor. This, they argue, can lead to improved living standards and reduced income inequality. The minimum wage debate in the US is complex, with conflicting studies and opinions adding to the uncertainty.

Recognizing the multifaceted nature of the issue, some advocate for a different approach altogether This third perspective emphasizes the importance of improving access to education and skills training, thereby enabling individuals to pursue higher-paying skilled labor opportunities.

Ultimately, whether a minimum wage increase proves beneficial or detrimental to its intended recipients remains a subject of ongoing debate. As the United States grapples with this issue, finding a consensus may require innovative solutions that address the diverse needs and circumstances of workers across the nation

Interest rates: what are they?

Judah Ostad, '26Understanding the intricacies of interest rates is essential for grasping their profound impact on both personal finances and the broader economic landscape. Despite the seemingly complex nature of this financial concept,

individuals need not possess an extensive background in finance to appreciate its significance. Let's delve into some key aspects of interest rates:

At the heart of the US financial system lies the Federal Reserve, entrusted with the task of establishing the federal funds rate a pivotal benchmark in determining borrowing and spending patterns across the economy Fluctuations in this rate wield considerable influence over consumer and business borrowing costs, with lower rates fostering a climate conducive to increased borrowing and spending, while higher rates tend to deter such activities

Consider, for instance, the scenario of a small business owner seeking financing to upgrade equipment for their enterprise. A favorable interest rate environment, characterized by, say, a modest 3% rate, would likely incentivize the pursuit of such investments. Conversely, a higher rate, hovering around 6%, may give pause due to the increased burden of interest payments

Furthermore, interest rates profoundly impact investment strategies, particularly in income-generating assets such as savings accounts and bonds During periods of low interest rates, investors may seek higher returns in riskier assets like stocks, drawn by the prospect of greater profitability Conversely, when interest rates are higher, safer investments may become more appealing

The connection between interest rates and the housing market is particularly pronounced, as fluctuations in mortgage rates can significantly influence homebuying activity. Lower mortgage rates typically stimulate demand for housing by reducing the cost of borrowing, whereas higher rates may dampen enthusiasm among potential buyers.

These examples only scratch the surface of the multifaceted impact of interest rates on various sectors of the economy, underscoring the importance of acquiring a fundamental understanding of this financial concept By understanding how

interest rates operate, individuals can make better financial decisions

Sports Business

THERAMAZBUISNESSJOURNAL

Lewis Hamilton leaves Mercedes to sign with Ferrari

Eleanor Abitbol, ‘26

The Formula 1 community was rocked by Lewis Hamilton's announcement on February 1st that he would be joining Ferrari for the 2025 season, marking a significant shift in the competitive dynamics of the sport. Hamilton, a legendary British F1 race car driver, has been a cornerstone of Mercedes' success for over a decade, contributing to their unprecedented dominance in recent years

Hamilton's decision to depart from Mercedes, despite a lucrative contract extension, highlights his strategic vision and ambition As one of the most impressive drivers in F1 history, Hamilton's move to Ferrari represents not only a personal milestone but also a strategic maneuver to position himself for continued success in the sport

His tenure with Mercedes has been synonymous with excellence, demonstrated by numerous championships and a record-breaking

number of wins However, the allure of driving for Ferrari, one of the most iconic teams in Formula 1 history, proved too compelling for Hamilton to resist

From a business perspective, Hamilton's move has broader implications for both Mercedes and Ferrari. For Mercedes, his departure represents a significant loss of talent and experience, prompting the team to recalibrate its strategy and roster of drivers. Conversely, Ferrari stands to benefit from Hamilton's arrival, as his unparalleled skill and track record of success could bolster the team's competitive edge and elevate its performance on the circuit

Hamilton's decision reflects the complex interplay of personal ambition, strategic foresight, and business considerations in the world of professional motorsport As he embarks on this new chapter with Ferrari, all eyes will be on Hamilton to see how he navigates the challenges and opportunities that lie ahead, both on and off the track

Cryptocurrency

THE RAMAZ BUISNESS JOURNAL

Bitcoin spikes past $47,000 to record highs

Samuel Medows, '26Bitcoin, the pioneering cryptocurrency, has surged past the $47,000 mark for the first time since January, showcasing a remarkable recovery in the crypto market. This surge comes as spot bitcoin exchange-traded funds (ETFs) have begun trading, contributing to increased investor confidence in digital assets.

According to data from Coin Metrics, since the launch of these ETFs, Bitcoin is trading 4 6% higher at $47,587 37, marking a significant milestone as it breaches the $48,000 level, reaching heights not seen since January 11 Ethereum, another leading cryptocurrency, has also witnessed a rise, advancing 2 69% to $2,492 97 The recent surge in Bitcoin's price can be attributed to various factors Firstly, the launch of spot bitcoin ETFs has injected new momentum into the market Since their inception, these ETFs have garnered significant attention from investors, contributing to positive sentiment and increased trading volume. One of the pivotal drivers behind Bitcoin's recent surge, is the introduction of spot bitcoin ETFs. These ETFs have provided investors with a new avenue to gain exposure to Bitcoin, offering a regulated and accessible investment vehicle. Since their inception, spot bitcoin ETFs have attracted significant attention and capital inflows, contributing to increased trading volume and positive market sentiment Furthermore, concerns regarding the crypto market have witnessed a period of subdued sentiment due to concerns surrounding large outflows from the Grayscale Bitcoin ETF However, recent developments indicate a slowdown in these outflows, alleviating investor apprehensions and paving the way for

renewed confidence in digital assets

Additionally, the positive momentum in the traditional stock market, particularly the S&P 500 reaching historic levels, has spilled over into the crypto market, further bolstering investor sentiment. The slowdown in outflows from the Grayscale Bitcoin ETF, coupled with the recent momentum in the S&P 500 reaching historic levels, has further bolstered confidence in the crypto market

Sylvia Jablonski, CEO and Chief Investment Officer at Defiance ETFs, suggests that the recent surge in Bitcoin's price could also be influenced by the anticipation of the upcoming halving event, which historically has led to optimism among investors and subsequent price increases. Additionally, favorable market conditions, including lower interest rates and falling inflation, have improved risk sentiment for digital assets. The positive movement in Bitcoin's price has not only impacted the cryptocurrency itself but has also reverberated across related sectors. Crypto exchanges Coinbase and Bitcoin Proxy Microstrategy, along with major mining companies like Riot Platforms and Marathon Digital, have witnessed significant gains Looking ahead, Bitcoin is approaching a key resistance level identified at $48,600 by Fairlead Strategies Surpassing this level could potentially pave the way for a new

all-time high, further fueling optimism in the crypto market In addition to the immediate market dynamics, long-term trends such as the upcoming halving event in April and increasing institutional participation are expected to drive Bitcoin's trajectory upward in 2024. These factors, combined with the recent approval of spot bitcoin ETFs and expectations of a Federal Reserve rate cut, underscore a renewed sense of optimism and resilience in the cryptocurrency sector As Bitcoin continues to surge, surpassing the $50,000 threshold for the first time in over two years, it signals a significant rebound for the crypto market, providing investors with renewed hope and confidence in digital assets amidst a rapidly evolving financial landscape

What is an NFT?

Samuel Medows, '26At its core, an NFT (Non Fungible Token) is a unique digital asset that represents ownership or proof of authenticity of a particular item. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are non-fungible, meaning each token is distinct and cannot be replicated or replaced by another token of equal value. This uniqueness is encoded into the token through blockchain technology, ensuring its scarcity and uniqueness. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are interchangeable and hold the same value, NFTs are unique digital assets They can represent various forms of digital content, including artwork, music, videos, and even tweets Each NFT has a distinctive digital signature stored on a blockchain, a decentralized ledger technology that ensures its authenticity and ownership NFTs operate on blockchain technology, typically the Ethereum blockchain When an NFT is created or "minted," its unique

code is recorded on the blockchain, establishing its originality and ownership This process makes it impossible to duplicate or interchange NFTs, ensuring their scarcity and value Understanding the term "non-fungible" is crucial to grasping the concept of NFTs Fungible assets, like traditional currencies, can be exchanged on a one-to-one basis In contrast, nonfungible assets, such as original artworks or rare collectibles, are unique and cannot be replaced by anything of equal value NFTs are digital equivalents of nonfungible assets, each possessing its distinct characteristics and value. NFTs have gained traction primarily in the art world, providing digital artists with a platform to monetize their creations directly. However, their applications extend beyond art to include gaming, virtual worlds, and digital collectibles NFTs offer creators a means to sell their work without intermediaries like galleries or auction houses, while collectors gain exclusive ownership of unique digital assets To buy and sell NFTs, you'll need a digital wallet capable of storing both NFTs and cryptocurrencies Platforms like OpenSea, SuperRare, and Nifty Gateway serve as marketplaces where users can browse, purchase, and trade NFTs Payment for NFT transactions is typically conducted using cryptocurrencies like Ethereum Artists can set royalties on their NFTs, ensuring they receive a percentage of the profits. The profitability of NFTs varies depending on factors such as demand, scarcity, and the popularity of the artwork. While some well-known artists have fetched substantial sums for their NFTs, lesser-known creators also have the opportunity to earn income through these digital assets NFT marketplaces cater to a diverse range of artists and collectors, fostering a dynamic ecosystem where creativity intersects with technology Block chains, a decentralized and immutable digital ledger, serves as the foundation for NFTs When an NFT is created or "minted," its unique identifier is recorded on the blockchain, establishing a permanent record of ownership and

provenance This distributed ledger technology guarantees the authenticity and integrity of NFT transactions, providing both creators and collectors with a transparent and secure platform for digital asset exchange. While NFTs have gained prominence in the art world, their applications extend far beyond traditional artwork. Digital creators across various industries, including music, gaming, virtual reality, and even social media, are harnessing the power of NFTs to monetize their content and engage with their audience. From digital artworks and music albums to virtual real estate and in-game assets, NFTs offer a versatile platform for digital asset ownership and trading The profitability of NFTs varies depending on factors such as demand, scarcity, and the reputation of the creator While some high-profile NFT sales have garnered significant attention and revenue, the market for NFTs is diverse, catering to both established artists and emerging creators The value of an NFT is ultimately determined by market dynamics, with collectors wills

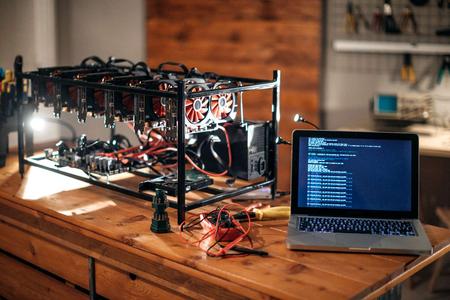

Cryptocurrency mining

Samuel Medows, '26

Cryptocurrency mining serves as the backbone of blockchain networks, ensuring the integrity of transactions and the creation of new digital assets Miners play a crucial role in verifying transactions, organizing them into blocks, and adding them to the blockchain through complex cryptographic puzzles. This process not only validates the authenticity of transactions but also maintains the decentralized nature of blockchain networks. Mining operations require specialized hardware, such as ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units), due to the computational complexity involved However, this specialized hardware comes with significant energy consumption, which has drawn attention to the environmental impact of mining

The energy-intensive nature of mining, coupled with reliance on fossil fuels for energy, has raised concerns about sustainability and carbon emissions

Despite the environmental concerns, mining remains a competitive landscape characterized by intense competition among miners.

Technological advancements, such as more efficient mining hardware and software optimizations, drive innovation within the industry. However, these advancements also raise concerns about centralization, as they may favor larger mining operations over smaller ones. Moreover, regulatory scrutiny and policy interventions add another layer of complexity to the mining landscape Regulatory clarity, tax implications, and

compliance requirements vary across jurisdictions and can significantly impact mining operations. Adapting to evolving regulatory environments is essential for miners to remain compliant and competitive. Mining profitability is influenced by various factors, including cryptocurrency prices and mining difficulty. Higher cryptocurrency prices generally translate to increased mining rewards, but volatility in prices can pose risks to profitability Mining difficulty, which measures the complexity of mining algorithms, directly impacts operational costs and resource allocation for miners

Despite these challenges, mining plays a crucial role in the broader crypto economy Mining ensures network security, influences token issuance rates, and contributes to market liquidity However, addressing environmental concerns is essential for the long-term sustainability of the crypto ecosystem Embracing energy-efficient mining practices, exploring alternative consensus mechanisms like proof-of-stake, and integrating renewable energy sources are steps toward mitigating the environmental impact of mining.

How will the new Apple Vision Pro affect the Metaverse

Samuel Medows, '25The Apple Vision Pro redefines immersive experiences within the metaverse by seamlessly integrating cutting-edge hardware and software innovations. Combining high-definition displays with 23 million pixels per eye, advanced gesture recognition, spatial audio technologies, and haptic feedback mechanisms, The Apple Vision Pro delivers unparalleled fidelity and realism These immersive technologies work synergistically to transport users into digital realms with astonishing detail and lifelike interactions Visual fidelity is ensured through crystal-clear images, while advanced gesture recognition allows

for natural and intuitive interactions with virtual environments Dynamic spatial audio further enhances immersion by enveloping users in rich, threedimensional soundscapes that respond dynamically to their movements and actions. Moreover, sophisticated haptic feedback technologies enable users to feel the virtual world in tangible waysdeepening their connection to the metaverse.

The Vision Pro's compatibility with Unity Engine holds profound implications for the integration of cryptocurrencies within virtual environments Unity Engine's robust development capabilities enable the creation of intricate in-game economies where digital assets and virtual goods play a central role Blockchain integration ensures the authenticity and ownership of virtual assets, paving the way for widespread adoption of cryptocurrencies as a medium of exchange within virtual worlds Additionally, the support for decentralized autonomous organizations (DAOs) within the metaverse further enhances crypto integration, allowing for decentralized governance and decisionmaking.

Furthermore, the Vision Pro's crossplatform compatibility ensures interoperability with other VR platforms, expanding the reach and accessibility of crypto-integrated metaverse environments This interoperability fosters a more

interconnected and vibrant metaverse ecosystem, where users can engage with virtual economies and digital assets seamlessly across different platforms. Additionally, the Vision Pro's intuitive interface and immersive technologies democratize access to the metaverse, making immersive virtual experiences accessible to users of all backgrounds and abilities. This inclusivity not only fosters greater diversity within virtual communities but also catalyzes innovation and creativity on a global scale

China’s property crisis causes global ripple

Alex Benalloul, '26China's property, once a problem contained in China, is now rippling and is starting global issues This crisis happened because of an effort to try and cheapen and deflate the accelerated inflation of the property market in China, as this growth wasn’t sustainable for the real estate market So, the Chinese Government tried stopping excessive money borrowing by curbing loans However, that just worsened the crisis due to the economy slowing down, causing people to lose confidence in the market, further straining the real estate market China's ytd for land sales as of October 2023 is 21% showing a huge decrease in the government revenue. Big companies have been defaulting on highloan properties because of the lack of liquidity in the loaning system, coming in at -1% as the debt coverage ratio for China's loaning system in quarter 2 of 2023, since no Chinese banks will loan a lot of money. China's crisis has caused supply chain and industrial issues worldwide

Real estate production in China has been a moneymaker for companies and investors worldwide The financial crisis, which has shocked Chinese development companies, has stalled the construction production of big projects all around China This also has caused unfulfilled debts from real estate development companies and unfulfilled orders from global suppliers of building materials This causes decreased demand for all of these materials, losing global suppliers money, and fluctuating the prices of building materials globally.

Investors' confidence in Chinese development has plummeted, causing global economic issues. Chinese investors are crucial for global economic

Real Estate

THE RAMAZ BUISNESS JOURNAL

prosperity because losing them will cause less money to go around globally. Additionally, investors will stop investing in riskier markets like any Chinese market and instead go with a safer option like any United States market This causes less global flow of money to emerging markets

The Chinese property market crisis has made a ripple effect throughout the globe It has affected not just the chinese economy, but also supply chains globally, with issues in building material distribution, and investors’ confidence Moreover, since their has been a decline in investors confidence, it has caused a global economic instability which has had repercussions on the flow of investments and global foreign trade. In addition, since their has been a decline in investor confidence in the Chinese economy emerging, markets are facing serious problems.

Why billionaire sports owners are snapping up so much real estateNathan Hiltzik, '25

Professional sports teams are diving headfirst into real estate development, transforming themselves into major players in the property market While they've historically relied on ticket sales, concessions, and TV deals for revenue, nowadays, they're turning to real estate projects to boost their financial standing and pump up the value of their franchises

Billionaire team owners have been

leading the charge, spearheading the construction of numerous stadiums and arenas, often with hefty taxpayer funding. A study revealed that between 1970 and 2020, state and local governments chipped in a whopping $33 billion in public funds for stadium projects, covering about 73% of the costs on average In return, teams have snagged development rights to the surrounding land, paving the way for mixed-use complexes packed with offices, apartments, hotels, and shops

Geoffrey Propheter, an expert in sports stadium economics at the University of Colorado Denver, points out the financial upside to this trend. He says that while stadiums are pricey to build and maintain, they offer juicy opportunities for real estate development. By locking in development rights, owners can rake in extra cash and jack up asset values, making the most of their investments. This shift towards real estate ventures is a game-changer for both sports leagues and urban areas Sports teams are now seen as real estate assets by billionaire owners, while stadiums act as catalysts for the development of bustling mixed-use districts, drawing in businesses and visitors alike This win-win situation not only fattens the wallets of team owners but also boosts economic growth and breathes new life into cities

But not everyone is cheering Critics argue that generous subsidies and sweetheart development deals favor team owners over taxpayers Despite these concerns, the allure of hosting professional teams often sparks fierce competition among cities and states, giving owners the upper hand in negotiations.

Mixed-use development is all the rage in sports stadium construction, marking a shift away from the suburban-centric model of the past. Iconic venues like Camden Yards in Baltimore have led the charge for downtown stadium projects,

Entrepreneurship

sparking urban renewal and driving investment in surrounding real estate Nowadays, nearly every new stadium proposal includes mixed-use elements, with luxury apartments, shops, and entertainment venues becoming staples of these projects

Driven by the promise of lucrative real estate opportunities, team owners are driving this trend, dreaming up mixeduse districts around stadiums From casino complexes near Citi Field to entertainment hubs next to basketball arenas, these ventures highlight the growing intersection of sports and real estate in shaping modern cityscapes.

Giving Magic interview

Maya Puterman, ‘25During COVID, Jacob Archibald ‘25, found himself with a lot of extra time and decided to teach himself how to do magic tricks. As he learned new tricks, he would perform them to anyone he knew, leading him to realize the power of magic. His experience with magic inspired him to start his organization Giving Magic where he leads magic workshops for people of all ages He begins his shows by performing magic tricks for the audience and ends by teaching participants how to do a trick Jacob has worked with organizations such as the American Cancer Society, Kips Bay Boys and Girls Club, the Kravis Center at Mount Sinai, and Kids in the Game

I Interviewed Jacob to learn more about his organization:

MP: What inspired you to start Giving Magic?

JA: During Covid, I did a Magic show for my friends and family and for my brother's grade. I saw how Magic could make people happy, especially during the pandemic and I realized the effects that it could have on others. I wanted to not

only spread this joy myself, but to teach others how to do magic so they could do the same

MP: How did you build partnership relationships with the organizations you have performed at?

JA: I started off sending lots of emails, around 50, to different organizations I wanted to work with. While I only ended up hearing back from a few, I was able to build relationships with those organizations. And since then, I have been able to expand to even more organizations.

MP: What’s been your favorite magic workshop experience and why?

JA: I really enjoy my workshops at American Cancer Society The people there are always so kind and grateful and enjoy the magic tricks It also makes me feel good to know that I am putting a smile on these patients' faces

MP: What are some lessons you learned through entrepreneurship?

JA: I have learned that things don’t always work out on the first try. As an

entrepreneur, I made a lot of mistakes, which were expected but I have taken away so much and learned from each mistake

MP: What is an accomplishment with Giving Magic that you are proud of?

JA: I am really proud of the Magic kits that I made. These kits let the kids take home the tricks they learn at the workshop.

MP: How do you balance school work with your organization? \

JA: I lead most of my workshops on Friday afternoons so I still have the weekend to do schoolwork

MP: What are some skills you think are important for a teen to have in order to start their own organization?

JA: I think that a teen needs to be willing to spend time and put in a lot of effort I also think the teen needs to be doing something that they love and are passionate about.

Startup Spotlight: a look into Intuitive

Joseph Kaufthal, ‘26In the late 1980s, an institute named SRI International began developing a prototype for a robotic surgical system Dr Frederic Moll, then working for Guidant, a medical technology lab, became interested in the SRI system in 1994 and tried convincing Guidant to back its development When this failed, Moll was introduced to John Freund and Robert Younge, both of whom had worked at the Acuson Corporation, and together they acquired the intellectual rights to the SRI System

In 1995, they founded a startup company named Intuitive Surgical Devices, based in Sunnyvale, California, dedicated to developing the SRI System. Moll, Freund, and Younge struggled to raise initial capital but eventually brought on investors from Mayfield Fund, Sierra Ventures, and Morgan Stanley.

After years of developing the prototype, they rebranded and commercialized the system as the Da Vinci Surgical System. While awaiting FDA approval, Intuitive presented Da Vinci in Europe. In 1997 in Belgium, the robotic surgery system was used in the first real surgery, successfully completing a cholecystectomy performed by Dr. Jacques Himpens.

By 1999, Intuitive began marketing and selling Da Vinci throughout Europe, and in 2000, Da Vinci was FDA-approved for use in laparoscopic surgery on the gallbladder Since then, the system has been approved and successfully used for many more types of surgical procedures, including cardiac, urologic, gynecologic, pediatric, and general surgery The Da Vinci system is not a robot that performs surgery for the doctor; it is a robotic system remotely controlled by the doctor to perform surgery via a console This offers many benefits to the patient, leading to a less invasive procedure with fewer complications, such as fewer infections at the surgical site. Overall, using the Da

Vinci system for surgery is a safer way of performing surgery that also allows the patient to recover more quickly. Since its inception, the Da Vinci system has been used to perform more than 12 million surgeries. As Da Vinci is currently the only FDA-approved system for roboticassisted surgeries, Intuitive has a dominant market position.

The company ended 2023 on a high note, with a 31 4% net income margin in Quarter 4 While such high profitability may not be sustainable for the future, Intuitive continues to innovate its technology to be more accessible and safer, and the company's revenue is expected to continue growing as more hospitals around the world use their Da Vinci systems for surgeries

History of Finance

How World War II transformed America's economic landscape

Jacob Yashar, ‘26Early in the 1940s, as war clouds started to gather over the world, few could have predicted the immense impact that World War II would have on the US economy Will there be another Great Depression? Or will America’s economy be revived? It is remarkable to think that this era set the foundation for America's success even though it was associated with what is often regarded as one of the biggest catastrophes in history. Despite the Holocaust and the worldwide catastrophe, the war's aftermath brought about an unexpected economic boom.

One of the first significant changes seen during the war was the increase in available jobs. When the war began, America needed to shift its focus from civilian to military production They needed to start mass-producing tanks, ammo, ships, weapons, and other necessary war materials In addition, since many men enlisted in the army, there were many job vacancies This opened up more jobs for minorities and women This industrial expansion created millions of new jobs and was the first step in reviving the economy following the Great Depression

In addition, with many soldiers being mobilized during World War II, the government was forced to invest unprecedented amounts of money. This injected much-needed funds into the economy and drove economic growth. Government contracts with businesses for war-related services provided a significant source of revenue, thereby contributing to the revival of many industries

Price controls and inflationary pressures were among the difficulties and modifications brought about by the y

economic mobilization for war. Inflation and price increases resulted from the wartime production objectives leading to shortages and a spike in demand for consumer products The government imposed price caps and rationing policies to ensure equitable distribution of limited resources to lessen these consequences

Even though these actions were required to preserve social order, they also facilitated the emergence of black markets and illegal trade

The shift from an economy in times of war to one in peace presented unique difficulties Careful planning and management were needed for the demobilization of millions of soldiers and the transition of businesses back to civilian output. The reduction in demand for goods and services by industries that had prospered from wartime contracts led to a serious worry over surplus production and inventory management. In addition, there were difficulties in reintegrating returning veterans into the workforce because many of them found it difficult to obtain work and adjust to civilian life But the post-war era also brought prospects for economic expansion, especially in sectors like housing development and consumer spending, supported partly by initiatives

like the GI Bill, which gave soldiers access to housing and educational advantages.

Generally speaking, World War II is seen as a turning point in the history of the American economy because it precipitated a remarkable shift from the depths of the Great Depression to an age of unmatched prosperity Before the war, the economy was dead, with 15% unemployment and a halt to industrial growth The need for wartime mobilization, however, sparked a boom in invention and production, which doubled the GDP from $91 billion in 1939 to nearly $166 billion by 1945 During the war years, industrial output more than doubled, with industries like electronics, aircraft, and automobiles prospering from government contracts for goods related to the war effort. By 1945, jobless rates had fallen to less than 2%, a dramatic departure from the double-digit numbers of the Great Depression. In addition, the post-war period saw continuous economic growth propelled by programs such as the GI Bill, which gave returning soldiers access to homes, jobs, and educational possibilities. With an unrivaled quality of life, the United States had solidified its position as the world's leading economic powerhouse by the 1950s

The evolution of capitalism and its impact on economies

Olivia Saar, ‘26

Capitalism is an economic system that has significantly evolved from its origins in the late Middle Ages. This evolution can be segmented into various stages, each marked by crucial changes that have profoundly impacted economies worldwide I will outline them and their impacts below:

Mercantile Capitalism (16th - 18th century): Dominated by merchant capitalists, this stage of capitalism involved widespread trade and business activities globally It was characterized by the rise of nation-states and colonial empires, creating a global economy where ex-colonies produced raw materials for the industries of former colonial powers. The mercantile system focused on accumulating wealth through trade and leveraging that wealth to build national power.

Industrial Capitalism (18th - late 19th century): As capitalism transitioned from an agrarian to an industrial economy, the Industrial Revolution began in Britain and spread across the Atlantic. This era was defined by the mechanization of production, the emergence of factories, and the mass production of goods It also saw the rise of the capitalist class (bourgeoisie), and the working class (proletariat), and transformative changes in social and labor relations

Financial Capitalism (Late 19th - early 20th century): This period saw a proliferation of financial institutions, such as banks and stock exchanges, which played a pivotal role in directing capital towards profitable ventures It was marked by an increased concentration and centralization of capital under the control of small financial oligarchies and the rise of corporate monopolies.

Keynesian Capitalism (Mid-20th century): Following the Great Depression and World War II, Keynesian economics became the predominant economic

model It advocated for government intervention in the economy to mitigate boom-bust cycles and ensure full employment This period also witnessed an expansion of the welfare state with increased public spending on social services.

Global Capitalism (Late 20th centurypresent): The late 20th century was characterized by the proliferation of global production networks, financial markets, technology, communications, and international trade agreements, leading to globalization This stage featured the globalization of capitalism, the emergence of multinational corporations, and the interconnectivity of financial markets globally It also marked a transition from manufacturing to service and information-based economies in many developed countries

Digital and Technological Capitalism

(21st century): Characterized by the digital revolution, this stage places technology and information at the economy's core It has witnessed the evolution of a digitized economy, e-commerce, and shifts in labor roles and production nature due to technological advancements. This era is also notable for concerns over the proliferation of technology giants, rising income inequality, and potential environmental harm linked to the digital revolution.

Each stage of capitalism's evolution has aligned with specific technological, political, and social changes, generating unprecedented wealth and remarkable human achievements However, it has also fostered deep-rooted social inequalities and environmental challenges The system continues to adapt to new challenges and opportunities

Environment

How ESG ratings are revolutionizing the business world

Noam Louzoun, ‘26

ESG, Environmental, Social, and Governance Criteria, represent a set of standards employed by socially conscious investors to evaluate potential investments based on a company's behavior These criteria are indeed influencing business practices, particularly in the realm of environmental sustainability

Environmental sustainability, equitable hiring practices and fair, transparent compensation of employees are all focal points for companies adhering to ESG standards. Companies are incentivized to adhere to ESG criteria by the vast pool of investment in ESG focused companies, totaling over $30 trillion worldwide, as reported by the Global Sustainable Investment Alliance

Moreover, ESG principles contribute to business growth by prioritizing risk management Proactively evaluating potential issues through ESG risk

management allows companies to identify and address risks early, minimizing their impact and enabling sustainable, long-term growth According to APIDAY.com, this proactive approach provides companies with the opportunity to develop cost-mitigating strategies before risks escalate into significant problems. With 59% of Americans having no opinion on ESG, and 28% viewing it positively, companies embracing ESG practices stand to gain an advantage by appealing to socially conscious investors

However, despite its benefits, ESG investing comes with its own set of challenges One notable issue is the higher than average expense ratios associated with ESG investments

According to LinkedIn, ESG investing requires additional research and due diligence, resulting in increased costs As a result, some companies, such as cable companies, opt not to implement ESG practices due to these financial considerations Additionally, the subjective nature of ESG criteria presents a challenge, as there is no universal definition of what constitutes an ESG investment. Different investors may have varying criteria, leading to discrepancies in evaluation.

FUN WORD SEARCH:

The war in Israel's effect on the Environmental Stock Market

Noam Louzoun, ‘26On October 7, 2023, Hamas launched an attack on Israel, prompting Israel to declare war the following day While much attention is typically focused on the geopolitical implications and global repercussions of such conflicts, it's important to also consider their economic effects, particularly on the environmental stock market.

One significant impact of the conflict is on energy markets. Energy prices are a key concern in the short term within financial markets, and the war has led to noticeable inflation According to analysis from Brookings edu, oil prices have surged by $5 per barrel since the onset of the conflict Additionally, the International Monetary Fund (IMF) predicts a global inflation of oil prices by 0 4% These figures underscore the negative impact of the Israel-Hamas conflict on the oil industry, contributing to economic uncertainty

Moreover, beyond its economic implications, the war is likely to impede progress on climate initiatives in the

Middle East With oil prices on the rise, wealthier nations in the region may be less inclined to invest in climate mitigation efforts in poorer, climatevulnerable countries. This setback could slow down the environmental progress that the Middle East has been striving to achieve.

In the context of Israel's environmental stock market, the conflict may initially lead to declines. However, history has shown that markets can rebound from such events, often emerging stronger in the long run While the war may pose challenges, Israel's environmental stock market has the potential to recover and thrive once again, demonstrating resilience in the face of adversity