insights

What to know about short-term rentals

Understanding land-use restrictions

insights

What to know about short-term rentals

Understanding land-use restrictions

insights

What to know about short-term rentals

Understanding land-use restrictions

insights

What to know about short-term rentals

Understanding land-use restrictions

The 34th Annual Outlook for Texas Land Markets delivers the time-honored knowledge and trusted forecasts of legal, economic, social, and natural resource issues influencing current Texas land market dynamics.

APRIL 10-11

Hyatt Regency Riverwalk

San Antonio, TX

TIERRA GRANDE MAGAZINE

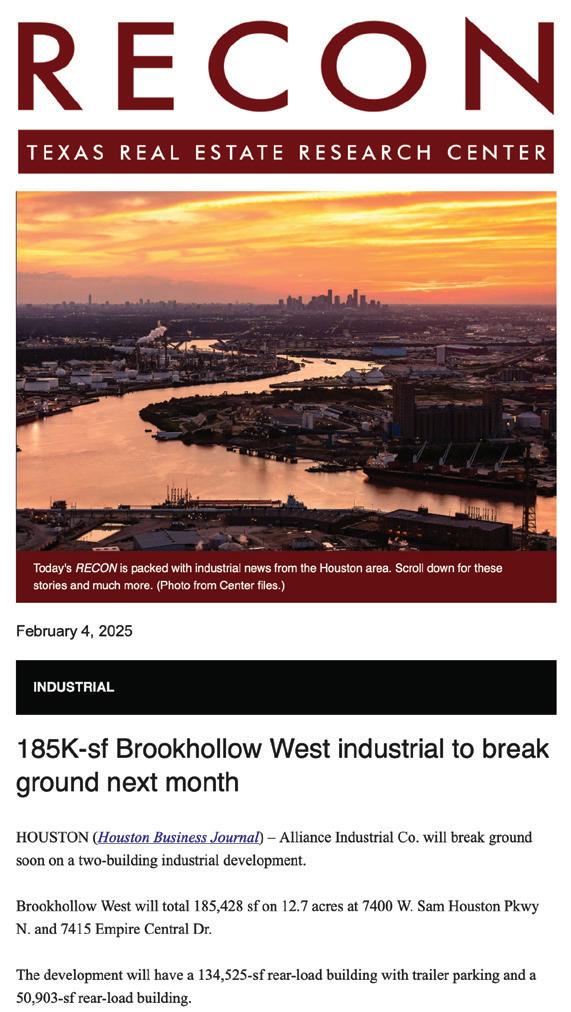

Artificial Intelligence and the Built Environment HAL 9000 made generations of moviegoers wary of artificial intelligence, but AI can have its uses, especially if you work in commercial real estate. Harold D. Hunt, Bucky Banks, and Stephen A. Ramseur

Texas real estate decisions impact everyone, from those buying or renting homes in the state’s smallest communities to global firms looking to relocate. Informed insights from our economic research team appear in this special forecast report.

Executive Director, PAMELA CANON

Research Director, DANIEL ONEY

Director of Communications, BRYAN POPE

Creative Manager, ALDEN DeMOSS

Contributing Designer, CAMILA ESCOBEDO

Circulation Manager, RYAN PERRY

Lithography, RR DONNELLEY, HOUSTON

What Buyers and Sellers Need to

Texas assignment law now includes notification requirements. Kerri Lewis offers a primer on assignments and the new requirements. Kerri Lewis

What’s Happened with ShortTerm Rentals Since Tarr?

Short-term rentals offer travelers spacious accommodations at a reasonable price while property owners earn a little extra income. Sounds like a win-win, right? But there’s been some pushback against them in recent years. Here’s the latest. Rusty Adams

Is a particular piece of land zoned only for smaller homes? Can a large barn be built on the property? Land-use restrictions are complex, but a solid understanding of them can help you better serve your client. Reid Wilson

ADVISORY COMMITTEE: Besa Martin, Boerne, presiding officer; Rebecca “Becky” Vajdak, Temple; assistant presiding officer; Troy C. Alley, Jr., Arlington; Kristi Davis, Carrollton; Vicki Fullerton, The Woodlands; Doug Foster, San Antonio; Patrick Geddes, Dallas; Harry Gibbs, Georgetown; Doug Jennings, Fort Worth; and Barbara Russell, Denton, ex-officio representing the Texas Real Estate Commission. TG (ISSN 1070-0234), formerly Tierra Grande magazine, is published quarterly by the Texas Real Estate Research Center at Texas A&M University, College Station, Texas 77843-2115.

VIEWS EXPRESSED are those of the authors and do not imply endorsement by the Texas Real Estate Research Center, Division of Research, or Texas A&M University. The Texas A&M University System serves people of all ages, regardless of socioeconomic level, race, color, sex, religion, disability, or national origin. Nothing in this publication should be construed as legal or tax advice. For specific advice, consult an attorney and/or a tax professional.

PHOTOGRAPHY/ILLUSTRATIONS: Center files, p. 1, 2, 7, 8-9, 11, 12, 22-23, 25; courtesy of Enchanted Rock, p. 4.

LICENSEE ADDRESS CHANGE. Log on to your Texas Real Estate Commission account to change your mailing address. © 2025, Texas Real Estate Research Center. All rights reserved.

By Harold D. Hunt, Bucky Banks, Stephen A. Ramseur

• AI and Generative AI are among the top three technologies expected to have the most significant impact on real estate over the next three years.

• AI tools could streamline processes related to underwriting, appraisal, lease administration, and property management.

• AI enhances work but requires human guidance for goal-setting, data validation, and accuracy.

• Technology adoption is driving demand for data center power, a critical factor for CRE professionals to consider.

New artificial intelligence (AI) functions are constantly being developed that will soon impact every sector of commercial real estate (CRE). More and more CRE firms are getting on board with the technology. But the problems that AI has begun to solve are increasing in complexity and accelerating the pace of business operations. As a result, an introduction to AI may be useful to those unfamiliar with the subject.

AI and Generative AI (GenAI) were ranked among the top three technologies expected to have the most significant impact on real estate over the next three years by investors, developers, and corporate tenants, according to JLL’s 2023 Global Real Estate Technology Survey. IBM defines AI as technology that simulates human learning, comprehension, problemsolving, decision-making, creativity, and autonomy. At its most basic level, it enables computers and machines to solve problems for people and organizations.

AI?

As tools using AI work their way into businesses and society, they will drive significant increases in global GDP, increasing productivity in the process. Goldman Sachs economists Joseph Briggs and Devesh Kodnani estimate a 0.4 percent growth boost to GDP per year from AI in the U.S. AI has enormous potential to reshape CRE by streamlining and optimizing many real estate functions, potentially resulting in more transactions. More transactions mean more money.

In an interview for CRE development organization NAIOP, Sean Ward, executive vice president at CRE services and investment firm CBRE, maintains that the amount of time analysts spend underwriting deals for brokers can be dramatically reduced using AI. Ward believes the appraisal, lease administration, and property management sectors will all be completely changed by AI as well.

“Companies that figure it out first will put themselves far ahead of the pack.” said Ward.

The broad concept of AI originated in the 1950s, while several subcategories of the field have emerged only in the past few years. Colliers, a professional CRE services and investment management firm, lists six subtypes of AI that are currently being used or likely to be used in the near future.

Natural Language Processing. Understands, generates, and interacts with human language. It bridges the gap between human communication and computer understanding, making technology more accessible and intuitive.

Expert Systems. Mimics decisionmaking abilities of a human expert in a particular domain. They automate tasks that typically require specialized human expertise.

Generative Models (GenAI). Creates original content in the form of text, videos, images or even music from large datasets in response to a request by users. (Examples are OpenAI’s ChatGPT, Microsoft’s Copilot, and Google’s Gemini.)

Machine Learning. It can learn from data, adapt, make informed decisions, and improve its performance over time without being explicitly programmed.

Predictive Analytics. Analyzes historical data to make predictions about future trends. It is designed to help companies anticipate future scenarios to optimize decision-making and formulate long-term strategies.

Computer Vision. Analyzes and interprets visual information. It’s intended to replicate humans’ ability to see and understand the visual world.

A more detailed discussion of these subcategories is available from Traction Technology.

As tools using AI work their way into businesses and society, they will drive significant increases in global GDP.

Public accounting and advisory firm BPM lists a number of ways CRE individuals and firms can begin using AI technology to enhance their businesses. They include:

• Identifying areas where AI can have the most immediate impact. For example, lead generation or property valuation.

• Investing in AI training and education to get up to speed with the latest AI developments, building enthusiasm for AI acceptance.

• Considering collaborations with AI specialists to help integrate AI technology into the firm’s operations.

• Attending industry conferences and workshops on AI and PropTech.

For more on this, read “Rise of PropTech in Texas: Transforming Commercial Real Estate.”

• Participating in online courses, communities, and forums about AI.

• Obtaining AI or data analytics certifications to demonstrate expertise to clients.

• Addressing employees’ skepticism about becoming obsolete or irrelevant by helping them focus

on things AI cannot replace, such as developing their interpersonal skills and local market knowledge.

Apprehension by CRE workers that AI will replace humans is real. However, a survey by the Altus Group suggests most CRE professionals view AI in a positive light. In its Q4 2023 CRE Industry Conditions and Sentiment Survey, Altus Group surveyed 197 CRE participants from 51 different firms across the U.S. The survey asked, “In what way do you think AI will affect the CRE industry?” Respondents could choose any or all of the following responses:

• AI has practical applications that will benefit CRE professionals and the industry.

• AI has the potential to fully disrupt and transform CRE roles and the industry.

• AI is unproven technology, so the impact to CRE is uncertain.

• AI poses a threat to CRE jobs and industry standards.

Overall, 72 percent of respondents viewed AI positively. However, 20 percent of participants did express concerns about AI’s potential threat to CRE jobs and industry standards.

Confidence in AI increased with firm size but decreased with years

of experience. Furthermore, owners, operators, and service providers saw far more practical applications for the technology than those in brokerage and lending who depend more heavily on personal relationships.

The more positive response from larger CRE firms could be due to several factors, including more resources at their disposal that facilitated an earlier adoption of AI tools.

For a more in-depth discussion of survey results, read “The Real Estate AI Debate: Risk or Revolution.”

Technology disruption in CRE has been gradual, accelerating in recent years with the increased use of the Internet. Online listings, virtual tours, and mobile apps have improved communication between the various CRE participants, but AI will still need human direction and input. Workers will be needed to define the right goals and metrics, identify the appropriate data sources, ensure data quality, and select the appropriate AI tools for solving a given problem. Humans will also be necessary to test, analyze, validate, and adjust the results produced by AI to ensure it is correctly solving a given problem. Harvard Business School professor Karim Lakhani summed up the more likely reality that lies ahead: “AI won’t replace humans, but humans with AI will replace humans without AI.”

Specific

Although future articles will discuss specific AI benefits and challenges in more depth, below is an overview of some of the ways AI can impact different CRE sectors.

Property Management. AI can be used to enhance property management through predictive maintenance systems that analyze data from sensors and historical records. Potential issues can be addressed before they

become major problems, reducing repair costs and improving tenant satisfaction. Automated tenant screening can streamline the process of background checks and credit scoring, saving time and reducing human bias in tenant selection. Finally, lease management can automate contracts, facilitate rent collection, and handle routine tenant inquiries, giving property managers additional time to focus on more strategic tasks.

Customer Experience. AI-powered virtual tours can provide immersive property-viewing experiences that allow potential buyers to visit properties remotely. AI-driven “chatbots,”

software designed to simulate human conversation through text or voice conversations, can offer 24/7 customer support and quickly answer inquiries about properties, neighborhoods, or the buying process. AI systems can analyze buyer preferences, budgets, and behavior to provide custom property recommendations.

Investment Analysis. AI systems can analyze vast amounts of market data, including economic indicators, demographic trends, and local development plans to identify potential property investments. AI tools can help investors manage and optimize their real estate portfolios through

data-driven insights that can be used in strategic decision-making.

Document Processing and Data Management. AI is streamlining document-related tasks such as lease abstraction, efficiently pulling key information from lease documents.

Rent roll processing tools can process and digitize rent rolls quickly, resulting in more productive data management and analysis.

AI implementation is on a path of rapid adoption in commercial real estate.

In a 2024 report on global AI usage, Colliers found that 33 percent of CRE leaders plan to employ AI systems in their firms within the next two years, while 59 percent plan to employ systems even sooner. Only 7 percent had no specific timeframe in mind. As a result, CRE organizations may want to consider exploring new AI applications before scaling them up to deliver added value.

CRE professionals should be aware that investing in solutions incorrectly or deceptively marketed as AI can lead to financial losses. Purchasing ineffective tools can waste funds that could be allocated more efficiently. Employing or learning subpar systems

also takes valuable time away from primary business activities.

Harold D. Hunt, Ph.D. (hhunt@tamu. edu) is a research economist with the Texas Real Estate Research Center; Bucky Banks (bbanks@mays.tamu.edu) is associate director and executive assistant professor for Texas A&M’s Master of Real Estate program in Mays Business School; and Stephen A. Ramseur is executive professor for Texas A&M’s Master of Real Estate program and holds the Julio S. LaGuarta Professorship in Real Estate.

Goldman Sachs Research estimates that U.S. data center power demand will increase by 160 percent by the year 2030, almost doubling their current percentage of total U.S. electricity usage. In Texas, comparatively low electricity rates and a large number of deregulated markets have turned Texas into a magnet for data centers. Research and policy center Environment Texas reports 329 data centers in Texas, with many more proposed.

Wider use of AI will drive further growth in data center power consumption going forward. According to Carboncredits.com, a single ChatGPT query requires about ten times the electricity needed for a Google search. AI applications already account for 10 to 20 percent of data center electricity usage.

Meanwhile, several ongoing challenges are hampering the development of sufficient electricity supply. Delays in building new transmission lines and the retirement of older coal, natural gas and nuclear baseload plants are part of the challenge. Replacement with wind and solar facilities adds new capacity, but they work only when the wind blows or the sun shines. As a result, data centers and other users requiring uninterrupted power are looking for alternatives.

One increasingly popular alternative is a “microgrid,” an onsite electricity generating system.

MICROGRID FACILITIES, like the one at Texas A&M University’s RELLIS campus, are helping companies and institutions meet increasing power needs from AI.

Microgrids have several advantages. They offer a “bridge-to-grid” system where generators can be installed quickly to provide primary power until utility transmission lines are in place, a process that can take years. They can disconnect from the local utility grid and function autonomously as backup power for facilities during outages or emergencies to prevent any disruptions. They can also provide extra power to the utility grid in periods of peak power demand.

One such microgrid system powered by natural gas is in operation at Texas A&M University’s RELLIS campus, which is on track to house several multimillion-dollar state and national research facilities. The Texas A&M University System has entered a longterm agreement with Houston-based Enchanted Rock (founded by alumnus Thomas McAndrew) to provide RELLIS with uninterrupted power, ensuring critical services are available at all times.

Kevin McGinnis, A&M System Executive Director of Risk Management & Benefits Administration, noted that the backup capacity was obtained with minimal capital outlay compared to financing its own generation system. Enchanted Rock operates and maintains the system for the life of the agreement, allowing the RELLIS Campus to focus its resources on other initiatives.

Commercial brokers should be aware of AI’s insatiable power appetite. Competition for uninterrupted, available power will only increase. CRE professionals may need to consider this in underwriting, lease terms, and other factors.

BY KERRI LEWIS

• In an assignment, the original buyer (assignor) transfers their equitable interest (the right to acquire the property) to a new buyer (assignee). This transfer does not change the underlying real estate contract terms but shifts responsibility for fulfilling them to the assignee.

• Texas law now requires notifying both the assignee and original seller of an intent to assign the buyer’s interest.

• Buyers can satisfy the new law’s notice requirements by (1) adding “and/or assigns” to their name in the original contract, (2) including a provision allowing assignment, or (3) providing a written statement to the seller after signing the original contract but before the assignment contract.

Texas has few laws regarding the assignment of a buyer’s interest in a real property contract, with most of the structure for such an assignment coming from the contract language itself or from case law. However, a new provision of the Texas Property Code, passed by the 88th Texas Legislature, went into effect Jan. 1, 2024, requiring notice to both the purchaser of the assigned interest and to the seller of the original contract of the intent to assign the buyer’s interest.

In Texas, assigning a real property contract generally means transferring the buyer’s interest under a contract to another party. This is often done

in commercial, unimproved property, and ranch real estate transactions, but it can occur in residential transactions as well. Assigning the contract allows the buyer to have a different or newly formed entity take title to the property or to “flip” the property to another third party before closing of the original contract. Some investors like to have different entities own different properties for liability or tax reasons. Wholesalers, who flip properties before consummating the purchase under the original contract, also commonly use assignments.

The underlying real estate contract is the agreement between the buyer and the seller to purchase the property. The seller has a legal interest in the property. The buyer has an equitable interest in the property. Legal interest refers to the actual ownership and title of a property. The legal property owner holds the legal title and has the full rights and responsibilities of owning the property. Equitable interest, on the other hand, means the person has the right to eventually acquire legal

title to a property and can sell or trade that interest. An equitable interest is generally created when the buyer and seller have fully executed the underlying real estate contract.

The assignment of the equitable interest does not extinguish the underlying real estate contract. The new buyer (assignee) will be bound by the terms of the contract, including the purchase price, the closing date, and any other contingencies agreed to by the original buyer (assignor). The seller will now have to deal with the new buyer instead of the original buyer.

An assignment will generally be permitted under the law unless there is an express prohibition against assignment in the underlying contract. The assignor does not need the consent of the seller but will need to notify the seller of their intent to assign the contract. An assignment of an equitable interest in a property is a separate transaction from the underlying real estate contract. This means a separate written agreement will need to be executed for the assignment.

Check to see if the underlying contract prohibits assignments or if there are any conditions or restrictions that might apply to an assignment, such as requiring the seller’s approval or limiting the assignment to certain types of buyers. Before agreeing to an assignment, it is important for the potential assignee to determine what stage the contract is in. Has earnest money been deposited? Is there any additional earnest money due? Has the option period expired? What, if any, inspections have been performed on the property? Has the period for title objections run? The answer to each of these questions can help determine the risk the assignee will be taking in acquiring the property and hence the purchase price for the assignment.

This is where the new law comes into play.

Prior to Jan. 1, 2024, the applicable law regarding notice was found in Texas Property Code §5.086. It required a person selling or assigning an interest in a contract to notify the potential buyer before entering into a contract that they are selling only an interest in an underlying contract and do not hold legal title to the real estate. This notice was generally given in the Assignment Contract itself.

During the 88th Legislative Session, the legislature redesigned and transferred Section 5.086 to Texas Property Code §5.0205 in SB 1577. The goal of this law is to ensure transparency and prevent potential misunderstandings and disputes between the parties. The revised law reads as follows:

Sec. 5.0205. EQUITABLE INTEREST DISCLOSURE.

Before entering into a contract to sell an option or assign an interest in a contract to purchase real property, a person must disclose in writing to:

(1) any potential buyer that the person is selling only an option or assigning an interest in a contract and that the person does not have legal title to the real property; and

(2) the owner of the real property that the person intends to sell an option or assign an interest in a contract.

The requirement to give notice to the potential buyer was continued under the new law, and a new requirement to notify the seller of the underlying contract that the buyer intends to assign an interest in the contract was added. Note that both notices are required before the assignment contract—not the underlying contract—is

signed. That does not mean the buyer couldn’t give that notice of intent in the underlying contract. In fact, it is a common practice in transactions involving farm and ranch, undeveloped land, and commercial properties for the buyer to add the phrase “and/ or assigns” at the end of the buyer’s name in the contract for sale to preserve the right to assign interest in the contract to a related entity or sell it to another person or entity for a profit. Adding “and/or assigns” to the buyer’s name in the underlying contract would satisfy the new requirement for buyers to notify sellers of their intent to assign their interest in the contract. Further, when a seller signs a contract with that phrase included, the seller has consented to an assignment. Another way to fulfill this new notice requirement to the seller of the underlying contract is to include a provision in the contract explicitly allowing assignment. This happens most often in commercial contracts, but it can be included in a contract for any type of

property. It is often in these provisions that sellers will add conditions such as consent or qualification requirements for the assignee. A word of caution: license holders cannot draft these provisions, and their clients should consult an attorney if they need help. A third way to give notice would be to send a written statement to the seller, after the underlying contract is signed but before the assignment contract is signed, that the buyer intends to assign the buyer’s interest in the contract. Note that the new law does not require the seller’s consent to any assignment, nor does it require disclosure of the purchase price or any other terms of the assignment. However, that doesn’t mean sellers won’t think they have the right to consent or demand information about the assignment. Waiting to give notice of intent to assign at this stage could result in a hostile seller at closing or even having to sue for specific performance of the contract, which costs time and money. Addressing the

issue of assignment in the underlying contract by one of the first two methods previously discussed is a better practice.

If the underlying contract requires the seller’s consent or satisfaction of conditions, ensure these have been met and the seller’s approval is received in writing.

The Texas Real Estate Commission does not promulgate any forms for license holders to use for an assignment of contract. Texas Realtors has an assignment form available for commercial transactions. License holders should direct their clients to use a competent real estate attorney for any assignment of contract. At a minimum, the Assignment Agreement should:

• Identify Parties. Clearly state the names of the assignor, assignee, and the seller.

• Describe the Contract. Specify the details of the underlying contract, including the property address and purchase price. The underlying contract can be attached as an exhibit.

• Describe Transfer of Rights and Obligations. Outline the specific rights and obligations being transferred from the assignor to the assignee, again making it clear that the assignor has an equitable interest in the property under a signed contract and does not own the property outright.

• Specify Consideration. Indicate the consideration (payment) being given to the assignor for the assignment. Does this include reimbursement of earnest money paid by assignor?

• Contain Default Provisions. Address what happens if either party defaults on their obligations under the assignment agreement.

Ensure both parties have executed the Assignment Agreement and that the purchase price for the assignment and any other agreed-upon funds (reimbursement of escrow money, option fees, inspection costs, etc.) are transferred between the assignor and assignee prior to the closing of the underlying contract.

Inform the seller and the escrow agent that the buyer’s interest has been assigned and give them the name and contact information for the assignee. This will help facilitate a smooth closing of the underlying contract.

While not required in Texas, recording the assignment (or affidavit of assignment if the parties do not want the terms of the assignment disclosed) in the county where the property is located can provide protection for the assignee against possible future thirdparty claims.

Nothing in TG should be considered legal advice. For advice or representation on a specific situation, consult an attorney.

Kerri Lewis, J.D. (kerrilewis13@ gmail.com) is a research fellow with the Texas Real Estate Research Center, a member of the State Bar of Texas, and former general counsel for the Texas Real Estate Commission (TREC).

By Rusty Adams

• Courts carefully construe deed restrictions to mean what they say.

• Amendments are valid if allowed by original terms and not against public policy.

• HOAs can’t change restrictions by rule in a way that conflicts with the deed restrictions.

Short-term rentals have become more popular in recent years. Travelers enjoy a homier feel at a lower cost than with a hotel. Owners enjoy the extra income. And with the advent of online platforms such as Airbnb and Vrbo, renting them is easier than ever. But not everyone is happy with the burgeoning growth of the industry. In fact, deed restriction cases have seen an uptick in response to the trend.

In 2018, the Texas Supreme Court issued its opinion in Tarr v. Timberwood Park Owners Ass’n, Inc.

As explained in “¿Mí Casa Es Su Casa? Restrictive Covenants and Short-

Term Rentals,” the implications of that case were not as far-reaching as many were led to believe.

The case did not render all prohibitions on short-term rentals unenforceable; it merely held that the restrictions in that case did not prohibit short-term rentals (STRs).

Tarr held that the Association’s restriction on single-family residences (the “structural” restriction) was a restriction only on the type of structures to be built. The restriction that all tracts be used solely for residential purposes (the “use” restriction) did not prohibit STRs for residential purposes (i.e., for living there, even for a short period of time). The court

noted that if Tarr had placed signs on the property advertising it as a “Bed and Breakfast Inn,” rented out multiple rooms, and had an onsite manager, that might have been prohibited under the “commercial use” restriction. However, simply renting out the house was not. The holding was confined to the language of the restrictions and the circumstances of the case.

What has happened on the STR front since then? This article discusses developments in the law on deed restrictions (restrictive covenants) involving STRs. STRs are also subject to governmental regulations such as municipal ordinances. Such governmental regulations are not discussed here.

One thing leads to another, even in the courts. In the years since the Supreme Court’s holding, courts generally uphold the basic premise announced in Tarr: Deed restrictions mean what they say. Restrictions on STRs are not forbidden, but the restrictions must be specific.

Shortly after Tarr, the Corpus ChristiEdinburg Court of Appeals construed restrictions requiring that the property be used for single-family dwellings, with occupancy limited to one family or no more than two unrelated persons. The owner offered his house for STR on Vrbo. The court followed Tarr in holding that the single-family dwelling restriction was a structural restriction rather than a use restriction. The occupancy restrictions were held to be use restrictions, but there was no evidence before the court that the owner ever actually rented the property in a way that violated the restrictions (i.e., to more than one family or more than two unrelated persons).

Another restriction prohibited commercial use, with no additional definitions or requirements. The court held

that under the restriction in this case, merely renting the property was a residential use rather than a commercial one. As in Tarr, the court might have reached another result if guest services, such as those provided by a hotel, were provided, or if business activities were actually conducted on the property.

In 2022, a case came to the Austin court after the trial court denied summary judgment. (Cases may be decided on summary judgment if the trial court finds that there is no genuine issue of material fact, and that the case may be determined by merely applying the law to the facts. In this case, the courts permitted an interlocutory appeal.) Deed restrictions provided that no lot could be used for any purpose except that of a private residence. The restrictions allowed business use as long as the operation of the business activity was not detectable by sight, sound, or smell from outside the residential unit. “Business” was defined to include “the provision of goods and/or services . . . for which the provider receives a fee . . .” The restrictions were made binding on owners and on any persons renting or leasing from the owners, and they allowed display of signs advertising

properties for sale or rent. The owner offered the property for STR.

The court observed that the restrictions do not prohibit and, in fact, contemplate renting the property to others, and held that tenant use of the property, even if it generates income, is generally allowed, provided that the rentals maintain the characteristics of a lease.

On the other hand, the court questioned how restrictions prohibiting the use of the property for other than a private residence applied to the facts of the case. Furthermore, whether business activity was prohibited depended on whether it was detectable from outside the unit.

Additionally, the rental agreements and the Airbnb platform contained language stating that the agreements created no property rights and were licenses for use as a vacation rental, rather than leases, raising questions about the character of the rentals.

The court of appeals affirmed, holding that the case turned on facts that must be determined in the trial court.

The next year, the Waco court considered deed restrictions providing that all lots shall be used for residential purposes and that living quarters for other than the family occupying the principal residence shall be used only

for bona fide servants or assistants. No duration was specified; in fact, the restrictions contained no prohibition on leasing at all. The owner planned to rent bedrooms to SpaceX executives.

The court held that the restrictions unambiguously prohibited occupation by non-family members unless they were servants or assistants. The owner argued that a 1958 case holding that “family” could sometimes include “lodgers or boarders” meant that lodgers should be allowed. The court rejected the owner’s argument, using a more contemporary dictionary definition of family that did not include them. Restrictions are construed according to their meaning at the time they were drafted.

Owners may love the restrictions just the way they are, but what about situations where deed restrictions are amended after the owner purchases the property? Can an association or other owners take away the right of owners to use property as a STR?

As shown in the cases below, amended deed restrictions will be upheld when three factors are satisfied: 1. The original restrictions must establish both the right to amend and the method of amendment.

2. The right to amend implies only those changes contemplating a correction, improvement, or reformation of the agreement rather than its complete destruction.

3. The amendment must not be illegal or against public policy. Amendments validly made that are consistent with the general plan or scheme of development will generally be upheld.

The DeGons bought a house in Poole Point Subdivision, subject to deed restrictions. The deed restrictions allowed only single-family residential use and prohibited business or commercial activity to which the general public is invited. There were no specific prohibitions on leasing and no duration requirements. The restrictions contained an amendment provision whereby the restrictions could be amended by the owners of more than 67 percent of the lots.

After the DeGons began leasing the property for terms less than 30 days, the owners amended the restrictions, by the terms therein, to prohibit rentals for less than 180 days.

The Austin Court of Appeals examined the conditions that must be met to amend deed restrictions.

First, the original restrictions must establish both the right to amend and the method of amendment. This was not disputed.

Second, the right to amend implies only those changes contemplating a correction, improvement, or reformation of the agreement rather than its complete destruction. The court held that the right to lease was not absolute or unlimited. It was subject to the restrictions, which permitted amendments. Under the amendment, there is still a right to lease; it is just subject to the minimum duration requirement. Placing conditions on use and duration is not “complete destruction” of the right to lease. The owners knew when they purchased the property that the restrictions could be amended, and they could not reasonably have expected that there could never be restrictions placed on their right to lease.

Third, the amendment must not be illegal or against public policy. The court noted that the Supreme Court in Tarr acknowledged that amending deed restrictions was an available and appropriate option for specifying a minimum duration for lease. The Supreme Court’s acknowledgment was an indication that such an amendment was not against public policy. More restrictive restrictions are not unreasonable or prohibited when they are consistent with the overall plan of development.

The court upheld the restrictions. Similar holdings and analyses are found in Adlong, Chu, Angelwylde, Cauthorn, and Cottonwood Trail (see citations sidebar).

JBrice Holdings, L.L.C. v. Wilcrest Walk Townhomes Ass’n, Inc.

In 2022, the Texas Supreme Court considered something a little different—the case of JBrice Holdings, which bought townhomes and offered them as STRs. The restrictions did not prohibit leasing or impose a minimum duration. In fact, they specified that leases must be in writing and include

a provision requiring tenants to abide by all neighborhood restrictions. They further stated, “Other than the foregoing, there shall be no restriction on the right of any townhouse owner to lease his unit.” The restrictions limited townhouse occupancy to “private singlefamily residence[s] for the Owner, his family, guests, and tenants.” There was also a prohibition on using the land for commercial use. The restrictions contained provisions for amendment of the restrictions with the agreement of 75 percent of the owners. When the dispute arose, however, the restrictions were not amended. Instead, the association adopted rules effectively prohibiting rentals less than 30 days, which it claimed it had the right to do under Section 204.010(a) (6) of the Texas Property Code.

The court held that neither the deed covenants nor the Property Code authorize the association to restrict STRs by adopting rules. The covenants explicitly forbid restraints on owners’ rights to lease unless the restriction is contained within the neighborhood’s governing documents, and the Property Code does not authorize associations to adopt rules that conflict with their governing deed covenants.

The court noted that the association was free to pursue relief if tenants create nuisances and to restrict leasing by amending the restrictions according to the amendment procedure. But it was not permitted to make rules inconsistent with the restrictions. The court also rejected the association’s argument equating STRs to hotel use, declining “to differentiate between short-term and long-term tenancy in a manner that the covenants themselves do not.”

Nothing in TG should be considered legal advice. For advice or representation on a specific situation, consult an attorney.

Rusty Adams, J.D. (r_adams@tamu.edu) is a member of the State Bar of Texas and a research attorney for the Texas Real Estate Research Center.

Rusty Adams talks more about this on TRERC’s YouTube channel.

Tarr v. Timberwood Park Owners Ass’n, Inc., 556 S.W.3d 274 (Tex. 2018).

Schack v. Prop. Owners Ass’n of Sunset Bay, 555 S.W.3d 339 (Tex. App.—Corpus Christi–Edinburg 2018, pet. denied).

Duncan v. Prewett Rentals Series 2 752 Military, LLC, No. 03-2100244-CV, 2022 WL 3567780 (Tex. App.—Austin Aug. 19, 2022, no pet.)(mem. op.).

Gantenbein v. Lacy, No. 10-2100323-CV, 2023 WL 4759109 (Tex. App.—Waco July 26, 2023, no pet.)(mem. op.).

Poole Point Subdivision Homeowners’ Ass’n v. DeGon, No. 0320-00618-CV, 2022 WL 869809 (Tex. App.—Austin Mar. 24, 2022, pet. denied)(mem. op.).

Adlong v. Twin Shores Prop. Owners Ass’n, No. 09-21-00166-CV, 2022 WL 869801 (Tex. App.— Beaumont Mar. 24, 2022, pet. denied)(mem. op.).

Chu v. Windermere Lakes Homeowners Ass’n, Inc., 652 S.W.3d 899 (Tex. App.—Houston [14th Dist.] 2022, pet. denied).

Angelwylde HOA, Inc. v. Fournier, No. 03-21-00269-CV, 2023 WL 2542339 (Tex. App.—Austin Mar. 17, 2023, pet. denied)(mem. op.).

Cauthorn v. Pirates Prop. Owners’ Ass’n, 679 S.W.3d 876 (Tex. App.—Houston [1st Dist.] 2023, pet. denied).

Cottonwood Trail Investments, LLC v. Pirates Prop. Owners’ Ass’n, No. 01-22-00400-CV, 2023 WL 5535664 (Tex. App.—Houston [1st Dist.] Aug. 29, 2023, pet. denied)(mem. op.).

JBrice Holdings, L.L.C. v. Wilcrest Walk Townhomes Ass’n, Inc., 644 S.W.3d 179 (Tex. 2022).

Real estate decisions affect the lives of more than 30 million Texans and untold others beyond the state. Wise decisions improve stewardship of our natural, cultural, and financial resources and make our economy more efficient, leading to better social and economic outcomes. This forecast is intended to inform Texans of anticipated market trends in 2025.

The forecast supports our stakeholders in two ways. First, it draws attention to the big-picture trends that influence real estate asset markets. These trends are defined by macroeconomic and demographic statistics (referred to here as macro drivers). Practitioners should watch these indicators as the new year unfolds, because they will have a significant impact on real estate markets. Second, the forecast gives a consensus projection of real estate transactions. Forecast users can consider the projected macro drivers and asset projections in their contingency planning. Readers can consider how their own assumptions differ when interpreting the implications of these results. If users hold different geopolitical or macroeconomic assumptions, they may easily adjust their perspective on the individual asset forecasts.

Our forecast process for the 12 months ending December 2025 began with an uncertain national and global picture. Expectations of an unsettled presidential election gave way to a quick resolution with a President Trump victory and Republican control of the House and Senate. This far from eliminates uncertainty over geopolitical and macroeconomic events, but the overall direction of national policy should be relatively consistent through 2025.

We began with four fundamental geopolitical assumptions that will influence the macro drivers in 2025.

1. Substantial changes in federal tax, spending, and regulations are possible in the long term and may have profound impacts on macroeconomic conditions. Improvements in business investment, workforce participation, inter-state migration, or even household formation/fertility rates may materialize in the coming years.

2. Executive orders and changes in agency leadership may influence international trade flows, oil and gas production, liquid natural gas exports, and reductions in international immigration. While the national impact of federal policy changes could increase in coming years, that impact may be minor in 2025.

3. On the international front, the likelihood of a wider Ukraine war decreases in 2025, but heightened risks emerge with recent decisions by the outgoing administration. Prospects for a resolution to Middle East conflict are less certain. Selective, punitive trade policies are expected, such as with China and Mexico, but wholesale tariff increases or a trade war are unlikely.

4. The prospects of a recession in 2025 may be less likely. Given the greater regulatory certainty and structural economic reforms, business and household optimism may boost investment and spending even before policy changes happen. This may have inflationary consequences.

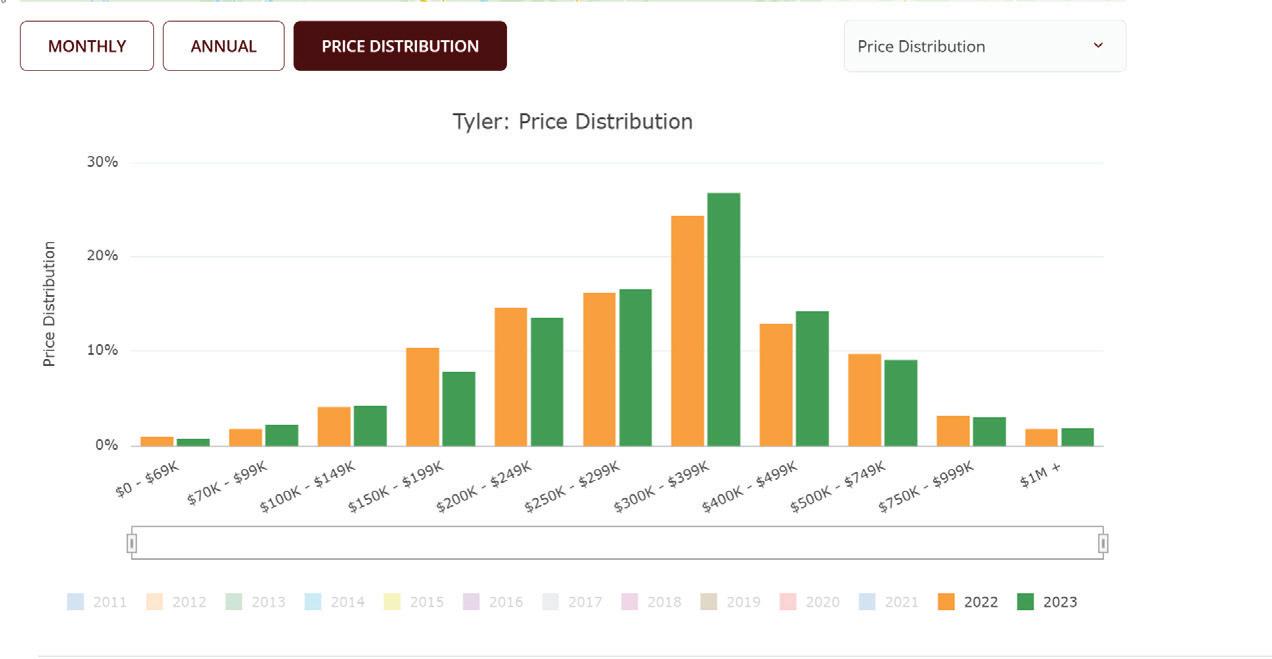

The Center tracks market performance of several assets in three broad categories: residential, including single-family homes (for sale and for rent) and multifamily (apartments); commercial space, including office, industrial, and retail; and rural land. Our researchers project supply, demand, transaction volume, and price or rent for each asset, as applicable. This report includes:

» A 2024 performance summary for each asset, which serves as the baseline for the 2025 forecasts. The 2024 summary necessarily includes an extrapolation to arrive at year-end numbers.

» The most important macroeconomic drivers for each asset. These have the most weight in the projections, and Center researchers applied the driver estimates in their forecasts of asset performance.

» Projections and a statement of the perceived uncertainty of each asset.

Sources for 2024 asset statistics:

Single-Family: Texas REALTORS® Data Relevance Project, U.S. Census Bureau American Community Survey.

Multifamily, Office, Industrial, and Retail: CoStar Group Inc, www.costar.com, U.S. Census Bureau American Community Survey. Rural Land: Texas A&M Natural Resources Institute, Texas Farm Bureau.

TRERC economists considered and adopted principles to inform the forecasting process. Keeping these principles in mind shapes how forecasts are created, evaluated, and communicated.

» Real estate decision-makers are the audience, because they have a financial stake in real estate markets. They include financiers, developers, builders, households, business occupiers, and real estate professionals who facilitate transactions.

» Asset forecasts should address supply and demand, transaction volume, and price.

» Results should reference the prior year and provide quantitative estimates where feasible.

» The forecast should use multiple methods integrating quantitative and qualitative methods and be informed by professional judgment. Each forecast element is developed by multiple researchers and subjected to review by the entire team.

» Plausible geopolitical and macroeconomic assumptions are the foundation of the asset forecasts. When consensus is impossible or uncertainty too high, alternative forecast scenarios should be developed.

» The forecast process should be regularly evaluated. The projections should be updated periodically as new data become available.

» Include appraisal by and recommendations from outside reviewers.

2024 Situation: Texas has 8.2 million single-family homes. After starting 2024 off strong but then substantially weakening over the summer, single-family home sales ended the year at about 330,000 units. Median home price for the year was trending to end at $343,000. Statewide single-family rents remained flat and were trending toward $2,200 per month at year end.

Single-family permits will come in at about 165,000 units in 2025, or 2.5 percent above the 2024 level. This will be the second year of growth in a row.

Moderating population growth and lower interest rates signal some price appreciation in 2025. Median home price will end the year just above $350,000.

Single-family rents will be flat to up slightly compared to their 2024 level, at about $2,200.

After being flat in 2024, home sales will increase some. While still below the 2021 peak, the projected 3 percent growth will be the first notable increase since the pandemic. Total units sold will be near 340,000.

2024 Situation: The state’s apartment market has over 2.5 million units, equating to one apartment for every 11 residents. In 2024, deliveries totaled over 116,000 units. Average per-unit monthly rent was flat and ended the year just above $1,400 per month.

Apartment deliveries will be much lower in 2025 than in 2024 as the under-construction pipeline has peaked. Statewide deliveries will be about half the 2024 total, or about 55,000 units.

Multifamily rent growth will soften some in 2025. Somewhat lower population growth and a large inventory will mean little to no rent growth through much of 2025. Rent will be negative in the most overbuilt markets and flat to slightly positive (perhaps 0.5 percent) statewide.

The following macro drivers are the most important determining factors in making a 2025 real estate forecast. Economic theory and actual historical performance suggest movements in one tend to accompany consistent positive or negative changes in others. Nevertheless, the level of certainty may differ across these metrics. The following color-coded icons convey TRERC’s level of uncertainty on all projections in this report.

2024 Situation: The Texas office market includes 1.2 billion square feet of leasable space, amounting to 82 square feet per payroll worker. This inventory grew by almost eight million square feet, or about 0.7 percent, in 2024. Statewide rents through 2024 ranged between $29 and $44 across major markets.

New deliveries will slow again in 2025, reflecting a smaller pipeline. About five to six million square feet will be added to statewide inventory, an increase of about half a percent.

Overall net absorption in 2025 will be slightly negative with new Class A space seeing strong absorption while older Class A and all Class B and C give up occupancy. The cumulative effect will be a negative 0.5 percent over 2025.

In 2025 rent growth will average 1.5 percent statewide across all classes. Premium, new buildings, which will account for a substantial portion of lease volume, command record-high rents. Much of the remaining inventory will see rent stagnation or concessions leading to rent decreases in real terms.

2024 Situation: Texas retail markets include 1.5 billion square feet of leasable space, amounting to 51 square feet per person. In 2024 a net ten million square feet was added to the inventory. Retail rent averaged $22.70 statewide in 2024.

Statewide inventory will grow by over six million square feet, or at about two thirds the rate of 2024. After an increase in 2024 to meet pent-up demand, the pipeline has slowed some.

By late 2024, net absorption was not keeping pace with new deliveries. This will be the case through much of 2025, with a cumulative year-end increase in net absorption of less than 1 percent of inventory.

Retail rent growth will soften in 2025 but remain positive at 3 percent over 2024 rates.

2024 Situation: The state’s industrial market has 2.7 billion square feet of leasable space, averaging out to 191 square feet per payroll worker. Inventory grew by 3 percent (83 million sf) in 2024. Rents across major markets ranged between $10.60 and $14.30 at year end.

The industrial pipeline has been shrinking since the peak in the pandemic. Total new deliveries will be down another 30 to 50 percent from 2024. The state should expect about 50 million square feet of deliveries in 2025, implying a statewide inventory increase of between 1 and 2 percent by December 2025.

With continued growth, Texas businesses will take up much of the new inventory. Statewide net absorption will be healthy at about 11 million square feet each quarter, or about 45 million square feet by the end of 2025. This amounts to a 1.5 percent net absorption rate.

Positive but weaker rent growth is expected overall in 2025. Expect to see some owner concessions, depending on market and product type. Big-box properties will lease more slowly than infill sites. Rent growth will fall early in 2025 and could strengthen some by year end with 3 percent growth overall.

2024 Situation: About 142.7 million acres comprise Texas’ rural land market. This accounts for approximately 83 percent of all Texas land. While median price rose year over year through 2024, the rate of growth has come in lower each quarter (through the third quarter). Conversely, the number of acres sold appears to have troughed in 2024 and, through the third quarter, it is higher than a year ago. Likewise, total dollar volume was positive year over year through the third quarter, for the first time in 2024. Overall, the market seems to be at an inflection point. Over the last year, market prices were sustained by sales of a high proportion of premium properties while less attractive land remained on the market longer.

With interest rates widely expected to be lower in 2025 than in 2024 and market sentiment on the rise, rural land sales volumes will be slightly higher in 2025 than in 2024.

MODERATE UNCERTAINTY

The following macro drivers are the most important determining factors in making a 2025 real estate forecast. Economic theory and actual historical performance suggest movements in one tend to accompany consistent positive or negative changes in others. Nevertheless, the level of certainty may differ across these metrics. The following color-coded icons convey TRERC’s level of uncertainty on all projections in this report.

Price expectations will likely moderate, with less lofty appreciation expectations in 2025. Median land price will come in lower, at least through the first half of the year.

MODERATE UNCERTAINTY

The TRERC forecast calls attention to new and emerging legal and regulatory issues. The Center expects potential impacts on real estate markets due to the following legal and regulatory issues. Their ultimate impact will depend on factors such as implementation and interpretation by the legal system and market participants.

At the federal level, President Trump will attempt to implement his agenda. The extent to which Congress will cooperate remains to be seen. Potential impacts include cuts to federal income taxes and federal spending. Spending cuts may include a reduction in federal government employees. Tariffs may have an impact on international trade and prices of goods and materials. TRERC also expects to see changes in federal agencies with respect to policies, rules, and enforcement.

The 89th Texas Legislature begins on Jan. 14, 2025, and filing has already begun. It’s still too soon to know what will pass, but the Legislature is likely to consider bills about:

» Property tax and/or appraisal reform

» Water and energy infrastructure

» Housing affordability

» Property rights and property owner associations

» Property insurance

» Illegal immigration

» Squatters

» School choice

» Foreign buyers

By Daniel Oney

This inaugural installment of our TG quarterly commercial column highlights the shifting fortunes of Texas office buildings with a focus on trends by property class.

It’s well known that office attendance has been slow to recover since employees were sent home during the lockdown of 2020. Even though Texas’ office-using employment has grown by half a million jobs since then, office use hovers at twothirds the pre-COVID level, according to Kastle Systems. This employment growth is not translating into significant office absorption (Figure 1). In the good old days, Austin and Dallas tenants added around 200 square feet for each new office-using job in the market. Houston’s energy-rich office economy was even more generous with absorption. Since COVID, all major markets have suffered with much lower absorption from new jobs.

Figure 1. Net absorption per new office-using job has collapsed

(average net sf absorbed per new office-using job in the MSA)

advantage of owner concessions and added space for growth.

(Trends vary. For example, see “The Verdict Is In: Legal Industry Key to Texas Office Markets” on trends in the Texas legal industry.)

The net effect of firms’ leasing activity has been felt differently across class. There appears to be a flight to quality, but firms have been much more interested in adding space in the best new buildings (Figure 2). This trend represents the decisions of newly arrived firms and existing firms choosing to relocate.

Figure 2. Premium buildings enjoy the little net absorption seen in Texas markets

(12-month net absorption as percent of inventory by class)

ment allowances. Still, asking rents reflect owner expectations and are the only systematic measure available.

With Austin’s generally newer office stock, there is little difference in asking rent growth between Class A+ and A buildings. In Dallas, A+ and C buildings have the highest rent growth. Opulent 1980s oil boom buildings lack the more efficient and environmentally certified attributes of newer properties. Historic Class C buildings often appeal to boutique firms and, in some lower-income submarkets, Class C properties are the only options. Houston’s office market, with nearly uniform rent growth across classes, still seems to suffer from the last energy bust. Its newer buildings lack significant pricing power. San Antonio’s asking rent growth resembles Austin’s, with higher classes enjoying higher growth. In the Alamo City’s case, however, slower but steady job growth and modest office deliveries allow the market to sort out a more normal rent structure.

Source: Texas Real Estate Research Center analysis of

Tenants continue to evaluate their leases in anticipation of future needs. Brokerages and data vendors like CoStar estimate that only half of the leases negotiated before 2020 have come up for renewal, so the full impact of new workplace policies is yet to be seen. While some firms have reduced space, others have taken

Note: A+ buildings are defined as primarily those built in the last five years in the highest-rent submarkets and with numerous amenities and solid sustainability ratings.

Source: Texas Real Estate Research Center analysis of

With ten million square feet of office space delivering in 2024, tenants have ample options. If we isolate the highest quality buildings (Class A+) we see that premium building owners in most markets enjoy positive net absorption. Most other classes are flat or losing occupancy across the state. The financial consequences of this sorting are playing out differently across our major markets. We know asking rents tell an incomplete picture. Anecdotes abound of significant concessions in terms of month’s free rent and generous tenant improve-

We are in the midst of an office resorting. Differences in local job growth and industry mix, combined with the unique legacies in each market’s office stock, will influence the outcome. The results will vary by market and even by neighborhood. New buildings in dynamic submarkets will continue to reap prestige tenants. Older Class A and good Class B buildings will stabilize with less choosy occupants. The fate of other buildings will be determined one by one as their (sometimes new) owner evaluates the prospects to renovate vs. convert vs. demolish. There will be spillover effects on surrounding properties, neighborhoods, and on local governments’ property tax base for years to come.

Daniel Oney, Ph.D. (doney@tamu.edu) is research director with the Texas Real Estate Research Center.

By Lynn D. Krebs

The last three years have been a wild ride for rural land market participants, but that cycle may be over. The Texas rural land market appears to be in flux and in search of a new direction. Annualized statewide price change continued to moderate, up 2.4 percent year-over-year through third quarter 2024 (Table 1).

While this rate of change may appear to indicate stabilization, some issues are worthy of discussion. First, market activity is still depressed (well below 2019 levels), and annualized total sales continued to decline, down 5 percent YOY.

Secondly, YOY price growth varied widely by region and was heavily influenced by recent sales price strength in Regions 1, 2, and 4, but it is worth

Table 1. Annual Change in Statewide Land Metrics, 3Q2024

noting that Regions 1 and 4 had substantial drops in total acres sold (Table 2). This is indicative of a market in which quality tracts are selling at higher prices while less attractive tracts are sitting on the market longer.

Though the number of sales was down in the third quarter, total acres sold was up 8.5 percent as the typical tract size jumped 36.6 percent. The typical size was pushed up by large tracts in Regions 1, 2, and 4. Statewide total dollar volume rose 11.1 percent over the prior annualized total.

Statewide median price rose to $4,737, which, as previously noted, was up 2.4 percent YOY. The real (deflated) price increased only 0.15 percent. The five-year compound annual growth rate (CAGR) is still strong at 9.92 percent, down from a peak of 10.85 percent at the end of 2023.

Prices declined 3.3 percent YOY in Regions 3 and 6. These were the only two regions with a YOY price decline. However, Region 7 was flat and Region 5 was up less than 1 percent.

Table 2. Annual Price, Sales Change by Region, 3Q2024

TRERC’s forecast model predicts small declines in statewide price followed by slightly more total acres sold over the next year. For this to happen, the dynamic described in the previous paragraph will need to change. It is likely that sellers will moderate their asking prices, which will attract new

6.

7.

Source:

While statewide annualized sales volume through Q3 was the lowest seen since 2Q2013, the rate of decline is the lowest since 1Q2022 when sales activity started to descend from the 2020-21 frenzy (see figure).

Regional price and volume dynamics indicate an unsettled market. Feedback from market participants consistently indicates many sellers are expecting prices that suggest a rate of appreciation that does not currently exist, at least not broadly. In other words, with the low volume of total sales, current market prices appear to be propped up by a relatively small number of well-off buyers securing premium properties.

buyers who will likely also be encouraged by lower interest rates. Additionally, many would-be buyers, fearful of the election and its potential aftermath, held off purchases. With the election over (and by the time of this publication the inauguration as well), those buyers may now be prepared to act.

Lynn D. Krebs, Ph.D. (lkrebs@tamu.edu) is a research economist with the Texas Real Estate Research Center.

For more information, see the Texas Real Estate Research Center’s rural land data page.

By Reid Wilson

• Texas land-use regulations include public and private rules, each affecting property use and value.

• Buyers and sellers should carefully examine land-use rules—including zoning, platting, covenants, and easements—to understand restrictions on the property.

• Rezoning, amending covenants, or modifying development plans can sometimes reduce regulatory obstacles, though these can be complex processes.

• Real estate professionals help gather information but should defer to legal experts on interpreting land-use regulations and advising clients.

Texas law permits both public and private regulation of land use. A landowner might be unaware of the regulations or their scope, or that third-party approval is required for a desired use. Regulations may limit a seller’s land value or marketability or prevent a buyer from accomplishing their intended plans for the property. Frustration and anger could lead to finger pointing, potentially even to litigation.

What is a licensed real estate professional to do?

To begin with, understanding the types of land-use regulations is critical. Regulations fall into two categories: public and private.

In Texas, public land-use regulations are primarily municipal and applicable only within city limits. Limited municipal regulations also apply in the extraterritorial jurisdiction (ETJ) of a city, which is a ring of land around cities—one-half to five miles in depth, depending on the city’s population. Under recent legislation (the constitutionality of which is being contested in court), an owner may opt out of the ETJ and avoid any city regulation.

Texas counties have limited landuse regulation authority, which does not include zoning but does include platting and a list of specific topics. Legal authority for imposing county regulations is derived from the local government code. Enforcement is by the applicable local government and can involve fines and criminal penalties or litigation seeking a judicial order to comply.

Zoning. Municipal zoning is a broad power held by all Texas cities of all sizes. It’s a discretionary process. Land use is regulated through a map showing geographic areas and a corresponding list or chart of permitted and prohibited uses (and definitions of those uses). Some uses are permitted only after sitespecific approval under a Special Exception or Special/Conditional Use Permit. If a desired use is not listed as permitted, then it is prohibited. City staff make the initial interpretation of whether a proposed use is permitted under the city’s regulations, and that decision must be promptly appealed or the owner’s right to challenge the interpretation could be lost.

If a use is prohibited, a multi-step discretionary rezoning process is

required to permit that use, which ultimately involves a city council vote after public notice and hearing. Rezoning can be political and is not final until the city council vote is completed. Neighbors have a statutory protest right, which triggers a super-majority vote requirement.

In addition to use regulations, zoning typically includes a long list of development limits such as lot size, building setbacks, height, and density. Some cities are adopting “form-based” zoning that focuses on detailed restriction of building and site dimensions and orientation. Some counties have limited zoning authority, primarily around specific lakes.

Platting. Platting is a government process regulating the division or development of land. It involves the creation of proper building sites, usually shown as lots, blocks, and reserves on the recorded plat. Once platted, the proper legal description of a tract is by reference the recorded plat and its specific tract designation.

Platting focuses on size/dimension of building sites, proper public access, and provision for proper government and private infrastructure (roads, utilities, drainage). The platting process relates to land development activities, not aboveground structures.

All cities may regulate platting within their city limits and ETJ (subject to owner opt-out of the ETJ). All counties may regulate platting within their county boundaries, but not within city limits. For most ETJs, the city and county are required to execute an interlocal agreement to allocate platting authority within ETJ (usually delegated to the city). Platting regulations outside city limits may not affect use or residential density.

Each local government is required to publicize (generally on their website) the requirements for a platting application. Platting is a rule-based process, and, if the applicant complies with the applicable rules, approval is required. After the platting process is initiated, the local government is required to proactively respond to the application and limit requirements to issues permitted by law through a detailed statutory process known in the development industry as the “plat shot clock.” If a local government ignores plat application timing, the application is deemed approved by operation of law.

Manufactured home rental communities outside city limits are exempted from platting and subject to a separate set of rules.

Building/Fire Code. All cities may adopt building codes, but they must be based on the International Code collection (a requirement added to ensure regulatory consistency throughout Texas). Counties have more limited authority, but they may regulate single-family homes and duplexes, but not manufactured or modular homes. Building codes protect citizens by imposing base safety and durability standards. Cities may adopt a fire code. Larger counties may adopt a fire code applicable only to commercial and multifamily structures.

Signage. All cities may adopt limits on signage, such as number,

size, type, lighting, and structure. Content of signage is not generally regulated due to constitutional protections of free speech under both the Texas and U.S. Constitutions. Sign regulations have dual purposes of aesthetics and safety (particularly traffic). City regulations may be extended to their ETJ. Counties do not regulate signage.

Drainage. All cities and counties may adopt regulations to ensure new developments properly handle drainage onto and from building sites. Some counties have authority to establish drainage districts controlled by the county. Drainage is regulated as part of the platting process or, if there is no new plat required, through development permits. Dams are regulated by the Texas Commission on Environmental Quality.

Private land-use regulations are established by private owners via recorded documents. Once the documents are part of the public record, all subsequent owners are deemed to have notice of these documents and subject to those regulations, even without actual knowledge or consent. Legal authority for these regulations is derived from contract law and real property law. Enforcement is by private lawsuit seeking a judicial order to comply and recovery of enforcement costs (and, in appropriate circumstances, damages for violation).

Restrictive Covenants. Owners might wish to restrict future use of their property for many reasons. For example, developers know poten-

tial homebuyers often like to have a clear, concrete understanding of future plans for a development before buying a home there, making lots in a comprehensively planned project more attractive—and therefore worth more—than lots in an unrestricted one. Or a landowner selling a portion of land may wish to protect the retained land from possible objectional uses or structures on the sold land. Such restrictions on future use are called restrictive covenants.

A restriction that is included in a deed when the land is conveyed is known as a “deed restriction.” When the restriction is contained in a separate document, it can go by various names, such as “Declaration of Covenants, Conditions, and Restrictions.” In all restrictive covenants, the owner agrees to the restrictions and, due to recording, all future owners are also restricted. Virtually any type of rational restriction is permitted. The terms and time period vary, but restrictive covenants commonly cover many of the same issues as public land-use regulations.

Restrictions may benefit specified individuals or entities (known as personal covenants) or designated land, such as an entire project or portion thereof (known as real covenants). Real covenants “run with the land” and bind all future owners until the restrictions terminate per their terms (although they may continue in perpetuity).

Restrictive covenants may provide for a comprehensive regulatory scheme for a multi-lot project (usually residential, but also commercial or industrial) to be managed by a property owners’ association.

The association is almost always a non-profit corporation created by the developer with a board of directors to make policy decisions benefiting the entire project. Initially appointed by the developer, the board is often controlled by the developer while the project is developed and sold

to the public, then transitions to a board elected by the property owners. This time period is known as the “development period” or “developer control period.” During this period, property owners may be frustrated by the developer’s control of the association and a perceived lack of owner input or consideration.

Most associations provide for mandatory assessments (without any opt-out right), which may increase as needed, but commonly with some limits. The association may enforce the applicable restrictive covenants. The association, either through the board or a separate architectural control committee (ACC), often must approve any development within the project. ACC approval is based on demonstrated compliance with the applicable restrictive covenants and is usually a broadly discretionary design/ architectural-style review. Discontent with association authority has led to a series of regulations in the property code.

Easements. An owner may grant a third party rights to use a portion of the owner’s land for that party’s benefit. This is called an easement. The owner retains fee ownership of the land subject to the easement, including the right to use that land for any purpose that does not interfere with the easement holders’ use rights. The owner is compensated for agreeing to the easement.

The easement is created by a recorded document setting forth the terms negotiated by the parties, such as location, use, duration, and maintenance of the easement. Once recorded, the easement burdens the land, and future owners are subject to the easement such that future use must accommodate the easement holders’ dominant rights.

The most common examples of easements are public or private utilities, private road access, and private pipelines. Several types of easements do not require a re-

corded document but are implied by physical use. These implied easements include easements by necessity, easements implied by prior use, and prescriptive easements. Ultimately, a court determines if an implied easement exists.

Most easements are for the benefit of specified land (known as appurtenant easements), and ownership follows the land benefited, even if the deed to the benefited land does not mention the easement. Pipeline easements are in a class of their own. They don’t necessarily benefit any particular piece of land, but rather are part of an assemblage of other pipeline easements to create a transportation system for liquids or gases (known as easement in gross).

Due diligence by the seller before the land is listed for sale and by the buyer before the land is purchased will reduce misunderstanding and disputes that could lead to litigation. In fact, most transactions have a due diligence period running from a few days for single-family houses to months for large land development transactions. During that period, the buyer may terminate the contract and the earnest money will be refunded, less an option fee retained by the seller, if the buyer’s due

diligence determines that the land is not acceptable for the buyer’s intended use and development.

Due diligence has several components.

Private land-use regulations are primarily based on recorded documents that should be listed in the Commitment for Title Insurance generated by the title company handling the transaction. They should be listed in Schedule B, with all restrictive covenants listed in Section B-1 and any recorded easements listed in later subsections.

Public land-use regulations are generally available on the website of the applicable city or county, but they are not generally listed in the title commitment. MuniCode, a private company that assists cities in their regulations, lists many city regulations on its website.

Determining whether land is within the city limits or ETJ is important. This can be done either by specifically requesting the surveyor to include that information on the land survey or by reviewing online maps on the city’s website.

Most cities and many counties will send a letter to a potential buyer listing any known regulatory deficiencies of a site and stating the applicable zoning district. Such letters often provide other pertinent information, including which uses are permitted. However, under Texas law, a local government is rarely held to such a letter if a later review determines it was erroneously issued. There are third-party services that prepare land-use reviews and issue reports. These are common in commercial transactions, particularly when a national lender is involved. Private land-use lawyers also provide this service.

the Land. Although covenants and easements are legal in nature, a layperson usually can, with diligence and patience, understand them well enough to generally determine how they might impact a piece of property. A review should focus primarily on permitted and prohibited uses and any limitations on size/density/ placement of new structures.

Public regulations can be extensive and complicated, but, as with private regulations, they are often understandable by a layperson. Zoning ordinances are, by far, the primary concern, particularly the applicable zoning district and the related-use list/chart (and related definitions). Each zoning ordinance has a related zoning map showing all districts. Ordinances and maps can usually be found on a city’s website. Once the zoning district is determined, identifying the permitted uses is simply a matter of finding either the unified-use chart or the separate sections applicable to the particular district (depending on how the zoning ordinance is drafted).

Through this process, someone may determine if the existing struc-

tures/uses are compliant with existing regulations and whether those regulations permit new structures/ uses that are consistent with highest and best-use valuation or the specific desires of an owner or buyer. If not, the owner or buyer should seek specialized legal counsel. Beware: This analysis can take weeks, not days.

Many options are available that can mitigate troublesome regulations, but they may not apply in all situations and could be too difficult, expensive, or time-consuming to be practical. Examples include:

• Legal consultation may conclude the regulations do not apply to the land, have lapsed, or don’t limit the use or structure. This process requires the assistance of qualified professionals plus a supportive title company.

• Restrictive covenants or easements may be amended, but this requires third-party consent.

• Rezoning may change use districts or amend regulations, but it requires time for the process leading to city council approval.

• The desired development might not be prohibited outright, but simply require certain government/ACC approvals. These approvals might be achievable with delay in closing and active engagement in the government/ ACC approval process.

• Non-compliance uses or structures might be allowed to continue through a variance process.

• Modifying the proposed project might yield a comparable result acceptable to the buyer, or the footprint of the land sold can be modified to avoid the most problematic regulation.

Deciding How to Proceed With the Transaction. Land can suffer a loss of marketability and value when problematic land-use regulations aren’t resolved, so it makes

sense for all parties to patiently and reasonably consider their options when dealing with these unforeseen complications.

When land-use regulatory issues are discovered, the buyer should always seek an extension of the due diligence period for further analysis. Sometimes the parties, assisted by legal counsel and licensed real estate professionals, can keep all parties at the table, working cooperatively to solve a regulatory problem and preserve the deal.