INSIGHTS FROM INDUSTRY PROFESSIONALS The Trusted Adviser: Empowering Mine Personnel with Expert Guidance Interview with Michael Meidow VP Technical Support, CR Powered by Epiroc. Revolutionizing the Iron Ore Mining Industry Technological Innovations, Sustainability Initiatives, and Community Engagement Shape the Future 30 An Examination of EV Mineral Deals In a move that underscores the administration's commitment to clean energy, President Biden's latest climate policy decision focuses on securing electric vehicle (EV) minerals. 16 Navigating Biden's Latest Climate Minefield 24 Volume: 112. Issue.6. June 2023 www.skillings.net

2 Skillings.net | June 2023 BIG RESULTS SMALL TEAM Optiro is a resource consulting and advisory group. Our 5 core services are Geology, Mining Engineering, Corporate, Training and Software. In eleven years, our team has travelled the world providing expertise to improve, value, estimate and audit the world’s minerals. Pound for pound we think you’ll find no-one delivers greater value –and BIG results. +$15 BILLION DEALS/ VALUATIONS >780 MILLION oz Au RESOURCE AUDITS >64 MILLION oz Au RESOURCE ESTIMATES >3,000 CLIENTS +2,000 PEOPLE TRAINED 24 COMMODITIES 53 COUNTRIES >4,300 MILLION lb NICKEL >5,100 MILLION lb COPPER +5 IRON ORE BILLION TONNES www.optiro.com contact@optiro.com +61 8 9215 0000

Revolutionizing the Iron Ore Mining Industry Technological Innovations, Sustainability Initiatives, and Community Engagement Shape the Future INSIGHTS FROM INDUSTRY PROFESSIONALS The Trusted Adviser: Empowering Mine Personnel with Expert Guidance Interview with Michael Meidow VP Technical Support, CR Powered by Epiroc. United States 20 Rio Tinto Makes a Surprise Acquisition of Scandium Aiming to Revolutionize the High-Tech Industry 42 Exploring the US Domestic Supply Chain Key Factors and Trends in the Mineral Mining Industry 16 36 30 24 Navigating Biden's Latest Climate Minefield An Examination of EV Mineral Deals In a move that underscores the administration's commitment to clean energy, President Biden's latest climate policy decision focuses on securing electric vehicle (EV) minerals. China’s Equity Markets Open Up to International Investors in the Mining Industry China has declared the internationalization of its equity markets in an effort to increase foreign investment in its mining sector. 07 Metso Secures Order to Supply Mill Lining Solutions to Mines in SE Asia 12 The Versatility of Cobalt Facts, Characteristics, and Applications in the Mining Industry 14 Coal Mining and Transportation: Processes, Techniques, and Environmental Impact 20 Rio Tinto Makes a Surprise Acquisition of Scandium, Aiming to Revolutionize the High-Tech Industry 23 Global Supply Length High Food Inflation Hurts European Polymer Demand, Squeezes Margins 28 Behind the Mining Productivity Upswing Technology-Enabled Transformation 35 2023 Metal Prices Guide: Exciting Trendsand Market Updates You Need to Know 40 NewRange Copper Nickel: A Rebranded Commitment to Sustainable Mining in Minnesota 42 Exploring the US Domestic Supply Chain Key Factors and Trends in the Mineral Mining Industry 44 Africa’s Mineral Wealt Draws Global Attention and Investment 3 Volume: 112. Issue.6. June 2023

Skillings Mining Review of CFX Network LLC, publishes comprehensive information on global mining, iron ore markets and critical industry issues via Skillings Mining Review Monthly Magazine and weekly. SMR Americas, Global Skillings and Skilling Equipment Gear newsletters.

Skillings Mining Review (ISSN 0037-6329) is published monthly, 12 issues per year by CFX Network, 350 W. Venice Ave. #1184 Venice, Florida 34284. Phone: (888) 444 7854 x 4. Printed in the USA.

Payments & Billing: 350 W. Venice Ave. #1184, Venice, FL 34284. Periodicals Postage Paid at: Venice, Florida and additional mail offices.

Postmaster: Send address changes to:

www.skillings.net

SKILLINGS MINING REVIEW NEWS ROOM

Digital Monthly Magazine 12 issues

Paywall-free website experience

Digital archive back to 1912

Skillings video stories and podcasts

Subscriber-only newsletter

Rich multimedia contentData, Photographs and Visuals

Access paperless reading across multiple platforms. Portable, carry with you, anytime, anywhere

UNITED STATES

$72 Monthly in US Funds

$109 Monthly in US (Funds 1st Class Mail)

OUTSIDE OF THE U.S.A.

$250 US Monthly for 7-21 day delivery

$335 US Monthly for Air Mail Service

All funds are monthly

Skillings mining review, 350 W. Venice Ave. #1184, Venice, Florida 34284.

Phone: (888) 444 7854 x 4.

Fax: (888) 261-6014.

Email: Advertising@skillings.net.

PUBLISHER

CHARLES PITTS chas.pitts@skillings.net

EDITOR-IN-CHIEF

JOHN EDWARD

john.edward@skillings.net

CONTRIBUTING EDITORS

ROB RAMOS

AALIYAH ZOLETA

MARIE GABRIELLE

MEDIA PRODUCTION STANISLAV PAVLISHIN media.team@ cfxnetwork.com

MANAGING EDITOR

SAKSHI SINGLA sakshi.singla@skillings.net

CREATIVE DIRECTOR MO SHINE mo.shine@skillings.net

DIRECTOR OF SALES & MARKETING

CHRISTINE MARIE advertising@skillings.net

MEDIA ADMINISTRATOR SALINI KRISHNAN salini.krishnan@ cfxnetwork.com

PROFILES IN MINING mining.profiles@skillings.net

GENERAL CONTACT INFORMATION info@cfxnetwork.com

CUSTOMER SERVICE/ SUBSCRIPTION QUESTIONS: For renewals, address changes, e-mail preferences and subscription account status contact Circulation and Subscriptions: subscriptions@Skillings.net. Editorial matter may be reproduced only by stating the name of this publication, date of the issue in which material appears, and the byline, if the article carries one.

4 Skillings.net | June 2023

Mining info you don't have to dig for...

CR

MINING NAYLOR PIPE MRC RECRUITING ME ELECMETAL

Skillings Mining Review is supported by these leading providers of materials, services and supplies to the mining industry. Please patronize them whenever possible and let them know you saw their advertisement in Skillings.

5

40 Years of Global Search Experience

MRC Recruiting is a family-run corporation with 40 years of global search experience, from entry to board levels.

MRC Recruiting was founded to provide resource companies with experienced and leading high-potential candidates to build a sustainable workforce. It is a family-run corporation with a global network of experienced recruiters. They bring their expertise directly to hiring managers in a collaborative effort to achieve their immediate recruitment goals. The company specializes in clear and specific communications, employing a fee structure that works with their clients' budget, and implementing a hiring process that has been proven through years of successfully building quality, high-performance teams.

MRC Recruiting possesses extensive knowledge of the resource/mining space and strives to provide suitable candidates for every position. Their expertise in human capital development and organizational development ensures that clients receive only top, qualified candidates.

Your Team of Skilled Experts

ۗ Your team of skilled Recruiters who’ve developed long-standing relationships with clients and candidates to ensure the best fit possible between the two.

ۗ A blend of Human Resource and Mining backgrounds who understand the nuances of the mining and resource industries.

ۗ With a successful history of working across commodities with exploration through major companies, consulting firms, private equity, mining technology and OEMs.

6 Skillings.net | June 2023

Metso Secures Order to Supply Mill

Lining Solutions to Mines in SE Asia

A large order has been placed with Metso, a pioneer in industrial equipment and services, to provide mill lining solutions to a copper and gold mine in Southeast Asia. As part of the multi-million-dollar deal, Metso will offer cutting-edge mill liner solutions to guarantee optimum grinding efficiency and minimize downtime.

The long-running Southeast Asian mine generates copper and gold concentrates, which are crucial elements in numerous industrial processes.

The mine’s owners are turning to Metso for their knowledge of mill lining solutions because they understand how crucial it is to maintain high levels of production efficiency. The mill

liner options from the firm are created to optimize grinding performance and decrease downtime, which saves mining companies a lot of money.

The company’s innovative designs use a combination of materials, such as rubber and metal, to produce a robust and long-lasting mill liner.

Exclusive Integral GET Stabilization System

Sami Takaluoma, president of Metso Outotec’s Minerals business unit, said, “We are happy to have been awarded this contract and to be able to support this major mining operation in Southeast Asia. Our mill liner solutions “help our customers achieve their production targets by maximizing efficiency and reducing maintenance costs.”

7 Preserves lip and fit dimensions Reduced repair time Lower maintenance costs Greater GET security CRmining.com

TLC and SaberEdge lip systems for wheel loaders and rope shovels.

Comminution Solutions

that exceed the expectations of our customers

With over 100 years of experience as a supplier and strategic partner in the mining industry, we provide new and better end-to-end solutions to our customers around the world

Premier Product Lines

Mill Liners: ME Elecmetal is the world leader in designing and supplying highly engineered mill liners and total liner solutions for SAG, AG, ball, tower and rod mills.

Grinding Media: ME Elecmetal designs, manufactures and supplies the highest quality forged steel grinding media for SAG, ball and rod mills.

Integral Solutions Add Value

Crusher Wear Parts: ME Elecmetal o ers wear parts for all makes and models of primary, secondary, tertiary and pebble crushers.

ME Elecmetal’s ME FIT System® programs are aimed at continuous improvement through Research + Development + Innovation, carried out by a multidisciplinary group of professionals with mutual collaboration between the client and ME Elecmetal. The programs involve several initiatives, that together, aim to solve challenges and uncover opportunities to positively impact our client’s key performance indicators: productivity, reliability, availability, safety, e ciency and / or energy consumption.

Technology: ME Elecmetal also o ers 3D laser scanning, liner design and engineering services, discrete and nite element modeling and mill and crusher optimization services as part of our extensive service portfolio.

We consider all factors a ecting the grinding processes. We collect operational data including processed tonnage, available power, down time, load levels and all other relevant information about how our customers’ mills operate. We measure how long media and liners last, what production levels they are achieving and what opportunities there are for improvement in the comminution process.

At ME Elecmetal, we align with the priorities of our customers, positioning ME Elecmetal as a true strategic partner in mining.

Grinding Crushing

Grinding Crushing

ME Elecmetal Minneapolis, MN • Tempe, AZ 763-788-1651 • 480-730-7500 www.me-elecmetal.com

Integrated solutions that add value

ME Elecmetal Comminution Solutions

Innovative Solutions - Proven Performance

ME Elecmetal o ers more than mill liners — we o er innovation, support, custom designs and valuable tools to develop a total comminution solution speci c to your needs. We are on the ground with our customers — setting common goals and providing timely responses based on e ective collaboration. Drawing on over 100 years of experience and advanced technologies, we will help you optimize processes, extend the lifespan of wear parts, reduce operational risks and increase pro tability.

Premium Quality Forged Steel Grinding Media for SAG, Ball & Rod Mills

• ME Super SAG®: 4.0” to 6.25”

• ME Ultra Grind®: 1.5” to 4.0”

• ME Ultra Grind®II: 2.0“ to 4.0”

• ME Performa®: 7/8” to 1.5”

Innovative Mill Lining Solutions for SAG, AG, Ball, Tower & Rod Mills

• Steel

• Rubber

• Composite

Wear Components for Primary, Secondary & Tertiary Crushers

• Gyratory Crushers

• Jaw Crushers

• Cone Crushers

www.me-elecmetal.com

10 Skillings.net | June 2023

11

The Versatility of COBALT

Cobalt is a highly adaptable and necessary element that finds use across a variety of industries, including the mining sector. It is a tough, fragile, silver-gray metal with special magnetic characteristics that is a crucial part of numerous industrial operations.

Uses in the Mining Industry

In the mining sector, it is used for a variety of purposes, including:

1. Manufacturing of alloys

It is frequently used to create alloys, which are substances created by fusing two or more metallic elements. The strong strength, resistance to abrasion and corrosion, and high-temperature resistance of cobalt alloys are well known.

2. Battery Manufacturing

Lithium-ion batteries, which are used in many electronic products such as smartphones, laptops, and electric cars, contain cobalt as a crucial component.

3. Superalloys

Superalloys are high-performance alloys used in gas turbines and jet engines, as well as other harsh environments.

4. Concrete carbides

Cemented carbides are composite materials composed of a metal matrix and a carbide material. It is an essential component of cemented carbides because it provides the material with strength and durability. Commonly used in mining drill blades, cemented carbides are resistant to high temperatures and drilling pressures.

The transition metal cobalt has an atomic mass of 58.93 and an atomic number of 27. It is mostly discovered in mineral deposits in the Russian Federation, Canada, Australia, and the Democratic Republic of the Congo. It is employed in a wide range of industrial processes, such as the creation of superalloys, alloys, and batteries.

The melting and boiling points of the hard, lustrous metal cobalt are 1,495 °C and 2,900 °C, respectively. It is reasonably hefty because of its 8.9 g/cm3 density. Because cobalt is a ferromagnetic metal, it is drawn to magnets. Due to this special quality, it is a crucial part of numerous industrial processes, such as the manufacturing of magnetic alloys and hard metals.

How is it extracted from the earth?

The production of alloys, batteries, and electronics are a few of the industrial uses for this precious and adaptable element. Most of the cobalt reserves in the world are found in the Democratic Republic of the Congo, and mining is the main method used to remove them from the soil.

1. Exploration

Exploration, which entails finding locations with high cobalt concentrations, is the initial step in the extraction. Geologists utilize a variety of methods, including drilling, remote sensing, and geological mapping, to find possible resources.

2. Mining

Mining comes next when a cobalt deposit is discovered. Usually, it is mined as a by-product of other metals like nickel and copper. Underground mining, which requires boring tunnels into the ground to obtain the cobalt ore, is the most popular mining technique used to extract the metal.

3. Processing

After being taken from the soil, the ore is processed to yield cobalt. The ore is

12 Skillings.net | June 2023

IT IS A VERSATILE AND INDISPENSABLE element with numerous applications in the mining industry. It is an essential component in many industrial processes, including the production of alloys, batteries, superalloys, and cemented carbides, due to its unique properties, such as its magnetic properties.

crushed into tiny pieces and then ground into a powder in the first phase of processing. To dissolve it from the ore, this powder is then combined with water and other chemicals, such as sulfuric acid.

4. Separation

After being dissolved, it is separated from the other metals in the ore using a variety of methods. Solvent extraction is a popular method that involves separating it from other metals using a chemical solvent. It is then recovered when the solvent has evaporated. Ion exchange is a different method that entails passing the dissolved cobalt through a resin that binds to the cobalt ions only, separating them from the other metals.

5. Refining

It is separated and then refined one more time to make it purer. Depending on its intended purpose, refined cobalt is often found as a metal or a powder. After that, the finished item is prepared for usage in a variety of industrial applications.

The difficult process of obtaining cobalt from the earth comprises exploration, mining, processing, separation, and refining. New extraction and refining methods are being developed in response to the rising demand for cobalt to maintain a constant supply of this priceless metal.

What are the most common characteristics of cobalt?

It is a special metal with several properties that make it valuable in a variety of industrial applications. We’ll go over some of the cobalt’s most salient traits in this piece.

Durability and strength

Its endurance and hardness are two of its most notable qualities. Cobalt is a strong, durable metal that resists rust and wear.

Superior Melting Point

It is a great material for use in high-temperature applications because of its high melting point of 1,495 degrees Celsius (2,723 degrees Fahrenheit). In gas turbines, jet engines, and nuclear reactors where it can tolerate high temperatures without melting or deforming, cobalt is frequently employed.

Magnetic Consistencies

Because cobalt is a ferromagnetic metal, it can be magnetized. It can be used to create permanent magnets and demonstrates high magnetic characteristics at room temperature.

Corrosion protection

Due to its exceptional corrosion resistance, it is a fantastic material to use in applications that frequently come into contact with moisture and other corrosive elements. Due to their resistance to corrosion and wear, cobalt-based alloys are frequently used in the production of surgical implants.

Color

It is easily recognized thanks to its distinctive blue-gray color. The cobalt oxide that is present on the metal’s surface is what gives it this color. Glass, ceramics, and paint are frequently made with cobalt as a pigment.It is a flexible metal with a variety of properties that make it valuable in numerous industrial applications. Cobalt-60, one of its radioactive isotopes, has significant uses in both industry and medicine.

13

Coal Mining and Transportation

Processes, Techniques, and Environmental Impact

For centuries, coal has been an indispensable resource for energy generation, industrial production, and electricity generation. However, extracting and transporting coal to power plants and other locations presents a number of environmental challenges and impacts.

Coal mining entails the extraction of coal from the surface or subsurface of the earth. Surface mining and underground mining are the two most common methods of coal extraction. Coal is extracted from subterranean mines through the practice of underground mining. This technique is used when the coal seam is far below the surface of the earth or when the rock that lies on top is too dense to be extracted by surface mining. Longwall mining, room-and-pillar mining, and retreat mining are all underground mining techniques.

Transportation of coal:

After coal has been extracted, it must be transported to power plants and other locations. The most typical means of transporting coal are by rail, barge, or vehicle.

Environmental Impact:

Significant environmental effects from coal mining and transportation include air pollution, water pollution, and land degradation.The transportation of coal can also have environmental consequences. Transportation vehicle emissions can contribute to air pollution, which can negatively impact human health and the environment.

In addition to causing water contamination and harming aquatic ecosystems, the transportation of coal by barge can also pollute the water and degrade aquatic habitats. We can reduce the negative effects of coal mining and transportation on the environment and public health by instituting more efficient and eco-friendly practices.

Methods of Transporting Coal: Overview and Comparison of Different Modes

Transporting coal from mines to power facilities and other destinations is an essential aspect of the coal industry. Rail

transport, barge transport, truck transportation, Conveyor Belt Transport, and Pipeline transport are different methods of coal transportation.

Pros and Cons of Using Barges for Coal Transportation

One of the most common methods of transporting coal from mines to ports or power facilities is by barge. It has several advantages and some disadvantages.

Advantages of transporting coal with barges: Barge transportation is a cost-effective method of transporting tons of coal, particularly over vast distances. It is less expensive than rail or truck transport because vast quantities of coal can be transported in a single trip.Large carrying capacity: These vessels can transport up to 1,500 metric tons of coal in a single journey due to their large carrying capacity. Shipping vessels can navigate rivers and canals, allowing them to reach areas inaccessible by rail or road. Using a riverboat leaves a smaller carbon footprint than vehicle or rail transport.

The disadvantages of transporting coal by barge are:

In locations accessible by waterways, only barges can transport coal. This can be a disadvantage in regions where there are no ports or power plants close to rivers or canals.Climate factors like floods and droughts can have an impact on water levels, which can hinder barge transportation. Infrastructure constraints: barge transportation requires well-established waterway infrastructure, such as ports, piers, and locks. Environmental hazards: It can pose environmental risks, particularly if a coal-carrying barge leaks or spills. Coal can contaminate water sources, harm aquatic ecosystems, and negatively impact public health.

14 Skillings.net | June 2023

15

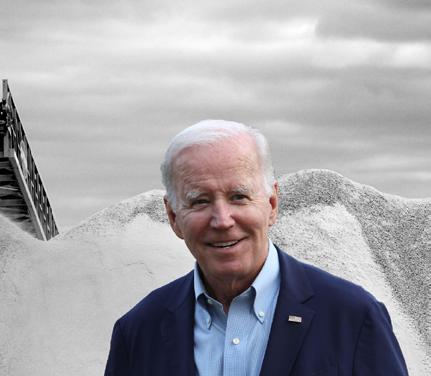

Navigating Biden's Latest Climate Minefield

An Examination of EV Mineral Deals

In a move that underscores the administration's commitment to clean energy, President Biden's latest climate policy decision focuses on securing electric vehicle (EV) minerals. This new agenda, however, presents a veritable minefield of environmental, geopolitical, and ethical considerations

16 Skillings.net | June 2023

President Joe Biden’s plan to use mineral trade agreements to boost electric vehicles (EVs) on U.S. roads is facing pushback from Republicans and environmentalists. The plan aims to prioritize domestic mineral production and ensure that producers in the United States reap the benefits of a coveted EV tax credit, known as 30D. The credit was included in last year’s Inflation Reduction Act. However, critics argue that the strategy imperils U.S. jobs and represents a potentially illegal end-run around Congress.

Minerals such as lithium and cobalt are essential for today’s fleet of EVs. Experts agree that mineral production and refinement will likely form the backbone of the clean energy economy in the future and the millions of jobs that come with it. Minerals are also necessary for a range of consumer electronics as well as precision-guided missiles and other weapons.

17

President Joe Biden points to a wind turbine size comparison chart during a meeting in 2022. Biden, as pledged, vetoed congressional efforts to limit using environmental, social and governance (ESG) considerations in the investments that 401(k)s and other retirement plans make. GETTY IMAGES

President Joe Biden's ambitious plan to boost electric vehicles (EVs) in the United States through mineral trade agreements is facing opposition from Republicans and environmentalists. While the plan aims to prioritize domestic mineral production and secure reliable access to EV minerals, it also raises concerns about environmental impact, ethical considerations, and geopolitical implications.

This article delves into the challenges associated with implementing global regulations for EV mineral production and trade, explores the potential consequences of pushback from various stakeholders, and examines the multifaceted approach taken by the Biden administration in navigating the complex landscape of EV mineral deals.

The Challenge of Global Regulations

Implementing global regulations for EV mineral production and trade encounters several challenges. One major obstacle is the concentration of mineral production in a few countries, which could lead to supply chain disruptions if geopolitical tensions or trade disputes arise. Many of the minerals essential for EVs, such as lithium, cobalt, and nickel, are predominantly sourced from countries like China, the Democratic Republic of Congo (DRC), Australia, and Chile. Dependence on these countries raises concerns about potential interruptions in the supply of critical minerals.

Pushback from Republicans and Environmentalists

The pushback from Republicans and environmentalists poses a potential hurdle for Biden's EV mineral deals. Critics argue that the strategy could jeopardize U.S. jobs and bypass Congress. They emphasize the need to prioritize domestic mineral production and ensure that American producers reap the benefits of

the EV tax credit. Moreover, permitting delays may limit the domestic supply of minerals, keeping EV prices high. However, the Biden administration has already allocated significant funding to miners developing new U.S. sources of EV minerals and has proposed legislation to spur domestic mining. The administration's goal is to establish a balance between supporting domestic industries and securing access to minerals through international agreements.

THE PUSHBACK FROM Republicans and environmentalists poses a potential hurdle for Biden's EV mineral deals. Critics argue that the strategy could jeopardize U.S. jobs and bypass Congress. They emphasize the need to prioritize domestic mineral production and ensure that American producers reap the benefits of the EV tax credit. Moreover, permitting delays may limit the domestic supply of minerals, keeping EV prices high.

gentina require large amounts of water and result in soil contamination and air pollution.To address these concerns, the Biden administration is investing in research and development for alternative extraction methods and recycling technologies. By promoting innovation in these areas, the administration aims to minimize the environmental impact of mining and reduce dependence on newly extracted minerals.

Geopolitical Implications

The Biden administration's efforts to secure EV minerals also have geopolitical implications. Currently, China controls a significant portion of the world's mineral resources and processing. By diversifying the sources of these minerals and reducing dependence on China, the United States aims to enhance its competitiveness in the global EV market and safeguard its national security interests.

Navigating the complexities of EV mineral deals is a challenging task for the Biden administration. Balancing economic interests, environmental sustainability, human rights, and geopolitical considerations requires careful planning and collaboration.

Environmental and Ethical Considerations

The production and sourcing of EV minerals have significant environmental and humanitarian implications. Mining operations in countries like the DRC have been associated with child labor, poor working conditions, and environmental damage. Lithium extraction methods in countries like Australia, Chile, and Ar-

While pushback from Republicans and environmentalists may impact the administration's plans, the commitment to transforming the American automotive industry and revitalizing the domestic mining sector remains strong.

As the narrative unfolds, it is crucial to monitor the developments and assess the effectiveness of global regulations, ethical sourcing, and technological advancements to ensure a sustainable and responsible transition to electric vehicles.

18 Skillings.net | June 2023

FloLevel Technologies

Aiming to Revolutionize the High-Tech Industry

Rio Tinto Makes a Surprise Acquisition of Scandium

Rio Tinto, one of the world’s largest mining corporations, make a surprise acquisition of scandium, a rare earth element garnering popularity in the high-tech sector. This is part of Rio Tinto’s endeavours to diversify its portfolio and increase its presence in the lucrative High-Tech industry.

The company’s CEO, Jakob Stausholm, commented on the acquisition, stating, “We are thrilled to add scandium to our portfolio of metals.” “This is an important step forward for Rio Tinto, as it will enable us to diversify our operations further and increase our presence in the high-tech industry.”

Stausholm added that Rio Tinto has a long history of innovation and technological advancement and that the acquisition of scandium is consistent with the company’s commitment to responsible and sustainable mining practices.The purchase of the assets is also anticipated to have a positive effect on the local communities in which Rio Tinto operates, as it will generate new jobs and stimulate economic expansion. In addition, the company has promised to collaborate closely with local authorities and interested parties to ensure that its operations are conducted safely and responsibly.

Scandium is a highly desirable metal used in a variety of high-tech applications, such as aerospace, defence, and electronics. In addition, it is an essential component in the production of solid oxide fuel cells, which are used to generate renewable energy. Its acquisition of scandium, as one of the few producers of the metal, is a significant coup for the company. Scandium is typically found in very small quantities and is difficult to extract, which makes it an extremely valuable commodity.

The Brazilian mining company will gain a substantial advantage in the high-tech industry as a result of the acquisition, as it will be able to provide its customers with a secure and reliable supply of scandium. This is crucial in light of the increasing demand for metal as more and more businesses incorporate it into their products.

The high-tech industry has welcomed the news of Rio Tinto’s acquisition of scandium, with many experts noting that it could have a significant influence on the development of new technologies.

“This is a really exciting development for the high-tech industry,” said Dr. Jane Smith, an authority in the field of materials science. Scandium is a very valuable metal with numerous potential applications in fields like aerospace and energy. The company’s emergence as a key player in the scandium market could have a significant impact on the future of these industries.

For the business and the entire high-tech sector, Rio Tinto’s acquisition of Scandium is significant. Due to its consistent

20 Skillings.net | June 2023

metal supply, the company is in a good position to grow into a significant player in the technology industry and contribute to the creation of cutting-edge technologies.

Rio Tinto’s Scandium Acquisition to Boost Production and Expand Technological Capabilities

Rio Tinto’s recent acquisition of Scandium is anticipated to have a substantial impact on the company’s technological and production capabilities.

Scandium is a rare earth element with exceptional properties, such as high melting points and corrosion resistance, making it an ideal material for use in

high-tech applications. In addition, it is an essential component in the production of solid oxide fuel cells, which are used to generate renewable energy.

Rio Tinto will be able to expand its production capabilities and provide a secure and reliable supply of the metal to its clients after acquiring scandium. The company has a proven track record of producing high-quality metals and minerals, and the addition of scandium to its portfolio will only strengthen its position as an industry leader.

The acquisition of scandium is anticipated to have a significant impact on Rio Tinto’s technological capabilities in addition to increasing production. The

company has a long history of innovation and technological advancement, and the addition of scandium will provide it with a new material for creating innovative new products.

The mining giant Rio Tinto is likely to concentrate its efforts on the advancement of solid oxide fuel cells. These fuel cells have the potential to revolutionize the energy industry because they generate electricity in a pure and efficient manner. Rio Tinto will be well-positioned to become a significant player in the solid oxide fuel cell market due to its reliable scandium supply.

Scandium’s purchase by Rio Tinto is also anticipated to have a positive effect on the

21 SOLVING YOUR MOST COMPLEX CHALLENGES. With SEH, you are a true partner and collaborator. Engineers | Architects | Planners | Scientists 800.325.2055 | sehinc.com/subscribe

environment. The company is committed to sustainable and responsible mining practices, and scandium is in high demand due to its potential application in renewable energy technologies. Rio Tinto will be able to support the development of these technologies and contribute to the reduction of carbon emissions if it can provide a secure and dependable supply of scandium.

The company anticipates that the acquisition of Scandium will have a positive effect on the local communities in which it operates. The company has a proven track record of collaborating closely with local authorities and stakeholders to conduct its operations in a safe and responsible manner. These communities will also benefit from the creation of new employment and the stimulation of economic growth.

Rio Tinto’s acquisition of Scandium is a significant action that is anticipated to have favorable effects on the company’s production capabilities, technological capabilities, and environmental impact. Rio Tinto is well-positioned to become a significant player in the high-tech industry and contribute to the development

of new and innovative technologies due to its reliable scandium supply.

Rio Tinto’s Current Annual Scandium Production

Rio Tinto is a leading mining corporation with global operations that is also one of the largest silver producers. Scandium is a rare earth metal with applications in the aerospace, electronics, and renewable energy industries, among others.

Rio Tinto’s annual scandium production is currently between 20 and 25 tons. This may appear to be a small amount compared to other metals, such as iron or copper, but scandium is extremely rare and difficult to extract.

It is typically found in extremely low concentrations in various ores and minerals, and its extraction is a difficult and costly process.

Due in part to its expertise in mining and metallurgy, Rio Tinto has been able to establish itself as a prominent producer of scandium despite these obstacles. The company has developed proprietary technologies that enable the efficient extraction of scandium from various

ores and minerals, thereby reducing the cost and complexity of the extraction procedure. The majority of the firm’s current annual scandium production is utilized in the aerospace and electronics industries, where scandium is used to create lightweight, resilient alloys. These alloys are utilized in a variety of applications, including aircraft structures and engine components, as well as high-end sports equipment.

Rio Tinto is anticipated to considerably increase its annual production of scandium as a result of its recent acquisition of scandium. This will enable the company to expand its customer base and provide a more dependable supply of scandium to its current clientele.

Additionally, as a result of the acquisition, Rio Tinto will be able to extract scandium from a wider range of ores and minerals. Scandium is typically found in numerous ores and minerals, such as bauxite, uranium, and lateritic nickel ores, among others. By diversifying its portfolio of scandium-containing materials, Rio Tinto will be able to increase its production capacity and better serve its clients.

Rio Tinto’s current annual scandium production is between 20 and 25 metric tons, and the recent acquisition of scandium is anticipated to substantially increase this amount. The company’s expertise in mining and metallurgy, as well as its dedication to innovation and technological advancement, have enabled it to become a prominent producer of scandium.

Rio Tinto is well-positioned to satisfy the growing demand for scandium in a variety of high-tech applications due to its expanded production capabilities.

22 Skillings.net | June 2023

High Food Inflation Hurts European Polymer Demand, Squeezes Margins

The European polymer industry is enduring difficult times due to a combination of global supply length and high food inflation, which have harmed demand and compressed margins. The situation has resulted in a sharp decline in polymer prices, which is causing manufacturers, suppliers, and traders alike considerable concern.

The European polymer industry faces significant challenges, including a surplus of polymers on the global market and excessive food inflation. This surplus has led to a drop in polymer prices, putting pressure on European manufacturers to reduce expenses. Additionally, the rising cost of bio-based polymer production inputs further strains manufacturers' margins.

These challenges have affected the entire polymer supply chain, making it difficult for manufacturers to sell products at profitable prices and suppliers to find customers for excess inventory. However, the industry can overcome these obstacles by developing high-value applications for polymers and investing in research and development to increase efficiency and reduce costs.

The demand for plastic packaging is also impacted by high food inflation. As food prices rise, people may consume fewer non-essential food items, reducing the need for plastic packaging. Moreover, the cost of manufacturing plastic packaging contin-

ues to increase, leading consumers to explore alternatives such as paper or biodegradable materials. High food prices also affect the profitability of food producers and retailers, potentially resulting in a decrease in the amount of plastic packaging used. The packaging industry is exploring alternative materials and focusing on increasing production efficiency through automation and sustainable energy sources.

Factors contributing to high food inflation in Europe include supply chain disruptions caused by the COVID-19 pandemic, climate change affecting crop production, increasing global demand for food and oil, and a decrease in the supply of agricultural goods. The decline in the euro's value relative to other currencies has also contributed to the rise in food inflation by making food imports more expensive. Rising costs for energy and transportation further drive up food prices. To address high food inflation, it is crucial to understand these factors and implement feasible solutions.

In conclusion, the European polymer industry and the demand for plastic packaging are impacted by a surplus of polymers on the global market and high food inflation. However, with strategic investments and a focus on innovation, the industry can overcome these challenges and maintain competitiveness. Similarly, addressing the causes of high food inflation, such as supply chain disruptions and climate change, will be crucial in stabilizing food prices in Europe.

Global

Supply Length

23

The Trusted Adviser: Empowering Mine Personnel with Expert Guidance

Interview with Michael Meidow VP Technical Support, CR Powered by Epiroc. United States globalsales@crmining.com

Michael Meidow is a self-motivated, results-oriented problem solver. He is a degreed engineer who is equally at ease interacting with the factory floor or overseeing an engineering team as he is interacting with customers. Michael is an effective team builder who values and respects individuals. He has successfully completed two international assignments with increasing levels of responsibility in a variety of functional areas, demonstrating that he is an adaptable, results-oriented professional. His skill set encompasses sales, design engineering, automation, product management, customer service, technical field support, and product management.

His areas of expertise include operational management, creative direction, communication, training and employee development, product design and marketing, and mobile application development.

Describe your education and professional experience:

A degreed mechanical engineer who feels equally comfortable in front of the customer as I do interfacing with the factory floor or leading an engineering or product team, I am working in the Mining Industry over 30 years.

I stared my career in Germany and worked with the 3 of 4 largest mining excavator OEM’s in Europe, CAT, Komatsu and Liebherr. The 4th one is Hitachi in Japan. I am now going on 4 years employed with what is now CR Powered by Epiroc as the VP of Technical Support.

Summarize your company business and current projects you are involved

in:

CR sells/ manufactures a range of mining equipment and technology including lips, GET, dragline buckets and rigging, conveyor systems, fixed plant wear products, plate block and wear, and digital solutions – from payload management to GET monitoring.

My role is to support our Regional Account Managers with technical Information and I support our products in the field and advice our clients, bucket shops and dealers on how to best install and use our products for optimized performance.

24 Skillings.net | June 2023

25

Throughout your career, you have held various leadership roles in the mining industry. What lessons have you learned about effective leadership, and how do you apply these to your current role as VP of Technical Support?

In my thirty years in the mining industry, I have visited Mines all over the world. In doing so I have come across a lot of different people with different backgrounds and cultures. In a global organization you experience the same thing. So as a leader you need to be open to listening.

You need to ask questions because you might have misunderstood something due to Language issues. Rather than telling people what to do you need to give them a framework and let them work independently in this framework. Let them make mistakes, but make sure those mistakes are not catastrophic for the organization. Provide opportunities for your employees, that can be a career move or just an exciting project where the individual will be the project leader and can show their potential.

In a nutshell: Lead by mentorship rather than by dictatorship. As you've worked with major mining excavator OEMs in Europe like CAT, Komatsu, and Liebherr, can you share some of the key lessons you've learned from these experiences?

I only worked a short period of time (10 years) with the Mining OEMs in Europe. During this time, I was working mainly with the engineering departments of the OEMs. Our company Engineering team was in the US and I was the liaison between OEM engineers and our company engineers.

I learned quickly that it is best if Engineers talk to each other but at that time the language barriers were still high so that I was used as a translator and was used to making certain points clear for each party. Same major new excavators were developed during that time and our Lip and GET system needed to meet the OEMs requirements to withstand those new forces of the bigger and stronger excavators. I learned a lot during this time, not only in engineering, but also in relationship building, negotiation skills and finally my technical English.

In general Mining Excavator OEMs are very good at designing these machines. Some of them have tried to design and manufacture GET. Some of the OEMs were successful but mainly in the construction market where the GET is a commodity. A lot of more effort is involved in designing Mining GET and most OEMs do not have the experience or the patience to get

this right. Most of the OEMs today have acquired one of the previous independent GET producers.

Can you give an overview of CR's mining equipment and technology offerings and how they are shaping the industry?

We offer Ground Engaging Tools (GET) featuring proven locking systems for Rope Shovels, Hydraulic Excavators, Wheel Loaders, and LHD machines. Our GET is designed to minimize machine downtime and safety hazards by eliminating the need for hot work while also improving productivity.

Additionally, we offer digital solutions for GET loss detection, payload monitoring, and drill navigation. These solutions generate data, which becomes the foundation for new insights and more effective mining operations enabling customers to link actionable data with the right decisions to meet their performance goals.

26 Skillings.net | June 2023

How does your role as VP of Technical Support allow you to provide valuable technical information to regional account managers and clients in the field?

The technical support team's first role is to train our sales team and the customers they serve. We also travel a lot to sites for hands-on training. We are also present when our lips are installed to buckets. The biggest challenge is to ensure that projects from two customers do not overlap, and we cannot serve them at the same time. Having a good travel schedule and getting awareness of the trip early enough from our sales team and the customer is very helpful. Sometimes we only have hours to prepare for a trip.

Customers in general, schedule bucket repairs and with that lip installations. The acceptance of Microsoft team, Zoom and others especially after COVID is very helpful.

Let's discuss the benefits of integral cast stabilization in SaberEdge and TLC. How do these features enhance the performance and longevity of mining equipment?

Any Lip that is used in any of the Mining Excavators, Rope Shovels and Front End Loaders uses either weld on adapter, mechanical adapter or a cast lip (where the adapter is eliminated and incorporated into the cast lip).

If you weld the adapter onto a plate lip you are relying on the weld to hold the adapter in place. During the operation on the machine the lip flexes during normal operation and that introduces stress in the lip. Cracks typically develop in the Heat affected Zone, this is the area next to the weld joint. To remove the weld, mechanically attach the adapter. The

adapter attachment system needs to reliably keep the adapter in place. Because the adapter is very large compared to the attachment system and the forces generated by the machine are enormous, adapter stabilization needs to be used in combination with the mechanical attachment system. Some GET manufacturers weld stabilization bosses/pads to the lip to generate the adapter stabilization, but for me that does not solve the welding problem, because those welds will create cracks that need to be fixed regularly.

without any re tightening during the life of the adapter.

Other screw-on systems need such a re tightening on a regular basis. Because of the adapter stabilization and the Hydraulic attachment system that keep the adapter tight on the lip during operation, the lip will not experience wear in the adapter area. No movement, no wear.

This will allow the customer to replace the adapter without lip repair before a new adapter is installed. Faster turnaround for the bucket and less cost on lip repair over the life of the lip.

What is the role of dedicated field representatives in CR's service model, and how do they help support customers and dealers?

A dedicated Field Service representative is responsible for a region, an area, or a mine site. This all depends on the number of buckets with our Lips and GET in the mine.

market where the GET is a commodity.

It also depends on our customer location and travel time to reach such customers to support our products. During mine visits we train mine-personnel on installation and removal practices if they just received one of our products. On an ongoing basis we still can do training if necessary (new people at the mine) or we discuss issues or potential improvement of processes or product with the mine employees.

In our Saber Edge with mechanically attached adapters, we integrate the stabilization into the lip. Our lips are cast lips and the adapter stabilization is cast into the lip.

Essentially, we have ribs cast into the lip where the adapters slide into. Our Hydraulic Attachments system is unique and allows the user to install the adapter

If the mine has questions about existing buckets / lips we provide recommendations and future repair and better wear protection solutions.

We want to be the trusted adviser for the Mine personnel.

27

I LEARNED A LOT DURING this time, not only in engineering, but also in relationship building, negotiation skills and finally my technical English. In general Mining Excavator OEMs are very good at designing these machines. Some of them have tried to design and manufacture GETs. Some of the OEMs were successful but mainly in the construction

Behind the Mining Productivity Upswing

Technology-Enabled Transformation

The mining business has changed significantly during the last few years. Previously thought of as a conventional and labor-intensive area, the industry has embraced technology to increase productivity, efficiency, and sustainability.

This change has fueled the current increase in mining productivity. In order to streamline their operations, mining businesses are utilizing technological advancements like automation, artificial intelligence (AI), and the Internet of Things (IoT).

Mining businesses are using these technologies to increase safety, cut costs, and streamline their operations.The mining industry has seen a dramatic change because of automation. Mining businesses are replacing human labor with robots, drones, and autonomous vehicles to complete jobs. These automated processes are safer, quicker, and more accurate. Mining businesses can lower their labor expenses and boost their bottom line by decreasing the demand for human labor.

Another technology that is revolutionizing the mining business is artificial intelligence (AI). AI is being used by mining corporations to analyze massive volumes of data and improve decision-making. Mining firms can use AI to streamline their processes, pinpoint areas for development, and lessen downtime.

The Internet of Things (IoT) is another cutting-edge innovation that is causing seismic shifts in the mining industry. By connecting their machinery, sensors, and various other devices to a centralized server, mining companies can collect data in real-time regarding their operations.

Technology is not the only factor in the mining industry’s change. Additionally, the industry’s culture needs to change. To make sure that their operations are

sustainable and socially responsible, mining corporations are taking a more collaborative approach and collaborating with suppliers, consumers, and local communities.

challenges of implementing technology in mining

Automation, artificial intelligence, and the Internet of Things are revolutionizing mining operations as the mining industry experiences a technological revolution. The adoption of new technology in the mining sector is not without difficulties, though. In this post, we’ll look at some of the difficulties mining firms encounter when integrating technology into their processes.

The expense of using technology in mining is one of the main obstacles. Mining firms must take the return on investment

28 Skillings.net | June 2023

(ROI) into account before making any decisions because the adoption of new technology demands a substantial investment. The expense of training and keeping skilled personnel to use and maintain the technology is in addition to the cost of the technology itself.

TECHNOLOGY IS NOT THE ONLY factor in the mining industry’s change. Additionally, the industry’s culture needs to change. In order to make sure that their operations are sustainable and socially responsible, mining corporations are taking a more collaborative approach and collaborating with suppliers, consumers, and local communities.

The lack of skilled labour is another problem. Skilled personnel are needed to implement new technologies and keep them running smoothly. Another difficulty that mining businesses encounter when integrating technology into their operations is data management. The adoption of new technologies generates enormous amounts of data, which requires collection, analysis, and management.

Regulatory and legal issues also seriously hinder the use of technology in mining. There are several laws that mining businesses must follow, including international variations on environmental and safety laws. Security is a challenge that mining companies face when incorporating technology into their daily operations. Cyberattack risk may rise with the adoption of new technologies, particularly those that are web-connected.

The adoption of new technology may have an impact on the workforce. Automation of some tasks may make it unnecessary to use human labor, which may result in job losses.

29 INDUSTRIAL GENERAL

crmeyer.com | 800.236.6650 Millwrighting • Ironwork • Piping • Concrete • Carpentry • Masonry Pile Driving • Boilermaking • Electrical • Demolition • Design/Build

CONTRACTOR

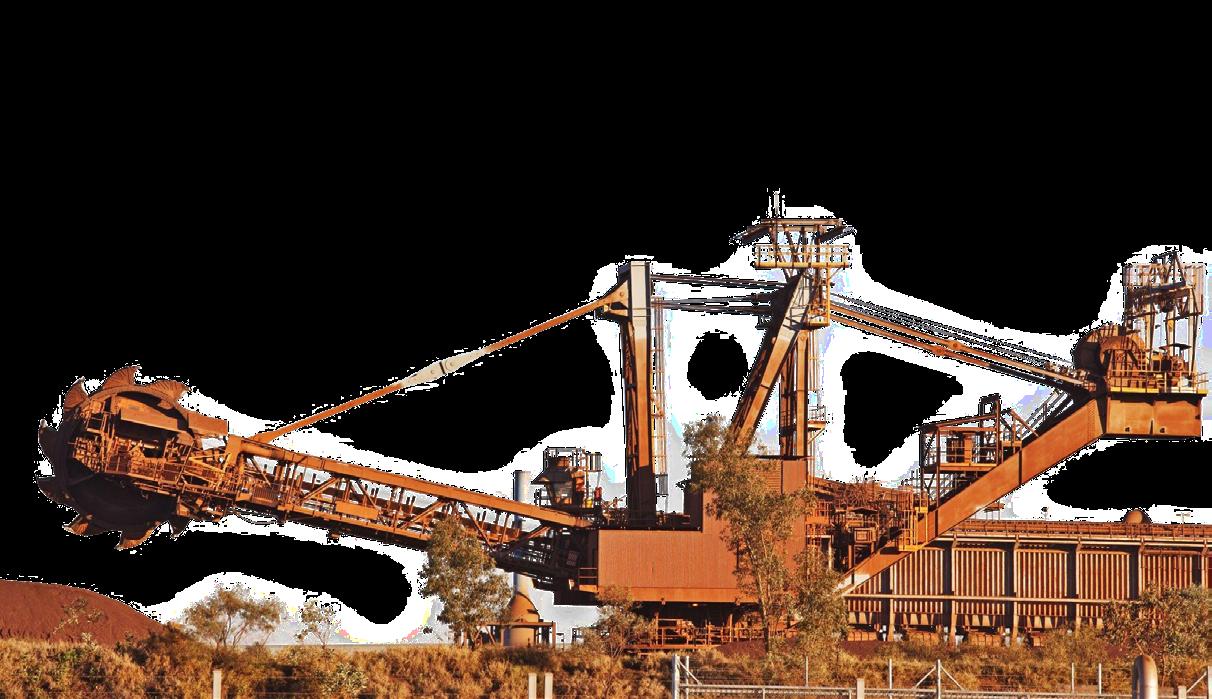

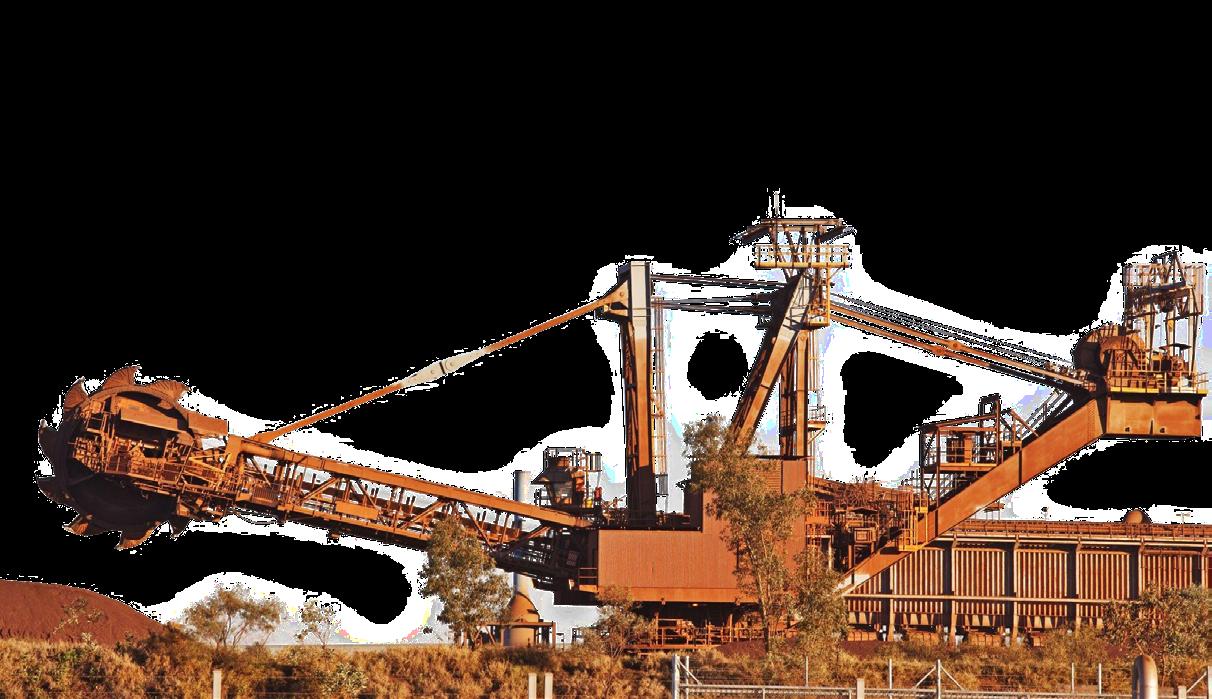

Revolutionizing the Iron Ore Mining Industry

Technological Innovations, Sustainability Initiatives, and Community Engagement Shape the Future

The iron ore sector is at the core of the mining industry's frenetic pulse. Corporations and investors are diving headlong into the world of iron ore mining projects, enticed by the prospect of high returns and the importance of iron in contemporary industrial economies. The construction, automobile, and machinery industries are predominantly responsible for the steady rise in iron ore demand worldwide.

30 Skillings.net | June 2023

China, as the largest steel producer in the world, has played a pivotal role in driving this demand. With continued infrastructure development and urbanization, the Asian superpower's iron ore appetite shows no sign of waning.

Several multinational mining corporations, such as Rio Tinto, Vale, and BHP, account for the lion's share of the world's iron ore production. However, their dominance has not deterred new competitors from entering the arena, resulting in a captivating diversification of the iron ore mining landscape.

Fortescue Metals Group is making progress in Australia with its innovative Iron Bridge Magnetite project. The project, which is anticipated to produce its first ore in 2023, plans to produce 22 million wet metric tonnes annually. This is a crucial stage in Fortescue's journey to deliver products with a higher iron content and to increase operational efficiency.

The Simandou project in Guinea, which is frequently referred to as the world's largest untapped highgrade iron ore deposit, represents an intriguing new frontier.

It is anticipated that a joint venture involving the Chinese-backed consortium SMB-Winning will improve Guinea's standing in the global iron ore export market. The initiative is anticipated to produce more than 100 million tonnes annually, contributing significantly to the economy of the nation.

The Kami initiative of Alderon Iron Ore Corp. is regarded as one of the most promising developments in Canada. The project, situated in the Labrador Trough, a prominent iron ore mining district, could produce an estimated 8 million tonnes per year. However, the initiative is currently seeking funding in order to move forward with production. Sustainability is a recurring motif in the mining industry, including iron ore mining. To reduce their carbon footprint, mining companies

31

Sustainability is a recurring motif in the mining industry, including iron ore mining. To reduce their carbon footprint, mining companies are increasingly employing environmentally friendly practices.

are increasingly employing environmentally friendly practices. As an example, Rio Tinto's AutoHaul initiative, the world's first automated long-distance, heavy-haul rail network, has established a new standard for lowering CO2 emissions.

The iron ore extraction industry faces a number of obstacles, such as fluctuating prices, regulatory constraints, and the need for substantial capital investment. Moreover, even as the global economy begins to recover, the ongoing COVID-19 pandemic poses operational and supply chain difficulties. Despite these obstacles, the iron ore mining industry remains an attractive investment opportunity.

In the future years, the industry's resilience, fueled by robust demand and technological advancements, is anticipated to stimulate expansion. As we continue to monitor the rise and decline of iron ore prices, the development of ongoing projects, and the emergence of new ventures, one thing is abundantly clear: the iron ore mining industry is an unshakeable pillar of the global economy.

Report on Iron Ore Mining Project in 2023

The global iron ore market is projected to increase from $405.1 billion in 2022 to $447 billion in 2023, at a compound annual growth rate (CAGR) of 10.3%. Major market players include Arcelor Mittal, Nippon Steel & Sumitomo Metal Corporation (NSSMC), POSCO, TATA STEEL, and VALE.

It is worthwhile to investigate the technological developments that will shape the future of iron ore mining initiatives. Automation, artificial intelligence, and machine learning are being implemented by mining companies to improve productivity, safety, and efficiency. BHP's Integrated Remote Operations

mote administration and supervision of their Pilbara iron ore operations. This cutting-edge technology has substantially increased operational efficiency and decreased downtime. Vale invests in autonomous vehicles and drills to increase its iron ore production capacity.

The Swedish mining company LKAB is creating waves on the environmental front with its HYBRIT project. This project seeks to replace coking coal, which is traditionally used in iron ore processing, with hydrogen in order to create the world's first steel made without fossil fuels. If effective, this innovative

strategy could significantly reduce the carbon footprint of iron ore mining and steel production. In recent years, indigenous rights and land ownership have also been major concerns. Mining companies now collaborate more closely with local communities to ensure their operations are conducted in an ethical and environmentally responsible manner.

Rio Tinto's recent pledge to update its agreements with traditional landowners in Western Australia represents a positive shift. In response to the backlash from the Juukan Gorge incident in 2020, the mining behemoth is redoubling its efforts to safeguard cultural heritage sites within its iron ore operations.

As the iron ore mining industry adapts to the changing socioeconomic climate, it continues to play an indispensable role in the global economy. Governments, mining companies, and other stakeholders are collaborating to mitigate challenges and realize the sector's enormous potential. The complexities of the global iron ore market, including supply and demand dynamics and price fluc-

IN 2020, THE TOP FIVE IRON ORE

mining nations, including Australia, Brazil, China, India, Russia, and South Africa, accounted for more than eighty percent of global production. Different countries' production and trade levels on the iron ore market have fluctuated, with China being a significant market participant.

32 Skillings.net | June 2023

Iron Bridge Magnetite Project, Australia

Fortescue Metals Group's ambitious project is expected to deliver high-grade magnetite concentrate products, with projected production of 22 million wet metric tonnes per annum.

S11D Eliezer Batista Complex, Brazil

Vale's project, named after the company's longtime head, is one of the largest iron ore mines in the world. The complex aims to reduce environmental impact by using truckless mineral transportation.

HYBRIT Project, Sweden

Though not a traditional mining project, this joint venture by LKAB, Vattenfall, and SSAB is worth mentioning for its potential to revolutionize iron ore processing by replacing coking coal with hydrogen in steel production.

Roy Hill Iron Ore Project, Australia

Owned by Hancock Prospecting and several investment partners, the Roy Hill project is one of the largest integrated pit-to-port operations. Boasting a peak capacity of 60 million tonnes per annum, the mine utilizes a high degree of automation and innovative technologies.

Solomon Hub, Australia

Owned by Fortescue Metals Group, Solomon Hub comprises the Firetail and Kings Valley mines, which together have an annual production capacity of 70-75 million tonnes. The operation stands out for its innovative use of autonomous haulage technology.

Minas-Rio, Brazil

Anglo American's Minas-Rio is one of the world's leading producers of high-grade pellet feed. Its integrated system includes a long-distance slurry pipeline, which transports iron ore from the mine to the company's dedicated export facility at the port of Açu.

Simandou Project, Guinea

This joint venture, involving the Chinese-backed consortium SMBWinning, is set to tap into what's often described as the world's largest untapped high-grade iron ore deposit. It's projected to produce over 100 million tonnes annually

South Flank Mine, Australia -

BHP's South Flank iron ore mine in Western Australia is one of the most technologically advanced mines, using autonomous trucks, drills, and trains to boost efficiency and safety.

Kami Project, Canada

Alderon Iron Ore Corp's project in the Labrador Trough is projected to yield an estimated 8 million tonnes annually. The project is currently seeking investment for production.

Koodaideri Iron Ore Mine, Australia

Rio Tinto's Koodaideri project, touted as a 'mine of the future', is set to be one of the most technologically advanced iron ore mines. The project will incorporate an advanced processing plant and a hightech, automated system for running and monitoring operations.

Zandrivierspoort (ZRP) Magnetite Project, South Africa

Kumba Iron Ore, a subsidiary of Anglo American, operates the ZRP project. The planned open-pit operation, with an estimated mine life of over 20 years, will significantly contribute to the production of high-grade magnetite concentrate.

Benson Mines, United States

Although currently inactive, this mine in New York State has considerable iron ore reserves. New York State and Clarkson University are working on a revitalization plan, making it a project to watch

33

tuations, highlight the need for in-depth analysis and well-informed decisions. We remain committed to providing the most comprehensive coverage of the iron ore mining industry as we continue to monitor these trends.

The industry of iron ore mining is at an intriguing crossroads. The sector holds promise for robust development, innovation, and sustainability as new projects are initiated and existing projects reach completion.

Countries have experienced the greatest increase in iron ore production

In 2020, the top five iron ore mining nations, including Australia, Brazil, China, India, Russia, and South Africa, accounted for more than eighty percent of global production. Different countries' production and trade levels on the iron ore market have fluctuated, with China being a significant market participant.

Innovations in technology are revolutionizing the iron ore mining industry. Advanced technologies, such as the Internet of Things (IoT), Big Data, and predictive analytics, are being incorporated into mining operations in an effort to increase efficiency and productivity.

Iron Ore Production Has Modified Over The Past Ten Years

The production of iron ore has fluctuated over the past decade. Iron ore production declined to 2,450 million tonnes in 2019, but rebounded to 2,472 million tonnes in 2020 and 2,537 million tonnes in 2021, a decade high. The quantity of exploitable iron ore produced worldwide will increase from 2,430 million metric tons in 2017 to 2,470 million metric tons in 2020. In contrast, iron ore production decreased for the first time in seven years in 2019.

Several companies are pioneering initiatives to reduce the environmental impact of iron ore extraction on the sustainability front. The HYBRIT endeavor by LKAB, Vattenfall, and SSAB in Sweden is one such initiative. The project seeks to replace coking coal with hydrogen in steel production, which could reduce CO2 emissions by as much as 90 percent.

INNOVATIONS IN

BHP's South Flank iron ore mine in Western Australia, for example, employs autonomous trucks, drills, and trains to carry out crucial duties. This automation not only improves safety by reducing human exposure to hazardous environments, but it also enables 24-hour operations, thereby boosting productivity.

The AutoHaul system developed by Rio Tinto has revolutionized the transpWortation of iron ore. The entirely autonomous, 1.7-kilometer-long trains, equipped with on-board cameras and remotely monitored by the operations center, have drastically reduced travel times and increased overall efficiency. Predictive maintenance powered by AI is another intriguing development.

By analyzing equipment performance data with machine learning algorithms, mining companies can anticipate equipment failures and schedule preventive maintenance. This innovation can result in substantial cost savings and reduce unscheduled disruptions.

In addition, mining companies are progressively forming partnerships with renewable energy suppliers to power their operations. Fortescue Metals Group, for instance, recently announced a partnership with Alinta Energy to power the Chichester Hub iron ore operations with solar and gas energy, a move that is expected to displace approximately 100 million liters of diesel annually. The mining industry faces socioeconomic challenges, such as land rights and the welfare of indigenous communities. Rio Tinto has taken steps to strengthen its relationships with local communities and preserve cultural heritage sites in the wake of the Juukan Gorge incident in 2020. The company has committed to revising its agreements with traditional landowners and enhancing its strategies for community engagement.

As we delve deeper into the dynamics of the iron ore mining industry, the interplay between technological innovation, environmental responsibility, and social responsibility emerges as the industry's future defining theme. We continue to provide exhaustive, data-driven insights into this thriving industry with a keen eye on these trends. These diverse projects further underscore the iron ore industry's commitment to leveraging technology, increasing efficiency, and minimizing environmental impact will undoubtedly play a critical role in shaping the industry's future.

34 Skillings.net | June 2023

technology are revolutionizing the iron ore mining industry. Advanced technologies, such as the Internet of Things (IoT), Big Data, and predictive analytics, are being incorporated into mining operations in an effort to increase efficiency and productivity.

2023 Metal Prices Guide

Exciting Trends and Market Updates You Need to Know

The metals market is poised for steady growth and stability in 2023. As economies recover from the COVID-19 pandemic and industries continue to evolve, the demand for metals remains strong. This article explores the performance and forecast of key metals, while discussing the factors that influence their prices.

Gold

Historically considered a safe-haven investment, gold's appeal as an inflation hedge is expected to persist in 2023. Geopolitical tensions and inflationary concerns drive the demand for gold, resulting in anticipated price increases. Some experts predict that the price of gold could reach $2,000 per ounce.

Silver

Silver's diverse industrial applications, particularly in renewable energy sectors like solar panels and electronics, contribute to its strong demand. As the transition to renewable energy continues, silver's demand is expected to remain high, potentially leading to price increases.

Aluminium

Used in various sectors such as transportation, construction, and packaging, aluminium’s demand is influenced by economic growth. As the global economy continues to recover, the demand for aluminium is expected to increase. However, due to the market's oversupply, the price of aluminium is likely to remain stable in 2023.

Copper

Widely used in the construction, electronics, and transportation industries, copper's demand is closely tied to economic growth. As the global economy recovers from the pandemic, copper demand is anticipated to increase, thus keeping its price high throughout 2023.

2023, especially if the demand for electric vehicles remains robust.

Factors Influencing Metal Prices

Several factors impact metal prices, including geopolitical tensions, inflation, and economic growth. Geopolitical strife, such as tensions between major players like the United States, China, and Russia, can affect both supply and demand dynamics.

Inflation drives the demand for precious metals like gold as a hedge, potentially leading to price increases. Economic expansion plays a crucial role in driving metal prices, with the ongoing global recovery expected to boost demand for metals like copper and iron ore.

Market Forecast

Steel Ore

As a crucial component in steel production, iron ore's price is closely correlated with steel demand. The ongoing recovery of the global economy is expected to drive steel demand, resulting in a continued high price for iron ore in 2023.

Nickel

With extensive use in stainless steel and electric vehicle batteries, nickel experienced significant price increases in 2022, driven by the growing demand from the electric vehicle industry. Experts anticipate this upward trend to continue in

Despite potential market hazards and uncertainties, industry experts predict steady growth and stability in the metal market for 2023. The continued global economic recovery, increasing demand for renewable energy and electric vehicles, and inflationary concerns contribute to this positive outlook. Factors such as ongoing trade tensions, interest rate shifts, and supply chain disruptions should be monitored as they may impact metal prices.

Investors seeking to capitalize on the anticipated growth and stability in the metals market in 2023 should consider metals like copper, nickel, silver, and gold as potential investment options.

35

THE METAL INDUSTRY IS in a perpetual state of change, and keeping abreast of the most recent trends and market developments is essential for anyone involved in the industry. In this guide, you will find the most recent updates on metal prices for 2023, as well as the factors influencing these trends.

China’s Equity Markets Open Up to International Investors

IN THE MINING INDUSTRY

China has declared the internationalization of its equity markets in an effort to increase foreign investment in its mining sector. The mining industry in China is one of the biggest and most significant in the world, and this move is anticipated to increase the prospects for foreign investors to participate in it

36 Skillings.net | June 2023

Foreign investors will be able to purchase shares in Chinese mining businesses listed on the Shanghai and Shenzhen stock exchanges thanks to the internationalization of China’s equities markets. This implies that international investors won’t need to use middlemen or invest in offshore firms but can make direct investments in these businesses.

China is making this move as part of its efforts to entice more foreign investment into its economy as it strives to become a major economic force on the world stage. Given that China is the world’s largest consumer of several minerals and commodities, including iron ore, copper, and nickel, this is particularly crucial for the mining sector. The Chinese government has actively encouraged foreign investment in the mining sector and has implemented a number of measures to make this possible. It has recently sped up the procedure for approving international mining companies to engage in China and offered tax breaks to entice foreign capital.

THE POSSIBILITY OF GREATER returns on their investments is one of the primary advantages of this decision for foreign investors. Due to the rising demand for minerals and metals, China’s mining industry has experienced rapid growth in recent years. In the upcoming years, it is anticipated that this expansion will continue, providing chances for foreign investors to generate sizable returns on their capital.

issues, foreign investors must carefully abide by these rules. Despite these difficulties, foreign investors in the mining sector have a great opportunity thanks to the globalization of China’s equity markets.

China is poised to play a bigger role in the global mining industry thanks to its abundant natural resources and expanding economy. The expansion of foreign investment prospects in China’s mining sector is a result of the internationalization of the country’s equity markets, which is a step in the right direction for the mining sector.

Foreign investors that are ready to manage the regulatory environment and linguistic difficulties are likely to gain the benefits of investing in China’s mining industry, even though there are obstacles to be overcome.

China’s Equity Market Internationalization: Impact on Mining Investors

China’s decision to open its equity markets to foreign investors is expected to have a significant impact on the mining sector. This action will provide foreign investors with additional chances to invest in one of the biggest and most significant mining sectors in the world—China.

Foreign investors will be able to directly purchase shares in Chinese mining businesses listed on the Shanghai and Shenzhen stock exchanges thanks to the internationalization of China’s equities markets. International investors will then have access to China’s abundant mineral riches and expanding economy.

As foreign investors are likely to bring in more cash and boost the trading volume of these firms, it is anticipated that the internationalization of China’s equities markets will also increase the liquidity of Chinese mining companies. These businesses will find it simpler to raise financing and finance their operations as a result.

However, there are issues with globalization. In order to ensure compliance and avoid any legal issues, foreign investors must carefully abide by these rules. of China’s equity markets as well. The regulatory environment is one of the biggest obstacles since Chinese laws and rules can be convoluted and unclear. In order to ensure compliance and avoid any legal

37

THE IMPROVED LIQUIDITY OF CHINESE

of the increased inflow of foreign capital, which will make it simpler for them to raise capital and finance their operations.

Nevertheless, there are dangers involved with investing in China’s stock markets. The regulatory environment, which can be confusing and complex, is one of the key dangers. To maintain compliance and steer clear of any legal pitfalls, international investors will need to carefully negotiate these restrictions.

The globalization of China’s equity markets will have a significant impact on foreign investors in the mining sector. This action gives foreign investors more chances to invest in China’s mining industry, potentially increasing returns and increasing portfolio diversification. Only two of the risks associated with investing in China’s equity markets that require management by foreign investors are the regulatory environment and the language barrier.

Mitigating Risks When Investing in China’s Equity Markets: Advice for Mining Investors

Mining investors should be aware of the dangers involved with these investments and take precautions to reduce them as China’s equities markets open up more to foreign investors. Here are some essential tactics for reducing risks while making investments in China’s stock markets.

Conduct thorough due diligence.

The possibility of greater returns on their investments is one of the primary advantages of this decision for foreign investors. Due to the rising demand for minerals and metals, China’s mining industry has experienced rapid growth in recent years. In the upcoming years, it is anticipated that this expansion will continue, providing chances for foreign investors to generate sizable returns on their capital.

International investors should expect their portfolios to be more diversified as a result of the internationalization of China’s equities markets, in addition to receiving higher returns. International investors can acquire exposure to a variety of minerals and metals, as well as various regions of China, by making investments in Chinese mining firms. The improved liquidity of Chinese mining businesses is another advantage for foreign investors. These businesses are anticipated to experience an increase in trade volume as a result

Prior to making an investment in a Chinese mining company, careful due diligence must be performed. This includes going over financial statements, legal filings, and other pertinent paperwork. Mining investors should also get professional guidance from nearby partners who have knowledge of the regional business scene.