The investment world likes to complicate everything. Our Managed Fund likes to keep it really simple. It’s made up of equities, bonds and cash, and we think to generate great returns, that’s all you need. The result is a balanced portfolio with low turnover and low fees. Beautifully straightforward, it’s been answering questions since 1987.

Please remember that changing stock market conditions and currency exchange rates will affect the value of the investment in the fund and any income from it. Investors may not get back the amount invested.

Find out more by watching our film at bailliegifford.com

Baillie Gifford & Co Limited is the Authorised Corporate Director of the Baillie Gifford ICVCs. Baillie Gifford & Co Limited is wholly owned by Baillie Gifford & Co. Both companies are authorised and regulated by the Financial Conduct Authority. Actual Investors•

•

•

•

•

•

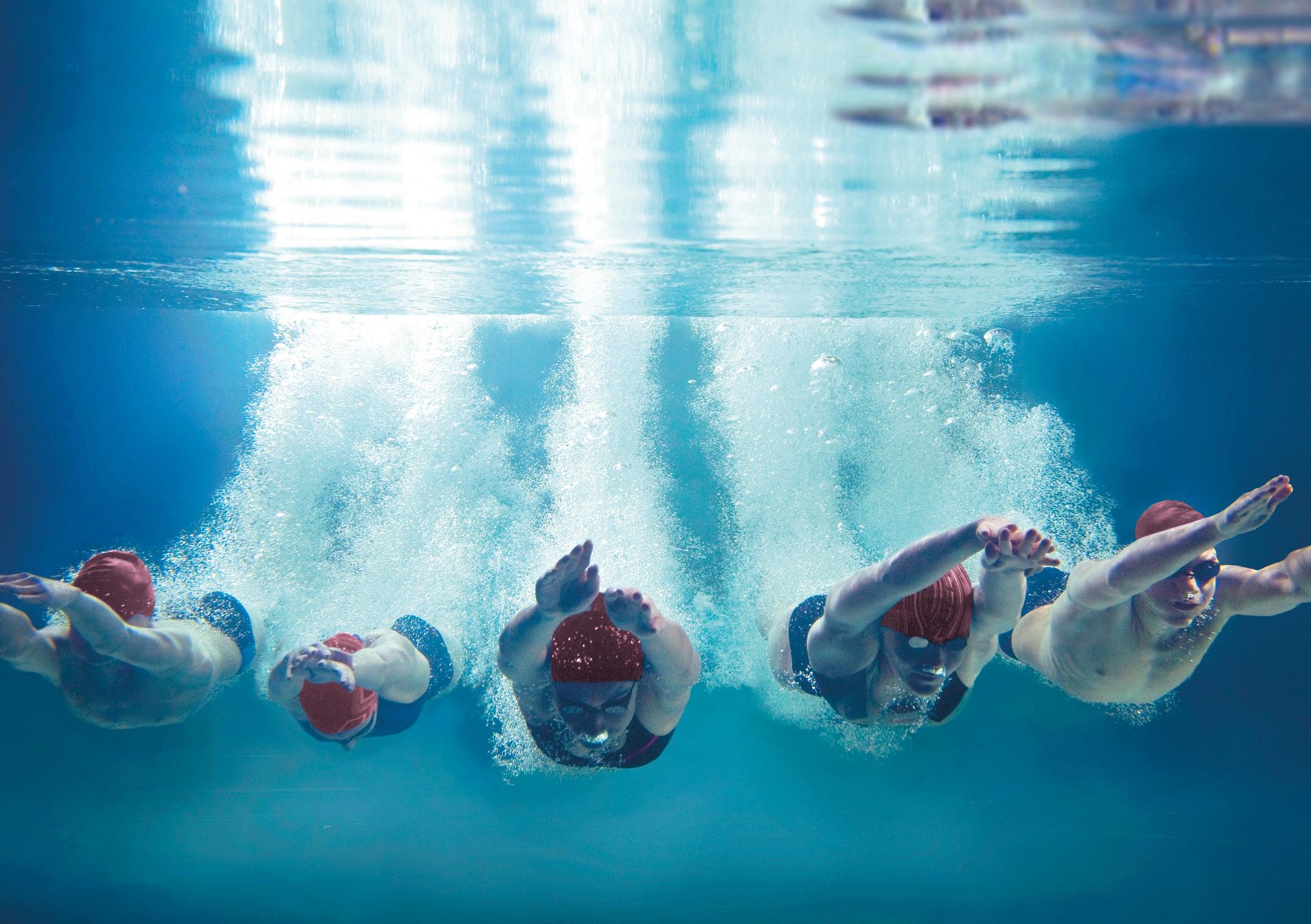

Trulyglobalandaward-winning,therangeissupported byexpertportfoliomanagers,regionalresearchteamsand on-the-groundprofessionalswithlocalconnections.

With400investmentprofessionalsacrosstheglobe,webelieve thisgivesusstrongerinsightsacrossthemarketsinwhichweinvest. Thisiskeyinhelpingeachtrustidentifylocaltrendsandinvestwith theconvictionneededtogeneratelong-termoutperformance.

Pastperformanceisnotareliableindicatoroffuturereturns. Thevalueofinvestmentscangodownaswellasupandyoumay notgetbacktheamountyouinvested.Overseasinvestmentsare subjecttocurrencyfluctuations.Thesharesintheinvestmenttrusts arelistedontheLondonStockExchangeandtheirpriceisaffected bysupplyanddemand.

Theinvestmenttrustscangainadditionalexposuretothemarket, knownasgearing,potentiallyincreasingvolatility.Someofthetrusts investmoreheavilythanothersinsmallercompanies,whichcan carryahigherriskbecausetheirsharepricesmaybemorevolatile thanthoseoflargercompaniesandtheirsecuritiesareoftenless liquid.

Theinvestmenttrustsusefinancialderivativeinstrumentsfor investmentpurposes,whichmayexposethemtoahigherdegreeof riskandcancauseinvestmentstoexperiencelargerthanaverage pricefluctuations.Someofthetrustsinvestinemergingmarkets whichcanbemorevolatilethanothermoredevelopedmarkets.

Tofindoutmore,scantheQRcode,goto fidelity.co.uk/itsorspeaktoyouradviser.

Management teams often talk the talk about streamlining a business but find it much tougher to walk the walk.

Just look at Royal Mail’s owner International Distributions Services (IDS) which for years has struggled to achieve the efficiencies it has promised thanks to a toxic relationship with its workforce.

The combination of weak parcel volumes and an inability to push through productivity improvements while in negotiations with the Communications Workers Union pushed the postal business into a £219 million loss for the six months to 25 September compared with a £235 million profit in the prior year.

This is among the most egregious examples but there are plenty of firms which have seemingly plucked figures out of the air when it comes to cutting costs. The risk is that short-term savings hit operational performance and a company loses important skills and capacity which subsequently must be added back at an even greater cost.

It was therefore refreshing to witness the latest investor day (17 November) from US consumer goods firm Procter & Gamble (PG:NYSE). The $341 billion cap has demonstrably delivered on the promises it made to shareholders back in 2018.

The company behind brands such as Head & Shoulders, Olay and Pampers has reduced the number of manufacturing sites by 20%, manufacturing platforms by 50% and its overall headcount by 30% once you factor in businesses it has sold off.

Procter & Gamble has moved to scale back external advertising, public relations and spending with other outside agencies, office buildings by 65% and its research and development centres by 30%.

It looks like the company has continued to perform through this period too with average

organic sales growth of 6% (3% on a volume basis) and core earnings per share growth of 12% at constant currency.

Procter & Gamble has also been able to reward shareholders handsomely – with $65 billion doled out over the four-year period in dividends and share buybacks. The shares have achieved a total return of more than 70% over the last four years.

Recent third quarter results were strong and as Berenberg analyst Fulvio Cazzol observed: ‘Management’s guidance continues to reflect higher elasticity and the company’s ability to defend share.’ In other words, despite pushing through higher prices, consumers are still willing to buy its products.

The company has reiterated targets of organic sales to grow ahead of the market, core earnings per share growth of mid-to-high single digits and a ratio of free cash flow to earnings of at least 90%. This focus on cash flow is encouraging – it suggests a business which is serious about performing rather than manipulating earnings to give the appearance of strong performance.

Killik’s senior equity analyst Andrew Duncan says: ‘Since its last investor day in 2018, P&G has delivered on its productivity plans, whilst investing back into the business to drive sales and earnings growth above the market.

‘Looking further out, we believe P&G can continue to outperform its peer group in terms of organic sales and earnings growth over the medium and long term, supported by a superior product offering and ongoing improvements in its supply chain.’

By Tom Sieber Deputy EditorShareholders in UK banks won’t need reminding of their sudden loss of income during the pandemic after the regulator put a stop to dividend payments.

With the country now forecast to go into recession and gloomy forecasts of up to a 30% drop in the housing market, could we be facing a similar situation in a year’s time?

The recent results from the big high street lenders were generally robust, as rising interest rates allowed them to grow their net interest margins without taking on undue risk.

While provisions for bad loans are rising, they are still well below the levels seen in previous downturns so the question is are shareholders being lulled into a false sense of security?

There was little to worry investors in the latest results from Virgin Money (VMUK), which saw strong growth in loans and deposits and raised its share buyback and final dividend.

In total, shareholder distributions for the year to September are set to reach £267 million or an impressive 57% of the bank’s earnings.

The message from chief executive David Duffy was that credit quality was ‘solid’ with low and stable arrears, and while some customers may struggle in the coming months the bank expected defaults to rise to no more than 0.3% to 0.35% of its loan book over the next year.

The company also said it would aim to pay out 30% of earnings next year and buy back up to £50 million of its shares, prompting a sharp jump in the stock price.

Analysts at Shore Capital predicted a round of earnings upgrades, describing the bank’s guidance for profits and dividends together with its return on capital target as ‘making a mockery’ of its current valuation.

Not everyone is so sanguine about the outlook,

Company

Natwest

6.2% Lloyds 5.9% Barclays 5.7% Virgin Money 4.7%

however, even big investors in the sector.

Alex Wright, manager of Fidelity Special Values (FSV), told Shares he had added to his banking holdings during the market volatility caused by the September ‘mini-Budget’ as the rising interest rate environment had made them more resilient to a recession.

However, Wright sees the banks having to raise their loan-loss provisions during a recession either of their own accord or under the Bank of England’s regular stress tests.

In the case of NatWest (NWG), for example, if there were a severe downturn which caused a 5% fall in GDP, a 20% fall in house prices and a 7% to 8% unemployment rate, the bank’s earnings would likely halve and therefore dividends could do the same, although Wright sees little chance of them being cut to zero altogether. [IC]

Frenzied trading in dating app is reminiscent of the meme stock volatility seen during lockdown

To say that 2022 has been a trickier for companies looking to list on the London stock exchange would be an understatement.

According to consultants KPMG a total of 11 firms listed in the first half of 2022 raising just £0.5 billion which is a whopping 95% down on the £9.9 billion raised in the first half of 2021.

But it’s not just a UK problem. US IPOs (initial public offerings) are down 91% and Europe has seen its IPOs shrink 88% year-on-year as macroeconomic headwinds bite into investor confidence.

Data compiled by Shares shows how the enthusiasm for IPOs has dwindled since the start of 2022. In January there were more than 15 potential listings and as we write there are just three. Many of the mooted new listings this year have failed to join the market.

One such company which originally intended to float in October is now making another attempt under a new name. AT85 Global MidMarket Infrastructure Income Trust is targeting investments in mid-market infrastructure assets which are adjacent to the core infrastructure markets.

The company is looking to purchase assets in the three key areas of transport & logistics infrastructure, utility-related infrastructure and digital infrastructure.

It has assets of £98.5 million and a total pipeline of £539.8 million while the company is aiming to issue 300 million shares at 100p per share.

The company has appointed Astatine Investment Partners as investment manager which has

delivered a net internal rate of return of 18.1% between February 2014 and June 2022 following the same strategy.

Shares in LGBTQ (Lesbian, gay, bisexual, trans, queer) focused dating and social network app company Grindr (GRND:NYSE) more than doubled after making their debut (18 November) on the New York stock exchange.

The shares began trading at $16.90 and surged as much as 323% to $71.51 before closing at $36.50. Trading in the shares were halted 15 times due to huge volatility which saw 2.7 million shares change hands.

The shares came to the market after merging with SPAC (special purpose acquisition company) Tiga Acquisition Corporation.

Grindr is joining the market after a turbulent few month for fellow dating app shares with Tinder owner Match Group (MTCH:NASDAQ) dropping 65% and Bumble (BMBL:NASDAQ) falling 32% year-to-date.

Grindr said first-half revenues grew 42% to $90 million while adjusted EBITDA (earnings before interest, taxes, depreciation, and amortisation) increased 26%.

The company is pinning it hopes on a unique business model which has a high brand awareness. This allows it to keep advertising spending to just 1% of revenue. The app has around 11 million active monthly users. [MG]

Aresurgence of Covid in China has put a spanner in the works for the big Asia reopening story. Many investors had bid up Asian stocks and Asia-focused funds and investment trusts in recent weeks in anticipation of the Chinese government taking a softer approach to dealing with the coronavirus.

There had been reports of a March 2023 exit plan which could see the introduction of a less stringent policy, with China having already relaxed several Covid measures for international travellers earlier in November.

Greater freedom for people to move around China would benefit multiple industries, hence why Hong Kong’s Hang Seng index jumped 25% in

value between 31 October and 15 November.

News that China had suffered its first coronavirus death in six months caused the Hang Seng to retreat more than 3% over two trading days (21-22 November).

What happens in China matters a lot to the global commodities market as the country is such a big importer of oil, gas, coal and metals. It is also a key market for many luxury goods companies who sell products to consumers in this country. [DC]

previous quarter and the slowest rate on record for the business.

Net income fell from $340.3 million to $48.4 million on a yearon-year basis and the company trimmed its revenue guidance for the year to 31 January 2023, blaming the stronger dollar.

Zoom Video Communications (ZM:NASDAQ) may have beaten expectations with its quarterly earnings (21 November) but investors focused on weak revenue guidance instead.

Zoom is one of those pandemic winners which has struggled as the world has moved to a new normality. This is reflected in a current share price of a little more than $80 compared with a 2020 peak closer to $600.

Growth is drying up and this, plus a wider shift by investors out of fast growth stocks as interest rates go up, has resulted in a significant equity derating, with the shares now trading on a little more than 20 times earnings.

Revenue in the three months to 31 October was up 5% year-on-year, down from a 8% growth rate in the

Zoom has been hit both by increased competition as larger and better-resourced rival Microsoft (MSFT) has pumped investment into its Teams platform.

The removal of Covid restrictions means many of the meetings which were happening on a screen are now occurring in person again.

Citigroup analyst Tyler Radke commented: ‘Despite some modest revenue upside, the leading indicators suggested signs of incremental deterioration.’ [TS]

ELECTRONICS RETAILER CURRYS’ (CURY) share price has managed a meaningful rebound in recent months. This implies the market is becoming more optimistic about the outlook and that a lot of bad news has already been factored into the share price.

Investors will get some insight when the company announces its first-half results on 15 December, which should include comments on its showing during Black Friday and Cyber Monday as well as how wider festive trading is going.

This is followed on 18 January 2023 by a trading update covering the Christmas period as a whole. Investors last heard from the company when it announced full year results on 7 July. These showed revenue down 2% to £10.12 billion. Store sales were up 24% but this was offset by a 29% decline in online sales.

Currys benefited from people buying laptops and other electronic goods during the pandemic but recent pressures on consumer spending and the fact that much

SHARES IN HILTON Food (HFG) hover near five-year lows at 546p and are down more than 50% year-to-date after a second profit warning (8 November) in as many months.

This has left a sour taste with investors mindful of the adage that profit warnings come in threes. In its latest earnings alert, the meat, seafood and vegetarian foods packer warned its UK seafood business will deliver a softer performance than initially expected.

While Hilton has made

‘good progress’ in either mitigating or passing through ‘unprecedented’ cost inflation to retailers, slower progress renegotiating pricing with customers, at a time when consumers are feeling the pinch, means full year operating profit will be below expectations.

Shore Capital cut its year-toDecember 2022 pre-tax profit estimate by 14% to £54.5 million and downgraded its earnings forecasts for 2023 and 2024.

The house broker knows that ‘a management team with

of this earlier spend is unlikely to be repeated in the near term have clouded the outlook for the company.

However, Liberum analyst Wayne Brown observes that net cash averaged £290 million in the 12-month period to 30 April 2022. He adds: ‘Currys has transformed over the past few years, but there remains a significant recovery and growth opportunity.’ [TS]

Currys

skin in the game will be hurting’, adding that ‘management has delivered considerable value to shareholders and it knows it needs to reassure to rebuild’.

In the first warning (15 September), Hilton Food stated that annual profits would fall short of expectations due to cost pressures on consumers, soaring seafood raw material prices, rising interest rates and start-up costs. [JC]

Hilton Food (p)

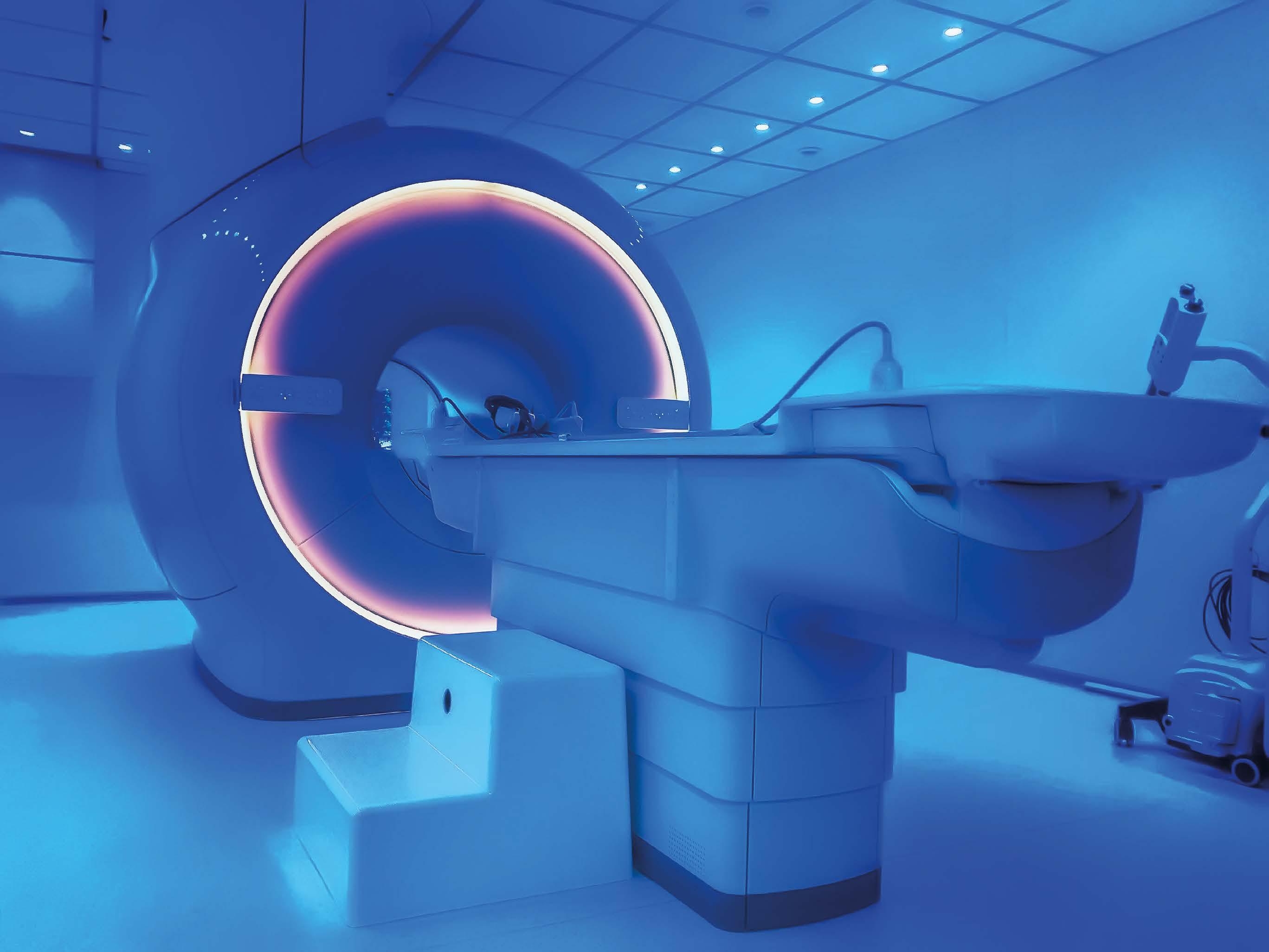

With global markets in turmoil and inflation on the rise, investors are worried about the health of their portfolios. As a specialist healthcare investment trust, we focus on powerful growth stories, from disruptive biotech to global pharmaceuticals. With a diversified and conservative approach, the Polar Capital Global Healthcare Trust accesses multi-decade themes while expertly navigating near-term volatility with its bias to large defensive companies. Forward looking. Actively managed. Highly specialised.

polarcapitalglobalhealthcaretrust.co.uk

Capital at risk and investors may not get back the original amount invested. This advertisement should not be construed as advice for investment. Important information: This announcement constitutes a financial promotion pursuant to section 21 of the Financial Services and Markets Act 2000 and has been prepared and issued by Polar Capital LLP. Polar Capital is a limited liability partnership with registered number OC314700, authorised and regulated by the UK Financial Conduct Authority (“FCA”) .

London Stock Exchange Ticker: PCGHThis stocks in this fund are cheaper than the FTSE 100 and yield nearly twice as much

With consumer prices hitting a 40-year high, more investors are searching for high-income instruments to try to offset the impact of inflation on their cash.

The danger with picking individual stocks just for their income is high yields are usually indicative of some underlying problem with the business and are not sustainable.

The iShares UK Dividend ETF (IUKD) takes much of the legwork out of hunting for high yields, and offers diversification across a large number of different stocks so that if one or two companies cut their dividends, your income won’t be too drastically affected.

The fund tracks the performance of an index composed of 50 shares with ‘leading’ dividend yields, giving diversified exposure to the highestyielding subset of the FTSE 100 index and the upper reaches of the FTSE 250 index.

In other words, it screens both indices by market value and automatically rejects any non-dividendpaying companies, focusing on those with the most attractive yields.

Due to the focus on dividends, the fund has a completely different look to the FTSE 100, which is most obvious from the fact that the top 10 holdings don’t include Shell (SHEL), AstraZeneca (AZN) or Unilever (ULVR), the top three stocks in the index.

Instead, the top three holdings in the fund are Rio Tinto (RIO), Anglo American (AAL) and Persimmon (PSN).

The smallest stocks in the fund are Centamin (CEY), Redrow (RDW) and Jupiter Fund Management (JUP), all of which are towards the top of the FTSE 250 in terms of market value.

The 12-month trailing yield on the fund is 6.5%, almost double the 3.3% offered by the FTSE 100, and the 12-month trailing PE (price to earnings multiple) is 8.6 times against 12.7 times for the index.

Fees are low at 0.4%, meaning investors get to keep more of the yield on offer, and dividends are paid quarterly.

The total return in 2021 was 23.2% against 20.7% for the FTSE 100, while for this year up to the end of October the ETF is down 8.2% against a 2% gain for the index representing a rare period of underperformance.

For investors wanting exposure to a broad selection of liquid, ‘best of’ dividend-yielding UK stocks with a low fee, a quarterly payout and scope for recovery potential, as well as somewhere to park their money until markets settle down, this fund is just the ticket. [IC]

Top 10 holdings in the UK Dividend ETF (November 2022)

Stock Market cap £ Weight

Stock Market cap £ Weight

Rio Tinto 46.4bn 5.6%

Rio Tinto 46.4bn 5.6%

Anglo American 42.4bn 5.1%

Persimmon 34.6bn 4.2%

Anglo American 42.4bn 5.1%

Persimmon 34.6bn 4.2%

Legal & General 30.9bn 3.7%

Vodafone 30.8bn 3.7%

Imperial Brands 29.8bn 3.6%

Legal & General 30.9bn 3.7% Vodafone 30.8bn 3.7%

Imperial Brands 29.8bn 3.6%

British American Tobacco 29.1bn 3.5%

British American Tobacco 29.1bn 3.5%

Aviva 28.2bn 3.4%

Aviva 28.2bn 3.4%

HSBC 27.1bn 3.3%

HSBC 27.1bn 3.3%

BP 26.0bn 3.1%

BP 26.0bn 3.1%

Data correct as of 14 November, 2022

Table: Shares magazine

• Source: iShares, Shares magazine

Data correct as of 14 November, 2022

Table: Shares magazine

• Source: iShares, Shares magazine

Sales of pharma firm’s flagship drug are expected to ramp up significantly

Indivior is executing its second $100 million share repurchase programme, equivalent to around 4% of total shares outstanding.

Heightened macroeconomic risks and recession worries increase the likelihood of seeing more downgrades in company earnings. This puts a premium on finding companies whose earnings are less affected by the worsening economic backdrop.

One such company in our view is Indivior (INDV) which develops medicines for drug addiction and mental illnesses. The company has seen continued strong demand for its lead drug Sublocade, leading to persistent earnings upgrades.

Indivior trades on 15.8 times expected 2023 earnings which looks too cheap against the growth potential.

Sublocade is the only long-acting treatment for OUD (severe opioid disorder) which delivers a measured and controlled amount of the drug.

This keeps patients on an even keel and prevents the ‘highs’ and ‘lows’ associated with drug abuse. Injections are made monthly and can only be delivered by certified healthcare professionals.

The drug has generated strong sales momentum since launch in 2018 when it generated sales of $12 million. This year sales are expected to reach over $400 million while the firm’s medium-term sales target is $1 billion.

A key part of management’s strategy is to diversify the business beyond its marketleading opioid drug into other therapies such as schizophrenia, cannabis use disorder and alcohol use disorder.

The company is building a pipeline of drugs currently in clinical development to address these huge markets. Indivior plans to use the roughly $1 billion of cash on the balance sheet to make selective acquisitions and buyback shares.

On 14 November the company announced a deal to buy Nasdaq-listed Opiant Pharmaceuticals (OPNT:NASDAQ) for $145 million, representing a 112% premium to the undisturbed share price.

The deal further strengthens Indivior’s leadership position in addiction medicine while giving the company ownership of an opioid overdose rescue treatment OPNT003.

Management sees sales potential of between $150 million-to-$250 million after a potential launch in late 2023.

Shareholders have approved an additional listing for Indivior in the US which is expected to take place in the spring of 2023 alongside a five-for-one share consolidation.

The idea is to increase liquidity and attract wider analyst coverage and interest in the shares. The bulk of Indivior’s business is conducted in the US.

In October management increased 2022 revenue guidance by around 4% to between $890-to-$915 million. Analysts’ consensus estimates sit around the middle of the range at $900 million.

One risk to be aware of is the risk of further litigation regarding legacy OUD drug Suboxone. [MG]

Shares highlighted the compelling case for buying Walt Disney (DIS:NYSE) in January 2021 at $171.82, but after generating early gains, the shares have drifted lower to leave the shares 43% on our entry point.

But there is hope at hand, as former boss Bob Iger is back as CEO for the next two years and customers, staff and shareholders believe he can bring some of the magic back to the ‘House of Mouse’, since Disney’s shares did exceptionally well during his first period in the hot seat.

Disney has parted ways with CEO Bob Chapek after a lacklustre tenure since his February 2020 appointment. Staff morale appears to have got worse, and customers are angry

at large price hikes and constant disruption to rides in its theme parks. Chapek also riled those working for the company by getting rid of wellrespected TV content executive Peter Rice.

But it was the recent fourth quarter results (8 November) that proved the final straw for Chapek, as the numbers fell short of expectations for sales and profits. Direct-to-consumer revenues for the quarter increased 8% to $4.9 billion, yet the operating loss increased by $0.8 billion to $1.5 billion due to a higher loss at Disney+ and disappointing results at Hulu, partially offset by improved results at ESPN+.

Disney is worth sticking with for the long run. Iger was the driving force behind the launch of the streaming strategy in 2019 and he should reassure investors that the streaming business is on the right track.

We’d also expect Iger to devote attention to the profitability of the domestic parks, a very important part of the Disney investment case alongside the streaming service.

However, not everyone is welcoming Iger back with open arms. The Wall Street Journal has reported that activist investor Nelson Peltz opposes his rehiring and wants a seat at the board to push for more cost cuts. [JC]

The Merchants Trust aims to provide an above average level of income that rises over time. So whilst we focus on investing in large UK companies with the potential to pay attractive dividends, you can focus on travel, family, home, retirement – whatever really matters to you. Although past performance does not predict future returns, we’ve paid a rising dividend to our shareholders for 40 consecutive years, earning us the Association of Investment Companies’ coveted Dividend Hero status. Beyond a focus on dividends, Merchants offers longevity too. Founded in 1889, we are one of the oldest investment trusts in the UK equity income sector. To see the current Merchants dividend yield, register for regular updates and insights, or just to find out more about us, please visit us online.

www.merchantstrust.co.uk

A ranking, a rating or an award provides no indicator of future performance and is not constant over time. You should contact your financial adviser before making any investment decision. This is a marketing communication issued by Allianz Global Investors GmbH, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, D-60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The summary of Investor Rights is available at https://regulatory.allianzgi.com/en/investors-rights. Allianz Global Investors GmbH has established a branch in the United Kingdom deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website (www.fca.org.uk).

INVESTING INVOLVES RISK. THE VALUE OF AN INVESTMENT AND THE INCOME FROM IT MAY FALL AS WELL AS RISE AND INVESTORS MAY NOT GET BACK THE FULL AMOUNT INVESTED.

By Martin Gamble and Tom Sieber

By Martin Gamble and Tom Sieber

THE IDEA BEHIND value investing is to buy shares for less than they are worth in the hope they reach their so-called ‘fair’ value and generate a better than market return.

This article explores popular yardsticks used to find value shares, explains how they are used and highlights the advantages and drawbacks.

Before starting it is worth bearing in mind that none of the metrics discussed are perfect and they should never be used in isolation. There is no substitute for in-depth research into a business.

One of the more popular ways to look for value is the PE (price to earnings) ratio which has the advantage of being easy to calculate. Simply divide the current share price by the forecast earnings per share.

For example, premium brand alcoholic beverage company Diageo (DGE) is expected to deliver 174p of earnings per share for the year ending 30 June 2023. Its share price of £36.66 implies a forward PE ratio of 21 times.

The Merchants Trust aims to provide an above average level of income that rises over time. So whilst we focus on investing in large UK companies with the potential to pay attractive dividends, you can focus on travel, family, home, retirement – whatever matters to you. Although past performance does not predict future returns, we’ve paid a rising dividend to our shareholders for 40 consecutive years. Beyond a focus on dividends, Merchants offers longevity too. Founded in 1889, we are one of the oldest investment trusts in the UK equity income sector. To see the current Merchants dividend yield, register for regular updates and insights, or just to find out more about us, please visit us online.

Looking through the FTSE 350 index the highest rated company is cyber technology firm Darktrace (DARK) with a forward PE of 73 times while the cheapest is oil and gas company Harbour Energy (HBR) which trades on three times next year’s earnings.

It would take 73 years of cumulative current profit to recoup your original investment in Darktrace while only three years from investing in Harbour Energy.

This implies investors expect lots of earnings growth at Darktrace and perhaps falling earnings at Harbour Energy. So, while a low PE can indicate good value, it is important to think about what growth is implied. Does it seem reasonable or not?

Another useful way to use the PE ratio is to compare it with either a firm’s own history or the sector average.

Studies have shown the PE to be mean reverting which simply means it moves up and down around a long-term average. Shares trading significantly below the average are considered cheap and those above expensive.

The PEG or PE to earnings growth ratio adds a growth element to the humble PE. Simply divide the forward PE by expected earnings growth. The idea is to find companies which trade on a PE ratio below their sustainable growth rate.

For example, tobacco company Imperial Brands (IMB) is expected to grow its earnings by 30% in the year to 30 September 2023 to 293p per share. The current share price of £21.15 implies a PE of 7.2.

Therefore, the company trades on a PEG ratio of 0.24. It seems unlikely the Imperial Brands can sustainably grow earnings at 30% a year, so some caution is required when interpreting the results.

A ratio of one indicates a stock is ‘fair’ value, a ratio between 1 and 0.5 is considered good value while a ratio below 0.5 is considered excellent value.

The ratio is often used by growth-oriented fund managers looking to find growth at a decent price rather than pure value-style managers.

Book value is shareholders’ capital and sometimes referred to as net assets. It is calculated by taking a company’s total assets minus total liabilities.

Let’s take housebuilder Barratt Developments (BDEV) to illustrate how this works. It has total assets of £8.2 billion and total liabilities of £2.58 billion which means it has net assets of £5.62 billion.

There are 1.023 billion shares outstanding which equates to 549p of book value per share. At the current price of 401p the shares trade at a discount of 27% or a price to book of 0.73.

In general, any value below one is considered cheap, but in practice shares can trade below book value for good reason.

As explained at the beginning, such tools are only the starting point for further analysis. There could be fears, for example, that housebuilders will be forced to ‘mark down’ their land values if the UK property market suffers a big fall in prices.

Price to book is often used in specific sectors such as banks, insurance companies, housebuilders, property firms and investment trusts.

Things like land, property, machinery, and furniture are called tangible assets. In other words, they can be seen and touched.

The price to book ratio is arguably a less useful metric of value for companies which do not employ a lot of physical assets, such as technology firms.

The asset base of many successful firms today is comprised of intangible assets. These can be things like patents, brands, trademarks, copyrights, customer lists, and knowhow or intellectual property.

This makes it harder to measure capital in the modern economy and by inference relegates the usefulness of the price to book ratio as a reliable measure of value for some sectors.

Some investors see cash flow as a more appropriate measure of value than earnings or book value. After all, shareholders have a claim on all future cash flows.

One of the main advantages of cash flow is that it is harder to manipulate than earnings or book value.

Free cash flow is operating cash minus capital expenditure or capex. Operating cash is what is left after deducting all operating expenses, and financial charges.

To calculate a free cash flow yield, you can divide free cash flow by market capitalisation then multiply by 100 to get a percentage. Most companies give free cash flow in the annual accounts. Some people prefer to use enterprise value (incorporating a firm’s net cash or net debt) when calculating the free cash flow yield.

Food-on-the-go sausage roll company Greggs (GRG) reported cash from operations last year of £286 million while capex was £54 million, equating to a free cash flow of £232 million.

The current market cap of Greggs is £2.26 billion which means its free cash flow yield is 10.2%.

Software services such as Sharepad and Stockopedia also provide free cash flow yields.

Higher yields represent better values. Some investors use 10-year bond yields as a hurdle comparison. With 10-year gilts yielding around 4% only companies offering more than 4% free cash flow yield are seen as good value.

Unlike the metrics discussed so far, the free cash flow yield is often used by both value managers and growth managers.

For example, investment manager and founder of Fundsmith, Terry Smith is fond of the metric. But Smith makes an adjustment to free cash flow where he deducts ‘maintenance’ capital expenditures from operating cash flow rather than total capex.

His reasoning is that companies should not be penalised for spending money to grow the business. After all, that is precisely what he wants to see, so long as it earns a good return.

Stripping out growth capex increases free cash flow and free cash flow yield.

Maintenance capex is the amount of spending needed to keep a company competitive. The problem is, not many companies split capex in this way, so investors need to make an educated guess.

One company which does explicitly separate out maintenance capex is gym operator Gym Group (GYM:AIM).

A rough proxy for maintenance capex is the annual depreciation charge which can be found in the accounts.

The EV/EBITDA (enterprise value to earnings before interest, tax, depreciation and amortisation) metric is popular with analysts and investment bankers. Its main advantage is that it can be used to compare companies in the same sector which have different financing structures.

It is also important in mergers and acquisitions

• Illiquid assets – i.e. they may not be easy to sell quickly

• The assets may be difficult to value

• The assets may be overvalued

• Concerns among investors that the assets are falling in value

• The assets aren’t generating a good return

• Selling the assets would create a tax liability

because EV or enterprise value represents the total amount of funds a company needs to secure to proceed with a takeover.

Enterprise value is the total value of a business including its net debt or net cash. Net debt is added onto the market cap, net cash is subtracted from it to calculate the EV.

EBITDA is a proxy for cash flow. Its disadvantage is that unlike cash from operations EBITDA does not include finance costs.

In addition, it doesn’t take account of depreciation or amortisation costs.

The Merchants Trust aims to provide an above average level of income that rises over time. So whilst we focus on investing in large UK companies with the potential to pay attractive dividends, you can focus on travel, family, home, retirement – whatever really matters to you. Although past performance does not predict future returns, we’ve paid a rising dividend to our shareholders for 40 consecutive years, earning us the Association of Investment Companies’ coveted Dividend Hero status. Beyond a focus on dividends, Merchants offers longevity too. Founded in 1889, we are one of the oldest investment trusts in the UK equity income sector. To see the current Merchants dividend yield, register for regular updates and insights, or just to find out more about us, please visit us online.

www.merchantstrust.co.uk

A ranking, a rating or an award provides no indicator of future performance and is not constant over time. You should contact your financial adviser before making any investment decision. This is a marketing communication issued by Allianz Global Investors GmbH, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, D-60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). The summary of Investor Rights is available at https://regulatory.allianzgi.com/en/investors-rights. Allianz Global Investors GmbH has established a branch in the United Kingdom deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website (www.fca.org.uk).

As the first part of this article has amply illustrated there are different ways of identifying value and the term doesn’t necessarily mean the same things to different people.

Shares has spoken to various managers of investment trusts with a value focus or an emphasis on finding stocks on attractive valuations to discover how they define value, how they uncover bargains and the names they have been snapping up recently.

about a firm being attractively valued they mean that on ‘balance of probability’ it is capable of achieving greater sales and earnings growth than implied by the share price.

Temple Bar (TMPL) manager Ian Lance defines value investing as ‘the purchase of something for significantly less than a conservative estimate of its intrinsic value.’

He goes on to say: ‘Strangely we would have thought that should just be the definition of “investing”. “Quality” refers to the characteristics of the business you are buying whilst growth is an input into the calculation of value, but the purchase of quality or growth businesses in the absence of valuation has historically led to poor investment returns.’

Co-manager at Mid Wynd International (MWY) Alex Illingworth looks for value, but tries to avoid value traps, so he assesses not just how a company is priced but its growth potential and threats to cash flow. ‘The most obvious one today is rising interest rates, which can make the cost of debt very painful. But there are other threats.’

Joe Bauernfreund, the manager of AVI Global Trust (AGT), takes things right back to brass tacks. He says: ‘At its simplest, value investing means buying something for less than it’s worth.’

Merchants Trust (MRCH) manager Simon Gergel adds: ‘For equities we aim to buy fundamentally strong businesses, which benefit from positive structural or thematic drivers, and that are cheap versus their history, peers or the broader market.’

Laura Foll who helps steer the Lowland Investment Trust (LWI) notes when her team talk

Illingworth highlights the example of Amazon (AMZN:NASDAQ) which is valued on the basis it might one day have to pay the rate of tax most people think it should.

Odyssean Investment Trust (OIT) takes a slightly different approach, applying private equity skills to invest in what it calls ‘misunderstood companies’. ‘Our approach to value is based on the team’s combined private and public equity experience,’ says manager Stuart Widdowson.

First up the Odyssean team consider the ‘static’ value of the business – including the likely value a trade buyer or private equity investors would place on a business to buy it.

‘We believe that our private equity and M&A experience means we are better placed than many equity fund managers in evaluating the attractiveness of quoted companies to potential private equity and trade bidders, and how these bidders are likely to value these companies,’ adds Widdowson.

Second, Odyssean looks at ‘dynamic value’ or how the value could change over the next three to five years, identifying five levers that companies can pull to unlock value including: growing sales

Among the simplest and most consistent approaches is that pursued by Joe Bauernfreund at AVI Global Trust, something which is replicated across parent investment manager Asset Value Investors, namely investing in firms trading at a discount to net asset value.

‘More holistically, we recognise that value for value’s sake – or simply focusing on wide discounts – is not enough. We are focused on buying high quality assets, the value of which will likely grow over time, at discounted valuations,’ Bauernfreund says.

Widdowson at Odyssean says his emphasis is on long-term enterprise value (which is the market cap plus net debt) to sales ratios, enterprise to operating profit, price to earnings, free cash flow yield and price to book.

‘When earnings are volatile or depressed in a company which is in a recovery phase, we tend to focus much more on enterprise value to sales and price to book ratios, which are more consistent valuation metrics and less prone to manipulation than earnings,’ he explains.

Gary Channon at Aurora Investment Trust (ARR) focuses on a metric called CROCC or cash return on core capital. Core capital is defined as the capital you would need to replicate the business in question.

Channon observes this is typically fixed assets plus working capital, adding ‘then we look at what clean cash return is made on that capital’. He adds: ‘This removes all the intangible and non-cash accounting noise and the effect of past acquisitions and shows truly whether at its core the business activity generates high returns.’

Mid-Wynd International’s Illingworth says traditional value investing is always derived from the balance sheet. ‘Beyond, and separate from our cash flow valuations, we also look to the balance sheet to assess the cost of rebuilding the franchise the company has created.

‘To do this we factor in intangible assets – like the value of a brand. The accounting equivalent of this is goodwill, but that isn’t always very accurate. We’ll do some quite complicated calculations to put a value on intangible assets.

‘The whole two-part process allows us to assess

traditional (balance sheet) value as well as value implied by the cash flows.’

Lowland’s Laura Foll makes the salient point that different metrics are sometimes suited to different industries. For example, she uses price to book for banks and for industrial companies she tends to favour enterprise value to sales.

As AVI Global’s Bauernfreund observes: ‘Whilst painful in the short term, market volatility and panic are our friends – sowing the seeds for longterm performance.’

Many of the managers Shares has consulted have used the volatility and market weakness seen in 2022 to buy discounted stocks.

Odyssean’s Widdowson says the company recycled cash from media business Euromoney (ERM), following its £1.6 billion takeover by Becketts Bidco, into Ascential (ASCL) which Widdowson says is ‘a similar sized B2B media company, whose shares had more than halved in value despite maintaining forecasts’.

He observes that, like Euromoney, at the trust’s entry price the shares were trading at a substantial discount to its view of the sum of parts valuation.

Widdowson also secured an ‘extremely undemanding’ entry valuation in diversified services group James Fisher (FSJ). He expects the end markets served by the business to recover after a terrible two years which, alongside management initiatives, should aid a recovery in earnings and the balance sheet.

Gergel at Merchants Trust says there have been various situations where share price declines have allowed him to buy strong businesses at attractive prices. ‘Unilever (ULVR) is a strong, defensive company that was oversold in the spring, and we bought it for the first time in many years.

his team have found the most value within their circle of competence. This includes what he describes as ‘cyclical UK-centric businesses’ like UK housebuilders Barratt Developments (BDEV) and Bellway (BWY) and online businesses which benefited from the pandemic but are now struggling like AO World (AO.) and Netflix (NFLX:NASDAQ).

market leader in pork in the UK and is gradually expanding in chicken supply as well. While this is not a particularly glamourous industry, Cranswick is better invested than its peers and therefore capable of making an above-peer margin. It is taking the knowledge learned from pork over many years and applying this to poultry, where it is taking market share.

‘There is the potential for it to go significantly further, providing a pathway to long-term earnings growth if successful. From a valuation perspective, the shares are trading at a substantial discount to their five and 10-year average valuation.’

He adds: ‘This looks like one of the great valuebuying windows because we are able to buy at prices where we see 200% of upside to intrinsic value.’

Pursuing value doesn’t necessarily mean buying outright bargain-basement stocks, reflected in Swiss/American firm Mettler Toledo (MTD:NYSE) –highlighted by Mid Wynd manager Illingworth.

A world leader in specialised weighing scales for labs and supermarket self-service tills, it was long admired by the Mid Wynd team. With its rating having fallen from 40 times earnings, the trust picked up shares at the much lower rating of 27 times earnings.

Laura Foll at Henderson says Lowland has invested in Cranswick (CWK) this year. ‘It is a

Over the past decade, we have experienced a prolonged period of very subdued inflation, low interest rates and modest economic growth. This has been an environment which has very much favoured growth companies at the expense of attractively valued companies with lower downside risk that we favour.

We believe the current market environment of higher and stickier inflation, rising interest rates and greater economic volatility is more representative of the longer-term pattern seen over the last 100 years. History suggests that over the long-term, value tends to outperform given generally higher discount rates and a reversion to the mean. By targeting unloved stocks on depressed valuations and leveraging Fidelity research resources, I believe value as a style could outperform growth over the next decade.

Those who have held on to their vinyl records over the years, will understand why investing in what’s not in vogue can pay off It’s something the trust’s portfolio managers appreciate, too Supported by an ex tensive research team, they look to invest in out of favour companies, having spotted potential triggers for positive change they believe have been missed by others

It ’s a consistent and disciplined approach that has worked well; the trust has outper formed the F T S E All Share Index over the long term, both since the current manager took over in September 2012 and from launch

over 27 year s ago. A s with vinyl, the true value of a good company is almost always reco gnised in time, even if it temporarily falls out of fashion

The value of investments can go down as well as up and you may not get back the amount you invested Overseas investments are subject to currency fluctuations The trust can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The trust invests more heavily than others in smaller companies, which can carr y a higher risk, because their share prices may be more volatile than those of larger companies and the securities are often less liquid.

While Jeremy Hunt may have stuck to the government’s promise not to raise tax rates, the Autumn Statement means more of most peoples’ income and capital will find its way into the Treasury’s coffers during the course of this parliament.

In order to fill the £55 billion ‘black hole’ in government finances caused by the energy support package and higher borrowing costs, the chancellor outlined £30 billion of spending cuts and £25 billion of tax grabs.

The reaction across the currency, government bond and equity markets was fairly muted, in contrast to the Kwarteng ‘mini-Budget’, which is as close to a seal of approval as it gets these days.

The most obvious winners are pensioners, a key demographic for the Conservatives, thanks to the decision to reinstate the ‘triple lock’, which means the state pension rises by 10.1% next April in line with September’s consumer price index.

Weekly payments will rise from £185.15 to £203.85, while the annual payment rises to £10,600, topping the £10,000 figure for the first time.

Pension credit, which is a top-up benefit for pensioners on the lowest income, will also rise in line with inflation and could be worth up to £3,300 per year.

The downside for those approaching retirement is the state pension age review next spring is likely to recommend increasing the pension age from 66 to 68 earlier than previously planned.

Banks will be celebrating the news the banking surcharge is to be cut from 8% currently to 3%

Personal

Annual exempt amount now £12,300

Amount from April 2023 £6,000

Amount from April 2024 £3,000

Dividend allowance

Allowance now £2,000

Allowance from April 2023 £1,000

Allowance from April 2024 £500

Table: Shares magazine • Source: Shares magazine

next April, and electricity companies including renewable energy producers can consider themselves winners despite the introduction of a 45% windfall tax.

The devil is in the detail as the tax is temporary and it targets excess profits not overall profits. The pricing level at which it applies is higher than feared and there are investment allowances which can offset its impact to a large degree.

North Sea oil and gas companies will see their windfall tax extended to 2028, but again the tax is at a higher price level than previously anticipated.

Small businesses will benefit from a cut to business rates, which will reduce the burden on them by £5 billion next year, with retail, hospitality and leisure especially favoured.

However, a rise of 9.7% in the national living wage – which will help the low-paid – will add to the costs facing small and large businesses.

House buyers can celebrate a small win as the stamp duty cut has been extended to the end of March 2025, and by increasing taxes by the back door the chancellor has reduced the pressure on the Bank of England to raise rates as sharply, meaning the housing market is likely to deflate

slowly rather than implode.

Also, around four million families living in rented social housing will receive help in the form of 7% cap on rent rises next year.

The main losers are high earners, as the threshold for the 45% marginal tax rate comes down from £150,000 to £125,140 in a move expected to raise £12 billion.

Also, the tax-free personal allowance has been frozen from 2026 out to 2028 meaning it stays at £12,570 for basic-rate tax payers while the upper earnings limit and upper profit limit stay at £50,270 for 40% tax payers.

Freezing these thresholds for another two years means up to three million extra workers will move into higher tax brackets, saving the Treasury as much as £6 billion per year.

Exemption from capital gains tax falls from £12,300 to £6,000 and the dividend allowance falls from £2,000 to £1,000 in April 2023 and £500 in April 2024, which will impact anyone who doesn’t invest using a tax wrapper such as a SIPP or an ISA.

Demand for tax and investment advice is likely

to soar as is the use of higher-risk products and services such as VCTs (venture capital trusts) and spread betting, where capital gains are tax-exempt.

The cut to dividend allowances will also impact business owners who are paid via dividends, which attract a lower tax rate than earnings, while the cut to capital gains tax exemption will affect business sellers, owners of second homes and landlords.

Drivers and companies which use road transport will also be also worse off under a proposal by the OBR (Office for Budget Responsibility) to raise fuel duty by 23% or 12p per litre from next March.

This particular nugget was not included in the Autumn Statement but looks to reverse the 5p per litre cut made by Rishi Sunak when he was chancellor and reinstate the long-abandoned price escalator of CPI plus 6%.

Owners of electric vehicles will also be worse off from April 2025 when they will be expected to pay vehicle excise duty.

While extending the duty will come nowhere near replacing the £30 billion per year raised from

fuel tax, which will disappear once the roads are dominated by electric vehicles, it does signal a change in attitude as electric cars and vans become more mainstream.

Martin Beck, chief economic advisor to the EY ITEM Club, summarised the measures as follows: ‘In the end, the statement was a package of tax rises, mainly on energy producers, high earners and unearned incomes, and public spending restraint, peaking at £55 billion per year, or just over 2% of GDP (gross domestic product), in 2027-28.

‘The size of the package was broadly in line with expectations. What also met predictions was that most of the planned fiscal tightening will not kick in until the second half of the decade, when, in the EY ITEM Club’s view, the economic situation may give a future chancellor the option to change course.’

By Ian Conway Companies Editor

By Ian Conway Companies Editor

Seasoned investors will have seen many false dawns from the Japanese stock market. After an extraordinary run of performance in the 1970s and 80s, the Japanese stock market reached a peak in 1989 that, more than 30 years later, it is yet to surpass. Now, however, the stars appear to be aligning for a prolonged period of better performance. Here we explore the reasons why and explain how the Schroder Japan Growth Fund plc is poised to benefit.

Most global equity portfolios today are underexposed to the Japan stock market. Years of underperformance and dashed hopes of recovery have led to many investors progressively giving up on the region. Gradual capitulation on this scale can eventually be the friend of the disciplined, contrarian, long-term investor. It may feel comfortable following the herd, but there is always elevated risk in a crowded trade. There is less risk, however, investing in parts of the global equity market that are less congested, because valuations tend to be much more modest.

As the chart below demonstrates, that is certainly the case for the Japanese stock market today.

Global lethargy towards this once highly respected regional stock market has increasingly weighed on valuations. With the exception of the dislocation associated with the start of the Covid pandemic in 2020, Japanese equities have been becoming steadily cheaper in price/earnings terms for more than a decade. Many other regional stock markets have become much more expensive during this time, as typified by the US S&P 500 index shown on the chart. This leaves the Japanese stock market in attractive valuation territory in both absolute terms, and relative to other regions.

Meanwhile, the value-oriented investment approach employed by Masaki Taketsume and Schroders’ investment team in managing the Schroder Japan Growth Fund plc, means the portfolio is keenly focused towards the most attractively valued parts of the Japanese market. The portfolio typically consists of 60-70 of the highest quality undervalued companies that can be found in Japan, with a current bias towards mid and small cap companies with excellent growth prospects.

Japan is still perceived by many to be a low growth economy, with poor returns and an anachronistic corporate culture. We would agree that the Japanese economy continues to have its problems, including poor demographics and a high government debt to GDP ratio, but many other mature economies will soon face similar dynamics.

Indeed, in many other respects, Japan has changed dramatically in recent years, as we

Japanese equities are cheap in absolute and relative terms

explore below. Much of the rest of the world has not yet given Japan the credit it deserves for this transformation, and the gap between the old perception and the new reality, means Japan has a golden opportunity to surprise positively from here. Recent corporate results support this thesis, as Masaki explains:

“Overall, the most recent earnings season saw results again coming in ahead of expectations and profit margins appear to have remained resilient. With many companies having made conservative forecasts for this fiscal year, there is scopefor upward revisions.”

Masaki Taketsume, Portfolio Manager, Schroder Japan Growth Fund plcExperienced investors will have heard much of this before – several times. So, it is important that we explore the changes that Japan has been undergoing which make the current environment a genuinely interesting time to be considering investment in the region.

The first of these changes relates to corporate governance. Historically, the structure of corporate Japan has been dominated by the keiretsu system, which is a structure of cross-shareholdings and close relationships between customers, suppliers, their banks and competitors. As the Japanese economy has struggled over the last thirty years, this system has been increasingly criticised from a governance perspective, because it can lead to inefficient capital allocation and poor decisionmaking. The system has also made it hard for shareholders to agitate for management change and has fostered a culture that was generally unresponsive to shareholder demands.

Corporate Japan is changing, however. The transformation began in 2014, when the late Shinzo Abe’s government commenced a push to overhaul corporate governance as part of a broader effort to make Japanese companies more competitive on the global stage. A new corporate governance code was introduced in 2015, and ongoing revision since then have focused on specific issues, including the unbundling of cross-shareholdings. As Taketsume explains, this is already having a meaningful impact for investors.

“We remain very positive on the ongoing improvements in corporate governance and the scope for this to generate real value for

investors. Although this is partly a qualitative assessment through our discussions with company managements, there are also measurable impacts such as improving Return on Equity and a record level of share buybacks.”

Masaki Taketsume, Portfolio Manager, Schroder Japan Growth Fund plcThis transformation is illustrated in the chart below, which shows dividends and share buybacks at all-time highs. The fact that Japanese companies are generally in good financial health, with high cash levels compared to their counterparts in the US and Europe, should help this trend to continue.

Meanwhile, the second major change to consider is the economic environment which, for the first time in decades, paints Japan in a favourable light compared to its global peers. The Japanese economy has been blighted by deflationary pressures for years, but may now be heading into a period of sustainably positive inflation. Indeed, the Bank of Japan may be the only central bank to welcome some of the global inflationary pressure seen in 2022. By contrast, inflation is seen as a threat in the west. The Japanese economy, however, is not seeing the same level of inflation as that being experienced in the US and Europe, which is a relative positive. Masaki describes the Bank of Japan as “a clear outlier in global monetary policy”, with interest rates being maintained at very low levels, which provides support for the domestic economy and indeed its stock market. Consensus forecasts continue to point to modest growth for the Japanese economy in 2023, at a time when much of the rest of the developed world is increasingly at risk of recession.

This more benign economic environment, coupled with the prospect of improving returns, could help underpin an attractive long-term opportunity in Japanese equities.

Source: Schroder, Eikon as at 27 September 2022

Masaki Taketsume was appointed as portfolio manager of the Schroder Japan Growth Fund plc in July 2019, and performance since then has been encouraging. Market conditions have favoured his value-oriented investment style during a period in which the growth style has faltered. Alongside good stock-picking, this has led to top of peer group performance over the last three years, in terms of both share price and net asset value. Despite this, the discount between the trust’s share price and net asset value is yet to narrow.

The portfolio contains a good balance between domestic and export exposure. Despite the travails of the last thirty years, Japan remains the third largest economy in the world and, in addition to a huge domestic opportunity, it is home to many world-leading companies with capabilities that are often under-appreciated by investors. The portfolio also has a small cap bias, particularly within the domestic service sectors, where Masaki anticipates a strong recovery. As a long-term fundamental investor, with the backing of Schroders’ small cap specialists in Tokyo, he sees consistent opportunities to add value in small cap, given how underresearched this part of the market is compared to larger Japanese companies.

Overall, it does finally feel as though the time may have arrived for the Japanese stock market to shine brightly once more, and we believe the Schroder Japan Growth Fund plc is well positioned to capture this long-term opportunity.

Find out more at www.schroders.com/sjg

This information is a marketing communication. This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder Japan Growth Fund plc (the “Company”). Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares.

Any reference to sectors/countries/stocks/ securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on any views or information in the material when taking individual investment and/ or strategic decisions.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Schroder Japan Growth Fund plc have expressed their own views and opinions in this document and these may change. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

Third party data is owned or licensed by the data provider and may not be reproduced or extracted and used for any other purpose without the data provider’s consent. Third party data is provided without any warranties of any kind. The data provider and issuer of the document shall have no liability in connection with the third party data. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.schroders.com.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don’t already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk

Issued in November 2022 by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU.

Registration No 4191730 England. Authorised and regulated by the Financial Conduct Authority

Rebased to 100

Walmart Target

Christmas could be bleak for some

USretail sales posted their largest increase in eight months in October, with the value of purchases up a forecast-beating 1.3%, demonstrating the US consumer is holding up well despite rising rates and high inflation, supported by the government’s pandemic stimulus package.

Yet a frenetic third quarter earnings season gave fresh clues about the health of the US consumer heading into Christmas. Shoppers are now cutting back on non-essentials, suggesting a bleak holiday season in prospect for purveyors of discretionary categories like clothing, homewares and electronics.

Walmart (WMT:NYSE) and Target (TGT:NYSE) both sell food, clothing, home goods and kitchen appliances, but the former generates a far larger slice of sales from groceries than the latter. This is helping Walmart lure in cash-strapped shoppers as inflation squeezes budgets and partially explains the companies’ diverging outlooks.

Walmart’s forecast-beating third quarter results (15 November) showed US like-for-like sales up 8.2% thanks to further grocery market gains and the retail behemoth also raised full year operating earnings guidance.

Brian Cornell-bossed Target’s massive third quarter earnings (16 November) miss ahead of Christmas rattled Wall Street. Adjusted earnings per share of $1.54 was almost 50% down year-onyear and Target lowered fourth quarter guidance based on ‘softening sales and profit trends that emerged late in the third quarter and persisted into November’, with shoppers pruning back spend on clothing, electronics and home goods.

Worryingly, Cornell warned sales and profit trends softened ‘meaningfully’ in the latter weeks

120

100

80

60

Jan 2022 Apr Jul Oct 40

Chart: Shares magazine • Source: Refinitiv

of the quarter with shopping behaviour ‘increasingly impacted by inflation, rising interest rates and economic uncertainty’.

Robust quarterly earnings from Home Depot (HD:NYSE) on 15 November and Lowe’s (LOW:NYSE) on 16 November showed the home improvement duo holding up well, despite weakening house sales and prices amid a rise in mortgage rates.

American homeowners still have the cash for renovations judging by Home Depot’s US comparable sales growth of 4.5%, and the Ted Decker-led retailer also reaffirmed its 2022 guidance. Lowe’s actually lifted its full year 2022 outlook after US ‘comps’ ticked up 3% amid strong sales to professionals and ‘improved DIY sales trends’.

Elsewhere, Macy’s (M:NYSE) raised (17 November) its annual earnings forecast after third quarter sales and earnings topped Wall Street expectations, though the department store left revenue guidance unchanged given a tougher festive sales backdrop, having seen a recent drop in sales.

By James Crux Funds and Investment Trusts Editor

American retailers are showing resilience, but the worsening backdrop suggests

Based on conversations with fund managers at AJ Bell’s annual Investival conference for financial advisers, there is a feeling that professional investors are starting to become more optimistic after what’s been a very tricky year on the markets.

This tallies with how stock markets in many parts of the world have recently started to pick up. Bank of America even says the middle of November saw the biggest inflows for equities in 35 weeks.

A key reason why some fund managers are more upbeat than you might expect is valuations. This year’s market sell-off has presented them with the opportunity to buy nearly everything on the market (apart from energy and tobacco stocks) at much cheaper levels than 2021.

While the headlines are full of doom and gloom, you just need to look at the news flow from listed companies to realise things aren’t as bad as you might think. Plenty of companies are hitting earnings forecasts which shows they are holding up well in the face of recession.

It’s important to remember that stock markets are forward-looking, and they’ve already priced in lots of bad news around a slowdown in the economy. Stocks have plummeted in general this year, yet earnings have held up relatively well. That has created a disconnect between company fundamentals (earnings) and share valuations.

In a nutshell, fund managers now have one of the best buying opportunities in years. Some have been buying more of what’s already in their portfolio and others have been taking new positions.

Retail investors are eager to know if the current rebound in the markets is sustainable or just a

short-term event. This is difficult to answer because there are still so many headwinds – inflation might be easing in places but remains high, consumer and business spending remains under pressure, and interest rates are still going up. The trick is to understand the key bits of information that would get a thumbs up from the market.

Kirsty Desson, manager of the Abrdn Global Smaller Companies Fund (B7KVX24), says some of the catalysts to drive markets higher will be inflation rolling over, labour markets softening and a pivot from the Federal Reserve with regards to the fierce pace and scale of interest rate hikes in the US.

While some of these catalysts might not emerge until later in 2023, the fact the latest US inflation figures weren’t as bad as feared might be the trigger for other dominos to fall as we move into the new year.

WILL RATES FALL IF THERE IS A FED PIVOT?

Clive Beagles from the JO Hambro UK Equity Income Fund (B03KR61) says it is important

equities have started to rebound over the past month

to understand that a pivot doesn’t mean we’ll suddenly see interest rates fall. ‘It means the trajectory flattens. We might see a 50-basis point increase, and then a 25-basis point rise at the following interest rate decision.’

He doesn’t believe rates will be cut any time soon and therefore it’s time for value stocks to shine. ‘It’s not time to buy growth shares,’ he adds.

As a reminder, the term growth stock typically refers to a company which is expected to generate much greater earnings in the future than today. Rising interest rates have a negative impact when calculating the present value of those expected cash flows. That’s why investors have exited growth stocks in their droves this year, as central banks aggressively push up rates.

They’re now looking at value stocks which offer good cash flow and profits today and trade on cheaper valuations.

Polar Capital Technology Trust (PCT) is a good example of an investment trust that has suffered from having large exposure to growth stocks in 2022. Its share price is down 30% year-to-date as many of its holdings have derated – trading on lower multiples of earnings, something that’s also called ‘multiple compression’.

However, manager Ben Rogoff is remarkably upbeat, saying the potential rewards from investing in the sector look more interesting than 18 months ago as valuations are no longer excessive.

‘Despite near-term macro and market turbulence, we believe the worst of multiple compression is likely behind us and secular tailwinds remain robust,’ he says.

‘A lot of the excess has been worked off. Within the areas we like, a year ago there were 25 software companies trading on more than 20 times forward sales. Today there are none.’

Rogoff says if you looked at the fastest growing cohort of software companies at that time, on average the ones growing at more than 40% were trading at 40 times enterprise value to sales. The companies that comprise that group today now trade at 11-times. ‘There has been a very significant unwind,’ he comments.

‘The valuations now look much better and there is definite upside risk. We could be at peak inflation and peak Fed, we could see China reopen, who knows what will happen in Ukraine and maybe there are positives there; but there is no way that fund managers are positioned for that.’

Rogoff says cash levels among fund managers haven’t been this high since 9/11, implying that on broad scale there is still a sense of nervousness among professional investors.

‘The downside risks remain significant too,’ he admits. ‘We must anticipate higher volatility and people need to be sure about the investment timeframe they are looking at. But we still remain optimistic.’

DISCLAIMER: Financial services company AJ Bell referenced in this article owns Shares magazine. The author (Daniel Coatsworth) and editor (Tom Sieber) of this article own shares in AJ Bell. The author has a personal investment in Abrdn Global Smaller Companies Fund

Aurora Investment Trust plc is a closed end fund that invests in UK equities and trades daily on the London Stock Exchange. Since January 2016 the portfolio has been managed by the specialist investment boutique, Phoenix Asset Management Partners. Phoenix have a unique approach to stock picking.

What makes us different?

We are focused. We typically hold 15 to 20 stocks in the portfolio because we believe in backing our best ideas. This gives us sufficient diversification and allows us to concentrate our efforts on what we own.

We stick to what we know. We have developed a deep expertise in some areas and don’t operate beyond that.

We buy to hold.

Although we are buying shares, we consider ourselves as buying a whole business. Ideally, we look for a company whose prospects are so good we could hold them forever.

The ride can be bumpy. Buying a focused portfolio of stocks that are out of favour can result in a lot of volatility. Unlike most of the financial services industry, we don’t consider volatility to be risk. Volatile markets provide investment opportunity.

Phoenix was founded by Gary Channon in 1998. He was inspired to create a fund management business using the “value investing” principles of great US investors such as Warren Buffett and Phillip Fisher. Over the last 20 years the Phoenix style has evolved, now applying value principles to buying a small number of high quality businesses, temporarily cheap due to short term bad news.

Aurora has a fee structure which aligns Phoenix’s interests with those of investors. There is no management fee. Instead, each year, Phoenix earns one third of the outperformance above the FTSE All Share. Investors are protected from subsequent underperformance by a “clawback” mechanism.

www.aurorainvestmenttrust.com

This advertisement is issued by Phoenix Asset Management Partners Limited (PAMP), registered office 64 66 Glentham Road London SW13 9JJ, Company number 03514660. Authorised and regulated in the UK by the Financial Conduct Authority. Aurora Investment Trust Plc (“theTrust”) is a UK investment trust listed on the London Stock Exchange. Shares in an investment trust are traded on a stock market and the share price will fluctuate in accordance with supply and demand and may not reflect the underlying net asset value of the shares. The value of investments and any income from them may go down as well as up and investors may not get back the amount invested. There can be no assurance that the Company’s investment objective will be achieved and investment results may vary substantially over time. Past performance is not a reliable indicator of future performance.This advertisement is for information purposes only and does not constitute an offer or invitation to purchase shares in the Trust.The information contained within this advertisement has been obtained from sources believed to be reliable and accurate at the time of issue. Prospective investors should not rely upon this document for tax, accounting or legal advice and should consult their own advisors prior to making any investment. Copies of the prospectus are available from the Aurora website: www.aurorainvestmenttrust.com

We’re long-term value investors, known for the depth of our researchAward Winner: Citywire Investment Trust Awards 2022, Category: UK All Companies

It was in the months following the global financial crisis that Robert started becoming interested in the stock market. In a graduate IT job with Barclays (BARC) based in Canary Wharf, he’d had a front row seat during the teeth of the financial shock, but he has developed his own stocks-only DIY investment style during the decade-plus since.

In this article we talk through how he goes about identifying potential investments, discuss some of the stocks in his portfolio, and why he has been thinking about buying his first ETF recently.

‘I knew nothing about investing, and that was a real wake-up call,’ Robert says of the financial markets meltdown of 2008 and 2009. ‘I knew someone who worked at Lehman Brothers and saw dozens of people walk out the door carry their things in boxes.’

Around this time, Robert relied on cash ISAs for a home for his savings. He’d spoken to work mates who had put a few grand into banking stocks – Lloyds (LLOY) and Barclays and others –

but thought that sounded far too risky, he says.

‘I knew cash ISAs were a [virtually] risk-free way to grow my money,’ he says but over the following months he started to read more about investing and the stock market. ‘I started subscribing to the hard copy of Shares magazine around 2009 and began reading various bulletin boards, like ADVFN (AFN:AIM),’ he says. ‘They were places I could get ideas.’

His interest was ‘spurred’ when he finally plucked up the courage to make his first investment – £300 in budget airline EasyJet (EZJ). ‘I remember my pulse racing,’ Robert says. ‘It felt like a lot of money at the time and seeing the shares lose the price of a sandwich made me feel very nervous.’