P O R T F O L I O

As we enter the final quarter of 2023, RWC is proud to present the October edition of Portfolio magazine.

In this month’s edition, Ray White Head of Research Vanessa Rader takes a look at how Australia’s influx of new business starts influences the commercial property market, impacting the office, retail, medical and industrial markets. Vanessa also shares her insights into the domestic tourism industry and how demand for tourism-based assets remains high.

We also share a summary of the September Between the Lines webinar which discussed the Gold Coast’s commercial property market.

Vanessa hosted the webinar and was joined by Ray White Special Projects Queensland Director Matthew Fritzsche and RWC Gold Coast Team Leader Luke Boulden. The panel spoke about the market for current commercial assets such as office and medical, as well as future developments to accommodate the Gold Coast’s growing population.

The next Between the Lines webinar will be held on October 12 and will focus on the childcare sector.

James Linacre General Manager

Hundreds of people tuned in to watch RWC’s September Between the Lines webinar which took a deep dive into the Gold Coast’s thriving commercial property market.

Ray White head of research Vanessa Rader hosted the webinar, and was joined by RWC Gold Coast team leader Luke Boulden, and Ray White Special Projects Queensland Director Matthew Fritzsche.

“Ray White Special Projects specialises in the sale of development sites and specialised property assets throughout Queensland and northern NSW.

“The type of properties we sell range from high density sites in the metropolitan areas to broad acre land, everything from townhouses to land subdivision sites.

“We’ve seen a huge amount of activity on the Gold Coast over the last few years.”

Gold Coast born and raised, Mr Fritzsche spoke about the Shaping SEQ Update which talks about the growth of south east Queensland over the medium to long term.

“We’re projected to go from a current population in SEQ of about 3.5 million to 5.3 million in 2046. So that document talks about population forecasts, infrastructure and zoning and how it looks to accommodate that growth.

“As part of the Shaping SEQ document it appears that the major focus is not on the expansion of greenfield land but rather the consolidation of our urban centres and gentle densification.

“On the Gold Coast there is very little greenfield land remaining, so a lot of that consolidation will probably be focussed in existing infill locations.

“What we have seen over the last two years and throughout Covid is a lot of activity in the medium and high density space. There has been a lot of new development along the coastal spine of the Gold Coast.

“That activity remains strong, but we have seen it soften a little bit in the face of a difficult construction market.”

Ms Rader said alongside the strong population growth came a growing need for medical facilities, and asked Mr Boulden what he saw happening in that part of the market.

“There is a very strong appetite from investors for healthcare backed assets, I think there’s a lot of confidence around them given we are a growing region,” Mr Boulden said.

“The migration into south east Queensland has been impressive over recent years, generated by the COVID-19 pandemic, but at the same time that was a huge global health scare which has probably triggered people to be more conscious of their health as well.

“We’ve seen a massive emergence of healthcare providers in south east Queensland and predominantly the Gold Coast. We’ve seen EDQ really pushing their health and knowledge precinct called Lumina.

“There’s also the emergence of smaller scale medical hubs and one-stop shop healthcare precincts.”

While office markets struggle to adjust to the workfrom-home trend, Ms Rader said the Gold Coast had the best performing office market in the country. She asked Mr Boulden what his take was on the region’s office market.

“We are going from strength to strength, and we can attribute a lot of that to the migration during Covid, but the other thing is the affordability compared to other office markets,” Mr Boulden said.

“Our prime grade stock like 50 Cavill Avenue are going for around $650/sqm gross, whereas for a comparative building in Brisbane or Sydney you’d be looking at double that.

“Traditionally we are more of an SME market, or B-grade stock, which has traditionally been our best performer, they’re the ones that continue to be robust.

“We’ve seen uplift in rentals across all grades and contractions in vacancy rates and a contraction in incentives as well.

“I think that’s really due to the migration and the emergence of new small businesses as well, I think the Australian Bureau of Statistics report 4400 new businesses on the Gold Coast in the last three years.”

With strong demand for housing on the Gold Coast off the back of the growing population, Ms Rader asked Mr Fritzsche what the market for residential developments was like, and if it had been affected by the price of construction.

“There is a lot pent up demand for products from buyers on the Gold Coast, but we’re not seeing that translate now into new development more recently as a result of the construction crisis that we’re going through.

“There are developers who are sitting on sites that they’ve bought pre or during COVID, and they’re not able to deliver those developments because of the construction cycle we’re currently in, so I think that will impact forward supply and have some impact on affordability.

“What we’re seeing in the dynamic of the shifting market is a move towards build-to-rent as a focus, and community housing providers as well, social and affordable housing groups are now entering the market in a big way.

“There’s been some big institutional funds taking positions on the Gold Coast and more generally south east Queensland, but it’s good to see some of those players getting really active on the Gold Coast in the major sectors of the market.”

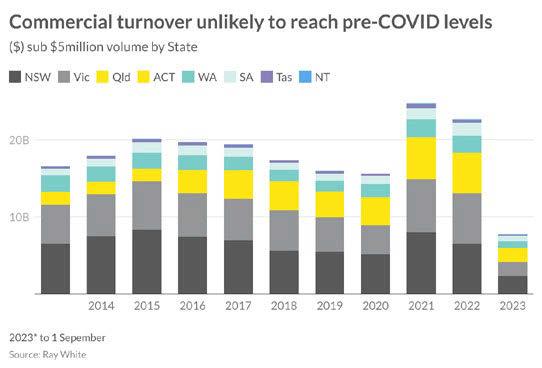

As interest rates show some stability, there has been a renewed confidence in commercial property investment with enquiry levels reportedly up. 2023 has been a tough year for the commercial property market, with interest rates peaking, resulting in financing difficulty and borrowing levels inline with 2020 where volumes took a tumble. Coupled with mixed results across various asset classes, both buyers and sellers have been quiet the first half of the year opting to sit and wait and for market sentiment to improve.

Private investor activity however has dominated the commercial landscape this year, with many opportunistic investors and “cashed up” speculators seeking out assets which offer a good rate of return or hedge to inflation. Across the sub $5 million price range, both owner occupiers and private buyers have grown in activity; to September 1, volumes have reached $7.7 billion well below the $24.7 billion, which turned over during the 2021 peak investment year.

Data from the first eight months of 2023 show a 65.9 per cent decline compared to the full 2022 year, however remains approximately 50 per cent down compared to the quieter 2020 period. Despite this anticipated uptick in activity, we expect 2023 to remain historically a low volume transaction year achieving below the 2020 turnover level of $15.6 billion and ten year annual average of $19.0 billion.

NSW, Queensland and WA have all seen similar levels of interest decline, however, Victoria and Tasmania have seen a greater decrease in activity. Encouragingly the smaller SA and NT markets have seen volume trends most aligned to prior years. However, these reductions are not limited to the smaller end of the market.

The difficulty in commercial transactions has been evident across all price points. The over $5 million market recorded declines in excess of 50 per cent (so far this year) compared to

the highs of 2022. 2020 was a historically low volume year across the larger end of the market with $40.2 billion in sales recorded - below the ten year average $57.3billion per annum. As the first eight months of 2023 has achieved $27.1 billion, volumes are on track to exceed this low 2020 period, albeit not pull ahead of the longer term average.

While private investors have been the most active sellers this year, they continue to also be the most active buyers with net acquisitions in excess of $2 billion. This is the first time these buyers have held a positive net position in the last ten years, highlighting the opportunistic nature of this buyer type, capitalising on market uncertainty and future development, value-add or land banking opportunities. REITs and listed funds have been strong sellers in the marketplace, disposing of more than $7 billion in assets, with net acquisitions at -$5.4billion. This is their lowest net position of the last ten years. Similarly, cross border investment has had the quietest year of the last 10, despite the favourable Australian dollar, due to uncertainty in office markets and limited trophy assets on offer.

Transactions by asset type highlight this reduction in office assets, however, retail and industrial remain active with investment by state showing similar trends with NSW, Victoria and Queensland remaining the most active while the smaller ACT, Tasmania and NT markets have seen a greater decline.

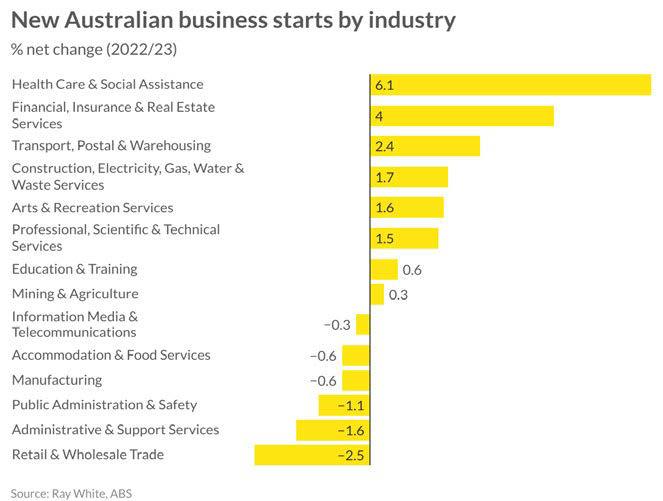

Over the last three years there has been a significant increase in new business starts across the country. Many of these have been borne out of COVID-19 requirements bolstering some industries, while for some the entrepreneurial spirit resulting from job losses aiding in this growth. Encouragingly, we continue to see strong increases in new businesses and positive survival rates in some states and industry types. For some, the growing nature of their businesses requires commercial accommodation.

During the 2022/23 there were 406,365 new businesses registered, bringing the total number of Australian businesses to 2,589,873. NSW has the largest number of businesses, however, only grew 0.9 per cent this period. Victoria, despite being home to the second highest number of businesses, saw losses this year by -0.9 per cent, with Queensland the most active in attracting new business up 2.3 per cent, followed by the Northern Territory at 2.0 per cent.

While it’s no surprise Queensland has led the charge, given its robust population growth over the last few years, the most active industries align with the changing demographic. Healthcare and social assistance businesses were the greatest segment of the market to grow business counts, up 6.1 per cent, this strong growth in line with the strong demand for healthcare assets be it hospitals, medical centres and suites and integrated facilities. Fuelling continued demand across the industrial sector has been the growth in transport, postal, and warehousing businesses. While low vacancies remain across most industrial markets, the requirement for distribution and storage facilities is not expected to wane, however, a reduction in manufacturing businesses may assist in opening up some industrial assets.

Despite the woes of many office markets across the country, new business starts in the professional sectors including finance, insurance and real estate may see the office market turn a corner, while retail continues to be a difficult business and asset class. With rising interest rates, retail trade has seen some reduction and the tightening of belts has seen business counts reduce, down 2.5 per cent across the retail and wholesale trade category.

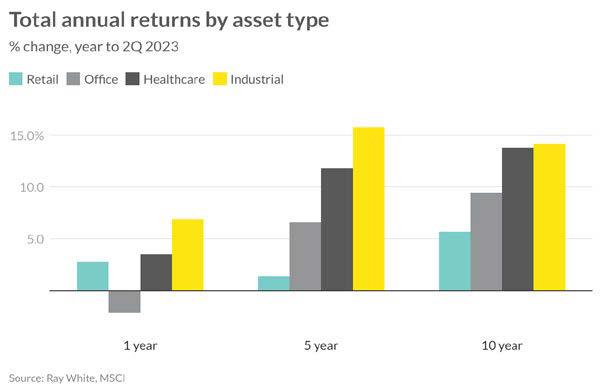

The change in business activity marries well with the recent MSCI returns data for commercial assets across the country. Demand remains for investors in the healthcare and industrial sectors looking to take advantage of the long term capital gains associated with these asset classes. Strong and stable income

returns are also a feature of these asset classes, while the mismatch between demand and supply to occupy has ensured income certainty. Over the last ten years we have seen annual total returns for industrial and healthcare at 14.2 per cent and 13.8 per cent respectively ahead of both retail and office assets.

For office, the high vacancy environment will take some time to play through, keeping returns subdued and investor demand levels dampened until substantial price corrections are achieved. Encouraging new business starts in the white collar, professional arena, however, the shift in workplace behaviours around working from home the greater stumbling block for this asset class. Retail assets are also grappling with the changing consumer sentiment towards bricks and mortar retail, while income returns remain stable this uncertainty has seen limited positivity in capital returns over the last ten years.

After strong turnover levels in the last few years, increased interest rates have done much to dampen investment demand, for those in the market the healthcare and industrial sectors represent good buying given their limited supply and strong occupancies fuelled by new and growing businesses and our growing population. Over the last year returns have favoured these assets up 3.5 per cent for healthcare and 6.9 per cent for industrial, with retail total returns remaining positive given its income stability at 2.8 per cent while office has started its fall, recording -2.2 per cent this period.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

TOWNSVILLE, QLD

Architecturally designed business park, comprising of 28 units in the heart of Townsville’s commercial hub

752m2 approx building situated on a prominent corner block, consiting of creative and professional tenants

KELMSCOTT, WA

High profile neighbourhood shopping centre featuring Woolworths, BWS, Wizard Pharmacy, Red Rooster and 7 specialities

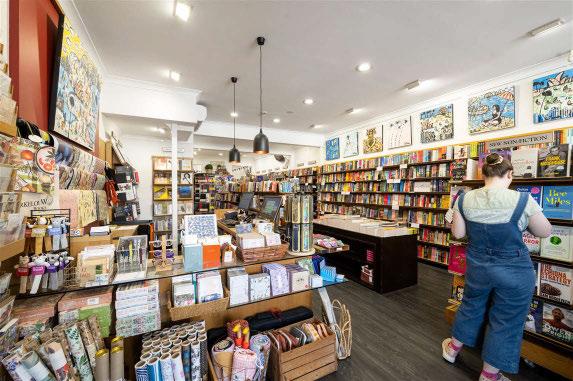

CAIRNS, QLD

Heritage listed former hotel and now retail centre comprising a mixture of retail and entertainment tenancies

CAPALABA, QLD

2,335m² showroom area on a 4,858m² lot, large format retail precinct on long-term leases to national tenants Repco and Rebel

GUNGAHLIN,

State of the art green energy building. 1,000m2 of retail & 4,200m2 of office space housing Defence Housing Australia

37 Joan Street, Bungalow, 4870

Property features include:

•2,857 sqm* of Low Impact Industry Land

•1,233 sqm* HACCP cold store/warehouse facility

•13 secure car spaces

•Functional layout with truck access

•Designated truck loading facilities

•3 phase power to the building

•80 sqm* office plus two separate production offices

•7.9 km from Cairns Airport

•2 km from Cairns CBD

•2 km from Cairns Port

Auction Friday 13 October at 10am Level 26, 111 Eagle Street, Brisbane QLD

Brocke Hambrecht 0466 599 724

brocke.hambrecht@raywhite.com

RWC Queensland

raywhitecommercial.com

Offers To Purchase Over $1,500,000 + GST

A unique commercial premises offered in vacant possession, which would suit a variety of uses including health care services, childcare, community use, office, shop or residential care facility.

•Expansive 1,137sqm* site area

•223sqm* of building area plus additional 82sqm* of covered verandah area

•Zoned Community Facilities (Community Purposes)

•Disabled access and onsite parking provided

•Commercial kitchen facilities, electric access gate and high clearance car and bus ports

•Well maintained building & yard area

•Offered with Vacant Possession

Michael McCullagh 0403 426 474 mmccullagh@raywhite.com

James Hanley 0408 999 755 james.hanley@raywhite.com

RWC Queensland

raywhitecommercial.com

381 Ruthven Street, Toowoomba City, 4350

Under instructions from Michael McCann & Matthew Byrnes as Joint and Several Receivers and Managers of Oxford Capital Pty Ltd (Receivers and Managers Appointed).

•4,775m2* site area within Principal Centre Zone

•6,246m2* GFA

•Principal Centre Zone in the heart of Toowoomba CBD

•10 storey maximum building height (STCA)

•Holding Income from Wilson Parking

•Dual street frontage

•Forecast population growth of 52%* by 2046 underpinning future development

•Adaptive re-use potential

Auction

Wednesday 4 Oct 2023 at 11:00am

Oaks Conference Centre Toowoomba

John Dwyer 0439 034 010

Michael McCullagh 0403426474

Paul Schmidt-Lee 0499 781 455

Peter Marks 0400 111 952

RWC Queensland

raywhitecommercial.com

181 Bridge Street, North Toowoomba, 4350

•9,490sqm* Parcel (Lot 5 on SP195667) with 65m* frontage in excellent location opposite Bunnings Toowoomba North

•Total 5,723sqm* Showroom, warehousing & covered parking/loading area

•3,892sqm* T1 - Anchor tenant Fantastic Furniture + adjoining 1,831sqm* T2 - Allstar Gymnastics

•Both long-term tenure since 2006 & 2012 respectively

•Large format Bulky Goods & Indoor Sport & Rec. (60% Plot Ratio) with 3 street frontage & western site drive through ability

•Freehold sale only - businesses & associated equipment excluded

Offers To Purchase

Building Area: 5,723sqm*

Land Area: 9,490sqm*

Craig Bradley 0488 075 167 craig.bradley@raywhite.com

RWC Toowoomba

raywhitecommercial.com

40 Annand Street, Toowoomba City, 4350

RWC Toowoomba is proud to present to the market the commercial asset of 40 Annand Street / 57-61 Neil Street, Toowoomba. This exceptional development opportunity is being offered to the market as vacant possession. With unlimited future development possibilities, and benifiting from Principal Centre zoning, it is ideally suited for a variety of large commercial developments.

•Just 20m* from Empire Theatre

•Next to Toowoomba Regional Council car park

•Two blocks from Grand Central Shopping Centre

•Rare opportunity to invest in growing CBD

•Unlimited future development opportunities of up to 12 storeys^

•Become a part of our growing CBD

Expressions Of Interest

Closing 6 October

Land Area: 3,160sqm* Floor Area: 2,045sqm*

Peter Marks 0400 111 952 peter.marks@raywhite.com

RWC Toowoomba

raywhitecommercial.com

64-68 Neil Street, Toowoomba City, 4350

•Redevelopment site with holding income of $143,888.00p.a.* Gross

•Total land area of 4,707sqm*, 'Principal Centre' zoning

•Opportunity to subdivide

•Wide variety of development options including office, apartments & accommodation

•Potential to build up to 12 storeys^

•100m* from Empire Theatre

•Close to Council Admin/parking & Grand Central Shopping Centre

Expressions Of Interest Closes 4pm, 13 October Land Area: 4,707sqm*

Peter Marks 0400 111 952 peter.marks@raywhite.com

Paul Schmidt-Lee 0499 781 455 paul.schmidt-lee@raywhite.com

RWC Toowoomba

raywhitecommercial.com

1 Lawson Street, Southport, 4215

Fully-fitted 420m2* office suite

High quality 'A' Grade fit-out

Approximate net income $140,700.00pa + GST

Brand new 5 + 5 year lease

Four (4) titles to be sold collectively

Australia's most competitive office market

Boutique building in central CBD location

Auction Wed 18 October at 11am Gold Coast Turf Club, Bundall

Luke Boulden 0423 159 170

l.boulden@rwsp.net

RWC Gold Coast

raywhitecommercial.com

33-35 Daintree Drive, Redland Bay, 4165

Sizes range from 179sqm*-271sqm*

Mezzanines can be fitted to create elevated work spaces

Electric container-height roller door for easy access

3-phase power and high-speed NBN connections

Disability-compliant amenities

Secure gated complex close to M1 & Gateway M'ways

Vacant possession | Suit start-ups, downsizers & storage

Hugh Fletcher 0429 583 765

hugh.fletcher@raywhite.com

Nathan Moore 0413 879 428

nathan.moore@raywhite.com

RWC Bayside

raywhitecommercial.com

6 brand new units ideal for work, play and store

52-54 Jardine Drive, Redland Bay, 4165

Container-height roller door

Fully fitted office mezzanines

3-phase power capabilities

Disability-compliant amenities

Secure gated complex

23 on-site car parks

Vacant possession

Hugh Fletcher 0429 583 765

Nathan Moore 0413 879 428

Nicole Plath 0410 328 319

RWC Bayside

raywhitecommercial.com

1/79 Eastern Road, Browns Plains, 4118

24km from Brisbane CBD

Direct access to Mt Lindsey Highway & Logan Motorway

Great internal warehouse height & natural light

Modern tilt panel unit, container height door

Small gated complex of only four units

Ample onsite parking

To be sold on vacant possession

Auction Thursday October 26th The Glen Hotel

6:00pm

RWC CSR

raywhitecommercial.com

Christina Li 0430 360 408 christina_li@raywhite.com

121-139 Compton Road, Underwood, 4119

3.69 hectares

224.6 metre frontage to Compton Road

Daily passing traffic count 40,000 - 60,000

Zone: Mixed Use

Bunnings & BCF - 1km

Officeworks - 1.2km

Adjoins Spotlight Group owned site

Sale

Julie Ryan 0447 445 453 julie.ryan@raywhite.com

Grant Turner 0457 766 812 grant.turner@raywhite.com

raywhitecommercial.com

RWC CSR2&3/5 Hasking Street, Caboolture, 4510

Aaron Canavan and Troy Sturgess are pleased to present 2&3/5 Hasking Street, Caboolture for Sale.

FEATURES:

• 186m2 fitted out office/retail space across 2 tenancies

• $56,883 net income per annum

• Fully leased until 2026, with options

• Glass frontage

• Signage opportunities on site

• Direct onsite car parking

This property is located in the heart of Caboolture, offering excellent exposure and convenience. It is surrounded by a range of amenities and is located within minutes drive of the Bruce Highway & 150m walking distance from the Caboolture Train Station.

Aaron Canavan 0447 744 948 aaron.canavan@raywhite.com

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

raywhitecommercial.com

Champion Cellars

• Surrounded by major ongoing development & infrastructure

RWC Northern Corridor Group raywhitecommercial.com

Cnr Price Street & Hospital Road, Nambour, 4560

Significant 5,029m2* land area over 5 titles

Expansive 75m* wide corner street frontage

15m height limit

Walking distance to Nambour CBD

Located in one of the fastest-growing regions

Located opposite the Nambour Railway

Specialised centre zoning

Abi Rowlands 0402 028 663 abi.rowlands@raywhite.com

Emily Pendleton 0402 435 446 emily.pendleton@raywhite.com

RWC Northern Corridor Group raywhitecommercial.com

Aaron Canavan 0447 744 948 aaron.canavan@raywhite.com

Chris Massie 0412 490 840 chris.massie@raywhite.com

39

Street,

The Yards - exceptional storage facility

Brand new storage units with high quality finishes

Construction commencing 2024, completion August 2024*

Strategic location close to the northern and southern suburbs

Stages 1-4, 38 storage units with 14 already sold

Areas ranging from 40sqm* to 110sqm*

Sale $139,900 - $362,200

Helen Crossley 0412 772 882 helen.crossley@raywhite.com

Susan Doubleday 0408 038 380 susan.doubleday@raywhite.com

RWC Cairns

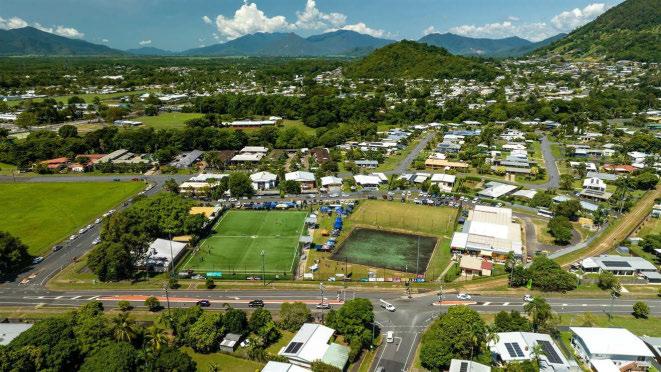

117-125 Toogood Road, Woree, 4868

Multi-tenanted sports and recreation facility

Tenanted by 6 long-term businesses

Sporting facility including FIFA quality fields

Large parcel of land 1.7144 ha

Options to increase revenue with storage facility

ROI 7.5% - WALE 4.1

Sale Offers Over $2,300,000

Grant Timmins 0422 534 044 grant.timmins@raywhite.com

raywhitecommercial.com *Approx. Outline indicative only.

Fully fitted 175sqm café/carvery with equipment

Small warehouse/storage area for dry stock

Outdoor seating area

Located in busy complex

Cold room/freezer

Food display cabinets

Lease

Dylan Thomas 0428 242 935 dylan.thomas@raywhite.com

RWC Milton

raywhitecommercial.com

2/7 Millennium Place, Tingalpa, 4173

100m2* office/showroom over two floors

250m2* clear span warehouse

Toilet amenities on both floors

5 exclusive car parks

Minimum 6m clearance

One of only three units in the complex

Lease

Maclay Kenman 0490 196 600 maclay.kenman@raywhite.com

RWC Milton

raywhitecommercial.com

810sqm* single floor, level 2 office tenancy

$254,922.56*p.a. net income

3 year lease commenced 1/11/22 with further options

$91,102.00 security bond

Leased to Creation Homes

CPI rent reviews

Sale

$3,400,000

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

RWC TradeCoast

raywhitecommercial.com

1307 Kingsford Smith Drive, Pinkenba, 4008

Units from 123sqm* - 429sqm* but can be flexible

Ultra-modern design by Sparc Architects

Self-contained amenities with A/C mezzanine

Exclusive carparks for each unit

Heavy Duty concrete floors

PWD toilet & shower for exclusive use of owners / tenants

Stage 2 completion early 2025

Sale/Lease

Price on Application

Jack Gwyn 0424 807 166 jack.gwyn@raywhite.com

Jared Doyle 0408 160 570 jared.doyle@raywhite.com

• Freestanding retail/ office building over 2 levels

• Medical centre and pharmacy with new 5 year lease + 5 year option (long standing tenants)

• 6 Tenants in total

• Building area 924 sqm

• Land area 2,036 sqm

• Current net income $309,242.84 p.a.

• New elevator recently installed

• Building is fully compliant for disabled access

• Ground floor area 501 sqm

• First floor office area 425 sqm

• 30 On-site car parking spaces

• Zoned Centre in the heart of bustling Logan Central

• Potential to increase GFA or re-development to maximise income

• Excellent exposure to Wembley Road with prime corner position

Auction 18th October 202311am On-site

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

RWC Springwood

raywhitecommercial.com

3351 Pacific Hwy, Slacks Creek, 4127

Freestanding industrial building 1,800sqm on 4,034sqm of land

• 400sqm office area over 2 levels

• 1,400sqm

Sale $4,500,000 + GST

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

Adrian Hamilton 0428 875 444 adrian@rwcs.com.au

RWC Springwood raywhitecommercial.com

103 Cronulla Street, Cronulla, 2230

Gross income $139,296 inc GST and 50% outgoings

Ground floor shop + 2 bedroom residence above

Auction Tuesday 10 October, 10:30am

Auction Works - Mezzanine Level, 50 Margaret Street, Sydney

Phillip Elmowy 0425 285 444 p.elmowy@rwcss.com

Anthony Vella 0412 232 904 a.vella@rwcss.com

Ideal investment with capital growth

Positioned in a lively commercial retail hub

Proximity to pristine beaches and recreational amenities

RWC South Sydney

Lock up garage + off street parking via rear street raywhitecommercial.com

G02/77 Dunning Avenue, Rosebery, 2018

Ground level retail investment opportunity

Strata area 28sqm* plus storage space

Anthony Vella 0412 232 904 a.vella@rwcss.com

John Skufris 0414 969 221 j.skufris@rwcss.com

Long lease to cafe operator at $60,300pa net

RWC South Sydney

Bonus exclusive use seating area in the building's lobby raywhitecommercial.com

691 Botany Road, Rosebery, 2018

159sqm* total, mixed-use zoning

Ground floor shop + 2 bedroom residence

18.8sqm* retail

Onsite car parking at rear via Emanuel Lane

Scope to uplift & add further value^

199-203A Malabar Road, South Coogee, 2034

Located in a prime coastal location

3 shop fronts over 2 titles + 2x2 bedroom residences

Currently leased at $103,000pa*

Versatile options for investors and owner occupiers

Opportunity to refurbish and maximise rental

Auction Tuesday 10 October, 10:30am

Auction Works - Mezzanine Level, 50 Margaret Street, Sydney

Phillip Elmowy 0425 285 444 p.elmowy@rwcss.com

Anthony Vella 0412 232 904 a.vella@rwcss.com

RWC South Sydney

raywhitecommercial.com

11-17 Hutchinson Street, St Peters, 2044

DA Approved: 4-storey building

Total land area 824.76sqm*

Frontage 24m*

Warehouse with roller door

Period cottage in unrenovated condition (3 bed/1 bath)

Shared side driveway/off-street car parking

Expressions Of Interest

Closing 13 October 2023

Anthony Vella 0412 232 904

a.vella@rwcss.com

John Skufris 0414 969 221

j.skufris@rwcss.com

RWC South Sydney

raywhitecommercial.com

82-90 Alexander Street, Crows Nest, 2065

3,673 sqm* total approved Net Saleable Area

1,262 sqm* rectangular site

Favourable unit mix caters to downsizers

Dual 34m* frontages with rear lane access

Ideal short WALE and holding income

250m* from the Metro Station

Expressions Of Interest

Closing Wednesday 18 October at 3pm

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Tim Abbott 0425 285 833

tim.abbott@raywhite.com

RWC SC

raywhitecommercial.com

Level 3, 263 Clarence Street, Sydney, 2000

Plug and play fit out with large reception

Excelent natural light

Mixture of private office and open plan areas

Private kitchen and break out space

Utilities area, separate server or data room

EOT facilities including bike racks and showers

Three lifts and quality building service

469 388

Level 8, 9 Barrack Street, Sydney, 2000

Whole top floor with pitched exposed timber ceilings

Reception, 10pax boardroom, 4pax meeting room

Open plan w/ room for 31 workstations, office

Casual meeting area, ERCO LED lighting

Beautifully appointed kitchen/breakout space

Bathroom & showers with high end finishes on floor

Lease Area m2: 311.2 approx

Rent $/m2: $1,195 Gross

Rental PA: $371,884

Anthony Harris 0409 319 060

aharris@raywhite.com

RWC Sydney Office Leasing

raywhitecommercial.com

102 Hunter Street, Newcastle, 2300

Occupying a key strategic corner location on Hunter & Bolton Streets, 102 Hunter Street stands proudly as an architectural landmark of the Newcastle CBD cityscape and embodiment of grand early 20th century Palazzo style. Comprising five floors currently fully let on commercial tenancies, this represents a rare exceptional freehold investment opportunity with a potentially diverse range of future upside & repurpose opportunities (STCA).

•Site area of 278m2*

•Lettable area of 900m2*

•Zone MU1: Mixed Use

•5 floors with upgraded modern lift

•Fully let with 6 existing tenancies

•Net annual income $197,000 + GST*

Expressions Of Interest

Closing at 3PM

Tuesday 17th October 2023

Lee Follington 0417 443 478

lee.follington@raywhite.com

RWC Newcastle

raywhitecommercial.com

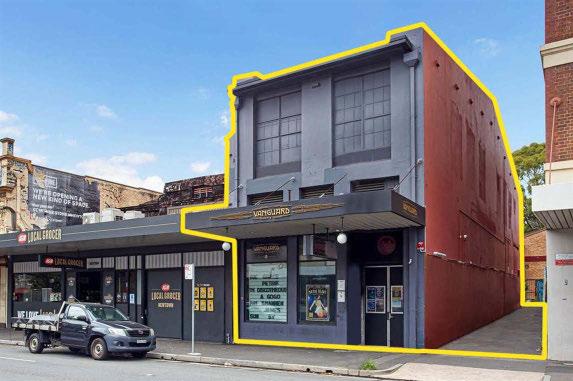

42 King Street, Newtown, 2042

Prime King Street Newtown location

Sought-after freehold opportunity

Imposing 2-level plus mezzanine building

Late night licence with Primary Service Authorisation

Renowned live music venue with full set-up

Strong social media presence

Ability to reposition the business

Kamal Silwal 0430322459

kamal.silwal@raywhite.com

Ronan Braham 0401500679

ronan.braham@raywhite.com

RWC Sydney City Fringe

raywhitecommercial.com

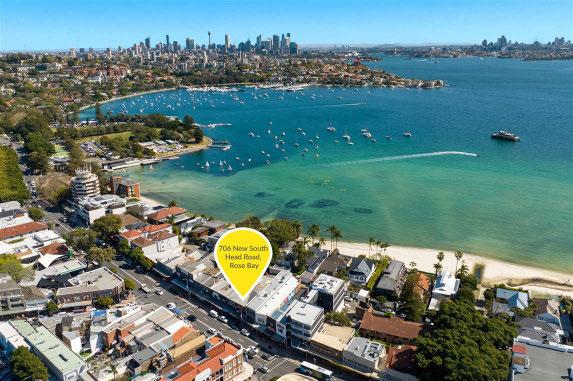

706 New South Head Road, Rose Bay, 2029

Net Lettable Area: 194 sqm*

Land Area: 202 sqm*

Parking for up to 3 cars on a stacked basis

Rear Lane Access to Collins Avenue

Gross Income of $95,481 per annum + GST*

Auction 12 October 2023

Ray White Double Bay 365 New South Head Road, Double Bay NSW 2028

Grant Whiteman 0418 244 566 gwhiteman@raywhite.com

Max Stephens 0429 500 156

max.stephens@raywhite.com

RWC Sydney North

raywhitecommercial.com

28 Grose Street, Parramatta, 2150

Two level commercial building of 510m2*

Expressions Of Interest

Closing Wednesday 25 October 2023 at 3:00pm.

Joseph Assaf 0401 397 696

jassaf@raywhite.com

Victor Sheu 0412 301 582

Onsite car parking for 5 vehicles

Passing net rental of $192,379pa Net + GST

Versatile and functional floor plan layout 200m* to the new proposed Fennell Street Light Rail

Walking proximity to Parramatta CBD

victor.sheu@raywhite.com

RWC Western Sydney

raywhitecommercial.com

Units 233 & 234 / 4-10 Cape Street, Dickson ACT, 2602

Prime ground floor location

Unit 233 - 124sqm

Unit 234 - 121sqm

Basement car parks

High visibility with frontage on Cape Street

Versatile retail spaces suitable for various businesses

Surrounded by a thriving community

Sale/Lease Contact agent

Steven Shang 0411 374 432

steven.shang@raywhite.com

RWC Canberra

raywhitecommercial.com

128-130 Balcombe Road, Mentone, 3194

Two opportunities | buy one buy both

5x separate income streams | $121,806 p/a*

Combined building area | 349m2*

Combined land area | 674m2*

Combined frontage | 12.76m*

Suit Investors/Occupiers/Developers^

Laneway access via ROW

ACZ - Activity Centre Zone - Schedule 2

Auction Friday 27th October 2023

On-site & Online

Ryan Amler 0401 971 622

Theo Karkanis 0431 391 035

George Ganavas 0478 634 562

RWC Oakleigh

raywhitecommercial.com

3/323-327 Ingles Street, Port Melbourne, 3207

Auction 12th October 2023 at 12pm

/ Online

Total building area | 180m2*

Two (2) allocated car spaces

Ryan Amler 0401 971 622

Simon Liang 0451 954 318

Tom Carroll 0410 698 033

New 2 + 2 year lease from Aug 2023

RWC Oakleigh

Leased to Ivy & Eve since 2015 raywhitecommercial.com

4 Lawrence Street, Blackburn South, 3130

Potential fully let rental | $65,000 p/a*

Total land area | 240m2*

Total building area | 223m2* over two levels

Shop Leased until March 2027 + 4 year option

Immaculate two b/room residence with gas

Opposite Woolworths & McDonalds

Secure car parking accessible via R.O.W

Auction Thursday 5th October 2023, at 11:00 am

On-site & Online

34/195 Wellington Road, Clayton, 3168

Theo Karkanis 0431 391 035 theo.karkanis@raywhite.com

Anthony Anastopoulos 0488 095 057 anthony.anastopoulos@raywhite.com

RWC Oakleigh raywhitecommercial.com

*Approx

52 & 54 Johnston Street, Fitzroy, 3065

Only 1km* from Melbourne CBD

Combined land area | 229m2*

Combined building area | 302m2*

Each with modern 1st floor office/residence

Shop 52 - vacant possession & kitchen fit-out

Shop 54 - passing income of $58,752.96 p/a*

Excellent rear access via wide R.O.W

Sale Expressions Of Interest

Closing Wednesday 11th October at 2pm

Theo Karkanis 0431 391 035 theo.karkanis@raywhite.com

Sale

RWC Oakleigh raywhitecommercial.com

4x car spaces on title

Secure with 24hr access

Total area | 106m2* Vacant possession or lease back

Ryan Amler 0401 971 622 ryan.amler@raywhite.com

Tom Carroll 0410 698 033 tom_carroll@raywhite.com

RWC Oakleigh raywhitecommercial.com

*Approx

6/518 Mt Dandenong Road, Kilsyth, 3137

Total building area | 79m2*

Total land area | 79m2*

Open plan area / blank canvas

Suitable for many uses

Sold with vacant possession

Gas connection + 3-phase power

Commercial 1 Zoning (C1Z)

Auction Friday 6th October 2023 at 12pm On-site & Online

*Approx

George Kelepouris 0425 798 677 george.kelepouris@raywhite.com

Simon Liang 0451 954 318 simon.liang@raywhite.com

RWC Oakleigh raywhitecommercial.com

13 Arcade Road, Mont Albert North, 3129

Development opportunity

Total building area 72sqm*. Total land area 264sqm*.

Development Upside (STCA)

Large Shop Front

Kitchenette

Large Storage Yard

Commercial 1 Zone (C1Z)

Auction 31/10/2023 at 11:00am on site

Mitch Rosam 0402 355 805

mitch.rosam@raywhite.com

Nitish Taneja 0416 890 577

nitish.taneja@raywhite.com

RWC Ferntree Gully

raywhitecommercial.com

231-237 Koornang Road, Carnegie, 3163

Infrastructure in place for cafe/restaurant

Land Area: 600sqm*

Zoning - Commercial Zone 1

Extensive seating capacity

Two Street Frontage - 70sqm*

Lease

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

242-244 Springvale Road, Glen Waverley, 3150

Key tenant - Glen Waverley Medical Centre, with over 30-year legacy

Total Land Holding 2,197sqm*

Near new 5 year Lease plus options

AAA corner site opposite 'The Glen'

Fully renovated property adjoining, suitable for residential/medical use

Premier 2-level medical centre

Sale

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422883011 will.jonas@raywhite.com

Glen Waverley

raywhitecommercial.com

RWC

Exceptional coastal freehold hotel opportunity

Popular local’s pub and live entertainment venue

Pathways to increase revenues across the business

Positioned on a 1,473m2 corner block

Prominently situated within the Bunbury CBD

Classic pub layout with expansive f&b facilities

Expressions Of Interest

Closing Thur 12 Oct at 4:00pm AWST

RWC WA

raywhitecommercial.com

Phil Zoiti 0419 993 656 phil.zoiti@raywhite.com

81 Yelverton Drive, Midland, 6056

Join St John of God, Curtin University medical school and more

First floor specialist suites - 66m2 - 746m2

Ideal for healthcare, innovation knowledge and Allied Health

Second floor - 2,012m2 (can be split) 9A classification

Suitable for day surgery, short stay hospital and commercial offices

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

187 Adelaide Terrace, East Perth, 6004

Significant landholding of 2,987m2*

Existing building area of 3,555m2* over three levels

Unique freehold building in CBD incorporating Basil Kirke Studio

Potential to adapt or redevelop in consultation with Heritage Council

Mixed-use development potential - hotel, entertainment, education

Sale Contact Agent

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

RWC WA

raywhitecommercial.com

132 Rokeby Road, Subiaco, 6008

Focal corner location

356m2* single level building

460m2* freehold site

Zoned ‘Centre’ R-AC0

Options galore retail - food - hospitality - medical

Offers To Purchase

Closing Wed 18 Oct 2023

Michael Milne 0403 466 603 michael.milne@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

18 Waymouth Street, Adelaide, 5000 Lease

This rare opportunity consists of two levels of office space - approximately 297 square metres with a flexible, open-plan layout to suit a variety of uses (S.T.C.C.).

Great features include:

•Beautiful skylight is visible on both levels providing an abundance of natural light in the space.

•Prime location on Waymouth Street opposite the Advertiser Building and within walking distance of a wide range of amenities including restaurants, cafes, shopping and public transport.

•Superb two storey self-contained building

•Excellent Showroom/Retail and/or office accommodation

•Rear lane access

•Currently being refurbished. Available late 2023.

Ian Lambert 0413 155 665

ian.lambert@raywhite.com

Lauren Herman 08 7228 5600

rwcadmin@raywhite.com

RWC Adelaide Asset Management

raywhitecommercial.com