READY FOR

FOR LIFT-OFF LIFT-OFF FUNDS PRIMED FOR AN UPTURN IN FORTUNES

READY FOR

FOR LIFT-OFF LIFT-OFF FUNDS PRIMED FOR AN UPTURN IN FORTUNES

Living and working in Asia, our investment team navigate Asia’s fast-growing markets as locals.

With a history stretching back decades, we look for the best opportunities to invest your money in quality smaller companies with the potential to grow.

Can Marks & Spencer maintain its ‘remarkable’ momentum?

ProCook can carve off a tasty slice of a fragmented market

19 Trainline issues second profit upgrade in two months

From an employee share scheme at Rolls Royce to the Dogs of the FTSE – how Paul approaches the financial markets

Looking for opportunities in underperforming funds and trusts

We search through the funds and investment trusts which have lagged over three years to find those primed for a return to form.

Everything you need to know about dividends

Why companies pay them, what form they can take, what happens when they are distributed and how much tax you might need to pay.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

My Portfolio: a new series where we ask readers to talk us through their investing journey and how they manage their holdings

Whether you are a dividendgatherer, an all-out growth investor or somewhere in between, this is your chance to tell your story.

There’s a lot of potential noise for investors in the remaining weeks of the year

As it stands, there are only two months left of 2024 and yet, for investors, the next few weeks could be some of the most consequential of the year.

We provide a snapshot of the Budget and the market response to it in our News section this week but you can expect further analysis of the fall-out on our website and in next week’s issue too.

Also check our site for coverage of the latest Magnificent Seven results which were due as we went to press. Then there’s the small matter of the US presidential election next week.

The bookies seem to be leaning towards a Trump victory but, as this column observed last week, they have been wrong before and most of the polling suggests this remains a closely-fought election. This has its own implications for the market – particularly if any result is contested.

Towards the end of next month, Nvidia (NVDA:NASDAQ) – which has set the tone for markets over the last year or more – is set to unveil its latest quarterly earnings.

That’s a lot of information or ‘noise’ for investors to digest. So, what exactly should they do with it all. At Shares we’ll be doing our best to provide you with insights into the implications of these bits of news but perhaps the most useful thing to remember is that investing, done best, is a long-term endeavour.

There could well be some volatility ahead but the dangers of overreacting are much greater than sitting on your hands. Study after study shows that if you miss just a few of the best days of the market (which often follow the worst) then it can have an extremely deleterious impact on your returns and the key to success is time in the markets rather than timing the markets.

After reaching its first new record high in March since December 1989, Japan’s flagship index has found it much tougher going for a variety of reasons – the latest being a snap election which failed to deliver the mandate new PM Shigeru Ishiba was looking for, leaving him fighting for his political life.

Investors will fear a dose of governmental paralysis which could herald another period in the wilderness for Japanese stocks. However, one possible catalyst which could get things moving is M&A (mergers and acquisitions).

Dealmaking has historically not been a big feature of Japanese markets but there are whisperings that the bid for 7-Eleven parent Seven & I (3382:TYO) from Canadian convenience store group Alimentation Couche-Tard (ATD:TSE) could fire the starting gun on a wave of Japanese takeovers. Something to watch at least.

The market gave a largely positive response to Labour’s first Budget with the domestic-facing FTSE 250 index and AIM market both enjoying strong gains following the unveiling of chancellor Rachel Reeves’ plans.

While the inheritance tax exemption on AIM shares was halved it wasn’t abolished as had been feared. Rachel Winter, partner at Killik & Co: ‘AIM shares have suffered from a perfect storm in recent years. Brexit has damaged confidence in British companies, and higher interest rates have made investors more risk adverse and less willing to hold shares in smaller companies.

‘The AIM index lost half its value between late 2021 and late 2023. There were some tentative signs of a recovery in 2024, but the index had been heading downhill again since Labour’s victory in the election due to fears that Business Relief would be removed. The index has rallied on the news that AIM shares will attract an inheritance rate of 20% rather than the usual 40%.’

Capital gains tax was increased although not as

JD Wetherspoon and Marston’s toasted news of a 1.7% reduction in duty on draught alcohol

much as had been feared in some quarters. The lower rate going up from 10% to 18% and the higher rate from 20% to 24%. However, Reeves sprung something of a surprise by removing the inheritance tax exemption on pensions. While the death of the British ISA proved not to be exaggerated as the mooted new tax wrapper was scrapped.

Gilt yields moved higher after initially falling while the pound made some progress against the dollar. There was an increase in the amount employers will pay on their employees’ national insurance contributions from 13.8% to 15% from April 2025, with the current £9,100 annual threshold lowered to £5,000. Although there were protections for smaller businesses.

On stocks and sectors, there was relief in the gambling sector which had feared punitive new tax measures with Ladbrokes-owner Entain (ENT) among the gainers, up nearly 7%.

Elsewhere, pubs groups JD Wetherspoon (JDW) and Marston’s (MARS) toasted news of a 1.7% reduction in duty on draught alcohol served in hospitality settings.

As expected the windfall tax on the oil and gas industry was increased but North Sea operators like Serica Energy (SQZ:AIM) surged on relief that some allowances will be retained.

Infrastructure names Costain (COST) and Balfour Beatty (BBY) got a boost on news the HS2 rail line will run to Euston. Costain CEO Alex Vaughan says: ‘This is positive news that gives certainty and clarity for the UK’s largest and most complex infrastructure programme.’ [TS]

major player in the car loan business it is expected to be held liable for customer redress.

Just days after celebrating better-thanexpected third-quarter net income and earnings, investors in Lloyds (LLOY) received a cold shower as the shares lost 10% of their value in response to a court ruling in a motor finance case.

On 25 October, the Court of Appeal ruled in favour of three claimants against FirstRand Bank and Close Brothers (CBG) over the duty of motor dealers acting as credit brokers to disclose to customers commissions paid to them by lenders, and by extension the liability of lenders for any non-disclosure by the dealers.

The news sent shares in Lloyds down more than 7% and shares in Close Brothers down almost 25%, with follow-on-losses for the pair of 3% and 10% on 28 October.

Close Brothers, whose market value has now shrunk almost 70% to a little more than £400 million, said it would temporarily pause writing new UK motor finance business ‘while we review and implement any relevant changes to our documentation and processes to ensure compliance with these new requirements’, but as a

Lloyds, which through its Black Horse agency is the UK’s largest provider of motor finance, said it was ‘assessing the potential impact of the decisions, as well as any broader implications, pending the outcome of the appeal applications’.

The bank also said the court’s determination that lenders were liable for dealers’ non-disclosure ‘sets a higher bar for the disclosure of and consent to the existence, nature, and quantum of any commission paid than had been understood to be required or applied across the motor finance industry prior to the decision’.

The FCA (Financial Conduct Authority) said it was ‘carefully considering’ the court’s decision in light of its own review into discretionary commissions ahead of its ruling due in May 2025.

‘If the FCA adopts a wider lens thanks to this latest ruling then the results of its investigation may well come in later than next May,’ commented Danni Hewson, head of financial analysis at AJ Bell.

‘This will increase nervousness and potentially prolong the agony for Lloyds and the other names affected.’

Shore Capital’s Gary Greenwood went as far as to question whether the ruling could be extrapolated more broadly to include other types of lending where commissions are used as an incentive.

‘The ramifications of this could be huge if it was to include mortgage distribution, which is a largely intermediated industry, albeit there is no suggestion at this stage that this could be the case’, observed Greenwood. [IC]

Disclaimer: Financial services company AJ Bell referenced in this article owns Shares magazine. The author of this article (Ian Conway) and the editor (Tom Sieber) own shares in AJ Bell.

Knock out earnings and more bullish predictions get investors excited again

Turning a lacklustre 2024 on its head, Tesla (TSLA:NASDAQ) delivered stronger third-quarter profits than Wall Street expected after the close on 23 October 2024. Elon Musk’s electric vehicle maker reported its first year-on-year bottom line growth of 2024 to the delight of investors, sparking a 22% rally in the share price, its biggest one-day jump in more than a decade.

The share price rally added more than $80 billion to the company’s market capitalisation, taking the gain for the year to close on 6%, and helped power the Nasdaq Composite Index to within a fraction of an all-time high.

The announcement gave analysts and investors plenty to chew over, from a third-quarter profit beat and strong deliveries to an improved growth outlook, low-cost electric vehicle update, and Robotaxi rollout, but it was the margin story that prompted most of the positive remarks across Wall Street.

‘We saw this all-important metric [automotive gross margins ex credits] spike back to 17.1%, handily beating the Street’s estimate at 15.1% and now appearing to be on a trajectory back into the 20% level in the second half of 2025,’ wrote Wedbush in a note to clients.

Tesla delivery growth for 2025 of 20% to 30% beat consensus forecasts of 10% to 12% heading into the print, the note added. Tesla chief executive Musk touted a myriad of growth drivers for the electric vehicle maker over the next few years. These included a more affordable sub $30,000 model, autonomous and full self-driving and AI strategy rolled out, further plans to reduce costs, Cybercab production and Semi adding to the company’s product portfolio and growing energy and storage business adding to the Tesla growth story.

Yet sceptics will be wary of buying the entrepreneur’s hype given his record for wild predictions in the past failing to materialise. In

2014, Musk promised Tesla vehicles would be capable of driving themselves within six years, and two years later he predicted a Tesla would drive itself from Los Angeles to New York without driver intervention within 12 months. In May 2022, Musk claimed that achieving full autonomy was Tesla’s ‘number one priority’, while on the same earnings call admitting that full self-driving ‘was one of the hardest problems ever’.

Investors are still waiting for Tesla to bag the regulatory approvals it needs to get its full self-driving technology used on roads in the US, unlike Google-owned Waymo, Alphabet’s (GOOG:NASDAQ) robotaxi service which already offers autonomous rides to ordinary people in San Francisco, Los Angeles, Phoenix and is launching services in Atlanta and Austin. [SF]

Now more than ever, investors want to know exactly what they’re investing in.

abrdn investment trusts give you a range of carefully crafted investment portfolios – each built on getting to know our investment universe through intensive first-hand research and engagement.

We deploy over 800 professionals globally to seek out opportunities that we think are truly world-class – from their financial potential to their environmental credentials.

Allowing us to build strategies we believe in. So you can build a portfolio with real potential.

Please remember, the value of shares and the income from them can go down as well as up and you may get back less than the amount invested.

The genre seems as popular as ever with readers worldwide

Investors in fantasy and fiction publisher Bloomsbury (BMY) are living in a dream world at the moment as the group continues to book double-digit annual growth in both sales and earnings and raise its outlook, sending its shares to a record high of 758p.

For the first half to the end of August, revenue grew 32% to a record £180 million and profit leapt 50% to £26.6 million, partly due to the inclusion of the Rowman &

Littlefield academic portfolio but mainly thanks to the continued rip-roaring success of fantasy fiction as a genre.

Consumer revenue rose 47% to £131 million, with JK Rowling’s Harry Potter series still a best-seller 27 years after it was first published and sales of Sarah J Mass’ fantasy series topping 40 million copies all told after being translated into 38 languages.

There was more good news to come though –thanks to its strong firsthalf performance and ‘good’ trading in September and October, the firm now expects its results for the full year to February

2025 to be ahead of the current consensus.

As it stands, analysts have pencilled in sales of £319 million, down 7% on the previous year, and profit before tax of £37.5 million, down 23% on the previous year. [IC]

Digital mental health provider Kooth (KOO:AIM) saw its shares slump after the company revealed (18 Oct) it had received a 30-day notice from the US state of Pennsylvania to terminate its pilot contract.

The contract was first signed on 11 October 2021 and was extended by a

regarding Kooth’s service in California which contained ‘outdated’ information underestimating the product’s uptake and effectiveness. Kooth has subsequently put the record straight and the shares seem to have stabilised. The company said its product has already demonstrated meaningful clinical benefits with 70% of those accessing single-session therapy reporting positive outcomes. [MG] The board’s expectations for 2024 and 2025 remain unchanged

year from 30 June 2024 to June next year, whilst negotiations on a new contract were ongoing.

The company said the status of its work in the state going forward was now ‘unclear’ and it was urgently seeking clarification. Analysts at Stifel believe politics played a role and the decision was not related to the product, which received positive user feedback and utilisation.

The share-price reaction looks severe given it was worth just $3 million and paled into insignificance compared with the four-year $188 million contract signed with the state of California.

Unfortunately, on 24 October the shares fell a further 20% following publication of a newsletter article

FIRST-HALF RESULTS

5 Nov: Totally, Braemar

7 Nov: Wizz Air, Auto Trader, National Grid, Sainsbury (J), BT, Urban Logistics Reit, Trainline TRADING STATEMENTS

1 Nov: City of London

7 Nov: Endeavour Mining, Hikma Pharmaceuticals, Howden Joinery Group

The retail stalwart is in rude health, but the shares have already rallied hard this year

Marks & Spencer’s (MKS) stock is up the best part of 80% over one year and has rallied 40% year-to-date, driven by positive momentum in both food and clothing and a recent return to the dividend trail which has attracted income seekers.

This suggests the British retail institution will need to deliver a positive outlook and/or another profit upgrade alongside its first-half results (6 November) if its share price re-rating has further to run. Another impending catalyst an investor event (12 November), where management will update the market on the FTSE 100’s retailer’s growth strategy including exciting store renewal and expansion plans.

Under the stewardship of chief executive Stuart Machin, Marks & Spencer has become Britain’s fastest growing supermarket and strong trading is expected to have continued through the first half in food, driven by the retailer’s focus

on value and innovation, with Shore Capital expecting sales growth of 8.3% in this division.

Marks & Spencer is consistently delivering market share gains in the revitalised clothing and home division too, although tough prior year comparatives, a cautious UK consumer and unfavourable summer weather suggest first-half sales will have been more subdued, with the division well placed to produce stronger growth in the second half as comparatives ease. At the interims, investors will also be updated on the performance of M&S International, where analysts anticipate an earnings decline amid challenges in India and Marks & Spencer’s Middle Eastern markets.

Shore Capital believes its year-toMarch 2025 adjusted pre-tax profit forecast of £755 million ‘may prove to be conservative’ given the strength Marks & Spencer is displaying in food combined with progress on cost savings. The house broker also sees the medium- to long-term potential at Marks & Spencer as ‘very exciting as it hones in on full year 2028 targets’. [JC]

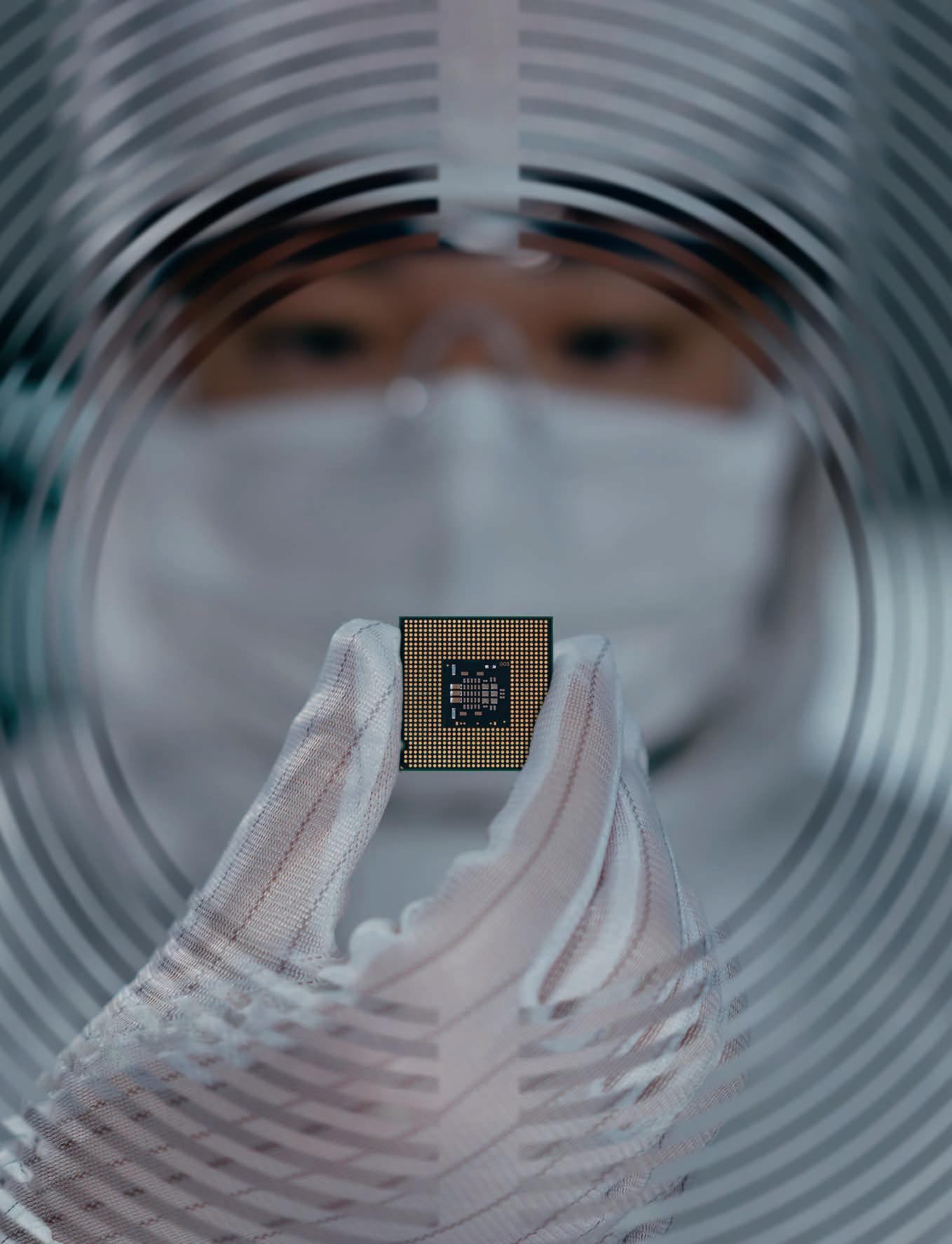

The recent legal wrangling between UK chip architecture designer Arm Holdings (ARM:NASDAQ) and one of its major clients Qualcomm (QCOM:NASDAQ) is likely to be one of the big talking points when the firm reports second-quarter earnings for fiscal 2025 next week (6 November).

The dispute is over a license agreement which Qualcomm obtained through its acquisition of Nuvia back in 2021.

Arm has been unable to say anything about the spat recently due to its pre-earnings ‘closed period’, so the market will expect some level of clarification in response to what appears to be an escalation of the saga.

Analysts at Citi are not alone in reading speculation that Arm could dump Qualcomm as a client as nothing more than a tactic in its ongoing negotiations to get a bigger cut of revenue from chips Qualcomm is designing using Arm technology.

However, it does highlight the complexities of licensing agreements and negotiations in the tech industry,

especially when significant revenue streams and partnerships are involved.

Legal dispute aside, Arm has been enjoying a banner year thus far, with sales guidance for fiscal 2025 pitched at between $3.8 billion and $4.1 billion, a sizeable jump on last year’s $3.23 billion.

The stock has rallied 117% year to date and was a recent inclusion in the PHLX Semiconductor Sector Index, a benchmark for the semiconductor market segment, marking a significant milestone in its growth. [SF]

QUARTERLY RESULTS

1 Nov: Exxon Mobil, Chevron, Simon Property, T Rowe, PPL, Waters

4 Nov: Berkshire Hathaway, Vertex, Palantir, Constellation Energy, NXP, AIG, Fox Corp

5 Nov: Emmerson, Marathon Petroleum, Microchip, Gartner, Yum!Brands, Targa Resources, Devon Energy

6 Nov: Qualcomm, Arm, Gilead, CVS Health Corp, Williams, Sempra Energy, Iron Mountain, Super Micro Computer, Marathon Oil, Match Group

7 Nov: Arista Networks, Duke Energy, Airbnb, Motorola, Air Products, Fortinet, Datadog, Hershey Co, Halliburton, Moderna, Warner Bros Discovery, Expedia, News Corp, Ralph Lauren

For once, Investors’ focus over the next couple of weeks has nothing to do with interest rates or macro events but politics.

In the UK, by the time Shares goes to press we will have been treated to the first Labour Budget in 14 years.

Chancellor Rachel Reeves has said in order to fill the ‘black hole’ left by the previous government the Treasury needs to raise around £22 billion, but to get the economy back on the right footing it needs to find around £40 billion.

In the US, all eyes are now on next week’s presidential election – the result of which, like the budget, should come out before next week's issue of Shares sees the light of day – with the candidates tied neck-and-neck in a deeplypolarised race.

Recently betting markets have moved towards predicting a Trump victory, with Bitcoin in demand given the Republican candidate's enthusiasm for all things crypto.

Harris’s policies have been backed by 23 Nobel prize-winning economists who called them ‘vastly superior’ to Trump’s and said they would ‘improve our nation’s health, investment, sustainability, resilience, employment opportunities and fairness’

In contrast, many economists have warned Trump’s tariff and tax policies are inflationary and likely to send the deficit soaring and the dollar swooning. On the flip-side, Trump's plans for corporate tax cuts might be welcomed by the market. What won't be welcome is the level of uncertainty, particularly if the process of getting to the final outcome proves protracted or the result of the election is disputed. [IC]

Games Workshop (GAW) £119.40

Market Cap: £3.9 billion

We flagged fantasy miniatures maker Games Workshop (GAW) in June 2022 at around £63 after the shares had halved in the prior nine months, arguing they rarely traded as cheaply.

The shares have since retraced the lost ground but still sit just below all-time highs of around £120 and effectively have gone sideways over the last year. Meanwhile the business has not stood still, throwing-off more than £10 in dividends per share as sales and free cash flow per share have grown by more than half.

We believe the shares are set to break new ground, driven by the next growth phase of the business as the company looks to put the postpandemic costs and logistics challenges firmly in

2022 2023 2024

Chart: Shares magazine • Source: LSEG

the rear-view mirror.

Intriguingly, for the first time in over a year, analysts appear to be revising up their 2026 earnings forecasts, which could portend the start of a sustainable trend supporting further share price gains.

In other words, Games Workshop could be back to under-promising and over-delivering, a feature which has characterised management in the past.

Games Workshop is a unique asset. The company has arguably under-exploited the IP (intellectual property) it owns, and, unlike real life characters, there is no limit to the future growth of the fantasy worlds it brings to life.

We like the straightforward strategy: ‘To make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever.’

Globally, the business has barely scratched the surface of the total market opportunity. One of its underappreciated routes to market is the stores, operated by enthusiastic hobbyists which, attract

other hobbyists eager to learn how to play, paint and collect fantasy soldiers.

Games Workshop is vertically integrated, which means it controls the whole process from design creation of the miniatures through to tooling, manufacturing, distribution, and sales. Crucially, this means it controls the pricing of its products and can optimise its costs more efficiently.

The Warhammer-community.com website and dedicated Warhammer TV channel are key assets and drivers of brand awareness and sales growth.

All these characteristics add up to some impressive financial metrics. Return on equity and capital employed (the company does not have any debt) have averaged 63% over the last six years.

Operating margins have averaged 36% per year and the business throws-off oodles of free cash flow which has grown by around 26% a year. Truly excess cash is given back to shareholders via dividends which have grown at a compound annual rate of 33% a year.

In short, Games Workshop is a quality compounder which we believe is well positioned to become a bigger business over the next decade.

The tie-up with Amazon (AMZN:NASDAQ) announced in December 2023 to create a Warhammer 40K film and tv series, and associated mechandising rights, is approaching its selfimposed deadline of 31 December 2024 to agree ‘creative guidelines’.

In its 2024 annual report, Games Workshop said the agreement with Amazon includes an option for Amazon to license equivalent rights in the Warhammer Fantasy universe following the release of the initial Warhammer 40K production.

It has been reported that Henry Cavill, the British actor known for his roles in fantasy films such as Superman and The Witcher and a huge fan of gaming, is set to star in the TV series for Amazon Studios.

There is a lot riding on the success or otherwise of the Amazon deal, which admittedly creates room for disappointment.

The Paramount+ TV adaptation of the hugelypopular Halo games franchise didn’t go down at all well with fans and was axed after just two series.

On balance, however, the risks appear to be skewed to the upside for Games Workshop.

Analysts at Jefferies estimate a 10-part series could net Games Workshop around $10 million (£7.7 million) in royalty income. For context, it earned £31 million of royalty income in the year to end of May 2024. This income is close to 100% profit.

More important, says Jefferies, is the brand exposure, which could create a significant downstream effect on miniatures revenue.

‘Given Amazon has previously reported circa 200 million Prime members streaming shows/ movies, the potential for Warhammer to build its global exposure is clearly a huge opportunity,’ writes Jefferies. [MG]

The knives, pots and pans purveyor has strong momentum and is on the front foot with store expansion again

Risk-tolerant investors seeking a compelling recovery play with tasty rerating potential should consider ProCook (PROC). This direct-to-consumer specialist kitchenware brand is carving out market share gains under management’s refreshed strategy to serve up profitable growth.

After a tough few years post its 2021 IPO (initial public offering), when the cost-of-living crisis led consumers to rein in discretionary spend and sales growth came off the boil, the outlook for ProCook is improving.

The £32.7 million cap has delivered five consecutive quarters of retail like-for-like growth, is back on the front foot in terms of store expansion and looks set fair for the peak Black Friday and

Christmas selling season.

So long as ProCook delivers the goods over its seasonally important second half, earnings upgrades and a re-rating should ensue, although investors should note this micro cap stock’s bid-offer spread could nibble into nearterm returns.

Founded over 25 years ago as a family business selling cookware sets by direct mail, present-day ProCook designs and retails a quality range of directly sourced and own-brand kitchenware.

Its value-for-money offering spans everything from knives, pots, pans and chopping boards to bowls, tongs, tenderisers and even small electricals such as slow cookers and ice cream makers.

Awareness of the brand, which sells directly through its own website and through 61 retail stores located across the UK, remains low and there is a sizeable opportunity for ProCook in a steadily growing UK kitchenware market valued at roughly £4 billion.

Under new chief executive Lee Tappenden, appointed in September 2023 having spent over a

Another reason for optimism was the performance of new stores, which are very different to the ProCooks of old, being located in high-profile and high-footfall shopping centres which, along with the evolving use of social media, should help raise awareness of the brand.

In line with management’s plan to open 10 new stores in full year 2025, ProCook pulled up the shutters on four new stores in the first half of the year and is legally committed to open a further six in the second half, the bulk of which should be open in time for Christmas.

For the year to March 2025, Canaccord Genuity forecasts an uptick in adjusted pre-tax profit from £1 million to £2.5 million, ahead of £3.8 million in 2026, with EPS (earnings per share) building from 1.6p this year to 2.4p next year.

Those estimates place ProCook on an undemanding prospective PE (price to earnings) ratio of 12.1 times, which drops to single digits on the broker’s 3.3p EPS estimate for full year 2027, during which ProCook may well pay a maiden dividend.

quarter of a century with Walmart (WMT:NYSE) and Asda, and chief finance officer Dan Walden, ProCook is accelerating profitable growth to deliver the group’s medium-term objectives of 100 UK retail stores, £100 million of revenue and a 10% operating margin.

The Gloucester-headquartered group’s secondquarter trading update (16 October) showed total revenue grew 8.8% year-on-year to £17 million in the 16 weeks to 13 October amid market outperformance by ProCook, with like-for-like sales growing for the fifth consecutive quarter as initiatives around product and value gained further traction.

Ecommerce revenue increased by 12.2% to £5.9 million, a significantly improved performance yearover-year, and the brand has also relaunched on the Amazon UK marketplace after a brief hiatus.

Positive progress is being made to streamline operations to improve service levels and product availability, while net debt at the end of the first half of £4.2 million reflected an increased inventory position, prudently secured by Tappenden and the team in advance given the significant disruption to global freight markets.

Canaccord Genuity argues the current valuation ‘does not reflect the growth opportunities from further store expansion and like-for-like initiatives’.

Peel Hunt believes that with ProCook in ‘such good shape ahead of peak’ the numbers can ‘start to move north towards the £100 million sales, 10% operating margin goal in time. Any hint of that happening should see a material re-rating here: the shares are too cheap in our view.’ [JC]

Gain to date: 15.1% Market cap: £1.5 billion Shares

It is barely two months since the rail ticketing app Trainline (TRN) said it was raising its full-year 2025 guidance and it has now repeated the trick.

We flagged the stock’s appeal in early February because of the continuing potential in its domestic market and, in particular, its ability to tap into European growth.

WHAT HAPPENED SINCE WE LAST SAID BUY?

Since we last updated on this idea in September the stock has hit a new three-month high although it is still below its 52-week high of 393.8p set on 20 March 2024.

For the 12 months to 28 February 2025 the company now expects net ticket sales year-onyear growth of between 12% and 14% (previous guidance was for growth at the top end of 8% to 12% range).

Trainline cited robust growth, continued momentum and a benefit from ‘operating leverage’ (revenue rising faster than costs) for the upgrade as it scales up the business.

The company is set to report first-half results in full on 7 November when investors will get more colour on the performance of the business.

WHAT SHOULD INVESTORS DO NOW?

We remain upbeat about Trainline. The company is making progress in Spain, Italy and is the most downloaded rail app in Europe. In the UK, Trainline has already acquired a 60% share of the online market.

With the new Labour government confirming that it has no immediate plans for a statecontrolled ticketing app, a major threat looming over the investment case has eased.

Shore Capital analyst Katie Cousins says: ‘We continue to see Trainline as a dominant player within the UK rail network, set to benefit from the increasing digitalisation demand from consumers.

‘Beyond this, we believe the international opportunity, which is building, is not factored into the current group multiple of around 10 times EV/EBITDA (enterprise value to earnings before interest, tax, depreciation and amortisation), a discount to wider UK platform peers.’ [SG]

Discover the methods this retiree uses to keep on top of his investments

Paul’s very first taste of investing came when his employer, aerospace and defence company Rolls Royce (RR.), introduced an employee share scheme which gave him what seemed to be a low-risk way of getting exposure to its shares.

It seemed low risk, explains Paul, because the scheme allowed employees to save a monthly or four weekly amount for five years and at the end of the period the savings and interest could be converted into Rolls’ shares at a fixed conversion rate or be cashed out.

Paul worked for Rolls Royce for almost 30 years and seldom found an opportunity to convert into shares because either the shares did not move much in the intervening period, or he had some other use for the money.

He also read somewhere that owning shares in the company you worked for could be risky. If the firm got into trouble, there was a chance you could lose your investment and job in one fell swoop.

Moving to more recent times Paul purchased some Rolls shares ahead of the company’s rights issue in 2020. Given the company was not paying dividends at the time, Paul admits this went against the grain of his investing style.

‘I am looking to increase the value of dividends received by my portfolio,’ explains Paul.

Nevertheless, he held onto the shares and eventually sold at a profit, acknowledging he could have held on longer to squeeze out an even bigger profit. However, the sale allowed him to reinvest the proceeds into a ‘dividend generating’ investment.

Having worked for the company for so long,

Paul believes he has a good understanding of the how the business works. It is the long-term maintenance contracts which are the real moneyspinner for Rolls, says Paul, as they earn income based on the number of hours the engines are in use.

And with pent-up demand after flights were grounded by the pandemic Paul reasoned that Rolls’ shares would be in demand thanks to the perception the company would benefit from an increase in hours flown.

Outside of work Paul dabbled in unit trusts but never really got to grips with how they worked, although he noticed the income focused ones tended to perform better.

Eventually he realised the products he invested in were quite concentrated (i.e. had only a small number of holdings) which explained why their prices moved around quite a bit as individual company results and news buffeted the value of the overall assets.

Later Paul decided to open a PEP (personal equity plan), a precurser to the ISA and take financial control of his investments. However, all these investments disappeared when Paul got married which he describes as ‘the best decision I ever made, although not financially’.

The last decade has not been kind to Paul, he lost his wife in 2014, his father three years later and his mother in 2019. After this tumultuous period Paul started to invest again and set up a monthly investment plan.

He also consolidated his various pots and transferred them to a single provider, making it

UK

Ashted

Barratt Redrow

Diageo

Drax

Evraz

Brookfield Asset Management

Etan Allen Interiors

Flex LNG

Lakeland Industries

Nextera Energy

HSBC Northwest Bancshares

Imperial Brands

Legal & General

Liontrust Asset Management

Lloyds Banking

M&G

Man Group

Mondi

National Grid

Phoenix Group

Rio Tinto

Smiths News

Spirent Comms

Sthree

TP ICAP

Unilever

Palantier Technologies

Stag Industrial

Steelcase Inc

The Coca-Cola Co

Arbor Realty Trust

Bluefield Solar Income

Caretrust REIT

Greencoat UK Wind

IGC Enterprice Trust

Impact Healthcare REIT

International Biotechnology Trust

Lowland Investment Company

Omega Healthcare Investors

Permian Bain Royalty Trust

SPDR Global Dividend Aristocrats

SPDR S&P Dividend Aristocrats

The City of London Investment Trust

The Mercantile Investment Trust

Table: Shares magazine • Source: Investors' own records

easier to monitor and manage. The two themes running through Paul’s holdings are diversification and a growing income.

The portfolio is invested across nearly 60 individual shares, eight investment trusts and five REITs (real estate income trusts). Taking account of the securities held by the trusts, the overall portfolio has exposure to close to 800 names, making it very diversified.

As well as income focused trusts such as City of London (CTY) the portfolio is invested in renewable energy plays like Bluefield Solar Income

(BSIF) and Greencoat UK Wind (UKW), providing dividend yields of 8.6% and 7.7% respectively.

The portfolio has exposure to specialist sectors like biotechnology through its holding in International Biotechnology Trust (IBT) as well as property-related healthcare such as Impact Healthcare REIT (IHR) and US-based Omega Healthcare Investors (OHI).

The share selection includes perennial dividend payers like tobacco company Imperial Brands (IMB) with a 7% yield, and high yielding banks Lloyds (LLOY) and HSBC (HSBC).

For one pot of money, Paul has started to invest in a ‘Dogs of the FTSE’ strategy after following how the strategy worked through a virtual portfolio while out of the markets.

‘I created spreadsheets and revalued them and although performance has been varied from year to year, and security to security, all the portfolios increased in value over the long-term, after adding in dividends,’ explains Paul.

Earlier in his investment journey Paul focused on higher dividend paying stocks but now he is experienced he has come to realise that a growing income might be more important than a high yield.

Paul does not obsess about performance on a day-to-day basis but prefers to see ‘blue’ on the screen rather than red when he does check in. A monthly investment plan means either toppingup existing holdings or investing in a new position which has potential to grow income.

This monitoring also includes weeding out shares which are not providing expected income growth. In terms of risk appetite, Paul tends to be drawn towards lower risk investments with a focus on quality dividend yielders.

He stays clear of growth investments, observing: ‘If the prospect is high growth, the risk is also big losses ’ He reckons his risk profile has not changed over time but his means of assessing risk has evolved.

Stocks are sold if the outlook for the dividend diminishes, or it has been cut or cancelled with no prospect of it returning in the near term. When investing new money Paul is always conscious of the benefits of diversification, which means investing in sectors not already represented in the portfolio.

There are times when an existing holding is swapped out for a better-quality dividend payer. Paul generates investment ideas by reading titles like Shares and The Daily Telegraph

For finding US stock ideas Paul reads publications such as The Dividend Hunter, Oxford Club, Zacks and Forbes magazine.

Paul does not use stop-losses to protect the portfolio from big losses but says he is beginning to think he should.

Since officially retiring and receiving the state

pension Paul has started saving and investing more but laments it is getting harder to keep income and expenditures in balance.

DISCLAIMER: Please note, we do not provide financial advice in My Portfolio articles, and we are unable to comment on the suitability of the subject’s investments. Individuals who are unsure about the suitability of investments should consult a suitably qualified financial adviser. Past performance is not a guide to future performance and some investments need to be held for the long term. Tax treatment depends on your individual circumstances and rules may change. ISA and pension rules apply.

By Martin Gamble Education Editor

We are looking for individuals or couples to share their experiences of managing their own investment portfolios.

If you would like to take part, we want to know why you chose certain stocks, funds or bonds, why you might have subsequently sold some of them, and what you hope to achieve from investing.

We will pay £50 in John Lewis vouchers as a thank you to anyone whose story is published in the digital magazine.

Drop us a line with your name and two lines describing your investment experience. For those picked to feature in the magazine, we’ll be in touch to get the full story.

CONTACT: shareseditorial@ajbell.co.uk with the words My Portfolio in the subject line.

DISCLAIMER: Shares/AJ Bell does not provide advice or personal recommendations. The My Portfolio articles are for information only. You must do own research and consider your own personal circumstances before making investment decisions.

Funds inevitably have their up and downs in performance. When a fund has gone through a particularly poor spell, does this represent a buying opportunity for investors in the expectation it will bounce back to form?

Likewise for existing investors, should they stick or twist? Fortunately, there are lots of studies from the institutional fund management world which provide answers to that question and we round off this article by looking at three underperforming funds which look ripe for a recovery.

Typically, institutional fund managers are walking on thin ice after three years of underperforming their benchmark and peer group.

A 2006 study by Amit Goyal and Sunil Wahal covering institutional hiring and firing decisions by around 3,500 pension plan sponsors over a 10-year period from 1994 to 2003 showed that the subsequent return of the fired managers was frequently positive and better than the new

managers hired.

There have been several studies over the last 20 years which come to the same conclusion. This should not come as too much of a surprise for readers of our recent article on the seven deadly sins of investing.

In it we discussed how professional investors are often more susceptible to being tripped-up by behavioural biases than the ordinary investor.

These challenges also apply to consultants who hire and fire fund managers. Chasing fund performance (buying the winners and selling the losers) and overconfidence in picking the best managers are two factors which go a long way to explaining the results of the studies.

It is unrealistic to expect a fund manager to outperform an index or peer group all the time. Holding different stocks to peers or the

benchmark inevitably means performance will diverge, both positively and sometimes negatively.

There is nothing special about a three-year period which magically indicates loss of fund manager’s mojo, which begs the question, what is a reasonable period of underperformance?

In 1984, Warren Buffett wrote an article for the Columbia Business School magazine Hermes titled ‘The Superinvestors of Graham-and-Doddsville’. In it he presented and discussed the investment performance of some of his peers who had been taught by the legendary Benjamín Graham.

Over periods ranging from 13 years to 28 years, the group outperformed the market by between 8% and 17% per year.

What is striking about these ‘superinvestors’ is that they all suffered significant underperformance at some point along the way to building spectacular long-term track records.

On average, they underperformed around a third of the time they managed money (the range is 7.1% to 42%). The worst three-year underperformance (peak to tough percentage loss) saw one manager fall almost 50% behind the benchmark.

The lesson from these results was neatly summed up by Eugene Shahan, who graduated from the Columbia Business School, and wrote an article on Buffett’s findings.

We have identified some names which managed to follow a poor three years up to October 2021 by turning things around in the subsequent three years.

Value-focused investment trust Temple Bar (TMPL), steered by experienced investor Ian Lance, struggled to make any progress between 2018 and 2021 but has returned to form to become a top-quartile performer since then.

Another fund which has demonstrated bouncebackability is Jupiter UK Income (B5VXKR9). Although the imminent departure of well-regarded manager Ben Whitmore to set up his own boutique investment fund means this portfolio changed hands in April to be steered Chris Morrison and Adrian Godsen.

He said: ‘It may be another of life’s ironies that investors principally concerned with short-term performance may very well achieve it, but at the expense of long-term results.’

Factors other than performance can be helpful in ascertaining whether to stick with or invest in a fund. Most successful funds have a well-defined philosophy and investment process which is consistently applied through good times and bad.

Therefore, one area to probe is how consistently a manager applies his or her chosen investment process. If a manager starts to waver from the principles which produced past returns, it could be a sign of style drift and indicate future underperformance.

A good example is Neil Woodford. After setting up his own shop, he famously moved away from what had made him so successful at Invesco Perpetual. At Invesco he had been buying mainly large cap stocks whose income potential had been undervalued by the market but he moved into unquoted early-stage businesses with disastrous consequences for investors.

Any noticeable change in the way the fund is managed such as the number of stocks held in the portfolio, or how often the stocks are changed, are potential red flags unless the changes are clearly justified by the investment manager.

It is worth noting that style drift is different from making tweaks to the investment process to improve performance.

For example, Fundsmith founder Terry Smith told Shares that after reviewing the team’s selling discipline, they believed it could be improved.

Shares which Smith and head of investment research Julian Robins believe should be sold but are benefiting from an identifiable tailwind from themes such as AI (artificial intelligence) should be given more time before pushing the sell button.

Change of personnel is another sign that a fund might be undergoing a fundamental shift which could impact future performance.

In order to identify funds and trusts which have endured a recent bout of underperformance but where we still believe in the strategy and longterm potential we ran a screen of the market. We looked for products which had chalked up fourth quartile performance over the last three years.

Read on to discover the three names from the resulting list of more than 200 which we now think could be ready for lift-off.

PRICE: 688.84P

FUND SIZE: £684.5 MILLION

Mark Slater and his team have delivered an excellent long term track record managing the Slater Growth Fund (B7T0G90) which has a cumulative return since inception in 2012 of 198.2%, compared with the 111.9% return of the IA (Investment Association) UK All Companies index.

Over the last three years the fund has underperformed its peer group by a wide margin, down 23% compared with a 9% gain for the AI UK All Companies index.

Shares believes the pedigree of the manager suggests the fund has good bounce back potential.

Slater applies a proven investment process which starts with a screening of the UK universe across several criteria, including the PEG (price earnings ratio to growth rate) popularised by his father Jim Slater, and sustainable earnings growth.

The team then conducts thorough in-house research and if they still like the business they meet company management. An assessment of the risks and opportunities is then made before a final decision is made.

Slater puts recent underperformance down to a big de-rating in the small and mid-cap parts of the UK market plus rising interest rates, accentuated by fund outflows. Slater believes this section of the market is so beaten up it is now ‘pretty resilient to bad news’.

The manager points out that historically when small caps as a group trade on under 10 times earnings they have subsequently rallied around 60% over the following two years. This part of the market now trades on a PE (price to earnings) ratio under nine times, says Slater.

Top holdings include outsourcing company Serco (SRP) which Slater says is a much better business than it was a few years ago, something which is yet to be fully appreciated by the market. [MG]

PRICE: 105P MARKET CAP : £177 MILLION DISCOUNT TO NAV: 11.6%

Montanaro Asset Management was set up in 1991 and has 16 analysts and fund managers dedicated to picking smaller stocks, which could just make them the biggest small-cap team in the UK.

Founder and chief executive Charles Montanaro chose the closed-end investment trust structure for his high-quality growth strategy as it meant not having to buy and sell stocks depending on inflows and outflows.

The team looks for simple businesses in distinct niches, which makes them less vulnerable to the vagaries of the economic cycle, and they have to be profitable – there are no early-stage or venture-capital style investments in the portfolio, companies have to be money-making before they even get on the radar.

It is well-known that small-caps outperform large-caps over the long term – with some of them eventually becoming large-caps in the process – and the dearth of publicly-available research means there are plenty of opportunities for the Montanaro team to find undiscovered gems.

Unusually, especially for a small-cap growth strategy, the trust pays a regular dividend of 1% of its NAV (net asset value) every quarter, equivalent

to a yield of 4% per year.

The fund generated almost a 950% return from its inception in 1995 to September 2021, but in the three years since it has struggled as smallcap value has outperformed growth aided by the sharp rise in interest rates.

The fund was back on track in the first half of 2024, outperforming the index as it became apparent rates were set to fall, but the sluggish pace of cuts has held it back in the third quarter despite excellent results from its portfolio companies.

The current top 10 holdings include FTSE 250 stars 4Imprint (FOUR), Big Yellow (BYG), Bytes Technology (BYIT), Clarkson (CKN), DiscoverIE (DSCV), Games Workshop (GAW) and XPS Pensions (XPS), and we firmly believe the trust is set for a return to form in the years ahead. [IC]

£2bn+ (16%)

£1.5bn-

£2bn (6%)

£0m-£250m (4%)

£250-

£500m (12%)

£1bn-

£1.5bn (28%)

30 September 2024

£500bn£1bn (35%)

Chart: Shares magazine • Source: Montanaro Asset Management

It’s been a challenging three years and a lost decade for capital preservation and growth fund RIT Capital Partners (RCP), whose stated purpose is ‘to grow your wealth meaningfully over time, through a diversified and resilient global portfolio’. FE fund info data shows the £2.65 billion cap has produced a negative 33% three-year return, while performance lags the MSCI AC World (50% £) benchmark over ten years, which is reflected in a near-30% share price discount to NAV (net asset value).

at 30

A difficult period for NAV performance in 2022, concerns over the valuations of unquoted investments and a headwind from cost disclosures drove a sharp de-rating and left investors questioning what role RIT Capital played in their portfolios. And as Deutsche Numis explains, ‘many were left without the information to answer these questions and we believe this has contributed to the selling and lack of demand’, but the broker believes RIT Capital’s NAV has ‘potential to deliver an attractive return profile in future and the discount offers a value opportunity’.

More recently, manager Maggie Fanari has been articulating her plan to revive the trust’s fortunes to investors who’ve seen an uptick in portfolio performance, while buybacks continue apace and

falling interest rates should offer a tailwind.

As of 30 September 2024, NAV was £26.19 per share, up 1.5% from the previous month, and meaning the fund had generated a positive NAV total return of 8.8% year-to-date. Recent performance has been driven largely by the quoted equities book, boosted by the rally in Chinese holdings rallied, with private investments and uncorrelated strategies chipping in with positive contributions.

It is also worth noting that many of RIT Capital Partners’ largest direct investments are profitable companies with growing earnings, while its private fund portfolio includes some of the globe’s best performing funds, which are well positioned when the IPO (initial public offering) window opens. [JC]

Country’s central bank recently hiked rates amid a stronger than expected economic performance

Chart: Shares magazine •Source: MSCI, 30 September 2024

Brazil’s central bank went against the grain by announcing its first interest rate hike in two years in September 2024 on concerns that the more robust than anticipated levels of economic activity might stoke inflationary pressures. The door was left open to further increases.

Higher rates are not always taken positively by equity markets and the MSCI Brazil index has taken a step back since rates were increased. However, on a three-year view the index has outperformed MSCI Emerging Markets benchmark with an annualised total return of 7.3% versus 0.4% for the broader benchmark.

In part this has been thanks to its exposure to commodity markets. More than 30% of the index is accounted for by resources stocks – this

compares with a smidge above 10% for MSCI Emerging Markets. Financials also have a significant weighting in the index at 36.9%. Among the largest stocks in the index is Itau Unibanco (ITUB:BVMF) which is the largest banking institution in Latin America.

Despite their recent outperformance of other emerging markets, Brazilian shares are less expensive. MSCI Brazil’s constituents have an average dividend yield of 6.2% and forecast price to earnings ratio of 8.2 times versus the 2.5% and 12.4 times averages for MSCI Emerging Markets.

Sponsored by Templeton Emerging Markets Investment Trust

Three things the Templeton Emerging Markets Investment Trust team are thinking about today.

1.

China steps up: Chinese policymakers have announced a slew of stimulus measures targeted at reversing the downturn in economic growth and deflationary forces in the economy. Similar to the end of Covid-19 lockdowns in 2022, the policy change is sudden and dramatic. Reasons for the change in policy direction are being hotly debated. One potential factor was the start of the US Federal Reserve’s (Fed’s) interestrate-cutting cycle, which has put downward pressure on the US dollar, which fell 4% in the third quarter. The weaker dollar has taken some pressure off the dollar-renminbi spot rate, which Chinese policymakers did not want to see weaken excessively.

2.

Middle East tensions rise: The Middle East conflict has escalated, with Israel conducting multi-front offensives. Despite these developments, a full-scale war between Israel and Iran remains a low probability event

the short term. The escalating tensions have impacted the regions asset markets and global oil markets. This region accounts for 40% of the world’s seaborne oil trade. We remain watchful of the situation and managing risk associated to our investment exposure to the region.

3.

Equities in the emerging Latin American region advance. Mexican equities slid after a controversial judicial reform was signed into law. Brazil’s central bank started raising interest rates to control inflationary environment amid stronger-than-expected economic activity. This move marks a contrast with most other global central banks, which have begun to ease rates.

TEMIT is the UK’s largest and oldest emerging markets investment trust seeking long-term capital appreciation.

Leading the energy transition and driving positive impact on the environment and society.

VH Global Sustainable Energy Opportunities plc (GSEO) invests globally in a diverse range of sustainable energy infrastructure assets, working towards its strategic goals of accelerating the energy transition towards a net zero carbon world and providing shareholders attractive risk-adjusted returns.

Why invest in GSEO?

A vehicle presenting a distinctive combination of access, return and impact.

• Access to global private markets energy investments

• A geographically and technologically diversified portfolio of actively managed, high-impact investments which aim to ensure an effective and just climate transition

• Targeting total NAV return of 10%, net of costs and expenses

• Progressive dividend target of 5.68p reaffirmed for 2024

• High degree of inflation-linkage with over 90% of revenues that are inflation-linked

• Minimal interest rate risk exposure

• Creating environmental and social impact transforming lives and communities without compromising on returns

• Transparent impact reporting

• SFDR Article 9 fund

Everything you need to know about dividends (but were afraid to ask)

We outline the basics about dividends from what they actually are to how they can provide a regular income

Adividend is quite simply a portion of a company’s earnings distributed to its investors.

In the UK most companies pay two ordinary dividends per year, one at the half-way stage (the interim or first-half dividend) and one at the end of the year (the final dividend). Some UK firms pay quarterly dividends.

Sometimes, companies will decide to pay a special dividend on a one-off basis if their earnings have been particularly strong or they have sold a business and have no use for the cash themselves.

Investment trusts and funds also pay dividends to investors and they can be half-yearly, quarterly or even in some cases every month.

HOW DO YOU RECEIVE AN ORDINARY DIVIDEND?

To receive a dividend, you need to have a holding in a company, fund or investment trust that pays a dividend to its shareholders.

There are four important dates to keep in mind:

• Declaration date – The day the board of a company, fund or trust reveals its intention to pay a dividend, including the date and the amount per share.

• Ex-dividend date – Investors who own the shares before this date qualify for the upcoming dividend, those who buy the shares after this date and before the payment date are not entitled to the dividend.

• Record date – This is the date the company, fund or trust uses to determine who owns its shares and are therefore entitled to the dividend.

• Payment date – The dividend is dispensed and appears in your account. This is usually around one month after the record date.

In the days leading up to the ex-dividend date, the price of your shares might go up as other investors decide to buy because they also want the dividend.

On the day the stock goes ex-dividend, the share price usually drops by the same amount in order to compensate for the fact that if you buy the shares

On 16 October, fantasy games and miniatures retailer Games Workshop (GAW) declared it would pay a dividend of 85p per share ‘in line with the company’s policy to distribute truly surplus cash’, taking dividends declared up to that point for the financial year ending in May 2025 to 185p per share.

The dividend will be paid on 29 November to shareholders who are on the register on 25 October, with an ex-dividend date of 24 October.

The last date for elections for the dividend reinvestment plan is 8 November.

now you have no right to the dividend (they are ‘exrights’, in market parlance).

In the Games Workshop example, the company mentions a dividend reinvestment plan (sometimes shortened to DRIP) which is a way to reinvest the income you receive back into buying more Games Workshop shares.

A number of companies have a DRIP, which you are free to sign up to as a shareholder, although not everyone will want to reinvest the income as some investors rely on their dividend income to help pay their monthly outgoings. Most investment platforms also offer a dividend reinvestment service.

In the Games Workshop example already discussed, unless you own a lot of shares, it may not be practical reinvesting the income as each share costs nearly £120, but you are only getting 85p to reinvest. You would need to own 140 shares to get enough money in dividends to buy one more share.

It is also important to note that there will be fees for reinvesting your dividend income, so if you own shares through a trading platform you should find out what these are before signing up to reinvest the proceeds.

Sometimes companies will give you the option of having more shares rather than a cash dividendthis is known as a ‘subscription’ or ‘scrip’ issue of new shares in lieu of dividends.

There are a couple of advantages to ‘scrip’ dividends. For investors, there is no dealing fee or stamp duty payable on the shares, while for the company it means they can keep the cash within the business.

However, ‘scrip’ dividends are taxed the same way as cash dividends, so if you fill in a selfassessment tax form you will need to declare them as income.

As a reminder, if you earn more than £500 from dividends in a year you will need to pay tax on this income unless your investment is held within an ISA.

You do not pay tax on any dividend income which falls within your personal allowance.

Many large UK companies pay scrip dividends, such as Barclays (BARC), BP (BP.), HSBC (HSBA), National Grid (NG.), Pennon Group (PNN) and Rolls Royce (RR.).

DO COMPANIES HAVE TO PAY DIVIDENDS?

There is no guarantee a company will pay a dividend, and firms may cut or suspend their dividend altogether if the business isn’t performing well.

It could be there has been a dramatic fall in earnings or the company has lowered its forecasts for the future due a change in its market.

During the pandemic, the whole of the UK banking was forced to suspend dividend payments by the regulator, which was concerned about their capital ratios and their ability to pay depositors. Many other firms also suspended their dividends in light of the uncertainty.

In March 2024 builders merchant Travis Perkins (TPK) cut its dividend by 58% after announcing a major overhaul of its business to reduce costs and restructure its operations.

In July 2024, luxury group Burberry (BRBY) suspended its dividend altogether after it posted a disappointing trading update and its chief executive stepped down with immediate effect.

By Sabuhi Gard Investment Writer

That mean’s it’s time for some crude calculations

Equity markets are buoyant, fixed income markets seem more nervous judging by the way yields are rising (at least for government-issued in the developed West), and commodity prices continue to march to their own beat, with gold and silver surging, industrial metals largely flat and oil and gas remaining subdued.

The relative calm pervading hydrocarbon prices is in many ways surprising, given the ongoing war in Ukraine and Russia’s role as a top-three supplier worldwide together with heightened tensions in the Middle East.

Oil and gas prices trade a long way from recent peaks

Source: LSEG Refinitiv data

There are clearly far more important, humanitarian issues at stake in both conflicts, but from the narrow perspective of financial markets investors must pay attention, too, especially because of oil and gas.

The equity markets’ preferred scenario of cooling inflation, a soft landing for Western economies and falling interest rates from central banks is playing out to perfection, such that the S&P 500 and NASDAQ Composite in the US, the DAX and MIB-30 in Europe, and even the benighted FTSE 100 trade

at or very close to multi-year or even all-time highs. Weakness in energy prices is a key part of this, as it is feeding into lower inflation meaning any resurgence in hydrocarbon prices could lead to an upset.

Therefore, as part of any risk management process, it is surely worth assessing the key sensitivities here.

Energy components of consumer price indices are helping to cool headline inflation rates

Source:

Near-term sentiment toward oil and gas prices remains broadly negative for three reasons.

The International Energy Agency (IEA) continues to assert that demand growth remains anaemic, thanks to China in particular. It argues demand will increase by less than one million barrels per day on average in 2024, a marked slowdown from the twomillion-plus pace seen post-pandemic in 2022 and 2023. OPEC has also just cut its demand growth forecasts for this year and next, although it is more optimistic than the IEA with a forecast of 1.4 million barrels per day for 2024 and 1.6 million barrels per day for 2025.

The IEA also argues supply is plentiful, even allowing for tensions in the Middle East and output disruptions in Libya thanks to the febrile political

situation there. OPEC+ continues to restrain capacity too, meaning there is scope for increased supply here. Meanwhile, American output continues to surge and stands near record highs of 13.2 million barrels per day, thanks to shale, so OPEC+ is not the only game in town.

Israel has promised not to target Iranian oil facilities in any attacks. The Kharg Island terminal is particularly important to the region as it ships 1.6 million barrels of oil per day or just under 1.5% of total global demand.

Overlaying of all of this is the long-term issue of the global transition toward more renewable sources of energy and away from hydrocarbons which should, in theory, dampen demand for oil in particular.

Central bankers, politicians and consumers will doubtless all be hoping the previous prognosis

proves correct and energy prices remain contained, as may environmental campaigners.

Only oil company executives and shareholders may be less pleased, and in the case of the latter they will note the S&P Global 1200 Energy sector is back down to just 3.8% of total S&P Global 1200 market capitalisation. Indeed, the energy sector’s entire market cap of $2.7 trillion is less than that of Apple (AAPL:NASDAQ), Nvidia (NVDA:NASDAQ) or Microsoft (MSFT:NASDAQ).

However, it could be unwise to write off oil just yet, also for three reasons.

Demand continues to grow – even if the IEA and OPEC expect less growth than before, the globe continues to rely heavily on hydrocarbons.

Even though we continue to consume more oil and gas, drilling activity remains subdued thanks to the pricing environment and the combination of political and public pressure. If demand does stay more robust for longer than expected, then supply may not be as adequate as we would like to hope.

The US Strategic Petroleum Reserve (SPR) is still diminished at 385 million barrels, way below its 714-million-barrel capacity, after the Biden administration’s liquidation of assets to try and cap fuel and gasoline prices for US consumers. At some stage it would make sense to top this back up, especially at a time when energy supply could be a matter of national security.

Moreover, the OVX index, which measures anticipated oil market volatility just as the VIX index does for stock markets, trades at 47, well above its historic average of 37. That suggests oil traders remain on a state of high alert, even if equity prices are not putting much, if anything, of a geopolitical premium on hydrocarbon prices. Let’s just hope this complacency doesn’t lead to shocks further down the road.

In recent US Presidential elections, healthcare has been a huge topic of debate, contributing to considerable volatility in the biotech sector, as investors have struggled to price in the implications of various proposed policy initiatives and election outcomes for share prices.

Although the industry appears to be playing a more subdued role in the current election campaign, it remains important for investors to understand how different outcomes may impact the biotech sector in the years to come. A study of recent history is valuable here, as is an analysis of current policy stances.

The Affordable Care Act (ACA), introduced by President Barack Obama in 2010, aimed to make healthcare more affordable and accessible. Often referred to as Obamacare, the ACA expanded Medicaid, created health insurance exchanges and introduced the individual mandate, which required most Americans to purchase health insurance or face a tax penalty, thereby balancing the cost of healthcare provision more fairly across society.

For the biotech sector specifically, debate around Obama’s plans for healthcare reform prompted some market nervousness, with fears that government intervention and increased regulation could lead to pricing pressure. Ultimately, however, the ACA has been a net positive for the sector, because it has expanded healthcare system coverage. Prescription drugs only accounted for around 9% of the US government spending on healthcare in 2021 with hospital care taking up the lion’s share. So, while pricing pressure may have been felt by larger pharmaceutical companies selling well established products, biotech innovation has continued to be rewarded, particularly where it reduces, expensive, hospitalisations and thereby lowers long-term healthcare costs.

Nevertheless, Obama’s efforts to democratise the US healthcare system laid the foundations for the industry becoming a key political battleground in subsequent elections.

Donald Trump’s election campaign in 2016 promised a swift reversal of Obama’s healthcare policies. Trump had repeatedly called the ACA a “disaster”, citing rising premiums and government overreach. His campaign included a promise to repeal and replace the ACA with a market-driven alternative, something he never achieved.

By contrast, Hillary Clinton’s healthcare rhetoric in the 2016 election was focused on expanding the ACA and lowering drug prices. While supportive of Obama’s reforms, Clinton’s calls for drug price controls created some market concern. In 2015, her tweet denouncing pharmaceutical companies for “price gouging” prompted significant volatility for biotech company share prices, albeit she was subsequently keen to make clear her continued support for biotech innovation. Nevertheless, uncertainty over who would prevail continued to weigh on sentiment towards the sector throughout the campaign.

Ultimately, Trump was unable to dismantle the ACA during his Presidency, but his administration did

successfully eliminate the tax penalties that helped to enforce the individual mandate. A combination of factors, including divisions within the Republican Party and strong public support for the broad principles of the ACA, thwarted full repeal efforts, emphasising how entrenched this important piece of US healthcare legislation had become.

In the 2020 election, healthcare remained a central issue, though it was reframed by the Covid pandemic. Donald Trump campaigned on deregulation, continuing efforts to dismantle the ACA and promoting competition to reduce drug prices. Joe Biden, by contrast, positioned healthcare at the heart of his platform, and his plan to navigate the crisis by expanding access to healthcare and ensuring effective vaccine distribution, resonated with voters that were concerned with both pandemic management and healthcare affordability.

Ultimately, Trump’s stance on dismantling the ACA and criticism over his pandemic handling contributed to his electoral defeat, especially in swing states where healthcare access was a key voter issue.

Biden went on to enact the single most important piece of US healthcare legislation of the last few decades within the broader Inflation Reduction Act. The Act introduced pricing negotiations on the sales to Medicare of an expanding number of the most profitable well-established drugs, effectively ringfencing drug pricing at the innovative end of the biotech industry from government interference. Although this legislation will only come into force in 2026, initially covering just 10 drugs with the highest revenues, such as treatments for diabetes and heart disease, it has effectively addressed the contentious issue of drug pricing, thereby possibly removing it

from the top of incoming politicians’ “to do lists”.

In 2024, healthcare does not appear to be the subject of quite so much contention as in previous election campaigns. That said, the industry remains important, with healthcare spending and regulation still featuring in the debate.

Indeed, a recent poll shows that healthcare remains a top issue among voters, with two-thirds of Americans believing it hasn’t yet received enough consideration during the current election campaign.

This election is a very close race, and we won’t attempt to pick an ultimate winner. From a market perspective, the political uncertainty is unlikely to help sentiment in the next few weeks, but when the outcome becomes clear, the biotech sector should be well-placed to return to favour with investors, irrespective of who wins.

If Kamala Harris wins, she is expected to continue to build on the Biden administration’s efforts. She supports expanding Medicare’s negotiation powers to cover a larger number of established drugs, which may put further pressure on larger pharmaceutical companies. However, she is also committed to promoting innovation and ensuring that biotech companies are still incentivised to develop new treatments.

If Trump wins, his administration is likely to emphasise deregulation and more market competition within the healthcare system. He has gone back on his earlier “Favoured Nation Model” proposal to tie drug pricing to the prices paid by other nations. Further efforts to dismantle the ACA look likely but should continue to be challenging to implement. Meanwhile, we expect continued support for innovation, and we could see policies

that look to lower regulatory barriers and accelerate drug approvals. These could be beneficial for biotech firms looking to bring new products to market more quickly.

Gridlock is a real possibility. A divided government, with one party controlling the Senate and the other controlling the House of Representatives, would likely preserve the status quo, with neither party able to pass significant legislation without compromise. This would mean a period of relative stability, allowing biotech firms to continue to focus on innovation without the threat of broader policy reform that could impact profitability or market access.

While healthcare has been a politically charged issue in past elections, so far, it appears to be less contentious in 2024, probably because the Inflation Reduction Act is seen as having largely addressed the thorny issue of drug pricing of the long standing established drugs. Regardless of whether Trump or Harris wins, we would argue that the outlook for biotechnology remains positive. Even though both candidates have voiced a desire to bring down medical inflation, total healthcare spending looks set to continue to rise, driven higher by patient demand, an aging population and the rising cost of medical services and innovation. Innovative drugs which play a role in keeping patients out of hospital are unlikely to be the target of government intervention as it is hospitals that account for the largest share of US healthcare spending.

Regulatory appointments may prove important.

Trump is likely to favour more market-friendly leaders at regulatory institutions such as the US Food and Drug Administration (FDA) and the Federal Trade Commission (FTC), prioritising deregulation and faster approvals. Harris may focus on consumer outcomes, making appointments that could lead to increased scrutiny on mergers and acquisitions (M&A) to ensure fair competition and consumer protection. However, neither approach is likely to stifle innovation, which remains a core, and overwhelmingly positive, element of the biotech investment case.

Indeed, biotech’s long-term success is underpinned by its role in public health and scientific advancement. There is an implicit understanding between the state and the biotech industry – governments rely on biotech innovation to address pressing healthcare challenges, while the industry benefits from supportive regulatory frameworks and funding, and investors who fund biotech’s drug development efforts benefit from the potential for attractive returns on investment. This mutually beneficial relationship means that governments will continue to incentivise the biotech industry, given the critical need for innovation that can ultimately reduce healthcare costs and improve patient outcomes.

In summary, political uncertainty may cause some temporary volatility for the biotech sector, but probably in a more muted way than in previous elections thanks to progress made on drug pricing legislation. The industry’s long-term fundamental drivers remain incredibly strong, and the biotech sector is positioned to thrive as innovation continues to be cherished and rewarded.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk

Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www.schroders.co.uk/investor or on request.

For help in understanding any terms used, please visit address www.schroders.com/en-gb/uk/ individual/glossary/