WHY THE MARKET HAS SOURED ON APPLE

CAN THE TECH GIANT TURN THINGS ROUND?

CAN THE TECH GIANT TURN THINGS ROUND?

This is a marketing communication. The value of your investment may rise or fall and your capital is at risk. All opinions expressed herein are as of the published date and are subject to change. This information is provided for information purposes only. The value of investments and the income from them can fall as well as rise and you may not get back the amount you invested. Nothing herein constitutes investment advice or a recommendation relating to any security, commodity, derivative, investment management service or investment product. Investments in securities, derivatives and commodities involve risk, will fluctuate in price, and may result in losses. Certain assets held in Lazard’s investment portfolios, in particular alternative investment portfolios, can involve high degrees of risk and volatility when compared to other assets. Similarly, certain assets held in Lazard’s investment portfolios may trade in less liquid or efficient markets, which can affect investment performance. This information is intended only for persons residing in jurisdictions where its distribution or availability is consistent with local laws and Lazard’s local regulatory authorisations. The information is approved by Lazard Asset Management Limited, 50 Stratton Street, London W1J 8LL. Incorporated in England and Wales, registered number 525667. Lazard Asset Management Limited is authorised and regulated by the Financial Conduct Authority. There can be no assurance that the Company’s objectives or performance target will be achieved. Any investment is subject to fees, taxation and charges within the Trust and the investor will receive less than the gross yield. Investors should read and note the risk warnings in the Company’s Key Information Document (KID). Copies of the KID and Report & Accounts are available on Lazard Asset Management’s website or on request. The tax treatment of each client will vary and you should seek professional tax advice.

The Trust is listed on the London Stock Exchange and is not authorized or regulated by the Financial Conduct Authority. This information has been issued and approved by Lazard Asset Management Limited and does not in any way constitute investment advice. The company currently conducts its affairs so that the ordinary and subscription shares in issue can be recommended by financial advisers to ordinary retail investors in accordance with the Financial Conduct Authority’s (“FAC’s”) rules in relation to non-mainstream investment products and intends to do so for the foreseeable future.

Is the US in an ‘earnings bubble’ instead of a valuation bubble?

Early bird ISA investors swoop on £19,000 gain

Disney 1: Nelson Peltz 0. Are activist investors losing their magic touch?

Why am I getting less income from my pension pot despite setting a fixed monthly amount?

Shares, funds, ETFs and investment trusts in this issue

Why Apple is no longer the market’s favourite tech stock

Shares looks at the challenges facing the firm’s various businesses and whether it can regain its appeal with investors

Our 2024 Tips are off to a strong start

Performance would have been better still if our US stocks had played ball but we’re sticking with all 10 picks

The cruise industry is riding the crest of a wave

More and more people are opting to cruise rather than fly abroad on holiday, leading to the first new orders for ships since the pandemic

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

Nvidia, Shell and Rolls Royce among the most bought stocks before the tax year end

US mood music changes, Tesla deliveries ‘disaster’ | Wall Street Week

profit guidance

Reddit and Astera help push new US float funding to $9.6 billion in first quarter

Microsoft (MSFT:NASDAQ)backed cybersecurity firm Rubrik (RBRK:NYSE) plans to raise up to $750 million as it becomes the latest company to unveil plans for an IPO (initial public offering) in the US.

The roster of companies planning to go public is starting to fill out after two years of relative drought following recent successes by social media platform Reddit (RDDT:NYSE) and semiconductor connectivity company Astera Labs (ALAB:NASDAQ), which met or exceeded their IPO

fundraising goals and then rose on their trading debuts.

Reddit and Astera helped push the total funding raised via IPOs on US exchanges to $9.6 billion during the first quarter of 2024, according to data compiled by Bloomberg

Digital marketing software firm Ibotta and UKbased commodities dealer Marex are among other companies which have filed for IPOs, while firms believed to be mulling IPOs this year include payment businesses such as Stripe, Klarna and Checkout.com and UK digital bank Starling.

Rubrik, a cloud computing and data security start-up, was founded in 2013 and released its first product in 2016. It now claims more than 6,100 customers, including governments and universities. Leading corporate clients include banks Barclays (BARC), Goldman Sachs (GS:NYSE) and Citigroup (C:NYSE), consumer products providers like Home Depot (HD:NYSE) and PepsiCo (PEP:NASDAQ), biotech firm Illumina (ILMN:NASDAQ), fintech Fiserv (FI:NYSE) plus the Denver Broncos American Football organisation.

In a letter to investors included in the prospectus, Rubrik chief executive and chairman Bipul Sinha said no government or business was immune to cyberattacks. ‘While our company has grown in organisational size and experience, our mindset, sense of urgency, and risk posture remain as if we were still in the same tiny room as on day one’, Sinha said.

Microsoft made an equity investment in Rubrik in 2021 in a financing round which valued the startup at $4 billion, according to Bloomberg, and to date the company is estimated to have raised around $1.8 billion from early investors based on data from Pitchbook.

The company’s subscription annual recurring revenue grew 47% in the year to 31 January 2024 according to the filing documents, but the figures also show a substantial increase in losses as the company invests to grow. The Palo Alto-based business reported net losses of $354 million on revenue of $628 million for the fiscal year versus $278 million on revenue of about $600 million a year earlier, according to the filing.

Other significant backers of Rubrik include venture capital firms Bain Capital, Lightspeed Venture Partners, Greylock Partners and Khosla Ventures. [SF]

Fed chair Powell has dismissed recent high inflation readings as bumps in the road

With geopolitical tensions rising, the price of Brent Crude could top $100 a barrel for the first time since Russia’s invasion of Ukraine in 2022 suggests former White House advisor Bob McNally in an interview with Bloomberg.

Brent Crude has rallied more than a quarter since December 2023 and almost touched $92 per barrel last Friday (5 April) raising fears of a commodity-led rebound in inflation.

The timing of this spike in prices could not be much worse for the US Fed following a much stronger than expected March jobs report (5 April) which saw the economy add 303,000 new jobs and unemployment fall back to 3.8%.

US 10-year bonds touched a new high for the year following the payroll data while marketderived odds of a July rate cut fell back towards 50%.

The strength in oil prices is more than just geopolitics. The underlying cause of oil’s renaissance has been a combination of supply-side shocks and Mexico’s recent move to cut crude exports to the US by a third.

That matters these days because the US has become the world’s largest oil producer. More barrels consumed domestically means fewer barrels available for the world market.

In total the US, Mexico, Qatar and Iraq have cut production by around one million barrels per day

Chart: Shares magazine

• Source: LSEG

over the last month according to data tracked by Bloomberg.

On top of that, the UAE (United Arab Emirates) has seen the state oil company divert more supplies to its own refinery curbing shipments by as much as 41% compared with the average of 2023 say traders.

With Europe still engaged in rerouting tankers around Africa due to rebel attacks, which is delaying deliveries, the pinch in global oil supplies is having a real impact on prices at the margin.

The US EIA (Energy Information Administration) in now predicting global inventories will fall by around 900,000 barrels per day in the current quarter, which is a big downward revision to its previous forecast of unchanged inventories.

The shortfall, which is equivalent to the production from Oman, means stockpiles are forecast to decline for the first time since 2021. Meanwhile, US refiners are preparing to boost production ahead of the peak driving season with millions hitting the roads leading to a peak in gasoline consumption.

Higher gas prices at the pump will do Joe Biden few favours with voters ahead of November’s election, while for Fed chair Jay Powell higher oil prices muddy the inflation backdrop.

Higher input costs are not helpful when the manufacturing sector is back in expansion territory as shown by the latest ISM data. [MG]

Uncertainty has fallen while confidence and risk appetite have risen

In its latest quarterly survey of UK CFOs (chief financial officers), entitled ‘Turning The Corner’, business advisory group Deloitte paints a picture of the UK corporate scene which will be music to investors’ ears.

Optimism among the UK’s largest businesses is running at well above average levels, ‘suggesting the worst of the economic downturn is behind us’ says the survey.

Not only is sentiment well above its long-term average, it is at the same levels which preceded periods of good growth in 2010, 2014 and 2021.

Moreover, for the first time in three years CFOs expect average corporate profit margins to increase over the next 12 months.

‘The uncertainties which have clouded the business scene for much of the last eight years, driven by Brexit, domestic politics, COVID and, in recent years, inflation, seem to be clearing. CFOs’ perceptions of external risk facing their businesses have dropped to a two-and-a-half-year low’, say the survey’s authors.

‘Our uncertainty index is running at less than half the peak seen in autumn 2022 in the wake of Russia’s invasion of Ukraine as inflation gathered pace.’

Even worries over the exceptionally-high levels of inflation which had dominated CFO thinking since late 2021 seem to be drawing to an end.

One by one, ‘concerns about inflation, energy supply, labour shortages and interest rates have dropped down CFOs’ list of worries’, finds the report.

At the same time, finance officers say credit conditions have improved in the last six months with credit now reported to be more available than at any time in the last two years.

Expectations for the general economy have also improved, with inflation seen at 2.9% a year from now and 2.3% in two years’ time, not far above the Bank of England’s official 2% target.

The bank base rate is expected to fall by 100

basis points or one percentage point to 4.25% in a year’s time, an improvement of 50 basis points since the last survey.

There are of course still a few areas of concern, with geopolitics seen as the biggest business risk over the next 12 months and specifically a rise in cyber-attacks which are becoming increasingly frequent.

Next on the list of concerns are a fall-off in demand and higher energy prices or disruption to energy supplies as a result of geopolitics.

In terms of their own businesses, CFOs say their priorities for the next 12 months are controlling costs and building up cash, with increased capital spending or the launch of new products and services ‘on the back burner’ for now. [IC]

CFOs who expect UK corporates’ operating margins to increase over the next 12 months

Although Pinewood Technologies (PINE), the SAAS (software-asa-service) provider to motor dealers, may not seem familiar to UK investors at first glance, it is simply the rump of the old Pendragon business following the sale of the UK motor and leasing division to North American dealership group Lithia (LAD:NYSE).

a large cash pile which it promised to return to shareholders.

Last week the firm, which is currently valued at £675 million, confirmed it would hand back £358 million or more than half its market cap in the form of a 24.5p per share special dividend in early May.

The shares have risen 140% over the last year after Lithia had to hike its offer from £280 million to almost £400 million to seal the deal, leaving Pinewood with

As a standalone business, Pinewood is now a pure-play cloud software firm with gross margins close to 90%, high levels of recurring revenue and strong growth potential.

After a strong post-lockdown rebound, soft drink and mixer maker Britvic (BVIC) seems to have well and truly lost its fizz over the last year with the shares slumping to 12-month lows last week.

Quite why the market has soured on the £2 billion market-cap firm isn’t obvious, given it has an enviable portfolio of brands including Fruit Shoot, J2O, Robinsons and Tango as well as making Pepsi and

7UP for US drinks giant PepsiCo (PEP:NASDAQ)

The company posted a positive trading update for the first quarter to December, with group sales up 8% led by growth of more than 20% in Brazil, and said it had ‘exciting plans’ for 2024 across its markets including the first brand refresh for Pepsi in 14 years.

Meanwhile, the UK hospitality industry appears to be in rude health with sales up close to 12% in March,

Lithia – which owns 20% of the shares – has agreed to transfer some 2,500 UK customers to Pinewood, which will underpin its domestic growth, while the longerterm plan is for the UK firm to access the much larger US market. [IC]

although the month did include five weekends and Easter was earlier than last year, but even with this in mind the year seems to be off to a promising start.

Investors will therefore be keen to see what the company can do to revive its flagging share price when it reports its first-half results on 15 May. [IC]

Henderson High Income Trust has a simple aim of delivering high and stable investment income. So it takes the smart approach of blending UK equities and bonds. Helping investors boost their potential income while benefiting from increased stability. Find out how simple it is to invest for high income at www.janushenderson.com/HHI

The Leicester-based furniture-to-lighting purveyor is putting up a robust performance despite pressures on household budgets

16 April:

Billington Holdings, Equals Group, Accesso Technology, Gresham Technologies, Next 15

17 April:

Inspecs Group, Touchstar, Winkworth

18 April: LBG Media

TRADING ANNOUNCEMENTS

15 April: Kainos Group, Berkeley Group

16 April: IntegraFin, QinetiQ

17 April:

Liontrust Asset Management, easyJet, Entain

18 April:

Rentokil Initial, Segro, AJ Bell, Hays, Dunelm

18 April: Pod Point

Investors will be hoping for news of a strong start from new spring lines, continued market share gains and growth in active customers when Dunelm (DNLM) delivers its third quarter update on 18 April.

The leader in a fragmented UK homewares market, Dunelm will provide a read on the health of the UK consumer and the margin outlook amid Red Sea disruption and promotional market conditions.

The company will also update analysts on whether it is on track to deliver full-year 2024 pre-tax profits within the £199 million to £207 million consensus range.

On 14 February, the curtain, quilt and kitchenware seller’s resilient first-half results revealed a 4.5% revenue uptick to £872.5 million and a 4.8% rise in pre-tax profit to £123 million, underpinned by share gains in homewares and furniture.

Edison analyst Russell Pointon said the performance demonstrated

the benefits of Dunelm’s strategy of broadening its addressable market by ‘strengthening the core offer and expanding into newer categories, while also growing the store base and marketing more effectively. This is driving growth in active customers, who shop with greater frequency, leading to further market share gains in a static market.’

Led by digitally-savvy chief executive Nick Wilkinson, Dunelm upped the ordinary dividend and declared a special dividend on top, demonstrating some confidence in the ongoing resilience of its customers. The FTSE 250 retailer said it was ‘pleased’ with trading in the second half so far, although it cautioned the consumer outlook ‘remains uncertain’. [JC]

Table: Shares magazine

• Source: Refinitiv, Edison

Table: Shares magazine

• Source: Refinitiv, Edison

Table: Shares magazine

• Source:

Healthcare giant Johnson & Johnson (JNJ:NYSE) is expected to report firstquarter earnings on 16 April before the market open. Consensus forecasts call for EPS (earnings per share) of $2.63, a slight fall of 2% compared with the same period in 2023.

Over the prior four quarters the company has bested consensus estimates by an average of around 5% according to Nasdaq.com.

Fourth-quarter 2023 earnings topped expectations helped by strong sales of J&J’s blockbuster psoriasis treatment Stelara, but the drug faces fresh competition this year from biosimilar versions as J&J loses exclusivity.

The company said it expected volumes of surgical procedures to remain above pre-Covid levels during

2024. In February, medical devices maker Becton Dickinson (BDX:NASDAQ) raised its full year earnings guidance after seeing strong demand for surgical equipment.

On 5 April, J&J boosted its medical devices portfolio after agreeing to purchase Shockwave Medical (SWAV:NASDAQ) for about $12.5 billion or $335 per share, representing a 5% premium to the prior closing price.

News of J&J’s interest surfaced on 26 March, sending shares in Shockwave up 11% on the day.

California-based Shockwave makes devices which use shockwaves to break down calcified plaque in heart vessels. [MG]

Commentators put the latest surprise down to ‘US exceptionalism’

To paraphrase pop singer Britney Spears, ‘oops, it’s done it again’ would probably be a fair response to last week’s US non-farm payrolls which once again blew past expectations and dashed any lingering hopes of an early cut in interest rates.

Rather than 214,000 news jobs being added last month there were 303,000 new roles created, making March the 39th straight month of employment growth and suggesting the economy

is a long way from going into recession.

There was slight comfort from the fact wage growth slowed somewhat, but it remains stubbornly above the Federal Reserve’s target of 3% to 3.5% and the recent bump in crude oil means gasoline prices are going up which won’t help bring inflation down either.

Market commentators put the strength of the labour market down to ‘US exceptionalism’, although the main areas of growth last month appeared to be in government and the health care sector.

Construction was another area of growth, which makes sense as the seasons change and the weather improves, and leisure and hospitality returned to its February 2020 (pre-pandemic) level for the first time.

Investor confidence will face another test on Wednesday, just before Shares goes to press, in the shape of the US consumer price data and in particular the ‘core’ reading which strips out food and energy prices to give an underlying reading of inflationary pressures.

Outside the US there is an ECB (European Central Bank) meeting, where rates are likely to be kept on hold a while longer, and UK February GDP which is also unlikely to surprise.

Next week’s focus will be on UK and euro-zone inflation, where as in the US the ‘core’ reading will be closely watched, along with the German ZEW investor sentiment survey which has been particularly gloomy in recent months. [IC]

Table: Shares magazine

• Source: Morningstar, central bank websites

Table: Shares magazine

• Source: Morningstar, central bank websites

•

Table: Shares magazine

Table: Shares magazine

• Source: Morningstar, central bank websites

NextEnergy Solar Fund is a leading specialist solar energy and energy storage investment company that is listed on the premium segment of the London Stock Exchange and is a constituent of the FTSE 250. NextEnergy Solar Fund invests primarily in utility scale solar assets, alongside complementary ancillary technologies, like energy storage.

NextEnergy Solar Fund is driven by a mission to lead the transition to clean energy.

Don’t overlook this dual-listed fund with a formidable long-run record on an unusually wide discount

An unusually wide 41% discount to NAV (net asset value) presents a compelling entry point into Torontoand London-listed Canadian General Investments (CGI), a trust with a formidable longrun track record.

The cavernous discount provides investors with broad exposure to the Canadian equity market and a winning total return strategy focused on quality Canadian firms and US-listed star turns including the subject of this week’s cover story, Apple (AAPL:NASDAQ), and the likes of Amazon.com (AMZN:NASDAQ) and Nvidia (NVDA:NASDAQ).

This proxy for Canada aims to beat the S&P/TSX Composite Index by investing in quality Canadian companies with a US equity allocation capped at 25%. Managed by Greg Eckle, the portfolio is a bargain way to access Canadian stocks which remain underappreciated by international investors despite the country’s abundant natural resources, worldclass banking sector and vibrant tech industry.

Canadian General has persistently traded at a discount of late, partly due to its concentrated shareholder register and the fact the company is unable to buy back shares, but a wider appreciation of Eckle’s stock-picking prowess could help bring the discount in.

The manager has repeatedly delivered in terms of NAV performance and has an excellent record of identifying winners early, having bought chip designer Nvidia in 2016 and invested in Apple in 2010.

The trust, which typically owns around 60

stocks with portfolio turnover kept low, also owns Canadian logistics firm TFI International (TFII:TSE), tech company Descartes Systems (DSG:TSE) and Canadian forestry company West Fraser Timber (WFG:TSE), the latter well positioned given a major undersupply of new and affordable housing coupled with the likelihood of falling interest rates.

Another standout name is Canadian Natural Resources (CNQ:TSE), a natural fit for the fund as one of the country’s premium energy companies offering exposure to the Canadian oil patch.

At 31 March 2024, the trust’s NAV per share was $62.80, resulting in year-to-date and 12 month NAV returns with dividends reinvested of 13.4% and 22.2% respectively, ahead of the 6.6% and 14% returns of the benchmark S&P/TSX Composite on a total return basis.

It is worth flagging Canadian General is one of 32 investment trusts which would have made investors more than £1 million had they invested the full annual ISA allowance in the company each year from 1999 to 2023, according to research from the AIC) (Association of Investment Companies).

It is also among the AIC’s ‘next generation’ of Dividend Heroes, a select band of 32 trusts which have consistently raised shareholder returns over the last 10 to 20 years. [JC]

New management led by Phil Bentley has transformed the business

Founded in 1987, Mitie Group (MTO) is the UK’s largest facilities management company looking after two and a half million assets for more than 3,000 customers.

The firm takes care of buildings from banks to retailers, schools, hospitals and critical government sites, as well as the people who work in them, helping make them safer, more efficient and greener.

That means as health and safety regulation grows, and more companies take up the challenge of reaching net zero emissions, Mitie’s order book is only going to increase.

It may seem hard to believe now but from the early 2000s to around 2016 outsourcers were considered exciting growth stocks and in truth they enjoyed stellar margins and earnings.

After the Brexit vote, however, many companies and government departments put their spending plans on hold, leading to a slump in bookings and revenue for the sector and triggering multiple profit warnings.

At the end of 2016, Mitie chief executive Ruby McGregor-Smith stepped down after a decade at the helm and her successor, ex-British Gas chief Phil Bentley, was left to pick up the pieces.

division which was subsequently sold off for just £2 in order to clear the decks.

Mitie also faced criticism over its running of detention centres and other local government facilities, and a combination of negative news flow and investor mistrust saw its share price halve from 300p to 150p between mid-2017 and the end of 2019.

In early 2017, the firm issued its third profit warning and admitted to accounting failures, including an over-valuation of its healthcare

Worse was to follow though, with the shares cracking during the pandemic and tumbling to an all-time low of less than 30p in late 2020.

Ironically, Covid was good news for Mitie: in the six months to September 2020 the firm won or renewed £500 million of security and cleaning contracts, around a quarter of which were directly Covid-related.

In the year to March 2021, the firm increased its revenues by 19% to over £2.5 billion, strengthened its balance sheet and took over failing rival Interserve, completing a four-year transformation under Bentley’s leadership.

It also predicted trading for the year to

March 2022 would be ‘materially ahead of prior expectations’, replacing profit warnings with upgrades.

Sure enough, by March 2022 revenue had surged to almost £4 billion thanks to new contract wins, growth at Interserve and around £450 million of flexible rapid-response Covid-related contracts.

Free cash inflow was £133 million against a £25 million outflow the prior year, and the firm announced a £50 million share buyback as part of a strategy to reward its long-suffering shareholders, a gesture it repeated in 2023.

Having gone from hero to zero and back again, Mitie is a much more focused and margindriven business than in the past and in the six months to September 2023 the firm met or significantly exceeded all of the financial targets it set out at the start of 2022.

In the third quarter to December 2023, the company reported an acceleration in momentum with revenues 14% above the previous year and 6% above the second quarter to a record £1.15 billion, reflecting continued growth in key accounts, upselling on projects, contract repricing and ‘infill’ M&A deals.

The total contract value of new wins and extensions in the third quarter alone was £900 million, three times the previous year’s figure, taking the nine-month total to £3.5 billion or 46% more than the prior-year period.

Despite a strong final quarter last year, the firm predicted good revenue momentum for the three months to March 2024, albeit in the

mid-single digit range rather than double digits, still comfortably ahead of the wider facilities management sector.

In terms of valuation, Mitie shares trade on 10 times March 2024 earnings according to Stockopedia, although the current forecast of 10.2p per share implies growth of just 4.4%, which seems conservative.

The forecast for March 2025 is even less demanding with the consensus pitched at 10.5p per share or 2.7% higher than this year, suggesting there is scope for upgrades when the company releases its full-year trading update later this month.

With the bar set low, the firm growing rapidly and its shares trading on 10 times earnings, we wouldn’t be surprised if Mitie became an M&A target in the near future.

Alex Wright, long-serving manager of Fidelity Special Values (FSV), holds Mitie among his top 10 positions and has been a fan for the last couple of years.

Under Bentley the firm has undergone ‘a massive turnaround’, leaving it in a much better position says Wright, while the acquisition of Interserve, which was controversial at the time, is ‘quite possibly the best acquisition I’ve seen’ says the manager, given the lowly price Mitie paid and its improved competitive position today.

‘The business showed its resilience through Covid and has subsequently shown good organic growth with an improved balance sheet. At 10 times this year’s earnings the shares are attractively priced’ adds Wright. [IC]

Fidelity American Special Situations should also withstand any short-term volatility

It’s easy to get complacent when markets are doing well, and the success of US equities since last October is a case in point.

While investors might have enjoyed decent gains, there are growing concerns valuations are looking a bit rich and highly-rated stocks could be punished if we see a pull-back in the market.

That’s where it can pay to have a value tilt to part of your portfolio. Shares highlighted the attractions of Fidelity American Special Situations (B89ST70) last December, selecting the fund for its value bias and as a way of providing portfolio diversification.

It looks for companies which have quality characteristics but where the shares look too cheap versus their intrinsic value, often as a result of shortterm negative issues.

The fund has returned 12.7% since our original tip, in line with the performance of the S&P 500 index of US-listed companies.

Some of the fund’s biggest holdings have perked up on the stock market, helping to boost the value of the portfolio. Shares in FedEx (FDX:NYSE) hit a three-year high last month after the company’s third-quarter results beat expectations and it unveiled a $5 billion share buyback plan.

FedEx has been cutting costs and improving digital capabilities, underpinning Fidelity’s confidence in the

company’s turnaround.

Norfolk Southern (NSC:NYSE), another portfolio holding, has also enjoyed a strong share price performance of late. The freight train operator is currently the target of activist investor Ancora, and Fidelity believes the company plays into the growing trend for ‘onshoring’ as well as being positioned to benefit from cost efficiencies and margin improvement.

Keep buying the fund. A resilient economy, growing inflationary pressures and a solid jobs market suggests that the Fed won’t rush to cut interest rates. That presents a serious risk of a market correction.

Lower-value companies with quality characteristics should fare better than gogo growth stocks on high multiples, hence the Fidelity fund could provide some ballast to a portfolio. [TS]

Defined outcome strategies that increase potential to reduce systematic risk and equity volatility.

Mega-cap outperformance has left America’s market minnows trading at attractive relative valuations

US-listed large-caps shone last year with shares in mega-caps, and the ‘Magnificent Seven’ in particular, surging higher. However, this outperformance only widened the valuation gap between US large and small-caps and left shares in the latter cohort languishing at the low end of historical valuations.

Over one and five years, the Russell 2000 index of US small-cap stocks is up 14.6% and 30.5% at the time of writing. That lags the performance of the S&P 500, which is up 26.2% over one year and 80% over five years. The tech-heavy Nasdaq index has chalked up gains of 33.2% and 104.6%.

While investor sentiment towards America’s market minnows remains weak, the asset class will enjoy its day in the sun once more since US smallcaps offer investors the benefits of rapid growth beyond the Magnificent Seven, and US small-caps actually began to outshine their larger brethren towards the back end of 2023, suggesting conditions are ripe for a rebound.

As the late, great investment sage Jim Slater once said, ‘elephants don’t gallop’, meaning small companies have the capacity to grow much faster than big ones. Along with the capacity for superior

growth, small-cap companies are also more likely to be taken over. Given it is the deepest and bestperforming major stock market with the best governance, the US offers fertile ground for stock pickers seeking to diversify their US equity exposure by investing in a wider pool of smaller, but no less dynamic, companies.

Investors who limit themselves to the S&P 500 are letting a plethora of world-leading smaller US-listed firms slip through their fingers. As Kepler analyst Alan Ray pointed out in a recent note (27 March 2024) on JPMorgan US Smaller Companies (JUSC): ‘When a few stocks drive the performance of a whole stock market, it’s very easy to forget about important disciplines such as diversification and valuation, and JUSC offers both to investors looking for US equity exposure, with the additional potential kicker that smaller companies have historically performed extremely well at the tail-end of inflation and interest rate cycles.’

Despite the volatile geopolitical backdrop, prospects for the US economy upon which smaller companies have a greater dependence remain

pretty favourable. Consumer spending is holding up well, supported by continuing jobs growth and rising wages, while falling inflation and interest rate cuts should provide a positive backdrop for US equities, and sentiment could shift away from the mega-caps and towards US small-caps given their sensitivity to the local economy and interest rates, their attractive valuations versus large-caps and the fact many investors have little exposure to the asset class.

The US small-cap market remains underresearched by Wall Street analysts, which means smaller fry are often seriously mispriced. Merger and acquisition activity in small-caps was dormant in 2023, but an awakening in the coming years would be positive for the funds which invest in this space.

As Chris Berrier, manager of Brown Advisory US Smaller Companies (BASC), said at the investment trust’s first-half results (12 February): ‘Although it may take some time to manifest itself, we believe in a future of sustained small-cap leadership. In our view, the market is simply too concentrated - the largest five names by market capitalisation are three times the total Russell 2000 Index - and

the historical evidence too strong to ignore the category’s potential. Although we cannot say the area is a steal (i.e., cheap), we remain off the highs, relative valuation is compelling, and we believe the size segment should move as capital disperses from the Magnificent Seven.’

Specialist funds in this space include the Cormac Weldon-managed Artemis US Smaller Companies (BMMV576), which has generated a one-year total return of 32% and offers exposure to building materials supplier Builders FirstSource (BLDR:NYSE), trucking company Saia (SAIA:NASDAQ) and frozen French fries producer Lamb Weston (LW:NYSE) among others.

A stand-out five and 10-year performer is CT American Smaller Companies (B8358Z8), awarded a five-star rating by Morningstar, whose top holdings include American energy concern Avista (AVA:NYSE) and investment bank Moelis (MC:NYSE), while Jonathan Moyes, head of investment strategy at Wealth Club, highlights T. Rowe Price US Smaller Companies (BD446P5). This fund has returned more

than 80% over five years and provides exposure to many small and mid-sized US firms that an S&P 500 index tracker would miss.

Investors aren’t exactly spoilt for choice when it comes to dedicated US small-cap investment trusts, with just two funds sitting in the Association of Investment Companies’ (AIC) North American Smaller Companies sector.

However, at roughly 40% of its geographical allocation, North America is the biggest regional exposure for the Global Smaller Companies Trust (GSCT). Managed by Peter Ewins and Nish Patel and trading on a double-digit discount to NAV, this AIC ‘Dividend Hero’ has raised the shareholder reward for the last 53 years.

Other options include Katie Potts-managed Herald (HRI), the TMT-focused vehicle with just under a third of its assets in North America, Baillie Gifford’s Edinburgh Worldwide (EWI) with over 70% of its portfolio invested in North America and Smithson (SSON), the quality global small and mid-cap trust with almost 45% of its assets in the USA at last count.

As the table shows, the superior 10-year share price total return performer among the two dedicated trusts is JPMorgan US Smaller Companies, up 157.2% versus a 110.1% gain for Brown Advisory US Smaller Companies, although the latter is ahead over one year.

Led by Don San Jose since 2008, the team at the former emphasises a hands-on approach to investing, preferring to ‘walk the floor’ of its investee companies to really get to know them, while the latter is managed by experienced US small-cap investor Berrier, who is ‘eagerly’ anticipating ‘a return to small-cap market leadership, from which BASC will be well-positioned to benefit in the longterm’ and believes now is the perfect time to invest in US small-caps.

Brown Advisory US Smaller Companies’ ‘3G’ approach - seeking businesses with durable Growth, sound Governance and scalable Go-to-market ability – helps to concentrate Berrier’s gaze on companies with an above-average potential to compound earnings and cash flows over a multi-year period. The trust’s largest holdings include Waste

Connections (WCN:NYSE), a non-hazardous solid waste collection services play, as well as Midwest convenience stores operator Casey’s General Stores (CASY:NASDAQ) and social networking site Pinterest (PINS:NYSE)

VT DE LISLE AMERICA FUND (B3QF3G6) 743.95P

ONGOING CHARGE: 1.05%

Funds: US Small Caps

Offering exposure to the US small-cap value style is VT De Lisle America (B3QF3G6), the five-star Morningstar-rated fund which aims to ‘look beyond Wall Street’ for missed or ignored opportunities rather than the big tech growth stocks which dominate many US funds. Manager Richard De Lisle invests in US small-cap value, the best longterm asset class in the world according to Nobel economics laureate Eugene Fama and his research

partner Kenneth French, which makes VT De Lisle America’s portfolio of 179 stocks a good complement to existing US equity exposure. VT De Lisle America uses a top-down thematic investment process combined with forensic bottom-up analysis, searching for companies exhibiting high-quality metrics with attractive valuations. Top 10 positions include Cameco Corp (CCJ:NYSE), the world’s largest publicly-traded uranium company, American teddy bear, stuffed animal and character retailer Build-A-Bear Workshop (BBW:NYSE) and late 2022 spin-out MasterBrand (MBC:NYSE), formerly the kitchen-cabinet division of Fortune Brands (FBIN:NYSE). Another notable holding is Super Micro Computer (SMCI:NASDAQ), renowned for its energy-efficient servers, which recently left the Russell 2000 and entered the S&P 500. VT De Lisle America has generated annualised 10-year total returns of 14.3%, ahead of the 11.6% from Morningstar’s US Small-Cap Equity benchmark.

Funds: US Small Caps

A 12% NAV discount presents a compelling entry point into this quality growth-focused trust, which invests in US smaller companies with sustainable competitive advantages and competent management teams which the portfolio managers Don San Jose, Dan Percella and Jon Brachle believe trade at a discount to intrinsic value. This is a highquality portfolio of US smaller companies on a lower valuation than the market, and the board has been

buying shares back since early 2022 in response to the wider-than-average discount. As investment trust scrutineer Kepler observes, JPMorgan US Smaller Companies has a good long-term track record of outperforming the Russell 2000, having beaten the benchmark over five and 10 years with NAV total returns of circa 51% and 204% for those two periods compared to the benchmark’s 40% and 158%. Top 10 positions include the likes of workspace and portable storage solutions play WillScot (WSC:NASDAQ) and childcare and early education services provider Bright Horizons (BFAM:NYSE), not to mention tech solutions supplier Novanta (NOVT:NASDAQ), a play on the reshoring and deglobalisation theme, and RBC Bearings (RBC:NYSE), a ball-bearing manufacturer which, through the use of precision automation, competes in a market that often depends on lower wage economies.

By James Crux

By James Crux

The recent strong relative performance of the UK equity market has gone largely unnoticed by investors, reinforcing its unloved status. Alex Wright, portfolio manager of Fidelity Special Values PLC, believes the value-oriented areas of the UK market represent a strong investment opportunity.

Despite the UK being a value market, many of those who invest in the market don’t invest with a value bias. However, Alex looks to construct portfolios focused on unloved UK companies entering a period of positive change. The market is often slow to recognise change in out-of-favour stocks which creates opportunities to add value by identifying companies whose improving growth prospects are not yet recognised by other investors.

Our broad analyst coverage means that we are able to find ideas across the market cap spectrum, giving us many shots on goal. Our network of over 400 investment professionals around the world place significant emphasis on questioning management teams to fully understand their corporate strategy. They also take time to speak to clients and suppliers of companies in order to build

conviction in a stock. Our approach translates into a clear bias towards small and mid-cap value stocks, compared to most of our competitors who are often less differentiated.

It’s a consistent and disciplined approach that has worked well; the trust has significantly outperformed the FTSE All Share Index over the long term both since Alex took over in September 2012 and from launch over 29 years ago.

To find out more visit www.fidelity.co.uk/specialvalues

Past performance is not a reliable indicator of future returns

Past performance is not a reliable indicator of future returns

Past performance is not a reliable indicator of future returns

Morningstar as at 31.01.2024, bid-bid, net income reinvested. ©2024 Morningstar Inc. All rights reserved. The FTSE All Share Index is a comparative index of the investment trust

Source: Morningstar as at 31.12.2023, bid-bid, net income reinvested. ©2024 Morningstar Inc. All rights reserved. The FTSE All Share Index is a comparative index of the investment trust

Source: Morningstar as at 31.12.2023, bid-bid, net income reinvested. ©2024 Morningstar Inc. All rights reserved. The FTSE All Share Index is a comparative index of the investment trust

The value of investments can go down as well as up and you may not get back the amount you invested. Overseas investments are subject to currency fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The Trust can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. The trust invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser.

This year, Apple (AAPL:NASDAQ) shares have fallen nearly 9%. If that doesn’t sound like a big deal, consider that for the world’s second most valuable company it means the loss of something like $230 billion. That’s the equivalent of an entire PepsiCo (PEP:NASDAQ), or Shell (SHEL) – the UK’s current largest company – plus a British American Tobacco (BATS) thrown in.

On a one-year view, the stock has recorded a total return (share price performance plus dividends) of 2.67%, according to Morningstar data, versus nearly 35% of the Nasdaq Composite. It is not what investors have come to expect from the Cupertino tech colossus, a shocking showing compared to the near 25% a year racked up over the past decade.

Peering into the forecast future, analysts see little better than 1% growth in revenue this financial year (to 30 September) and a mere 6.5% in fiscal 2025, with no better anticipated for net profits. On a PE (price to earnings) multiple of close on 25 and a PEG of 3.3 (price to earnings growth), investors might well be wondering whether Apple’s best days are behind it and if the current $169.65 share price, and $2.62 trillion market cap, do not fairly reflect this.

But is this a true picture of Apple’s investment potential today? Analysts overwhelmingly still back the business and its shares. According to Koyfin data, of the 45 experts who follow the company, 26 (58%) are telling clients to buy the stock while only four (9%) have slapped sell recommendations on the shares (the rest are fencing-sitting holds).

The consensus price target stands at just over $200, implying around 18% upside over the next 12 months, while $250 tops the range, nearly 48% above the current level. And while it’s true that Warren Buffett’s Berkshire Hathaway (BRK.B:NYSE) sold around 10 million Apple shares late in 2023, Berkshire’s remaining 5.9% stake is worth roughly $155 billion (based on the current valuation) or about 17% of Berkshire’s $910 billion market cap. Quite the commitment.

Multiple factors have worked against Apple, the most recent its wrangling with regulators over its smartphone dominance. Antitrust legal challenges have become par for the course in the technology industry, and the (sometimes hefty) fines incurred are typically written off by analysts and investors as part of doing business.

But Apple now finds itself under threat on three of its most important fronts; Europe, China and now its own US backyard. In late March 2024, the US Department of Justice launched a lawsuit accusing the iPhone maker of violating antitrust laws and suppressing competition by blocking rivals from accessing hardware and software features on its devices.

The challenge saw Apple stock lose more than 4%, its biggest one-day fall since August 2023 according to Bloomberg. The sell-off this year stands in stark contrast to the rest of big tech. The US-listed Roundhill Magnificent Seven ETF, which tracks the performance of the ‘Magnificent Seven’ stocks, is up around 16% year-to-date, led by Nvidia (NVDA: NASDAQ) and Meta Platforms (META:NASDAQ), up 78% and 48% respectively.

Tesla (TSLA:NASDAQ), down 31%, is the only other ‘Magnificent Seven’ loser this year.

The US suit also puts Apple’s Services business in the watchdog’s crosshairs, the firm’s biggest source of growth in recent years. Home to the App Store, Apple Pay, Apple Music and other stuff, the Services

Full year to 30 September

arm is fed by more than two billion Apple devices in use. Services revenue expanded 9% in fiscal 2023 while product revenue, including iPhones, Macs and iPads, dropped 3%.

Despite accounting for just 22% of Apple’s sales, Services generated more than a third of profit making investors particularly sensitive to any regulatory attacks to the division.

But analysts urge shareholders against panic Apple stock selling. ‘We still believe most Apple users opt into the firm’s premium closed ecosystem, and we don’t predict significant attrition for the firm’s products and services even in a more open environment,’ says William Kerwin, analyst at Morningstar.

‘We assume the suit will result in some opening of Apple’s walled garden ecosystem, similar to what we expect from the European Union’s Digital Markets Act,’ adds Kerwin.

Worries about iPhone demand are also keenly felt and underline a widely-held view that Apple has fallen way behind on the innovation front, leaving the iPhone to shoulder most of the growth burden,

albeit with Services increasingly helping out.

The powerhouse of growth since the iPhone was launched in 2007, Apple arrested four straight quarters of revenue declines in the first quarter of financial year 2024 (released in early February) yet it continues to face challenges in China, its third largest market.

Chinese revenue fell 13% in the first three months of the year, declining to $20.82 billion and falling short of analyst estimates of $23.53 billion according to data from LSEG. China has been a major growth driver for Apple, but fierce completion from Huawei and Xiaomi and changing geopolitics are weighing, and investors’ concerns are mounting that the situation may not improve in 2024.

According to analysis of the supply chain for

Apple’s smartphone production, the company has reduced orders for key semiconductor components for the iPhone in 2024 to about 200 million units, down 15% from the previous year. This is a key reason why many analysts have been trimming iPhone expectations this year and some are predicting Apple may experience the largest decline in sales among global smartphone brands.

Some are hoping a new iPhone 16, due for release in the last quarter of 2024 in time for the Christmas run-in, could arrest declines. However, consumers are increasingly demanding integrated generative AI features to justify splashing out on a new smartphone, and many analysts do not expect Apple to release new iPhone models with significant design changes and a more comprehensive and differentiated AI ecosystem

applications before 2025.

Until then, this is likely to hurt iPhone shipments and the growth of the Apple ecosystem. Respected Apple analyst Ming-Chi Kuo, of TF International Securities, forecasts shipments of the iPhone 15 and the new iPhone 16 to decline by between 10% and 15% year-on-year in the first and second quarters of 2024, compared to shipments of the iPhone 14 line in the first quarter of 2023 and the iPhone 15 in the second quarter of 2023.

The launch of the Vision Pro multi-reality headset doesn’t look anything like a mass-market adoption option at $3,500 a pop, and the company had to fend off criticism it is heavy and uncomfortable when worn for very long.

None of this necessarily alters the longer-term potential of Apple and its ecosystem, but it does show how the company has fallen behind on the innovation race, as illustrated by its strange relative silence on AI.

Since generative AI capabilities were launched by OpenAI at the end of 2022, Apple has been worrying silent on its AI strategy, losing ground to the likes of Microsoft (MSFT:NASDAQ), Meta Platforms and Alphabet (GOOG:NASDAQ).

That, at least, seems to be changing. Having ditched its inhouse electric car fantasy – Project Titan – rumours suggest much of the technical talent tied up in that will now be shifted to

an AI projects space, which sounds much more like Apple turf, led by executive John Giannandrea. If true, it would also demonstrate far more sensible capital discipline than chasing fancy moonshots.

We may learn more in June when Apple plans to kick off its annual Worldwide Developers Conference, where the company is expected to unveil its long-anticipated artificial intelligence strategy. Apple isn’t giving details away but people allegedly in-the-know say the presentation (1014 June) will focus heavily on AI, and perhaps announce rumoured tie-ins with Google and China’s Baidu (BIDU:NASDAQ)

With an approximate two billion Apple devices worldwide ready to embrace whatever the company does, this is an exciting prospect. Perhaps an AI-powered Siri is one obvious option. But until we have answers about where AI fits in at Apple investors are likely to handle the stock with care.

There is no question the company has built a vast ecosystem with strong brand loyalty among its users, equating to a powerful profits machine. We would not recommend upending your portfolio with mass sales of Apple stakes, but the company needs something else to capture the imagination of consumers and investors.

Morningstar analysts estimate a fair value on the stock of $160 and have a ‘medium uncertainty rating’ following the US antitrust suit. That neatly sums up where we are with Apple right now.

Gallagher, Head of Investment Trusts, BlackRock

Gallagher, Head of Investment Trusts, BlackRock

In March 2024, the government announced the introduction of the UK ISA, which will provide a new tax-free savings opportunity for savers to invest in the UK, while supporting UK companies. Here we examine what we know about this extension to the highly successful, tax-efficient Individual Savings Account (ISA) and explain why we believe it could be important for UK investors.

In the 2024 Spring Budget, Chancellor of the Exchequer, Jeremy Hunt, announced the introduction of the UK ISA. This represents an opportunity for investors to shelter a further £5,000 from the tax authorities annually, on top of the existing £20,000 annual ISA allowance, as long as this additional amount is invested in the UK.

As is typical with new policies, the concept is currently under “consultation”, which means the investment industry and other interested parties can help shape the precise design and implementation of the policy, making it fit for purpose and as effective as possible.

One key debate revolves around the exact definition of what should be considered a “UK company”. The proposal suggests that any business that is incorporated in the UK and listed on the UK stock market should be included. However, some industry commentators have argued that the policy should exclude companies that conduct most of their activities overseas. That would mean, the argument goes, the impact of the policy can be more directly focused on British businesses and the broader UK economy.

Meanwhile, the qualification of investment trusts will also require clarity. These are listed on the UK stock market, but many of them are focused on investment opportunities elsewhere in the world. For example, BlackRock manages a range of nine investment trusts, but only three of these are specifically focused on opportunities in UK equities.

The consultation process comes to an end in June 2024, so we don’t have long to wait for these finer details. In the meantime, we know that the Association of Investment Companies (AIC), the industry body that represents and promotes the investment trust sector, is calling for all UKlisted investment trusts to be included1.

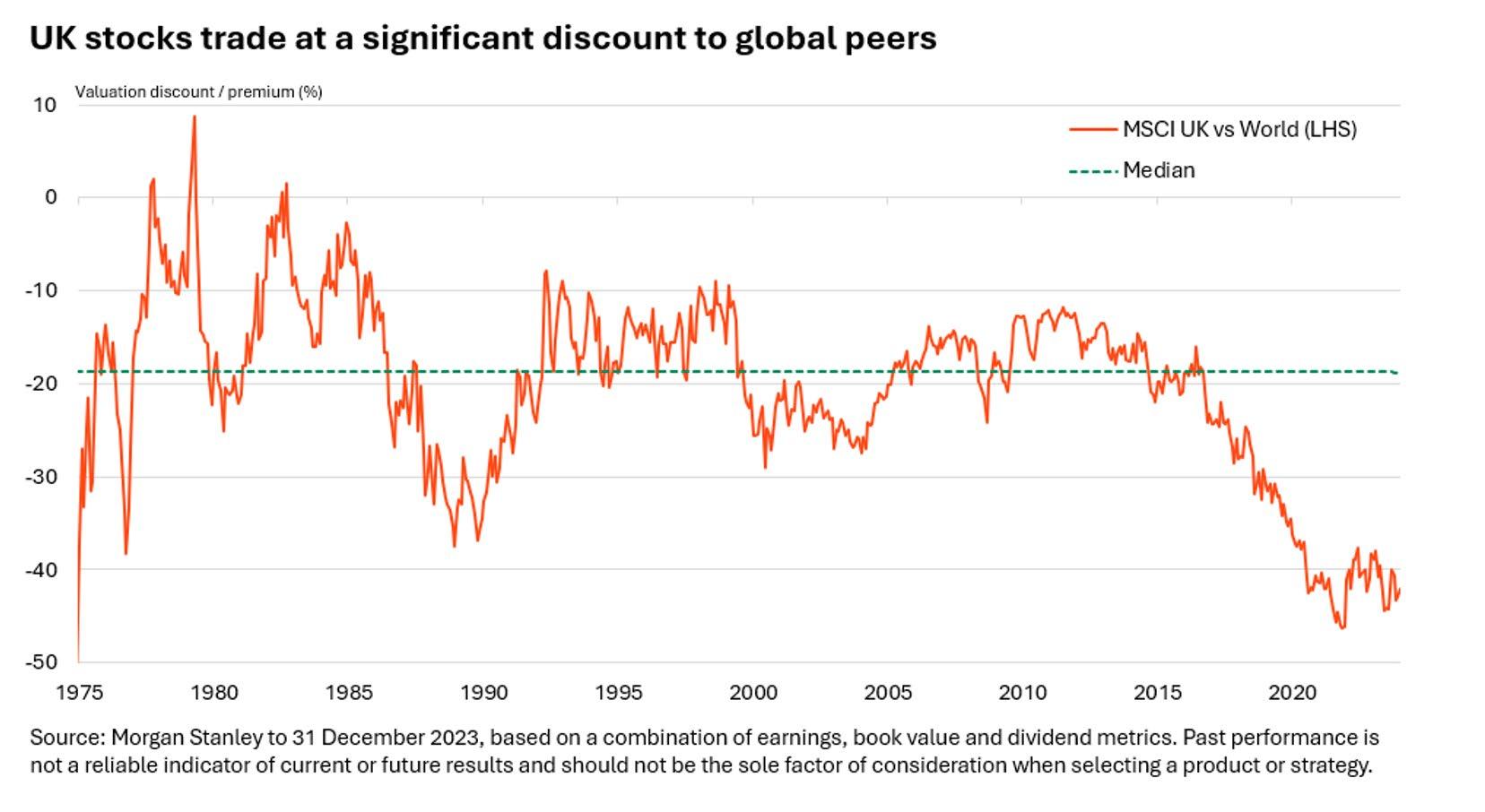

The UK equity market has had a difficult run in recent years, and this has left many UK-listed businesses trading at a significant discount to similar companies that are listed elsewhere.

While this substantial discount persists, however, foreign companies and private equity are seeking to capitalise on the depressed prices they can find in the UK. Barely a week passes without news of another well-known UK company being acquired from overseas. Indeed, merger and acquisition activity may be a catalyst for better performance from UK stocks, but it may not be enough on its own. Hence, policymakers are looking to intervene, anxious about the implications for the health of the economy and stock market should UK businesses continue to be acquired.

Many in the industry have also called for proactive measures to encourage domestic investors to reallocate capital towards UK equities, in order to strengthen this important part of the country’s financial infrastructure.

The overall aim of the British ISA is ultimately to encourage more demand for UK equities. Stock markets are balancing mechanisms through which the forces of supply and demand find an equilibrium through movements in price. The socalled “invisible hand” of the market moves prices higher when there are more buyers than sellers. A higher share price incrementally encourages more sellers and deters a few buyers until equilibrium is restored. The same thing happens in the opposite direction should sellers of a stock outnumber buyers.

RISK WARNINGS

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

All else being equal, encouraging more demand for UK equities therefore equates to the prospect of higher prices and valuations for British businesses. However, it remains to be seen as to whether the policy stimulates enough demand to make a meaningful difference. Critics suggest that, at £5,000 per person annually, the size of the additional British ISA allowance is too low to make a big difference, and the number of savers who are fortunate enough to be able to fully utilise their ISA allowance each year is too small.

If there is an impact, it is perhaps likely to be felt most significantly by smaller UK listed businesses, where a small amount of additional demand could make a meaningful difference to share prices. Two of BlackRock’s three UKfocused investment trusts are explicitly targeting these smaller companies.

Overall, perhaps the policy should be seen as a positive step in the right direction. The fact that policymakers are trying to address the undervaluation of UK equity is encouraging and, in time and with other measures, it could signal the start of a period of better long-term performance from the UK stock market.

In conclusion, the British ISA should be seen as a helpful addition to the savings regime. It means investors have the opportunity to shelter even more of their savings from the tax authorities. That makes it a quick win for savers, and potentially an even bigger win for the UK economy and stock market over time.

For further information on BlackRock’s range of investment trusts, please visit www.blackrock.com/its

Our UK-listed contingent has performed particularly strongly

Our portfolio of picks for 2024 is off to a solid start in what proved an uneven first quarter for the stock market as a whole. Our return of 9% is comfortably ahead of our FTSE All-Share benchmark at 3.9%. It’s a tale of feast and famine, however, with half of our selections achieving double-digit gains while 40% are in the red.

At the end of 2023, shares in biotech specialist Puretech Health (PRTC) received a significant boost after it announced Karuna Therapeutics, one of its ‘Founded Entities’, was being acquired by Bristol Myers Squibb (BMS:NYSE) for a total equity value of $14 billion.

Puretech operates a unique business model, investing its own capital to develop a pipeline of assets as well as running a ‘Founded Entities’ business for outside investors. It had funneled $18.5 million into the founding and development of Karuna and in total has generated $1.1 billion of cash from that investment. The company announced in March it intended to return $100 million to shareholders through a tender offer. Also performing strongly is Just Group (JUST), the retirement products and services specialist. The shares hit 12-month highs on the back of a strong set of 2023 results (8 March) with underlying operating profit up 47% to £377 million and confirmation that momentum in the business had continued into 2024.

Shares in energy services outfit Hunting (HTG) have chalked up a decent advance amid rising

oil prices. Its 2023 results were in line with expectations, with sales up 28% year-on-year to $929 million and good visibility on forward work thanks to an order book up 19% at $565 million (28 February).

Reflecting on the numbers, Canaccord Genuity analyst Alex Brooks commented: ‘We see these results as an important step in Hunting’s steadily-building record of growth and profitability; as highlighted in the results presentation, there remains extensive scope for further improvement, as well as the potential that a robust balance sheet and profitable underlying business enables.’

Bowling alley operator Hollywood Bowl (BOWL) has seen its shares maintain their recent momentum as it has progressed the £10 million share buyback programme announced alongside its results for the 12 months to 30 September 2023 (18 December 2023). The company is set to unveil its numbers for the six months to 31 March on 3 June.

We saw data analytics specialist RELX (REL) as a beneficiary of the AI (artificial intelligence) theme and this combined with a robust set of 2023 results – with revenue growth of 8% to £9.2 billion and underlying operating profit growth of 13% to £3 billion – has acted as a catalyst for the stock yearto-date. A £1 billion share buyback announced alongside these results (15 February) hasn’t done any harm either.

Struggling to make progress are medical products company Smith & Nephew (SN.) and discount retail chain B&M European Value Retail (BME). OUR PICKS:

Despite revealing 5% revenue growth in the ‘golden quarter’ which encompasses the Christmas period, the latter has received short shrift from the market thanks to issues around disruption to Red Sea shipping and the knock-on effect on its supply chain, concerns about the wider retail sector and its market share in food.

However, Liberum analyst Adam Tomlinson sees these concerns as unwarranted and says: ‘New management has brought even greater strategic clarity – focusing on price, product, availability, and store standards. Our pricing survey, store visits and the track record of delivery all give us confidence.’

B&M is set to update on its performance in the 12 months to 30 March on 16 April ahead of announcing the results in full on 5 June.

Some lingering scepticism around the company’s ability to achieve its 20% margin target in 2025 has hit sentiment towards Smith & Nephew with its 2023 results proving solid rather than spectacular. As Berenberg analyst Sam England observes, the company is now approaching a ‘critical phase’ in its turnaround. Investors will be hoping to see signs of further progress when the company updates on first quarter trading (likely at the end of this month).

Despite the UK market lagging many of its global counterparts in 2024, if we just looked at the performance of our UK-listed selections in isolation we are sitting on a 15%-plus gain. The two major laggards are our US tech selections, reflecting the reality that while some stocks in this space have continued to surge others have struggled.

Creative digital software firm Adobe (ABDE:NASDAQ) took a hit in mid-March as it a predicted weaker-than-expected outcome for its second quarter and missed analyst estimates for annualised recurring revenue in its Digital Media division. This tempered some of the recent excitement about the company’s AI-related potential.

Meanwhile the prospect of slowing growth in 2024 has put the skids under database software specialist MongoDB (MDB:NASDAQ).

By Tom Sieber Editor

By Tom Sieber Editor

Nearly four decades of bottom-up fundamental investing.

Asset Value Investors (AVI) has managed the c.£1.3bn* AVI Global Trust (AGT) since 1985. The strategy over that period has been to buy durable growing companies held through unconventional structures and trading at a discount to estimated underlying net asset value. The strategy is global in scope, and we believe that attractive risk-adjusted returns can be earned through detailed research with a long-term mind-set.

The companies we invest in are durable businesses that are growing in value.

They are trading at discounted valuations.

We take an active approach to unlock and grow value.

AVI has a well-defined, robust investment philosophy in place to guide investment decisions. Our core portfolio of 25-35

listed companies gives us exposure to a concentrated-yet-diverse collection of attractive global businesses. This underlying portfolio is diversified across all sectors and geographies. Buying these companies trading at a discount to their net asset values provides a margin of safety. Our 14 strong investment team does in-depth research which forms the cornerstone of

our active approach.

Once an investment has been made, we seek to establish a good relationship and actively engage with the managers, board directors and, often, families behind the company. Our aim is to be a constructive, stable partner and to bring our expertise – garnered over three decades of investing in asset-

backed companies – for the benefit of all.

AGT’s long-term track record bears witness to the success of this approach, with a NAV** total return well in excess of its benchmark.**

We believe that this strategy remains as appealing as ever and we continue to find plenty of exciting opportunities.

A wider appeal across generations and options to suit all pockets have led to a boom in the industry

The cruise industry is enjoying an unprecedented boom with around 35.7 million passengers expected to book a trip this year, up from 31.5 million in 2023 and 6% more than the number of passengers who set sail in 2019 according to the CLIA (Cruise Lines International Association).

Going on a cruise holiday is slowly become a more popular alternative then jumping on a plane or a high-speed train to Europe.

In a survey of 4,500 UK travellers carried out by the CLIA, 91% of respondents who had cruised previously said they intended to take a holiday at sea again, a 14% increase on 2019.

Of those who had never cruised, 72% said they were open to the idea, a 1% increase from 2019.

Many of those who wouldn’t normally consider going on a cruise are getting on board because all-inclusive package deals work out cheaper, not just for families but for solo travellers, and sailing is considered by some as being more environmentally-friendly than air travel.

‘We remain positive on travel going into 2024, with trading data around the year-end suggesting positive booking trends for summer 2024 for all aspects of travel, from tour operators to cruise lines,’ say analysts at HSBC.

‘Overall, the market is extremely strong, especially the top end of the market in terms of the most high-end luxury cruises,’ said Bob Levinstein, chief executive of cruise marketplace Cruise Compete.

Cruise companies offer consumers a ‘one stop

shop’ holiday experience combining transport, accommodation and entertainment which means travellers can sit back and enjoy their time on board.

There is a huge amount of choice in terms of itineraries, most of which include multiple destinations and ports of call which is an attractive option for holidaymakers as opposed to just visiting one destination by plan or train.

They also offer ‘all-inclusive’ packages meaning meals, drinks and tips on board are part of the deal which is appealing for those on a budget.

Historically the cruise market was aimed at older generations and retirees, who had large amounts of disposable income, but operators are increasingly keen to attract couples and families, while some have tailored their offering to the ‘young, free and single’ market.

As well as accommodation, restaurants and bars, most modern cruise liners now come with nightclubs, swimming pools and fitness centres for those that want to stay active rather than watch the scenery float by.

Like the rest of the travel and leisure sector, the cruise industry suffered heavily during the pandemic as all sailings were cancelled.

In the second quarter of 2020, US operator Royal Caribbean (RCL:NYSE) reported a net loss of $1.6 billion while rival Carnival (CCL:NYSE) racked up $4.4 billion of losses.

Customers typically book their holidays between six months and a year in advance, meaning not only did the operators not receive any new

Cruise operators

35.7 MILLION PASSENGERS EXPECTED TO BOOK A TRIP THIS YEAR

Source: Insidehook.com

UP TO 250 TONS OF FUEL USED DAILY BY A LARGE SHIP

Source: College of Engineering and Applied Science at the University of Colorado Boulder

85% of travelers who have cruised will cruise again, 6% higher than prepandemic

Source: CLIA Cruise Traveler Sentiment, Perception, and Intent Survey (Dec.2022)

46.5 THE AVERAHE AGE OF A CRUISE TOURIST

Source: CLIA Cruise Traveler Sentiment, Perception, and Intent Survey (March 2023)

$155BN IS THE VALUE OF CRUISE TOURISM TO THE GLOBAL ECONOMY

Sector Report: Cruise operators

Taking a seven-day cruise is more than three times as carbonintensive as flying and staying abroad

*Estimated CO2 emissions per passenger for a sevenday trip in Europe, only including travel and accommodation

$750 AVERAGE SPEND PER CRUISER IN PORT CITIES OVER A TYPICAL SEVEN-DAY CRUISE

*Calculations are estimates assuming a seven-day return cruise from Southampton to A Coruña, via La Rochelle, Bilbao and Le Havre (3,052km) at peak efficiency vs a return flight to A Coruña, Spain (2,192km) and seven-day stay at a hotel in France sharing one bedroom. **Travel and accommodation included together for cruise.

90% UP TO 90% OF FRESH WATER CAN BE PRODUCED ONBOARD THROUGH STATE-OFTHE-ART SYSTEMS AND PRACTICES

bookings but they had to refund or rebook thousands of tickets while still covering the costs of keeping their ships operational and paying their staff.

From the start of 2020 to their low in early April that year, shares in Royal Caribbean fell 82% to $24.39 while shares in Carnival fell 84% to $8.49 over the same period.

Both firms have recovered strongly in the interim, with Royal Caribbean’s earnings consistently beating analysts’ forecasts over the past few quarters taking the shares back above their pre-Covid highs.

Carnival recently posted record quarterly revenue together with a reduced loss per share and saw record booking volumes for all future sailings, with the company able to pass through higher prices thanks to ‘an early start to a robust wave season’.

Cashing in on the renewed popularity of cruising and travel stocks in general, Swiss-headquartered operator Viking Holdings announced in February it intended to raise $500 million or more in a US listing.

Founded 27 years ago by Torstein Hagen, who is currently chairman, Viking is backed by private equity firm TPG among others and operates a fleet of more than 90 vessels on rivers, lakes and oceans across the globe.

One of the big image problems the cruise sector has is its carbon footprint, with environmental group Friends of the Earth claiming the industry is ‘devastating our environment, oceans, sea life and coastal communities’.

According to the organisation, even a mid-sized cruise ship burns 150 tons of fuel daily and uses the cheapest, dirtiest fuel on the market.

However, cruise operators have gone back to the drawing board and new ships have advanced hulls which cut through the water more efficiently, saving fuel, as well as solar panels, energy-saving appliances and cooking-oil conversion systems to reduce waste, while itineraries are designed to minimise fuel consumption.

According to the CLIA more than 15% of the vessels to be launched in the next five years will be equipped to incorporate fuel cells or batteries and 85% of CLIA member ships coming online between

now and 2028 will be able to plug into shoreside electricity, allowing engines to switch off at berth meaning a significant reduction in emissions.

The ‘big beasts’ of the sector in terms of their operations and market size are Carnival and Royal Caribbean, both listed in New York although Carnival also has a secondary listing in London.

Carnival has a portfolio of cruise brands covering just about every market segment with the mostrecognised brands in the five big markets – North America, the UK, Italy, Germany and Australia – which make up 85% of the world’s cruise passengers.

It operates more than 90 ships, mostly based out of the US and mostly in the mid-to-upper tier, together with Cunard and Seabourn in the luxury

Data correct as of 4 April 2024

Table: Shares magazine

• Source: Stockopedia

segment, AIDA in the ‘casual premium’ market aimed at German customers, Costa in the Southern European and Chinese markets and P&O in the UK and Australian markets.

Chief executive Josh Weinstein said the firm had enjoyed ‘a fantastic start to the year’, with booking volumes hitting an all-time high and prices ‘considerably higher’, meaning customer deposits hit a first-quarter record of $7 billion, surpassing the previous record by $1.3 billion.

Although the Baltimore bridge collapse forced the company to switch its homeport temporarily, the impact is likely to be $10 million at most, or less than 1% of this year’s net income.

More significantly the firm has ordered its first new ships in five years, to be delivered to Carnival Cruise Line in 2027 and 2028.

In a research note, Shore Capital analysts said: ‘We continue to see significant attractions to the global cruise industry, especially the long-term structural fundamentals, although this appears to be very much reflected in Carnival’s current valuation, especially given its elevated debt levels.’

Rival Royal Caribbean operates around 30 ships under three brands – Royal Caribbean, Celebrity Cruises and Silversea Cruises – with some of its newest vessels such as Star of the Seas the size of a small town.

At the beginning of February, the company posted better-than-expected 2023 earnings thanks to a strong final quarter and said it expected record earnings this year.

President and chief executive Jason Liberty called 2023 ‘an exceptional year, propelled by unmatched demand for our brands from new and loyal guests’ and said the firm had ‘the wind in our sails’ with record-breaking bookings already for this year.

Also listed in New York is Norwegian Cruise Line Holdings (NCLH:NYSE), which like Royal Caribbean operates around 30 ships under three brands, Norwegian Cruise Line, Oceania and Regent Seven Seas.

The company ended 2023 with $8.5 billion of revenues, a 32% increase on the previous year, and returned to full profitability for the first time since 2019 thanks to full occupancy, higher prices and substantially lower costs.

President and chief executive Harry Sommer called 2023 ‘a momentous year of growth and achievement’ with the firm having taken delivery

of three new ships, the most in a single year since it was founded in 1966.

Sommer also said Norwegian had entered 2024 at ‘all-time highs in our booked position and pricing’ with year-end advance ticket sales of $3.2 billion, a new company record and 56% above the level of the end of 2019.

Analysts at Morningstar said in a research note: ‘With ships fully deployed at historical occupancy levels, pricing surpassed pre-pandemic levels in 2023 and momentum has persisted into 2024. While Norwegian could intermittently see pricing competition in periods of macroeconomic distress, we believe its freestyle offering and attractive itineraries will keep passengers engaged with the brand.’

Although it is primarily known for its films and theme parks, US entertainment giant Disney (DIS:NYSE) operates its own cruise business which, like its rivals, enjoyed a highly successful 2023 thanks to strong demand and higher ticket prices.

The group has six ships, all with a much more classical design than their larger rivals and all designed to appeal to families, bringing elements of the theme parks to sea in addition to story elements from films by Walt Disney Animation studios and Pixar such as ‘Frozen’ and ‘Star Wars’.

In Europe, one of the larger companies in the sector is TUI Group (TUI) which operates 16 ships under three brands, TUI River Cruises, Hapag-Lloyd Cruises and Marella Cruises.

Over-50s travel and insurance group Saga (SAGA) also operates a cruise business and said it had ‘an outstanding year’ in 2023, with the trend set to continue this year thanks to ‘robust’ bookings.

The firm is expecting ocean cruise revenue to be up around 30% for the year to January 2024 while its river cruise business is expected to return to underlying profit for the first time since the pandemic.

However, the future of the cruise division is up in the air as Saga weighs its options to reduce its escalating £650 million debt pile.

By Sabuhi Gard Investment Writer

By Sabuhi Gard Investment Writer

Cash deposits might seem a safe way to save. But if you hold onto cash for long periods, it can pose a serious risk to your wealth.

Cash savings accounts are extremely useful ways of setting aside money to use for short-term spending or emergencies. They are also familiar and reassuring: after all, the cash is somewhere secure.

But in fact for longer-term goals – such as buying property, paying for education or saving for retirement – cash is not so smart. Over time. cash savings are riskier than other forms of investment. This is because cash is less likely to keep pace with inflation, meaning your overall wealth could fall.

For the past 30 years inflation around the world has averaged at well over 5% per year1. With inflation at 5%, a bunch of flowers which cost $20 one year would cost $21 the next.

Unless your savings deliver returns of 5% or more, you are losing money.