WINTER 2022 / V20 N239

NAVIGATING THE FUNDING FUNNEL SUPPLY CHAIN CHALLENGES CHOKE REBOUND FRICTIONLESS CHECKOUT & A NEW RETAIL EXPERIENCE

Hip & Humble | Expanding soon to FLL

Liberty Park Market

Your Vision, Our Expertise To the benefit of our airport partners, we fully seek and embrace the visions they define for their terminal, and design our retail and restaurant programs with that focus. The results are authentic and engaging environments that allure travelers. Our efforts at SLC speak volumes as we captured a genuine sense of place that skillfully promoted the region while delivering modern, sleek designs that complemented SLC’s amazing new terminal.

Visit Salt Lake

paradieslagardere.com

14

24

6

14 Money Talks

Airports are readying projects as they eye the federal infrastructure money earmarked for airports. Meantime, some earlier designated recovery funds from the government have yet to make their way to concessionaires.

20 Chain, Chain, Chain

Supply chain issues abound, to say the least. From lack of product to lack of hands to stock, prepare and sell that product, concessions managers across the country are juggling challenges as they try to meet passenger expectations.

24 Rethinking Retail

3 Letter From the Editor-in-Chief 4 Data Check

30 A New Face

6 Latest Buzz

Airport retailers are expanding options for frictionless checkout experiences, and early results are promising.

Just a few years ago, many thought they had time to adjust to the increasing numbers of younger people in airports. In a postCovid world, the average traveler looks very different than before; what are their expectations?

AX Fact Book Data shows that, though passenger traffic was down overall in 2020, spend per enplaned passenger was actually greater that year than in 2019 for leading airports.

Orlando Melbourne International is preparing for growth with new international service and a nearcomplete terminal expansion.

10 Director’s Chair

New leader Chad Makovsky shares his vision for a rebounding Phoenix Sky Harbor International Airport.

34 5&Under

The pilot shortage has only been exacerbated by the pandemic; smaller hubs that rely on alreadylimited service will suffer as airlines have to prioritize larger, fuller flights.

37 Advertising Index 38 Before You Take Off

Officials at Greenville-Spartanburg International Airport wanted something innovative to solve their parking transportation issues, so they went gasless. Or driverless. Actually, they did both.

A X NEWS WINTER 2022

1

TEAM Desiree Hanson

Executive Vice President

Melissa Montes Publisher

Carol Ward

Editor-in-Chief

Andrew Tellijohn

Senior Reporter

Shafer Ross

Copy Editor and Writer

Sally Kral

Contributing Writer

David Ward

Contributing Writer

Barbara Moreno

Portfolio Coordinator

Chad Wimmer

Senior Editorial Art Director

Rae Lynn Cooper

Production Manager

Amanda Gochee

Group Marketing Director

Paige Heady

Senior Marketing Manager

Catherine Babbidge

Marketing Coordinator

FEB. 27 - MAR. 2, 2022 ROSEN SHINGLE CREEK | ORLANDO, FL REGISTER TODAY

Simon Kimble Chairman

Greg Topalian

President and Chief Executive Officer

Mark Wilmoth Explore our AX News Membership options, giving you access to our expansive media offering and exclusive discounts on conference registration. CONFERENCE.AIRPORTXNEWS.COM

Chief Financial Officer

Airport Experience® News Is a Division of CLARION Events 6421 Congress Ave., Suite 107 Boca Raton, FL 33487 Phone 561.257.1026 Fax 561.228.0882 To subscribe visit https://airportxnews.com/subscribe/ ISSN: 1948-4445 Copyright © 2022 Airport Experience® News, all rights reserved. Any reproduction of this magazine is strictly forbidden without prior permission from Airport Experience® News.

2

A X NEWS WINTER 2022

WINTER 2022

Dear Readers, WINTER 2022 / V20 N239

NAVIGATING THE FUNDING FUNNEL SUPPLY CHAIN CHALLENGES CHOKE REBOUND FRICTIONLESS CHECKOUT & A NEW RETAIL EXPERIENCE

Happy New Year! It’s hard to believe we are entering the third year of the pandemic. We first started hearing murmurs of concern in January and February of 2020, and those murmurs turned to roars just a month or two later. This industry has been remarkably resilient throughout the crisis and it seems rebound, growth and stability are within reach. As all of you have altered your business models, AXN is also in a constant state of evolution. Shortly after the pandemic began, we switched to the digital magazine format and introduced a range of digital media options, including AXiNsights (webinars), AXiNterviews (video interviews) and the AXiNsider (podcast). This year we’re mixing it up again. We have transitioned to four digital issues of AXN – winter, spring, summer and fall – which will be complemented by two print issues: our annual Conference Issue and a Leadership Issue to end the year. This Winter Issue of AXN includes an assessment of the funding landscape for airports, with updates on when and how distributions of federal funds will happen. The industry’s ongoing supply chain challenges and best practice solutions are brought to the fore, and airport retailers share their strategies for facilitating touch-free transactions for passengers. As you know, last year we were forced to postpone our annual live conference due to the ongoing pandemic. This year, the Airport Experience Conference is back to its original schedule and will run from February 27 to March 3 at the Rosen Shingle Creek in Orlando, Fla. More information can be found on our conference site, or you can sign up to receive email updates whenever new speakers, sessions or other conference experiences are announced. Up next for AXN is the Conference Issue and the 2022 Airport Experience Conference. Full details can be found on the conference website at www.airportxconference.com. We look forward to seeing you all there! Best regards,

Carol Ward Editor-in-Chief Airport Experience News

A X NEWS WINTER 2022

3

DATA CHECK

PANDEMIC IMPACT

Per Passenger Spending Up, Total Sales Down Dramatically In 2020 BY CAROL WARD

2020 By The Numbers*

*Based on data from 40 leading North American airports

10

Average Sales Per Enplanement up 3.4%

0 -10 -20 -30 -40 -50

News/gift

Enplanements

down 55.52%

down 59.7%

Specialty

down 63.4%

Duty free

-60

F&B

down 60.71%

Total Concessions Sales down 61.39%

down 72.2%

-70 -80 Source: Airport Experience Fact Book 2021

ales per enplaned passenger among the top 40 performing airports in North America averaged $12.63 in 2020, according to data compiled by Airport Experience News in the 2021 Airport Experience Fact Book. Nearly 80 airports participated by providing extensive sales details to AXN in autumn of 2021. The average SEP was up from the previous year’s $12.22 average expenditure despite significant upheaval in the sector in 2020. The pandemic that hit in March 2020 prompted a sharp downturn in overall enplanements, with the top 40 airports combining for just 292.1 million enplanements and $3.68 billion in food and beverage and retail sales. The 292.1 million enplanements in 2020 represent just 40 percent of enplanements of 726.2 million recorded the previous year by the leading 40 airports. Not surprisingly given the pandemic’s impact on air travel, total concessions sales were decimated in 2020. If not for the relatively healthy performances in January and February, before the pandemic started,

S

4

A X NEWS WINTER 2022

the situation could have been much worse. As it was, total concessions sales slumped 61.9 percent in 2020 among the 40 airports. As expected, among the major sales categories, duty free fared worst in 2020 due to the grounding of all but a sliver of international travel. Duty free sales were down 72.2 percent to just 287.7 million in 2020 among the 40 leading airports in the survey. Specialty retail also fared poorly. Concessions and airport executives say those people who did opt to travel by air in 2020 were more likely than ever before to eschew non-essential shopping. Slightly outperforming the field, news/gift stores at the leading 40 airports registered an average sales decline of 55.5 percent in 2020. Food and beverage sales mirrored the enplanements, with both dropping 60 percent in 2020.

Airport Standouts New York’s John F. Kennedy International Airport (JFK) was the best performing North American airport among survey participants in 2020, registering average sales per enplanement of $28.65. The airport also was first in 2019, but in 2020 managed to increase its SEP by more than $5. The other two major airports in the Port Authority of New York & New Jersey – LaGuardia Airport (LGA) and Newark Liberty International Airport (EWR) – also both ranked among the top five airports by SEP. LGA was third with an average of $21.18 and EWR was fourth at $21.15. Vancouver International Airport (YVR), which does not separate duty free from specialty retail sales, ranked second at $23.14 spent per passenger. At number five, Miami International Airport (MIA) registered an SEP of $16.48 in 2020. In-depth data on nearly 80 airports can be found in the 2021 Fact Book. For purchase information please go to www. airportxnews.com.

DATA CHECK

2021 Factbook Top Performing International Airports * (Includes duty free sales) IATA

2020 Enplanements

2020 F&B Sales

2020 Specialty Sales

2020 Newsstand/ Travel Sales

2020 DF Sales

2020 Total Sales

2020 Sales E/P

NEW YORK

JFK

5,947,278

$68,626,355

$13,794,383

$33,072,290

$54,875,681

$170,368,709

$28.65

VANCOUVER

YVR

3,647,014

$23,797,934

$52,052,688

$8,528,886

$0

$84,379,508

$23.14

NEW YORK

LGA

2,403,057

$30,238,137

$5,229,083

$15,148,831

$286,589

$50,902,640

$21.18

NEWARK

EWR

5,330,243

$67,853,099

$5,348,313

$28,093,848

$11,438,435

$112,733,695

$21.15

MIAMI

MIA

12,649,609

$102,622,268

$40,190,327

$28,669,401

$36,944,867

$208,426,863

$16.48

PHOENIX

PHX

10,961,921

$128,827,711

$6,897,520

$32,994,558

$471,122

$169,190,911

$15.43

LOS ANGELES

LAX

28,318,490

$223,514,090

$24,862,638

$108,770,642

$74,801,118

$431,948,488

$15.25

SAN FRANCISCO

SFO

8,180,718

$73,661,787

$16,270,417

$13,008,361

$16,498,480

$119,439,045

$14.60

MONTREAL

YUL

2,669,896

$15,634,027

$2,993,167

$4,204,357

$14,212,071

$37,043,622

$13.87

LAS VEGAS

LAS

10,912,419

$86,822,650

$22,593,620

$30,150,112

$3,993,122

$143,559,504

$13.16

SEATTLE

SEA

10,043,727

$79,495,225

$9,033,830

$31,845,929

$4,730,940

$125,105,924

$12.46

PITTSBURGH

PIT

1,822,219

$13,311,355

$5,978,645

$2,888,603

$80,736

$22,259,339

$12.22

DENVER

DEN

16,873,602

$140,678,522

$22,849,213

$39,562,677

$747,105

$203,837,517

$12.08

HOUSTON

HOU

3,244,352

$29,474,311

$2,823,845

$6,021,766

$363,693

$38,683,615

$11.92

WASHINGTON

IAD

ORLANDO

MCO

4,079,771

$26,131,973

$2,845,685

$8,116,661

$11,307,437

$48,401,756

$11.86

14,538,126

$113,294,672

$23,637,038

$24,055,142

$8,830,020

$169,816,872

$11.68

PHILADELPHIA

PHL

5,919,269

$48,635,346

$6,104,514

$12,961,563

$1,251,162

$68,952,585

$11.65

AUSTIN

AUS

3,084,072

$23,426,471

$4,734,345

$7,662,484

$65,124

$35,888,424

$11.64

BOSTON

BOS

6,259,851

$44,774,414

$5,356,470

$17,960,634

$4,483,465

$72,574,983

$11.59

CALGARY

YYC

2,837,744

$22,764,585

$2,234,540

$4,881,319

$2,853,691

$32,734,135

$11.54

CHICAGO

ORD

15,342,498

$122,609,657

$11,526,390

$27,303,979

$10,405,441

$171,845,467

$11.20

TAMPA

TPA

5,289,351

$38,394,018

$5,571,813

$14,123,019

$673,191

$58,762,041

$11.11

MINNEAPOLIS

MSP

7,415,203

$61,572,798

$9,351,280

$10,008,316

$1,035,907

$81,968,301

$11.05

HOUSTON

IAH

9,150,683

$63,033,228

$11,076,854

$18,486,002

$7,049,524

$99,645,608

$10.89

SAN DIEGO

SAN

4,629,628

$30,662,348

$5,058,924

$14,169,769

$275,856

$50,166,897

$10.84

CHARLOTTE

CLT

12,761,432

$90,681,125

$11,134,481

$29,574,130

$850,141

$132,239,876

$10.36

DALLAS-FORT WORTH

DFW

19,620,717

$144,393,846

$16,296,213

$34,558,467

$4,531,547

$199,780,073

$10.18

FORT LAUDERDALE

FLL

8,242,049

$51,389,637

$2,730,970

$24,929,774

$3,817,252

$82,867,633

$10.05

ATLANTA

ATL

21,378,111

$145,782,660

$29,501,397

$26,775,543

$7,467,432

$209,527,032

$9.80

CLEVELAND

CLE

2,059,668

$12,558,205

$1,641,851

$5,825,972

$81,830

$20,107,858

$9.76

DETROIT

DTW

7,026,591

$42,279,611

$8,028,575

$15,628,689

$2,159,701

$68,096,576

$9.69

VICTORIA

YYJ

282,610

$1,191,361

$0

$1,439,114

$0

$2,630,475

$9.31

RALEIGH/DURHAM

RDU

2,474,517

$13,405,266

$2,089,375

$7,067,033

$63,007

$22,624,681

$9.14

CINCINNATI

CVG

1,802,329

$9,518,979

$2,714,057

$3,924,235

$21,929

$16,179,200

$8.98

SAN JOSE

SJC

2,345,783

$12,904,173

$926,914

$6,766,114

$278,977

$20,876,178

$8.90

OAKLAND

OAK

2,306,385

$11,534,143

$1,429,384

$7,367,848

$113,736

$20,445,111

$8.86

SAN ANTONIO

SAT

1,996,820

$10,087,404

$1,947,139

$4,457,004

$393,160

$16,884,707

$8.46

SALT LAKE CITY

SLC

6,278,452

$37,119,887

$4,813,592

$10,973,737

$214,501

$53,121,717

$8.46

SANFORD

SFB

768,989

$2,743,643

$357,221

$2,526,674

$27,590

$5,655,128

$7.35

HARTFORD/SPRINGFIELD/W

BDL

1,208,233

$6,623,409

$544,686

$1,066,507

$35,946

$8,270,548

$6.85

292,103,427

$2,272,070,331

$402,571,397

$725,569,989

$287,731,526

$3,687,943,243

AVG=$12.63

TOTALS:

* Among airports that participated in AXN’s Fact Book Survey

A X NEWS WINTER 2022

5

LATEST BUZZ

CARPE DIEM

Orlando Melbourne International Nears Completion on Terminal Expansion And Upgrade as it Readies for Tourism, Business Travel Growth BY DAVID WARD

Above: Orlando Melbourne International Airport’s Terminal Upgrade Project also includes airfield improvements that enable the airport to accommodate wide-body international and domestic flights.

6

A X NEWS WINTER 2022

ooking to improve the experience of business travelers as well as attract new international leisure traffic, Orlando Melbourne International Airport (MLB) is nearing completion of a $72 million terminal expansion and improvement project that will add 86,000 square feet of new space, along with plenty of new amenities, to the airport. Greg Donovan, MLB executive director, says the original terminal was built in 1989, and in recent years it became apparent the terminal was in need of a major upgrade to accommodate and attract future growth. Unlike many warm weather airports that primarily rely on tourism, MLB had a 50-50 split between business and leisure traffic before the pandemic, Donovan says,

L

adding its location in the heart of Florida’s Space Coast has led many aerospace and aviation companies to establish operations on airport property. “The strong business market comes from our airport’s daily campus of 20,000, made up mostly of employees at major aerospace, defense and aircraft manufacturing companies,” he says. “In fact, we are the home to Northrop Grumman’s campus responsible for the design and engineering of the next generation B-21 Raider bomber, Embraer’s North American headquarters for the production and delivery of the world’s most successful business jet, L3Harris Technologies’ world headquarters, plus companies like Collins Aerospace, STS Mod Center, and more.”

LATEST BUZZ

Right: Among the new features of the new MLB terminal is a welcome center for both domestic and international travelers.

Left: The MLB expansion includes adding a new four-lane security checkpoint as well as expansion of the departure area to include new restaurant and retail options.

These large corporate tenants mean that MLB generates nearly 80 percent of its revenues from land leases, helping the airport keep per-enplanement costs for carriers down, Donavan says. But it was an opportunity to attract more international vacation travelers to MLB that triggered the decision to go ahead with the terminal expansion and upgrade at the airport. “In November 2019, TUI [Airways] announced its plans to make MLB its exclusive gateway to Central Florida for all its U.K. customers,” Donovan says. Upon completion, the terminal renovation and expansion will be able to accommodate the projected 150,000 new international visitors in 2022 from the U.K. alone on

two to three daily transatlantic Boeing 787 Dreamliner flights. “This expansion will also provide the operational capability and flexibility we need to accommodate growth from existing airlines, including our newest partner Allegiant Airlines that recently began new service to three cities,” he says. When its formally welcomes it first TUI flights on March 7, the renovated and expanded MLB terminal will feature three new common-use jet bridges paired with major apron upgrades that will allow the airport to accommodate large wide-body international and domestic operations. “Our existing U.S. Customs Federal Inspection Station was also renovated just a few years ago and is getting another round

of improvements,” Donovan adds. The terminal improvements also include a larger baggage claim area, and a new international welcome center with bathrooms, rental car facilities and access to ground transportation immediately outside of customs. Other improvements include a new fourlane security checkpoint, the expansion of a large departure area that will have new restaurant and retail options, a new VIP lounge, renovated common-use ticketing counters, new furniture and other amenities. The upgraded and expanded terminal will feature plenty of glass windows to both bring in natural light and provide views of the airport’s coastal surroundings. Looking to highlight its role in supporting the area’s strong aerospace/aviation businesses, Donavan says the airport is also reviewing more than 30 proposals from local and national artists to install Space Coast -themed murals on the exterior wall of the welcome center and a two-story interior wall leading up to the departure area from the security checkpoint.

Expanded Concessions Throughout the construction phase of the new project, MLB worked with its concessions partner Metz Culinary Management on a plan that more than

A X NEWS WINTER 2022

7

LATEST BUZZ

Below, Top: The $72 million MLB terminal expansion features expanded hold room space and new furniture. Bottom: Hold rooms feature windows to bring in natural light and a design that is both modern and airy.

8

A X NEWS WINTER 2022

doubles the amount of retail and food and beverage space, including a new full-service restaurant, grab-and-go food option, a news and gifts store, and a duty-free store, all grouped together and immediately available after the security checkpoint. Passengers will also be able to purchase access to a VIP lounge with additional bar, food and amenities. Rick Sell, vice president of operations for Metz Culinary Management, says the company is making a significant capital investment in the terminal transformation project to offer visitors a taste of all that central Florida has to offer. “In our Taproom we will be featuring fantastic local brewers and beer including Playalinda Brewing Company, Hell ‘n Blazes Brewing Company, Florida Beer Co.

and Intercoastal Brewing Company,” Sell says. “On the retail side we are working with local vendors such as Heaven Sent Local Gourmet Popcorn & Sweets, ER Body Care and the Grimaldi Candy Company to bring unique local and Florida based products to our guests.” Sell adds the company’s bar and duty free teams are also working with the Steel Tie Spirits Company out of West Palm Beach and St. Augustine Distillery out of St. Augustine to offer local spirits to international travelers. Metz Culinary Management adjusted some of its plans as a result of the pandemic, augmenting the traditional dine-in service with kiosk and mobile ordering options along with its separate restaurant graband-go and Butcher Block – Food-to-Go options. Even with the uncertainty about when the pandemic will end, Sell says MLB’s deal with the TUI Group should ensure a solid future for Metz Culinary Management at the airport. “This exciting addition to the international terminal along with existing air carriers adding service signals a strong future for all of us at MLB, Melbourne and the surrounding areas, he says. “We will continue to evaluate the number of locations and offerings we have at the airport to ensure that our concessions program meets the needs and demands of the MLB traveler.” Donavan says the terminal expansion project is being funded through a combination of grants from the Federal Aviation Administration (FAA) and Florida Department of Transportation (FDOT), airport-generated cash flow and reserves, and $15 million of issued debt to be paid back by passenger-generated revenues. As for the future, he says the expansion will enable the airport to play a much bigger role as a coastal gateway to Central Florida, as MLB looks to provide a stress-free, convenient and uncongested alternative to other airports in the region. “Our existing domestic airlines have already returned to pre-pandemic levels, plus the recent arrival of Allegiant is going to play a major role in continued growth,” he says. “The additional of TUI combined with the incredible pent-up demand for international travel will solidify the anticipated record year in 2022.”

AXiNterviews connects industry leaders with Airport Experience ® News reporters for oneon-one video conversations covering a range of subject areas. TO WATCH OUR INTERVIEWS WITH INDUSTRY LEADERS, VISIT AIRPORTXNEWS.COM/AXINTERVIEWS

DIRECTOR’S CHAIR

PHX ON THE REBOUND

Traffic Has Bounced Back, Creating Challenges, Opportunities For New Director Makovsky BY CAROL WARD

ditor’s Note: Chad Makovsky has spent the past three decades building his career in aviation, with experience at small airports such as Hollywood Burbank Airport (BUR), as well as large hubs including John F. Kennedy International Airport (JFK), Dallas/Fort Worth International Airport (DFW ) and Phoenix Sky Harbor International Airport (PHX). In recent years, he was assistant aviation director at PHX in the mid 2010s before heading to DFW for a stint as executive vice president in the operations division. Makovsky returned to PHX in March 2021 as director of aviation services. Despite the ongoing pandemic, both cargo and passenger demand at the airport are thriving and PHX is positioning itself for future growth. AXN Editor Carol Ward spoke with Makovsky in December 2021 about his vision for the airport going forward. This is an abridged version of the interview conducted in mid December 2021. The full video interview can be found on www.airportxhub.com.

E

Above: City of Phoenix Director of Aviation Services Chad Makovsky

10

A X NEWS WINTER 2022

WARD: You’ve been at the helm for about nine months now. I know taking the reins in the middle of a pandemic can’t have been easy. Can you give me an overview of your key goals for PHX? MAKOVSKY: Coming back from DFW to Phoenix Sky Harbor International Airport in the midst of a pandemic was certainly a challenge and a bit unexpected. Phoenix had lost about 90 percent of its customers and traffic, nearly overnight, as a result of the pandemic. I recognized that we would need to focus on rebuilding but I didn’t want to make any assumptions about all the work that the team had done. What I learned is the team had done an amazing job, frankly, of caring for our customers, caring for each other, and making sure that the airport was ready for customers when they were ready to travel again. They cut $40 million out of our operating budget. They deferred $800 million worth of capital projects. They took some very responsible steps, not knowing really what the bottom was going to be with the pandemic. I’m inspired by all that the team has accomplished.

WARD: In terms of passenger numbers, how is PHX faring and what are you expecting for 2022? MAKOVSKY: 2019 was the busiest year on record at Sky Harbor. We had 46 million passengers travel through our airport that year. We went from that to 2020, where at the end of the year, we had only served roughly 22 million passengers. When I came in, in March of 2021…we saw roughly 65 percent of pre-pandemic travel, and that steadily increased through the summer. In October we were sitting at 97.4 percent of pre-pandemic travel. That’s atypical - we recognize that. WARD: Tur ning to infrastr ucture, Terminal Three is now complete. Does that conclude all your major capital projects for the near future? MAKOVSKY: I’m going to ask you to check your couch cushion because we’re looking for money. We have about $6 billion in unmet needs at Sky Harbor Airport. Our cargo customers are telling us they want to grow and expand. Our airlines are telling us they want to grow and expand. And a lot of our ancillary businesses, including

DIRECTOR’S CHAIR

our fixed base operators and even our Air National Guard base, want to grow and expand. We have two major projects that are nearing completion. We are adding a new, eight-gate concourse. It will finish out Terminal Four, which is our largest terminal at Sky Harbor. That new concourse is going to be taken by Southwest Airlines. That will come online in June 2022. We also have a two and a half mile extension of Sky Train. It’s about a $750 million project that will very efficiently move our customers from the terminals to the rental car center, which is currently being served by buses today. We’re really excited about bringing this online because it’s going to allow us to take about 80 buses off of our roadways. Going forward, in terms of shovel-ready projects, we have another concourse in the works. It’s a six-gate concourse at Terminal Three. That’s ready for potential infrastructure funding. We’re very excited about what the federal government’s done with the Infrastructure Investment & Jobs Act. In addition to the formulary allocations that we get, we’re expecting that

we’ll be quite competitive in the process for securing additional funding to support the construction of that concourse, as well as some taxiway infrastructure. WARD: Let’s go inside the terminals. I know you’ve had labor issues. Others have as well. What’s the current state of play for your concessions? MAKOVSKY: The demand is there for these services, but [operators] are continuing to see both labor shortages and supply chain shortages. We are doing our very best to support them, and we do everything we can to lower the barrier of entry into the airport. Currently, in terms of the state of play, I would say between 60 and 70 percent of our concessions are open in the terminals. In Terminal Four, if you look at just food and beverage, we’re closer to 80 percent open. It’s great, but it’s not been without a lot of work – I really appreciate the work that our concessions partners are doing. They understand the importance of having these concepts open. They’ve gotten quite creative and innovative, providing self-service concepts as well. But, all that said, we’re still hearing from our customers.

Above: PHX saw a strong rebound in passenger traffic in 2021 with leisure passengers in particular flocking to the sun despite the ongoing pandemic. Below: Terminal 3 at PHX is the newest major renovation at the airport, but more – including two new concourses – is on tap as growth continues at the airport.

A X NEWS WINTER 2022

11

DIRECTOR’S CHAIR

Right: Concessions at PHX have operated without pricing constraints for the past two years, a policy Makovsky says is still under scrutiny.

They want more access to concessions during more hours of the day than we’re currently providing. WARD:. PHX is one of the few airports that doesn’t have any real constraints on concessions pricing. Two years into [the pricing policy shift], are you seeing what would be considered reasonable prices in your concessions? MAKOVSKY: It’s something we’re watching really closely. We wanted to test this. We recognized the challenges our concessionaires are going through.... But we have, on occasion, heard from our customers that they are concerned with some of the prices that they see. We’re very mindfully working with our concessionaires to make sure that they get it right. We do customer perception surveys. Every quarter, we ask if they feel the value they’re getting, for the price they’re paying for the offering, is reasonable. So far that metric has not skewed a whole lot from when we had the controls in place. [I’m] not completely sold that this is the right path, but we’re working with the concessionaires to make sure that we’re providing the offerings that the customers want at the price that they think is reasonable. WARD: More broadly, with virtually every airport having to provide relief from the MAG during the pandemic, going forward, do you see a significant shift in how you contract with concessionaires?

12

A X NEWS WINTER 2022

MAKOVSKY: We just put out a solicitation for our newest concourse that’s coming online next year and we decided to stick with the MAG. We’re very open to an alternate form of pricing or control, we just haven’t heard anything that’s viable yet. MAG isn’t perfect. We get that. And frankly, with a minimum annual guarantee, what good is a guarantee if you don’t live up to the guarantee? Arguably, we kind of lived through this force majeure event with the pandemic. We felt it was appropriate to waive MAG because we’re in this together and we knew the concessionaires desperately needed this relief. WARD: Is there anything else you’d like to add? MAKOVSKY: One interesting thing that we’re doing is [looking at] childcare. As we think of our industry and workforce challenges and barriers to entry, what we’ve really heard from our business partners and from the workforce is that they’re looking for affordable access to childcare services. Our mayor and city council were really forward-focused on this. They used some of the city’s ARPA (American Rescue Plan Act) funds to encourage and incentivize the airport to identify solutions to childcare challenges for the workforce at the airport.

We’ve done that in a couple of ways. We’re investing $4 million into vouchers for airport workers. We’re really excited about getting those out, in the beginning of 2022, to those who might have a need or

need additional assistance with childcare as a condition of getting to work again. After that, we’re looking at piloting a purposebuilt childcare facility on airport property to support our airport workers for the long term. So, more to come on that, but I’m really excited about that initiative. I think that’s going to be really a game changer, in terms of attracting and retaining the workforce necessary to keep our airports functioning. This is not just for city staff or airport employees within the City of Phoenix. This is for the entire campus, 50,000-plus employees that work on or around our airport. We recognize, especially for the entry level positions, the barriers to entry can be high and it’s our goal to do everything we can to reduce those barriers.

STAY CONNECTED!

SUBSCRIBE TO RECEIVE WEEKLY NEWSFLASHES AT https://airportxnews.com/email-signup/ Airport Experience® News is THE airport concessions industry media hub, with breaking news online, specialized news features in the monthly magazine and must-have information in the Fact Book, our annual resource guide. SUBSCRIBE TODAY AND BE IN THE KNOW!

Above: SEA officials are discussing how the airport can best use the infrastructure funds it will receive to help address about $4 billion in overall capital related needs.

14

A X NEWS WINTER 2022

Infrastructure Money Driving Airports On Path For Major Upgrades BY ANDREW TELLIJOHN

Seattle-Tacoma International Airport (SEA) has about $4 billion in capital needs related to its current facility, and that’s before the airport finishes an environmental review of its master plan. SEA is significantly overcrowded and has, throughout the global pandemic that paused capital investments at many airports across the country, continued doing whatever projects it could in order to expand capacity. So, the bipartisan infrastructure bill passed and signed in late 2021 that will push $25 billion into airport improvements nationwide was the latest good news for SEA and its peer airports that also need upgrades.

Word from the Federal Aviation Administration (FAA) that SEA’s first allotment would be $45 million came just before the 2021 winter holidays. The airport isn’t sure just how it will use those funds but is quite certain the proceeds will help. “We haven’t made any final decisions on which projects to fund until we see more from the FAA about specific grant criteria,” says airport spokesman Perry Cooper. “However, this generational investment in infrastructure will support SEA’s work to reduce wait times, improve the customer experience, help meet the growth that is coming as we fully recover from the pandemic and strive to become the greenest airport in North America.”

A X NEWS WINTER 2022

15

Left: Infrastructure funds didn’t drive SAN’s recent kick off of its Terminal 1 replacement project, but airport officials are eyeing those funds for other projects.

Big Money Helping Projects Move Forward

Above: The FAA got previous COVID-relief funding out “pretty expeditiously,” says Steve Van Beek, director at Steer, adding that spreading the infrastructure bill over five years gives airports time to make sure they are ready with their important projects.

16

A X NEWS WINTER 2022

The $25 billion invested in airports in the bill includes $15 billion in direct funding based on enplanement levels, $5 billion for air traffic control towers and $5 billion for a new terminal modernization grant program. Cooper says SEA hopes to tap into that latter grant program to the tune of $50 million to $100 million more in funding once parameters are set. Among projects the airport is considering right now is an upgrade of its South Satellite, the oldest facility at SEA built in the 1970s, which needs upgrades ranging from seismic and HVAC systems to sustainability and customer service investments. “Given our significant infrastructure investment needs, we want to be strategic about how we leverage these dollars to maximum impact and benefit as part of our overall funding plan for our facility upgrades,” Cooper says. “At this point our general inclination is to focus our funds – both our direct allocation plus whatever we can get in competitive dollars – on a few larger projects rather than spreading it thin on many small projects.” The FAA announced in mid-December how it would allocate the first $3 billion. It is encouraging airports to submit proposals that prioritize safety, equity and sustainability.

“The Bipartisan Infrastructure Law has given us a once-in-a-generation opportunity to build safer and more sustainable airports that connect individuals to jobs and communities to the world,” said U.S. Transportation Secretary Pete Buttigieg in announcing the allocations. “With this new funding, urban, regional and rural airports across the country now can get to work on projects that have waited for years, modernizing their infrastructure and building a better America.” Couple those investments with proceeds from three pandemic-related disaster relief bills passed since COVID-19 hit in early 2020, and a faster-than-expected recovery of traffic experienced starting in mid-2021, and the industry has seen capital projects back on the docket. SEA is not alone in its readiness in dealing with infrastructure needs. Airports large and small had already, throughout 2021, begun reactivating capital projects slowed by the pandemic. Many more are eager to get moving. San Diego International Airport (SAN) broke ground in late 2021 on a Terminal 1 replacement. A spokeswoman said infrastructure funds were allocated after the start and did not factor into that initial projects. The San Diego County Regional Airport Authority will figure out how to apply its first-round funding of $24 million after getting further guidance from the FAA, she said.

A new, more spacious and modern terminal planned for Des Moines International Airport (DSM) could be accelerated by two years with the help of several state and funding resources, including the infrastructure bill, according to the Des Moines Register. Asheville International Airport (AVL) is moving forward with scheduled construction in the summer of 2022 but will definitely benefit from the infrastructure money, says Lew Bleiweis, executive director. “The new funding will absolutely make a difference,” he says. “It will help in two ways. One, project costs are rising due to supply chain issues and labor market issues. Two, whatever funding we get will be applied to the funding sources and help reduce my debt requirement.” It may also increase the scope of the project, he adds, “to include some additional items needed but we lacked the debt capacity to move forward.”

San Francisco International Airport (SFO) intends to use its cut of the infrastructure funds to complete the final phase of Harvey Milk Terminal 1, which had been delayed by the COVID-19 pandemic. That fourth phase will create a North check-in lobby that will primarily be used by Delta Air Lines, says spokesman Doug Yakel. It’s now slated for a spring 2024 completion date.

Smartly Spreading It Out Joel Bacon, executive vice president of government and public affairs with the American Association of Airport Executives (AAAE), was thrilled to hear of the investment in airports, though he was not able to comment in depth because of uncertainty surrounding the specifics of how the money could be used. “There are formulas in the law and allocations released in December provided

Below: The final phase of the Harvey Milk Terminal 1 at SFO, delayed due to the COVID-19 pandemic, will be completed using funds from the 2021 infrastructure bill.

A X NEWS WINTER 2022

17

Right: Members of ARRA are running into some airports that are requiring operators to agree to concessions before receiving rent relief authorized under various relief bills, says Andrew Weddig, executive director.

airports with specifics on what they can expect in the first year,” he says. “FAA is working on guidance for airports on how they can access and utilize the funds. Until we have the specifics from the FAA, the money can’t be spent. We’re arguing for the release for guidance and funding as soon as possible with maximum flexibility to airports for their use.” If it’s anything like the previous relief packages it should be available in a reasonably timely manner, says Steve Van Beek, a director and head of North American aviation with Steer. “I give the FAA credit. During the CARES Act, they did get the money out – not as fast as everybody would like, but pretty expeditiously,” he says. “That was money at the time that could be used for any lawful purpose as opposed to having the traditional limits on airport grants. So, you know, we have a little bit of experience with that since COVID.” While it will take a while to get the money moving, Van Beek did say airports are starting to spend money on getting projects ready and preparing to move quickly once it does start funneling into their bank accounts. He credited the government for spreading the program out over five years and called on airports to keep working on environmental assessment work to ensure that when the funds become available they are ready to turn shovels. And he added that the investments the government made in helping airlines, airports and, with the trickle down that occurs when new terminals open new concessions programs, operators, the U.S.

18

A X NEWS WINTER 2022

aviation industry has been put in position to be more competitive internationally over the next five to 10 years. “Even if you’re not complete with your assessments now, in a year you might be, in two years you might be and you’ll still have an avenue into these funds,” Van Beek says. “I think it was deliberate to try to maximize the value of those investments. While it’s great to have near-term money spent, I think there’s a recognition that some of these needs airports have are long-term and that many airports had mothballed projects for a couple of years and now this really kickstarts the industry in a very beneficial way.” Another upside to the infrastructure bill is it will push investments into general aviation further with more money available from the Airport Improvement Program (AIP), Van Beek says.

Concessionaire Relief Slowed AAAE’s Bacon says the funding from the American Rescue Plan Act (ARPA), the last of the three relief packages allocated by the federal government, was slower than the previous packages were. That was, in part, due to resource shortages with the FAA and the agency move to establish a separate process for airports to claim their share of the $800 million made available for concessionaires. In November 2021, FAA updated guidance on providing concessionaire relief and began making those funds available to airports for execution, but challenges remain.

Andrew Weddig, executive director of the Airport Restaurant & Retail Association (ARRA), says operators are still waiting for rent relief stemming not just from ARPA but from the Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA), which was passed in late December 2020. Combined, the bills offered $1 billion in relief for concessionaires. In some cases, Weddig says, delays are understandable. The ARPA guidance came out late enough in 2021 where airports may still be working relief requests through legal requirements before submitting them to the FAA. Relief related to the CRRSAA bill should long ago have been rendered, he adds. More troubling to Weddig is that many ARRA members have told him several airports have been tying relief to stipulations of varying levels of severity. Some are asking for plans relating to how they plan to reopen shops and restaurants, while others have asked for measures that amount to changing the terms of their contracts by amending leases, imposing hiring requirements or requiring labor harmony agreements. ARRA is investigating the specifics of the situation, Weddig says. So far the organization has asked its members to advise associations of any such instances so the ARRA board can go to the FAA seeking clarification. “We haven’t put anything formally yet,” Weddig says of communications with members. “Our concern is there are customers out there so we want to have our stores open. That’s how we start to recover. Given the overall labor situation, given the supply chain situation, it’s difficult to open.” He says members want to open stores, but want to be able to provide good service, as well. He adds that while recovery has happened in the intervening months, members are far from being made whole. “The bill was passed in March when the world was a very different place,” he says. “Recognize that the conditions have changed but that the rent that this was intended to provide relief for was rent that was being paid – or was not being paid – back nearly a year ago. So, there has been a recovery, but that recovery isn’t what this relief was intended to cover.”

AXiNsider is an interview-style podcast featuring in-depth discussions with professionals, leaders and wave-makers in the airport and concessions industries.

TO LISTEN TO THE AXINSIDER PODCASTS, VISIT AIRPORTXNEWS.COM/AXINSIDER

SUPPLY CHAIN STRUGGLES Shortages And Delays Are Keeping Concessionaires On Their Toes BY SALLY KRAL

20

A X NEWS WINTER 2022

The supply chain affects just about every aspect of our everyday lives. When all is going well and the supply chain is running as intended, it’s not something we even notice. That has changed dramatically since the COVID-19 pandemic hit. “I think most people right now can relate to the situation of going to the store and they’re either out of the products you need or they’re not in the right size or your preferred brand,” says Patrick Murray, executive vice president of SSP America. “Right before Thanksgiving, my wife sent me to the grocery store for sage and rosemary and neither was on the shelf.” Murray points out that there’s a lot behind those herbs, from the farm where they’re grown to the packaging facility to the distributor to the produce company which ultimately gets them to stores and restaurants. “Every one of those businesses requires

MAIN CAUSES: Many cite the labor shortage as the main cause of the current supply chain disruptions happening all around the world, though the spike in product demand has contributed as well. BEST PRACTICES: Swift adaptation has been the key to navigating supply chain issues. Sourcing substitutions for out-of-stock product, building up inventory and enhancing internal forecasting efforts are just some of the ways that concessionaires are remaining agile, flexible and creative in the face of these disruptions. HARDEST HIT ITEMS: Concessionaires are facing shortages of all types of products, including proteins like chicken wings and ground beef; packaging and disposable products; foodservice equipment; and construction materials like concrete, steel, copper and PVC products. DOMESTIC VS. IMPORTED GOODS: Imported furniture, fixtures and equipment are typically more affordable for concessionaires to source, but with shipping issues and port delays causing much longer lead times for these items, some businesses are transitioning to domestic goods, which are often costlier but are more readily available. TECH SOLUTIONS: The supply chain is currently reliant on many human-centered processes and stands to benefit from more automation and tech solutions, especially in the face of the current labor shortage.

human beings, and every one of those businesses is severely challenged right now,” he says. “So, it’s really affecting every component of our lives.” Indeed, from an individual not being able to find the herbs they’re looking for while grocery shopping to a multinational chain like Wingstop not being able to procure chicken wings and instead pivoting to selling chicken thighs, supply chain challenges are showing up everywhere. That includes airports. “These issues are like nothing we’ve seen before,” says Claude Guillaume, senior vice president of restaurant operations for Paradies Lagardère. “It has impacted an extremely high percentage of our items or needs in both our retail and dining operations over the course of the past year. Like many retailers and restaurateurs, our airport operations have dealt with delayed

shipments, unavailable products, cancelled orders and so many other challenges.” And like many things right now, the future of the supply chain remains unknown. “Something like this just cuts so deep,” Murray says. “It has reverberations in the business that are going to take us quite a bit of time to work out.”

Root Causes And Main Effects For SSP America, basic food items like hamburger buns, hamburgers, French fries and chips, as well as packaging materials for these items, are some of the hardest hit by delays. “Every one of those things is experiencing some element of a breakdown right now,” Murray says.

A X NEWS WINTER 2022

21

He notes that the biggest challenge the company has faced has been over the past several months, as New York, Chicago, San Francisco and Seattle have all had major disruptions in their distribution centers. “Seattle recently went 13 days without a delivery – our business in Seattle generally takes two tractor-trailers a day to our remote commissary,” Murray says. “So, we were literally sending out our trucks to go shopping at Costco and Sam’s Club, and if need be, the smaller grocery stores, just to have products to be able to sell in the airport. And, of course, they’re not the right products, they’re not sized correctly. If the recipe on the wall for a cook says these French fries get cooked for 30 minutes but the ones we bought at Costco are actually thicker, that presents a problem.” Murray points to the labor shortage as the biggest cause of the supply chain breakdown. “You have fewer people working in every capacity; it’s almost like the economy tapped the brakes and everybody just slowed down,” he says. “And somehow we’ve got to grease the skids and get us back up and going again because we’re just not quite there yet.” Regina Chin, vice president of supply chain and quality assurance for HMSHost, notes that the three components of supply chain issues are product availability, transportation of

product and labor – and that, indeed, labor is the main sticking point right now. “The labor shortage coupled with the spike in product demand has created this situation,” she says. She adds that for HMSHost, bottled beverages, disposables and proteins have been the most impacted. “Suppliers are having a hard time getting raw materials to produce PET plastic bottles. Likewise, there’s a short supply of raw materials for disposables and an increase in demand, making it difficult to procure cups and containers. We’ve also seen an increase in prices and a lack of availability of many proteins because there is little to no automation in meat processing. The labor shortage has had an immediate and damaging effect on item availability for products like chicken wings and ground beef.” Kris Irwin, vice president of design and construction at Delaware North, notes that the products that have been the hardest for the company to come by have been foodservice equipment, which often has shortages of certain parts, as well as construction materials like concrete, steel, copper and PVC products. “And then there are the shipping issues, whether from delayed off-loading at ports or not having enough drivers once product is ready to ship.”

Aaron Bonham, chief merchandising officer for Paradies Lagardère, notes that two areas that have been particularly difficult for the company are imported products and items from larger domestic manufacturers where there’s competition with big box retail. “From actually finding items to order to having those delivered in a timely fashion, almost each day presents its own trials,” he says.

Best Practices And Possible Solutions Andrew Weddig, executive director of the Airport Restaurant & Retail Association (ARRA), notes that adapting quickly to new circumstances has been key to concessionaire survival. “Since supply chain challenges are generally one-of-a-kind and unforeseen, responses are necessarily reactive,” he says. “Honing one’s ability to adapt – that is, to be agile, flexible and creative – is really the only tactic there is.” Indeed, navigating the supply chain over the last year or so has been an ad hoc experience, Murray says. “We’re trying to learn from everything that has happened in the past and assume that it will happen again so we can predict the best-case scenarios to solve those things.” He adds that at SSP America’s large operations around the country where storage is available, they’ve been stocking up as much as possible on frozen and non-perishable goods. “But there are still places where that’s not so easy, where there’s not enough to buy. So even if you want to stock up on them, you can’t.” Irwin says that some tactics Delaware North has taken from the start include constantly leveraging the company’s relationships with vendors to mitigate shortages and delays, plus locking in purchase orders early to alleviate inflationrelated cost increases. HMSHost, too, has been working closely with vendors to stay up to date on product and labor shortages so the company can adapt accordingly. “We moved quickly with

Left: Similar to “street” operators, airport concessionaires are facing significant supply challenges that are exacerbated by labor shortages.

22

A X NEWS WINTER 2022

our vendors to identify substitute products and find new vendors that offer similar products and are less impacted by supply chain shortages,” Chin says. “We’ve also been working with our current suppliers to provide modifications to contracts that allow us to purchase competitor products due to their shortages.” Chin adds that she’s seeing manufacturers actively working on reducing lead times by locally sourcing raw material and analyzing opportunities to bring overseas production to the U.S. to mitigate long lead times and the growing concern of freight increases. Finding the right balance between domestic furniture, fixtures and equipment and imported ones has been another strategy of Delaware North. “We’ve had to consider the tradeoff between sourcing domestic or North American products, which typically cost more but are available sooner, versus imported products, which are often cheaper but with longer lead times due to shipping issues and port delays,” says Gonzalo Checa, the company’s vice president of category management. Paradies Lagardère’s Bonham notes that transitioning from import to domestic supply sources to cut down on delivery distances is one of four key initiatives in the company’s multi-pronged approach to mitigating supply chain issues. “Switching

to domestic products where possible has been mostly relevant for our retail operations, but in our dining operations we’ve re-engineered menus to provide offerings from a list of items more readily available,” he says. “Additionally, we’ve expanded our grab-and-go programs, which was a category that was on a strong growth track even prior to the pandemic.” The other initiatives in Paradies Lagardère’s approach include finding comparable products to substitute for items that are unavailable; committing to an even greater level of anticipation of needs through trends and sales reporting; and building inventory levels in the company’s airport locations to the best of their ability. “The earlier-than-normal orders and a strong on-site inventory base alleviates the pressure from slower delivery schedules or supplies that are completely out of stock at times,” Bonham says. “In general, extreme flexibility has been key to our efforts.” Bonham adds that as a “side solution” to supply chain woes, the company has expanded their service levels in stores and restaurants with contactless order and payment options. “From our Scan, Pay & Go and self-checkout kiosks in our retail stores to mobile order and pay options on the Grab app in our restaurants, we’re helping travelers navigate their transactions

Above: With product shortages rampant, many concessionaires are stocking up as much as possible on frozen and non-perishable goods.

more easily, which adds value to the customer interaction and helps relieve a perception of product shortages.” Chin believes that the supply chain is too reliant on many human-centered processes and needs automation technology. “COVID-19 outbreaks in plants continue to shut down operations for days, making it impossible to break the cycle of issues,” she says. “Still, our hope is that these issues improve each quarter and things are normalized by the first quarter of 2023.” Paradies Lagardère’s Guillaume, too, hopes and expects supply chain issues to subside over time. “However, there’s such a domino effect in the supply chain process that a full ‘return’ will take some time,” he says. “Like when facing most challenges, we’ll continue to adapt so we can keep a normal cadence of operations, but we’ll also use the situation as a learning opportunity to discover previously unrecognized advantages that may evolve into more permanent efforts rather than temporary fixes.”

A X NEWS WINTER 2022

23

HANDS-FREE SHOPPING Pandemic Driven Touchless Payment Programs Continue Growth BY ANDREW TELLIJOHN

24

A X NEWS WINTER 2022

In late 2021, Zippin, in conjunction with SSP America and JFKIAT, launched a contactless payment option for passengers that allows them to zip through the Camden Food Express store at Gate B 42 in Terminal 4 at John F. Kennedy International Airport (JFK). Customers enter the store through a turnstile, tapping their credit card to identify themselves as they enter, then pick their desired items off the shelves and leave. Zippin’s artificial intelligence system identifies the items, builds a virtual cart and automatically charges the customer’s card. That makes Zippin the latest entry into the North American airport touchless payment scene. “We are thrilled that JFK T4 has become the first airport location to feature Zippin’s

innovative retail concept,” says Roel Huinink, president and CEO of JFKIAT, which has worked with other retailers including Hudson and DFS Group to launch an automated contactless retail concept for high-end brands in the same terminal. “We have continued to innovate T4’s offerings in the wake of the COVID-19 pandemic and enabling a more contactless customer journey is critical to our mission to provide customers with a safe, seamless experience.”

Autonomous And Accurate Zippin is a relatively new entrant to the airport scene, with its checkout-free stores at JFK and Rio de Janeiro/Galeão–Antonio Carlos Jobim International Airport (GIG), but the company has a presence in several off-airport retail shops, in sporting venues, train stations and other venues Customers check in at the entrance. “That’s the only place they have to do something,” says CEO Krishna Motukuri. “After that they just shop naturally. They take whatever they want, they put it back if they don’t want it and when they’re done, they walk out. They don’t have to scan anything while they are in the store.” The AI-powered technology combines cameras and sensors on shelves to keep track of what people are taking. It differs in that respect, Motukuri says, from selfcheckout stores where travelers have to actually scan codes to purchase product. And it works whether passengers are wearing masks or gloves or whether they are buying pre-priced items or purchasing

Above: Zippin, in conjunction with SSP America, recently launched its contactless payment option for passengers at the Camden Food Express store in JFK’s Terminal 4.

Left, below: Hudson has opened two Hudson Nonstop stores, one at DAL and one at MDW, using Amazon’s Just Walk Out technology. Passengers need no assistance to buy their products after checking in at the entrance with a payment card.

A X NEWS WINTER 2022

25

a coffee or other custom items as prepared by a barista, he says. The Camden store, for example, has drip coffee in a dispenser and customers get charged for the number of cups they take. Motukuri says the technology can not only reduce costs at airports, but also can increase sales by giving hurried travelers an easy way to buy without waiting in line. He says the company expects to open 100 new stores in 2022 spread among airports, train stations and other venues worldwide. “Airports have always been our sweet spots,” he says. “Shoppers, travelers are short on time in airports and so they want something quick, they don’t want to wait in line and when they see lines, they actually avoid going in. They may skip the purchase altogether.”

Growing Prevalence Walk-out retail is expanding on the street and at airports in increasingly complex ways. In November, Starbucks and Amazon announced the opening of

a cashierless store in New York City that is combining use of the order ahead feature on Starbucks’ app with Amazon’s Just Walk Out technology. OTG, in March 2020, brought Amazon’s Just Walk Out to select CIBO Express Gourmet Markets in a move CEO Rick Blatstein at the time said would revolutionize the airport experience for travelers. The company declined to provide an update. Hudson has used the same Amazon technology in opening two Hudson Nonstop stores, one at Chicago’s Midway International Airport (MDW) and one at Dallas Love Field (DAL). And there will be more on the way in 2022, says Brian Quinn, executive vice president and CEO, who adds that the technology performs well and capable staff quickly resolve any rare error that arises. The technology – which allows customers to input a payment card, walk through the store aisles grabbing whatever items they want, and then leave without talking to anyone while the charges accrue

automatically on the card – has broad applicability, Quinn says. The company is considering taking Hudson Nonstop to other types of travel locations where it does business. “We’re very pleased not only with the financial performance and average ticket spend, but with the efficiency of the space, as well,” he says. “We are able to drive a significant number of travelers through the Hudson Nonstop stores each day without disruption or taking away sales from our other stores in those airports.” Hudson staff are looking into next steps, such as introducing promotions like a snack and water combo, which performs well in traditional travel convenience stores. Quinn says it was relatively simple to implement. “There really was no learning curve,” he says. “Our expertise in developing leading store designs, layouts and merchandising assortments together with support from both the Hudson and Amazon teams allowed us to meet business plan expectations within the first week.”

Left: Paradies Lagardère will significantly expand its use of MishiPay’s Scan, Pay & Go technology after a successful test at two airport stores. Customer reviews ranked the technology a 4.8 out of 5.

26

A X NEWS WINTER 2022

Above, Left: HMSHost Corp. has brought touchless check-out to some of its airport locations through Mashgin, a visual technology that recognizes products when customers place them on a Touchless Checkout system, as well as self-order kiosks, QR code transactions and card-accessed freezers in gate holds.

Paradies Lagardère Expands Scan, Pay & Go Touchless payments have popped up in a number of shapes and sizes over the last couple years. Paradies Lagardère has been working with different self-checkout options since 2019 and continues to look at more options that require varying levels of technological savvy. Last year the company began testing and recently announced plans to expand the deployment of MishiPay’s Scan, Pay & Go mobile self-checkout technology across its system. MishiPay requires shoppers to scan the barcode of any product in a store and then pay using whatever payment method is set on their phones. Jeff Flowers, senior vice president for store operations and loss prevention, says the company initially tested the technology at two stores, one at Charlotte Douglas International Airport (CLT) and one at Fort Lauderdale-Hollywood International Airport (FLL) and drew rave reviews from customers, who collectively rated the app a 4.8 out of five. “It’s really exciting that when the consumers begin to utilize it and see just how simple and easy it is - they’re astounded to say the least,” he says. “We’re talking thousands of reviews.” Phase two of the Scan, Pay & Go technology rollout will involve

implementing the system in stores in more than 20 airports, largely focused initially on travel essential stores. “We’re looking at a whole bunch of walk out, scan and pay options,” Flowers says. “We know how important all of this was pre-pandemic. It’s really interesting to see the adoption of the consumer. With people cautious on touching stuff, it’s become even more important.” Flowers says it’s all about providing options for travelers and about being more efficient, he adds, indicating that if people see a line of four or five people waiting to check out, they often skip the purchase. “We truly believe this will add incremental sales to our stores,” he says. “This can be an additional sale, it doesn’t interrupt the line. It’s really about the perception that we are keeping that traveling consumer moving through our store in an efficient manner.”

Not Just For Retail While retail has been at the heart of the touchless revolution, HMSHost Corp. has

brought touchless self-checkout to some of its airports operations as well. “We’ve quietly been really expanding our footprint in digital in a really impactful way,” says Neil Thompson, vice president of digital. At Farmers Market in Terminal B at Kansas City International Airport (MCI), the company debuted an AI payment technology powered by Mashgin, which allowed passengers to grab cold drinks, sandwiches and snacks and place them on a Touchless Checkout System where visual technology instantly recognizes them, displays prices and prompts a user to complete payment. HMSHost has expanded that to 27 units in eight airports. “It does a transaction in anywhere from 10 to 20 seconds and really allows the guest to choose ‘do I want the more traditional way of interacting with a staff member or do I just want to grab something and be on my way,’” Thompson says. The company also has employed around 100 touchless coolers located in gate hold areas where passengers tap a credit card to

A X NEWS WINTER 2022

27

gain access to refrigerated items. The cards are billed automatically. “We like this … at the gate hold as a way of grabbing that lasts minute item as they want to board the plane,” he says. And, at restaurants, the company utilizes some of the same technologies available at many restaurants these days, such as QR code ordering and self-order kiosks. Selforder kiosks are in about 80 HMSHost restaurants today, the same as it had before the pandemic. But utilization has increased from 10 percent of transactions to 30 percent, Thompson says. “That just shows you the guest, the traveler is looking for this kind of solution,” he says. “They want to engage in a way that will make the transaction smoother for them. This comes back to the ability to choose how you want to engage with us that is really at the cornerstone of the way we are viewing digital these days.” HMSHost intends to continue trying new things in an effort to increase sales and provide convenience for travelers who are

both more used to utilizing technology and increasingly pressed for time. Thompson described this time as “the tip of the iceberg” in terms of the industry transition. “Our environment gives us the opportunity at engaging with the travelers earlier,” he says, “Maybe as far back as allowing them to select a table, make a reservation and select exactly where they want to sit at the time they are booking their flight. We want to find ways to interact with guests while they are waiting in the security line, and be able to take their order then. Those are things we are looking at that are unique to being in airports. And utilizing our environment to try to gain a bigger footprint for digital and make the travel journey that much smoother for the traveler.”

Labor And Data Airport retail consultant Stu Holcombe, founder and managing partner with Travel Retail Partners, says walk-out technology is great, especially in store concepts where

products are grab-and-go. “There are certain store concepts that it will flourish and do well in,” he says. “It’s a godsend for concepts like travel convenience. It’s great.” During a time when all operators are having a hard time meeting staffing needs, this can help by allowing the staff on any given shift to spend more time on stocking shelves and cleaning, Holcombe says. Another upside? The potential capture of more detailed consumer behavior data that will help store operators learn about shopper intentions, product positioning and overall better engagement. “It’s the data we really want,” he says. “When a person comes into a store and picks up something and they put it back, why did they put it back? Why didn’t they purchase it? Were they just looking at it and getting familiar with it? Then you start looking at it and how many people are going in, picking up and walking out because it’s a pre-determined purchase intent. That’s great knowledge.”

AXiNfo Live brings you live, bite-sized interviews with industry leaders broadcast on social media channels.

TO WATCH OUR INTERVIEWS WITH INDUSTRY TRAILBLAZERS, VISIT OUR INSTAGRAM @AIRPORTXNEWS

AXInfoLive12_AXNFB_2011.indd 1

28

A X NEWS WINTER 2022

10/28/20 12:30 PM

FACT BOOK VOL. 24

2021 FACT BOOK

ORDER YOUR COPY TODAY ORDER TODAY AIRPORTXHUB.COM/PLANS

The Face Of The Average Traveler Has Changed; What Expectations Should Airports Anticipate? BY SHAFER ROSS

30

A X NEWS WINTER 2022

Right: Jason Dorsey, president of the Center for Generational Kinetics, says Millennials are currently the largest generation in the workforce.

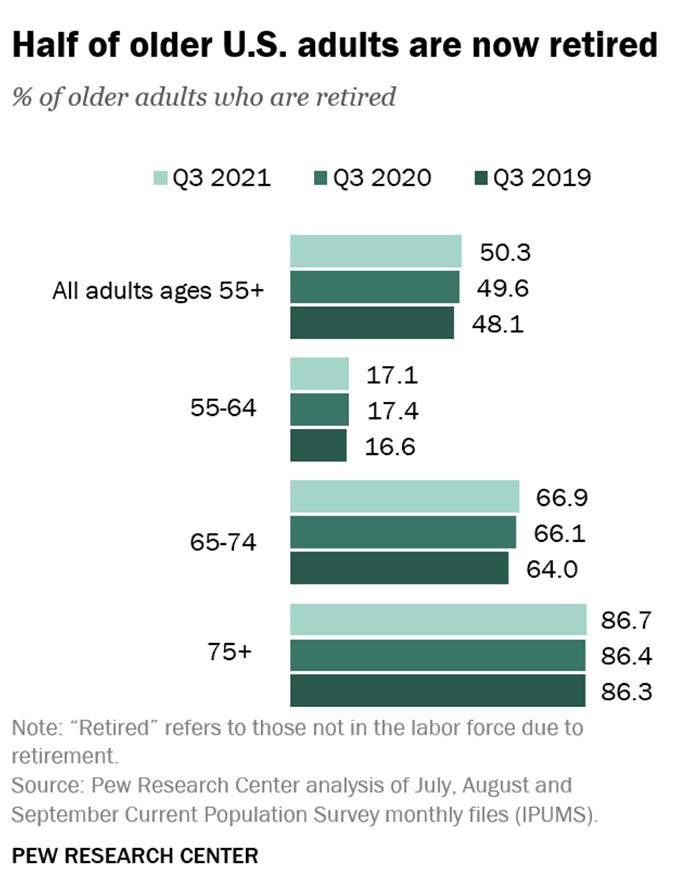

For years now, even before the pandemic, experts and researchers were saying Millennials have been on their way to taking over from Baby Boomers as the primary traveling group. The oldest Millennials own homes, have established careers and are now entering middle age. “A lot of times people think Millennials are 25 years old and their pants are falling off and they live in their mom’s basement. The truth is, the oldest Millennials are over the age of 40, which most people are shocked to hear. They’re the largest generation in the workforce,” says Jason Dorsey, president of the Center for Generational Kinetics (CGK), a generational research and advisory firm that works to demystify the differences between demographic groups. In fact, according to an analysis of the most recent official labor force data published by the Pew Research Center in early November of 2021, Baby Boomers are exiting the workforce at breakneck speed, especially as the pandemic begins to wane. Pew says just over half (50.3 percent) of adults aged 55 and over “said they were out of the labor force due to retirement. …In the third quarter of 2019, before the onset of the pandemic, 48.1 percent of those adults were retired.” The analysis by Pew goes on to say that “between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million.” This exodus from the work force of “the only working age population since 2000 to increase their labor force participation” and

the resulting shift in traveler demographics has airports and their concessionaires searching for solutions to both attract and intrigue a new “typical traveler.”

Begging for Business Travel “Not only are [Millennials] older than most people assume, they’re at places in their careers where they would be more likely to travel, as well,” Dorsey says. “Whether that’s traveling for meetings, for conferences, for client work, site visits and so forth, we do expect that they’re going to eventually really drive the business travel trends. “It’s important that people shake off the old mystique of who Millennials were and

better embrace who they are now, or you’re going to be left behind by the market in five years,” he adds. Welcome advice by many, considering business travel had been the backbone of the aviation industry for years before COVID-19 struck and halted the ability to travel for work. Leisure travel boomed in 2021, which has certainly helped elevate traffic levels to within a few percentage points of 2019 at times, but that market is so dependent on the whims of those doing the planning that it’s difficult for many airports to rely on as a sure sign of a comeback. “We’ve seen a fairly strong recovery, although I will tell you most of that recovery has occurred in a leisure base, not in a business base. I think those of us in airport management are waiting to see more suitcoats and briefcases than flip flops and shorts,” said Scott Brockman, president and CEO of Memphis-Shelby County Airport Authority, in an episode of AXiNterviews that was released in September of last year. The authority manages Memphis International Airport (MEM), which relied quite heavily on business travel pre-pandemic, like many smaller hubs around the country.

Left: According to an analysis of the most recent official labor force data published by the Pew Research Center, Baby Boomers are exiting the workforce at breakneck speed.

A X NEWS WINTER 2022

31

Left: Scott Brockman, president and CEO of Memphis-Shelby County Airport Authority, told AXN’s Carol Ward in an episode of AXiNterviews that his airport is still waiting for the stability business travel brings.

The Global Business Travel Association (GBTA), a professional association focused on bettering and supporting business travel around the world, released the results of its business travel index BTI Outlook in November of last year, revealing that “in a poll of 40 CFOs across North America, Latin America, Asia-Pacific and Europe… about half (52 percent) of respondents reported they expect their company’s business travel spend to reach 2019 levels in 2022.” Hopefully this optimism holds, as follow-through on those plans could mean quicker rebounds in air traffic. “Looking forward, business travel will continue to be significant for the air travel industry, not only in terms of travel volume but also revenue,” says Suzanne Neufang, CEO of the GBTA. “Although the road to business travel recovery may come with some bumps and adjustments, according to GBTA’s latest BTI forecast released in November, full recovery is expected in 2024, ending the year on pace with the 2019 pre-pandemic spend.” Of course, the same Covid scares that can turn leisure travelers from hot to cold in the span of a single CDC guideline update can also affect the viability of business travel. As airports continue to try adapting to new strains and spikes of the virus, there are ways for them to be especially businesstraveler-friendly, Neufang says. “Business travelers are savvy travelers but even for them, the fast pace of change is a challenge to follow,” she says, echoing a problem travelers and airport officials, employees and administration alike

32

A X NEWS WINTER 2022

Right: Suzanne Neufang, CEO of the Global Business Travel Association, says the organization expects full recovery of business travel by 2024.

share. “From one day to the next while planning or during a business trip, there may be changes to vaccination, testing, quarantine, documentation and other requirements – based on destination, not origin. So, an airport of origin needs to have all of those things in mind when even savvy business travelers show up without the right test, vax or other documentation required.” Making options available, as well as continuing to innovate new ways to keep abreast of health concerns, will be key. “As a significant part of the travel ecosystem, airports play a critical role in facilitating the mitigation of risk factors and the myriad pandemic requirements needed – such as testing, vaccinations, masking, and digital health certificates – to continue to ensure safe and responsible travel,” Neufang says. The BTI Outlook states that four main factors will contribute to “full recovery in global business travel: the global vaccination effort; national travel policy;

business traveler sentiment; and corporate travel management policy. The recovery remains highly dependent on the vaccine rollout, employees’ return to the office, and a normalization of travel policies on both the national and corporate levels.” Whatever the timeline, whether recovery of business travel should be looked at optimistically or not, as airports and concessionaires alike welcome back business travelers with open arms, they are going to be seeing new faces and, more importantly, facing new expectations.

New Brains To Pick Because of the way air travel and its ubiquity have developed over the past few decades, as well as the recent onset of a pandemic which rapidly accelerated a transition already in motion, airport stakeholders are looking around for ways to appeal to a traveler whose needs they don’t really understand yet.

Above: Erica Orange, executive vice president and chief operating officer of The Future Hunters, says Covid didn’t start new trends, rather it exacerbated existing ones.