Growth & Innovation

the companies in question and reproduced in good faith.

Members of staff may hold shares in some of the securities written about in this publication. This could create a conflict of interest.

the companies in question and reproduced in good faith.

Members of staff may hold shares in some of the securities written about in this publication. This could create a conflict of interest.

Welcome to Spotlight, a bonus report which is distributed eight times a year alongside your digital copy of Shares.

It provides small caps with a platform to tell their stories in their own words.

The company profiles are written by the businesses themselves rather than by Shares journalists.

They pay a fee to get their message across to both existing shareholders and prospective investors.

These profiles are paidfor promotions and are not independent comment. As such,

they cannot be considered unbiased. Equally, you are getting the inside track from the people who should best know the company and its strategy.

Some of the firms profiled in Spotlight will appear at our webinars and in-person events where you get to hear from management first hand.

Click here for details of upcoming events and how to register for free tickets.

Previous issues of Spotlight are available on our website

Where such a conflict exists, it will be disclosed.

This publication contains information and ideas which are of interest to investors.

It does not provide advice in relation to investments or any other financial matters.

Comments in this publication must not be relied upon by readers when they make their investment decisions.

Investors who require advice should consult a properly qualified independent adviser.

This publication, its staff and AJ Bell Media do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

A large number of junior market names have flown out of the blocks so far this year

Serabi Gold is a top performing stock

We may only be two months in to 2025 but some AIM-quoted businesses have already chalked up big returns. In this article we discuss the best-performing AIM-quoted stocks year-to-date. The data shows that small cap gold miners, oil exploration and technology companies are among those to shine.

UK-based palladium, platinum, rhodium, iridium and gold mining company Eurasia Mining (EUA:AIM) has seen shares gain a staggering 97.8%. Along with other gold miners Serabi Gold (SRB:AIM) up 42.6% and Empire Metals (EEE:AIM) up 38.7% as investors look to gold’s ‘safe haven’ status amid stock market volatility at the start of the year with the inauguration of US President Donald Trump and the DeepSeek related sell-off at the end

of January.

Falklands-based oil outfit Rockhopper Exploration (RKH:AIM) has gained 66.7% yearto-date fuelled by developments in its flagship Sea Lion oil field project. Last November the company said it now expects the Sea Lion project to yield (at a peak) 55,000 bpd (barrels per day). In October, Rockhopper also secured an extension of its petroleum production license in both the North and South Falkland basins (until December 2026).

Peruvian-based hydrocarbons producer PetroTal Corp (PTAL:AIM) and its Asia-Pacific sector peer focused Jadestone Energy (JSE:AIM) have seen shares rise 27% and 26% respectively. PetroTal recently reported a strong first-quarter performance and

declared a welcome cash dividend of $0.015 per common share to shareholders.

Jadestone Energy has been making waves recently with its commitment to global energy transition goals and diversifying its portfolio of production and development assets in countries such as Australia, Malaysia, Indonesia, Thailand and Vietnam.

Moving away from oil, offshore drilling firms, is household furnishings company Victoria (VCP:AIM). Victoria shares have gained 72.9% year-to-date despite reporting disappointing first-half results for the 26 weeks to 28 September 2024. The floorings maker, which dates back to 1895, remains upbeat for the long term with ‘cost initiatives management’ in place. Geoff Wilding, Victoria’s

executive chair said: ‘We anticipate earnings increasing sharply with mid-high teen margins achievable.’

Shares in Filtronic (FTC:AIM) hit an all-time high on 13 February as the communications kit designer continues to benefit from successive contract wins from Elon Musk backed space venture SpaceX. On 10 February, the company signed a £16.8 million contract to be fulfilled between now and the end of 2026.

Filtronic has also secured business with QinetiQ (QQ), BAE Systems (BA.) and the European Space Agency.

Podcast platform Audioboom (BOOM:AIM) has gained an impressive 51.5% so far this year, but the shares are still some way from 2022 highs. In 2023, it issued a profit warning following challenging conditions in the advertising markets, but since then it has made progress.

In its trading update (15 January) for the year ending 31 December, the company reported a 13% increase in revenue to $73.4 million ahead of the IAB’s (Interactive Advertising Bureau) industry growth forecast.

Audioboom also announced several multi-year partnerships with Triton Digital and renewals with ‘key creators’ including Tim Dillon, The Bulwark Network, Cryptic County, No Such Thing As A Fish and Kendall Rae. These shows contribute more than 11 million downloads per month to the Audioboom Creator Network.

Finally Concurrent Technologies (CNC:AIM) has gained 33.5% yearto-date which comes as no surprise considering its most recent trading update (16 January) for the year ending 31 December.

The designer and manufacturer of leading-edge computer products expects to report both revenues and pre-tax profit ahead of market expectations driven by the group’s strategy to invest more assertively in talent and product development. The firm added ‘full year 2024 is set to be a record year, with revenue expected to be approximately 25% ahead of full year 2023’.

Disclaimer: The author (Sabuhi Gard) owns shares in Audioboom.

The space industry is on the verge of becoming one of the most lucrative sectors in the global economy.

With the space economy currently valued at $600 billion and projected to reach $1.8 trillion by 2035, the opportunity for growth is immense.1

The space sector is not just about exploration, it’s becoming a multifaceted industry poised to revolutionise industries and provide exceptional opportunities across the global market.

Space technology is more integrated into our daily lives than most realise.

From weather forecasting to satellite-enabled communication, space systems power much of the modern world.

As access to space becomes more affordable, the potential applications of space technology are expanding across a range of industries including agriculture, emergency management, communications, sustainability and global security.

For example, satellites are essential for global supply chain management, disaster

response, and broadband connectivity.

One key driver of this growth is the reduction in costs associated with launching and maintaining satellites.

The decline in prices has lowered the barriers to entry for new companies, resulting in an explosion of space-based startups.

These companies are at the forefront of groundbreaking technologies that are revolutionising nearly every industry on Earth, creating transformative solutions with real-world applications that will reshape our world for decades to come.

As the cost of accessing space continues to decrease, the space sector is rapidly emerging as a dominant industry with immense investment potential.

Already outperforming other tech markets, space startups saw $8.6 billion in venture capital investment in 2024, marking a 25% year-on-year increase from 2023.2

This growth has occurred despite broader market downturns, underscoring the resilience of the space economy.

One key driver of this growth is the dramatic expansion

of satellite constellations, groups of interconnected satellites, that enable global data collection and real-time monitoring.

These constellations are transforming industries like transportation, agriculture, and telecommunications.

Much like the early days of personal computers, the internet, and smartphones, the space sector is riding a wave of innovation, unlocking new opportunities for both businesses and investors.

The potential for space technologies to help address some of the world’s biggest challenges, from climate change and sustainability to global security, is vast.

Space is central to achieving the SDGs (United Nations Sustainable Development Goals), including supporting

Shares Spotlight

Seraphim

efforts to achieve net zero. It offers the tools to measure, model, and predict the Earth’s vital signs, providing insights that are critical for making informed decisions about resource use and conservation.

These technologies are already making a tangible impact, playing an ever more crucial role in gathering environmental data, monitoring greenhouse gas emissions, and improving weather forecasting. They continue to evolve, their potential to drive sustainable development will grow.

For example, as extreme weather events become increasingly regular, the use of satellites for food security, through tracking deforestation, assessing soil health, and improving crop yields, will become essential.

Space technologies are essential to global security and defence agendas.

Satellites provide realtime global communication, intelligence through earth observation, and precise navigation via GPS, supporting military operations and crisis response.

They also aid in early warning systems for missile threats and natural disasters, enhancing national security and global stability.

The space economy is expanding at an exponential rate, and the investment opportunities are diverse.

Nearly 50% of the 18,000 satellites ever launched have been in the past five years, and that number is expected to increase tenfold over the

next decade.

As demand for satellite-based services grows, so too does the market for space infrastructure.

New startups are emerging in areas like direct to cell communications, space-based pharmaceutical research, and in-space servicing.

Some of the world’s most valuable private companies, like SpaceX and Blue Origin, are in the space sector, and many startups have already achieved valuations of over $1 billion.

As the space sector continues to mature, it offers an expanding pool of investment opportunities, with new companies focused on innovative technologies that promise to revolutionise a range of industries.

With increasing investment from both private companies and governments, space will continue to transform industries and open up new opportunities for investors.

The intersection of space technology with other megatrends, such as AI (artificial intelligence), autonomous transportation, and renewable energy, will only increase the value of spacerelated investments.

Whether it’s through satellite-based data collection, infrastructure development,

or in-space servicing, the opportunities in space are bound to expand across industries.

The space economy represents a truly unique opportunity for forward-thinking investors.

As new technologies emerge and new applications are realised, the growth potential is exponential. For those looking to participate in one of the most exciting growth sectors of the 21st century, the space industry offers unparalleled opportunities.

Seraphim Space Investment Trust PLC (SSIT) is the world’s first listed SpaceTech fund. It is an externally managed closed ended investment company that was launched in July 2021. SSIT seeks to generate capital growth over the long term through investment in a diversified, international portfolio of predominantly growth stage privately financed SpaceTech businesses that have the potential to dominate globally and are category leaders with first mover advantages in areas such as global security, cybersecurity, food security, climate change and sustainability.

Capital at risk. The value of an investment and the income from it can go down as well as up and investors may not get back the amount invested.

Aquis-listed Valereum (VLRM:AQUIS) is sitting at the forefront of the financial technology revolution, pioneering tokenisation and digital markets to reshape how capital and assets are settled and traded. With a mission to ‘unlock capital and create value’, Valereum aims to become the global market leader in the burgeoning tokenised markets sector.

Valereum is a fintech company that specialises in tokenisation technology and DFMI (digital financial market infrastructure). Its flagship solution, The Bridge, exemplifies its innovative approach. This full-stack DFMI integrates asset issuance, trading, settlement, registry, and custody of tokenised assets across multiple blockchain protocols.

By delivering ‘T-Instant’ settlement at the point of trade, The Bridge eliminates inefficiencies inherent in traditional financial systems, enabling seamless and secure transactions. Valereum’s technology is showcased through VLRM Markets, a growing ecosystem of tokenised marketplaces.

Valereum envisions a world

where financial markets operate with unparalleled efficiency, transparency, and accessibility. By leveraging its deep expertise in capital markets and partnerships with leading technology providers, it has designed solutions that go right to the heart of the challenges of legacy systems, such as high costs, complexity, and counterparty risk.

The company‘s strategy is two-fold:

• Technology Provision: Licensing The Bridge DFMI to exchanges, brokers, and custodians worldwide. This solution revolutionises settlement processes by integrating the CSD (Central Securities Depository) with the trading engine, enabling instant settlement.

• Marketplace Operation: Establishing and managing tokenised marketplaces for public securities, digital assets, and RWA (real

world assets). These marketplaces unlock value in previously illiquid assets and offer investors diverse investment opportunities.

Tokenisation is the process of converting assets into digital tokens that can be traded on a blockchain. This technology is gaining recognition from financial giants like JPMorgan (JPM:NYSE) and Mastercard (MA:NYSE) for its ability to boost efficiency, reduce costs, and unlock capital. By 2030, the tokenised RWA market is projected to be worth between $16-$64 trillion, while traditional public markets currently exceed $100 trillion in capitalisation.

Valereum’s solutions exploit these opportunities by targeting critical pain points:

• Cost Reduction: Activitybased pricing models lower the cost of adoption for market participants.

• Efficiency Gains: The Bridge eliminates settlement delays and reduces the need for intermediaries.

• Liquidity Creation: Tokenisation facilitates the trading of previously illiquid assets, attracting a broader investor base.

• Risk Mitigation: By ensuring T-Instant settlement, Valereum eliminates counterparty and replacement cost risks.

At the heart of Valereum’s offerings is The Bridge DFMI, a turnkey solution that combines state-of-the-art technologies. These include high-performance trading engines, on-chain registry systems, and multi-asset wallet and custody solutions.

Notable features include:

• Final Irrevocable Settlement: Trades are settled instantly at the point of execution, eliminating failed trades and reducing systemic risk.

• Cost and Capital Efficiency: Unlocks capital tied up in central counterparties and minimises operational expenses.

• Global Interoperability: Opens access to panjurisdictional liquidity pools, fostering price discovery and market integration.

Valereum’s solutions cater to diverse market segments:

• Private Markets:

Tokenisation of real-world assets such as real estate, artwork, and royalties, unlocking trillions in untapped value.

• Public Markets: Creating regulated exchanges for tokenised securities, enabling 24/7 trading and seamless integration with traditional systems.

• Institutional Clients: Providing tools for brokers, fund managers, and banks to streamline operations and expand product offerings.

Valereum’s unique value proposition lies in its ability to merge innovative technology with practical market applications.

The company’s offerings include:

• Cost-Effective: An activitybased pricing model ensures affordability and scalability.

• Agile: Designed for swift deployment, free from the constraints of legacy systems.

• Comprehensive: Integrates multiple functions into a single infrastructure, addressing the entire asset lifecycle.

Valereum’s journey has been marked by a series of significant achievements.

The company recently secured a £19 million investment, plus £1 million from a UK institutional investor. The funding supports four acquisitions and Valereum’s expansion in tokenisation and digital assets, strengthening its position as a bridge between traditional finance and blockchain innovation.

Strategic partnerships have been established through collaborations with technology leaders such as Tokeny and Fireblocks to enhance security and functionality.

An RWA Marketplace has been established as a licensed marketplace in El Salvador, showcasing the practical application of the technology.

Technological advancements include the near-completion of The Bridge V1, and ongoing enhancements to support additional asset classes and blockchain protocols.

As tokenisation becomes increasingly important in modern finance, Valereum stands poised to participate in this transformation. By removing inefficiencies in existing markets and creating platforms for new opportunities, the company is not only redefining how assets are traded but also expanding access to global capital pools.

It is a compelling story of innovation, growth, and the rewards of challenging the status quo. Whether through its cutting-edge technology or its vision of inclusive and efficient markets, Valereum is looking to play its part in the future of finance.

To discover more head to our interactive investor hub. Here you will find company news and additional content to further explain Valereum’s vision.

Vinanz (BTC) listed on the LSE (London Stock Exchange) main market on 13 January 2025.

Securing this BTC ticker makes Vinanz very uniquely positioned from a global brand perspective.

This LSE listing marks a significant milestone in the company’s journey as a rapidly growing player in North America’s bitcoin mining industry and makes Vinanz a unique investment opportunity in the UK. Vinanz is debt free and offers exposure to the bitcoin sector.

With global interest in cryptocurrencies reaching new heights, bitcoin is increasingly recognised as a mainstream asset class.

Over the past year, the approval of multiple spot bitcoin ETFs (exchange traded funds) in the US and other markets has further legitimised digital assets.

These ETFs are attracting institutional investors and reinforcing bitcoin’s position as a credible alternative to traditional fiat currencies.

Today, bitcoin’s total market value stands at around $2 trillion, with predicted robust growth ahead.

Since its initial listing on the Aquis Exchange in April 2023, Vinanz has achieved remarkable success.

The transition to the

main market represents a transformational step, providing access to a broader and more diverse investor base, both in the UK and internationally.

As part of the ongoing digital currency revolution, Vinanz is committed to expanding its role in the bitcoin ecosystem and being a part of the adoption of digital assets worldwide.

Significantly for the future of bitcoin, President Trump signed an executive order on 23 January 2025, titled: ‘Strengthening American Leadership in Digital Financial

Technology.’

The order aims to establish the US as a global leader in blockchain innovation while reducing regulatory uncertainty for the crypto industry.

Should the US government adopt the policy of holding a strategic bitcoin reserve as part of its US dollar currency, backing bitcoin prices could benefit substantially.

When Satoshi Nakamoto mined the first bitcoin in 2009, the ultimate number of bitcoins was determined to only ever reach 21 million.

Right now, there are 19.81 million bitcoins mined, and it is estimated that it will take another 140 years to mine to the very

last one.

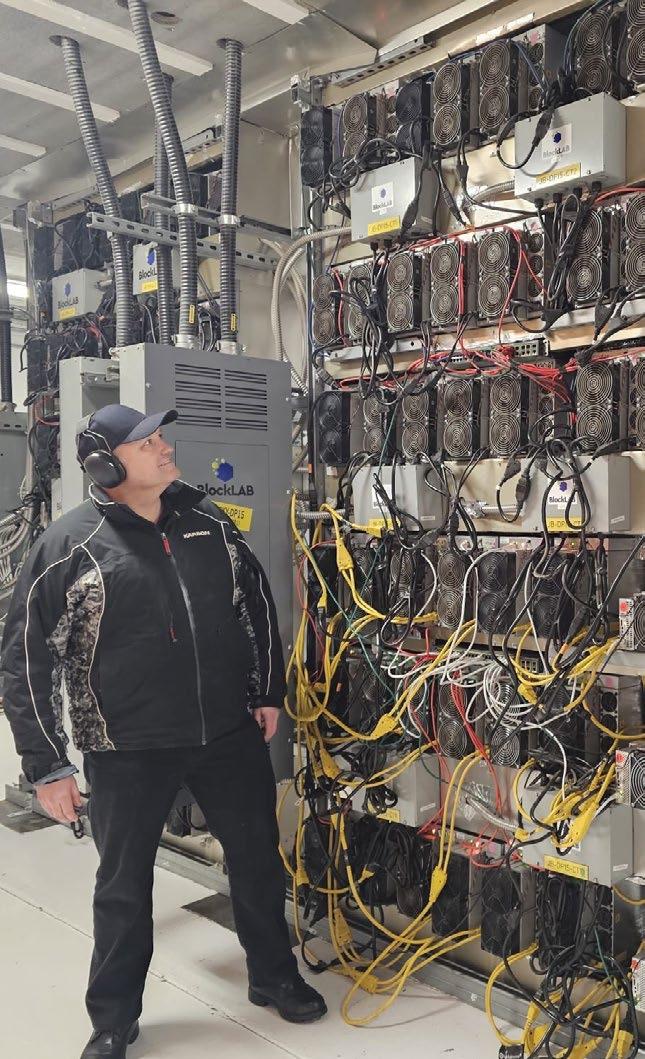

Vinanz is building up a strategic bitcoin holding by installing miners within third-party hosting facilities throughout the US and Canada.

Currently, Vinanz operates bitcoin miners in Indiana, Iowa, Nebraska, and Texas in the US and in Labrador (Canada) and this footprint is set to expand in 2025.

Vinanz ultimately plans to have 500 miners hashing to Vinanz’s wallet in each North American state, providing a diverse and de-risked platform for revenue generation.

With each new expansion, it aims to install new miners that have a healthy and attractive operating margin of the prevailing bitcoin price on installation, thereby always modernising the fleet and keeping up to date with the latest and most competitive technology.

Vinanz’s financial model is now tried and tested, and provides a linearly expandible model, limited only by the amount of capital deployed.

Vinanz remains at the forefront of the bitcoin mining industry by adopting stateof-the-art ASIC (ApplicationSpecific Integrated Circuit) miners, ensuring continuous upgrades with each new model to maximize efficiency and output. As the cryptocurrency landscape rapidly evolves, Vinanz is committed to maintaining its competitive edge through technological innovation and operational excellence.

This forward-thinking approach aligns with the risk-reward appetite of investors seeking exposure to innovative, high-growth firms in the digital asset sector.

By consistently optimising its mining infrastructure, Vinanz reinforces its position as a leading player in the European-listed bitcoin mining industry, while delivering long-term value to shareholders.

With bitcoin and other digital assets garnering mainstream acceptance, regulatory clarity is becoming more pronounced.

Various governments and financial institutions

worldwide are reassessing their stance on cryptocurrency, with some considering regulatory frameworks that promote growth.

The UK is steadily moving toward creating a comprehensive regulatory landscape for digital assets, which could further legitimise companies like Vinanz in the eyes of investors.

Vinanz sees the long-term growth prospects of bitcoin market as significant.

Many analysts predict that bitcoin will continue to appreciate over the next decade as government policy changes, mainstream adoption increases, and supply diminishes due to the halving events that occur about every four years.

By establishing a stake in Vinanz, readers can potentially capitalise on the long-term price appreciation of bitcoin while benefiting from the company’s operational expansion and market share growth. For those looking to diversify their portfolios and explore new avenues of growth, Vinanz presents a prospect worth serious consideration.