10 How Rwanda’s Exploitation of Eastern Congo Fuels a 20-Year Crisis

18 Trump Admin Tariffs Ignite Gold and Silver Market Volatility

10 How Rwanda’s Exploitation of Eastern Congo Fuels a 20-Year Crisis

18 Trump Admin Tariffs Ignite Gold and Silver Market Volatility

Volume: 114. Issue.02. February 2025

As we navigate through 2025, the global iron ore exploration landscape is undergoing significant transformations, influenced by a confluence of market dynamics, geopolitical shifts, and technological advancements.

Rat Hole Mining: A Deadly Practice Claims Lives in India’s Coal Mines

Mine Safety: U.S. Mining Industry Achieves Milestone of No Pattern of Violations

Exploration & Geology in 2025: Innovations, Challenges, and the Future of Mining

As the mining industry navigates the complexities of 2025, exploration and geology are at the forefront of its evolution.

In 2025, the mining industry is undergoing a transformative shift in training methodologies for equipment operators, driven by technological advancements, safety imperatives, and the pressing need to address labor shortages. 14

05 Keystone Project Nevada: U.S. Gold Corp.’s High-Stakes Bet in the Cortez Trend

06 Future Minerals Forum 2025

08 China’s Copper Demand Stabilizes Global Markets Amid Renewable Energy Boom

12 GoviEx Uranium Advances Muntanga Project with Strong Feasibility Study Results

12 Metso Expands African Presence with New Screen Centre in Germiston, Johannesburg

22 Geopolitics, Arctic Dominance, & Economic Ambitions: Rare Earth Elements in Greenland

24 Rio Tinto and Glencore’s Merger Talks

28 Environmental Considerations and Community Impact

32 Global Coal Demand Hits Record in 2024

34 Phoenix Tailings’ Green Revolution in Critical Metals

35 Lithium-Ion Battery Recycling

37 Mining Boom Fuels Employment in Sierra Leone

44 Trump Administration Could Spur Deep-Sea Mining Boom Amid Controversy

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284. Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

SKILLINGS MINING

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284.

Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF JOHN EDWARD john.edward@skillings.net

CONTRIBUTING EDITORS ROB RAMOS AALIYAH ZOLETA MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING

CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

U

.S. Gold Corp. (NASDAQ: USAU) is advancing the Keystone Project Nevada, a district-scale gold exploration initiative spanning 20 square miles in the Cortez Trend, one of North America's most prolific mining corridors. Some geologists believe this region could surpass the Carlin Trend in economic potential.

The Keystone Project hosts Carlin-style sedimentary rock-hosted mineralization, hydrothermal alteration zones, and oxidized, cyanide-soluble gold—all characteristics of Nevada’s largest gold deposits. Since acquiring Keystone, U.S. Gold Corp. has conducted gravity surveys, geochemical sampling, geological mapping, and scout drilling to refine exploration models. A 2019 drilling program in the Nina Skarn target revealed

significant gold-bearing material, suggesting a larger gold system.

In 2023, the company completed a hyperspectral study using satellite imaging to detect hydrothermal alteration signatures, identifying multiple high-priority drilling targets. As existing gold mines deplete, Keystone represents a vital opportunity for future gold production, supported by Nevada’s pro-mining policies. If exploration efforts confirm high-grade deposits, Keystone could emerge as a game-changing discovery for U.S. Gold Corp. and the global gold industry.

Terra Drone Arabia took center stage at the Future Minerals Forum 2025 in Riyadh, unveiling advanced drone and AI-powered solutions tailored for the mining sector.

As Saudi Arabia accelerates its mining ambitions under Vision 2030, Terra Drone Arabia’s technologies enhance exploration, production, and reclamation, improving operational efficiency, safety, and cost-effectiveness.

Mahmoud Attia, Technical & Business Director, emphasized the company’s role in integrating technology to support Saudi Arabia’s mining expansion. With an estimated $2.5 trillion in untapped mineral resources, the Kingdom aims to diversify its economy, making mining a key industrial pillar.

Looking ahead, Terra Drone Arabia plans to localize operations by establishing production facilities and R&D centers to support job creation, technological advancement, and sustainability. By aligning with Vision 2030, the company is set to contribute significantly to Saudi Arabia’s mining transformation and long-term economic growth.

In a strategic mining acquisition, China’s Zijin Mining Group is in talks to acquire a 40% stake in Zangge Mining, a Chinese potash and lithium producer valued at approximately $6.4 billion.

The deal could significantly bolster Zijin’s position in the lithium market as global competition intensifies for this critical battery metal.

Zijin Mining, traditionally known for its gold and copper operations, is reportedly negotiating with Zangge Mining’s two major shareholders, Tibet Zangge Venture Capital and Ningbo Meishan Bonded Port Area Xinsha Hongyun Investment Management. Together, these entities control 40% of Zangge, which focuses on potash production but derives about one-third of its revenue from lithium extraction.

Zangge Mining operates primarily in Qinghai, a mineral-rich province in western China, and produced 9,278 metric tons of lithium carbonate in the first nine months of 2024. The company’s lithium assets are centered on salt lake brines, a resource vital for lithium-ion battery production.

For Zijin, this mining acquisition represents an opportunity to diversify its portfolio and accelerate its lithium ambitions. Chairman Chen Jinghe has spearheaded the company’s transition from a regional gold miner into a global resource powerhouse, with growing interests in green energy metals.

The acquisition could enhance Zijin’s control over the Julong copper project in Tibet, where the two companies are joint venture partners. Julong, China’s largest single copper mine, recently received regulatory approval to increase output to 350,000 metric tons per day. Beyond domestic expansion, Zijin is advancing lithium projects internationally. The company plans to begin lithium production in the Democratic Republic of Congo by 2026, while its Argentina and Tibet projects are slated to come online in 2025, following delays attributed to weak lithium prices and permitting challenges.

By 2028, Zijin aims to achieve an annual lithium production capacity of 300,000 metric tons. While current output remains limited, acquiring Zangge Mining through this mining acquisition would provide a significant boost to this goal.

ME Elecmetal offers more than mill liners — we provide innovative, tailored solutions for your comminution needs. With over a century of expertise, we focus on strong customer relationships, collaboration, and delivering effective solutions that optimize processes, extend wear life, reduce risks, Discover how we can improve your grinding

• Rubber

FEBRUARY 23-26, 2025 | DENVER, CO BOOTH 1601

• SAG Mills: 4.0” to 6.5”

• Composite

• Ball Mills and Regrind Mills: 7/8” to 4.0”

• Rod Mills: 3.0” to 4.0” Diameter

• Gyratory Crushers

• Jaw Crushers

• Cone Crushers

China’s copper demand is playing a crucial role in stabilizing global copper markets, even as economic slowdowns and geopolitical tensions impact demand in other regions. potential oversupply, and material substitution could influence the longterm outlook for the metal.

China's ambitious green energy strategy is not only transforming the nation's power landscape but also significantly reshaping global copper markets. As the world’s largest consumer of copper, China’s rapid investment in renewable energy infrastructure, electric vehicles (EVs), and power grids is driving strong copper demand.

However, this growth comes with challenges, including supply bottlenecks, geopolitical tensions, and rising costs. Here’s a closer look at how China’s green energy expansion is influencing the copper industry and the strategies being employed to meet its growing needs.

China's role in the global copper market is undeniable. Copper is essential in numerous green energy technologies, especially in solar panels, wind turbines, and electric vehicles, all of which are at the core of China’s clean energy revolution.

The country is already the world leader in EV production and adoption, with over 8 million EVs sold in 2023—a number expected to increase in 2024. Each EV uses nearly three times more copper than a traditional car, thanks to copper-in-

tensive components such as motors, batteries, and charging infrastructure.

This surge in EV demand, bolstered by government incentives and large-scale investments in charging networks and battery technologies, will continue to be a significant driver of copper consumption. In addition, China’s leadership in renewable energy expansion is adding even more pressure on copper supplies.

By 2030, the International Energy Agency (IEA) projects China will account for 60% of global renewable energy expansion, which requires extensive copper wiring, transformers, and connectors to integrate new energy sources into the grid. Large-scale power grid upgrades are also necessary to manage the increased load

from renewables, further solidifying China’s copper needs.

While demand for copper in China remains robust, the global supply chain faces significant risks. The International Copper Study Group (ICSG) predicts a surplus of 469,000 tons of copper in 2024, easing to 194,000 tons in 2025, driven by aggressive mining expansion in previous years. However, global copper supply remains vulnerable to disruptions, including political instability in major copper-producing regions like Chile and Peru, declining ore quality, and logistical challenges. These issues create price volatility, making it harder for companies to plan long-term investments

in copper. To stabilize prices and ensure a steady supply, new mining projects like the Warintza Project in Ecuador are emerging as potential solutions.

This project, led by Solaris Resources, focuses on sustainable copper production, reflecting the growing trend towards responsible mining practices. Such projects are closely watched by investors seeking long-term, stable sources of copper.

In response to potential supply disruptions, China is taking proactive steps to secure its copper needs. One approach involves material substitution, where aluminum is used in place of copper in certain applications. Aluminum, being more abundant, cheaper, and lighter

than copper, could ease some pressure on China’s copper demand, though it is not a perfect replacement for all copper uses.

Another key strategy is ramping up copper recycling. China aims to increase its recycled copper output from 2.5 million tons in 2024 to over 3.5 million tons by 2030.

This move not only helps reduce reliance on newly mined copper but also aligns with China’s carbon reduction goals. By focusing on secondary copper production, China seeks to stabilize supply and minimize the environmental impact of its copper consumption.

While China’s green energy investments have provided stability to global cop -

per demand, long-term sustainability challenges remain. The combination of stringent environmental regulations, rising operational costs, and community resistance to large-scale mining may limit the growth of new copper projects. Latin America, home to some of the world’s largest copper reserves, will play a critical role in meeting future demand.

However, overcoming regulatory hurdles and ensuring the economic viability of projects like Warintza will be crucial in securing a stable copper supply.

As global electrification accelerates, the copper industry’s ability to balance supply with sustainable practices will determine how well China’s green energy strategy can continue to drive copper demand in the coming decade.

In 2019, President Donald Trump’s suggestion to “purchase” Greenland seemed outlandish to some, but it highlighted the growing strategic importance of the Arctic region. Beneath the surface of this diplomatic curiosity lies a deeper story—Greenland’s vast reserves of rare earth elements (REEs), which are critical to modern technologies and defense applications.

Trump’s proposal, though controversial, underscored the United States’ increasing interest in Greenland as a resource hub with significant geopolitical implications.

The Strategic Value of Greenland’s Rare Earths

The U.S. has long had an eye on Greenland. Efforts to acquire the island date back to 1868, with a more significant push under President Harry Truman

in 1946 when the U.S. offered Denmark $100 million in gold for Greenland. Trump’s 2019 proposal to buy the territory marked a continuation of this historical interest, but this time, it was driven by the growing importance of rare earth elements.

Greenland is home to some of the world’s richest deposits of REEs, including neodymium, dysprosium, and scandium. These minerals are indispensable in

the production of electric vehicles, wind turbines, and advanced defense systems. Particularly valuable is the Kvanefjeld deposit, which contains rare earths as well as uranium, positioning Greenland as a potential game-changer in the global REE market.

“Greenland is strategically vital, not just as a resource hub but as a potential chokepoint in global supply chains,” says Neha Mukherjee, senior critical minerals analyst at Benchmark Mineral Intelligence. The island’s abundance of these rare elements has the potential to shift the balance of power in global markets dominated by China.

As of 2024, China controls approximately 70% of global rare earth mining and 90% of its processing. This near-mo-

nopoly provides Beijing with significant leverage in geopolitical disputes, especially since rare earths are crucial for cutting-edge technologies like electric vehicle batteries, fiber optics, and military systems.

In October 2024, China further tightened its control by banning the export of REE extraction technologies, highlighting the growing urgency for nations like the U.S. to diversify their supply chains.

Greenland’s vast REE reserves could offer a viable solution to reduce U.S. dependence on China. Establishing a presence in Greenland would help the U.S. secure a more reliable source of these critical minerals, boosting both economic security and supply chain resilience.

However, diversifying away from China is easier said than done. Chinese firms benefit from economies of scale, substantial government subsidies, and vast stockpiles, which allow them to undercut global competitors. Additionally,

many rare earths are by-products of mining other minerals, such as iron ore, complicating efforts to ensure a consistent, high-quality supply.

Greenland’s rare earths are not the only factor making the Arctic region strategically important. The U.S., Russia, and China are all vying for influence in the region.

Russia has prioritized the Northern Sea Route, a key Arctic shipping lane, and is expanding its mining activities. Meanwhile, China has declared itself a “near-Arctic state,” signaling its own ambitions in the region.

For the U.S., gaining access to Greenland’s resources would not only help secure vital rare earth supply chains but also strengthen its strategic position in the Arctic. Trump’s suggestion to treat Greenland as a “national security” asset reflects the broader geopolitical importance of the region.

GoviEx Uranium Advances Muntanga Project study underscores the project’s attractiveness as a shallow open-pit mine with heap leaching capabilities, positioning it favorably in a tightening uranium market.

GoviEx Uranium has revealed promising feasibility study results for its Muntanga uranium project in Zambia, positioning it as an attractive investment in the tightening uranium market. The project offers a low-risk, cost-effective operation with a focus on sustainable practices, set to capitalize on the growing demand for nuclear energy.

The Muntanga project is expected to deliver an after-tax net present value (NPV) of $243 million and an internal rate of return (IRR) of 20.8%, based on a uranium price of $90 per pound. The project’s NPV is sensitive to uranium price fluctuations, with each $5 increase in prices adding $45 million to the NPV. Muntanga is designed as a shallow openpit mine with heap leaching capabilities, forecasted to produce 2.2 million pounds of U₃O₈ annually over a 12-year mine life. Additional inferred resources and satellite deposits present opportunities for further growth.

The project’s design emphasizes cost-efficiency with soft rock mining, minimal crushing, low acid consumption, limited energy requirements, and high

uranium recovery rates, contributing to both economic and environmental sustainability.

Muntanga prioritizes environmental sustainability by forgoing tailings storage, in line with the global push for greener mining practices. The use of existing infrastructure, including roads, water, and electricity, further enhances the project’s environmental credentials.

CEO Daniel Major highlighted the project’s low operating cost of $32.20 per pound of U₃O₈ and its strong profitability, underscoring its low technical risk and fast uranium recoveries.

With growing demand for nuclear energy and a global supply gap due to years of underinvestment, the Muntanga project is well-positioned to meet rising uranium needs.

Production could begin as early as 2028, depending on financing. Muntanga’s favorable economics and sustainable design make it a promising development in the growing uranium sector.

Metso, a global leader in industrial equipment, has opened a new screen centre in Germiston, Johannesburg, to enhance its regional supply and delivery capabilities. The facility, inaugurated on January 16, marks a significant step in Metso’s commitment to better serving Africa’s industrial and mining sectors.

The new centre focuses on assembly, testing, and painting of Metso’s screening solutions, providing a more efficient response to African market needs. Ian Barnard, President of Metso’s Africa market area, highlighted the importance of adapting global technologies for local manufacturing, ensuring faster delivery and customized solutions for customers.

In line with its regional strategy, Metso aims to position itself closer to African customers by expanding local engineering, sourcing, and technical support. Adrian Wood, Vice President of Screening Central, emphasized that this initiative will strengthen Metso’s presence and foster market-focused development in Africa.

Metso offers a wide range of high-performance screening solutions, including the UFS Series™ for fine material processing and the EF Series™ for precise classification.

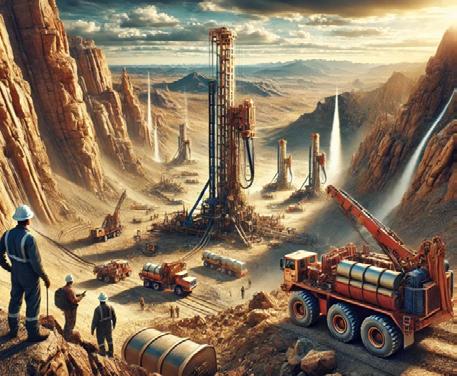

Innovations, Challenges, and the Future of Mining

As the mining industry navigates the complexities of 2025, exploration and geology are at the forefront of its evolution. The imperative to secure critical minerals essential for renewable energy technologies has intensified, prompting a surge in global exploration initiatives. Concurrently, technological advancements are revolutionizing traditional geological methods, enhancing efficiency and sustainability.

The global shift towards renewable energy has escalated the demand for minerals like lithium, copper, and cobalt. In response, countries worldwide are intensifying their exploration efforts. For instance, India is set to apply for licenses to explore deep-sea minerals in the Pacific Ocean, aiming to secure critical minerals essential for energy transition technologies.

Similarly, Japan has discovered a vast deposit of valuable minerals, including manganese, nickel, and cobalt, around Minami Torishima Island, with plans to extract resources gradually to minimize environmental impact.

In Africa, Zambia is attracting significant foreign investment in its copper assets. Saudi Arabia's Manara Minerals has expressed interest in investing in critical minerals projects, especially copper, in Zambia, aligning with the country's plans to increase copper production to 3 million tons per year within a decade.

Technological innovation is reshaping mineral exploration. Artificial intelligence (AI) and machine learning are being integrated to enhance the discovery and delineation of mineral resources. A notable development is the end-to-end

and machine learning are being integrated to enhance the discovery and delineation of mineral resources. A notable development is the end-to-end workflow combining ambient noise tomography (ANT) and AI, which improves decisionmaking capabilities for targeting mineralization.

workflow combining ambient noise tomography (ANT) and AI, which improves decision-making capabilities for targeting mineralization.

Additionally, companies like Fleet Space Technologies are pioneering the use of low Earth orbit nanosatellites and ground-based sensor arrays to create 3D subsurface geological maps. This approach accelerates the exploration process, making it more accurate and environmentally friendly.

Policy changes are significantly impacting the mining sector. In the United States, President Donald Trump has halted $300 billion in clean energy loans, affecting projects in manufacturing and renewable energy. This decision has introduced uncertainty into the clean energy sector, influencing companies like Fortescue to reassess their green energy initiatives in the U.S.

Conversely, Indonesia's parliament has proposed revisions to its mining law to expedite the development of the mineral processing industry and regulate mining permits for religious groups and universities. This initiative reflects a strategic move to enhance the country's mineral value chain and create domestic employment opportunities.

The pursuit of mineral resources is increasingly balanced against environmental concerns. Deep-sea mining, for example, has sparked debate due to potential ecological impacts. Scientists warn that such activities could disrupt delicate marine ecosystems and release stored CO2, exacerbating climate change. Despite these concerns, countries like Norway are exploring deep-sea mining opportunities, highlighting the tension between resource acquisition and environmental preservation.

The landscape of exploration and geology in 2025 is characterized by a dynamic interplay of increased global exploration efforts, technological innovation, policy shifts, and environmental considerations. As the demand for critical minerals escalates, the industry must navigate these complexities to ensure sustainable and responsible resource development.

In 2025, the mining industry has increasingly recognized the value of collaboration and partnerships in overcoming shared challenges. Major players in the sector are forming alliances to pool resources, knowledge, and technology.

For instance, Rio Tinto and BHP are working jointly on a decarbonization initiative aimed at reducing emissions across their operations, including exploration activities. This partnership leverages cutting-edge technology and sustainable practices to align with global climate goals.

Additionally, smaller exploration firms are partnering with universities and research institutions to gain access to advanced technologies and specialized expertise. These collaborations not only enhance the precision of exploration but also provide new insights into geochemical and geophysical processes.

As nations race to secure critical minerals, some regions have emerged as hotspots of interest. In South America, Chile and Argentina continue to lead in lithium production, while Peru is attracting investment for its untapped copper reserves.

The European Union has also identified Greenland as a strategic source of rare earth elements and is exploring ways to develop its resources sustainably. The EU’s Critical Raw Materials Act, passed in 2024, has set clear targets for domestic mineral production and recycling to reduce dependency on external suppliers.

In North America, Canada is ramping up its exploration initiatives, with significant discoveries reported in the Yukon and Quebec.

The Canadian government is also providing financial incentives for exploration projects focused on critical minerals, reflecting its commitment to strengthening its domestic supply chains.

Despite these advancements, the industry faces significant challenges. Geopolitical tensions have disrupted exploration efforts in some regions, particularly in areas with valuable deposits. For example, escalating tensions between major powers have raised concerns about the security of critical mineral supply chains.

Moreover, the rising costs of exploration, driven by inflation and stricter environmental regulations, are putting pressure on companies to optimize their operations. While technological innovations help mitigate some of these challeng-

es, the initial investment required for such technologies can be prohibitive for smaller firms.

The importance of community and Indigenous engagement has become a central focus for exploration projects in 2025. Companies are increasingly adopting a collaborative approach, ensuring that local communities are not only consulted but also benefit directly from mining activities. This includes agreements for profit-sharing, employment opportunities, and investments in local infrastructure.

In Australia, for instance, mining companies are partnering with Aboriginal groups to co-manage exploration activities on traditional lands. These partnerships aim to respect cultural heritage while promoting sustainable development.

As we move further into 2025, the exploration and geology sector is poised for transformative growth, driven by the global energy transition and technological innovation. However, the industry's success will depend on its ability to address environmental concerns, foster collaboration, and navigate geopolitical complexities.

By 2030, the integration of artificial intelligence (AI) in exploration may become ubiquitous. Predictive algorithms, coupled with extensive geological datasets, could enable companies to identify mineral-rich zones with unprecedented accuracy. Advances in machine learning could also model underground conditions in real-time, reducing the risk of exploratory drilling and optimizing resource allocation.

Imagine an AI-powered digital twin of the Earth, continuously updated with satellite and subsurface data. Such a system could not only predict mineral deposits but also monitor environmental changes and community impacts, guiding sustainable practices at every stage of exploration.

Quantum computing, while in its infancy, holds immense potential for exploration. By harnessing quantum mechanics, these machines could solve complex geological problems that traditional supercomputers cannot. For instance, quantum algorithms might simulate subsurface mineral formations with atomic-level precision, revolutionizing the accuracy of exploration models.

Speculatively, quantum systems could also analyze the vast volumes of data generated by nanosatellites and autonomous drones, providing insights that reshape the way we understand Earth's geology.

Despite its controversies, deep-sea mining could gain traction as terrestrial resources become scarcer. Advances in robotics and autonomous vehicles might enable the efficient extraction of nodules rich in manganese, cobalt, and other critical minerals from the ocean floor.

However, this raises ethical and ecological questions: Could we develop technologies to mitigate the environmental impacts of deep-sea mining? Could artificial ecosystems or bioremediation strategies repair the damage? Speculative innovations, such as underwater reforestation or symbiotic partnerships with marine life, may hold the key to balancing resource extraction with conservation.

Blockchain technology could revolutionize how exploration data is shared and validated. By creating decentralized networks of geological data, exploration companies might collaborate on a global scale while maintaining data security and transparency. Imagine a blockchain-based platform where stakeholders, including governments, companies, and local communities, can verify exploration claims in real time.

This could also pave the way for community-led exploration initiatives, where local groups have a stake in the decision-making process and share in the profits of resource development.

Speculation around space mining is no longer confined to science fiction. The demand for rare earth elements and critical minerals might push humanity to look beyond Earth for resources. Companies like Planetary Resources and government agencies like NASA are already exploring the feasibility of asteroid mining. By 2035, it is conceivable that robotic missions to extract metals from near-Earth asteroids could become a reality.

Such developments would bring new challenges, including the ethical implications of space exploration, the potential militarization of extraterrestrial resources, and the environmental consequences of mining in microgravity environments.

Another speculative frontier lies in synthetic geology. Advances in material science and biotechnology might enable the creation of synthetic minerals or the enhancement of existing deposits through bioengineering. Engineered microbes, for instance, could “grow” metals in controlled environments, providing a sustainable alternative to traditional mining.

This shift could redefine exploration, moving it away from destructive practices and toward controlled, lab-based resource generation. Such innovations might also decentralize resource production, reducing the geopolitical tensions associated with critical mineral supply chains.

While these speculations may seem futuristic, the rapid pace of technological and societal change suggests that they are within reach. The mining industry’s ability to adapt to these possibilities will determine its relevance in an increasingly resource-conscious world.

In the coming decades, exploration might not only involve finding minerals beneath the Earth’s surface but also in the skies, the oceans, and even laboratories. The industry stands at the brink of a renaissance, where imagination, innovation, and responsibility will shape the next chapter of human progress.

The inauguration of President Donald Trump has ignited dramatic gold and silver market volatility, with investors scrambling to respond to potential Trump administration tariffs on imported bullion.

Speculation surrounding the new administration’s trade policies has sent ripples through global financial markets, driving up lease rates, futures premiums, and demand for physical metals.

The possibility of Trump administration tariffs on imported gold and silver, first floated in late 2024, has thrown precious metals markets into turmoil. Hedge funds and banks rushed to close short positions, spiking futures prices well above spot prices. Typically aligned, the divergence between these benchmarks reflects mounting uncertainty.

For example, in the days preceding President Trump’s January 20 inauguration, the premium for front-month silver futures surged from $0.56 to $1.12 per ounce—far exceeding the typical $0.14 range. Gold futures experienced a similar trend, with the premium jumping from $12 to $44 per ounce before plummeting to $8 after a Trump administration memo eased concerns about immediate tariffs.

The memo outlined plans to review trade imbalances before imposing broad measures, calming markets briefly. However, gold and silver market volatility resumed later that day when Trump hinted at potential 25% tariffs on Mexico and Canada starting February 1.

Behind the market turbulence lies a frenzied rush to relocate physical gold and silver into the U.S. Major dealers, bracing for the prospect of Trump administration tariffs, have ramped up bullion shipments.

Since November 2024, 7.4 million ounces of gold have been delivered to CME Group warehouses in the U.S., underscoring the scale of the operation.

This physical demand has driven gold lease rates in London to their highest levels in decades.

Typically near zero, these rates spiked to an annualized 3.5%—a clear indicator of tightening supply and elevated demand for short-term gold loans.“The markets are in total dislocation,” said Robert Gottlieb, former managing director at JPMorgan Chase & Co., in a recent Bloomberg interview. “There seems to be a scarcity of available stocks in both gold and silver.”

The combination of speculative activity and physical demand is fueling bullish technical signals in precious metals. Gold recently broke out of a consolidation triangle pattern, sparking optimism among traders that the metal is poised for further gains.

Silver, meanwhile, appears to be nearing a breakout from its own consolidation range, setting the stage for a potential rally.

These developments highlight a broader trend: uncertainty surrounding Trump administration tariffs is pushing investors toward safe-haven assets. Precious metals, traditionally viewed as a hedge against economic and geopolitical instability, are benefiting from this flight to safety.

While near-term volatility dominates headlines, many analysts view recent developments as a buying opportunity. Following a sharp pullback after the November 5 election, gold and silver have resumed their upward trajectory, supported by robust demand and constrained supply.

The broader macroeconomic backdrop remains favorable. Central banks’ dovish monetary policies, persistent inflation concerns, and geopolitical tensions continue to underpin

the case for higher precious metals prices. As the U.S. evaluates its trade policies, the uncertainty alone could provide further impetus for gold and silver market volatility to persist, driving prices higher.

The onset of the Trump presidency has injected a new layer of unpredictability into global markets, particularly for gold and silver. Trump administration tariffs, physical bullion demand, and tight supply chains are driving unprecedented gold and silver market volatility, creating both risks and opportunities for investors.

While the road ahead remains uncertain, one thing is clear: gold and silver are once again proving their mettle as indispensable safe-haven assets in times of economic turbulence. For those willing to navigate the volatility, 2025 may be a golden opportunity.

Premier African Minerals Limited, listed on the AIM Stock Exchange, has raised $4.35 million in a critical fundraising effort to revive its Zulu Lithium and Tantalum Project in Fort Rixon, Zimbabwe.The initiative marks a pivotal moment in the company’s strategy to restore production at one of its flagship ventures amid mounting financial obligations and operational setbacks.

The financing includes a retail offer of $2.87 million through the issuance of 8.263 billion new ordinary shares at a price of 0.0275 pence per share, representing a 30% discount to the mid-market closing price as of January 15, 2025. An additional $1.5 million was raised through a share placement. The

new shares are expected to be admitted for trading on AIM by January 23, 2025, subject to regulatory approval.

Premier CEO George Roach emphasized the importance of the funding, stating, “This capital injection ensures we have the means to complete critical stages of the Zulu Lithium and Tantalum Project and bring it back to operational status.

Other key allocations include:

• Government Obligations: $250,000 to settle deferred VAT and other statutory payments owed to the Zimbabwean government.

• Employee Wages: $400,000 to cover overdue salaries, alleviating labor pressures.

• Maintenance Costs: $180,000 earmarked for suppliers of plant spares and upkeep.

We are confident in our ability to deliver results.”

The bulk of the capital will be allocated to completing the commissioning of the Primary Flotation Plant and acquiring a Secondary Flotation Plant for the Zulu

Lithium and Tantalum Project. The company plans an initial test run lasting three to five days, a step expected to cost $800,000. The remaining funds will be used for partial payments to contractors and creditors, ensuring continuity of operations at Zulu Lithium and Tantalum Project while addressing long-standing financial liabilities.

Premier African Minerals is also in discussions with creditors to settle outstanding debts, exploring the option of issuing new shares as partial or full repayment.

The outcome of these negotiations is expected to be announced in the coming

weeks, a critical step in stabilizing the financial health of the Zulu Lithium and Tantalum Project.

Premier African Minerals’ Zulu Lithium and Tantalum Project has faced delays and funding shortfalls amid broader challenges in the global mining industry.

The project, known for its lithium and tantalum reserves, holds strategic importance as demand for lithium—a critical component in electric vehicle batteries—continues to grow. However, operational hurdles and geopolitical

complexities in Zimbabwe have tested the company’s resilience. The successful fundraising effort reflects cautious optimism among investors, though the heavily discounted share issuance highlights the pressure Premier faces to maintain liquidity.

As Premier African Minerals moves toward restarting production at the Zulu Lithium and Tantalum Project, the stakes remain high.

The company’s ability to meet operational milestones and manage creditor relationships will be closely watched.

In a move that blends economic ambition with national security strategy, President Donald Trump’s suggestion to “purchase” Greenland has reignited longstanding U.S. interest in the Arctic landmass.

While dismissed as a diplomatic curiosity by some, the proposition underscores deeper geopolitical stakes, particularly in the realm of rare earth elements in Greenland—critical to modern technologies and defense applications.

The U.S. government’s fascination with Greenland is not new. The first recorded attempt to acquire the territory dates back to 1868, with a more concerted effort under President Harry Truman in 1946, when the U.S. offered Denmark $100 million in gold.

Trump’s proposal to purchase Greenland during his 2019 term reflected a continuation of this historical pattern, though his methods were less conventional, sparking international debate.

Unlike past attempts, Trump’s push ties directly to Greenland’s abundant reserves of rare earth elements, including neodymium, dysprosium, and scandium.

These minerals are indispensable to the production of electric vehicles, wind turbines, advanced defense systems, and nuclear energy applications. Greenland’s Kvanefjeld deposit, a treasure trove of rare earths and uranium, makes the island uniquely valuable.

“Greenland is strategically vital, not just as a resource hub but as a potential chokepoint in global supply chains,” says Neha Mukherjee, senior critical minerals analyst at Benchmark Mineral Intelligence.

Rare earth elements are vital to the global economy, yet their production and processing remain heavily concentrated in China.

As of 2024, China accounted for approximately 70% of global rare earth mining and 90% of processing. The dominance is even starker in heavy rare earths, critical for cutting-edge technologies like EV batteries and fiber optics, where Beijing commands 99% of processing.

This monopoly provides China with significant geopolitical leverage. Beijing

has weaponized its control over rare earths, using export restrictions to exert pressure in trade disputes. In October 2024, China further tightened its grip by banning the export of REE extraction technologies. Such actions underscore the urgency for nations like the U.S. to diversify supply chains.

Greenland’s vast reserves of rare earth elements offer a solution. By establishing a foothold in Greenland, the U.S. could reduce reliance on Chinese rare earths, enhancing supply chain resilience and economic security.

Breaking China’s stranglehold on rare earth elements is easier said than done. Economies of scale, heavy government subsidies, and extensive stockpiles allow Chinese firms to undercut global competitors. Additionally, many rare earths are

by-products of mining other minerals like iron ore, complicating efforts to ensure consistent production. Moreover, developing Greenland’s resources presents its own set of challenges. Harsh Arctic conditions, environmental concerns, and geopolitical tensions could slow exploration and production efforts.

“Resource-rich regions like Greenland hold immense promise, but the infrastructure and investment required to operationalize these reserves are daunting,” Mukherjee notes.

Greenland’s rare earth elements are only one piece of the Arctic puzzle. The region is increasingly a focal point for

“GREENLAND IS strategically vital, not just as a resource hub but as a potential chokepoint in global supply chains”

Neha Mukherjee, senior critical minerals analyst, Benchmark Mineral Intelligence.

great-power competition, with Russia and China asserting their influence. Russia has prioritized the Northern Sea Route, a critical Arctic shipping lane, and is expanding its mining activities in the region. Meanwhile, China has declared itself a “near-Arctic state,” signaling its ambitions in the polar zone.

The U.S., for its part, sees Greenland as a critical counterbalance. Gaining access to its resources would not only secure rare earth element supply chains but also bolster U.S. strategic positioning in the Arctic. Trump’s framing of Greenland as a “national security” asset reflects this dual imperative.

While Trump’s proposal to buy Greenland may not have gained traction, it brought attention to the strategic importance of the island’s resources.

The Arctic, once a frozen frontier, is now a geopolitical hotbed where economic interests and national security intertwine.

The mining industry could be on the brink of a major transformation as Rio Tinto and Glencore engage in merger talks that have the potential to reshape the sector. Although it remains unclear whether discussions will lead to a finalized deal, the prospect of such a merger could send shockwaves through the industry.

With both companies being major players in copper production, the combined entity would create a dominant force, positioning itself as a key competitor to BHP, the world’s largest mining company.

One of the main factors driving the merger talks between Rio Tinto and Glencore is the surging global demand for copper. Copper is a critical element in the energy transition, playing a central role in the infrastructure needed for solar panels, wind turbines, and electric vehicles. As the world moves towards renewable energy and electrification, copper’s importance has skyrocketed.

Currently, Glencore is set to produce about 1 million metric tons (Mt) of copper in 2024, while Rio Tinto is expected to reach 720,000 metric tons. Combined, their production would rival that of BHP, creating a powerful entity capable of meeting the growing demand for copper. This would not only give them a stronger market position but would also make the merger a strategic move to dominate the copper market in the coming decades.

Tinto and Glencore would create one of the most powerful players in the global mining market.

The potential merger would create a mining giant with an enhanced valuation and production capabilities. Rio Tinto, valued at $103 billion, ranks as the second most valuable mining company in the world, while Glencore’s market capitalization stands at $55 billion. If the merger is successful, it could create an entity that surpasses Rio Tinto’s current value and potentially challenges BHP’s leadership in both market capitalization and copper output.

However, the mining industry has faced declining valuations since 2022, driven by macroeconomic challenges and shifting investor sentiment. Despite these headwinds, the merger talks underscore a fundamental shift in the industry, with copper becoming an even more critical commodity as the demand for clean energy solutions rises globally.

While the merger talks between Rio Tinto and Glencore are captivating attention, they face numerous obstacles. One significant challenge would be navigating the regulatory hurdles. The merger would likely attract intense scrutiny from competition regulators in

key jurisdictions, including Australia, the UK, and the US. The combined entity would hold substantial power in key markets, particularly copper, which could raise concerns over reduced competition and market dominance.

In addition to regulatory challenges, investor skepticism may also play a role in the deal's success. Mergers of this scale often face doubts regarding their ability to deliver on synergies and long-term value for shareholders. Both companies would need to convincingly address these concerns to secure broad investor support.

A merger between Rio Tinto and Glencore would create one of the most powerful players in the global mining market. This development highlights the increasing importance of copper and critical minerals in the global energy transition. As governments and corporations continue to push for net-zero emissions, demand for copper, lithium, and other essential materials is expected to surge.

If the merger goes ahead, it could serve as a catalyst for further consolidation within the mining sector. The deal would not only reshape competition but also highlight the growing strategic value of securing key minerals for future energy needs. As the talks progress, the outcome will undoubtedly have a lasting impact on the trajectory of the mining industry for years to come.

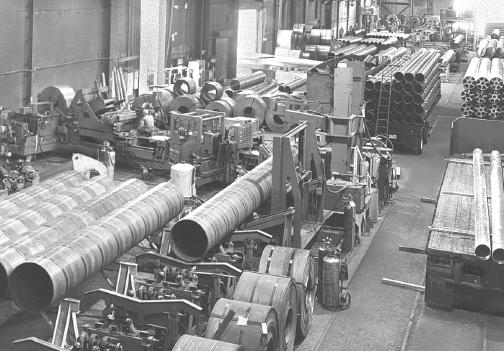

GLOBAL IRON ORE EXPLORATION 2025

As we navigate through 2025, the global iron ore exploration landscape is undergoing significant transformations, influenced by a confluence of market dynamics, geopolitical shifts, and technological advancements.

The global iron ore market is experiencing a nuanced balance between supply and demand. Brazilian mining giant Vale has projected an iron ore production range of 325 to 335 million tonnes for 2025, aligning closely with its 2024 output of approximately 328 million tonnes. This steady production underscores Vale's strategic approach to maintaining market equilibrium amidst fluctuating demand.

In parallel, Australia's dominance in iron ore production is poised to strengthen. Analysts from S&P Global Commodity Insights anticipate that Australia will widen its lead as the top iron ore producer in 2025 and beyond, driven by robust mining activities and expansion projects. This projection is bolstered by the country's rich resource base and advanced mining infrastructure.

Geopolitical factors are exerting considerable influence on iron ore exploration and production. Notably, the Simandou iron ore project in Guinea, a collaboration between Rio Tinto and a Chinese consortium, has secured all necessary regulatory approvals from both local and Chinese authorities.

This project, anticipated to be the world’s largest and highest-grade new iron ore mine, is expected to commence production by the end of 2025, significantly impacting global supply chains.

Conversely, Fortescue Metals Group's nearly $900 million hydrogen project in Arizona faces uncertainty due to policy changes following Donald Trump's return to the White House. The company is reevaluating its focus on this and other green energy projects in Norway and Brazil, highlighting the sensitivity of mining investments to political shifts.

The pursuit of sustainable mining practices is gaining momentum. Rio Tinto and BHP have initiated a collaboration to develop a pilot plant aimed at producing "green" direct reduced iron using natural gas and hydrogen.

If successful, this technology could reduce emissions by up to 80% compared to traditional iron production methods, marking a significant stride towards decarbonizing the steel industry.

Additionally, Epiroc has secured a substantial order from BHP for autonomous surface mining equipment to be de-

The pursuit of sustainable mining practices is gaining momentum. Rio Tinto and BHP have initiated a collaboration to develop a pilot plant aimed at producing "green" direct reduced iron using natural gas and hydrogen.

ployed at an iron ore mine in Western Australia's Pilbara region. This move underscores the industry's commitment to integrating automation and digitalization to enhance operational efficiency and safety.

Economic indicators present a complex picture for the iron ore market. China, which purchases more than two-thirds of global seaborne iron ore, imported 1.124 billion tonnes in the first 11 months of 2024, up 4.3% year-on-year, despite a 2.7% decline in its crude steel output over the same period.

This trend suggests a decoupling of iron ore imports from domestic steel production, potentially due to stockpiling or shifts in supply chain strategies.

Looking ahead, the global iron ore market is expected to experience fluctuating growth trends in 2025, influenced by policy volatility in China.

According to Wood Mackenzie, iron ore miners will adopt divergent strategies, with some focusing on high-grade ore production to meet environmental standards, while others may scale back operations in response to market conditions.

In addition to the established mining giants, emerging players in underexplored regions are making significant strides. West Africa, in particular, is gaining attention as a burgeoning hub for iron ore exploration.

Countries like Sierra Leone and Liberia are witnessing renewed interest in their mineral-rich landscapes, supported by foreign investments and infrastructure projects. This

region's development could diversify global iron ore supplies and reduce dependence on traditional powerhouses like Australia and Brazil. For instance, the ArcelorMittal-operated Tokadeh mine in Liberia has ramped up production, signaling a resurgence in the region’s mining potential.

Meanwhile, Sierra Leone’s Tonkolili mine, operated by China’s Kingho Mining Company, continues to expand its output, supported by extensive rail and port upgrades.

These developments are part of broader efforts to integrate West African resources into global supply chains.

The environmental impact of iron ore mining remains a critical issue, as communities near mining sites demand greater transparency and accountability.

The industry is under pressure to address concerns over deforestation, water usage, and waste management. Companies are responding by adopting stricter environmental standards and increasing investments in community development.

In Guinea, the Simandou project has faced scrutiny for its potential ecological footprint, prompting Rio Tinto and its partners to implement extensive environmental assessments and community consultations.

The COVID-19 pandemic and geopolitical tensions have underscored the importance of supply chain resilience. Countries are increasingly pursuing resource nationalism to secure critical minerals, including iron ore.

Indonesia's recent move to limit exports of low-grade iron ore is a case in point, as the government seeks to develop its domestic steel industry. Such policies could reshape trade flows and incentivize other nations to consider similar measures.

Meanwhile, China is actively seeking to diversify its iron ore imports to reduce its reliance on Australia. The country has intensified efforts to develop domestic resources and explore new partnerships in Africa and South America.

THE RETURN OF PRESIDENT DONALD TRUMP TO THE WHITE HOUSE IN 2025

Similarly, Australian miners are working to minimize the environmental impact of operations in the Pilbara region, incorporating water recycling systems and biodiversity conservation initiatives.

These initiatives reflect broader shifts in global trade patterns as nations prioritize strategic resource security.

Advancements in technology are revolutionizing exploration and mining techniques. Artificial intelligence (AI) and machine learning are increasingly being used to analyze geological data and identify promising ore deposits.

Drones and remote sensing technologies are also enhancing efficiency and accuracy in exploration activities.

Moreover, blockchain technology is being adopted to improve transparency in the supply chain, ensuring that iron ore sourced from ethical and environmentally responsible operations is traceable.

The administration's approach includes waiving certain environmental reviews for federally funded critical minerals projects to boost U.S. production. Advisers have recommended bypassing the National Environmental Policy Act

(NEPA) requirements to expedite permitting and construction processes.

While this may accelerate project timelines, it raises concerns among environmental groups and local communities about the potential ecological

and social impacts of mining activities. The iron ore industry will need to navigate these dynamics carefully, balancing development objectives with environmental stewardship and community engagement.

This trend aligns with growing consumer demand for sustainably produced materials and the rise of ESG (environmental, social, and governance) criteria in investment decisions.

While 2025 presents numerous challenges for the iron ore industry, including volatile pricing, environmental concerns, and geopolitical risks, it also offers significant opportunities. The continued push for green steel production, driven by the global energy transition, is expected to create new demand for high-grade iron ore. Innovations in mining and exploration technologies are likely to enhance operational efficiencies and reduce environmental impact.

The return of President Donald Trump to the White House in 2025 signals a significant policy shift toward bolstering domestic fossil fuel industries, including oil, gas, and coal. This administration's energy strategy is poised to influence various sectors, including iron ore exploration and mining.

On his first day back in office, President Trump declared a national energy emergency aimed at accelerating oil and gas production. This initiative includes expediting permits for energy projects and reversing previous restrictions on

energy exploration in regions like Alaska. The administration's focus is on lowering energy costs and increasing U.S. energy exports. While the primary emphasis is on fossil fuels, the mining sector, particularly iron ore exploration, may experience indirect effects.

The administration's pro-industry stance suggests a potential relaxation of environmental regulations and permitting processes, which could facilitate the development of new mining projects. For instance, Rio Tinto is optimistic that its extensive copper mining project in Arizona will receive approval under the Trump administration after a prolonged permitting battle.

The administration has expressed interest in enhancing cooperation on critical minerals supply chains to reduce dependence on foreign sources, particularly China. Australia anticipates stronger collaboration with the U.S. in developing non-China supply chains for rare earths and other critical minerals.

While iron ore is not classified as a critical mineral, the administration's broader resource development policies could create a more favorable environment for iron ore exploration. The emphasis on domestic production and reducing reliance on imports may encourage investment in the iron ore sector.

The mining industry, a cornerstone of global infrastructure and energy, has long been a field associated with high wages and robust career opportunities.

However, as digital recruitment grows and demand for skilled labor surges, the industry has also become a hotspot for fraudulent job postings. These fake jobs not only waste the time of job seekers but also expose them to financial scams and identity theft. The types of fake jobs, the recruiters and companies most likely to perpetuate such schemes, and the steps job seekers can take to protect themselves.

Non-Existent Remote Roles: With the rise of remote work during the pandemic, some scammers exploit the trend by advertising mining-related jobs that can allegedly be performed from home. Roles like “Remote Mining Operations Coordinator” or “Virtual Mining Analyst” sound appealing but often do not align with the hands-on nature of the industry.

High-Paying Entry-Level Positions: Scammers prey on individuals desperate to break into the mining industry by advertising high-paying entry-level roles like “Assistant Drill Operator” or “Junior Site Supervisor.” These jobs often come with inflated salary promises and minimal qualifications, luring unsuspecting candidates.

“Pay-to-Play” Jobs: Some fraudsters advertise roles requiring candidates to pay upfront for training, certifications,

or specialized equipment. Common examples include positions like “Certified Excavator Operator” or “Mining Safety Inspector,” where the candidate is instructed to send money to a third-party vendor for “mandatory” requirements.

Bogus International Opportunities: The promise of lucrative international jobs in countries rich in mining resources, such as Australia, Canada, or South Africa, can be irresistible.

Roles like “Overseas Mining Consultant” or “Global Exploration Specialist” are frequently used by scammers who demand upfront visa fees or deposits for travel arrangements.

Recruitment Agent Frauds: Scammers posing as legitimate recruiters or hiring agencies advertise high-level positions such as “Chief Geologist” or “Mine Manager” and require candidates to pay administrative fees or provide sensitive personal information under the guise of background checks.

Fake Recruitment Agencies: Many scams originate from phony recruitment agencies that mimic the names and branding of legitimate organizations. These agencies often operate entirely online, making them harder to track.

Unvetted Job Boards: Some less-regulated job boards and social media platforms become breeding grounds for fake job postings. Scammers exploit platforms like LinkedIn, Indeed, or Facebook by posting listings under fabricated company profiles.

Small, Obscure “Mining Firms”: Fraudulent companies often create professional-looking websites and social media accounts to appear legitimate. These entities claim to be startups or international branches of existing firms, using names similar to well-known mining corporations. Recruiters

Targeting Vulnerable Populations: Scammers frequently target recent graduates, unemployed individuals, and workers from developing countries who are eager to secure opportunities in the lucrative mining sector.

Fraudsters Impersonating Real Companies: Some scammers impersonate well-known mining corporations, using cloned websites or official logos to deceive job seekers.

Victims often realize they’ve been duped only after receiving fake offer letters or fraudulent onboarding documents.

The mining industry has been an enduring backbone of global progress, providing essential resources that fuel economies and innovation. Yet, it is now under unfair scrutiny due to the unscrupulous actions of fringe scammers and fraudulent actors. Let’s be absolutely clear: these scams are

Upfront Payments: Genuine employers do not require payment for training, equipment, or administrative processes. Any request for money should raise immediate suspicion.

Unprofessional Communication: Emails from legitimate companies typically come from official domains. Scam-

mers often use generic email providers (e.g., Gmail, Yahoo) and poorly written messages riddled with grammatical errors.

Too Good to Be True: Be wary of job offers promising exceptionally high salaries, minimal qualifications, or guaranteed placement—especially for

not indicative of the mining sector itself but rather of opportunistic criminals exploiting its prestige and economic significance.

Mining has provided countless individuals with stable careers, financial security, and a sense of purpose. The industry’s reputation for rigorous standards and the rewarding nature of its work is what makes it a target for these malicious schemes. Unfortunately, instead of highlighting the critical role mining plays in supporting modern life—from powering renewable energy technologies to building global infrastructure—detractors often focus disproportionately on isolated negatives like job scams.

Here’s the truth: The mining industry is not only vital but also offers opportunities that are unparalleled in other sectors. For every fake job posting, there are legitimate, life-changing positions being offered by real companies that adhere to the highest standards of integrity. It’s imperative to separate the actions of bad actors from the broader, overwhelmingly positive contributions of mining firms.

The mining industry remains an irreplaceable pillar of global development, and its reputation should not be tarnished by the unethical practices of scammers. Job seekers must understand that the presence of fraudulent postings is not unique to mining but a symptom of a larger digital age issue. Let’s not let the actions of a deceitful few overshadow the tremendous value and opportunity the mining sector brings to society.

roles that traditionally require extensive experience or certifications.

Lack of Verification: Always verify job postings on the company’s official website or contact their HR department directly to confirm the position’s legitimacy.

Pressure Tactics: Scammers often pressure candidates to act quickly, claiming limited openings or urgent deadlines. Legitimate companies allow candidates sufficient time to review offers and complete onboarding requirements.

Global coal demand is expected to plateau in the coming years after reaching a record high in 2024, according to the International Energy Agency’s (IEA)

Coal 2024 report. The findings underscore the growing role of renewable energy in meeting global electricity demands and a gradual structural shift in the energy landscape.

After a sharp decline during the COVID-19 pandemic, coal consumption rebounded significantly, reaching an unprecedented 8.77 billion tonnes in 2024. This resurgence was driven by continued reliance on coal in major markets like China and persistently high global energy demand.

However, the IEA projects that coal use will plateau near this peak through 2027 as the global transition to renewable energy accelerates. Coal remains the dominant energy source for electricity generation, accounting for two-thirds of global consumption.

China, which accounts for one-third of global coal consumption, plays a pivotal role in shaping coal market trends. The IEA notes that China’s coal demand in 2027 could vary by as much as 140 million tonnes depending on weather-driven fluctuations in renewable energy output.

China is actively diversifying its energy mix through investments in nuclear pow-

er and rapid expansion of solar photovoltaic (PV) and wind capacity. However, urbanization, industrial growth, and increasing electricity demand—fueled by the electrification of transport and heating—may complicate efforts to curb coal reliance.

Keisuke Sadamori, IEA Director of Energy Markets and Security,

stated:

“The rapid deployment of clean energy technologies is reshaping the global electricity sector, which accounts for twothirds of the world’s coal use. However, weather factors—particularly in China, the world’s largest coal consumer—will have a major impact on short-term trends for coal demand.”

International coal trade is forecast to reach a record 1.55 billion tonnes in 2024, with Asia dominating both imports and exports. Major consumers like China, India, Japan, South Korea, and Vietnam rely heavily on shipments from key exporters, including Indonesia and Australia.However, global coal trade

volumes are expected to shrink after 2024, particularly for thermal coal, as countries prioritize renewable energy and seek energy independence.

Coal prices remain elevated, averaging 50% higher than pre-pandemic levels from 2017 to 2019. Despite record-high production in 2024, the IEA predicts production growth will stabilize through 2027 as renewable energy adoption accelerates and global coal demand plateaus.

The IEA highlights several uncertainties that could impact coal’s trajectory, including weather patterns, policy changes, and the speed of renewable energy adoption.

While the structural shift in the energy sector suggests a plateau in coal use, emerging economies’ demand and shortterm market dynamics could still disrupt this trend. As Sadamori emphasized, “The speed at which electricity demand grows will also be very important over the medium term.”

The record coal demand of 2024 reflects the complexities of balancing global energy needs with climate goals. While renewable energy is reshaping the global energy mix and reducing coal reliance in advanced economies, coal remains a cornerstone in emerging markets.

In a significant achievement for the U.S. mining sector, the Department of Labor’s Mine Safety and Health Administration (MSHA) reported that no mines met the Pattern of Violations (POV) criteria during its latest screening. This marks the first time since 2021 that no operations were flagged as chronic violators under Section 104(e) of the Mine Act.

The milestone, based on MSHA’s review of all U.S. mines during a 12-month enforcement period ending November 30, 2024, reflects progress in mine safety compliance and underscores the effectiveness of enhanced regulatory measures aimed at safeguarding miners.

“When the mining industry faced an alarming rise in fatalities in 2023, MSHA intensified efforts to address safety risks head-on,” said Chris Williamson, Assistant Secretary for Mine Safety and Health.

“Fatal mining accidents dropped by 30% in 2024, and no mines were flagged under the most recent POV screening. This progress highlights the critical role of rigorous enforcement and an adequately staffed MSHA.”

The POV screening process focuses on identifying mines with a high incidence of significant and substantial (S&S) violations—issues that pose serious risks to worker health and mine safety.

The agency’s enforcement measures, including impact inspections and targeted oversight, have proven effective in driving compliance. Over the past two years, the 200 mines with the highest number of S&S violations have collectively seen:

• A 15% reduction in S&S violations,

• A 10% decline in total violations, and

• A 26% drop in elevated enforcement actions.

“When the mining industry experienced a troubling increase in fatalities in 2023, MSHA actively led efforts to combat the trend, including enhanced enforcement like Pattern of Violations and impact inspections to improve compliance and focus on chronic violators,” said Assistant Secretary for Mine Safety and Health Chris Williamson.

“Mining fatal accidents decreased by 30% in 2024, and no mines were identified during the most recent POV screening. We know from recent experience and history that an active, adequately staffed MSHA is critical to preventing accidents and protecting miners’ safety and health.”

As the global transition to renewable energy accelerates, the demand for critical metals like copper, nickel, and rare earth elements is skyrocketing.

These materials power wind turbines, solar panels, and electric vehicles—technologies vital to decarbonizing the economy. Yet, much of the world’s supply chain for these metals relies on China, which refines about 60% of rare earth elements. This dependency has raised alarms in Washington, with the Biden administration labeling it a threat to both economic and national security.

Now, one Massachusetts-based startup is challenging this status quo. Phoenix Tailings, founded by MIT alumni, has developed an innovative mining waste recycling method to extract critical metals from mining waste, promising a domestic, sustainable alternative to foreign imports.

Every year, the U.S. mining industry generates approximately 1.8 billion tons

of waste, much of it laced with valuable metals. Traditionally, these metals have been overlooked due to the environmental and economic costs of extraction.

Phoenix Tailings aims to change that by using a proprietary mining waste recycling process that combines water, recyclable solvents, and electricity to recover metals from waste without producing toxic byproducts or carbon emissions.

At its pilot facility in Woburn, Massachusetts, Phoenix Tailings is refining rare earth metals such as neodymium and dysprosium, essential for the magnets in wind turbines, EV motors, and defense systems.

Unlike conventional methods, which often rely on hazardous chemicals, the company’s process is entirely carbon-free when powered by renewable energy.

“Our method allows us to recover these materials domestically, breaking reliance on foreign monopolies,” says co-founder Tomás Villalón, an MIT graduate. “We’re focused on creating critical materials for the next generation of technologies in a way that’s sustainable for the long term.”

With backing from the Department of Energy, Phoenix Tailings is scaling operations. By 2026, it aims to produce over 3,000 tons of rare earth metals annually—equivalent to 7% of the U.S.’s current output. The company has also received $2 million in federal grants to expand its mining waste recycling process to other materials, including nickel, magnesium, and iron, which are crucial for battery production and clean energy infrastructure.

The technology’s adaptability is key to its potential. “Mining waste comes in many forms, and our process is compatible with a wide array of ore types,” Villalón explains. “That opens up opportunities not just for rare earths but for other critical metals as well.”

Phoenix Tailings’ approach reflects a broader trend toward circular economies, where industrial byproducts are repurposed rather than discarded. By transforming waste into a resource

through mining waste recycling, the company addresses two challenges simultaneously: reducing environmental harm from mining operations and securing a domestic supply of critical metals.

“This is a solution that works on multiple levels,” says Villalón. “It’s not just about meeting demand but doing so in a way that aligns with our values and responsibilities as stewards of the planet.”

Phoenix Tailings began humbly in Villalón’s backyard, where he and co-founders Nick Myers, Michelle Chao, and Anthony Balladon tested early prototypes. Guided by lessons from their MIT coursework and mentorship from professors like Donald Sadoway, they refined their mining waste recycling system and produced their first batch of rare earth concentrate.

Today, the company operates on a much larger scale but remains committed to innovation. Villalón sees their work as part of a broader effort to redefine how materials are sourced and used.

As Phoenix Tailings expands, it faces challenges, including navigating complex regulations and scaling its technology economically. But the founders remain optimistic. “The U.S. has the talent, the resources, and the drive to lead in this space,” Villalón asserts. “What we’re doing is proof that it’s possible to build a sustainable supply chain for critical metals through mining waste recycling.”

For a world hurtling toward electrification, companies like Phoenix Tailings offer a glimpse of what the future could look like: cleaner, greener, and more self-reliant.

With the surge in global demand for electric vehicles and portable electronics, lithium-ion battery (LIB) recycling has become crucial for industrial innovation and environmental sustainability. The scarcity of critical metals like lithium, cobalt, and nickel—exacerbated by geopolitical risks—underscores the economic necessity of recycling. By 2050, the world could face a 46.7 million-ton shortfall in lithium, threatening industries reliant on these metals. Recycling not only mitigates these risks but also reduces dependency on volatile regions, turning LIB waste into valuable resources.

The global LIB recycling market is projected to reach $23.72 billion by 2030, driven by cost reductions in battery manufacturing and environmental benefits. Technological advancements, particularly in hydrometallurgy, have achieved over 99% recovery rates for key metals, making recycling more efficient and sustainable.

Innovations in solvent extraction and precipitation techniques further enhance metal recovery, though challenges like high costs and environmental impact persist. Despite these hurdles, the push for closed-loop systems—where recycled materials are continuously repurposed—signals a transformative shift. Companies like Tesla and Redwood Materials are leading this change, investing in scalable recycling solutions that align with global sustainability goals.

The urgency to develop and implement effective LIB recycling technologies is paramount. As demand accelerates, the question is not whether to recycle but how quickly it can be scaled. LIB recycling is not only an environmental obligation but a strategic imperative for sustaining future industries, ensuring economic security, and achieving environmental stewardship.

As the global push for decarbonization accelerates, the mining industry is navigating a critical dual mandate: scaling up production of essential minerals for electrification while meeting ambitious sustainability targets.

Industry events like the FT Mining Summit and MINExpo International in Las Vegas have highlighted the urgency of these challenges, with fleet electrification and operational efficiency taking center stage in the sector’s transformation.

Governments worldwide are driving sustainability mandates, prompting mining companies to electrify their off-highway vehicle fleets. While promising, this transition poses significant challenges. The capital required to replace diesel-powered fleets with electric alternatives is considerable, further strained by costs for engineering, maintenance, training, and installing charging infrastructure in remote areas.

A critical decision involves choosing between owning or leasing electrified fleets. Ownership requires substantial upfront capital expenditure (capex), while leasing incurs operational expenditure (opex), each with distinct financial and tax implications.

Additionally, the sector’s unique scale and safety requirements complicate the shift. Electrification technologies for large mining vehicles are still in their infancy, with limited products tailored

to industry-specific needs. Overcoming these barriers necessitates robust supply chain collaborations to drive innovation and reduce the risks of supply disruptions.

The mining industry’s role in advancing the circular economy has grown increasingly relevant amid concerns over potential shortages of critical minerals like lithium, cobalt, and rare earth elements. These materials are vital for renewable energy systems and electric vehicles.

To address rising demand sustainably, mining companies must adopt recycling initiatives and integrate secondary resource utilization into their operations. This not only conserves finite resources but also reduces reliance on new extractions, aligning with environmental, social, and governance (ESG) objectives. Data analytics and artificial intelligence (AI) are pivotal in these efforts, enhancing regulatory compliance, forecasting energy production, and optimizing grid performance.

As technology evolves and market demands shift, mining companies increas-