PORTFOLIO

JULY 2023

GROWING INVESTMENT FOR UNORTHODOX ASSET TYPES

PRESSURE ON THE RESIDENTIAL DEVELOPMENT MARKET

UNDERSTANDING THE CANBERRA COMMERCIAL PROPERTY MARKET

JULY 2023

GROWING INVESTMENT FOR UNORTHODOX ASSET TYPES

PRESSURE ON THE RESIDENTIAL DEVELOPMENT MARKET

UNDERSTANDING THE CANBERRA COMMERCIAL PROPERTY MARKET

As we enter a new financial year, we’re proud to present the July issue of Portfolio magazine.

In this issue we step outside the box and look at some of the more unorthodox commercial assets to invest in. Ray White Head of Research Vanessa Rader takes a look at the pros and cons of each asset, and how the assets have been performing in the market.

We also hear from Ray White Special Projects director Tony Williams. Tony speaks about the market for residential development sites, apartment buildings, and build-to-rent developments in south east Queensland, and what to expect from each of these asset classes into the future.

For last month’s Between the Lines Live webinar, host Vanessa Rader headed to Canberra to speak to Ray White Commercial Canberra head of industrial sales and leasing Frank Giorgi, and

Head of Office Agency Andrew Green about the commercial market in our nation’s capital city. The panel discussed the industrial market and the office market and what opportunities were forecast for the next financial year and beyond. The next Between the Lines Live webinar will be held on July 12 where Vanessa will head to Perth to hear about our west coast market.

Thank you to all the clients who have worked with our expert network here at Ray White Commercial over the last 12 months, and we look forward to providing you with the best service and results that we can in the new financial year.

Andrew Freeman Head of Agency Operations

Over the last 10 years we have seen a growing number of buyers invest in commercial assets. This was highlighted in particular during COVID-19 where interest rates hit rock bottom and investors looked to diversify their portfolios. In the quest to secure quality, high returning investments, we saw many buyers pivot towards alternative asset types. Childcare, service stations, fast food have all been options hotly contested for many years with investors attracted to their long-term, secure income streams, often backed by a national tenant. As values for these assets rapidly increased many buyers looked further afield for quality options, with medical being a stand out performer during the pandemic, resulting in a strong uptick in investment demand and compression of yields.

In the current market, these alternatives no longer seem all that alternative as many investors continue to move up the risk curve to secure a piece of commercial property. For some it's based on affordability, while others may focus on future growth or development potential, earning them quality longer term capital appreciation.

This is a use which can be as small and affordable as a single space through to multi level parking facilities. Many of these assets are privately owned but also have some institutional and offshore activity due to the large land parcels they often occupy. The longer term development potential is often a motivator for the parking sector, however, robust returns, particularly in major cities, make parking an attractive investment option, albeit often attracting high levies and taxes imposed by state or local governments recoverable by occupiers.

Some of the assets which have increased in popularity over the last few years include:

While some people may be put off by this asset, there are many private buyers happy to jump through the required hoops when purchasing assets with a cemetery. These assets typically are unable to be built upon or disrupted, the cemetery needs to be catalogued for historic record keeping, and the incoming owner may have the responsibility of caretaking and making the property available for those wanting to visit. Churches do not have the same issues, however, may have some restrictions in regard to allowable uses in existing premises based on local zoning. There have been many redevelopments of churches into residential or commercial premises, with those older properties maybe having heritage considerations when seeking redevelopment approval. The architecture and story attached to the property is often a drawcard for those looking to occupy or purchase existing or redeveloped church facilities.

Brothels are an allowable use within a zoning rather than an asset class in their own right. They transact rather regularly throughout the country and for those investing, this is considered an income stream not dissimilar to any other use. However, issues of insurance, security, and safety may deter some buyers, depending on borrowing levels, which may impact values. Investment is dominated by the private sector and despite their current use, there have been many examples of the redevelopment or repositioning of brothels to other commercial uses which may be more attractive to a broader range of investors.

In a residential market where there are historically low vacancies and rents are moving upwards, boarding houses are an increasingly attractive investment option despite interest rate movements. A build-to-rent type asset before build-to-rent was a thing, these assets range significantly in size and quality with a number of more modern facilities being completed in recent years, removing the stigma surrounding some of these assets. These assets provide affordable, short-term stays, however, given the current housing crisis, these properties are becoming more long-term for tenants with increasing returns.

An asset which has grown in sophistication over the last twenty years, these assets have become larger, automated and in strong demand by institutional and offshore buyers. Capitalising on the growing population and the need to store and distribute perishable food items as well as pharmaceuticals across the country has seen investment demand for this asset class grow and dictate new lows in yield. With technology improving and the various types and levels of temperature controlled facilities, these assets can quickly become outdated or be superseded, resulting in the divide between prime and secondary widen rapidly.

Storage assets have been around for a long time, and the potential returns for larger facilities have not gone unnoticed by institutional investors capitalising on society’s need to store goods. For some, these small facilities are an affordable means of entering the commercial property market with good returns on offer, this is similar to the “man cave”. The development of smaller sub-200sqm industrial units was popular prior to COVID-19 with a high volume of owner occupier activity. These units were dubbed “man caves” as they were considered storage facilities for “toys” such as cars, boats, caravans and other non-business uses which was an issue for some complexes as this often is in conflict with allowable use within an industrial zoning.

Many caravan parks transact every year and have been a favourite amongst private investors for a variety of reasons. Returns for these assets have seen some volatility, however, domestic tourism activity has shown strong results since the pandemic with a strong lift in occupancy rates and daily rates making it attractive for park operators. Many buyers, however, look to landbank these assets for possible future redevelopment opportunities while taking advantage of ongoing returns. These assets are often located in high quality, tourism nodes, however, can be affected by flooding, bushfire, etcetera, prohibiting future development.

The laws of supply and demand have been operating to their full extent in the south east Queensland residential development market, with supply of land, apartments and affordable housing under extreme pressure.

Throughout the residential subdivision market, we’re seeing high demand for land from developers, both in the current market and forward looking to secure a pipeline of future development. Sites with development approvals are in high demand as they remove planning risk and provide security for delivery timeframes. While consumer confidence has been wavering in the past 12 months softening sales rates, there is still firm activity across most price points. However, given the interest rate rises impacting loan serviceability, developers are positioning toward delivering product at more affordable levels, often leading to compression on block size. Delivery costs have seen significant increases, averaging 37 per cent across south east Queensland over the past 12 months, with the strongest impact being felt in earthworks, materials and skilled labour shortages. There doesn’t appear to be any relief in sight, particularly when considering the infrastructure projects planned across health, education and the Olympics in the next decade.

The future state of the market hinges on the result of the Queensland Government’s South East Queensland Regional Plan due in the coming months. However, in the medium-term, the forward view is that the land market will remain very strong, driven by undersupply with any future land delivery solutions likely to be too far on the horizon, where infrastructure crucial

to future land release is often lagged by several years for new land included in the footprint this year.

Demand for townhouses and apartments is on the rise, while owner occupiers seek more affordable options to house and land, and investors are spurred on by the rental crisis driving returns and tenant security. However, both these markets face challenges when it comes to delivery of new projects, as supply chain issues, build costs, and builder availability continue to hinder development. Forward supply for these projects is not likely to meet demand, and is only viable for projects that can achieve a revenue premium to cater for construction costs.

As much of the country faces a housing crisis, build-to-rent (BTR) projects are in the spotlight. BTR has been the subject of much discussion as a long-term housing solution. State and Federal Government incentives have been a welcome introduction to drive this much needed sector. As the market and product quickly mature, Queensland is well-placed for BTR projects - from a very limited supply previously, to some of Brisbane’s most exciting projects and a wave of new groups with a focus on south east Queensland. Brisbane is now drawing attention from international BTR platforms and institutional investors looking to capitalise on the housing undersupply, strong uplift in rental values and reduction in the MIT withholding tax rate from 30 per cent to 15 per cent.

More than 200 people tuned in to June’s Between the Lines Live webinar which focussed on the commercial real estate market in Australia’s capital city.

Ray White Head of Research Vanessa Rader hosted the webinar, and was joined by Ray White Commercial Canberra head of industrial sales and leasing Frank Giorgi, and head of office agency Andrew Green.

The panel discussed how to understand investment into Canberra assets in a rising interest rate environment, how working from home and the government’s need for fully electrified accomodation has affected the office market, and what constrained land supply means for the future of the industrial market where demand outweighs supply.

Mr Giorgi said Canberra’s investment mostly came from private buyers, with institutional funds only recently coming into the market.

“In the ACT we have a leasehold system so you have a 99 year lease as opposed to actually owning the land,” he said.

“It does spook some foreign and interstate buyers as it adds an extra layer of complexity.”

But Mr Giorgi said Canberra was a great place to purchase an industrial property, with the ACT’s $1.7 million stamp duty threshold playing a part.

“ACT yields haven’t been as strong as Sydney and Melbourne and during Covid people did their research and realised Canberra was a great market to buy in,” he said.

“Rents keep growing and there’s a lot of demand with Canberra’s industrial vacancy rate sitting at one per cent.”

With Canberra’s low industrial vacancy rate, Mr Giorgi said new industrial development was needed.

“There is no industrial zoned land ready to go in the ACT,” he said.

“We have the land that can’t be residential land but the government keep throwing curve balls with environmental health studies.

“I want to see the town thrive and big business come to Canberra. We do have the land and it’s quite frustrating.

“We need 700-800ha of land now due to the demand and need to be releasing an extra one hundred thousand square metres of land annually to 2035 to cater for population growth and the ever changing industrial landscape.

“People are often compromising on their buildings and could be so much more productive, but there isn't the land to accommodate those new builds.”

In the office market, Mr Green said work from home culture had had a big effect on office vacancies.

“We have a lot of large Commonwealth tenancies here in Canberra, and work from home is what most government agencies do, with a hybrid work environment being really common,” he said.

“There hasn't been a push to go back into the office at the government level like there has been for private companies.

“Generally in the town centre there’s one or two government agencies that have always historically anchored the commercial market, and local cafes and businesses rely on those government employees to survive.”

He said offices in the sub-500sqm range had been performing well.

“When companies are committing to space, the stock we’re seeing move are ones where the lessor has spent the money on a building refurbishment, and in most cases a spec fit out, so the lessee can move in, plug in their IT, and get to work,” Mr Green said.

“Properties that have undergone a refurbishment and have new spec fitouts within the tenancies are fetching premiums.” Mr Green said there may potentially be several opportunities within Canberra’s greater office market in the future.

“There are a lot of buildings which might be 25-35 years old that haven’t had the refurbishment they need to attract quality tenants and their vacancy is starting to creep up.

“So a few of those buildings might start to come to market providing opportunity for those investors willing to spend some money and re-invest into the building.

“With refurbishment of the building - including common areas and end of trip facilities - and construction of spec fit outs, rental growth could increase by $150/sqm$200/sqm from where the passing rents sit today.”

In the industrial market, Mr Giorgi said future opportunities relied upon the release of land.

“The more land that is released the more opportunity there will be,” he said.

“A lot of companies can come from Sydney, Campbelltown and Wollongong, where they are land locked and will look to Canberra and bring their workforces here.

“We just have to release the land in a timely manner. We’re still getting results in those five per cent yields, which is still historically low.”

Ray White Commercial manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. Ray White Commercial will have a management specialist located right near your property, so enquire with us today.

Premium office building in the heart of Manly with state-of-the art facilities, 3.5 NABERS energy rating and harbour views

Two prime showroom/warehouses

“Valley Plaza” - Four level office complex comprising 13 tenancies with dual level car park

5/7 Brown Street, Labrador, 4215

$37,492 p.a. net rent with 3% annual increases

Tenant 100% rebates O/Gs rates, water and levies

Lease expires September 2027 + 5 year option

Market rent review at end of first term

Income security via personal guarantees & tenant's visa

Internal + alfresco dining + large commercial kitchen

Ideal for stable, steady growth in your superfund

Auction Thursday 27 July at 11am Gold Coast Turf Club, Bundall

Craig Cornish 0414 897 256 c.cornish@rwsp.net

RWC Gold Coast

raywhitecommercial.com

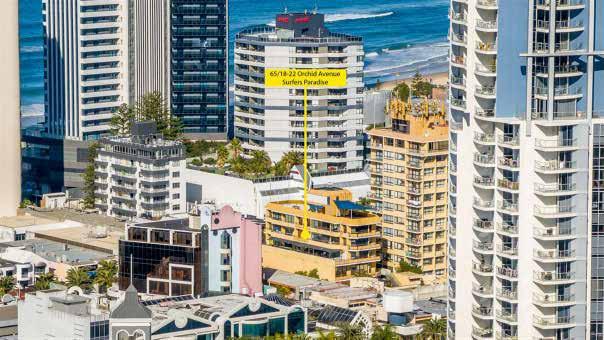

65/18-22 Orchid Avenue, Surfers Paradise, 4217

Auction Thursday 27 July at 11am

Gold Coast Turf Club, Bundall

ale - 306m2* Surfers Paradise ffice with ajor evelopment pside

Luke Boulden 0423 159 170 l.boulden@rwsp.net

Greg Bell 0414 380 555 g.bell@rwsp.net

Capitalise on $138 million Surfers Paradise rejuvenation

RWC Gold Coast

raywhitecommercial.com

3321-3323 Surfers Paradise Boulevard, Surfers Paradise, 4217

Approval for 214* units 42 levels*

Majority of development has uninterrupted ocean views

Corner site - direct access to Surfers Paradise beach

Land area 850m2*

Zoned high density residential, unrestricted height

Direct access to light rail station

All offers will be considered

Expressions Of Interest

Closing Thursday 27 July at 4pm

Brad Merkur 0414 389 300 b.merkur@rwsp.net

Harry Devine 0411 877 933 h.devine@rwsp.net

RWC Gold Coast

raywhitecommercial.com

399 Piggabeen Road, Cobaki Lakes, 2486

•Land area: 15.47Ha* positioned directly opposite future Cobaki Parkway Masterplan Community of around 5500 dwellings and 10,000 - 12,000 residents

•Potential for passive income from the function centre, reinstatement of the Golf Course or self operate

•Substantial existing infrastructure includes Wedding Chapel, Reception Venue with Bar & Commercial Kitchen, 7 Bedroom Residence, 2 Bedroom Managers Residence

Expressions Of Interest

Closing Wed 12 Jul 2023 4pm

Tony Williams 0411 822 544

Matthew Fritzsche 0410 435 891

Mark Creevey 0408 992 222

RW Special Projects (Queensland) raywhitecommercial.com

Lot 270 College Drive, Norman Gardens, Rockhampton, 4701

•Approval for 12 x 3 bedroom townhouses

•Land area: 4,508m²*

•Design incorporates 3 bedrooms, 2 bathrooms, 2 car, single storey, townhouse configurations

•Situated within the popular Crestwood Estate, in the conveniently located Rockhampton suburb of Norman Gardens

•2mins* to Yeppoon Road and 3mins* to the Bruce Highway providing connectivity to the regional centres Gladstone, Mackay and Yeppoon

Expressions Of Interest

Closing Thur 20 Jul 2023 4pm

Christopher Czernik-Wojcicki 0413 481 971

chris.cw@raywhite.com

Tony Williams 0411 822 544

tony.williams@raywhite.com

RW Special Projects (Queensland) raywhitecommercial.com

39 & 41 Caloundra Road, Caloundra West, Sunshine Coast, 4560

Annual net income $832,660*

Multi-tenanted - 6 quality tenancies anchored by BCF

High exposure location, proximity to Caloundra CBD

Combined site area 8,231m2* | NLA 2,981m2*

Specialised Centre Zone

Expansive main street frontage with dual street access

80 car spaces

Expressions Of Interest

Closing 28 July 2023

Paul Butler 0418 780 333 paul.butler@raywhite.com

Len Greedy 0401 691 807 len.greedy@raywhite.com

RWC Noosa & Sunshine Coast

raywhitecommercial.com

207 Narrows Road, Montville, Sunshine Coast, 4560

World-class eco resort, Secrets on the Lake

Established business with huge growth potential

Bespoke treehouses/cabins, lakefront owners' villa

Award-winning restaurant, wedding chapel

$20M+ (replacement value) of existing infrastructure

Breathtaking vistas of lake and ancient rainforest

Approvals to expand accommodation

44 Smith Street, Capalaba, 4157

2,313sqm* site

384sqm* air-conditioned showroom

609sqm* warehouse with container-height roller door

192sqm* warehouse with container-height roller door

15 on-site car parks

Offered with vacant possession

Low Impact Industry zoning

Expressions Of Interest

Closing Wed 26 July, 4pm

Nathan Moore 0413 879 428

nathan.moore@raywhite.com

Alex Sinclair 0487 183 573

alex.sinclair@raywhite.com

RWC Bayside

raywhitecommercial.com

54 Falconer Street, Southport, 4215

DA & BA approved

6* levels (17* units)

708*sqm Corner Block

20* at grade car parking

Corner position on Falconer & Tweet Street

Ryan Langham 0420 581 164

ryan.langham@raywhite.com

Travis Rayner 0416 628 930

travis.rayner@raywhite.com

RWC Burleigh Group

raywhitecommercial.com

416 Ruthven Street, Toowoomba City, 4350

Expressions

Peter Marks 0400 111 952 peter.marks@raywhite.com

Four tenancies (three tenanted)

Top floor tenancy 250sqm* + 70sqm* ground floor

9 rear car parks, air-con & NBN

Land area 893sqm*, NLA 812sqm* RWC Toowoomba

Central CBD location neighbouring Heritage Bank

Exceptional condition & value fit-out

Office and retail with front and rear entrances raywhitecommercial.com

Grant

Currently a double-storey brick home set on 860m2 of land

Be a landlord in a suburb where 54.9% of the population are renters

Develop into duplexes, townhomes, or apartments up to 3 storeys

Excellent transport links, easily accessible by Pacific Motorway

Catchment area for Cavendish Road State High School

Proximity to Brisbane CBD (10min drive)

Proximity to the future Olympics precinct in Woolloongabba

Sale

Sid Arora 0469 831 089 sid.arora@raywhite.com

Kim McRae 0493 551 143 kim.mcrae@raywhite.com

RWC CSR raywhitecommercial.com

1/7 Manning Street, South Brisbane, 4101

38sqm of retail space on the ground floor

Floor to ceiling glass shop frontage

Shared WC amenities on the ground floor

Access to 7 visitors' carspaces

Access to rooftop entertaining area & BBQ area

Sale

Mukhtaar Hashim 0433 364 786 mukhtaar.h@raywhite.com

Kim McRae 0493 551 143 kim.mcrae@raywhite.com

47 Clarence street, Coorparoo, 4151

740sqm* of office and warehouse area

Existing Sports and Recreation use

Tightly held mixed-use commercial and industrial precinct

Currently leased with the lease expiring on 1 January 2025

Suitable for both occupiers and investors

Flood Free site in 2011 and 2022

Sale

Ben Sands 0432 547 164 ben.sands@raywhite.com

RWC TradeCoast raywhitecommercial.com

14 Jijaws Street, Sumner, 4074

Units from 131sqm* - 588sqm*

Units 1-7 will be brand new

Units 8-17 will be like new/ refurbished

Epoxy sealed warehouse floors

Amenities in each unit

Electric roller doors

80amps of 3 phase power to each unit

Sale/Lease

Available late 2023

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

5991 Giinagay Way, Nambucca Heads, NSW

Gross site area of 14 hectares*

Mixed Zoning: E3, C2 and C3

Wide range of permitted uses^

2.5 km* to Pacific Highway

4 km* to Nambucca Heads village centre

5 km* to Nambucca train station

40 km* to Coffs Harbour airport

Expressions Of Interest

Closing Wednesday, 19 July 2023 at 3pm (AEST)

Baxter van Heyst 0447 113 025

baxter.vanheyst@raywhite.com

Samuel Hadgelias 0403 254 675

shadgelias@raywhite.com

RWC SC

raywhitecommercial.com

207 Maroubra Road, Maroubra, 2035

Blue Chip Location

Land area 621sqm*

Zoned E2

Trophy asset freestanding 2 level building

Rear lane access to undercover parking for 10 cars

Ex bank premises

Ideal for owner occupation or development S.T.C.A.

Expressions Of Interest

Phillip Elmowy 0425 285 444 p.elmowy@rwcss.com

Anthony Vella 0412 232 904 a.vella@rwcss.com

RWC South Sydney

raywhitecommercial.com

70-74 Majors Bay Road, Concord, 2137

Site Area; 415sqm* Building area; 408sqm*

Well under permissible GFA of 747sqm^

Prime retail position on Majors Bay Road

Suit Medical Consulting, DA approved for Boutique Gym

2 storey freehold building with rear lane access

Parking for eight cars & council car park at the rear

Exceptionally busy retail village precinct

Sale

Medical/Consulting

Land/Development

Retail

Kristian Morris 0411 415 297

kristian.morris@raywhite.com

Kamal Silwal 0430322459

kamal.silwal@raywhite.com

RWC Sydney City Fringe

raywhitecommercial.com

14 Butler Road, Hurstville, 2220

A collection of 8 full-floor apartments

All apartments boast private balconies and internal fitout

The top floor apartment offers an exclusive rooftop

Higher floors enjoy stunning district views

Existing draft strata scheme in place

Rare mixed-use building opportunity

Located a mere 90m* from Hurstville Station

Auction On-Site, Thursday 27 July 2023 at 1:30pm.

Peter Vines 0449 857 100

Victor Sheu 0412 301 582

Vee Li 0416 825 333

RWC Western Sydney

raywhitecommercial.com

Section 228 Block 1 Gungahlin, Gungahlin ACT, 2912

10,171m2

Located in the heart of Gungahlin

Zoned for a mix of commercial and residential uses

Expressions Of Interest

Two-Stage Request for Tender

Closing Thurs 21 Sep 2023 at 2pm

RWC Canberra raywhitecommercial.com

Daniel McGrath 0411140523

daniel.mcgrath@raywhite.com

Anthony Alvaro 0406995383 anthony.alvaro@raywhite.com

1 Roden Culter Drive, Jacka ACT, 2914

19 Packaged Lot and Multi-Unit Sites

Canberra's newest all-electric community

Each packaged lot and multi-unit will be sold separately

Online Auction

2 Day Auction 30 & 31 Aug 2023 at 10am

RWC Canberra

raywhitecommercial.com

Daniel McGrath 0411140523

daniel.mcgrath@raywhite.com

14/167 Beavers Road, Northcote, 3070

Expressions Of Interest

Closing 26th July at 4pm

Brett Diston 0439 365 532

brett.diston@raywhite.com

Zoning | Commercial 1

Roller door access

Two office areas

Toilet

Building area | 265sqm* Kitchenette Shower

Lofty ceiling

3 phase power 7km to Melbourne CBD

Allocated 2 car spaces

Secure gated entry

500m walk to tram

Invest or owner occupy

raywhitecommercial.com

RWC Diston Asset Services1716 Ferntree Gully Road, Ferntree Gully, 3156

Total Building Area 122 sqm*

Land Size 767 sqm*

Medical Permit

Onsite Parking for up to Nine (9) Vehicles

Four (4) Consulting Rooms

Reception & Waiting Room

Auction 20th of July at 11:00am Onsite

Mitch Rosam 0402 355 805 mitch.rosam@raywhite.com

Paul Waterhouse 0417 660 153 paul.waterhouse@raywhite.com

RWC Ferntree Gully

raywhitecommercial.com

Total Building Area: 125 sqm*

Total Land Area: 170 sqm*

Freehold Ownership (No Owners Corporation Fees)

Potential for Development (STCA)

Rear Access for Parking and Deliveries

Proximity to the Eastern Freeway

Auction Thursday 13th July - 1pm

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

G01/9 Balcombe Road, Mentone, 3194

New 5-year lease to January 2028 plus option to 2033

Net Income: $60,000 pa* plus GST

Annual fixed 4% increases

Two onsite car spaces & storage cage on the title

Excellent investment for the passive investor & superfund purchase

Sale

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

2543 Great Northern Highway, Bullsbrook, 6084

Hotel / Motel in prominent location

Large format retail Liquor Store & drive-thru

Hotel Licence & Liquor Store Licence

Sportsbar, restaurant, function room

3 x Commercial Units - 240m2

Large 11,513m2 of prime land

Close to new 2,500 + lot sub-division

Expressions Of Interest

Phil Zoiti 0419 993 656 phil.zoiti@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

RWC WA raywhitecommercial.com

23 & 26 Sharpe Avenue, Karratha, 6714

The best Thai restaurant in Karratha

Lease: 5 years exp Dec 2027

Karratha central location

123m2* restaurant + 27m2* alfresco

$840,000 (Going Concern)

Sale

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

3.1ha of Cleared, Flat Industrial Land

Part of Muchea Industrial Park Precinct 1, North A

Power and Water to Site

Zoned "Indicative General Industry"

40 Minutes to the CBD

Sale

Lachlan Burrows 0499 552 296 lachlan.burrows@raywhite.com

Tom Jones 0478 771 117 tom.jones@raywhite.com

RWC WA raywhitecommercial.com

96 & 110 William Street & 255 Murray Street, Perth, 6000

A prime development opportunity with strong income

Land Area - 1705m2

Massive dual frontages of 81 metres

Net Potential Income $4.5m*

Multiple development opportunities plot ratio of 5:1

Opposite Perth Station & Raine Square

Expressions Of Interest

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

9, 11 & 13 Langman Avenue, Magill, 5072

3 Separate titles available as a whole or individually

Land size of 2,280m2 approx.

Zoned 'Employment'

Suit a variety of uses (S.T.C.C.)

Great location just outside of the Adelaide CBD

Expressions Of Interest Closing Tuesday 18th July at 2:00pm

665

Over 9,700 tenancies managed across Australia and New Zealand. Utilising the most upto date technology to ensure your investment is always performingatits optimal level.

Over 120 property management specialists, supported by over 350 industry-leading commercial agents in over 49 locations across Australasia.