A BUSINESS INTERACTION PUBLICATION Volume 9 | Issue 2 | April 2023 R75.00 Incl. VAT 9772411292008 23009 Information | Innovation | Inspiration | Transformation Manufacturing sector paying a HIGH PRICE offers brighter future for SMBs SA’s biggest opportunity INVESTMENT IN BIOTECH, TECHNOLOGY: Renewables revolution COVER FEATURE new approach to address critical Prof Glenda Gray Prof Glenda Gray SA’s energy transition SA’s energy transition Collaboration key to enhancing healthcare Collaboration is key to enhancing healthcare skills shortage SA’s hydrogen economy Growing Role of electric vehicles in

Transformation has been a buzz word for years. For some it creates anxiety, for some it signals opportunity, and for some it's just a word.

We are currently at a point where so much is happening - a lot of it downright scary.

Transformation can also be construed as a fancy word for change, and change is inevitable.

The shock factor is the fast rate at which we are having to adapt. Circumstances out of our control, are forcing us all – in both a professional and personal capacity – to be more flexible, resilient and open to opportunities if we want to succeed.

One of the critical areas we are having to adapt to is load-shedding. Many businesses, particularly SMMEs, are having to rework budgets to invest in alternative energy solutions to try to ensure sustainability. Long term this initial investment could work out more costeffective for the future.

Similarly, the introduction of new technologies is seen as intimidating to some, but in essence could provide more efficiencies and opportunities for enhancing skills.

Change is here, but it is up to each of us to unlock the opportunities it brings...

FROM www.ixist.co.za info@ixist.co.za

FAST & SECURE web hosting R65 per month

2023 be

Follow us... @SABImagazine

South African Business Integrator

Tashne Could

a transformative year?

NOTE Eds TASHNE SINGH

Healthcare | Re�rement | Investment Consul�ng | Financial Planning | Actuarial Services | Short-Term Risk Insurance T&Cs apply. The NMG SA Group of Companies are authorized financial service providers t/a NMG Benefits If tragedy struck today will you and your family be financially, okay? Is my family and I secure in our journey to financial success and freedom? www.nmg.co.za Connect with us today finplanning@nmg.co.za 011 509 3000

56 Uncovering the truth behind ‘greenwashing’

58 The role of electric vehicles in SA’s energy transition

62 Logistics industry trends that are reshaping supply chains

64 Manufacturing sector paying a high price

66 Successfully plan for supply chain challenges

68 Five challenges every young construction business must overcome

72 SA’s landfills are filled with construction waste

74 Fintech is a path to democratised financial services

78 Women in tech: progression hampered

82 Technology: New approach to address critical skills shortage

86 Advertorial: Aims International 5 reasons to get ‘psyched’ about executive psychometric assessments

88 When is it time to bring in a BPO partner?

92 Risks when preparing for a B-BBEE verification

4 sabusinessintegrator.co.za 8 Cover Feature: South African Medical Research Council Collaboration is key to enhancing healthcare 12 SAMRC hosts 15 universities for research capacity development 14 Q&A: 3Sixty Global Solutions Group Investment in biotech, SA’s biggest opportunity 20 Q&A: BLSA Invest in South Africa to make it work 24 Advertorial: Mazi Asset Management SA’s grey-listing by FATF 26 South Africa has been grey listed! What are the implications? 30 Q&A: BUSA Action needed to mitigate threats to SA’s economy 32 Addressing industry skills shortages in the mining sector 38 Uncertainties in base and precious metals supply: Is Africa ready? 42 Q&A: Dry Ice Blasting Services Dry ice blast cleaning on electrical stators & rotors can cut downtime by as much as 80% 46 Renewables revolution offers a brighter future for SMBs

Small businesses urged to ‘go solar’

50

CONTENTS

How to grow SA’s hydrogen economy

92 50 74 26

CREDITS

South African Business Integrator

PUBLISHER

Elroy van Heerden-Mays elroy@mediaxpose.co.za

EDITOR

Tashne Singh editor@sabusinessintegrator.co.za

SUB-EDITOR

Tessa O’Hara tessa.ohara@gmail.com

CONTENT MANAGER

Wadoeda Adams artwork@mediaxpose.co.za

DESIGNERS

Anja Bramley artwork1@mediaxpose.co.za

Shaun van Heerden-Mays artwork2@mediaxpose.co.za

EDITORIAL CONTRIBUTORS

Webber Wentzel Finance Team

Institute of Waste Management of Southern Africa

Jacques Farmer

Dennis Phillips

COVER

South African Medical Research Council

IMAGES

DISTRIBUTION

Media Support | On the Dot

PUBLISHED BY

6 Carlton Crescent, Parklands, 7441

Tel: 021 424 3625 Fax: 086 544 5217

E-mail: info@sabusinessintegrator.co.za

Website: www.mediaxpose.co.za

Disclaimer: The views expressed in this publication are not necessarily those of the publisher or its agents. While every effort has been made to ensure the accuracy of the information published, the publisher does not accept responsibility for any error or omission contained herein. Consequently, no person connected with the publication of this journal will be liable for any loss or damage sustained by any reader as a result of action following statements or opinions expressed herein. The publisher will give consideration to all material submitted, but does not take responsibility for damage or its safe return.

Roland Innes

Kearney

Pieter Bensch

Yershen Pillay

Thabiso Foto

Jessica Hawkey

Tennille Bell

ADVERTISING SALES MANAGER

Rashieda Wyngaardt rashieda@sabusinessintegrator.co.za

ADVERTISING SALES

Jacqueline-Ann Marsh jacqui@mediaxpose.co.za

MEDIA PARTNERSHIPS

Maurisha Niewenhuys maurisha@mediaxpose.co.za

DIGITAL MARKETING

Jay-Dee van Rensburg digital@mediaxpose.co.za

SOCIAL MEDIA CO-ORDINATOR

Kyla van Heerden social@mediaxpose.co.za

DISTRIBUTION & SUBSCRIPTIONS

Shihaam Gyer distribution@mediaxpose.co.za

Sherwin Kastoor sherwin@mediaxpose.co.za

CHIEF FINANCIAL OFFICER

Shaun van Heerden-Mays shaun@mediaxpose.co.za

ADMIN ASSISTANT

Ketsia Makola ketsia@mediaxpose.co.za

WEBSITE DEVELOPER/ADMINISTRATOR

Justin McGregor justin@mediaxpose.co.za

RECEPTION

Daniëla Daniels receptionist@mediaxpose.co.za

Image credits: 123rf.com A BUSINESS INTERACTION PUBLICATION Volume 9 Issue 2 | April 2023 R75.00 Incl. VAT 9772411292008 23009 Information | Innovation | Inspiration Transformation Manufacturing sector paying a HIGH PRICE offers brighter future for SMBs SA’s biggest opportunity INVESTMENT IN BIOTECH, TECHNOLOGY: Renewables revolution COVER FEATURE new approach to address critical Prof Glenda Gray SA’s energy transition SA’s energy transition Collaboration key to enhancing healthcare Collaboration is key to enhancing healthcare skills shortage SA’s hydrogen economy Growing Role of electric vehicles in

@SABImagazine

A BUSINESS INTERACTION PUBLICATION

6 sabusinessintegrator.co.za

Meet at in Cape Town. The land of sea, beaches, mountains and vineyards. Let our experienced team help you create an exceptional event at the Cape Town International Convention Centre (CTICC). Enjoy our flexibility and world-class services, not to mention the exquisite beauty of our mother city, ranked amongst the most beautiful in the world. ADD A DIGITAL ELEMENT WITH OUR HYBRID SOLUTION, CTICC +27 (0) 21 410 5000 sales@cticc.co.za www.cticc.co.za the CTICC

Collaboration is key

to enhancing healthcare

During the Covid-19 pandemic, Prof Glenda Gray, President and CEO of the South African Medical Research Council (SAMRC), played a key advisory role. Here, Prof Gray speaks to SA BUSINESS INTEGRATOR about SA’s impressive legacy of pioneering medical innovation and research, and how the medical sector can be used as an instigator of proactive change using a multidisciplinary approach.

How can our medical sector impact change on a socio-economic level, improve partnership opportunities with the private sector, and develop and retain talented individuals in STEM?

The South African Medical Research Council (SAMRC) harnesses its science talent to address the four intersecting epidemics facing our country today, that of:

1. communicable diseases (HIV, TB and SARS-CoV-2);

2. communicable disease (diabetes, hypertension, cardiovascular diseases and cancer);

3. maternal and infant mortality; and

4. trauma (intimate partner violence, interpersonal violence, car accidents, etc).

COVER FEATURE: SOUTH AFRICAN MEDICAL RESEARCH COUNCIL

8 sabusinessintegrator.co.za

By addressing these intersecting epidemics, we can impact on survival and life expectancy. We are committed to the transformation of health research in South Africa, and as the SAMRC President and CEO I have overseen this both in the Council and in our extramural programmes at universities.

We have improved equity in science funding through driving initiatives that have significantly improved funding for young scientists, black African scientists and women. The SAMRC has also established key collaborations and partnerships that will impact scientific research locally.

We have established a collaboration with the Beijing Genomics Institute to fund the first whole genome sequencing resource in South Africa. The vision to design and establish the first facility on the African continent capable of large-scale whole genome sequencing started in 2017. We opened this Genomics Centre in 2019, displaying the latest sequencing technology and cutting-edge facility design. This dedicated centre builds on South Africa’s previous participation in the Human Heredity and Health in Africa initiative (H3Africa).

Mindful of the lack of science leaders in South Africa, we established a novel grant to support mid-career scientists to become science leaders. We have established key funding initiatives within the BRICS countries, Grand Challenges South Africa with the Bill and Melinda Gates Foundation, the SAMRC-UK MRC Newton Fund, SAMRC-Forté (Sweden) Collaboration to Support Inequalities in Health and Health Systems, the SAMRC-CIHR Healthy Life Trajectories Initiative (HeLTI) in collaboration with Canada, China and India, the US-South Africa Programme for Collaborative Biomedical Research (NIH), and the India- South Africa Collaborative Research Programme on HIV/AIDS and TB, as well as an SAMRC-EDCTP collaboration on Malaria in Mozambique.

Another area we are interested in is funding innovation in cancer and non-communicable diseases using precision medicine methods. We

collaborate with the Technology Innovation Agency (TIA) and Department of Science and Innovation (DSI) in this area as well as investing in medical devices and diagnostics.

How important is it to secure more private sector partnerships, and what will this look like?

Working with the private sector ensures the commercialisation of the technologies we have invested in. Our recent collaboration with Afrigen and Biovac in vaccine manufacturing is a critical partnership to ensure the sustainability of that sector.

Private sector partnerships are critical for innovation. We do need partners who can commercialise drugs, devices, diagnostics and vaccines.

We are able to partner with the private sector right from inception, or to support product or clinical development or transfer innovation to the private sector for commercialisation.

The SAMRC also supports pharma-funded product or drug development, and these partnerships enable the movement of these products towards commercialisation.

In terms of achieving SDG 3, how is SA progressing?

Sustainable Development Goal 3 (good health and wellbeing) is a critical SDG for countries in Africa, where universal health coverage is limited, and health systems are under tremendous strain.

We will need both curative and preventative/ promotive approaches if we are to attain SDG3. Legislative changes should focus on mechanisms to attain universal health coverage.

At a population level, interventions to detect, diagnose and treat non-communicable diseases like hypertension and diabetes will improve morbidity and improve survival, especially in the elderly. Any interventions that increase life expectancy will have

COVER FEATURE: SOUTH AFRICAN MEDICAL RESEARCH COUNCIL

9 sabusinessintegrator.co.za

ramifications in all facets of our society, including socio-economic benefits and GDP growth.

How can a multidisciplinary approach

unlock opportunities?

South Africa has complexities that are becoming increasingly challenging. These complex matters affect the broader society and its most vulnerable members; it needs knowledge that is not in one discipline.

A multidisciplinary approach by definition requires work and knowledge outside of that known discipline. It needs to cross cognitive boundaries by sharing scientific understanding and consequently integrating institutional capacity to provide real solutions in real time. Health research concerns itself with building on knowledge and expertise to improve the health of all South Africans. We cannot ignore that improvement does not occur in silos.

A benefit to that reality is that although problems become more complex, there is accelerated growth of knowledge and strength from varied disciplines to reach South Africans in all levels of society. For example, if access to clinics is an issue in a rural environment, then there should be a way that technology and business can come together to bring treatments and healthcare to people.

What is the scope for a multidisciplinary approach for tackling challenges?

There are two ways in which a multidisciplinary approach can expand the work of improving the health of South Africans in the context of health science research:

1. Capacity development: The SAMRC is the most significant local funder of health research and a custodian of the values that embody health research and has developed funding mechanisms, which supports research leaders in different areas of health

research. The purpose of doing so is to create opportunities that grow early-career and mid-career scientists.

The outcome of developing such scientists is proven through the opportunity given to them to implement the findings of their research by work. For example, maternal health – specifically breastfeeding – is an area studied by health systems, producing a breastfeeding series through The Lancet journal to scientifically illustrate the proven lifelong benefits of breastfeeding for infants and children.

Combining this research with business would seek to not polarise commercialised baby formula with scientifically incorrect messaging – the intention is to ensure parents make an informed decision.

2. Funding and collaboration: More funding and support towards health science research is important from all sectors of business. Tackling health care challenges require a multidisciplinary approach. Researchers need to work together to share ideas and solutions even if they work in a different research discipline. The health challenges that we face in this world cannot be solved by medical research alone, we need scientists to continue to collaborate just like they did during the Covid-19 pandemic.

What are the greatest challenges facing the medical research sector?

Health equity: South Africa is diverse in population but also in access. There are disparities in healthcare capacity across different regions. Health equity is an area that experienced challenges pre-apartheid and now post-apartheid. There are lots of improvements but a much more advanced conversation needs to happen in ensuring health equity.

An advanced conversation towards health equity can include a bigger intention on personalised

10 sabusinessintegrator.co.za COVER FEATURE: SOUTH AFRICAN MEDICAL RESEARCH COUNCIL

medicine. Personalised medicine aims to provide more precise and effective medical care to individuals, as opposed to a “one-size-fits-all” approach, with the goal of improving patient outcomes and overall health.

Personalised medicine is a medical model that is used to characterise an individual’s phenotype and genotype (e.g. molecular and genetic profiling, medical imaging, and lifestyle data), to tailor the right therapeutic strategy for the right person at the right time, and to determine the predisposition to disease, and to deliver timely and targeted prevention.

Advancing healthcare technology: Again, here we can emphasise on the importance of ‘transdisciplinarity’ to create sustainable healthcare through research science and other disciplines.

For example, BGI Group recently donated a gene sequencer, DNBSEQ-G400, to the SAMRC. This equipment helps to further improve the institute’s sequencing capability and benefit the people of South Africa and beyond. It is also imperative that such contributions are made by South African businesses within technology. To understand what these contributions can be, businesses must engage with health science research.

What interventions are needed to overcome challenges?

Grow healthcare research scientists: A varied pool of healthcare research scientists is needed. There is still room. Filling up that room in the long term means educating the current generation about opportunities available as a scientist.

One can easily argue that is it solely up to organisations like the SAMRC to avail that education to scholars, but predominantly that education needs to happen through career guidance.

With health equity and the interest in pertinent matters such as personalised medicine it is

important to make use of AI technology. AI technology can source information readily and make it timeously available to career guidance counsellors.

Health equity therefore can be broken down to the simple detail of information sharing; information being accessed at the right time by right people to benefit a large community. That requires an investment that needs to be evaluated so that it can identify areas of growth and improvement.

More state-of-the-art labs and equipment: South Africans are pioneering their own healthcare research in this generation, ensuring the continued contributions of healthcare research.

What are the key opportunities that can help cement SA as a leading medical research, innovation and production hub?

Paediatrics and child health: Having completed a post-doctorate in clinical epidemiology, focusing on clinical trial designs, socio-behavioural and translational research, I see that there are still opportunities in managing childhood illnesses and investing in early childhood development.

HIV and AIDS research: Recently, an international study gave a thumbs-up for the safe use of Tenofir Disoproxil Fumarate and Emtricitabine as pre-exposure prophylaxis (PrEP), a big step towards change. Yet, HIV and AIDS are still a significant problem and there are still socio-demographic factors that impact providing treatment.

What are some of the key lessons you have learned as a leader?

Growth is constant! This is one of the major lessons I have acquired; the lesson that illustrates that I am always learning and discovering that through science life can be improved. As a leader this teaches you compassion for those you lead and also for yourself.

COVER FEATURE: SOUTH AFRICAN MEDICAL RESEARCH COUNCIL 11 sabusinessintegrator.co.za

SAMRC hosts 15 universities for research capacity development

The South African Medical Research Council (SAMRC), through its Research Capacity Development (RCD) division, hosted more than 65 RCD grant holders from 15 universities during its annual grant holder’s meeting on 8-9 March this year, under the theme of “Building Research Leadership for Societal Impact”.

As the most significant local funder of health research and a custodian of the values that embody health research excellence in South Africa, the SAMRC has, over the years, developed research capacity development funding mechanisms to

support emerging research leaders in different areas of health research. The purpose of the RCD grant programmes is to create opportunities to fast-track and transition early-career and mid-career scientists into independent research leaders.

RCD grants programmes account for 60% of the RCD budget, with more than 70% of grant holders being hosted at historically disadvantaged institutions (HDIs), namely the University of Fort Hare, University of Zululand, University of Limpopo, University of Venda, Mangosuthu University of Technology, Walter Sisulu University of Technology, Sefako Makgatho Health Sciences University, and the University of the Western Cape.

SOUTH AFRICAN MEDICAL RESEARCH COUNCIL

12 sabusinessintegrator.co.za

The SAMRC’s RCD grant holder’s annual meeting is a capacity development opportunity with this year’s event bringing together beneficiaries from RCD grant programmes, including the SAMRC Intramural Postdoctoral Fellowship Programme, Clinician Postdoctoral Career Development Programme, Early Investigators and Mid-Career Scientists Programmes (Principal investigators in pre-selected strategic research areas), and the Research Capacity Development Initiative (Principal Investigators) from selected HDIs. With a strong focus on the science, the meeting provided an opportunity for grant holders to present on their research, to learn about new topics of relevance to their research endeavours, to network and to seek new collaborations.

The meeting was attended by some of the SAMRC Board members, the SAMRC President and CEO, Prof Glenda Gray, and other members of the SAMRC’s Executive Management Committee.

The meeting also included esteemed keynote speakers who delivered outstanding lectures on various topics in the context of “Building Research Leadership for Societal Impact”, spanning ethics in research, innovation and intellectual property,

career development and research, societal impact, research translation and indigenous knowledge systems.

Commenting on the presentations made by the grant holders, SAMRC Board member, Prof Mosa Moshabela, noted how the universities were working together.

“What is more interesting is the strong collaboration that could be seen between researchers from various institutions,” he said.

In her address to the beneficiaries, Prof Gray said: “By receiving a research grant, even a small amount, emerging researchers can gain access to resources and expertise that would otherwise be unavailable to them. Additionally, research grants can help emerging researchers develop their skills and gain recognition in their field”.

The meeting showcased the high quality of the research being supported through the RCD grants programmes and the successes achieved to date in building research capacity in the featured institutions and was an inspiration for the health research leaders of tomorrow.

www.samrc.ac.za

SOUTH AFRICAN MEDICAL RESEARCH COUNCIL

13 sabusinessintegrator.co.za

The RCD grant holder’s annual meeting

SA’s biggest opportunity Investment in biotech,

3Sixty Global Solutions Group evolved from funeral services to financial services, and is now diversifying into biotechnology (pharmaceuticals).

SA BUSINESS INTEGRATOR spoke to Khandani Msibi, Executive Chairman of 3Sixty Global Solutions Group and Group CEO of NUMSA Investment Company, to learn more.

Q&A: 3SIXTY GLOBAL SOLUTIONS GROUP 14 sabusinessintegrator.co.za

What was the rationale for diversification into the fields of biotechnology and pharmaceuticals?

When I joined 3Sixty Global Solutions Group, its major business was provision of burial and cremation services through Doves Group as well as Independent Crematoriums South Africa (ICSA). We saw this business model as unscalable and extremely hard to market. Thus, we shifted our focus to the “life-enhancement” side of things instead of the “end of life” side of things. The immediate diversification was to get into life insurance with the acquisition of Union Life in 2009, which we later rebranded as 3Sixty Life.

Our strategic view about our clients was that it is more desirable to help them live longer, healthier lives and pay us a premium for longer, as opposed to relying on a business model which entails a once-off transaction, burial or cremation services. We classified death as an unfortunate event for which our clients must be covered to ensure a dignified send-off in its eventuality.

We expanded our business strategy to encompass business models which can help prolong life and active economic participation. The medical aid industry became very attractive as a means to begin executing that strategy. As a result, a 10-year strategy was developed from 2010 to enter the healthcare industry.

The Group started at the bottom by establishing two healthcare advisory companies; NUMSA Financial Services and 3Sixty Client Solutions, and progressed to the acquisition of Sechaba Medical Solutions, which we have since rebranded as 3Sixty Health. 3Sixty Health administers both the Sizwe-Hosmed Medical Scheme and the South African Breweries Medical Aid Society.

Further analysis indicated that medical aid costs are driven by hospitalisation, pharmaceutical products, and specialist services. We attempted to enter the hospital industry with

little success. Our view at that time was that the entry into pharmaceuticals was difficult, and that South African pharmaceutical companies were primarily distributors of products from foreign companies – a position we do not want to be in.

We regarded specialists as the “Gods” of the industry that kept power to themselves and could not be disrupted.

It was not until I met Martin Magwaza, that the possibility of playing in the biotech space through innovation, as an equal amongst international innovation-based companies, became apparent.

We have, over the past five years, invested significantly in biotech to develop, reformat, and reformulate existing compounds, which have set us apart from existing South African pharmaceutical companies. We created four startup companies, which focus on well specified and well-chosen areas of biotechnology, namely:

1. 3Sixty Biopharmaceuticals: In this subsidiary we invested in Covid therapeutics, Covid vaccines, and antimalarials. The Group successfully completed animal tests for a Virus-Like Particles vaccine grown off tobacco leaves, with the majority of our work having been internationally published in peer-reviewed journals. We are about to conduct animal tests for our Covid therapeutics and malaria drugs. 3Sixty Biopharmaceuticals is currently expanding

Q&A: 3SIXTY GLOBAL SOLUTIONS GROUP

... the entry into pharmaceuticals was difficult... South African pharmaceutical companies were primarily distributors of products from foreign companies.

15 sabusinessintegrator.co.za

its anti-infectives portfolio to tackle multidrug resistant infections through a new strategic partnership. Our company is also pursuing compounds that show potential for the treatment of Alzheimer’s.

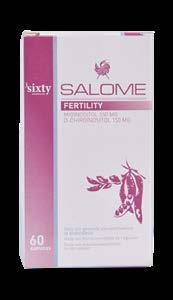

2. Sixty Biomedicine: Under 3Sixty Biomedicine, we have botanical extractbased women’s health products, the first migraine prophylaxis capsule and proprietary strains of rationally designed probiotics for gastric health and metabolic disorders.

3. 3Sixty Nuclear Medicine: We are preparing to launch radioisotopes for cancer treatment, rheumatoid arthritis, and haemophilic synovitis.

4. Cape Sativa: This is our cannabinoid business focused on using nanotechnology to produce finished dose formulations. This subsidiary is not in the business of growing cannabis nor doing primary processing. Our focus is to develop cannabinoid-based therapeutics for cancer, communicable diseases, metabolic and mental health disorders. The business is about to start animal trials for our cancer applications. Additionally, we have developed watersoluble cannabinoids for use in beverage and nutritional products.

What opportunities are there for South Africa in terms of pushing R&D, development and production of biotech and pharmaceutical products?

South Africa lost a culture of investment in innovations as the State has been discouraged from being entrepreneurial, with the gap left by the State not filled. You would remember that the Sasol coalto-fuel Pebble Bed Modular Reactor, Rooivalk, and many other technologies we led the world with were part of the State’s investment in innovations.

Despite having vast technological innovation, South Africa fails to capitalise on these technologies, which are available from universities and state research agencies. Despite South Africa’s world-class research capability, it lacks entrepreneurship collaboration, so our scientists do research out of scientific curiosity rather than progressing technologies from conception to commercialisation.

Additionally, unlike Nasdaq in the USA, the Johannesburg Stock Exchange (JSE) does not have a culture of supporting new ventures. The requirements for listing are such that you need to have a track record of at least three years of revenue and profitability. Our retirement fund legislation is such that investment in unlisted assets is uncommon and venture capital funding is limited.

Unless we unleash funding to entrepreneurs,

16 sabusinessintegrator.co.za Q&A: 3SIXTY GLOBAL SOLUTIONS GROUP

value in the JSE will always be driven by the problem of “too much money” chasing “too few assets”, and the JSE appreciation will remain at variance with the performance of the economy for its citizens; red hot stocks in the mist of increasing unemployment.

Investment in innovation is the only reason why the USA dominates the world economy. The rest of us are their clients and at times we copy what they have produced. Investment in innovation for South Africa will make us the industrial giant we should be; it’s the only way we can eliminate unemployment and poverty and solve some of our most complex problems.

As an African organisation with global aspirations, the diseases of the developing world like tuberculosis (TB) and malaria will receive serious attention from us. We need to ask ourselves how can TB remain as the number one killer in South Africa in this day and age? How can malaria be the number one killer in Africa, and both without Africans and South Africans making significant investment in research? That being the case, investment in such areas will be our contribution to society amongst other things.

Does SA have the capacity to compete in the biotech sphere on a global scale?

Yes, South Africa has enormous research capability and capacity in State agencies and universities. These capabilities exist but they have remained unrecognised because we lost the culture of investing in innovations at the level of the State.

Our economy is too skewed towards financial services and mining. Banks employ engineers so that they can assess mining proposals, but they are in the dark about biotech. A country will only become successful in areas it focuses on and heavily invests in from a research and investment perspective.

Our competitive advantages as a country

include: being the lowest cost research destination; having a strong manufacturing base; a skilled workforce that is unemployed; and having the South African Health Products Regulatory Authority (SAHPRA) – a globally recognised regulatory agency.

Although limited, South Africa has a few companies that specialise in clinical studies and the University of Cape Town’s Institute of Infectious Disease and Molecular Medicine has a Biosafety level three (high containment) accredited facility managing highly infectious disease agents required for basic research and diagnosis.

Our country has the skills to become a biotechnology powerhouse, a position we occupied before losing it to India. As an organisation we picked this opportunity and have spent the past five years gobbling up technologies, registering patents, developing and testing products.

What potential opportunities linked to the energy and telecommunications sectors is The Group investigating?

We regard energy

and

telecommunications as the next frontier for us after biotech. The organisation has looked at Small Modular Reactors (SMRs) and the Open Base Transceiver Station (Open BTS). Our work on SMRs has led to contacts with companies in the USA, South Korea, and China.

Our telecommunications technology is a local innovation based on Open BTS, a USA open-source platform that enables calls into the Global System for Mobiles (GSM) at minimal cost. We placed the former on abeyance and some work continues on the latter, all due to the disruption of Covid and the 3Sixty Life curatorship.

17 sabusinessintegrator.co.za

Q&A: 3SIXTY GLOBAL SOLUTIONS GROUP

What are some of The Group's offerings to mitigate challenges?

Our investment is designed to address the challenges of rising healthcare costs caused by the burden of disease. For instance, our investments in weight loss technologies (three weight loss products will be launched) will have a positive impact on diabetes and hypertension.

In conjunction with this investment, we are acquiring a company that specialises in treating diabetes and hypertension. They have a vision to expand services to include renal dialysis, pathology, and a whole lot of areas in which we can bring costs down whilst making a decent profit.

We remain in an environment where we are exposed to an abundance of technology, so much so that we are like kids in a candy shop, and had to quickly develop the discipline to choose high impact technologies.

How is the 3Sixty Global Solutions Group unique in its offerings?

Partnership symbiosis is one of our strengths as we are able to engage with local and international partners effectively, because we have a unique biotechnological innovative offering to put on the table.

Partnerships are transformative in that through complementing one another we are able to advance each other’s objectives much quicker and more cost effectively.

Our growth will be driven by entry into global markets through partnerships as well as offering inward and outward innovative products. We will export South African Intellectual Property (IP) and integrate with the best global IP to advance mutual benefits with numerous partners.

Is the vision of being "a listed Pan African Group with significant global market presence by 2025" on track?

This objective remains on track, albeit in different shapes. We have broken the Group into two groups now, Doves Group Holdings (DGH) which offers funeral services and insurance, and 3Sixty Global Solutions Group (3Sixty GSG) which offers healthcare and biotechnology solutions. The paths taken will be different, but the objective will be met.

What are the opportunities for The Group, despite the challenges?

Our investment in biotech remains the single biggest opportunity. We remain one of the few in South Africa who have invested heavily in biotech research and development, especially considering our size.

Khandani Msibi, Executive Chairman, 3Sixty GSG, has 30 years’ experience, which started in manufacturing in the steel industry and later moved on to the FMCG industry, working for companies like Bristol Myers, Bromor Foods and ABI senior management level.

His introduction into sales was when he was appointed National Sales Director at Fedics. After a short stint in at the Water Board as CEO, he joined NUMSA Investment Company when it was being liquidated and rescued it with a team of professionals.

Msibi and his team transformed NUMSA Investment Company from a funeral services company into a group of companies in life insurance, medical aid, retirement funding and investment, and more recently, biotechnology.

18 sabusinessintegrator.co.za Q&A: 3SIXTY GLOBAL SOLUTIONS GROUP

Our investment is designed to address the challenges of rising healthcare costs caused by the burden of disease

Smile Foundation transforms the lives of children with facial abnormalities and severe burns through the best possible surgical and psychological care.

We are currently based in 14 of South Af rica’s leading hospitals where we invest in development programs and purchase much needed medical equipment for depar tments specialising in plastic and reconstructive surger y.

With the compassion and suppor t of our benefactors and teams of medical staff, we can sprinkle a little bit of magic into the lives of these children and give them a future full of joy.

Please donate to help us continue our work and suppor t children in need.

EVERY CHILD DESERVES TO SMILE.

(010) 753 3034 | smilefoundationsa.org

Invest in South Africa

to make it work

Busisiwe Mavuso, Chief Executive Officer at Business Leadership South Africa (BLSA), talks to SA BUSINESS INTEGRATOR about the biggest challenges facing the South African economy, what is needed to mitigate this, and more...

What are the biggest threats facing the South African economy and/or business?

From BLSA’s perspective, these are the scourge of criminality and corruption; the energy (electricity) crisis; the woeful state of our transport and logistics network (particularly freight rail and the operations of our ports); and threats to water availability and infrastructure.

BLSA

sabusinessintegrator.co.za 20

Q&A:

What is required to mitigate this?

An all-of-government approach is required, delivered by an effective and capable, professionalised civil service. This is arguably one the key initial steps.

In addition to this, the policy environment needs to encourage the private sector to partner with government to deliver some of the essential services referred to above. For example, the private sector is already contributing to energy generation and there is scope for further private sector participation in transmission and distribution.

The same is true for transport and logistics; the conditions need to be attractive to allow the private sector to invest and contribute to social goods (like facilitating the maximisation of export revenue).

And of course, we need to urgently ramp up our collective efforts to eliminate as far as possible corruption across the public and private sectors, and generally minimise the endemic criminality that is significantly affecting economic growth and job creation.

Which sectors need urgent intervention to bring about positive change?

The network industries are critical. Without these operating effectively, all other sectors are compromised. We’ve seen this in manufacturing, agriculture, mining and services across the economy.

What interventions are needed?

Put simply, we need to move away from a statist conceptualisation of the economy and towards recognition of the fundamental, catalytic role that unleashing the power of the private sector can play.

We are making tentative moves in this direction, but this needs to be speeded up significantly. Concessioning of ports, railways, power stations, etc. are obvious examples but this has to be accompanied by a crackdown on criminality.

What are some of the key opportunities that businesses can capitalise on?

South Africa has a lot going for it – a vibrant democracy, a strong judiciary, a capable and patriotic private sector, and enviable endowments of natural resources conducive to major sectors like mining, agriculture, tourism (to name just a few).

With the right policy mix and a professional, capable civil service, there is little we cannot achieve.

What role does BLSA play in helping to unlock and enable opportunities?

BLSA as an industry association works hard to unlock opportunities. We do this by advocating for appropriate regulation, capacitating the state wherever possible (at local and national government level, as well as state institutions), and providing technical expertise for the realisation of specific objectives (e.g. supporting NECOM, Operation Vulindlela, the Presidential SOE Council, SAPS, NPA, etc.).

How much leeway does the private sector have to bring about proactive change to help drive growth?

The private sector is ready and willing, and already contributes extensively to finding solutions. However, there is always the need for the basics to be in place – a willing partner in government with the requisite appetite and skills to effectively partner with business.

Business has no option (other than divestment, which would be disastrous to SA) but to invest in making South Africa work.

Short-termism won’t help – we need to focus on sustainable solutions to our most pressing problems, like load shedding, or we will be stuck with the status quo indefinitely. That would not be good for business or society as a whole.

21 sabusinessintegrator.co.za Q&A: BLSA

Q&A: BLSA

Why should multinational corporations want to (or continue to) invest in SA?

South Africa enjoys a number of advantages, notwithstanding our very serious deficiencies. We have an effective judiciary (sanctity of contracts), an ecosystem of a solid private sector, enviable natural endowments, a reputation as a reasonable choice as a gateway to the region, preferential trade agreements with the EU, UK and the US, soon to be augmented by the African Continental Free Trade Agreement.

Looking at the recent budget speech, what would you say was lacking?

We thought the budget speech was excellent, considering the multiple challenges facing the country. The fact that the Minister was able to balance fiscal consolidation (albeit with some slippage on the debt-to-GDP ratio) with multiple spending pressures was very impressive.

We do, however, think that more should have been done to incentivise off-grid energy solutions. For example, expanding the tax incentive for solar power generation to include batteries would have been prudent given the severity of the electricity crisis.

The constraints emanating from our network industries especially militates against meaningful growth. We would not be surprised to see growth coming in at around the SARB’s expectations.

What growth is SA expected to achieve in 2023?

We are unfortunately quite conservative in our estimations. The constraints emanating from our network industries especially militates against meaningful growth. We would not be surprised to see growth coming in at around the SARB’s expectations.

How do you see the year unfolding?

A lot of political “noise”, but (and this is crucial) slow and steady progress on the economic reform front.

The work that Operation Vulindlela in the Presidency is doing is very important and should over time significantly move the dial on growth if implemented effectively.

Busisiwe Mavuso is a Chartered Certified Accountant, CCA, qualified with Association of Certified Chartered Accountants (ACCA–UK) and holds a Master’s Degree in Business Leadership, a Postgraduate Qualification in Management from GIBS, a BCompt in Accounting from the University of South Africa (UNISA), and is currently completing her PhD.

She is the Chief Executive Officer at Business Leadership South Africa (BLSA); Business Unity South Africa (BUSA) and Resultant Finance (a PIC investee company) and serves on the Human Resources Development Council (HRDC), the Advisory Committee of the Local Government Ethical Leadership Initiative (LGELI), The Alcohol Industry Advisory Council (TAIAC), the Drinks Federation of South Africa (DF-SA) Council of Members and the Social Justice Council. Furthermore, she is a Visiting Adjunct Professor at the Wits Business School (WBS). Mavuso is also a member of the YPO (Young President’s Organisation), the IoDSA and ACCA.

22 sabusinessintegrator.co.za

SAICA M KERS DIFFERENCE

NOMINATE A SAICA MEMBER OR ASSOCIATE TODAY

2023 NOMINATIONS NOW OPEN

The SAICA Chairman’s Di erence Makers Awards seek to recognise SAICA members and associates who are #di erencemakers in various areas of business and society – those who have bridged the gap between being good and being excellent. These awards acknowledge SAICA members and associates who make decisions that provide sustained prosperity for all; individuals who make a valuable contribution to shaping communities, economies, and society while applying the highest standards of ethics, integrity, and accountability.

THE CATEGORIES FOR NOMINATIONS ARE:

PUBLIC SECTOR

SUSTAINABILITY

ACADEMIA AWARD TRAINING OFFICE AWARD FUTURE FIT AWARD FINANCE LEADER AWARD SMP AWARD LIFETIME ACHIEVER AWARD

AWARD

AWARD

SCAN THE QR CODE BELOW TO NOMINATE A SAICA MEMBER OR ASSOCIATE BY 30 APRIL 2023.

SA’s grey-listing

by FATF

On 24 February 2023, South Africa was placed on the Financial Action Task Force’s (FATF) grey list. This is a list of countries and jurisdictions where the FATF exercises enhanced monitoring with regards to anti-money laundering (AML) and combatting the financing of terrorism (CFT) legislation and the effectiveness of the implementation of the laws.

There were 12 key areas identified where South Africa needed to improve and these related to the strength of our processes as well as institutions regarding AML and CFT. The table below lists the countries on the FATF’s monitoring lists:

•

• Iran

enhanced due diligence in the processing of transactions, vetting clients, verifying the sources of funds, and tracking their use.

• Myanmar

This has the effect of undermining the credibility of the country and tarnishing its reputation. Further, the enhanced vigilance will increase the cost of doing business for local entities when engaging with foreign counterparts.

Next steps

• Albania

• Barbados

• Burkina Faso

• Cayman Islands

• Democratic Republic of Congo

• Gibritar

• Haiti

• Jamaica

• Cambodia

What is FATF?

• Jordan

• Mali

• Mozambique

• Nigeria

• Panama

• Philippines

• Senegal

• South Africa

• Morocco

The (FATF) is the global money laundering and terrorist financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society. (Source: FATF)

What does it mean for SA and what is our plan?

Whilst not having specific adverse consequences, this classification does signal that greater scrutiny and caution needs to be exercised by other countries and institutions when dealing with South African entities at large. Foreign institutions are therefore likely to exercise

• South Sudan

• Syria

• Tanzania

• Turklye

• Uganda

• United Arab Emirates

• Yemen

Drawing from our rest of Africa research, Mauritius was also subjected to a similar fate. That country instituted swift actions and was promptly removed from the list in less than two years.

The South African government has outlined a plan of action and allocated a budget of R41 billion towards these efforts. It is believed that this plan should be implemented over the next few months. South Africa has requested to be formally reassessed in June of this year and this could pave the way for a reversal of the listing by 2024. In terms of the FATF process, the shortcomings identified need to be rectified by the end of January 2025.

It is hoped that the status is likely to be reversed in 2024 as the action plan appears achievable. The 12 areas identified are relatively similar to those Mauritius needed to address and hence there is confidence that the milestones can be achieved. There is also sufficient political will to believe that there will be a concerted effort in addressing the issues identified by the FATF.

24 sabusinessintegrator.co.za

ADVERTORIAL: MAZI ASSET MANAGEMENT

Asanda Notshe, Chief Investment Officer at Mazi Asset Management

High-risk jurisdictions subject to a call for action (i.e. the 'black list')

Republic of Korea

Democratic People's

Jurisdictions under increased monitoring (i.e. the 'grey list') (lastest additions highlighted in red)

No longer subject to increased monitoring

Source: FATF

We invest in the diverse opportunities life has to offer Mazi Asset Management Prime Equity Fund Mazi Asset Management Prime Africa Fund Mazi Asset Management Prime Global Fund Mazi Asset Management Prime Money Market Fund Delivery Through Diversity Mazi Asset Management (Pty) Ltd is an authorized Financial Service Provider. FSP No. 46405 mazi.co.za

South Africa has been grey listed!

What are the implications?

South Africa’s grey listing by the Financial Action Task Force (FATF) has significant implications for its economic growth and global competitiveness but moves are already being taken to satisfy the FATF.

By the Webber Wentzel Finance Team

By the Webber Wentzel Finance Team

The main implication of grey listing is that members of the international community are "warned" that conducting business with the impugned country could facilitate terrorism financing and money laundering.

South Africa has taken certain measures to address FATF concerns

In April 2022, the Investigating Directorate (ID) was established within the National Prosecuting Authority to prosecute individuals and entities that were involved in state capture. Besides, South Africa submitted several reports to the FATF, prosecuted several money laundering offenders, and utilised extraditions to get fugitive offenders. The National Treasury also moved quickly to enact necessary legislation.

On 22 December 2022, the General Laws (AntiMoney Laundering and Combating Terrorism Financing) Amendment Act commenced after being signed by the President. The Act amends five pieces of legislation including the:

1. Companies Act, 2008;

2. Financial Intelligence Centre Act;

3. Financial Sector Regulation Act, 2017;

4. Nonprofit Organisations Act, 1997; and

5. Trust Property Control Act, 1988.

For more details on the amendments made to the aforementioned legislation and when the relevant sections in the Act are commencing, please visit www.webberwentzel.com/News/Pages/ commencement-of-the-general-laws-anti-moneylaundering-and-combating-terrorism-financingamendment-act.aspx

On 23 December 2023, the Protection of Constitutional Democracy Against Terrorist and Related Activities Amendment Act commenced after being signed by the President. This Act

ECONOMIC GROWTH

26 sabusinessintegrator.co.za

expands the definition of terrorist activities; provides for crimes related to terrorist training, the joining of terrorist organisations, and the possession and distribution of publications with terrorism-related content.

In February 2023, South Africa made a highlevel political commitment to work with the FATF and ESAAMLG to strengthen the effectiveness of its AML/CFT regime. Since the adoption of the Mutual Evaluation Report (MER) in June 2021, South Africa has made significant progress on many of the MER’s recommended actions to improve its system, including by developing national AML/CFT policies to address higher risks and newly amending the legal framework for TF and TFS, among others.

What are the implications for the country moving forward?

The implications of grey listing for South Africa are two-fold: reputational and economic. South Africa now has a negative reputation in the global economy. It may also be downgraded by credit rating agencies, which would affect the country's ability to borrow on the international capital markets. Economic consequences of grey listing can be summarized as follows:

1. Less capital flows into South Africa: According to a report by the International Monetary Fund (IMF), grey listing leads to a significant decrease in capital inflows. For vulnerable countries, this could result in a balance of payments crisis. This is because grey listing entails that all transactions of South African companies and individuals will be seen as high-risk transactions, resulting in complicated compliance and administrative duties, and likely disincentivising investment into and trade with South Africa.

2. Economic penalties might be imposed on South Africa: FATF member states and other international bodies might impose economic penalties and similar measures against South Africa. International finance flows to and from SA will entail higher compliance obligations and transaction costs.

Regulators in the US, EU, and the UK might place restrictions on their banks regarding transacting with South African banks. Some international financial institutions have policies that prevent them from doing business with grey listed countries or at least, limit the scope of business that can be conducted. Such restrictions will further impede business and foreign investment.

3. Less foreign direct investment (FDI): Grey listing will discourage FDI in South Africa and

ECONOMIC GROWTH

27 sabusinessintegrator.co.za

reduce capital inflows. It will raise the cost of doing business in South Africa, making foreign investors reluctant to invest in the economy. This is because international counterparts will have to undertake increased due diligence when dealing with South African entities. As transaction costs rise, there is a disincentive to do business with South African firms. South Africa will be viewed as a high-risk jurisdiction for business, so some foreign investors might take out their investments.

4. Decrease in South Africa's external reserves: If there are lower capital inflows and FDI into South Africa, this could reduce external reserves as there will be less tax revenue.

5. Difficulty obtaining financing on the international market: Given the implications of grey listing, South African companies will find it harder to obtain financing from foreign lenders on the international capital markets, and from multilateral lenders such as the World Bank.

6. Decreased competitiveness of South African companies in the global economy: South African companies, due to enhanced monitoring, will face more requirements to prove sources of funding, leading to higher transaction costs and delayed execution of transactions. This will ultimately harm the competitiveness of South African companies and South Africa as a whole in the global market.

Financial institutions that rely heavily on global trade in their treasury departments will be heavily impacted. Trading offshore will come with higher due diligence hoops to jump through and more red tape. Trading revenue is therefore going to decline. The South African insurance industry will particularly be impacted.

7. Climate adaptation will be impacted: South Africa urgently needs to adapt to climate change, and financing from international partners is needed. At COP 26, the US, EU, UK, France, and Germany pledged to give USD8.5 billion to South Africa to finance its transition to a lower carbon economy. After grey listing, international finance flows to and from South Africa will be riddled with higher compliance obligations and transaction costs. Even if South Africa does receive the funding, it is likely to need the support of other foreign investors and companies to successfully transition to a lower carbon economy. Grey listing will make it harder for the country to achieve its ESG goals.

What does South Africa need to focus on?

The FATF has identified eight areas that South Africa needs to focus on, which include improving South Africa's risk-based supervision of identified risks. South Africa is also required to improve their investigation and prosecution of serious and complex money laundering and terrorist financing activities. Competent authorities are also required to ensure that they have accurate and up to date beneficial ownership information.

It is important to note that, as Mauritius has shown, South Africa can come off the grey list within as little as two years if government and the private sector co-operate to take decisive actions to address the FATF’s concerns.

Government is clearly committed to these actions. Finance Minister Enoch Godongwana, in his Budget speech on 22 February, said the outstanding deficiencies would be addressed through regulations and the eight actions summarised above. South Africa has a plan of action, it is now about implementation.

28 sabusinessintegrator.co.za ECONOMIC GROWTH

to mitigate threats to SA’s economy Action needed

The lack of leadership and of decision-making, and the inability to implement critical interventions needed to instil confidence, attract investment and grow the economy are the biggest threats to South Africa, says Cas Coovadia, CEO of Business Unity SA (BUSA).

Considering South Africa’s grey listing, how is this expected to impact business?

As regards foreign investment, this will further erode confidence and potential investors will be concerned about South Africa’s ability to combat money-laundering and terrorism financing. This erosion of confidence will also lead to lower investment and an inability to grow the economy to create jobs, thus causing a negative impact on job-creation. Businesses will find it difficult to retain jobs in a shrinking economy.

What are your thoughts on President

Cyril Ramaphosa’s calls on the private sector to intervene and find solutions?

The private sector has bent over backwards to support government. Examples are the mobilisation of the private sector during Covid and support of the private sector to help NECOM implement the President’s Energy Plan.

Q&A: BUSA

30 sabusinessintegrator.co.za

How much freedom does the private sector actually have to enact proactive change?

The private sector needs to move away from concentrating on expectations of government’s positive response to offers of help from the sector, to focusing on areas we can implement on our own and make a real difference in the national interest.

What are the tangible solutions and actions to drive sustainable growth in South Africa?

We need to work on specific sectors and identified products to drive growth, but government must work on structural reforms to the economy to enable this. Critical sectors are mining, agriculture, manufacturing, automotive and services.

Is there sufficient intervention from government to help businesses navigate the energy challenge?

There has been some progress on this as laid out in the President’s budget speech. The President’s Energy Plan needs to be implemented urgently to help solve the energy crisis and assist business.

Is the privatisation of SOE’s a viable option, and why?

There must be an option to increase efficiencies, reduce state exposure and drive economic growth; but within the context of the rationalisation of SOE’s and the closure of some.

What are some of the other challenges that can be expected in 2023 and going forward?

Logistics and law and order are critical challenges. Also, a looming water crisis and dysfunctionality of municipal government.

How do you see the rest of the year unfolding from a business perspective? Jobs will be shed without decisive moves to attract investment and enable growth. Immediate appropriate interventions in energy, logistics and law and order could improve the environment.

Progress in improving leadership in government and implementing critical interventions will help raise confidence. BUSA encourages government to send the message that South Africa is open for business in order to attract investment.

What are some opportunities that can be unlocked?

The private sector generation of energy and driving Transnet towards greater participation of the private sector in logistics. And the South African private sector has the capacity, resources and skills to do this.

Cas Coovadia took over the reins as CEO of BUSA on 1 April 2020, after retiring as Managing Director of The Banking Association SA (BASA) where he spent 15 years. He was instrumental in positioning BASA as one of the leading business organisations in SA and positioning it as a credible voice for the banking industry.

Q&A: BUSA

31 sabusinessintegrator.co.za

Addressing industry skills shortages in

the mining sector

In its global risk barometer for 2022, international financial services provider Allianz surveyed 2 650 risk experts in 89 countries on the biggest perils facing industries in the coming year. Notably, skills shortages were identified as the eighth biggest risk in South Africa currently.

By Jacques Farmer, MD of PRISMA and Roland Innes, Group CEO of Dyna Training

MINING

32 sabusinessintegrator.co.za

Our economic recovery and growth in the aftermath of the Covid-19 pandemic will depend largely on our ability to address skills shortages in the labour market and the workplace. Companies and individuals should make the most of every opportunity to develop skills and align these skills with the Quality Council for Trades and Occupations (QCTO).

Responsible for the oversight of the accreditation, implementation, assessment, and certification of occupational qualifications, part-qualifications, and skills programmes, the QCTO has a major role to play in tackling skills shortages. It does so by placing vocational certification by means of learnership and apprenticeship programmes at the centre of South Africa’s skills creation system.

Urgent need for practical skills and artisans

There has been an increased demand worldwide for artisans, engineers and technicians along with individuals skilled in sales and marketing. This highlights the fact that practical skills are urgently needed in the labour market and that there should be an increased focus on training artisans.

South Africa’s QCTO was established to manage the Occupational Qualifications Sub-Framework (OQSF) by setting and developing standards, while assuring the quality of national occupational qualifications. The purpose of the OQSF is to facilitate the development and registration of quality-assured occupational and trade-related qualifications, part-qualifications and skills programmes from the National Qualifications Framework (NQF) Level 1 to 8. This is intended to meet the needs of existing and emerging sectors by ensuring that all learners, professionals, workers, unemployed and those classified as NEET (Not in Employment, Education or Training), are equipped with relevant and transferable competencies to enhance lifelong employability.

Win-win for businesses and labour market

Ultimately the QCTO is intended to replace the Sector Education and Training Authority (SETA), while closing the gap whereby individuals in the labour market have the skills but lack the formal certifications or paperwork necessary to find employment or to maximise earning potential. While higher-level qualifications are essential, it is also necessary to address the immediate gap that stands between an individual coming out of school and becoming eligible to embark on the national qualification process.

To this end, the QCTO has implemented skills programmes, effectively a shorter skills syllabus, at the end of which a learner can gain entry into a qualification or a part-time qualification. This also has the immediate benefit of making the individual more employable.

In addition to increasing and keeping their own skills in-house, businesses can contribute to the career development of their people which provides a greater level of motivation and incentive. Skills development training also assists with reducing absenteeism where workers feel that the training they’re getting is valuable to their personal growth, contributing to a more committed workforce.

Where companies offer skills development opportunities, it becomes possible to redirect budget spend previously used for recruitment into training, shifting the focus to retention instead of acquisition.

more committed workforce.

MINING

33 sabusinessintegrator.co.za

Skills development training also assists with reducing absenteeism where workers feel that the training they’re getting is valuable to their personal growth, contributing to a

The nitty gritty of the QCTO: how does it work?

As mentioned, the QCTO is responsible for the accreditation of Skills Development Providers (SDPs), authorising them to facilitate programmes and qualifications that fall under the OQSF. These include occupational qualifications including ‘old’ trades, N4-N6 Programmes, historically registered qualifications, and the shorter, bridging skills programmes. Any SDP offering training or intending to offer training in any of these must seek accreditation from the QCTO and must comply with the entity’s minimum criteria.

Out with SETA, in with QCTO

From June 2023, SETA accreditation will be subject to a teach-out period, after which qualifications and skills programmes will need to be aligned with QCTO. This is a valuable opportunity for training providers to align their offerings to the QCTO accreditation standards, as that is the direction in which we are headed.

It will be necessary to work hand-in-hand with industry leaders in developing learning material to ensure that the necessary knowledge is combined with practical experience, hands-on learning opportunities and assessments.

Additionally, a major focus of these skills development and training programmes will be ensuring that learners are placed at companies where they can gain experience and skills in the workplace, and ultimately take up employment after assessment and qualification. The output from SDPs will be assessed by Assessment Quality Partners (AQPs), and it is the responsibility of the AQP to sign off on the provider issuing a Statement of Result to the learner which gives them entry to the Integrated Summative Assessment for certification.

Smarter approach to skills development

For companies to maximise this opportunity, both from a tax rebate and Broad-Based Black Economic Empowerment (B-BBEE) scoring perspective, they will need to ensure that they coordinate training initiatives with SDPs that are

accredited by the QCTO.

SDPs will need to modernise their curriculum to be more learner-focused, while forming relationships with AQPs. In order to exit learners smoothly, organisations will need to prepare their workplaces so that they are compliant with QCTO requirements, developing the necessary mentoring infrastructure to enable those placements while giving learners the best possible support.

In shifting the focus from generic skills training to inclusive learner development and facilitation through the QCTO framework, it becomes much easier to address South Africa’s skills shortage effectively and sustainably.

The mining perspective

With the South African and pan-African mining sectors growing significantly over the past few years, the skills shortage in this industry has widened massively across the entire spectrum of skills – including artisans, engineers and technicians. This skills shortage was further compounded by the COVID-19 pandemic, with mining houses being reluctant to develop qualified people during times of economic uncertainty and limited activity.

As a result, private training providers, such as SDPs, have seen a recent spike in the uptake of their services – not only for the development of skills within mining houses themselves, but also for the upskilling of local communities in which these miners operate. The need is not only to catch up

34 sabusinessintegrator.co.za MINING

on the skills that have been neglected during the pandemic, but equally to focus on skills that need to be developed for the future. Hence, there is currently a renewed emphasis on learning and development within the mining industry in South Africa, in SADC, as well as across other parts of the continent.

However, there seems to be a significant margin for improvement in the commitment of local mining houses to learning and development initiatives. While South Africa currently has more than 2 000 recognised and operational mining operations within its borders, only about 50% of them proactively submit their annual Work Skills Plans and Annual Planning Reports, as required by the Mining Qualifications Authority (MQA), to qualify for training-related tax rebates.

There might be bigger changes on the cards for organisations operating in other sectors, where no practical training component can be provided before a trainee is deemed competent.

Repositioning legacy qualifications

Despite there being more than 2 000 operational mining houses in South Africa, there are currently only 183 SDPs. Due to the phasing out of SETAs from June 2023, these SDPs are currently working closely with the MQA and qualified curriculum designers to reposition their legacy qualifications as occupational qualifications, as well as partqualifications, as per QCTO requirements.

In 2020/21, a number of occupational qualifications were selected to be redesigned and registered with the QCTO, and the training sector as a whole is largely in line with its targets

for registering the new qualifications by June 2023. From that date, all unit-standard-based training will lapse and will be no longer be registered on the mining qualification system. Instead, unitstandard qualifications will essentially be replaced or incorporated into modular training or partqualifications.

Currently, mining training providers, or SDPs, obtain their accreditation through the MQA, but as the MQA will be replaced by an AQP in June 2023, all legacy qualifications will be placed in the QCTO basket, with this body taking charge of qualifications going forward.

Under the new structure, SDPs will still be able to obtain accreditation as different types of qualification bodies, such as those that provide training in the knowledge spectrum or compliance spectrum. For the third spectrum – workplace approval – SDPs will need to conclude a service level agreement with a mining house that runs its own training centre to obtain Workplace Approval Accreditation. Essentially, this means that SDPs will still be involved in all three spectrums of mining training.

Changes for miners

Traditionally, the training offered by private training providers to the mining industry has always been of a circular nature – encompassing a knowledge component, a practical component and a workplace component, and this will largely still be the case. The specifics of the relationship between SDPs and AQPs is yet to be determined.

Hence, mining houses are not expected to see significant changes to how SDPs provide training under QCTO. There might be bigger changes on the cards for organisations operating in other sectors, where no practical training component can be provided before a trainee is deemed competent. Nevertheless, miners will need to remain vigilant of developments in the QCTO space and specifically the emerging role of AQPs.

35 sabusinessintegrator.co.za

MINING

Uncertainties in base and precious metals supply:

Is Africa ready?

The ongoing Ukraine war and ensuing sanctions imposed on Russia have resulted in spasms in the oil and natural gas markets, driving well-documented disruptions to energy supplies, as well as agricultural resources.

By Kearney

METALS

38 sabusinessintegrator.co.za

However, the shortages in supplies of crucial basic and precious metals, which are just as concerning to Africa's business leaders as those in energy and agriculture – have garnered far less coverage and attention.

"The sanctions against Russia, one of the world's biggest exporters of raw materials, is causing knock-on effects that are rippling throughout many spheres of business, from the sustainability of Africa's mining operations to the stable functioning of the manufacturing base," explains Igor Hulak, a Partner at Kearney, a leading global management consulting firm. The suspension of foreign shipping operations has triggered a worldwide shipping container shortage. With existing infrastructure insufficient for handling the redirection to and through Asia of raw materials in their full volumes, industries are looking for solutions.

In addition, alternatives that make use of ageing infrastructure are unsuitable as they pose massive environmental risks, as proved by the catastrophic 2020 diesel spill at Norilsk Nickel, Russia's worst-ever Arctic environmental disaster. China may have been able to fill the supply gaps, but ongoing Covid-related shutdowns and supply chain interruptions have made that difficult.

These sanctions and shutdowns will continue to affect Africa's consumers as well, having manifested in increased prices for food and fuel.

Deficit in global nickel supply is an opportunity for African nickel producers

Since early 2022, the five base metals that Russia produces on a vast scale; nickel, aluminium, copper, iron, and zinc; have experienced sharp price increases, and continued supply disruptions are likely to see prices rise further still.

"Nickel, which is a critical ingredient in lithium-ion batteries and essential for the global energy transition, is in short supply. Russian companies such as Norilsk Nickel, the world's largest nickel producer, had historically supplied global markets. However, the sanctions have made Russia, which accounts for roughly 10% of the global share of nickel, unable to meet this global demand," Hulak notes.

"This deficit in global supply presents an opportunity for African nickel producers, such as Zimbabwe and Botswana, to step in and fill the gap. However, overcoming existing inadequate export infrastructure will be a major challenge, requiring government buyin and a collaborative multi-sector approach. Though the challenges are formidable, Africa must find a way to seize this opportunity and emerge as a key player in the new global metals market," Hulak asserts.

Hulak says that prices of other base metals for which the world is less reliant, such as iron and zinc (of which Russia produces 4% and 2% of the global share, respectively), are likely to stabilise.

Precious metal prices have, by contrast, shown less volatility. However, as these too are crucial to the electric economy, experts warn that price increases are still on the cards.

METALS

39 sabusinessintegrator.co.za

Nickel, which is a critical ingredient in lithium-ion batteries and essential for the global energy transition, is in short supply.

Most significant increases expected for platinum

The most significant increases are expected in the platinum group. Russia accounts for almost 40% of the world's supply of palladium and 11% of platinum, which is essential for hydrogen-based energy technologies (as well as alloys, circuitry, and ceramic capacitors).

According to Hulak, market and pricing drivers are currently indicating long-term price increases for the platinum group metals. This presents a golden opportunity for South Africa, still the world's largest producer of these metals, to step in and fill the supply gaps. Moreover, this is a unique opportunity for South Africa to leverage its already strong position and expand its operations in the sector to meet the escalating global demand.

Hulak goes on to add that platinum group metals are typically associated with rare earth metals such as rhodium, iridium, and palladium. With Russia unable to supply such metals, and with potential higher demand for these metals from increased military activity, it creates a market gap that African countries can fill.

"Traditionally a reliable safe-haven investment, gold (of which Russia is a major producer) is likely to see moderate price increases. This could work in favor of Africa's gold production powerhouses like Ghana and South Africa.

The silver price is, however, expected to stabilise, mainly because of the lack of direct sanctions and Russia's minor share of global production (6%).

Can the market find enough critical raw materials needed to support energy transition?

At this pivotal moment, with the energy transition enjoying popular public backing, the major concern now is whether the market can find enough of the critical raw materials needed to support it. Apart from exacerbating the disruptions driven by the Covid pandemic, these supply shocks are compounding the price pressures associated with this global shift and the resources this requires.

Offshore wind plants, for example, need more than seven times the amount of copper compared to equivalent gas-fired plants; and EVs use more than six times more minerals than internal combustion-powered vehicles.

Supply disruptions will likely continue to affect global markets. As a result, some African companies may need to pivot or scale down to withstand the current strains and maintain their operations.

However, Africa's wealth of natural resources, including many of the basic and precious metals currently in short supply, could allow her to leverage the opportunities presented by the shift towards an electric economy. By leveraging these resources effectively, Africa has the potential to drive additional economic growth, develop industries along the value chain, and create jobs.

Overall, however, the balance in global supply will not change significantly. As a result, prices for many base metals are expected to revert to the global consensus-forecast levels. Still, for some commodities, like nickel and precious metals, price increases look like they're here to stay.

REFERENCES

i https://www.weforum.org/agenda/2022/05/africa-faces-new-shock-aswar-raises-food-and-fuel-costs/

ii https://www.statista.com/statistics/1058851/russia-gold-productionvolume/#:~:text=In%202021%2C%20Russian%20gold%20 production,366%20metric%20tons%20in%202019.

iii https://www.businesslive.co.za/bd/markets/2022-02-24-higher-metalprices-benefit-sa-amid-ukraine-turmoil/