IS THE PARTY OVER?

The UK says it wants a conscious uncoupling from China. But at what cost?

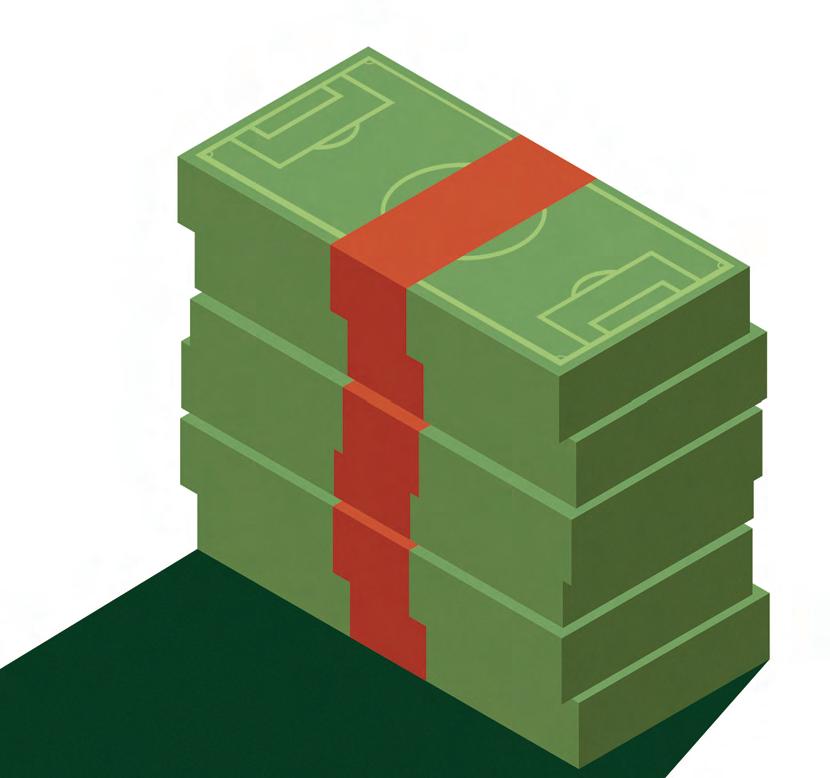

BEAUTIFUL GAME

Corruption has tainted football’s image, but new governance is in the offing

ALL SHOPPED OUT?

Why there’s hope for the high street despite a three-pronged attack

CARBON CHALLENGE

The rocky road to meeting net-zero targets

THE JOURNAL FOR THE CHARTERED INSTITUTE OF PUBLIC FINANCE & ACCOUNTANCY MARCH/APRIL 2023 PUBLICFINANCE.CO.UK

Gain a clear understanding of how your frontline services are performing to make robust and sustainable decisions. With a comprehensive collection of dashboards spanning a range of frontline services, CIPFAstats+ gives you access to powerful data insights

well as community outcomes.

New for the 2023/24 subscription year: new dashboards will be added to cover the following areas, Levelling up, Cost of Living, and Grants.

We will be enhancing the quality of the analysis across all our dashboards by the inclusion of new statistical techniques, visualisations and key indicators. And, for

historical data Predictive Analytics will be included, using machine learning algorithms , to build a model capable of generating evidence-based, robust predictions of a

Book your demo visit cipfa.org/services/cipfastats

email customerservices@cipfa.org

call +44 (0) 20 7543 5600

Redactive Publishing Ltd, 9 Dallington Street, London EC1V 0LN publicfinance.co.uk @public_finance_

EDITOR

Chris Smith 020 7324 2796 chris.smith@publicfinance.co.uk

GROUP EDITOR

Jon Watkins 020 7324 2788 jon.watkins@publicfinance.co.uk

REPORTERS

Oliver Rudgewick 020 7324 2768 oliver.rudgewick@publicfinance.co.uk

Calum Rutter 020 7324 2794 calum.rutter@publicfinance.co.uk

SUB-EDITOR

Caroline Taylor caroline.taylor@redactive.co.uk

LEAD DESIGNER

David Twardawa 020 7324 2704 david.twardawa@redactive.co.uk

PICTURE EDITOR

Claire Echavarry 020 7324 2701 claire.echavarry@redactive.co.uk

SENIOR DIGITAL CONTENT EXECUTIVE

Daniel Kelly 020 7324 2745 daniel.kelly@redactive.co.uk

SALES

020 7880 6203 advertising@publicfinance.co.uk

RECRUITMENT SALES

020 7880 7621 pfjobs@redactive.co.uk

PRODUCTION MANAGER

Aysha Miah-Edwards 020 7880 6241 aysha.miah@redactive.co.uk

ACCOUNT DIRECTOR

Joanna Marsh 020 7880 8542 joanna.marsh@redactive.co.uk

PRINTING

Warners Midlands

To subscribe to Public Finance at the annual UK cost of £100, call 01580 883844 or email subs@redactive.co.uk. International annual subscriptions are in the £130-£205 range.

Public Finance is editorially autonomous and the opinions expressed are not those of CIPFA or of contributors’ employing organisations, unless expressly stated. Public Finance reserves the copyright in all published articles, which may not be reproduced in whole or in part without permission. Public Finance is published for CIPFA by Redactive Publishing Ltd.

Public Finance, Redactive Publishing Ltd, 9 Dallington Street, London EC1V 0LN

ISSN 1352-9250

CHRIS SMITH

Plusça change…

The more things change, the more they stay the same. The 1849 quotation from French writer Jean-Baptiste Alphonse Karr is the central theme to this edition of PF, and we’re daring to be optimistic about the future. We’re thinking how challenges evolve over time and how we respond to them. If you were around in the 1970s and early ’80s, you’ll recall TV news reels about the trial of the Gang of Four in China and the Cultural Revolution.

In just a few short years, what was a country largely closed to the West became a central part of our lives. Has the Great Unravelling begun? The prime minister seems to think so, and that has implications for public finances. So we’re considering if it is more complicated than a trade spat.

Tel: 020 7543 5600 Fax: 020 7543 5700

Email: corporate@cipfa.org

Address: CIPFA, 77 Mansell Street, London E1 8AN

We want to know what visionary projects look like, and have been privileged to find out more about how The Clink Charity is breaking the cycle of offending.

The high street also needs some inspiration, because its future is critical for communities across the UK – as well as public sector balance sheets. Internet shopping isn’t sustainable, and small traders – which make up the majority of UK employers – can’t do it all themselves.

Average circulation

13,428

(Jul 19–Jun 20)

In an earlier life, I was part of a team working on a regeneration project backed by Chinese investment. It didn’t materialise, and a new backer is now being sought – in all probability, a property developer. The local community remains left behind, and there has been no attempt to enable them to create the science or engineering start-ups we badly need. The project and the UK are in no-man’s land.

Later in the edition, we go back in time. Our quest to find the oldest copy of PF brought a response from John Harker, who shared his edition from 1976. War was driving uncertainty, a Democrat president was setting his agenda in the US, and Britain was in financial crisis. Sound familiar?

John shares how public services responded, as well as some familiar issues – reporting standards were a concern. He reminds us that we’ve been here before and got through it. We can do the same again.

I hope you enjoy the edition.

CHRIS SMITH Editor chris.smith@publicfinance.co.uk

PUBLICFINANCE.CO.UK 3 EDITORIAL WELCOME

Best Magazine Launch or Re-launch Memcom Membership Excellence Awards 2021 Best Association Magazine (circulation under 25,000) The Association Excellence Awards 2021

In 1976, war was driving uncertainty, a Democrat president was setting his agenda in the US, and Britain was in financial crisis. Sound familiar?

Health and care integration is not a new phenomenon but has been a constant and

Over time, integration has moved from voluntary partnerships with no formal accountabilities. The Health and Care Act 2022 (the Act) put integrated care systems (ICSs) on a statutory footing, and provides a legislative framework that moves away from competition in the NHS and aims to better support collaboration and partnership working.

CIPFA believes that for integration to be a success, a whole systems approach to public

Our recent publication, Integrating care: policy, principles and practice for places, aims to support such an approach. It provides an overview of the changes as a result of the Act and what integration is seeking to achieve.

CIPFA’s Integrating care: policy, principles and practice for places is available as a free download on the CIPFA website.

Learn more: visit cipfa.org/services/integrating-care email customerservices@cipfa.org

call +44 (0) 20 7543 5600

NEED TO KNOW

7

reoffending, asks The Clink Charity CEO

34 Whole new ball game

New governance aims to address corruption and bribery in football

40 High hopes

What does the future hold for the high street?

48 In it together

A PF round table explores strategies to navigate the challenges ahead

IN PRACTICE

20

Why

PUBLICFINANCE.CO.UK 5

Catch up CIPFA to review atrisk councils; Treasury spending controls

News analysis Cost of going green; children’s services reform

News analysis Indian infrastructure boost; Ukrainian budget

Big picture Germany ‘frees the leopard’ for Ukraine

Campaign

World in numbers

Safety at stake

NHS estate is crying out for capital investment

The Chinese way There are lessons we could learn from China 39 Governing by committee CfGS takes another look at the committee system 45 Play list Buildings that boost quality of life IN

10

12

14

16

17

OPINION 19

The

25

DEPTH

Exit the dragon?

UK may be ‘standing up to’ China, but how much

political rhetoric?

Interview

The

is

28

CONTENTS MARCH / APRIL 2023

won’t the UK fund services proven to reduce

55 Radical thinking Carbon pricing solutions

57 Social fix Integrating health and social care

houses? The building safety levy

Déjà vu

Pensions

LGPS

58 Safe as

59

1970s local government 60

Three vital updates for

schemes

and careers Crypto roles at Treasury

Speak easy Encouraging staff views

Events

On account

police finance

Last word 28 40 34 63 20

61 Jobs

63

64

65

Improving

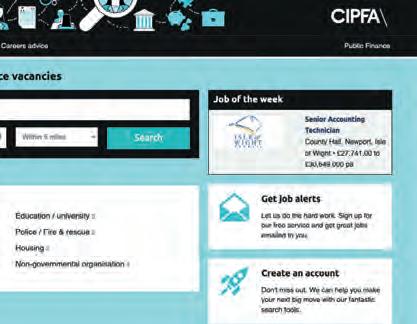

66

Robust and compliant procurement is key in the delivery of public services as organisations need to meet statutory obligations and deliver value for money for taxpayers. CIPFA is committed to helping public sector organisations reduce the costs and risks associated with procurement to improve outcomes. We offer:

• Advisory and consultancy: CIPFA offers end-to-end support for systems, outsourcing and service procurement –from market testing and business case and selection.

• Lifelong learning: CIPFA offers several training courses to help upskill staff and strengthen good procurement and contract management practices.

• CIPFA Procurement and Commissioning Network (CPCN): The CPCN is a leading and popular forum for public sector procurement practitioners, offering valuable guidance, updates, networking and training on a wide range of procurement areas.

• CIPFA Property Networks: Whether building homes, hospitals, schools or roads, CIPFA’s property networks will keep you up-to-date with the latest thinking, helping you with your procurement journey.

Find out more: contact us to discuss how we can help you tackle your procurement challenges.

visit email chris.tidswell@cipfa.org call

p9

WHITEHALL POWERPLAY

‘Levelling up’ could fall prey to capital spending restrictions

p11 GANG CULTURE

Kids in care remain vulnerable despite service reforms

INSPECTION CIPFA reviews set to tighten intervention process

By Calum Rutter

By Calum Rutter

The government has chosen CIPFA to scrutinise select councils’ finances and governance, to inform any intervention it then decides to make.

The institute, along with Grant Thornton and the Good Governance Institute, will carry out “targeted external assurance reviews”, aiming

p13

‘ZERO-TOLERANCE’

Ukraine targets corruption as it budgets for rebuilding

to present a comprehensive picture of the challenges, risks and issues local authorities are facing, revealed the Department for Levelling Up, Housing & Communities. These will include the impact of rising inflation, economic uncertainty, increased service demand and the continuing effects of Covid-19.

PUBLICFINANCE.CO.UK 7 NEWS / ANALYSIS / OPINION / DEBATE

Photography: Alamy

CIPFA confirmed that its programme is separate from its discussions with Warrington Borough Council

CATCH UP

MARKETS QUESTION BANK OF ENGLAND DIRECTION

Reductions in some long-term gilt yields have come despite Bank of England interest rates hikes. David Blake, director at treasury adviser Arlingclose, told PF: “The assessment from the markets was that the [Bank] might end up over-egging the pudding, putting rates up to too high and having to correct them.”

The evidence gathered will inform any further actions DLUHC believes are necessary.

“Local authorities are no exception [to the pressures on the entire public sector] and are facing some tough challenges as they continue to deliver their essential services in very difficult circumstances,” said CIPFA chief executive Rob Whiteman.

“I am really pleased that CIPFA has been chosen as the lead reviewer, which is a testament to our expertise around financial management in local government.

“As ever, we remain committed to the public sector, and I hope that these reviews will bring about positive outcomes for those involved.”

CIPFA confirmed that the programme is separate from the recently announced discussions set to take place between the institute and Warrington Borough Council.

“The financial sustainability of many councils remains precarious, and local leaders are facing myriad challenges, including double-figure inflation, rising

interest rates and growing demand for services,” said Phillip Woolley, partner and head of public sector consulting at Grant Thornton.

“This work represents an important step in ensuring there is a collective plan across both central and local government for helping those who are most at risk.”

Professor Andrew Corbett-Nolan, chief executive of the Good Governance

Institute, said that governance is the key to financial recovery at challenged councils.

“The reviews will help local authorities establish a platform to build on and enable them to better service their local communities, while at the same time dealing with pressing financial issues,” he said.

The government also announced that CIPFA would be reviewing Eastleigh Borough Council in Hampshire for potential “excessive risk” from debt.

The council gets income from commercial interests, including a DIY store and a sports ground.

Local government minister Lee Rowley said: “The council remains one of those with [a] larger amount of debt... and a reliance on commercial income.”

INTERNATIONAL

Pension reforms look uncertain for France

Attempts by the French government to reform pensions have met stiff resistance.

More than 750,000 people took to the streets across the country in February during three days of action against plans to

Dateline move for valuations criticised

raise the retirement age from 62 to 64. It followed a national walkout in January, when a million people protested.

Public transport and oil refinery deliveries were part of the disruption, aimed at challenging president Emmanuel Macron. The action was timed to coincide with government debates on the legislation.

Parliamentary arithmetic – and striker numbers – will clinch the issue, as the president lacks a working majority, with opposition from left- and right-wing parties.

Government proposals to move the date for annual Local Government Pension Scheme valuations just weeks before they take place will create further administrative burdens for funds, experts have said.

Under LGPS regulations, pension scheme members face paying more in tax if the change in their pension value exceeds a yearly limit set by HMRC.

Currently, funds calculate yearly changes in pension values based on annual CPI inflation from the previous September

– and apply these changes on 1 April. But HMRC currently calculates its allowance on 6 April, based on CPI inflation from the previous September.

Ian Colvin, head of LGPS benefit consultancy at pensions consultancy Hymans Robertson, said: “Matching the dates up does make sense. But the concern for me now is the timescale. We have a twoweek consultation and then all the LGPS funds will have to update their systems to make this change.”

8 PUBLIC FINANCE MARCH/APRIL 2023

NEED TO KNOW

This work represents an important step in ensuring there is a collective plan

PENSIONS

IN BRIEF

Treasury power grab will hit ‘ levelling up’

By Oliver Rudgewick

Capital spending restrictions imposed on the Department for Levelling Up, Housing & Communities will hamper local authority investment and harm the government’s flagship policy, experts have warned. The Treasury has barred DLUHC from approving new capital spending without its sign-off.

A DLUHC spokesperson told PF that robust spending controls are a normal way for the government to ensure departments are delivering value for money: “The government’s central mission is to level up every part of the UK by spreading opportunity, empowering local leaders and improving public services. DLUHC will continue to deliver its existing programme of capital projects as planned.”

Zoë Billingham, director of thinktank IPPR North, said the move puts the Treasury “firmly in the driving seat for many decisions on ‘levelling up’”.

“The Treasury has been on a go-slow on ‘levelling up’, so this is concerning

for what is electorally still the government’s flagship agenda,” she said.

“For councils, this will likely mean delays on funding decisions, but what this really points to is the impact of central government taking decisions that should be held locally. Citizens should not have to wait to have basic housing improvements because of Whitehall powerplay.”

Jonathan Werran, chief executive of local government think-tank Localis, told PF that the decision marks a breakdown in trust between the Treasury and DLUHC, but said the announcement overshadows wider financing issues that councils are facing in meeting their capital needs.

“It does betoken a need to have a more sustainable long-term means of investing in place,” Werran said.

“It is stopping a route of capital finance for local authorities, which isn’t the entire answer, but, with the patchwork of funding needs, might be a significant gap in the defences.”

Residents take hit for financial failures

Allowing three struggling local authorities to raise council tax beyond the normal limit only pushes the cost of their failure onto residents, experts have said.

Thurrock and Slough will be able to increase council tax by an extra 5%, and Croydon by 10%, on top of the standard 5% rise already allowed next year, without triggering a referendum.

“Council tax payers suffer, but it is central departments that dropped the ball,” said PAC chair Meg Hillier.

Scotland targets higher earners for tax increases

Scottish government proposals for increasing taxes on higher earners to fund more generous benefits are more progressive than in the rest of the UK, but are at risk of being avoided, the Institute for Fiscal Studies has warned.

The draft 2023-24 budget proposed increasing the top two rates of income tax by 1p per pound, to 42% and 47% respectively, and freezing the majority of tax bands.

Hong Kong lures tourists with free flights

The Hong Kong government is set to give away 500,000 free air tickets from March in a bid to entice visitors.

The ‘Hello Hong Kong’ campaign will run for six months and will cost HK$255m directly, with a further HK$100m spent on promotion.

After the Covid-19 lockdown and high-profile demonstrations against the government, the country’s tourist trade has suffered.

PUBLICFINANCE.CO.UK 9

Photography: Getty

WHITEHALL

TACKLING CLIMATE CHANGE

It’s not easy being green

The political and financial costs of meeting net-zero targets are becoming

By Oliver Rudgewick and Chris Smith

Indications of the challenges ahead in reducing carbon emissions have emerged as work gets under way to meet the legal target of net zero by 2045.

1 Political wrangling over UK delivery has begun

The UK government announced the creation of a new Department for Energy Security & Net Zero, tasked with securing our long-term energy supply.

Prime minister Rishi Sunak said: “The move recognises the need to secure

clear

more energy from domestic nuclear and renewable sources as we seize the opportunities of net zero.”

But two Conservative mayors, Andy Street and Ben Houchen, said devolving more money was the way to create more green jobs.

“This is about pounds, shillings and pence as much as environmentalism,” said Street.

And Whitehall expert Jill Rutter warned that curbing the Treasury’s power had to come first.

She said: “[I’m] not clear this is the answer if you

are serious about energy and climate change. The Department of Energy & Climate Change made a lot of progress decarbonising power, but was too weak to influence beyond that.”

4 Infrastructure reboot is too slow

Campaigners and industry argue that the pace of green energy development is glacial. In England, just two wind farms were built last year, generating less than 1MW.

2

Behavioural change in a city isn’t easy New York has started phasing out natural gas from housing developments – and that could move domestic markets.

New York governor Kathy Hochul passed a bill that effectively bans gas in new buildings, starting in 2024 for those under seven stories and in 2027 for anything taller.

The New York Post claimed the ban “would affect oldtimers and millennials, who are obsessed with castiron pans”. A 70-year-old Brooklyn resident told the paper: “We lost electricity… during Hurricane Sandy. The only thing we had to heat up our food was gas. What if that happens again?”

3

Scotland the brave?

Cannock Chase District Council changed its netzero goal from ensuring the entire area was carbon-neutral by 2030 to simply the authority’s own operations, because a report estimated that the former would need more than £4bn of investment.

Scotland’s net zero, energy and transport committee said that while councils are best placed to fight climate change, wider funding constraints are seeing authorities prioritise resources to support services.

The Energy Networks Association revealed that up to 600 projects in England and Wales, with a combined capacity of 176GW, are waiting to be connected to the National Grid – up to 2036.

“Nobody can hold a project for that long,” said one industry insider.

5 Clean air brings a filthy row

The capital’s streets are gridlocked, but plans to charge motorists with older cars are deadlocked.

The Ultra-Low Emissions Zone expansion has turned into a flashpoint for London mayor Sadiq Khan. He wants the scheme live in August, but 11 London boroughs are either against the expansion or are calling for a delay. A court battle looks likely, a protest group has formed, and there was even a petition for a referendum.

Harrow leader Paul Osborn shared his concerns for the future of ULEZ if the expansion is given the green light, suggesting that it would be unwise to move ahead with the plans amid the cost-of-living crisis.

“Expanding the zone when inflation is at 10%, when energy bills are going up, when fuel bills are going up, when people’s food prices are going up; it’s not the right time to do it – even if it was the right solution,” he said.

10 PUBLIC FINANCE MARCH/APRIL 2023 NEED TO KNOW NEWS ANALYSIS

New York state will phase in a ban on gas in new buildings, starting in 2024

This is about pounds, shillings and pence as much as environmentalism

Reforms fail to tackle gang exploitation of kids in care

By Oliver Rudgewick

Children in care remain at risk of gang exploitation unless the government develops a clear plan to effectively regulate private care providers, an expert has said.

The UK government’s children’s social care implementation strategy proposed greater financial oversight of providers. But it also risks reversing progress made on removing gang influence over homes.

The plan outlined spending of £200m by 2025 on improving sector pay, hiring more social workers and piloting new family help services.

However, Sarah Parker, research and development officer at youth charity Catch22, criticised the plan, saying it lacked changes to the oversight of homes, which is key to reducing child exploitation.

More than 2,000 county lines are operating across the UK, according to the National Crime Agency

90% of English police forces have seen county lines activity in their area

27,000 young people are involved in county lines (Home Office), including 4,000 teenagers in London alone (Children’s Society)

“This strategy is a missed opportunity,” she said.

“There is a huge issue with insufficiency, both in terms of foster carers and appropriate accommodation.

“Preventing gangs from targeting vulnerable children is hard; as long as a child has a phone in their hand, they are accessible to people who wish to harm or exploit them.

“This is why children require care up to the age of 18, and some unregulated accommodation falls woefully short of that.”

Parker said the lack of funding to support mental health and exit from care is also harming the ability to tackle gang influence.

“[Young people] also need greater material and emotional support, and access to services and opportunities such as financial advice or help finding work,” she said.

Analogue shift

According to the National Youth Agency, the data on child exploitation reveals changes .

During lockdown, police operations shut down 102 lines. “But child criminal exploitation continues,” warned the NYA.

After their EncroChat phones were compromised, organised crime gangs have shifted to handwritten notes and verbal communication. Phones are for foot soldiers. And recruitment has diversified in both social media platforms and types of young people.

The NYA thinks the solution is analogue: “Detached and outreach workers know their area, and the young people in them, and are best placed to identify and respond to the changes in county lines.”

“This is particularly true when it comes to living semiindependently.”

Exploitation of children in care has become more prevalent in recent years, and the Children’s Society said the cost-of-living crisis could put more people in danger.

Research from the charity showed that 51,000 children’s bank accounts were used for fraud in 2021 – a 21% increase on the previous year.

The National Police Chiefs’ Council said fighting county lines crime remains a top priority, including prevention and safeguarding work.

NEED TO KNOW NEWS ANALYSIS

PUBLICFINANCE.CO.UK 11

Photography: Alamy, iStock

FACT FILE

CHILDREN’S SERVICES

Reforms to children’s social care are a missed opportunity – and won’t stop ‘exploitation’, experts say

India’s government has set its sights on a major building programme to overhaul infrastructure and meet net-zero targets.

In her Budget speech, finance minister Nirmala Sitharaman set a capital budget of INR10trn (£99bn) next year – a 33% year-onyear rise, and equal to 3.3% of gross domestic product.

The 2023-24 Budget has outlined INR35trn (£347bn) of revenue spending, with the Ministry of Defence set to receive the most funding at INR6trn (£59bn).

She said the Budget proposals mean capital spending will have tripled since 2019-20, adding that the investment will stimulate growth and “cushion against global headwinds”.

“Investments in infrastructure and productive capacity have a large multiplier impact on growth and employment,” Sitharaman said.

“After the subdued period of the pandemic, private investments are growing again. The Budget takes the lead once again to ramp

India goes for growth with infrastructure boost

this year – India’s fiscal year ends in March. This will reduce to 5.9% next year, before contracting further to 4.5% by 2025-26.

Investment in the transition to net zero will also ramp up next year, including a ‘green credit programme’ to encourage the use of renewables and carbon reduction by businesses and local bodies.

The Budget includes INR350bn (£3.4bn) of priority capital funding towards renewable energy and energy security.

By Oliver Rudgewick and Chris Smith

up the virtuous cycle of investment and job creation.”

Sitharaman announced that up to INR1.3trn (£12.8bn) has been set aside in 50-year, interest-free loans to state governments to “spur investment” in infrastructure.

It is a critical issue. S&P Global Ratings highlighted

March of the makers

Manufacturing is back. President Biden has focused the US budget on supporting makers, and India is doing the same.

S&P Global Ratings projects India’s GDP to grow around 8% for the next three fiscal years. The Indian government will significantly boost the manufacturing sector to contribute about

25% of GDP by 2025, from below 16% currently.

The shift comes as China moves toward consumption-led growth.

But it won’t come cheap – the Indian government estimates that it requires US$1.5trn in infrastructure investments over the next decade.

See cover story, p20

warnings from experts that corporate growth is being held back by an infrastructure deficit. Part of the problem is a cost of up to 5% of GDP resulting from inefficiencies.

Under the proposals, states will have to spend the funds in 2023-24 on new police stations, libraries and digital infrastructure. They will be allowed a fiscal deficit of 3.5% of their GDP, of which 0.5% will be tied to power sector reforms, the Budget stipulates.

Sitharaman also announced tax cuts for the “hard-working middle class” just over a year before the general elections in April and May 2024. The government has proposed lowering the top rate of tax from 42.7% to 39%.

Ministers have forecast a fiscal deficit of 6.4% of GDP

The announcement coincided with the opening of the first stages of a £10.8bn expressway to link Delhi with Mumbai. The route will ultimately cut road travel down to 12 hours.

But it also signals India’s intention to catch up with geo-political rival China.

That point hasn’t been missed by investors, as S&P Global Ratings pointed out in a recent report: “India’s ambition of sustaining its relatively high growth depends on one important factor – infrastructure. The country, however, is plagued with a weak infrastructure, incapable of meeting the needs of a growing economy and growing population.”

It added: “Timely execution of projects within budgeted costs will be a key challenge, even if funding is available for economically viable projects.

“Power generation and transmission are improving, but transportation infrastructure capacity constraints continue to limit corporate performance and investments.”

12 PUBLIC FINANCE SEPTEMBER/OCTOBER 2020

MARCH/APRIL 2023 NEED TO KNOW NEWS

ANALYSIS

Photography: Getty INFRASTRUCTURE

The Indian government is raising capital spending in 2023-24, in a bid to ‘ramp up the virtuous cycle of investment and job creation’

$9bn

The approximate amount of international aid money needed by Ukraine to keep its government and military operating each month

Ukraine sets sights on the future and purges graft

needed to quicken. Nato secretarygeneral Jens Stoltenberg said delivery of military assistance to Ukraine should be expedited.

Alongside the plea to world leaders from Ukraine to continue their financial support came a visible sign that graft was also going to be tackled.

Zelenskyy acts

Rumours of money not reaching its intended projects were answered with a series of high-profile and swift sackings.

By Oliver Rudgewick and Chris Smith

By Oliver Rudgewick and Chris Smith

The Ukrainian government has earmarked a major tranche of new spending for small businesses and crumbling infrastructure, while targeting corruption infrastructure, and this figure would rise to $15bn to meet European best practices.

The Ukrainian parliament has approved an amended Budget bill, earmarking an additional UAH10bn (£224m) in loans, grants and credit funds this year.

The Ministry of Finance will allocate more than UAH4.5bn (£101m) to help renew rolling railway stock, and repair the airfield and energy infrastructure at Lviv airport.

More than UAH2.5bn (£56m) will be used to rebuild and modernise hospitals and bridge infrastructure, and a further UAH1.3bn (£29m) will provide grants for small and micro-businesses.

The remainder of the funding will be spent on improved border checks and partial loan guarantees for farmers.

A year on from the Russian invasion, Ukraine said it needs around $9bn of aid per month to fund its military and keep government services running.

Part of this would go to creating a universal basic income for all Ukrainians, to helping people who have lost their jobs and to providing emergency accommodation for the homeless.

President Volodymyr Zelenskyy made his first state visits to the UK and France, aiming to garner further financial support.

His ministers said it would cost $6.4bn to repair and rebuild damaged medical

The Ministry of Health said its draft Healthcare Infrastructure Recovery Plan will prioritise rebuilding hospitals, improving mental health and rehabilitation services to ensure they are compliant with EU legislation.

Deputy health minister Ihor Kuzin said: “During the past year, we have been synchronising with international partners to move in unison on the restoration of the healthcare system and to coordinate the technical support from various international sources.

Fighting intensifies

The focus on rebuilding came despite intensified fighting, particularly around Bakhmut, and indications that Russia was readying for a spring offensive.

Western military leaders made clear that the pace of support from allied countries

President Zelenskyy announced the departure of Ruslan Dziuba as deputy commander of the National Guard.

It was announced in a decree issued by the president’s office and did not come with an explanation.

Zelenskyy had already made clear that the Defence Ministry needed to get a handle on where money was going to ensure corruption didn’t hand the military advantage to Russia – or upset international donors.

The ministry revealed that audits had led to hundreds of officials being disciplined for failings.

The president said: “The purity of the work of state structures must be guaranteed.”

NEED TO KNOW NEWS ANALYSIS

PUBLICFINANCE.CO.UK 13

UKRAINE

Leopards change Germany’s spots

Asmall number made a historic change for Germany.

The country’s post-war reluctance to be drawn into battles ended with an historic Zeitenwende or turning point – the decision to send 14 Leopard 2 tanks to Ukraine ahead of a likely spring offensive by Russia.

It followed days of soul-searching among the country’s politicians – and relentless pressure from Poland and other EU countries that wanted to send some of their German-made Leopard 2 tanks under licence.

The announcement came after an allied summit in January at Ramstein airbase failed to get agreement. In response came a wave of protests across Germany, urging the government to ‘Free the Leopard’.

German chancellor Olaf Scholz faced a tough decision. His SPD party has historically respected Russia and been suspicious of Nato. The country’s leaders have been mindful of its history in military involvement since the Second World War. Some politicians raised fears of a Russian escalation.

A deciding factor was a missile strike on a Ukrainian apartment block, killing dozens of civilians. A government spokesman said the decision “follows our well-known line of supporting Ukraine to the best of our ability”.

As well as Poland, the US is sending at least 30 M1 Abrams tanks – part of a fresh $2.5bn support package – and the UK is sending 14 Challenger 2 tanks.

Russia’s response was that the tanks would “burn like all the rest”.

Photography: Getty 14 PUBLIC FINANCE MARCH/APRIL 2023 NEED TO KNOW BIG PICTURE

UKRAINE

PUBLICFINANCE.CO.UK 15

Counting the cost: online safety

Unlimited social media access is risking lives and costing money. Ministers are under pressure to act

Police chiefs have urged ministers to place a legal duty on tech firms to prevent livestreaming during a major incident.

PF understands the government is being asked to include a ‘Christchurch clause’ in its online safety legislation, which would prevent terrorists broadcasting on social media. It is named after the 2019 atrocity in New Zealand, in which 51 people died.

It is part of the ongoing negotiations with politicians and the legislation team at the Department for Culture, Media & Sport. The Online Safety Bill received its second reading in the House of Lords on 1 February.

Campaigners, including the Molly Rose Foundation, want tech firms to face penalties if they don’t restrict access to harmful online material. The charity is named after Molly Russell, who was 14 when she committed suicide after viewing content directed to her by web algorithms.

Her father, Ian, said the material would not have been published by the traditional media: “This harrowing content was reviewed during last year’s inquest into Molly’s death by a child psychiatrist, who described it as ‘very disturbing’.

“I have never met a parent who has been happy with their child viewing this kind of content. It drove my daughter to take her own life.”

The cost of online harm is estimated to be £365m a year, but PF has urged DCMS to calculate an accurate figure for the cost placed on the public sector.

Police forces are warning that unrestricted livestreaming is a security risk and that broadcasts could affect future trials –as well as posing a trauma risk. A case is being investigated where a defendant livestreamed sentencing from their phone, despite legal restrictions.

MEDIA Agenda: Whitehall funding

Council budget negotiations and ‘levellingup’ announcements put local funding on the agenda at the start of the year.

PF responded to an article in the FT on regional funding in January with a letter that was published in full.

The FT rightly pointed out local communities have almost no say in funding decisions that affect the places where they live.

PF argued there are alternatives to the current funding system, which dates back to the poll tax

era - not least, the option of giving people the chance to invest in their own communities.

We said: “The biggest stumbling block… is that most local challenges involve every agency: councils, the NHS, policing and education. The current approach leaves no time or money for problem-solving.

“Some councils can weather the storm because they have reserves or [are] fêted with favourable grants from central government to keep them on side.”

Read our full opinion at publicfinance.co.uk

Comment: editorial@publicfinance.co.uk

GOVERNANCE

Why auditors matter

The sector has a shortage of people trained in treasury roles. Addressing this shortfall is critical for timely reporting of accounts and to prevent public sector organisations from being damaged by financial losses. We are backing CIPFA’s call for urgent government action to increase recruitment. In January, Grant Thornton published a report into governance at Cheshire East Council up until 2015. The auditor said the costs of governance failures were serious.

Grant Thornton said: “In our view, there remains a public interest in these matters being aired publicly and analysed, both for accountability purposes for the local electorate and more widely to identify the underlying causes for the benefit of the local government sector as a whole.”

LEGISLATION

IF

ASKED

Is

public sector debt bad?

“The state can usually cope with more debt as it grows richer, just like you”

NEED TO KNOW CAMPAIGN 16 PUBLIC FINANCE MARCH/APRIL 2023

Michael Blastland and Andrew Dilnot, BBC review of taxation, public spending, government borrowing and debt reporting

This kind of content… drove my daughter to take her own life

$84BN

£4BN

$29BN

€8.266

The total assets of euro area insurance corporations, according to the European Central Bank.

73.2%

The OECD labour force participation rate, stable in the third quarter of 2022 – the highest level since 2008.

The number of Leopard 2 tanks being sent to Ukraine by Germany.

PUBLICFINANCE.CO.UK 17

NEED TO KNOW WORLD IN NUMBERS

TRILLION

WORLD

IN NUMBERS

14

Expected growth in the used goods market by 2030, according to a GlobalData consumer survey. 5M

The valuation of ChatGPT, the AI language software that mimics human conversation.

The estimated cost for Cannock Chase District Council of meeting its net-zero goal by 2030.

The age of Britain’s oldest lorry driver.

90

The number of Ukrainian children whose education has been affected by war.

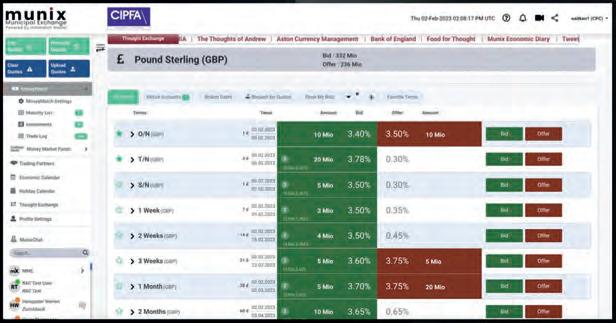

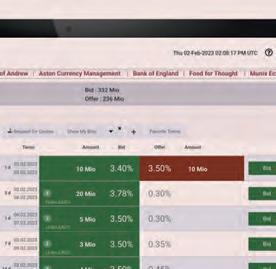

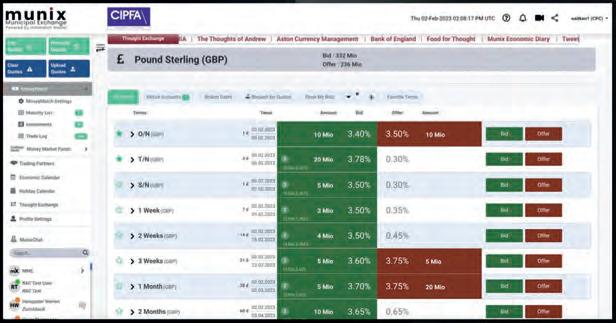

Digital transformation in treasury management

Digitisation is touching all aspects of our lives, so it’s no surprise that it is now set to transform and improve treasury management

Optimising cash balances, controlling costs and improving efficiencies are all key responsibilities for any treasury team. Years of cost-cutting, resource constraints and hybrid working have made the treasury team’s role even more challenging. In this article, we examine the current landscape and how technology can enable treasury teams to achieve efficiencies, cost savings, reduce risk and ensure best practice.

Treasury managers undoubtedly play a crucial role within their authorities. For most, their modus operandi has remained unchanged; namely ensuring sufficient liquidity is available and that liquidity is managed actively and securely. Money market trades are normally executed with a small number of trusted counterparties or relationship banks; these are then confirmed and reconciled manually. This all takes time, introduces operational risks and is inefficient. Additionally, this old process means you are not optimising the returns available, since money markets are opaque with no clear picture of pricing and depth to make informed decisions.

Ask yourself a few basic questions. How do you get your information currently? Can you rely on that information? What is the cost of actually dealing? Are you getting the best price available to you?

Recognising these challenges and the value of timely information in treasury operations, platforms such as Munix have been developed to solve those questions. They give direct access to live money market pricing and depth of market without incurring the high costs of vendors such as Bloomberg or Reuters.

Full disclosure in terms of price, size and approved counterparties enables you to make informed pre-trade decisions. Chat functionality and electronic notifications enable you to digitise the dealing process, while electronic trade confirmations ensure full compliance and immutable record keeping. Email connectivity across your whole team keeps everyone informed and ensures the post-trade environment is smooth and efficient while also reducing operational risk. Platforms improve efficiency, both in time spent and by positively impacting workflow across the dealing cycle.

It is therefore not surprising that expectations of improved treasury management in the form of best execution

and reduction of operational risk are front and centre in the minds of Section 151 officers. This means transparency, choice and straight-through processing are becoming more important than ever. Furthermore, in this time of remote working, audibility and security are key to ensure the orderly conduct of business away from the office. Munix and similar platforms solve many of these issues and will add value to your daily finance operations.

For more information, contact Munix at info@munix.co.uk

PARTNER CONTENT

SAFFRON CORDERY

Fixing the roof is critical for more than patients

Strikes by nurses and ambulance workers have laid bare the effect on many NHS staff of longstanding, severe pressures right across our health and care system.

Trust leaders were already geared up for a tough winter – always the most difficult time of year – and many feared it could be the worst they’ve ever seen. So it is proving.

And while they and their staff pull out all the stops to ensure patient safety amid industrial action and soaring demand for overstretched services, they have to contend with underlying issues that have caused concern for years.

Capital is one of those fundamental problems. The very fabric of the NHS – its estate – is coming apart at the seams, leaving trusts ill-equipped to do everything that NHS England and the government ask of them.

Major operational and strategic capital investment is needed, not least to tackle the £10.2bn maintenance backlog across the NHS. Far too many buildings and facilities are in a bad state, and the latest figures show that things are getting worse as the costs of trying to patch up creaking infrastructure mount. The maintenance backlog has grown by 11 % in a year, and more than half of it poses a ‘high and significant risk’.

“We operate 21st-century healthcare from 19th-century buildings – increasingly unsustainable.” That’s what one NHS leader said, responding to an NHS Providers survey of trusts

included in the government’s New Hospital Programme (NHP).

The safety of patients and staff is at stake. Without proper funding, leaky roofs, obsolete equipment and ageing IT don’t get fixed or replaced, compromising quality of care.

Take mental health services, for example. A £677m maintenance backlog across mental health trusts is an unwelcome extra burden on overstretched services struggling with a record 1.8 million people in contact with them.

Another recent NHS Providers survey found that almost three in four mental health and learning disability trusts had trouble getting capital funding this financial year, and trusts reported a lack of prioritisation of mental health services in the bidding process.

It is vital that the pressing problems of capital investment in the NHS are addressed urgently. Trusts that need to replace unsafe, decades-old, reinforced lightweight concrete blocks in ceilings and walls are still waiting to hear from the government if they will get the necessary funding.

Shovels and picks at the ready, trusts in the NHP are poised to start construction but are still waiting for confirmation of funding. Those forced to delay for months have faced spiralling, inflationdriven increases in the cost of building materials, far above initial forecasts.

The NHP can transform a sizeable chunk of the NHS estate and the delivery of

healthcare by providing badly needed renewals for acute, mental health, community and ambulance services. But, throughout the NHS, there just isn’t enough capital funding available to invest in anything beyond business-asusual needs.

Major strategic capital investment has the potential to radically improve the NHS. Trust sites designed to support new models of care, digital transformation and clinical research can deliver measurable improvements in key health outcomes. And with the right level of investment, the NHS could play an even bigger role in turning the government’s net-zero and ‘levelling up’ ambitions into reality.

The NHS, its staff and patients need safe, efficient, reliable buildings and equipment, not wards where crumbling ceilings have to be propped up. If we don’t build modern, safe settings now, where staff can give patients first-class care, it will cost the NHS and the public purse dear for years to come.

Illustration: IKON

With the right capital investment, the NHS could meet netzero and ‘levelling up’ demands while keeping the UK healthy

PUBLICFINANCE.CO.UK 19 OPINION NHS

SAFFRON CORDERY is interim chief executive at NHS Providers

END OF A

GOLDEN ERA?

Wspace, shops and hundreds of new homes. But situations change.

For a while, the UK and China were the best of friends; that relationship has now firmly shifted into ‘it’s complicated’ territory.

In November, UK prime minister Rishi Sunak used his first foreign policy speech to announce that the “golden era” of British-Chinese relations was over.

hen it comes to failed regeneration projects, the Royal Albert Dock in East London is in a league of its own. The empty office blocks, barren wastelands and half-finished roads are more dystopian than anything a Hollywood film director could dream up.

Of course, it was never meant to be like this. When the scheme was announced in 2013 by then London mayor Boris Johnson and Newham mayor Sir Robin Wales, it was claimed the development would signal the dawn of a “golden era” of Sino-British relations.

The 35-acre site was handed over to Chinese developer Advanced Business Parks, which pledged to transform it with office

The prime minister declared that the closer economic ties of the previous decade had been “naïve”, and added that the UK would in future be “standing up with robust pragmatism” to the Chinese government.

Tough talk

The speech followed renewed pressure from some Conservative MPs for a tougher line with Beijing, following various concerns over security, human rights abuses and Chinese policies in Hong Kong and Xinjiang. But how much of the UK’s tougher stance on China is just the usual rough and tumble of political rhetoric? Has there really been a fundamental shift in Sino-British relations?

Dr Robyn Klingler-Vidra, associate dean at King’s Business School, King’s

FEATURE CHINA

WORDS JAMIE HAILSTONE PHOTOGRAPHY RICHARD GLEED

Whitehall may want to loosen ties with China, but it needs to balance that with trade and investment

20 PUBLIC FINANCE MARCH/APRIL 2023

PUBLICFINANCE.CO.UK 21

“The growth in UKChina trade stems from the strength of UK manufacturers and services, combined with the expanding Chinese middle class, and, by extension, the massive Chinese consumer market”

Dr Robyn Klingler-Vidra, King’s College London

Dr Jamie Gruffydd-Jones, University of Kent

College London, says the value of total trade between the UK and China is now nearly double what it was in 2012.

She adds that the UK is exporting high-value goods, such as cars, pharmaceuticals and scientific instruments to China. As the country starts to open up after the pandemic, we could see demand for travel services between the two nations grow again.

“The growth in UK-China trade stems from the strength of UK manufacturers and services, combined with the expanding Chinese middle class, and, by extension, the massive Chinese consumer market,” Klingler-Vidra tells PF

“The marked advance of China’s technology firms has also boosted the growth in trade volume and complexity.”

And Dr Jamie Gruffydd-Jones, a lecturer in politics and international relations at the University of Kent, argues that trade between the two nations remains “relatively healthy”, despite Brexit, Covid-19 and recent disputes over Huawei, although he notes there have not been any highlevel bilateral talks for a while.

He adds that the prime minister’s declaration should be seen as political rhetoric, as it is a line that will go down well with many Tory politicians and members.

“But there is a reason why it goes down well, which is that it does reflect a genuine shift in the way that politicians, the media and members of the public are talking and thinking about China –in a much more critical way than they were a few years ago,” he explains.

“This is not unique to the UK, but the shift in public attitudes towards China in Britain is dramatic – according to Pew Research Center surveys, 69% of British people have a negative view of the country – almost double the level in 2018,” says Gruffydd-Jones.

He adds that there is now a heightened political sensitivity around anything to do with Chinese

investment in the UK, particularly any projects with links to national security or human rights.

Going nuclear

Nuclear power is, of course, one such area. Back in 2015, China General Nuclear signed a strategic investment agreement to participate in three nuclear projects here – Hinkley Point C in Somerset, Sizewell C in Suffolk, and Bradwell B in Essex.

A key part of the deal was the implicit understanding that the UK government would support CGN’s plans to build its own Hualong One nuclear reactor in Bradwell B.

In February 2022, the Office for Nuclear Regulation and the Environment Agency approved the Hualong One reactor as suitable for construction in the UK.

But in November, then business secretary Grant Shapps told MPs that CGN had been bought out of its stake in Sizewell C and would no longer be involved in its future development.

Dr Paul Dorfman, who chairs the Nuclear Consulting Group and is an associate fellow at the University of Sussex Science Policy Research Unit, says it was an “appalling decision” back in 2015 to include China in the UK’s nuclear power plans.

“No other OECD country would let China anywhere near its critical nuclear infrastructure for reasons that have now become apparent,” he tells PF

“And those reasons are not simply China’s newfound aggressive tendencies,” he adds. “If you’re going to let China build its own reactor at Bradwell, then it will really be able to get into the guts of the UK’s nuclear energy infrastructure.”

At this point, there has been no confirmation that the Bradwell B reactor will go ahead, especially given the tensions between the UK and China. Meanwhile, construction work on Hinkley Point C remains ongoing.

“Trade between the two nations remains relatively healthy, despite Brexit, Covid-19 and recent disputes over Huawei, although there have not been any high-level bilateral talks for a while”

FEATURE CHINA

22 PUBLIC FINANCE MARCH/APRIL 2023

TRADE STATISTICS

Money talks

Figures from the then Department for International Trade show China remains Britain’s fourth largest trading partner, accounting for 6.3% of total UK trade in 2022.

In the 12 months to December 2022, total UK exports amounted to £27.9bn, up 1.9% or £509m on 2021. Imports from China totalled £65bn, down 3% or £2bn.

According to the latest official figures, the total amount of foreign direct investment in the UK from China in 2020 was £3.4bn. This accounted for 0.2% of total UK inward investment. However, given that this was the year that Covid-19 effectively shut the world down, maybe not too much should be read into that figure.

Surveillance

Another security concern is the widespread purchase and operation of CCTV systems from Chinese manufacturers Hikvision and Dahua.

Last year, an investigation by the campaign group Big Brother Watch found that 73% of British local authorities use CCTV cameras made by the two firms.

In November, the UK government ordered a halt to the installation of CCTV cameras supplied by the firms at sensitive sites.

Ministers have also been informed that all existing cameras will be disconnected from departmental core networks in Whitehall.

Madeleine Stone, legal and policy officer at Big Brother Watch, says while the government’s decision to end the deployment of the surveillance equipment is an important first step, the protection afforded to ministers and civil servants must be expanded to all of us.

“Our research has found that Chinese stateowned CCTV is used by over 60% of public bodies,” she adds.

A further example of the British government getting tough with foreign investors, including China, comes in the form of the National Security and Investment Act, which came into force in January 2022.

It covers 17 ‘sensitive’ areas, including computing communications, computing hardware and data infrastructure.

John Schmidt, a partner at law firm Arnold & Porter, London, says the primary focus of legislation is to address potential issues arising from economic activities of systemic rivals, particularly China and Russia.

“All prohibitions so far under the act relate to companies at least indirectly owned by companies or nationals from those two countries,” he adds.

“Out of the five deals blocked so far, one concerned an acquirer with links to Russia, with the other four involving Chinese or Chinesebacked acquirers.”

John Ferguson, practice lead, globalisation, trade and finance, at the consultancy Economist Impact, says the new law is not specifically aimed at Chinese investment, but it will provide a further barrier and deterrent.

He adds that UK businesses with links to China may also see their supply chains become more difficult to manage.

“For these businesses, there is already a shift under way to diversify suppliers away from an overreliance on Chinese companies,” he tells PF

“Countries like Vietnam are picking up a lot of these supply-chain shifts, along with other

PUBLICFINANCE.CO.UK 23

LIGHTS, CAMERA, ACTION

Screening out China’s story

Despite opening up to the West in the 1970s, China’s cultural output hasn’t reached the global big screens. Since 1979, it has put forward 36 films for the Oscars. Just two have been nominated; the last was Hero in 2002. None have ever won, although films about China have won Oscars.

The Last Emperor, released in 1987, won multiple awards. It was directed by Italy’s Bernardo Bertolucci, backed by a British

producer and made by a US film company. Then in 2000, Crouching Tiger, Hidden Dragon won Oscars for best foreign language film, best art direction, best original score and best cinematography. But it was backed by Sony, the Japanese entertainment giant.

Chloé Zhao won the Academy Award for best director for her film Nomadland

Ironically, films produced in Hong Kong have been more successful.

countries in South-East Asia. While this is a coherent strategy in the current geopolitical environment, it will be costly in the short term, as it takes time to find and develop new suppliers in these markets.”

Super power

But, as many experts have pointed out, ChineseBritish relations are also affected by other factors –namely, the economic and foreign policies of the US. Gruffydd-Jones argues that US pressure over Huawei effectively changed UK policy.

“A bipartisan hawkishness towards China in the US and subsequent effects on US-China relations cannot help but have a significant impact on how the UK media, public and policymakers see China,” he states.

Professor Guido Cozzi from the Institute of Economics at the University of St Gallen, Switzerland, says the US badly needs British and European partners to match China’s economic power, as its GDP is predicted to grow over the next two decades.

“The UK is critical because of its strong ties with the Indian subcontinent. India’s GDP will, by 2048, reach that of the US. Hence, its loyalty to the West must contain China’s influence worldwide.

“These geopolitical aspects [will] not eliminate trade and foreign direct investment flows. What is necessary, though, is the emancipation from an excess dependency on China. British multinationals [will] diversify and rely more on India, Pakistan and Bangladesh than on China,” adds Cozzi.

Domestic goods

Closer to home, many local authorities will have slightly different and more urgent priorities in terms of securing funding for large-scale regeneration projects. In 2016, Birmingham City Council landed two property deals with Chinese investors, following trade missions to the Far East. In the same year, Nottingham City Council signed a five-year deal with counterparts in the Chinese city of Ningbo in a bid to become the UK’s ‘most China-friendly city’.

Nigel Wilcock, executive director at the Institute of Economic Development, says that, in many cases, foreign direct investment has provided tremendous benefits. He points to the Chinese investment through Envision AESC in Nissan’s new electric battery plant in Sunderland as the only “large-scale basis for UK automotive manufacturing electrification”.

However, he adds that growing uncertainty over the risk of some overseas investment capital coincides with UK financial institutions showing greater interest in investing in longer-term domestic projects. “Organisations such as Legal & General, Aviva and Triple Point are firmly behind the ‘levelling up’ agenda, making investments in locations where less spectacular but solid longterm returns may be generated,” states Wilcock.

Meanwhile, what is happening with the Royal Albert Dock scheme? In July last year, the Greater London Authority terminated its leasehold agreement with ABP to regenerate the site for failing to meet the obligations in the agreement.

At the same time, PwC appointed three joint liquidators of 23 companies within the ABP Group. Last month, it was reported that Irish property entrepreneur and champion jockey David Maxwell was in the process of buying the 700,000 sq ft first phase out of liquidation.

The remainder of the 35-acre site is now back in public ownership, and a GLA spokesman said it is considering the best way to bring forward the regeneration. So watch this space.

FEATURE CHINA

24 PUBLIC FINANCE MARCH/APRIL 2023

GARDNER

There’s a lot we can learn from China, but we can only achieve that by understanding how its society works from the perspective of its own people.

I’ve been a regular visitor, thanks to family commitments. I get to see China from the perspective of a citizen. In many ways, it is similar to the UK. From that viewpoint, differences are more subtle than you would imagine. Whereas we have democracy and human rights, China has a social contract. Some of the things I hear and read about the country through UK media are not the things I recognise when I am there.

China is now completely connected in a way that the UK is not. You must have a Chinese bank account. For online purchasing, it has to be an Alibaba account (the Chinese version of Amazon) and for social media, it is a WeChat account (imagine blogging, twitter and Facebook all rolled into one). It’s all monitored by the state, but you forget about this over time. In the same way as we forget about CCTV cameras and our relationship with the state in the UK while we get on with our daily lives. Much of this integration we are seeing slowly emerging in the UK as robotic automated processes.

In China, they have social credit scoring, which rates citizens and organisations according to how good a citizen they are. For example, giving to the community results in rewards like priority health services. It may not be not perfect but it is an example of how China works.

The Chinese government has some ideas that are worth UK considering, especially at the moment. For example, ordinary people in China are committed to the social contract. As a result, China sees high productivity, and citizens enjoy reasonably

good standards of living. That said, concerns are justified; China doesn’t understand Western democracy very well. No-one should look at the country through rosetinted spectacles. But, equally, you couldn’t put a Western democracy in China – it would never work.

The UK, Europe and the US are all thinking about their ties with China in different ways.

Our links with China are quite considerable, and its investments into UK establishments and businesses have come under criticism. It is not about agendas but structural change and how the business relationship is interpreted.

We have been very quick to talk about distancing our dependence on China. But we need to look at our relationship, as well as our history. If we were in China’s position, would we expect our government to behave any differently?

We haven’t yet worked out how to do it on a more equal footing. It seems like we haven’t stepped away from an approach to our relationship that resulted in the Opium Wars – and neither have they.

China needs technology and we need investment, so there’s clear need on both sides. But the negotiating mechanism needs some work, especially around trust. We need to build on the things that bind us and not focus on the things we believe to be differences.

What will be the impact of this shift by the UK government? It’s like when former Chinese premier Zhou Enlai was asked in 1972 about the impact of the French Revolution. His response: “Too early to say.”

PUBLICFINANCE.CO.UK 25

You couldn’t put a Western democracy in China – it would never work

VIEWPOINT CHINA

MALCOLM GARDNER is managing director of Visionary Network

MALCOLM

The words of truth are always paradoxical

China doesn’t operate in Western ways, so don’t see its actions through Western eyes, says Malcolm Gardner

The big numbers racket

Does the claim of China’s dominance really stand up?

The five largest economies in the world, according to the World Economic Forum, are the US, China, Japan, Germany and India. Together, they make up half the global gross domestic product. The top 25 countries account for 84% of global GDP. The remaining 167 countries hold just 16%.

But is GDP the only marker? Compare global debt rankings and a different picture emerges.

For example, Japan is up near the top in terms of GDP – but at a huge price. It has the highest national debt in the world at 259% of GDP. The reasons include the financial crisis in the 1990s, the economic stagnation that followed, the 2008 financial crisis and the 2011 Fukushima nuclear disaster. It also has an ageing population to contend with.

So, superpowers don’t have super finances; they carry significant debt. Real power is the ability to pay back.

26 PUBLIC FINANCE MARCH/APRIL 2023 Data sources: CEIC Data; Statista; WorldData.info; World Economic Forum; World Population Review US CHINA $29.5 TRN $23.3 TRN $10.1 TRN $17.7 TRN UK FRANCE $3.0 TRN $3.1 TRN $3 TRN $3.3 TRN RUSSIA BRAZIL $1.5 TRN $1.6 TRN $1.8 TRN INDONESIA NETHERLANDS $0.5 TRN $1.2 TRN $0.5 TRN $1.0 TRN

CHANGE OF PERSPECTIVE DATA CHINA INFOGRAPHIC KEY COUNTRIES’ GDP ($ TRN ROUNDED UP) AMOUNT OF NATIONAL DEBT ($ TRN ROUNDED UP) $0.3 TRN

It depends how you view the data

PUBLICFINANCE.CO.UK 27 JAPAN GERMANY INDIA $13.1 TRN $3.0 TRN $4.9 TRN $4.3 TRN $2.4 TRN $3.2 TRN ITALY CANADA SOUTH KOREA $2 TRN $2.2 TRN $0.9 TRN $1.8 TRN AUSTRALIA SPAIN MEXICO $1.4 TRN $1.7 TRN $1.0 TRN $0.7 TRN $1.6 TRN $1.3 TRN SAUDI ARABIA TURKEY SWITZERLAND $0.8 TRN $0.8 TRN $0.8 TRN $2.1 TRN $3.2 TRN $0.3 TRN $0.2 TRN $0.3 TRN

WITH THE CRIMINAL JUSTICE SYSTEM ON ITS KNEES, WHY WON’T THE GOVERNMENT FUND SERVICES WITH A PROVEN TRACK RECORD OF REDUCING REOFFENDING, ASKS YVONNE THOMAS OF THE CLINK CHARITY

FOOD

FOR

THOUGHT

FEATURE INTERVIEW

WORDS CALLUM RUTTER PHOTOGRAPHY PETER SEARLE

eoffending is a blight that affects everyone involved – the victims, society at large, the reoffenders themselves and the public sector that deals with the case. The Ministry of Justice estimates that reoffending (defined as subsequent offences within 12 months of a conviction or release from custody) costs the economy £18.1bn – about half of which is from theft reoffences.

The key to getting this figure down is fairly obvious, Yvonne Thomas tells PF. She is chief executive of The Clink Charity, which works in prisons to give prisoners formal qualifications and experience working in hospitality, whether in one of the charity’s three restaurants, a prison kitchen or its event catering business. She says people need structure, opportunities and support – all of which are provided by The Clink and services like it.

We are in The Clink’s stylish restaurant at HMP Brixton, soundtracked by lounge music and the noises of the establishment preparing for service. During the interview, various treats are brought to the counter from the bakery – recently opened in the long-disused site of Gordon Ramsay’s Bad Boys Bakery, set up for his 2012 programme Gordon Behind Bars. Drawn portraits of Nelson Mandela and Malcolm X sit on the walls, alongside pictures provided by the Koestler Trust, which helps exoffenders and prisoners to produce art.

Traineeship at The Clink is about more than just keeping prisoners busy – it’s about preparing for life and a career ‘on the outside’. “The first thing is that we don’t simulate a work environment; we run a real work environment,” says Thomas. “It really prepares people for life out of prison. We have interviews, a dress code, an attendance code – the trainees are subject to everything you would expect an employee to be subject to.”

Starting over Graduates, imbued with a sense of purpose and responsibility, and with a framework for a new life outside prison, are far less likely to reoffend than average ex-prisoners. The Clink provides each graduate with a support worker, who meets with them between three and six months ahead of their release and supports them indefinitely, as long as they need support, in areas such as benefits, housing, job applications and reintegration into society.

“We try to ease people’s transition, to help support them when they need to start making different choices than the ones that got them into prison in the first place,” says Thomas. “If you have been in prison for 10 years, you come out and the world has changed. That can take some adjustment, and it isn’t always easy. The people who train with us are achieving a qualification, often for the first time, and it’s a really down-to-earth training environment. These men and women have often not really attended school. The sense of achievement and self-worth and self-respect that this builds shouldn’t be underestimated.”

The results speak for themselves. A 2020 report from RBB Economics found that, from 2010 to 2016, Clink graduates reoffended at a rate of 0.46 reoffences per

FEATURE INTERVIEW 30 PUBLIC FINANCE MARCH/APRIL 2023

HMP Brixton is currently one of three The Clink restaurants across the UK

individual, compared with 0.63 in the comparison group. Combined with Home Office figures suggesting a cost of at least £111,000 per reoffence (implying an average benefit of at least £18,900 from every person who graduates) and an estimated cost of £3,900 per individual trained, this means that, overall, The Clink saves £4.80 for every £1 spent. The report also suggested that because The Clink works exclusively with prisoners, rather than offenders with non-custodial sentences, the true figure might in fact be even higher.

“It’s an investment,” explains Thomas. “Even on pure economic grounds, it makes sense. Bearing in mind that the cost of a prison place is about £45,000 per year, wouldn’t it be more sensible to use that money to stop people coming to prison in the first place? Also, how do you count the cost of avoided future victims? You can’t put a price on that, can you?”

She says other charities are doing similar things, and also achieving results. She names Bounce Back, whose focus is on training and helping exoffenders into employment, and Catch22, which runs intervention services in communities as well as custody to help people make positive changes to their lives. “Our models are proven to work. All of us are making a significant difference,” says Thomas. “People can be helped in this way, and if

LAST STRAW

Covid-19’s lethal legacy

During lockdown, prisoners were spending 22.5 hours in their cells per day, court backlogs grew, and hundreds of thousands of hours of community service went uncompleted. This coincided with changing demand. From October 2020 to September 2021, crime was 14% higher than two years prior – driven by huge increases in fraud and sexual offences. The government’s ambition to recruit 20,000 new police officers by March 2023 (the programme’s success is unclear at the time of writing, although it was on track this time last year) will, according to the Criminal Justice Inspectorates, “do little to address the lack of experienced detectives and digital forensic specialists that are much-needed today”. And criminal barristers went on an indefinite strike last September over legal aid changes, exacerbating an already-huge court backlog.

you can help those people you can probably stop about half of them from reoffending.”

So, presumably, politicians are champing at the bit to fund services like this? Doesn’t the potentially immense benefit to public finances, let alone to the lives of the people involved, leave them no other option? Apparently not. The Clink isn’t given anywhere near the support it needs from Westminster, says Thomas. About 15% of its budget comes from government grants, with the rest coming from charitable donations, a charitable foundation and revenue from some of its activities, such as the restaurants. She says The Clink has a “very good relationship” with the Ministry of Justice, but it is not civil servants who make the big calls on funding.

“Ultimately, whatever political policies are in place are the ones they have to implement,” she says. “We have had public support from the secretary of state for justice. He’s very complimentary about what we do, but that’s not followed up with money to help us do it

PUBLICFINANCE.CO.UK 31

“The people who train with us are achieving a qualification, often for the first time”

sustainably.” So why not? “It’s just not a headlinegrabber,” Thomas reasons.

The criminal justice system could really use the help, however. Reoffending rates generally have declined over the past few years, although they are still pretty high. But the problems in the system go far beyond just reoffending. Covid-19 and the impact of lockdown restrictions left services running at terrible levels.

“It’s not just the pandemic,” says Thomas. “The prisons system has been under pressure for years. The staffing issues have been there for years. And money has been tight across all parts of the criminal justice system. The effect in a prison is that people don’t get trained, [or] supported to make different choices. It’s an own-goal not to invest in prison staff and services like ours that support rehabilitation, but that’s where we are.”

The Clink’s finances are also far from where Thomas wants them to be. She says the charitable foundation will run out in about 18 months’ time,

at which point it will need to either be re-funded or closed. Setbacks such as the charity experienced in Cardiff don’t help. The Clink restaurant at HMP Cardiff was forced to close at the end of 2022 after 10 years of running, because its lease was not extended. “That was so sad,” says Thomas. “It was our biggest training site, as it included people on probation as well people from prison, who were bussed in from HMP Prescoed.”

Looking to the future

So, what next? “We have sufficient training places across the estate to train 750 people over a year. Extending restaurant opening hours would allow us to train more people. The market for customers seems to be holding up,” she says. Another events business is on the cards, and there’s ambition to open a restaurant in the North (“maybe Leeds or Durham”), and to return to Cardiff with a community facility – “we feel being absent from Wales isn’t fair for people leaving prison there,” Thomas says. But there is also work to be done at the existing sites. “We’re working on filling our training places. I want to prove that The Clink Charity can provide training cost-effectively with brilliant outcomes, so we can make an even better case for providing our services.”

The case is already being made, though, and, despite the results, the support from Westminster is just not enough, adds Thomas. Time and time again, she says, the government refuses to fund a sensible, provably effective solution to a problem in society that it says it cares about. The Clink is one such example, and finding a sustainable way to allow it to carry out its work would help not just to save money but also to make the lives of some of the people its work touches indescribably better.

32 PUBLIC FINANCE MARCH/APRIL 2023 FEATURE INTERVIEW

“We try to ease people’s transition, to help support them when they need to start making different choices than the ones that got them into prison in the first place”

“We

run a real work environment that really prepares people for life out of prisons,” says The Clink Charity’s Yvonne Thomas

Time to think the unthinkable?

Norse Group CEO Justin Galliford reflects on the difference between today’s financial challenges and the austerity of 2008

The financial challenges for local government are mounting. Almost daily there are reports of councils struggling to meet their budgets, and for some it is becoming a question of survival. Costs are rising, as are the expectations of local residents. Government funding will not be sufficient. And we are dogged by uncertainty – about the new waste regulations and procurement legislation.

Austerity 2.0 is here.

It feels like we’ve been here before, but I sense that this is very different to the 2008 austerity.

I view the sector’s challenges through the prism of our partnerships. Norse Group has over 20 joint ventures with local authorities, delivering essential services including waste and recycling collection, property services, social housing repairs and facilities management. Our partner councils chose our joint-venture model for a variety of reasons, but after 2008 the primary motivation was financial – the need to control costs and develop external revenue streams, but without compromising their commitment to social value.

During austerity, one thing I have noticed is the remarkable resilience of local government. Councils have responded by adopting new, innovative ways of delivering services, proving that they could adapt to tighter financial constraints, and still serve their local communities.

In many cases, services improved, thanks to greater efficiency. Local authorities demonstrated adaptability and flexibility, and rose to the challenge. This was particularly noticeable during the Covid-19 pandemic, when rapid redeployment of resources was essential.

The past is not the present However, in my discussions with our partners and the local government community, I detect a feeling that this time it’s different. The ongoing recovery from the pandemic, high inflation, skills shortages and instability both nationally and globally are combining to create pressures that did not exist back then.

There is deep concern about what the sector sees as a prescriptive, rather than collaborative, relationship between central government and local authorities; a threat of league tables that fail to reflect local priorities; and a feeling that local government is seen as just a delivery vehicle for Whitehall.

Thinking the unthinkable

To a significant number of peoplemembers, officers, employees and residents – taking the control of frontline services out of the hands of the council is unthinkable.