EXPERTS DISCUSS RESIDENTIAL DEVELOPMENT AND PROJECT SALES IN THE CURRENT CYCLE

Ray White Commercial’s Between the Lines live webinar attracted 300 listeners this month as experts discussed residential development and project sales in the current cycle

The session was hosted by Ray White head of research Vanessa Rader who was joined by managing partner of Ray White Projects Eddie Mansour and Partner | Residential Development of Ray White Valuations Peter Wiltshire who discussed what factors are currently at play impacting the residential market, the shift in which assets are in demand from buyers, and the changing attitudes towards financing from large developers down to first-time buyers.

“It’s a really interesting topic at the moment as we have a mismatch between the fundamentals at play - interest rates are up, supply is down, construction costs are up and there’s labour shortages, and residential vacancies are really low,” Ms Rader said.

“So it's a really good time to look at what’s happening in the market.”

Mr Wilshire said he was still seeing his more experienced clients purchasing sites and getting projects underway.

“There’s some short term pain with interest rates and construction costs but they can see in 18 months there’s going to be an undersupply,” he said.

“They know if they can get through the short term pain there’ll be huge demand there.”

Mr Mansour said while he was seeing the projects space gaining momentum, there was still some uncertainty around house and land as prices were perceived by buyers as having peaked.

“When construction prices started increasing it really started throwing a lot of developers’ feasibility into question and whether the project could pull through, but I think we’re past that period now,” he said.

“It seems that construction costs have plateaued and developers are starting to get reenergized and are commencing projects again.

10 | PORTFOLIO | Ray White Commercial

“With house and land we’ve seen a lot more people nervous - if they’re starting with a certain price it’s being blown out by the end of it.

“I’m seeing a return to one contract with the land and house being built together. It’s giving buyers confidence there’s a set price.”

Ms Rader said the apartment market had seen a consolidation in prices but a decline in turnover, and asked our experts what was happening in the off-the-plan market.

“A majority of the construction finance was coming from the banks but now it’s a lot of the non-banks doing finance these days,” Mr Wiltshire said.

“The banks have taken a step back which has given these nonbank lenders the chance to get a bigger market share.

“It costs a bit more in rates but you can get started a lot quicker, it’s easier to sell off-the-plan when you can see activity on site.”

Mr Mansour said the off-the-plan market was gaining momentum in Australia.

“We’re seeing a lot of parent assisted buyers and, looking at the market now, you need some kind of assistance,” he said.

“I don’t mind when we’ve got parents who come along because they ask questions, and it’s all about confidence when you’re buying off the plan.

“There’s some great questions being asked - who was the developer was the biggest question, but it’s now who is the builder.

“We want to give them that transparency they want when it comes to off-the-plan.

“Australia is still pretty new to off-the-plan when in some asian markets apartment living is the norm.”

Stay tuned for our next Between the Lines live webinar on October 25.

PORTFOLIO | Ray White Commercial | 11

“IT SEEMS THAT CONSTRUCTION COSTS HAVE PLATEAUED AND DEVELOPERS ARE STARTING TO GET REENERGIZED AND ARE COMMENCING PROJECTS AGAIN.”

VANESSA RADER

Head of Research

THE COLD STORAGE ASSET CLASS HAS GONE THROUGH A FEW PERIODS OF CHANGE OVER THE LAST TEN YEARS. THE EVOLUTION OF THIS INDUSTRIAL ASSET CLASS HAS SEEN INVESTMENT DEMAND INCREASE MORE RECENTLY, NOTABLY FROM OFFSHORE AND INSTITUTIONAL GROUPS. POPULARITY IN THE ASSET WAS REIGNITED AGAIN DURING THE PANDEMIC PERIOD WITH EXPANDED USE INTO HEALTH SCIENCES, AS THE NEED TO MANUFACTURE, STORE AND TRANSPORT VARIOUS MEDICAL GRADE PRODUCTS GREW. THIS NARROW SUBSET OF AN ALREADY LUCRATIVE INDUSTRIAL ASSET SAW DEMAND TO PURCHASE INCREASE, RESULTING IN STRONG COMPRESSION OF YIELDS LAST YEAR, ALBEIT INTO 2022 THIS HAS MODERATED.

12 | PORTFOLIO | Ray White Commercial

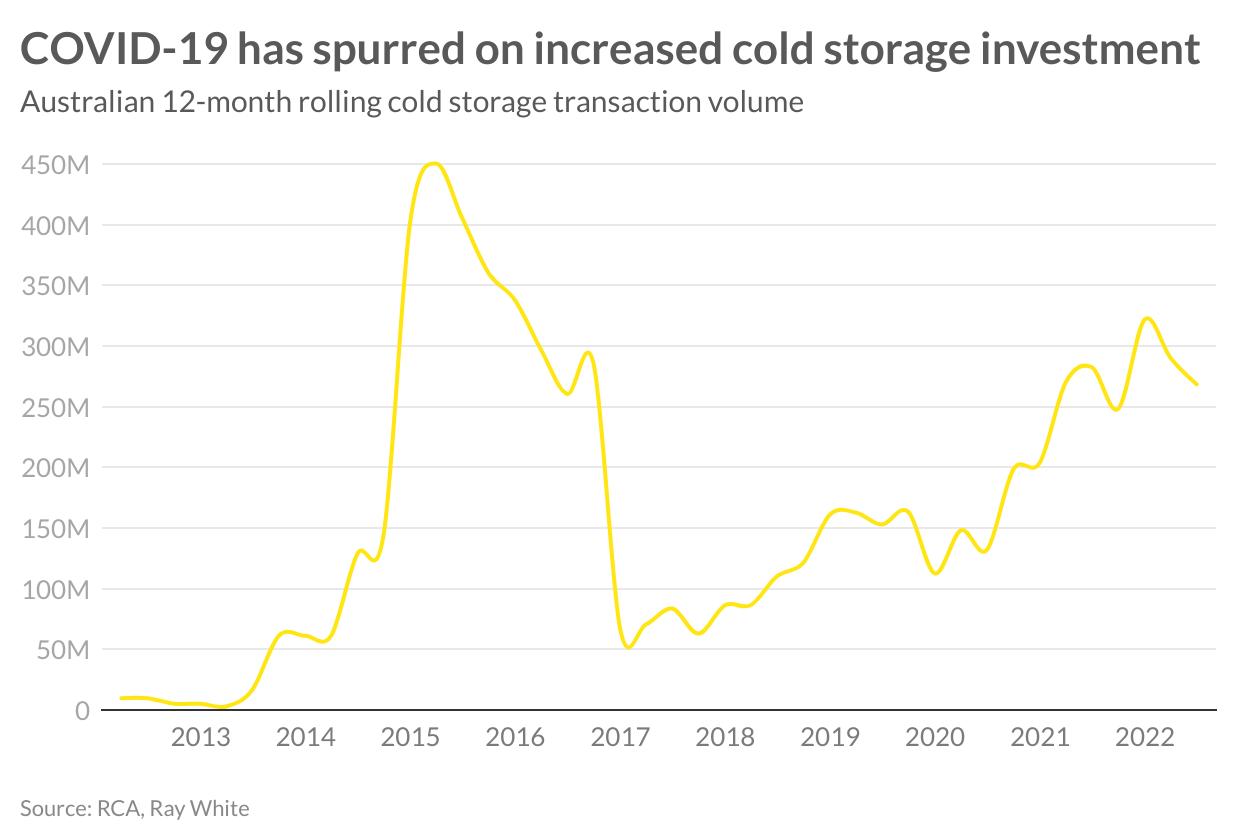

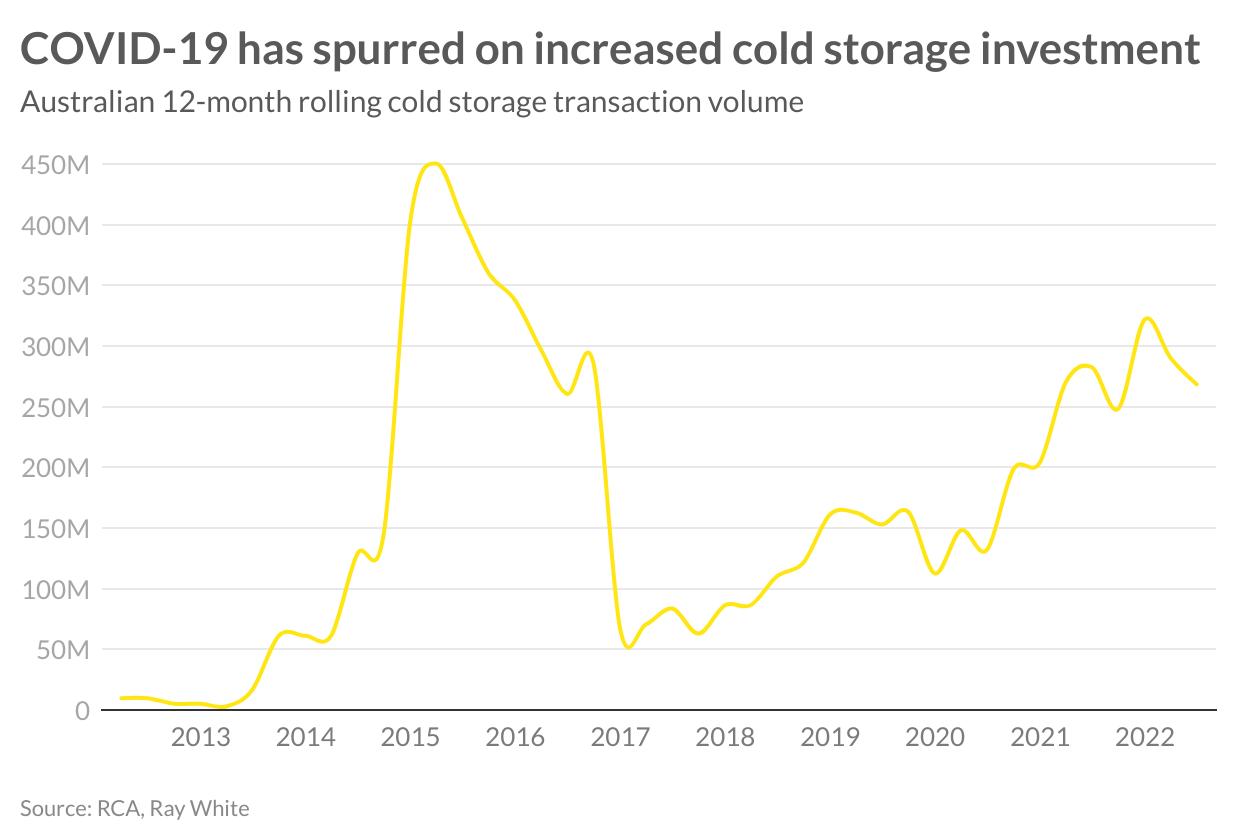

Growing in popularity as an asset class during the 2015-2018 period, this asset type, which was often termed as “food & beverage”, is a subsector to industrial also known as refrigerated warehousing. During this time, this sector evolved into a dynamic and less owner-occupied asset due to users demanding better innovations in technology and the changing requirements of the end consumer wanting reduced timeframes for the delivery of perishable food items. The peak in transactions was witnessed in 2014/2015 where over $450 million changed hands driven by portfolio transitions across the country, notably the eastern seaboard.

Post this period we did see tempered investment activity; however, since 2019, transactions once again grew fuelled by quality stock being completed, together with the increasing retail demand for fresh food, as well as quickly changing health science needs. During the 2021 calendar year over $320 million has changed hands with yields ranging from as low as 4.3 per cent through to 5.5 per cent, with institutional demand instrumental in compressing these yields which were in the 6 per cent to 7.5 per cent range a few years prior. During 2022, however, transaction levels have decreased inline with the overall decline in commercial investment activity, due to rising interest rates and inflation which is expected to impact yield levels.

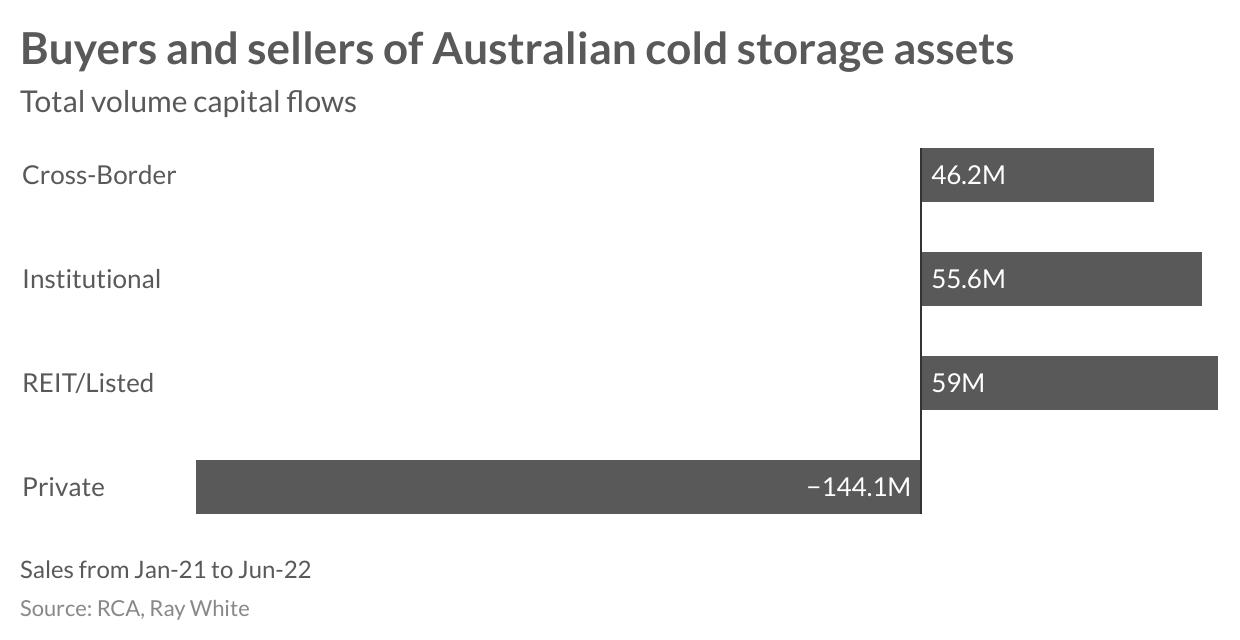

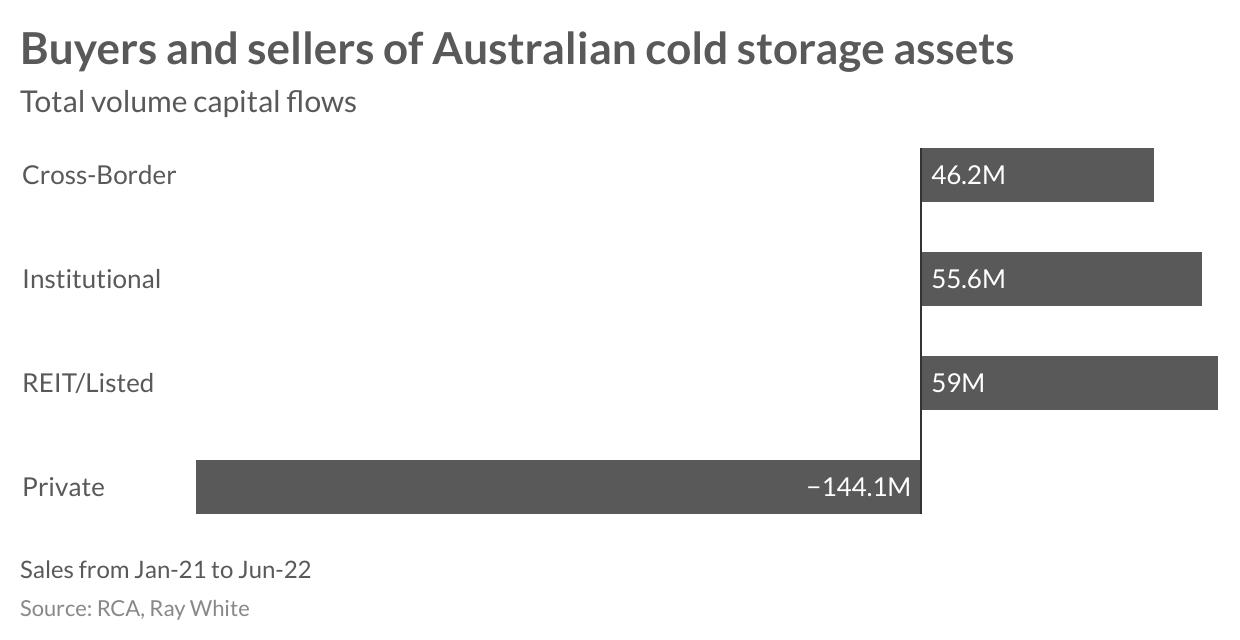

Refrigerated facilities that cater to food and beverage production, along with refrigerated warehouse and distribution facilities in Australia attracted several new players over the past five years, notably international companies with strong track records in their own respective countries. Since this time, we saw ongoing interest from these offshore buyers and domestic institutional investors fuelling competition for this bespoke asset type. Looking at sales over the past 18 months, the continued decline in owner-occupiers is clear, representing more seller activity while a combination of cross-border, institutional and REITs as net buyers seek to capitalise on high user demand, low vacancy and rising rental rates in the current high inflationary market.

Looking ahead, despite high occupancy and ongoing need for cold storage assets, broader market conditions will see some moderation to yields and slow down in investment activity; however, these specialised assets will be one to continue to watch in the short to medium term particularly due to their expanded need across both food and beverage, and health science industries.

•$50,853*FY2022NetOperatingProfit(NOP) •$28,951*perannumcurrentCaretakersalarywithCPIannualincreases •16yearsleftoncaretakerandlettingagreements-expiryin2038 •11unitsoutofthe22-unitcomplexareinpermanentlettingpool •Spaciousmanager'sunitincludesbasementstorageroomand1carpark •idealentry-levelmanagementrightsopportunityadjacenttoBlueChipCroninIsland c.cornish@rwsp.net PERMANENTLETTINGPOOLINOUTSTANDINGLOCATION StanhillDrive,ChevronIslandQLD SALE $715,000 raywhitecommercialgoldcoast.com CraigCornish 0414897256

s.wells@rwsp.net BradMerkur 0414389300 b.merkur@rwsp.net PRIMEFREEHOLDINVESTMENTWITHUPSIDE 34OrchidAvenue,SurfersParadiseQLD AUCTION Thursday,20Octoberat11amattheGoldCoastTurfClub,Bundall raywhitecommercialgoldcoast.com ScottWells 0412766163 •Primeinvestmentopportunity •Developmentupsideintheheartof SurfersParadise •GFA864m2*over3levels •Landsize473m2* •Fullyleasedwith10tenants •13basementcarparks •Rarefreeholdbuilding •Mixofretailandofficetenancies •Mustbesold! *Approx

nathan.huxham@raywhite.com RyanLangham 0420581164 ryan.langham@raywhite.com SUITFRANCHISEE|OWNEROCCUPIERS|INVESTORS 12/71-75Esplanade,CairnsCityQLD AUCTION Auction17thNovember2022 raywhitecommercialbroadbeach.com NathanHuxham 0403583306 Firstopportunitytoacquirealongthe Esplanadeasanowneroccupierinovera decade.Exitingtenant(CoffeeClub),has pavedthewayforanewoccupantto acquire. •88*sqminternalNLA •100*sqmalfrescolicencedarea •Tobesoldvacantpossession •Incrediblefoottrafficnumbers estimated8,000-10,000*daily •Don'tmissthisrareandonceina decadeopportunity!

nathan.huxham@raywhite.com RyanLangham 0420581164 ryan.langham@raywhite.com SUITMHEOROVER55'SLIVINGCOMMUNITY Lot41ManikatoPlace,TareeNSW AUCTION Auction7thOctober raywhitecommercialbroadbeach.com NathanHuxham 0403583306 CurrentlyapprovedforManufactured HomeEstateallowingforavarietyof housingoptions.50SitesDAapproved potentialforupto100homesby convertingsinglesintodoubles. •33,453sqm*ofland •4.8km*fromTareeRegionalAirport •2.9km*fromManningHospital •4.4km*fromMayoPrivateHospital •BacksontotheManningValley Racecourse Don'tmissthisoutstandingOpportunity!

•Primeinvestmentwithupsideorlandbankopportunity •Significantindustrialpropertywith3,675m/2ofnetlettablearea •Expansive7,549m/2Northfacinglandholding •OneofthelargestsitesinBurleighGardensIndustrialEstate •Solidincomeacross14individualtenanciesofvaryingsizes •Multiplestreetfrontageswithhighimpactindustryzoning tony.stone@raywhite.com FULLYLEASEDFREEHOLDINDUSTRIALCOMPLEX 17-25GregChappellDrive,BurleighHeadsQLD EXPRESSIONSOFINTEREST ClosingThursday3rdNovemberat4pm raywhitecommercialrobina.com.au TonyStone 0409792650

maclay.kenman@raywhite.com DavidHighman 0488109768 david.highman@raywhite.com ENDLESSPOTENTIALINTHEHEARTOFBULIMBA 17GodwinStreet,BulimbaQLD EXPRESSIONSOFINTEREST Closing30thSeptat4pm raywhitecommercialmilton.com.au MaclayKenman 0490196600 •Total678sqm*landarea •20sqm*frontage •300sqm*freestandingbuilding •Idealforanowneroccupiertolandbank withfutureupsideORforimmediate development •Zoning:Mixeduse(Innercity) •Ampleonsiteparking •Vacantpossessionsale •Developmentpotential •Exclusivelocationinthesoughtafter epicentreofBulimba

•Siteareaof604m2* •Idealforaccountant,lawyer,estateagent,health,beauty,tattoo,etc^ •Off-streetandon-streetparking •Offeredwithvacantpossession •InnercityCBDlocation •Freestandingcottagepreviouslyleasedtoconstructionbusinessandtattoostudio andrew.allen@raywhite.com AtlasCorrin 0434314283 atlas.corrin@raywhite.com MUSTBESOLD-RARECBDOPPORTUNITY 31RoseberryStreet,GladstoneQLD ONLINEAUCTION Wed5thOctober2021 raywhitecommercialgladstone.com AndrewAllen 0408799585 *Approx^SubjecttoCouncilApproval

•Theonlyshoppingcentrewithinan80kmradiusofCollinsville. •Anchoredfor27yearsbyafull-lineCornettsSupermarket,whoisQueensland's largestIGAoperator. •Firsttimeofferedtomarketinover25years. •EstimatedFullyLeasedNetIncomeof$203,776+GSTp.a. •Supportedbyalong-establishedbakery(23years)andhairdresser(5years). lokeeffe@raywhite.com MichaelFeltoe 0447714899 michael.feltoe@raywhite.com ENTRY-LEVELCORNETTSIGAANCHOREDCENTRE IGACollinsvillePlaza,40StanleyStreet,CollinsvilleQLD AUCTION Friday14thOctorber,10:15amAEST raywhitecommercialqld.com LachlanO'Keeffe 0413464137 *Approx

ThishighprofileexBeaurepairessiteisbeingsoldasvacantpossession •Landarea:1093m2*(36mtr*frontage) •Reception,offices&workshop •Highvolumeofpassingtraffic&offstreetparking •Willsuitabusinessenduser,investorordeveloper len.greedy@raywhite.com MAINROADWORKSHOP-SUNSHINECOAST 701NicklinWay,CurrimundiQLD AUCTION Auction6thOctober11am,InRooms,SunshineCoastFunctionCentre raywhitecommercialcaloundraandsunshinecoastsouth.com LenGreedy 0401691807 *Approx

•PrimepositioninProfessionalHerriesStreetPrecinct •5Tenanciesofvarysizes •Kitchen,amenitiesandonsitecarparking •17carparksincludedonsite •Greatopportunitytopurchaseawonderfulpropertyinasortafterposition •MultipleTenantIncomeof$110,020.96Nett+GSTperannum(30July2022) paul.schmidt-lee@raywhite.com PeterMarks 0400111952 peter.marks@raywhite.com AUCTION-CBDOFFICE-GREATLOCATION Lot1/109HerriesStreet,EastToowoombaQLD SALE Auction-1:00pm,Monday10October2022 raywhitecommercialtoowoomba.com PaulSchmidt-Lee 0499781455

•2,866sqmsite withMediumImpactIndustryzoning •Groundfloorshowroomandworkshoptenancyof800sqm,currentlyleasedto TownsvilleStoneat$117,874p.aexpiring30/06/2023. •Firstfloorofficetenancyof325sqmconfiguredas11servicedofficeswithcommon areabathrooms,kitchen,andtrainingroom. •Firstfloorofficescurrentlyproducingagrossincomeof$62,101p.a+GST troy.townsend@raywhite.com SUBSTANTIALFREESTANDINGINDUSTRIALWORKSHOP ANDOFFICECOMPLEX 5-7HamillStreet,GarbuttQLD SALE/LEASE $1,600,000orforleasebynegotiation raywhitecommercialtownsville.com TroyTownsend 0407213887

Outlineand LocationsIndicative Only •LandArea:3.948Ha*^ •DevelopmentApproval&OPWfor62lotsranginginsizefrom245m2*to680m2* (avg.433m2*) •ComprisesStage6ofestablishedCarver'sReachEstate •Siteclearedwith partial earthworksundertaken •Well positioned toShoppingCentres,SchoolsandCommercialCentres tony.williams@raywhite.com MarkCreevey 0408992222 mark.creevey@raywhite.com RECEIVERS'SALE|APPROVED62LOTSUBDIVISION 168and180ParkRidgeRoad,ParkRidgeQLD EXPRESSIONSOFINTEREST ClosingThur20Oct20224pm(AEST) raywhitespecialprojects.com TonyWilliams 0411822544 ^Subject to Council requirements including infrastructure agreement *Approx

PriceonApplication raywhitecommercialsouthwest.com.au 9DanStreet,SlacksCreekQLD MIXEDUSEMULTITENANTEDINVESTMENT EXPRESSIONSOFINTEREST JaemsBalfour 0411404249 j.balfour@raywhite.com •1,263m2GFA •2,699m2landarea •7separatetenancies •Flexiblemixedusezoning •LargelandparceljustoffMossStreet •Fullyleasedincome$144,127Gross+GST •Undermarketrentals •Staggeredleaseexpiries LachieHale 0414911099 lachie.hale@raywhite.com PriceonApplication raywhitecommercialsouthwest.com.au 6/2BooranDrive,WoodridgeQLD MODERNUNITWITHMAINROADEXPOSURE EXPRESSIONSOFINTEREST JaemsBalfour 0411404249 j.balfour@raywhite.com •212m2mixedoffice/retailspace •Highendmodernfitout •MainroadKingstonRoadexposure •Exposuretoapprox.35,000vehicles/day •Onandoffstreetparking •Signagepylonrights •Recentinternalrenovations •Onsitecafe LachieHale 0414911099 lachie.hale@raywhite.com

Outlineindicativeonly raywhitecommercialbayside.com 46/17CairnsStreet,LoganholmeQLD MODERNINDUSTRIALUNITADJACENTTOM1MOTORWAY EXPRESSIONSOFINTEREST NathanMoore 0413879428 nathan.moore@raywhite.com •488sqm*office/warehouse(406sqm* groundfloorand82sqm*mezzanine) •Largeon-sitecarpark •Container-heightrollerdoor •Air-conditionedoffice/showroomareas •EasyM1Motorwayaccess •Tenanteduntil9February2023withanett incomeof$67,772.40 HughFletcher 0429583765 hugh.fletcher@raywhite.com Outlineindacatveonly raywhitecommercialbayside.com 7/12-20DaintreeDrive,RedlandBayQLD INDUSTRIALUNIT-SUITINVESTORS&OWNER-OCCUPIERS EXPRESSIONSOFINTEREST NathanMoore 0413879428 nathan.moore@raywhite.com •198sqm*groundfloorwarehouse •40sqm*groundfloorreception/staffroom •42sqm*mezzanineoffice •3splitsystemair-conditioners •Container-heightelectricrollerdoor •3-phasepowerandhigh-speedNBN connectionsavailable •Tenanteduntil31March2023 HughFletcher 0429583765 hugh.fletcher@raywhite.com

ArtistImpressionOnly ContactAgent raywhitecommercialtradecoast.com 1305LyttonRoad,HemmantQLD NEWINDUSTRIALDEVELOPMENT-6UNITSREMAINING SALE/LEASE JaredDoyle 0408160570 jared.doyle@raywhite.com •Units3and11are380sqm*with280sqm* groundfloor+100sqm*mezzanine •Allotherunitsfeature140sqm*groundfloor +50sqm*mezzanine •Minimumof2allocatedcarspacesperunit •5m*electricrollerdoors,3phasepower •Bathroom&kitchenette •CompletionduecircaQ32023 JackGwyn 0424807166 jack.gwyn@raywhite.com *Approx PriceUponApplication raywhitecommercialtradecoast.com 1808LoganRoad,UpperMountGravattQLD MTGRAVATTMEDICALPRECINCT-FINALTENANCIES SALE/LEASE FranzStapelberg 0430655676 franz.stapelberg@raywhite.com •Consultingsuitesfrom68sqm* •Medicaloptions100sqm*-1081sqm* •Securedparking&ambulancebay •Disabilityaccess&146carspaces •Twohospitalgradelifts •Toiletandamenitiesoneachfloor •Cafeonsite •Varietyofflexiblesale&leasingoptions NickRooney 0404921212 nick.rooney@raywhite.com *Approx

ContactAgent raywhitecommercialnortherncorridorgroup.com.au 48EdisonCrescent,BaringaQLD 1,920M2WAREHOUSE LEASE SamuelHoy 0423795273 •1,652m2clearspanwarehouse •200m2mezzanine* •68m2reception* •32carparks(6undercover) •Enclosedreception&office •Dualkitchen+toiletfacilities •5rollerdoors DavidGoldsworthy 0481996794 *Approx OffersOver$2,700,000 raywhitecommercialnortherncorridorgroup.com.au 52&60PeachesterRoad,BeerwahQLD DEVELOPMENTSITE SALE ChristineFreney 0432170380 •52PeachesterRoad,Beerwah-5,310m2 •60PeachesterRoad,Beerwah-1,100m2 •MediumDensityResidentialZone •Mainroadlocationclosetoallamenitiesand inwalkingdistancetoshops •Locatedinahighgrowthcorridorwith developmentupside(stca.) EmilyPendleton 0402435446 Outlines&markingsindicativeonly $515,000 raywhitecommercialnortherncorridorgroup.com.au 2/115-117BuckleyRoad,BurpengaryEastQLD RETAILINVESTMENTINFAST-GROWINGREGION SALE AaronCanavan 0447744948 aaron.canavan@raywhite.com •76m2*strataunit •Leaseduntil2026withoptionsto2031 •Netincomeof$31,564.94*perannum •ImmediateHighwayaccess •Locatedinathrivinglocalshopping centre"TheHub"anchoredbyIGA,Medical Centre&ChildCareCentre •TheHubiscurrently100%occupied ChrisMassie 0412490840 chris.massie@raywhite.com *Approx

•Freestandinggarage60m2* •Multipleconsultationrooms •NDIScompliantbuilding&Disabilityaccess •Ampleonsiteparking $69,000PANet+GST+Outgoings raywhitecommercialspringwood.com Unit1/1352CreekRoad,CarinaQLD MEDICAL/OFFICE171M2* LEASE AldoBevacqua 0412784977 •Totalarea495m2* •ExcellentexposuretoPacificHwy&M1 •Fasciaandilluminationpylonsignage •Disabledaccess •Hugeonsitecarparking •Internetconnectionavailable •Easyaccesstomajorarterialroads $123,750PANet+GST+Outgoings raywhitecommercialspringwood.com 10/3360PacificHighway,SpringwoodQLD CORPORATEOFFICE LEASE AldoBevacqua 0412784977 •Land2916m2*&Building 692m2* •Warehouse428m2*-Multiple3phase power •ModernOffice260m2*&SecureAwning 260m2* •Undercoverstorageshedwith3phasepower •SecureAlarmedsitewithElectricGateaccess $175,000PANET+GST+Outgoings raywhitecommercialspringwood.com 22-24NevillesStreet,UnderwoodQLD WAREHOUSE LEASE AldoBevacqua 0412784977 •Stronglocationintightlyheldcommercial precinct •Masonryblockconstructedunit •Fullyair-conditionedtenancy •Exposuredailyto22,335oftrafficflow •Illuminatedexternalfaciasignage •15kw3Phasesolarsystem $75,000PANet+GST+Outgoings raywhitecommercialspringwood.com Unit2/2938LoganRoad,UnderwoodQLD SHOWROOM493M2* LEASE AldoBevacqua 0412784977

•6.6Hasite •HighexposurepropertylocatedalongtheMonaroHighway •VarietyofpotentialusesSTCA^(RetirementLiving,Residential,FoodPrecinct) •Ownercommittedtodeadlinesale •50and80paxrestaurant,managersquartersand6unitmotel •Servicestationwithlargerestaurantarea&longlease ben.faulks@raywhite.com DougMerriman 0419999001 doug.merriman@raywhite.com MIXEDUSEDEVELOPMENT^SITE 1RyrieStreet,MichelagoNSW AUCTION Thursday27October2022at11am raywhitecommercialcanberra.com.au BenFaulks 0432028645 ^SubjecttoCouncilApproval

Outlineindicativeonly •Sitearea12,520m2 •Zoned:IN2LightIndustrial •3bedx2bathhouse •144m2*warehouse •1,625m2*dressagearena •30,000Lwatertankstorage+borewater Thursday27October2022at11am raywhitecommercialcanberra.com.au 120-122EllendonStreet,BungendoreNSW RAREOPPORTUNITY AUCTION FrankGiorgi 0403839822 JakeBattenally 0413313676 *Approx •Sitearea1,056m2 •Buildingarea340m2 total •175m2 offices/showroom •165m2 warehouses •Concretehardstandyard •Fullyfencedsite •3phasepower Thursday27October2022at11am raywhitecommercialcanberra.com.au 9AuroraAvenue,QueanbeyanNSW OWNEROCCUPIERSDREAM AUCTION FrankGiorgi 0403839822 Outlineindicativeonly •Sitearea1,611m2* •IN2LightIndustrialBlock •Clear&flatblock •DAApprovedplans •DirectaccesstoYassRoad&KingsHighway Thursday27October2022at11am raywhitecommercialcanberra.com.au 69ThurralillyStreet,QueanbeyanNSW ONLYINDUSTRIALBLOCK AUCTION FrankGiorgi 0403839822 *Approx •Siteareaof1,393m2 •Buildingareaof685m2* •NetIncome-$68,550.13*pa exGST •Amazingstreetappealwithsecureyard •3rollerdoors •3phasepower •3tenanciesallwithamenitiesandseparately Thursday27October2022at11am raywhitecommercialcanberra.com.au 15-17KemblaStreet,FyshwickACT TENANTEDINVESTMENT AUCTION FrankGiorgi 0403839822 *Approx

•GreatviewsofSydneyHarbour,BotanicalGardens&FarmCove •Professional,modern&inspiredworkspacew/mainlobbyarea •3luxemeetingrooms,7executiveoffices,9workstations •Internalkitchen,integratedstorage,endoftripfacilities aharris@raywhite.com GREATVIEWSOFSYDNEYHARBOUR Level10,131MacquarieStreet,SydneyNSW2000 LEASE Aream2:480approx Rent$/m2:$1,200Gross RentalPA:$576,000 raywhitesydneyleasing.com.au AnthonyHarris 0409319060

•ExclusivecommercialpremisesinZetland's'Symphony'development •234sqm*internal,3.9mhighceilings,glassfrontage •Northfacingshopfilledwithabundantnaturallight •Kitchenettepluslimitedmobilityaccessiblewashroom •2tandemparkingspacespluscagedstorage a.santelli@rwcss.com SUITESINLUXURYZETLANDDEVELOPMENT 3&4/6RoseValleyWay,ZetlandNSW LEASE $137,000.00pa+GST raywhitecommercialsouthsydney.com AlexSantelli 0403104146 *Approx

$45,000+GSTperannum raywhitecommercialsc.com 102/410ElizabethStreet,SurryHillsNSW LIGHTFILLEDOFFICESPACENEARCENTRALSTATION LEASE SamuelHadgelias 0403254675 shadgelias@raywhite.com •Availableimmediately •101sqm* office plusstorage •Openplan+2 offices • Air-conditioned; internalcabling •Free useofseven meeting rooms •Newlyrefurbishedbuilding •Prime location withexcellenttransport options *Approx ContactAgent raywhitecommercialsc.com PartLevel7/70 Pitt Street,SydneyNSW CREATIVEOFFICESPACENEARMARTINPLACE LEASE MarcusPlummer 0400469388 mplummer@raywhite.com •242sqm* office space •$650psmgross+GST • Creativefitout withpolishedconcreteand exposedceilings • Reception, boardroom, meeting roomand openplanspacewith workstations •Kitchenandstoragespace •Availablenowwith flexible leaseterms SamuelHadgelias 0403254675 shadgelias@raywhite.com *Approx

raywhitecommercialnswgss.com C3.02/16WurrookCircuit,CaringbahNSW NEARNEWOFFICE-QUALITYINVESTMENT SALE BradLord 0439594121 blord@raywhite.com •Nearnewstateoftheart office suite (45m2)* •Secureleaseinplace until Jan25 •NorthEastcorneroftop floor, abundanceof naturallight •Singlecarspacewithhighendcommunal amenities and meeting rooms DeanMunk 0451100654 dean.munk@raywhite.com *Approx CONTACTAGENT- Attractive rental raywhitecommercialnswgss.com Level2/7-11TheAvenue,HurstvilleNSW CENTRALSOPHISTICATION LEASE BradLord 0439594121 blord@raywhite.com •382sqm*-modern fitout &furniture •Six(6)secureallocatedcarspaces • 108councilcarspaces(3hourlimit)under thebuilding •CCTVSecuritythroughoutbuilding •Adjacentto Westfield ShoppingCentre •Full time, onsitebuildingmanager *Approx

•TotalBuildingArea476sqm(Approx) •TenantedInvestment •Returning$62,400PerAnnumplusGST&Outgoings •Six(6)CarParks •HighClearance •Industrial1Zone(IN1Z) mitch.rosam@raywhite.com BreeTaylor 0438424807 bree.taylor@raywhite.com SECUREINDUSTRIALTENANTEDINVESTMENT 8/174-186AtlanticDrive,KeysboroughVIC AUCTION 25thOctober202211:00amOnsite raywhitecommercialferntreegully.com MitchRosam 0402355805

•Twolongterm,bluechiptenantswhohaveoccupiedthepropertysinceconstruction •Netincomeofapprox$152,500+GSTperannum •Tenantspayoutgoings,aspertheleaseagreement •Highlevelofinternalfitoutbybothtenants •CloseproximitytotheHospitalprecinctgivingyoufutureoptions •8carparksonsiteforstaffandonstreetparkingforclients sam.borner@raywhite.com NEWFIVEYEARLEASESTONATIONALTENANTS 1025SturtStreet,BallaratCentralVIC EXPRESSIONSOFINTEREST raywhiteballarat.com.au SamBorner 0439655509

ExpressionsofInterestClosing25thOctoberat4pm raywhitecommercialdistonassetservices.com 5/31RushdaleStreet, Knoxfield VIC INDUSTRIALINVESTMENTTORUSHFOR SALE Brett Diston 0439365532 brett.diston@raywhite.com •Returns $22,659.96 panet • Building area|214sqm* •Zoning| Industrial 1 •3Phase power • Idealentry investment •LeaseTerm|2 years • Options |2Years •1of5inthecomplex *Approx raywhitecommercialdistonassetservices.com 3HeatherdaleRoad,RingwoodVIC LANDTHISONE EXPRESSIONSOFINTEREST Brett Diston 0439365532 brett.diston@raywhite.com • Land area|2,874sqm* •Zoning| Activity CentreZone •ExposuretoWhitehorse Road / Maroondah Hwy •Flexiblelease termsavailable • Easy accesstomajorarterials •Walking distance to HeatherdaleStation *Approx

This hard-to-findindustrialfacility with anexcellent hard stand is available fora long-termlease. The propertyboastsgreat car parking with truck access andmultiplerollerdoors. Tenantswillenjoyanexcellentstand-alonefacility withthe privacy tooperate without disruption. raywhitecommercialglenwaverley.com 10-12JohnstonCourt,Dandenong South VIC INDUSTRIAL/WAREHOUSEFORLEASE LEASE RyanTrickey 0400380438 ryan.trickey@raywhite.com WillJonas 0422883011 will.jonas@raywhite.com Wednesday 19 October at1 pm. raywhitecommercialglenwaverley.com 12-14 Station Street,PakenhamVIC INVESTINTWOESTABLISHEDRESTAURANTS AUCTION RyanTrickey 0400380438 ryan.trickey@raywhite.com •A secureinvestmentopportunity. Two restaurantsin theheartof Pakenham. •Two Tenants -GLA345 m2* (*denotes approx) • PrimeLocationin a busyactivitycenter. Great landholding,multipleincomestreams. Total Net Income; $93,600 PANET+O/G & GST* WillJonas 0422883011 will.jonas@raywhite.com

ContactAgent raywhitecommercialoakleigh.com 1/118-122MalcolmRoad,BraesideVIC BRAESIDELOCATION LEASE GeorgeGanavas 0478634562 •Totalbuildingarea|1365m2* •Qualityofficesover2levels|489m2* •Dualroller-dooraccess&3PhasePower •On-siteparkingforThirty(30)vehicles •Streetfrontagewithsignageopportunity •Industrial1Zone(IN1Z) RyanAmler 0401971622 *Approx •Totallandarea|130m2* •Totalbuildingareaovertwolevels|130m2* •5YearLeaseCommencedOctober2021 •Currentlyreturning$57,000p/anet •GenerousR.O.W.atrearplusparking •Servicedbymajorarterialroadsincluding ToorakRoad&MonashFreeway(M1) ForthcomingAuction(UnlessSoldPrior) raywhitecommercialoakleigh.com 736BurkeRoad,CamberwellVIC RETAILINVESTMENT AUCTION GeorgeKelepouris 0425798677 GeorgeGanavas 0478634562 *Approx Friday4thNovember2022@12pmOn-site raywhitecommercialoakleigh.com 7DissikStreet,CheltenhamVIC INDUSTRIALFREEHOLD AUCTION RyanAmler 0401971622 •TotalBuildingArea|600m2* •TotalLandArea|966m2* •Two(2)rollerdoors,3PhasePower&Gas •Amenities|kitchenette,toilet&shower •Ampleon-siteparking •VacantPossession •Industrial1Zone(IN1Z) GeorgeGanavas 0478634562 *Approx •Buildingarea|270m2* •Goodinternalclearance •Directstreetaccess •On-siteparking •VacantPossession •Industrial1Zone(IN1Z) Thurs20thOctober2022@12pmOn-site raywhitecommercialoakleigh.com 3/27WintertonRoad,ClaytonVIC PRIMEINDUSTRIAL AUCTION RyanAmler 0401971622 SimonLiang 0451954318 *Approx

•PrimelocationonSturtStreetAdelaide •Twolevelsofofficesplusstoragecellar •Lettableareaof515squaremetersapprox. •Valuableonsitecarparking •Beautifullyrenovatedwithaliftandanabundanceofnaturallight ian.lambert@raywhite.com OWNEROCCUPIER/INVESTMENT/LEASEOPPORTUNITY 94-98SturtStreet,AdelaideSA SALE/LEASE ExpressionsofInterest raywhitecommercialadelaideassetmanagement.com.au RLA225073 IanLambert 0413155665

•HighQualityMedicalRooms •5+5+5yearleasecommencing1July2022 •Approx.190m2pluscellar •AmpleOnSiteCarParking •RearLaneAccess •Excellentconditionthroughout ian.lambert@raywhite.com SECURELYLEASEDINVESTMENTOPPORTUNITY 38TheParade,NorwoodSA SALE PublicAuction:Friday21October10:30amonsite raywhitecommercialadelaideassetmanagement.com.au RLA225073 IanLambert 0413155665

nick.syrimi@raywhite.com UNIQUEFREESTANDINGOFFICEPREMISES 2MalukaDrive,PalmerstonCity,NT EXPRESSIONSOFINTEREST ExpressionsofInterestclosing3pmFriday28October2022unlesssoldprior rwcnt.com NickSyrimi 0412537638 •FreestandingCommercialOffice •Strategicallylocatedrightintheheartof thePalmerstonCBD •Cornerexposurewithonsiteparking •Areaundertitle-3,040m2 •Totalbuildingfootprint-1,800m2 •19carparkingbays •Prominentbuildingsignageandbranding potential •Singlelevelbuildingwitheasyaccess •Fittedoutinternally&airconditioned throughout

•Landarea5,348sqm* •Surveyedpadarea3,240sqm* •ZonedLight&ServiceIndustry $1,500,000+GST raywhitecommercialwa.com 12ArgongChase,CockburnCentralWA GREATVALUELAND SALE EnriqueReyes 0421888688 enrique.reyes@raywhite.com JoshSumner 0488221331 josh.sumner@raywhite.com *Approx ContactAgent raywhitecommercialwa.com Partof135DixonRoad,EastRockinghamWA EXCELLENTEXPOSURE LEASE EnriqueReyes 0421888688 enrique.reyes@raywhite.com •FullyFittedFrontOffice&Reception •120sqm*Workshop/WarehouseArea •BuildingSignageOpportunity •A/CintheOffiicearea •3automatedrollerdoors •SolarPower •Goodworkshopaccess •AbundantCarParking JoshSumner 0488221331 josh.sumner@raywhite.com

From$369,000(NILGST) raywhitecommercialwa.com 1&2/2CommerceStreet,MalagaWA RAREENTRYLEVELOFFICES SALE TomJones 0478771117 tom.jones@raywhite.com •Unit1-$369,000(NILGST-Sellersarenot registered) •Ground flooroffice •Totalstrataareaof141sqm* •103sqm* office footprint •38sqm*connectedgarage/storageareawith rollerdooraccess. LachlanBurrows 0499552296 lachlan.burrows@raywhite.com *Approx ContactAgent raywhitecommercialwa.com Lot82/12StGeorgesTerrace,PerthWA BOUTIQUESTGEORGESTERRACEOFFICESUITE SALE LukePavlos 0408823823 luke.pavlos@raywhite.com •Lot82-94sqmcommercial office suite •Highquality fit out insitu,includinga reception, boardroom,3 partitionedoffices andopenplanforapprox7 workstations •Excellentlight infiltration •Refurbished floor, including lift lobbyand bathrooms •Onesecurecarbay

Affordable,self-containedwarehouseunit.Versatileconcretetilt-slabunitof 166m2*+ mezzanineof68m2*.5-6*onsitecarparks, 3 phasepower,containerheightrollerdoor.Handy locationneartheRingRoadprovidingeasyaccesstothePortandaroundthecity.Idealfora tradie,workshop,ortheultimate"mancave".Vendorretiring,fordefinitesale. DeadlineSaleclosingThursday13thOctober 2022 atLevel2, 76 HerefordSt,Christchurch www.rwcchristchurch.co.nz RayWhiteCommercial(Christchurch)-RaineBlackadderLtd-Licensed(REAA2008) Bromley,Christchurch AFFORDABLEINDUSTRIALUNIT-OCCUPYORINVEST SALE BryanAshworth +64212129308 bryan.ashworth@raywhite.com *Approx Situatedinapopular,highprofile,bulkretail/showroomcomplexintheCentralCity.Available onthegroundflooris 850m2*&703m2* orcombinetocreate1,553m2*.Modernwith extensiveglassfrontageandhighexposuretocentralarterials.JoinSpotlight,TargetFurniture, HarveyNorman,CityFitness & LaserStrike.Generoussharedonsitecarparking. ByNegotiation +GST+ outgoings www.rwcchristchurch.co.nz RayWhiteCommercial(Christchurch)-RaineBlackadderLtd-Licensed(REAA2008) MoorhouseAvenue,Christchurch 703M2*-1,553M2*BULKRETAILONMOORHOUSE LEASE PaulaRaine +64272214997 paula.raine@raywhite.com *Approx