THE SEVEN DEADLY SINS OF INVESTING

THE BIG PITFALLS TO AVOID

Can the ‘Magnificent Seven’ continue to lead the market higher?

Can the ‘Magnificent Seven’ continue to lead the market higher?

At Scottish Oriental we believe in the power of Asian smaller companies in the world’s fastest-growing economies.

With careful selection and long-term investment, these hidden treasures can provide growth opportunities.

Quality smaller companies managed with integrity can help your investment grow into something bigger over time.

1

The seven deadly sins of investing and how to avoid committing them

As investors our biggest fault can often be our own biases and behaviour, in particular overconfidence, so here is a guide to how to put emotion to one side.

Can the ‘Magnificent Seven’ live up to expectations?

We preview the upcoming results from the US tech companies which have led the global stock market rally.

Did you know that we publish daily news stories on our website as bonus content? These articles do not appear in the magazine so make sure you keep abreast of market activities by visiting our website on a regular basis.

Over the past week we’ve written a variety of news stories online that do not appear in this magazine, including:

3

High-yielding investments trusts selling at big discounts

Over half of top-yielding UK trusts are trading at a sizeable discount to net assets – an income investor’s dream.

‘historic’ decision to

As Martin Gamble discusses in this issue, some businesses are awaiting the upcoming Budget on 30 October with real trepidation. However, an announcement from the Labour Government was cause for celebration with one smaller company when this author had the opportunity to meet with them in early October.

Flow battery technology firm Invinity Energy Systems (IES:AIM) has had a tough little spell due to delays with some projects hitting revenue projections – something of an occupational hazard for emerging businesses – but it sees reasons for real optimism on the back of recently announced support for long-duration energy storage.

Longspur Research analyst Adam Forsyth says: ‘The UK Government has confirmed it will support long-duration energy storage projects though a cap and floor revenue support model potentially with a soft cap. The electricity regulator, Ofgem, will run the programme.

‘Ofgem will need to collect further information before it can confirm details of the investment framework. A technical decision document will be published “this winter” with final decisions expected to allow Ofgem to open a scheme to applications in 2025.’

The belief is Invinity could benefit from this support in time. The company is focused on creating and selling flow batteries, which are designed to store energy for long periods. In this way they can provide a solution to the intermittent nature of renewable energies like wind and solar. Unlike traditional batteries which might degrade quickly, flow batteries use liquid electrolytes, in theory making them more durable and more efficient for large-scale energy storage.

Visiting the company’s recently-acquired new facility in Motherwell, its VS3 unit does resemble a simple shipping container. However, there’s a fair amount of intellectual property which goes into these units in the form of the cell stacks which sit

within it. These are developed in partnership with Gamesa Electric, a wholly owned subsidiary of Siemens Energy (ENR:ETR).

The cell stacks are put together at the company’s site in Bathgate and shifted across the Central Belt to Motherwell where the VS3 is assembled in a near-100-year-old facility which used to make bridges in the region’s industrial heyday. From there it is transported across the globe, with Invinity batteries currently in use in the UK, North America and Australia.

For the end user, the VS3 is designed to be fairly simple and rather than requiring significant setup on site, unlike other flow batteries, is more or less ready to be plugged in when it reaches the customer. The new Mistral product uses much of the same technology as VS3 but scaled up to allow it to be employed for larger projects, and includes refinements aimed at reducing costs including short-side access for maintenance and assembly. Its launch is expected before the end of the year.

The company is confident it can reach its target of being free cash flow positive by 2026 without having to come back to the market. Even if chief executive Jonathan Marren (who stepped up from chief finance officer in September) admits to Shares that having greater resources than the last reported £49 million of net cash would help it expand quicker. On a side note, this is more than the company’s current market valuation. I, for one, will be watching how this story develops with interest.

Vague detail on timelines and regulation leaves investors barely any wiser

The stock market was hungry for detail on Tesla’s (TSLA:NASDAQ) robotaxi launch timelines and regulatory roadblocks, but all it got was a slick film-set demonstration vague on vital information leaving investors barely any the wiser.

Elon Musk showcased Tesla’s ‘Cybercab’ during the company’s highly anticipated ‘We, Robot’ presentation (10 Oct), but investors were left underwhelmed and the stock plunged 9% post-event.

Cybercab is a fully autonomous car without a steering wheel or pedals, a wirelessly-charged (according to Musk) electric vehicle capable of moving people from point A to point B completely independent of a driver.

According to Musk, the Cybercab will be 10 to 20 times safer than ordinary cars and could cost as little as $0.20 to $0.30 per mile, far cheaper than the average $0.81 per mile it cost Americans to run a car in 2023, according to figures from the Financial Times.

Production, Musk promises, should begin between 2026 and 2027, although the Tesla chief executive has a history of over-egging delivery times.

In 2014, he promised Teslas would be capable of driving themselves within six years, and two years later he predicted a Tesla would drive itself from Los Angeles to New York without driver intervention within 12 months.

In May 2022, Musk claimed that achieving full autonomy was Tesla’s ‘number one priority’, while on the same earnings call admitting that full selfdriving ‘was one of the hardest problems ever’.

Little wonder there remains an army of sceptics. ‘Tesla is not a player in the robotaxi market because they are prohibited from running on public roads’, said Dan O’Dowd, founder of safety advocacy group The Dawn Project.

‘Tesla is limited to yawn-inducing demonstrations in Hollywood studios while its competitors’ robotaxis transport 100,000 paying customers around major

Tesla share price is down 46% since its $407 peak in 2021.

American cities every week.’

O’Dowd was referring to Google-owned Waymo, Alphabet’s (GOOG:NASDAQ) robotaxi service which already offers autonomous rides to ordinary people in San Francisco, Los Angeles, Phoenix and is launching services in Atlanta and Austin.

The massive robotaxi opportunity is to turn a vehicle from a one-time purchase driven 100,000 to 200,000 miles into a lifetime one-million-mile recurring revenue asset.

At the rough $1 per mile cost of public transport, it could turn a $30,000 Cybercab into a vehicle capable of producing $1 million in lifetime revenue. Whether that is a Tesla Cybercab or rival robotaxi remains a huge question.

Tesla shares have risen about 40% since announcing its robotaxi event, but they are still down 46% since their $407 peak in 2021.

Overall, the gambling industry tax rate is 37% if the Lottery and Horseracing levy are included

Investors have been braced for changes to online gambling regulations aimed at leveling the playing field between land-based operators and online, but very few were expecting the UK Treasury to raid the whole sector to help the government fund its budget deficit.

Share prices fell across the board on Monday (14 Oct) following a report by The Guardian that Rachel Reeves was considering proposals to double taxes levied on parts of the sector to raise between £900 million and £3 billion.

The industry is likely to push back, warning of the economic damage to the sector which claims to support 110,000 jobs.

‘The betting industry will argue higher taxes could lead to an increase in illegal black-market gambling and ultimately firms may well pass on any extra costs they incur to punters, potentially doing more harm’, commented AJ Bell investment director Russ Mould.

The scale of the share-price falls suggests investors do not believe tax increases will be anything like the scale the report suggests.

Analysts at Berenberg have crunched the numbers and believe the most likely scenario is an increase in remote gaming duty to 25% from 21% and a 10% increase in remote betting duty to 25%.

Assuming the changes come in from 1 January 2025, the implied impact to EPS (earnings per share) would be most negative for 888-owner Evoke (EVOK) whose earnings could halve.

Ladbrokes owner Entain (ENT) could see a 19% drop in earnings, while Paddy Power operator Flutter (FLTR) is the relative winner with a projected 12% hit to earnings.

The most draconian scenarios would push the UK businesses of Entain and Evoke into losses while Flutter’s UK profit could halve, reducing the government’s tax take, say

the analysts.

The timeline for implementing the changes is unclear but it is worth noting adjustments to gambling taxes can be made via secondary legislation, avoiding the need to get a new law passed by parliament.

This would make any changes at the 30 October budget more likely to be implemented, according to Berenberg.

Paul Leyland, partner at gambling consultancy Regulus Partners, argues the industry can afford to pay higher taxes, but to work effectively they can only be genuine ‘tweaks’, raising possibly another £300 million, and certainly ‘not anywhere close’ to one billion pounds.

Leyland concludes: ‘A damaging and self-defeating tax raid cannot be ruled out, especially given the Labour donor connection, but there are reasons why the Treasury has not been so reckless before and we doubt they will be so reckless this time.’ [MG]

Disclaimer: Financial services company

AJ Bell referenced in the article owns Shares magazine. The author (Martin Gamble) and the editor (Ian Conway) own shares in AJ Bell.

JPMorgan and Wells Fargo earnings top forecasts while BlackRock sees record inflows

stocks hit fresh all-time highs last week after the thirdquarter earnings season started with a bang, with both JPMorgan Chase (JPM:NYSE) and Wells Fargo (WFC:NYSE) beating consensus profit forecasts.

Heavy buying of both stocks helped push the KBW Banking Index up over 3%, with JPMorgan shares gaining 4.4% to $222.29 and Wells Fargo shares climbing 5.6% to $60.99.

JPMorgan reported total revenue of $42.65 billion against $39.87 billion in the same quarter a year ago and the consensus of $41.38 billion.

As well as buoyant investment banking revenue, the market was surprised by the resilience of net interest income given the firm had previously warned analysts not to expect a strong performance.

Earnings per share (EPS) came in at $4.37, up from $4.33 a year earlier and well ahead of the $3.98 consensus, although provisions for loan losses more than doubled due to a rise in credit card borrowing.

On the conference call, chief finance officer Jeremy Barnum once again sought to play down expectations, saying the bank’s results ‘will be somewhat challenged as normalisation continues’ over the next couple of quarters.

Barnum also commented that the bank’s earnings performance year-to-date was ‘consistent with the soft-landing narrative’.

Over at Wells Fargo, total revenue for the quarter was lower than last year and slightly below forecasts at $20.37 billion, but EPS, although lower than last year, was comfortably ahead of expectations at $1.42.

and strong customer inflows.

Assets rose 8% during the third quarter driven by $160 billion of long-term flows into low-cost ETFs (exchange-traded funds) and index products, but investors also poured more than $60 billion into cash management products.

Also helping to lift the market to new highs was money manager BlackRock (BLK:NYSE), whose shares gained 3.6% to $990 after the company revealed its AUM (assets under management) had swollen to $11.5 trillion thanks to rising markets

The group’s quarterly revenue and operating income both set new records, up 15% and 26% year-over-year respectively, while its operating margin rose 350 basis points (3.5%) to 45.8%, also a new record.

On a conference call with analysts, BlackRock founder and chief executive Larry Fink said the opportunities ahead of the firm ‘have never been better’, adding he expected momentum ‘to further build to year’s end and into 2025’.

Fink also observed many investors have large cash holdings, with money market industry assets hitting new records in the quarter, including BlackRock’s own cash position, and predicted investors would ‘have to re-risk to meet their long-term return needs’, suggesting the market rally could continue. [IC]

Shares in N Brown (BWNG:AIM) have enjoyed a bounce since early summer, taking year-to-date gains to the best part of 60% as investors applaud progress against CEO Steve Johnson’s multi-year transformation plan.

The turnaround of the Manchester-headquartered online clothing and homewares seller is all the more impressive considering a soft trading backdrop and 2024’s unseasonal weather.

N Brown whose fashion brands include JD Williams, headline sponsor for ITV (ITV) dating reality show My Mum, Your Dad and whose new brand ambassador is Gok Wan, returned to profit for the

year to February 2024.

The company, which also owns fashion brands Simply Be and Jacamo, built on this achievement with encouraging results (10 October) for the half to August 2024. These revealed a surge in adjusted pre-tax profits from £100,000 to £3.6 million driven by cost efficiencies, a stronger focus on ‘profitable trade’ and a lower interest bill, with net debt down almost 20% to £211.6 million.

While first-half revenue decreased by 6.7% to £277.2 million, with product and financial services revenue going backwards, management flagged an improving sales trend through the half and into

Active fund manager hit by economic and political uncertainty ahead of Budget

Shares in Liontrust (LIO) fell more than 7% to 486p in a week as the fund manager reported net outflows of £1.1 billion for the three months ending 30 September.

The company’s shares hit a 52week low on 11 October with AuMA (assets under management and advice) falling 4% to £26 billion.

Liontrust CEO John Ions blamed political and economic uncertainty around the new Labour government for the recent outflows.

Alexander Bowers, analyst at

the third quarter, giving N Brown the confidence to leave its full year 2025 outlook unchanged.

‘We are not letting ourselves become carried away though,’ commented house broker Shore Capital. ‘There is more to do and deliver, but this update allows us to be as encouraged about N Brown’s equity thesis as we have been for some years.’ [JC]

Berenberg thinks the short-term flows are ‘challenging to predict’ and expects the business to remain ‘in net outflows in the second half’.

The company will hope conditions improve when uncertainty around changes to taxation are resolved when the Budget is announced on 30 October.

Berenberg believes that ‘it is well

positioned when investor sentiment returns to the UK equity market, with the potential of declining base rates acting as a tailwind.

‘We expect the company to target a low-to-mid-30% adjusted pre-tax profit margin (we forecast a full year 2025 adjusted operating margin of 32%).’ [SG]

FULL-YEAR RESULTS

21 Oct: Tristel

INTERIMS

24 Oct: Bloomsbury Publishing, HarbourVest Global Private Equity, W.A.G. Payment Solutions

TRADING

ANNOUNCEMENTS

21 Oct: Ros Agro

22 Oct:

Intercontinental Hotels Group, Petra Diamonds

23 Oct: Barratt Redrow, Fresnillo, Lloyds Banking Group, Reckitt Benckiser, WPP

24 Oct: Anglo American, Barclays, Dunelm, Hunting, Inchcape, London Stock Exchange Group, RELX, Renishaw, Softcat, Unilever

Attention is likely to centre on the top line and the cost ratio

Despite the strong market reaction to results from the US banks last week, we can’t see investors getting quite so excited when the UK’s biggest financial institutions unveil their latest earnings over the coming weeks.

As usual, the country’s largest mortgage lender Lloyds Banking Group (LLOY) gets proceedings under way with its third-quarter trading update on Wednesday 23 October.

Although it posted a better-thanexpected pre-tax profit at the halfyear stage, shares in Lloyds sank on the report due to a fall in net interest income and a higher cost of deposits as savers sought out better rates.

Therefore, we suspect the focus is once again likely to be on the top line and the net interest margin – the

spread it makes on loans minus the cost of deposits – rather than the bottom line.

At the half-year stage, the net interest margin was down 24 basis points or 0.24% from the previous year to 2.94%, while this time a year ago the margin was 3.08% and the bank has set a full-year target of more than 2.90%, so anything starting with a three for the third quarter would be positive.

Another disappointing feature of the half-year results was the unexpected surge in the cost-to-income ratio, which determines the direction of earnings, from 48.8% to 57.1%, which the bank blamed on increased investment, higher severance costs and inflation.

A year ago, this ratio was just under 50% (49.5%) and chief executive Charlie Nunn has said he wants to get it back to that level by 2026 so progress on reining in costs will be key.

Given the economy looks to be in reasonable shape, as shown by August’s positive GDP (gross domestic product) figure, investors’ big bug-bear – bad loans – shouldn’t be an issue for now, but as always comments on how customers are behaving will be read with interest. [IC]

Given the rapturous response last week to results from two of Wall Street’s biggest banks and the growing feeling the US economy is on track for a ‘soft landing’, it should be no surprise shares in leading creditcard provider American Express (AXP:NYSE) are trading at all-time highs ahead of its third-quarter results on 18 October.

Revenue for the three months to September are expected to be up around 8% to $16.65 billion, while EPS (earnings per share) are seen more or less flat at $3.27, although the group has surprised positively in three of the last four quarters and raised its guidance last time round, so statistically speaking Friday’s results should be a shoe-in.

We suspect there is likely to be just as much interest in the firm’s comments on the health of the US consumer as there is in the actual numbers – in other words, the quality rather than the quantity of the report.

At the half-year stage, the group noted a slight slowdown in some categories of travel and entertainment such as airlines and hotels, but

restaurants – one of its biggest businesses – remained strong.

By customer, its premium subscriber base continued to show steady growth in the first half, while interestingly US ‘millennial’ and ‘GenZ’ customers grew their spending by 13% driving the highest billed business within the travel and entertainment segment.

Moreover, according to chief finance officer Christophe Le Caillec, these younger card members show strong engagement with the brand, transacting over 25% more on average than older customers, and in some categories like dining, transacting almost twice as much.

‘While we are not in a high-growth spend environment, particularly in the US, our spending volumes are tracking in line with our expectations and support our revenue expectations for the year,’ said Le Caillec. [IC]

FULL-YEAR RESULTS

18 Oct: Ally Financial, American Express, Procter & Gamble, Schlumberger

22 Oct: Alphabet, Baker Hughes, CoStar, Danaher, FreeportMcMoRan, General Motors, Kimberly-Clark, Lockheed Martin, Moody’s, Philip Morris, Texas Instruments, Verizon

23 Oct: AT&T, Boeing, Boston Scientific, Coca-Cola, General Dynamics, Hilton Worldwide, NextEra Energy, Tesla, Thermo Fisher Scientific, United Rentals

UK investors have plenty of reasons to be cheerful right now as the macro data all seems to be pointing towards a gentle glide path for the economy into Christmas and the New Year.

Last week we had a positive surprise courtesy of the August GDP (gross domestic product) print, which showed economic activity turned positive over the summer.

As PwC chief economist Barret Kupelian commented, the economy ‘reached cruising speed north of 1% year-on-year in August with all sectors of the economy growing’.

This came on the back of some sluggishness in previous months, but ‘we expect the positive

momentum to continue given some of the tailwinds we see’ added Kupelian.

There was good news for the Bank of England too, as wage momentum slowed in the three months to August – private sector regular pay growth, the bank’s preferred measure, slowed to 4.8%, well below last summer’s peak and heading towards the 3% to 3.5% range the bank sees as consistent with its 2% inflation target.

Talking of which, September’s consumer price index came in at an annual rate of 1.7%, below target and below expectations, thanks to lower energy costs and a sharp drop in service sector inflation.

All of which ought to give the Monetary Policy Committee the confidence to cut interest rates by another 0.25% in November, so the thinking goes.

Talking of rate cuts, the European Central Bank meets today (17 October) with the market already pricing in a 0.25% cut due to lower growth and lower inflation with downside risks to the eurozone economy if it doesn’t act.

The bank has already downgraded its estimates for real GDP growth across the zone, and inflation across the four main economies of France, Germany, Italy and Spain is well below its 2% target. [IC]

We think the sell-off in shares of 4imprint (FOUR) since the direct marketer of promotional products released its first-half trading update in August presents a good opportunity to buy into a high-growth, cash-generative business at an attractive price.

The firm is one of the leading players in the $25 billion-a-year North American promotional market, which is highly fragmented and ripe for consolidation.

Its ability to deliver was evident in the first half, when the firm increased its revenue by 5% against tough comps (it posted 23% growth in the prior-year period) and a challenging market and increased its market share to 6.3% from 5% at the end of 2023.

With US corporate earnings booming and confidence improving as rate cuts feed through into the economy, we believe the opportunities for 4Imprint to grow its business and its earnings over the next few years are there for the taking (analysts at Panmure Liberum see potential for the firm’s market share to reach 10%).

Outside North America, the firm does a small

amount of selling in the UK and Ireland (less than 2% of group revenue) although with a total addressable market of $1 billion per year there is plenty of upside should the opportunity arise.

For the six months to June, the company managed to increase customer numbers, increase order volumes and increase its average order value, which was no mean feat.

As chairman Paul Moody admitted, revenue growth was harder to achieve than in previous years but the firm continued to outperform the rest of the industry and by doing so gained market share.

It also managed to increase its operating margin by 50 basis points or 0.5% to 10.5% thanks to carefully-targeted price rises, management of supplier cost rises and a more flexible marketing mix, so earnings per share increased by 11% and the dividend was hiked by 23% as a reward for shareholders.

Moody forecast a similar level of sales growth for the second half, but said once the firm has managed its way through the current market conditions there were ‘attractive prospects for significant further organic growth over the medium term’.

One of the big attractions of 4imprint’s business as an investor is it is highly cash-generative, with consistent negative working capital requirements.

*PBT and EPS (fully diluted) are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. **Excluding special dividends.

Shares

Edison

The firm sells a wide range of promotional products like branded bags, pens and stationery to companies in North America, but rather than manufacturing the goods it sells, it outsources the work to third parties which means it has limited capital needs.

As well as stationery, the company has branched out with outdoor brand ‘Crossland’ which produces fleece jackets, beanie hats, vacuum mugs, backpacks and coolers, and its ‘Refresh’ line focuses on affordable water bottles, tumblers and travel mugs.

Where the firm spends money is on marketing, including advertising on tv, and it maintained that spend in the first half with the result that revenue per marketing dollar slipped to $7.64 from $8.22 in 2023, but we consider this an investment in the brand.

At the end of June, the company had net cash and short-term deposits of $121.5 million, up from $104.5 million at end of 2023.

With limited investment needs, the firm raised the interim dividend, and given its exceptionallystrong balance sheet we would not be surprised if at some point there could be additional returns to shareholders, either in the form of a special dividend or a buyback.

The sell-off in the shares since the first-half results means they are up around 12% year-to-date, significantly less than the S&P 500 index which is up 23% and has just registered its 46th new high

of 2024.

We conservatively estimate 4imprint has grown its earnings at around a 17% compound annual rate from the start of the 2000s up to 2020, and despite an obvious drop-off due to the pandemic and a pause in promotional activity, earnings have bounced back with a vengeance to sit considerably above their previous trend.

Consensus forecasts for this year and next year suggest that far from reverting to their old trend, earnings are on a new, higher plane, which means the shares look cheaper than they have done in a long while.

Add in the fact the firm is almost completely exposed to the US market - where public valuations are much higher than they are in the UK - and is highly cash-generative with a rock-solid balance sheet offering the potential for enhanced shareholder returns, and the shares begin to look like something of a gift at the current price.

It’s also worth noting that with a market cap of less than £1.5 billion ($1.8 billion) and a free float of more than 98%, with no major controlling shareholder, the business has to be on the radar of private equity investors, who are currently sitting on record amounts of ‘dry powder’.

The obvious risk to the investment case is if one of the other major players, for example Amazon (AMZN:NASDAQ), decides to start a turf war, but we suspect they are much more likely to buy 4Imprint to build market share rather than cut their own margins for the same outcome. [SG]

This high-quality global fund focuses on leaders and innovators with superior long-term growth potential

Market cap: £241.2 million

Falling inflation and a rate cutting cycle mean better times are ahead for Martin Currie Global Portfolio Trust (MNP), a collection of high-quality growth companies with strong cash flows and robust balance sheets managed by Zehrid Osmani.

Higher rates have whipped up headwinds for the long-duration growth stocks favoured by Osmani, a former Paris Saint-Germain Academy footballer with a proven record of successful stock picking during periods when the market’s focus is on company fundamentals over macroeconomic fluctuations.

The £241 million cap fund offers exposure to leaders and innovators at the forefront of multidecade themes including AI (artificial intelligence), the rise of electric vehicles and the growth of the emerging market middle class.

Due to the board’s zero discount policy, Martin Currie Global Portfolio’s discount to NAV (net asset

A collection of high-quality growth companies with strong cash flows and robust balance sheets”

of 30 September 2024)

value) is modest at 2.6%, albeit slightly wider than the 12-month average, so don’t expect a massive re-rating.

Rather, investors should back Osmani’s ability to grow the NAV over time by selecting long-term winners, supported by the deep fundamental company and industry research he conducts with his team.

One of the smaller trusts in the Association of Investment Companies’ (AIC) Global sector, Martin Currie Global Portfolio’s NAV total return of 4.4% for the six months to 31 July 2024 lagged the MSCI

All Country World index’s 11.5% haul.

Only holding Microsoft (MSFT:NASDAQ) and Nvidia (NVDA:NASDAQ) of the ‘Magnificent Seven’ stocks which make up some 20% of the benchmark proved detrimental to performance.

Higher rates and the market rotation away from quality growth towards value have left the trust’s 10-year share price total return of 165.6% lagging the sector’s 246% and the returns delivered by the likes of Scottish Mortgage (SMT), Manchester & London (MNL) and Brunner (BUT).

Yet Shares sees the recent performance as a bump in the road, given Martin Currie Global Portfolio Trust has generated returns ahead of its benchmark since launch a quarter of a century ago and headwinds to Osmani’s quality growth style are abating.

Falling borrowing costs should boost the fund’s 31-company strong portfolio of high-quality, longduration assets, and we are reassured by Osmani’s focus on companies with resilient earnings, pricing power, solid balance sheets and exposure to structural growth prospects.

Another tick in the box is the manager’s valuation discipline, reflected in a significant underweight exposure to the frothy-looking US market and an overweight to Europe, where Osmani sees ‘more valuation support’.

‘Whilst we realise the weak short-term relative performance will be disappointing to our shareholders’, wrote Osmani at the half-year results in October, ‘we remain confident that the exposures we have in the company are enabling us to harness attractive structural growth opportunities across themes which we favour.’

The fund bundles eight mid-term themes into three broad areas: energy transition, ageing population and artificial intelligence. Osmani tells Shares AI is ‘an opportunity that remains underestimated by the market, both in terms of its potential and the speed at which it is going to be taken up’, a bullish view expressed through the likes of Microsoft and semiconductor holdings including Nvidia, with shares in the latter testing all-time highs at the time of writing.

Health care, the

(as of 30 September 2024)

An opportunity that remains underestimated by the market, both in terms of its potential and the speed at which it is going to be taken up”

trust’s second largest sector exposure at last count, includes names such as Sartorius Stedim (DIM:EPA), a provider of innovative equipment for the pharmaceutical and biotechnology industries, as well as Wegovy weight-loss drug maker Novo Nordisk (NOVO-B:CPH), bought earlier this year on share price weakness and after Osmani had revised its obesity addressable market potential ‘quite sizeably up’.

Other exciting top 10 positions include luxury supercar maker Ferrari (RACE:NYSE), Swedish industrial star turn Atlas Copco (STO:ATCO-A) and Moncler (MONC:BIT), the Italian luxury fashion brand backed by industry leviathan LVMH (MC:EPA).

Another key holding is French personal care powerhouse L’Oreal (OR:EPA), currently outperforming its US counterpart Estee Lauder (EL:NYSE). The trust has a reasonable ongoing charge of 0.64% and there is no performance fee to complicate cost considerations for investors. [JC]

Stimulus hopes are rapidly meeting reality and a 30% gain is worth booking

HSBC MSCI China (HMCH) 546.5p

Gain to date: 30.4%

We flagged this exchange-traded fund back in January noting how out of favour the China was and how this was a low-cost way of gaining exposure to big Chinese stocks.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

For a while, very little. The ETF (and the MSCI China index it tracks) eked out some modest gains in the spring before the Chinese equity story lost momentum again. However, the promise of major stimulus from Beijing, as it looks to hit its 5% annual GDP growth target, proved a major catalyst in late September.

Measures announced included a lending pool to help fund managers, insurers and brokers buy more stock and initiate share buybacks as well as moves to stimulate a struggling Chinese property market.

Meanwhile, in mid-October the finance ministry pledged to ‘significantly increase’ debt to boost the economy and announced proposals to help stoke consumer demand.

While some of the initial excitement has faded, we are still up more than 30% on our initial entry point.

WHAT SHOULD INVESTORS DO NOW?

We think they should book this profit. The stimulus announcements haven’t stood up that well to closer examination, with analysts at investment bank Jefferies noting: ‘As stimulus hopes meet the reality, companies with the worst channel health face more risks. The recent market rally thus looks increasingly unjustifiable.’

We would agree and also believe that any exposure to China should be tactical rather than long term. We see significant geopolitical risks in the future and would also note China faces substantial demographic challenges which are more akin to those faced in the West than other emerging economies. A legacy of its longstanding one-child policy which means achieving material economic growth could be a major challenge.

For those who continue to want Chinese exposure this remains a perfectly good product, but for the reasons detailed above it is not one we would recommend buying at this point. [TS]

Can the ‘Magnificent Seven’ continue to lead the market higher?

The US third-quarter earnings season is already upon us and with it earnings from the biggest drivers of the stock market rally this year, the so-called ‘Magnificent Seven’.

Given the consensus forecast for S&P 500 earnings growth for 2024 is 15%, and with Technology and Communication Services expected to contribute over one third of the earnings from

the index, there is quite a lot riding on a successful reporting season for this handful of stocks.

ALPHABET UNDER SCRUTINY

As well as being the first to report on 22 October, Alphabet (GOOG:NASDAQ) finds itself in the unenviable position of being on the wrong end of a government anti-monopoly crusade and an attempt to break up Google.

Normally the company would be expected to shoot the lights out with its earnings report but this

time round it almost feels as though it’s ‘damned if it does, damned if it doesn’t’.

For the quarter to 30 June, the company posted revenue of $84.7 billion, an increase of 14%, and EPS (earnings per share) of $1.89 against $1.44 last year, a 31% increase.

For the quarter to 31 September, the market is forecasting revenue of $86.3 billion against $76.7

billion last year and EPS of $1.83 against $1.55, an 18% increase.

Software giant Microsoft (MSFT:NASDAQ) reports the same day as Alphabet, and after record bookings and strong demand for cloud services last quarter expectations will be for more of the same.

For the three months to 30 June, the firm reported revenue of $64.7 billion, an increase of 15%, and EPS of $2.95, up 10% on the previous year.

For the most recent quarter, analysts are predicting revenue of $64.6 billion, an increase of 14%, and EPS of $3.10, up just 3.7% on last year when earnings jumped 27% driven by the cloud business.

Next to report, on 23 October, is electric vehiclemaker Tesla (TSLA:NASDAQ), which disappointed with its recent delivery data and has seen its market share in China drop from 9% to 6.5% as

local rivals like BYD (1211:HKG) capitalise on the shift in demand away from pure EVs (electric vehicles) towards hybrids.

In the quarter to the end of June, the firm reported a 9% drop in car sales in dollar terms but a slight rise in total revenue to $25.5 billion thanks to a bump in energy generation and storage and service fees.

For the three months to September, analysts are forecasting total revenue of $25.5 billion against $23.4 billion last year and basic EPS of $0.59 against $0.58 last year.

The following day, web services provider to retail behemoth Amazon (AMZN:NASDAQ) reports earnings, with some analysts warning its costly spend on AI (artificial intelligence) and space investments is hindering margin progress.

For the last couple of quarters investors have sucked up disappointing revenues on the basis operating margins would continue to grow driven by cloud computing and advertising, but that may no longer be the case.

For the quarter to June, Amazon posted a 10% net sales increase to $148 billion and EPS of $1.26: for the quarter to September, the consensus is calling for sales of $157 billion against $143 billion last year, and EPS of $1.13 against $0.94.

The end of the month sees updates from Meta Platforms (META:NASDAQ) and Apple (AAPL:NASDAQ), on 30 October and 31 October respectively.

When founder and chief executive Mark Zuckerberg presented the firm’s results for the second quarter, he claimed Meta AI was ‘on track to be the most-used AI assistant in the world by the end of the year’ so investors will rightly be looking for him to back that up with the numbers.

For the three months to the end of June, Meta posted revenue of $39 billion and diluted EPS of $5.16: for the most recent quarter, the consensus is $40.1 billion and $5.19, a considerable step up from $34.1 billion and $4.39 last year.

Tim Cook, Apple CEO, was equally ebullient when he presented the firm’s results for the June quarter, citing record revenue of $85.8 billion and ‘incredible updates’ to the firm’s software platforms including Apple Intelligence for iPhones,

iPads

and Macs.

However, channel checks have shown demand for the new iPhone 16 to be weaker than predicted in China leading to broker downgrades coming into these earnings.

Analysts are forecasting revenue of $94.5 billion and diluted EPS of $1.59 for the three months to September compared with $89.5 billion and $1.46 in the same period a year ago.

That just leaves chipmaker Nvidia (NVDA:NASDAQ), which doesn’t report until 14 November but which may be the most significant ‘Magnificent Seven’ member of all.

Contract producer TSMC (2330:TPE), which makes chips for Apple and Nvidia, recently revealed third-quarter sales were way above market expectations, with September alone up around 40% on last year, which suggests Nvidia’s revenue and EPS will at least meet if not beat the $32.9 billion and $0.74 consensus.

If Nvidia’s general manager of enterprise platforms Bob Pette is to be believed, the world is at the dawn of a new industrial revolution in terms of ‘accelerated computing’, in part due to the groundbreaking energy efficiency of the firm’s Blackwell processors.

By Ian Conway Deputy Editor

Marcus Phayre-Mudge, fund manager, TR Property Investment Trust

Tax changes, more demanding energy efficiency standards, and higher mortgage rates are piling the pressure on the UK’s landlords, with the buy-to-let market losing its lustre as an attractive wealthbuilding strategy.

For aspirant real estate investors, listed property companies offer a strong alternative. These companies provide access to the leveraged returns and regular income that many individual landlords seek, but with the added advantages of liquidity and a lower barrier to entry.

At TR Property Investment Trust, we aim to make it easy for investors to own the best of Europe’s listed landlords and developers via a single investment. Private investors are recognising this and now make up more than a fifth of our share register. Our investment universe spans over £167 billion in market capitalisation, covering a wide range of sectors like industrial, office, residential, retail, self-storage, healthcare, data centres and student accommodation. But not all property companies are created equal, so careful selection is essential.

Many listed property companies are effectively largescale landlords. They own, develop, and manage portfolios of commercial and residential properties, offering exposure to the underlying real estate markets. As with all leveraged asset classes, the property sector faced challenges during the rise in interest rates. However, market cycles over the past 30 years have shown that property equities typically rebound strongly once rates peak. We are already witnessing this trend, with the total return from TR Property’s share price, including dividends, reaching 32.9 per cent in the year to 30 September.

While a more benign rate environment is welcome, TR Property’s strategy does not solely depend on it. The companies we invest in have moderate debt levels, but even more crucially, they operate in sectors where tenant demand remains robust and supply is constrained—factors that create favourable conditions for rental growth and position companies to prosper

Risk disclaimer

even if rates remain elevated.

The uptick in merger and acquisition (M&A) activity within the listed property sector highlights the inherent value in many property companies. Large private equity firms are acquiring listed property companies at premiums, recognising that public markets are currently undervaluing their assets, with M&A being a key contributor to TR Property’s outperformance for shareholders this past year.

While open-ended property funds (PAIFs) are restructuring or winding down, closed-ended investment trusts remain well-suited for long-term property investments. Shares in TR Property trade on the London Stock Exchange, and unlike open-ended funds, we do not create new shares to meet investor demand. This structure allows us to hold long-term positions without being forced to sell assets to return cash to investors. This long-term focus is crucial, as real estate is a cyclical asset class. By managing our portfolio through market fluctuations, we capture value over time.

Listed property companies continue to trade at significant discounts to their asset value, making it a good time to buy quality real estate companies at bargain prices. But sorting through what ‘quality’ looks like is time and expertise intensive – especially in an environment where so much attention must be paid to debt levels.

TR Property Investment Trust offers a simple way to access a diversified portfolio of UK and European property companies, providing broad, balanced exposure to the sector. With TR Property itself trading at a modest discount, new investors can benefit from a “double discount” that has the potential to unwind as interest rates ease. For those looking for a liquid, income-generating investment backed by tangible assets, investing in listed landlords through TR Property is an appealing option.

Your capital is at risk. TR Property Investment Trust PLC is an investment trust and its Ordinary Shares are traded on the main market of the London Stock Exchange. English language copies of the key information document (KID) can be obtained from Columbia Threadneedle Investments, Cannon Place, 78 Cannon Street, London EC4N 6A. Email: inv.trusts@ columbiathreadneedle.com or electronically at www.columbiathreadneedle.com. Please read before taking any investment decision. The information provided in the marketing material does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell or otherwise transact in the Funds. The manager has the right to terminate the arrangements made for marketing. Financial promotions are issued for marketing and information purposes; in the United Kingdom by Columbia Threadneedle Management Limited, which is authorised and regulated by the Financial Conduct Authority, approved as at 09/10/2024.

More than half of equity-focused investment trusts offering a 4.5%-plus yield trade on double-digit discounts

Acentral bank interest rate cutting cycle is well underway, the Federal Reserve having slashed US rates by 50 basis points and further cuts expected from the Bank of England following August’s 25 basis point reduction. Falling rates mean lower rates on cash and bonds, so this seems like a sensible time for investors searching for long-term income and capital growth to review their portfolios.

Helpfully, The Association of Investment Companies (AIC) recently published (2 October) a comprehensive list of the 26 investment trusts that invest in equities and offer a yield of at least 4.5%. Nearly all of these trusts, 23 out of 26 to be precise, currently trade at a discount to NAV (net asset value), while over half (15) sell on a double-digit discount to their underlying assets.

A total of 18 trusts yield 5% or more, while a further eight offer yields of between 4.5% and 5%. Of the aforementioned 26 trusts, the highest yielding is Henderson Far East Income (HFEL), whose bumper 10.3% yield is clearly welcomed by investors given that the shares trade at a 2.4% NAV premium. Managed by Janus Henderson Investors’ Sat Duhra, the fund aims to provide a growing annual dividend and capital appreciation from a diversified book of high quality, Asia-Pacific-based firms, with top 10 holdings including from world’s biggest memory chips and smartphone maker Samsung Electronics (005930:KS) and the globe’s largest contract chip manufacturer TSMC (TSM:NYSE). Henderson Far East Income is one of the AIC’s ‘next generation’ dividend heroes - trusts that have increased the dividend for 10 or more years in a row but fewer than the 20 required for ‘dividend hero’ status - having hiked the shareholder reward for 16 consecutive years, and the board has an increased willingness to dip into the trust’s revenue reserves to support future payments. Duhra has reduced the trust’s exposure to China, which drove

underperformance in full year 2023, and increased positions in well-priced value names in populous India and Indonesia.

Also trading at a premium, and offering a plump 7.4% yield, is Chelverton UK Dividend Trust (SDV), which has outperformed Henderson Far East Income on a 10-year share price total return basis, having generated 85.4% versus the latter’s 50.5% haul. Steered by David Horner and Oliver Knott, Chelverton UK Dividend aims to deliver a high and growing income by investing in mid and small caps outside the FTSE 100 and returned to a position where the dividend is being paid entirely from the current year revenue surplus after costs. In the future, the board plans to increase dividends by a level in excess of prevailing inflation and use any surplus to replenish the trust’s revenue reserves.

Almost a quarter (six) of the highest yielding investment trusts are fully fledged AIC dividend heroes with at least 20 years of unbroken dividend growth under their belts. They include the popular City of London (CTY), the UK Equity Income sector stalwart offering a gateway to large international companies with a strong long-run performance record. City of London has achieved 58 years of consecutive dividend hikes, the longest streak amongst the dividend heroes, and upped its year-

Table: Shares magazine • Source: AIC/Morningstar (to 27 September 2024)

to-June 2024 payout by 2.5% to 20.6p, ahead of UK CPI (consumer price index) inflation, while revenue reserves increased by 5.8% to 9.4p, leaving City of London well-placed to extend its formidable dividend growth record.

Also with more than half a century of dividend increases to its name is JPMorgan Claverhouse

(JCH), on 51 years of undisturbed payout growth, while the Simon Gergel-managed Merchants (MRCH) has notched up over four decades of unbroken dividend growth. Sue Noffke-steered Schroder Income Growth Fund (SCF) and the Manny Pohl-managed Athelney Trust (ATY) sit on 29 years and 21 years respectively.

But the highest yielding dividend hero is abrdn Equity Income Trust (AEI), which offers an attractive 7.2% yield and a dividend which it has upped for 23 years on the spin. While manager Thomas Moore has been finding a number of attractive opportunities across the undervalued UK stock market of late, NAV performance has lagged the FTSE All-Share index over the past five years, with factors such as a greater allocation to midcaps than peers at play.

While 11 of the 26 trusts yielding at least 4.5% emanate from the AIC’s UK Equity Income sector, there are two trusts from each of the following sectors - UK Smaller Companies (Marwyn Value Investors (MVI), Athelney), Flexible Investment (UIL (UTL) and CT Global Managed Portfolio Income (CMPI), and Asia Pacific Equity Income (Henderson Far East Income and abrdn Asian Income Fund (AAIF)).

Income seekers can also gain exposure to highyielding trusts targeting other key regions of the

globe. BlackRock Latin American (BRLA) offers an optically attractive 7.1% yield, but this reflects a poor 10-year share price total return of 16.3% delivered in what remains a volatile region, while European Assets (EAT) offers a play on the earnings and dividend growth potential of continental small caps. Trading on a 5.3% yield is abrdn Asian Income Fund, which offers a diversified entrée into the compelling dividend story emerging in Asia. Also meriting mention is Middlefield Canadian Income (MCT), an AIC North America sector constituent trading on a double-digit NAV discount with an attractive 4.5% yield. Focused on generating high income from great Canadian businesses, rate cuts by the US Fed and the Bank of Canada should create a tailwind for the Canadian dividend-paying companies targeted by managers Dean Orrico and Rob Lauzon.

By James Crux Funds and Investment Trusts Editor

TBy Martin Gamble Education Editor

here is a huge body of academic work highlighting behavioural biases which consistently trip-up investors’ supposedly rational thinking. In this article we look at seven big sins of investing, with some examples and insights on how to avoid them.

A lot of the credit for these principles goes to Daniel Kahneman and Amos Tversky who collaborated in the 1960s to research apparent anomalies and contradictions in human behaviour.

Behavioural finance specialist James Montier compiled a list of the most common mistakes today’s investors make in a seminal piece of work when employed by Dresdner Kleinwort in 2005. This feature draws on Montier’s work to provide you with some ideas about how to improve your investment performance.

SIN ONE PRIDE

Sixth century poet Lao Tzu wisely observed: ‘Those who have knowledge, don’t predict. Those who predict don’t have knowledge.’

Forecasting sits at the heart of many investment processes in the professional money management world, whether it involves forecasting ‘top down’ economic growth or ‘bottom-up’ company specific earnings.

There is nothing intrinsically wrong with attempting to forecast the future. That is, if the forecaster has a realistic view of his or her chances of being accurate. The problem is the odds are wildly stacked against forecasters. There is overwhelming evidence supporting the idea

that humans are very poor forecasters.

This would not be such an issue if people recognised they were not very good. Unfortunately, this is not the case and overconfidence compounds the problem. Studies have shown that the worst forecasters tend to be those who are most overconfident.

These people are too sure about their ability to predict. They are described by statisticians as ‘not well calibrated’. Psychologists have devised simple tests for this. Imagine you were asked several difficult questions such as how old Martin Luther King was when he died, the diameter of the moon in miles and the weight of an empty Boeing 747 in pounds.

Your task is to provide a low and high answer to each question which captures the actual answer. For example, you might guess 25 years to 50 years for the death of Martin Luther King (the answer is 39 years of age).

In one study of 1,000 participants who were asked 10 questions, fewer than 10 people gave nine correct answers and most respondents were in the four to seven range.

The main point here is that people who are well calibrated recognise what they do not know and adjust their guesses accordingly to make sure they capture the answer. The good news for retail investors is studies have shown that so-called experts in many fields, including professional money managers, tend to be more overconfident than lay people.

The bottom line is, there is a lot of evidence suggesting peoples’ opinions of their skills and abilities are at best moderately correlated with

After leaving Invesco in 2013 and setting up his own asset manager Woodford Investment Management, Woodford increasingly pursued a more growth-focused approach which involved picking smaller and in some cases unquoted businesses which he perceived as having significant growth potential.

In doing so he moved away from what had made him so successful at his previous employer Invesco Perpetual, namely buying mainly large cap stocks whose income potential had been undervalued by the market.

actual performance. A good way of dealing with these biases is to take analysts’ forecasts with a pinch of salt. If your chosen investment approach involves gazing into the future, it is wise to handicap your expectations to match your knowledge and degree of uncertainty. As investor Warren Buffet says: ‘I try to be roughly right rather than precisely wrong.’

Information is more widely available today than ever before. There is a popular notion that having access to more information than anyone else is the key to outperformance, but sadly information is not the same thing as knowledge.

Studies have shown that less is more when it comes to information. Humans do not deal with information overload very well due to cognitive constraints. Another difficulty is related to the idea that once an investment decision has been made, new information merely increases confidence in the original decision rather than improving overall accuracy.

In other words, what you do with new information is far more important than how much of it you get. In the excellent book SuperForecasting by Philip Tetlock and Dan Gardner, the authors find that the best forecasters deal with new information in a balanced, iterative way.

One of his big calls was buying big tobacco stocks in the early 1990s when others were fearful aggressive US authorities would drive them out of business. He subsequently benefited from significant capital gains and a steady flow of dividends.

By early 2019 nearly 20% of his eponymous Equity Income Fund was in companies which were not listed on a recognised stock market with ultimately disastrous consequences for the fund and its investors.

This is a learned skill honed by practice and requires the forecaster to be humble, cautious, and open-minded. These are the opposite traits of overconfident people. Another common bias in dealing with lots of information is investors tend to seek out confirmatory information supporting their investment thesis and ignore or downplay information undermining that thesis.

The psychological challenges of dealing with huge amounts of information can be mitigated to some extent by developing a mindset which focuses on what really matters and ignoring the noise. This involves thinking more like a long-term owner of a business rather than getting distracted by short-term share price volatility. It takes time and effort to figure out the key drivers of a business, but it can pay dividends in the long run.

Retail investors do not get the same level of access to senior management teams as fund managers, but this could be a good thing according to Montier.

Given the primary reason for visiting companies is to collect more information, this activity suffers from the same psychological challenges just discussed. It should also be remembered that companies are not allowed to discuss information not already in the public domain.

Overconfidence is not in short supply when it comes to company managements. For example, a Duke University chief financial officers study showed that corporate managers are always more optimistic about the outlook for their company than the economy at large.

Montier believes meetings between fund managers and companies can turn into ‘loveins’ rather than constructive debates. Another challenge which comes into play with meeting managements is that people are poor at spotting deception. Company visits can be useful for getting a better understanding of how a business works, but if you are searching for an informational edge, you might be disappointed.

From a retail investor point of view, it is still worth engaging with opportunities to hear direct

from management teams but it is always worth listening to their messaging with a healthy dose of scepticism.

One study shows that 75% of investment managers believe they are better than average. This shouldn’t be surprising given the earlier discussion on overconfidence. The reality is few fund managers beat the market averages over the long term.

Even the very best managers suffer long periods of underperformance. Terry Smith’s Fundsmith Equity (B41YBW7) is a case in point, trailing its benchmark over the last three and five years.

Longer term the fund has a superior track record, delivering a 15% annualised return since inception versus 11.8% for its benchmark.

The evidence suggests a period of underperformance is the price investors must pay for achieving long term success. This means investors might be better off focusing on achieving their long-term investment goals, within the parameters of their individual risk appetite, rather than worrying how other investors are performing.

In his original paper Montier introduces the idea of a beauty contest to represent how fund management works. The goal is not to pick the prettiest person but to choose who you think will receive the most votes.

It comes from economist John Maynard Keynes who said: ‘We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.’

This brings the discussion to overtrading. Montier highlights that average holding periods at US mutual funds has fallen from over a decade in the 1950s to under five years today. Speculating on the short-term direction of the market or a

Research from BlackRock shows if you missed just the five best days on the S&P 500 between 31 December 2003 and 31 December 2023 you would have reduced the size of your final pot from an initial $10,000 investment from $63,637 to $40,193.

Missing the best 10 days more than halved the hypothetical return and missing 25 days left you with just $14,093. This shows the merits of staying invested rather than seeking to trade in and out of the market during periods of volatility.

$50,000

Stocks are represented by the S&P 500 Index, an unmanaged index that is generally considered representative of the U.S. stock market. Past performance does not guarantee future results. It is not possible to invest directly in an index

Chart: Shares magazine • Source: BlackRock, Bloomberg as of 12/31/2023

particular stock is not a sensible strategy for most investors, bar a few professionals who can make it successful.

Timing the market is virtually impossible and is far less important than time in the market. Compounding works best when it is allowed time to do its magic.

Montier recalls a conversation with a colleague who said, ‘stockbrokers exist to sell dreams,’ to which Montier later added, ‘but they deliver nightmares’. Financial academics naively assume investors gather evidence, weigh up the risks, then make a rational investment decision, but that is not how things work in practice.

The reality, explains Montier, is that investors collect evidence, usually in a biased fashion, then construct a story to explain the evidence. This

story, not the original evidence, is then used to reach an investment decision.

Humans are innately very good story tellers. We have a need to make sense of the world and often see phantom connections. The same instincts which make us good story tellers can also get us into trouble when it comes to investing.

Stories may make sense in hindsight but on refection they are usually simplistic and fail to convey the complexity of underlying reality.

Author and statistician Nassim Taleb calls this the ‘narrative fallacy’ in his book The Black Swan.

Daniel Kahneman explains it as follows: ‘Flawed stories of the past shape our views of the world and our expectations for the future. Narrative fallacies arise inevitably from our continuous attempt to make sense of the world.’

When you add confirmation bias to the equation, whereby we tend to look for supporting evidence and ignore contradictory information, it is easy to see how our expectations are often upended.

A defence against our weakness for a good story is to apply more scepticism and check the

Excitement about the potential for online groceries play Ocado (OCDO) to sell its so-called Ocado Smart Platform – an out-of-the-box solution for global supermarkets – took the stock to an all-time high market valuation of more than £21 billion in early 2021. The excitement was stoked by the pandemic and the almost overnight switch towards lots more people

underlying facts, while reflecting on the logic being purported. Stories which sound too good to be true invariably are.

Readers who participate in share clubs or collaborate with friends in making investment decisions are also subject to behavioural biases. You might expect a higher quality, more insightful decision from a group compared to individuals. Studies show this is not the case.

There is a tendency to conform rather than explore different views, and groups are at risk of suffering polarization and, in the extreme, groupthink.

These conclusions run counter to the idea of the wisdom of crowds, popularised by the book of the same name by James Surowiecki, so what is going on?

It transpires that under specific conditions, groups do outperform. For example, in one study

buying their weekly shop on the web. To put the peak valuation into perspective, the company’s total revenue was around £2.3 billion in the 12 months to 30 November 2020 and it chalked up a pre-tax loss of £44 million. While it has secured some agreements with big global retail brands, those losses have only increased, reaching £154 million in the six months to 2 June 2024. For all the excitement, Ocado is yet to build a tangible business generating profit and cash flow.

Chart: Shares magazine • Source: LSEG

comprising a group of 56 students who were asked to guess how many beans were in a jar containing 850 beans, they guessed 871, a better guess than almost all group members.

The ‘wisdom’ comes partly from the effect of outlying guesses cancelling each other out and the fact that each person’s guess is independently made without influence from other members of the group. When people get together, they tend to amplify rather than cancel out individual biases and extreme views. In reaching a consensus, variance is reduced.

The desire to find a consensus means the discussion tends to centre on information available to all group members which reduces the chances of uncovering anything new. Social pressure can also prohibit the sharing of information by people who do not want to look stupid in front of colleagues.

What can be done to defend against these biases? Secret ballots can remove some of the worst effects. Playing the role of ‘Devil’s Advocate’ is an effective way of discussing contrarian views and exploring non-consensus views. Finally, when group members are acknowledged to be experts, disparate viewpoints are easier to deal with and it is easier for unshared information to come to light.

Companies repurchasing shares may be positive in general but that’s not always the case on an individual basis

As tobacco firm Imperial Brands (IMB) announced its latest share buyback, there was an extraordinary, albeit logical, observation from broker Panmure Liberum.

Analyst Rae Maile noted that, if it continued at its current pace, the company stood a good chance of buying back all of its shares within a decade.

‘Since October 2022, the company has bought back 106 million shares at an average price of £19.20, with the annualised dividend saving more than £160 million per annum and rising,’ Maile explained.

‘Repurchases to date have retired 11.2% of the opening share count, or put another way, in two years Imperial has bought more shares than are owned by all but one of its institutional shareholders.

‘As we have said before, share repurchases are not only excellent financial sense at a PE (price to earnings) ratio of seven times but also the right stock market strategy when so many traditional

There are two main ways a company can return cash to shareholders, either through dividends (regular or one-off) or buybacks. Typically, once a firm has purchased its own shares, they are cancelled, reducing the number of shares in issue. The advantages of buybacks versus dividends are they can be more tax-efficient for shareholders, assuming they would prefer to pay tax on a capital gain than the income from dividends; by reducing the amount of shares in issue, the remaining shares are eligible for a higher dividend in the future (assuming one is paid); and they imply the management team of a company, rightly or wrongly, believes the shares are undervalued.

shareholders have been beset by outflows.’

The company unveiled its latest £1.25 billion buyback programme (to complete no later than 29 October 2025) alongside its trading update on 8 October, and there has been a clear trend for UK companies to buy back an increasing amount of their own shares in recent times.

In June this year, Morgan Stanley observed that 50% of companies in the 77-strong MSCI UK index had bought back shares in the previous 12 months. Members of the FTSE 100 returned £58.2 billion to their shareholders through buybacks in 2022 and £52.6 billion in 2023 and are on track for another bumper year this year with £49.9 billion worth of buybacks already declared by the end of the third quarter.

Ian Lance, co-manager of income-focused investment trust Temple Bar (TMPL), observed earlier this year that buybacks, along with M&A, were one of the key catalysts to unlocking the value on offer from UK stocks.

Lance identifies four key reasons why a company would buy back shares rather than pay a dividend:

• Dividends are sticky as companies are loath to cut them, whereas buybacks are not;

• Dividends return cash to all shareholders,

buybacks only to those who choose to sell;

• Dividends and buybacks may have different tax consequences since they are treated as income and capital gains, respectively;

• Buybacks affect the share count, dividends do not.

The latter point, as Lance observes, means the amount of earnings attributable to each individual shares goes up. He also notes the cheap cost of debt had been a driver of buybacks over the decade leading up to 2021 when rates started to go up.

Lance adds: ‘The idea that executives could buy back shares only when they are trading below intrinsic value is fine in theory but more complicated

• A buyback which is part of a sensible capital allocation hierarchy

• Financed from free cash flow rather than debt

• Buying back stock which is demonstrably very undervalued

in practice, as it relies on first, CEOs knowing how much their business is worth, and second, on them being able to control their emotions.

‘We continue to believe most UK companies are doing the right thing by buying back their own undervalued stock using excess cashflow, but share buybacks must be judged as part of a hierarchy of capital allocation and therefore cannot always be assumed to be positive.’

• Buying back expensive stock

• Buying back stock while at the same time issuing stock to employees

• Using debt to buy back expensive stock when the company is already financially vulnerable

Charles Luke, Investment Manager, Murray Income Trust PLC

• The UK market is seen as offering more for dividend or value investors than for growth investors

• Yet UK companies are exposed to a number of key areas of structural growth in the global economy and that should provide comfort for long term earnings and dividend growth potential

• Murray Income looks at four themes: digitisation, the energy transition, the ageing population and growing global wealth

It has become a familiar refrain that the UK market lacks options for growth investors. Investors tend to turn to it for dividends, or for a naturally defensive tilt in a downturn, but the prevailing wisdom is that growth investors need to explore the stock markets of Asia or the US to access the most exciting themes in the global economy.

Part of the reason the UK has picked up this reputation is that the concept of growth in financial markets has become increasingly narrow. Investors have equated growth initially with technology, then with Artificial Intelligence (AI), and then with an increasingly narrow segment of the AI industry – those companies involved with building out AI infrastructure.

On this definition, the UK cannot compete. It does not have semiconductor companies, cloud computing groups, or AI pioneers. Its listed technology is tiny, limited to a handful of smaller companies, and it has no Silicon Valley-style ecosystem

pumping out the technology giants of the future.

However, that is not the same as saying it has no skin in the game on digitisation. The UK has companies that could harness AI to turn their proprietary data into strong, usable insights for their customers. These are companies such as Experian, Relx or the London Stock Exchange. At a time when investors are wondering ‘what next’ for AI, these companies can legitimately claim to be the next wave of beneficiaries.

The digital transformation theme is one of four key growth themes in the Murray Income portfolio. The other themes are less explored by investors in the current AI-focused environment but may prove equally as powerful in the longer term.

The ageing population, for example, is a multi-year trend across many Western economies. Populations are becoming top-heavy, increasing the strain on healthcare systems and the public purse. Some of the beneficiaries are clear: the pharmaceutical sector is operating against a backdrop of increasing demand for medicines, for example. The pharmaceutical companies we hold in the portfolio – AstraZeneca, GSK and Novo Nordisk – all have drugs that address major healthcare needs such as cancer treatment, vaccine development and obesity care.

We also hold Convatec, which specialises in chronic care. This is an unglamorous but crucial area of healthcare. The company has four divisions: wound care, infusion care (supplying the cannulas for diabetes pumps), continence care and

ostomy care.

Haleon is slightly different. There is still a gap between life expectancy and healthy life expectancy, which will need to be addressed to reduce the strain of ageing populations on public healthcare systems. It has areas such as vitamins, specialist toothpaste, pain relief and indigestion relief. In particular, the group sells Centrum Silver, one of the very few vitamins with clinical trials proving that they work to improve cognitive ability and bone strength in people over 50.

The UK remains at the forefront of the energy transition. The incoming government has made clean energy a priority, which creates a supportive environment for companies in the energy sector. Great British Energy aims to accelerate investment in renewable energy, and offshore wind in particular.

National Grid is a vital cog in the transition to renewable energy. It should benefit from investment in transmission and distribution, but also from renewed support for decarbonisation. It began the ‘Great Grid Upgrade’ in May, adapting the UK’s transmission and distribution infrastructure to meet the growing demand for electricity. National Grid estimates that electricity consumption in the UK will increase by approximately 50% by 2036 and more than double by 2050, placing increasing pressure on the grid.

The distribution of energy generation will also change as renewable energy sources come on stream, with electricity generated by wind farms needing to move to the areas of greatest demand, particularly the UK’s major cities. This will require significant infrastructure development. Overall, the asset bases of National Grid and SSE will increase significantly.

There are other important businesses involved in the transition. Genuit, for example, has a range of products that helps homes become more energy efficient. That includes underfloor heating, recyclable plastic pipes and ventilation products. It is likely to see growing demand as efficient homes become a priority for government.

While the UK’s economic performance has been lacklustre, there are pockets of growth across the world. There are emerging, fast-growing consumer economies in Asia and Latin America for example. UK companies are tapped into the potential of these markets. These might include Unilever and Diageo, who are selling powerful brands to growing consumer markets around the world. 58% of Unilever’s business is now in emerging markets. These will be key beneficiaries of growing global wealth, and we see an attractive pipeline of growth.

AI infrastructure is by no means the only growth theme in the global

Risk factors you should consider prior to investing:

• The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

• Past performance is not a guide to future results.

• Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

• The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

• The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

• The Company may charge expenses to capital which may erode the capital value of the investment.

• Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

• There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

economy. And after a strong run for the technology giants, it may be past its prime anyway. These areas of growth have been overlooked in the race for AI, and as a result, their valuations are often more attractive. Investors do not risk a Nvidia situation, where the market greets a 122% rise in revenue with a shrug because expectations are so high. In many cases, investors have not yet spotted the potential for many of these companies.

The UK does have growth. It just doesn’t have the type of growth that markets have wanted. We believe this could change as investors recognise that they don’t have to pay high prices to tap into supportive long-term themes in the global economy.

• As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

• Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

• Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Issued by abrdn Fund Managers Limited, registered in England and Wales (740118) at 280 Bishopsgate, London EC2M 4AG, authorised and regulated by the Financial Conduct Authority in the UK.

Find out more at www.murray-income.co.uk or by registering for updates. You can also follow us on social media: Facebook, X and LinkedIn

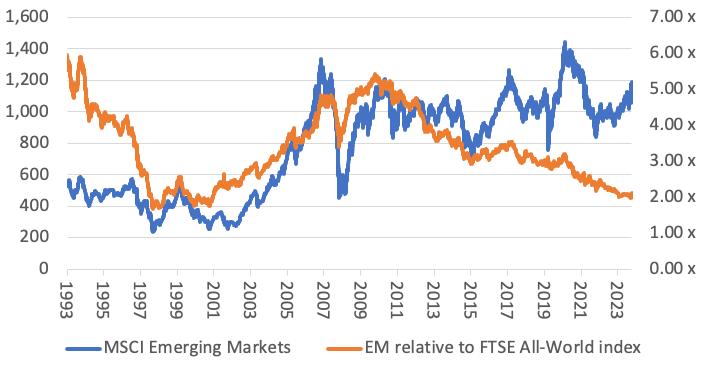

Is it time for emerging markets to pop higher?

The potential catalysts for stocks in the developing world to rally