RWC is proud to present to you the April edition of Portfolio magazine. As we head into the second quarter of the calendar year, we can reflect on the renewed energy we’ve seen in the commercial property market in 2024.

In this edition of Portfolio, Ray White Head of Research Vanessa Rader has also reflected on the market so far this year, and answers the question – is now the time to buy commercial property? She takes a look at how each major asset is performing, and whether now is the time to invest.

Vanessa also takes a deep dive into the industrial market, taking a further look at whether industrial assets still remain the favourite asset class for investors in 2024.

We hosted our third Between the Lines Live webinar for the year in March, where our panel of experts discussed the market for hotel and leisure assets in the post-covid environment. While more than 200 people tuned in to watch the webinar live, we have shared a summary of the discussion in this month’s magazine.

James Linacre General Manager

James Linacre General Manager

THERE IS NO DOUBT THAT INDUSTRIAL HAS BEEN A PRIZED INVESTMENT TYPE OVER THE PAST FEW YEARS.

Growing population continued to spur on the need for logistics and warehousing facilities, while limited new stock additions have seen most markets keep vacancies minimal and rental growth positive.

Specialised industrial assets such as selfstorage facilities and cold storage have been popular; and over the past few years we have seen a mix of buyers converge on these various industrial assets due to their high occupancy, growing rent and range of prices, suitable for first time investors and owner occupiers through to offshore and domestic funds, and REITs.

As the cost of finance increases the spotlight has been put on the industrial asset class, yields, and what this means for land and capital values. With construction prices remaining elevated, new rental assets coming to the market will dictate a higher economic rent as owner occupiers continue to scurry to secure a piece of industrial property sheltering from uncertainty in rental prices. With land supply limited in many markets and the demand for space unlikely to dissipate, what will that mean for the industrial asset class and the appetite for buyers to continue to invest?

By market (%)

By

The latest data from MSCI shows the strong reductions in returns for industrial. While income returns have kept in a positive direction, capital returns have fallen considerably, with Brisbane and Melbourne showing the greatest correction, followed by Sydney. As a result we have seen both Melbourne and Brisbane total returns falling into negative territory representing -2.3 per cent and -2.2 per cent respectively. While Sydney is heading downwards, some markets are performing better than others, with Sydney’s north capital returns at -3.5 per cent, while Sydney’s south, central west and outer west hover around zero percent. The rest of Australia has been propped up by Perth industrial which continues to yield more positive results, albeit falling inline with the national trend.

This reduction in values aligned with the change in yields, despite the underlying demand to occupy space. The mismatch between financing levels and these capitalisation rates resulted in a required uplift despite fundamentals still in check for this asset class. Other industrial assets such as cold storage and self-storage assets continue to buck the trend with their limited supply, keeping investment yields tight and interest elevated, with offshore buyers as well as domestic funds vying for a piece of this part of the market.

With national average yields for industrial assets moving upwards to average 5.1 per cent after the lows of 4.1 per cent during 2022, does this signal now is the time to invest in industrial property? A correction of 100 basis points is a far cry from the increase in cash rate of 425 basis points over the same period, however, some markets and specific asset types and qualities have more than others. Brisbane’s average is sitting at 5.4 per cent after bottoming at 4.4 percent, similar to Melbourne at 5.1 per cent from 4 per cent. Sydney has not been immune to this as yields approach 5 per cent, well ahead of the sub 4s achieved during the pandemic period.

So have yields reached their peak? With the expectation of rate cuts coming the first half of this year, confidence has returned to the investment market. Industrial and its underlying supply issues, together with high occupancy, is compelling for many investors especially when considering other asset types. Poor office occupancy is impacting returns, retail and its changing face, not to mention the alternatives and their uncertain track record, may result in investors circling back to industrial this year. Industrial was the major investment type in 2023 after historic office domination, a trend we expected to continue in 2024.

Ray White head of research

Vanessa Rader hosted the webinar and was joined by Ray White Valuations Hotel and Leisure Director Adam Ellis, and HTL Property National Director for Accommodation Andrew Jackson to discuss the outlook for the hotel asset class.

Despite being one of the most impacted asset classes during the pandemic, Mr Jackson said the outlook was positive for the nation’s hotel and leisure market.

“Deal flow was more subdued last year than it had been the year prior, but there were still some big ticket deals,” he said.

“There were more domestic buyers and less prevalent activity from offshore buyers which was an interesting trend.Private investors and family offices featured prominently.

“Enquiry has been very encouraging so far this year and we’ve had a noticeable increase in offshore interest.

“However, we still think domestic private buyers will be dominant this year, particularly established portfolio owners who have operational data and expertise to draw from when assessing deals and existing banking relationships, giving them an advantage in terms of transaction timing and certainty offered.”

Mr Ellis said the sector had bounced back very well when compared to precovid levels.

“RevPar, or revenue per available room is up 29 per cent compared to pre covid, and average daily room rate is up 8 or 9 per cent compared to 2019,” he said.

“Next year we will see occupancy rebuilding. In 2024 I think ADR growth will be slower, and RevPar will be built on occupancy.

“ADR is slowing, we had a lot of growth in the last few years so it had to slow down eventually, and occupancy will catch up.”

Mr Ellis said cap rates were also increasing.

“Cap rates are on the rise in 2024, but that doesnt mean values are going backwards because incomes are higher,” he said.

“Cap rates are on the rise but that’s not bringing values down.”

Mr Jackson said he didn’t expect to see downward pricing adjustments in the hotel sector.

“We don’t expect to see discounting of assets in 2024. The sector as a whole continues to trade strongly and while there has been evidence of yield softening in other sectors, it is difficult to see that in the accommodation hotel sector”.

“Pricing has remained firm in the hotel and leisure sector generally, largely because of the high barriers to entry” he continued.

“Hotel yields are not as sharp as other sectors and therefore offer a far more attractive risk reward return profile” he said.

“One of the attractions of hotels as an investment class is that room prices can be adjusted in real time to pass on operational cost increases, offering investors a hedge against inflationary pressures that other investments cannot do in the same real time.”

“This has resulted in increased investor interest and allocation to this sector” he said.

“That’s the beauty of hotel and leisure assets, there’s a lot of operational levers you can pull to maximise the return.”

Ms Rader asked what was driving sales activity and where it would be focused in 2024.

“We have just been through one of the most aggressive interest rate hiking cycles in recent history, and this higher cost of debt funding is likely to drive sales activity this year, with investors freeing up capital through the sale of non-core assets,” Mr Jackson said.

“We are seeing more interest and enquiry this year already, with notable interest returning from offshore investors. The ongoing improvement in hotel trading conditions will see investor interest return to capital city hotel assets, which are more reliant on corporate and international travel.

“However we still expect interest to remain for quality regional assets. A key take out of the pandemic was our collective renewed interest and appreciation for the regional centres and investors now are looking through a wider lens that takes in this landscape.”

Ms Rader asked the experts where they would invest their hard earned money.

Mr Jackson said: “I would invest in a simple 200 room operation in the middle of Sydney city, or a holiday park on the coast with a nice point break directly out front where I can hand my suit in at the door.”

Mr Ellis said: “I would invest in a well located room-only hotel in Sydney or Brisbane, or I think office conversions in the fringe areas have a lot of legs as well.”

The next Between the Lines Live webinar will be held on April 10, where Ms Rader will speak to RWC North Sydney agent Scott Stephens and RWC Eastern Suburbs agent Zorick Toltsan about the highstreet retail market.

“THAT’S THE BEAUTY OF HOTEL AND LEISURE ASSETS, THERE’S A LOT OF OPERATIONAL LEVERS YOU CAN PULL TO MAXIMISE THE RETURN.”

VANESSA RADER Ray White Head of Research

VANESSA RADER Ray White Head of Research

THE COMMERCIAL PROPERTY MARKET HAS HAD SOME MIXED FORTUNES OVER THE LAST FEW YEARS.

The onset of COVID-19 and the lowering interest rates saw investor interest skyrocket resulting in strong compression in investment yields across all asset types. With low interest rates came new investors. First time buyers looking to diversify their portfolios made their first forays into commercial property while larger syndicates, trusts, and funds competed for a wider range of property bringing new highs in capital values. In 2021 we saw peak investment activity after a subdued 2020 with renewed confidence emerging across commercial properties with finance availability high. Upon the commencement of interest rate increases in 2022 we saw a swift slow down in investment activity with buyers more considered given the uptick in cost of finance.

Volumes of sales fell considerably during this time and 2023 transaction volumes were akin to the uncertainty seen in 2020 during the height of the pandemic. Greater distress appeared in the marketplace as sales with increased yield ranges emerged, as the pool of buyers remained low due to reduced sentiment. As we entered 2024 a wave of optimism returned to the commercial property market. Spurred on by the most recent inflation numbers, giving confidence that the next move in interest rates was down and perhaps sooner than first expected. With talk across the economy suggesting two or three reductions this year, sentiment has lifted and enquiry levels across most markets have rebounded.

Across all asset classes, capital values have taken a hit according to MSCI data from December 2023. Reductions have been felt across major asset classes, with office one of the worst hit, down 10.5 per cent, and markets such as Parramatta, North Sydney, Canberra and Melbourne doing it the toughest. For retail, results have been far more moderate due to population increases driving more activity in retail centres, with a small pool of buyers for larger regional centres, prices have been propped up with greatest change in capital returns for smaller neighbourhood and sub-regional centres. Industrial remains the golden child of traditional commercial property investment, while increases in yields have had a negative impact on capital returns, currently sitting at -2.8 per cent, continued income growth has kept total returns in positive territory.

Alternative sectors have also had mixed results. Medical, despite its alignment with population growth, has seen some negativity surrounding capital returns given the increased

cost of finance. For the hotel market, however, strong income returns have kept total returns in positive territory with capital declines marginal at 0.8 per cent

So given these results and the uplift in sentiment regarding investment, are we at the bottom of the market?

Fundamentals for some asset classes are more difficult than others, such as office, which continues to be hampered by low occupancy and limited optimism surrounding rental appreciation in the short term. Industrial and its low vacancy and limited supply pipeline is keeping rents elevated, while the uptick in population may be fuelling an improvement in the retail and medical sectors. Similarly, continued international and domestic tourism growth has seen room rates and occupancy grow which could signal a turnaround for the hotel market also. An interesting time for 2024 as opportunistic funds seek out commercial property options which will likely slow yield growth and prop up capital value appreciation once again.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

RWC WA

KARDINYA, WA

Kardinya Park Shopping Centre is a 13,724 sqm* sub regional shopping centre anchored by Coles, Kmart and 46 specialty shops. The site includes a pad site for 7-Eleven and has parking for over 840 cars

RWC SC

POTTS POINT, NSW

A selection of corner positioned retail stores in the bustling hub of Potts Point.

RWC BAYSIDE

WELLINGTON POINT, QLD

Purpose-built single-level retail building with 716 sqm* NLA across five tenancies set on a high profile 2,218 sqm* lot with 40m* main road frontage and a large on-grade car park

RWC DISTON ASSET SERVICES

PARKINSON, QLD

Fully leased shopping centre consisting of 18 tenancies underpinned by Drakes Supermarket, Parkinson Medical Center, Discount Drug Store Pharmacy and 15 other specialties

4 Traders Way, Currumbin Waters, 4223

Auction 3 May 2024 12:00pm

Occupy or invest-industrial investment dream

800*sqm of NLA

1,635*sqm of land

15*m max build height

Holding income optional

Suit owner occupier or investor

Ryan Langham 0420 581 164 ryan.langham@raywhite.com

Damon Walker 0412 298 820 damon.walker@raywhite.com

4* Wide roller doors raywhitecommercial.com

RWC Burleigh Group

34A Eiser Street, Toowoomba, 4350

Expressions Of Interest

Offers To Purchase

Exclusively listed with Nathan Huxham and Ryan Langham

Nathan Huxham and Ryan Langham are super excited to bring you an outstanding opportunity to acquire multiple parks in one line. This asset class has come in high demand in resent years and only a handle full of these privately own parks are still available on the East coast of Australia.

•Strong current and forecasted cashflow

•140+ mix of sites and cabins

•Fantastic market rate ROI

•Multiple parks on offer

•Market rate ROI

•QLD locations

•Further value add potential

Nathan Huxham 0403 583 306

nathan.huxham@raywhite.com

Ryan Langham 0420 581 164

ryan.langham@raywhite.com

RWC Burleigh Group

raywhitecommercial.com

4/155 Varsity Parade, Varsity Lakes, 4227

Auction

5 April 2024

At 12:00pm

Investors dream, tenant has occupied for over a decade

291m2* office

1* kitchen in the office

11* car spots on the title

Private bathrooms with showers

Fully fitted and recently renovated

Net income for $125,508*+ GST+Outgoings

Emilio Ciavarella

0422 080 051

emilio.ciavarella@raywhite.com

RWC Burleigh Group

raywhitecommercial.com

1531 Beechmont Road, Beechmont, 4211

Expressions Of Interest

Closing 4pm, 30 April 2024

(if not sold prior)

55 acres unique country lifestyle, huge homestead accommodation & business

Farm stay property accommodating approx. 60 guests

9 brms, 15 bthrms, commercial kitchen , dining views

Timber floors, fireplaces, pool room, BBQ area, hot tub

Architecturally built for int. students & group retreats

GC Hinterland overlooking Surfers & Burleigh beaches

Party barn, animal paddocks, bore, spring fed dams

Fruit trees, rainforest track. STCA weddings & cabins

David Djurovitch 0411 133 307

d.djurovitch@rwsp.net

RWC Gold Coast

raywhitecommercial.com

15 Young Street, Southport, 4215

Expressions Of Interest

Closing Wed 24 April 2024 at 4:00pm

Southport's most iconic development site

Land Area 4440m2*

Proposed 2 Tower Development

Bulk Excavation Complete*

4 Street Frontages

Precinct 1 Southport (PDA)

Ideal Mixed-Use Situation in Chinatown

Brad Merkur

0414 389 300

b.merkur@rwsp.net

RWC Gold Coast

raywhitecommercial.com

3/175 Varsity Parade, Varsity Lakes, 4227

Sale Price on Application

Immaculate 114sqm* first floor office - ideal owner occupier opportunity

Open plan, three offices, large boardroom & LED lighting

Soundproof podcast webinar room

Recently refurbished, vinyl flooring & roller blinds

3 full walls of glass windows allowing abundance light

Centre Zone Code - office, education, health care^

Four allocated car spaces

Sold vacant possession

Luke Boulden 0423 159 170 l.boulden@rwsp.net

Floyd na Nagara 0422 667 973 f.nanagara@rwsp.net

RWC Gold Coast

raywhitecommercial.com

59 Evans Drive, Caboolture, 4510

Offers To Purchase

Closing Thursday 11 April at 4pm 2,251m2 allotment

Government-tenanted freehold industrial facility

1,384m2* industrial warehouse & office facility

Leased to Queensland Government until June 2027

Options to 2030

$243,160.64* net income per annum

3.5% annual fixed rent increases

Central to Sunshine Coast and Brisbane

Located close to Bruce Highway, in fast growing region

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

RWC Northern Corridor Group

raywhitecommercial.com

Chris Massie 0412 490 840 chris.massie@raywhite.com *Approx

Alan Cunningham Drive, Gatton, 4343

Balance of the Woodchester Land Estate in Gatton

Prelim Approval for 465 lots with 55 lots delivered so far

D.A & OPW for 48 lots & can be developed cost

Located in the Lockyer Valley 93km* west of Brisbane

Strong local economy with low supply of developed lots

Lockyer Valley housing vacancy rate of 0.57%#

Expressions Of Interest

Closing Thu 18 Apr 2024 4pm (AEST)

Tony Williams 0411 822 544

Mark Creevey 0408 992 222

Craig Bradley 0488 075 167

RW Special Projects Queensland

raywhitecommercial.com

*Approx #Source: Real Estate Investar

1/225 Hawken Drive, St Lucia, 4067

Expressions Of Interest

Closing Monday 15 April at 12pm (AEST)

Prominently positioned in a high traffic location

3 year lease (expiring 22/06/2026)

Located across the road from the IGA Marketplace

Less than 1km from UQ St Lucia campus

Capitalise on a stable rental income stream

Alex Sinclair 0487 183 573 alex.sinclair@raywhite.com

Justin Marsden 0413 944 837 justin.marsden@raywhite.com

Nett income of $49,400 PA* (excluding GST) raywhitecommercial.com

RWC Bayside

107 Herries Street, East Toowoomba, 4350

Offers To Purchase

Land Area: 682 square metres*

Floor Area: 152 square metres*

Presenting to the market, is this characteristic Queenslander with open space and high ceilings. This is an outstanding opportunity to own a freehold commercial investment in a blue-chip Toowoomba city location.

•Complete with five (5) large offices with airconditioning, NBN, storage room, kitchen/lunchroom and amenities

•Generous 682sqm* standalone property with ten (10) car parks on-site

•Great exposure to picturesque Herries Street

•'Mixed Use' zoning

•Walking distance to Toowoomba CBD

Paul Schmidt-Lee 0499 781 455

paul.schmidt-lee@raywhite.com *Approx

RWC Toowoomba

raywhitecommercial.com

Build ready lots 1400m2- 5066m2 available Bunworth Park Edwin Campion Drive, Monkland, 4570

National Tenants - Harvey Norman, BCF, Chemist Warehouse

Excellent exposure and signage opportunities

Specialised Centre

•All 4 tenants with long term leases

• Current net income - $451,280.04 PA Net + GST + Outgoings

• Building area - 377sqm

• Land area - 4,588sqm

•1193sqm of vacant land ideal for car wash and extra income

• Low site coverage with value add or redevelopment potential

• Fully leased multi-tenanted investment

• Anchored by Metro Petroleum

• 13,000 Approx daily passing traffic

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

RWC Springwood raywhitecommercial.com

T3.0/200 Kingston Road, Slacks Creek, 4127

Iconic

Lease Contact Agent

•Total area 225sqm

• Internal area 125sqm

• Al fresco dining area 100sqm

• Attractive leasing incentives available

• Prime location on Kingston Road

• Brand-new retail and commercial hub in the well-established Slacks Creek industrial precinct

• Join national retailers including United Petroleum Fuels and Slim's Quality Burgers in a high traffic corner location with 35,000 cars passing daily

• Currently seeking a variety of food types and cuisines to create a food destination

• There is ample on-site customer parking for 109 cars (40 basement secured)

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

90 Wembley Road, Logan Central, 4114

•Current net income $307,842.77 PA

• Long term leases and tenants in place

• Medical Centre and Pharmacy with new 5 year lease + 5 year option

• 6 Tenants in total

• Freestanding retail/ office building over 2 levels

• Building area - 924 sqm

• Land area - 2,036 sqm

• Ground floor area 501 sqm

• First floor office area 425 sqm

• New elevator recently installed

• Building is fully compliant for disabled access

• 30 On-site car parking spaces

• Zoned Centre in the heart of bustling Logan Central

• Potential to increase GFA or re-development

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

RWC Springwood raywhitecommercial.com

1/16-18 Cinderella Drive, Springwood, 4127

• Public transport and the Pacific, Gateway and Lease Contact Agent

RWC Springwood raywhitecommercial.com

•Private data centre with redundant cooling and power

• Dual independent fibre links

• NBN connected to the building

• Fit out in place

• Reception area with waiting room

• Corporate sized fully equipped boardroom

• Multiple open plan areas + training room

• 7 Executive offices

• 2 Storage rooms

• Ducted air conditioning throughout

• Full size modern kitchen

• Spacious outdoor undercover eating area

• Male & Female amenities

• Security system in place

• Data room & archive room

• 13 Allocated basement car parking

Aldo Bevacqua 0412 784 977 aldo@rwcs.com.au

RWC Springwood raywhitecommercial.com

464 Comleroy Road, Kurrajong, 2758

Auction Thursday, 11 April 2024 at 10:00am (AEST)

Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Boutique accommodation asset | acreage | homestead

Large-format main residence with 6 x bedrooms

2 x separate luxury self-contained cottages

Commercial laundry facilities

Ample sized dam and 3 phase irrigation system

Further redevelopment potential^

Repositioning upside for alternative uses^

Substantial arable land offering

Samuel Hadgelias 0480 010 341

Liam Regan 0488 542 600

Katherina Kostrzak-Adams 0410 648 503

RWC SC

raywhitecommercial.com

9-11 Bollard Place, Picton, 2571

Expressions Of Interest

Closing on Thursday, 11 April 2024 at 12pm (AEST)

968 sqm* building

385sqm* awning with 7.3m* clearance

Offered with vacant possession or flexible leaseback

Low site coverage with numerous development options^ Fully secure site and hardstand with perimeter fencing

Nick Ward 0433 702 903 nick.ward@raywhite.com

RWC SC

7.4km* to the Hume Highway

Significant 11,933sqm* regular shaped site raywhitecommercial.com

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com *Approx

447 Old South Head Road, Rose Bay, 2029

Receivers and managers appointed

Land size - 411m2*

Internal area - 146m2*

Currently configured as high-end dentist surgery

4 x consulting rooms (potential bedroom conversions)

Dual entryway

1.5km* to Rose Bay Wharf/Ferry Terminal

Auction Thursday, 11 April 2024 at 10am (AEST)

Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Samuel Hadgelias 0480 010 341

Liam Regan 0488 542 600

Zorick Toltsan 0411 227 784

Warren Ginsberg 0411 024 116 *Approx

RWC SC

raywhitecommercial.com

1559-1563 Botany Road, Botany, 2019

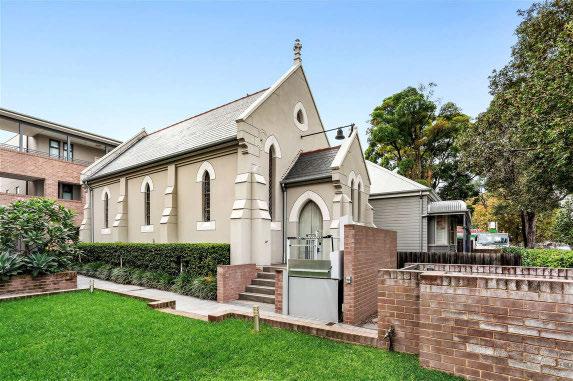

An exceptional historic masterpiece built circa 1880

Features extensive renovations + original features

Internal 74sqm* open plan

Exclusive 64sqm* external courtyard

Land Zoning MU1: Mixed Use

Amenities, soaring ceilings Sale

4 secure tandem car spaces covering 61sqm* + storage

Alex Santelli

0403 104 146

a.santelli@rwcss.com

RWC South Sydney

raywhitecommercial.com

20 Clevedon Street, Botany, 2019

Auction Offers Now or Auction

Tuesday 30 April 2024

AuctionWORKS: 50 Margaret St, Sydney

Freehold industrial building with modern office

Total Building Area: 384sqm* (not including hardstand)

Zone E3 Productivity Support

Roller shutter access 4.8m height

Concrete floors oversized driveway / loading zone

Alex Santelli 0403 104 146 a.santelli@rwcss.com

Land Size: 500sqm* raywhitecommercial.com

RWC South Sydney

Sale

$2,000,000 (+ GST if applicable)

Prominently located and boasting a variety of amenities and features, this is a property poised to benefit from a potentially diverse range of re-purpose and upside opportunities^.

860m2* site area

600m2* building area over two floors

Zone MU1: Mixed Use

Onsite parking at rear

Offered with vacant possession

Barry Price 0402 140 240

barry.price@raywhite.com

Lee Follington 0417 443 478

lee.follington@raywhite.com

RWC Newcastle

raywhitecommercial.com

590-594 King Street, Erskineville, 2043

Key highlights include:

•Net passing income $250,000* + GST per annum

•Long lease to national tenant Industrie Clothing occupying the whole ground floor

•Freehold terrace zoned for mixed commercial/residential use

•3 private newly renovated three bedroom dual level residences

•Prominent high visibility corner block, dual street frontage

•Each residence features a private entry and a deep courtyard

•The total combined land size of the three tri-level terraces 361sqm

Sale Private Treaty

Kristian Morris 0411 415 297

kristian.morris@raywhite.com *Approx

RWC Sydney City Fringe

raywhitecommercial.com

71-75 Willoughby Road, Crows Nest, 2065

Auction 30 April 2024

Auctionworks 50 Margaret Street Sydney NSW 2000

Exceptional freehold development opportunity landmark position

First time offered in 30 years*

Prime 680 sqm* land area

Landmark corner position

Outstanding development opportunity (STCA)

Excellent holding income

Scott Stephens 0434 341 001 scott.stephens@raywhite.com

Over 58m* street frontage + laneway access raywhitecommercial.com

RWC Sydney North

Logan Grisaffe 0403 916 433 logan.grisaffe@raywhite.com *Approx

Sale Limited Offering - from $820,000

•Floor area from 60sqm* to 860sqm*

•Warm shell fit-out including floorings, LED lighting & air conditioning.

•Secure car parking spaces.

•Moments from Burwood Station, Westfield, Burwood Road Retail Precinct & all amenities Burwood has to offer.

•Permissible for a range of business types, including education establishments, corporate headquarters, co working office, tech & IT, medical practitioners, accounting and law & social services.

•Estimated completion date: Q4 2024

Peter Vines 0449 857 100

Victor Sheu 0412 301 582

Joseph Assaf 0401 397 696 *Approx

RWC Western Sydney

raywhitecommercial.com

2 Paddington Street, Paddington, 2021

Lease

Landmark architectural building

Approx 285m2 - set over two light filled levels

Highly versatile layout

Reception, meeting rooms & separate office zones

Sleek modern kitchen with bespoke cabinetry

Floor-to-ceiling glass doors

Sun dappled paved courtyard

Zorick Toltsan

0411 227 784

ztoltsan@raywhite.com

RWC Eastern Suburbs

raywhitecommercial.com

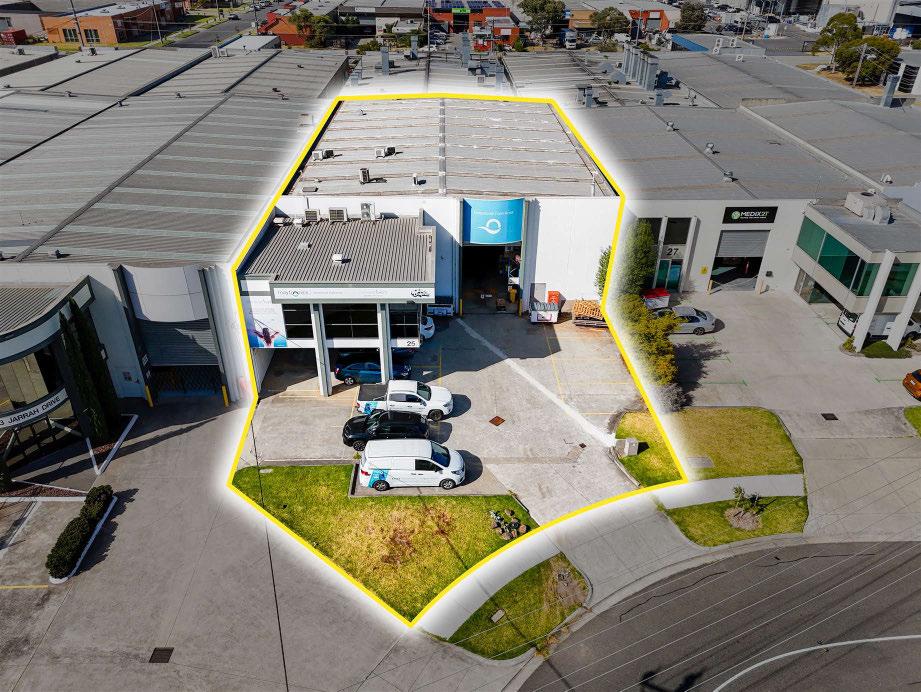

Auction Public On-site & Online

Wednesday 24 April 2024 at 12:00pm

•Offered with vacant possession

•Total building area | 940m2*

•Total land area | 1,200m2*

•Comprising of office and reception over two levels

•On-site parking for 15 cars (6 under cover)

•Container height warehouse with height of 8.2m*

•Industrial 1 Zone (IN1Z)

Ryan Amler 0401 971 622

ryan.amler@raywhite.com

George Ganavas 0478 634 562

george.ganavas@raywhite.com

RWC Oakleigh

raywhitecommercial.com

91 Koornang Road, Carnegie, 3163

•Total building area | 168m2*

•Positioned directly in front of the main pedestrian crossing

•Only 180m* from Carnegie Station

•Woolworths Carpark directly behind

•Rear on-site parking & access

•Suitable for food or general retail use (STCA)

•Commercial 1 Zone (C1Z)

Lease

Ryan Amler 0401 971 622

Joshua Luftig 0425 887 156

RWC Oakleigh

Tan Thach 0422 510 626 *Approx

raywhitecommercial.com

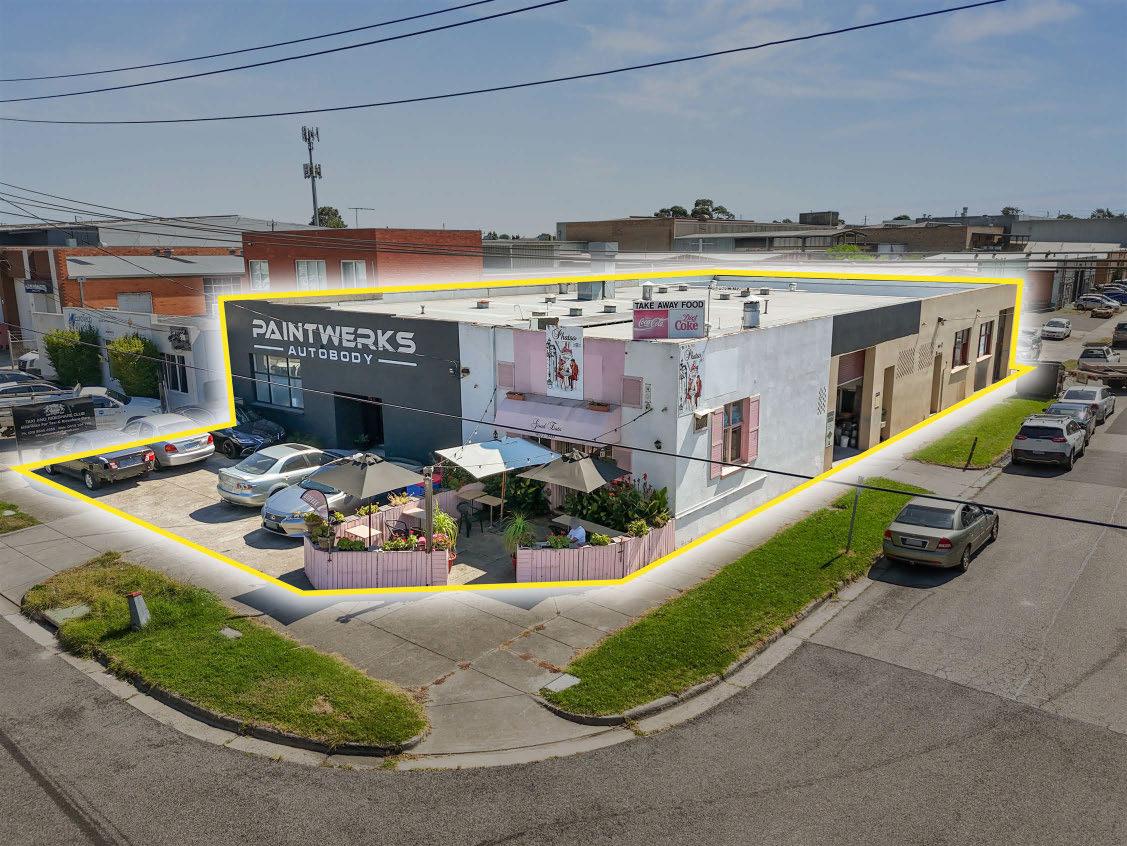

9 Ebden Street, Moorabbin, 3189

Auction Public On-site & Online

Thursday 2 May 2024 at 12:00pm

Corner industrial freeholdtwo warehouses plus separate take-away

.

•Total building area | 760m2*

•Total land area | 946m2*

•Comprising of 2 warehouses plus take-away

•Corner site with frontages to Ebden & Walter St

•65m* of prominent street frontage

•Opportunity to occupy and/or invest

•Current combined income | $75,816 p/a net

•On-site parking at front

•Industrial 1 Zone (IN1Z)

Ryan Amler 0401 971 622

ryan.amler@raywhite.com

George Ganavas 0478 634 562

george.ganavas@raywhite.com

RWC Oakleigh

raywhitecommercial.com

•Total land area | 190m2*

•Total building area | 120m2*

•Comprising of a retail/office plus 2 bedroom apartments at rear

•Asbestos roof replaced with new Zincalume roof sheets in 2022

•All gutters and downpipes replaced in January 2024

•First time offered in 40* years

•Council parking at the front

•Suits investors, owner occupiers and developers alike

•Two (2) car spaces

•Commercial 1 Zone (C1Z

George Kelepouris 0425 798 677 george.kelepouris@raywhite.com

Anthony Anastopoulos 0488 095 057 anthony.anastopoulos@raywhite.com

RWC Oakleigh

raywhitecommercial.com

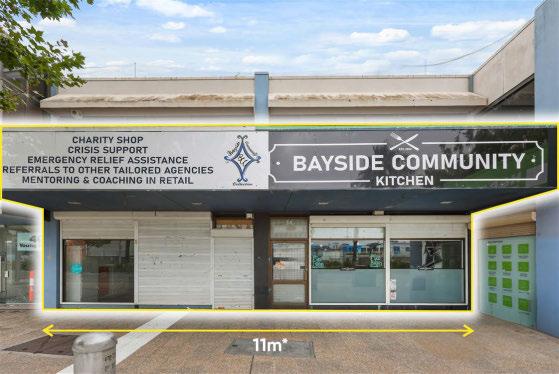

34 & 36 Young Street, Frankston, 3199

•Total building area | 270m2*

•11m* of double frontage plus rear access via ROW

•Easily convert into one large space

•100m* from Bayside Shopping Centre

•300m* to Peninsula Aquatic Recreation Centre

•Fit-out to remain including kitchen infrastructure

•Suitable for a variety of uses (STCA)

•Commercial 1 Zone (C1Z)

Sale Deadline Private Sale (Unless Sold Prior)

closing Thursday 4 April 2024 at 4:00pm

RWC Oakleigh

raywhitecommercial.com

Theo Karkanis 0431 391 035 theo.karkanis@raywhite.com

George Ganavas 0478 634 562 george.ganavas@raywhite.com

*Approx

*Approx

Rental $78,990 NET 23 McCartin

Outgoings - Land tax fully recovered

Long established location

Two (2) years from 1 February 2024 to 31 January 2026

One (1) further Three (3) year options to 31 January 2029

Auction Fri 19 April 2024 1pm

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Vincent Daniele 0428 272 887 vincent.daniele@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

Will Jonas 0422 883 011 will.jonas@raywhite.com Residential

RWC Glen Waverley

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Generous parking ratio available Modern building with end of trip facilities

Significant incentives available

Suits office / medical / education 8 Davidson Terrace, Joondalup, 6027 5 star NABERS Energy rating

Potential suites from 260m2* up to 2,221m2* Lease Net effective rent deals from $260/m2 3.5 star NABERS Water rating High

Luke Pavlos 0408 823 823 luke.pavlos@raywhite.com

Lachlan Burrows 0499 552 296 lachlan.burrows@raywhite.com

Adaptable building, corporate headquarters & high density dev site

Two-level office building

Building: 668m2* (NLA) | Land: 774m2*

13 parking bays

Adaptable floor plates and flexible zoning

Great street presence and accessibility

Redevelopment potential, six storey height limit

Sold with vacant possession or with passing income

Sale

$2,450,000

Stephen Harrison 0421 622 777 stephen.harrison@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

1397 Wanneroo Road, Wanneroo, 6065

Drovers Marketplace

Multiple spaces available ranging from 385m2* - 2,032m2*

Retail/showroom/medical/food processing^

3,147m2* NLA for fresh food sales, showroom or retail

2,032m2* refurbished food processing facility

385m2* suitable for medical

Spaces can be easily adjusted

Over 23,000* cars passing daily

Sale/Lease Contact Agent

Lachlan Burrows 0499 552 296

lachlan.burrows@raywhite.com

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com